Licensing & Registration Service

BOAT

DEALER

MANUAL

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 2 of 45

(Rev 10/2023)

Contents

INTRODUCTION ................................................................................................................................................................. 4

PURPOSE ........................................................................................................................................................................ 4

GENERAL INFORMATION .................................................................................................................................................. 4

BOAT SHOW TEMP .................................................................................................................................................... 5

BONDING AND SURETY REQUIREMENTS ................................................................................................................. 5

DEALER DEMONSTRATION NUMBERS ...................................................................................................................... 5

DISCIPLINARY PROCESS ............................................................................................................................................. 6

DEALER LICENSING REQUIREMENTS......................................................................................................................... 6

DEALER RECORDS ...................................................................................................................................................... 7

MARYLAND DEALER RESPONSIBILITIES .................................................................................................................... 7

VESSELS .......................................................................................................................................................................... 9

BROKERED VESSELS ................................................................................................................................................... 9

DEALER’S DISCOUNT ................................................................................................................................................. 9

EXTENSION REQUEST (prepayment) ........................................................................................................................ 9

FEDERAL DOCUMENTATION – U.S. COAST GUARD ............................................................................................... 10

HULL IDENTIFICATION NUMBER ............................................................................................................................. 10

NUMBER AND TITLING ............................................................................................................................................ 12

PENALTY & INTEREST .............................................................................................................................................. 13

SECURITY INTEREST ................................................................................................................................................. 13

TEMPORARY CERTIFICATES OF NUMBER ............................................................................................................... 13

TRADE-IN ALLOWANCE ........................................................................................................................................... 14

TRAILER .................................................................................................................................................................... 16

TRANSMITTAL OF TAX AND FEES ............................................................................................................................ 16

TRUST (TITLED IN NAME OF TRUST) ....................................................................................................................... 17

VESSEL EXCISE TAX .......................................................................................................................................................... 17

GENERAL INSTRUCTIONS ................................................................................................................................................ 18

ASSIGNMENT OF MD VESSEL NUMBERS .................................................................................................................... 20

DNR FORM B-240 ........................................................................................................................................................ 21

NEW VESSEL TO BE TITLED/REGISTERED IN MD ........................................................................................................ 23

PRINCIPLE OPERATION IN MD – DOCUMENTED VESSEL ........................................................................................... 24

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 3 of 45

(Rev 10/2023)

PRINCIPLE OPERATION OUTSIDE MD – NEW OR USED VESSEL ................................................................................. 25

REPOSSESSED VESSEL .................................................................................................................................................. 26

TEMPORARY REGISTRATION DECALS ......................................................................................................................... 27

TITLE – REPLACEMENT OR CORRECTION .................................................................................................................... 28

USED VESSEL – TITLED IN MD: DEALER ....................................................................................................................... 29

USED VESSEL – TITLED IN MD: BROKERED ................................................................................................................. 30

WARRANTY RETURN OF VESSEL ................................................................................................................................. 31

DEFINITIONS .................................................................................................................................................................... 32

APPENDIX A: DNR REGIONAL SERVICE CENTER INFO .................................................................................................... 36

LICENSING & REGISTRATION REGIONAL SERVICE CENTERS ...................................................................................... 36

LICENSING & REGISTRATION ADMINISTRATION........................................................................................................ 37

APPENDIX B: U.S. COAST GUARD CONTACT INFO ......................................................................................................... 37

APPENDIX C: HULL IDENTIFICATION NUMBERS ............................................................................................................. 38

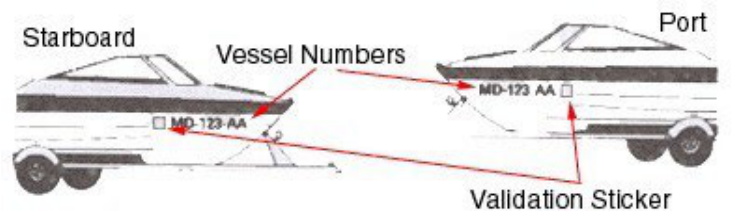

APPENDIX D: DISPLAY of MARYLAND BOAT NUMBER .................................................................................................. 40

APPENDIX E: WATERWAY IMPROVEMENT FUND .......................................................................................................... 41

APPENDIX F: BOAT DEALER AUDITS ............................................................................................................................... 42

DNR FORMS ..................................................................................................................................................................... 45

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 4 of 45

(Rev 10/2023)

INTRODUCTION

PURPOSE

It is the responsibility of Maryland licensed boat dealers to prepare applications for Maryland

certificates of title and number on behalf of their customers, to collect from their customers

all applicable taxes and fees, and to promptly forward the applications, taxes, and fees to

the Department.

The purpose of this manual is to provide assistance to the dealer in the execution of those

responsibilities. Revisions will be provided as needed. This manual supersedes and

replaces all manuals existing prior to the revision date shown below.

GENERAL INFORMATION

Citations are from the Maryland Annotated Code, Natural Resources Article, Title 8 Waters,

Subtitle 7 State Boat Act, unless otherwise noted, and are accurate at the revision date.

http://www.mgaleg.maryland.gov Go to “Laws” “Statutes” “Related Links”

“LexisNexis – Unannotated Code of Maryland” Natural Resources

Title 8 Waters Subtitle 7 State Boat Act

Maryland regulations can be found at

http://www.dsd.state.md.us/COMAR/ComarHome.html

The following websites may be helpful:

Maryland Department of Natural Resources

http://www.dnr.maryland.gov

National Association of State Boating Law Administrator

http://www.nasbla.org/

The facilities and services of the Maryland Department of Natural Resources

are available to all without regard to race, color, religion, sex, sexual

orientation, age, national origin, or physical or mental disability.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 5 of 45

(Rev 10/2023)

BOAT SHOW TEMP

• A special temporary is issued for transporting vessels to and from Maryland in-water

boat shows.

• Not less than one week before the first date of transport, submit a written request

(preferably by email) to the Director that includes:

o Dates and location of the boat show

o Description of each vessel to be transported - including Hull ID number

o Dates of Transport

BONDING AND SURETY REQUIREMENTS §8-710.1

• Dealers are required to provide the Department with a surety bond or other security

deemed sufficient and adequate by the Department to guarantee payment of the

taxes and fees collected on behalf of the Department.

• Bond should reference the address of the managing DNR Service Center. Example:

Annapolis dealers only will use 160 Harry S Truman Pkwy, Annapolis address.

• Failure to remit revenue due the Department will result in forfeiture of the bond or

other security. Corporate officers are personally liable for any amount in excess of

the bond payout.

• Cancellation of the surety by the bonding company or financial institution will result in

automatic suspension of the dealer license.

• An annual review determines the amount of surety that must be provided for the next

calendar year based on gross annual sales for the previous year of business.

Required bond amounts can be found in COMAR 08.04.09.01.

• New dealers are required to provide surety in the amount of $20,000 for their first

license year.

DEALER DEMONSTRATION NUMBERS §8-714

• Dealers can obtain “demo numbers” for the purpose of testing or demonstrating any

new or used boats held in their inventory by submitting a written application to DNR.

• The quantity of demo numbers issued to a dealer will be determined by the

Department (maximum of 5) and is based on both inventory size and the size of the

sales force.

• A vessel displaying dealer numbers cannot be used for pleasure – only for testing or

demonstration purposes.

• Dealer numbers cannot be used on charter, rental or leased vessels.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 6 of 45

(Rev 10/2023)

• Demo numbers should be affixed in a temporary manner and moved from vessel to

vessel as needed.

• Demo numbers are not issued to dealers who operate solely as brokers.

• In order to demonstrate a brokered vessel, the dealer must ensure that the seller’s

registration or USCG document is current at all times the vessel is listed for sale.

