Goods and Services Tax (GST)

Logistics Sector - GTA, CFS & FF business

Saurabh Singhal (C.A., LL.B.)

Email: saurabh@iurislegal.in

Mobile: 9910 72 8800

Scope of Logistics Sector

• Transportation of goods

• Air Transport Services

• Ocean Transport Services

• Road Transport Services

• Rail Transport Services

• Courier Services

• Warehousing of goods

• Storage & warehousing solutions

including Cold Storage

• In-transit warehousing

• Pure renting of space for warehousing

2

• Clearance & Handling

• Custom House Agent services

• Terminal Handling

• Loading/Unloading

• Documentation charges

• Weighment charges

• Ground rent

• Haulage charges

• Stuffing charges

• Lift on/ Lift off charges

• Terminal access charges

• Etc.

Flow of Discussion

• Legal Provisions

• Rate Notifications

• Exemptions Notifications

• Reverse Charge Notifications

• Place of Supply (POS) Provisions

• Composite vs. Mixed supplies

• Goods Transportation Sector

• GTA – whether Consignment Note is

mandatory

• Ocean Transport – RCM on inbound

ocean freight

• CFS Business

• Ground Rent – whether Intra-state or

Inter-state supply

• FF Business

• Supply of services to Nepal & Bhutan

– whether export or exempt

• Handling services to foreign

customers – Export or taxable

• SEIS

• Foreign Trade benefit on terminal

handling

3

Legal Provisions

4

Rate Notification

5

HSN

Description

Rate

Conditions

Rail Transport

9965

Transport of goods by Indian

Railways

5%

ITC on goods not available

9965

Transport of goods in containers by

other than Indian Railways

12%

NIL

Ocean Transport

9965

Transport of good in a vessel

5%

Provided that credit of input tax charged on

goods (other than on ships, vessels including

bulk carriers and tankers) used in supplying

the service has not been taken.

Rate Notification

6

HSN

Description

Rate

Conditions

Road Transport

9965

Services of goods transport

agency (GTA)

5%

Provided that credit of input tax charged on

goods and services used in supplying the

service has not been taken.

or

9965

12%

Provided that the goods transport agency

opting to pay GST @ 12% under this entry

shall thenceforth be liable to pay GST @12%

on all the services of GTA supplied by it

9966

Rental services of transport

vehicles with operators (other

than passenger vehicles and

vessels)

18%

NIL

9973

Leasing or renting of goods

(without operator)

Same rate as on

the sale of

goods

NIL

7

HSN

Description

Rate

Conditions

Others

9965

Goods transport service other than above

18%

9965

Multimodal transportation of goods

“Multimodal transportation" means carriage of goods, by at

least two different modes of transport from the place of

acceptance of goods to the place of delivery of goods by a

multimodal transporter

.

Applicable only on domestic transportation. Applicable only

when transporter acts as a principal and not as agent of carrier.

12%

9968

Postal and courier services

18%

Rate Notification

Exemption Notification

8

HSN

Description

Conditions

Road Transport

9966 or

9973

Services by way of giving on hire to a GTA, a means

of transportation of goods

NIL

9965

Service by way of transportation of goods by road

other than by

-

(i)

GTA; and

(ii)

Courier

NIL

Air Transport

9965

Transportation of goods by air from customs station

of clearance in India to outside India

NIL

9965

Transportation of goods by air from outside India

upto the customs station of clearance in India

NIL

Exemption Notification

9

HSN

Description

Conditions

Ocean Transport

9965

Transportation of goods by a vessel from India to

outside India

NIL

Others

9965

Services by way of transportation of specified goods

(agricultural produce) by rail or vessel within India

NIL

9983

Services relating to loading, unloading, packing,

storage, or warehousing of agricultural produce

NIL

9965

Services by GTA by way of transport of specified

goods (agricultural produce) or upto specified value

in goods carriage

NIL

9965

Service by GTA to unregistered person

NIL

Reverse Charge Notification

10

Description of service

Supplier of service

Recipient of Service

Service by GTA (who has not opted for 12%)

to recipient other than unregistered person

GTA

Organized Sector such as

registered factory, society,

body corporate etc.

Any service supplied by any person who is

located in non

-taxable territory to any

person located in taxable territory

Any person located

in a non

-taxable

territory

Any person located in the

taxable territory.

Service supplied by a person located in non

-

taxable territory by way of transportation of

goods by a vessel from a place outside India

up to the customs station of clearance in

India.

Any person located

in a non

-taxable

territory

Importer as defined in the

Customs Act, 1962 located in

the taxable territory.

