Cover Image

This report provides data and analysis on Covered California’s efforts to improve the performance of

California’s health care system and to ensure that its members receive affordable, high-quality care.

The people featured on the cover are individuals who have benefited from these efforts. Their stories —

and those of others told here: https://www.coveredca.com/real-stories/ — go beyond the data to provide

personal perspectives on what Covered California has achieved over the past five years.

This document is in the public domain and may be copied or reproduced without permission.

Suggested citation: Covered California. (2019). Covered California Holding Health Plans Accountable

for Quality and Delivery System Reform.

Foreword

The Affordable Care Act opened the door to quality care for millions of Americans who had previously

been shut out of our health care system. A companion to this report, “Covered California’s First Five

Years: Improving Access, Affordability and Accountability”, provides an overview of how California —

the state government, Covered California, and other stakeholders — are working together to use the

tools provided by the Affordable Care Act to lower costs for consumers and provide meaningful choice

and coverage that truly meets consumers’ needs. The state is now building on and going beyond the

Affordable Care Act on the path toward universal coverage.

This report details how for more than five years, Covered California has held itself accountable as a

public entity charged with assuring consumers get the right care at the right time, while we hold the 11

health insurance companies we have chosen to contract with accountable for making sure that

consumers receive high-quality care and that both insurers and providers are implementing the delivery

system reforms needed to improve care for all Californians.

For Covered California, accountability means making sure health plans are meeting consumers’ needs

today and seeing that they are taking concerted and deliberate action to improve how health care is

paid for, organized and delivered in California. The goal of this accountability is to have a health care

system that truly addresses the triple aim of improving health, delivering better-quality care and

lowering costs.

This report focuses on how contracted health insurers are held accountable for assuring quality care

and for promoting delivery system reform. Chapter 1 describes the framework that now guides this

work. Chapters 2 through 6 describe how Covered California holds insurers accountable for assuring

quality care, including not only the specific measures used to track performance, but also the progress

that has been made overall and by individual insurers on these measures. Chapters 8 through 11 then

summarize the approaches to holding each health insurer accountable for advancing health care

delivery reform.

We share this report not because we believe our work is done, but rather because it is just beginning.

Improving health care quality and lowering underlying health costs is long-term pursuit. That pursuit is

central to Covered California’s mission, and this report identifies progress made and areas of needed

attention as we move forward.

Peter V. Lee

Executive Director

Covered California Holding Health Plans Accountable for Quality

and Delivery System Reform

Table of Contents

Chapter 1: Covered California’s Framework for Assuring Quality Care and Promoting

Delivery System Reform ................................................................................................................. 1

ASSURING QUALITY CARE ......................................................................................................... 6

Chapter 2: Individualized, Equitable Care — Best Possible Care for All ....................................... 6

Chapter 3: Health Promotion and Prevention .............................................................................. 25

Chapter 4: Mental Health and Substance Use Disorder Treatment ............................................ 34

Chapter 5: Acute, Chronic and Other Conditions ......................................................................... 43

Chapter 6: Complex Care ............................................................................................................. 52

EFFECTIVE CARE DELIVERY .................................................................................................... 59

Chapter 7: Promotion of Effective Primary Care .......................................................................... 59

Chapter 8: Promotion of Integrated Delivery Systems and Accountable Care Organizations .... 66

Chapter 9: Networks Based on Value .......................................................................................... 73

Chapter 10: Appropriate Interventions ......................................................................................... 79

Chapter 11: Sites and Expanded Approaches to Care Delivery .................................................. 89

Chapter 12: Summary and Implications for the Future .............................................................. 102

APPENDICES ............................................................................................................................. 103

Appendix 1: Limitations and Major Caveats about Health Disparities Data .............................. 104

Appendix 2: Additional Health Plan Measures Reported to Quality Rating System ................. 105

Appendix 3: 2019 Marketplace Quality Rating System Measure Set ........................................ 139

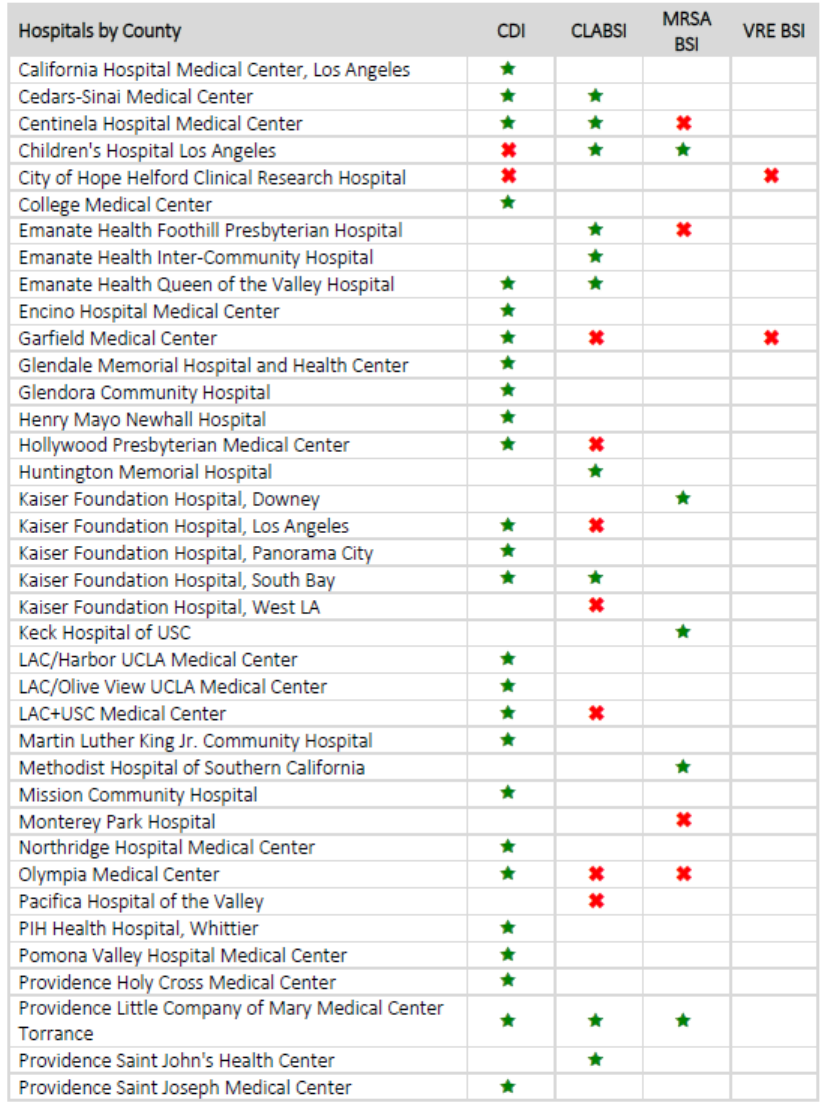

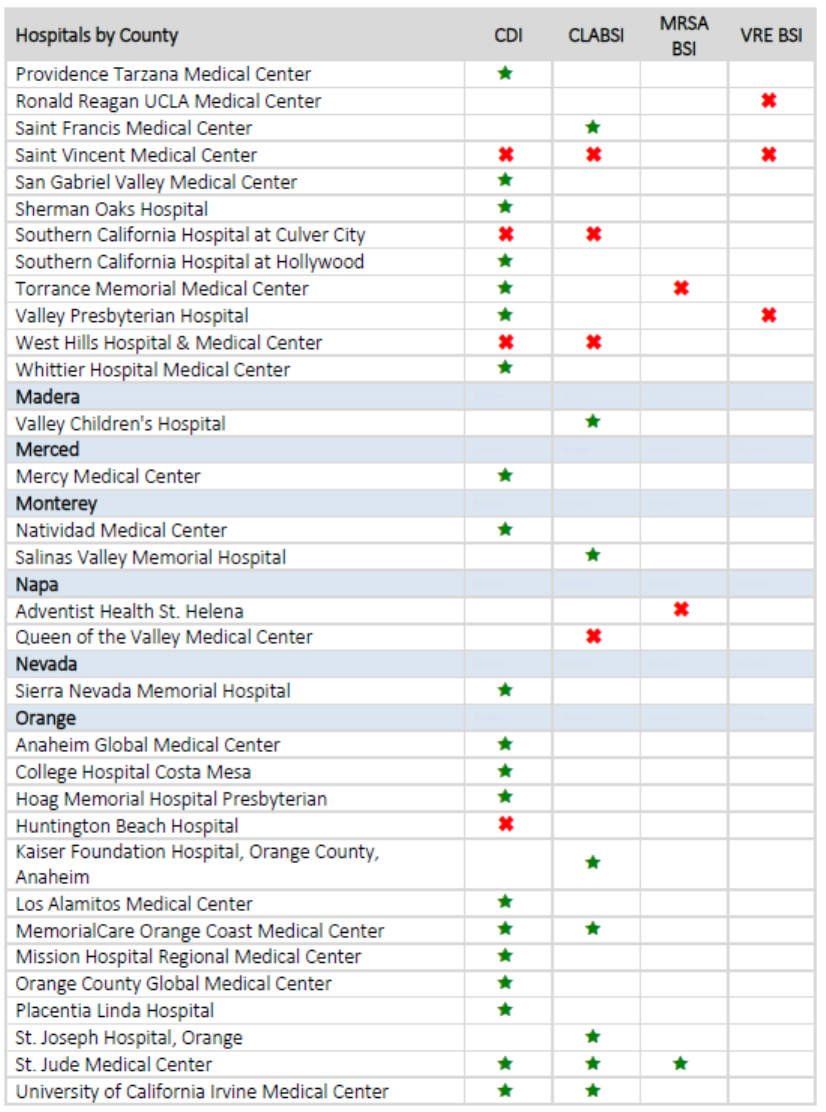

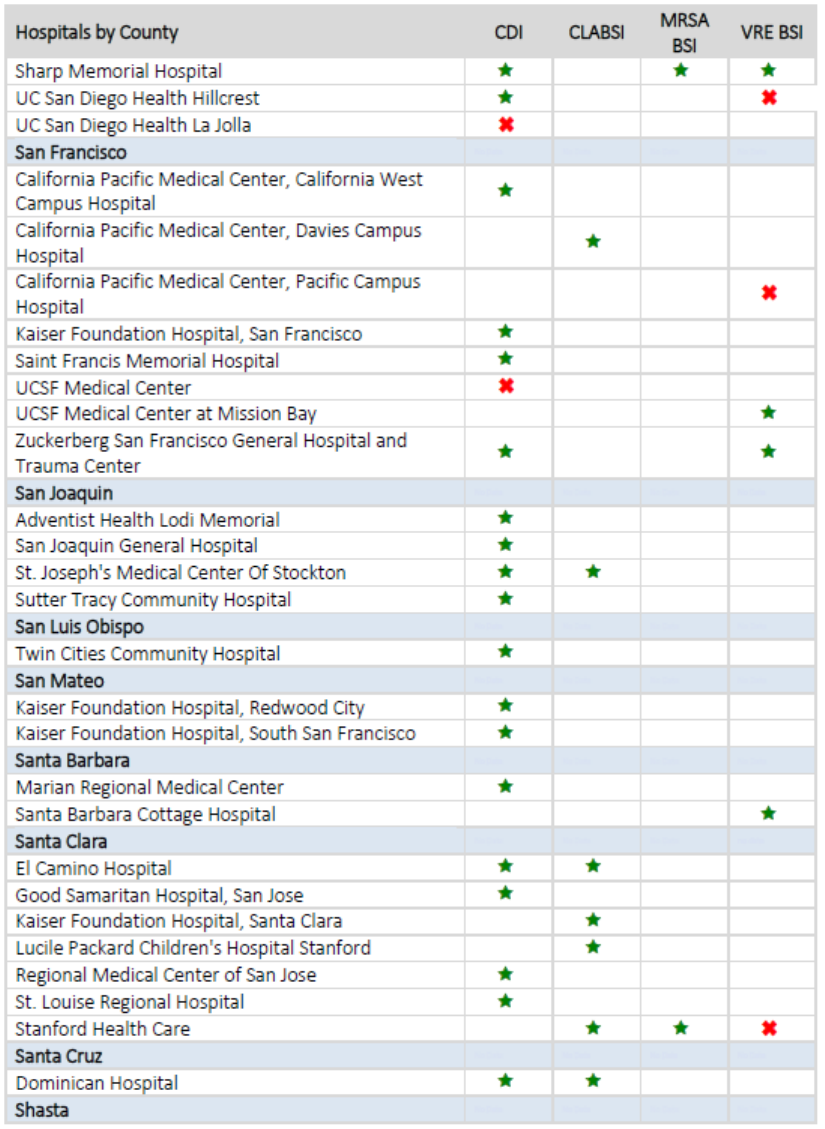

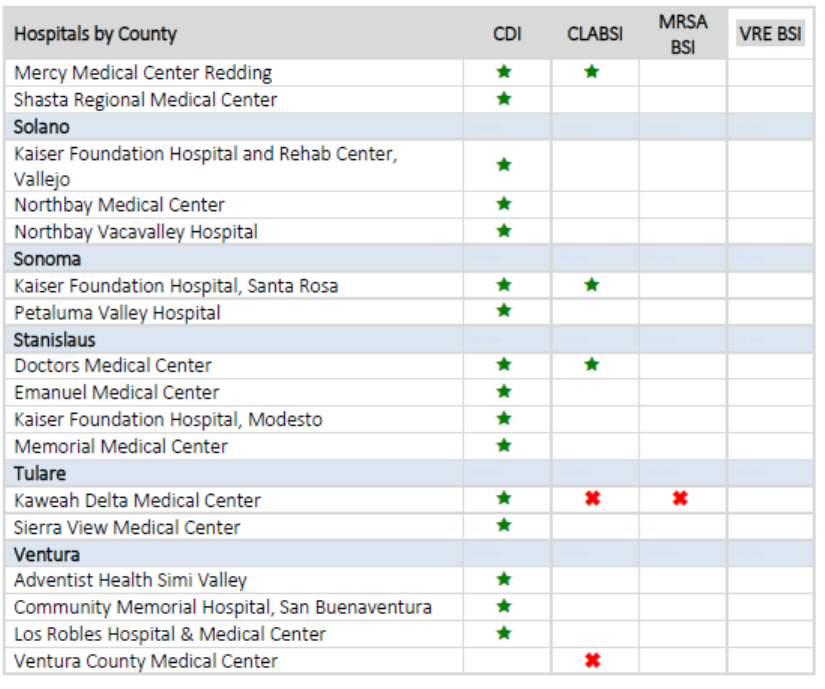

Appendix 4: Additional Publicly Reported Hospital Quality and Safety Data ............................ 141

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

CHAPTER 1

COVERED CALIFORNIA 1

Chapter 1: Covered California’s Framework for Assuring Quality Care and

Promoting Delivery System Reform

Covered California’s current contract requirements with qualified health plan (QHP) issuers (also

referred to as “health insurance companies”, “insurers” or “health plans” in this report)

1

are laid out in

Attachment 7: Quality, Network Management, Delivery System Standards and Improvement Strategy of

the QHP issuer contract. The contract is designed to hold insurers accountable for ensuring that people

get the right care at the right time and that care is individualized for their specific needs, while seeking

to improve how care is delivered and promoting care that is increasingly high-quality, equitable and

cost-effective.

2

The current Attachment 7 is composed of nine articles; each article has a distinct focus, including

ensuring networks are based on value and reducing health disparities. In addition, multiple articles have

elements related to quality improvement, network management and delivery system reform

requirements. Attachment 7 includes a number of initiatives that require concerted, multi-year efforts of

health insurance companies across the California delivery system. Insurers report annually and as part

of quarterly review meetings with Covered California on their Attachment 7 performance. Covered

California staff review and assess the information submitted for both contract compliance purposes and

to assess the success of the Attachment 7 initiatives in achieving the priority outcomes of quality care

and effectively delivering that care.

Covered California is working to update its health insurance company contract terms for the 2022-2024

plan years and is seeking to refresh its requirements for the future that continue to address the “Triple

Aim” of lowering costs, improving quality and improving health outcomes, with a focus on reducing

health disparities. This update will include a revised framework for Attachment 7 that is organized and

composed of two main strategies: Assuring Quality Care and Effective Care Delivery. This report

describes the progress Covered California contracted health insurance companies have made between

2014 and 2019

3

in implementing the requirements within the current Attachment 7 organized by the

revised framework described in Figure 1. Covered California’s Framework for Holding Plans

Accountable for Quality Care and Delivery Reform Framework.

Assuring Quality Care

Covered California is committed to ensuring that care is individualized and equitable for not only those

people currently needing or receiving treatment, but for those who are working to stay healthy. The

1

The term “health insurance companies” or “insurers” refers to the organizations providing health coverage and “health plan” refers to the

health coverage products they provide, such as an HMO plan vs. a PPO plan.

2

Beginning with the inaugural 2014 plan year and updated in 2017, Covered California set forth standards and strategies for quality

improvement and delivery system reform in its QHP issuer contract, specifically in the section of the contract titled “Attachment 7: Quality,

Network Management, Delivery System Standards and Improvement Strategy”. See more: https://hbex.coveredca.com/insurance-

companies/PDFs/Attachment-7_2020_Clean_Final-Model.pdf.

3

This report does not include data for plan year or measurement year 2014; rather it describes the progress Covered California contracted

health insurance companies have made since 2014 on Attachment 7 requirements with the first year of data representing plan year or

measurement year 2015 for most requirements.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

CHAPTER 1

COVERED CALIFORNIA 2

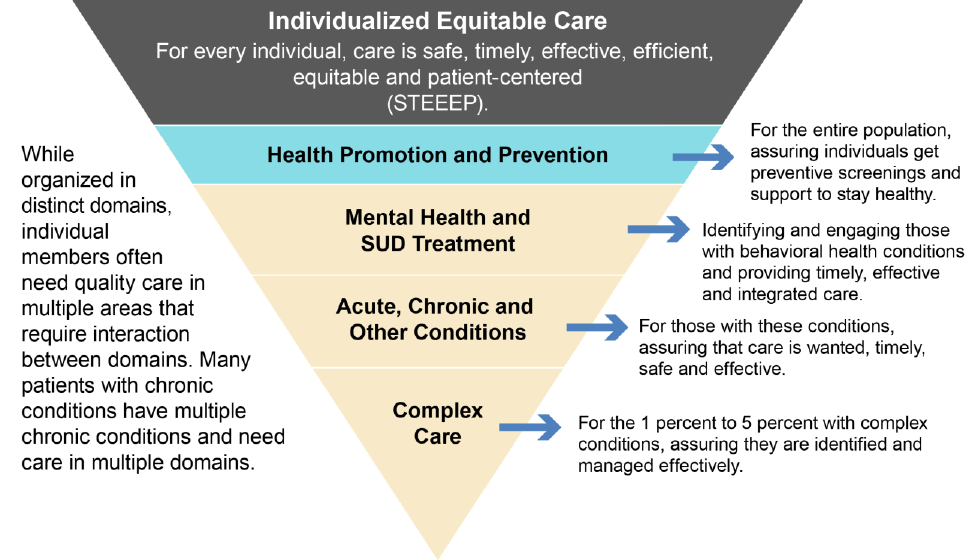

Figure 1. Covered California’s Framework for Holding Plans Accountable for Quality Care and Delivery

Reform Framework

concept of individualized, equitable care

4

means regardless of one’s circumstances, race, gender,

where one lives or other socioeconomic factors — and for some decisions where more than one

evidence-based treatment is available, based on one’s values and preferences — every individual

deserves the best possible care that is personalized for them and delivered in the right setting at the

right time, does not cause harm and is the most cost-effective possible. These goals are consistent with

the six domains of health care quality identified by the Institute of Medicine:

5

safe, timely, effective,

efficient, equitable and patient-centered (STEEEP). In addition to assuring quality care for those

insured through the marketplace, Covered California will continue its efforts to identify and reduce racial

and ethnic health disparities for the entire population.

What follows are the organizing domains for assuring quality care beyond the cross-cutting concept that

all care should be individualized and equitable:

• Health promotion and prevention: Everyone is encouraged to receive preventive care

services and health screenings and use support tools that promote a healthy lifestyle. This

includes everything from regular checkups to smoking cessation and dietary programs.

• Mental health and substance use disorder treatment: Identifying, engaging and supporting

through treatment people with mental health conditions and substance use disorders and

ensuring that they are provided with timely and effective care that is integrated with their other

health care needs.

4

In the current contract, Covered California focused health equity efforts on reduction of health disparities. While inclusive of health

disparities reduction, the revised framework of Individualized, Equitable Care is intended to capture the broad goal of care that is

individualized to address an individual’s health needs.

5

Committee on Quality Health Care in America, Institute of Medicine. (2001). Crossing the quality chasm: a new health system for the 21st

century. Washington, D.C.: National Academy Press.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

CHAPTER 1

COVERED CALIFORNIA 3

• Acute, chronic and other conditions: Actively managing care for people with acute

conditions, which are defined as illnesses or diseases that are short term and last typically a few

days to weeks, such as an infection or an injury; chronic conditions, which typically develop

slowly over time and last months to years, such as diabetes, most cancers, cardiovascular

disease, and infectious diseases like Human Immunodeficiency Virus (HIV); and other

conditions that are temporary, such as pregnancy or gestational diabetes.

• Complex care: Effectively managing very complex conditions for individuals that require a

multitude of specialty, high-cost treatments — such as cancer or transplants — or require end of

life care. These are individuals who need to be managed effectively or seen in very specialized

settings by providers who know how to manage their condition well and can provide coordinated

interventions.

The concept of individualized, equitable care as it applies to the specific care domains is illustrated in

Figure 2. Covered California’s Domains for Assuring Contracted Health Plans Deliver Quality Care,

recognizing that some members with mental health, substance use disorders or multiple chronic

conditions need care in multiple domains.

Figure 2. Covered California’s Domains for Assuring Contracted Health Plans Deliver Quality Care

Effective Care Delivery

In addition to addressing various populations and the care they receive, Covered California also

focuses on effective care delivery strategies and its contractual requirements promote improving the

way care is delivered for our enrollees and all Californians, whether it is provided by a primary care

physician, hospital, clinic or other provider. What follows are the organizing strategies for effective care

delivery:

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

CHAPTER 1

COVERED CALIFORNIA 4

• Effective primary care: The foundation of providing appropriate and equitable care is built on

team-based, data-driven primary care that is well integrated, coordinated and continuous. While

many consumers benefit from an ongoing continuous relationship with a single physician, there

is strong evidence that primary care through well-integrated sites of care or delivery systems are

more effective.

• Promotion of integrated delivery systems and accountable care organizations: Effectively

caring for and managing a person’s health requires an integrated care system that can

coordinate across providers, sites and time for a variety of conditions while delivering good

outcomes and quality at an affordable cost.

• Networks based on value: All clinicians, providers, hospitals and sites of care are selected and

regularly assessed based on how those individuals or institutions provide care that is safe,

timely, effective, efficient, equitable, and patient-centered. Ideally, every network is composed of

integrated systems, effective primary care and designed considering the value it provides.

Regardless of the organizing strategies — whether focused on primary care, an integrated delivery

system or the overall network — Covered California aims to ensure the interventions that patients

receive are both appropriate and delivered through sites and services that meet their needs:

• Appropriate interventions: The use of clinical interventions, such as prescriptions,

procedures, diagnostic tests and devices that are rooted in the STEEEP domains and based on

strong evidence and shared decision-making.

• Sites and expanded approaches to care delivery: Covered California supports patients in

getting health interventions and treatments in the most appropriate setting. That means assuring

quality care is delivered not only in hospitals, whether on an in-patient or outpatient basis, but in

ambulatory settings such as a doctor’s office, urgent care facilities, retail facilities such as drop-

in clinics, at home, or through telehealth. Expanded approaches to care delivery also include

who provides care in addition to physicians, such as registered nurses, pharmacists, midwives

or other non-licensed providers like community health workers.

Key Drivers of Quality Care and Effective Delivery

Covered California recognizes that moving health reform forward in an impactful way within a delivery

system shared among many purchasers and health insurance companies will require aligning with

other purchasers and working with all relevant payers in a way that reduces the burden on providers.

When considering the key drivers of quality care and effective delivery, Covered California has looked

to the National Quality Strategy

6

and mirrored many of the same levers initially noted in 2011.

Many of these levers or drivers are specifically articulated as expectations of health insurers in

Attachment 7 as ways to assure individuals get the right care. Insurers are working to improve the

delivery system over time. However, some of the “community drivers” that are identified may be outside

of the scope of an individual insurer’s responsibility or Covered California’s contract. Nevertheless, it is

important to recognize these drivers are a part of the context within which health care is delivered and

the quality of health that consumers experience. Examples of community drivers are detailed after the

roster of drivers specific to health insurer’s work. Key drivers include:

6

Agency for Healthcare Research and Quality. (2011) 2011 Report to Congress: National Strategy for Quality Improvement in Health Care.

Retrieved from https://www.ahrq.gov/workingforquality/reports/2011-annual-report.html

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

CHAPTER 1

COVERED CALIFORNIA 5

1. Benefit design: Helping consumers make informed decisions by standardizing benefit designs,

so they are easier to understand and compare, and incentivize access to the right care at the

right time. Benefit design may include incentives to encourage patients to use particular

providers or particular sites of care or formulary and other designs to encourage providers to

select particular interventions as appropriate.

2. Measurement for improvement, choice and accountability: Providing meaningful and

actionable performance feedback to providers, insurers and the public to improve care and

compare treatment results, cost and patient experiences for consumers.

3. Payment: Rewarding and incentivizing delivery of high-quality, patient-centered care that

promotes better health, quality improvement and value while also fostering innovation,

improving efficiency and adopting evidence-based practices.

4. Patient-centered social needs: Identifying, and, as needed, addressing patient-centered

support for non-medical services, recognizing that many people may face barriers that prevent

them from staying healthy and receiving the right care at the right time, such as food insecurity,

housing insecurity and lack of transportation to their doctor.

5. Patient and consumer engagement: Increasing support for and the level of participation by

patients and consumers in managing their health and making their personal health care

decisions.

6. Data sharing: Making patient data available and accessible to support clinical care and

coordination, decrease health care costs, reduce paperwork, improve outcomes and give

patients more control over their health care.

7. Data analytics: Inspecting, transforming and modeling data to discover timely and reliable

information that will aid in a patient or provider’s decision-making processes.

8. Administrative simplification and provider burden reduction: Implementing system

changes to maximize the time providers spend with patients and minimize unnecessary

administrative burden.

9. Certification, accreditation and regulation: Employing existing regulatory and accreditation

processes and work with other agencies and departments to ensure approaches meet safety

and quality standards. For example, California’s Departments of Insurance and Managed Health

Care enforce the regulatory standards that Covered California relies on for network adequacy.

The National Committee for Quality Assurance (NCQA), among others, conducts health plan

accreditation.

10. Quality improvement and technical assistance: Promoting initiatives that will lead to better

patient outcomes and better care delivery approaches, strengthening the evidence base to

inform better decision-making and fostering learning environments that offer training, resources,

tools and guidance to help organizations achieve quality improvement goals.

Beyond the drivers of more effective care and healthier populations that relate to what an individual

insurer can do or be held accountable for, Covered California recognizes and seeks to better

understand the impact of broader social and structural issues on health status, care and care delivery.

Community health drivers include:

• Workforce: Investing in people to prepare the next generation of health care professionals and

support lifelong learning for providers.

• Community-wide social determinants: Addressing structural social and economic influences

that impact individual and group differences in health.

• Population and public health: Increasing the health of a community through broad

interventions that address public health, homelessness or food insecurity.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 6

ASSURING QUALITY CARE

Chapter 2: Individualized, Equitable

Care — Best Possible Care for All

Covered California’s overarching goal is to

ensure that everyone receives the best possible

health care. This goal entails striving to ensure

that care is personalized, does not cause harm,

is delivered in the right setting at the right time,

and is as cost effective as possible. For

decisions where more than one evidence-based

treatment is available, the goal is to support

individuals in choosing treatment based on their

values and preferences. In the framework

proposed by the Institute of Medicine 20 years

ago, everyone should receive care that is safe,

timely, effective, efficient, equitable, and patient-

centered (often captured by the acronym

“STEEEP”).

7

Unfortunately, the quality of care

delivered in the United States varies

dramatically.

Of the elements related to the Institute of

Medicine’s framework, the domain that has too

often not been given central focus is the charge

to ensure that care is equitable. Addressing

health equity and disparities in health care has

been integral to Covered California’s mission.

Given that focus, after reviewing some important

overall indicators of how health plans are

generally meeting consumers’ needs, much of

this chapter specifically addresses Covered

California’s focus on the issue of equity. The

other domains of the STEEEP framework are

addressed throughout the report and are integral

to Covered California’s approach. The Quality

Rating System (QRS), which includes

performance measures based both on clinical

measures and on patients’ reported experience

of getting care, provides a global picture of how

Covered California’s health plans are doing at

providing the best possible care. In this chapter,

the Global and Summary Components of the

7

Committee on Quality Health Care in America, Institute of Medicine. (2001). Crossing the quality chasm: a new health system for the 21st

century. Washington, D.C.: National Academy Press.

• Covered California enrollees are generally

very satisfied with their experience with

their health plans and their health care,

with the vast majority enrolled in plans that

score above the 50

th

percentile for enrollee

satisfaction with their health care and plan.

• Global Quality Ratings have improved

since their launch in 2016, but a dip in 2019

has generated further scrutiny.

• Covered California has launched a long-

term initiative to reduce health disparities.

In response to contractual requirements, 93

percent of enrollees are in plans that were

at or above the 80 percent requirement for

enrollee self-identification of race/ethnicity.

• All 11 insurers are analyzing disparities in

care for patients with diabetes,

hypertension, asthma and depression for

all of their lines of business, not just

Covered California, and planning targeted

interventions.

• Gaps in quality by race/ethnicity were

found for all insurers — but were not

consistent (e.g., for some insurers African

Americans warranted targeted

interventions for diabetes, and Latinos in

others).

• Racial and ethnic disparities are generally

smaller than the differences in quality

across plans: enrollment in Sharp Health

Plan or Kaiser Permanente is a better

predictor of receiving good care than race

or ethnicity is.

• Nevertheless, all insurers have identified a

disparity where a targeted intervention can

improve help reduce disparities and

improve health.

Highlights

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 7

health plan quality ratings are presented, along with two measures that relate to enrollee satisfaction

with their health plan and their care.

