IPOL

EGOV

DIRECTORATE-GENERAL FOR INTERNAL POLICIES

ECONOMIC GOVERNANCE SUPPORT UNIT

5 July 2017 Authors: B. Mesnard, A. Margerit, M. Magnus PE 602.084

contact: [email protected]

BRIEFING

Precautionary recapitalisations under the Bank Recovery and

Resolution Directive: conditionality and case practice

This briefing focusses on the possibility provided by the Bank Recovery and Resolution Directive

(BRRD) to recapitalize a bank outside resolution. It explains the legal framework, in particular the

conditionality attached to such precautionary recapitalisations, and reviews the few cases where the

use of this instrument was discussed.

The current legal framework

To reduce the cost of bank failures for taxpayers, the BRRD provides that resolution costs

should be first and foremost borne by banks’ shareholders and creditors. To that end, the BRRD

(i) empowers resolution authorities to bail-in capital and debt instruments, (ii) create a new

requirement for banks to hold such bail-inable instruments at all times (the minimum requirement for

own funds and eligible liabilities, MREL), and (iii) provides that such bail-in would be enforced prior

to any injection of State aid into the bank. Indeed, in line with article 32.4 BRRD, the provision of

extraordinary public support entails the recognition that the beneficiary bank is failing or likely to

fail, thereby triggering its liquidation or its winding down under regular insolvency proceedings (see

Annex 1 for the full wording of article 32 BRRD, and Box 1 for an extract of its fourth point).

However some flexibility was introduced by the legislators to allow for targeted measures

aiming at promoting financial stability, and to cater for systemic liquidity shortages or situations

where a solvent bank would be unable to raise capital privately in the markets following a stress test

or a comprehensive assessment. Three specific forms of extraordinary public support are thereby

allowed outside resolution (see Box 1): the provision of a State guarantee to issue new liabilities, the

provision of a State guarantee to access central bank refinancing, and the recapitalisation of a solvent

bank subject to strict conditions.

Box 1: Article 32.4 BRRD: precautionary recapitalisation

(...) an institution shall be deemed to be failing or likely to fail in (...) the following circumstances:

(a) the institution infringes (...) the requirements for continuing authorisation (...);

(b) the assets of the institution are (...) less than its liabilities;

(c) the institution is (...) unable to pay its debts or other liabilities as they fall due;

(d) extraordinary public financial support is required except (...) any of the following forms:

(i) a State guarantee to back liquidity facilities provided by central banks (...);

(ii) a State guarantee of newly issued liabilities; or

(iii) an injection of own funds or purchase of capital instruments at prices and on terms that do not

confer an advantage upon the institution (...).

(...) The guarantee or equivalent measures referred to therein shall be confined to solvent institutions and

shall be conditional on final approval under the Union State aid framework. Those measures shall be of a

precautionary and temporary nature and shall be proportionate to remedy the consequences of the serious

disturbance and shall not be used to offset losses that the institution has incurred or is likely to incur in the

near future.

Support measures (...) shall be limited to injections necessary to address capital shortfall established in the

national, Union or SSM-wide stress tests, asset quality reviews or equivalent exercises (...)

PE 602.084 2

Precautionary recapitalisations are subject to various conditions (article 32.4(d)(iii) BRRD):

1. The aid is granted “in order to remedy a serious disturbance in the economy of a Member State

and preserve financial stability”: this wording refers to article 107.3(b) TFEU which states that

granting State aid “to remedy the serious disturbance in the economy of a Member states” may be

considered to be compatible with the internal market. The Commission has repeatedly indicated that

the financial crisis and its consequences constitute a serious disturbance in the economy, lastly in

recital 5 of the 2013 Banking Communication, which allows the Commission to authorize aid under

article 107(3)(b) of the Treaty. This Communication has been in force since 1 August 2013.

2. The extraordinary public financial support consists in “an injection of own funds or purchase of

capital instruments”: this means that not all forms of capital support may qualify for the exemption

listed in article 32.4(d)(iii). For instance, a transfer of assets above market prices would not per se be

eligible albeit it constitutes indirectly a form of capital support.