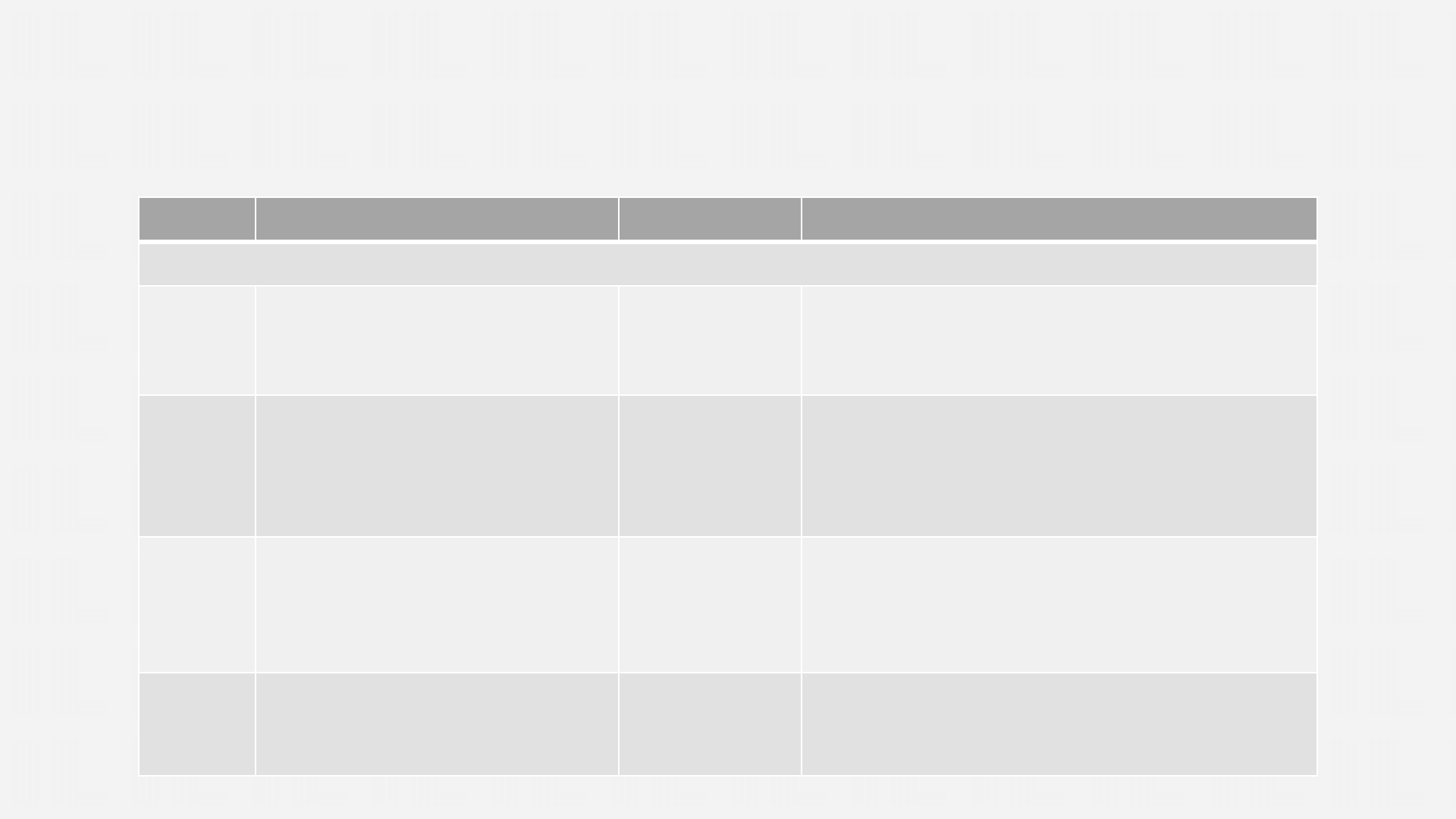

POS- General Rule

(Location of supplier and recipient in India)

gag

POS- General Rule

(Location of supplier and recipient in India)

General Rule

B2C Supply

B2B Supply

Location of

Recipient

Address on

record ?

Location of

Recipient

Location of

Supplier

Yes

No

Particulars Place of Supply

Supply

of services

(a)

directly in relation to an immovable

property,

including services provided by architects,

interior

decorators, surveyors, engineers and other

related

experts or estate agents, any service provided by

way

of grant of rights to use immovable property or

for

carrying out or co-ordination of construction work;

or

(a)

any service ancillary to the service referred above

Location of immovable

property, boat or vessel,

or intended to be located

POS - Immovable Property

(Location of supplier and recipient in India)

Particulars Place of Supply

Services by way of

–

Transportation of goods, including by mail

or courier

➢

to a registered person, shall be the

location of such person

➢

to a person other than a registered

person, shall be the location at which

such goods are handed over for their

transportation

➢ provided that where the transportation

of goods is to a place outside India, the

POS shall be destination of such goods

(w.e.f. 1

st

Feb 2019)

POS - Transportation of Goods

(Location of supplier and recipient in India)

