CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 1

Truth in Lending Act

1

The Truth in Lending Act (TILA), 15 U.S.C. 1601 et seq., was enacted on May 29, 1968, as title

I of the Consumer Credit Protection Act (Pub. L. 90-321). The TILA, implemented by

Regulation Z (12 CFR 1026), became effective July 1, 1969.

The TILA was first amended in 1970 to prohibit unsolicited credit cards. Additional major

amendments to the TILA and Regulation Z were made by the Fair Credit Billing Act of 1974, the

Consumer Leasing Act of 1976, the Truth in Lending Simplification and Reform Act of 1980,

the Fair Credit and Charge Card Disclosure Act of 1988, the Home Equity Loan Consumer

Protection Act of 1988.

Regulation Z also was amended to implement section 1204 of the Competitive Equality Banking

Act of 1987, and in 1988, to include adjustable rate mortgage loan disclosure requirements. All

consumer leasing provisions were deleted from Regulation Z in 1981 and transferred to

Regulation M (12 CFR 1013).

The Home Ownership and Equity Protection Act of 1994 (HOEPA) amended the TILA. The law

imposed new disclosure requirements and substantive limitations on certain closed-end mortgage

loans bearing rates or fees above a certain percentage or amount. The law also included new

disclosure requirements to assist consumers in comparing the costs and other material

considerations involved in a reverse mortgage transaction and authorized the Federal Reserve

Board to prohibit specific acts and practices in connection with mortgage transactions.

The TILA amendments of 1995 dealt primarily with tolerances for real estate secured credit.

Regulation Z was amended on September 14, 1996 to incorporate changes to the TILA.

Specifically, the revisions limit lenders’ liability for disclosure errors in real estate secured loans

consummated after September 30, 1995. The Economic Growth and Regulatory Paperwork

Reduction Act of 1996 further amended the TILA. The amendments were made to simplify and

improve disclosures related to credit transactions.

The Electronic Signatures in Global and National Commerce Act (the E-Sign Act), 15 U.S.C.

7001 et seq., was enacted in 2000 and did not require implementing regulations. On November

9, 2007, amendments to Regulation Z and the official commentary were issued to simplify the

regulation and provide guidance on the electronic delivery of disclosures consistent with the

E-Sign Act.

In July 2008, Regulation Z was amended to protect consumers in the mortgage market from

unfair, abusive, or deceptive lending and servicing practices. Specifically, the change applied

protections to a newly defined category of “higher-priced mortgage loans” that includes virtually

all closed-end subprime loans secured by a consumer’s principal dwelling. The revisions also

applied new protections to mortgage loans secured by a dwelling, regardless of loan price, and

required the delivery of early disclosures for more types of transactions. The revisions also

1

These reflect FFIEC-approved procedures.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 2

banned several advertising practices deemed deceptive or misleading. The Mortgage Disclosure

Improvement Act of 2008 (MDIA) broadened and added to the requirements of the Board’s July

2008 final rule by requiring early Truth in Lending disclosures for more types of transactions and

by adding a waiting period between the time when disclosures are given and consummation of

the transaction. In 2009, Regulation Z was amended to address those provisions. The MDIA also

requires disclosure of payment examples if the loan’s interest rate or payments can change, as

well as disclosure of a statement that there is no guarantee the consumer will be able to refinance

in the future. In 2010, Regulation Z was amended to address these provisions, which became

effective on January 30, 2011.

In December 2008, the Board adopted two final rules pertaining to open-end (not home-secured)

credit. The first rule involved Regulation Z revisions and made comprehensive changes applicable

to several disclosures required for: applications and solicitations, new accounts, periodic

statements, change in terms notifications, and advertisements. The second was a rule published

under the Federal Trade Commission (FTC) Act and was issued jointly with the Office of Thrift

Supervision and the National Credit Union Administration. It sought to protect consumers from

unfair acts or practices with respect to consumer credit card accounts. Before these rules became

effective, however, the Credit Card Accountability Responsibility and Disclosure Act of 2009

(Credit CARD Act) amended the TILA and established a number of new requirements for open-

end consumer credit plans. Several provisions of the Credit CARD Act are similar to provisions in

the Board’s December 2008 TILA revisions and the joint FTC Act rule, but other portions of the

Credit CARD Act address practices or mandate disclosures that were not addressed in these rules.

In light of the Credit CARD Act, the Board, NCUA, and OTS withdrew the substantive

requirements of the joint FTC Act rule. On July 1, 2010, compliance with the provisions of the

Board’s rule that were not impacted by the Credit CARD Act became effective.

The Credit CARD Act provisions became effective in three stages. The provisions effective first

(August 20, 2009) required creditors to increase the amount of notice consumers receive before the

rate on a credit card account is increased or a significant change is made to the account’s terms.

These amendments also allowed consumers to reject such increases and changes by informing the

creditor before the increase or change goes into effect. The provisions effective next (February 22,

2010) involved rules regarding interest rate increases, over-the-limit transactions, and student

cards. Finally, the provisions effective last (August 22, 2010) addressed the reasonableness and

proportionality of penalty fees and charges and re-evaluation of rate increases.

In 2009, Regulation Z was amended following the passage of the Higher Education Opportunity

Act (HEOA) by adding disclosure and timing requirements that apply to lenders making private

education loans.

In 2009, the Helping Families Save Their Homes Act amended the TILA to establish a new

requirement for notifying consumers of the sale or transfer of their mortgage loans. The

purchaser or assignee that acquires the loan must provide the required disclosures no later than

30 days after the date on which it acquired the loan.

In 2010, the Board further amended Regulation Z to prohibit payment to a loan originator that is

based on the terms or conditions of the loan, other than the amount of credit extended. The

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 3

amendment applies to mortgage brokers and the companies that employ them, as well as to

mortgage loan officers employed by depository institutions and other lenders. In addition, the

amendment prohibits a loan originator from directing or “steering” a consumer to a loan that is

not in the consumer’s interest to increase the loan originator’s compensation.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act)

amended the TILA to include several provisions that protect the integrity of the appraisal process

when a consumer’s home is securing the loan. The rule also requires that appraisers receive

customary and reasonable payments for their services. The appraiser and loan originator

compensation requirements had a mandatory compliance date of April 6, 2011.

The Dodd-Frank Act generally granted rulemaking authority under the TILA to the Consumer

Financial Protection Bureau (CFPB).

Title XIV of the Dodd-Frank Act included a number of

amendments to the TILA, and in 2013, the CFPB issued rules to implement them. Prohibitions on

mandatory arbitration and waivers of consumer rights, as well as requirements that lengthen the

time creditors must maintain an escrow account for higher-priced mortgage loans, were generally

effective June 1, 2013. The remaining amendments to Regulation Z were effective in January

2014.

2

These amendments include ability-to-repay requirements for mortgage loans, appraisal

requirements for higher-priced mortgage loans, a revised and expanded test for high-cost

mortgages, as well as additional restrictions on those loans, expanded requirements for servicers of

mortgage loans, refined loan originator compensation rules and loan origination qualification

standards, and a prohibition on financing credit insurance for mortgage loans. The amendments

also established new record retention requirements for certain provisions of the TILA. On October

22, 2014, the CFPB issued a final rule providing an alternative small servicer definition for

nonprofit entities and amended ability to repay exemption for nonprofit entities. The final rule also

provided a cure mechanism for the points and fees limit that applies to qualified mortgages. The

final rule was effective on November 3, 2014, except for one provision that will be effective on

August 1, 2015.

In 2013, the CFPB also revised several open-end credit provisions in Regulation Z. The CFPB

revised the general limitation on the total amount of account fees that a credit card issuer may

require a consumer to pay. Effective March 28, 2013, the limit is 25 percent of the credit limit in

effect when the account is opened and applies only during the first year after account opening. The

CFPB also amended Regulation Z to remove the requirement that card issuers consider the

consumer’s independent ability to pay for applicants who are 21 or older and to permit issuers to

consider income and assets to which such consumers have a reasonable expectation of access. This

change was effective May 3, 2013, with a mandatory compliance date of November 4, 2013.

In 2013, the CFPB further amended Regulation Z as well as Regulation X, the regulation

implementing the Real Estate Settlement Procedures Act (RESPA), to fulfill the mandate in the

2

The amendment to 12 CFR 1026.35(e) was effective July 24, 2013; the amendments to section 12 CFR 1026.35(b)(2)(iii),

1026.36(a), (b), and (j), and commentary to section 1026.25(c)(2), 1026.35, and 1026.36(a), (b), (d), and (f) in Supp. I to Part

1026, were effective January 1, 2014. These FFIEC examination procedures cover amendments to Regulation Z that were issued by

the CFPB in final form as of January 20, 2015.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 4

Dodd-Frank Act to integrate the mortgage disclosures under TILA and RESPA sections 4 and 5.

Regulation Z now contains two new forms required for most closed-end consumer mortgage

loans. The Loan Estimate is provided within three business days from application, and the

Closing Disclosure is provided to consumers three business days before loan consummation.

These disclosures must be used for mortgage loans for which the creditor or mortgage broker

receives an application on or after August 1, 2015.

3

Format of Regulation Z

The rules creditors must follow differ depending on whether the creditor is offering open-end

credit, such as credit cards or home-equity lines, or closed-end credit, such as car loans or

mortgages.

Subpart A (sections 1026.1 through 1026.4) of the regulation provides general information that

applies to open-end and closed-end credit transactions. It sets forth definitions (§1026.2) and

stipulates which transactions are covered and which are exempt from the regulation (§1026.3). It

also contains the rules for determining which fees are finance charges (§1026.4).

Subpart B (sections 1026.5 through 1026.16) relates to open-end credit. It contains rules on

account-opening disclosures (§1026.6) and periodic statements (§§1026.7-8). It also describes

special rules that apply to credit card transactions, treatment of payments (§1026.10).and credit

balances (§1026.11), procedures for resolving credit billing errors (§1026.13), annual percentage

rate calculations (§1026.14), rescission rights (§1026.15), and advertising (§1026.16).

Subpart C (sections 1026.17 through 1026.24) relates to closed-end credit. It contains rules on

disclosures (§§1026.17 - 20), treatment of credit balances (§1026.21), annual percentage rate

calculations (§1026.22), rescission right (§1026.23), and advertising (§1026.24).

Subpart D (sections 1026.25 through 1026.30) contain rules on oral disclosures (§1026.26),

disclosures in languages other than English (§1026.27), record retention (§1026.25), effect on

state laws (§1026.28), state exemptions (§1026.29), and rate limitations (§1026.30).