3. The price and terms of the recapitalisation should not “confer an advantage upon the institution”.

This wording seems to exclude any capital injection which would not be done at market terms.

However, the very purpose of this provision is to enable a bank, which is “unable to raise capital

privately in markets” (recital 41 of the BRRD), to raise capital from public sources without triggering

resolution. It is to be noted that in the first decision of the Commission on the use of exemptions

contained in article 32.4 BRRD, the wording used by the Commission refers to “undue advantage”,

that is to say “an advantage incompatible with the internal market under State aid rules” (see below

the case of National Bank of Greece): the Commission somehow acknowledges that any

recapitalisation in such circumstances (when a bank is unable to raise capital privately in the markets)

involves State aid (i.e. it favours the beneficiary bank).

4. Precautionary recapitalisations “shall be confined to solvent institutions”. The EBA has clarified

that solvent institution means an institution which does not fall within article 32(4)(a), (b), and (c):

this means the institution does not and is not likely to, in the near future:

- infringe the conditions for authorisation;

- hold less assets than liabilities;

- fail to pay its debts as they fall due (see annex 1).

5. The measure shall be “conditional on final approval” under State aid rules: the Commission has to

approve the measure before any capital is injected into the beneficiary bank. This includes the

approval of a restructuring plan in line with recital 50 of the 2013 Banking Communication (see

Box 2).

6. Those measures shall be of a “precautionary and temporary nature”. The word “temporary”

suggests that the measures should be undone in the future if need be. An injection of capital in the

form of contingent convertible bonds typically complies with this requirement, since the bank can, if

its capital position improves later on, repay the State in full. An injection of equity in the form of

ordinary shares does not offer the same flexibility in practice. “Precautionary” refers to the forward

looking nature of the recapitalisation, in the meaning that it should not cover past losses.

7. The precautionary recapitalisation shall be “proportionate” to remedy the consequences of the

serious disturbance in the economy: this means that the recapitalisation shall be limited to the amount

of capital necessary to address the capital shortfall estimated by the supervisor.

8. The measure shall not be used “to offset losses that the institution has incurred or is likely to incur

in the near future”: therefore past losses as well as losses that the bank is going to incur with a high

degree of certainty cannot be offset by a precautionary recapitalisation. In practice this means that

losses stemming from an asset quality review or from the baseline scenario of a stress test must be

covered by private funds.

In addition, the bank must not fall under the circumstances described in points (a), (b) and (c) of

article 32(4) BRRD, otherwise the bank would be considered failing or likely to fail. Similarly, the

circumstances referred to in article 59(3) BRRD shall not be met.

3 PE 602.084

Box 2: Assessment of capital support to failing banks under State aid rules

State aid which distorts or threatens to distort competition is forbidden by the Treaty. Article 107.1 provides

that “Save as otherwise provided in the Treaties, any aid granted by a Member State or through State resources

in any form whatsoever which distorts or threatens to distort competition by favouring certain undertakings

or the production of certain goods shall, in so far as it affects trade between Member States, be incompatible

with the internal market.”

However a number of exceptions are listed in the Treaty, including aid measures aimed “to remedy a serious

disturbance in the economy of a Member State” (Article 107.3(b)). On this basis, the Commission has

published a number of communications since the start of the crisis, to explain its assessment of compatible aid

to failing banks. As a general rule, the measure should be appropriate, necessary and proportionate: it shall

address the serious disturbance efficiently, be limited to the minimum amount necessary, and avoid spill-over

effects (2008 Banking Communication).

The Commission later on detailed the specific rules regarding the different forms of support (guarantees,

recapitalisations, and impaired asset measures) as well as its assessment of banks restructuring plans. For the

aid to be limited to the minimum amount necessary, any injection of capital shall ensure a sufficient

remuneration for the State. To that end, the bank shall return to long-term viability, and contribute to the costs

of its own restructuring to the maximum extent: this is the concept of burden sharing, which means that the

costs of a bank rescue should be minimized by the contributions from shareholders, creditors (through

voluntary liability management exercises and a coupon and dividend ban), managers as well as the bank itself

(for instance through the sale of assets and various cost reductions). In additions the beneficiary bank shall

implement measures to limit distortions of competition (divestments, acquisition ban, advertising ban, price

leadership ban). All those measures (return to long term viability, burden sharing, and limitations to distortions

of competition) together with assumptions of the future evolution of the business are submitted to the

Commission in the form of a restructuring plan, which must be approved for the aid to be found compatible

with the internal market.