Social, economic and geographic disparities in health and health care pose a particularly serious

challenge to the goal of ensuring the best possible care for all. Because social and environmental

factors are powerful determinants not only of the care individuals receive but also of their underlying

health, reducing disparities requires efforts within the health care delivery system and in the broader

community. Covered California recognizes that meaningful progress will require multi-pronged and

multi-year efforts.

Covered California is working to reduce disparities and promote health equity. To this end, Covered

California has hired a new health equity officer who plans, implements and integrates Covered

California’s health equity agenda with Covered California’s quality improvement and delivery system

reform efforts. The health equity officer leads the work of the new Population Care Unit within the Plan

Management Division, which is composed of staff positions dedicated to quality improvement, health

equity and social determinants of health.

Covered California is working with health plans to reduce health disparities and promote health equity

by: (1) identifying the race/ethnicity of all enrollees; (2) collecting data on diabetes, hypertension,

asthma and depression to measure how quality varies by race/ethnicity; (3) conducting population

health-improvement activities and interventions to narrow observed disparities in care; and (4)

promoting community health initiatives that foster better health, healthier environments, and promote

healthy behaviors. This chapter describes how Covered California has moved forward in each of these

areas.

This chapter on individualized, equitable care is organized as follows:

Section 1. Qualified Health Plan Experience

Section 2. Health Plan-Reported Measures for Health Disparities

Section 3. Implications for the Future

Section 1. Qualified Health Plan Experience

Health Plan Measures Reported to the Quality Rating System

This section presents performance data reported by health insurance companies for contract

requirements and includes assessments and observations by Covered California. One key mechanism

used by Covered California for health plan oversight and accountability is public reporting of global and

individual health plan quality-performance measures to the Centers for Medicare and Medicaid

Services’ Marketplace Quality Rating System (QRS). In the current contract requirements, health plans

are required to:

1. Annually collect and report to Covered California for each product type the measure numerator,

denominator and rates for its QRS data, including Healthcare Effectiveness Data and

Information Set (HEDIS) measures, Consumer Assessment of Healthcare Providers and

Systems (CAHPS) survey data and other performance data.

2. Submit HEDIS and CAHPS scores to include the measure numerator, denominator and rate for

the required measures set reported to NCQA Quality Compass and the Department of Health

Care Services (DHCS), for each product type for which it has data in California.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 8

Global and Summary Component Health Plan Quality Ratings

The Marketplace QRS global quality ratings show how health plans compare on helping members get

the right medical care and on member-reported experiences of care and service. Covered California

displays each health plan’s QRS rating to enrollees through the plan shopping experience and on

coveredca.com.

Plans are rated on a scale of one to five stars. To assign the star rating, each health plan’s results are

compared to about 200 marketplace health plans nationwide. A five-star plan means that health plan

scored among the top plans nationwide; a one-star rating means the plan’s score was among the

lowest.

QRS is composed of a global quality ratings and summary component ratings for three major aspects

of health plan performance.

8

Each health plan’s product (HMO, PPO, EPO) receives a separate QRS

rating.

Global quality rating: The global quality rating is a roll-up of three summary components per the

following weighting:

Summary Components

Weights

Getting Right Care (HEDIS)

66%

Members’ Care Experience (CAHPS)

17%

Plan Services (HEDIS and CAHPS)

17%

A global quality rating is constructed for each health plan that has at least two of the three component

scores, and one of the scores must be for the “Getting the right care” component:

• Getting the right care: Each year, a sample of members from each health plan is selected, and

their records are checked to compare their medical care with national standards for care and

evidence-based treatments. More than 30 HEDIS measures are tracked using medical charts

and billing records sent by providers and hospitals. These quality measures include how well

the health plan and its providers care for enrollees, such as controlling high blood pressure,

lowering cholesterol and getting the right medications.

• Members’ care experience: Members’ experiences with their doctor and care are based on the

CAHPS survey that asks about members’ recent experiences when visiting the doctor and

getting medical care. About one of every five people who receive a survey in the mail or by

phone provides a response, with about 250 members from each plan completing surveys.

CAHPS surveys are currently only available in English or Spanish, but insurers are encouraged

to translate the surveys into other languages that reflect their patient population. Translation

guidelines are readily available from CMS.

• Plan services for members: A sample of plan members’ records is checked to see if patients

got unnecessary care — services that could be harmful and wasteful. The CAHPS member

survey is also used to report on members’ experiences in getting help and information from the

insurer’s customer service staff.

8

See the Appendix 2 for the complete list of measures used to determine each summary component rating of QRS.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 9

The QRS ratings of Covered California health plans have generally improved over time, but there was a

downward trend in 2019.

9

For the 2019 reporting year, which represents the 2018 measurement year,

the overall trend is lower star ratings compared to 2018: for the global rating, only one plan has a 5-star

rating and one plan has a 4-star rating while most have 2 and 3-star ratings (see Table 1. Global

Quality Ratings by Reportable Products for Individual and CCSB Markets, 2016-2019).

