Barclays

Simpler, Better, More balanced

Investor Update: 20

th

February 2024

27

February 2024

Barclays Investor Update

Barclays today

1

Clients defined as any relationship from which we generate >£10,000 income per annum from our existing product set. UK Corporates defined as the stock of companies (group entities considered together) with annual turnover of >£6.5m. Includes clients across UK

Corporate and the International Corporate Bank within the Investment Bank |

2

“=#” rank represents shared rank with another bank whose revenues are within 5% of Barclays. 1H23 Coalition Greenwich Global Competitor Analytics. Peer group is based on the following

banks: BofA Securities, Barclays, BNP Paribas, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, J.P. Morgan, Morgan Stanley and UBS. Analysis is based on Barclays’ internal business structure and internal revenues|

3

Industry rank data per Dealogic for the period

covering 2023 |

4

#6 Global Markets and Investment Banking. Global Markets rank based on Barclays’ calculations using Peer reported financials. Top 10 Peers includes Barclays and; US Peers: Bank of America, Citi, Goldman Sachs, JP. Morgan, Morgan Stanley. European

Peers: BNP Paribas, Credit Suisse, Deutsche Bank, UBS. Investment Banking rank based on Dealogic as at 31 December 2023 |

We have built a leading Global Markets and Investment Banking business

>20m

Barclays UK

customers

25%

UK corporates

are clients

1

20m

US credit

card customers

Strong customer franchises in the UK and US

Top 3

Global Fixed

Income Credit

2

=#1

Fixed Income

Financing

2

#1

UK Investment

Banking Fees

3

Leading non-US

Investment Bank

4

330 years of innovation

28

February 2024

Barclays Investor Update

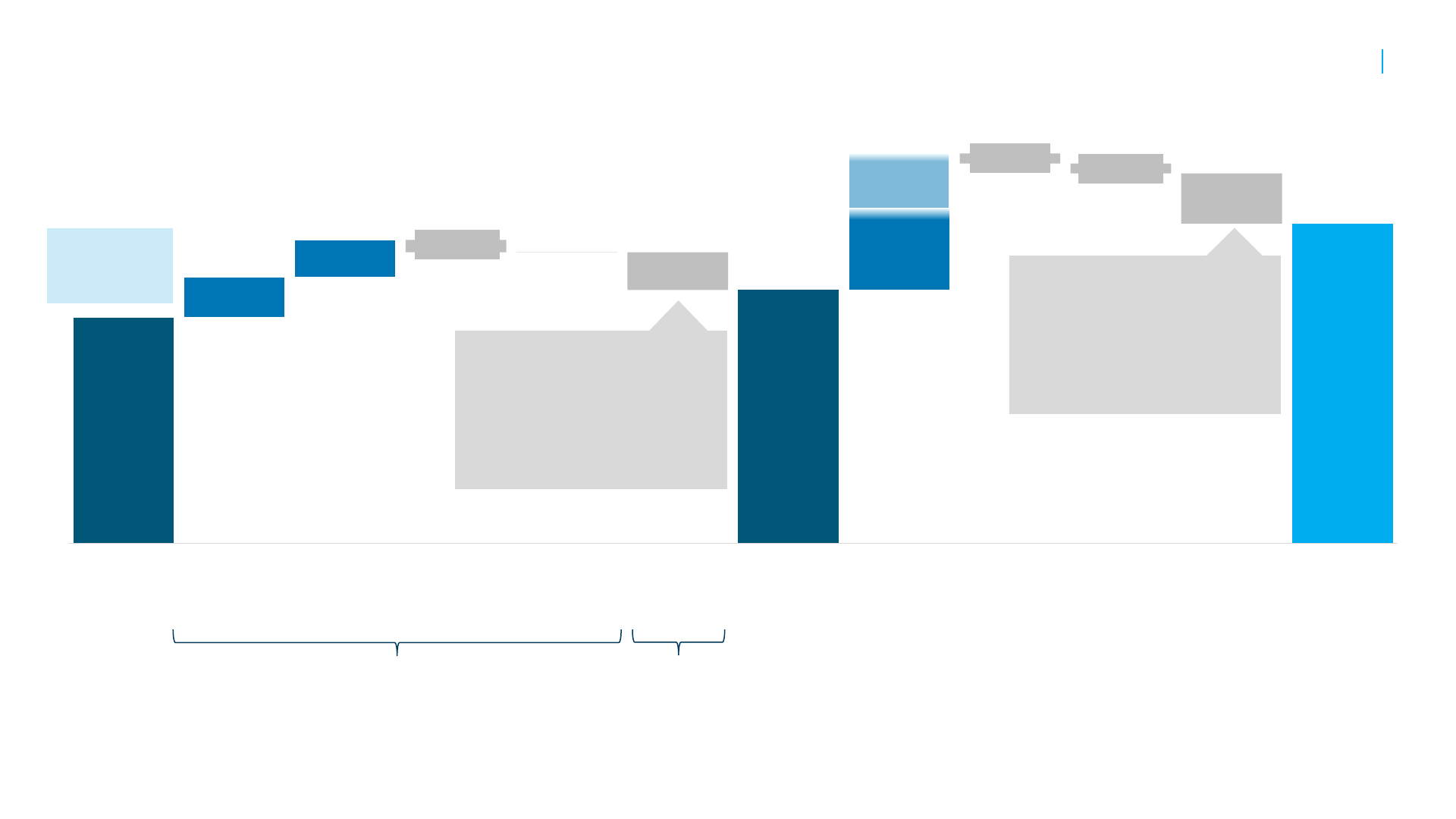

Over the last decade we have become well-capitalised and leaner

1

Barclays Strategy Update at May 2014. £436bn RWA and 9.3% CET1 ratio as at FY13 results |

