2024

Guide for Property Owners

Wisconsin Department of Revenue

PB-060 (R. 1-24)

Back to table of contents

2

2024 Guide for Property Owners

Wisconsin Department of Revenue

Table of Contents

I. Introduction ......................................................................................... 4

II. General Property .................................................................................... 4

A. Real property, real estate and land .................................................................. 4

B. Uniform property tax .............................................................................. 4

C. Taxable/nontaxable property ....................................................................... 4

III. Assessment and Its Purpose ......................................................................... 5

IV. Assessors ............................................................................................ 5

A. Certication ........................................................................................ 5

B. Wisconsin Property Assessment Manual (WPAM) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

V. Assessment Process .................................................................................. 6

A. Municipal assessor is responsible for the assessment process ........................................ 6

B. Assessment classications of real property .......................................................... 6

C. Property information ............................................................................... 7

D. Information used to determine assessments ........................................................ 8

E. Notice of Changed Assessment ..................................................................... 9

F. Equitable assessment .............................................................................. 9

G. Assessment of personal property.................................................................... 10

VI. Manufactured and Mobile Homes ................................................................... 11

A. Denitions ......................................................................................... 11

B. Exempt mobile and manufactured homes .......................................................... 11

C. Monthly municipal mobile home permit fee ......................................................... 12

D. Mobile home assessment appeals ................................................................... 13

E. Mobile home exemption disputes................................................................... 13

F. Overview of manufactured and mobile home unit property taxes .................................... 13

VII. Equalized Value ...................................................................................... 14

A. Uses of equalized value ............................................................................. 14

B. Assessment compliance ............................................................................ 15

C. Full value law ....................................................................................... 15

VIII. Reassessment/Revaluation .......................................................................... 15

A. Initiating a reassessment ........................................................................... 16

B. Supervised assessment ............................................................................. 16

C. Initiating a revaluation ............................................................................. 16

D. Trespassing and Revaluation Notice ................................................................. 17

E. Sample Revaluation Notice ......................................................................... 18

F. Assessment roll .................................................................................... 18

G. Assessment questions .............................................................................. 18

H. Open Book ......................................................................................... 18

I. Appealing your assessment ......................................................................... 19

Back to table of contents

3

2024 Guide for Property Owners

Wisconsin Department of Revenue

IX. Board of Assessors (BOA) ............................................................................ 19

A. Cities with a BOA ................................................................................... 19

B. BOA information ................................................................................... 19

X. Board of Review (BOR) ............................................................................... 20

A. Requirements to appeal an assessment to the BOR .................................................. 20

B. BOR members ...................................................................................... 20

C. BOR details ......................................................................................... 21

D. Providing information to the BOR ................................................................... 22

E. Appeal a BOR decision ............................................................................. 23

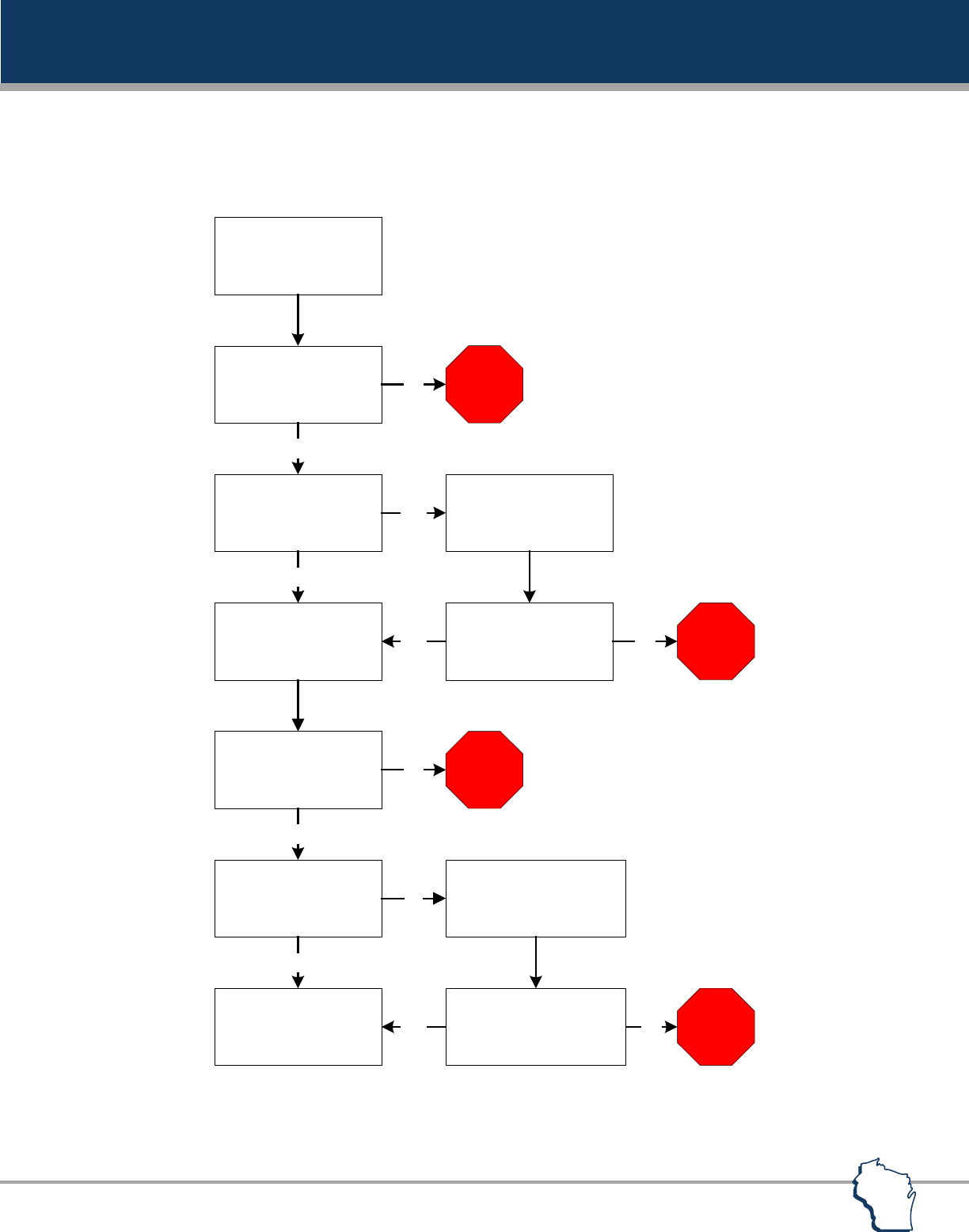

F. Flowchart of the assessment appeal process ........................................................ 25

XI. Levy and Rates ....................................................................................... 26

A. Property tax base/rate .............................................................................. 26

B. Tax rate ............................................................................................ 26

C. General property tax bill ............................................................................ 26

D. School taxes ....................................................................................... 27

XII. Collection ............................................................................................ 27

A. Property tax bills ................................................................................... 27

B. Payment of property taxes .......................................................................... 27

C. Interest on unpaid taxes ............................................................................ 27

D. Unlawful tax claim ................................................................................. 28

E. Excessive assessment claim ......................................................................... 28

F. Denial of unlawful tax or excessive assessment claim ................................................ 29

XIII. Assistance with Property Taxes ...................................................................... 29

A. Homestead tax credit ............................................................................... 29

B. Property tax deferral loan program ................................................................. 29

C. Assistance for the elderly ........................................................................... 29

D. Property tax exemption for veterans ................................................................ 29

XIV. Real Estate Property Tax Bill ......................................................................... 31

XV. Tax Rate .............................................................................................. 34

XVI. Special Purpose Costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

XVII. Statutory References ................................................................................ 34

XVIII. Glossary .............................................................................................. 35

XIX. Contact Information ................................................................................. 38

Back to table of contents

4

2024 Guide for Property Owners

Wisconsin Department of Revenue

I. Introduction

This guide provides information about property assessment and appealing your assessment. This guide also

describes the role of the assessor, local Board of Review (BOR), and taxation process. For additional information

on property valuation, see the Wisconsin Property Assessment Manual (WPAM). Contact your local assessor for

information about your property assessment and your local clerk for information about your property taxes.