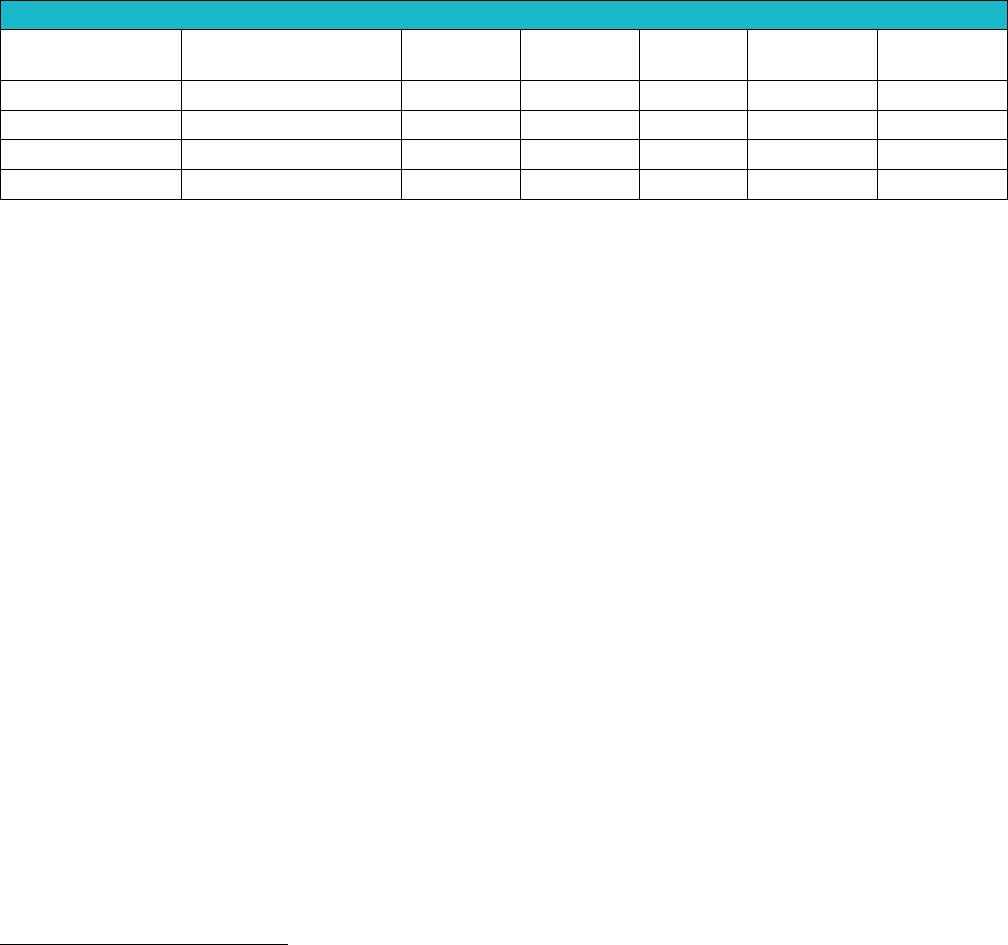

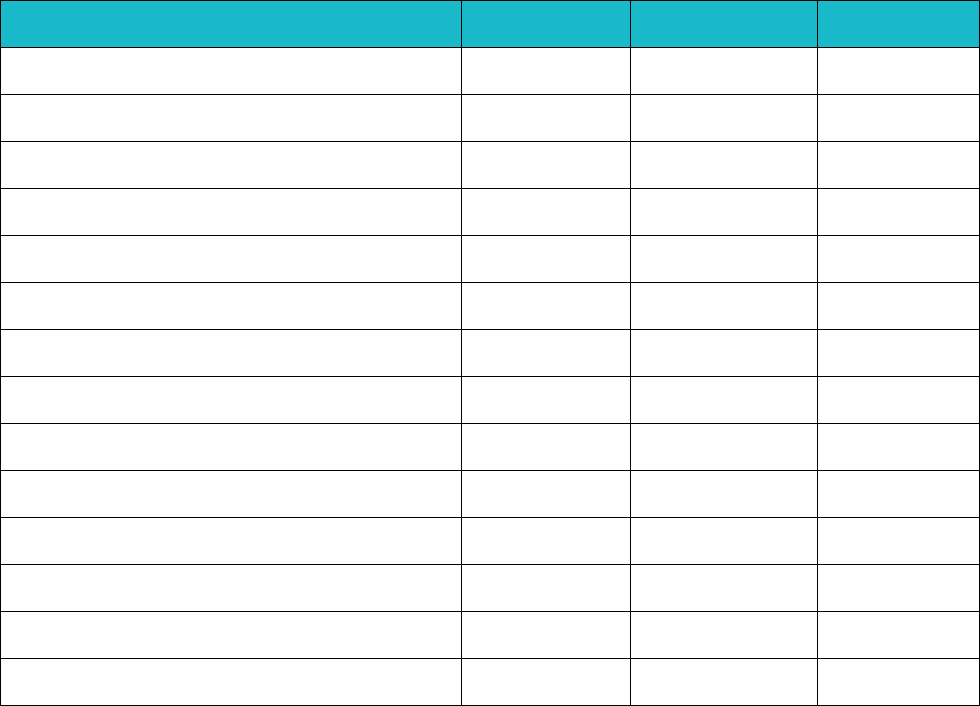

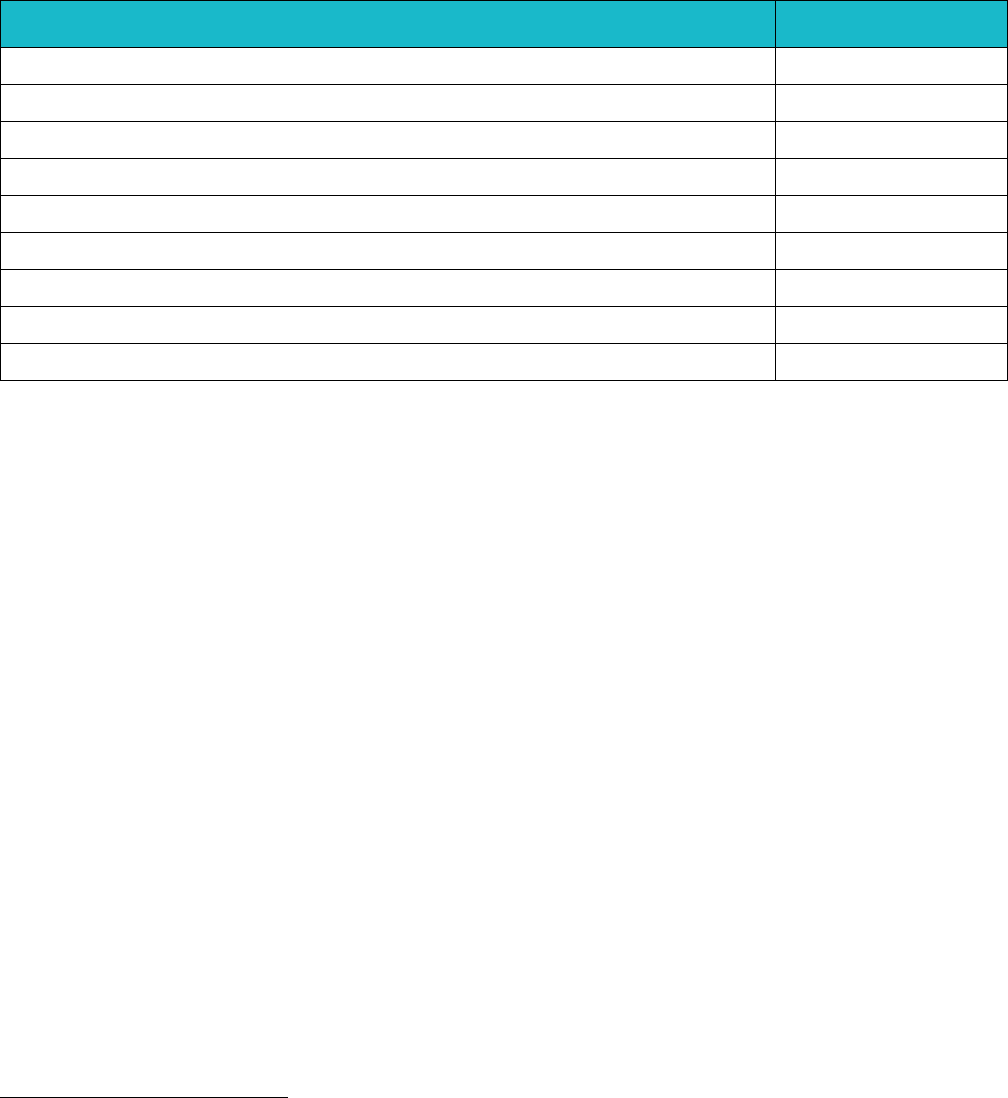

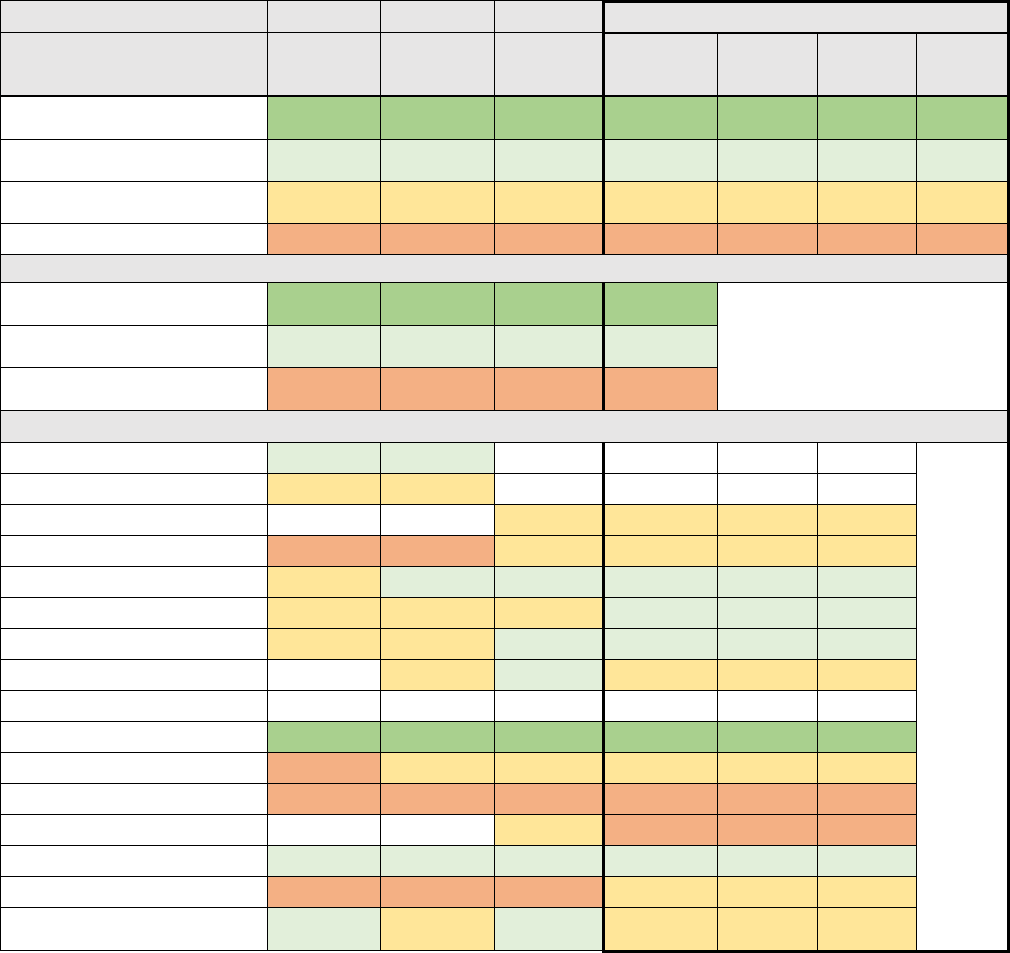

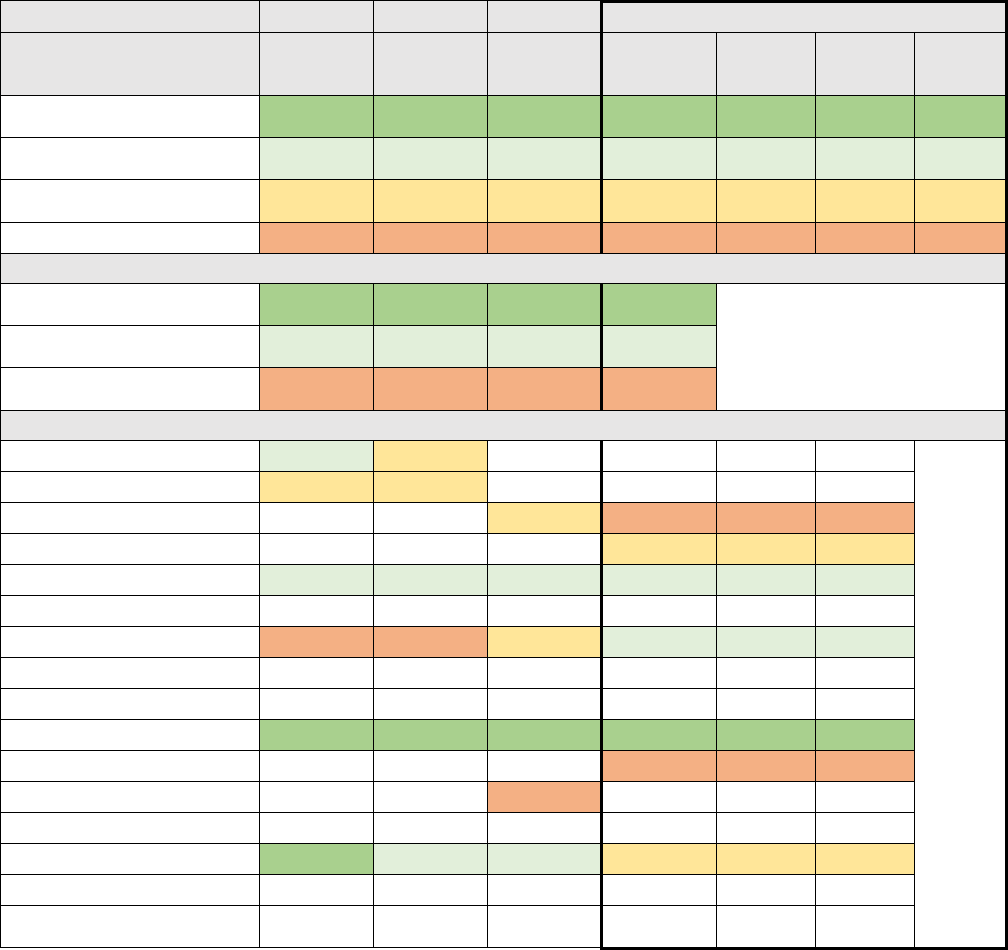

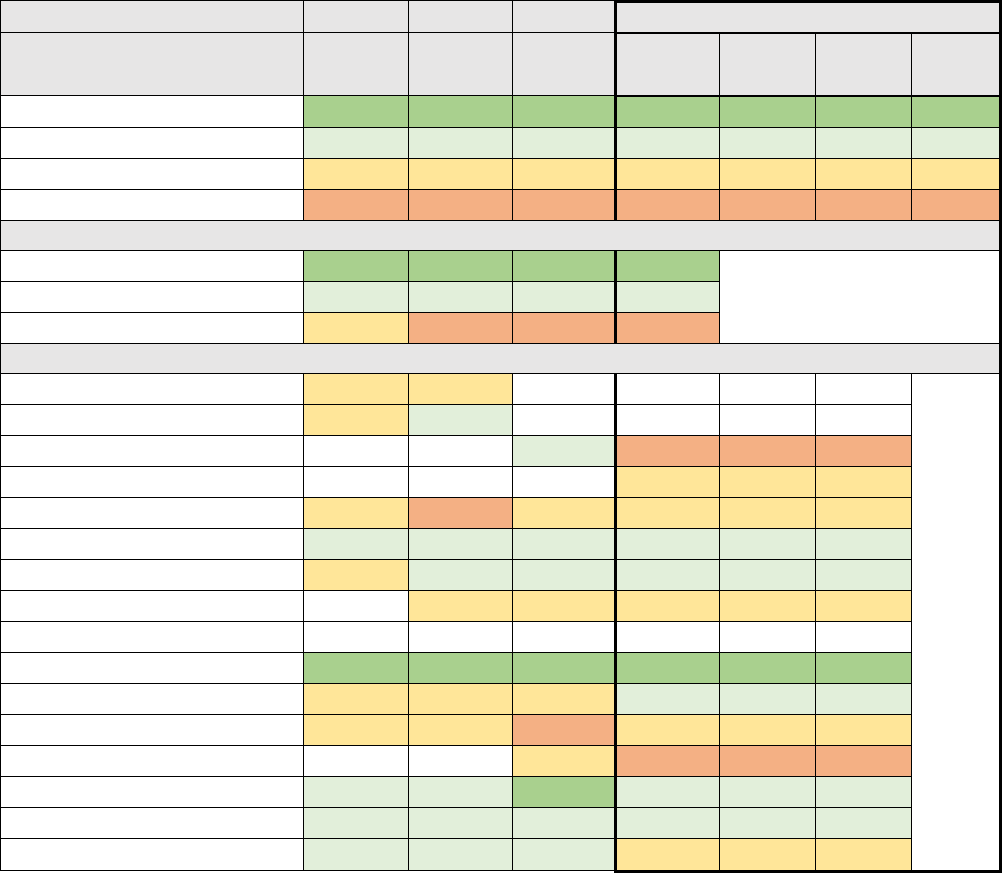

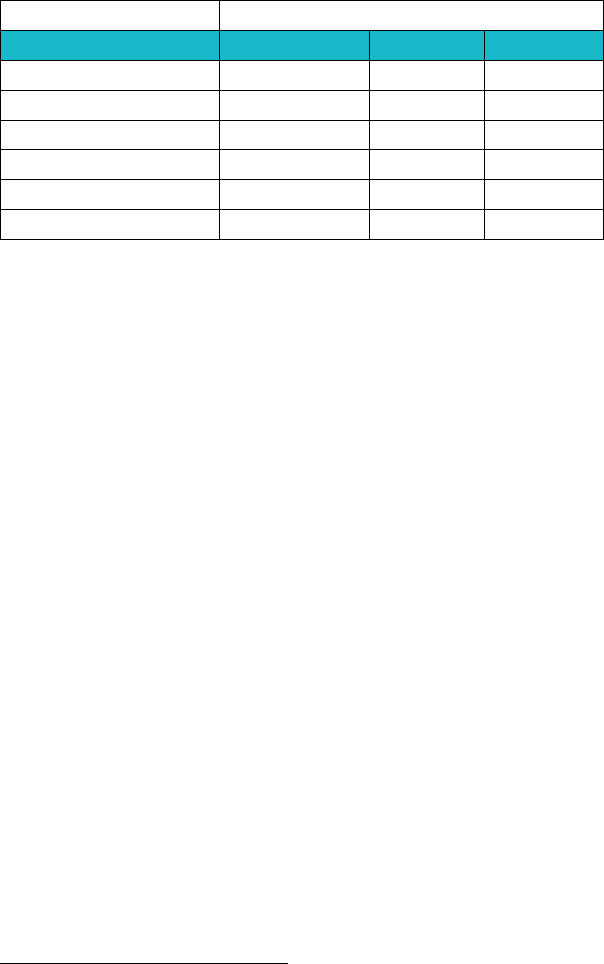

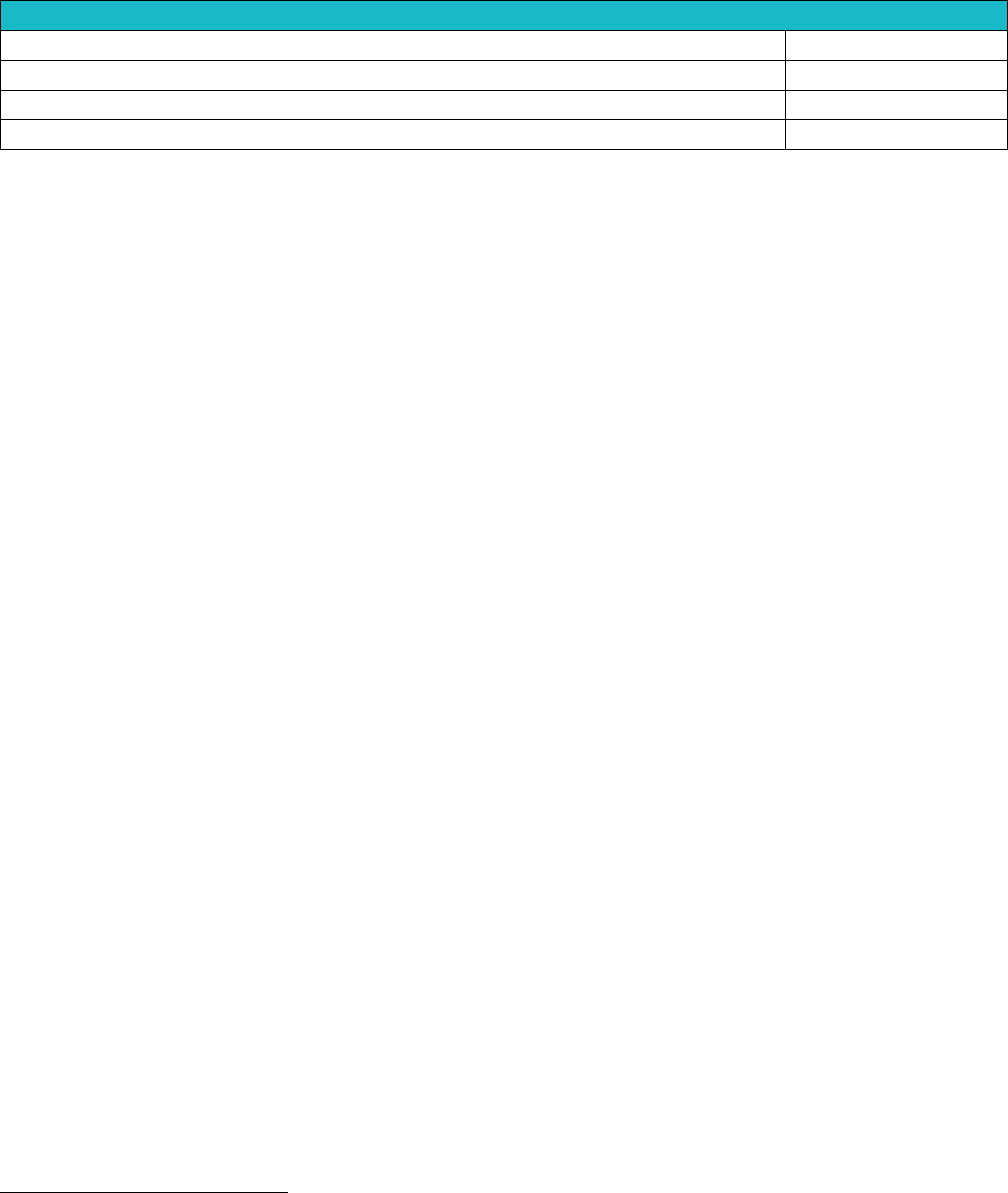

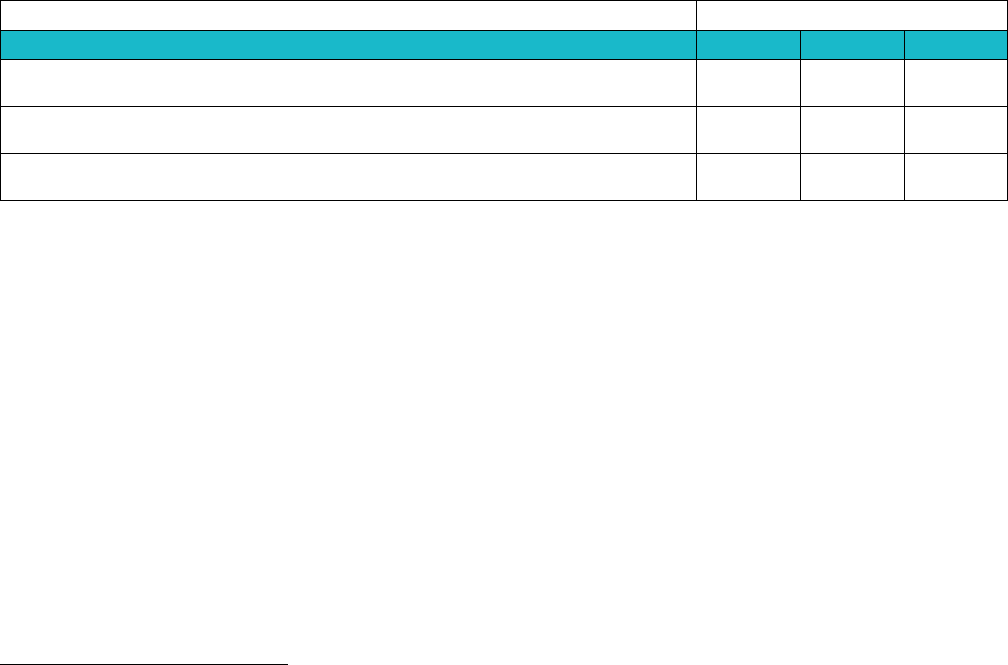

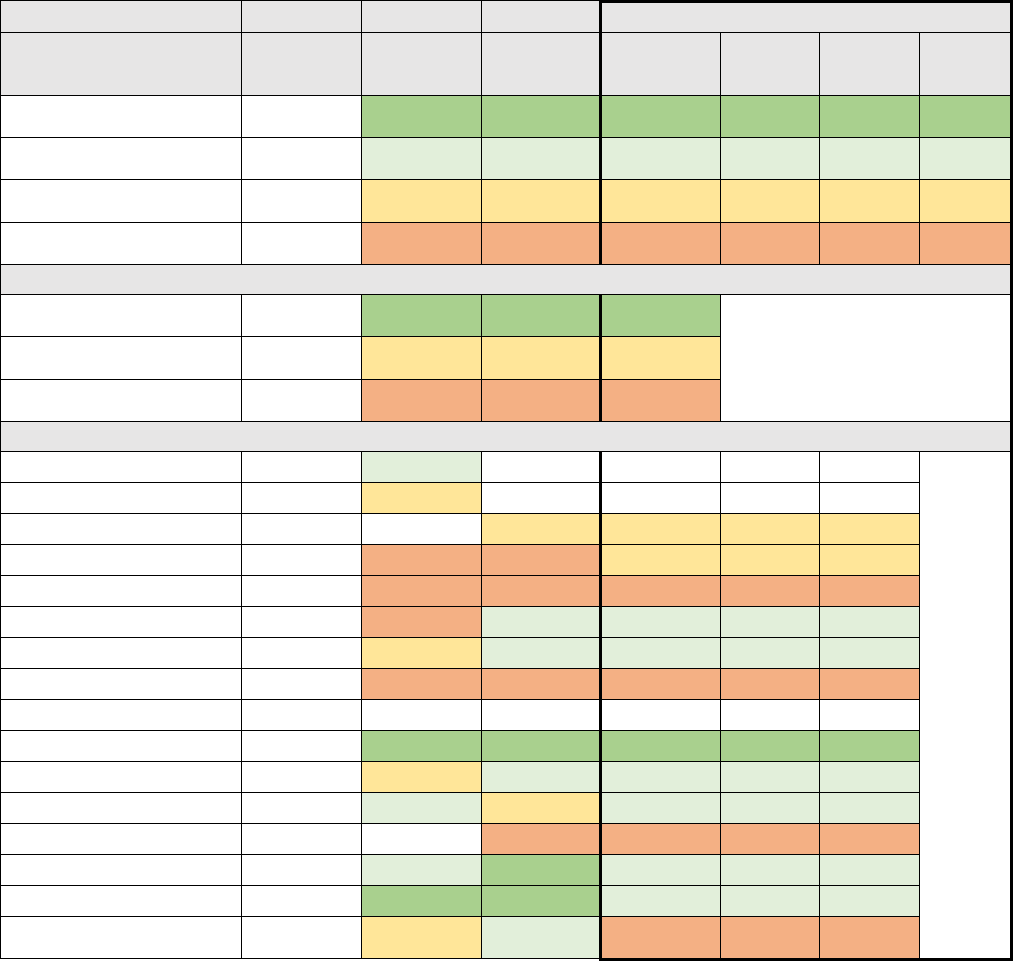

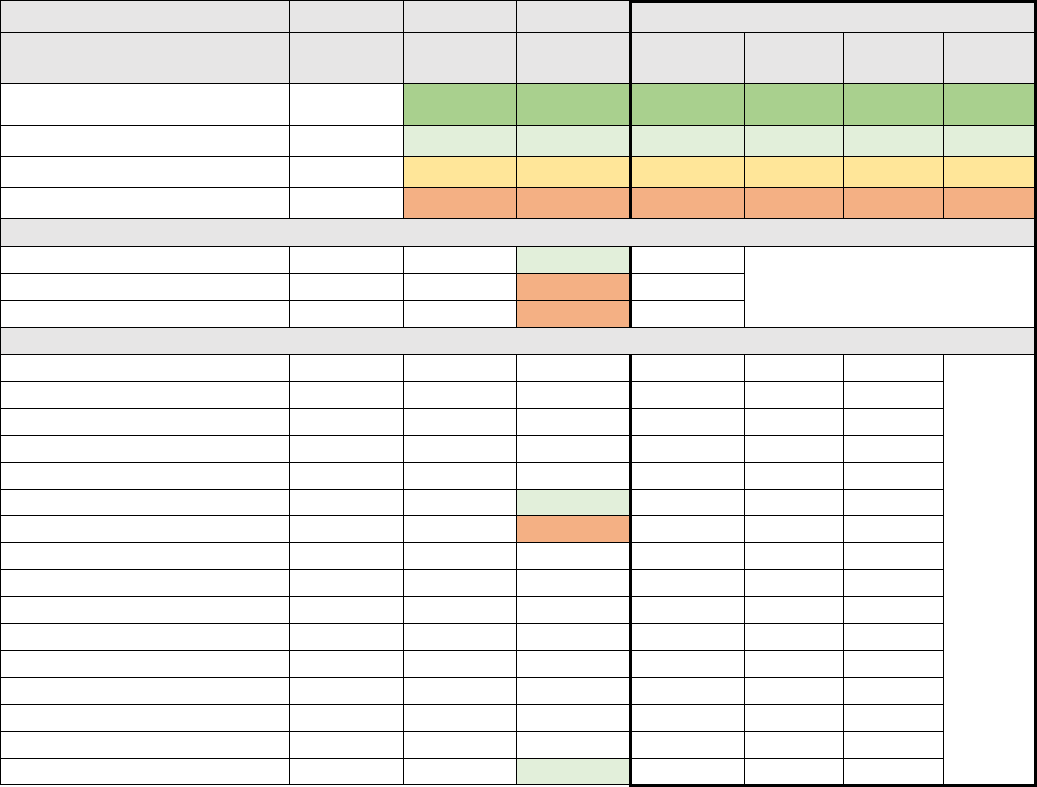

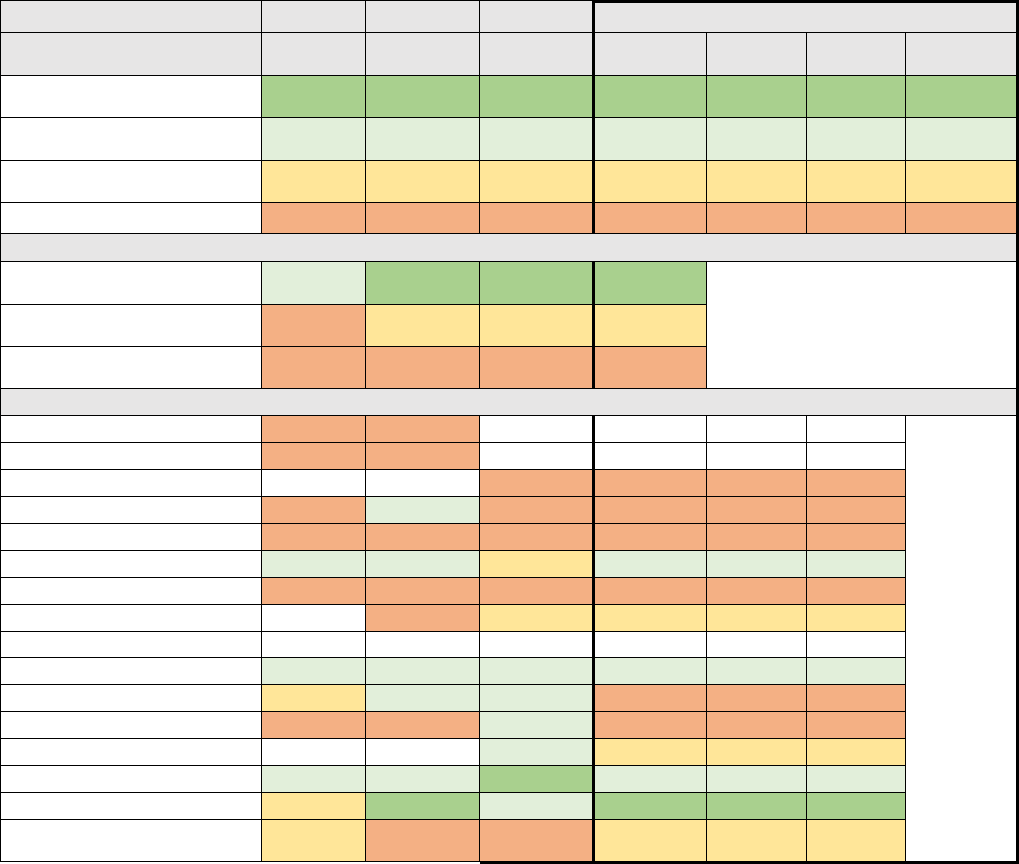

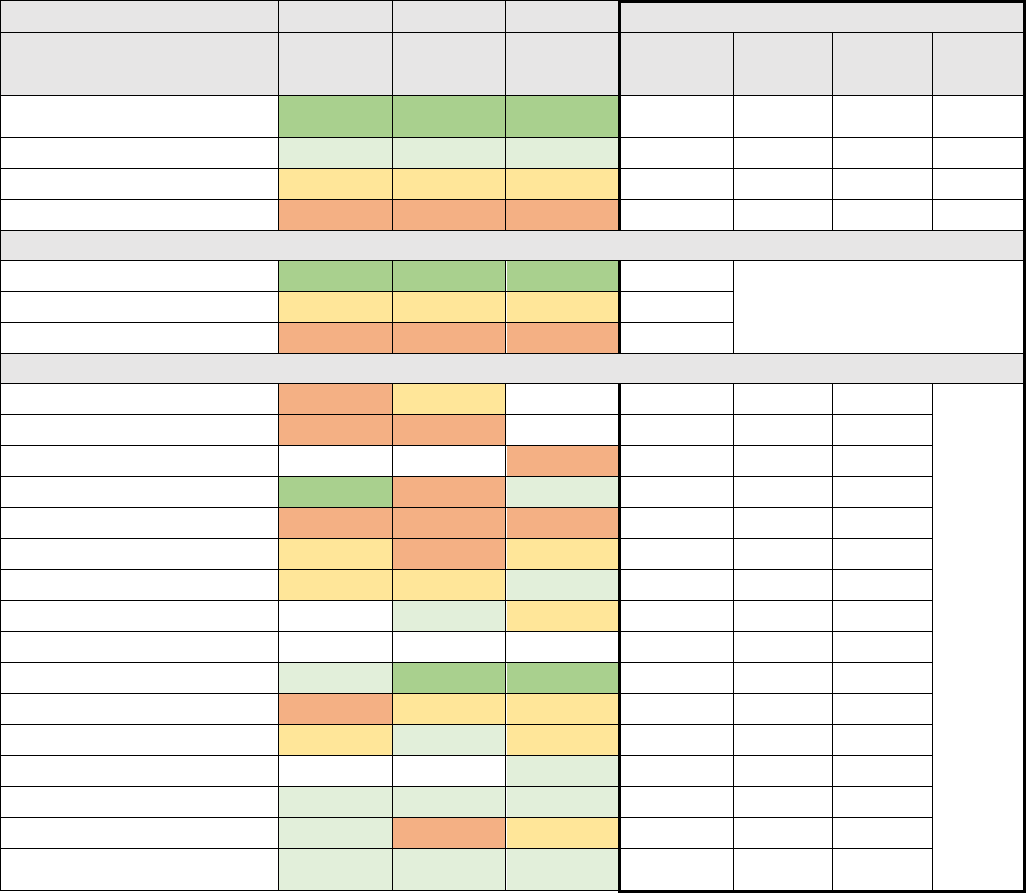

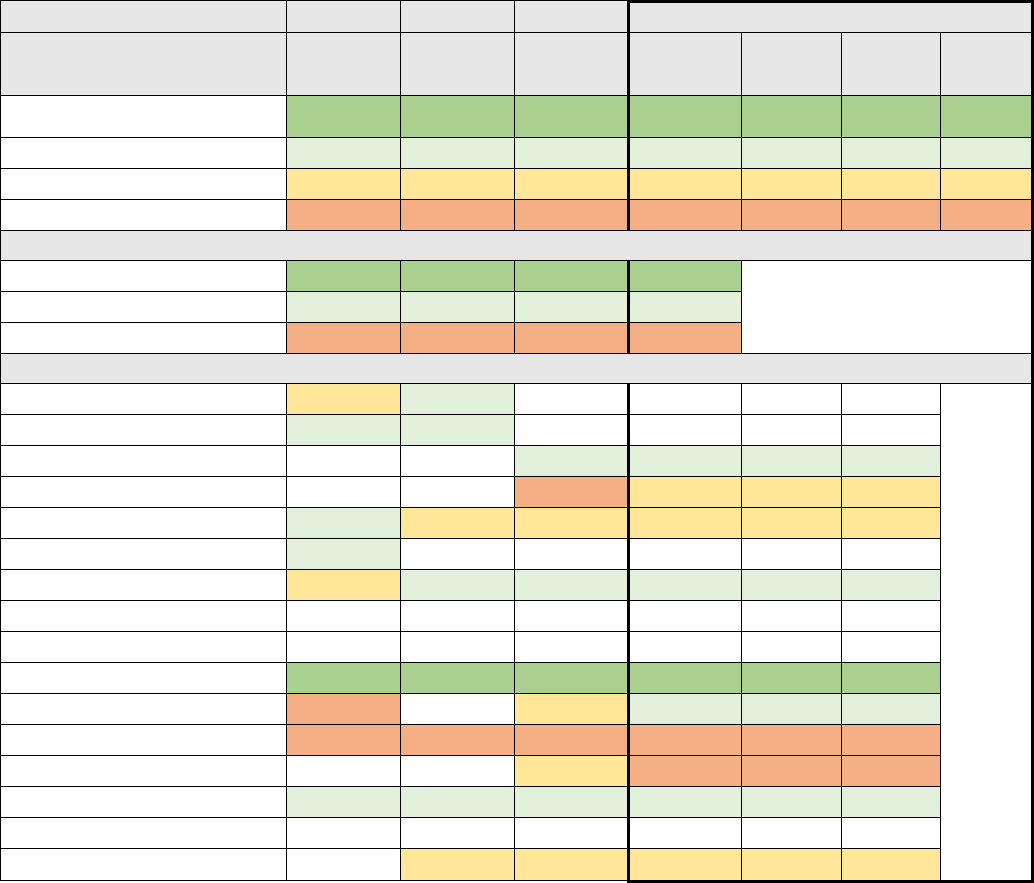

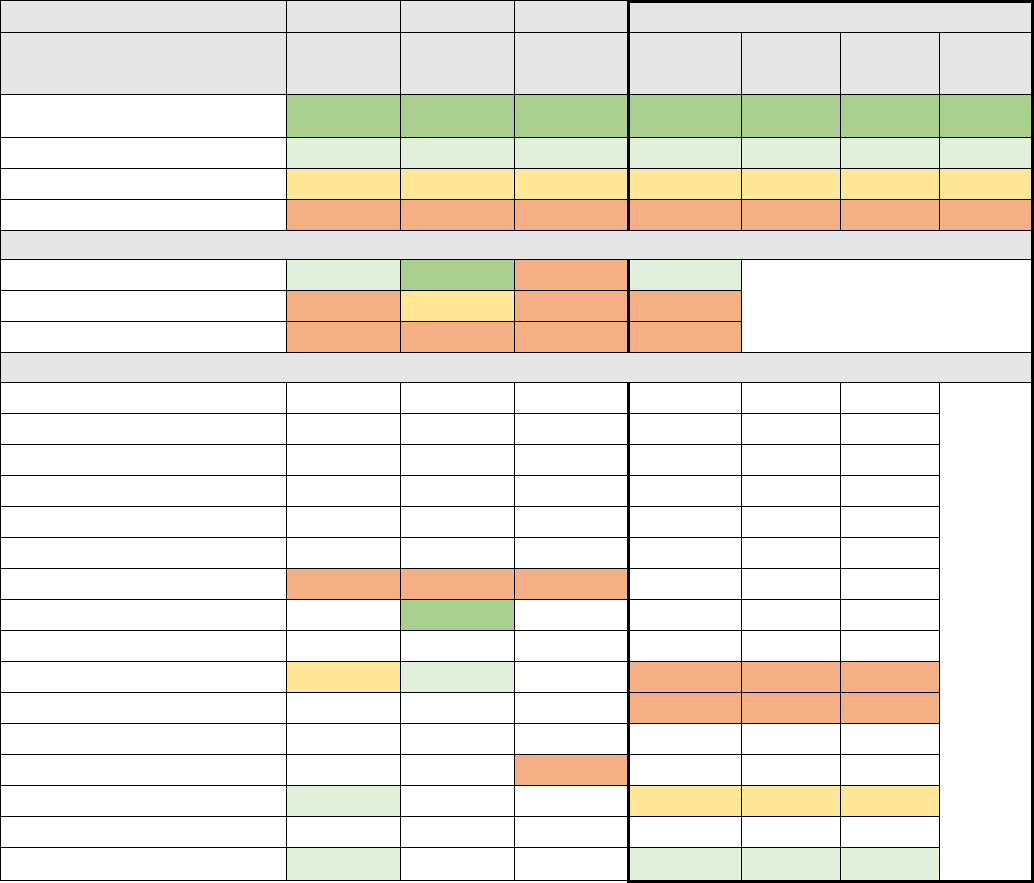

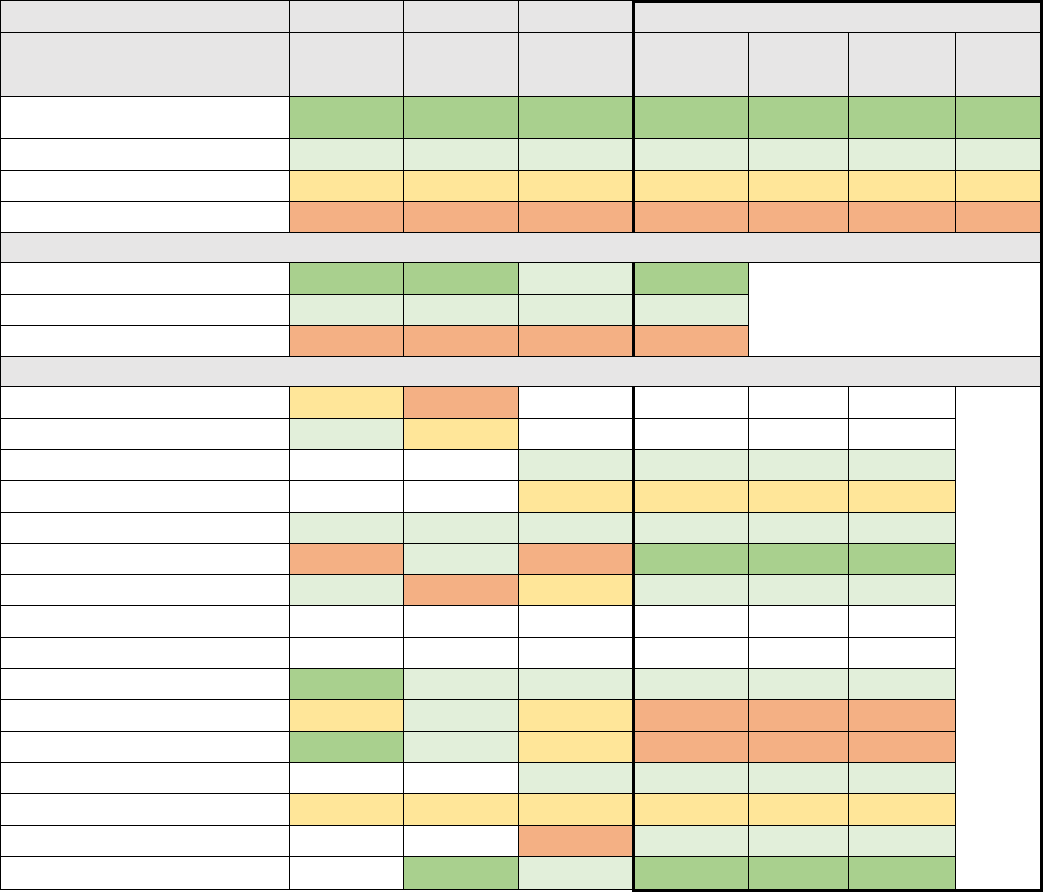

Table 1. Global Quality Ratings by Reportable Products for

Individual and Covered California for Small Business (CCSB) Markets, 2016-2019

Overall Quality Ratings by Reportable Products for Individual and CCSB Markets

# Products with

No Global Rating

1 Star

★

2 Star

★★

3 Star

★★★

4 Star

★★★★

5 Star

★★★★★

2019 QRS

3*

0

5

5

1

1

2018 QRS

3*

0

0

6

4

2

2017 QRS

4*

0

3

6

1

1

2016 QRS

5*

1

7

2

1

1

*No global rating if a newer product and not eligible for reporting or insufficient sample sizes to report results for at least 2 of the 3 summary

component categories.

Source: Covered California Health Plan QRS Reporting

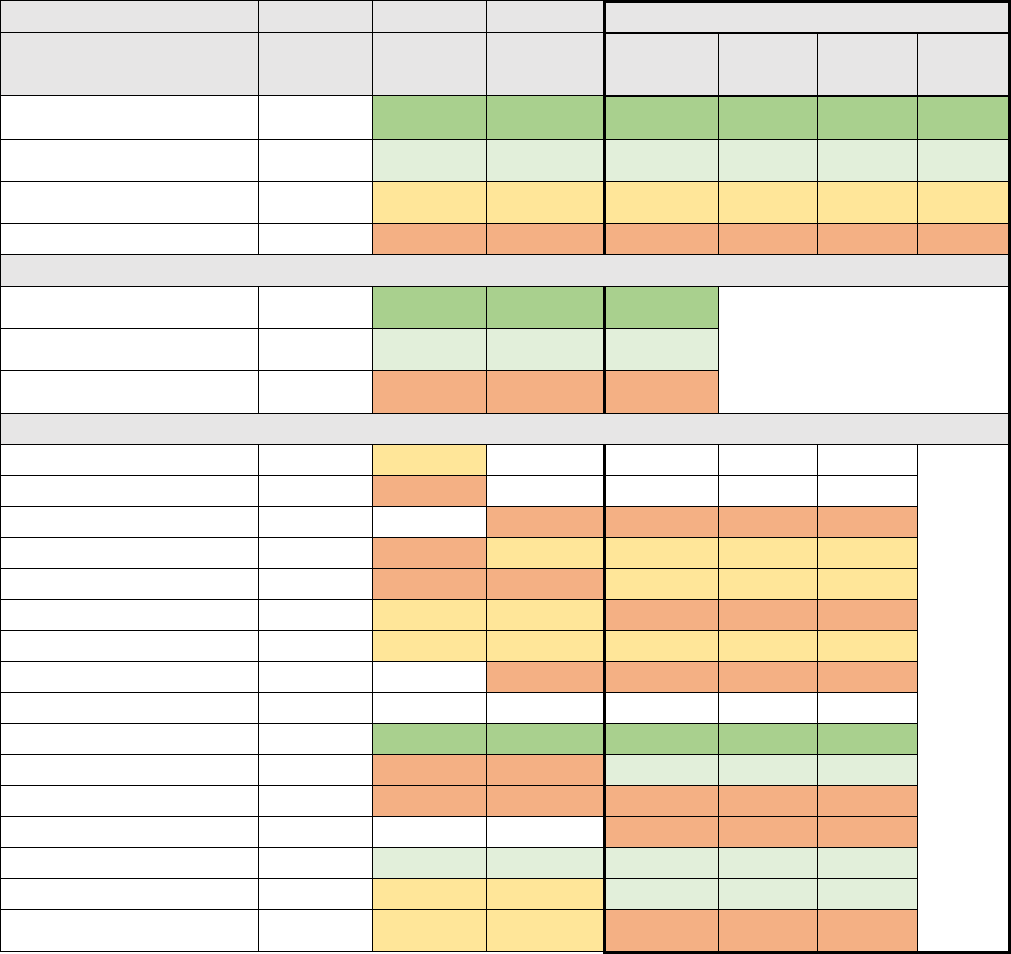

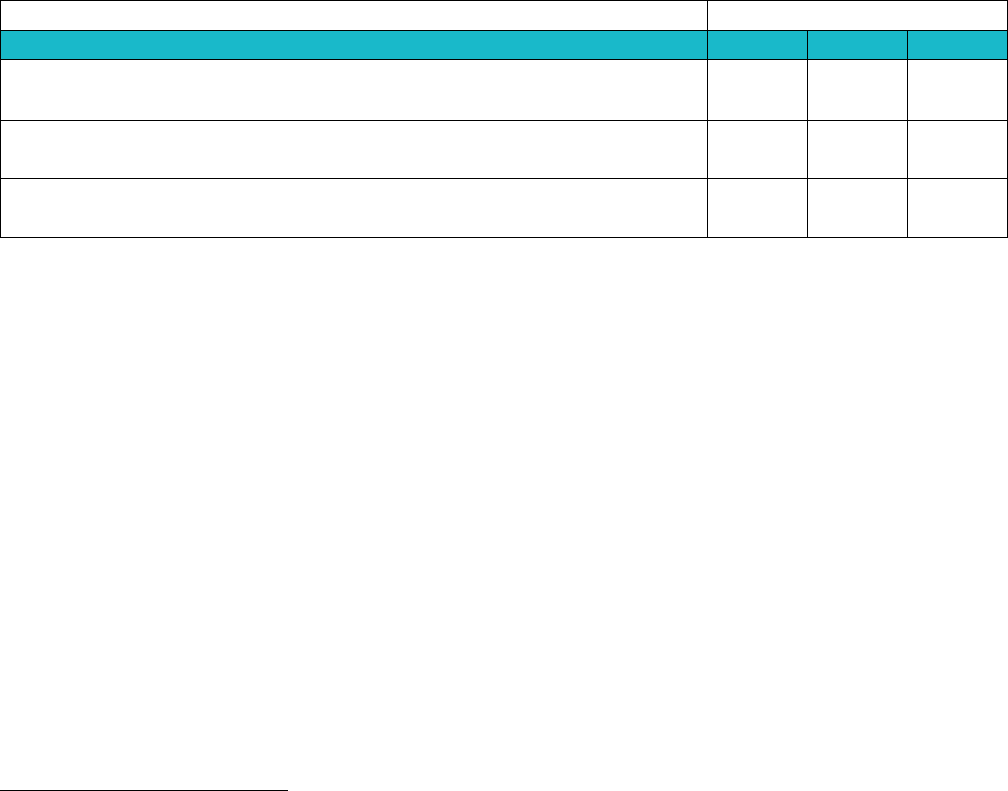

Table 2 lists the global rating and the three summary component ratings for each Covered California

health plan for 2019. Covered California health plans generally performed well on the Plan Services for

Members component rating, with all plans receiving a 3-star rating or above on this component.