2

Litigation and conduct charged to the income statement for the period 2014-2023 including in relation to customer redress, market manipulation and governance. Please see

our Legal, competition and regulatory matters note on pg.473 of ARA 2023 for further detail |

139,600

colleagues

>50

countries

£436bn

RWAs

Strategy Update

May 2014

1

9.3%

CET1 ratio

Non-priority business exits

• Africa

• Commodities

• Europe retail banking

• Reduced non-CIB footprint in Asia

• US and Asia Wealth

• Considering options for merchant acquiring Payments business

• Sale of German consumer finance business

• Disposal of Italian retail mortgages book

Refocused business priorities

• Invested in building at scale CIB franchise

c.£16bn litigation and conduct addressed

2

• Customer redress

• Market manipulation

• Governance

13.8%

CET1 ratio

Investor Update

February 2024

92,400

colleagues

38

countries

£343bn

RWAs

29

February 2024

Barclays Investor Update

Improved RoTE and increased distributions with room to grow

1

The FY23 RoTE of 10.6% excludes £927m of structural cost actions taken in Q423. Statutory RoTE of 9.0%. Impact of 1.6% relates to structural cost actions |

2

Market capitalisation as at 13 February 2024 |

13.1%

10.4%

9.0%

1.6%

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Strong Return on Tangible Equity in each of the last three years

Increased shareholder distributions: distributed c.35% of market cap since 2021

2

1.0

1.2

1.2

1.5

1.0

1.8

1.1 1.1

0.5

0.5

1.1

0.5

0.9

2.5

2.2

3.0

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Dividend

Share buyback

(£bn)

10.6%

1

SCA

Impact

1

30

February 2024

Barclays Investor Update

We know we need to do even better

“Consistently excellent”

Improve customer experience

Reduce organisational complexity

Continue to upgrade legacy technology

Further uplift operational controls

Operationally

Drive towards higher returns within our divisions

Demonstrate stronger cost control

Invest RWAs in higher returning consumer and

corporate businesses

Broadly stable Investment Bank RWAs including

regulatory headwinds

Predictable and higher shareholder distributions

Enhanced financial reporting

Financially

31

February 2024

Barclays Investor Update

Which will deliver

1

FY23 RoTE of 9.0% includes Q423 structural cost actions of £927m. RoTE of 10.6% excluding these actions |

2

Market capitalisation as at 13 February 2024 |

3

63% based on prior Corporate and Investment Bank segmentation. Re-segmented Barclays Investment Bank 58% |

Targets

Total Payout

Statutory

RoTE

Investment

Bank RWAs

(% of Group)

2023

9.0%

1

£7.7bn

2021-2023

63%

3

2026

>12%

At least £10bn

2024-2026

c.50% of market cap

2

c.50%

2024

>10%

This multiyear plan is subject to supervisory and Board

approval, anticipated financial performance and our

published CET1 ratio target range of 13-14%

32

Barclays Investor Update

February 2024

Our journey to achieve

More balancedBetterSimpler

33

February 2024

Barclays Investor Update

What Simpler means

Simpler business

Simpler operations

Simpler organisation

34

February 2024

Barclays Investor Update

Simpler business: five focused divisions

Barclays UK Consumer, Cards and Payments Corporate and Investment Bank

Barclays InternationalRing-fenced bank

Barclays UK (BUK) Private Bank & Wealth

Management (PBWM)

UK Corporate Bank

(UKC)

Investment Bank

(IB)

US Consumer Bank

(USCB)

35

February 2024

Barclays Investor Update

Simpler organisation and operations: continuing the journey

1

Barclays Execution services, the Group service company |

2

Full time employees |

Starting point We will continue

BX

1

c.70k FTEs

2

Right

-sizing headcount; gross

c.5k FTE exits in 2023

Private Bank & Wealth

Management unification

Reposition c.30%

of BX employees

into businesses

Simplified decision making

Improved

delivery oversight

Improved speed of execution

Enhanced front to back

accountability

Increased use of low

-cost,

industry standard technology

Reduced complexity and better

operational risk management

Increase to 85

-90% workload

on cloud

Decommission a further 450

-

500 legacy applications

Simpler

organisation

Simpler

operations

75% workload on cloud

c.400 legacy applications

decommissioned since 2021

Example actions Outcome

Reduce organisational

complexity

Continue to upgrade legacy

technology

Further uplift operational

controls

36

February 2024

Barclays Investor Update

What Better means?