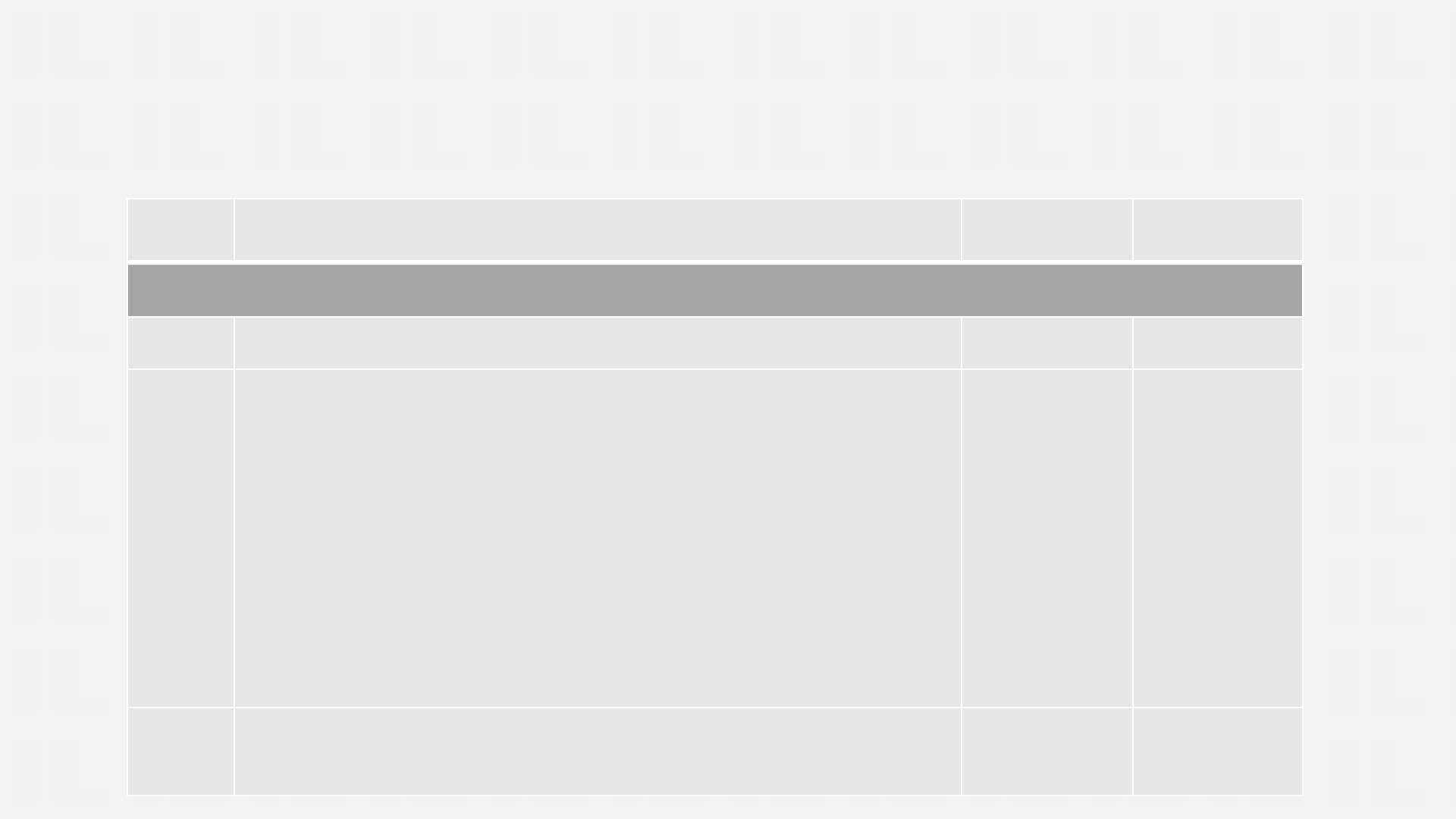

Location of the recipient of service

Location of service recipient is not available in the ordinary

course of business, then the location of supplier of service

General

Rule

POS - General Rule

(Location of supplier/recipient outside India)

Particulars Place of Supply

Supply

of services

(a)

directly in relation to an immovable

property,

including services provided by architects,

interior

decorators, surveyors, engineers and other

related

experts or estate agents, any service provided by

way

of grant of rights to use immovable property or

for

carrying out or co-ordination of construction work.

Location of immovable

property

POS - Immovable Property

(Location of supplier/recipient outside India)

Particulars Place of Supply

Services supplied

in respect of goods which are

required to be made

physically available by the

recipient of

services to the supplier of services in

order to provide the services.

Place

where service are

actually performed

Transportation of goods, other than by way of mail or

courier

Place of

destination of goods

POS – Handling and Transportation

(Location of supplier/recipient outside India)

Composite vs. Mixed Supply

‘Composite supply’ means a supply made by a taxable person to a recipient

consisting of two or more taxable supplies of goods or services or both, or any

combination thereof, which are naturally bundled and supplied in conjunction with

each other in the ordinary course of business, one of which is a principal supply.

A composite supply comprising of two or more supplies, one of which is a principal

supply, shall be treated as a supply of such principal supply.

17

Composite vs. Mixed Supply

‘Mixed supply’ means two or more individual supplies of goods or services, or any

combination thereof, made in conjunction with each other by a taxable person for a

single price where such supply does not constitute a composite supply.

A mixed supply comprising of two or more supplies shall be treated as a supply of

that particular supply which attracts the highest rate of tax.