9

The 2018 reporting year, which represented the 2017 measurement year, was impacted by a federal statistical methodology that appears

to have inflated star ratings for that year. Covered California is working with CMS to achieve a more stable methodology that will allow

better year-to-year comparisons of star ratings based on changes in performance. This affected only the star rating, not the underlying

measure scores reported below.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 10

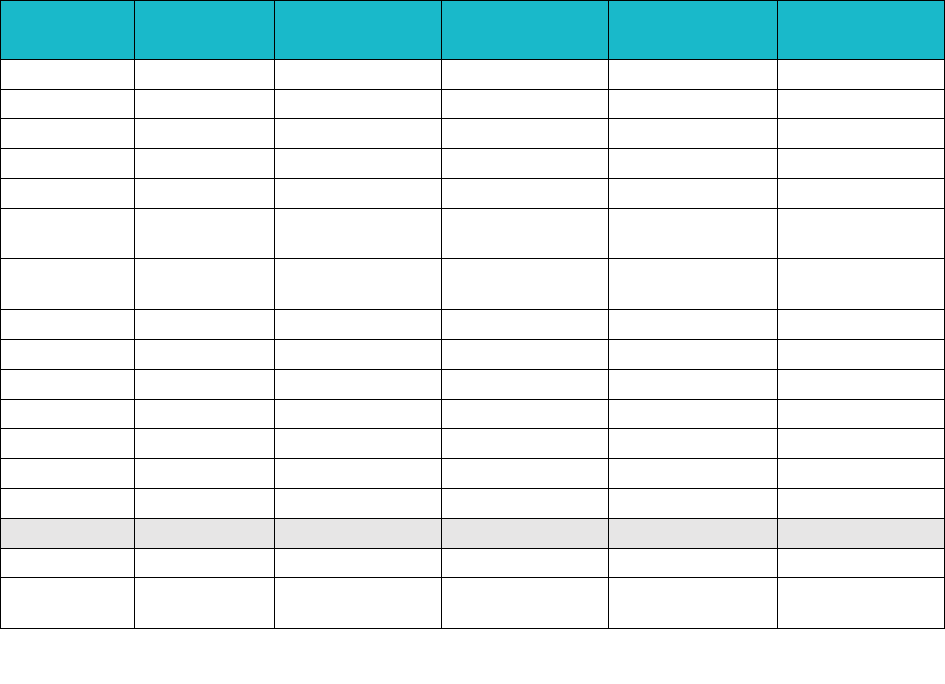

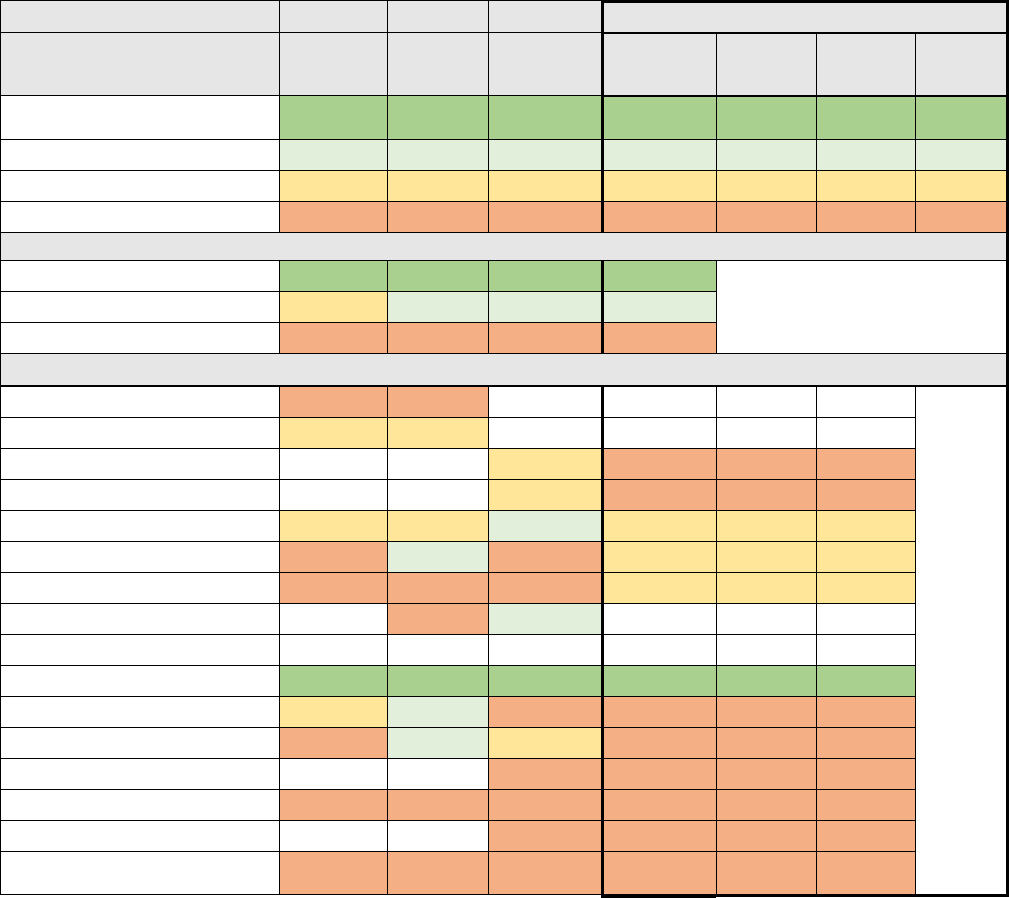

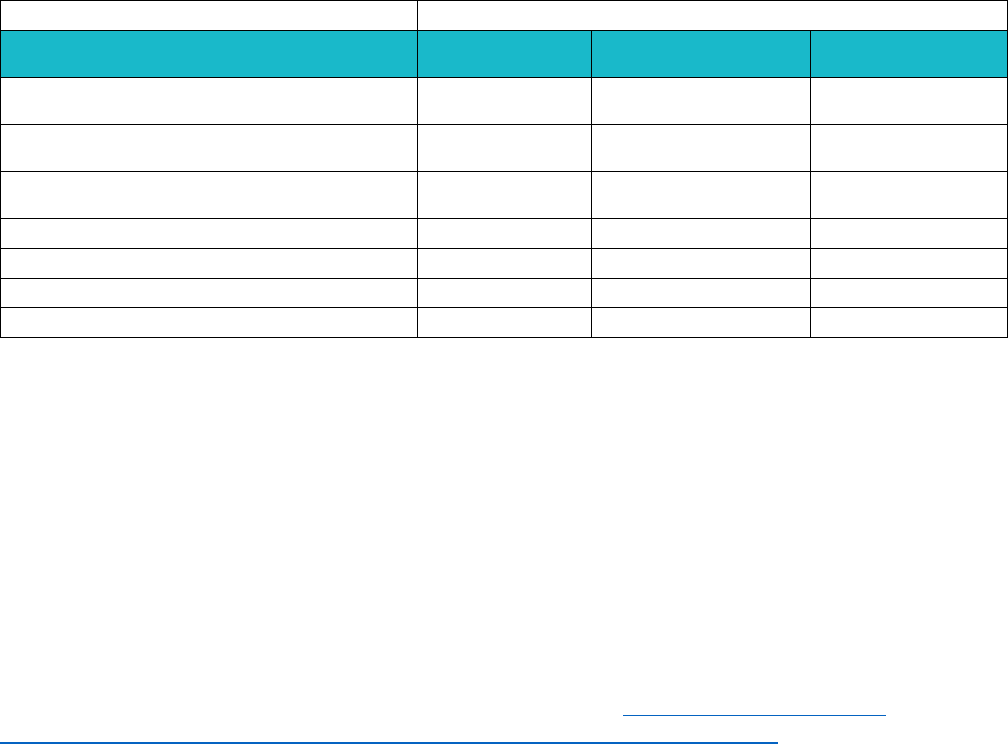

Table 2. Covered California Health Plan QRS Global and Summary Component Ratings, 2019

Health Plan

Product

Type

Global Rating

Getting the

Right Care

Members’ Care

Experiences

Plan Services

for Members

Anthem

EPO

★★

★★

★★

★★★

Blue Shield

PPO

★★★

★★

★★★

★★★

Blue Shield

HMO

★★★

★★

★★★

★★★

CCHP

HMO

★★★

★★★

★★

★★★★★

Health Net

HMO

★★

★★★

★

★★★

Health Net

EPO

One Quality

Rating Available

★★

Not

Reportable**

Not

Reportable**

Health Net

PPO

Quality Rating

in Future*

Quality Rating

in Future*

Quality Rating in

Future*

Quality Rating

in Future*

Kaiser

HMO

★★★★★

★★★★★

★★★★

★★★★★

LA Care

HMO

★★★

★★★

★★

★★★

Molina

HMO

★★

★★

★★

★★★

Oscar

EPO

★★

★★

★★★

★★★★★

Sharp

HMO

★★★★

★★★★

★★★

★★★★

Valley

HMO

★★★

★★★★

★

★★★

WHA

HMO

★★

★★

★★★

★★★★

Blue Shield

HMO/CCSB

★★★

★★

★★★

★★★

Health Net

PPO/CCSB

Quality Rating

in Future*

Quality Rating

in Future*

Quality Rating in

Future*

Quality Rating

in Future*

*Quality ratings are reported for a health plan product after its first two years with Covered California.

**Not enough data to calculate a score according to the quality rating methodology.

Source: Covered California Health Plan QRS Reporting

Enrollee Satisfaction With Their Health Care and Health Plan

Assuring that care is patient-centered requires assessment of a range of elements, including the extent

to which patients receive the right care, at the right time, and in the most appropriate setting. As

discussed in Chapter 10: Appropriate Interventions, it also means that care provided is informed and

based on the patient’s preferences and their understanding of the implications of their choices. At a

high level, however, a starting point of making sure care is patient-centered is considering patient

voices in assessing health plans’ performance.

Among the health plan measures reported to the Marketplace Quality Rating System are Consumer

Assessment of Healthcare Providers and Systems (CAHPS) measures that reflect consumers’

perspectives and their reported experience with care received. These Marketplace Quality Rating

System (QRS) standard performance measures are a key mechanism used by Covered California for

health plan oversight and accountability. To more sharply focus health plan accountability efforts,

Covered California examined over 40 measures used by QRS and is proposing to prioritize a subset of

13 measures that were selected based on the following criteria: (1) health impact; (2) extent of health

plan variation; (3) performance improvement opportunity; (4) alignment with other California

accountability programs; and (5) balance across domains of care, such as prevention, chronic illness

care and behavioral health. Three of the 13 measures overlap with the measures currently collected by

race/ethnicity for health disparities reduction interventions as discussed in Section 2 of this chapter.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 11

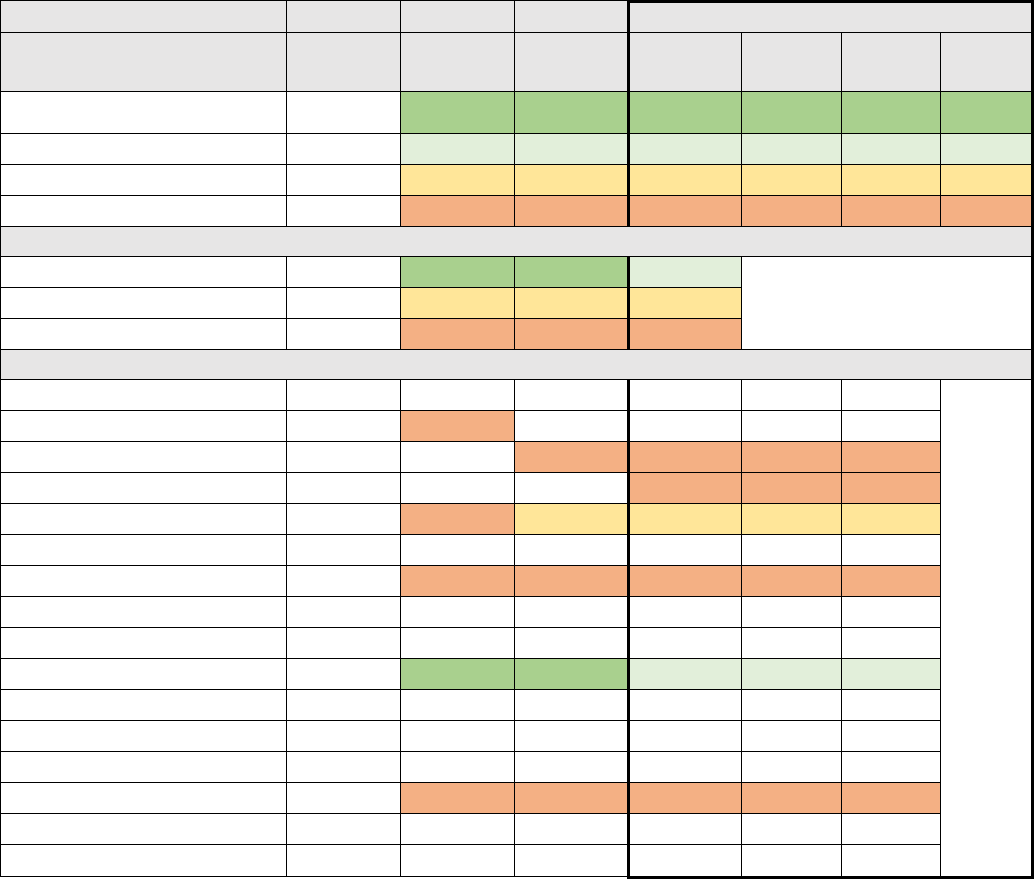

The following tables display the priority measures for individualized, equitable care in the QRS measure

set and include the Covered California weighted average, the highest- and lowest-performing plans,

plan-specific performance and national percentiles for all marketplace plans:

1. Rating of Health Plan (Table 3).

2. Rating of All Health Care (Table 4).

These two CAHPS questions the reflect consumers’ overall satisfaction with their health plan and the

care they received. As evident from each of these measures, there is generally high satisfaction among

Covered California enrollees with their health plans (with 95 percent of enrollees reporting satisfaction

that is above the 50

th

percentile nationally) and with their care (75 percent of enrollees reporting

satisfaction that is above the 50

th

percentile nationally). (See Figure 3. Covered California Enrollment in

Health Plans by Consumer Rating of Health Plan — 95 Percent of Enrollees in Plans Scoring Above

the 50

th

Percentile Nationally, and All Enrollees in Plans Above the 25

th

Percentile, 2019.)

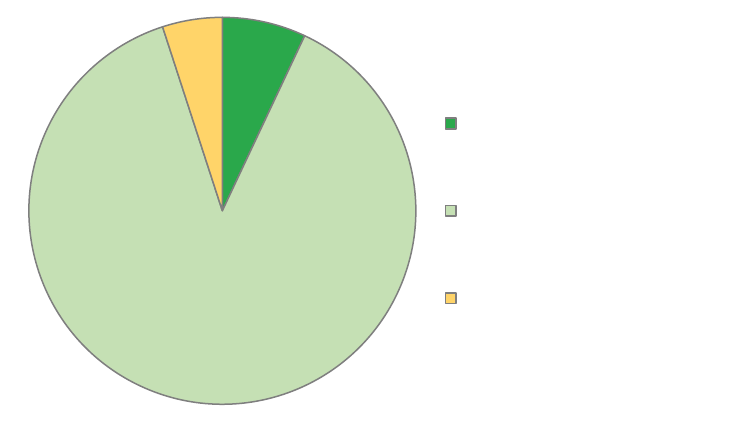

Figure 3: Covered California Enrollment in Health Plans by Consumer Rating of Health Plan — 95 Percent

of Enrollees in Plans Scoring Above the 50

th

Percentile Nationally, and All Enrollees in Plans Above the

25

th

Percentile, 2019

7%

88%

5%

Enrollees in Plans at 90th

Percentile and Above

Enrollees in Plans at 50th to

90th Percentile

Enrollees in Plans at 25th to

50th Percentile

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 12

Rating of Health Plan

The Rating of Health Plan measure indicates enrollee experience related to the rating of health plan

QHP Enrollee Survey question.