Better returns

Better quality income

Better investments

Better customer

experience and outcomes

37

February 2024

Barclays Investor Update

Better returns: our divisions contribute through growth and performance

1

Includes Head Office |

2

FY22 RoTE of 10.4% includes the impact of the Over-issuance of Securities (FY22 financial impacts: income gain of £292m, litigation & conduct charges of £966m). RoTE of 11.6% excluding these impacts |

3

FY23 RoTE of 9.0% includes Q423

structural cost actions of £927m. RoTE of 10.6% excluding these actions |

Barclays UK

Barclays

UK Corporate Bank

Barclays

Private Bank & Wealth Management

Barclays

Investment Bank

Barclays

US Consumer Bank

Barclays Group

1

18%

19%

19%

High teens %

2021 2022 2023 20262024

14%

19%

20%

High teens %

23%

36%

33%

>25%

14%

9%

7%

In line with Group

17%

13%

4%

In line with Group

13%

10%

2

9%

3

>10%

>12%

Statutory RoTE

38

February 2024

Barclays Investor Update

2023 2026

Better investments: facilitating growth in all divisions

1

Investments related to driving income growth and protection, and cost efficiency. Excludes investment related to regulation and control and structural cost actions |

Investments in businesses outside of the Investment Bank

1

£bn cost spend (P&L)

0.5

0.3

Investing more on

driving future returns

• Improving customer journeys

• Modernising platforms

• Reducing legacy technology

Barclays US Consumer Bank

Barclays Private Bank and Wealth Management

Barclays UK Corporate

Barclays UK

Barclays Investment Bank

c.70%

c.60%

Expected payback:

• Income growth and protection c.1 year

• Cost efficiency c.2 years

c.2x

39

February 2024

Barclays Investor Update

Better quality income: diverse sources of income to support growth

1

2022 excludes the impact of the Over-issuance of Securities (Income of £292m) |

2

Global Markets Financing includes income related to client financing in both FICC and Equities. In FICC this includes fixed income securities repurchase agreements, structured credit,

warehouse and asset backed lending. In Equities this includes prime brokerage margin lending, securities lending, quantitative prime services, futures clearing and settlement, synthetic financing, and equity structured financing. All other items are considered intermediation

|

3

Retail & Corporate consists of income from Barclays UK, Barclays UK Corporate Bank, Barclays Private Bank and Wealth Management, the International Corporate Bank, Barclays US Consumer Bank and Head Office |

11.9

13.9

16.2

2.2

2.9

2.9

4.3

5.7

1

4.3

3.7

2.2

2.0

2021 2022 2023 Retail &

Corporate

Financing Intermediation Investment

Banking Fees

2026

Income (£bn)

24.7

1

21.9

Retail &

Corporate

3

More stable income

streams expected to

contribute >70% of

Group income by 2026

Financing

2

Intermediation

Investment

banking fees

We have grown more

stable income streams

+c.35% since 2021

25.4

c.30

+c.15%

+19%

+14%

Global Markets

40

February 2024

Barclays Investor Update

Better customer experience and outcomes: where we need to do more

1

Based on a Barclays Brand 12-month rolling net promoter score as at December 2023 (Source: IPSOS FRS Survey). Benchmarked vs. 12 banks which are Barclays, Co-op, First Direct, Halifax, Lloyds, TSB, HSBC, Metro Bank, Monzo, NatWest, Nationwide, RBS, Santander |

2

Savanta |

3

Overall score across Private Bank UK and Private Bank International clients from Barclays Promising Outcomes client survey 2023 |

4

USCB digital tNPS. A newly tracked metric measuring USCB customer experience at the digital journey level |

5

Dealogic for the

period covering 2019 to 2023 |

•

More resilient platforms

•

Tailored servicing model

•

Enhanced offerings

•

More regional and sector coverage

•

Expanded offerings and drive proposition

adoption

•

Breadth of products and services with

seamless referrals across the Group

•

Digital customer and partner platforms

•

Wide rollout of AI digital assistants

•

Deliver multiple services in coordinated fashion

•

Invest in talent and continue to grow a winning

culture

•

Barclays UK Brand NPS ranked 8th

1

•

56% of UK Corporate clients rate overall

quality of service as excellent or very good

2

•

43% of Private Bank clients rate Barclays as

best for client experience

3

•

US Consumer Bank: digital NPS c.60%

4

•

Investment Banking Fees market share

reduction of 1% from 2019 to 2023

5

Barclays tomorrowBarclays today

Best-in-class

customer

and client

experience

41

February 2024

Barclays Investor Update

What More balanced means?

