Accounting Waiver Examination

Sample Questions and Solutions

This document contains two exams that cover different topics. The actual waiver

exam is just one exam that covers both sets of topics. There will be only one set

of financial statement excerpts to which the waiver exam questions will refer.

For each sample exam, there are three sets of material: the questions, the

financial statement excerpts that are relevant, and the solutions.

1

Name

ACCOUNTING 6130

Sample Midterm Exam

Instructions:

• Please print your name in the space provided above

• The exam is open-book, open-notes; electronic devices are allowed.

• The exam is to be done individually!

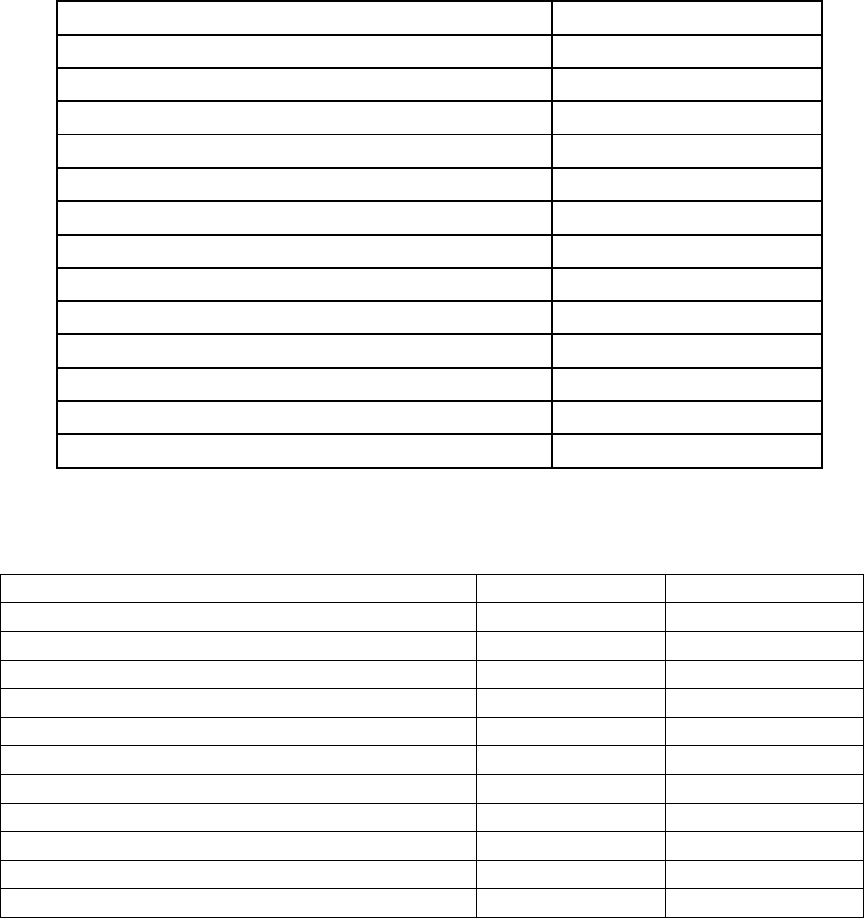

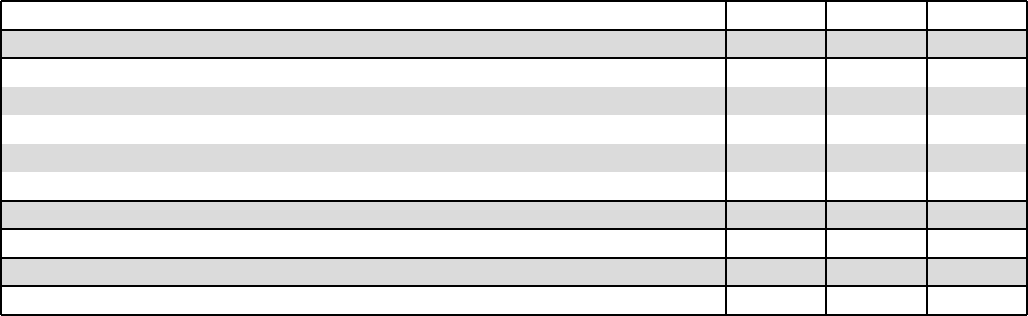

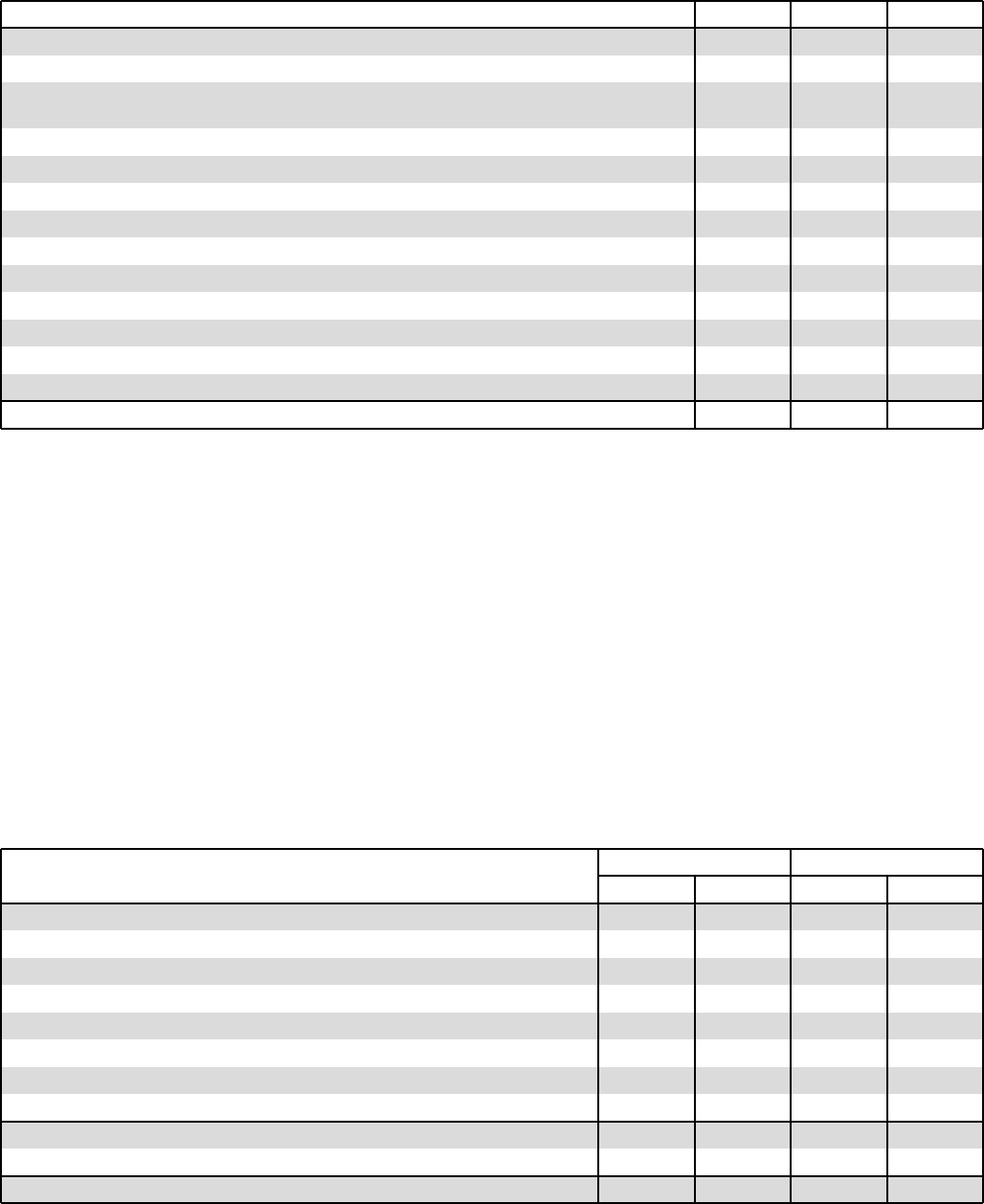

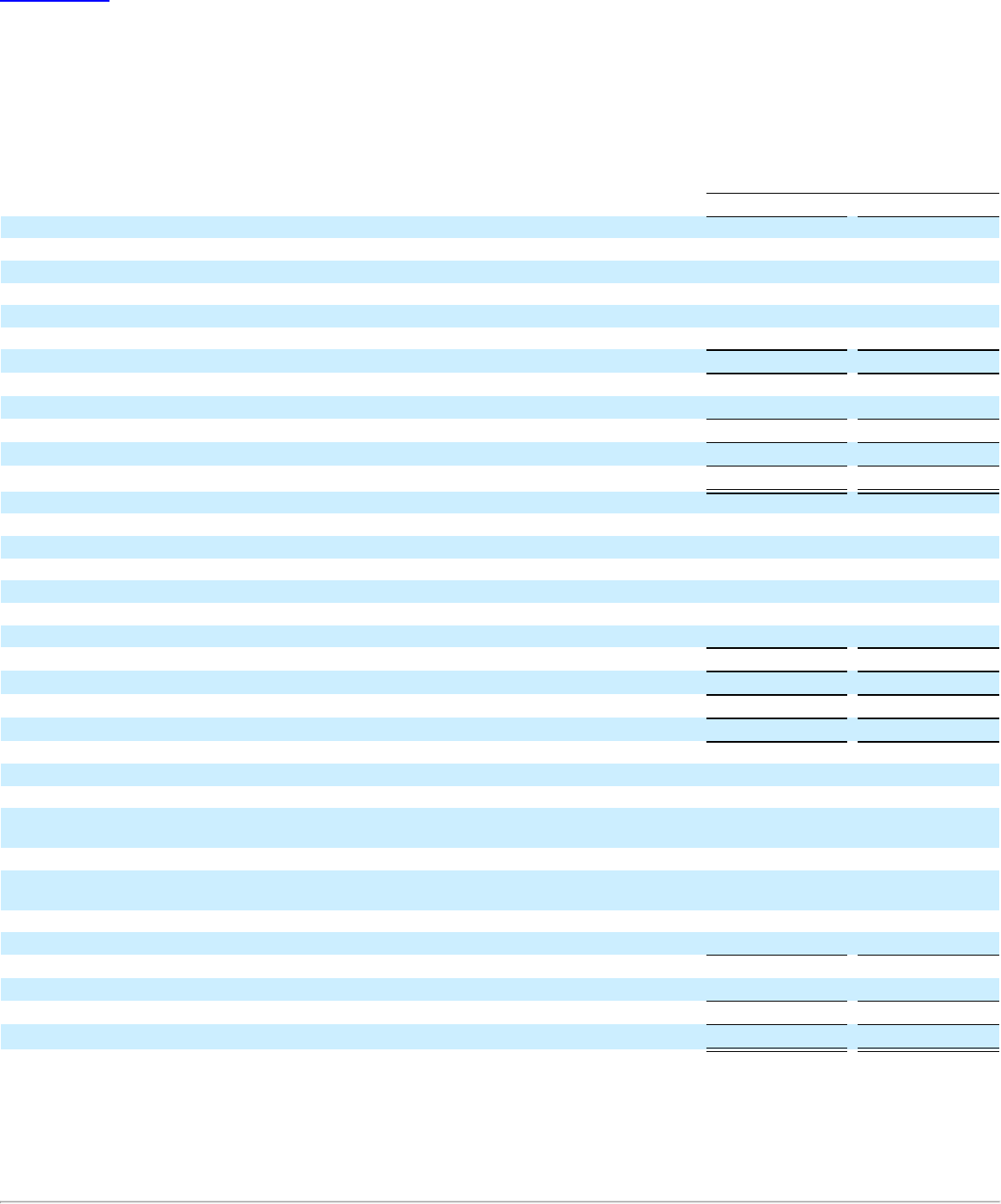

Question Points Possible Points Scored

Question I (Mechanics) 31

Question II (Miscellaneous) 20

Question III (Revenue Recognition) 21

Question IV (FS Analysis) 17

Question V (Cash Flow) 17

Total . 106

2

Question I: (31 points) Journal Entries

Give me the Journal Entries for each of the following transactions / events.

Answer each of these independently

1. (3 pts) A firm borrows $10,000 in cash in the form of a long-term note.

2. (3 pts) A firm buys Inventory on Credit for $20,000.

3. (3 pts) A firm records $30,000 of Depreciation Expense.

4. (4 pts) Employees earn $40,000 in wages this year. Of this amount, $35,000 was paid in

cash and the remainder will be paid next year.

3

5. (8 pts) A firm sells Inventory that originally cost them $60,000. The inventory had been

purchased and paid for last year. The firm receives $25,000 in Cash and also receives a

Receivable in the amount of $40,000.

• What are the journal entries this year?

• How does the above transaction show up on the cash flow statement? (Give me the effect

on income and the applicable adjusting entries, if any)

6. (10 pts) A firm sells land that it had purchased many years ago for $100,000. It receives

shares of stock (from the selling company) valued at $900,000. The firm’s main business

does not involve buying and selling land.

• What are the journal entries?

• Are any adjusting entries required on the cash flow statement? Explain.

• Is a footnote to the cash flow statement required related to this transaction? Explain.

4

Question II (20 points) Miscellaneous

Answer each of the following independently

1. (4 pts) Suppose the Beginning Balance of Inventory was $100,000. The firm purchased

$20,000 of inventory for cash and $30,000 of inventory on credit that it has not yet paid.