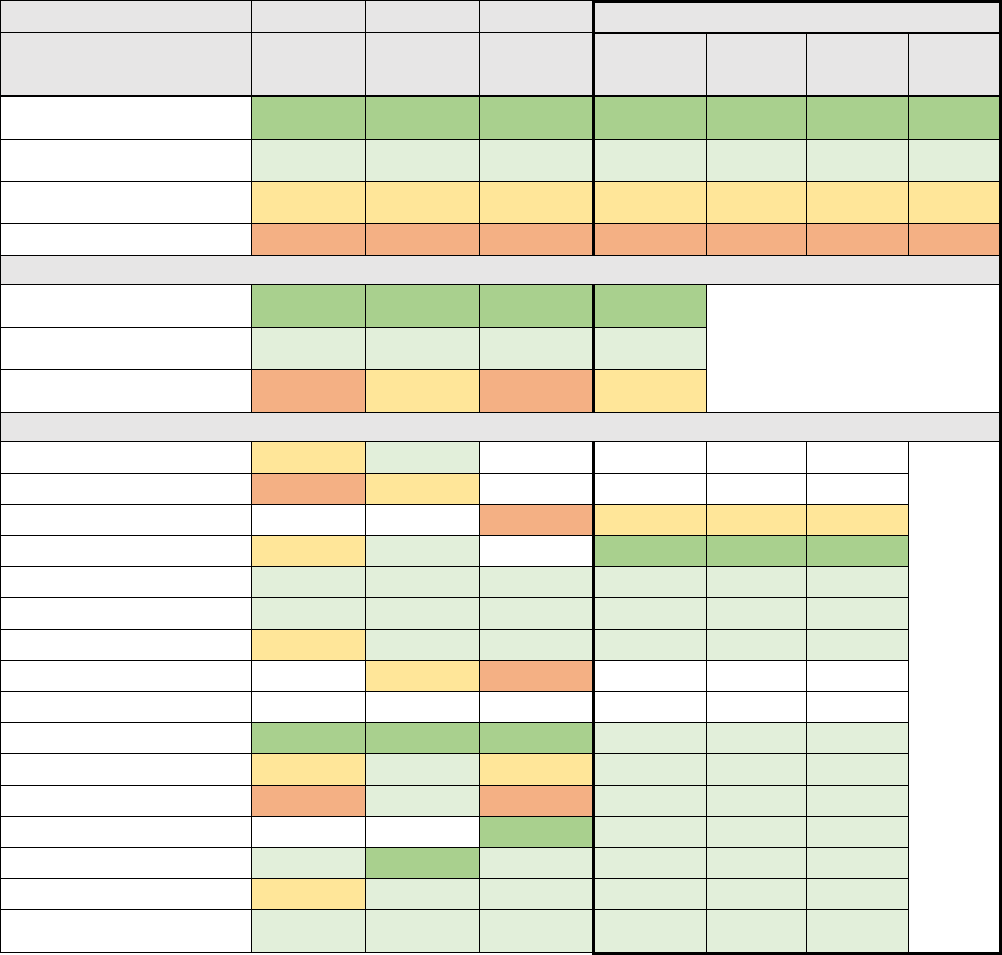

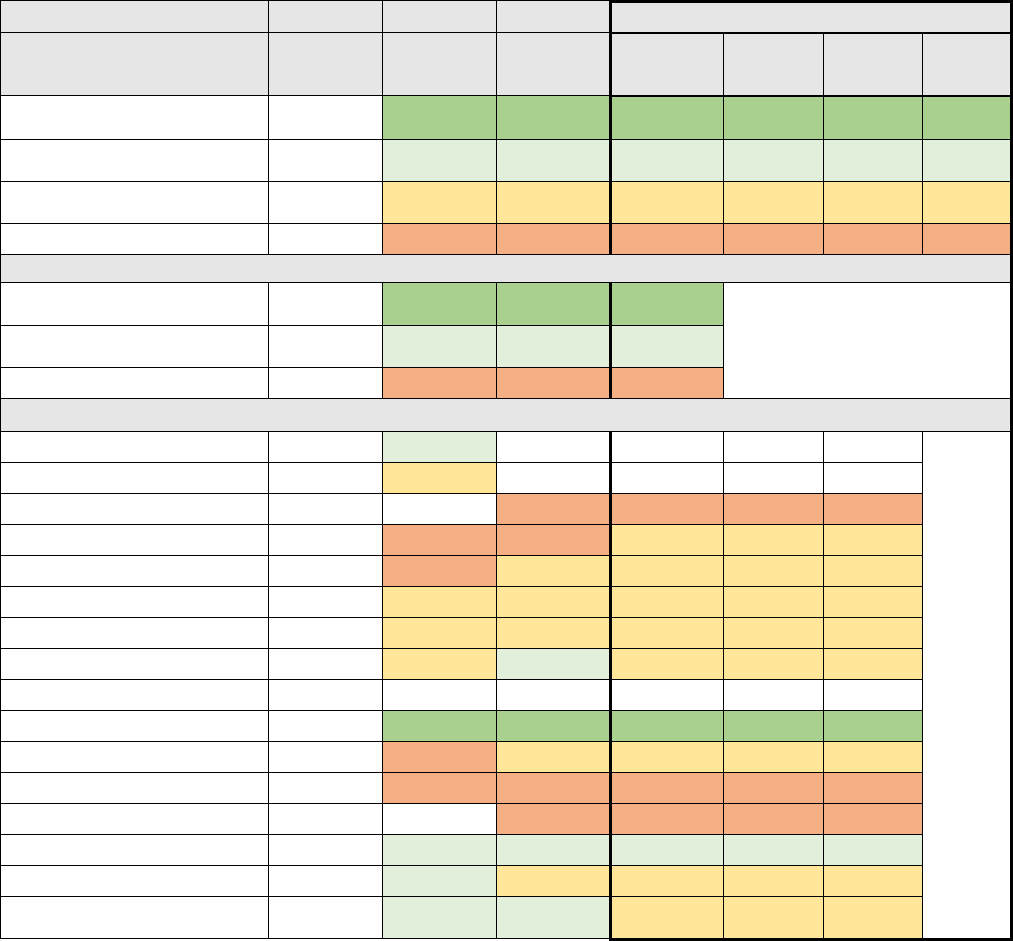

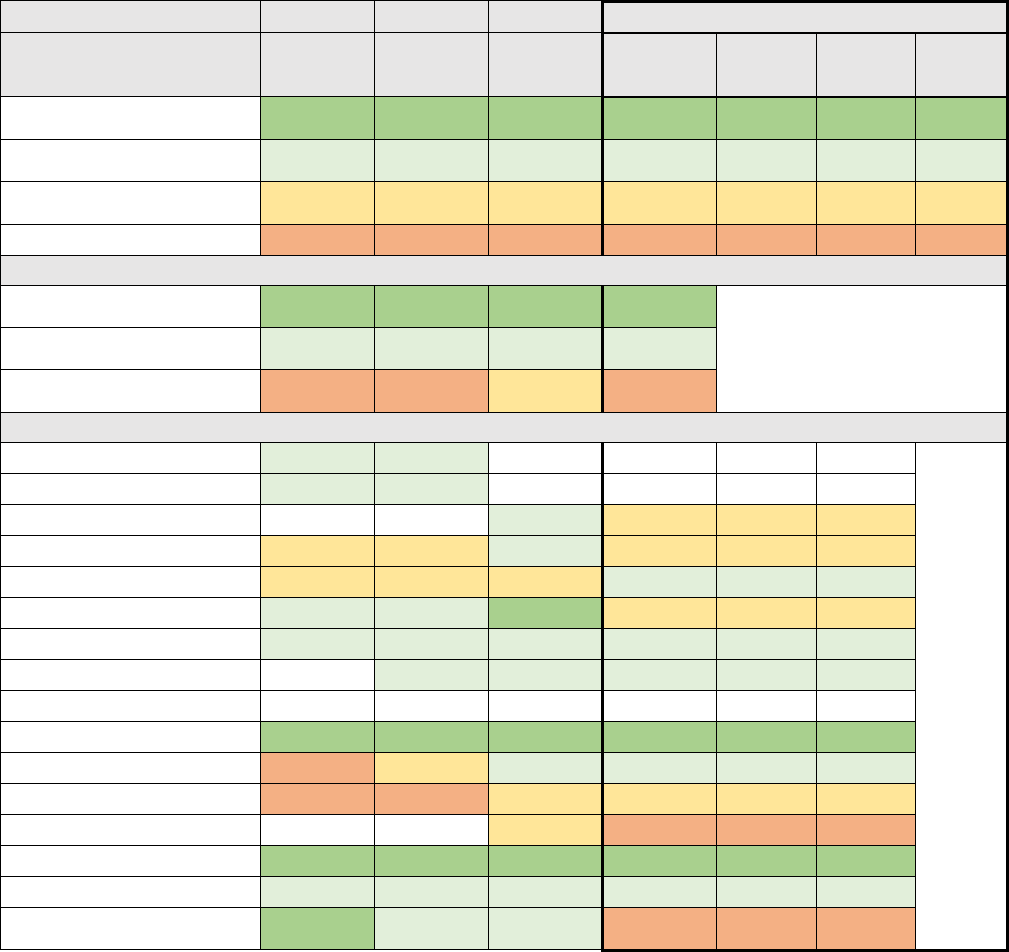

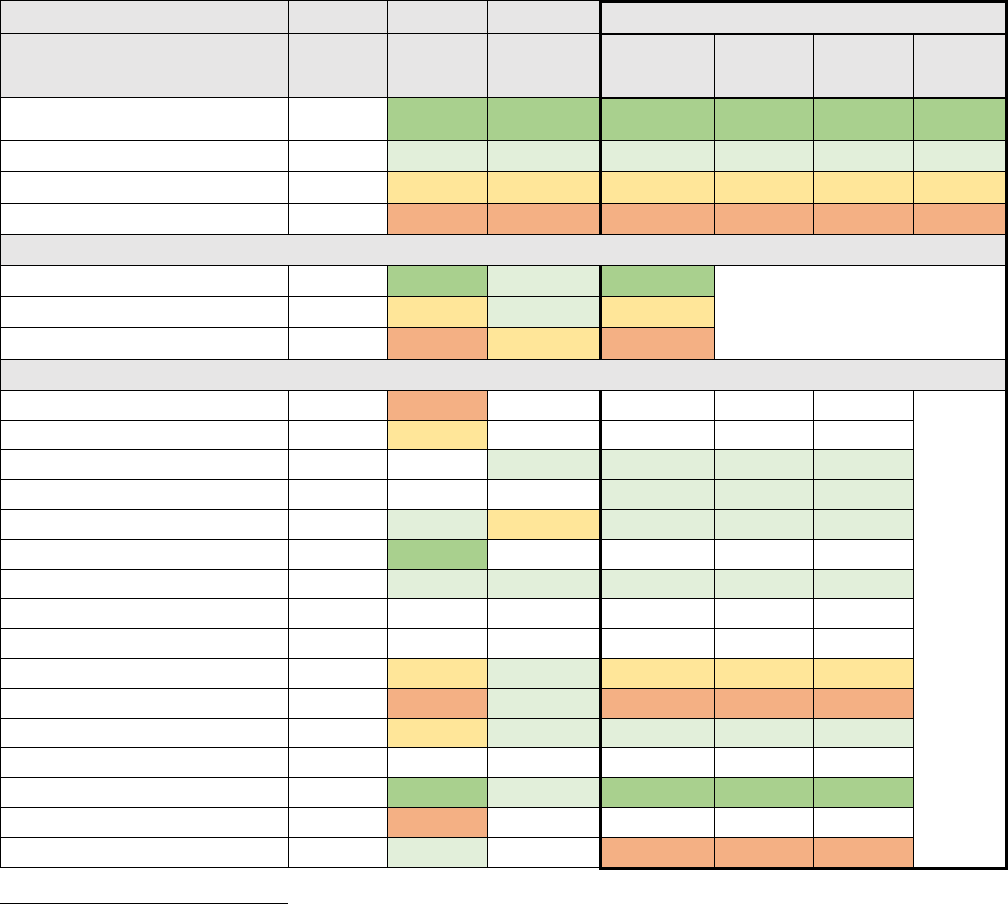

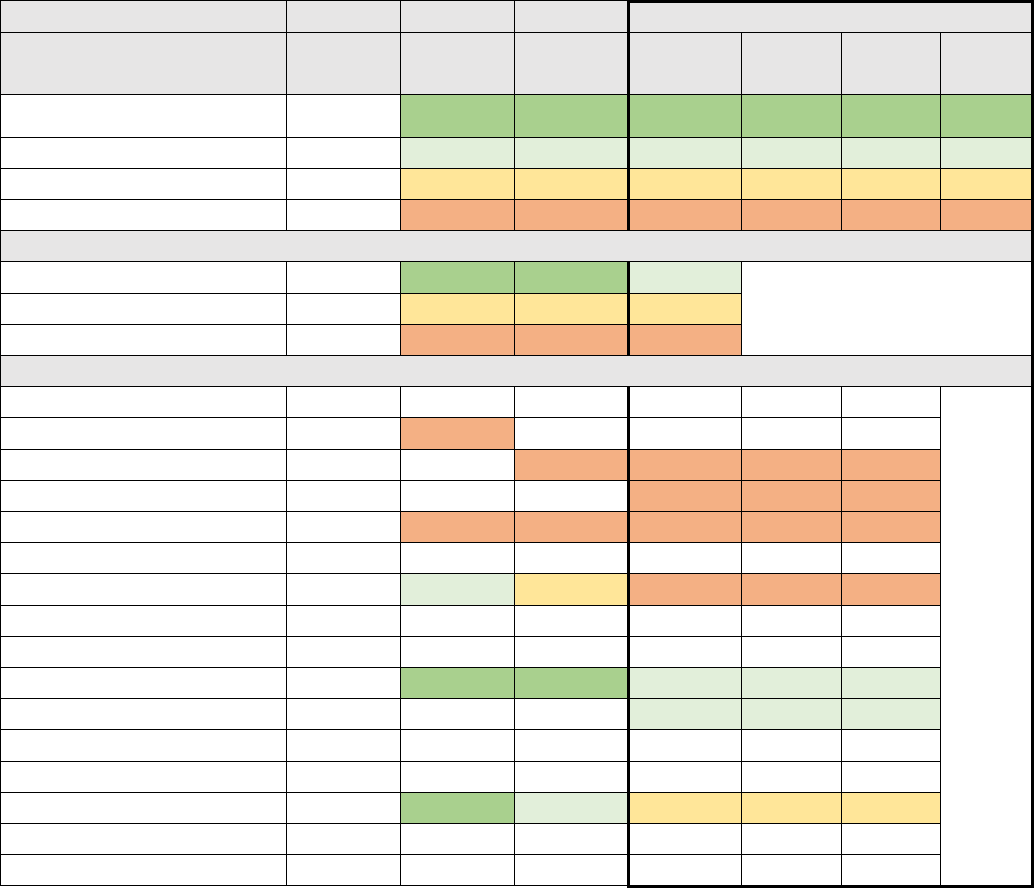

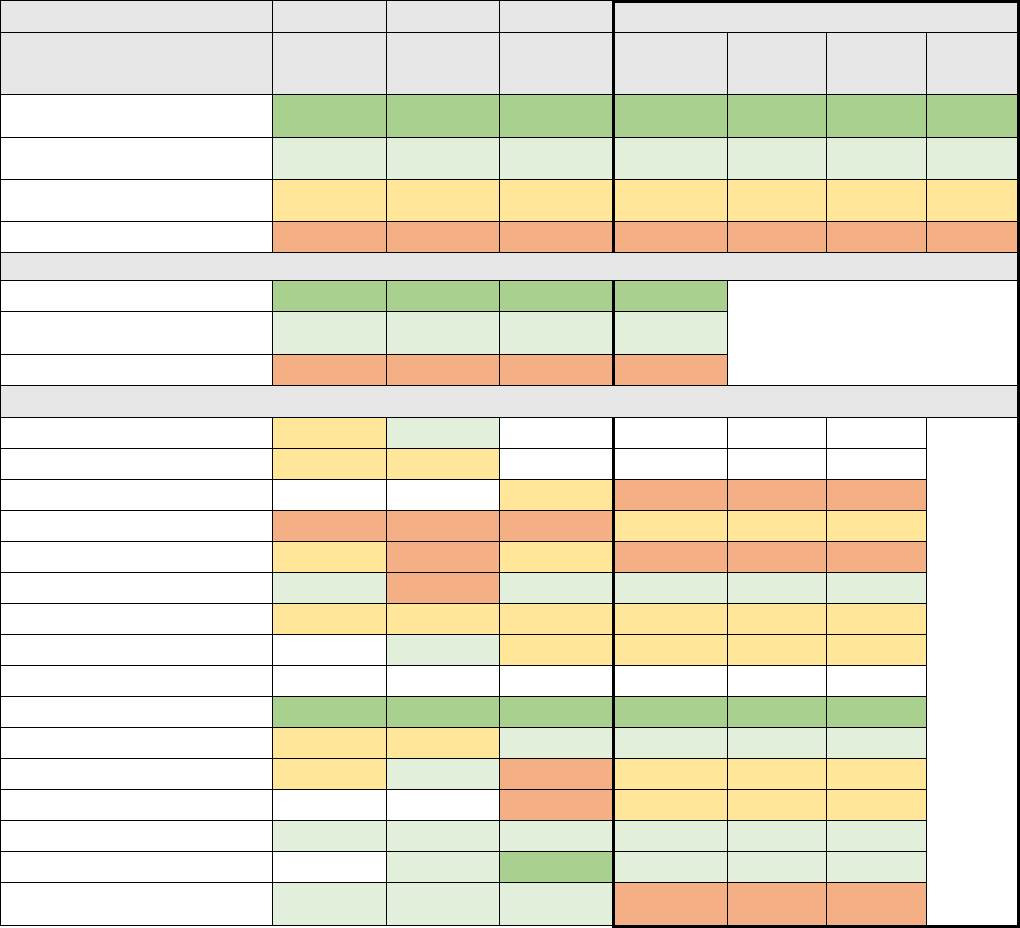

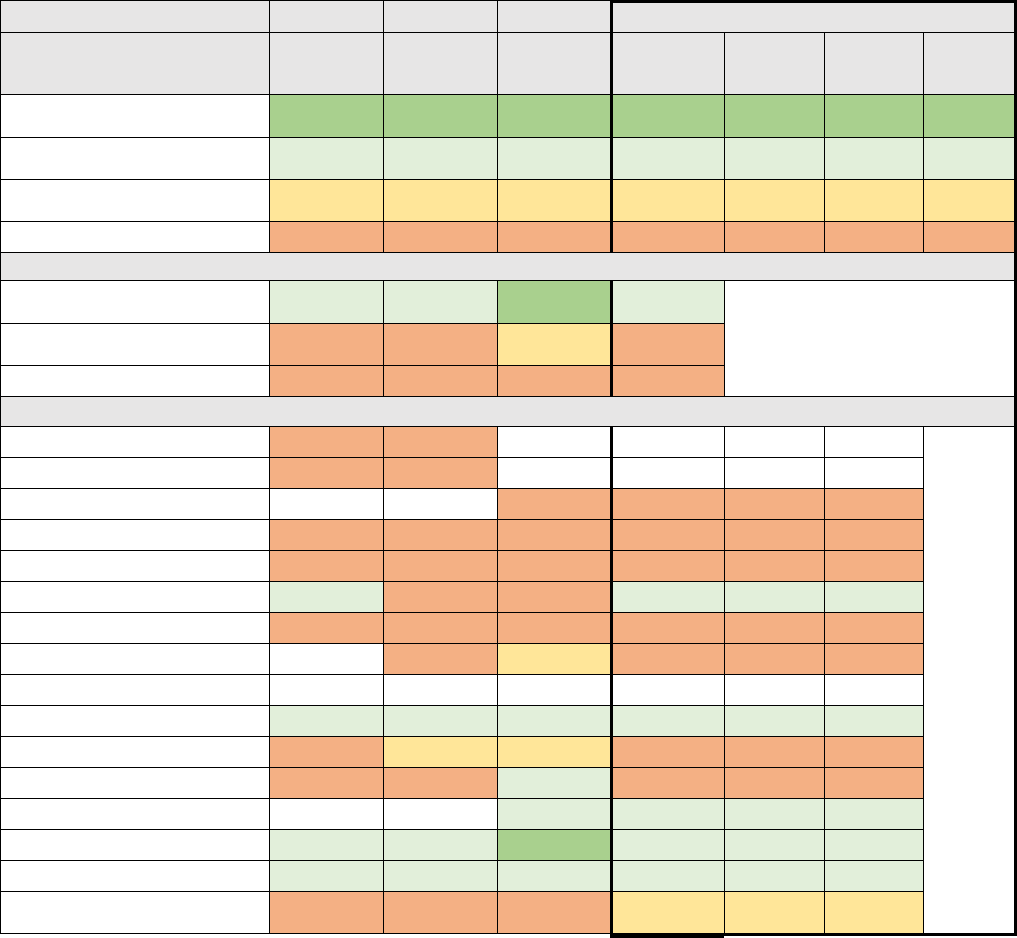

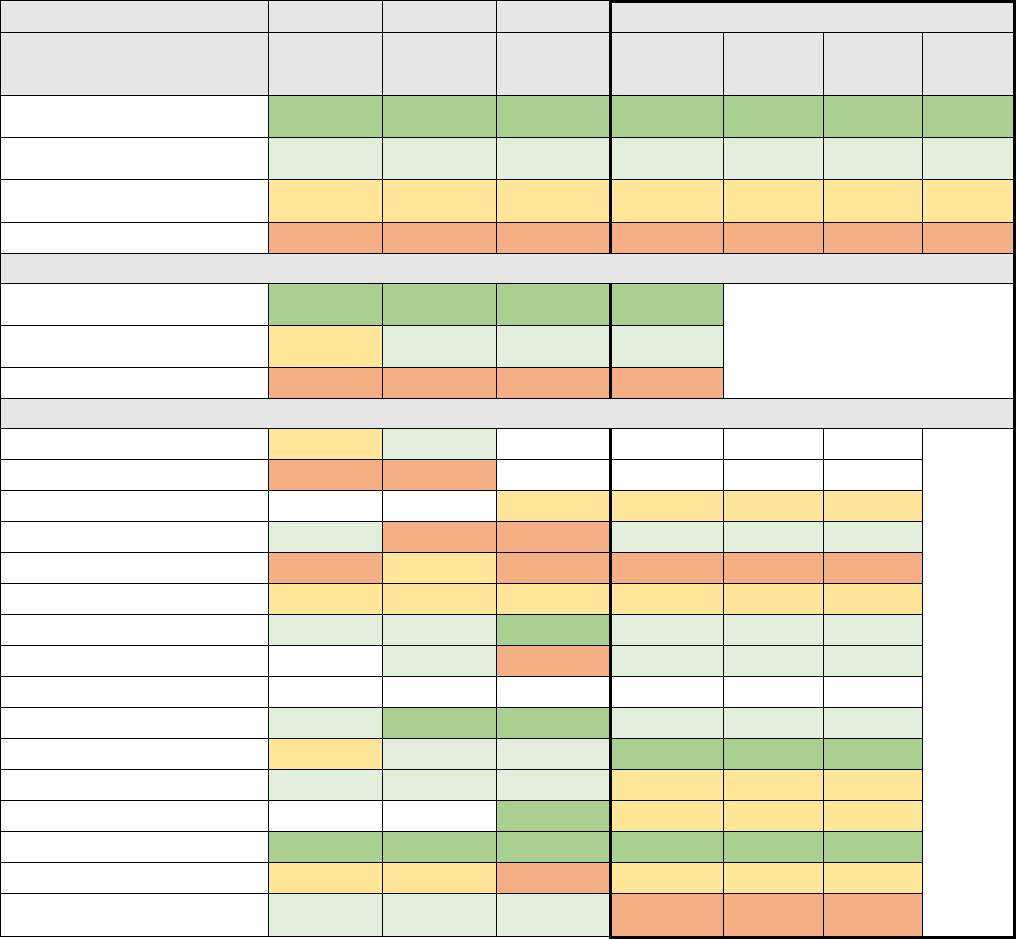

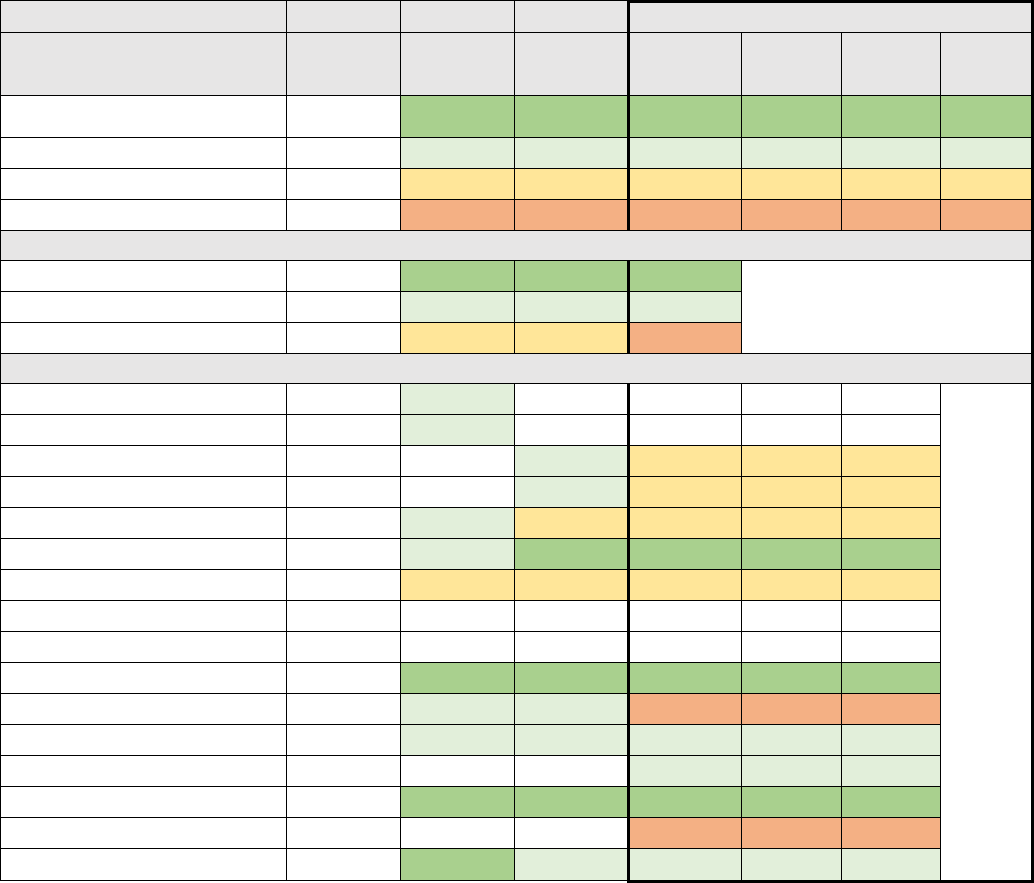

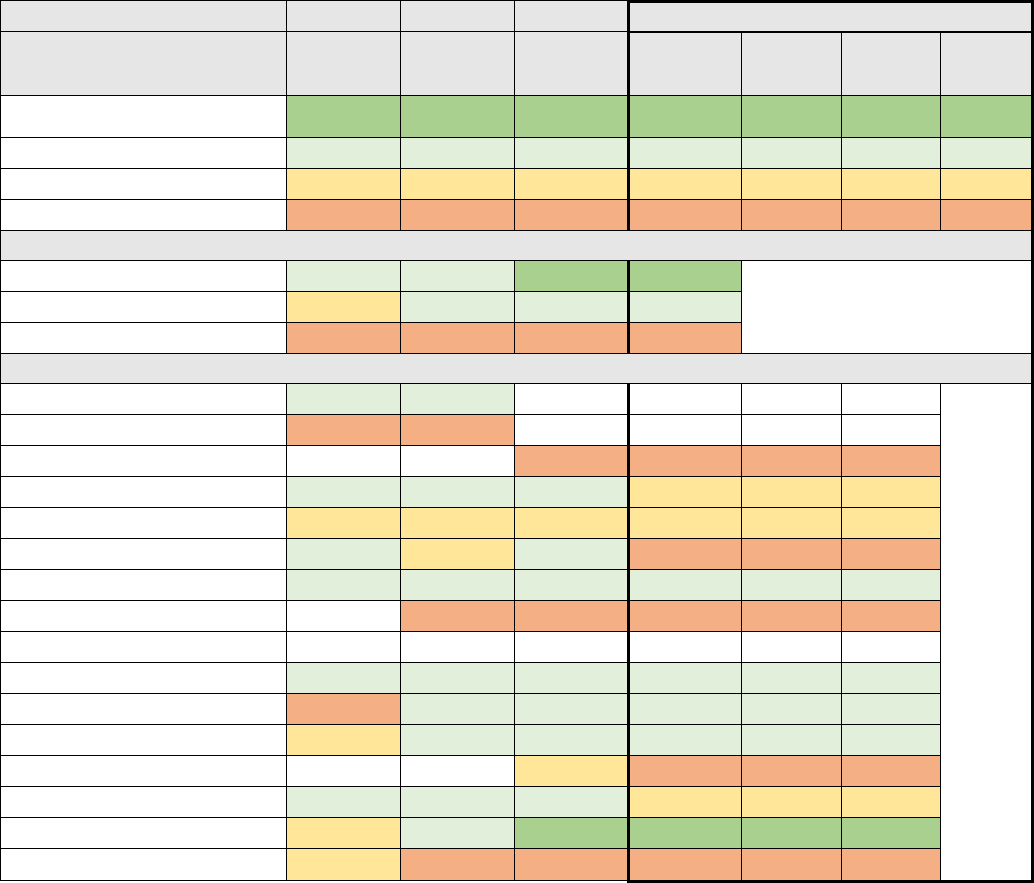

Table 3: Covered California Enrollees Rating of Health Plan (CAHPS)