More balanced allocation of RWAs

More balanced geographical footprint

42

February 2024

Barclays Investor Update

Including

+c.£16bn regulation

3

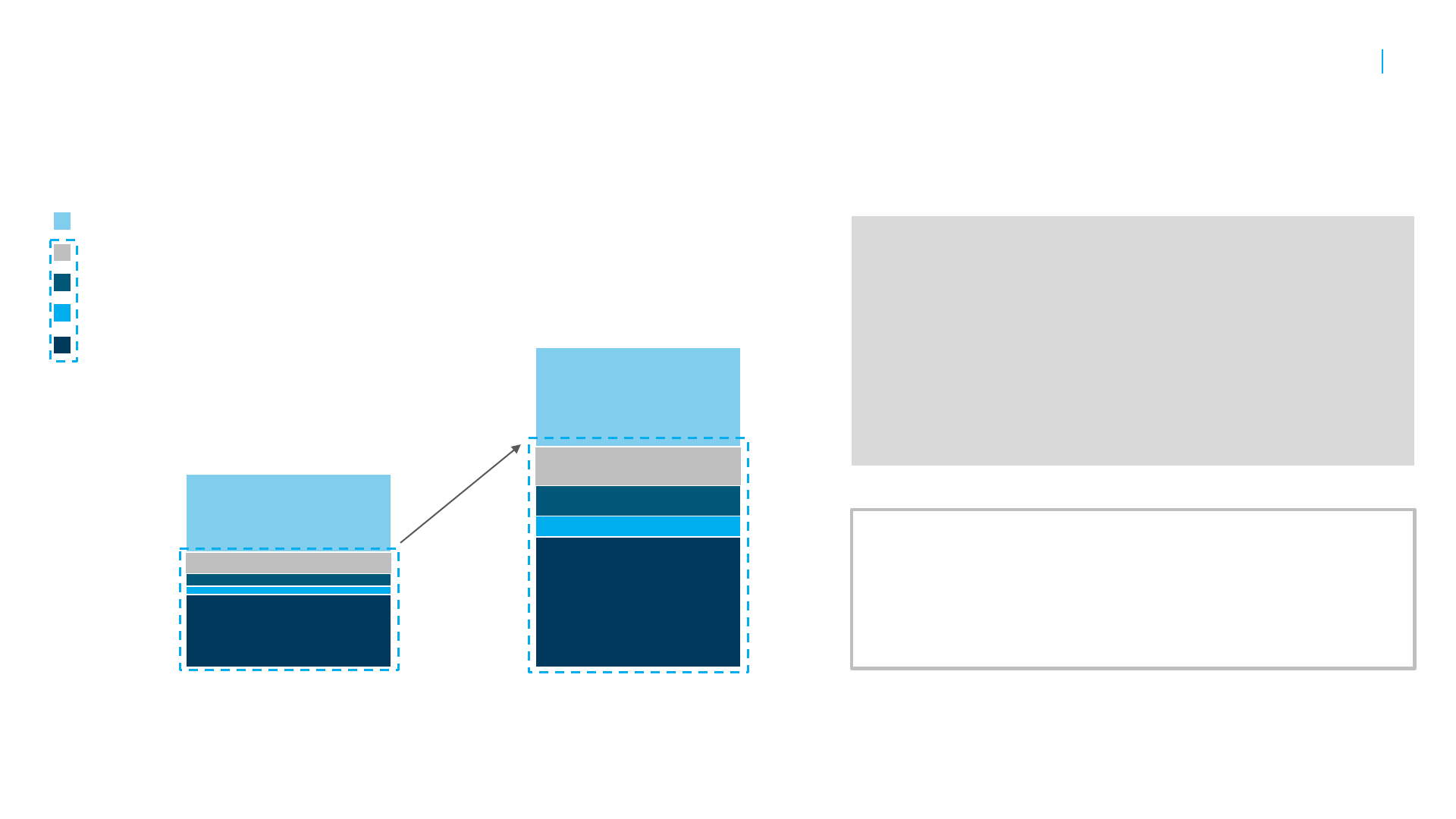

Capital allocation to our highest returning divisions

1

Includes Head Office FY23 RWA: £19bn |

2

Relates to RWA effect on day 1 |

3

US IRB H224 expected impact | Note: Charts may not sum due to rounding |

Barclays UK

19% £74bn

Barclays

UK Corporate Bank

18% £21bn

Barclays

Private Bank & Wealth Management

31% £7bn

Barclays

US Consumer Bank

11% £25bn

Barclays

Investment Bank

10% £197bn

Barclays Group

1

(Incl. Head Office)

11% £343bn

Statutory RoTE

FY21-FY23 average

RWA% of Group

2023

+c.£30bn

21%

6%

2%

58%

7%

RWA 2023

Allocation of RWAs

across the three

highest returning

divisions (includes

c.£8bn Tesco

Bank

2

)

Growth

2026 vs. 2023

Drivers

+c.£20bn

Whilst absorbing

Basel 3.1

Broadly stable

+c.£50bn

43

February 2024

Barclays Investor Update

Barclays Investment Bank c.50% of Group RWAs by 2026

58% c.50%

Investment Bank

2023

Investment Bank

2026

63%

Corporate & Investment Bank

2023

% of Group RWA

Investment Bank competitive and at scale

Re-segmented Group

Includes Global Markets and Investment Banking, which incorporates Investment Banking Fees and

International Corporate Bank

44

February 2024

Barclays Investor Update

Now is the right time to grow in our UK home market

Deep rooted presence and brand

1.

UK economy remains resilient to geopolitical events

2.

Strong and trusted regulatory environment

3.

London is our global financial centre

4.