Information in this publication was prepared by the Wisconsin Department of Revenue’s Oce of Technical and

Assessment Services.

II. General Property

Dened by state law, general property includes all taxable property, except property taxed under special provisions

(ex: utility, forest crop, woodland tax, and managed forest property).

A. Real property, real estate, and land

The land and all buildings, improvements, xtures, and rights and privileges connected with the land.

B. Uniform property tax

Article VIII of the state constitution requires the uniform taxation of property. Article VIII also provides the following

property taxation standards:

• Legislature prescribes taxes on forest property

• Taxation of agricultural land and undeveloped land does not need to be uniform with the taxation of other

real property

The state legislature enacts all property tax and assessment laws. The property tax assessment laws are covered in

ch. 70, Wis. Stats.

C. Taxable/nontaxable property

All property is taxable unless exempted by state law. Common property types exempt

by state law:

• State and municipal property

• Public and private school property

• Cemeteries

• Property used for abatement of air and water pollution

• Household furniture and furnishings

• Manufacturing machinery specic processing equipment

• Apparel and musical instruments for personal use

• Money, bonds and stocks

• Motor vehicles and aircraft

• Livestock, inventories and merchant’s stocks

• Computers and electronic peripheral equipment

Back to table of contents

5

2024 Guide for Property Owners

Wisconsin Department of Revenue

Obtaining an exemption

• Sec. 70.109, Wis. Stats., provides for a presumption of taxability. Exemptions shall be strictly construed, with the

burden of proof resting with the entity claiming the exemption.

• Secs. 70.11, 70.111, and 70.112, Wis. Stats., list property eligible for a property tax exemption

• To obtain an exemption from property tax, most exemptions under sec. 70.11, Wis. Stats., require a Property Tax

Exemption Request Form (PR-230). File the form with the municipal assessor where the property is located by

March 1. On the form, the property owner requests an exemption under a specic state law and the property in

question must meet the requirements of that state law to receive an exemption.

• See the Unlawful tax claim section in this guide for information on the process to contest taxability

• See Chapters 19 and 21 of the WPAM for more information

III. Assessment and Its Purpose

An assessment is the value an assessor places on your property. This value determines what portion of the local

property tax levy is covered by your property.

An assessed value is the value a local assessor places on taxable property. Under state law, all non-agricultural

assessments must be based on the property’s market value as of January 1. State law recognizes every municipality

cannot be assessed at market value each year. The law requires each municipality is within 10% of market value

once every ve years. Assessed values are used to distribute the municipality’s tax burden among the individual

property owners.

The assessor of each taxation district determines the assessed value of all taxable property, with the exception

of manufacturing property. The Wisconsin Department of Revenue (DOR) annually assesses all manufacturing

property in the state. The assessor is appointed or elected at the local level. When the assessor completes the

assessments, the Assessor’s Adavit (PA-533) is signed and attached to the assessment roll as required by law. Both

are then turned over to the BOR. State law also provides for establishing county assessors. Currently, there is no

county with a county assessor in Wisconsin.

IV. Assessors

A. Certication

State law requires certication of assessors by DOR. Certication involves an exam that tests their knowledge of

appraisal and assessment law and administration. While there is no formal training required, assessors must show

that they have acquired the knowledge essential to do a satisfactory job through successful completion of the

certication exam.

In addition, many assessors in Wisconsin are active in professional organizations with established professional

standards for assessors and appraisers. The municipally employed assessor and the independently contracted

assessor and their sta (except clerical help) must have a current assessor certication at the appropriate level.

Five levels of assessor certication

1. Assessment technician

2. Property appraiser

3. Assessor 1

4. Assessor 2

5. Assessor 3

Back to table of contents

6

2024 Guide for Property Owners

Wisconsin Department of Revenue

B. Wisconsin Property Assessment Manual (WPAM)

The WPAM species technical, procedural and administrative practices. It also denes procedures, policies, legal

decisions and assessor performance expectations.

State law (sec. 73.03, Wis. Stats.) provides DOR with the authority to prepare and publish the WPAM. The law

requires DOR to prepare a manual that discusses and illustrates accepted assessment methods, techniques and

practices with a view to more nearly uniform and consistent assessments of property at the local level. It also

requires that the manual be amended by DOR from time to time to reect advances in the science of assessment,

court decisions concerning assessment practices, statutory changes, costs, and statistical and other information

deemed valuable to local assessors by DOR.

V. Assessment Process

A. Municipal assessor is responsible for the assessment process

• Discover – all property is subject to tax unless exempted by law

• List – property characteristics determine value

• Value – determine the value subject to property tax

B. Assessment classications of real property

State law requires the assessor to classify land on the basis of use. Classication aects the assessed value.

Beginning with assessments as of January 1, 2017, 2017 Wisconsin Act 115 created the following provision for

drainage district corridors: "…the assessor shall assess the land within a district corridor described under sec. 88.74

in the same class under sub. (2)(a) as the land adjoining the corridor, if the adjoining land and the land within the

corridor are owned by the same person."

Drainage districts are local governmental entities organized under a county drainage board for the primary

purpose of draining lands for agriculture. A drainage district establishes a legal mechanism for managing drains

and related facilities to ensure reliable drainage. Landowners who benet from drainage must pay assessments

to cover the cost of constructing, maintaining, and repairing district drains. As of June 2021, the Wisconsin

Department of Agriculture, Trade and Consumer Protection (DATCP) stated there were 190 districts located in 27

counties. See DATCP’s drainage district website for additional information including an interactive map.

Eight statutory classications for real property

• Residential (class 1) – sec. 70.32(2)(c)3., Wis. Stats.

» Any parcel (or part of a parcel) of untilled land not suitable for the production of row crops, on which a

dwelling or other form of human abode is located

» Vacant land where the most likely use is residential development

» Mobile homes assessed as real property are classied as residential

» Apartment buildings of up to three units are also classied as residential

• Commercial (class 2)

» Land and improvements primarily devoted to buying and reselling goods

» Includes the providing of services in support of residential, agricultural, manufacturing and forest uses

• Manufacturing (class 3)

» State law (sec. 70.995, Wis. Stats.) provides for the state assessment of manufacturing property

» Contact the Manufacturing Bureau District Oce for information on qualifying uses

Back to table of contents

7

2024 Guide for Property Owners

Wisconsin Department of Revenue

• Agricultural (class 4)

» State law (sec. 70.32(2)(c)1g., Wis. Stats.) describes this as "land, exclusive of buildings and improvements,

which is devoted primarily to agricultural use"

» Land devoted primarily to the production of crops (excluding forestry operations) or the keeping, grazing,

or feeding of livestock

» Buildings and dwellings associated with growing, production and associated services are classied as

class 7– other

» Agricultural Assessment Guide for Wisconsin Property Owners provides classication examples

• Undeveloped (class 5) – sec. 70.32(2)(c)4., Wis. Stats.

» Areas commonly called marshes, swamps, thickets, bogs or wet meadows

» Fallow tillable land (assuming agricultural use is the land’s highest and best use)

» Road right-of-way, ponds and depleted gravel pits

» Land because of soil or site conditions is not producing or capable of producing commercial forest products

• Agricultural forest (class 5m)

» State law (sec. 70.32(2)(c)1d, Wis. Stats.) denes agricultural forest as land producing or capable of producing

commercial forest products, if the land satises any of the following:

- Forest land is contiguous to a parcel that is classied in whole as agricultural land. The forest land and the

contiguous agricultural parcel must have the same owner. Contiguous includes separated only by a road.

- Forest land is located on a parcel containing agricultural land for the January 1, 2004 assessment and on

January 1 of the current assessment year

- Forest land is located on a parcel where at least 50% of the acreage was converted to agricultural land for

the January 1, 2005 assessment year or thereafter

» Agricultural Assessment Guide for Wisconsin Property Owners provides classication examples

• Productive forest land (class 6) – sec. 70.32(2)(c)2., Wis. Stats.

» Land producing or capable of producing commercial forest products. Forest land cannot include buildings

and improvements.

