Environmental Defense Fund

This is a translation of the original Chinese version that was published on July 18, 2021.

A carbon market or emissions trading systems (ETS) is one of the main types of carbon

pricing. A carbon market is designed to cap the total level of greenhouse gas emissions and

allow those industries with low emissions to sell their extra allowances to larger emitters. By

creating supply and demand for emissions allowances, a carbon market can effectively

advance market price discovery for greenhouse gas emissions. The cap helps ensure that the

required emission reductions will take place to keep the emitters (in aggregate) within their

pre-allocated emission allowances.

China's national carbon market started online trading on July 16, 2021, a significant step to

help the country peak before 2030 and achieve carbon neutrality before 2060. Carbon

emissions from more than 2,000 power companies covered in the first batch of trading are

estimated to exceed four billion tonnes per year, making the market the world's largest in

terms of the amount of greenhouse gas emissions covered.

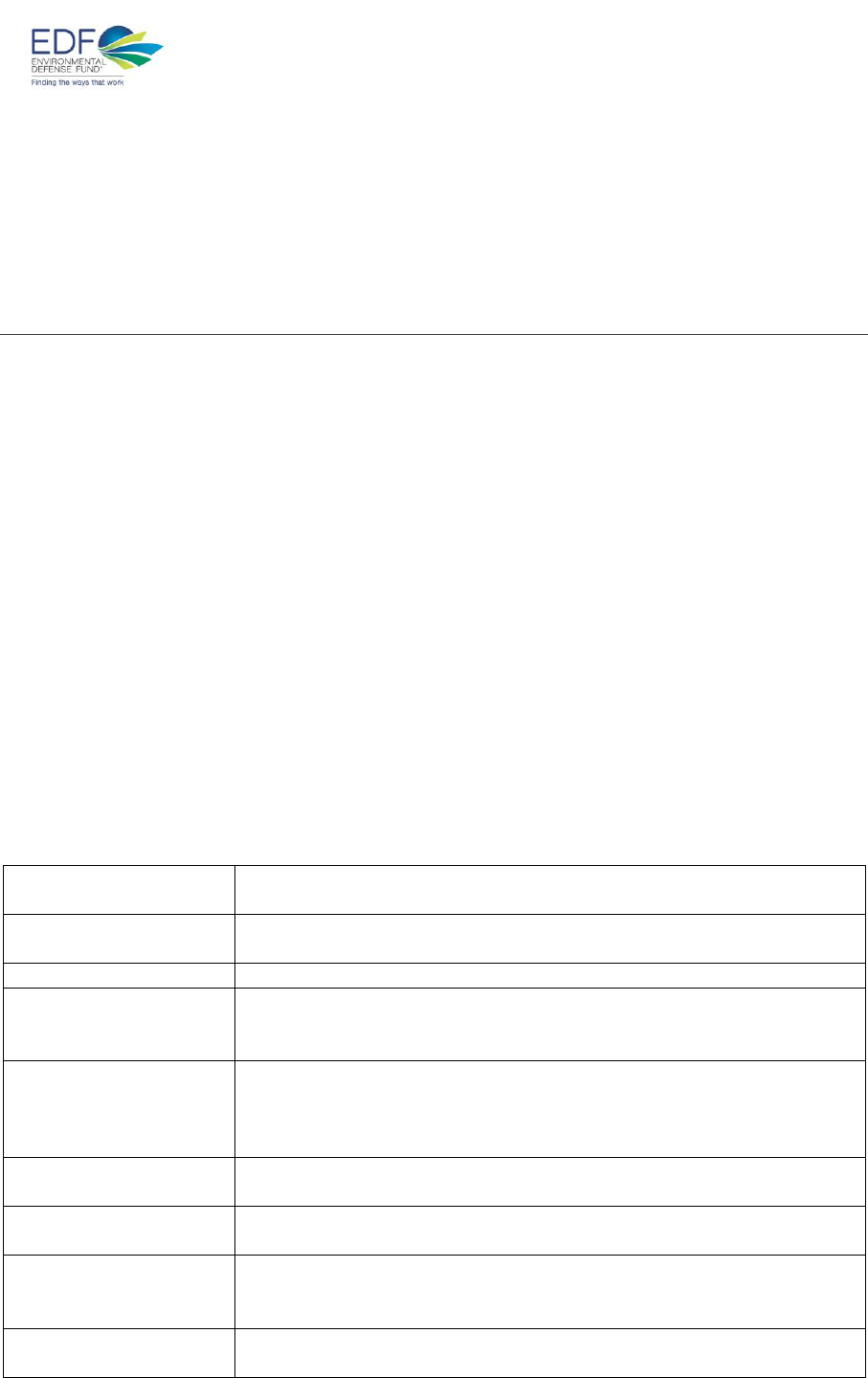

Key Elements

Climate Goal

China aims to have CO

2

emissions peak before 2030 and achieve

carbon neutrality before 2060.

Compliance Period

2019-2020 is the first compliance period that requires all covered

entities to fulfill their compliance by the end of 2021

Covered GHGs

Carbon Dioxide (CO

2

)

Covered Industries

for data reporting

Power Generation, Petrochemical and Chemical, Building

Materials, Iron and Steels, Nonferrous Metals, Papermaking, and

Aviation

Covered Industries

for Emissions

Trading and

Compliance

Power Generation Industry

Covered Key

Emitting Entities

2,162 key emission power generation entities

Thresholds

The key emitting entities emitted 26,000 tonnes of carbon

dioxide equivalent and above in any year from 2013 to 2020

Carbon Price

(Listed

Transaction)

From July 16

th

to August 11

th

, the lowest price was $7.4 US (¥48

Chinese Yuan), and the highest price was $9.42 (¥61.07).