DISCIPLINARY PROCESS

• Disciplinary action may be taken for the following reasons:

o Failure to file DNR Form B-207 monthly.

o Failure to transmit tax and fees timely

o Failure to provide required paperwork

o Incomplete or inaccurate paperwork

o Attempt to defraud

• Possible actions:

o Verbal warning

o Warning letter

o Bond amount increased

o Suspension of temporary registration privileges

o Short-term suspension of dealer license

o Long-term denial of dealer license

o Criminal charges

§8-739(b) Any person who violates §8-716.1 of this subtitle is guilty of a

misdemeanor and on conviction is subject to a fine not exceeding

$10,000 or imprisonment not exceeding 5 years, or both.

DEALER LICENSING REQUIREMENTS §8-710

• A license is required in order to engage in the business of buying, selling or

exchanging vessels in Maryland.

• §8-701(c)(1) defines “dealer” as any person who engages in whole or in part in the

business of buying, selling, or exchanging new and unused vessels or used vessels,

or both, either outright or on conditional sale, bailment, lease, chattel mortgage, or

otherwise, and has an established place of business for sale, trade and display of

vessels.

• A dealer must pay the $25 annual license fee (effective January 1 through December

31) pursuant to §8-710(c) and ensure active/continuation of surety bond.

• §8-701(c)(2) also defines “dealer” as a yacht broker and a holder of a lien created

under Title 16, Subtitle 2 of the Commercial Law Article who sells the vessel pursuant

to that title (including an auctioneer and a company commonly known as a lien and

recovery company).

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 7 of 45

(Rev 10/2023)

• The license, issued by the Department, is valid from January 1 through December 31

and must be displayed conspicuously in the dealer’s place of business.

• A separate license is required for each location established by a dealer where selling

activity takes place.

DEALER RECORDS §8-719

• Every dealer must maintain for 3 years a record of any vessel the dealer purchased,

sold, exchanged or received for sale or exchange (Appendix F)

• This record shall be open to inspection by Department representatives during

reasonable business hours.

• Audits are generally conducted:

o every 3 years, as a general rule, or

o when a business closes – “exit audit”, or

o when a dealer fails to comply with MD laws and regulations

See Appendix F for recordkeeping requirements

MARYLAND DEALER RESPONSIBILITIES

The most current edition of the MD Boat Dealer Manual can be found on the DNR website

www.dnr.maryland.gov

Forms → Maryland Boat Dealer Documents

• Dealer should possess a general knowledge of the laws and regulations

pertaining to the numbering and titling of vessels and the collection of

excise tax in Maryland.

• Dealer is responsible for training all employees involved in the sale of

vessels and the preparation of applications.

• Collection and remittance of Maryland vessel excise tax is a contractual

obligation of every licensed Maryland boat dealer pursuant to §8-716.1(a)

of Maryland’s State Boat Act

• Any dealer who fails to transmit vessel excise tax to the Department in a

timely manner is guilty of a misdemeanor and on conviction is subject to a

fine not exceeding $10,000 or imprisonment not exceeding 5 years, or

both, pursuant to §8- 739(b) of Maryland’s State Boat Act.

• Only those fees authorized by Maryland’s State Boat Act can be charged

for title and registration.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 8 of 45

(Rev 10/2023)

• A line item on the dealer purchase agreement and/or invoice entitled “DNR

fees” (or similar wording indicating required State charges) cannot exceed

those fees authorized by Maryland’s State Boat Act:

$2 – title only

$26 – $2 title + $24 registration

$41 – $2 title + $24 registration + $15 lien fee

• U.S. Coast Guard documented vessel

$10 – documented use fee MD registered vessel

• Applications and reports required on Departmental forms must be prepared

on the most current version of those forms and submitted timely with all

taxes and fees due.

• Dealership records regarding the purchase, sale and transfer of vessels,

collection and remittance of excise tax, titling and registration fees, and the

issuance of temporary registration decals must be maintained for a period

of three (3) years and be available for inspection during regular business

hours by authorized representatives of the Department (Appendix F).

• The ability to issue numbers and temporary registration decals is a

privilege. Failure to fulfill dealer responsibilities could result in suspension

of that privilege.

• Dealer must immediately advise the Department of any changes to

ownership or operation.

• If a dealer anticipates difficulty satisfying their contractual obligations to the

State, they should immediately contact their managing Service Center.

§8-716.1(g) holds corporate officers personally responsible for tax, interest and/or penalties that

have not been forwarded to the Department as required. Any person violating the provisions of §8-

716.1 is guilty of a misdemeanor and, upon conviction, is subject to a fine not exceeding $10,000

or imprisonment not exceeding 5 years, or both.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 9 of 45

(Rev 10/2023)

VESSELS

State of Principle Operation – The state on whose waters a vessel is operated or to be

operated most during a calendar year.

• Determining the state in which a vessel must be numbered is based on “principal

operation", not residency.

• A motorized vessel must be numbered either with the specific state or jurisdiction in

which the vessel is to be principally operated or documented with the U.S. Coast

Guard.

• A vessel duly registered in another jurisdiction may use Maryland waters for a

cumulative total of 90 days in a calendar year without being deemed principally used

in Maryland.

• A vessel duly registered in another jurisdiction may use Maryland waters for longer

than 90 days so long as the vessel is principally operated in another single

jurisdiction more days than in Maryland.

BROKERED VESSELS

• Trade-in credit does not apply.

• Exempt from vessel excise tax while under brokerage so long as DNR Form B121 is

submitted within 10 days of the signing of the brokerage agreement.

o Must be duly registered in another jurisdiction or federally documented.

o Vessel may only be used for a sea trial.

Mail DNR Form B121 to your managing service center location.

DEALER’S DISCOUNT

o Dealer may retain 1.2% of the tax collected when submitted to the Department

within 30 days [Multiply gross tax due x 0.988].

Total due the Department = net excise tax + fees.

EXTENSION REQUEST (prepayment)

• When all required documentation is not available within 30 days of sale, collected

vessel excise tax and fees must be forwarded to the Department along with:

o DNR Form B-240 marked “Tax Payment Only/Request for Extension”

Photocopy of:

Bill of Sale

Out-of-state registration or Certificate of Documentation (if applicable)

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 10 of 45

(Rev 10/2023)

DNR Form B-241 Trade-In Verification (if applicable)

An automatic 15-day extension will be granted.

o Additional extensions may be granted at the Department’s

discretion.

o Transaction will not be accepted if paperwork presented is

insufficient to determine vessel excise tax liability and

fees.

FEDERAL DOCUMENTATION – U.S. COAST GUARD

• A U.S. Coast Guard documented vessel operated principally in Maryland waters must

satisfy Maryland’s vessel excise tax requirement.

• A documented pleasure vessel with principal operation in Maryland must display MD

documented use stickers. §8-712.1(a)(1)

• After the certificate of documentation is received by the Purchaser, they would submit

a copy to the Department along with a DNR Form B-240, vessel excise tax and $10

fee to obtain biennial documented use decals. Taxes must be submitted within 30

days of purchase.

• If your customer has obtained an interim MD title and registration, once

documentation is received, they must:

o Remove MD numbers and registration decals.

o Within 15 days, return the Maryland registration card and title to the

Department with the notation “documented” and include a copy of their USCG

documentation certificate, a DNR Form B-240, and $10 fee to obtain biennial

documented use decals.