Aim to become the UK-centred leader in global finance

45

Barclays Investor Update

February 2024

More balancedBetterSimpler

Outcome

46

February 2024

Barclays Investor Update

9.0%

>10%

>12%

1.6%

>1.5%

c.(0.5%)

c.(0.0%)

<(1.5%)

<(0.5%)

c.(0.5%)

c.(2.0%)

2023 Q423 SCA Income Costs Impairment Book value

growth &

Other

2024 Income Costs Impairment Book value

growth &

Other

2026

Retail &

Corporate

2

Investment

Bank

Earnings impacts

3

Tangible equity

impacts

Includes:

Cash flow hedge reserve

amortisation c.(0.5)%

Incremental equity for RWA

growth c.<(0.5)%

Includes:

Cash flow hedge reserve

amortisation c.>(0.5)%

Incremental equity for RWA

growth c.>(1.0)%

>5%

Statutory RoTE: driving to above 12% by 2026

1

Excludes Q423 structural cost actions of £927m |

2

Retail & Corporate consists of income from Barclays UK, Barclays UK Corporate Bank, Barclays Private Bank and Wealth Management, the International Corporate Bank, Barclays US Consumer Bank and Head Office |

3

The bridging items from 2023-24 exclude the impact of Tesco Bank, with acquisition expected in H224. Statutory RoTE target of >10% includes the impact of Tesco bank|

FY23

adjusted

RoTE: 10.6%

1

47

February 2024

Barclays Investor Update

Income: deploying c.£30bn of RWA to our home UK market

1

6% of total book is HLTV vs. 12-14% peer average. Peer average based on an average of estimated proportion of HLTV at HSBC, Lloyds and NatWest (definition of HLTV mortgages varies between banks) |

2

Kensington Mortgage Company |

3

Credit card market share

based on total balances (Source: Bank of England) |

4

Market share based on Barclays Consumer Loans, excluding Barclays Partner Finance, as a % of total consumer credit excluding credit cards and student loans (Source: Bank of England) |

0.5

11.0

3.3

7.6

1.8

1.2

25.4

c.30

2023 2026

Income (£bn)

Grow

share

PBWM

UKC

Barclays UK

USCB

IB

Head Office

High LTV mortgages

6%

total book

1

Grow presence

Leverage Kensington

2

Broader propositions

Better decisioning

Business Banking

UK Corporate

26%

LDR

31%

LDR

Competitive pricing

Automated journeys

Regain

share

Tesco Bank acquisition

Simplified journeys

Barclaycard UK

Barclays UK

Consumer Loans

15%

pre-Tesco

market share

3

Tesco Bank acquisition

Open market strategy

2%

pre-Tesco

market share

4

Lending growth underpinned by c.£30bn RWA deployment

Product 2023

Action

48

February 2024

Barclays Investor Update

1.8

1.7

1.4

2.2

3.6

3.8

2.9

1.9

0.7%

0.0%

1.1%

4.1%

3.4%

1.1%

0.9%

0.7%

0.9%

1.5%

00.0

01.0

02.0

03.0

04.0

05.0

06.0

07.0

08.0

09.0

10.0

2019 2020 2021 2022 2023 2024 2025 2026

Income: predictable uplift from the structural hedge

1

Gross hedge income divided by period end hedge notional |

2

UK Pound Sterling SONIA OIS Zero 5 Year Point (Refinitiv: GBPOIS5YZ=R) |

3

Refers to the impact to NII of hedges that have already been executed |

4

We expect to roll around three quarters |

Gross Structural

Hedge income

£bn

Income locked

in by 2023

3

5-year swap rate

2

Average hedge yield

1

Average maturing yield of c.1.5% on c.£170bn maturing

4

Gross contribution

resilient to marginal

changes in rates

and notionals

Two-thirds of gross

hedge income

within Barclays UK

49

February 2024

Barclays Investor Update

Income: realistic assumptions underpin Investment Bank growth

1

Total industry wallet represents Markets & Banking revenues. 2019-2022 Markets industry revenue based on Coalition Greenwich Global Competitor Analytics, for the following peer group: BofA Securities, Barclays, BNP Paribas, Citigroup, Credit Suisse, Deutsche Bank,

Goldman Sachs, J.P. Morgan, Morgan Stanley and UBS. Analysis is based on Barclays’ internal business structure and internal revenues. 2023 based on Barclays internal estimates. Dealogic Banking wallet as at December 31st 2023 for the period covering 2019 to 2023 |

2

Excluding the impact of Over-Issuance of securities in 2022 |

3

Global Markets share based on Barclays’ calculations using Peer reported financials, including restatements. Top 10 Peers includes Barclays and; US Peers: Bank of America, Citi, Goldman Sachs, JP. Morgan,

Morgan Stanley. European Peers: BNP Paribas, Credit Suisse, Deutsche Bank, UBS |

4

Dealogic Banking Fee share as at December 31st 2023 for the period covering 2019 to 2023 |

5.3

7.6

6.4

8.6

7.2

2.5

2.7

3.7

2.2

2.0

172

218

252

204

178

c.200

-400.0

-300.0

-200.0

-100.0

0.0

100.0

200.0

300.0

00.0

02.0

04.0

06.0

08.0

10.0

12.0

14.0

16.0

18.0

2019 2020 2021 2022 2023 2024 2025 2026

Markets

Income £bn

2

Investment

Banking

Fees £bn

Combined

Wallet $bn

1

Global Markets

Share %

2,3

6.1 6.7 6.3 7.0 6.5 Recovery in 2024, with stability to 2026

Banking Fee

Share %

4

4.1 3.6 3.6 3.1 3.1 Rebuilding to 2019 level

• Markets broadly flat

• Banking reverting

to 10-year average

50

February 2024

Barclays Investor Update

Costs: c.£2bn cost efficiency by 2026

1

Excludes Q423 structural cost actions of £927m | Note: Charts may not sum due to rounding | Note: Group plan based on an average USD/GBP FX rate of 1.27