Subpart E (sections 1026.31 through 1026.45) Subpart E contains special rules for mortgage

transactions. The rules require certain disclosures and provide limitations for closed-end credit

transactions and open-end credit plans that have rates or fees above specified amounts or certain

prepayment penalties (§1026.32). Special disclosures are also required, including the total annual

loan cost rate, for reverse mortgage transactions (§1026.33). The rules also prohibit specific acts

and practices in connection with high-cost mortgages, as defined in 12 CFR 1026.32(a),

(§1026.34); in connection with closed-end higher-priced mortgage loans, as defined in 12 CFR

3

There are additional regulations that take effect on August 1, 2015, regardless of whether an application has been received on

that date. Specifically, the rule restricts the imposition of fees on a consumer before the consumer has received the Loan Estimate

and indicated an intent to proceed, providing a consumer with a written estimate of terms or costs (prior to providing the Loan

Estimate) without also providing a written statement informing the consumer that the terms or costs may change. The rule also

restricts a creditor from requiring the submission of documents verifying information related to the consumer’s application before

providing the Loan Estimate.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 5

1026.35(a), (§1026.35); and in connection with an extension of credit secured by a dwelling

(§1026.36). Disclosure requirements, effective August 1, 2015, for most closed-end transactions

secured by real property, as required by 12 CFR 1026.19(e) and (f) are also provided

(§§1026.37-38).

Subpart F (sections 1026.46 through 1026.48) relates to private education loans. It contains

rules on disclosures (§1026.46), limitations on changes in terms after approval (§1026.48), the

right to cancel the loan (§1026.47), and limitations on co-branding in the marketing of private

education loans (§1026.48).

Subpart G (sections 1026.51 through 1026.60) relates to credit card accounts under an open-end

(not home-secured) consumer credit plan (except for §1026.57(c), which applies to all open-end

credit plans). This subpart contains rules regarding credit and charge card application and

solicitation disclosures (§1026.60). It also contains rules on evaluation of a consumer’s ability to

make the required payments under the terms of an account (§1026.51), limits the fees that a

consumer can be required to pay (§1026.52), and contains rules on allocation of payments in

excess of the minimum payment (§1026.53). It also sets forth certain limitations on the imposition

of finance charges as the result of a loss of a grace period (§1026.54), and on increases in annual

percentage rates, fees, and charges for credit card accounts (§1026.55), including the reevaluation

of rate increases (§1026.59). This subpart prohibits the assessment of fees or charges for over-the-

limit transactions unless the consumer affirmatively consents to the creditor’s payment of over-the-

limit transactions (§1026.56). This subpart also sets forth rules for reporting and marketing of

college student open-end credit (§1026.57). Finally, it sets forth requirements for the Internet

posting of credit card accounts under an open-end (not home-secured) consumer credit plan

(§1026.58).

Several appendices contain information such as the procedures for determinations about state

laws, state exemptions and issuance of official interpretations, special rules for certain kinds of

credit plans, model disclosure forms, standards for determining ability to pay, and the rules for

computing annual percentage rates in closed-end credit transactions and total-annual-loan-cost

rates for reverse mortgage transactions.

Official interpretations of the regulation are published in a commentary. Good faith compliance

with the commentary protects creditors from civil liability under the TILA. In addition, the

commentary includes more detailed information on disclosures or other actions required of

creditors. It is virtually impossible to comply with Regulation Z without reference to and reliance

on the commentary.

NOTE: The following narrative does not discuss all the sections of Regulation Z, but rather

highlights only certain sections of the regulation and the TILA.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 6

Subpart A – General

This subpart contains general information regarding both open-end and closed-end credit

transactions. It sets forth definitions (§1026.2) and sets out which transactions are covered and

which are exempt from the regulation (§1026.3). It also contains the rules for determining which

fees are finance charges (§1026.4).

Purpose of the TILA and Regulation Z

The TILA is intended to ensure that credit terms are disclosed in a meaningful way so consumers

can compare credit terms more readily and knowledgeably. Before its enactment, consumers

were faced with a bewildering array of credit terms and rates. It was difficult to compare loans

because they were seldom presented in the same format. Now, all creditors must use the same

credit terminology and expressions of rates. In addition to providing a uniform system for

disclosures, the act:

• Protects consumers against inaccurate and unfair credit billing and credit card practices;

• Provides consumers with rescission rights;

• Provides for rate caps on certain dwelling-secured loans;

• Imposes limitations on home equity lines of credit and certain closed-end home mortgages;

• Provides minimum standards for most dwelling-secured loans; and

• Delineates and prohibits unfair or deceptive mortgage lending practices.

The TILA and Regulation Z do not, however, tell financial institutions how much interest they

may charge or whether they must grant a consumer a loan.

Summary of Coverage Considerations

– Sections 1026.1 and 1026.2

Lenders must carefully consider several factors when deciding whether a loan requires Truth in

Lending disclosures or is subject to other Regulation Z requirements. The coverage

considerations under Regulation Z are addressed in more detail in the commentary to Regulation

Z. For example, broad coverage considerations are included under section 1026.1(c) of the

regulation and relevant definitions appear in section 1026.2.

Exempt Transactions – Section 1026.3

The following transactions are exempt from Regulation Z:

• Credit extended primarily for a business, commercial, or agricultural purpose;

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 7

• Credit extended to other than a natural person (including credit to government agencies or

instrumentalities);

• Credit in excess of an annually adjusted threshold not secured by real property or by personal

property used or expected to be used as the principal dwelling of the consumer;

4

• Public utility credit;

• Credit extended by a broker-dealer registered with the Securities and Exchange Commission

(SEC) or the Commodity Futures Trading Commission (CFTC), involving securities or

commodities accounts;

• Home fuel budget plans not subject to a finance charge; and

• Certain student loan programs.

However, when a credit card is involved, generally exempt credit (e.g., business purpose credit)

is subject to the requirements that govern the issuance of credit cards and liability for their

unauthorized use. Credit cards must not be issued on an unsolicited basis and, if a credit card is

lost or stolen, the cardholder must not be held liable for more than $50 for the unauthorized use

of the card. (Comment 3-1)

When determining whether credit is for consumer purposes, the creditor must evaluate all of the

following:

• Any statement obtained from the consumer describing the purpose of the proceeds.

o For example, a statement that the proceeds will be used for a vacation trip would indicate

a consumer purpose.

o If the loan has a mixed-purpose (e.g., proceeds will be used to buy a car that will be used

for personal and business purposes), the lender must look to the primary purpose of the

loan to decide whether disclosures are necessary. A statement of purpose from the

consumer will help the lender make that decision.

o A checked box indicating that the loan is for a business purpose, absent any

documentation showing the intended use of the proceeds could be insufficient evidence

that the loan did not have a consumer purpose.

• The consumer’s primary occupation and how it relates to the use of the proceeds. The higher

the correlation between the consumer’s occupation and the property purchased from the loan

proceeds, the greater the likelihood that the loan has a business purpose. For example,

proceeds used to purchase dental supplies for a dentist would indicate a business purpose.

4

The Dodd-Frank Act requires that this threshold be adjusted annually by any annual percentage increase in the Consumer Price

Index for Urban Wage Earners and Clerical Workers (CPI-W). Accordingly, based on the annual percentage increase in the CPI-

W as of June 1, 2012, the exemption threshold increased from $51,800 to $53,000, effective January 1, 2013.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 8

• Personal management of the assets purchased from proceeds. The lower the degree of the

borrower’s personal involvement in the management of the investment or enterprise

purchased by the loan proceeds, the less likely the loan will have a business purpose. For

example, money borrowed to purchase stock in an automobile company by an individual who

does not work for that company would indicate a personal investment and a consumer

purpose.

• The size of the transaction. The larger the size of the transaction, the more likely the loan will

have a business purpose. For example, if the loan is for a $5,000,000 real estate transaction,

that might indicate a business purpose.

• The amount of income derived from the property acquired by the loan proceeds relative to

the borrower’s total income. The lesser the income derived from the acquired property, the

more likely the loan will have a consumer purpose. For example, if the borrower has an

annual salary of $100,000 and receives about $500 in annual dividends from the acquired

property, that would indicate a consumer purpose.

All five factors must be evaluated before the lender can conclude that disclosures are not

necessary. Normally, no one factor, by itself, is sufficient reason to determine the applicability of

Regulation Z. In any event, the financial institution may routinely furnish disclosures to the

consumer. Disclosure under such circumstances does not control whether the transaction is

covered, but can assure protection to the financial institution and compliance with the law.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 9