HULL IDENTIFICATION NUMBER §8-711

U.S. Coast Guard Requirements

[33 CFR Part 181 Federal Register]

o The regulations requiring Hull Identification Numbers (HINs) for recreational boats

are intended to provide a uniform positive identification of each boat

manufactured in or imported into the United States.

o The Coast Guard uses the HIN to identify the safety standards that apply to a

particular boat and in identifying specific boats involved in a defect notification

campaign.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 11 of 45

(Rev 10/2023)

o States use the HIN to identify boats for State registration and titling.

o State marine police units and Federal law enforcement agencies (such as the FBI

and National Crime Information Center) use the HIN to trace stolen boats.

o A hull identification number is required by the U.S. Coast Guard to be

permanently affixed, engraved or embossed by the manufacturer or importer to

the starboard half of the transom on the outboard or exterior side, so that it can be

seen from the outside of the vessel, and on an unexposed location inside the boat

or beneath a fitting or item of hardware.

• HIN VERIFICATION

o 12-digit HINs

Prior to August 1, 1984

• ABC123450883

• XYZ45678M84A

August 1, 1984 and after

• BMA45678H485

o For any vessel that is offered for sale by your dealership, verify that the HIN

recorded on the Certificate of Origin or the official ownership documents is the

same as the HIN engraved on the vessel.

o If the HIN does not match:

For a new vessel, obtain the correct Certificate of Origin from the

manufacturer/importer.

For a used vessel, take a rubbing of the HIN and submit it to the

Department stapled to the Application for Maryland Certificates or

the Certificate of Title.

o If vessel has no HIN, indicate “NO HIN” on application.

Include DNR Form B-119 Affidavit signed by vessel owners. The

Department will assign a Maryland (MDZ) hull identification number.

This is in addition to and does not replace the Maryland vessel

registration number that has been assigned to that vessel.

This 12-digit hull identification number must be permanently affixed,

engraved or embossed to the starboard half of the transom on the

outboard or exterior side so that it can be seen from the outside of

the vessel. It must also be permanently engraved on the interior of

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 12 of 45

(Rev 10/2023)

the vessel.

Model years 1973 to 1983 – HIN < 10 characters.

Model years 1984 and beyond – HIN < 12 characters:

• Tracing or photograph is required.

• The Department will issue a 12-digit HIN.

NUMBER AND TITLING §8-712

• All mechanically propelled, undocumented vessels principally operated in Maryland

must be numbered by the Department of Natural Resources (33 CFR § 173.15) and

must display a Maryland boat number and current registration decals in order to be

used on Maryland waters.

• A vessel required to be numbered in Maryland must be titled by the Department

before a certificate of number can be issued.

• Sailboats, rowboats and canoes without motors are exempt from the requirement to

be numbered but may be numbered and titled at the owner’s discretion.

• A vessel that is documented with the U.S. Coast Guard and principally operated in

Maryland for pleasure must display a current Maryland documented use sticker.

• Documented commercial vessels principally operated in Maryland are liable for

excise tax but are exempt from the requirement to display a use sticker.

• Vessels purchased or taken in trade by a dealer that are documented or numbered in

a state other than Maryland must be titled in the dealership name within 15 days and

cannot be offered for sale until they are titled in the name of the dealership. § 8-

715(f)

• Vessels declared a total loss by an insurer must be retitled in insurer’s name before

resale to a salvage buyer to document the chain of ownership.

• All information recorded on certificates of title and number is taken directly from the

Application for Maryland Certificates (DNR Form B-240), prepared by the dealer. It is

essential that the application be completed accurately and legibly.

• Unless directed otherwise by the purchaser, certificates of title and number are

mailed to the vessel owner(s) at the address recorded on the DNR Form B240.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 13 of 45

(Rev 10/2023)

PENALTY & INTEREST §8-716.1(d)(1)

• Failure to remit tax and fees within 30 days results in:

o Forfeiture of 1.2% dealer discount.

o 1.5% interest per month for each month or portion of a month tax is

outstanding.

o 10% penalty on the gross tax due.

o 100% penalty when attempt to defraud.

SECURITY INTEREST §8-729

• When any of the proceeds used by an individual to purchase a vessel have been

borrowed, the lender may require that a lien be recorded on the Maryland title. In that

case, it is important that the names of the purchaser(s) be recorded (perfected) on

the Application for Maryland Certificates exactly as they appear on the loan

agreement and the appropriate fee ($15) paid.

• When a lien is recorded, a Notice of Security Interest Filing is created by the

Department and mailed to the lien holder.

• The name and address of the lien holder is displayed on the Certificate of Title held

by the owner of the vessel.

• A ship mortgage on a USCG documented vessel is recorded with the U.S. Coast

Guard and will not be reflected on the Department record.

TEMPORARY CERTIFICATES OF NUMBER §8-710.2

• A dealer is not required to issue Maryland vessel numbers.

• The Department grants qualified dealers the privilege of issuing Maryland vessel

numbers and temporary registrations for vessels they have sold that are to be titled

and registered in Maryland.

• A temporary certificate of number is valid for 60 days.

• Date of issuance = date of sale.

• Record each temporary certificate issued on DNR Form B-207:

o Affix one of the boat number stickers provided (do not hand write boat number

on form). If vessel was previously MD numbered, enter the MD # previously

issued.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 14 of 45

(Rev 10/2023)

o Sales report must be legibly printed or typed in black/blue ink.

o Complete in full, sign and date.

o Due the 1

st

day after the end of the reporting month to your managing Service

Center by fax or email. Report is considered late after the 15

th

of the month.

o Submit a Separate Report for each month. If no sales, check the “NO SALES”

designated box.

o Report ALL sales, including vessels not primarily used in Maryland waters.

When applicable, check the designated B110 box. Mail B110 form separately.

o Mail VOIDED decals with a signed explanation of the void to your managing

Service Center. Check the designated VOID box.

o Retain copies of each report for your records.

o Call your managing Service Center is you have any questions

o Neither a temporary registration nor a vessel number may be issued unless

Maryland’s vessel excise tax requirement has been satisfied and an

application for Maryland title and registration completed and signed by the

purchaser of the vessel.

o Only one temporary registration can be issued.

o Three violations of these provisions in any 12-month period will result in

suspension of the privilege for six months. After reinstatement, a subsequent

violation will result in suspension for one year.

TRADE-IN ALLOWANCE §8-716(a)(3)(i)

• A licensed boat dealer may give vessel excise tax credit for the value of any vessel traded

as part of the consideration for a sale (not brokerage transactions).

o The trade and the purchase must be simultaneous transactions.

o Individual receiving trade-in credit must be vessel owner of record at the time of the

taxable event.

o Select one of the following sources accepted by the Department as evidence of

trade-in value:

BUC – average of retail low and retail high.

NADA – average retail.

Notarized closing statement containing:

• Purchased vessel description

(year, manufacturer, HIN, length)

• Traded vessel description (year, manufacturer, HIN, length)

• Boat registration number issued to traded vessel

• Trade-in allowance given

• (vessel and trailer listed separately)

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 15 of 45

(Rev 10/2023)

• Date and signature of all parties to the sale

Survey by a NAMS [National Association of Marine Surveyors] or

SAMS [Society of Accredited Marine Surveyors] marine surveyor,

certified under penalty of perjury (converted to trade-in value at 80% of

market/resale value).

DNR Form B-240 – Section 4 – include the total purchase price, the

amount of the trade, and the adjusted purchase price.

The dealer must complete and submit the Trade-In Verification

Statement with the application for the newly purchased boat, along with:

o Photocopy of valuation page from the most current edition of the

reference source (with the valuation underlined) or copy of

survey.

If the trade-in vessel was registered in another jurisdiction documented:

§

8-715(f) requires that a Maryland boat dealer title the

vessel in the name of the dealership within 15 days of

acquisition. Vessel cannot be offered for sale until titled in

dealer’s name.

Titling for resale is tax exempt.

Submit ownership confirmation:

Certificate of Documentation/Abstract of Title.

Original title or copy of registration.

Copy of boat record from registration state.