Allowances

Allocation

Free Allocation based on the Allowance Allocation

Implementation Plan

China National Carbon

Market

Fact Sheet

Environmental Defense Fund

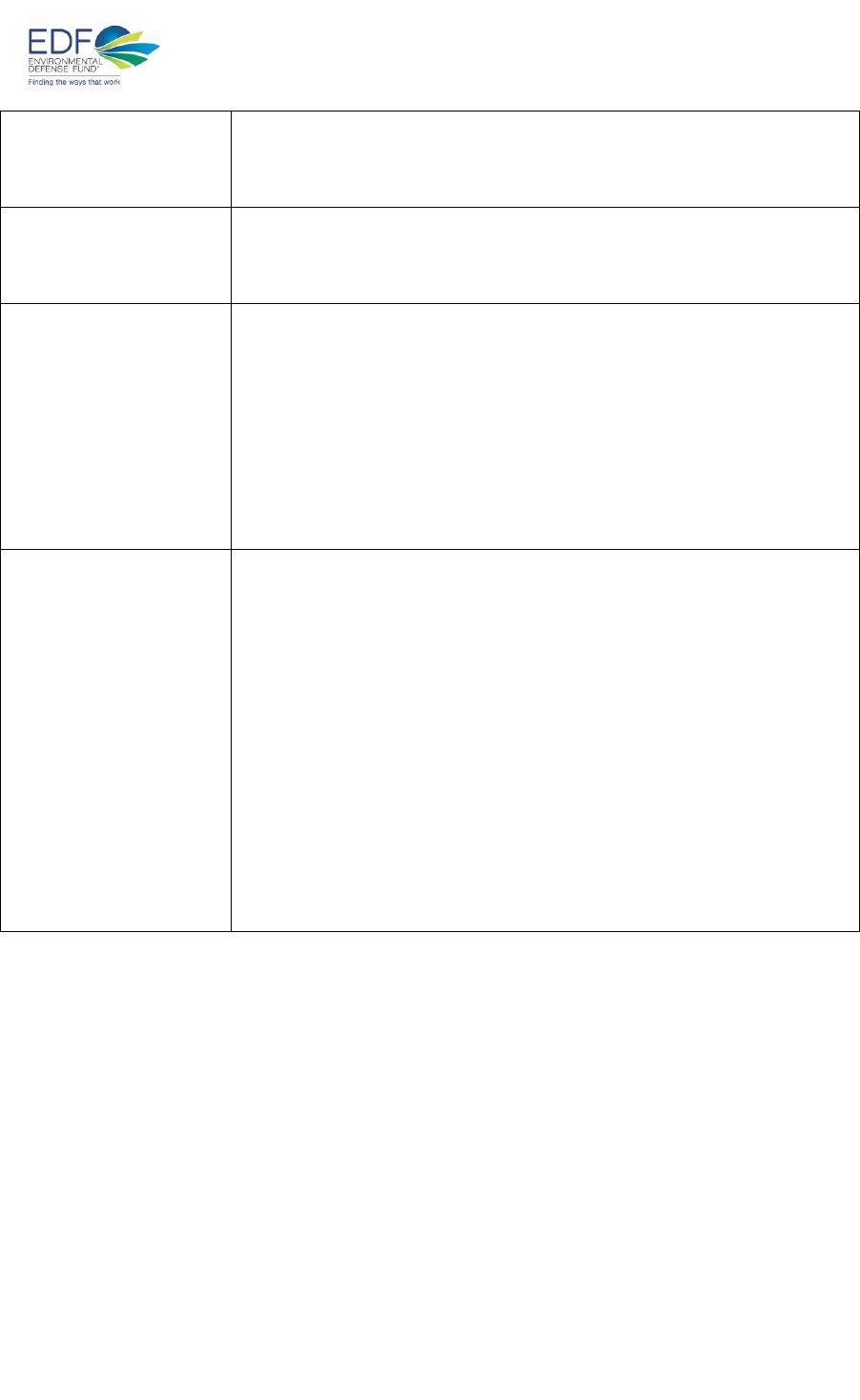

Price Control

The price of listed transaction shall be between ± 10% of the

closing price of the previous trading day.

The price block trade shall be between ± 30% of the closing price

of the previous trading day.

Offset Mechanism

According to Measures for the Administration of National Carbon

Emissions Trading (Trial), key emitting entities may use China

Certified Emission Reductions (CCERs) to offset up to 5% of their

annual carbon emission allowances that should be surrendered.

Penalties

The national level Regulations on the Administration of Carbon

Emission Trading is still under review.

According to Measures for the Administration of National Carbon

Emissions Trading (Trial), key emitting entities make false

reports will be subject to a fine of more than ¥ 10,000 but less

than ¥ 30,000. The key emitting entities that fail to surrender

carbon emission allowances will be subject to a fine of more than

20,000 yuan but less than 30,000 yuan and will be allocated the

emission allowances for the next year that deducted the amount

equivalent to allowances not surrendered.

MRV

Key emitting entities shall prepare annual GHG emissions

reports specifying the quantity of their GHG emissions as well as

report this information to the provincial ecological and

environmental authorities for their place of business before

March 31 of the following year. Key emitting entities shall be

responsible for the authenticity, completeness and accuracy of

their GHG emission reports.

Provincial ecology and environment authorities shall organize the

verification of GHG emission reports of key emitting entities and

shall notify key emitting entities of the verification results as a

basis for their surrender of carbon emission allowances.

Provincial ecology and environment authorities may entrust