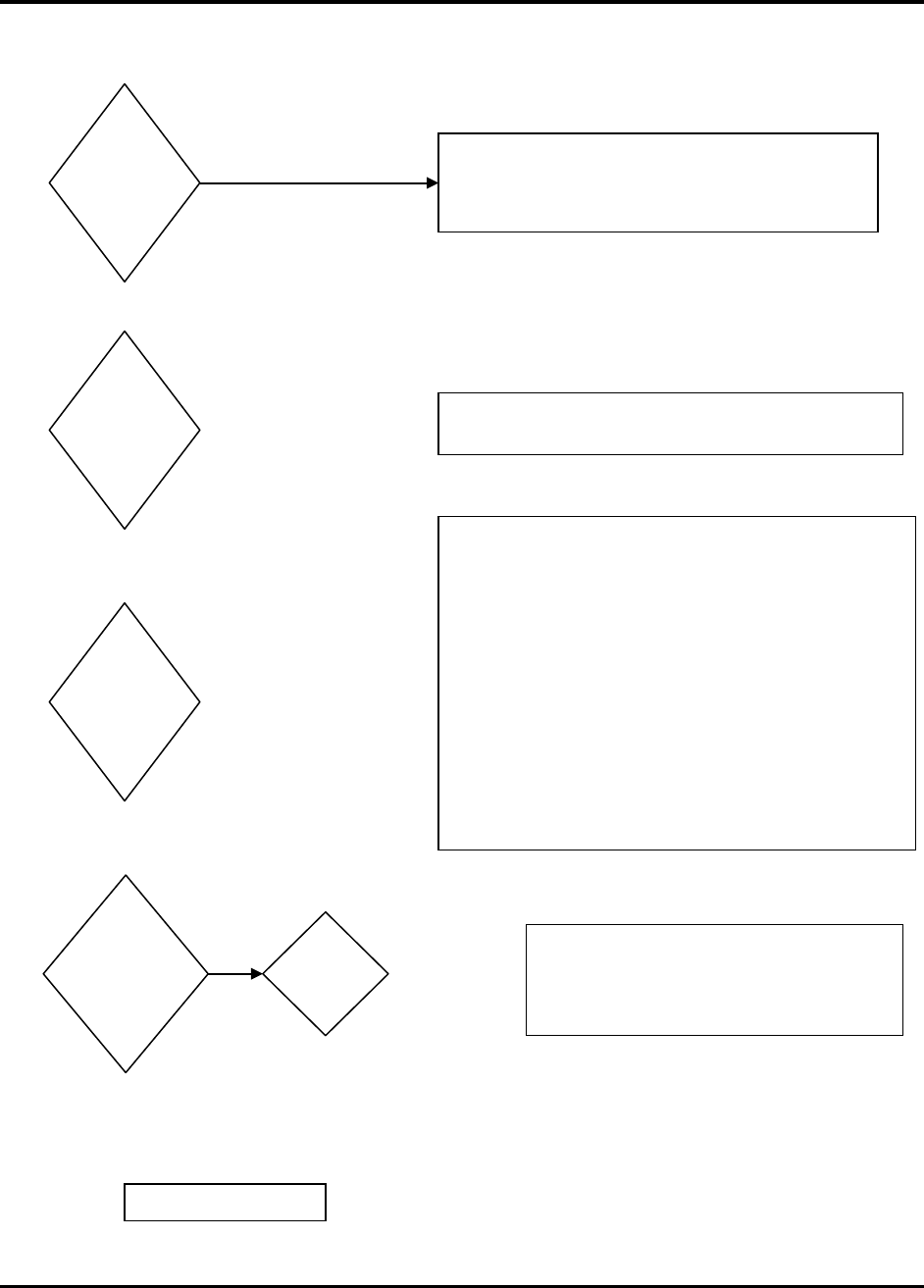

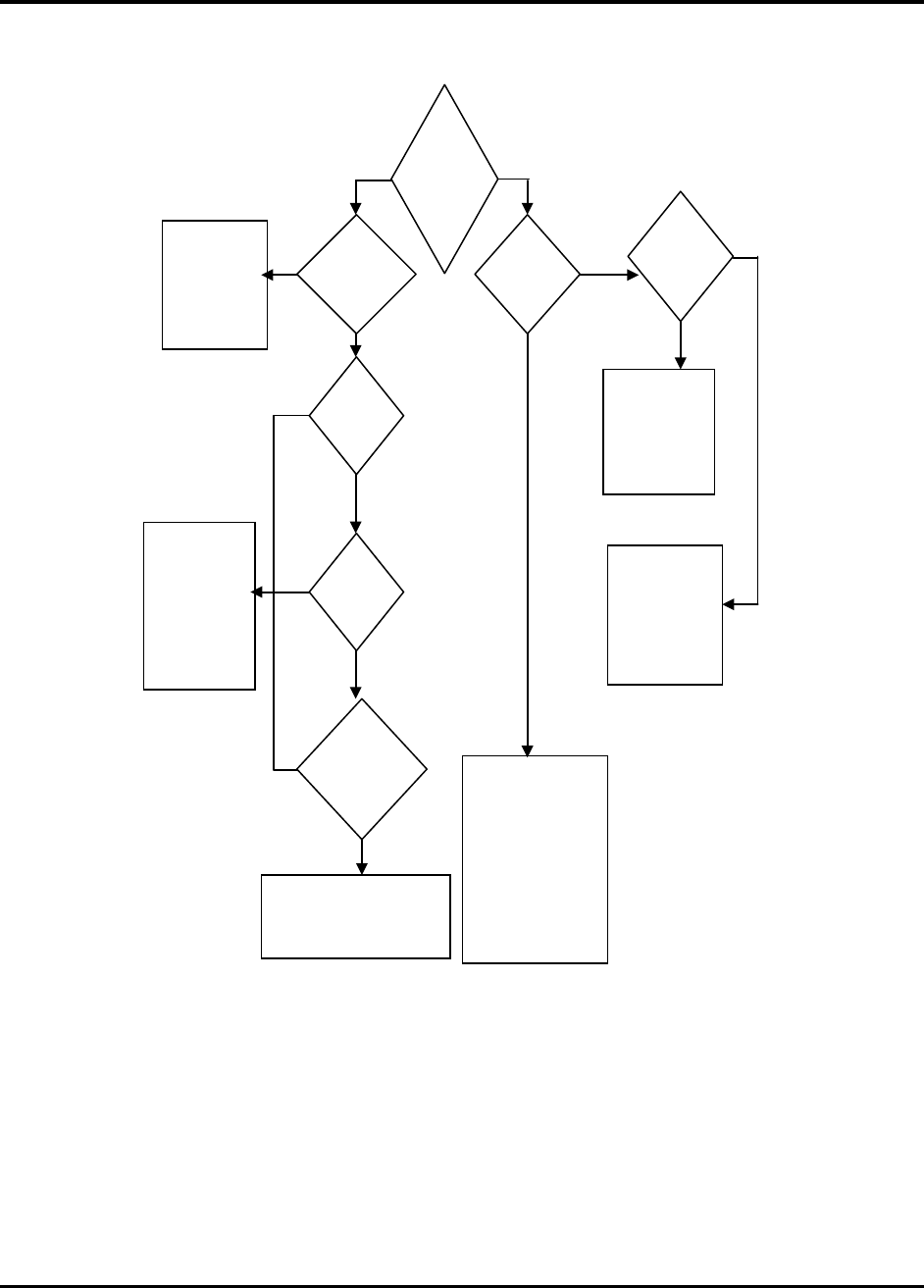

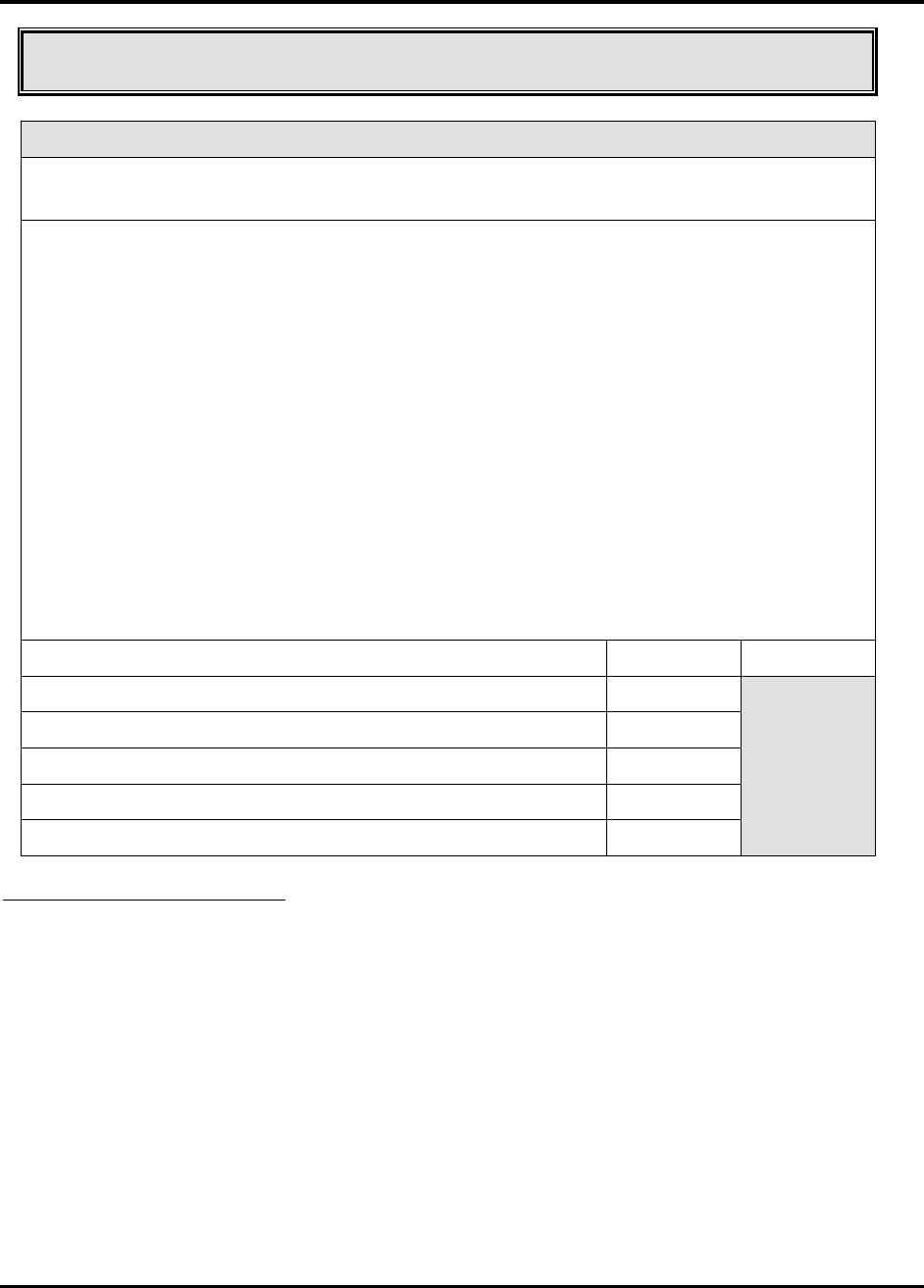

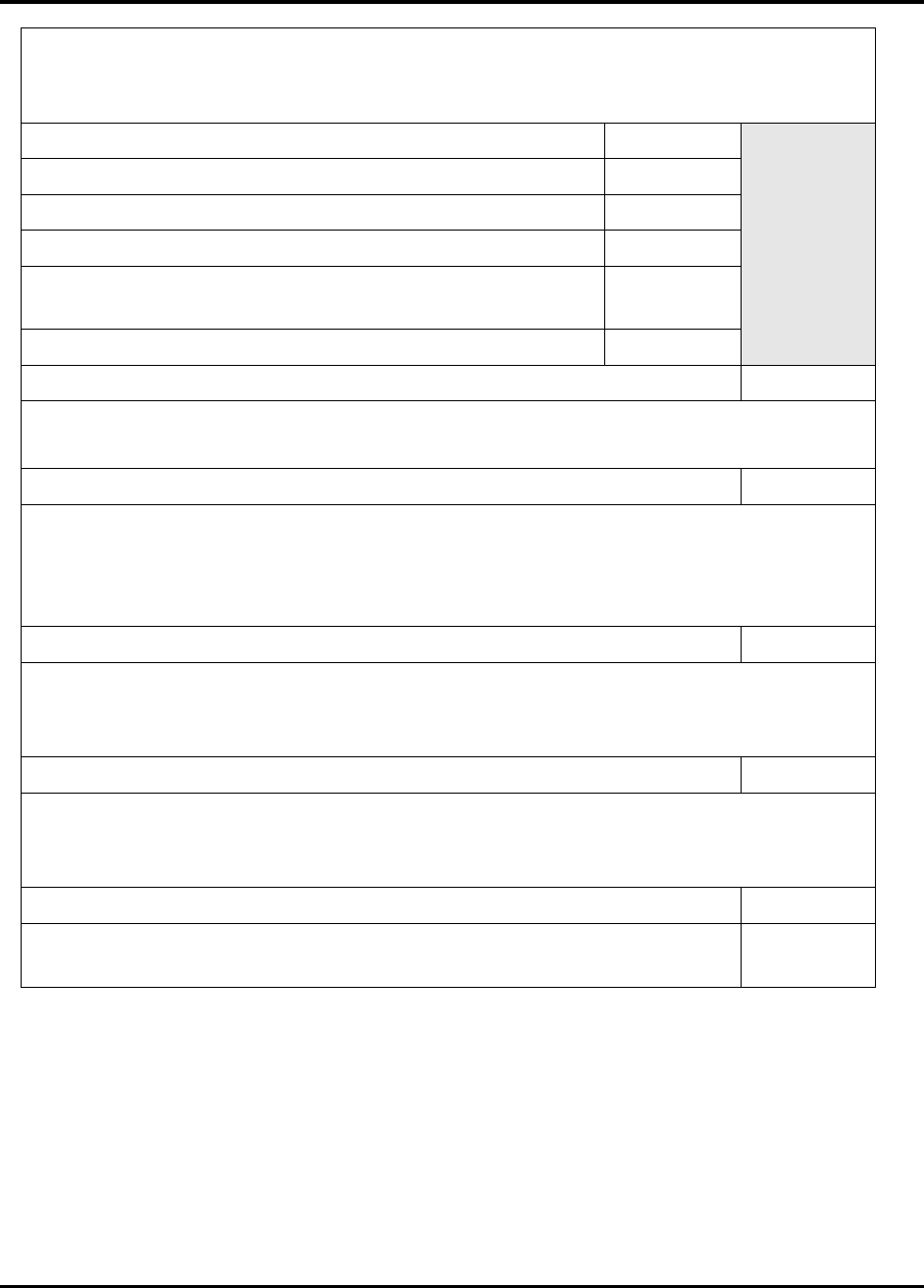

Coverage Considerations under Regulation Z

Yes

No

Yes

No

Yes

No

No

Yes Yes

Regulation Z does not apply, except for the rules of issuance of and

unauthorized use liability for credit cards. (Exempt credit includes loans

with a business or agricultural purpose, and certain student loans. Credit

extended to acquire or improve rental property that is not owner-occupied

is considered business purpose credit.)