The 2013 Banking Communication further strengthened this framework, in particular by forcing banks to

submit the restructuring plan before the approval of the measure, by making mandatory the bail-in of

subordinated creditors before any capital be injected into the bank, and by imposing a salary cap to the

management.

A review clause is included in article 32.4 BRRD, whereby “by 31 December 2015, the Commission

shall review whether there is a continuing need for allowing the support measures (...) and the

conditions that should be met (...)”.

Piraeus Bank and National Bank of Greece (2015)

In December 2015 the European Commission approved two precautionary recapitalisations in

Greece, for Piraeus Bank and National Bank of Greece (NBG). Following the sharp deterioration

of the economic environment in Greece in the first half of 2015, and the political gridlock which led

to the imposition of capital controls in June 2015, the Greek authorities and the creditors agreed on a

third economic adjustment programme on 19 August 2015. This programme amounted to

EUR 86 billion and included a further recapitalisation of the four major Greek banks, which had been

impacted by the rise in non-performing loans and significant deposit outflows since January 2015.

The ECB carried out an asset quality review and a stress test in the autumn of 2015, the results of

which were disclosed in November 2015.

The four Greek banks reported capital shortfalls of EUR 4.4 billion in the baseline scenario and

EUR 14.4 billion in the adverse scenario. The Greek Parliament approved the new recapitalisation

law on 31 October 2015, requesting banks to raise private capital through share capital increases,

bond swaps or asset sales. All four large Greek banks managed to raise significant amounts of capital

(see Table 2), and thereby escaped resolution. However National Bank of Greece and Piraeus only

managed to address the baseline scenario through private funds (including the conversion of all

subordinated and senior bondholders).