Calculation of vessel excise tax for a boat with a trade-in:

$10,000.00 Total purchase price

($3,000.00) less Trade-In value

$ 7,000.00 Adjusted purchase

x 0.0494 Tax rate less 1.2% dealer discount

$ 345.80 Tax due to the Department

Ordered vessel – Credit may be given for a vessel traded on a new

vessel yet to be built so long as documentation substantiates a

simultaneous transaction. These additional documents will be

required when titling the new vessel:

o Trade-In Verification Statement.

o Copy of ownership document for the traded vessel (title,

certificate of documentation, or registration card for non-title

states).

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 16 of 45

(Rev 10/2023)

o Evidence of simultaneous transaction that references the

traded vessel (copy of signed invoice, new boat order,

purchase contract, etc.).

TRAILER

• Purchase price of the trailer should be recorded separately on the bill of sale.

• Trailer must be registered with, and appropriate tax paid to the MD Motor Vehicle

Administration (or equivalent agency).

• Contact the Maryland Motor Vehicle Administration at http://www.mva.maryland.gov.

TRANSMITTAL OF TAX AND FEES

• Must be received by the Department within 30 days of date of sale.

Count is 30 days from date of sale – not 1 month!

If the 30th day falls on a weekend, payment is due the next business

day.

Taxable event is the earlier of:

• Purchaser takes delivery with intended principal use in MD

• Temporary registration is issued

• Vessel’s entry into Maryland for principal use

• Full payment received (cash, trade, loan proceeds)

• Transfer of ownership

“Sale” consists in the passing of title from the seller to the buyer for a

price (UCC §2-106) and, unless explicitly agreed, title passes to the

buyer at the time and place at which the seller completes performance

(UCC §2-401).

Transaction will not be accepted if paperwork presented is insufficient

to determine vessel excise tax liability and fees.

The 30 days is intended to allow time for receipt of all documents and

for funds to clear.

A missing or illegible postmark will be considered received timely if the

envelope is received by the Department within 33 days from the taxable

event.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 17 of 45

(Rev 10/2023)

TRUST (TITLED IN NAME OF TRUST)

• Submit copy of those portions of the trust document that identify the trust and the

trustee(s)’ authority, along with the signature page when selling a vessel that is titled

in the name of a trust.

• Trust document must give signatory authority to transfer assets.

o SAMPLE: Trustee(s) under this Trust Agreement are authorized to acquire,

sell, convey, encumber, lease, borrow, manage and otherwise deal with

interest in real and personal property in the Trust’s name.

o Trust may reference the Annotated Code of Maryland, Estates & Trusts, Title

15 Fiduciaries, Subtitle 1 General Provisions, §15-102(b)(3)(c).

VESSEL EXCISE TAX

Vessel excise tax exempt

o A vessel titled in the dealer’s name is exempt from vessel excise tax only

when held for resale or rental/lease.

Maryland registration decals will not be issued for a vessel titled in the

dealer’s name unless vessel excise tax has been paid.

Boats owned by a dealer for rental or lease are exempt from vessel

excise tax but must comply with the requirements for boat livery

operation in COMAR 08.04.08 (recordkeeping, lifesaving and safety

equipment, etc.).

• Used vessels in dealer inventory

o When a dealer acquires a vessel (via trade or purchase) that is

documented or numbered in another state, the dealer must secure

title in their name within 15 days and may not offer the vessel for sale

until title is in the name of the dealership [§8-715(f)].

• Sale of vessels to be used principally in Maryland

o Pursuant to §8-710.3(a), Maryland vessel excise tax must be collected on

all sales of vessels to be titled and numbered and on all sales of vessels to

be federally documented with intended principal operation in Maryland.

Due whether the vessel is to be registered with the U.S.

Coast Guard or with the State of Maryland.

Calculated at 5% of total purchase price, tax cap applies.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 18 of 45

(Rev 10/2023)

A manufacturer’s rebate is taxable.

All inbound freight charges are taxable (cost of transport from

manufacturer or seller to boat dealer).

• Delivery charges to the end purchaser are not taxable

[§11-101(j)(e)(i) Tax-General].

Accessories (excluding trailer) are included in the sales price

of the vessel if they are purchased at the same time the boat

is purchased.

• On audit, the dealer must be able to provide proof that

either sales tax was collected, or the cost of the

accessories was included in the purchase price for the

purchase price for vessel excise tax purposes.

• Sale of vessels to be used principally Outside of Maryland

o Maryland vessel excise tax is not due and is not required to be collected on

the sale of vessels that are to be used principally outside the State of

Maryland.

o A DNR Form B-110 Certification of State of Principal operation must be

completed and certified to by the dealer and all purchasers at the time the

purchase is finalized.

o A DNR Form B-110 is not required when the vessel, the buyer and the seller

are all located out of state.

o Original DNR Form B-110 must be forwarded to your managing service

center location within 30 days in lieu of the application for Maryland

Certificate.

GENERAL INSTRUCTIONS

A.

Payment for a dealer transaction must be cash, a dealer check, or a

dealer credit card. The Department cannot accept payment drawn on

the purchaser’s account or that of another entity because the dealer

bond would not then protect the Department in event of default.

B.

Dealer number must be recorded on all forms where requested.

C.

Type or print legibly in black or blue ink on all applications, certificates, forms, etc.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 19 of 45

(Rev 10/2023)

1.

Alterations and/or erasures will void official documents.

2.

All information recorded on certificates of title and number is taken directly from

the DNR Form B-240. It is essential that all applicable data items on the

application are completed entirely, accurately, and legibly.

D.

Ensure that all required paperwork is available, dated and signed by all owners. All

documents should contain full and complete legal names and signatures – first name,

full middle name, last name, any suffix (Jr., Sr., etc.) as displayed on a driver’s

license or other standard form of identification.

1.

Vessel excise tax and applicable fees.

2.

DNR Form B-240 or executed reverse of title.

3.

Original certified Bill of Sale (vessel description, purchase price, purchase date,

purchaser’s name, signature of all owners/sellers).

4.

Transfer of ownership.

i.

Registered vessel

1.

Original title (properly executed on reverse), registration card (if not title

State) or official State record.

2.

Original certified Bill of Sale (description, purchase price,

date) if the reassignment does not contain all elements.

ii.

Documented vessels

1.

Copy of USCG stamped Bill of Sale (description, purchase price, date).

2.

Copy of current USCG Certificate of Documentation.

3.

USCG Abstract ($25 from the USCG National Vessel Documentation

Center -- see Appendix B).

4.

Satisfaction of mortgage if Abstract indicates ship mortgage

5.

Original Power of Attorney.

6.

Original Discharge of Security Interest required (when applicable) or USCG

Abstract showing ship mortgage has been released.

E.

Applications may be mailed or hand-carried to the Service Center upon making an

appointment.

F.

A maximum of 3 applications can be presented at the Service Center for immediate

processing. Additional transactions can be left for processing.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 20 of 45

(Rev 10/2023)

ASSIGNMENT OF MD VESSEL NUMBERS

EXCISE TAX AND FEES MUST BE COLLECTED BEFORE NUMBER IS ISSUED.

NUMBERS MUST BE ISSUED IN NUMERIC SEQUENCE

New vessels – issue a number

Used vessels

If MD registered, use the existing MD boat number. If

registered elsewhere, issue a MD boat number.

NOTE: If the Department discovers that the vessel was

previously registered in Maryland, Purchaser will have to use the

existing MD boat number, not the number issued by the dealer.

Dealership transaction

o

Title only – you may issue a number

o

Not applying for title – do not issue a number

Contact DNR when purchase is intended for rental or lease.(A special registration

number is required.)