Ending Inventory was $40,000.

How much was the Cost of Goods Sold?

2. (8 pts) Suppose that Retained Earnings was $150,000 at the beginning of the year. During

the year, we did the following (all of this has already been entered into the accounts, and the

closing entries have taken place): Some of these might not be relevant!

Issued Shares (for cash) worth $ 40,000

Bought Back Shares (for cash) worth $ 20,000

Issued Long Term Debt (for cash) worth $ 17,000

Recognized Net Income of $ 90,000

Invested in Long Term Assets (for cash) worth $ 5,000

Sold Marketable Securities (for cash) worth $ 20,000

Declared and Paid Dividends of $ 30,000

(a) (4 pts) What was the ending balance for Retained Earnings?

(b) (4 pts) How much was Cash From Financing Activities?

5

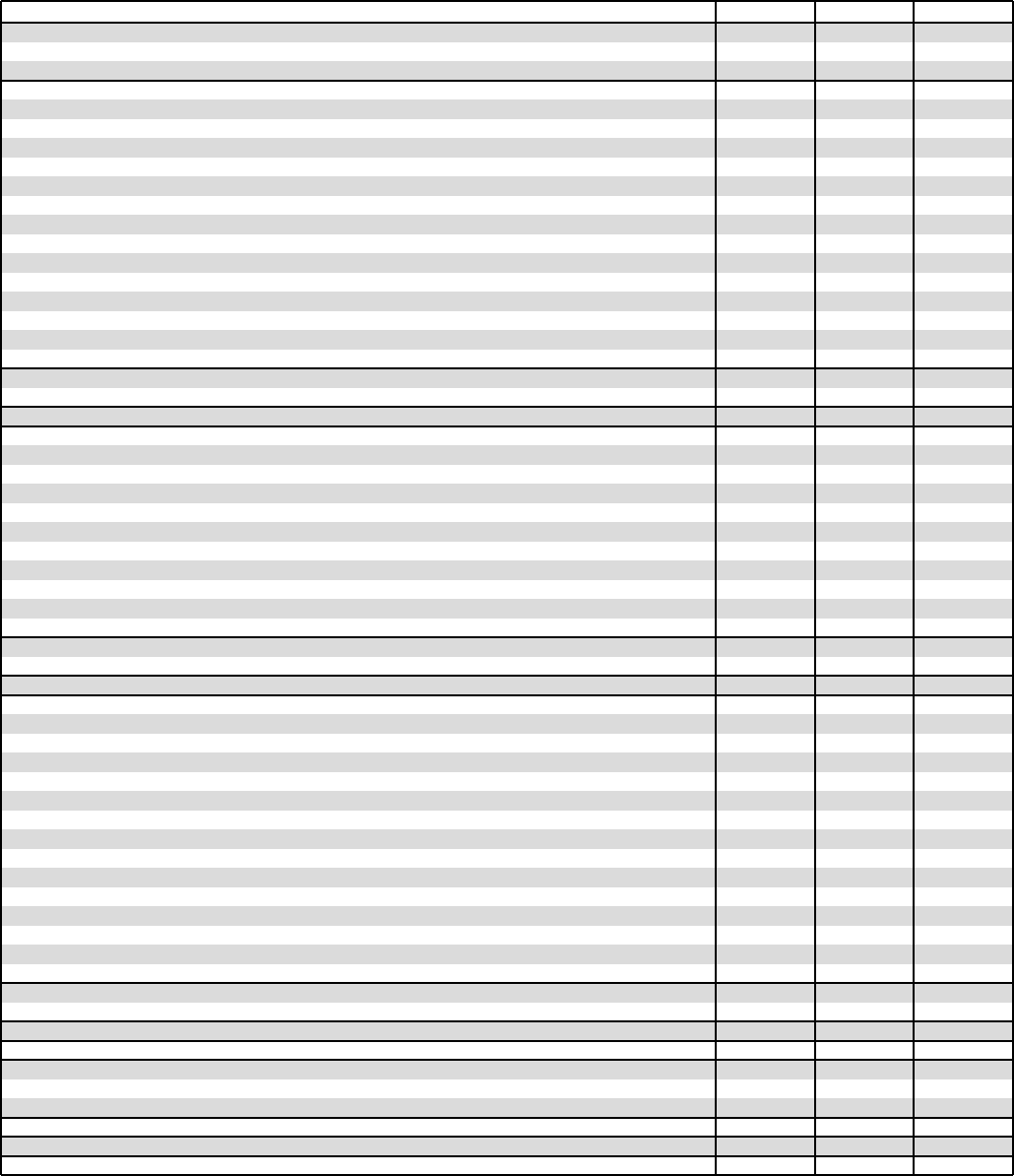

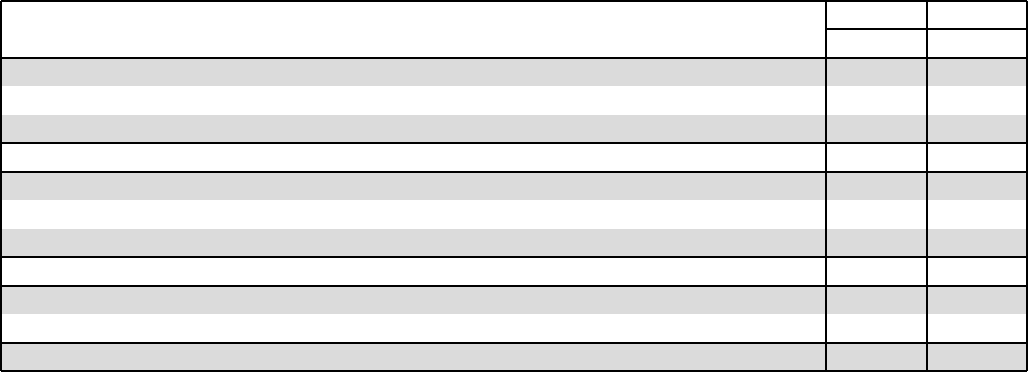

3. (8 pts) Closing Entry - THIS IS INDEPENDENT OF THE PRIOR PROBLEMS

At the end of the year, the company’s books contain the following Trial Balances (All Adjusting

Entries have already been made). That is, all entries have been made except the closing entries.

Note that not all balance sheet accounts are shown.

Adjusted Trial Balance

Accounts Payable

100,000

Accumulated Depreciation and Amortization

200,000

Common Stock

350,000

Cost of Goods Sold

300,000

Depreciation and Amortization Expense

50,000

Dividends Payable

10,000

Interest Expense

40,000

Interest Payable

220,000

Inventory

140,,000

Litigation Loss

60,000

Retained Earnings

2,000,000

Sales Revenue

1,000,000

Selling and Administrative Expenses

400,000

• (5 pts) What is the Closing Journal Entry for the year?

Account Titles

Debit

Credit

• (3 pts) How much was NET INCOME for the year? Be sure to indicate if it’s a

profit or it’s a loss.

6

Question III (21 points) – Revenue Recognition

On January 1, 2022, a firm signs a customer to a 4-year, noncancelable contract for subscription

services. The total cost is $4800, payable in annual installments. The service commences

immediately (on January 1, 2022). The bill each year is sent on January 1, and it is due in 30

days.

1. (4 pts) What journal entry (or entries) does the firm make on January 1, 2022? (if any)

2. (3 pts) What journal entry (or entries) does the firm make when the customer makes the first

payment (if any)? Assume it was made on time.

3. (3 pts) What journal entry (or entries) does the firm make at the end of each month to record

pro-rata delivery of service (if any)?

4. (3 pts) What is the balance for Unearned Revenue on the balance sheet on December 31,

2022?

7

5. (3 pts) How much cash has the firm not yet collected on this contract at the end of December

31, 2022?

6. (5 pts) A consultant claims that if the firm billed for the entire 4 years up front at the

beginning of the contract (i.e., $4800), it could report revenue quicker. Do you agree?

Explain.

8

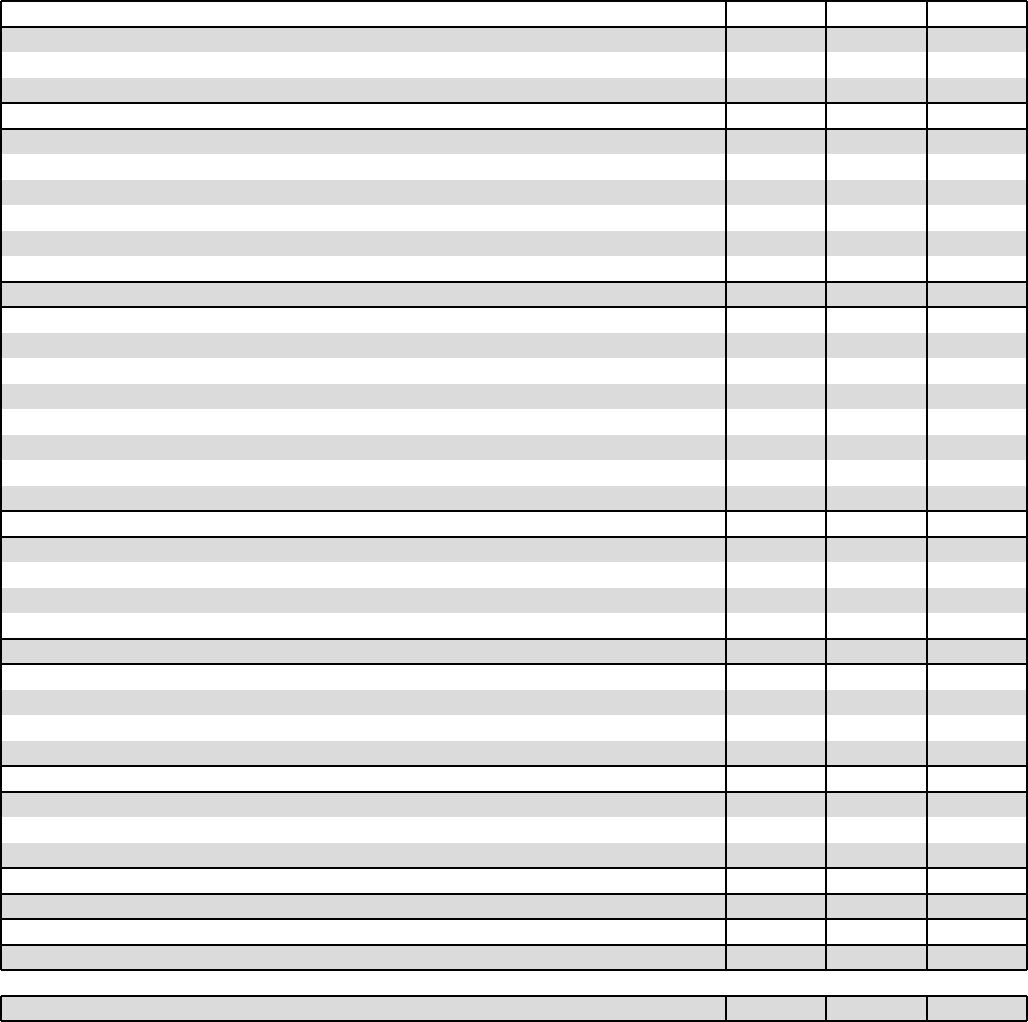

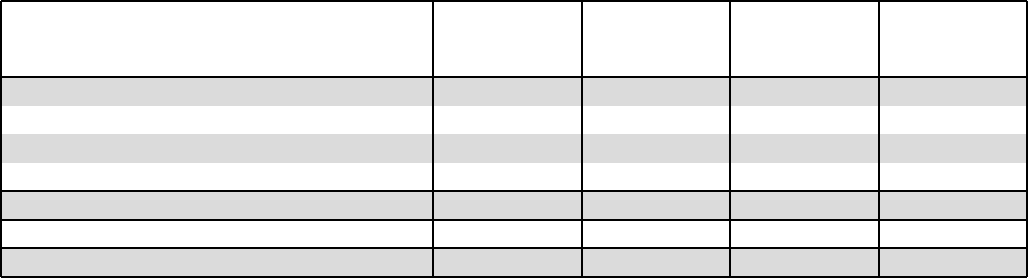

Question IV (17 points) Financial Statement Analysis

Below are selected financial ratios for two years from a company. Note that ROE, which is an

important measure of firm profitability, is higher in year 2 than in year 1.

Year 2

Year 1

ROE = Net Income / Stockholders Equity

83.33%

73.91%

Quick Ratio = Quick Assets / Current Liabilities

0.75

0.69

Profit Margin = Net Income / Sales

12.50%

9.71%

Leverage Ratio Version A = Liabilities / Stockholders Equity

2.33

1.17

Leverage Ratio Version B = Assets / Stockholders Equity

3.33

2.17

Leverage Ratio Version C = Liabilities / Total Assets

0.70

0.54

Return on Assets = Net Income / Total Assets

25.00%

34.00%

Current Ratio = Current Assets / Current Liabilities

1.25

1.25

Asset Turnover Ratio = Sales / Assets

2.00

3.50

1. (13 pts) Given the ratios above, explain what the drivers were of the increase in ROE.

Provide as much detail as you can. Explain which specific ratios you are referring to, and

use the numbers to explain the magnitudes of the effects (not just the directions). NOTE

THAT I AM ONLY INTERESTED IN PROFITABILITY HERE – NOT LIQUIDITY OR

SOLVENCY. HINT – SOME OF THE RATIOS ARE IRRELEVANT!