» Forested areas that are managed or set aside to grow tree crops for "industrial wood" or to obtain tree

products (ex: sap, bark, seeds)

» Forested areas with no commercial use made of the trees, including cutover

» Cherry orchards, apple orchards and Christmas tree plantations are classied as agricultural property

» Lands designated forest crop land and managed forest land by the Department of Natural Resources are

entered separately in the assessment roll

» Improvements on forest crop lands and managed forest land must be listed as real property under state law

(secs. 77.04(1) and 77.84, Wis. Stats.)

» Forested areas primarily held for hunting, trapping or in the operation of game preserves, must be classied

as forest, unless clearly operated as a commercial enterprise or exempt

• Other (class 7) – sec. 70.32(2)(c)1m., Wis. Stats.

Buildings and improvements on a farm (ex: houses, barns and silos along with the land necessary for their

location and convenience)

C. Property information

Wisconsin has an annual assessment. This means that each year’s assessment is a new assessment. The assessor

is not obligated to keep the same assessment each year. The assessor may change your assessment because of

building permits or sales activity even if the assessor did not inspect your property.

Back to table of contents

8

2024 Guide for Property Owners

Wisconsin Department of Revenue

State law requires property be valued from actual view or from the best information that can be practicably

obtained. An interior inspection results in a better-quality assessment; however, it is not always possible to conduct

interior inspections. To ensure receiving a complete and accurate valuation, it benets the property owner to

provide interior viewing access of their residence. For the purposes of valuation, if access is denied, the assessor

will then base the valuation on the next best information available. However, if facts exist making an interior view

necessary to complete an accurate valuation, the assessor may seek a special inspection warrant under state law

(sec. 66.0119, Wis. Stats.), to view the interior of the home.

1. Notication process with Request to View Property Notice

Secs. 70.05(4m) and (4n), Wis. Stats. require assessors to provide property owners written notice when requesting

an interior view of the residence. DOR recommends sending a letter, allowing 14 calendar days for a response. If

the assessor does not receive a response, they may attempt in-person contact to obtain consent. If that step is

unsuccessful, the assessor may send a certied letter including the notice. If an interior view remains necessary to

complete an accurate valuation, refusal of entry can provide basis for seeking a special inspection warrant.

2. Sale of the property

• When a property sells, the assessor must review the sale

• Assessor veries the facts surrounding the sale to determine if it is an arm’s-length sale and usable for assessment

purposes, this may include an interior inspection (requiring notice to the property owner) of the property

• Assessor uses sales to update assessments in a municipality when conducting a revaluation (Reassessment/

Revaluation)

3. New construction and improvement maintenance

• Under state law, the assessment must be based on the market value of the improvement. The assessor looks at

how much the total value of the building and land changed due to the improvement. The cost may not be the

true measure of any change in market value. If there is an increase in market value, it should be reected in an

increase in assessed value.

• If a building is under construction as of January 1, the best way for the assessor to get this information is with an

on-site inspection and recording the data on the appropriate property record card

• Onsite inspection reveals new or remodeled improvements not previously recorded

• If the property owner started new or remodeled improvements before January 1 (the assessment day) and

nished after January 1, the assessor must nd out how much was completed as of January 1 and assess the

existing improvements as of January 1

• Normal home repairs and maintenance generally prevent property values from falling and usually do not

warrant a change in the assessment

Example: A property is worth $90,000. As of January 1, the property owner started an addition, but only has a

foundation. The property should be appraised at the $90,000 plus the value of the foundation as of January 1. In

such a case, the value of the foundation should be determined by the construction cost and could possibly be

veried with construction receipts or the building permit.

D. Information used to determine assessments

Assessors consider information from many sources to determine your assessment.

1. Recent arm’s-length sales

Under state law, the best indicator of market value is a recent arm’s-length sale of a property provided it is in line

with recent arm’s-length sales of reasonably comparable property.

The assessor may not change the assessment of property based solely on the recent arm’s-length sale of property

without adjusting the assessed value of comparable properties in the same market area.

• Sales should be recent – those several years old may not reect current market conditions

Back to table of contents

9

2024 Guide for Property Owners

Wisconsin Department of Revenue

• Sales must be arm’s-length – there should be no relationship between the buyer and seller aecting the sales

price (ex: sales between relatives are typically not arm’s-length sales)

• Buyer and seller are typically motivated

• Both parties are well informed or well advised, and are acting in what they consider their own best interests

• Reasonable time is allowed for exposure in the open market

• Payment is made in terms of cash in U.S. dollars or in terms of comparable nancial arrangements

• Price represents the normal consideration for the property sold unaected by special or creative nancing or

sales concessions granted by anyone associated with the sale

2. Recent arm’s-length sales of reasonably comparable property

If you did not recently purchase the property, the next best evidence is recent arm’s-length sales of reasonably

comparable property.

• Comparable properties are those similar to your property in location, style, age, size and other features

• Example: You own a ranch home built in 1962 that has 1,200 square feet, three bedrooms, one full bath and one

half bath, a two-car garage, and is on a level 7,200 square foot lot

» You should try to nd recent arm’s-length sales of property in your area with the same or similar features

» The more features of the sale properties that are the same as your property, the stronger the indication that

these sales prices represent your home’s market value

• Assessor should be able to tell you what comparable sales they used to determine the market value of your property

3. No recent arm’s-length comparable sales

When there are no recent arm’s-length comparable sales, the value may be estimated using other available

information. This may include sales of less comparable properties, asking prices, cost and income approaches to

value, options to purchase, recent appraisals of your property, and insurance estimates.

E. Notice of Changed Assessment

Under state law (sec. 70.365, Wis. Stats.), whenever an assessor changes the total assessment of any real property

by any amount, the owner must be notied. The assessor is not required to provide notice if land is classied

as agricultural land, as dened in sec. 70.32(2)(c)1g., Wis. Stats., for the current year and previous year and the

dierence between the assessments is $500 or less. However, failure to receive a notice does not aect the validity

of the changed assessment.

The notice must be in writing and mailed at least 15 days (30 days in revaluation years) prior to the BOR meeting

(or meeting of the Board of Assessors if one exists). The notice contains the changed assessment amount and

the time, date and place of the local BOR (or Board of Assessors) meeting. The notice must include information

notifying the owner of the procedures to use to object to the assessment.

F. Equitable assessment

If your property’s assessment ratio is similar to the assessment level of the taxation district (see the Glossary section

of this guide), then your assessment is equitable. To determine your property’s assessment ratio, divide your

property’s assessed value by your property’s current market value.

Your Property’s Assessed Value

= X%

Current Market Value of Your Property

To make a sound decision, you must know your property’s assessed value, current market value and the

assessment level of the taxation district.

Back to table of contents

10

2024 Guide for Property Owners

Wisconsin Department of Revenue

G. Assessment of personal property

Eective with the January 1, 2024, assessment, 2023 Wisconsin Act 12 created sec. 70.111(28), Wis. Stats., which

exempts personal property. The exemption applies to:

• Personal property as dened in sec. 70.04, Wis. Stats.

• Steam and other vessels, furniture, and equipment

The exemption does not apply to:

• Real property as dened in sec. 70.03, Wis. Stats.

• Buildings, improvements and xtures on leased land, exempt land, managed forest land that is assessed as real

property under sec. 70.17(3), Wis. Stats.

Act 12 amended 70.17(1), Wis. Stats. and removed the option of assessing improvements on leased land as

personal property or real property. Starting with the 2024 assessment, improvements on leased land must be

assessed as real property. State law provides two processes to list and value buildings, improvements, and xtures

that are on leased land, exempt land, forest cropland and managed forest land.

Processes include:

1. Update the existing parcel’s listing and value to include all buildings, improvements & xtures

» Assessor updates the existing parcel’s real property listing and valuation to include the land and all

buildings, improvements, xtures and rights and privileges appertaining thereto.

» Listing and valuation includes:

- Manufactured and mobile homes (unless subject to a parking permit fee under sec. 66.0435(3), Wis. Stats.,

or otherwise exempt under a state law discussed below.)