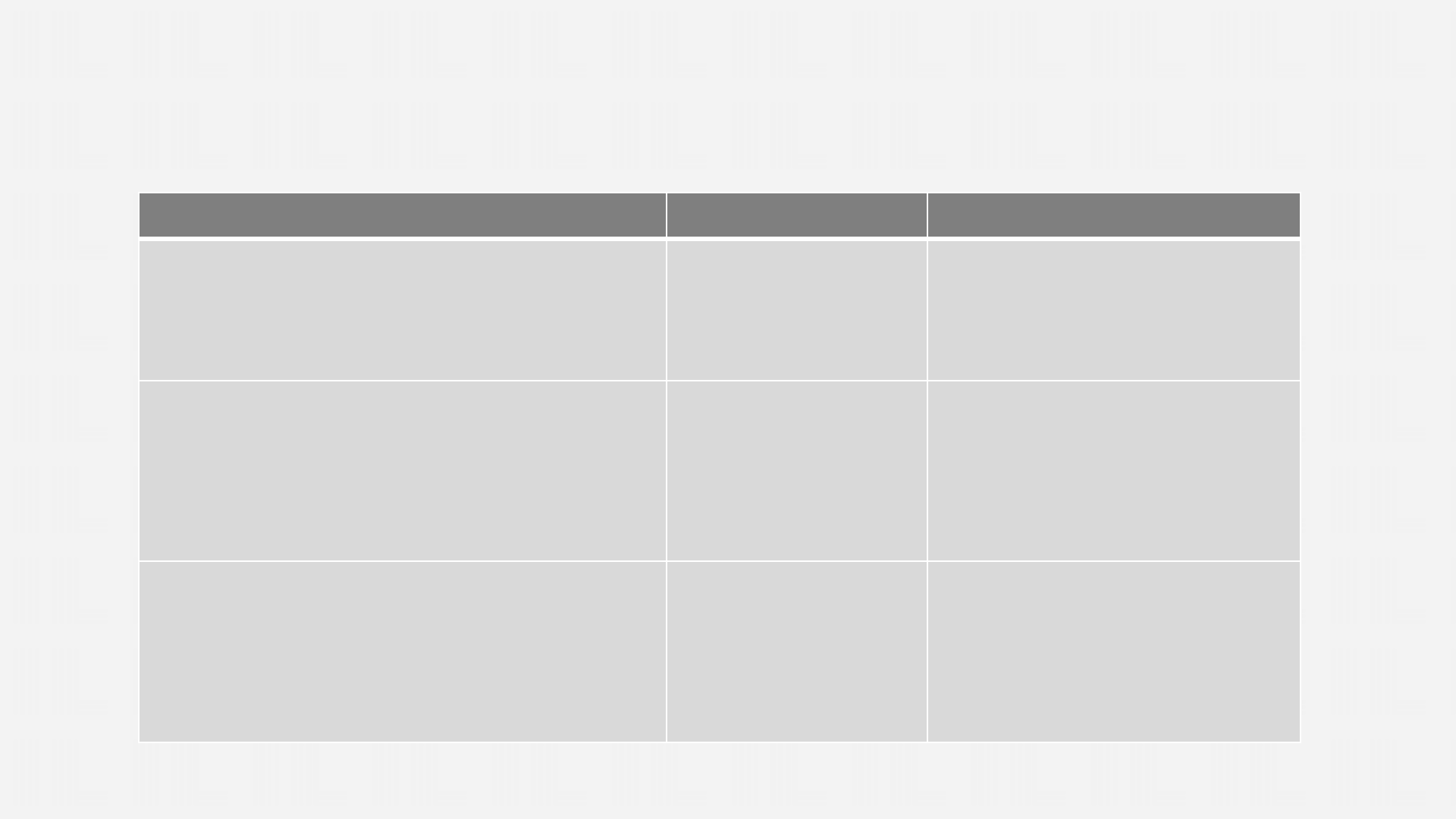

Road Transportation - GTA

Domestic Transportation

Customer

Means of Transportation

Taxability

Indian customer

(POS

- location of regd.

recipient)

By GTA

Other than by GTA

Taxable at 5% / 12%

Exempt

Foreign customer

(POS

- destination of goods)

By GTA

Other than by GTA

Taxable at 5% / 12%

Exempt

21

Customer

Means of

Transporta

tion

Place of Supply

Taxability

Indian customer

– Inbound

GTA

Location of regd.

recipient

Taxable

Indian customer

– Outbound

GTA

Outside India

Taxable

(Credit ?)

Foreign customer

– Inbound

GTA

India

Taxable

Foreign customer

– outbound

GTA

Outside India

Zero rated supply

International Transportation

Whether a person can negate GST liability

by not issuing Consignment Note ?

Who is a GTA ?

‘Good Transport Agency’ means -

• any person who provides service in relation to transportation of goods by road; and

• issues a consignment note, by whatever name called.

‘Consignment Note’ is not defined in GST Law. Reference may be made to Service Tax Law.

‘Consignment Note’ means a document-

• issued by a GTA;

• against the receipt of goods for the purpose of transport of goods by road in a goods carriage;

• which is serially numbered; and contains-

▪ Name of consignor and consignee;

▪ Registration number of goods carriage in which goods are transported;

▪ Details of goods transported;

▪ Details of the place of origin and destination.

23

Who is a GTA ?

Carriage by Road Act 2007

Common carriers are required to register with State Transport Department, in order for them

to legally engaged in transport business.

Common carrier covers a wide gamut of service providers including transporters, transport

agents, brokers, transport contractors, goods booking agents, that is, anybody involved in one

way or the other in the business of road transportation of goods.

Common carrier is required to issue a ‘goods receipt’, which has particulars similar to

consignment note.

Carriage by Road Act does not apply to Private Carrier. ‘Private Carrier’ is distinct from a

common carrier as it has the discretion to refuse to sell its services. A private carrier does not

make a general offer to carry goods and enters into a contract with other parties to carry

goods on mutually agreed terms.

Who is a GTA ?

CBEC Flyer No. 39 dated 1

st

January 2018

Thus, it can be seen that issuance of a consignment note is the sine-qua-non for a supplier

of service to be considered as a Goods Transport Agency. If such a consignment note is not

issued by the transporter, the service provider will not come within the ambit of goods

transport agency.

It is only the services of such GTA, who assumes agency functions, that is being brought into

the GST net. Individual truck/tempo operators who do not issue any consignment note are

not covered within the meaning of the term GTA. As a corollary, the services provided by

such individual transporters who do not issue a consignment note will be covered by the

entry at s. no. 18 of notification no. 12/2017-Central Tax (Rate), which is exempt from GST.

25

Can there be two consignment note for

single transportation ?

Two Consignment Notes for single transportation

M/s Liberty Translines – Maharashtra AAR

There cannot be two consignment notes for single transportation. Consignment note

is issued by the person who is appointed by consignor or consignee and who takes

the responsibility of the goods from consignor or consignee.

Subcontractor to a GTA cannot be a GTA but is a person providing trucks on hire.

Consignor

Transporter-1

Transporter-2

Can one legal entity have both RCM and

FCM ?

Single Entity – FCM & RCM both

29

GST is a registration based law. Each registration is considered as separate person.

A legal entity is bound to take separate registration in each state.

A legal entity having more than one place of business in one state, can opt take separate registration