9

2. (4 pts) Based on the numbers above, are there any potential “negative consequences”

associated with how the firm increased its ROE? Explain.

10

Question V – (17 points) Cash Flow Statement

Refer to the excerpts (contained at the back of this booklet) from the 2021 Annual Report

of Procter and Gamble (P&G)

1. (3 pts) How much did P&G spend on business acquisitions in 2019? NOTE THE YEAR!

2. (3 pts) In which year did Accounts Receivable increase the most? Explain.

3. (3 pts) In which year did Depreciation and Amortization add the most cash flow? Explain.

11

4. (4 pts) P&G had a huge outflow of cash in 2021 related to FINANCING Activities. What

were the two types of financing activities for which P&G’s outflows were most different than

for the corresponding activity in 2020?

5. (4 pts) For the three years of data provided, why are Cash From Operations and Net Income

most different from each other in 2019 compared to the other two years? I don’t want a

detailed dollar-for-dollar reconciliation; I want the biggest factor. Also, EXPLAIN WHY

this item causes income and cash to be different from each other.

Consolidated Statements of Cash Flows

Amounts in millions; Years ended June 30

2021 2020 2019

CASH, CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING OF YEAR

$ 16,181 $ 4,239 $ 2,569

OPERATING ACTIVITIES

Net earnings 14,352 13,103 3,966

Depreciation and amortization 2,735 3,013 2,824

Loss on early extinguishment of debt 512 — —

Share-based compensation expense 540 558 515

Deferred income taxes (258) (596) (411)

Loss/(gain) on sale of assets (16) 7 (678)

Goodwill and indefinite-lived intangible impairment charges — — 8,345

Change in accounts receivable (342) 634 (276)

Change in inventories (309) (637) (239)

Change in accounts payable, accrued and other liabilities 1,391 1,923 1,856

Change in other operating assets and liabilities (369) (710) (973)

Other 135 108 313

TOTAL OPERATING ACTIVITIES

18,371 17,403 15,242

INVESTING ACTIVITIES

Capital expenditures (2,787) (3,073) (3,347)

Proceeds from asset sales 42 30 394

Acquisitions, net of cash acquired (34) (58) (3,945)

Purchases of investment securities (55) — (158)

Proceeds from sales and maturities of investment securities — 6,151 3,628

Change in other investments — (5) (62)

TOTAL INVESTING ACTIVITIES

(2,834) 3,045 (3,490)

FINANCING ACTIVITIES

Dividends to shareholders (8,263) (7,789) (7,498)

Increases/(reductions) in short-term debt (3,333) 2,345 (2,215)

Additions to long-term debt 4,417 4,951 2,367

Reductions of long-term debt

(1)

(4,987) (2,447) (969)

Treasury stock purchases (11,009) (7,405) (5,003)

Impact of stock options and other 1,644 1,978 3,324

TOTAL FINANCING ACTIVITIES

(21,531) (8,367) (9,994)

EFFECT OF EXCHANGE RATE CHANGES ON CASH, CASH EQUIVALENTS

AND RESTRICTED CASH

101 (139) (88)

CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH

(5,893) 11,942 1,670

CASH, CASH EQUIVALENTS AND RESTRICTED CASH, END OF YEAR

$ 10,288 $ 16,181 $ 4,239

SUPPLEMENTAL DISCLOSURE

Cash payments for interest $ 531 $ 434 $ 497

Cash payments for income taxes 3,822 3,550 3,064

(1)

Includes early extinguishment of debt costs of $512 in 2021.

42 The Procter & Gamble Company

See accompanying Notes to Consolidated Financial Statements.

Accounting Waiver Sample Midterm - SOLUTION

1

Name

ACCOUNTING 6130

Sample Midterm Exam -- SOLUTION

Instructions:

• Please print your name in the space provided above

• The exam is open-book, open-notes

• The exam is to be done individually!

Question Points Possible Points Scored

Question I (Mechanics) 31

Question II (Miscellaneous) 20

Question III (Revenue Recognition) 21

Question IV (FS Analysis) 17

Question V (Cash Flow) 17

T

otal . 106

Accounting Waiver Sample Midterm - SOLUTION

2

Question I: (31 points) Journal Entries

Give me the Journal Entries for each of the following transactions / events.

Answer each of these independently

1. (3 pts) A firm borrows $10,000 in cash in the form of a long-term note.

Dr Cash 10,000

Cr Notes Payable 10,000

2. (3 pts) A firm buys Inventory on Credit for $20,000.

Dr Inventory 20,000

Cr Accounts Payable 20,000

3. (3 pts) A firm records $30,000 of Depreciation Expense.

Dr Depreciation Expense 30,000

Cr Accumulated Depreciation 30,000

4. (4 pts) Employees earn $40,000 in wages this year. Of this amount, $35,000 was paid in

cash and the remainder will be paid next year.

Dr Wage Expense 40,000

Cr Cash 35,000

Wages Payable 5,000

Accounting Waiver Sample Midterm - SOLUTION

3

5. (8 pts) A firm sells Inventory that originally cost them $60,000. The inventory had been

purchased and paid for last year. The firm receives $25,000 in Cash and also receives a

Receivable in the amount of $40,000.

• What are the journal entries this year?

Dr Cash 25,000

Accounts Receivable 40,000

Cr Sales Revenue 65,000

Dr COGS 60,000

Cr Inventory 60,000

• How does the above transaction show up on the cash flow statement? (Give me the effect

on income and the applicable adjusting entries, if any)

Impact on Net Income = Revenue – COGS = 65,000 – 60,000 = 5,000

Adjustments

Increase in Accounts Receivables (40,000)

Decrease in Inventory 60,000

Cash From Operations 25,000

6. (10 pts) A firm sells land that it had purchased many years ago for $100,000. It receives

shares of stock (from the selling company) valued at $900,000. The firm’s main business

does not involve buying and selling land.

• What are the journal entries?

Dr Common Stock 900,000

Cr Land 100,000

Gain on Sale 800,000

Note that the buyer was holding some of our shares worth $900,000. Therefore, we’re getting

some of our shares back. The Debit could have been to Treasury Stock as well.

If instead you interpreted the problem as saying the buyer gave 900,000 worth of his own stock,

then the debit would be to a Marketable Securities type account. This was perfectly fine too.

• Are any adjusting entries required on the cash flow statement? Explain.

Yes. Net Income, which is the starting point for cash from operations contains the gain of

$800,000. This is not cash so we have to adjust it out. We do this with a “negative

adjustment” – we subtract out the gain. Note that there is no cash at all from this transaction!

• Is a footnote to the cash flow statement required related to this transaction? Explain.

Yes, this is a noncash investing /financing activity

Accounting Waiver Sample Midterm - SOLUTION

4

Question II (20 points) Miscellaneous

Answer each of the following independently

1. (4 pts) Suppose the Beginning Balance of Inventory was $100,000. The firm purchased

$20,000 of inventory for cash and $30,000 of inventory on credit that it has not yet paid.

Ending Inventory was $40,000.

How much was the Cost of Goods Sold?

Ending Inv = Beg Inv + Cost of Purchases – COGS

40,000 = 100,000 + (20,000 + 30,000) – COGS

COGS = 110,000

Inventory went down by 60,000, so we much have sold 60,000 more than we bought. We

bough 50,000, so the COGS has to be 110,000

2. (8 pts) Suppose that Retained Earnings was $150,000 at the beginning of the year. During

the year, we did the following (all of this has already been entered into the accounts, and the

closing entries have taken place): Some of these might not be relevant!

Issued Shares (for cash) worth $ 40,000

Bought Back Shares (for cash) worth $ 20,000

Issued Long Term Debt (for cash) worth $ 17,000

Recognized Net Income of $ 90,000

Invested in Long Term Assets (for cash) worth $ 5,000

Sold Marketable Securities (for cash) worth $ 20,000

Declared and Paid Dividends of $ 30,000

(a) (4 pts) What was the ending balance for Retained Earnings?

Ending RE = Beg RE + Net Income – Dividends

= 150,000 + 90,000 – 30,000 = 150,000 + 60,000 = 210,000

(b) (4 pts) How much was Cash From Financing Activities?

Issued Shares gives us cash 40,000

Buying back shares costs us cash (20,000)

Issuing long term debt gives us cash 17,000

Paying a dividend costs us cash (30,000)

Cash from Financing 7,000

Accounting Waiver Sample Midterm - SOLUTION

5

3. (8 pts) Closing Entry - THIS IS INDEPENDENT OF THE PRIOR PROBLEMS

At the end of the year, the company’s books contain the following Trial Balances (All Adjusting

Entries have already been made). That is, all entries have been made except the closing entries.

Note that not all balance sheet accounts are shown.

Adjusted Trial Balance

Accounts Payable

100,000

Accumulated Depreciation and Amortization

200,000

Common Stock

350,000

Cost of Goods Sold

300,000

Depreciation and Amortization Expense

50,000

Dividends Payable

10,000

Interest Expense

40,000

Interest Payable

220,000

Inventory

140,,000

Litigation Loss

60,000

Retained Earnings

2,000,000

Sales Revenue

1,000,000

Selling and Administrative Expenses

400,000

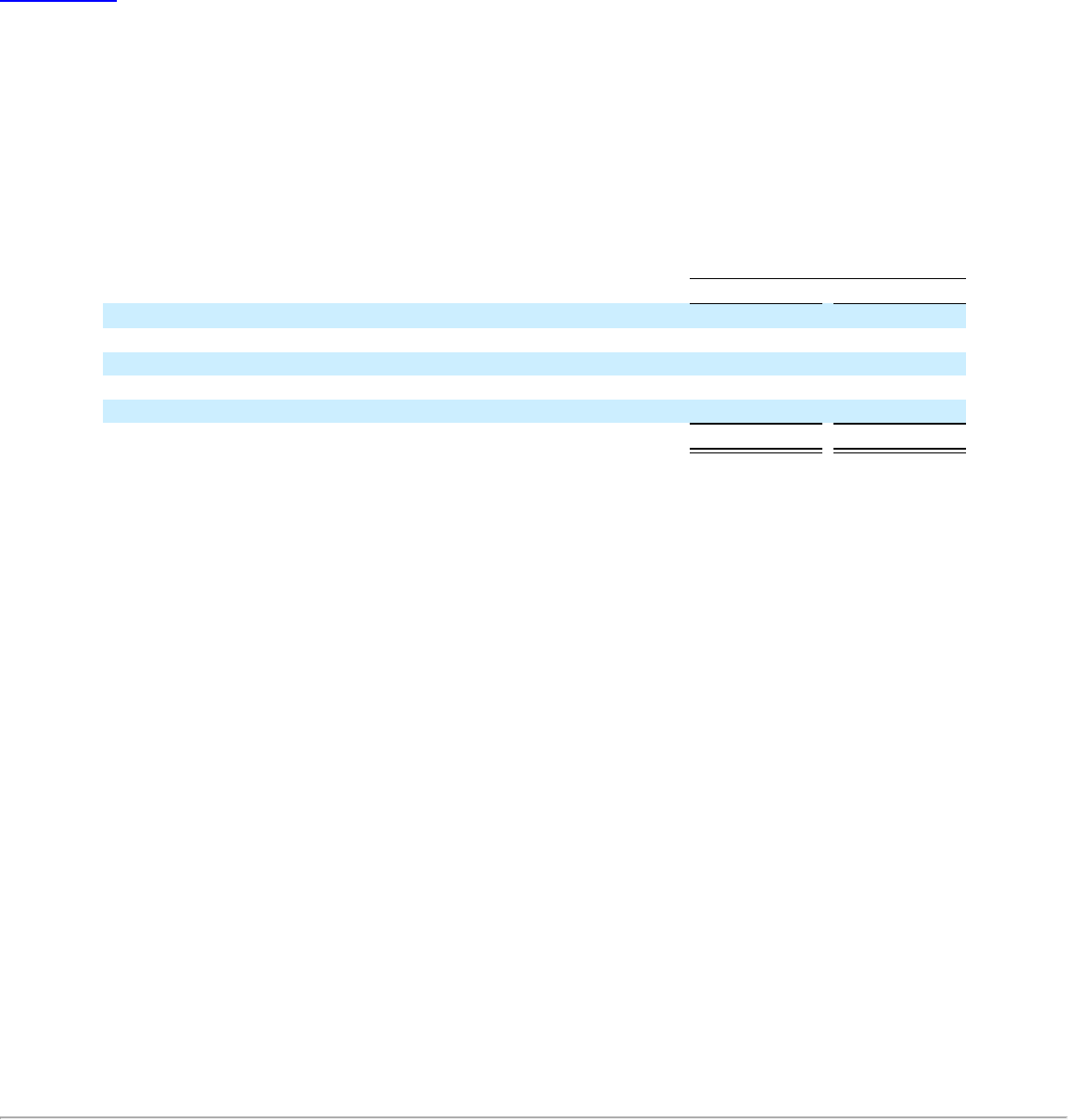

• (5 pts) What is the Closing Journal Entry for the year?

Account Titles

Debit

Credit

Sales Revenue

1,000,000

COGS

300,000

Selling and Admin Expenses

400,000

Depreciation and Amortiz Expense

50,000

Litigation Loss

60,000

Interest Expense

40,000

Retained Earnings (plug)

150,000

• (3 pts) How much was NET INCOME for the year? Be sure to indicate if it’s a

profit or it’s a loss.