16.0

c.17.0

0.9

1.2

c.0.2

1.7

c.(2.0)

c.(0.1)

2023 Efficiency

savings

Inflation Investments Regulation &

Control

Business

growth

2026

• Efficiency savings more than offsetting

inflation

o c.£0.5bn in 2024 from £1.0bn of

structural cost actions in 2023

o c.£1.5bn driven by prior and on-going

efficiency investments and business-

as-usual structural cost actions of

c.£200-300m per year

• Business growth costs increase in line

with expected income generation

Q423

SCAs

CIR

63%

1

CIR

High 50s%

£1.0bn in 2024

£1.0bn 2025-2026

£bn

51

February 2024

Barclays Investor Update

Costs: lower regulatory change spend facilitates investments in growth

Note: Charts may not sum due to rounding |

1.0

c.1.1

c.1.0

c.0.9

0.3

c.0.4

c.0.5

c.0.5

1.0

c.0.2 c.0.2

c.0.2

2023 2024 2025 2026

Total investment (including structural cost actions)

£bn cost spend (P&L)

2.3

c.1.8

Regulation and control

Investments (income growth and protection

and cost efficiency)

Structural cost actions

c.1.7

c.1.6

Structural cost actions to normalise going forwards

Investments &

Regulation

and control

spend broadly

flat from 2023

to 2026 with a

change in mix

52

February 2024

Barclays Investor Update

Costs: better CIRs and opportunity vs. best in class

1

Cost savings are indicative and not formal business targets |

2

Peer benchmarking based on top quartile of comparable businesses averaged as at FY22 compared to Barclays FY26 guidance |

3

Includes planned savings from strategic review of business portfolio |

4

Excludes

Q4 structural cost actions of £927m (Barclays UK: £168m, UK Corporate Bank: £27m, Private Bank & Wealth Management: £29m, Investment Bank: £169m, US Consumer Bank: £19m) |

2024-26

Barclays UK

c.£0.7bn

Barclays

UK Corporate Bank

c.£0.1bn

Barclays

Private Bank & Wealth Management

c.£0.1bn

Barclays

Investment Bank

c.£0.7bn

Barclays

US Consumer Bank

c.£0.1bn

Head Office

c.£0.3bn

3

Group

c.£2.0bn

60%

58%

50%

Mid 40s%

59%

69% 69%

High 50s%

69%

54%

64%

High 60s%

59%

49%

50%

High 40s%

68%

60%

56%

c.50%

2021 2022 2023

4

2026

c.£2bn cost efficiency savings by business

1

Cost: income ratio

Further efficiency savings expected post 2026

Top quartile peer

benchmark as at FY22

2

67% 67%

63%

High 50s%

53

February 2024

Barclays Investor Update

0bps

600bps

Impairment: lending growth to maintain loan loss rate of 50-60bps

1

Protection against funded on-balance sheet exposure in the Corporate lending portfolio in Barclays Investment Bank and Barclays UK Corporate Bank. In terms of credit protection, individual asset level hedges may vary, but cover a significant and diverse portion of our

lending portfolio, with higher average levels of protection for selected vulnerable sectors, lower quality credits and unsecured exposure |

2

Includes Consumer Loans excluding Barclays Partner Finance | Note: In 2023, Corporate loans primarily included in Barclays UK,

Barclays Investment Bank and Barclays UK Corporate Bank. Retail unsecured primarily included in Barclays UK, Barclays Private Bank and Wealth Management and Barclays US Consumer Bank. Retail Mortgages primarily included in Barclays UK and Barclays Private Bank and

Wealth Management |

£155bn

£172bn

£60bn

£48bn

£113bn

£128bn

£328bn

£348bn

2019 2023 2026

Retail unsecured

Retail mortgages

Customer loans

and advances

Corporate loans

50-60bps loan loss rate through the cycle

Significant risk transfers provide loss protection

36% protection against c.£50bn of exposure

1

LLR

Maintaining risk discipline as we grow unsecured lending

US Consumer Bank

Well established affordability assessments in place

54% average balance weighted LTV

UK Cards and Consumer Loans

2

2026

c.400bps

20232019

0bps

600bps

LLR

2023 20192026

54

February 2024

Barclays Investor Update

Plan returns based on realistic scenarios

1

FY23 RoTE of 9.0% includes Q423 structural cost actions of £927m. RoTE of 10.6% excluding these actions |

2

Source: Dealogic wallet as at 31 December 2023 | Note: Group plan based on an average USD/GBP FX rate of 1.27 | Note: Markets 2023 wallet and forward-

looking metrics based on internal Barclays estimates and are factored into the medium-term plan |