No

Is the

purpose of

the credit

for

personal,

family or

household

use?

Regulation Z applies

Is the

consumer

credit

extended to a

consumer?

Is the

consumer

credit

extended

by a

creditor?

Is the loan or

credit plan

secured by

real property

or by a

dwelling?

Is the

amount

financed or

credit limit

$50,000 or

less?

The institution is not a “creditor” and Regulation Z does not apply unless at

least one of the following tests is met:

1) The institution extends consumer credit regularly and

a) The obligation is initially payable to the institution and

b) The obligation is either payable by written agreement in more than four

installments or is subject to a finance charge

2) The institution is a card issuer that extends closed-end credit that is subject to

a finance charge or is payable by written agreement in more than four

installments.

3) The institution is not the card issuer, but it imposes a finance charge at the

time of honoring a credit card.

Regulation Z does not apply, but may apply later if the loan

is refinanced for $53,000 or less. If the principal dwelling is

taken as collateral after consummation, rescission rights will

apply and, in the case of open-end credit, billing disclosures

and other provisions of Regulation Z will apply.

Regulation Z does not apply. (Credit that is extended to a land trust is deemed

to be credit extended to a consumer.)

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 10

Determination of Finance Charge and Annual

Percentage Rate (“APR”)

Finance Charge (Open-End and Closed-End Credit)

– Section 1026.4

The finance charge is a measure of the cost of consumer credit represented in dollars and cents.

Along with APR disclosures, the disclosure of the finance charge is central to the uniform credit

cost disclosure envisioned by the TILA.

The finance charge does not include any charge of a type payable in a comparable cash

transaction. Examples of charges payable in a comparable cash transaction may include taxes,

title, license fees, or registration fees paid in connection with an automobile purchase.

Finance charges include any charges or fees payable directly or indirectly by the consumer and

imposed directly or indirectly by the financial institution either as an incident to or as a condition

of an extension of consumer credit. The finance charge on a loan always includes any interest

charges and often, other charges. Regulation Z includes examples, applicable both to open-end

and closed-end credit transactions, of what must, must not, or need not be included in the

disclosed finance charge (§1026.4(b)).

Accuracy Tolerances (Closed-End Credit)

– Sections 1026.18(d) and 1026.23(g)

Regulation Z provides finance charge tolerances for legal accuracy that should not be confused

with those provided in the TILA for reimbursement under regulatory agency orders. As with

disclosed APRs, if a disclosed finance charge were legally accurate, it would not be subject to

reimbursement.

Under the TILA and Regulation Z, finance charge disclosures for open-end credit must be

accurate since there is no tolerance for finance charge errors. However, both the TILA and

Regulation Z permit various finance charge accuracy tolerances for closed-end credit.

Tolerances for the finance charge in a closed-end transaction, other than a mortgage loan, are

generally $5 if the amount financed is less than or equal to $1,000 and $10 if the amount

financed exceeds $1,000. Tolerances for certain transactions consummated on or after September

30, 1995, are noted below.

• Credit secured by real property or a dwelling (closed-end credit only):

o The disclosed finance charge is considered accurate if it is not understated by more than

$100.

o Overstatements are not violations.

• Rescission rights after the three-business-day rescission period (closed-end credit only):

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 11

o The disclosed finance charge is considered accurate if it does not vary from the actual

finance charge by more than one-half of 1 percent of the credit extended or $100,

whichever is greater.

o The disclosed finance charge is considered accurate if it does not vary from the actual

finance charge by more than 1 percent of the credit extended for the initial and

subsequent refinancings of residential mortgage transactions when the new loan is made

at a different financial institution. (This excludes high-cost mortgage loans subject to

section 1026.32, transactions in which there are new advances, and new consolidations.)

• Rescission rights in foreclosure:

o The disclosed finance charge is considered accurate if it does not vary from the actual

finance charge by more than $35.

o Overstatements are not considered violations.

o The consumer can rescind if a mortgage broker fee that should have been included in the

finance charge was not included.

NOTE: Normally, the finance charge tolerance for a rescindable transaction is either 0.5

percent of the credit transaction or, for certain refinancings, 1 percent of the credit

transaction. However, in the event of a foreclosure, the consumer may exercise the right of

rescission if the disclosed finance charge is understated by more than $35.

See the “Finance Charge Tolerances” charts within these examination procedures for help in

determining appropriate finance charge tolerances.

Calculating the Finance Charge (Closed-End Credit)

One of the more complex tasks under Regulation Z is determining whether a charge associated

with an extension of credit must be included in, or excluded from, the disclosed finance charge.

The finance charge initially includes any charge that is, or will be, connected with a specific

loan. Charges imposed by third parties are finance charges if the financial institution requires use

of the third party. Charges imposed by settlement or closing agents are finance charges if the

bank requires the specific service that gave rise to the charge and the charge is not otherwise

excluded. The “Finance Charge Tolerances” charts within this document briefly summarize the

rules that must be considered.

Prepaid Finance Charges – Section 1026.18(b)(3)

A prepaid finance charge is any finance charge paid separately to the financial institution or to a

third party, in cash or by check before or at closing, settlement, or consummation of a

transaction, or withheld from the proceeds of the credit at any time.

Prepaid finance charges effectively reduce the amount of funds available for the consumer’s use;

usually before or at the time the transaction is consummated.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 12

Examples of finance charges frequently prepaid by consumers are borrower’s points, loan

origination fees, real estate construction inspection fees, odd days’ interest (interest attributable

to part of the first payment period when that period is longer than a regular payment period),

mortgage guarantee insurance fees paid to the Federal Housing Administration, private mortgage

insurance (PMI) paid to such companies as the Mortgage Guaranty Insurance Company (MGIC),

and, in non-real-estate transactions, credit report fees.

Precomputed Finance Charges

A precomputed finance charge includes, for example, interest added to the note amount that is

computed by the add-on, discount, or simple interest methods. If reflected in the face amount of

the debt instrument as part of the consumer’s obligation, finance charges that are not viewed as

prepaid finance charges are treated as precomputed finance charges that are earned over the life