- Buildings, improvements, and xtures on leased lands, on exempt lands, or on DNR forest program land

(managed forest land)

» Parcel owner:

- Receives the Notice of Changed Assessment

- Is able to appeal the assessment

- Receives the tax bill

2. Create a separate parcel for the buildings, improvements & xtures

» The property owner may create a separate parcel through a certied survey map, subdivision plat or

condominium plat that contain parcel descriptions and are recorded with the ROD

- See the Register of Deeds Association website for a recording document specic to a building,

improvement or xture

- Contact the County Real Property Lister where the property is located to determine what process may

work best for the property

» The municipality may create a separate parcel through the assessor plat process

» Each land parcel owner and each building, improvement or xture parcel owner:

- Receive a separate Notice of Changed Assessment specic to the parcel

- Is able to appeal the assessment specic to the parcel

- Receives a separate tax bill specic to the parcel

See the Unlawful tax claim section of this Guide for information on the process to contest taxability. See DOR’s

Personal Property Exemption Common Questions and Chapter 18 of the WPAM for additional information.

Back to table of contents

11

2024 Guide for Property Owners

Wisconsin Department of Revenue

VI. Manufactured and Mobile Homes

State law (sec. 70.17(3), Wis. Stats.) requires real property assessment of manufactured and mobile homes unless

subject to a monthly municipal permit fee or exempt from monthly municipal permit fees and property tax.

A. Denitions

• Mobile home – "That which is, or was as originally constructed, designed to be transported by any motor

vehicle upon a public highway and designed, equipped and used primarily for sleeping, eating, and living

quarters, or is intended to be so used; and has the meaning given in sec. 101.91(10), Wis. Stats. and includes any

additions, attachments, annexes, foundations and appurtenances."

• Manufactured home – dened by state law (sec. 101.91(2), Wis. Stats ), for property taxation as: a structure

that is designed to be used as a dwelling with or without a permanent foundation and that is certied by the

federal department of housing and urban development as complying with the standards established under 42

USC 5401 to 5425 and includes any additions, annexes, foundations and appurtenances

• Camping trailer and recreational mobile home – state law (sec. 70.111(19)(a), Wis. Stats.) denes

camping trailers by reference to sec. 340.01(6m), Wis. Stats. as "a vehicle with a collapsible or folding structure

designed for human habitation and towed upon a highway by a motor vehicle"

State law (sec. 70.111(19)(b), Wis. Stats.) denes recreational mobile home by reference to sec. 66.0435(1)

(hm), Wis. Stats.

a. Prefabricated structure that is no larger than 400 square feet

b. Certied by the manufacturer as complying with the code promulgated by the American National Standards

Institute as ANSI A119.5

c. Designed to be towed and used primarily as temporary living quarters for recreational, camping, travel, or

seasonal purposes

B. Exempt mobile and manufactured homes

Some mobile and manufactured homes are exempt from property tax. State law (sec. 70.111(19), Wis. Stats.),

exempts camping trailers and certain recreational mobile homes from taxation. A November 2020 Wisconsin Tax

Appeal Commission decision ruled secs. 70.111(19)(b), and 66.0435(1)(hm), Wis. Stats. exempt recreational mobile

homes (RMH) whether or not the RMH is attached to the real estate.

1. Recreational mobile homes (RMH)

• Exemption applies to:

» RMHs dened in sec. 66.0435(1)(hm), Wis. Stats.

» Steps and a platform, not exceeding 50 square feet that lead to a doorway of a RMH

• Exemption does not apply to:

» Land where the RMH is located

» Other additions, attachments, decks or patios (ex: garages, foundations, sheds)

» RMH that is a prefabricated structure that exceeds 400 square feet or is not certied by the manufacturer as

complying with the code promulgated by the American National Standards Institute as ANSI A119.5

» RMH that is not designed to be towed and used primarily as temporary living quarters

• Measuring a mobile home for exemption:

» Total square footage (rounded to the nearest square foot) should be calculated using the outside length and

width of the mobile, including the area of any additions and attachments

» Only additions and attachments that are clearly attached to the recreational mobile home are included in the

calculation of total square footage

Back to table of contents

12

2024 Guide for Property Owners

Wisconsin Department of Revenue

» Length and width of a mobile home or manufactured home should not include the excess measurements

caused by the protrusion of corner caps and end caps as this could inuence the exemption determination

» Freestanding structures (appurtenances) should not be included in the mobile home or manufactured home

area calculation

» Square footage disagreements should rst be discussed with the assessor .

2. Camping trailers

Sec. 70.111(19)(a), Wis. Stats. exempts camping trailers as dened in sec. 340.01(6m), Wis. Stats. – "a vehicle with a

collapsible or folding structure designed for human habitation and towed upon a highway by a motor vehicle."

• Exemption applies to camping trailers that meet all of the following:

» A vehicle with a collapsible or folding structure

» Designed for human habitation

» And towed upon a highway by a motor vehicle during the year prior to the assessment date (e.g. was towed

on the highway during 2023 for the January 1, 2024, assessment)

• Exemption does not apply to:

» Land where the trailer is located

» Additions, attachments, decks or patios

» Trailers that are not towed upon a highway by a motor vehicle during the year prior to the assessment date

(ex: was not towed on the highway during 2023 for the January 1, 2024, assessment)

3. Vacant until held for sale by a dealer

Vacant mobile or manufactured homes held for sale and owned by a licensed dealer, no matter its location, are

considered merchant’s stock-in-trade and are exempt under state law (sec. 70.111(17), Wis. Stats.). Vacant mobile or

manufactured homes held by the manufactured or mobile home community operator, that is not a licensed dealer

are taxable or subject to a monthly municipal permit fee.

4. Recreational motor homes

State law (sec. 70.112(5), Wis. Stats.), exempts motor vehicles from property taxation. This statute exempts items

such as Winnebago motor homes, Ford campers, and other motorized vehicles known as RVs. Licensed vehicles

and trailers are not considered mobile homes or manufactured homes.

5. Garages, sheds, and other freestanding structures determined to be real property are

assessed as:

• Real estate

• Assessor determines what is an addition and attachment

C. Monthly municipal mobile home permit fee

State law (sec. 70.112(7), Wis. Stats.), exempts from property taxation “every mobile home unit subject to a monthly

parking municipal permit fee.” According to state law, a municipality may enact an ordinance to collect a mobile

home or manufactured home parking monthly municipal permit fee from all units located within the municipality

except for:

• Mobile homes or manufactured homes that are improvements to real property as dened in sec. 70.17(3), Wis.

Stats. Recreational mobile homes and camping trailers per sec. 70.111(19), Wis. Stats.

• Recreational mobile homes located in campgrounds licensed under sec. 97.67, Wis. Stats.

• Mobile homes located on land where the principal residence home owner is located per sec. 66.0435(9), Wis. Stats.

Vacant units that have been repossessed by the nancial institution are not subject to municipal parking fee

under sec. 66.0435(3)(c)9, Wis. Stats., "No monthly municipal permit fee may be imposed on a nancial institution,

Back to table of contents

13

2024 Guide for Property Owners

Wisconsin Department of Revenue

as dened in sec. 69.30(1)(b), Wis. Stats., that relates to a vacant unit that has been repossessed by the nancial

institution."

D. Mobile home assessment appeals

The mobile home or manufactured home owner may appeal the assessment by appearing at the BOR and

presenting sworn testimony as to its true and correct market value. This applies to a mobile home or manufactured

home whether it is assessed as real estate, or subject to the monthly municipal permit fee.

E. Mobile home exemption disputes

Disputes concerning exemption issues are not heard at the BOR. Property owners contesting exemption status may

le a claim of unlawful tax with the municipality by January 31 of the year in which the tax is payable, under state

law (sec. 74.35, Wis. Stats.). If the municipality rejects the claim, a direct appeal may be made to circuit court of the

county in which the property is located.