Net Income = 1,000,000 – (300,000 + 400,000 + 50,000 + 60,000 + 40,000) = 150,000

Ending Balance of RE = Beginning Balance + NI = 2,000,000 +150,000 = 2,150,000

Accounting Waiver Sample Midterm - SOLUTION

6

Question III (21 points) – Revenue Recognition

On January 1, 2022, a firm signs a customer to a 4-year, noncancelable contract for subscription

services. The total cost is $4800, payable in annual installments. The service commences

immediately (on January 1, 2022). The bill each year is sent on January 1, and it is due in 30

days.

1. (4 pts) What journal entry (or entries) does the firm make on January 1, 2022? (if any)

On January 1 we commenced providing service and we sent a bill

Dr Accounts Receivable 1200 (=4800 / 4)

Cr Unearned Revenue 1200

You Could use Deferred Revenue or Advances from Customers account titles instead

Technically we could also record a day’s worth of revenue.

2. (3 pts) What journal entry (or entries) does the firm make when the customer makes the first

payment (if any)? Assume it was made on time.

Dr Cash 1200

Cr Accounts Receivable 1200

Note that receiving cash does not trigger any recognition of revenue.

3. (3 pts) What journal entry (or entries) does the firm make at the end of each month to record

pro-rata delivery of service (if any)?

Dr Unearned Revenue 100 (1/12

th

of the annual amount)

Sales Revenue 100

4. (3 pts) What is the balance for Unearned Revenue on the balance sheet on December 31,

2022?

ZERO – note that we haven’t billed anything for the next year yet

Accounting Waiver Sample Midterm - SOLUTION

7

5. (3 pts) How much cash has the firm not yet collected on this contract at the end of December

31, 2022?

$3600 – this is not on the balance sheet anywhere, but you could disclose it in a footnote

6. (5 pts) A consultant claims that if the firm billed for the entire 4 years up front at the

beginning of the contract (i.e., $4800), it could report revenue quicker. Do you agree?

Explain.

No. This speeds up the collection of cash (which could be a good thing), but it does not

speed up the recognition of revenue. We recognize revenue as we deliver the service (it will

still be $100 a month).

A negative consequence is that we may lose customers if the whole thing is due up front, or

we might have to lower the price (to compensate for the time value of money)

Accounting Waiver Sample Midterm - SOLUTION

8

Question IV (17 points) Financial Statement Analysis

Below are selected financial ratios for two years from a company. Note that ROE, which is an

important measure of firm profitability, is higher in year 2 than in year 1.

Year 2

Year 1

ROE = Net Income / Stockholders Equity

83.33%

73.91%

Quick Ratio = Quick Assets / Current Liabilities

0.75

0.69

Profit Margin = Net Income / Sales

12.50%

9.71%

Leverage Ratio Version A = Liabilities / Stockholders Equity

2.33

1.17

Leverage Ratio Version B = Assets / Stockholders Equity

3.33

2.17

Leverage Ratio Version C = Liabilities / Total Assets

0.70

0.54

Return on Assets = Net Income / Total Assets

25.00%

34.00%

Current Ratio = Current Assets / Current Liabilities

1.25

1.25

Asset Turnover Ratio = Sales / Assets

2.00

3.50

1. (13 pts) Given the ratios above, explain what the drivers were of the increase in ROE.

Provide as much detail as you can. Explain which specific ratios you are referring to, and

use the numbers to explain the magnitudes of the effects (not just the directions). NOTE

THAT I AM ONLY INTERESTED IN PROFITABILITY HERE – NOT LIQUIDITY OR

SOLVENCY. HINT – SOME OF THE RATIOS ARE IRRELEVANT!

First, we can decompose ROE into two drivers: Operating Performance and Financial Leverage

Operating Performance is Measured by ROA

Financial Leverage is Measure by Leverage Ratio B (Assets / Stockholders Equity)

ROE = Net Income = Net Income x Total Assets

Share Equity Assets Share Equity

Year 2

Year 1

ROE

83.33%

73.91%

ROA

25.00%

34.00%

Leverage Ratio B

3.33

2.17

Check: ROA x Lev

83.33%

73.91%

Note that the increase in ROE in year 2 is entirely driven by the increase in leverage! Operating

Performance (ROA) is actually worse.

The firm did worse with its assets (in terms of ROA) but used a lot of debt to leverage this into a

higher return for shareholders (but see the next part)

Accounting Waiver Sample Midterm - SOLUTION

9

Next, we can decompose ROA into two drivers: Profit Margin and Asset Turnover

ROA = Net Income = Net Income x Sales

Total Assets Sales Total Assets

Year 2

Year 1

ROA

25.00%

34.00%

Profit Margin

12.50%

9.71%

Asset Turnover

2.00

3.50

Check: PM x AT

25.00%

34.00%

Vulcan’s ROA in year 2 was lower despite a higher profit margin. This is because assets did not

generate as many dollars in sales as in year 1.

If we had more detailed data, we could explore the reasons for the higher profit margin (and if

we thought it was recurring). We could also look at why assets are not generating as much sales.

(maybe there is a big increase in assets – funded by debt – and it will take more time to see the

increase in sales? )

2. (4 pts) Based on the numbers above, are there any potential “negative consequences”

associated with how the firm increased its ROE? Explain.

One of the factors that caused ROE to go up is the higher leverage. Higher leverage means more

debt in the capital structure, which implies a greater risk of default.

Accounting Waiver Sample Midterm - SOLUTION

10

Question V – (17 points) Cash Flow Statement

Refer to the excerpts (contained at the back of this booklet) from the 2021 Annual Report

of Procter and Gamble (P&G)

1. (3 pts) How much did P&G spend on business acquisitions in 2019? NOTE THE YEAR!

From the Investing Section: Acquisitions 3945

2. (3 pts) In which year did Accounts Receivable increase the most? Explain.

An increase in receivables is a NEGATIVE adjustment on the cash flow statement

The largest negative adjustment is (342) in 2021

3. (3 pts) In which year did Depreciation and Amortization add the most cash flow? Explain.

Depreciation doesn’t add cash. This adjustment exists to offset the noncash charge in the

income statement related to depreciation

Accounting Waiver Sample Midterm - SOLUTION

11

(4 pts) P&G had a huge outflow of cash in 2021 related to FINANCING Activities. What were

the two types of financing activities for which P&G’s outflows were most different than for the

corresponding activity in 2020?

Comparing 2021 and 2020 in the Financing Section, the biggest differences are

Reduction in Short Term debt: (3333) in 2021 compared to +2,345 in 2020

That is, the incurred more short term debt in 2020, and bought it back (or paid it off) in

2021

Treasury stock repurchases: (11,009) in 2021 compared to (7,405) in 2020

They bought back a lot more of their own shares

4. (4 pts) For the three years of data provided, why are Cash From Operations and Net Income

most different from each other in 2019 compared to the other two years? I don’t want a

detailed dollar-for-dollar reconciliation; I want the biggest factor. Also, EXPLAIN WHY

this item causes income and cash to be different from each other.

Net Income in 2019: $ 3,966

Cash from Operations in 2019: $15,242

The biggest adjustment to get from NI to CFO is Goodwill and indefinite lived intangible

impairment charges of 8,345

These are long term assets that P&G wrote down in 2019. These reduce income in 2019.

However, these are not cash outflows, so the cash flow statement adds them back.

Note that even though these are not cash outflows this year, they are a signal that future cash

inflows will be lower.

Accounting Waiver Sample Final Exam Questions

Name _____________________________________________ _________

Accounting 6130

Sample Final Exam

• Please print your name in the space provided above

• The points allocated to each problem are noted at the bottom of this page and at the beginning

of each problem.

• The exam is open-book, open-notes

•

The exam is to be done individually!