of the loan.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 13

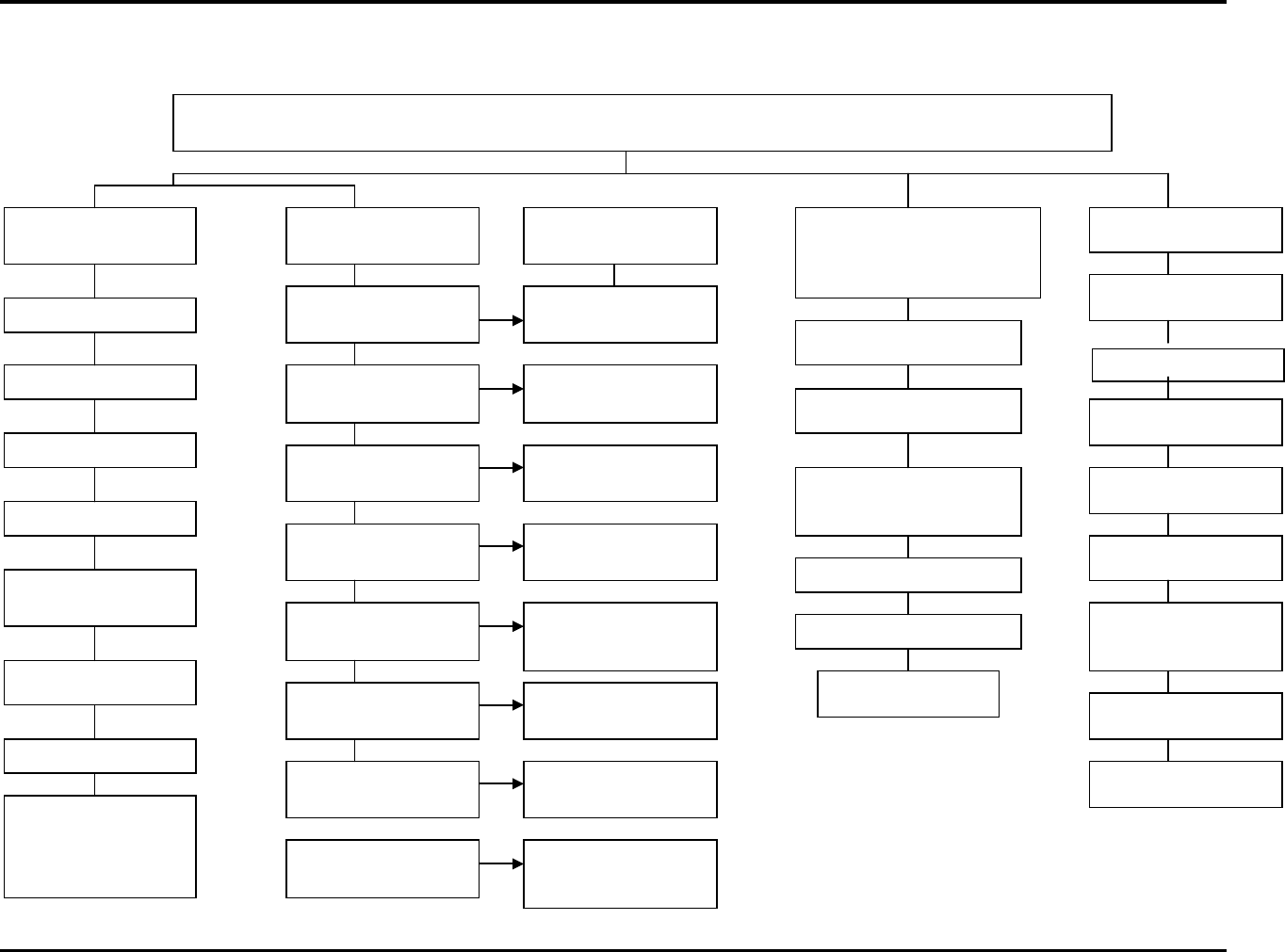

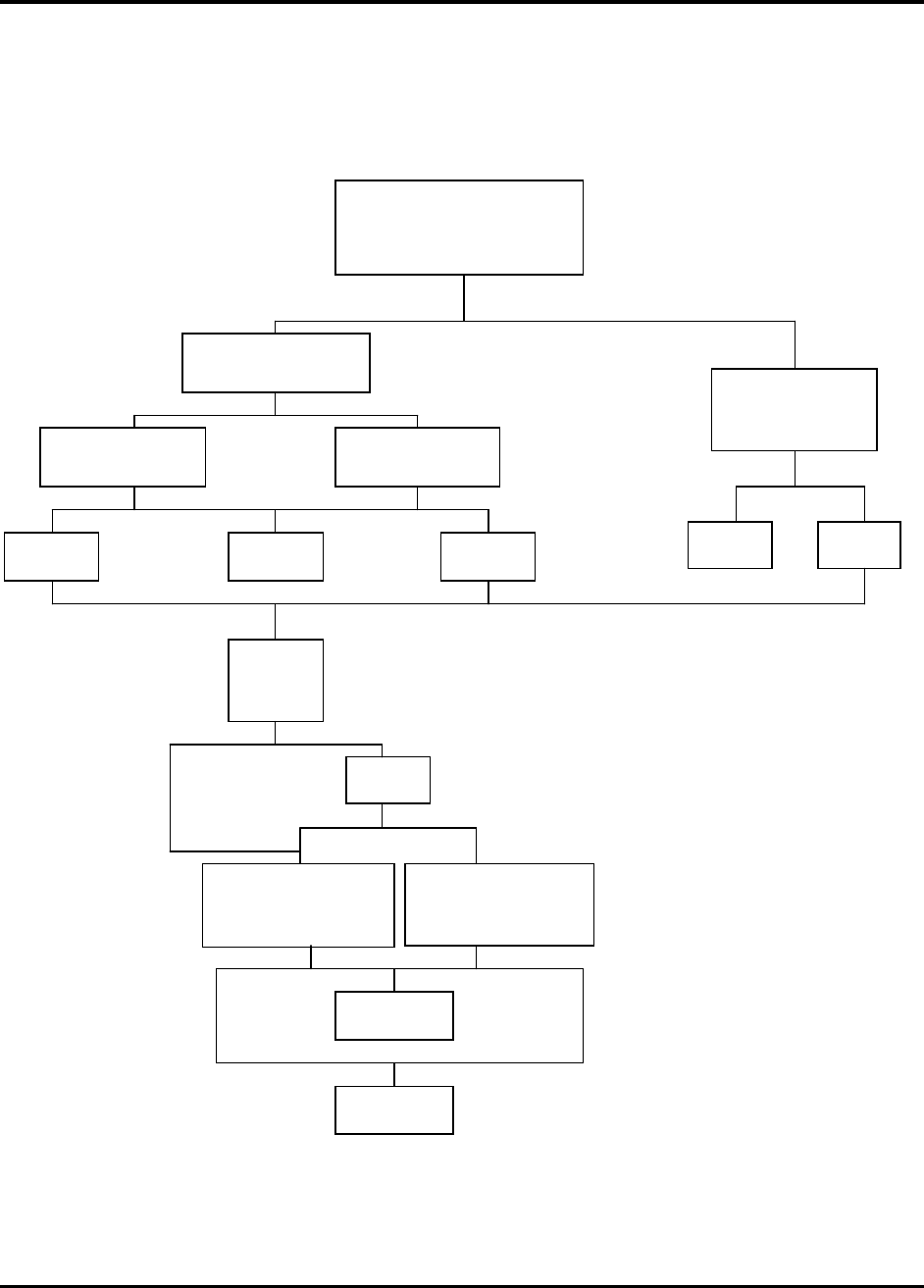

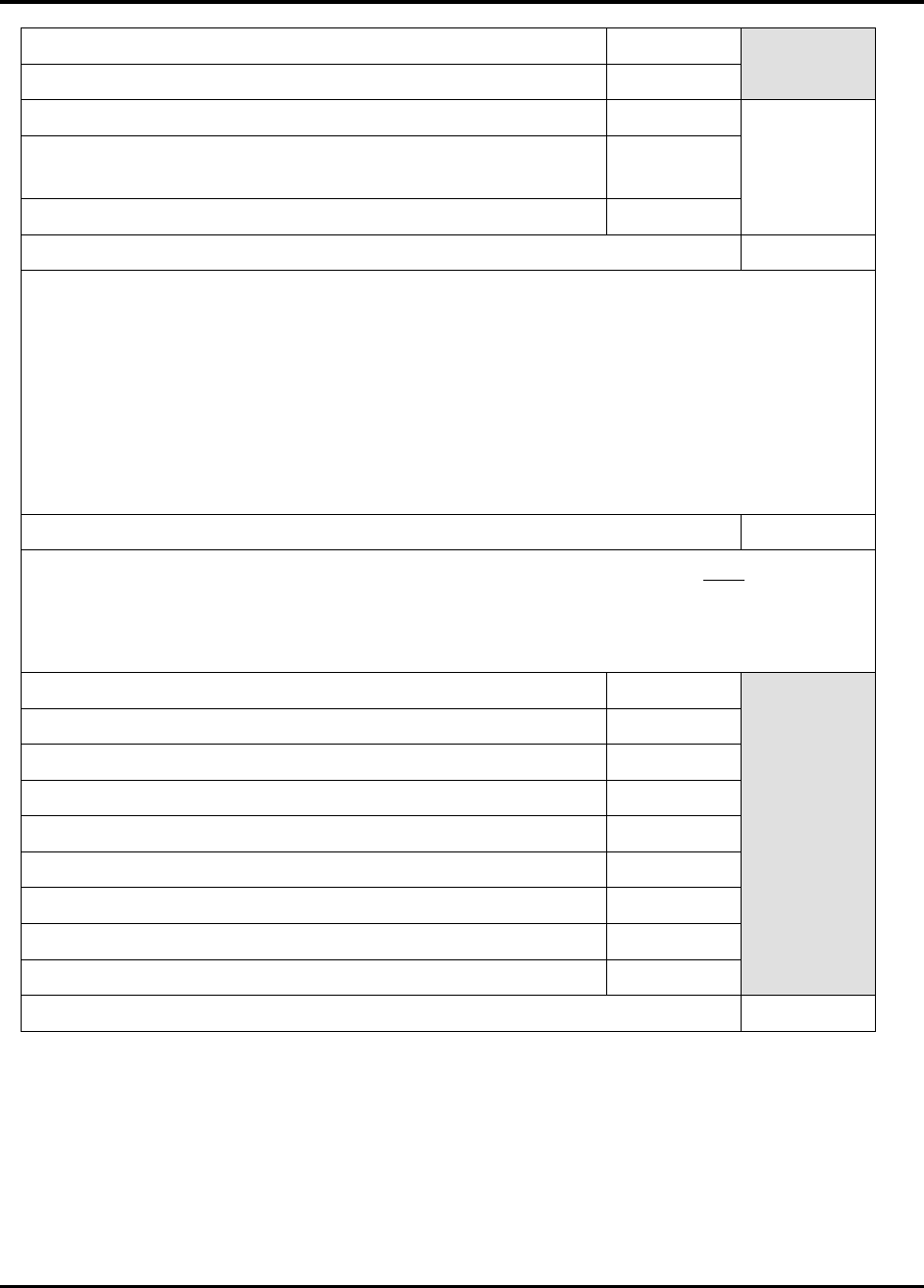

Finance Charge Chart

FINANCE CHARGE = DOLLAR COST OF CONSUMER CREDIT: It includes any charge payable directly or indirectly by

the consumer and imposed directly or indirectly by the creditor as a condition of or incident to the extension of credit.

CHARGES ALWAYS

INCLUDED

CHARGES INCLUDED

UNLESS CONDITIONS

ARE MET

CONDITIONS

(Any loan)

CHARGES NOT INCLUDED IF BONA

FIDE AND REASONABLE IN AMOUNT

(Residential mortgage transactions and

loans secured by real estate)

CHARGES NEVER

INCLUDED

Charges payable in a comparable

cash transaction.

Fees for unanticipated late

payments

Overdraft fees not agreed to in

writing

Seller’s points

Participation or membership fees

Discount offered by the seller to

induce payment by cash or other

means not involving the use of a

credit card

Interest forfeited as a result of

interest reduction required by law

Charges absorbed by the creditor as

a cost of doing business

Interest

Transaction fees

Loan origination fees Consumer

points

Credit guarantee insurance

premiums

Charges imposed on the creditor for

purchasing the loan, which are

passed on to the consumer

Discounts for inducing payment by

means other than credit

Mortgage broker fees

Other examples: Fee for preparing

TILA disclosures; real estate

construction loan inspection fees;

fees for post-consummation tax or

flood service policy; required credit

life insurance charges

Premiums for credit life, A&H, or

loss of income insurance

Debt cancellation fees

Premiums for property or liability

insurance

Premiums for vendor’s single

interest (VSI) insurance

Security interest charges (filing

fees), insurance in lieu of filing fees

and certain notary fees

Charges imposed by third parties

Charges imposed by third-party

closing agents

Appraisal and credit report fees

Insurance not required, disclosures

are made, and consumer authorizes

Coverage not required, disclosures

are made, and consumer authorizes

Consumer selects insurance

company and disclosures are made

Insurer waives right of subrogation,

consumer selects insurance

company, and disclosures are made

The fee is for lien purposes,

prescribed by law, payable to a third

public official and is itemized and

disclosed

Use of the third party is not required

to obtain loan and creditor does not

retain the charge

Creditor does not require and does

not retain the fee for the particular

service

Application fees, if charged to all

applicants, are not finance charges.

Application fees may include

appraisal or credit report fees.

Fees for title insurance, title examination,

property survey, etc.

Fees for preparing loan documents,

mortgages, and other settlement documents

Amounts required to be paid into escrow, if

not otherwise included in the finance

charge

Notary fees

Pre-consummation flood and pest

inspection fees

Appraisal and credit report fees

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 14

Instructions for the Finance Charge Chart

The finance charge initially includes any charge that is, or will be, connected with a specific

loan. Charges imposed by third parties are finance charges if the creditor requires use of the third

party. Charges imposed on the consumer by a settlement agent are finance charges only if the

creditor requires the particular services for which the settlement agent is charging the borrower

and the charge is not otherwise excluded from the finance charge.

Immediately below the finance charge definition, the chart presents five captions applicable to

determining whether a loan related charge is a finance charge.

The first caption is charges always included. This category focuses on specific charges given in

the regulation or commentary as examples of finance charges.

The second caption, charges included unless conditions are met, focuses on charges that must be

included in the finance charge unless the creditor meets specific disclosure or other conditions to

exclude the charges from the finance charge.

The third caption, conditions, focuses on the conditions that need to be met if the charges

identified to the left of the conditions are permitted to be excluded from the finance charge.