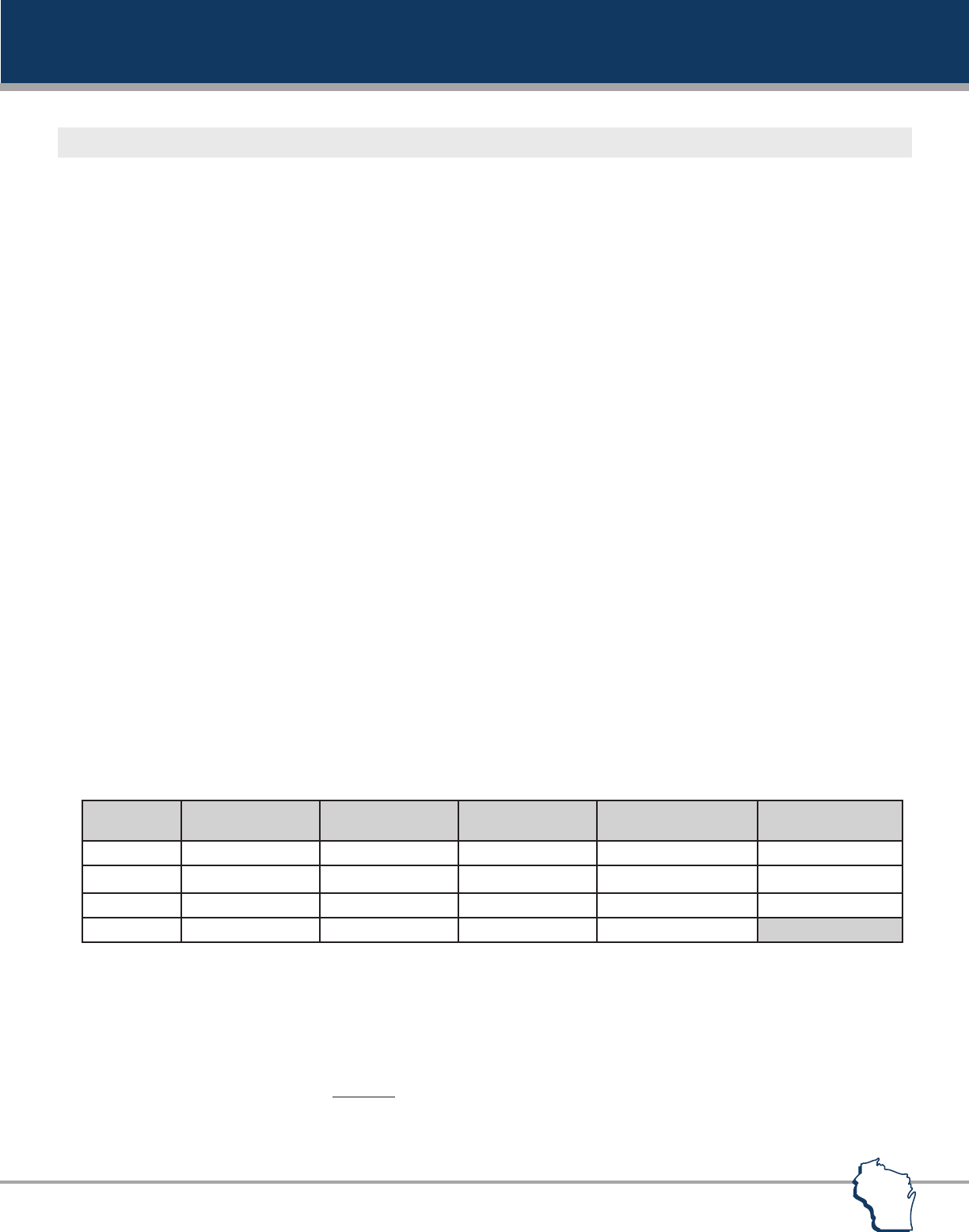

F. Overview of manufactured and mobile home unit property taxes

Item

Unit per

66.0435(1)(j)

Subject to

General Property Tax

Subject to

Municipal Permit Fee

Comments

Unit of any size including

additions

Yes Yes, as real property No

Meets denition in 66.0435

and real property in 70.17(3)

Unit of any size including

additions still on wheels

Yes

Yes, as real property unless

subject to permit fee

Yes, if located in

municipality with

66.0435 permit fee

Meets denition in 66.0435

and real property in 70.17(3).

Subject to permit fee if in

66.0435 community; if subject

to fee, exempt from property

tax under 70.112(7)

Recreational mobile

home or vehicle no larger

than 400 square feet

designed to be towed

and used as temporary

living quarters

Yes

Exempt under 70.111(19)(b) to

include steps and a platform,

not exceeding 50 square feet

leading to a doorway of a

recreational mobile home, does

not apply to any other addition,

attachment, deck, or patio

No, by 66.0435(3)(c)

Meets denition in 66.0435(1)

(hm); and is exempt from

property tax under 70.111(19)

(b); exempt from permit fee

under 66.0435(3)(c).

Camping trailer designed

to expand into a tent

with built-in space for

mattress and other

xtures

No Exempt under 70.111(19)(a) No, by 66.0435(3)(c)

"Pop-up" trailer meets

denition of camping trailer

in 340.01(6m) as trailer

with collapsible or folding

structure towed on the

highway.

Twin-section units

transported on wheels

or dolly and assembled

on site

No Yes No

Not a unit under 66.0435.

Assessable if determined real

property

Buses or vans No Exempt under 70.112(5) No

Motor vehicle exempt from

property tax under 70.112(5)

Vacant unit held for sale

by a dealer

No No No

Considered merchant’s stock

under 70.111(17)

See Chapter 18 of the Wisconsin Property Assessment Manual for additional information.

Back to table of contents

14

2024 Guide for Property Owners

Wisconsin Department of Revenue

VII. Equalized Value

An equalized value is the estimated value of all taxable property in a taxation district, by class, as of January 1

and certied by DOR on August 15 of each year. The value represents market value (most probable selling price),

except for agricultural property, which is based on its use (ability to generate agriculture) and agricultural forest and

undeveloped lands, which are based on 50% of their full value.

It is necessary for DOR to determine an equalized value for each taxing jurisdiction. Equalized values are needed

since property is assessed in dierent taxing districts at dierent percentages of market value. Uniform values

are called equalized values because local levels of assessment are equalized and all non-agricultural property are

valued on an equal basis, 100% of full taxable value.

Note: The assessed value is important for maintaining equity among individual taxpayers within the municipality

while the equalized value maintains equity between municipalities and counties.

A. Uses of equalized value

Equalized values are used for apportioning county property taxes, public school taxes, vocational school taxes and

for distributing property tax relief. Apportioning is the process of dividing the tax levies for each taxing jurisdiction

among all municipalities containing territory in the jurisdiction, based on each district’s total value. For example, a

state levy is apportioned among all municipalities in the state; an individual county’s levy among all municipalities

in the county; and a school levy among the municipalities in the school district.

The value of all property in dierent municipalities (but in the same taxing jurisdiction) must be known to calculate

how much of the total tax levy to apportion to each municipality. The values determined by local assessors cannot

be used to apportion levies among dierent municipalities. To do so would violate the rule of uniformity, since the

assessed values are not comparable among municipalities, whereas the equalized values are all at market value.

Example – this mathematical example helps show how equalized values are used:

• County has within its borders three primary assessment districts: town, city and village

• County wishes to levy a property tax of $40,000

• Since the county has no assessment roll of its own, it will apportion the total levy among the three primary

assessment districts by sending a bill to each of them

• Assessed and equalized value of three primary assessment districts and the county are shown below

Local

Assessed Value

% to County Total

of Assessed Value

Full Value or

Equalized Value

% to County Total

of Equalized Value

Ratio of Assessed

to Equalized Value

Town 2,100,000 28.4% 2,000,000 25.0% 105.0%

City 4,500,000 60.8% 5,000,000 62.5% 90.0%

Village 800,000 10.8% 1,000,000 12.5% 80.0%

County Total $ 7,400,000 100.0% $ 8,000,000 100.0%

Since the county levy is a levy on property, the most logical way to apportion that levy among the districts is

according to the proportionate amount of property in each district.

If the assessed values were used, the apportionment of the county levy would be:

Town 28.4% of $40,000 = $ 11,360

City 60.8% of $40,000 = $ 24,320

Village 10.8% of $40,000 = $ 4,320

Total County Levy $ 40,000

Back to table of contents

15

2024 Guide for Property Owners

Wisconsin Department of Revenue

By using the equalized values, the apportionment of the county levy is changed substantially:

Town 25.0% of $40,000 = $ 10,000

City 62.5% of $40,000 = $ 25,000

Village 12.5% of $40,000 = $ 5,000

Total County Levy $ 40,000

While the example relates only to the apportionment of the county tax, the apportionment of school tax, sanitary

districts and other apportionments follow a similar pattern. There are over 100 statutory uses of equalized values.