technical service agencies to provide verification services through

government procurement. Such technical service agencies shall

be responsible for the authenticity, completeness and accuracy of

submitted verification results.

Timeline

2009-2017: pilots

Acting in accordance with international requirements for green development, China passed

the Resolution on Climate Change at the 10th Meeting of the Standing Committee of the 11th

National People's Congress on August 27, 2009. The resolution proposed to adopt favourable

policies and measures to take active steps on climate change, while strengthening energy

conservation and conventional pollutants emissions reduction efforts, and striving to control

greenhouse gas (GHG) emissions. The "Decision of the State Council on Accelerating the

Cultivation and Development of Strategic Emerging Industries" issued by the State Council

on October 10, 2010 (No. 32 [2010]) explicitly proposed to "speed up the establishment and

the development of a trading system for major pollutants and carbon emissions," from which

the nation emissions trading scheme (ETS) came to fruition.

In 2011, to encourage enterprises to undertake GHG emission control targets, China started

to develop pilot carbon markets. The State Council and the National Development and

Reform Commission subsequently issued documents approving the pilot work of carbon

Environmental Defense Fund

emission trading in seven provinces (cities) including Beijing, Shanghai, Tianjin, Hubei,

Chongqing, Guangdong and Shenzhen, in preparation for the later "establishment of a

unified national carbon market."

The first pilot carbon market was launched in Shenzhen in 2013, and all seven pilots were

launched before the end of 2014. In addition, a voluntary regional carbon market in Fujian

went into operation in 2016. These provincial and city level carbon markets are still in

operation and provide experiential knowledge for the establishment of the national carbon

market in China. These markets will still operate once the National Market is open for

business.