2016

2017

2018

2019

US

Benchmark

US

Benchmark

US

Benchmark

US

Benchmark

Percent of

Enrollees

Number of

Enrollees

Number

of Plans

Plans at 90th Percentile and

Above

78 +

78 +

79 +

75 +

7%

93,322

1

Plans at 50th to 90th

Percentile

72 to 78

72 to 78

73 to 79

69 to 75

88%

1,187,877

10

Plans at 25th to 50th

Percentile

67 to 72

68 to 72

69 to 73

64 to 69

5%

64,031

1

Plans Below 25th Percentile

Below 67

Below 68

Below 69

Below 64

0%

-

0

Covered California High/Average/Low Performers

Covered CA Highest

Performer

79

80

82

76

Covered CA Weighted

Average

73

76

78

73

Covered CA Lowest

Performer

66

69

65

69

Covered California Plan-Specific Performance

Anthem HMO

71

74

Anthem PPO

67

70

Anthem EPO

67

69

5%

64,031

Blue Shield HMO

70

75

76

7%

93,322

Blue Shield PPO

75

75

78

71

25%

335,176

CCHP HMO

74

76

78

73

1%

10,013

Health Net HMO

70

75

73

70

11%

145,183

Health Net EPO

69

65

Health Net PPO

Kaiser Permanente HMO

79

80

82

74

36%

477,683

LA Care HMO

68

77

73

73

6%

84,750

Molina Healthcare HMO

66

72

69

71

4%

56,023

Oscar Health Plan EPO

80

71

3%

35,962

Sharp Health Plan HMO

77

80

78

75

1%

17,335

Valley Health Plan HMO

70

76

78

75

1%

16,366

Western Health Advantage

HMO

77

77

78

72

1%

9,386

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 13

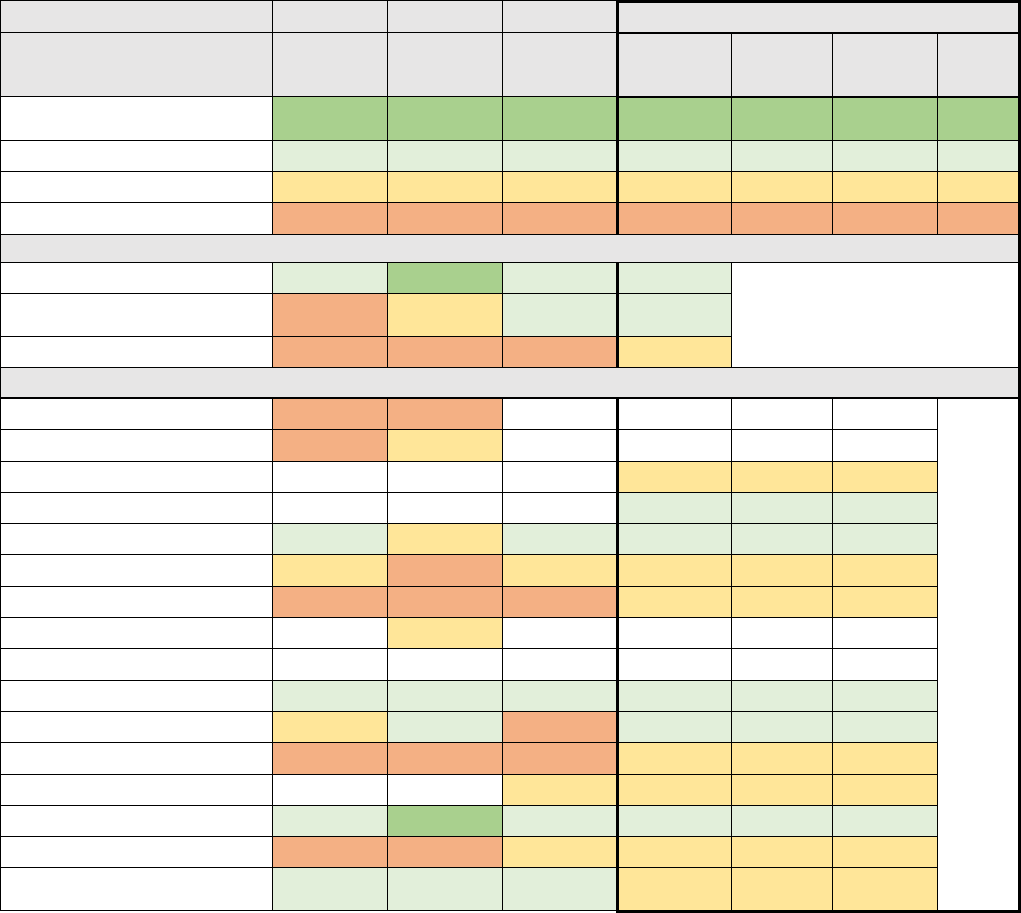

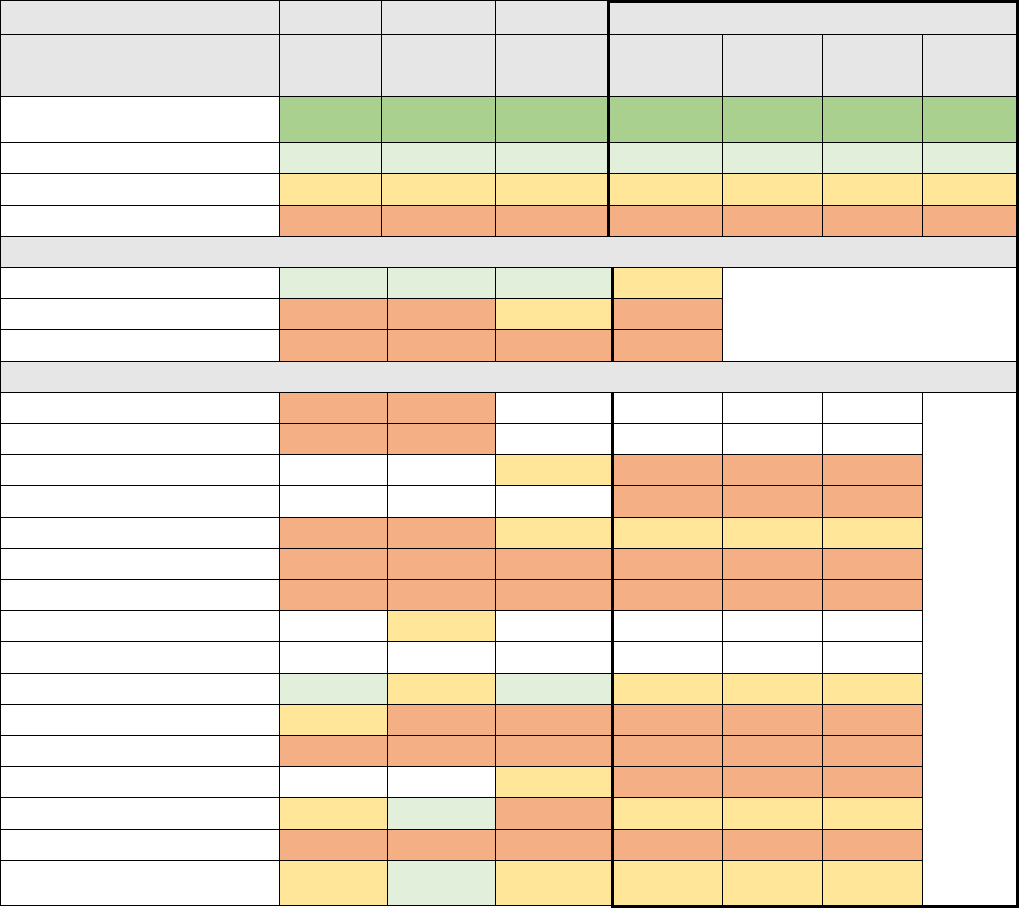

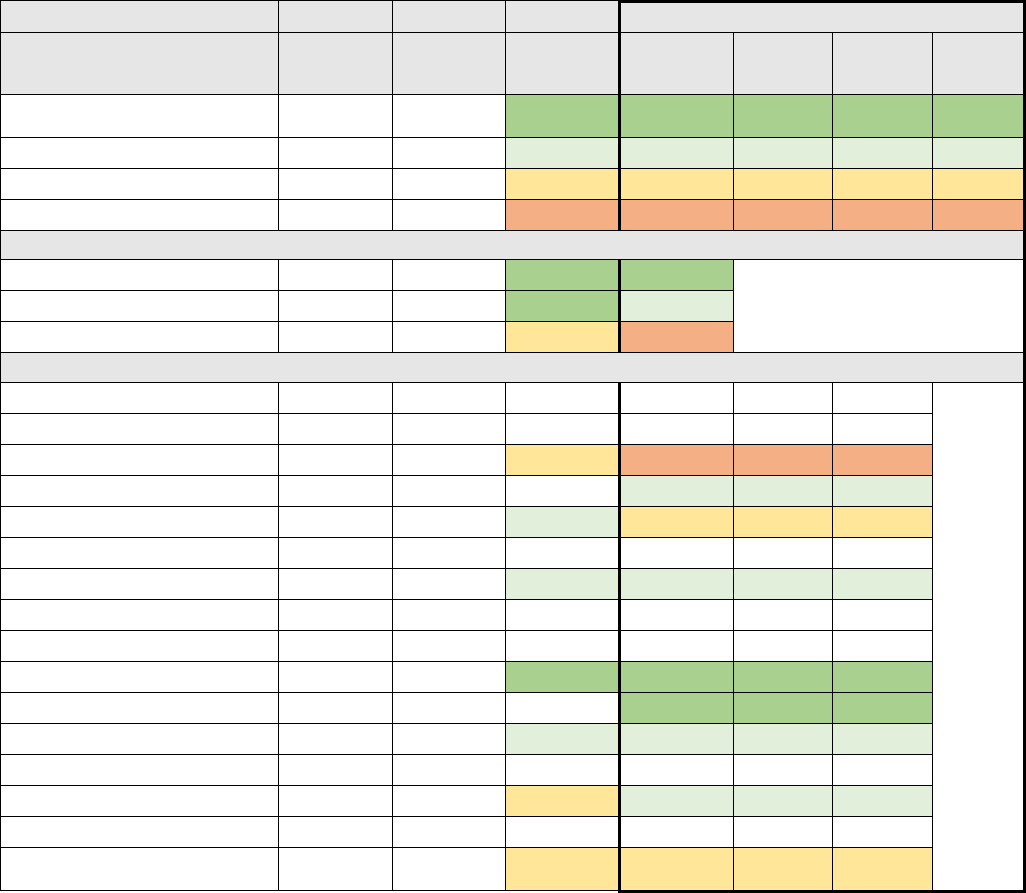

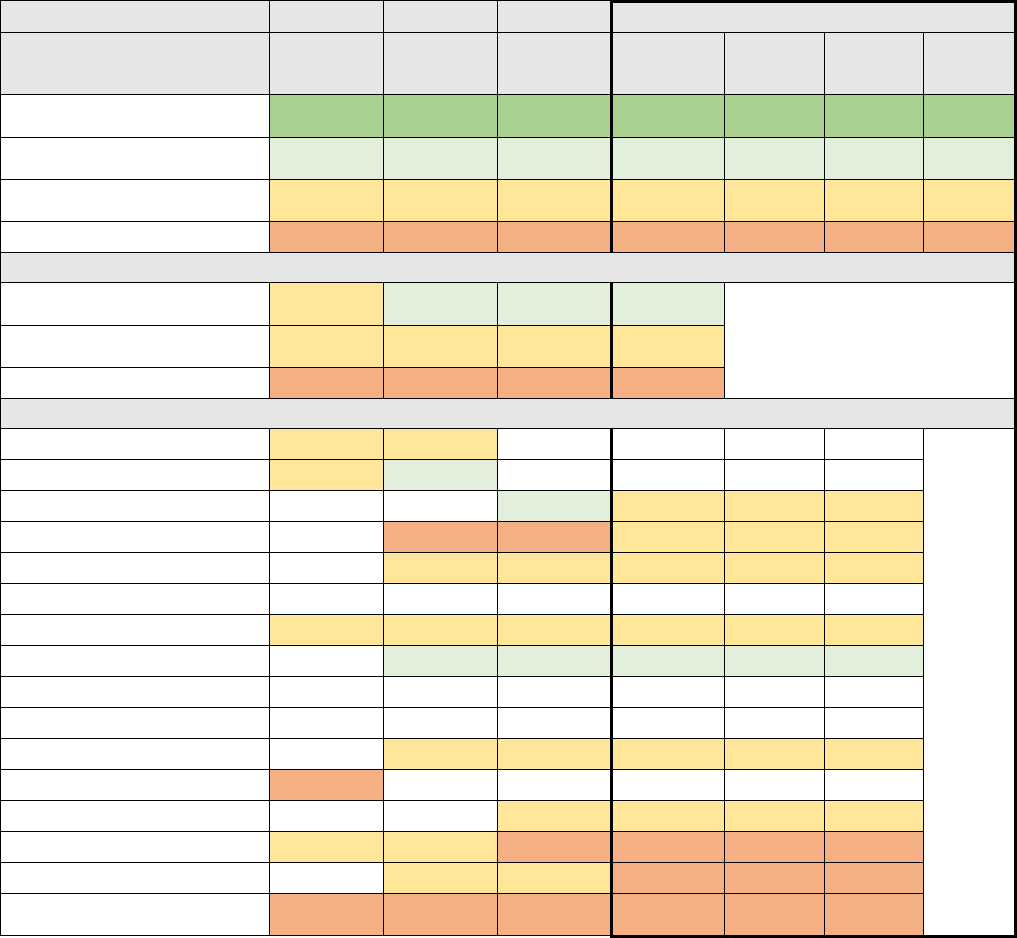

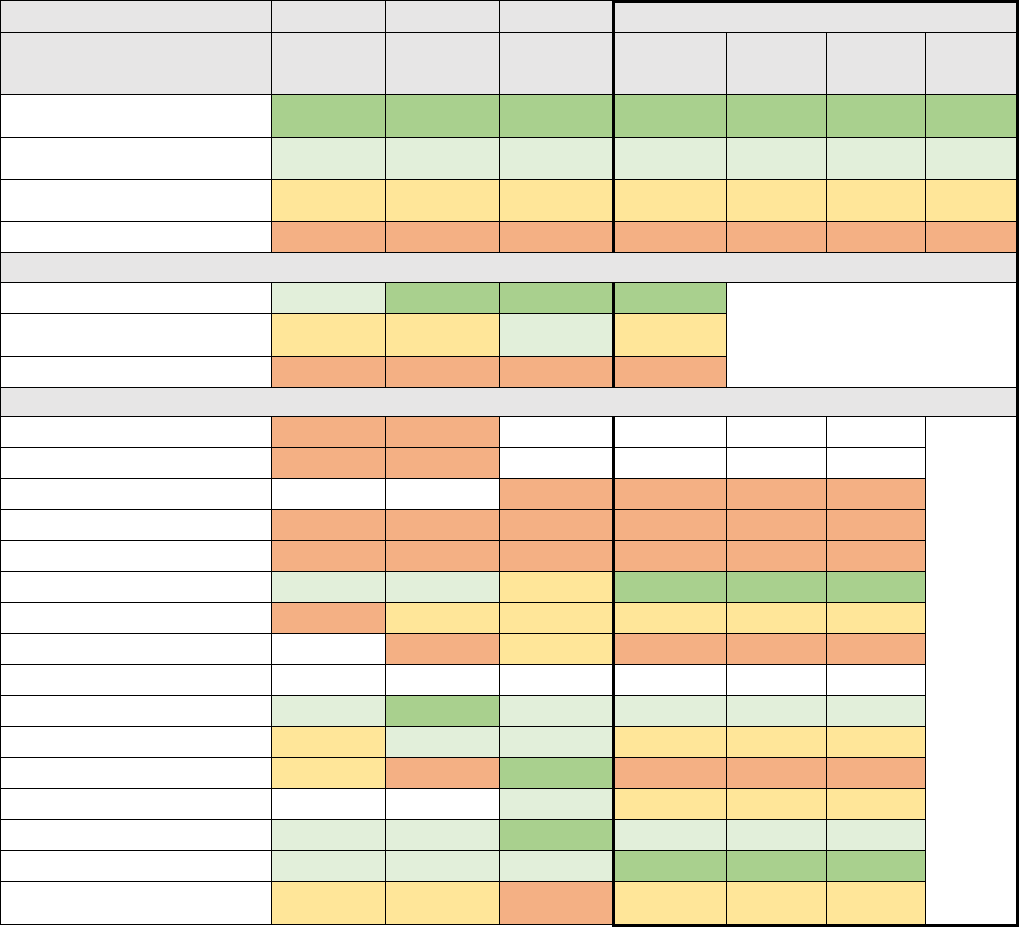

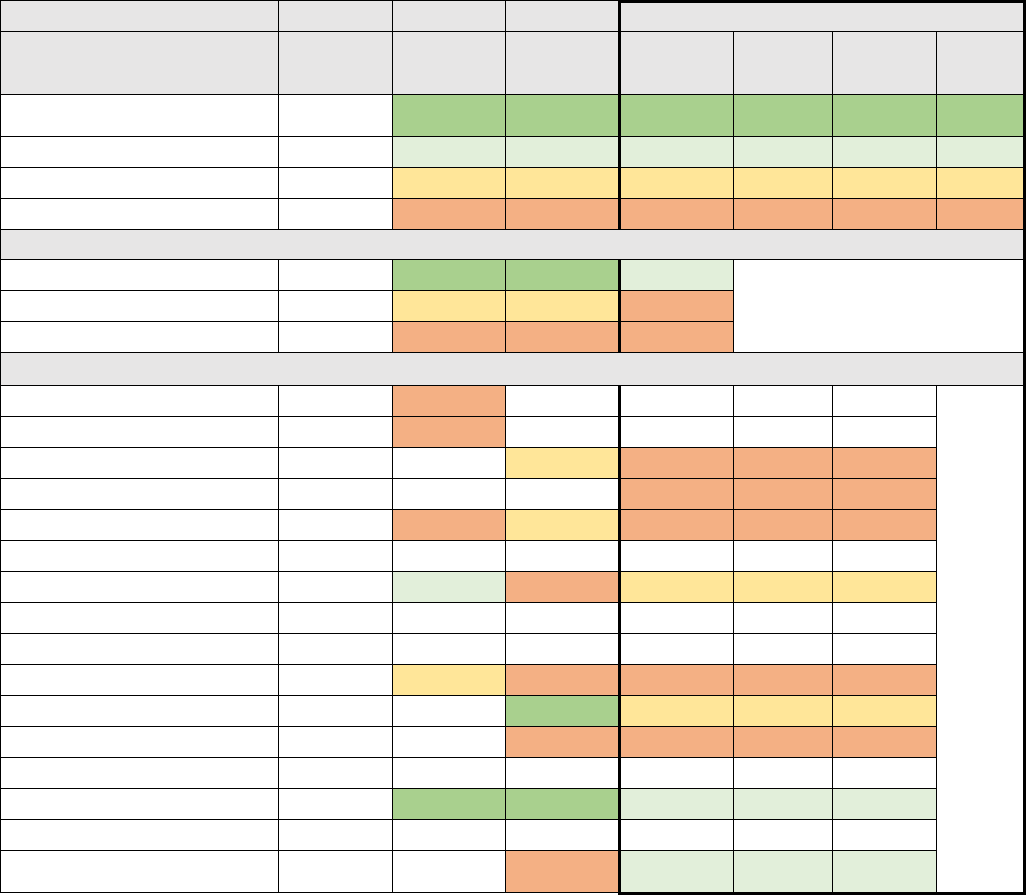

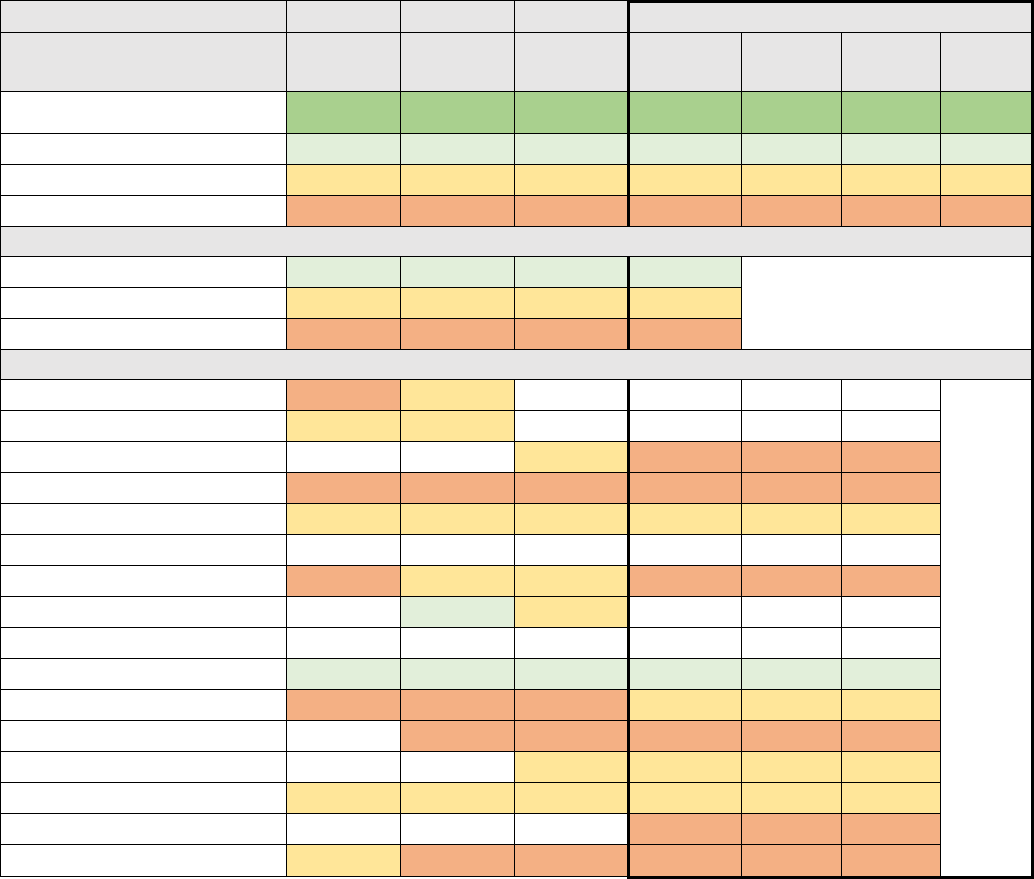

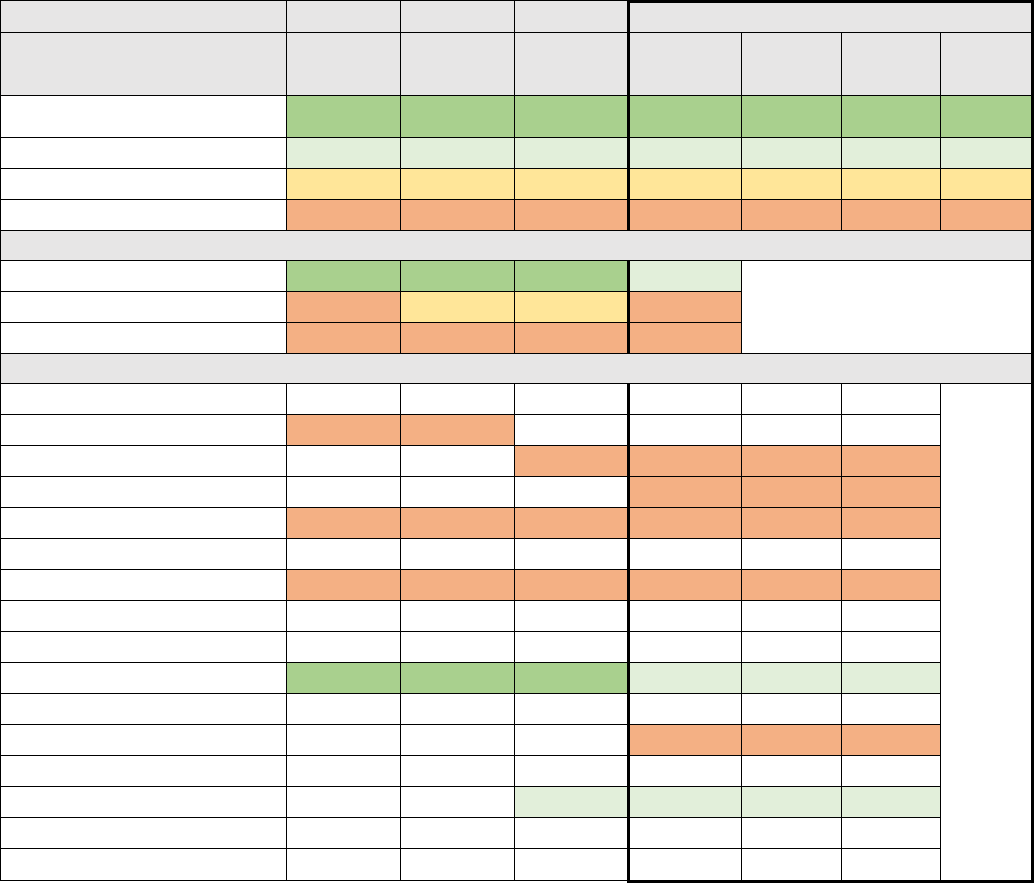

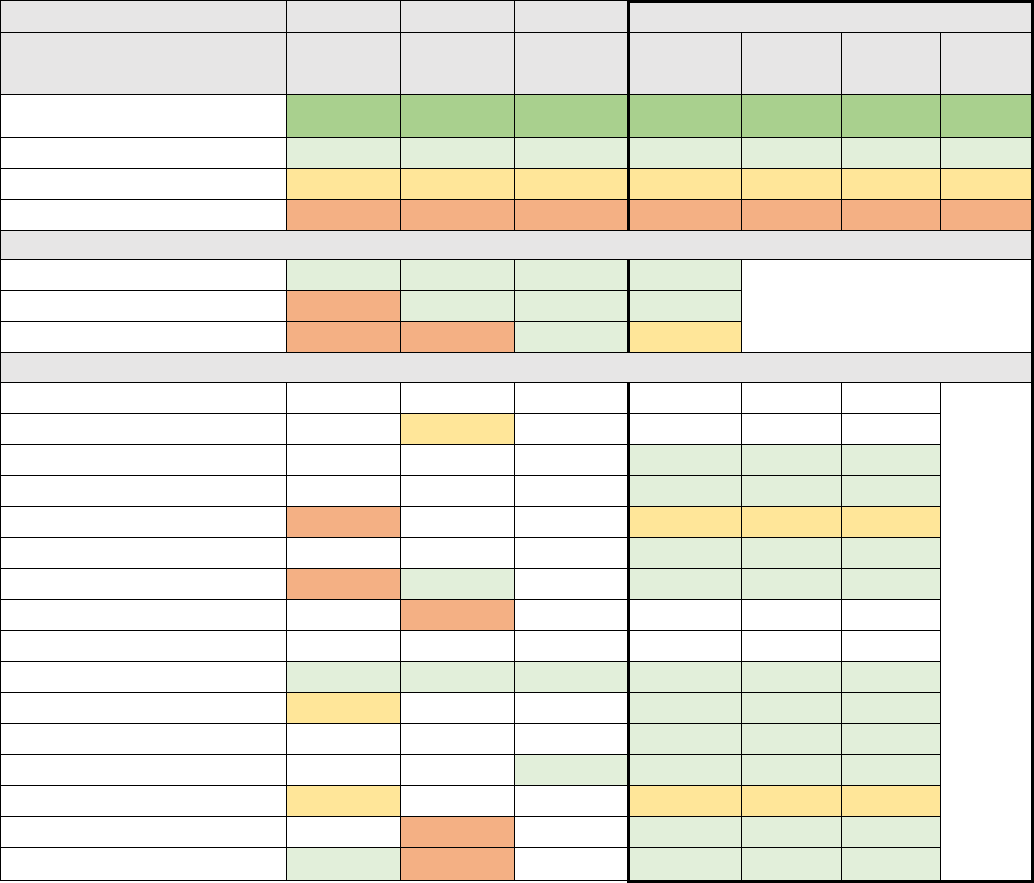

Rating of All Health Care

The “Rating of all health care” measure is an overall indicator of enrollees’ satisfaction (0-10 scale) with

their health care based on the QHP Enrollee Survey.

Table 4: Covered California Enrollees’ Rating of All Health Care (CAHPS)

2016

2017

2018

2019

US

Benchmark

US

Benchmark

US

Benchmark

US

Benchmark

Percent of

Enrollees

Number of

Enrollees

Number

of Plans

Plans at 90th Percentile and

Above

85 +

86 +

86 +

82 +

0%

-

0

Plans at 50th to 90th Percentile

82 to 85

83 to 86

83 to 86

78 to 82

75%

1,008,266

5

Plans at 25th to 50th Percentile

80 to 82

81 to 83

81 to 83

75 to 78

25%

336,964

7

Plans Below 25th Percentile

Below 80

Below 81

Below 81

Below 75

0%

-

0

Covered California High/Average/Low Performers

Covered CA Highest Performer

84

88

86

80

Covered CA Weighted

Average

80

81

83

78

Covered CA Lowest Performer

69

75

74

75

Covered California Plan-Specific Performance

Anthem HMO

78

79

Anthem PPO

76

82

Anthem EPO

76

5%

64,031

Blue Shield HMO

80

7%

93,322

Blue Shield PPO

83

82

85

78

25%

335,176

CCHP HMO

80

80

81

77

1%

10,013

Health Net HMO

74

78

78

75

11%

145,183

Health Net EPO

81

Health Net PPO

Kaiser Permanente HMO

84

84

86

80

36%

477,683

LA Care HMO

80

83

76

78

6%

84,750

Molina Healthcare HMO

69

75

74

76

4%

56,023

Oscar Health Plan EPO

82

76

3%

35,962

Sharp Health Plan HMO

83

88

85

80

1%

17,335

Valley Health Plan HMO

76

80

81

77

1%

16,366

Western Health Advantage

HMO

83

85

84

76

1%

9,386

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 14

Covered California’s Attention to Equity and Health Disparities

Covered California has prioritized initiatives to narrow health care and coverage disparities and ensure

health equity for all. Reducing health disparities is part of Covered California’s vision and mission

statement and has the potential to benefit all Californians (with over 4 million consumers served to date

through Covered California

10

) and because the populations measured and targeted for improvement by

health insurance companies include all of their enrollees under age 65 across all lines of business.

While disparities are influenced by social

and economic factors beyond the control

of the health care delivery system, there

is agreement and evidence that health

care disparities can be narrowed through

quality improvement activities tailored to

the needs of specific populations and

targeting select measures at the health

plan level. To this end, Covered

California has laid out a health

disparities and health equity agenda

centered on four requirements:

1. Promoting community health initiatives that foster better health, healthier environments and

healthy behaviors.

2. Identifying the race or ethnicity of all enrollees through self-identification or imputed

methodology.

3. Collecting data by race/ethnicity for disease control and management measures for asthma,

depression, diabetes and hypertension — conditions with especially high levels of morbidity and

mortality experienced by disadvantaged populations.

4. Conducting population-health improvement activities and interventions to narrow observed

disparities in care.

See Section 2 for information on health plan progress in conducting interventions to narrow observed

disparities in care and collecting data by race/ethnicity for disease control and management measures

for asthma, depression, diabetes and hypertension.

Promoting Community Health Initiatives That Foster Better Health, Healthier

Environments, and Promotion of Healthy Behaviors

Under contract requirements, Covered California included requirements for engagement and promotion

of community-wide initiatives that foster better health, healthier environments, and the promotion of

healthy behaviors across the community. Covered California specifically encouraged community health

initiatives that have undergone or are being piloted through systematic review to determine

10

This figure only includes on-exchange enrollment since 2014. The figure is higher if off-exchange mirrored plan enrollment is included.

Covered California’s Mission and Vision

Covered California’s vision is to improve the health of

all Californians by assuring their access to affordable,

high quality care.

Covered California’s mission is to increase the number

of insured Californians, improve health care quality,

lower costs, and reduce health disparities through an

innovative, competitive marketplace that empowers

consumers to choose the health plan and providers that

give them the best value.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 15

effectiveness in promoting health and preventing disease, injury or disability and have been

recommended by the Community Preventive Services Task Force. Such programs may include:

1. Partnerships with local, state, or federal public health departments such as Let’s Get Healthy

California.

2. CMS Accountable Health Communities.

3. Organizations that operate preventive and other health programs, such as Cal Fresh.

4. Hospital activities undertaken under the Community Health Needs Assessment required every

three years under the Affordable Care Act.

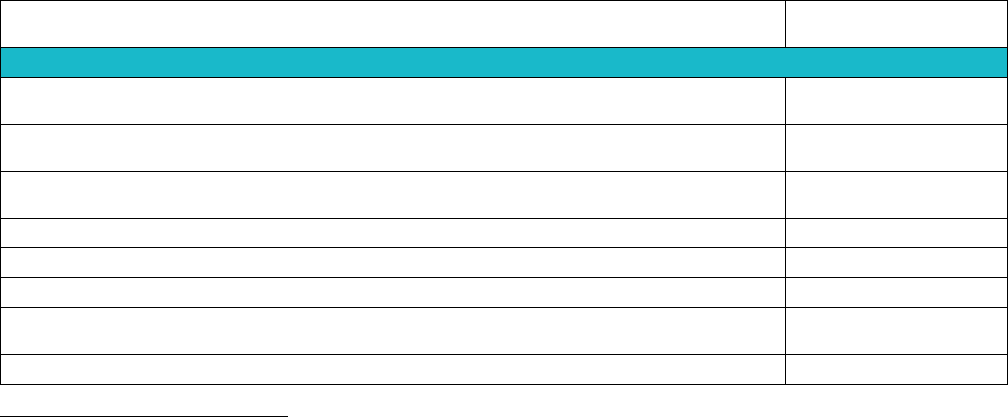

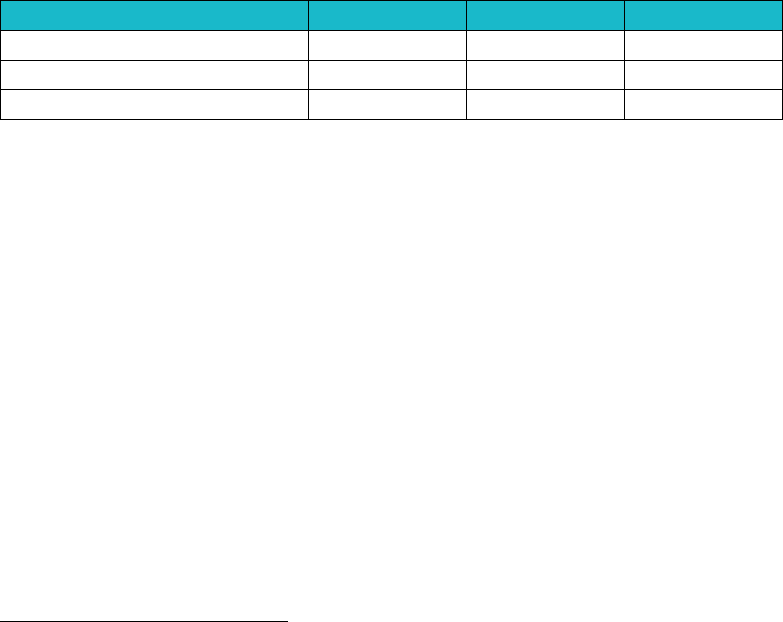

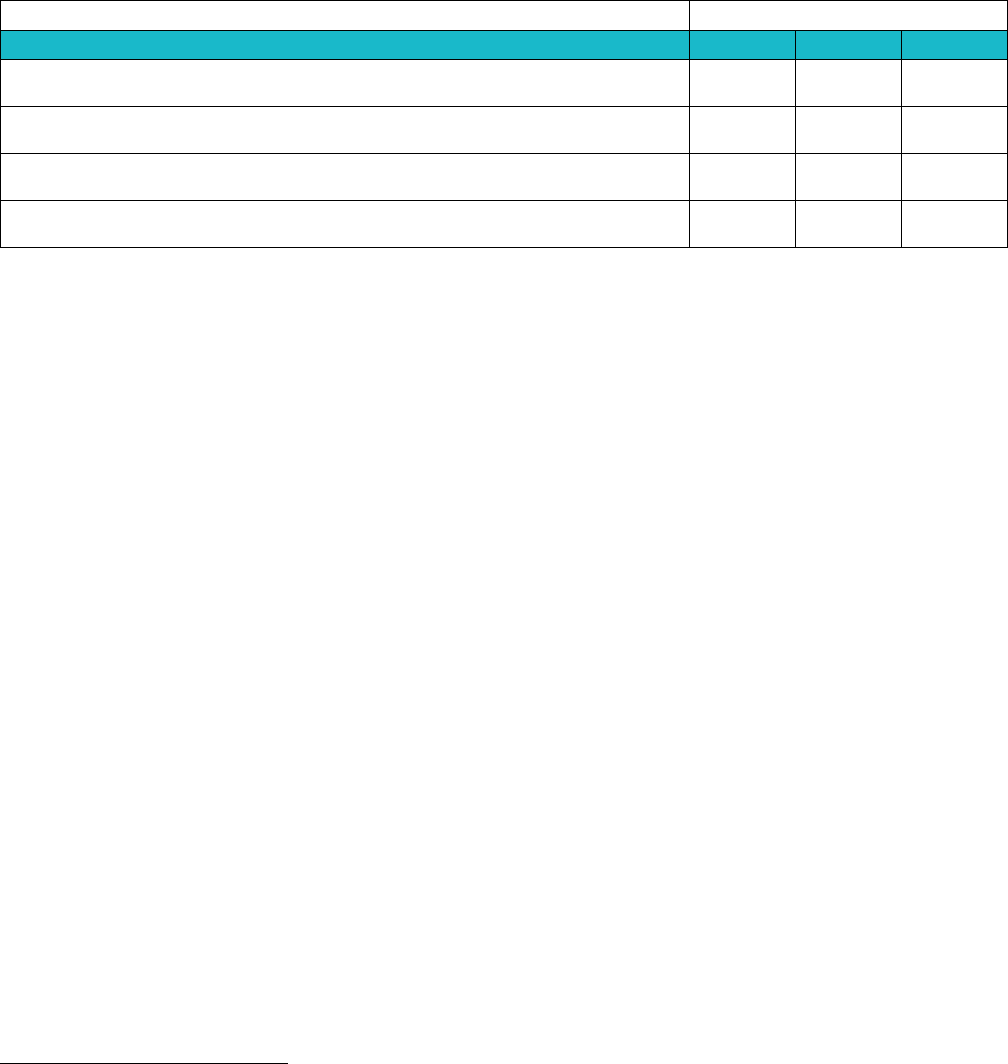

Table 5. Covered California Insurer Activities to Improve Community Health, 2018 shows health insurer

reported initiatives, programs and projects that improve community health apart from the health delivery

system. Health insurance company involvement in external-facing activities is used by Covered

California to identify potential disparity-reduction opportunities.

Identifying the Race or Ethnicity of All Enrollees

Understanding disparities in care requires data collection on demographics and other social

determinants of health. Health insurance companies vary in the degree to which demographic data is

collected and integrated into member records. While state law requires health insurance companies to

collect race, ethnicity, and language data, insurers use different methods to obtain this information and

have different rates for the percentage of membership self-identifying race/ethnicity (i.e. race/ethnicity

self-identification rates).

11

Before the initiatives described below, no purchaser or state agency in

California monitored the success of collecting self-identification rates and there had been no broad

attempt to use the data to evaluate disparities in care.

To achieve high self-identification rates across all health insurance companies, Covered California set a

goal for all insurers to achieve identification of at least 80 percent of all Covered California membership

by year-end 2019 and encouraged use of various data collection methods beyond the membership

enrollment application to identify race/ethnicity. Starting with the 2018 plan year, insurers were

assessed on a contract performance standard for the self-identification rate and received financial

penalties or credits based on whether they achieved the target. Insurers proposed intermediate

milestones for the performance standard for the 2018 plan year and will be assessed on whether they

achieved a target of 80 percent in 2019.

Based on analysis of data gathered for this performance standard, eight insurers have achieved the 80

percent target as of 2018 and some have exceeded 95 percent. Insurers have attributed the increased

identification rates to improved data collection and incorporation of best practices for asking enrollees

for race/ethnicity information.

11

Senate Bill 853, Chapter 717, Statutes of 2009.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 16