B. Assessment compliance

Under state law (sec. 70.05(5)(b), Wis. Stats.), each municipality must assess all major classes of property within

10% of full value in the same year, at least once within a ve-year period. A 'major class' of property is dened

as a property class that includes more than 10% of the full value of the taxation district. If a municipality is non-

compliant after four consecutive years, DOR must notify the municipality of its non-compliance status. DOR issues

the municipality a second non-compliance notice after ve consecutive years of non-compliance, and issues an

order for supervised assessment after six consecutive years of non-compliance.

C. Full value law (sec. 70.05(5), Wis. Stats.)

An example of how DOR monitors compliance under the six-year cycle.

• 2018, 2019, 2020, 2021 – First notice of non-compliance

The municipality has been non-compliant for four consecutive years, DOR issues the rst notice of non-

compliance by November 1, 2021.

• 2022 – Second notice of non-compliance

The municipality has been non-compliant for ve consecutive years, DOR issues the second notice of non-

compliance by November 1, 2022.

• 2023 – Order for supervised assessment

The municipality has been non-compliant for six consecutive years, DOR issues an order for a state supervised

assessment by November 1, 2023.

• 2024 – DOR supervises a revaluation

State supervised assessment completed.

VIII. Reassessment/Revaluation

The term reassessment, under state law (sec. 70.75, Wis. Stats.), means to completely redo the assessment roll. After

receiving a petition, DOR may order a reassessment of all (or any part) of the taxable property in a municipality if its

investigation determines the assessments are not in compliance with the law. DOR appoints one or more persons

to prepare a new assessment roll. The assessment roll, after completion by the appointed person(s), is substituted

for the original assessment roll. The municipality pays all expenses connected with a reassessment.

A revaluation is done by the assessor when the property records are outdated or inaccurate, assessment uniformity

is poor, a full revaluation hasn’t been done for 10 years, or reassessment is required under state law (sec. 70.75, Wis.

Stats.). A full revaluation includes on-site inspections (interior and exterior), measuring and listing all buildings,

taking photos, and sketching buildings.

Back to table of contents

16

2024 Guide for Property Owners

Wisconsin Department of Revenue

A. Initiating a reassessment

Under state law (sec. 70.75, Wis. Stats.), except in rst-class cities (Milwaukee), the owners of at least 5% of the

assessed value of all property in the municipality may submit a written petition to DOR for a reassessment of

the municipality. The basis of the petition must be that the property assessment in the taxation district is not in

compliance with the law and the public interest will be promoted by a reassessment. A petition for reassessment

may be obtained from the Equalization Bureau District Supervisor. The district supervisor can also answer any

questions you may have about circumstances of a potential sec. 70.75, Wis. Stats. petition. It is not necessary for

property owners to have appeared at the BOR to petition for a reassessment.

1. Reassessment details

For a reassessment, the assessment roll in question would be completely redone. The property owners do not have

to appear at the BOR to petition for a reassessment.

DOR holds a public hearing once a petition is veried to contain at least 5% of the assessed value of all property in

the municipality. The public hearing provides property owners and municipal ocials an opportunity to present

evidence for or against a reassessment.

2. DOR investigates the assessment and can:

• Order a reassessment

• Order special supervision of succeeding assessments

• Deny the petition

• Dismiss the petition

See DOR’s Guide for 70.75 Reassessments for more information.

B. Supervised assessment

A supervised assessment is an alternative to a reassessment. Under state law (sec. 70.75(3), Wis. Stats.), one or

more persons are appointed by DOR to assist the assessor in making the assessment for the following year. DOR

supervises the assessment work. The municipality pays all costs involved in a supervised assessment. A supervised

assessment is very similar to a revaluation under sec. 70.055, Wis. Stats., in that new assessment records and

assessed values are created. The previous year’s assessment roll is not aected.

C. Initiating a revaluation

1. A complete revaluation of all taxable property within a municipality is periodically

necessary. There may be several reasons for this, including:

• Current assessment was not made in substantial compliance with the law

• Inequities may exist within property classes

• Inequities may exist between property classes

• Governing body may want updated records to show the physical characteristics of all its taxable property

• Governing body may want an original inventory of all its taxable property

When inequities happen, some property owners are paying more than their fair share of the property taxes and

some are paying less. A complete reassessment or revaluation may be the only remedy. Most property owners are

willing to pay the expenses of a revaluation to be assured that all are paying their fair share of property taxes.

Property owners fear that taxes will go up if a revaluation is done. This may or may not be the case. Taxes are

directly tied to the amount of money that the municipality needs to collect. This is called the levy. If the total levy

remains the same, only those properties that are not presently paying their fair share of the tax burden will pay

more taxes after a revaluation. Properties presently paying more than their fair share will pay less.

Back to table of contents

17

2024 Guide for Property Owners

Wisconsin Department of Revenue

Another area that property owners question is the tax rate. If the assessed values established by a revaluation are

greater than they were before and the tax levy is the same, then the tax rate will be less. For example, if the tax levy

remains unchanged and the total assessed value of the taxation district is doubled, the tax rate will be cut in half.

2. Before/after revaluation

• Before: Levy/(Total Assessed Value) = $200,000/$4,000,000 = .05 or 5%

• After: Levy/(Total Assessed Value)=$200,000/$8,000,000= .025 or 2.5%

D. Trespassing and Revaluation Notice

State law lists the following requirements before entry onto private property or a construction site (not including

buildings, agricultural land or pasture, or livestock connement areas) is allowed, once per year (assessment cycle),

for property tax assessment purposes unless the property owner authorizes additional visits:.

1. Requirements

• Purpose – reason for the entry must be to make an assessment on behalf of the state or a political subdivision

• Date – entry must be on a weekday during daylight hours, or at another time as agreed upon with the property

owner

• Duration – assessor’s visit must not be more than one hour

• Scope – assessor must not open doors, enter through open doors, or look into windows of structures

• Notice – if the property owner or occupant is not present, the assessor must leave a notice on the principal

building providing the owner information on how to contact them

2. Denial of entry

The assessor may not enter the premises if they received a notice from the property owner or occupant denying them

entry. The assessor must leave if the property owner or occupant asks them to leave. (sec. 943.15(1m)(f), Wis. Stats.)

If a reasonable written request (see Notication Process with Request to View Property Notice) to view the property

is refused, the assessor should not enter the property. The assessor may seek a special inspection warrant to view

the property, if necessary. The assessment should be based on the best information available – recent sale of the

subject or comparable properties, building permits, or previous viewings.

Notication must be published or posted before an assessor begins a revaluation. State law (sec. 70.05(5)(b), Wis.

Stats.) provides that before a city, village or town assessor conducts a property revaluation, the city, village or

town must publish a notice on its municipal website stating a revaluation will occur, listing the approximate dates.

The notice should describe the assessor’s authority to enter land, under secs. 943.13 and 943.15, Wis. Stats. If a

municipality does not have a website, it must post the required information in at least three public places within

the city, village or town.

The city, village or town should provide links to the above noted statutory references, so persons visiting the

website can click those links and review the statutes.

Back to table of contents

18

2024 Guide for Property Owners

Wisconsin Department of Revenue

E. Sample Revaluation Notice

A revaluation of property assessments in the (municipality) shall occur for the (year) assessment year. The approximate

dates of the revaluation notices being sent to property owners is expected to be in (month/year). Please also notice that

the Assessor has certain statutory authority to enter land as described in state law (secs. 943.13 and 943.15, Wis. Stats.).

The ability to enter land is subject to several qualications and limitations, as described within the foregoing statutes.

Copies of the applicable statutes can be obtained at public depositories throughout the State of Wisconsin, and from

the Wisconsin State Legislature website or a copy may be obtained from the municipal clerk upon payment of applicable

copying charges.

F. Assessment roll

Each property is described in books called “assessment rolls” that are open for examination at the clerk’s or

assessor’s oce during regular oce hours. You may also view properties other than your own.

Assessment roll contains the following for each property:

• Parcel number (also appears on tax bill)

• Property owner’s name and address

• Legal description of the property

• Assessed values, by class

G. Assessment questions

Contact your assessor if you have questions about your assessment:

• When you meet with your assessor, review your property records and discuss how your assessment was made

• Assessors maintain a record of your property, which includes a physical description and information on how

your assessment was developed

• These property records are considered open records, which means the public has the right to inspect them. This

right does not include information gathered under a pledge of condentiality or where access is restricted by law.