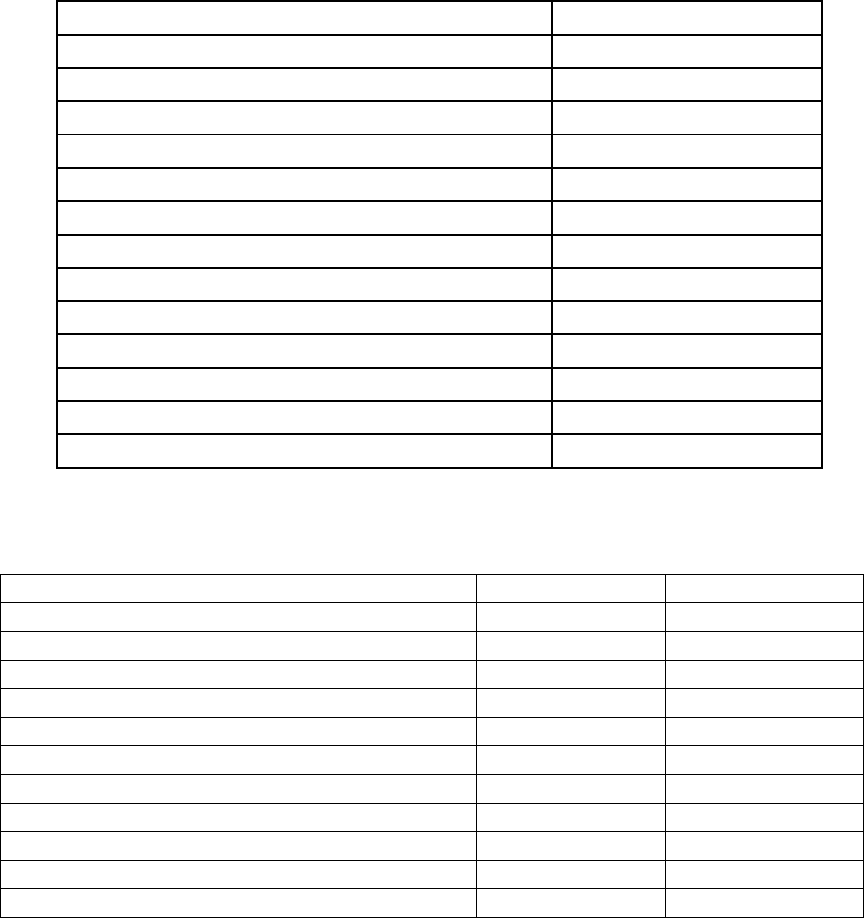

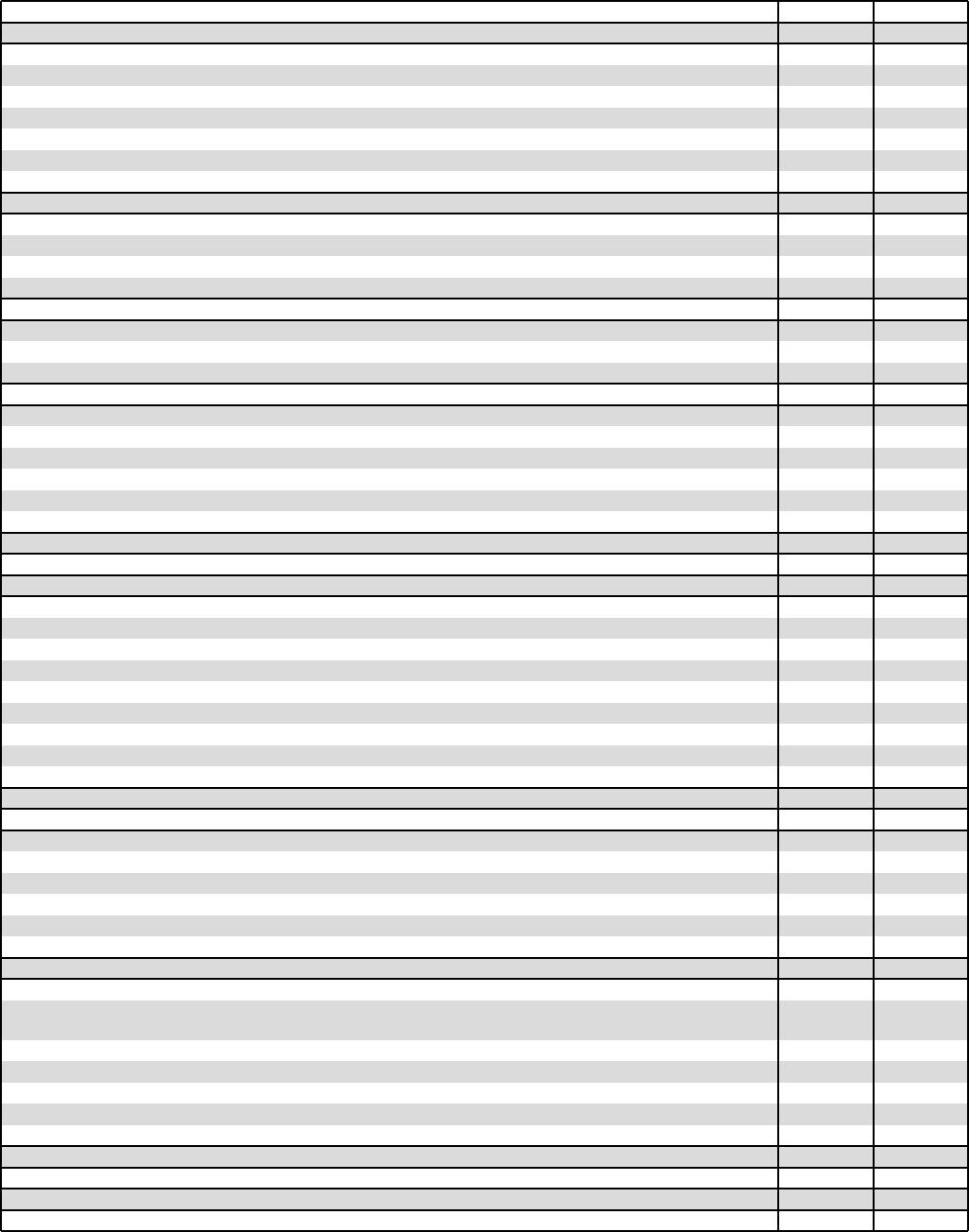

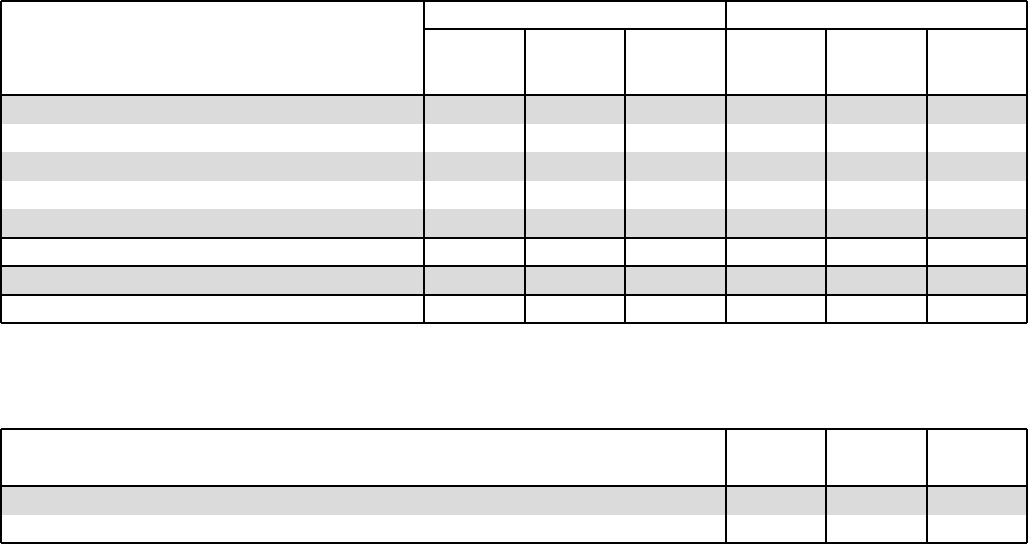

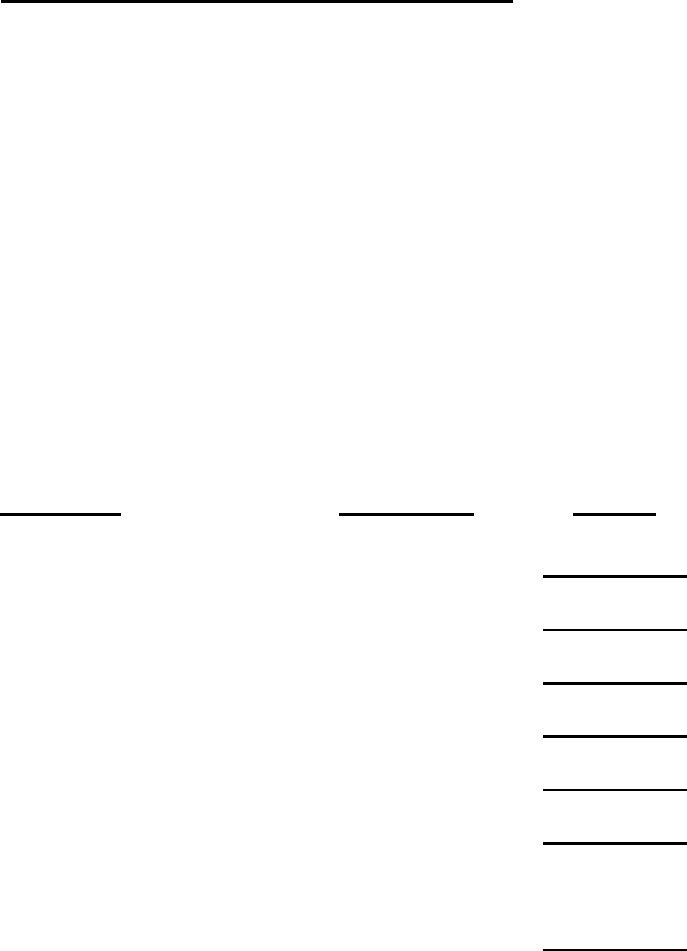

PROBLEM MAXIMUM SCORE

I. Accounts Receivable (Dow) 19

II. Long Term Assets (Dow) 21

III. Stockholders’ Equity (Dow) 25

IV. Income Taxes (Dow) 28

V. Inventory (Valero) 15

VI. Long Term Debt (Valero) 28

TOTAL 136

Accounting Waiver Sample Final Exam Questions

2

Question I (19 points) Accounts Receivable -- DOW

Refer to the excerpts from Dow’s financial statements. Assume a tax rate of 20% if necessary.

1. (3 pts) How much do customers owe to Dow at the end of 2021? Use the Trade Accounts

Receivable, not the “Other” Accounts Receivable. Also ignore Noncurrent Receivables.

2. (4 pts) What was the journal entry for Dow’s bad debt expense in 2021?

3. (3 pts) How much was Dow allowed to deduct on their income taxes related to bad debt /

writeoffs / customer defaults during 2021?

Accounting Waiver Sample Final Exam Questions

3

4. (5 pts) Assume that Dow’s bad debt expense is contained in their Selling, General and

Administrative Expense line on the income statement. How much did Dow collect from

customers in 2021?

5. (4 pts) Suppose (hypothetically) that a large set of Dow’s customers went bankrupt, and Dow

had to write off $40 (in millions) in Accounts Receivable. How would this likely affect pre-

tax income (if at all)? I’m not looking for a numerical calculation – just explain your

reasoning.

Accounting Waiver Sample Final Exam Questions

4

Question II. (21 Points) Long Term Assets -- DOW

Refer to the excerpts from Dow’s financial statements. If you need to assume a tax rate, use a

20% tax rate.

1. (2 pts) How much was Dow’s R&D Expense in 2021?

2. (5 pts) How much of Dow’s total “Depreciation and Amortization” is Depreciation?

3. (3 pts) How much Goodwill did Dow write down (impair) in 2019? (Note the year!)

4. (4 pts) Dow’s Goodwill also went down in 2021. Was this also from impairment?

Explain.

Accounting Waiver Sample Final Exam Questions

5

5. (3 pts) What is Dow’s largest identifiable intangible asset (not including goodwill) in

2021?

6. (4 pts) Accumulated Amortization for Dow’s “Software” intangible asset went DOWN,

not UP during 2021? How can this be?

Accounting Waiver Sample Final Exam Questions

6

Question III (25 points) Shareholders’ Equity -- DOW

Refer to the excerpts from Dow’s financial statements. If you need to assume a tax rate, use a

20% tax rate.

1. (2 pts) What is the par value per share of Dow’s common shares?

2. (3 pts) How many common shares outstanding does Dow have at the END of 2021?

3. (3 pts) What is the average price Dow has paid for the Treasury shares still listed on its

balance sheet at the end of 2021? (not how much did they pay IN 2021)

4. (2 pts) How much did Dow pay (in cash) in dividends to stockholders in 2021?

Accounting Waiver Sample Final Exam Questions

7

5. (2 pts) What is the balance for Accumulated Other Comprehensive Income (AOCI) at the end

of 2021?

6. (3 pts) Which of these has had the biggest impact on AOCI through the end of 2021 (not

necessarily DURING 2021)? (Circle one)

• Unrealized Gains and Losses on Investments

• Cumulative Translation Adjustment (on foreign assets and liabilities)

• Pensions and Other Post Retirement Benefits

• Derivatives

7. (2 pts) How much in stock-based compensation expense did Dow recognize during 2021?

8. (3 pts) How many exercisable options does Dow have at the end of 2021?

Accounting Waiver Sample Final Exam Questions

8

9. (5 pts) Suppose Dow grants employees new options this year (e.g., Year 1) with an exercise

price equal the market price at the date of grant. The options have a three-year vesting period.

During Year 2, Dow’s stock price goes up. Explain TWO reasons why these options lower

Dow’s DILUTED Earnings Per Share in Year 2. (no numerical calculations are needed)

Accounting Waiver Sample Final Exam Questions

9

Question IV (28 points) Income Taxes -- DOW

Refer to the excerpts from Dow’s financial statements. If you need to assume a tax rate, use a

20% tax rate. (Of course, if you’re asked to calculate a tax rate, 20% is probably not the right

answer for this question).

1. (2 pts) How much is DOW’s income tax expense (on continuing operations) in year

2021? (You do not need to separately provide Federal, State and Foreign tax expenses, just the

total). Be sure to indicate if this is an expense or a benefit.

2. (2 pts) How much is DOW’s Current Portion of their Income Tax Expense in 2021?

(You do not need to separately provide Federal, State and Foreign components of this, just the

total). Be sure to indicate if this is an expense or a benefit.

3. (3 pts) What was Dow’s effective tax rate in 2021?

4. (5 pts) Calculate Dow’s “cash effective tax rate” in 2021. This is the ratio of “cash taxes

paid” to Pre-tax Book Income. (this is what the new tax bill will look at to establish a

minimum tax).

Accounting Waiver Sample Final Exam Questions

10

5. (4 pts) Did Dow face a higher or lower tax rate on its foreign income relative to the US federal

rate of 21% in 2021? Explain.

6. (4 pts) What is the biggest reason why Dow’s effective tax rate is so much HIGHER than

the US Federal rate in 2020? (NOTE THE YEAR!) Give me the “line item” and explain why

this increases Dow’s effective tax rate

Accounting Waiver Sample Final Exam Questions

11

7. (4 pts) Dow’s pre-tax book income is negative in 2019 (note the year). Do you think the

income they reported to taxing authorities in 2019 was negative? Explain.

8. (4 pts) How much of Dow’s Tax Operating Loss Carryforwards expire more than 5 years

from now? Give me a dollar amount. Does Dow’s calculation of this Deferred Tax Asset

reflect the time value of money? Explain.

Accounting Waiver Sample Final Exam Questions

12

V. Inventory (15 points) - VALERO

Refer to the excerpts from Valero Corporation’s financial statements. Valero is an Oil and Gas

Company. Assume a 20% tax rate if necessary.

1. (3 pts) How much is Valero’s LIFO Reserve at the end of 2021? (give me a number)

2. (4 pts) Valero’s pre-tax income in 2021 was $1,543 (in millions). What would their pre-

tax income have been in 2021 had they always been using FIFO for their inventory valuation?

(give me a number)

3. (4 pts) How much has Valero saved in taxes cumulatively through the end of 2021 through

the use of LIFO? (assume a 20% tax rate has always applied)

Accounting Waiver Sample Final Exam Questions

13

4. (4 pts) Valero’s footnotes report that in 2020 they experienced a Lower of Cost or Market

Adjustment. This is essentially a write-down of inventory. Explain why Inventory write

downs are less common for firms that use LIFO compared to firms that use FIFO.

Accounting Waiver Sample Final Exam Questions

14

Question VI (28 points) Long Term Debt -- VALERO

Refer to the excerpts from Valero’s financial statements. Valero is an Oil and Gas company. If

you need to assume a tax rate, use a 20% tax rate.

1. (3 pts) How much in LEASES are included in Valero’s Debt line of the balance sheet at the

end of 2021? (give me a dollar number)

2. (4 pts) If debt was issued at a discount, which of the following is true (Circle one)

• Interest Expense is smaller than Coupon Payment

• Interest Expense is equal to the Coupon Payment

• Interest Expense is greater than the Coupon Payment

3. (3 pts) What is the fair value of Valero’s debt (excluding leases) at the end of 2021? (give me a

dollar number)

4. (4 pts) Based on the comparison of Valero’s book value and fair value of their debt (excluding

leases), what has happened to market interest rates, on average, since their debt was issued?

(Circle one)

• Interest Rates Went Down

• Interest Rates Have Stayed the Same

• Interest Rates Went Up

Accounting Waiver Sample Final Exam Questions

15

5. (14 pts) Consider Valero’s 4% Senior Notes due in 2029. For convenience, assume that the

interest payments are due on June 30 and December 31. Therefore, this debt is due exactly 8

years (or 16 semi-annual periods) from the date of the financial statements. Suppose market

interest rates jumped to 10% at the end of December 31, 2021 (remember that we have to use

semi-annual compounding).

a. (4 pts) What is the semi-annual coupon payment that Valero makes on this debt?

b. (3 pts) What is the (updated) present value of the stream of coupon payments

Valero will be making on this debt (as assessed on December 31, 2021 – the date

the interest rates jumped up)?

c. (3 pts) What is the market value of this debt (on December 31, 2021)?

d. (4 pts) What effect does this spike in interest rates have on the book value of this

Senior Note? (circle one)

• Decreases the Book Value

• Has No Effect on the Book Value

• Increases the Book Value

ACCOUNTING 6130

Final Exam

Excerpts from Financing Statements

Note: This booklet contains excerpts from TWO sets of financial statements:

Dow and Valero

M

ake sure you’re referring to the correct set of financial statements when

answering a problem!