Although most charges under the second caption may be included in the finance charge at the

creditor’s option, third-party charges and application fees (listed last under the third caption)

must be excluded from the finance charge if the relevant conditions are met. However, inclusion

of appraisal and credit report charges as part of the application fee is optional.

The fourth caption, charges not included, identifies fees or charges that are not included in the

finance charge under conditions identified by the caption. If the credit transaction is secured by real

property or the loan is a residential mortgage transaction, the charges identified in the column, if

they are bona fide and reasonable in amount, must be excluded from the finance charge. For

example, if a consumer loan is secured by a vacant lot or commercial real estate, any appraisal fees

connected with the loan must not be included in the finance charge.

The fifth caption, charges never included, lists specific charges provided by the regulation as

examples of those that automatically are not finance charges (e.g., fees for unanticipated late

payments).

Annual Percentage Rate Definition – Section 1026.22

(Closed-End Credit)

Credit costs may vary depending on the interest rate, the amount of the loan and other charges,

the timing and amounts of advances, and the repayment schedule. The APR, which must be

disclosed in nearly all consumer credit transactions, is designed to take into account all relevant

factors and to provide a uniform measure for comparing the cost of various credit transactions.

The APR is a measure of the cost of credit, expressed as a nominal yearly rate. It relates the

amount and timing of value received by the consumer to the amount and timing of payments made.

The disclosure of the APR is central to the uniform credit cost disclosure envisioned by the TILA.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 15

The value of a closed-end credit APR must be disclosed as a single rate only, whether the loan

has a single interest rate, a variable interest rate, a discounted variable interest rate, or graduated

payments based on separate interest rates (step rates), and it must appear with the segregated

disclosures. Segregated disclosures are grouped together and do not contain any information not

directly related to the disclosures required under section 1026.18.

Since an APR measures the total cost of credit, including costs such as transaction charges or

premiums for credit guarantee insurance, it is not an “interest” rate, as that term is generally

used. APR calculations do not rely on definitions of interest in state law and often include

charges, such as a commitment fee paid by the consumer, that are not viewed by some state

usury statutes as interest. Conversely, an APR might not include a charge, such as a credit report

fee in a real property transaction, which some state laws might view as interest for usury

purposes. Furthermore, measuring the timing of value received and of payments made, which is

essential if APR calculations are to be accurate, must be consistent with parameters under

Regulation Z.

The APR is often considered to be the finance charge expressed as a percentage. However, two

loans could require the same finance charge and still have different APRs because of differing

values of the amount financed or of payment schedules. For example, the APR is 12 percent on a

loan with an amount financed of $5,000 and 36 equal monthly payments of $166.07 each. It is

13.26 percent on a loan with an amount financed of $4,500 and 35 equal monthly payments of

$152.18 each and final payment of $152.22. In both cases the finance charge is $978.52. The

APRs on these example loans are not the same because an APR does not only reflect the finance

charge. It relates the amount and timing of value received by the consumer to the amount and

timing of payments made.

The APR is a function of:

• The amount financed, which is not necessarily equivalent to the loan amount. For example, if

the consumer must pay at closing a separate 1 percent loan origination fee (prepaid finance

charge) on a $100,000 residential mortgage loan, the loan amount is $100,000, but the

amount financed would be $100,000 less the $1,000 loan fee, or $99,000.

• The finance charge, which is not necessarily equivalent to the total interest amount (interest

is not defined by Regulation Z, but rather is defined by state or other federal law). For

example:

o If the consumer must pay a $25 credit report fee for an auto loan, the fee must be

included in the finance charge. The finance charge in that case is the sum of the interest

on the loan (i.e., interest generated by the application of a percentage rate against the loan

amount) plus the $25 credit report fee.

o If the consumer must pay a $25 credit report fee for a home improvement loan secured by

real property, the credit report fee must be excluded from the finance charge. The finance

charge in that case would be only the interest on the loan.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 16

• The payment schedule, which does not necessarily include only principal and interest (P + I)

payments. For example:

o If the consumer borrows $2,500 for a vacation trip at 14 percent simple interest per

annum and repays that amount with 25 equal monthly payments beginning one month

from consummation of the transaction, the monthly P + I payment will be $115.87, if all

months are considered equal, and the amount financed would be $2,500. If the

consumer’s payments are increased by $2.00 a month to pay a non-financed $50 loan fee

during the life of the loan, the amount financed would remain at $2,500 but the payment

schedule would be increased to $117.87 a month, the finance charge would increase by

$50, and there would be a corresponding increase in the APR. This would be the case

whether or not state law defines the $50 loan fee as interest.

o If the loan above has 55 days to the first payment and the consumer prepays interest at

consummation ($24.31 to cover the first 25 days), the amount financed would be $2,500 -

$24.31, or $2,475.69. Although the amount financed has been reduced to reflect the

consumer’s reduced use of available funds at consummation, the time interval during

which the consumer has use of the $2,475.69, 55 days to the first payment, has not

changed. Since the first payment period exceeds the limitations of the regulation’s minor

irregularities provisions (see §1026.17(c)(4)), it may not be treated as regular. In

calculating the APR, the first payment period must not be reduced by 25 days (i.e., the

first payment period may not be treated as one month).

Financial institutions may, if permitted by state or other law, precompute interest by applying a

rate against a loan balance using a simple interest, add-on, discount or some other method, and

may earn interest using a simple interest accrual system, the Rule of 78’s (if permitted by law) or

some other method. Unless the financial institution’s internal interest earnings and accrual

methods involve a simple interest rate based on a 360-day year that is applied over actual days

(even that is important only for determining the accuracy of the payment schedule), it is not

relevant in calculating an APR, since an APR is not an interest rate (as that term is commonly

used under state or other law). Since the APR normally need not rely on the internal accrual

systems of a bank, it always may be computed after the loan terms have been agreed upon (as

long as it is disclosed before actual consummation of the transaction).

Special Requirements for Calculating the Finance Charge and APR

Proper calculation of the finance charge and APR are of primary importance. The regulation

requires that the terms “finance charge” and “annual percentage rate” be disclosed more

conspicuously than any other required disclosure, subject to limited exceptions. The finance

charge and APR, more than any other disclosures, enable consumers to understand the cost of the

credit and to comparison shop for credit. A creditor’s failure to disclose those values accurately

can result in significant monetary damages to the creditor, either from a class action lawsuit or

from a regulatory agency’s order to reimburse consumers for violations of law.

If an APR or finance charge is disclosed incorrectly, the error is not, in itself, a violation of the

regulation if:

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 17

• The error resulted from a corresponding error in a calculation tool used in good faith by the

financial institution.

• Upon discovery of the error, the financial institution promptly discontinues use of that

calculation tool for disclosure purposes.

• The financial institution notifies the CFPB in writing of the error in the calculation tool.

When a financial institution claims a calculation tool was used in good faith, the financial

institution assumes a reasonable degree of responsibility for ensuring that the tool in question

provides the accuracy required by the regulation. For example, the financial institution might

verify the results obtained using the tool by comparing those results to the figures obtained by

using another calculation tool. The financial institution might also verify that the tool, if it is

designed to operate under the actuarial method, produces figures similar to those provided by the

examples in appendix J to the regulation. The calculation tool should be checked for accuracy

before it is first used and periodically thereafter.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 18

Subpart B – Open-End Credit

Subpart B relates to open-end credit. It contains rules on account-opening disclosures (§1026.6)

and periodic statements (§§1026.7-.8). It also describes special rules that apply to credit card

transactions, treatment of payments (§1026.10) and credit balances (§1026.11), procedures for

resolving credit billing errors (§1026.13), annual percentage rate calculations (§1026.14),

rescission requirements (§1026.15) and advertising (§1026.16).

Time of Disclosures (Periodic Statements)

– Section 1026.5(b)

For credit card accounts under an open-end (not home-secured) consumer credit plan, creditors

must adopt reasonable procedures designed to ensure that periodic statements are mailed or

delivered at least 21 days prior to the payment due date disclosed on the periodic statement and

that payments are not treated as late for any purpose if they are received within 21 days after

mailing or delivery of the statement. In addition, for all open-end consumer credit accounts with

grace periods, creditors must adopt reasonable procedures designed to ensure that periodic

statements are mailed or delivered at least 21 days prior to the date on which a grace period (if

any) expires and that finance charges are not imposed as a result of the loss of a grace period if a

payment is received within 21 days after mailing or delivery of a statement. For purposes of this

requirement, a “grace period” is defined as a period within which any credit extended may be

repaid without incurring a finance charge due to a periodic interest rate. For non-credit card

open-end consumer plans without a grace period, creditors must adopt reasonable policies and

procedures designed to ensure that periodic statements are mailed or delivered at least 14 days

prior to the date on which the required minimum periodic payment is due. Moreover, the creditor

must adopt reasonable policies and procedures to ensure that it does not treat as late a required

minimum periodic payment received by the creditor within 14 days after it has mailed or

delivered the periodic statement.

Subsequent Disclosures (Open-End Credit)

– Section 1026.9

For open-end, not home-secured credit, the following applies:

Creditors are required to provide consumers with 45 days’ advance written notice of rate

increases and other significant changes to the terms of their credit card account agreements. The

list of “significant changes” includes most fees and other terms that a consumer should be aware

of before use of the account. Examples of such fees and terms include:

• Penalty fees;

• Transaction fees;

• Fees imposed for the issuance or availability of the open-end plan;

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 19

• Grace period; and

• Balance computation method.

Changes that do not require advance notice include:

• Reductions of finance charges;

• Termination of account privileges resulting from an agreement involving a court proceeding;

• The change is an increase in an APR upon expiration of a specified period of time previously

disclosed in writing;

• The change applies to increases in variable APRs that change according to an index not

under the card issuer’s control; and

• Rate increases due to the completion of, or failure of a consumer to comply with, the terms of

a workout or temporary hardship arrangement, if those terms are disclosed prior to

commencement of the arrangement.

A creditor may suspend account privileges, terminate an account, or lower the credit limit

without notice. However, a creditor that lowers the credit limit may not impose an over limit fee

or penalty rate as a result of exceeding the new credit limit without a 45-day advance notice that

the credit limit has been reduced.

For significant changes in terms (with the exception of rate changes, increases in the minimum

payment, certain changes in the balance computation method, and when the change results from

the consumer’s failure to make a required minimum periodic payment within 60 days after the

due date), a creditor must also provide consumers the right to reject the change. If the consumer

does reject the change prior to the effective date, the creditor may not apply the change to the

account (§1026.9(h)(2)(i)).

In addition, when a consumer rejects a change or increase, the creditor must not:

• Impose a fee or charge or treat the account as in default solely as a result of the rejection; or

• Require repayment of the balance on the account using a method that is less beneficial to the

consumer than one of the following methods: (1) the method of repayment prior to the

rejection; (2) an amortization period of not less than five years from the date of rejection; or

(3) a minimum periodic payment that includes a percentage of the balance that is not more

than twice the percentage included prior to the date of rejection.