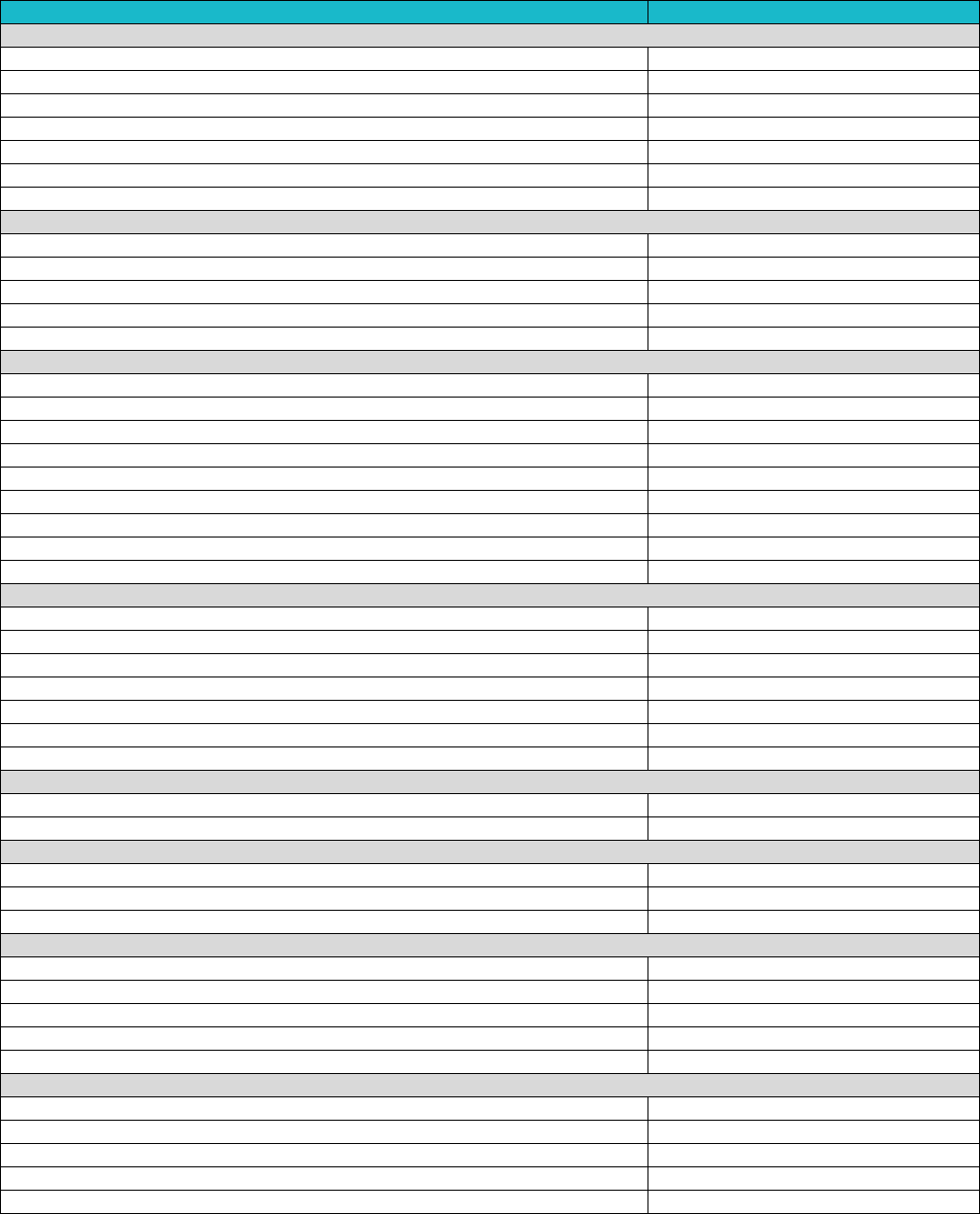

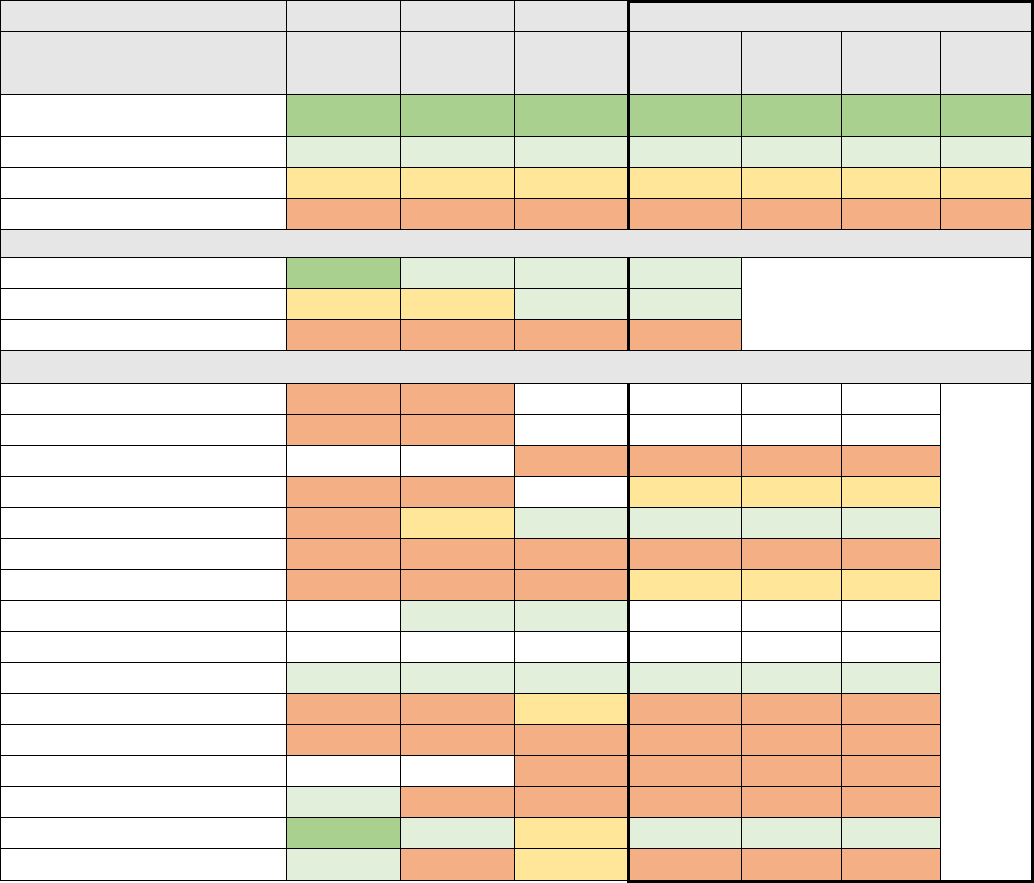

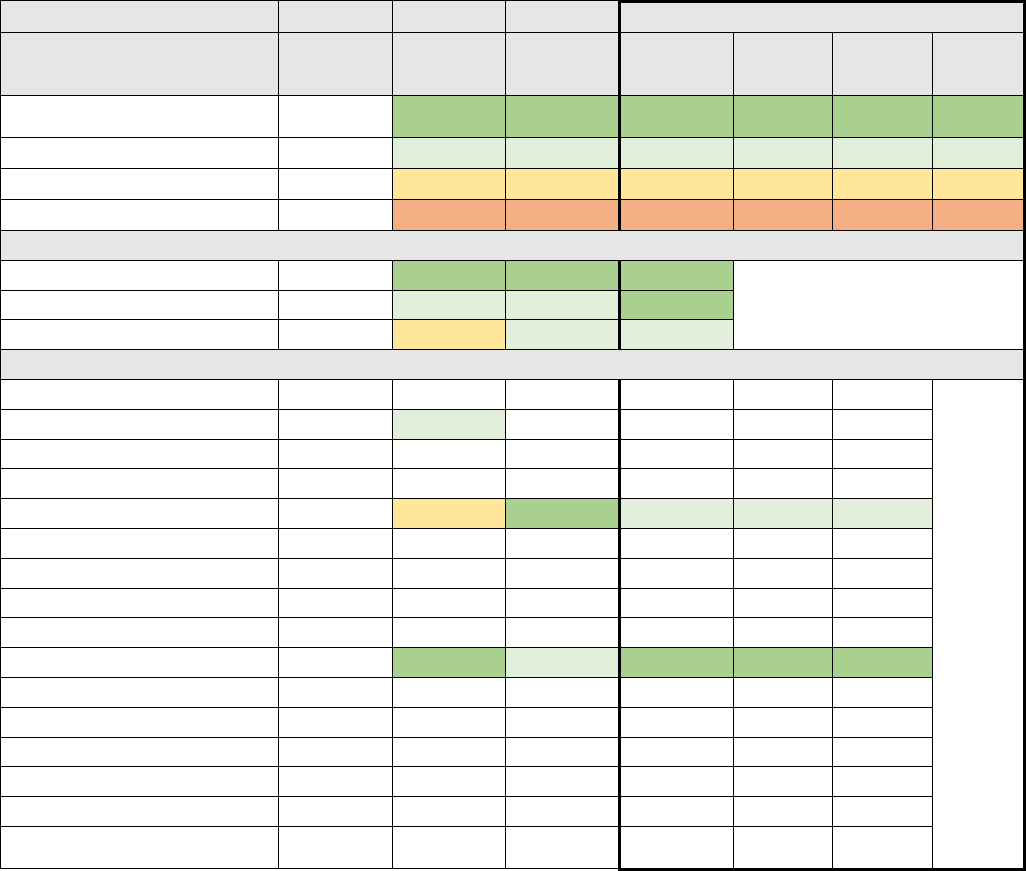

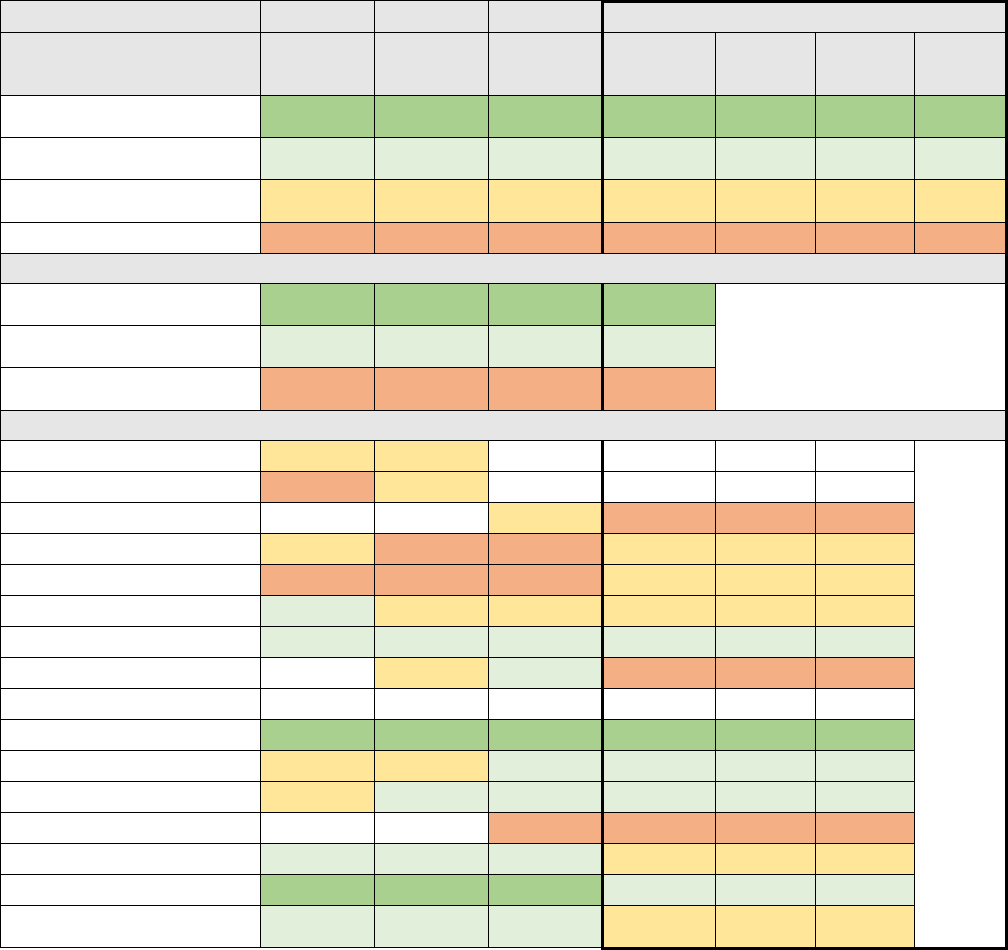

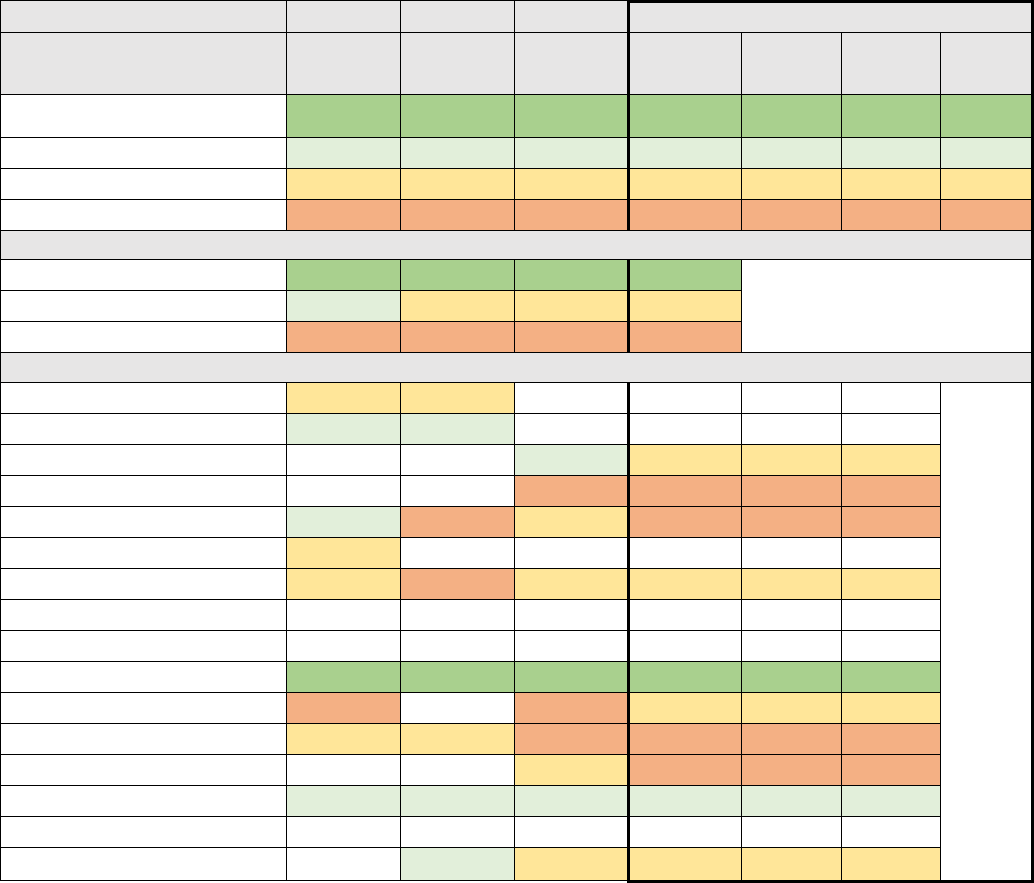

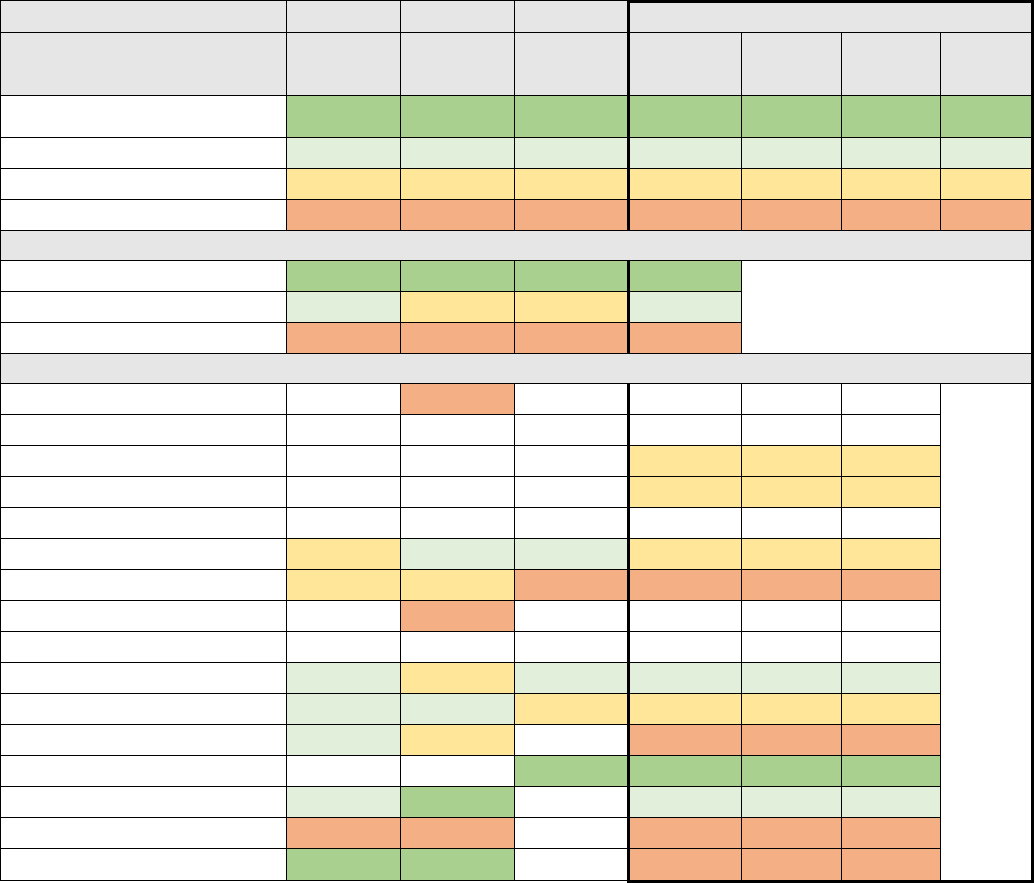

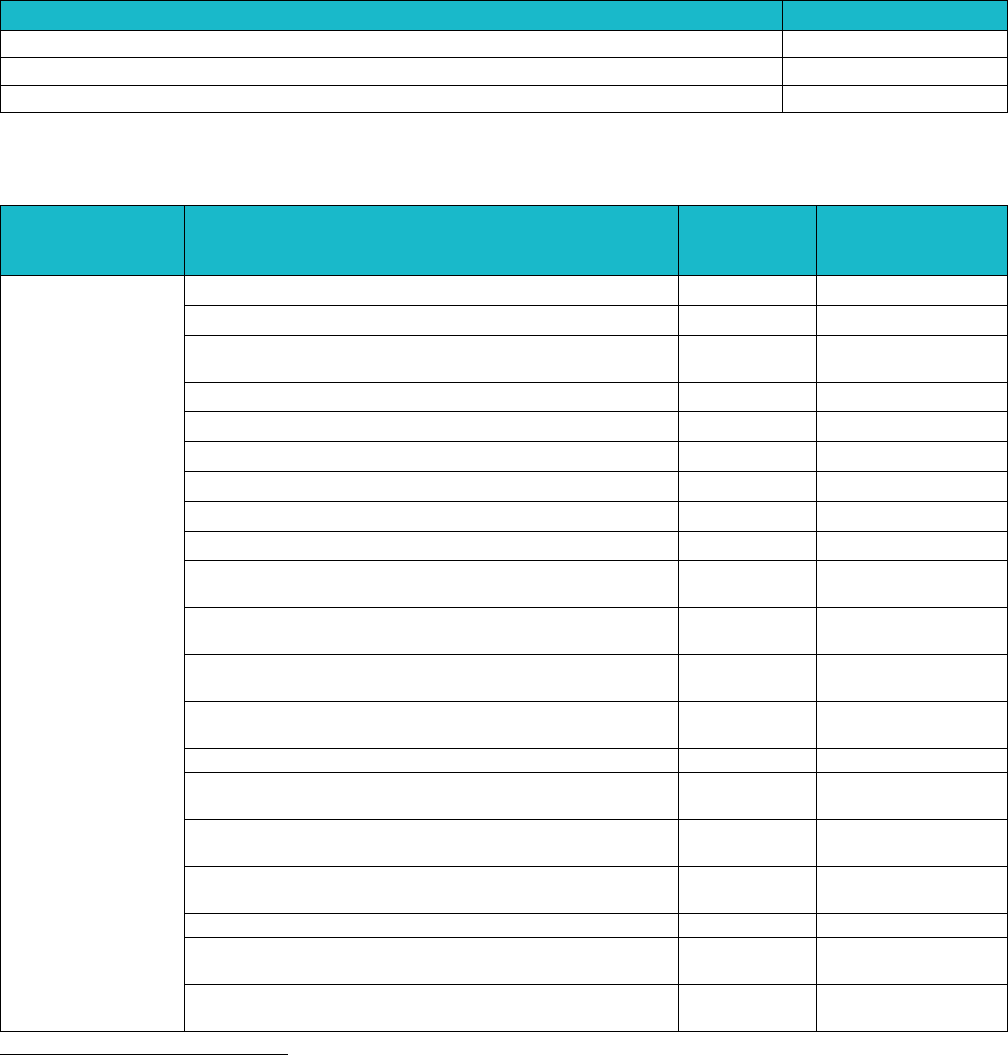

Table 5. Covered California Insurer Activities to Improve Community Health, 2018

Number of Health Plans

Internal facing, member related efforts

Health education portal

3

Quality collaboratives

1

Member outreach

2

Lifestyle or disease-specific workshops and classes

8

Educational materials

5

Incentive programs

2

Connections to outside orgs and programs

2

Internal facing, member related efforts non-health-related

Philanthropy

1

Non-health classes

1

Health insurance education

6

Financial counseling/decision-making support

2

Interpreting services availability education

1

External or community facing activities, health-related

Health fairs (starred if funded)

7

Screening events (starred if funded)

2

Enrollment fairs

1

Public health conferences

1

Statewide or community collaboratives and taskforces

5

Community workshops/classes or peer to peer support

3

Health promotors program

2

Financial support of community health programs

4

Educational materials

2

External facing, non-health-related

Employee volunteers

1

Ads and newsletters

2

Community events

3

Financial support of community non-health programs

2

Education support

2

Non-health coalitions (e.g. homelessness)

2

Health plan option education

1

Engaged with health systems for community risk assessments identifying high priority needs

Through providers

3

Health plan activities

5

Community health effort

School programs

1

In-home assessments

1

Educational campaign

2

Health plan-funded community health programs based on needs assessments or other activity

Grant programs

4

Health fairs

2

Health resource center(s)

2

Community clinics

2

Screening events

2

Participated in geographic disaster relief efforts

Safety policies

1

Member services in affected areas

1

Disaster relief as part of government

1

Disaster preparedness programs

2

Community partner support around disaster relief

2

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 17

Table 6. Number of Insurers Meeting the 80 Percent Target for Identification of Race/Ethnicity

2015

2016

2017

2018

Number of Insurers

5

4

5

8

Source: Covered California Staff Analysis of Qualified Health Plan Submitted Data

Challenges in Data Collection

Health insurance companies can collect self-identification data from several sources. The race/ethnicity

question in the Covered California enrollment application is voluntary and is included in the enrollment

file sent to insurers. Beyond enrollment data, insurers have reported receiving data from providers,

customer service, health risk assessments and website registration. Methods for data collection vary by

insurer, resulting in considerable variation during 2015-18 in how well each insurer met Covered

California’s goals for ensuring race/ethnicity identification for quality improvement purposes.

12

While all insurers have demonstrated improvement towards the 2019 target, it is important to note that

these rates represent Covered California membership only. As discussed in Section 2. Health Plan-

Reported Measures for Health Disparities, an objective of the health equity agenda is to track and trend

a select set disparities measures that include a health insurance company’s full book of business

excluding Medicare. Larger numbers are necessary to be able to accurately measure performance,

especially for relatively small minority populations. Identification of member race/ethnicity when

reporting health disparities measures is similarly challenging. For this reason, Covered California has

encouraged insurers to supplement self-reported identification with a proxy methodology based on

surname and census track. Covered California will continue to work with insurers to improve and

validate self-identification of race and ethnicity.

Section 2. Health Plan Reported Measures and Efforts to Narrow Health

Disparities

Many of Covered California’s contracted health insurance companies have been actively engaged in

efforts to understand and address health care disparities for many years. These efforts are reflected in

a range of activities. Four of Covered California’s health insurance companies, Health Net, Kaiser

Foundation Health Plan of Southern California, L.A. Care and Molina Healthcare, representing 36

percent (503,220 out of 1,384,030) of enrollment in 2018 earned the National Committee for Quality

Assurance’s (NCQA) Distinction in Multicultural Health Care (MHC), a program that recognizes

organizations that provide culturally and linguistically sensitive services and work to reduce disparities

in health and health care.

13

In 2017, Covered California began an initiative to measure and seek improvement in health equity

across all contracted insurers. In collaboration with health insurance companies and consumer

12

In 2018, Covered California examined current self-identification rates in the Covered California enrollment file to compare to insurer

reported rates. Covered California’s self-identification rate in 2017 was 75.5 percent across all insurers. In theory, insurer reported rates

should be equal to or higher than the rate provided in the enrollment file, assuming all data is transferred to the insurer and the insurer’s

other avenues of data collection supplement the race/ethnicity field in its membership file. In practice, some insurers have reported

considerably lower rates and are currently evaluating internal data collection to understand the discrepancies. Covered California is also

aware of some errors in the 834 data transmission related to race/ethnicity categorization and is actively working on a system change

request to appropriately identify membership answering this question in the enrollment application.

13

See more: https://www.ncqa.org/programs/health-plans/multicultural-health-care-mhc/.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 18

stakeholders, Covered California targeted four conditions that affect large numbers of consumers, have

serious potentially avoidable complications, and for which there is strong evidence of racial or ethnic

disparities:

• Asthma: Although asthma affects all populations, the burden of this disease falls

disproportionately on minority populations: the prevalence of childhood asthma is 12.7 percent

among non-Hispanic blacks compared to 8 percent among non-Hispanic whites and 6.4 percent

among Hispanics. Even more striking, the asthma mortality rate among non-Hispanic black

children is nearly eight times that of non-Hispanic whites.

14

• Depression: National surveys indicate that nearly one in six Americans has experienced a

major depressive episode, with many experiencing multiple episodes. Depression is a leading

cause of disability and death, largely related to the nearly tenfold higher risk of suicide among

those with depression.

15

Depression is undertreated in all populations, but more so among

minorities. Although 40 percent of non-Latino whites with depression failed to receive treatment,

64 percent of Latinos, 69 percent of Asians, and 59 percent of African Americans failed to

receive any treatment.

16

• Diabetes: While diabetes affects almost 10 percent of the U.S. population overall, the

prevalence in Hispanics (11.9 percent) and African Americans (13.4 percent) is much higher

than it is in non-Hispanic Whites. Diabetes is the seventh leading cause of death and

contributes to an increased risk of heart attacks, stroke, amputation and kidney disease.

17

• Hypertension: Almost one third of adults have hypertension (high blood pressure), a major risk

factor for heart attacks (the leading cause of death in the U.S.) and strokes (the seventh leading

cause of death). The prevalence of hypertension among non-Hispanic blacks (41 percent) is

substantially higher than among whites (29 percent) or Hispanics (28 percent). Among those

with hypertension, the proportion who were well controlled differed dramatically: whites at 53

percent, non-Hispanic blacks at 43 percent and Hispanics at 30 percent.

18

Because of the public health importance of these conditions and the serious disparities in health and

health care that have been documented and the potential for targeted interventions to reduce morbidity

and mortality, Covered California selected 14 measures related to these conditions to track, of which

five are National Committee for Quality Assurance (NCQA) Healthcare Effectiveness Data and

Information Set (HEDIS) measures and nine are based on Agency for Healthcare Research and Quality

(AHRQ) Prevention Quality Indicators (PQI). Importantly, these measures are now being reported by

insurers annually not only for Covered California’s enrollees, but also for all non-Medicare commercial

14

Forno, E., and Celedón, J. C. (2012). Health disparities in asthma. American journal of respiratory and critical care medicine, 185(10),

1033–1035. doi:10.1164/rccm.201202-0350ED

15

McLaughlin K. A. (2011). The public health impact of major depression: a call for interdisciplinary prevention efforts. Prevention science:

the official journal of the Society for Prevention Research, 12(4), 361–371. doi:10.1007/s11121-011-0231-8

16

Alegría, M., Chatterji, P., Wells, K., Cao, Z., Chen, C. N., Takeuchi, D., … Meng, X. L. (2008). Disparity in depression treatment among

racial and ethnic minority populations in the United States. Psychiatric services (Washington, D.C.), 59(11), 1264–1272.

doi:10.1176/appi.ps.59.11.1264

17

Centers for Disease Control and Prevention. National Diabetes Statistics Report, 2017. Atlanta, GA: Centers for Disease Control and

Prevention, U.S. Dept of Health and Human Services; 2017. Retrieved from: https://www.cdc.gov/diabetes/pdfs/data/statistics/national-

diabetes-statistics-report.pdf.

18

Centers for Disease Control and Prevention. Prevalence of Hypertension and Controlled Hypertension — United States, 2007–2010.

Atlanta, GA: Centers for Disease Control and Prevention, U.S. Dept of Health and Human Services; 2013. Retrieved from:

https://www.cdc.gov/mmwr/preview/mmwrhtml/su6203a24.htm.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 19

and Medi-Cal lives, with rates supplied by race/ethnicity (see Table 7. Covered California Insurer “All-

Plan” Reported Measures for Health Disparities).

Data for the full non-Medicare population was required for the following principal reasons: (1) narrowing

disparities requires quality improvement interventions regardless of coverage type; (2) the larger

population size makes measurement of disparities more accurate; and (3) high turnover in the

individual market results in consumers transitioning to other sources of coverage, such as employer-

based coverage or Medi-Cal. These markets are served by the same health insurance companies that

participate in Covered California.

During the first year of reporting for plan year 2015, insurers reported on 10 measures, and an

additional four measures were phased in for plan year 2016. Insurers will continue reporting the data for

all 14 measures through plan year 2020 as Covered California continues to evaluate insurer’s data and

the progress of planned interventions.

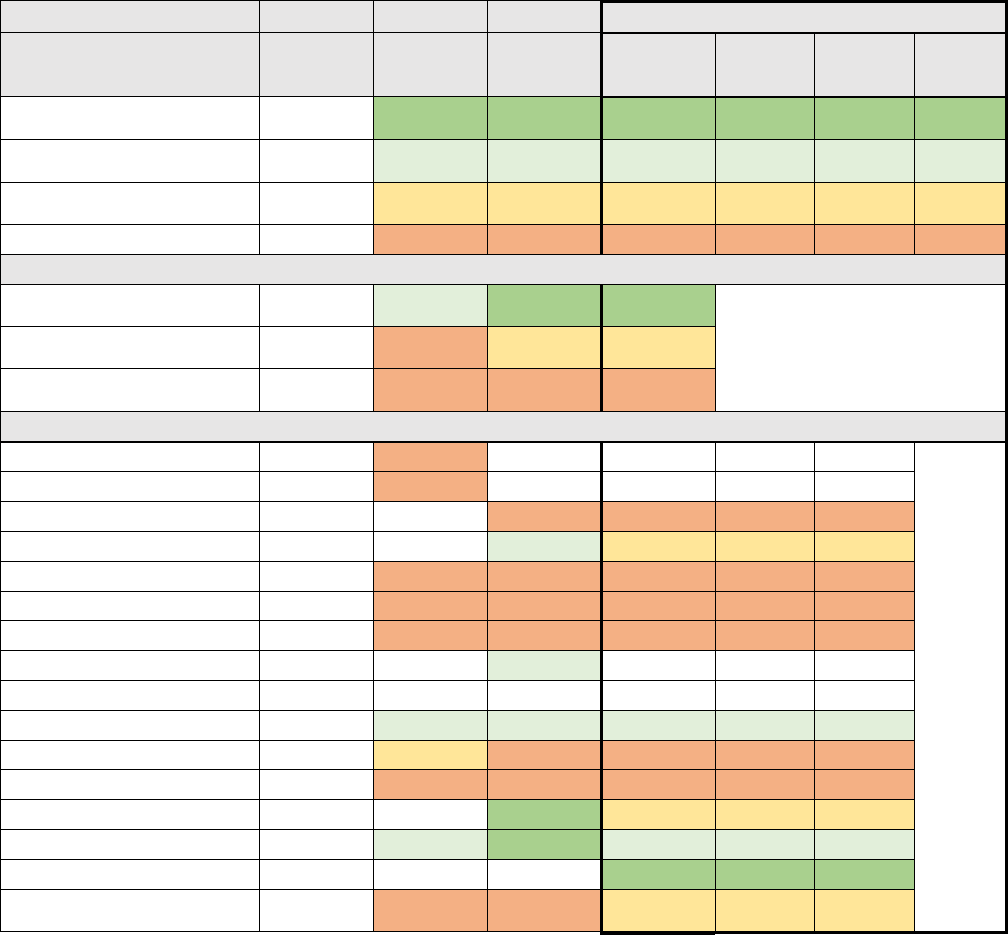

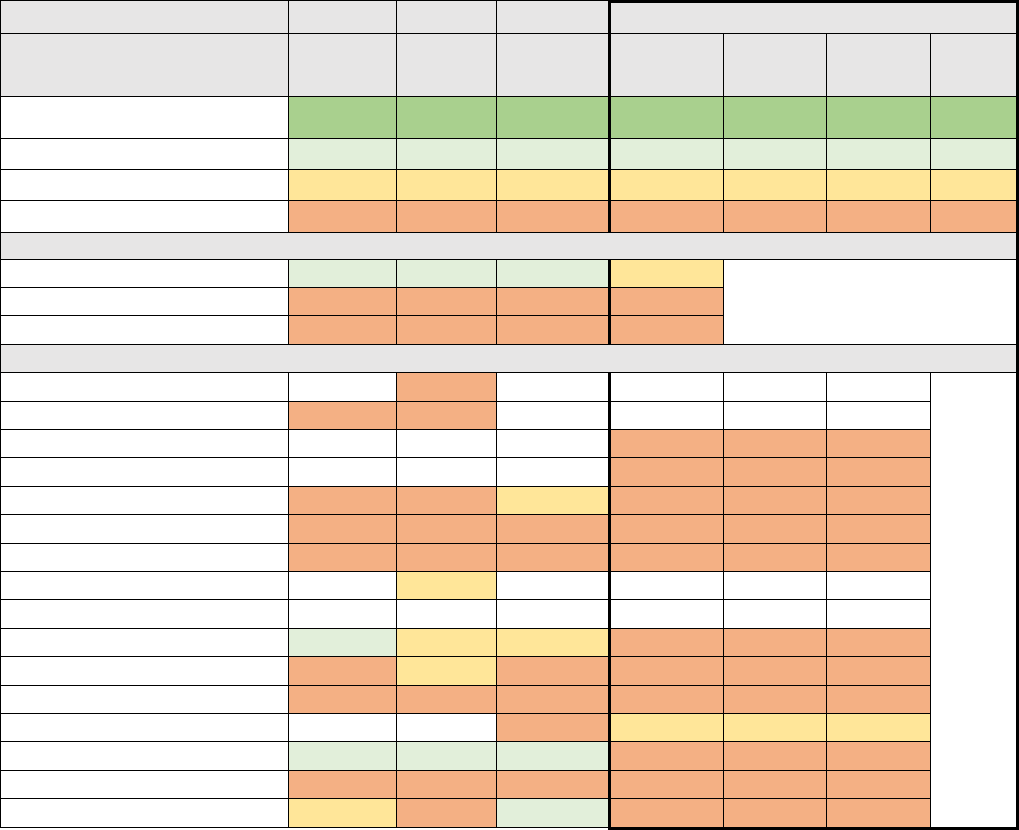

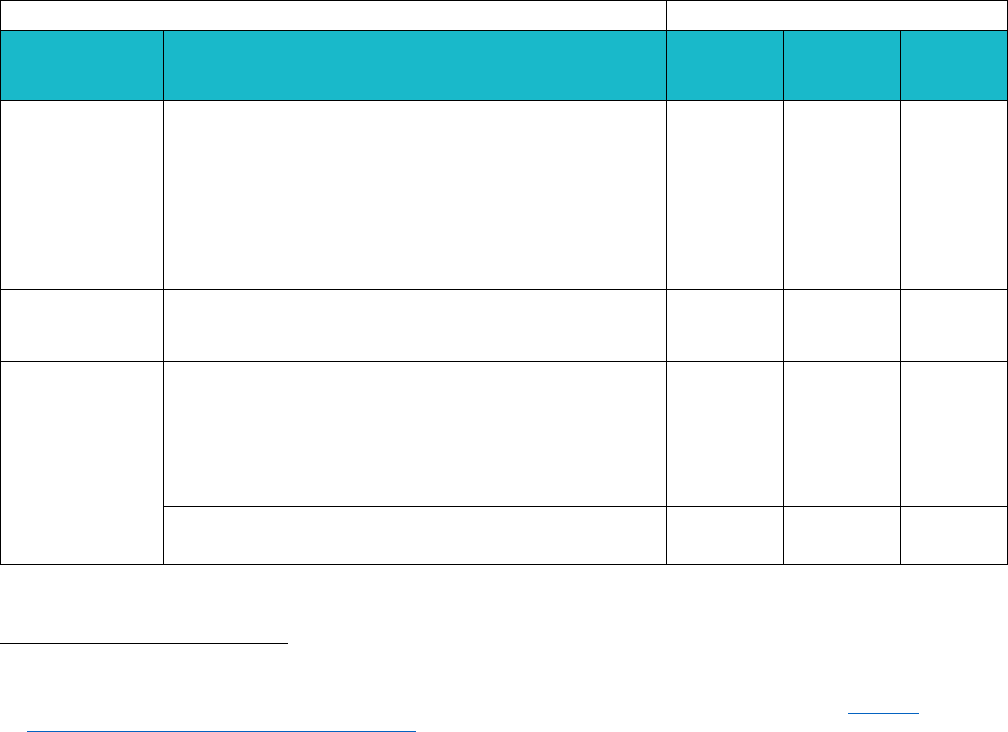

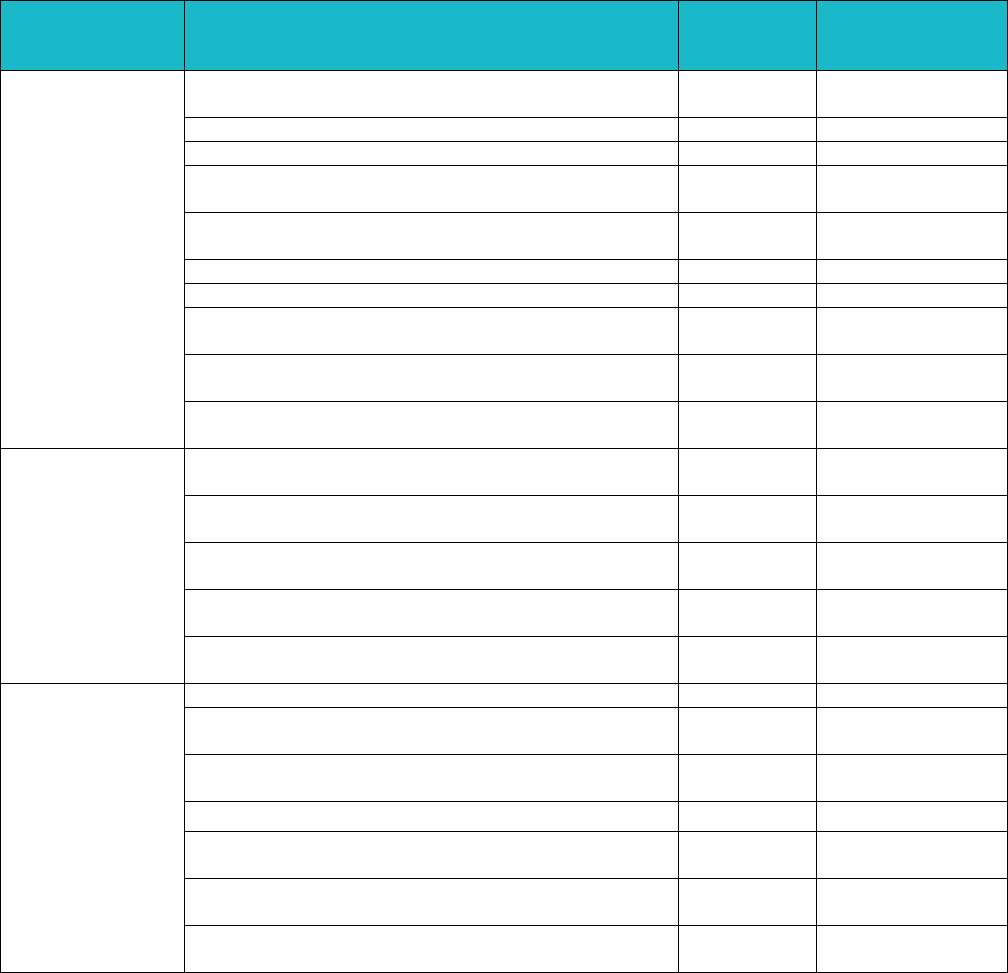

Table 7. Covered California Insurer “All-Plan” Reported Measures for Health Disparities

Measure

Measure

Steward

Years Reported

Condition

AMR - Asthma Medication Ratio Ages 5-85

NCQA

MY 2015, 2016,

2017

Asthma

Admissions for Asthma among Older Adults with

Asthma

AHRQ PQI

MY 2015, 2016,

2017

Asthma

Admissions for Bacterial Pneumonia among

Members with Asthma

AHRQ PQI

MY 2016, 2017

Asthma

Admissions for Asthma among Children and

Younger Adults with Asthma

AHRQ PQI

MY 2015, 2016,

2017

Asthma

Antidepressant Medication Management

(Effective Acute Phase Treatment)

NCQA

MY 2015, 2016,

2017

Depression

Antidepressant Medication Management

(Effective Continuation Phase Treatment)

NCQA

MY 2015, 2016,

2017

Depression

Diabetes Care: HbA1c Control < 8.0% (NQF

0575)

NCQA

MY 2015, 2016,

2017

Diabetes

Admissions for Diabetes Short-term

Complications among Members with Diabetes

AHRQ PQI

MY 2015, 2016,

2017

Diabetes

Admissions for Diabetes Long-Term

Complications among Members with Diabetes

AHRQ PQI

MY 2015, 2016,

2017

Diabetes

Admissions for Uncontrolled Diabetes among

Members with Diabetes

AHRQ PQI

MY 2016, 2017

Diabetes

Admissions for Lower-Extremity Amputation

among Members with Diabetes

AHRQ PQI

MY 2016, 2017

Diabetes

Controlling High Blood Pressure (NQF 0018)

NCQA

MY 2015, 2016,

2017

Hypertension

Admissions for Hypertension among Members

with Hypertension

AHRQ PQI

MY 2015, 2016,

2017

Hypertension

Admissions for Heart Failure among Members

with Hypertension

AHRQ PQI

MY 2016, 2017

Hypertension

Opportunities for Intervention

The dataset used to evaluate insurer populations for disparities is unique in that it aggregates data for

enrollees under 65 across all lines of business. In addition to serving different geographies with known

variations among them, each insurer has a very different mix of population served ranging from

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 20

predominantly employer-based commercial enrollees to predominantly Medi-Cal enrollees. Insurers

also have varying quality of data, most aggregating 400-person HEDIS samples for each line of

business but some having access to robust clinical data from electronic health records. For these

reasons and more as detailed in Appendix 1: Limitations and Major Caveats about Health Disparities

Data, Covered California has determined that the results cannot be used to compare performance

across plans.