DNR Form B-207 VESSEL NUMBER REPORTING FORM

Record boat numbers and decal numbers issued in consecutive order

Request electronic form from your managing Service Center

Forward to managing service center by the 1st of each month (fax, or email)

o

Submit a separate form for each month

o

Complete in full, sign and date – must be legible, black/blue ink only

o

If no sales, check the “NO SALES” designated box.

o

Will be considered late if not received by 15

th

of the month

o

Report all sales, including vessels not primarily used in Maryland waters. When

applicable, check the designated B110 box. Mail B110 form separately.

o

Mail VOIDED decals with a signed explanation of the void to your managing

service center. Check the designated VOID box.

o

Retain copy for your records

USE OF MD NUMBER STICKERS PROVIDED

DNR Form B-207

o

Do not hand write boat number – use stickers provided!

Sale of new vessel

o

Affix 1st sticker in the B-240 upper right corner -- top page(white)

o

Affix 2nd sticker to customer copy

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 21 of 45

(Rev 10/2023)

o

Affix 3rd sticker to DNR Form B-207 - Complete vessel information; purchaser’s

information; issue date; purchase price.

Dealership transactions – title only

o

Affix 1st sticker in the upper right corner of the top page (white) of DNR Form B-

240

o

Affix 2nd sticker to the DNR Form B-207. Complete vessel information; write

purchase by dealer for purchaser’s information

o

Affix 3rd sticker to DNR Form B-240 dealer file copy

DNR FORM B-240

Record the MD boat number issued or USCG number in boxes provided in upper right corner.

Indicate type of transaction

(vessel may be MD numbered while awaiting USCG documentation)

o

MD registered vessel

Title only

Registration only

Title & registration

o

Documented vessel

Decal only

Tax payment and decal

o

Extension request – tax payment only

Section 1 – Owner information

o

Full name (including full middle name and any suffix)

o

Date of birth

o

Mailing Address, including city, state, zip and county

o

Social security number (last 4 only) or FIN

o

Driver’s license number and state of issue

o

Gender

o

Email address for each owner

o

Daytime Phone Number for each owner

o

Ownership Type (more than one owner):

Tenants in Common: Ownership share becomes an asset of the estate of

the deceased

Joint Tenants with Rights of Survivorship - Surviving owner receives full

ownership

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 22 of 45

(Rev 10/2023)

Section 2 - Vessel information

o

Vessel information must match vessel description on title or USCG

documentation

o

Note whether "new" or used"

o

"Date of purchase = date of taxable event

o

"Date of purchase" and "date vessel entered MD"

determine whether penalty and interest are due

o

Hull identification number must match HIN on vessel title (used vessel)

received from seller or Certificate of Origin (new vessel)

o

Length is represented on USCG documents in decimal format. Maryland

records length in feet and inches. When completing the DNR B-240 for

previously documented vessels, use the conversion chart below:

USCG

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

Maryland

1”

2”

3”

5”

6”

7”

8”

9”

11”

Section 3 - Security Interest Information

o

Required only when a lien is to be recorded

o

Security interest filing will be mailed to the address provided.

Section 4 – Taxes and fees (must be received by DNR within 30 days of taxable event)

-- separate check required for each transaction

o

Purchase price

Includes motor, accessories and freight-in

Does not include prep charges or discount

Rebate is subject to vessel excise tax

Trailer should be listed on the purchase agreement/invoice, and is taxed

upon titling with MVA

o

Enter trade-in credit (when applicable)

o

Enter trade-in hull ID# in Section 5

o

5% vessel excise tax on purchase price -- tax cap applies

o

$2 title fee

o

2-year decal

Registered vessels

o

$24 – vessels > 16’ or over 7.5 hp motor

o

FREE – vessels < 16’ with < 7.5 hp motor

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 23 of 45

(Rev 10/2023)

Documented vessels

o

$10 documented use decal

o

$15 security interest filing fee (if lien is to be recorded)

o

Penalty

10% penalty assessed if taxes and fees are not paid within 30 days of

taxable event

100% penalty assessed where fraud is evident

o

Interest

§

8-716.1(d)(1)

1.5% per month or fraction of a month from the time the tax was due until

paid.

Section 5 – Dealers Only

o

Enter dealer number

o

Check if brokerage sale

o

Complete when appropriate:

Temporary decal #

Trade-in hull ID#

o If requesting extension:

Provide reason (missing data due within 15 days)

Dealer must sign below owners in Section 6

Section 6 – Certification -- must be signed by all owners or authorized

persons.

NEW VESSEL TO BE TITLED/REGISTERED IN MD

DNR Form B-240 Sections 1, 2, 3, 4, 5 and 6

Manufacturer’s Certificate of Origin

Complete the first assignment

o Name and address of the purchaser(s)

o Any lien information

o Date

o Dealer’s signature

o Dealer number

o Gross purchase price

Recorded to the left of the assignment or beside the

transfer section on the Certificate of Origin.

If the purchase price is not shown on the Certificate of Origin, an original

certified Bill of Sale or original signed dealer invoice is also required.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 24 of 45

(Rev 10/2023)

Transfer to another dealer for resale

Complete first assignment

New dealer will use the second assignment for the purchaser(s)

PRINCIPLE OPERATION IN MD – DOCUMENTED VESSEL

NEW VESSEL TO BE DOCUMENTED

TO OBTAIN INTERIM MARYLAND REGISTRATION

DNR Form B-240

Original Certificate of Origin

Original Bill of Sale or Official USCG Stamped Bill of Sale

Original Power of Attorney (if applicable)

Remit Maryland vessel excise tax and fees due

Once Certificate of Documentation is received:

o Advise purchaser(s) that they must apply to DNR for documented use decals

after receiving their USCG Certificate of Documentation.

o Dual registration is prohibited by law. If vessel owner has secured MD title and

registration while awaiting documentation, they must submit a copy of current

documentation and surrender the Maryland title and registration certificate.

USED VESSEL -- PREVIOUSLY DOCUMENTED

TO OBTAIN DOCUMENTED USE STICKERS

DNR Form B-240

o Mark “Tax Payment and Decal”

o Complete Sections 1, 2, 3 (if applicable), 4, 5 and 6

Copy of the certificate of documentation

USCG Abstract of Title

Original certified Bill of Sale

Original Power of Attorney (if applicable)

Remit Maryland vessel excise tax and $10 use decal fee

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 25 of 45

(Rev 10/2023)

PRINCIPLE OPERATION OUTSIDE MD – NEW OR USED VESSEL

DNR Form B-110

o

Vessel description

o

Vessel owner(s) information

o

Dealer’s certification

o

Owner’s certification

o

Retain dealer’s copy

o

Give copy to purchaser

o

Forward original and 2nd copy to your managing service center location

Owner will be required to attest to the specific location of principal operation

Citations are from the

Maryland Annotated Code, Natural

Resources Article, Title 8 Waters, Subtitle

7 State Boat Act

§

8-701(p) State of Principal operation – “State of principal operation” means the

state on whose waters a vessel is used or to be used most during a calendar year

(January 1 through December 31).

§8-701(r) Use – “Use” means to operate, navigate, or employ a vessel. A vessel is in

use whenever it is upon the water, whether it is moving, anchored, or tied up to any

manner of dock or buoy. A vessel is also in use if it is kept in any structure in

readiness for use.

§8-716(e)(8)(i) A vessel is not deemed used on the waters of the State if the vessel is

used for 90 days or less of a calendar year.

§8-716(3) A vessel is not considered to be in use for any period of time that it is

held for maintenance or repair for 30 consecutive days or more.