2024 20262023

9.0%

1

>10%

>12%

Statutory RoTE

4.3%

4.8%

4.7%

4.8%

3.7%

4.3% 4.3% 4.3%

2023 2024 2025 2026

7.4%

3.0%

1.9%

2.0%

4.1%

2.7%

2.1% 2.1%

2023 2024 2025 2026

Unemployment

UK

US

Inflation

UK

US

5.25%

4.00%

3.25%

3.25%

3.36%

3.58%

3.49%

3.49%

2023 2024 2025 2026

UK rates

Bank

rate

5-year

swap

rate

111 111 111

115

67

70

80

84

2023 2024 2025 2026

Markets & Banking wallet ($bn)

Markets

Banking

2

55

February 2024

Barclays Investor Update

Capital distributions: prioritising returns to shareholders

1

This multiyear plan is subject to supervisory and Board approval, anticipated financial performance and our published CET1 ratio target range of 13-14% |

Increase returns to our

shareholders

Capital distributions through

dividends and share

buybacks, with a continued

preference for buybacks

Grow our business for the

benefit of all our stakeholders

Investments meet long term

return hurdle rates

2. Shareholder distributions 3. Investment1. Regulatory capital

Operate within 13-14%

target CET1 range

Plan to return at least

£10bn 2024-2026

1

Group RoTE >12%

by 2026

Protect our customers,

clients and investors

Sufficient headroom to

absorb regulatory headwinds

56

February 2024

Barclays Investor Update

Capital distributions: greater free capital available to shareholders

1

Includes attributable profit for the year and other capital supply movements |

RWA investment

• Focused on higher

returning businesses

Reg change

• Basel 3.1

• IRB

Capital distributions

capacity

Capital generation from 2024-26

Statutory RoTE Capital generation

1

2023

9.0%

>125bps

(bps of CET1)

2026

>12%

>200bps

(bps of CET1)

Free capital RWA investment Regulatory change

RoTE targets will drive higher

capital generation

Shareholders to receive greater

proportion of capital generated

57

February 2024

Barclays Investor Update

Capital distributions: plan to return at least £10bn

1

1

This multiyear plan is subject to supervisory and Board approval, anticipated financial performance and our published CET1 ratio target range of 13-14% |

2

Market capitalisation as at 13 February 2024 |

Plan to keep total dividend stable at 2023 level in absolute terms, with progressive dividend growth per share driven

through share count reduction as a result of increased share buybacks

c.15% of market cap

2

£1.8bn buyback

£1.2bn dividend

£3.0bn

2023

Broadly in line

with 2023

2024

Progressive

increase

2025-2026

Plan to return

at least

£10bn

2024-26

1

c.50% of market cap

2

2024-2026

Capital distributions through dividends and share buybacks, with a continued preference for buybacks

58

February 2024

Barclays Investor Update

Our financial goals for the next three years

1

This multiyear plan is subject to supervisory and Board approval, anticipated financial performance and our published CET1 ratio target range of 13-14% |

2

63% based on prior Corporate and Investment Bank segmentation. Re-segmented Barclays Investment Bank 58% |

3

Excludes Q423 structural cost actions of £927m |

Targets 2023 2024 2026

Statutory RoTE 9.0% >10% >12%

Total payout

£7.7bn

2021-2023

>

At least £10bn

1

2024-2026

Investment Bank RWA

(% of Group)

63%

2

> c.50%

Continue to target a 13-14% CET1 ratio range

Supporting targets 2023 2024 2026

Income £25.4bn > c.£30bn

Cost: income 63%

3

c.63% High 50s%

Loan Loss Rate (LLR) 46bps

50-60bps

Through the cycle

50-60bps

Through the cycle

59

February 2024

Barclays Investor Update

Why Barclays?

1

This multiyear plan is subject to supervisory and Board approval, anticipated financial performance and our published CET1 ratio target range of 13-14% |

High returning UK retail and corporate franchises

1

2

Top-tier global Investment Bank with focus and scale, operating in

core UK and US markets

Multiple levers to allocate capital in a disciplined way to drive growth

within higher returning divisions and greater RWA productivity in

the Investment Bank

3

.

4

Reset level of returns, delivering double-digit RoTE, targeting

>12% by 2026

Growing capital return to shareholders; at least £10bn

1

2024-2026

5

Disclaimer

Important Notice

The terms Barclays or Group refer to Barclays PLC together with its subsidiaries. The information, statements and opinions contained in this presentation do not constitute a public offer under any applicable legislation, an offer to sell or solicitation of any offer to buy any

securities or financial instruments,or any advice or recommendation withrespect to such securities or other financial instruments.

Information relating to:

• regulatory c

apital, leverage, liquidity and resolution is based on Barclays' interpretation of applicable rules and regulations as currently in force and implemented in the UK, including, but not limited to, CRD IV (as amended by CRD V applicable as at the reporting date)

and CRR (as amended by CRR II applicable as at the reporting date) texts and any applicable delegated acts, implementing acts or technical standards and as such rules and regulations form part of domestic law by virtue of the European Union (Withdrawal) Act 2018,

as amended. All such regulatory requirementsare subject to changeand disclosures made by the Group will be subject to any resulting changesas at the applicablereporting date;

• MREL is ba

sed on Barclays' understanding of the Bank of England's policy statement on "The Bank of England's approach to setting a minimum requirement for own funds and eligible liabilities (MREL)" published in December 2021, updating the Bank of England's June

2018 policy statement, and its MREL requirements communicated to Barclays by the Bank of England. Binding future MREL requirements remain subject to change including at the conclusion of the transitional period, as determined by the Bank of England, taking

into `flight path, end-state capital evolution andexpectationsand MREL build are based on certain assumptions applicable at the date of publication only which cannot be assured and are subject to change.