• You may also view the records for other properties

• Discussing your assessment with the assessor may eliminate the need for a formal appeal to the BOR

H. Open Book

Attend the Open Book if you are unable to meet with your assessor – highly recommended

• Open Book refers to a period of time (before BOR begins) when the completed assessment roll is open for

examination

• This period of time is an opportunity to discuss your property value with the assessor and provide reason for

changing the value, if appropriate

• Assessor must be present for at least two hours while the assessment roll is open

• State law (sec. 70.45, Wis. Stats.), requires the municipal clerk (or commissioner of assessments in rst class cities)

to publish or post a notice specifying the open book date(s) at least 15 days (30 days in revaluation years when

combining the Open Book and BOR notices) before the rst day the assessment roll is open for examination

• Instructional materials on appealing your assessment to the BOR should be available at the open book

• At Open Book, the assessor is allowed to make any changes that are necessary to perfect the assessment roll

• When Open Book ends, any changes to the assessment roll (your property value) requires formal process in

front of the Board of Review or circuit court

• Board of Review starts a minimum of seven days after the assessment roll is open for examination (Open Book)

under state law (sec. 70.45, Wis. Stats.) (sec. 70.47(1), Wis . Stats .)

Back to table of contents

19

2024 Guide for Property Owners

Wisconsin Department of Revenue

I. Appealing your assessment

If you disagree with your assessment, under state law (sec. 70.47, Wis. Stats.), you may appeal the assessment.

The BOR is the rst step in the appeal process (except for appeals to properties in cities with a Board of Assessors

(BOA) (see below). There is a local BOR for all property assessed by the local assessor. The Wisconsin Department of

Revenue’s BOA reviews manufacturing property assessed by the state assessors.

You may also appeal the property classication since it aects the assessed value of land classied as agricultural,

undeveloped, and agricultural forest.

Mobile home or manufactured homeowners may appeal their assessment by appearing at the BOR and presenting

sworn testimony as to its true and correct market value. This applies to a mobile home or manufactured home

whether it is assessed as real estate, or subject to the monthly municipal permit fee.

The property owner cannot appeal to the circuit court under an action for certiorari or to DOR under state law (sec.

70.85, Wis. Stats.), unless the property owner rst appears before the BOR.

Sources of information are listed below

• Property’s assessed value is recorded in the assessment roll and is shown on your tax bill

• Purchase price is usually the best evidence of market value if you have recently purchased the property

• Sale price of other property comparable to yours is the next best evidence of market value

• Professionally prepared appraisal is a reliable estimate of market value

• Assessment level of the taxation district – to view, contact the assessor

• Estimated fair market value of your property (determined by dividing your assessment by the assessment level)

is shown on your tax bill

IX. Board of Assessors (BOA)

A. Cities with a BOA

Most Wisconsin cities do not have a BOA. You should call the city assessor or clerk if you are not certain whether

your municipality has a BOA.

• Only rst-class cities (Milwaukee) – are required to have a BOA

• Second-class cities – may decide to provide a BOA

B. BOA information

• BOA consists of members of the assessor’s sta

• BOA investigates assessment complaints

• BOA is an intermediate step in the appeal process to ease the burden on the BOR. Depending on the nature of

the complaint, the BOA may review the assessor’s records, talk to you directly and inspect your property.

• You are required to complete an Objection Form for Real Property Assessment (PA-115A) to initiate a BOA

review. You must answer all the questions on the form and provide all the information relating to the property’s

value, including:

» Purchase price of your property

» Your opinion of market value

» Basis for your opinion

• BOA will notify you of its decision. The time period required for you to receive notication will vary depending

on the workload. Once you receive notication, you have 15 days to provide a notice of intent in writing to

Back to table of contents

20

2024 Guide for Property Owners

Wisconsin Department of Revenue

the commissioner of assessments (rst-class cities) or city assessor (second-class cities) requesting to provide

testimony at the Board of Review (BOR). As previously stated, you must complete a Board of Review Objection

Form (PA-115A) before appearing at the BOR.

• If your municipality does not have a BOA and you feel your assessment is incorrect, your formal appeal begins

with the BOR

X. Board of Review (BOR)

A. Requirements to appeal an assessment to the BOR

• If you intend to le an objection, you must provide the BOR clerk with written or oral notice of intent to le

an objection at least 48 hours before the rst scheduled BOR meeting (or, for a late BOR, the rst scheduled

meeting after the roll is complete) under sec. 70.47(7)(a), Wis. Stats. There is no specic form for your notice.

» BOR may waive the 48-hour notice deadline if it is shown good cause and you submit objection form

(PA-115A) prior to or during the rst two hours of the BOR’s rst scheduled meeting, the BOR may waive the

48-hour notice requirement

» You must le a completed written and signed Objection Form for Real Property Assessment (PA-115A) with

the BOR clerk prior to or during the rst two hours of the BOR’s rst scheduled meeting (or the rst scheduled

meeting after the roll is complete for late BORs)

» You must object to the property’s total value

» If an improved parcel, you cannot object to only the land value or only the improvement value

» Objection forms are available from the local clerk or on DOR’s State Prescribed Forms web page

• BOR may also waive the requirement up to the end of the fth day of the BOR session if you submit proof of

extraordinary circumstances for failing to appear during the rst two hours of the rst scheduled meeting. Sec.

70.47(3)(ak), Wis. Stats., allows the BOR to waive the notice of intent and objection form to the end of the fth day

BOR is responsible for raising and lowering any incorrect valuations and for correcting any errors in the roll.

Note: BOR’s function is not one of valuation, but of deciding if the facts presented, under oath before the BOR, are

valid. All deliberations must be done in open session and the BOR is required to decide each objection by a roll call

vote. If the BOR votes to change an assessment, it must state on the record the amount of the correct assessment

and that the correct assessment is reasonable in light of all relevant evidence received. A Notice of Board of Review

Determination (PR-302) should be sent to property owners as the BOR completes its work.

B. BOR members

Generally, the BOR consists of municipal ocials. In rst-class cities and in all other towns, cities and villages who

pass an ordinance to that eect, the BOR may consist of ve to nine residents of the town, city or village. In most

cases, the municipal clerk also functions as the BOR clerk.

A BOR may not convene unless it includes at least one voting member who attended a BOR training session prior

to the BOR’s rst meeting. Note: Eective 2022, at least one BOR member must complete BOR training each year

under sec. 70.46(4), Wis. Stats.

Each year, the municipal clerk must provide an adavit to DOR stating whether the member training requirement

is fullled.

Back to table of contents

21

2024 Guide for Property Owners

Wisconsin Department of Revenue

C. BOR details

1. BOR is required by law to meet

Each year, during the 45-day period beginning with the fourth Monday in April, but no sooner than seven days

after Open Book. In towns and villages, the BOR meets at the town or village hall, or some other place designated

by the town or village board. If there is no hall, it meets at the clerk’s oce. In towns, it meets in the location the

last annual town meeting was held. In cities, it meets at the council chamber or some other place designated

by the council. In Milwaukee it meets at a place designated by the tax commissioner. All BOR meetings and

deliberations must be publicly held and open to all citizens at all times.

If the assessment roll is not completed, the BOR will adjourn to some future date. At least 15 days (30 days in

revaluation years) before the rst meeting of the BOR, the BOR’s clerk must publish a class 1 notice; post a notice in

at least three public places and place a notice on the door of the town, village or city hall announcing the time and

place of the rst meeting. These notices must also contain the requirements for objecting to an assessment under

state law (sec. 70.47(7) (aa) and (ac) to (af), Wis. Stats.).

2. Holding a BOR

The BOR operates like a court; it hears evidence from you and the assessor before making a decision. The BOR can

act only on sworn evidence presented at the hearing.

During the rst two hours of the BOR’s rst meeting, the assessment roll and other assessment data are open for

examination. The BOR must establish a time for hearing each properly led objection. At least a 48-hour notice

of the hearing time must be given to the objector or the objector’s attorney, and to the municipal attorney and

assessor. When all parties are present and waive the notice, the hearing may be held immediately.