for each place of business

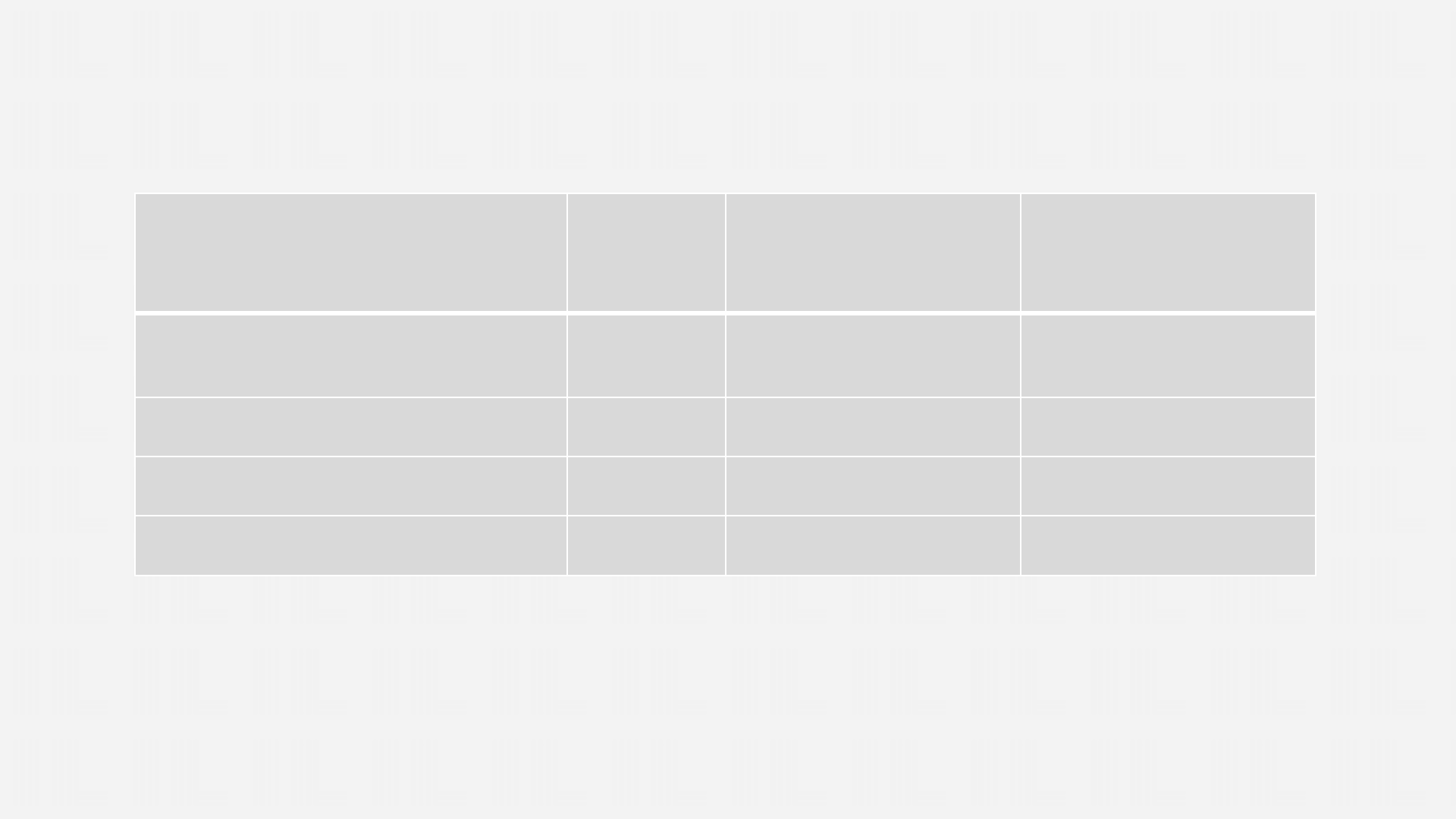

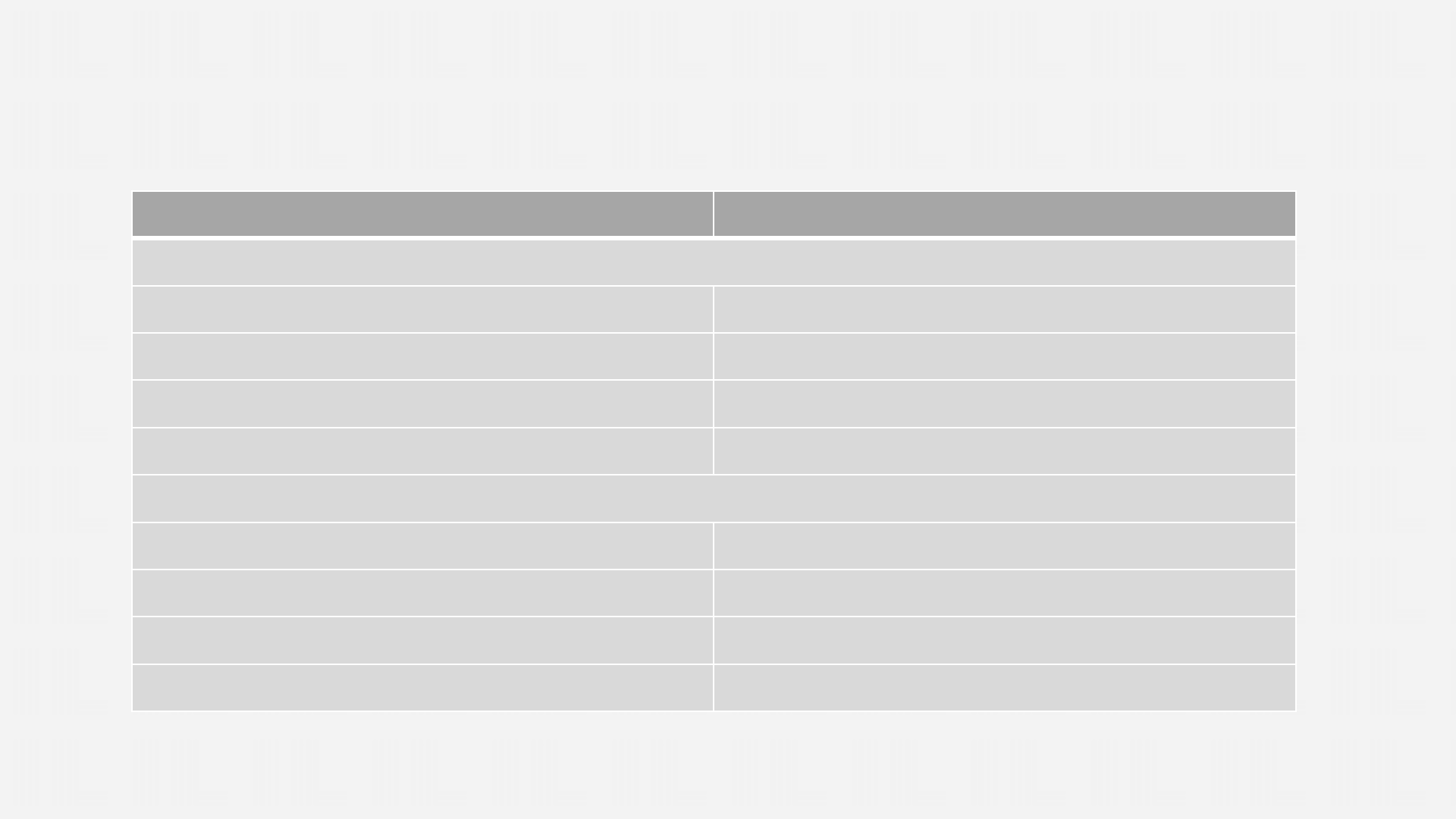

S.No

Situation

Allowability

1.

Entity A is doing

•

GTA RCM business in Haryana

•

GTA FCM business in Uttar Pradesh

Allow

2.

Entity B is doing GTA business in Haryana

•

GTA RCM business through its Office-1

•

GTA FCM business through its Office-2

Allow

Single Entity – FCM & RCM both

Implication where truck given by registration paying tax under

FCM to registration paying tax @5%?

Whether exemption available to giving on hire trucks to GTA –

mandatory or optional ?