§8-716(k)(1) … a vessel is deemed to be held for maintenance or repair if:

(i)

The maintenance or repair work is provided in exchange for compensation;

(ii)

The maintenance or repair work is performed pursuant to a schedule pre-

established with one or more marine contractors; and

(iii)

The total cost of the maintenance or repair work is at least two times the

reasonable current market cost of docking or storing the vessel.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 26 of 45

(Rev 10/2023)

REPOSSESSED VESSEL – file within 30 days of repossession

If the name of the lienholder repossessing the vessel is different from the

recorded lienholder, include written explanation on company letterhead.

LIENHOLDER TO TITLE REPOSSESSED VESSEL IN LIENHOLDER’S NAME

MD titled vessel

o

DNR Form B-122 or DNR Form B-106

o

Title fee

Out-of-state titled or untitled vessel

o

DNR Form B-106

o

Form B-240 marked “title only"

o

Copy of lien agreement

o

True test copy of the State’s official vessel record

o

Title fee

Documented vessel

o

Original USCG abstract or current USCG Deletion of Documentation

o

USCG Affidavit of Repossession or current USCG Deletion of Documentation

o

DNR Form B-106

o

DNR Form B-240

o

Title fee

LIENHOLDER TO TRANSFER OWNERSHIP DIRECTLY TO THE PURCHASER

MD titled vessel

o

DNR Form B-122 or DNR Form B-106

o

Vessel excise tax and fees

Out-of-state titled or untitled vessel

o

DNR Form B-106

o

DNR Form B-240

o

True test copy of official state vessel record

o

Copy of lien agreement

o

Vessel excise tax and fees

Documented vessel

o

DNR Form B-240

o

Original USCG abstract or current USCG Deletion of Documentation

o

USCG Affidavit of Repossession or current USCG Deletion of Documentation

o

Original certified Bill of Sale containing date, purchase price, vessel description,

purchaser’s name, seller(s)' signature

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 27 of 45

(Rev 10/2023)

TEMPORARY REGISTRATION DECALS

ISSUANCE

May be issued for any vessel sold that is to be titled in Maryland

Valid for 60 days

Only 1 temporary can be issued by a Dealer for each vessel

Additional temporary can only be secured from DNR

Record preprinted decal control number and current date on the same line

of Form B-207 as the boat number

Expiration date must be recorded on decal in permanent ink using the

format MM/YY (i.e., 10/04)

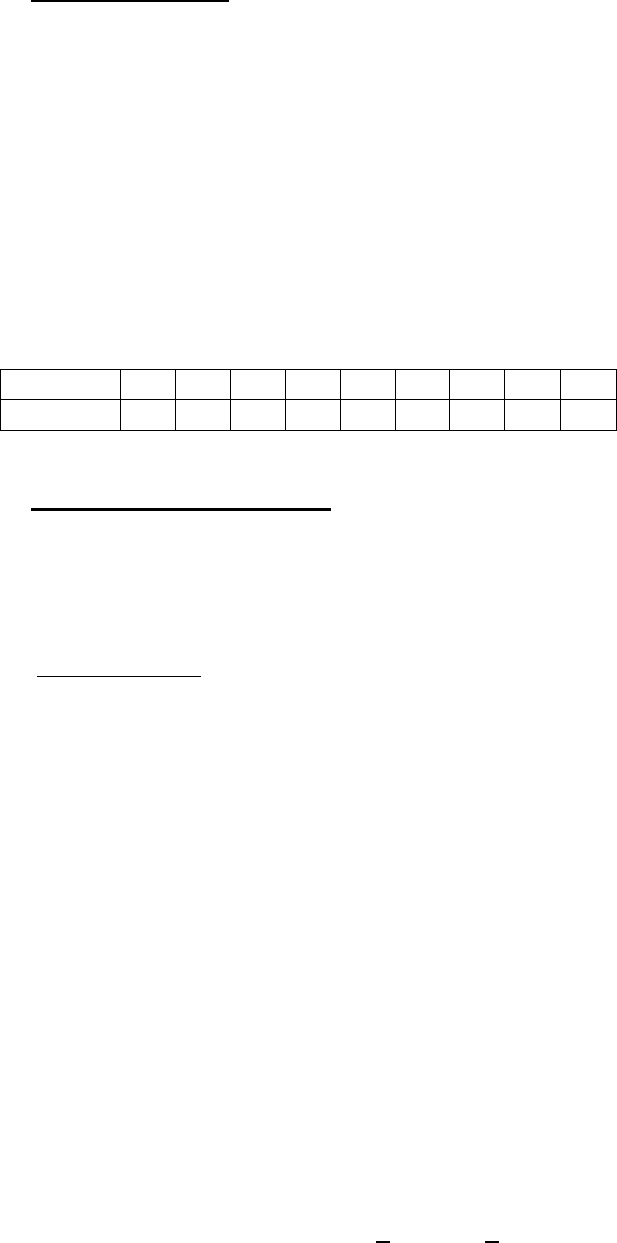

Month of issuance

1

2

3

4

5

6

7

8

9

10

11

12

Expiration month

3

4

5

6

7

8

9

10

11

12

1

2

Example: The temporary registration for a vessel sold in

July (7) would expire in September (9).

NEW VESSELS

Issue temporary decals

Complete the temporary registration card (DNR B-107A)

Record boat number, decal’s preprinted decal control number, current date

and name and address of the purchaser on the Form B-207

VESSEL WITH EXISTING MD BOAT NUMBER

Issue temporary decals

Complete the temporary registration card (DNR B-107A)

Record existing boat number, decal’s preprinted decal control number,

current date and name and address of the purchaser on the Form B-207

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 28 of 45

(Rev 10/2023)

TITLE – REPLACEMENT OR CORRECTION

REPLACEMENT TITLE

Complete DNR B-108

o

Maryland vessel number

o

Name and address of owner(s)

o

Check appropriate block under “Items”

o

Fill in applicable fees

o

State reason for application

o

Signature of owner(s) and date

o

Power of Attorney (if applicable)

CORRECTED TITLE

Original incorrect certificate of title

Complete B-108

o

Maryland vessel number

o

Name and address of owner(s)

o

Check appropriate block under “Items”

o

Fill in applicable fees

o

State reason for application

o

Note required corrections

o

Signature of owner(s) and date

o

Power of Attorney (if applicable)

Change(s) and/or correction(s)

o

New vessel

Replacement Manufacturer’s Certificate of Origin is required to change

the hull identification number (HIN), length and/or hull material

o

Used vessel

A tracing of the hull identification number (HIN) is required to change the

HIN, manufacturer and/or model year

The Department may request additional supporting documentation as needed.

Replacement and corrected titles are mailed to the vessel owner(s) at the address on

file with DNR.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 29 of 45

(Rev 10/2023)

USED VESSEL – TITLED IN MD: DEALER

that has been taken in trade or purchased by dealers

Maryland titled vessel

Complete assignment section on MD title

Record name of dealership as purchaser

Record “N/A” in the space provided for purchase price

All owners of record must sign and date the assignment of title (unless a Power of

Attorney applies)

When vessel is sold

o

Complete dealer’s reassignment and the purchaser(s)’ application for certificates

section, recording all requested information

o

Must contain name(s) and address(es) of all purchasers

o

Must include dealer #

o

Include lien and registration information

o

All purchaser(s) must sign and date title in the certification block at

o

bottom of title

o

Attach the Discharge of Security Interest (if applicable)

o

Attach original Power of Attorney (if applicable)

o

Calculate vessel excise tax and fees due

Out-of-state titled or untitled vessel

Vessels, other than MD titled vessels taken in trade or purchased outright by a dealer,

must be Maryland titled IN THE DEALER’S NAME within 15 days of acquisition and

before the vessel is offered for sale.

Complete DNR Form B-240

Must include dealer #

Title fee is due

No vessel excise tax is due on vessels held for resale

Original out-of-state title signed by all sellers and assigned directly to the dealer must

accompany the application for MD title.