However, Covered California and each insurer found actionable differences in measures across

race/ethnicity groups that justify interventions. In addition, one of the key observations was that the

apparent disparities based on race/ethnicity were in almost all cases far smaller than the differences in

care or treatment across health plans — with enrollment in Kaiser Permanente or Sharp Health Plan

being a far better predictor of receiving good care than race/ethnicity. This observation was consistent

with Covered California’s findings regarding the generally superior care provided by integrated delivery

systems (see Chapter 3 and Chapter 4).

The following sections present high-level summaries of key trends based on preliminary analysis of

insurer-reported data and examples of disparity reduction proposals.

Conducting Population Health Improvement Activities and Interventions to Narrow

Observed Disparities in Care

After collection and submission of three years of baseline data for the indicators of potential gaps in

care related to the four conditions, Covered California has worked with each insurer to select a quality

improvement project aimed at narrowing a health care disparity found in the baseline data related to the

four target conditions. Covered California has met with each insurer to discuss opportunities for

conducting quality improvement activities and interventions to narrow each health insurer’s specific

observed health care disparities. In 2020, each Covered California insurer will implement a quality

improvement project aimed at narrowing a health care disparity and will periodically report their

progress. Covered California will hold insurers accountable for narrowing the selected disparity while

maintaining or improving outcomes for targeted enrollees, which in most cases encompasses more

than just Covered California members — sometimes including all commercial enrollees and other

enrollees in the individual market or all Medi-Cal enrollees.

In addition to data reporting and analysis, insurers are reporting progress on infrastructure and staffing

enhancements needed to develop their health care disparity reduction project, as well as related and

aligned activities to support this Covered California initiative. These activities range in scope and scale:

some represent the next phase of multi-year efforts while others are starting by proposing time-limited

or smaller scale projects. The following are examples of activities reported by insurers:

• Enhanced member education, messaging, incentives and self-management tools.

• Enhanced provider education and clinical guidance reminders.

• Streamlined data collection processes to increase reporting and monitoring quality.

• Focused partnerships with community stakeholders.

• Disease registry development and sharing between providers and insurers.

• Outreach events and mobile care in at-risk communities.

• Enhanced care team support for affected populations.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 21

These important efforts are building the foundation for increasingly effective interventions to improve

care for all while reducing disparities in both health and health care.

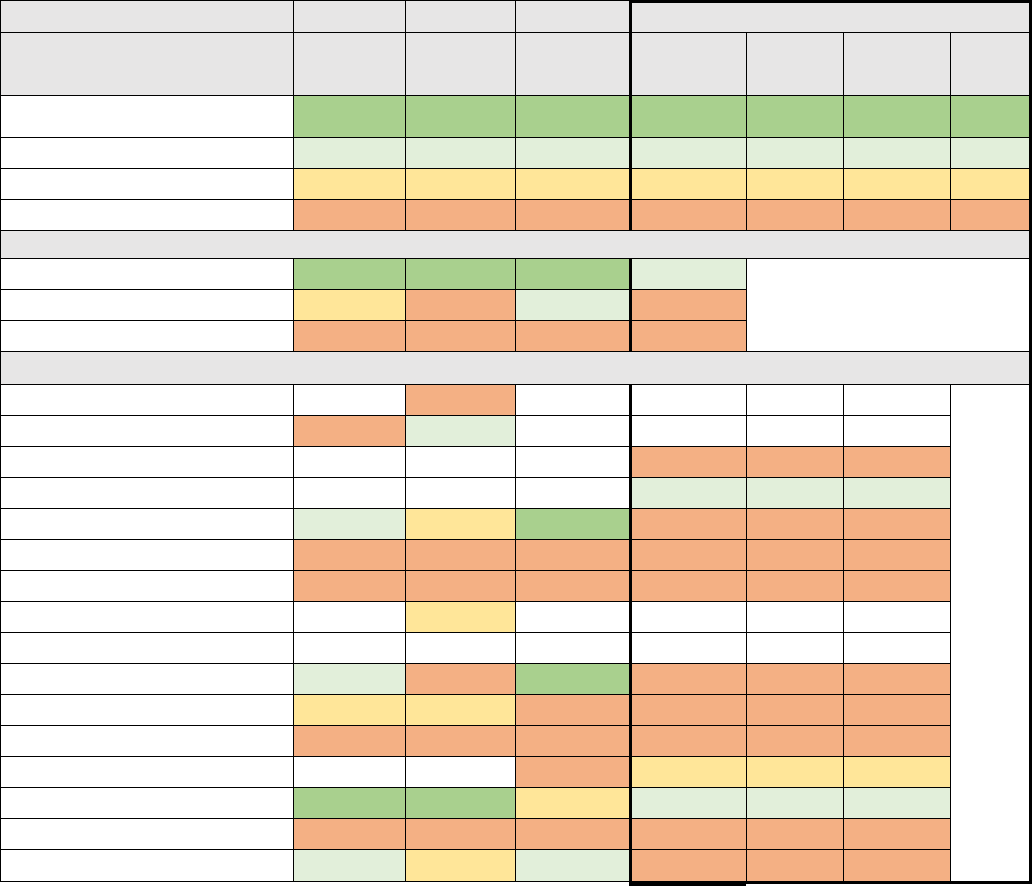

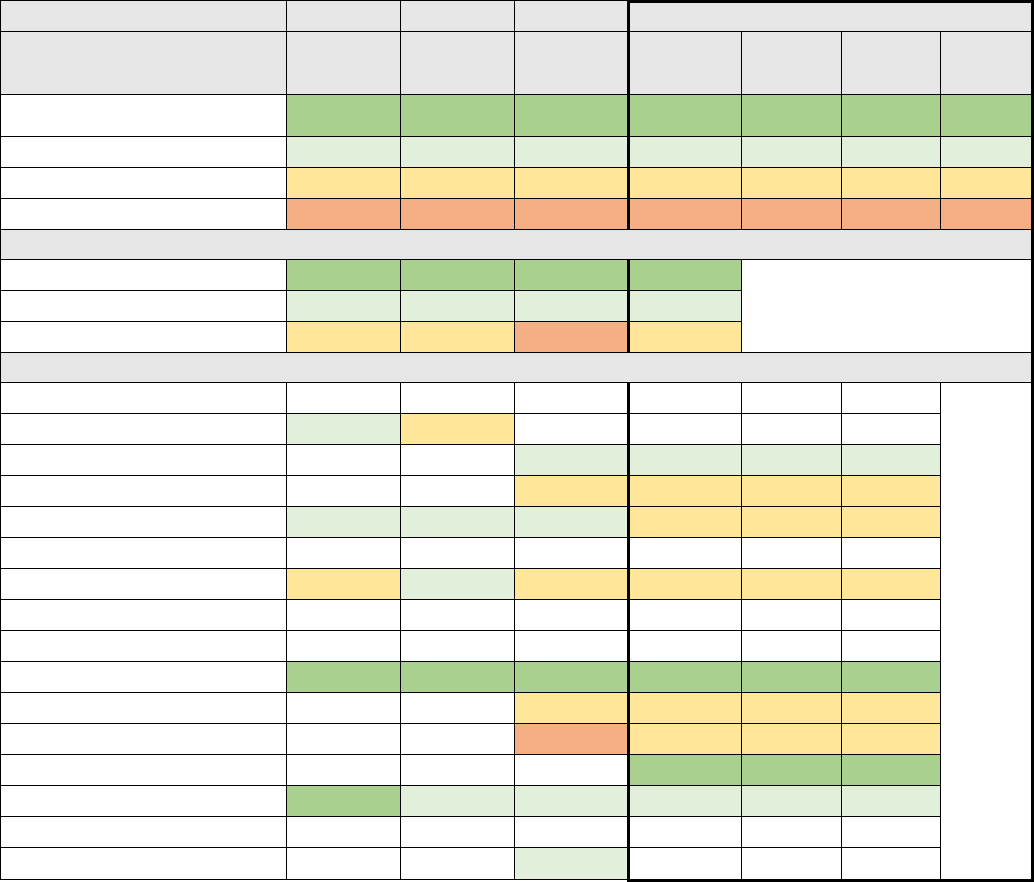

The tables below document four representative examples of the target populations, measurement gaps

and interventions proposed to be undertaken by health insurance companies.

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 22

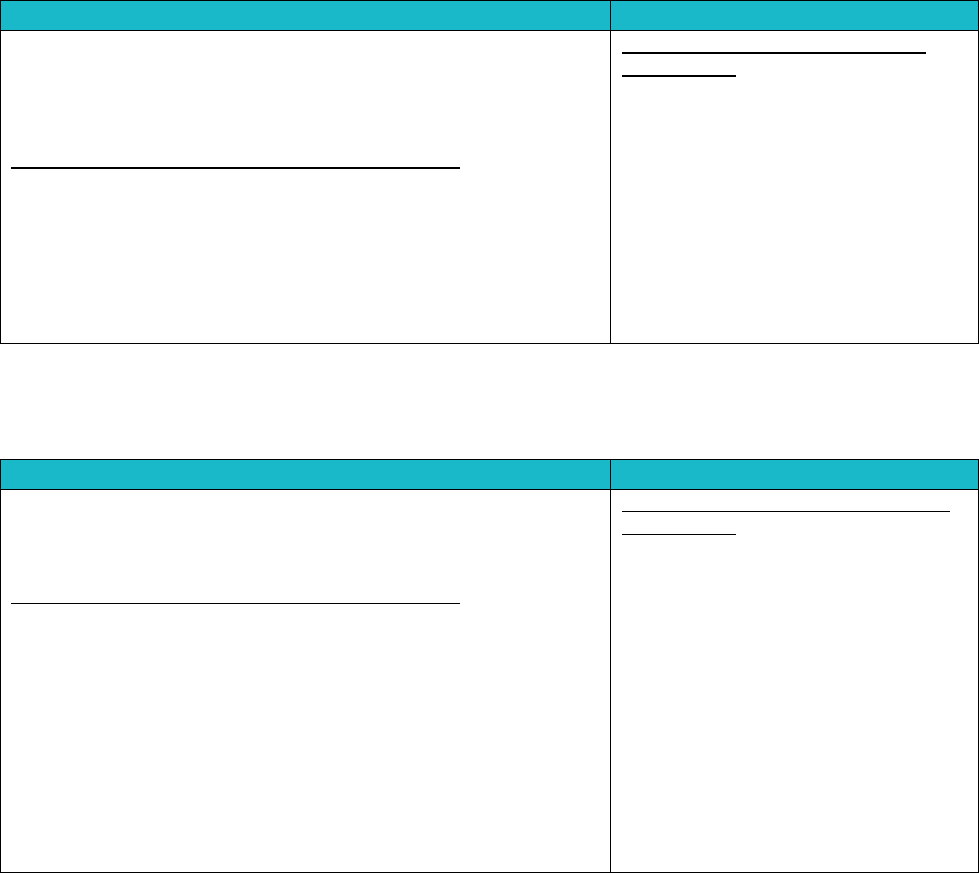

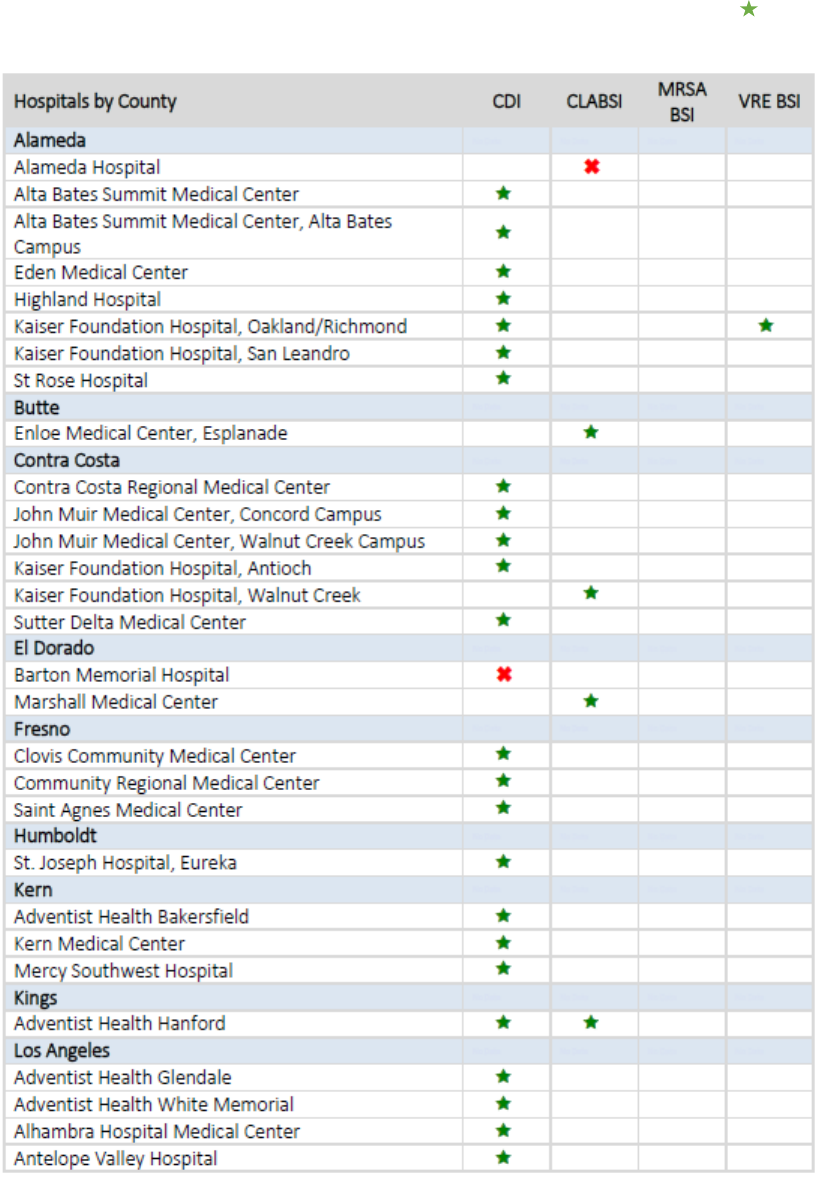

Table 8. Health Net’s Proposed Interventions for Improved Diabetes and Hypertension Management

Rationale and Target Population(s) for Intervention

Summary of Select Interventions

Health Net proposes to target African American and Latino

members for improved diabetes and hypertension management

across Medi-Cal and individual market (Covered California and

off-exchange) lines of business.

Rationale and Target Population(s) for Intervention

• Rates for HbA1c control for African American members are 14

percent lower than white members with diabetes.

• Rates for blood pressure control for African American

members are 32 percent lower than white members with

hypertension.

• Rates for blood pressure control for Latino members are 28

percent lower than white members with hypertension.

Community, Member and Provider

Interventions

• Focus on the social determinants

of health (SDOH), social

marketing, and community

coalition and advisory group.

• Collection of member-level SDOH

data, one-stop clinics, medication

adherence bundle protocols;

nutrition and food insecurity pilot.

• Partnership with select clinic and

hospital; modified workflow;

motivational interviewing training.

Source: Covered California Staff Analysis of Qualified Health Plan Submitted Data

Table 9. LA Care’s Proposed Interventions for Improved Diabetes Management

Rationale and Target Population(s) for Intervention

Summary of Select Interventions

L.A. Care proposes to target African American and American

Indian/Alaskan Native members for improved diabetes

management for the Covered California line of business.

Rationale and Target Population(s) for Intervention

• The prevalence of diabetes among African Americans is 40

percent higher compared to the overall Los Angeles County

population.

• The prevalence of diabetes among American Indian/Alaskan

Natives is more than 50 percent higher compared to the

overall Los Angeles County population.

• Rates of HbA1c control for African American members are 8

percent lower than the total diabetes population.

• Rates of HbA1c control for American Indian/Alaskan Native

members are 12 percent lower than the total diabetes

population.

Member, Provider and Administrative

Interventions

• Online member portal diabetes

education course.

• Provider feedback, education and

reminders of guideline therapies

for members with diabetes control

below target.

• Systematic data collection process

improvements to improve the

accuracy and timeliness of HbA1c

laboratory data.

Source: Covered California Staff Analysis of Qualified Health Plan Submitted Data

Covered California Holding Health Plans Accountable for Quality and Delivery System Reform

ASSURING QUALITY CARE • CHAPTER 2

COVERED CALIFORNIA 23

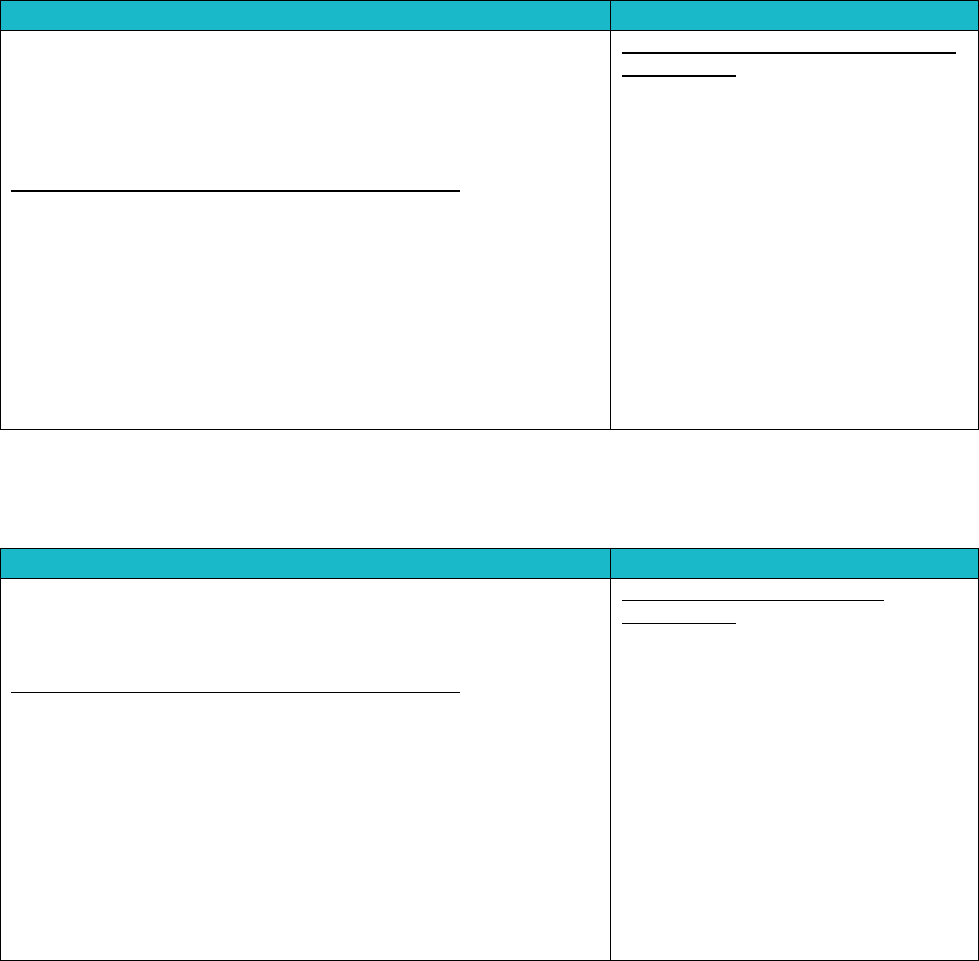

Table 10. Kaiser Permanente’s Proposed Interventions for Improved Diabetes and Hypertension

Management

Rationale and Target Population(s) for Intervention

Summary of Select Interventions

Kaiser Permanente proposes to target African American and

Latino members for improved diabetes and hypertension

management across Commercial lines of business (employer-

based and individual market, for both Covered California and off-

exchange enrollment).

Rationale and Target Population(s) for Intervention

• Mortality due to diabetes is 50 percent higher in

Hispanic/Latino than in White members.

• Mortality due to hypertension is 4-5 times higher in African

Americans than in white members.

• Rates of HbA1c control among Hispanic/Latino members are

12 percent lower than the overall Commercial diabetes

population.

• Rates of blood pressure control for Black/African American

members are 7 percent lower than for the overall Commercial

hypertensive population.

Member, Provider, and Administrative

Interventions

• Forums across sites for sharing

best practices

• Ongoing review of patient-facing

materials for culturally responsive

messaging

• Language concordant care for

Latino diabetics

• Innovative approaches to

community outreach (e.g. Mobile

Health Vehicle to churches, blood

pressure checks in barber shops)

• Specialty blood pressure clinic for

Black/African American members

Source: Covered California Staff Analysis of Qualified Health Plan Submitted Data

Table 11. Anthem’s Proposed Interventions for Improved Depression Medication Management

Rationale and Target Population(s) for Intervention

Summary of Select Interventions

Anthem proposes to target Hispanic/Latino members for improved

depression medication management for the Covered California

line of business.

Rationale and Target Population(s) for Intervention

• Rates for the Antidepressant Medication Management

(Effective Acute Phase Treatment) for Hispanic/Latino

members are 40 percent lower than White Covered California

members.

• Rates for the Antidepressant Medication Management

(Effective Continuation Phase Treatment) for Hispanic/Latino

members are 32 percent lower than White Covered California

members.

Member, Provider, and Policy

Interventions

• Member outreach and coaching

through mail and telephone;

telehealth initiatives for psychology

and psychiatry services; pilot for

prescribing providers and

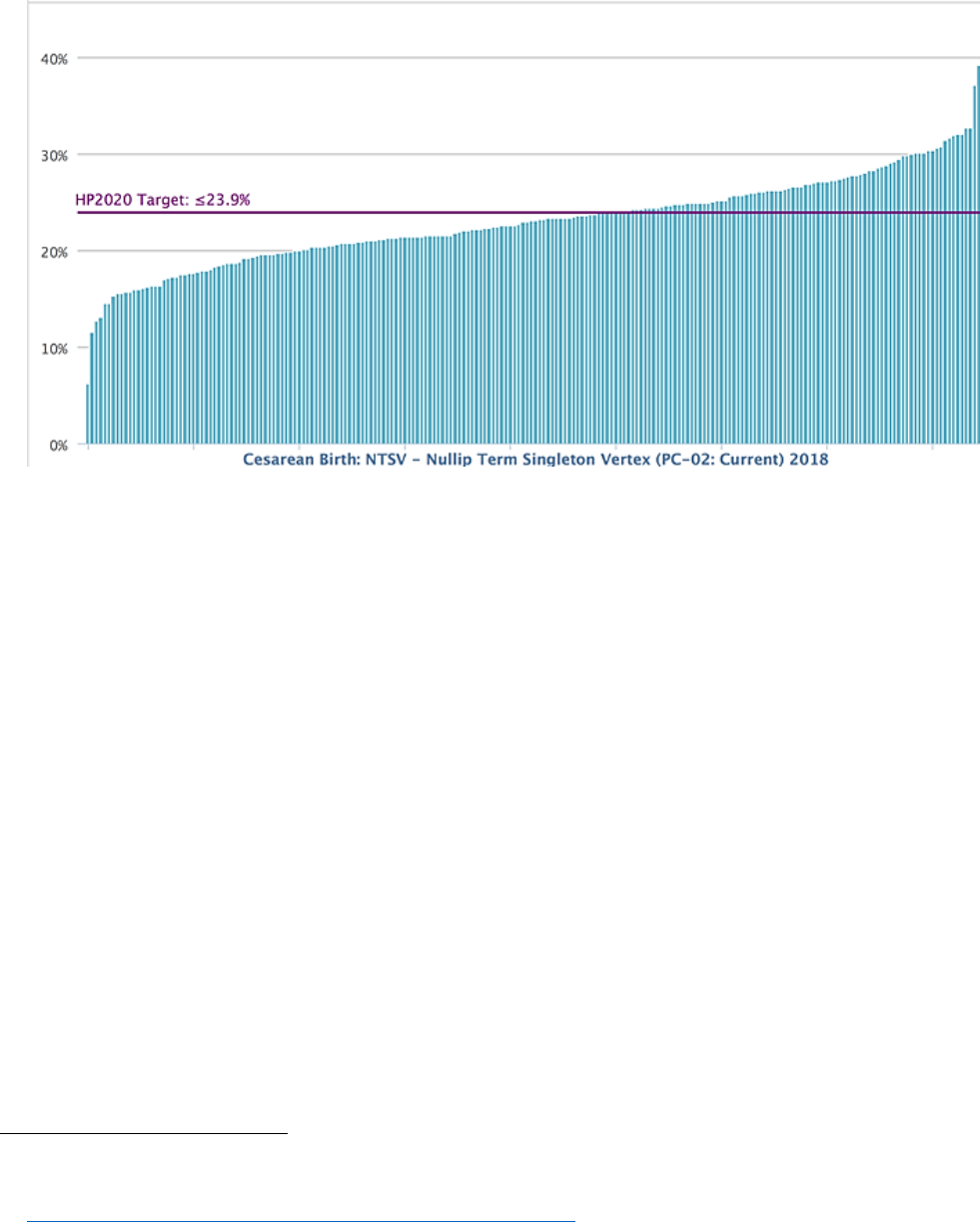

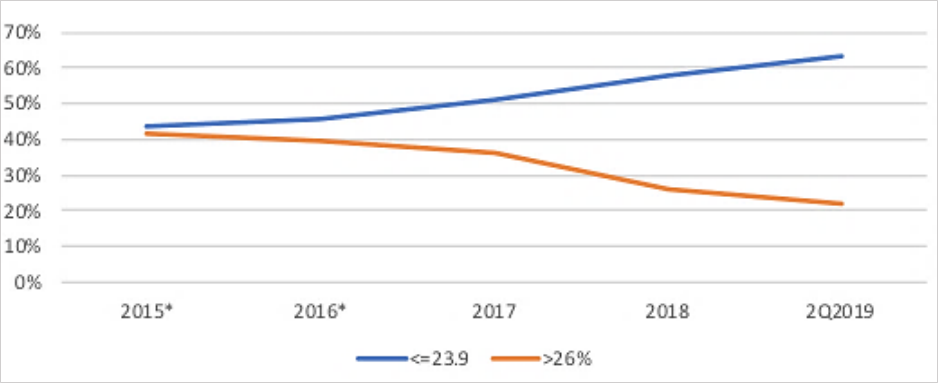

members