30

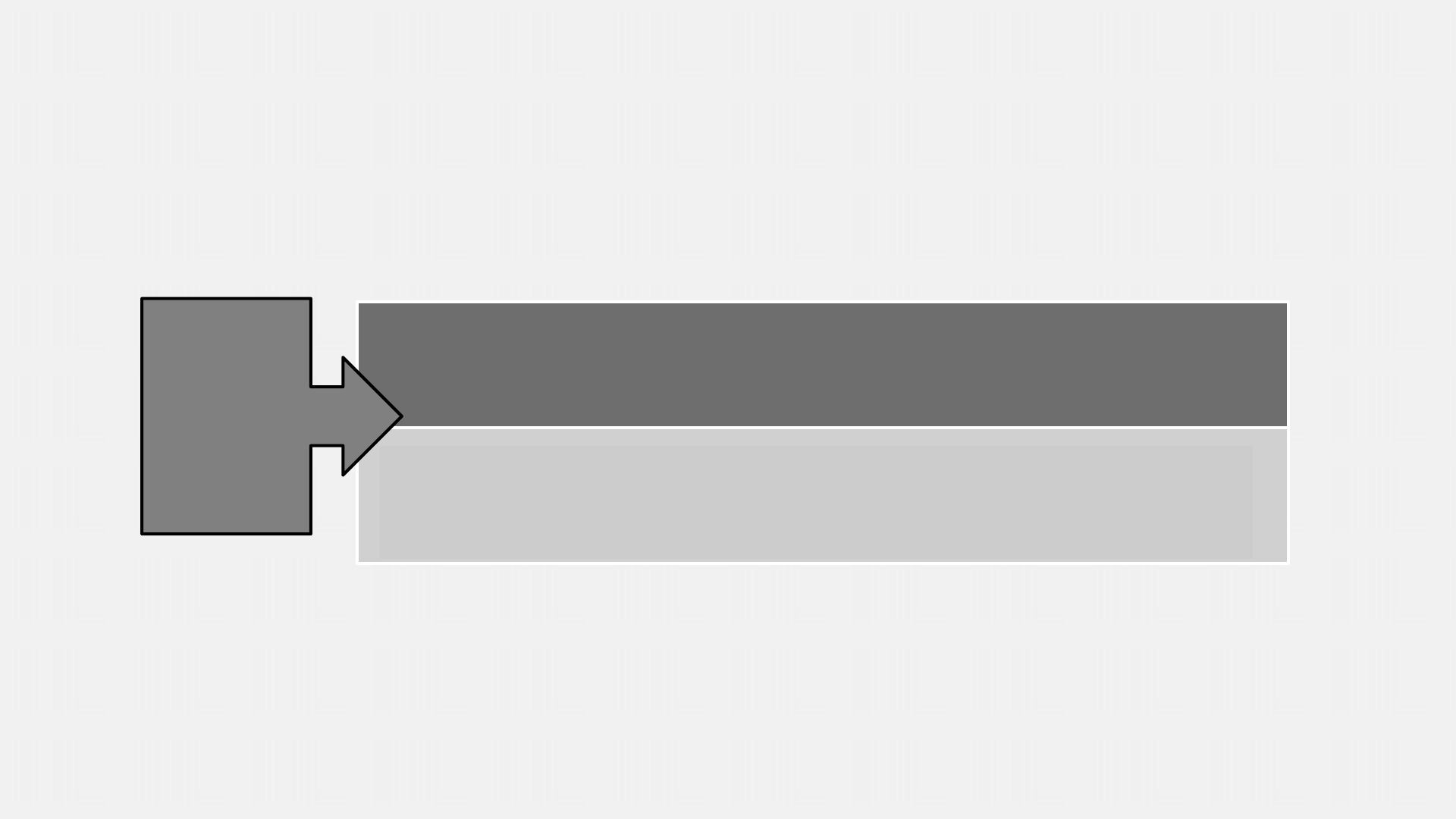

Centralized vs. Decentralized Billing?

Centralized vs. Decentralized Billing

32

Head Office

Delhi

Sales Office

UP

Sales Office

Haryana

Scenarios –

Scenario (i) – Movement from Delhi to Haryana

Scenario (ii) – Movement from UP to Maharashtra

Scenario (iii) – Movement from Punjab to West Bengal

Location of supplier of service-

(a) Registered place of business from where

services are provided;

(b) If services supplied from more than one

place of business, the place of business most

directly concerned with the service

provision.