State law allows the BOR to waive the BOR hearing for the property owner to appeal directly to the circuit court.

The BOR determines whether it will waive the BOR hearing. Contact the municipal clerk if you would like to appeal

directly to the circuit court.

State law requirements include:

• Prohibiting a person scheduled to appear before the BOR from contacting or providing information to any BOR

member about their objection

• Providing a notice to the BOR’s clerk at least 48 hours before the rst BOR meeting, stating whether the objector

is asking for removal of a board member from hearing the appeal, identifying the person to be removed and

estimating the length of time of the hearing

• Requiring the objector, when appearing before the BOR, to specify (in writing) an estimate of the property’s

land and improvement value and to specify the information used to arrive at that estimate

• Prohibiting a person from appearing before the BOR if the person or the assessor valued the property using

the income approach unless the owner supplies the assessor with all the income and expense information the

assessor requests

• State law (sec. 70.47(7)(aa), Wis. Stats.) provides that the BOR may deny a hearing to a property owner who

does not allow the assessor to complete an exterior view. However, the Wisconsin Supreme Court expressed

due process concerns regarding a similarly worded statute in Milewski v. Town of Dover, 2017 WI 79, 377 Wis. 2d

38, 899 N.W.2d 303. It is DOR’s recommendation to allow a BOR hearing even if the property owner denied an

interior or exterior view. The lack of access to view, and the credibility of evidence oered can be managed as an

evidentiary issue at a BOR hearing, rather than denying access to the BOR.

3. BOR must correct any assessment errors

The BOR examines the roll and corrects all apparent errors in descriptions or calculations (inadvertently or

otherwise), and adds any omitted property to the roll. The BOR must notify the property owners concerned and

hold hearings before omitted property can be added to the assessment roll and before any other lawful changes

can be made.

Back to table of contents

22

2024 Guide for Property Owners

Wisconsin Department of Revenue

4. BOR cannot address tax issues

The BOR can only hear evidence relating to the assessment or value of your property. The BOR will not hear

evidence or act if your concern is that your taxes are too high.

5. BOR can question accuracy of a property assessment

State law makes no provision for you to appeal another individual’s property assessment. However, if the BOR has

reason to question the accuracy of a property assessment, which is not appealed, the BOR has the authority to

schedule a hearing to review the assessment. The BOR must notify the owner or agent of its intent to review the

assessment, and provide the date, time and place of the hearing. The hearing must be conducted according to the

procedure established in state law (sec. 70.47(8), Wis. Stats.). The BOR may then adjust the assessment based on the

evidence before them.

6. Removal of a BOR member

a. Objectors can remove a BOR member (except in rst- and second-class cities), if either of

these conditions apply:

• Person objecting to his/her assessment requests the removal of a BOR member for any reason – only one

member may be removed for this reason

• Member must show bias or prejudice (ex: a separate pending court action)

BOR members may be removed for other reasons. A municipality must remove any BOR member who has

a conict of interest under a municipality ordinance in regard to the objection. An interested party can also

remove a BOR member for bias when submitting an adavit that states the nature of the bias or prejudice. In

addition, any BOR member who violates the code of ethics for local government ocials under state law (sec.

19.59, Wis. Stats.), by hearing an objection shall recuse himself or herself from the hearing.

b. Request must be made at:

• The time the objector provides his/her written or oral notice of intent to le an objection

• At least 48 hours before the rst scheduled BOR meeting or at least 48 hours before the objection is heard if

the BOR waived the 48-hour notice requirement

The notice must identify the member(s) to be removed.

D. Providing information to the BOR

State law allows the BOR to accept sworn written statements or testimony by telephone from property owners.

The BOR determines whether it accepts information in writing or over the phone. Contact the municipal clerk to

determine if the BOR accepts these forms of information.

The BOR can accept testimony by telephone, upon oath, from all ill or disabled persons. You must be prepared to

present to the BOR a letter from your physician, surgeon, or osteopath conrming your illness or disability. This

letter should be led with your objection form. You may designate a personal representative to appear before the

BOR on your behalf. You must submit a completed agent authorization request with the objection form.

1. Testimony at hearing

Keep in mind, the assessor’s value and classication are presumed correct. You should not make the mistake of

comparing your assessment to other properties. To have the assessment reduced, you must prove the property

is over assessed compared to sales in the municipality. To have the classication changed, you must prove the

property is not classied according to its predominant use.

Under state law (sec. 70.47(7)(ae), Wis. Stats.), if you are planning to protest an assessment, you must provide

the BOR, in writing, your estimate of the land value and all improvements you are objecting . You must specify

the information you used to arrive at that estimate. You should have information on the market value of your

Back to table of contents

23

2024 Guide for Property Owners

Wisconsin Department of Revenue

non-agricultural property, including: a recent arm’s length sale of your property and recent sales of comparable

properties. Other factors include: size and location of the lot, size and age of the building, original cost,

depreciation and obsolescence, zoning restrictions and income potential, presence or absence of various building

components; and any other factors or conditions aecting the property’s market value.

The BOR allows sucient time for the assessor and the objector to present information. The assessor can also

request the BOR to subpoena witnesses to provide sworn testimony.

If you are ling an objection to valuation, you must submit your written objection form before the rst meeting or

during the rst two hours (except, with proof of extraordinary circumstances, an objection may be led up to the

end of the 5th day of the BOR session). The BOR must establish a time for hearing each properly led objection.

At least a 48-hour notice of the hearing time must be given to the objector or the objector’s attorney, and to the

municipal attorney and assessor. When all parties are present and waive the notice, the hearing may be held

immediately.

2. Witnesses/assessor

• Property owner may have witnesses or experts provide sworn testimony on his/her behalf

• Witnesses and experts must be prepared to provide documentation of their testimony

• After you present your evidence and answer any questions, it is the assessor’s turn to present evidence. The

assessor presents evidence to support the assessment and answers questions from BOR members. You will also

have an opportunity to ask the assessor questions.

E. Appeal a BOR decision

A property owner has two ways to appeal a BOR decision. One is appealing to the circuit court under state law (sec.

70.47(13), Wis. Stats.), and the other is appealing to DOR under sec. 70.85, Wis. Stats. If a number of property owners

feel there are severe inequities in the entire assessment roll, they may appeal for a reassessment of the entire

municipality under sec. 70.75, Wis. Stats. (see 70.75 Reassessment Guide).

1. Appeal BOR decision to circuit court

Under state law (sec. 70.47(13), Wis. Stats.), you may appeal a BOR determination by action of certiorari (a court

order to review the written record of the hearing) to the circuit court. The court will not issue an order unless an

appeal is made to the circuit court within 90 days after the you receive notication from the BOR and pay the ling

fee. You must clearly state the improper action of the BOR and cannot submit new evidence. There is no trial for the

appeal to the circuit court, and may not even be a hearing. The court decides the case based solely on the written

record made at the BOR.

There are several limits on the circuit court’s review of the BOR

• Circuit court must presume rightful action by the BOR. The valuation placed on the property is presumed

correct and binding on the BOR in the absence of evidence showing it to be incorrect.

• BOR’s determination will be upheld if there is any substantial basis for it

• If the taxpayer pursues certiorari review, the circuit court’s review is limited solely to review of the BOR record.

The circuit court cannot conduct its own factual inquiry or admit any new evidence. On certiorari review,

the circuit court can consider "(1) whether the BOR’s acted within its jurisdiction; (2) whether the BOR acted

according to law; (3) whether the BOR’s action was arbitrary, oppressive or unreasonable, representing its will

rather than its judgment; and (4) whether the evidence was such that the BOR might reasonably make the order

or determination in question." (see Waste Management of Wisconsin Inc. v. Kenosha County Board of Review, 184

Wis.2d 541 (1994))

Back to table of contents

24

2024 Guide for Property Owners

Wisconsin Department of Revenue

2. Appeal BOR decision to DOR

You may le an appeal to DOR under state law (sec. 70.85, Wis. Stats.), for the current year only, and only if you

contested the property assessment for that year to the BOR.

a. Appealing a BOR decision under state law (sec. 70.85, Wis. Stats.)

• DOR must receive a written complaint (letter) within 20 days after delivery of the BOR determination

or within 30 days after the mailing date on the clerk’s adavit (if there is no return receipt). This date is