PE 602.084 4

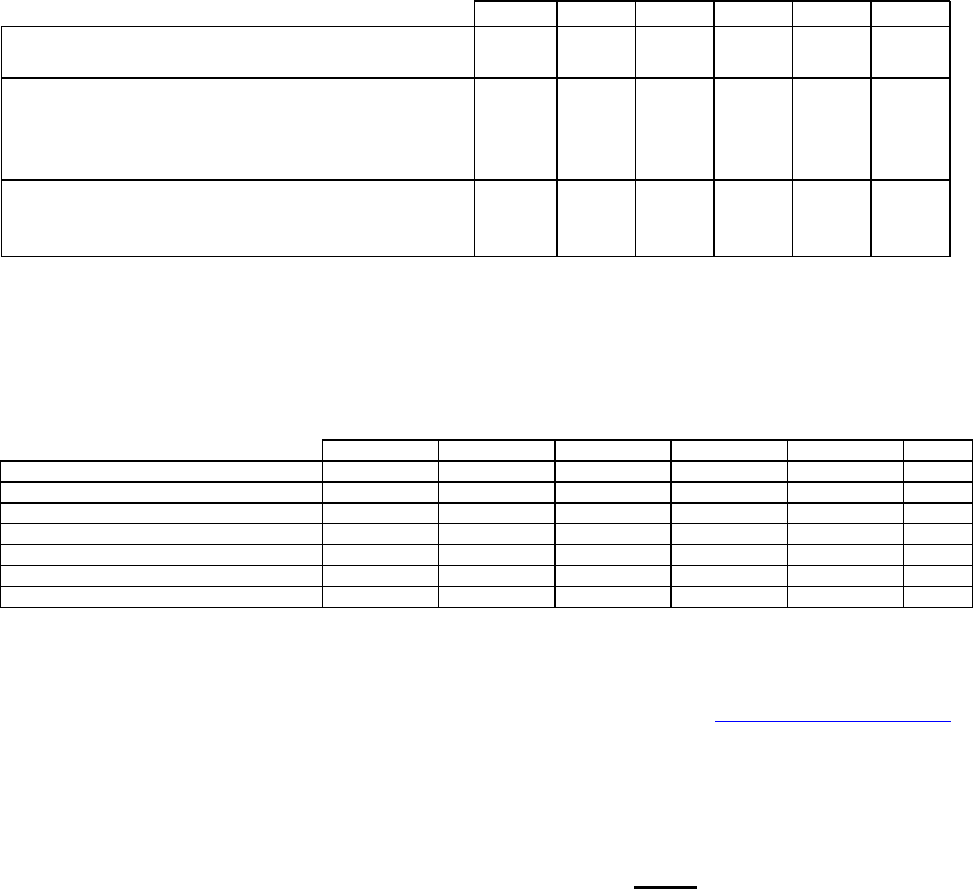

Table 1: Results of the 2015 comprehensive assessment

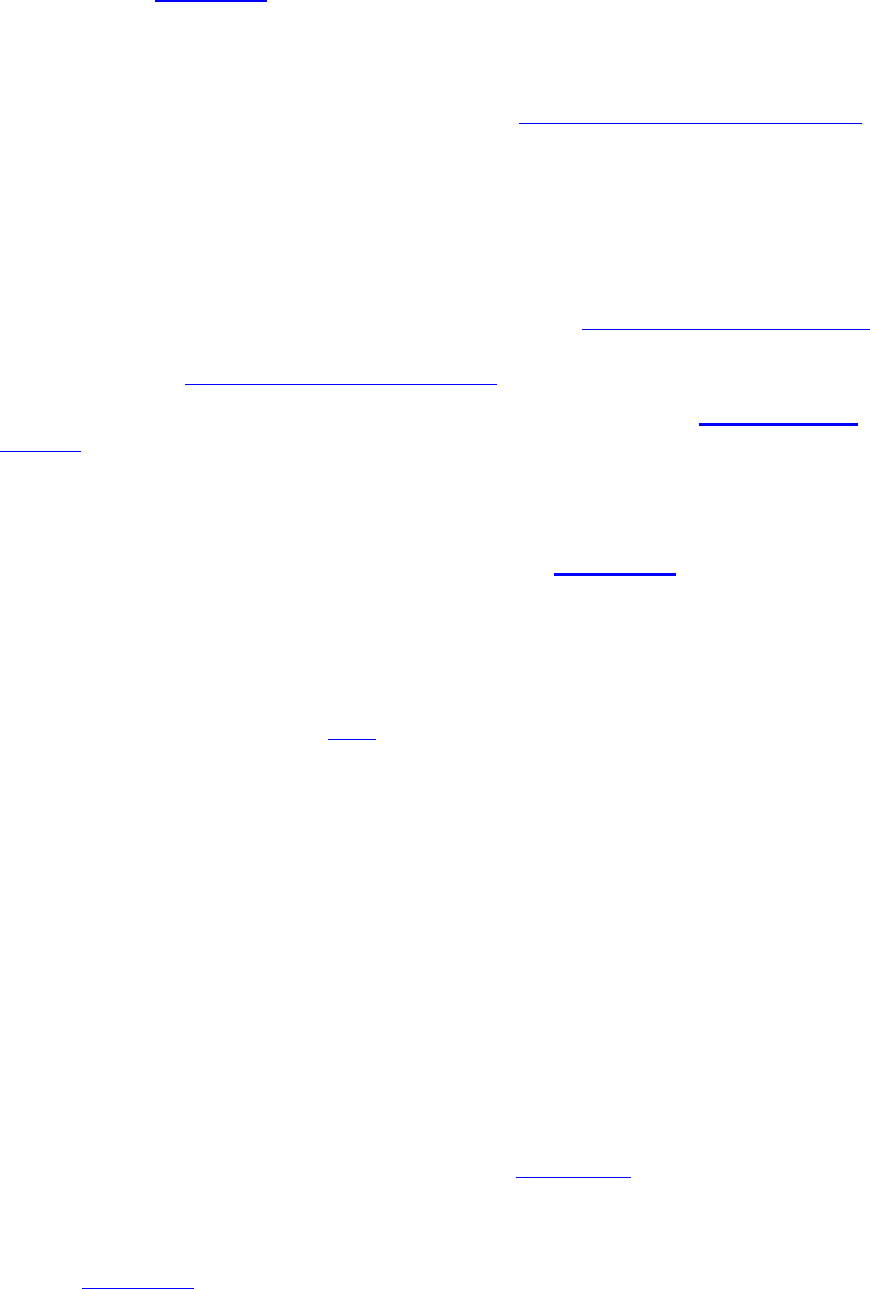

Piraeus Bank and NBG resorted to a precautionary recapitalisation to bridge the shortfall