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________to__________

Commission

File Number

Exact Name of Registrant as Specified in its Charter,

Principal Office Address and Telephone Number

State of

Incorporation or

Organization

I.R.S. Employer

Identification No.

001-38646

Dow Inc.

Delaware 30-1128146

2211 H.H. Dow Way, Midland, MI 48674

(989) 636-1000

001-03433

The Dow Chemical Company

Delaware 38-1285128

2211 H.H. Dow Way, Midland, MI 48674

(989) 636-1000

Dow Inc. and Subsidiaries

Consolidated Statements of Income

(In millions, except per share amounts) For the years ended Dec 31,

2021 2020 2019

Net sales

$ 54,968 $ 38,542 $ 42,951

Cost of sales

44,191 33,346 36,657

Research and development expenses

857 768 765

Selling, general and administrative expenses

1,645 1,471 1,590

Amortization of intangibles

388 401 419

Restructuring, goodwill impairment and asset related charges - net

6 708 3,219

Integration and separation costs

— 239 1,063

Equity in earnings (losses) of nonconsolidated affiliates

975 (18) (94)

Sundry income (expense) - net

(35) 1,269 461

Interest income

55 38 81

Interest expense and amortization of debt discount

731 827 933

Income (loss) from continuing operations before income taxes

8,145 2,071 (1,247)

Provision for income taxes on continuing operations

1,740 777 470

Income (loss) from continuing operations, net of tax

6,405 1,294 (1,717)

Income from discontinued operations, net of tax

— — 445

Net income (loss)

6,405 1,294 (1,272)

Net income attributable to noncontrolling interests

94 69 87

Net income (loss) available for Dow Inc. common stockholders

$ 6,311 $ 1,225 $ (1,359)

Per common share data:

Earnings (loss) per common share from continuing operations - basic

$ 8.44 $ 1.64 $ (2.42)

Earnings per common share from discontinued operations - basic

— — 0.58

Earnings (loss) per common share - basic

$ 8.44 $ 1.64 $ (1.84)

Earnings (loss) per common share from continuing operations - diluted

$ 8.38 $ 1.64 $ (2.42)

Earnings per common share from discontinued operations - diluted

— — 0.58

Earnings (loss) per common share - diluted

$ 8.38 $ 1.64 $ (1.84)

Weighted-average common shares outstanding - basic

743.6 740.5 742.5

Weighted-average common shares outstanding - diluted

749.0 742.3 742.5

See Notes to the Consolidated Financial Statements.

73

Dow Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(In millions) For the years ended Dec 31,

2021 2020 2019

Net income (loss)

$ 6,405 $ 1,294 $ (1,272)

Other comprehensive income (loss), net of tax

Unrealized gains (losses) on investments

(45) 40 115

Cumulative translation adjustments

(425) 205 (32)

Pension and other postretirement benefit plans

2,225 (778) (899)

Derivative instruments

123 (76) (338)

Total other comprehensive income (loss)

1,878 (609) (1,154)

Comprehensive income (loss)

8,283 685 (2,426)

Comprehensive income attributable to noncontrolling interests, net of tax

94 69 99

Comprehensive income (loss) attributable to Dow Inc.

$ 8,189 $ 616 $ (2,525)

See Notes to the Consolidated Financial Statements.

74

Dow Inc. and Subsidiaries

Consolidated Balance Sheets

(In millions, except share amounts) At Dec 31,

2021 2020

Assets

Current Assets

Cash and cash equivalents

$ 2,988 $ 5,104

Accounts and notes receivable:

Trade (net of allowance for doubtful receivables - 2021: $54; 2020: $51)

6,841 5,090

Other

2,713 2,300

Inventories

7,372 5,701

Other current assets

934 889

Total current assets

20,848 19,084

Investments

Investment in nonconsolidated affiliates

2,045 1,327

Other investments (investments carried at fair value - 2021: $2,079; 2020: $1,674)

3,193 2,775

Noncurrent receivables

478 465

Total investments

5,716 4,567

Property

Property

57,604 56,325

Less: Accumulated depreciation

37,049 36,086

Net property

20,555 20,239

Other Assets

Goodwill

8,764 8,908

Other intangible assets (net of accumulated amortization - 2021: $4,725; 2020: $4,428)

2,881 3,352

Operating lease right-of-use assets

1,412 1,856

Deferred income tax assets

1,358 2,215

Deferred charges and other assets

1,456 1,249

Total other assets

15,871 17,580

Total Assets

$ 62,990 $ 61,470

Liabilities and Equity

Current Liabilities

Notes payable

$ 161 $ 156

Long-term debt due within one year

231 460

Accounts payable:

Trade

5,577 3,763

Other

2,839 2,126

Operating lease liabilities - current

314 416

Income taxes payable

623 397

Accrued and other current liabilities

3,481 3,790

Total current liabilities

13,226 11,108

Long-Term Debt

14,280 16,491

Other Noncurrent Liabilities

Deferred income tax liabilities

506 405

Pension and other postretirement benefits - noncurrent

7,557 11,648

Asbestos-related liabilities - noncurrent

931 1,013

Operating lease liabilities - noncurrent

1,149 1,521

Other noncurrent obligations

6,602 6,279

Total other noncurrent liabilities

16,745 20,866

Stockholders’ Equity

Common stock (authorized 5,000,000,000 shares of $0.01 par value each;

issued 2021: 764,226,882 shares; 2020: 755,993,198 shares) 8 8

Additional paid-in capital

8,151 7,595

Retained earnings

20,623 16,361

Accumulated other comprehensive loss

(8,977) (10,855)

Unearned ESOP shares

(15) (49)

Treasury stock at cost (2021: 29,011,573 shares; 2020: 12,803,303 shares)

(1,625) (625)

Dow Inc.’s stockholders’ equity

18,165 12,435

Noncontrolling interests

574 570

Total equity

18,739 13,005

Total Liabilities and Equity

$ 62,990 $ 61,470

See Notes to the Consolidated Financial Statements.

75

Dow Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In millions) For the years ended Dec 31, 2021 2020 2019

Operating Activities

Net income (loss) $ 6,405 $ 1,294 $ (1,272)

Less: Income from discontinued operations, net of tax — — 445

Income (loss) from continuing operations, net of tax 6,405 1,294 (1,717)

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

Depreciation and amortization 2,842 2,874 2,938

Provision (credit) for deferred income tax 278 258 (228)

Earnings of nonconsolidated affiliates less than (in excess of) dividends received (651) 443 1,114

Net periodic pension benefit cost 39 266 144

Pension contributions (1,219) (299) (261)

Net gain on sales of assets, businesses and investments

(105) (802) (81)

Restructuring, goodwill impairment and asset related charges - net 6 708 3,219

Other net loss 921 318 198

Changes in assets and liabilities, net of effects of acquired and divested companies:

Accounts and notes receivable (2,132) 171 1,253

Inventories (1,768) 515 668

Accounts payable 2,458 (84) (948)

Other assets and liabilities, net (5) 590 (586)

Cash provided by operating activities - continuing operations 7,069 6,252 5,713

Cash provided by (used for) operating activities - discontinued operations (60) (26) 217

Cash provided by operating activities 7,009 6,226 5,930

Investing Activities

Capital expenditures

(1,501) (1,252) (1,961)

Investment in gas field developments (92) (5) (76)

Purchases of previously leased assets

(694) (5) (9)

Proceeds from sales of property and businesses, net of cash divested 68 929 84

Acquisitions of property and businesses, net of cash acquired

(129) (130) —

Investments in and loans to nonconsolidated affiliates — (333) (638)

Distributions and loan repayments from nonconsolidated affiliates 51 7 89

Purchases of investments (1,366) (1,203) (899)

Proceeds from sales and maturities of investments 759 1,122 1,252

Other investing activities, net (10) 29 —

Cash used for investing activities - continuing operations (2,914) (841) (2,158)

Cash used for investing activities - discontinued operations — — (34)

Cash used for investing activities (2,914) (841) (2,192)

Financing Activities

Changes in short-term notes payable (48) (431) 307

Proceeds from issuance of short-term debt greater than three months 144 163 —

Payments on short-term debt greater than three months (130) (163) —

Proceeds from issuance of long-term debt 109 4,672 2,287

Payments on long-term debt (2,771) (4,653) (5,561)

Purchases of treasury stock (1,000) (125) (500)

Proceeds from issuance of stock 320 108 93

Transaction financing, debt issuance and other costs (537) (175) (119)

Employee taxes paid for share-based payment arrangements (12) (27) (60)

Distributions to noncontrolling interests (73) (62) (77)

Purchases of noncontrolling interests — — (297)

Dividends paid to stockholders (2,073) (2,071) (1,550)

Dividends paid to DowDuPont Inc. — — (535)

Settlements and transfers related to separation from DowDuPont Inc. — — 1,935

Cash used for financing activities - continuing operations (6,071) (2,764) (4,077)

Cash used for financing activities - discontinued operations — — (18)

Cash used for financing activities (6,071) (2,764) (4,095)

Effect of exchange rate changes on cash, cash equivalents and restricted cash (99) 107 (27)

Summary

Increase (decrease) in cash, cash equivalents and restricted cash (2,075) 2,728 (384)

Cash, cash equivalents and restricted cash at beginning of year 5,108 2,380 2,764

Cash, cash equivalents and restricted cash at end of year $ 3,033 $ 5,108 $ 2,380

Less: Restricted cash and cash equivalents, included in "Other current assets" 45 4 13

Cash and cash equivalents at end of year $ 2,988 $ 5,104 $ 2,367

See Notes to the Consolidated Financial Statements.

76

Dow Inc. and Subsidiaries

Consolidated Statements of Equity

(In millions, except per share amounts) For the years ended Dec 31,

2021 2020 2019

Common Stock

Balance at beginning of year $ 8 $ 8 $ —

Common stock issued — — 8

Balance at end of year 8 8 8

Additional Paid-in Capital

Balance at beginning of year 7,595 7,325 7,042

Common stock issued / sold 320 108 57

Issuance of parent company stock - DowDuPont Inc. — — 28

Stock-based compensation and allocation of ESOP shares 236 162 235

Other — — (37)

Balance at end of year 8,151 7,595 7,325

Retained Earnings

Balance at beginning of year 16,361 17,045 35,460

Net income (loss) available for Dow Inc.'s common stockholders 6,311 1,225 (1,359)

Dividends to stockholders (2,073) (2,071) (1,550)

Dividends to DowDuPont Inc. — — (535)

Common control transaction 46 177 (14,806)

Adoption of accounting standards — — (151)

Other (22) (15) (14)

Balance at end of year 20,623 16,361 17,045

Accumulated Other Comprehensive Loss

Balance at beginning of year (10,855) (10,246) (9,885)

Other comprehensive income (loss) 1,878 (609) (1,154)

Common control transaction — — 793

Balance at end of year (8,977) (10,855) (10,246)

Unearned ESOP Shares

Balance at beginning of year (49) (91) (134)

Stock-based compensation and allocation of ESOP shares 34 42 45

ESOP shares acquired — — (2)

Balance at end of year (15) (49) (91)

Treasury Stock

Balance at beginning of year (625) (500) —

Treasury stock purchases (1,000) (125) (500)

Balance at end of year (1,625) (625) (500)

Dow Inc.'s stockholders' equity 18,165 12,435 13,541

Noncontrolling Interests 574 570 553

Total Equity $ 18,739 $ 13,005 $ 14,094

Dividends declared per share of common stock $ 2.80 $ 2.80 $ 2.10

See Notes to the Consolidated Financial Statements.

77

NOTE 6 – RESTRUCTURING, GOODWILL IMPAIRMENT AND ASSET RELATED CHARGES - NET

The "Restructuring, goodwill impairment and asset related charges - net" line in the consolidated statements of

income is used to record charges for restructuring programs, goodwill impairments, and other asset related charges,

which includes other asset impairments.

95

2019 Goodwill Impairment

Upon completion of the goodwill impairment testing in the fourth quarter of 2019, the Company determined the

fair value of the Coatings & Performance Monomers reporting unit was lower than its carrying amount. As a result,

the Company recorded an impairment charge of $1,039 million in the fourth quarter of 2019, related to

Performance Materials & Coatings. See Note 13 for additional information.

Asset Related Charges

2020 Charges

In 2020, the Company recognized pretax impairment charges of $49 million, including additional pretax

impairment charges for capital additions made to a bio-ethanol manufacturing facility in Santa Vitoria, Minas

Gerais, Brazil ("Santa Vitoria"), which was impaired in 2017 and divested in 2020, as well as charges for

miscellaneous write-offs and write-downs of non-manufacturing assets and the write-down of certain corporate

leased equipment. The impairment charges related to Packaging & Specialty Plastics ($19 million),

Performance Materials & Coatings ($15 million) and Corporate ($15 million). See Note 23 for additional

information.