An original release of lien is required if a lien is recorded on the title.

If untitled:

o

The out-of-state registration certificate or a true test copy of that State’s official

vessel record.

o

Original certified Bill of Sale or agreement transferring the vessel from the seller

to the dealer must accompany the application for MD title.

New title in dealer’s name will be used to transfer the vessel when sold.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 30 of 45

(Rev 10/2023)

USED VESSEL – TITLED IN MD: BROKERED

Maryland titled vessel

Seller(s) must complete, sign and date the assignment of title

Dealer enters dealer license number in the appropriate area of the Dealer’s

reassignment, signs where appropriate.

Purchaser(s) must complete the application for certificates

o

Purchase price

o

Name(s)

o

Address(es)

o

Registration information

o

Lien information (if applicable)

Ensure that all purchaser(s) have signed and dated the title in the certification area

Attach a Discharge of Security Interest (if applicable)

Attach original Power of Attorney (if applicable)

Submit appropriate vessel excise tax and fees

Out-of-state vessel

Titled

o

Original out-of-state title required

o

Must be signed by all sellers

o

Must be assigned directly to the purchaser(s)

o

DNR Form B-240 Complete sections 1, 2, 4, 5 and 6

o

For a security interest filing, complete section 3 of DNR Form B-240

o

Attach an original release of lien (if applicable)

o

Attach original Power of Attorney (if applicable)

o

Submit appropriate vessel excise tax and fees

Untitled

o

Registration certificate or true test copy of the State’s official vessel record in the

seller’s name is required

o

DNR Form B-240 Complete sections 1, 2, 4, 5, and 6

o

For a security interest filing, complete section 3 of Form B-240

o

Attach an original certified Bill of Sale

o

Attach original Power of Attorney (if applicable)

o

Submit appropriate vessel excise tax and fees

Documented vessels

DNR Form B-240

Copy of Certificate of Documentation

USCG Abstract

Satisfaction of mortgage if Abstract indicates ship mortgage

Copy of Bill of Sale with USCG stamp indicating gross purchase price.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 31 of 45

(Rev 10/2023)

of Vessel

WARRANTY RETURN OF VESSEL

REPLACED

Returned vessel title must be signed over to manufacturer by owner(s)

o

Complete assignment of title to dealer/manufacturer

o

Forward title, registration card, decals, and $2 title fee to DNR for issuance of a

new title

To title/register replacement vessel:

o

DNR Form B-240

o

Original Certificate of Origin

o

Original certified Bill of Sale (if applicable)

o

DNR Form B-102 Manufacturer’s Affidavit of Replacement Under Warranty

completed by manufacturer

o

Credit will be given for vessel excise tax paid on the original vessel, but additional

vessel excise tax will be due if the replacement vessel has a higher value than

the replaced vessel (even when no additional money is paid)

o

Lienholder authorization to remove lien from original vessel and transfer to

replacement vessel. Authorization must clearly identify both vessels

NOT REPLACED

Submit manufacturer’s statement

o

Vessel has been returned under warranty

o

Will not be replaced

o

Sale is cancelled

Complete assignment of title transferring ownership back to dealer/manufacturer

Forward registration card and decals to DNR for cancellation

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 32 of 45

(Rev 10/2023)

DEFINITIONS

30 days – A dealer must transmit tax and fees collected to the Department within 30 days

of receipt – not 1 month. If the 30

th

day falls on the weekend, monies must be received by

the Department by the following Monday. The day immediately following the sale is Day 1.

Abstract of title – The U.S. Coast Guard record of vessel history containing all bills of

sale, mortgages, and notices of claim of lien.

Bill of sale – Document executed by the seller transferring title containing:

•

Transaction details

o

Seller's name and address

o

Purchaser’s name and address

o

Purchase date

o

Detailed vessel description (year, make, length, HIN, boat number)

o

Gross purchase price of the vessel (less trailer value)

•

Certification under penalty of perjury

o

SAMPLE: I declare and affirm under penalty of perjury that the facts in this Bill of

Sale are true and correct.

Certificate – Any certificate of number or title issued.

Certificate (MCO) or Statement of Origin (MSO) – The manufacturer’s or importer’s

document of “title” which establishes ownership of a vessel and provides for the transfer of

that ownership progressively from the manufacturer or importer to the dealer and

purchaser.

Co-owners – When more than one individual holds the title to a vessel. Vessel is

assumed to be jointly and equally owned unless stated otherwise. Signatures of all owners

are required to transfer ownership or request a replacement title.

Dealer

§

8-701(c)(1) defines “dealer” as any person who engages in whole or in part in the

business of buying, selling, or exchanging new and unused vessels or used vessels,

or both, either outright or on conditional sale, bailment, lease, chattel mortgage, or

otherwise, and has an established place of business for sale, trade, and display of

vessels.

§8-701(c)(2) also defines “dealer” as a yacht broker and a holder of a lien created

under Title 16, Subtitle 2 of the Commercial Law Article who sells the vessel

pursuant to that title (including an auctioneer and a company commonly known as a

lien and recovery company.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 33 of 45

(Rev 10/2023)

Dealer demonstration numbers – Maryland vessel “demo” numbers assigned to dealers

for the purpose of demonstrating or testing vessels owned by the dealer that are held for

resale.

Dealer discount – 1.2% of the gross vessel excise tax collected when received by the

Department within 30 days (not one month) -- retained by the dealer as compensation for

collecting the tax.

Department – The Maryland Department of Natural Resources.

Documented vessels – A vessel that has been documented by the U.S. Coast Guard

and issued a valid marine certificate. Commercial vessels weighing 5 net tons or more or

any commercial vessel 30’ or more in length (unless exemption is granted by the U.S.

Coast Guard) must be documented. Yachts or pleasure vessels may be documented at

the owner’s request.

Fair market value

Dealer sale – the total purchase price as certified by the dealer on a form

acceptable to the Department.

All other transactions – either (a) total purchase price verified by an original

certified Bill of Sale approved by the Department, or (b) valuation shown in a

national publication of used vessel values adopted by the Department (when

Bill of Sale does not exist or is more than 3 years old).

Hull identification numbers (HIN) – The unique vessel identification number, consisting

of a minimum of 12 characters, required by federal law to be assigned by the

manufacturer.

Lienholder – A person or business that holds a security interest in a vessel.

Manufacturer – Any person engaged wholly or in part in the business of building,

assembling, manufacturing or importing new and unused vessels, or new and unused

outboard motors.

Marine repair contractor – A person or entity engaged full-time in the business of

providing maintenance, repair, or similar services to vessels.

Penalty & interest –

The State Boat Act requires assessment of a 10% penalty when

vessel has not been registered within 30-days of taxable event, as well as interest at 1.5%

per month. Penalty is assessed at 100% when evidence of fraud exists.

Power of attorney – Legal document whereby an individual (the principal or grantor)

conveys to another (grantee) the right to act on their behalf as attorney-in-fact. May be

used on any document requiring the individual’s signature (grantee would sign grantor’s

name and then grantee’s name as Power of Attorney/POA). Original required.

Purchase price – The total price of a vessel at the time of sale, including motor,

accessories, freight-in (boat dealers only), duty (if any), and excluding the price of a trailer.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 34 of 45

(Rev 10/2023)

Preparation charges are not taxable.

Registered – Denotes vessel that displays State numbers and registration decals.

Renewal – Process of renewing biennial vessel registration (expires December 31 of the

year following issue). A renewal notice is sent to address of record approximately one

month before expiration.

Resident – An individual whose fixed, permanent and principal home for legal purposes is

located in the State of Maryland.

Sale – The passing of title from the seller to the buyer for a price.