stemming from the adverse scenario. The Hellenic Financial Stability fund injected EUR 2.7 billion

in each bank, in the form of contingent convertible bonds (CoCo’s) for 75% of the amount, and in

ordinary shares for the remaining amount (25%).

Table 2: Summary of the 2015 capital raising exercise

The two recapitalisations were approved by the Commission in December 2015. In its decisions,

the Commission indicates the reasoning underlying its assessment of the precautionary

recapitalisations. The following quotes were extracted from the decision on National Bank of Greece:

- “The Commission notes that measures A, B and C constitute State aid and therefore qualify as

extraordinary public financial support within the meaning of the BRRD” (recital 171);

- “The assessment of the measures [...] has already shown that the measures are granted to remedy

a serious disturbance in the Greek economy and to preserve financial stability in the Greek

banking sector” (recital 172);

- “The Commission notes that the aid measures do not confer an undue advantage to the Bank, i.e.

an advantage incompatible with the internal market under State aid rules(...)” (recital 173); in

recital 103 the Commission had also noted “that the HFSF is recapitalising the Bank in

circumstances and under terms that no private investor would accept”;

- “The aid is confined to a solvent institution as the Bank complied with the capital requirements”

(recital 174);

- “The aid injected into the Bank is of a precautionary and temporary nature as [it] will result in

the creation of prudential buffers in the Bank. (...) The temporary nature of the aid is ensured by

the fact that a high proportion of the aid (75%) is granted in the form of a repayable capital

instrument, i.e. CoCos, as well as by the overall objective of (...) privatisation (...)” (recital 177);

- “The HFSF will recapitalise the Bank only after the State aid decision is adopted” (recital 175);

- “The Commission has already concluded in the present Decision that the aid is proportionate to

remedy the consequences of the serious disturbance in the Greek economy” (recital 178);

- “The aid is not used to offset losses that the Bank has incurred or is likely to incur in the near

future” (recital 179) and “the aid measures (...) are limited to the injections necessary to cover the

capital shortfall arising under the adverse scenario of the stress test (...), after the capital shortfall

arising under the AQR and the baseline scenario of the stress test has been covered by private

means” (recital 180);

- “the circumstances referred to in point (a), (b) and (c) of article 32(4) BRRD are not met”

(recital 181).

threshold NBG Eurobank Alpha Piraeus Total

CET1 capital amount in EUR as of 30/06/2015 7.412 5.389 6.792 6.189 25.781

Risk Weighted Assets in EUR as of 30/06/2016 63.870 39.218 53.516 57.113 213.716

CET1 capital ratio as of 30/06/2015 11,6% 13,7% 12,7% 10,8% 12,1%

in % post AQR 9,50% 8,1% 8,6% 9,6% 5,5% 7,9%

in the baseline scenario 9,50% 6,8% 8,6% 9,0% 5,2% 7,3%

in the adverse scenario 8,00% -0,2% 1,3% 2,1% -2,4% 0,1%

Capital shortfall(-) / buffer(+) post AQR 9,50% 831- 339- 73 2.188- 3.285-

in EUR in the baseline scenario 9,50% 1.576- 339- 263- 2.213- 4.391-

in the adverse scenario 8,00% 4.602- 2.122- 2.743- 4.933- 14.401-

m€ NBG Eurobank Alpha Bank Piraeus Bank Total %

Conversion of creditors into equity 759 418 1.011 582 2.769 19%

Capital raised from private investors 757 1.621 1.552 1.340 5.271 37%

Capital injected by the HFSF 2.706 - - 2.720 5.426 38%

of which ordinary shares 676 680 1.356 9%

of which contingent convertible instruments 2.029 2.040 4.069 28%

Other capital actions 380 83 180 291 935 6%

Total capital shortfall 4.602 2.122 2.743 4.933 14.400 100%

sources: EGOV based on banks' websites

5 PE 602.084

The Commission concludes in recital 182: “therefore the aid measures do not trigger the “failing

or likely to fail” criterion under the BRRD in relation to the bank and can be implemented outside

resolution”.