2019 Charges

the fourth quarter of 2019, upon completion of an evaluation of its equity method investment in Sadara Chemical

Company ("Sadara") for other-than-temporary impairment, the Company determined that its investment in

Sadara was other-than-temporarily impaired and it was written down to zero. Additionally, as part of Dow's

evaluation of Sadara, the Company reserved certain of its notes and accounts receivable with Sadara due to

uncertainty on the timing of collection. As a result, the Company recorded a $1,755 million charge, related to

Packaging & Specialty Plastics ($370 million), Industrial Intermediates & Infrastructure ($1,168 million) and

Corporate ($217 million). See Notes 12 and 23 for additional information.

97

Supplemental Cash Flow Information

The following table shows cash paid for interest and income taxes for the years ended December 31, 2021, 2020

and 2019:

Supplemental Cash Flow Information

2021 2020 2019

In millions

Cash paid during year for:

Interest

$ 801 $ 842 $ 993

Income taxes

$ 731 $ 518 $ 881

NOTE 8 – INCOME TAXES

The financial statements for Dow Inc. and TDCC are substantially similar, including the reporting of current and

deferred tax expense (benefit), provision for income taxes on continuing operations, and deferred tax asset and

liability balances. As a result, the following income tax discussion pertains to Dow Inc. only.

Geographic Allocation of Income and Provision for Income Taxes on

Continuing Operations

In millions

2021 2020 2019

Income (loss) from continuing operations before income taxes

Domestic

1

$ 1,523 $ (681) $ (1,196)

Foreign

2

6,622 2,752 (51)

Income (loss) from continuing operations before income taxes $ 8,145 $ 2,071 $ (1,247)

Current tax expense (benefit)

Federal $ (46) $ (176) $ (287)

State and local 48 4 25

Foreign 1,460 691 960

Total current tax expense $ 1,462 $ 519 $ 698

Deferred tax expense (benefit)

Federal $ 130 $ 184 $ 52

State and local 26 19 19

Foreign 122 55 (299)

Total deferred tax expense (benefit) $ 278 $ 258 $ (228)

Provision for income taxes on continuing operations $ 1,740 $ 777 $ 470

Income (loss) from continuing operations, net of tax $ 6,405 $ 1,294 $ (1,717)

1. The 2019 amount includes approximately $1.4 billion of expense related to goodwill impairment and environmental matters. See Notes 13 and

16 for additional information.

2. The 2019 amount includes approximately $1.8 billion of expense for Sadara related charges. See Note 12 for additional information.

99

Reconciliation to U.S. Statutory Rate

2021 2020

1

2019

1

Statutory U.S. federal income tax rate 21.0 % 21.0 % 21.0 %

Equity earnings effect (2.2) 0.2 (3.2)

Foreign income taxed at rates other than the statutory U.S. federal income tax

rate (1.3) (2.3) (14.8)

U.S. tax effect of foreign earnings and dividends 1.7 3.9 1.9

Unrecognized tax benefits 4.7 7.3 1.0

Divestitures

2

— (5.1) —

Changes in valuation allowances 2.6 12.6 —

Impact of tax reform

3

— — 11.1

Federal tax accrual adjustment

4

(5.3) 0.3 10.4

State and local income taxes 0.2 0.3 (4.4)

Sadara related charges

5

— — (29.5)

Goodwill impairment

6

— — (17.5)

Other - net — (0.7) (13.7)

Effective tax rate 21.4 % 37.5 % (37.7) %

1. Certain prior year rates have been adjusted to conform with the current year presentation.

2. The 2020 impact relates to the divestiture of a bio-ethanol manufacturing facility in Brazil. See Note 6 for additional information.

3. Includes the impact of tax reform in Switzerland and the United States.

4. The 2021 impact represents a capital loss incurred on an internal restructuring fully offset by a valuation allowance reported in "Changes in

valuation allowances" line item. The 2019 impact primarily relates to the favorable impact of the restoration of tax basis in assets, driven by a

court judgment that did not involve the Company.

5. See Note 12 for additional information.

6. See Note 13 for additional information.

The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) was enacted on March 27, 2020 in the

United States. While the CARES Act had no significant impact on the Company's provision for income taxes on

continuing operations in 2020, the Company filed a tax loss carryback claim for $291 million in accordance with the

provisions of the CARES Act in 2020. This resulted in an increase in "Accounts and notes receivable - other" and a

decrease in "Deferred income tax assets" in the consolidated balance sheets. In 2021, the Company received

$247 million of the tax loss carryback claim with the residual balance expected to be received in 2022.

In the fourth quarter of 2020, a valuation allowance of $260 million was recorded in the United States, primarily due

to filing of the final combined Dow and DuPont tax return and related unutilized foreign tax credits. In 2021, the

Company's strong earnings and revised projections resulted in a reversal of the valuation allowance.

Deferred Tax Balances at Dec 31

2021 2020

1

In millions

Assets Liabilities Assets Liabilities

Property $ 484 $ 3,150 $ 448 $ 3,337

Tax loss and credit carryforwards 1,784 — 2,004 —

Postretirement benefit obligations 1,753 303 2,712 250

Other accruals and reserves 1,487 191 1,542 78

Intangibles 108 556 124 638

Inventory 33 203 30 198

Investments 31 26 142 51

Other – net 1,093 101 858 196

Subtotal $ 6,773 $ 4,530 $ 7,860 $ 4,748

Valuation allowances (1,391) — (1,302) —

Total $ 5,382 $ 4,530 $ 6,558 $ 4,748

1. Certain prior year balances have been adjusted to conform with the current year presentation.

100

Operating Loss and Tax Credit Carryforwards at Dec 31

2021 2020

In millions

Assets Assets

Operating loss carryforwards

Expire within 5 years $ 240 $ 274

Expire after 5 years or indefinite expiration 817 1,031

Total operating loss carryforwards $ 1,057 $ 1,305

Tax credit carryforwards

Expire within 5 years $ 227 $ 434

Expire after 5 years or indefinite expiration 103 265

Total tax credit carryforwards $ 330 $ 699

Capital loss carryforwards

Expire within 5 years $ 397

$ —

Total tax loss and tax credit carryforwards $ 1,784 $ 2,004

101

NOTE 13 – GOODWILL AND OTHER INTANGIBLE ASSETS

The following table shows changes in the carrying amounts of goodwill by reportable segment for the years ended

December 31, 2021 and 2020:

Goodwill

Packaging &

Specialty

Plastics

Industrial

Intermediates &

Infrastructure

Performance

Materials &

Coatings Total

In millions

Balance at Jan 1, 2020 $ 5,109 $ 1,100 $ 2,587 $ 8,796

Foreign currency impact 12 4 106 122

Sale of rail infrastructure (2) — — (2)

Sale of marine and terminal infrastructure (4) (4) — (8)

Balance at Dec 31, 2020 $ 5,115 $ 1,100 $ 2,693 $ 8,908

Foreign currency impact (10) (4) (130) (144)

Balance at Dec 31, 2021 $ 5,105 $ 1,096 $ 2,563 $ 8,764

The separation from DowDuPont did not impact the composition of the Company's six reporting units: Coatings &

Performance Monomers, Consumer Solutions, Hydrocarbons & Energy, Industrial Solutions, Packaging and

Specialty Plastics and Polyurethanes & Construction Chemicals. The ECP businesses received as part of the

separation from DowDuPont are included in the Hydrocarbons & Energy and Packaging and Specialty Plastics

reporting units. At December 31, 2021, goodwill was carried by all reporting units except Coatings & Performance

Monomers (“C&PM”).

Goodwill Impairments

The carrying amounts of goodwill at December 31, 2021 and 2020 were net of accumulated impairments of

$309 million in Industrial Intermediates & Infrastructure and $2,530 million in Performance Materials & Coatings.

Goodwill Impairment Testing

The Company performs an impairment test of goodwill annually in the fourth quarter. In 2021, the Company

performed qualitative testing for all reporting units that carried goodwill. Based on the results of the qualitative

testing, the Company did not perform quantitative testing on any reporting units (one in 2020 and two in 2019). The

qualitative testing on the reporting units indicated that it was not more likely than not that fair value was less than

the carrying value for the reporting units.

The quantitative testing conducted in 2020 concluded that no goodwill impairments existed.

Upon completion of the quantitative testing in the fourth quarter of 2019, the Company determined the C&PM

reporting unit was impaired. During 2019, the C&PM reporting unit did not consistently meet expected financial

performance targets, primarily due to the industry’s increased captive use of coatings products, which led to volume

reductions; reduced margins for products across the portfolio due to changes in customer buying patterns and

supply and demand balances; as well as a continuous trend of customer consolidation in end-markets, which

reduced growth opportunities. As a result, the C&PM reporting unit lowered its future revenue and profitability

projections. The fair value of the C&PM reporting unit was determined using a discounted cash flow methodology

that reflected reductions in projected revenue growth rates due to lower sales volume and price assumptions, as

well as reductions to future growth rates. These discounted cash flows did not support the carrying value of the

C&PM reporting unit. As a result, the Company recorded a goodwill impairment charge of $1,039 million in the

fourth quarter of 2019, included in “Restructuring, goodwill impairment and asset related charges - net” in the

consolidated statements of income and related to the Performance Materials & Coatings segment. The carrying

value of the C&PM reporting unit's goodwill was zero at December 31, 2019. No other goodwill impairments were

identified as a result of the 2019 testing.

107

Other Intangible Assets

The following table provides information regarding the Company’s other intangible assets:

Other Intangible Assets at Dec 31

2021 2020

In millions

Gross

Carrying

Amount

Accum

Amort Net

Gross

Carrying

Amount

Accum

Amort Net

Intangible assets with finite lives:

Developed technology $ 2,637 $ (1,871) $ 766 $ 2,638 $ (1,677) $ 961

Software 1,396 (945) 451 1,489 (989) 500

Trademarks/tradenames 352 (344) 8 352 (343) 9

Customer-related 3,204 (1,565) 1,639 3,301 (1,419) 1,882

Total other intangible assets, finite lives $ 7,589 $ (4,725) $ 2,864 $ 7,780 $ (4,428) $ 3,352

In-process research and development 17 — 17 — — —

Total other intangible assets $ 7,606 $ (4,725) $ 2,881 $ 7,780 $ (4,428) $ 3,352

The following table provides information regarding amortization expense from continuing operations related to

intangible assets:

Amortization Expense from Continuing Operations

2021 2020 2019

In millions

Other intangible assets, excluding software $ 388 $ 401 $ 419

Software, included in "Cost of sales" $ 90 $ 96 $ 96

108

Accumulated Other Comprehensive Loss

The changes in each component of AOCL for the years ended December 31, 2021, 2020 and 2019 were as follows:

Accumulated Other Comprehensive Loss

2021 2020 2019

In millions

Unrealized Gains (Losses) on Investments

Beginning balance $ 104 $ 64 $ (51)

Unrealized gains (losses) on investments (21) 104 178

Tax (expense) benefit 5 (23) (38)

Net unrealized gains (losses) on investments (16) 81 140

(Gains) losses reclassified from AOCL to net income

1

(38) (54) (33)

Tax expense (benefit)

2

9 13 8

Net (gains) losses reclassified from AOCL to net income (29) (41) (25)

Other comprehensive income (loss), net of tax (45) 40 115

Ending balance $ 59 $ 104 $ 64

Cumulative Translation Adjustment

Beginning balance $ (930) $ (1,135) $ (1,813)

Gains (losses) on foreign currency translation (375) 227 59

Tax (expense) benefit (40) 25 (2)

Net gains (losses) on foreign currency translation (415) 252 57

(Gains) losses reclassified from AOCL to net income

3

(10) (47) (89)

Other comprehensive income (loss), net of tax (425) 205 (32)

Impact of common control transaction

4

— — 710

Ending balance $ (1,355) $ (930) $ (1,135)

Pension and Other Postretirement Benefits

Beginning balance $ (9,559) $ (8,781) $ (7,965)

Gains (losses) arising during the period 2,094 (1,769) (1,699)

Tax (expense) benefit (464) 411 413

Net gains (losses) arising during the period 1,630 (1,358) (1,286)

Amortization of net loss and prior service credits reclassified from AOCL to net income

5

776 753 504

Tax expense (benefit)

2

(181) (173) (117)

Net loss and prior service credits reclassified from AOCL to net income 595 580 387

Other comprehensive income (loss), net of tax 2,225 (778) (899)

Impact of common control transaction

4

— — 83

Ending balance $ (7,334) $ (9,559) $ (8,781)

Derivative Instruments

Beginning balance $ (470) $ (394) $ (56)

Gains (losses) on derivative instruments 155 (96) (470)

Tax (expense) benefit 3 (1) 101

Net gains (losses) on derivative instruments 158 (97) (369)

(Gains) losses reclassified from AOCL to net income

6

(38) 30 44

Tax expense (benefit)

2

3 (9) (13)

Net (gains) losses reclassified from AOCL to net income (35) 21 31

Other comprehensive income (loss), net of tax 123 (76) (338)

Ending balance $ (347) $ (470) $ (394)

Total AOCL ending balance $ (8,977) $ (10,855) $ (10,246)

1. Reclassified to "Net sales" and "Sundry income (expense) - net."

2. Reclassified to "Provision for income taxes on continuing operations."

3. Reclassified to "Sundry income (expense) - net."

4. Reclassified to "Retained earnings" as a result of the separation from DowDuPont on April 1, 2019. See Note 3 for additional information.

5. These AOCL components are included in the computation of net periodic benefit cost of the Company's defined benefit pension and other

postretirement benefit plans. See Note 20 for additional information.