Finance Charge (Open-End Credit)

– Sections 1026.6(a)(1) & 1026.6(b)(3)

Each finance charge imposed must be individually itemized. The aggregate total amount of the

finance charge need not be disclosed.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 20

Determining the Balance and Computing the Finance Charge

The examiner must know how to compute the balance to which the periodic rate is applied.

Common methods used are the previous balance method, the daily balance method, and the

average daily balance method, which are described as follows:

• Previous balance method. The balance on which the periodic finance charge is computed is

based on the balance outstanding at the start of the billing cycle. The periodic rate is

multiplied by this balance to compute the finance charge.

• Daily balance method. A daily periodic rate is applied to either the balance on each day in

the cycle or the sum of the balances on each of the days in the cycle. If a daily periodic rate is

multiplied by the balance on each day in the billing cycle, the finance charge is the sum of

the products. If the daily periodic rate is multiplied by the sum of all the daily balances, the

result is the finance charge.

• Average daily balance method. The average daily balance is the sum of the daily balances

(either including or excluding current transactions) divided by the number of days in the

billing cycle. A periodic rate is then multiplied by the average daily balance to determine the

finance charge. If the periodic rate is a daily one, the product of the rate multiplied by the

average balance is multiplied by the number of days in the cycle.

In addition to those common methods, financial institutions have other ways of calculating the

balance to which the periodic rate is applied. By reading the financial institution’s explanation,

the examiner should be able to calculate the balance to which the periodic rate was applied. In

some cases, the examiner may need to obtain additional information from the financial institution

to verify the explanation disclosed. Any inability to understand the disclosed explanation should

be discussed with management, who should be reminded of Regulation Z’s requirement that

disclosures be clear and conspicuous.

When a balance is determined without first deducting all credits and payments made during the

billing cycle, that fact and the amount of the credits and payments must be disclosed.

If the financial institution uses the daily balance method and applies a single daily periodic rate,

disclosure of the balance to which the rate was applied may be stated as any of the following:

• A balance for each day in the billing cycle. The daily periodic rate is multiplied by the

balance on each day and the sum of the products is the finance charge.

• A balance for each day in the billing cycle on which the balance in the account changes. The

finance charge is figured by the same method as discussed previously, but the statement

shows the balance only for those days on which the balance changed.

• The sum of the daily balances during the billing cycle. The balance on which the finance

charge is computed is the sum of all the daily balances in the billing cycle. The daily periodic

rate is multiplied by that balance to determine the finance charge.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 21

• The average daily balance during the billing cycle. If this is stated, the financial institution

may, at its option, explain that the average daily balance is or can be multiplied by the

number of days in the billing cycle and the periodic rate applied to the product to determine

the amount of interest.

If the financial institution uses the daily balance method, but applies two or more daily

periodic rates, the sum of the daily balances may not be used. Acceptable ways of disclosing

the balances include:

• A balance for each day in the billing cycle;

• A balance for each day in the billing cycle on which the balance in the account changes; or

• Two or more average daily balances. If the average daily balances are stated, the financial

institution may, at its option, explain that interest is or may be determined by 1) multiplying

each of the average daily balances by the number of days in the billing cycle (or if the daily

rate varied during the cycle), 2) by multiplying each of the results by the applicable daily

periodic rate, and 3) adding these products together.

In explaining the method used to find the balance on which the finance charge is computed, the

financial institution need not reveal how it allocates payments or credits. That information may be

disclosed as additional information, but all required information must be clear and conspicuous.

NOTE: Section 1026.54 prohibits a credit card issuer from calculating finance charges based on

balances for days in previous billing cycles as a result of the loss of a grace period (a practice

sometimes referred to as “double-cycle billing”).

Finance Charge Resulting from Two or More Periodic Rates

Some financial institutions use more than one periodic rate in computing the finance charge. For

example, one rate may apply to balances up to a certain amount and another rate to balances

more than that amount. If two or more periodic rates apply, the financial institution must disclose

all rates and conditions. The range of balances to which each rate applies also must be disclosed.

It is not necessary, however, to break the finance charge into separate components based on the

different rates.

Annual Percentage Rate (Open-End Credit)

The disclosed APR on an open-end credit account is accurate if it is within one-eighth of one

percentage point of the APR calculated under Regulation Z.

Determination of APR – Section 1026.14

The basic method for determining the APR in open-end credit transactions involves multiplying

each periodic rate by the number of periods in a year. This method is used in all types of open-

end disclosures, including:

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 22

• The corresponding APR in the initial disclosures;

• The corresponding APR on periodic statements;

• The APR in early disclosures for credit card accounts;

• The APR in early disclosures for home-equity plans;

• The APR in advertising; and

• The APR in oral disclosures.

The corresponding APR is prospective and it does not involve any particular finance charge or

periodic balance.

A second method of calculating the APR is the quotient method. At a creditor’s option, the

quotient method may be disclosed on periodic statements for home-equity plans subject to

section 1026.40 (“HELOCs”).

5

The quotient method reflects the annualized equivalent of the

rate that was actually applied during a cycle. This rate, also known as the effective APR, will

differ from the corresponding APR if the creditor applies minimum, fixed, or transaction charges

to the account during the cycle. (§1026.14(c))

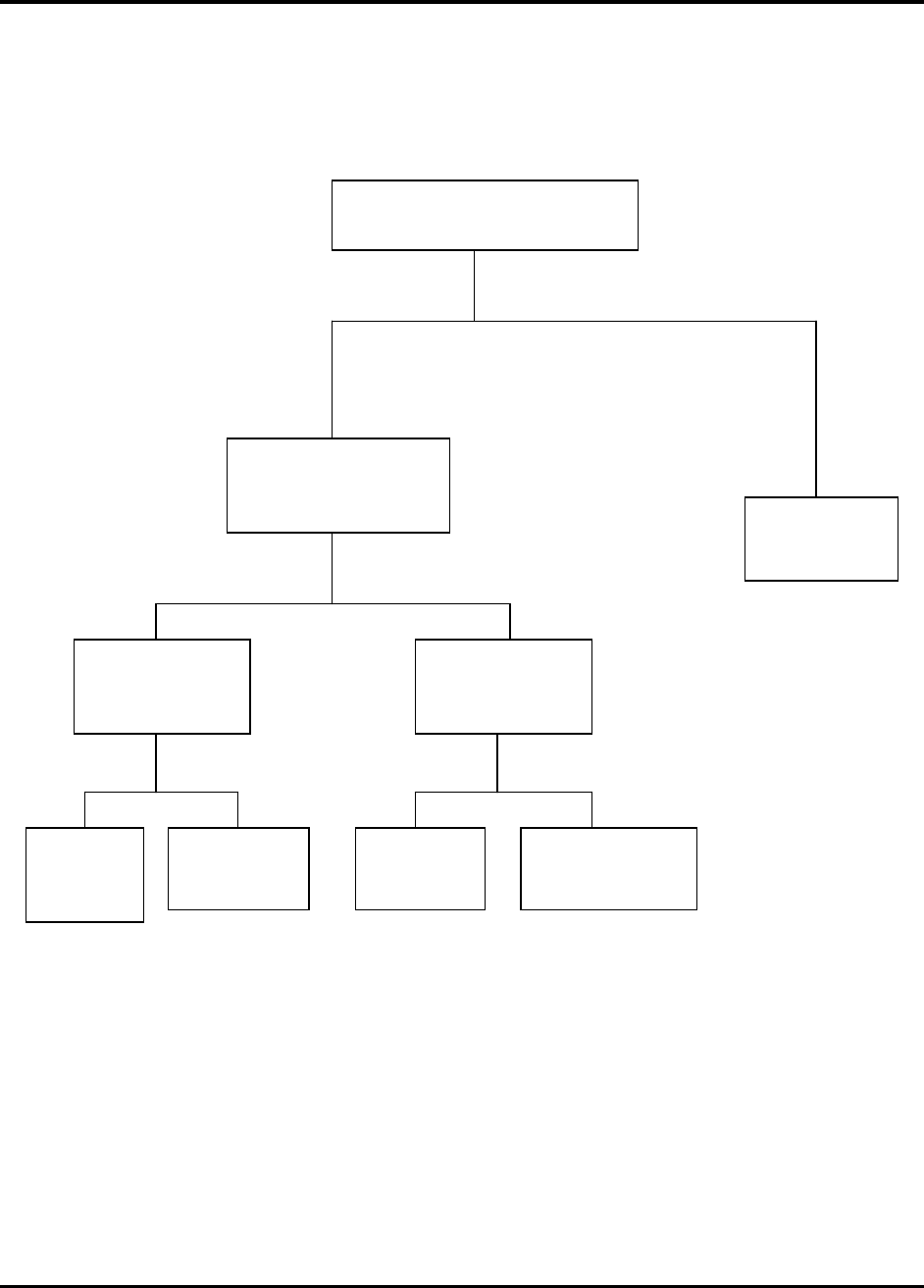

Brief Outline for Open-End Credit APR Calculations on Periodic Statements

NOTE: Assume monthly billing cycles for each of the calculations below.

I. Basic method for determining the APR in an open-end credit transaction. This is the

corresponding APR. (§1026.14(b))

A. Monthly rate x 12 = APR

II. Optional effective APR that may be disclosed on home-equity line of credit (HELOC)

periodic statements

A. APR when only periodic rates are imposed (§1026.14(c)(1))

1. Monthly rate x 12 = APR

Or

2. (Total finance charge / sum of the balances) x 12 = APR

B. APR when minimum or fixed charge, but not transaction charge imposed.

(§1026.14(c)(2))

5

If a creditor does not disclose the effective (or quotient method) APR on a HELOC periodic statement, it must instead disclose

the charges (fees and interest) imposed as provided in section 1026.7(a).

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 23

1. (Total finance charge / amount of applicable balance

6

) x 12 = APR

7

C. APR when the finance charge includes a charge related to a specific transaction (such as

a cash advance fee), even if the total finance charge also includes any other minimum,

fixed, or other charge not calculated using a periodic rate. (§1026.14(c)(3))

1. (Total finance charge / (all balances + other amounts on which a finance charge was

imposed during the billing cycle without duplication

8

) x 12 = APR

9

D. APR when the finance charge imposed during the billing cycle includes a minimum or

fixed charge that does not exceed $.50 for a monthly or longer billing cycles (or pro rata

part of $.50 for a billing cycle shorter than monthly). (§1026.14(c)(4))

1. Monthly rate x 12 = APR

E. APR calculation when daily periodic rates are applicable if only the periodic rate is

imposed or when a minimum or fixed charge (but not a transactional charge is imposed.

(§1026.14(d))

1. (Total finance charge / average daily balance) x 12 = APR

Or

2. (Total finance charge / sum of daily balances) x 365 = APR

Change in Terms Notices for Home Equity Plans Subject to

Section 1026.40 – Section 1026.9(c)

Servicers are required to provide consumers with 15 days’ advance written notice of a change to

any term required to be disclosed under section 1026.6(a) or where the required minimum

periodic payment is increased. Notice is not required when the change involves a reduction of

any component of a finance charge or other charge or when the change results from an

agreement involving a court proceeding. If the creditor prohibits additional extensions of credit

or reduces the credit limit in certain circumstances (if permitted by contract), a written notice

must be provided no later than three business days after the action is taken and must include the

specific reasons for the action. If the creditor requires the consumer to request reinstatement of

credit privileges, the notice also must state that fact.