Centralized vs. Decentralized Billing

Centralized billing-

(i) Consignment Note will be issued centrally.

(ii) Truck will have to be purchased at the address of centralized billing. If not, complete

credit will be lost.

(iii) Sometimes, it is not feasible to buy trucks at central location.

Decentralized billing-

(i) Either choose FCM or RCM uniformly at all locations;

(ii) If not, ensure FCM and RCM trucks are not used interchangeably.

Whether change from FCM to RCM

possible & vice-versa ?

Change from FCM to RCM

Rate Notification No. 8/2017-IT(R)

Provided that the goods transport agency opting to pay central tax @ 12% under this

entry shall, thenceforth, be liable to pay central tax @ 12% on all the services of GTA

supplied by it.

35

Change from RCM to FCM

ITC is available under FCM, whereas ITC was not available under RCM.

All inputs, input services and capital goods procured after changeover will be eligible for

ITC.

What happens to stock of inputs lying as on date of changeover and capital goods

purchased during RCM regime.

36

Change from RCM to FCM

Section 18(1)(d) – Provides for ITC when change from exempt supply to taxable

supply-

(i) on stock of goods on the date of changeover;

(ii) On capital goods exclusively used for exempt supply.

Above applies only on invoices not older than 1 year from date of changeover.

Exempt supply – Notification deems RCM GTA services as exempt supply for reversal

of proportionate ITC u/r 42 & 43.

37

STGU vs. TRUG ?

Effective control and possession.

Difference between Cargo Handling & GTA?

Difference between Courier & GTA?

Air & Ocean Transportation

Types of charges at Port

Rate of tax

Air Freight

Indian customer

- inbound

Exempt

Indian customer

- outbound

Exempt

Foreign customer

– inbound

Exempt

Foreign customer

– outbound

Zero rated

Ocean Freight

Indian customer

– inbound

Taxable at the rate of 5%

Indian customer

– outbound

Exempt

Foreign customer

– inbound

Taxable at the rate of 5%

Foreign customer

– outbound

Zero rated

International Transportation

Whether credit is required to be reversed

for exempt sea freight?

Whether freight forwarder is liable to pay

GST under Reverse Charge basis on inbound

sea freight ?

• FOB

• CIF ?

CFS Business

44

ICD / CFS - Meaning

• Inland Container Depots (ICDs) / Container Freight Stations (CFSs) are also called dry ports as they

handle all customs formalities related to import and export of goods at these locations.

• Section 2(12) of the Customs Act defines Inland Container Depot (ICD) as ‘Customs Port’. For the

purposes of customs law, CFS are also designated as ICD’s.

• ICD and CFS offer services for containerisation of break-bulk cargo and vice-versa. Most ICDs are

connected by rail to the respective gateway port, and this is a key difference between the ICD and

CFS. CFS(s) are typically adjoining or are in close proximity to the mother port and often do not have

rail connectivity.

• The primary functions of ICD or CFS may be summed up as under:

• Receipt and dispatch/delivery of cargo.

• Stuffing and stripping of containers.

• Transit operations by rail/road to and from serving ports.

• Customs clearance.

• Consolidation and desegregation of LCL cargo.

• Temporary storage of cargo and containers.

• Maintenance and repair of container units.

CFS - Procedure

Import Procedure

• For getting customs sealed containers from Port to CFS, Import General Manifest (IGM) is filed by

the steamer agent/liners/importers. Containers move to CFS under bank guarantee or bond.

• De-stuffing of goods can take place at CFS. Then a BOE is filed at Customs House located at ICD.

Assessment, examination, payment of duty, and out of charge issued for goods to be ultimately

released.

Export Procedure

• Goods are brought directly to CFS under a Shipping Bill. Export cargo in Less than Container Load

(LCL)/ Full Container Load (FCL) is received by the Custodian of CFS for safe custody.

• After stuffing of the goods, container is sealed by the Custom Officer and the same is removed from

CFS for export through the desired Port.

Whether various services provided by

CFS are composite supply / separate

supply / mixed supply ?

Ground Rent charged from

importers/shippers whether liable to

CGST+SGST ?

Validity of rebate charged by the

freight forwarder from CFS?

Tax rate on reserve space given in

CFS for specific use ?

Rate of tax on railway freight charges

from customers ?

E-way Bill compliances for CFS ?

Freight Forwarder

53

Freight Forwarder

• Freight Forwarder is a multi-function agent/operator who undertakes to handle the movement of

goods from point to point on behalf of the cargo owner.

• A freight forwarder, forwarder, or forwarding agent, is a person or company that organizes shipments

for individuals or corporations to get goods from the manufacturer or producer to a market, customer

or final point of distribution. Forwarders contract with a carrier or often multiple carriers to move the

goods.

• A forwarder does not move the goods but acts as an expert in the logistics network. The carriers can

use a variety of shipping modes, including ships, airplanes, trucks, and railroads, and often use

multiple modes for a single shipment. For example, the freight forwarder may arrange to have cargo

moved from a plant to an airport by truck, flown to the destination city and then moved from the

airport to a customer's building by another truck.

Whether FF should charge the same rate

as applied on various services, or

business support service rate @ 12% ?

How to deal with pure agent

expenses under GST ?

Services on goods to and from Nepal &

Bhutan ?

E-way Bill of transit cargo to/from Nepal

& Bhutan ?

Services to Nepal & Bhutan

➢ Supply of services to Nepal/ Bhutan does not fetch convertible foreign currency.

Consequently, supply of services to Nepal/ Bhutan did not qualify as export of

services.

➢ Circular No. 5/5/2017 dated 11

th

August 2017 clarifying that supply of service to

Nepal / Bhutan can be made without payment of tax. However, the circular

clarified that other export benefits would be available only if forex is received.