For more information on the Greek programme and the restructuring of the Greek banking sector, see

EGOV briefing PE 574.404.

Banca Monte dei Paschi di Siena (2017)

MPS stood out as the worst performer among all 51 banks which were scrutinized during the

EBA’s 2016 EU-wide stress test, according to the results published on 29 July 2016: under the

adverse scenario, MPS’ fully loaded CET1 capital ratio was reduced from 12.07 % at the end of 2015

to ‐2.44 % at the end of 2018, that is to say a reduction by EUR 10.1 billion (1451 basis points). No

other participating bank reported negative equity as a result of the stress test scenario. In the third

quarter of 2016 the bank booked additional losses on its portfolio of non-performing loans, following

further guidance by the ECB published in September 2016.

MPS failed to raise the amount of capital required from private investors (EUR 5 billion) and

announced before Christmas 2016 that it would ask for a precautionary recapitalisation from the

Italian government. Indeed, on 23 December the Italian government passed a decree allowing MPS

to benefit from the EUR 20 billion bail-out package approved on Wednesday 21 December 2016.

The ECB subsequently raised the capital requirements of MPS to EUR 8.8 billion. The bank

indicated that the ECB letter had stated that (i) the bank was solvent and complied with its pillar 2

requirements, (ii) that the application of an 8% CET1 threshold translated into a EUR 8.8 billion

capital shortfall, and (iii) that the liquidity position of the bank had rapidly deteriorated in December.

A long negotiation between the Italian authorities and the Commission was necessary before

the precautionary recapitalisation was approved on 4 July 2017. The total amount of capital

injected amounts to EUR 8.1 billion. This amount includes the conversion of junior bondholders for

EUR 4.3 billion, and a capital injection of EUR 3.9 billion by Italy. In addition, Italy will inject

EUR 1.5 billion to compensate the retail investors who were victims of misselling. It is not clear at

this stage whether the cost of this compensation will be fully borne by the State, or whether the

compensation will be borne by the bank, with Italy getting shares in exchange of this 1.5 billion

contribution. The press release of MPS seems to indicate that the State will only get shares in return

for its EUR 3.9 billion capital injection, while the press release of the Commission indicates that “the

State will inject EUR 5.4 billion, in return for shares in MPS”.

The State aid amounts to EUR 5.4 billion, and was approved as precautionary recapitalisation

by the Commission, meaning the bank was not deemed failing or likely to fail under Article 32

BRRD. The difference between the capital shortfall as calculated by the ECB (EUR 8.8 billion, see

below) and the capital injection (EUR 8.1 billion) is due to additional capital measures, namely asset

sales. MPS thereby disposed of several businesses and stakes in February and July 2017.

In addition, MPS will divest a EUR 26.1 billion portfolio of non-performing loans (NPLs) to a

private securitization vehicle. 95% of the junior and mezzanine tranches of this securitisation

vehicle will be purchased by the fund Atlante II. The deal was signed on 26 June 2017, one day after

the Commission approved the measures taken in relation to Veneto Banca and Banca Popolare di

Vicenza. The net book value at end 2016 was EUR 9.4 billion, and the portfolio will be transferred

against a consideration of EUR 5.5 billion (21% of the gross book value). The most senior tranche

will benefit from a guarantee of the Italian scheme GACS, an aid-free scheme approved by the

Commission in February 2016 (see EGOV briefing PE 574.395). This disposal is part of a wider

updated restructuring plan approved by the Commission, which aims at reorienting the business

model towards retail customers and SMEs, and at enhancing risk management. For more information

on the previous recapitalisations of MPS and State aid measures implemented by Italy, see EGOV

briefing PE 587.392).