Non-IFRS performance measures

Barclays’ management believes that the non-IFRS performance measures included in this presentation provide valuable information to the readers of the financial statements as they enable the reader to identify a more consistent basis for comparing the businesses’

performance between financial periods and provide more detail concerning the elements of performance which the managers of these businesses are most directly able to influence or are relevant for an assessment of the Group. They also reflect an important aspect

of the way in which operating targets are defined and performance is monitored by Barclays’ management. However, any non-IFRS performance measures in this presentation are not a substitute for IFRS measures and readers should consider the IFRS measures as

well. Refer to the appendix of the Barclays PLC Results Announcement for financial year ended 31 December 2023, which is available at Barclays.com, for further information and calculations of non-IFRS performance measures included throughout this presentation,

and the most directly comparable IFRS measures

.

Forward-looking statements

This document contains certain forward-looking statements within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended, and Section 27A of the US Securities Act of 1933, as amended, with respect to the Group. Barclays cautions readers

that no forward-looking statement is a guarantee of future performance and that actual results or other financial condition or performance measures could differ materially from those contained in the forward-looking statements. Forward-looking statements can be

identified by the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use words such as ‘may’, ‘will’, ‘seek’, ‘continue’, ‘aim’, ‘anticipate’, ‘target’, ‘projected’, ‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’, ‘believe’, ‘achieve’ or

other words of similar meaning. Forward-looking statements can be made in writing but also may be made verbally by directors, officers and employees of the Group (including during management presentations) in connection with this document. Examples of forward-

looking statements include, among others, statements or guidance regarding or relating to the Group’s future financial position, business strategy, income levels, costs, assets and liabilities, impairment charges, provisions, capital, leverage and other regulatory ratios,

capital distributions (including p

olicy on dividends and share buybacks), return on tangible equity, projected levels of growth in banking and financial markets, industry trends, any commitments and targets (including environmental, social and governance (ESG)

commitments and targets), plans and objectives for future operations and other statements that are not historical or current facts. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances.

Forward-looking statements speak only as at the date on which they are made. Forward-looking statements may be affected by a number of factors, including, without limitation: changes in legislation, regulations, governmental and regulatory policies, expectations and

actions, voluntary codes of practices and the interpretation thereof, changes in IFRS and other accounting standards, including practices with regard to the interpretation and application thereof and emerging and developing ESG reporting standards; the outcome of

current and future legal proceedings and regulatory investigations; the Group’s ability along with governments and other stakeholders to measure, manage and mitigate the impacts of climate change effectively; environmental, social and geopolitical risks and incidents,

pandemics and similar events beyond the Group’s control; the impact of competition in the banking and financial services industry; c

apital, liquidity, leverage and other regulatory rules and requirements applicable to past, current and future periods; UK, US, Eurozone and

global macroeconomic and business conditions, including inflation; volatility in credit and capital markets; market related risks such as changes in interest rates and foreign exchange rates; reforms to benchmark interest rates and indices; higher or lower asset valuations;

changes in credit ratings of any entity within the Group or any securities issued by it; changes in counterparty risk; changes in consumer behaviour; the direct and indirect consequences of the conflicts in Ukraine and the Middle East on European and global

macroeconomic conditions, political stability and financial markets; political elections; developments in the UK’s relationship with the European Union (EU); the risk of cyberattacks, information or security breaches or technology failures or other operational disruptions

and any subsequent impacts on the Group’s reputation, business or operations; the Group’s ability to access funding; and the success of acquisitions, disposals and other strategic transactions. A number of these factors are beyond the Group’s control. As a result, the

Group’s actual financial position, results, financial and non-financial metrics or performance measures or its ability to m

eet commitments and targets may differ materially from the statements or guidance set forth in the Group’s forward-looking statements. In setting

its targets and outlook for the period 2024-2026, Barclays has made certain assumptions about the macro-economic environment, including, without limitation, inflation, interest and unemployment rates, the different markets and competitive conditions in which

Barclays operates, and its ability to grow certain businesses and achieve costs savings and other structural actions. Additional risks and factors which may impact Barclays Bank Group’s future financial condition and performance are identified in Barclays PLC’s filings with

the US Securities and ExchangeCommission (“SEC”) (including, without limitation, Barclays PLC’s Annual Report on Form 20-F for the financial year ended31 December 2023), which are available on the SEC’s website at

www.sec.gov.

Subject to Barclays Bank PLC's obligations under the applicable laws and regulations of any relevant jurisdiction, (including, without limitation, the UK and the US), in relation to disclosure and ongoing information, we undertake no obligation to update publicly or revise any

forward-lookingstatements, whether as a result of new information,future events or otherwise.