➢ Notification No. 42/2017-IT(R) dated 27

th

October 2017 providing that supply of

services to Nepal/ Bhutan with POS in Nepal/ Bhutan shall be exempt from GST.

➢ Corresponding amendments also made in CGST Rules to provide for ITC on

inputs/ input services used in supplying services to Nepal/ Bhutan (Rule 43)

58

Services on goods in-transit Nepal & Bhutan

Notification No. 9/2017-IT(R) – Exemption on supply of services

Sl. No.

Chapter, Section,

Heading, Group or

Service Code (Tariff)

Description of

Services

Rate (per cent.) Condition

10B Chapter 99

Supply of services

associated with

transit cargo to

Nepal and Bhutan

(landlocked

countries).

Nil Nil

Cargo Handling Service at

Indian port invoiced to foreign

party ?

Cargo Handling Service at

foreign port invoiced to Indian

party ?

Exemption available to

transportation and handling

services for agricultural produce?

Reversal of credit on capital

goods ?

Service Export from India Scheme

(SEIS)

64

SEIS – Service Exports from India Scheme

▪ Objective:

▪ Encourage and maximize export of Notified Services from India.

▪ Reason

▪ To provide rewards to exporters to offset infrastructural inefficiencies and associated cost.

▪ Eligibility

▪ Service providers of Notified Services located in India. Notified services and reward rates are

as given in Appendix 3D & Appendix 3E

▪ Benefit

▪ Duty scrips at notified rates on net foreign exchange earned (as per Appendix 3D & 3E).

▪ These scrips are freely transferable.

SEIS – Service Exports from India Scheme

▪ Type of services allowed

▪ Supply of service from India to any other country (Cross Border Trade)

▪ Supply of service from India to service consumers of any other country in India

(Consumption abroad)

▪ Eligibility Criteria

▪ Minimum net free foreign exchange earnings should be as below-

For Individual, Sole Proprietorship: US $10,000 in the year for rendering of services.

For Others: US $15,000 in the year for rendering of services.

SEIS – Service Exports from India Scheme

▪ Reward Calculation

▪ Reward shall be a percentage of Net Foreign Earned.

▪ Net Foreign Exchange = Gross Earnings of Foreign Exchange minus Total expenses/

payment/ remittances of foreign exchange by the IEC holder, relating to service sector in

FY.

▪ Payment in Indian Rupees for service charges earned on specified services, shall be

treated as deemed receipt in foreign exchange. The list of such services is as per

Appendix-3E.

Late Cut

Application for SEIS to be filed online for a Financial Year within 12 months from the end of FY.

Wherever any application for any fiscal/financial benefits under FTP, complete in all respects is received

after expiry of last date for submission of such application, the application may be considered after

imposing a late cut in the following manner.

1

Application received after the expiry of last date but within six months from the

last date

2%

2

Application received after six months from the prescribed date of submission

but not later than one year from the prescribed date

5%

3

Application received after 12 months from the prescribed date of submission

but not later than 2 years from the prescribed date

10%

Appendix - 3D

S. No.

Sectors

CPV Prov. Code

Rate from

01.04.2015 to

30.10.2017

Rate from

01.11.2017 to

31.03.2019

1.

Business Services

C.

Rental/Leasing services

without operators

a.

Relating to ships

83103

5

7

b.

Relating to aircraft

83104

5

7

c.

Relating to other transport

equipment

83101

83102

83109

5

7

d.

Relating to other machinery

and equipment

83106

-83109

5

7

Appendix - 3D

S. No.

Sectors

CPV Prov. Code

Rate from

01.04.2015 to

30.10.2017

Rate from

01.11.2017 to

31.03.2019

9.

Transport Services

A.

Maritime Transport Services

b.

Freight transportation

7212

5

7

c.

Rental of vessels with crew

7213

5

7

d.

Maintenance and repair of

vessels

8868

5

7

e.

Pushing and towing services

7214

5

7

f.

Supporting services

for

maritime transport

745

5

7

Appendix - 3D

S. No.

Sectors

CPV Prov. Code

Rate from

01.04.2015 to

30.10.2017

Rate from

01.11.2017 to

31.03.2019

9.

Transport Services

C.

Road Transport Services

b.

Freight transportation

7123

5

7

c.

Rental of commercial vehicles

with operator

7124

5

7

d.

Maintenance and repair of

road transport equipment

6112

8867

5

7

e.

Supporting services

for road

transport services

744

5

7

Appendix - 3D

S. No.

Sectors

CPV Prov. Code

Rate from

01.04.2015 to

30.10.2017

Rate from

01.11.2017 to

31.03.2019

9.

Transport Services

D.

Services auxiliary to all modes

of transport

a.

Cargo handling service

741

5

7

b.

Storage and warehouse

services

742

5

7

c.

Freight transport agency

services

748

5

7

Appendix – 3E

Payments which have been received in foreign exchange or which would have been otherwise received in

foreign exchange, but paid in INR, including through its agents in India out of the amount of remittance to

the overseas principal, or out of remittances to be sent by the overseas buyer, for services rendered in

customs notified area to a foreign liner as listed below would be considered as deemed to be received in

foreign exchange and shall be eligible for issuing rewards under SEIS.

Appendix – 3E

S. No.

Sectors

CPV Prov. Code

Rate from

01.04.2015 to

30.10.2017

Rate from

01.11.2017 to

31.03.2019

Transport Services

(A)

Maritime Support Services

c.

Rental of vessels with crew

7213

5

7

d.

Maintenance and repair of

vessels

8868

5

7

e.

Pushing and towing services

7214

5

7

f.

Supporting services

for

maritime transport

745

5

7

Thank You

Saurabh Singhal (C.A., LL.B.)

Email: saurabh@iurislegal.in

Mobile: 9910 72 8800