6. Reclassified to "Cost of sales," "Sundry income (expense) - net" and "Interest expense and amortization of debt discount."

126

NOTE 21 – STOCK-BASED COMPENSATION

The Company provides stock-based compensation in the form of the Employee Stock Purchase Plan, which grants

eligible employees the right to purchase shares of the Company's common stock at a discounted price.

The Company also grants stock-based compensation to employees and non-employee directors under stock

incentive plans, in the form of stock options, stock appreciation rights, PSUs and RSUs.

I

135

I

The total stock-based compensation expense included in continuing operations in the consolidated statements

of income was $276 million, $171 million and $158 million in 2021, 2020 and 2019, respectively. The income

tax benefits related to stock-based compensation arrangements were $62 million, $39 million and $36 million in

2021, 2020 and 2019, respectively. Amounts disclosed throughout the remainder of this footnote are inclusive of

activity attributable to both continuing operations and discontinued operations, as the impact of discontinued

operations is not significant.

Accounting for Stock-Based Compensation

The Company grants stock-based compensation awards that vest over a specified period or upon employees

meeting certain performance and/or retirement eligibility criteria. The fair value of equity instruments issued

to employees is measured on the grant date. The fair value of equity and liability instruments is expensed over

the vesting period or, in the case of retirement, from the grant date to the date on which retirement eligibility

provisions have been met and additional service is no longer required. The Company estimates expected forfeitures

based on historical activity.

136

Stock Incentive Plan

Stock Options

The Company grants stock options to certain employees, subject to certain annual and individual limits, with

terms of the grants fixed at the grant date. The exercise price of each stock option equals the market price of the

common stock on the grant date. Options vest from one year to three years and have a maximum term of ten

years. The following table summarizes stock option activity for 2021:

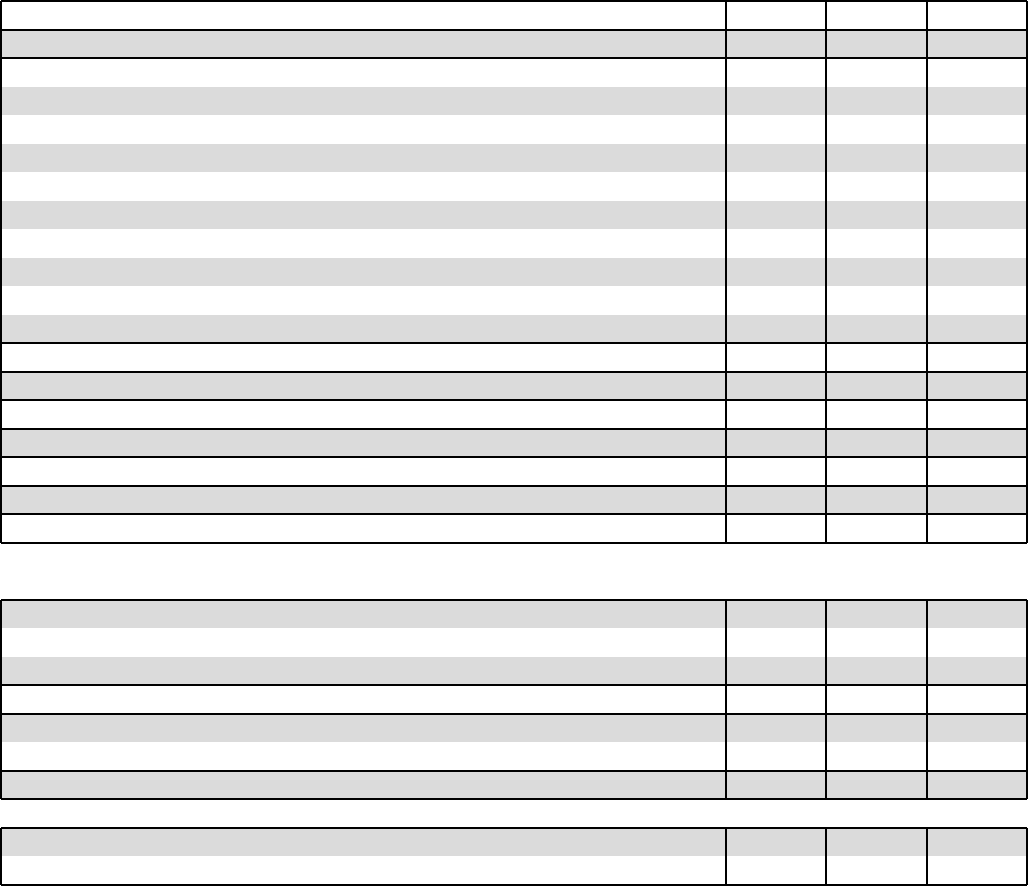

Stock Options

2021

Shares in thousands

Shares

Exercise

Price

1

Outstanding at Jan 1, 2021

20,252 $ 47.44

Granted

1,309 $ 57.67

Exercised

(5,179) $ 39.97

Forfeited/Expired

(102) $ 60.36

Outstanding at Dec 31, 2021

16,280 $ 50.56

Remaining contractual life in years

4.65

Aggregate intrinsic value in millions

$ 141

Exercisable at Dec 31, 2021

13,106 $ 49.96

Remaining contractual life in years

3.75

Aggregate intrinsic value in millions

$ 128

1. Weighted-average per share.

Additional Information about Stock Options

In millions, except per share amounts

2021 2020 2019

Weighted-average fair value per share of options granted

$ 10.37 $ 5.89 $ 7.99

Total compensation expense for stock option plans

$ 14 $ 22 $ 23

Related tax benefit

$ 3 $ 5 $ 5

Total amount of cash received from the exercise of options

$ 217 $ 108 $ 93

Total intrinsic value of options exercised

1

$ 121 $ 41 $ 77

Related tax benefit

$ 27 $ 9 $ 17

1. Difference between the market price at exercise and the price paid by the employee to exercise the options.

Total unrecognized compensation cost related to unvested stock option awards of $5 million at December 31, 2021,

is expected to be recognized over a weighted-average period of 1.47 years.

137

Dow Inc. and Subsidiaries

The Dow Chemical Company and Subsidiaries

Valuation and Qualifying Accounts

Schedule II

(In millions) For the years ended Dec 31,

2021 2020 2019

Accounts Receivable - Allowance for Doubtful Receivables

Balance at beginning of year $ 51 $ 45 $ 42

Additions charged to expenses

1

16 22 24

Deductions from reserves

2

(13) (16) (21)

Balance at end of year $ 54 $ 51 $ 45

Inventory - Obsolescence Reserve

Balance at beginning of year $ 23 $ 35 $ 23

Additions charged to expenses 3 2 19

Deductions from reserves

3

(12) (14) (7)

Balance at end of year $ 14 $ 23 $ 35

Reserves for Other Investments and Noncurrent Receivables

Balance at beginning of year $ 2,093 $ 2,215 $ 460

Additions charged to expenses

1

19 7 1,758

Deductions from reserves

4

(79) (129) (3)

Balance at end of year $ 2,033 $ 2,093 $ 2,215

Deferred Tax Assets - Valuation Allowance

Balance at beginning of year $ 1,302 $ 1,262 $ 1,225

Additions charged to expenses 201 313 140

Deductions from reserves (112) (273) (103)

Balance at end of year $ 1,391 $ 1,302 $ 1,262

1. In 2019, additions charged to expenses for "Accounts Receivable - Allowance for Doubtful Receivables" included $2 million and additions

charged to expenses for "Reserves for Other Investments and Noncurrent Receivables" included $1,753 million related to the Company's

investment in Sadara Chemical Company ("Sadara"). See Note 12 to the Consolidated Financial Statements for additional information.

2. Deductions included write-offs, recoveries, currency translation adjustments and other miscellaneous items.

3. Deductions included disposals and currency translation adjustments.

4. Deductions from reserves for "Reserves for Other Investments and Noncurrent Receivables" included $77 million in 2021 and 2020 related to

the Company's investment in Sadara. See Note 12 to the Consolidated Financial Statements for additional information.

167

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☑

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission file number 001-13175

VALERO ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

Delaware 74-1828067

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification No.)

One Valero Way

San Antonio, Texas 78249

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (210) 345-2000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol(s) Name of each exchange on which registered

Common stock VLO New York Stock Exchange

Table of Contents

VALERO ENERGY CORPORATION

CONSOLIDATED BALANCE SHEETS

(millions of dollars, except par value)

December 31,

2021 2020

ASSETS

Current assets:

Cash and cash equivalents $ 4,122 $ 3,313

Receivables, net 10,378 6,109

Inventories 6,265 6,038

Prepaid expenses and other 400 384

Total current assets 21,165 15,844

Property, plant, and equipment, at cost 49,072 46,967

Accumulated depreciation (18,225) (16,578)

Property, plant, and equipment, net 30,847 30,389

Deferred charges and other assets, net 5,876 5,541

Total assets

$ 57,888 $ 51,774

LIABILITIES AND EQUITY

Current liabilities:

Current portion of debt and finance lease obligations $ 1,264 $ 723

Accounts payable 12,495 6,082

Accrued expenses 1,253 994

Taxes other than income taxes payable 1,461 1,372

Income taxes payable 378 112

Total current liabilities 16,851 9,283

Debt and finance lease obligations, less current portion 12,606 13,954

Deferred income tax liabilities 5,210 5,275

Other long-term liabilities 3,404 3,620

Commitments and contingencies

Equity:

Valero Energy Corporation stockholders’ equity:

Common stock, $0.01 par value; 1,200,000,000 shares authorized;

673,501,593 and 673,501,593 shares issued 7 7

Additional paid-in capital 6,827 6,814

Treasury stock, at cost;

264,305,955 and 265,096,171 common shares (15,677) (15,719)

Retained earnings 28,281 28,953

Accumulated other comprehensive loss (1,008) (1,254)

Total Valero Energy Corporation stockholders’ equity 18,430 18,801

Noncontrolling interests 1,387 841

Total equity 19,817 19,642

Total liabilities and equity

$ 57,888 $ 51,774

See Notes to Consolidated Financial Statements.

71

Table of Contents

VALERO ENERGY CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

5. INVENTORIES

Inventories consisted of the following (in millions):

December 31,

2021 2020

Refinery feedstocks $ 1,995 $ 1,979

Refined petroleum products and blendstocks 3,567 3,425

Renewable diesel feedstocks and products 135 50

Ethanol feedstocks and products 273 297

Materials and supplies 295 287

Inventories

$ 6,265 $ 6,038

We compare the market value of inventories to their cost on an aggregate basis, excluding materials and supplies. In determining the market

value of our inventories, we assume that feedstocks are converted into refined products, which requires us to make estimates regarding the

refined products expected to be produced from those feedstocks and the conversion costs required to convert those feedstocks into refined

products. We also estimate the usual and customary transportation costs required to move the inventory from our plants to the appropriate

points of sale. We then apply an estimated selling price to our inventories. If the aggregate market value is less than the aggregate cost, we

recognize a loss for the difference in our statements of income.

The market value of our LIFO inventories fell below their LIFO inventory carrying amounts as of March 31, 2020, and as a result, we

recorded an LCM inventory valuation reserve of $2.5 billion in order to state our inventories at market.

As of December 31, 2021 and 2020, the replacement cost (market value) of LIFO inventories exceeded their LIFO carrying amounts by

$5.2 billion and $1.3 billion, respectively.

86

Table of Contents

VALERO ENERGY CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. DEBT AND FINANCE LEASE OBLIGATIONS

Debt, at stated values, and finance lease obligations consisted of the following (in millions):

Final

Maturity

December 31,

2021 2020

Credit facilities:

Valero Revolver 2024 $ — $ —

Canadian Revolver 2022 — —

Accounts Receivable Sales Facility 2022 — —

364-Day Revolving Credit Facility 2021 — —

DGD Revolver 2024 100 —

DGD Loan Agreement 2022 25 —

IEnova Revolver 2028 679 598

Public debt:

Valero Senior Notes

6.625% 2037 1,500 1,500

3.400% 2026 1,250 1,250

2.850% 2025 1,050 1,050

4.000% 2029 1,000 1,000

3.650% 2051 950 —

4.350% 2028 750 750

7.5% 2032 750 750

4.90% 2045 650 650

2.150% 2027 600 600

2.800% 2031 500 —

3.65% 2025 324 600

8.75% 2030 200 200

1.200% 2024 169 925

10.500% 2039 113 250

7.45% 2097 100 100

6.75% 2037 24 24

2.700% 2023 — 850

Floating Rate Notes at 1.3665% 2023 — 575

VLP Senior Notes

4.500% 2028 500 500

4.375% 2026 376 500

Gulf Opportunity Zone Revenue Bonds, Series 2010, 4.00% 2040 300 300

Debenture, 7.65% 2026 100 100

Other debt 2023 26 31

Net unamortized debt issuance costs and other (86) (90)

Total debt 11,950 13,013

Finance lease obligations (see Note 6) 1,920 1,664

Total debt and finance lease obligations 13,870 14,677

Less: Current portion 1,264 723

Debt and finance lease obligations, less current portion

$ 12,606 $ 13,954

<<<------------------------------------------------------------>>>

Table of Contents

VALERO ENERGY CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Other Financial Instruments

Financial instruments that we recognize in our balance sheets at their carrying amounts are shown in the following table along with their

associated fair values (in millions):

December 31, 2021 December 31, 2020

Fair Value