In April 2016, China signed the Paris Agreement, which agreed that China would slash its

carbon dioxide emissions per unit of GDP by 60-65% in 2030 compared with 2005 levels. A

carbon market was identified as one of the key means to achieve this new NDC emission

reduction goal.

2017-2020: Building a National ETS

In 2015, the People’s Republic of China decided to build a national carbon market to limit

and reduce CO2 emissions in a cost-effective manner. In 2017, a teleconference for launched

the construction phase of the national carbon market. Originally set to start during the 13th

Five Year Plan

1

(2016-2020), the national carbon market would initially cover coal- and gas-

fired power plants.

2020-2021: Looking Forward to the Launch of a National ETS

Climate action faced significant challenges in 2020, as COVID-19 unleashed major impacts

on social and economic conditions in China. Yet, 2020 was a vital year to set targets and

priorities for the 14th Five-Year Plan (2021-25). Despite the challenges of COVID-19, China

not only honoured its climate commitments, but also announced a goal of peaking CO

2

emissions before 2030 and achieving carbon neutrality before 2060 in September. Together,

these commitments provide strong political assurances for the establishment of national

carbon market.

Since November 2020, the Ministry of Ecology and Environment (MEE) has issued five

documents: “The National Measures for the Administration of Carbon Emission Trading

(Trial),” “National Carbon Emissions Registration Transaction Settlement Management

Measures (Trial),” “2019-2020 National Carbon Emission Trading Cap Setting and

Allowance Allocation Implementation Plan (Power Generation Industry) (Draft for

Comments),” “Guidelines for Enterprise Greenhouse Gas Emission Accounting and

Reporting (Power Generation Industry) (Draft for Comment),” and “Guidelines for

Enterprise Greenhouse Gas Verification (Trial)," for public consultation. These documents

signal a sense of urgency on climate action that has not been seen since 2017.

On December 25,

2020, “The National Measures for the Administration of Carbon Emission

Trading (Trial),” was passed by the Ministry of Ecology and Environment, and this policy has

been officially enforced since February 1, 2021. On December 30, 2020, MEE also released

“2019-2020 National Carbon Emission Trading Cap Setting and Allowance Allocation

Implementation Plan (Power Generation Industry)” and “Name List of 2019-2020 Major

Emitting Entities in Power Generation Sector,” which require the listed 2,225 power

generation companies to be covered under the national carbon market, and their 2019-2020

allowance pre-allocation information to be submitted to the MEE by January 29, 2021. The

release of the above-mentioned documents marked the official launch of the first compliance

Environmental Defense Fund

cycle of China’s National Carbon Market, and the corresponding official documents were

promulgated one after another thereafter

1

.

Under direct leadership of the MEE, significant progress and improvements have been made

to build the carbon market’s infrastructure, develop a sector test run plan, improve the

quality of carbon emission data at covered entity levels, and upgrade the greenhouse gas

(GHG) data reporting system. On March 30, 2021, the MEE released the “Interim

Regulations on the Administration of Carbon Emission Trading (Revised Draft)” for public

consultation, which has been included in the “2021 Legislative Work Plan of the State

Council of PRC”.

China's national carbon market is the largest in the world, covering the largest scale of

greenhouse gas emissions in the world. It initially involved only a portion of the power

generation sector that covers emissions of over 4,000 MtCO

2

e/year, with an inclusion

threshold set for entities with annual emissions of 26,000 tonnes of carbon dioxide

equivalent and above from 2013-2020. The scope is expected to be gradually expanded to

cover a total of eight sectors: power generation, petrochemical and chemical, building

materials, iron and steels, nonferrous metals, papermaking, and aviation.

Currently, China uses the benchmark allocation method for its national carbon market and

limits the permitted emissions of carbon dioxide

per unit of output. The national carbon

market will allocate allowances based on a plant’s generation output and its designated

benchmark. The benchmarks are differentiated by types of fuel and generation technologies.

If an entity emits less than allocated allowances, it can sell the surplus to another entity.

Benchmark allocation will create incentives to increase the efficiency of existing coal-fired

power plants.