6

For the following formulas, the APR cannot be determined if the applicable balance is zero. (§1026.14(c)(2))

7

Loan fees, points, or similar finance charges that relate to the opening of the account must not be included in the calculation of

the APR.

8 The sum of the balances may include the average daily balance, adjusted balance, or previous balance method. When a portion

of the finance charge is determined by application of one or more daily periodic rates, the sum of the balances also means the

average of daily balances. See Appendix F to Regulation Z.

9

Cannot be less than the highest periodic rate applied, expressed as an APR. Loan fees, points, or similar finance charges that

relate to the opening of the account must not be included in the calculation of the APR.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 24

Timely Settlement of Estates – Section 1026.11(c)

Issuers are required to establish procedures to ensure that any administrator of an estate can

resolve the outstanding credit card balance of a deceased account holder in a timely manner. If

an administrator requests the amount of the balance:

• The issuer is prohibited from imposing additional fees on the account;

• The issuer is required to disclose the amount of the balance to the administrator in a timely

manner (safe harbor of 30 days); and

• If the balance is paid in full within 30 days after disclosure of the balance, the issuer must

waive or rebate any trailing or residual interest charges that accrued on the balance following

the disclosure.

Minimum Payments – Section 1026.7(b)(12)

For credit card accounts under an open-end credit plan, card issuers generally must disclose on

periodic statements an estimate of the amount of time and the total cost (principal and interest)

involved in paying the balance in full by making only the minimum payments, and an estimate of

the monthly payment amount required to pay off the balance in 36 months and the total cost

(principal and interest) of repaying the balance in 36 months. Card issuers also must disclose a

minimum payment warning, and an estimate of the total interest that a consumer would save if

that consumer repaid the balance in 36 months, instead of making minimum payments.

Advertising for Open-End Plans– Section 1026.16

The regulation requires that loan product advertisements provide accurate and balanced

information, in a clear and conspicuous manner, about rates, monthly payments, and other loan

features. The advertising rules ban several deceptive or misleading advertising practices,

including representations that a rate or payment is “fixed” when in fact it can change.

If an advertisement for credit states specific credit terms, it must state only those terms that

actually are or will be arranged or offered by the creditor. If any finance charges or other charges

are set forth in an advertisement, the advertisement must also clearly and conspicuously state the

following:

• Any minimum, fixed, transaction, activity or similar charge that is a finance charge under

section 1026.4 that could be imposed;

• Any periodic rate that may be applied expressed as an APR as determined under section

1026.14(b). If the plan provides for a variable periodic rate, that fact must be disclosed; and

• Any membership or participation fee that could be imposed.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 25

If any finance charges or other charge or payment terms are set forth, affirmatively or negatively,

in an advertisement for a home-equity plan subject to the requirements of section 1026.40, the

advertisement also must clearly and conspicuously set forth the following:

• Any loan fee that is a percentage of the credit limit under the plan and an estimate of any

other fees imposed for opening the plan, stated as a single dollar amount or a reasonable

range;

• Any periodic rate used to compute the finance charge, expressed as an APR as determined

under section 1026.14(b); and

• The maximum APR that may be imposed in a variable-rate plan.

Regulation Z’s open-end home-equity plan advertising rules include a clear and conspicuous

standard for home-equity plan advertisements, consistent with the approach taken in the

advertising rules for consumer leases under Regulation M. Commentary provisions clarify how

the clear and conspicuous standard applies to advertisements of home-equity plans with

promotional rates or payments, and to Internet, television, and oral advertisements of home-

equity plans. The regulation allows alternative disclosures for television and radio

advertisements for home-equity plans. The regulation also requires that advertisements

adequately disclose not only promotional plan terms, but also the rates or payments that will

apply over the term of the plan.

Regulation Z also contains provisions implementing the Bankruptcy Abuse Prevention and

Consumer Protection Act of 2005, which requires disclosure of the tax implications of certain

home-equity plans.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 26

Subpart C – Closed-End Credit

Subpart C relates to closed-end credit. It contains rules on disclosures (§§1026.17-.20), treatment

of credit balances (§1026.21), annual percentage rate calculations (§1026.22), rescission rights

(§1026.23), and advertising (§1026.24).

The TILA-RESPA integrated disclosures must be given for most closed-end transactions secured

by real property for which the creditor receives an application on or after August 1, 2015. The

TILA-RESPA integrated disclosures do not apply to HELOCs, reverse mortgages, or mortgages

secured by a mobile home or by a dwelling that is not attached to real property. Truth in Lending

disclosures (TIL disclosures) and the Consumer Handbook on Adjustable Rate Mortgages

(CHARM) booklet must still be provided for certain limited closed-end loan transactions.

I. Disclosures, Generally

A. Timing

Generally, all disclosures provided to consumers must be made clearly and conspicuously in

writing, in a form that the consumer may keep ((§§1026.17(a), 1026.37(o), 1026.38(t)).

However, the timing of the disclosures may change depending on the transaction (§§1026.19(a),

1026.19(e)(1)(iii), 1026.19(f)(1)(ii), 1026.19(g)).

Disclosures in connection with non-mortgage closed-end loans and specified housing assistance

loan programs for low- and moderate-income consumers must be provided before consummation

of the transaction (§§1026.3(h), 1026.17(b) and 1026.18)).

For most closed-end transactions secured by real property for which the creditor receives an

application on or after August 1, 2015 (including construction-only loans, loans secured by

vacant land or by 25 or more acres, and credit extended to certain trusts for tax or estate planning

purposes), disclosures must be provided in accordance with the timing requirements outlined in

12 CFR 1026.19(e), (f) and (g). Generally, a creditor is required to mail or deliver the Loan

Estimate within three business days of receipt of the consumer’s loan application and to ensure

that the consumer receives the Closing Disclosure no later than three business days before loan

consummation (§§1026.19(e)(iii), 1026.19(f)(1)(ii)). If the loan is a purchase transaction, the

special information booklet must also be provided within three business days of receipt of the

consumer’s application (§1026.19(g)). The specifics of these disclosure timing requirements are

further discussed below, including a discussion about revised disclosures.

Mortgage loans not subject to 12 CFR 1026.19(e) and (f) (e.g., reverse mortgages, and chattel-

dwelling loans) have different disclosure requirements. For reverse mortgages, disclosures must

be delivered or mailed to the consumer no later than the third business day after a creditor

receives the consumer’s written application (§1026.19(a)). For chattel-dwelling mortgage loans,

disclosures must be provided to the consumer prior to consummation of the loan (§1026.17(b)).

Revised disclosures are also required within three business days of consummation if certain

mortgage loan terms change (§1026.19(a)(2)). For loans like reverse mortgages, the consumer

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 27

will receive the Good Faith Estimate (GFE), HUD-1 Settlement Statement (HUD-1), and Truth

in Lending disclosures as required under the applicable sections of both TILA and RESPA.

Consumers receive TIL disclosures for chattel-dwelling loans that are not secured by land, but

the GFE and the HUD-1 are not required. Finally, certain variable rate transactions secured by a

dwelling have additional disclosure obligations with specific timing requirements both prior to

and after consummation (see §§1026.20(c) and (d) below).

B. Basis for Disclosures

1. Generally

Disclosures provided for closed-end transactions must reflect the credit terms to which the

parties will be legally bound as of the outset of the credit transaction. If information required for

the disclosures is unknown, the creditor may provide the consumer with an estimate, using the

best information reasonably available. The disclosure must be clearly marked as an estimate.

Variable and Adjustable Rate

If the terms of the legal obligation allow the financial institution, after consummation of the

transaction, to increase the APR, the financial institution must furnish the consumer with certain

information on variable rates. Variable rate disclosures are not applicable to rate increases

resulting from delinquency, default, assumption, acceleration, or transfer of the collateral.

Some of the more important transaction-specific variable rate disclosure requirements follow.

• Disclosures for variable rate loans must be given for the full term of the transaction and must

be based on the terms in effect at the time of consummation.

• If the variable rate transaction includes either a seller buy-down that is reflected in a contract

or a consumer buy-down, the disclosed APR should be a composite rate based on the lower

rate for the buy-down period and the rate that is the basis for the variable rate feature for the

remainder of the term.

• If the initial rate is not determined by the index or formula used to make later interest rate

adjustments, as in a discounted variable rate transaction, the disclosed APR must reflect a

composite rate based on the initial rate for as long as it is applied and, for the remainder of

the term, the rate that would have been applied using the index or formula at the time of

consummation (i.e., the fully indexed rate).

o If a loan contains a rate or payment cap that would prevent the initial rate or payment, at

the time of the adjustment, from changing to the fully indexed rate, the effect of that rate

or payment cap needs to be reflected in the disclosures.

o The index at consummation need not be used if the contract provides a delay in the

implementation of changes in an index value (e.g., the contract indicates that future rate

changes are based on the index value in effect for some specified period, like 45 days

before the change date). Instead, the financial institution may use any rate from the date

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 28

of consummation back to the beginning of the specified period (e.g., during the previous

45-day period).

• If the initial interest rate is set according to the index or formula used for later adjustments,

but is set at a value as of a date before consummation, disclosures should be based on the

initial interest rate, even though the index may have changed by the consummation date.

CFPB

Laws and Regulations TILA

CFPB April 2015 TILA 29

II. Finance Charge, Amount Financed and APRs

A. Finance Charge – Section 1026.18(c)

The aggregate total amount of the finance charge must be disclosed for all loans. An itemization

of the amount financed is required (except as provided in 12 CFR 1026.18(c)(2) or (c)(3)), unless

the loan is subject to 12 CFR 1026.19(e) and (f) (i.e., most closed-end mortgage loans).

Amount Financed – Section 1026.18(b), 1026.38(o)

1. Definition

The amount financed is the net amount of credit extended for the consumer’s use. It should not

be assumed that the amount financed under the regulation is equivalent to the note amount,

proceeds, or principal amount of the loan. The amount financed normally equals the total of

payments less the finance charge.

To calculate the amount financed, all amounts and charges connected with the transaction, either

paid separately or included in the note amount, must first be identified. Any prepaid,

precomputed, or other finance charge must then be determined.

The amount financed must not include any finance charges. If finance charges have been

included in the obligation (either prepaid or precomputed), they must be subtracted from the face

amount of the obligation when determining the amount financed. The resulting value must be

reduced further by an amount equal to any prepaid finance charge paid separately. The final

resulting value is the amount financed.

When calculating the amount financed, finance charges (whether in the note amount or paid

separately) should not be subtracted more than once from the total amount of an obligation.

Charges not in the note amount and not included in the finance charge (e.g., an appraisal fee paid

separately in cash on a real estate loan) are not required to be disclosed under Regulation Z and