PE 602.084 6

Banca Popolare di Vicenza and Veneto Banca

Those two banks were rescued by the Atlante fund in 2016. The Atlante fund was set up to

recapitalize weak Italian lenders and purchase portfolios of NPLs after the two capital raising

exercises of Banca Popolare di Vicenza and Veneto Banca, which had been fully underwritten by

Itensa San Paolo and Unicredit respectively, failed. The fund injected EUR 2.5 billion of capital in

the two lenders in 2016 and a further EUR 0.9 billion in January 2017 in advance of the future capital

increase.

The two banks confirmed in April 2017 that the capital shortfall estimated by the ECB in the

adverse scenario of the 2016 stress test amounted to EUR 3.3 billion and EUR 3.1 billion

respectively. The two banks were planning to merge and had applied for a precautionary

recapitalisation, claiming that the January 2017 capital increases adequately addressed the shortfall

in the baseline scenario

1

. However it was reported in the public domain that the Commission had

requested that EUR 1.2 billion be raised from private investors, as part of the combined capital

increase.

However the ECB declared on 23 June 2017 that the two banks were failing or likely to fail. On

the same day the SRB concluded that the resolution of those banks was not warranted on the ground

of public interest. Therefore those two banks were subsequently liquidated under Italian insolvency

laws. In a press release Banca Popolare di Vicenza admitted it “took stock of the decision of the

European Commission to reject its admission to the “precautionary recapitalisation, submitted to the

Italian Economy and Finance Ministry on 17 March”. It confirms that the responsibility for assessing

the conditions for requesting a precautionary recapitalisation lies primarily in the Commission. For

more details on the orderly liquidation of the Veneto banks, see EGOV briefing PE 602.094.

1

See press release from Veneto Banca and Banca Popolare di Vicenza.

7 PE 602.084

Annex 1: Article 32 BRRD

1. Member States shall ensure that resolution authorities shall take a resolution action in relation to

an institution referred to in point (a) of Article 1(1) only if the resolution authority considers that all

of the following conditions are met:

(a) the determination that the institution is failing or is likely to fail has been made by the competent

authority, after consulting the resolution authority or,; subject to the conditions laid down in

paragraph 2, by the resolution authority after consulting the competent authority;

(b) having regard to timing and other relevant circumstances, there is no reasonable prospect that

any alternative private sector measures, including measures by an IPS, or supervisory action,

including early intervention measures or the write down or conversion of relevant capital

instruments in accordance with Article 59(2) taken in respect of the institution, would prevent

the failure of the institution within a reasonable timeframe;

(c) a resolution action is necessary in the public interest pursuant to paragraph 5.

2. Member States may provide that, in addition to the competent authority, the determination that the

institution is failing or likely to fail under point (a) of paragraph 1 can be made by the resolution

authority, after consulting the competent authority, where resolution authorities under national law

have the necessary tools for making such a determination including, in particular, adequate access to

the relevant information. The competent authority shall provide the resolution authority with any

relevant information that the latter requests in order to perform its assessment without delay.

3. The previous adoption of an early intervention measure according to Article 27 is not a condition

for taking a resolution action.

4. For the purposes of point (a) of paragraph 1, an institution shall be deemed to be failing or likely

to fail in one or more of the following circumstances:

(a) the institution infringes or there are objective elements to support a determination that the

institution will, in the near future, infringe the requirements for continuing authorisation in a way

that would justify the withdrawal of the authorisation by the competent authority including but

not limited to because the institution has incurred or is likely to incur losses that will deplete all

or a significant amount of its own funds;

(b) the assets of the institution are or there are objective elements to support a determination that the

assets of the institution will, in the near future, be less than its liabilities;

(c) the institution is or there are objective elements to support a determination that the institution

will, in the near future, be unable to pay its debts or other liabilities as they fall due;

(d) extraordinary public financial support is required except when, in order to remedy a serious

disturbance in the economy of a Member State and preserve financial stability, the extraordinary

public financial support takes any of the following forms:

(i) a State guarantee to back liquidity facilities provided by central banks according to the

central banks’ conditions;

(ii) a State guarantee of newly issued liabilities; or

(iii) an injection of own funds or purchase of capital instruments at prices and on terms that

do not confer an advantage upon the institution, where neither the circumstances referred

to in point (a), (b) or (c) of this paragraph nor the circumstances referred to in Article 59(3)

are present at the time the public support is granted.