Security Interest – An interest or lien that is reserved or created by an agreement which

secures payment or performance of an obligation and is generally valid against third

parties.

State of principal operation – The state on whose waters a vessel is principally operated

or to be principally operated most during a calendar year (January 1 through December

31).

A vessel duly registered in another jurisdiction may use Maryland waters for a

cumulative total of 90 days in a calendar year without being deemed

principally used in Maryland.

A vessel duly registered in another jurisdiction may use Maryland waters more than 90

days in a calendar year so long as the total days in Maryland waters is less than the

total days spent in the “principal operation” jurisdiction.

Titled – Term denoting vessels assigned a State number and issued certificate of title,

which is the legal documentation of ownership issued by the State of Maryland.

Trade-in value – Monetary value of vessel accepted as partial payment on the purchase

of another vessel pursuant to §8-716(a)(3)(i) of Maryland’s State Boat Act.

The Department accepts the following sources as evidence of trade-in value:

BUC Book – may not exceed average of retail low and retail high

N.A.D.A. – may not exceed average retail

Survey by a NAMS or SAMS marine surveyor, certified under penalty of

perjury (converted to trade-in value at 80% of market/resale value)

Notarized closing statement with full description of trade-in

vessel and vessel being purchased

Trade-in vessel – A vessel acquired by a dealer as part of the consideration for a sale.

Undocumented vessel – A vessel not required to be documented by the U.S.

Coast Guard and for which a valid USCG marine document has not been issued.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 35 of 45

(Rev 10/2023)

Use – §8-701(r) -- The operation, navigation or utilization of a vessel. A vessel is “in use”

whenever it is upon the water, whether it is moving, anchored or tied up to any manner of

dock or buoy. A vessel is also in use if it is kept in any structure in readiness for use. A

vessel stored on a trailer or in dry stack storage in Maryland is considered to be in

readiness for use.

Use decal – Biennial sticker issued to U.S. Coast Guard documented vessels with

principal operation in Maryland waters.

Vessel – Every description of watercraft, including an ice boat but not including a

seaplane, that is used or capable of being used as a means of transportation on water or

ice (includes the motor, spars, sails and accessories of a vessel).

Vessel excise tax – Tax imposed at the time of taxable event on all vessels used

principally in Maryland. See §8-716(e) of Maryland’s State Boat Act for exemptions.

Vessel number – Number assigned to undocumented vessels with principal operation in

MD in accordance with the USCG National Vessel Registration System. The

number consists of the letters “MD” followed by up to four numbers and up to 2

letters (the letters “I”, “O” and “Q” are not used.) Ex: MD 1234 AB.

Yacht broker – Person who brings together a willing buyer and a willing seller for

profit but does not take ownership or possession of the vessel(s).

Waters of the State - 8-701 (t) -- Any water within the jurisdiction of the State, the

marginal sea adjacent to the State, and the high seas when navigated as part of a

ride or journey to or from the shore of the state.

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 36 of 45

(Rev 10/2023)

APPENDIX A: DNR REGIONAL SERVICE CENTER INFO

LICENSING & REGISTRATION REGIONAL SERVICE CENTERS

Open by Appointment only Monday thru Friday 8:30 a.m. – 4:30 p.m. (except State holidays)

ANNAPOLIS

160 Harry S. Truman Pkwy

P.O. Box 1869

Annapolis MD 2140-1869

(410) 260-3220

(410) 260-3281 Fax

Christie Gross, Industry Liaison

christie.gross@maryland.gov

(410) 260-3284

Christopher Harrison, Manager

christopher.harrison@maryland.gov

(410) 260-3285

FREDERICK

1601 A Bowmans Farm Road

Frederick MD 21701

(240) 236-9950

(240) 236-9953 Fax

Sue Wilfong, Industry Liaison

susan.wilfong@maryland.gov

(240) 236-9952

Meghan Cadden, Manager

meghan.cadden@maryland.gov

(240) 236-9951

SALISBURY

251 Tilghman Rd. Rm #2

Salisbury MD 21804

(410) 713-3840

(410) 713-3849 Fax

Teresa Budnick, Industry Liaison

teresa.budnick@maryland.gov

(410) 713-3842

Monica O'Neill, Manager

monica.oneill@maryland.gov

(410) 713-3841

BEL AIR

501 W. MacPhail Rd. #2

Bel Air MD 21014

(410) 836-4550

(410) 836-4562 Fax

Amy Bell, Manager

amy.bell@maryland.gov

(410) 836-4577

CENTREVILLE

120 Broadway Avenue Suite 5

Centreville MD 21617

(410) 819-4100

(410) 819-4110 Fax

Heather Duncan, Industry Liaison

Heatherl.duncan@maryland.gov

(410) 819-4104

Marie Myers, Manager

(410) 819-4101

ESSEX (Mon/Wed/Fri only)

1338 Eastern Blvd. A

Essex MD 21221

(667) 401-0760

(667) 401-0765 Fax

Colleen Armstrong, Manager

colleen.armstrong@maryland.gov

(667) 401-0756

SOLOMONS

14175 Solomons Island Rd., S

P. O. Box 1309

Solomons, MD 20688

(410) 535- 3382

(410) 535-4737 Fax

Sandy Radcliff, Industry Liaison

sandra.radcliff@maryland.gov

(240) 607-5856

Michaela Spriggs, Manager

michaela.spriggs@maryland.gov

(240) 607-5855

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 37 of 45

(Rev 10/2023)

LICENSING & REGISTRATION ADMINISTRATION

Margie MacCubbin, Director

501 W. MacPhail Road

Bel Air MD 21014

margie.maccubbin@maryland.gov

(410) 836-4561

Management of MD boat dealers is distributed among Regional Service Centers as follows:

Annapolis – Howard, Montgomery and Prince George’s Counties, Baltimore City and northern

Anne Arundel County

Bel Air – Baltimore, Carroll and Harford Counties and western Cecil County

Centreville – Caroline, Kent, Queen Anne’s and Talbot Counties and eastern Cecil County

Frederick– Allegany, Frederick, Garrett and Washington Counties

Solomons – Calvert, Charles, and St. Mary’s Counties and southern Anne Arundel County

Salisbury – Dorchester, Somerset, Wicomico and Worcester Counties

APPENDIX B: U.S. COAST GUARD CONTACT INFO

NATIONAL VESSEL DOCUMENTATION OFFICE

792 T J Jackson Drive

Falling Waters, WV 25419-4502

(800) 799-8362

(304) 271-2400

(304) 271-2405 Fax

https://www.dco.uscg.mil/Our-Organization/Deputy-for-Operations-Policy-andCapabilities-DCO-D/National-Vessel-

Documentation-Center/

MD Department of Natural Resources BOAT DEALER MANUAL

Publication DNR-06-1208-0019 Licensing & Registration Service

0Page 38 of 45

(Rev 10/2023)

APPENDIX C: HULL IDENTIFICATION NUMBERS

U.S. Coast Guard requirements 33

CFR Part 181 Federal Register

Primary HIN will be located on a boat’s transom on the starboard side

within 2” of the top of the transom. If no transom is on the boat, it must be

located to the starboard outboard side of the hull, aft, within 1” of the stern,

within 2” of the top of the hull side, gunwale, or hull/deck joint. HINs will

have 12 characters; and characters must not be less than ¼” in height.

Current HIN Formats Example: BMA45678H485

• 12 characters that run consecutively (no space, slash or hyphen)

• The first three characters in every HIN are a Manufacturer

Identification Code assigned by the U.S. Coast Guard to the

manufacturer/importer

• Characters four through eight represent the hull serial number, which must

consist of letters of the English alphabet, Arabic numerals, or both, except

the letters “I”, “O” or “Q” (because of their similarity to the numbers “0” and “1”