In each of the cases mentioned in points (d)(i), (ii) and (iii) of the first subparagraph, the guarantee

or equivalent measures referred to therein shall be confined to solvent institutions and shall be

conditional on final approval under the Union State aid framework. Those measures shall be of a

precautionary and temporary nature and shall be proportionate to remedy the consequences of the

PE 602.084 8

serious disturbance and shall not be used to offset losses that the institution has incurred or is likely

to incur in the near future.

Support measures under point (d)(iii) of the first subparagraph shall be limited to injections necessary

to address capital shortfall established in the national, Union or SSM-wide stress tests, asset quality

reviews or equivalent exercises conducted by the European Central Bank, EBA or national

authorities, where applicable, confirmed by the competent authority.

EBA shall, by 3 January 2015, issue guidelines in accordance with Article 16 of Regulation (EU) No

1093/2010 on the type of tests, reviews or exercises referred to above which may lead to such support.

By 31 December 2015, the Commission shall review whether there is a continuing need for allowing

the support measures under point (d)(iii) of the first subparagraph and the conditions that need to be

met in the case of continuation and report thereon to the European Parliament and to the Council. If

appropriate, that report shall be accompanied by a legislative proposal.

5. For the purposes of point (c) of paragraph 1 of this Article, a resolution action shall be treated as

in the public interest if it is necessary for the achievement of and is proportionate to one or more of

the resolution objectives referred to in Article 31 and winding up of the institution under normal

insolvency proceedings would not meet those resolution objectives to the same extent.

6. EBA shall, by 3 July 2015, issue guidelines in accordance with Article 16 of Regulation (EU) No

1093/2010 to promote the convergence of supervisory and resolution practices regarding the

interpretation of the different circumstances when an institution shall be considered to be failing or

likely to fail.

9 PE 602.084

Annex 2: Article 107 TFUE (ex Article 87 TEC)

1. Save as otherwise provided in the Treaties, any aid granted by a Member State or through State

resources in any form whatsoever which distorts or threatens to distort competition by favouring

certain undertakings or the production of certain goods shall, in so far as it affects trade between

Member States, be incompatible with the internal market.

2. The following shall be compatible with the internal market:

(a) aid having a social character, granted to individual consumers, provided that such aid is granted

without discrimination related to the origin of the products concerned;

(b) aid to make good the damage caused by natural disasters or exceptional occurrences;

(c) aid granted to the economy of certain areas of the Federal Republic of Germany affected by the

division of Germany, in so far as such aid is required in order to compensate for the economic

disadvantages caused by that division. Five years after the entry into force of the Treaty of Lisbon,

the Council, acting on a proposal from the Commission, may adopt a decision repealing this point.

3. The following may be considered to be compatible with the internal market:

(a) aid to promote the economic development of areas where the standard of living is abnormally low

or where there is serious underemployment, and of the regions referred to in Article 349, in view of

their structural, economic and social situation;

(b) aid to promote the execution of an important project of common European interest or to remedy

a serious disturbance in the economy of a Member State;

(c) aid to facilitate the development of certain economic activities or of certain economic areas, where

such aid does not adversely affect trading conditions to an extent contrary to the common interest;

(d) aid to promote culture and heritage conservation where such aid does not affect trading conditions

and competition in the Union to an extent that is contrary to the common interest;

(e) such other categories of aid as may be specified by decision of the Council on a proposal from the

Commission.

DISCLAIMER: This document is drafted by the Economic Governance Support Unit (EGOV) of the European Parliament based on publicly available

information and is provided for information purposes only. The opinions expressed in this document are the sole responsibility of the authors and do

not necessarily represent the official position of the European Parliament. Reproduction and translation for non-commercial purposes are authorised,

provided the source is acknowledged and the publisher is given prior notice and sent a copy. © European Union, 2017