Impact

Carbon markets will play a crucial role in lowering the cost of reducing GHGs during this

process. Administrative means and market-based measures will be mutually supportive ways

for China to reduce climate pollution significantly in the medium to long term in order to

meet the targets of peaking GHG emissions before 2030 and carbon neutrality before 2060.

Covered Entities and Emissions

On July 16, 2021, China’s Ministry of Ecology and Environment announced that 2,162 power

generation companies, representing 4.5 billion tonnes of carbon dioxide emissions, are

covered by the national carbon market. The inclusion of captive power plants is a testament

to the fairness and comprehensiveness of the national carbon market management.

The number of covered entities has risen by about 500 since 2017, which extends the

coverage of the power generation entities. This update reflects not only the determination of

the national government to control the carbon emissions of the power sector through the

emissions trading scheme as a whole, but also demonstrates an open, fair and just attitude

towards the management of carbon trading.

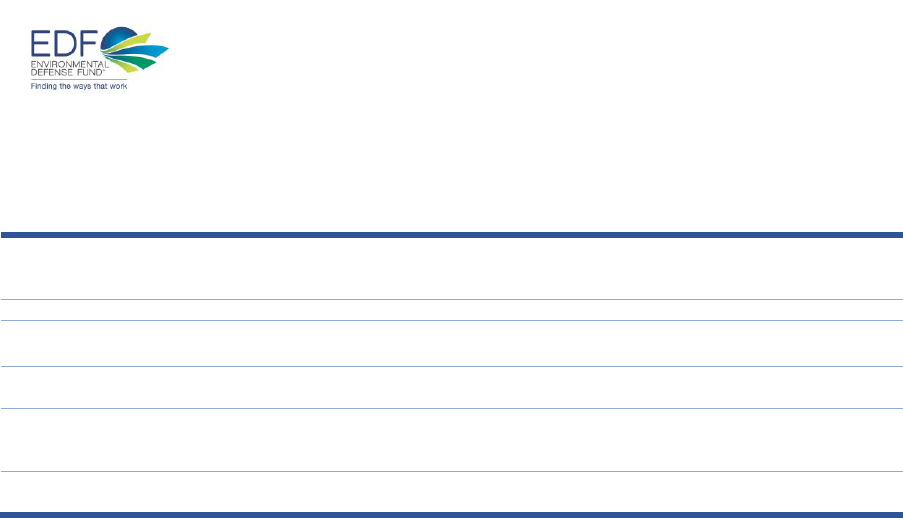

Regulations and Rules of China National Carbon market

The table below indicates the critical elements of China ETS, and its corresponding policies.

These policy documents just finished a public consultation process and are expected to be

1

December 31, 2020, officially released " Measures for the Administration of National Carbon Emissions Trading (Trial)”; March 26, 2021,

officially released of " Guidelines on Enterprises Greenhouse Gas Emissions Accounting and Reporting – Power Generation Facilities

(Trial)"; May 17, 2021, officially released "Rules for the Registration and Management of Carbon Emission Rights (Trial)", "Rules for the

Management of Carbon Emission Rights Trading (Trial)" and "Rules for the Settlement and Management of Carbon Emission Rights (Trial)"

Environmental Defense Fund

released soon. For international carbon markets, the following critical elements are key

components to ensure the success and efficient operation of the market.

ETS Key

Elements

Regulation and Rules

Legislation

Interim Regulations on the Administration of Carbon Emission Trading (Revised

Draft);

Measures for the Administration of National Carbon Emissions Trading (Trial)

Covered Entities

Name List of 2019-2020 Major Emitting Entities in Power Generation Sector

Allowance

Allocation

“2019-2020 National Carbon Emission Trading Cap Setting and Allowance Allocation

Implementation Plan, (Power Generation Industry)”

MRV

Guidelines for Enterprise Greenhouse Gas Emission Accounting and Reporting, (Power

Generation Industry); Guidelines for Enterprise Greenhouse Gas Verification (Trial)

Registration,

Trading and

Settlement

"Rules for the Registration and Management of Carbon Emission Rights (Trial)",

"Rules for the Management of Carbon Emission Rights Trading (Trial)" and "Rules for

the Settlement and Management of Carbon Emission Rights (Trial)"

Compliance

Measures for the Administration of National Carbon Emission Trading (Trial) (Draft

for comment)

Environmental Defense Fund

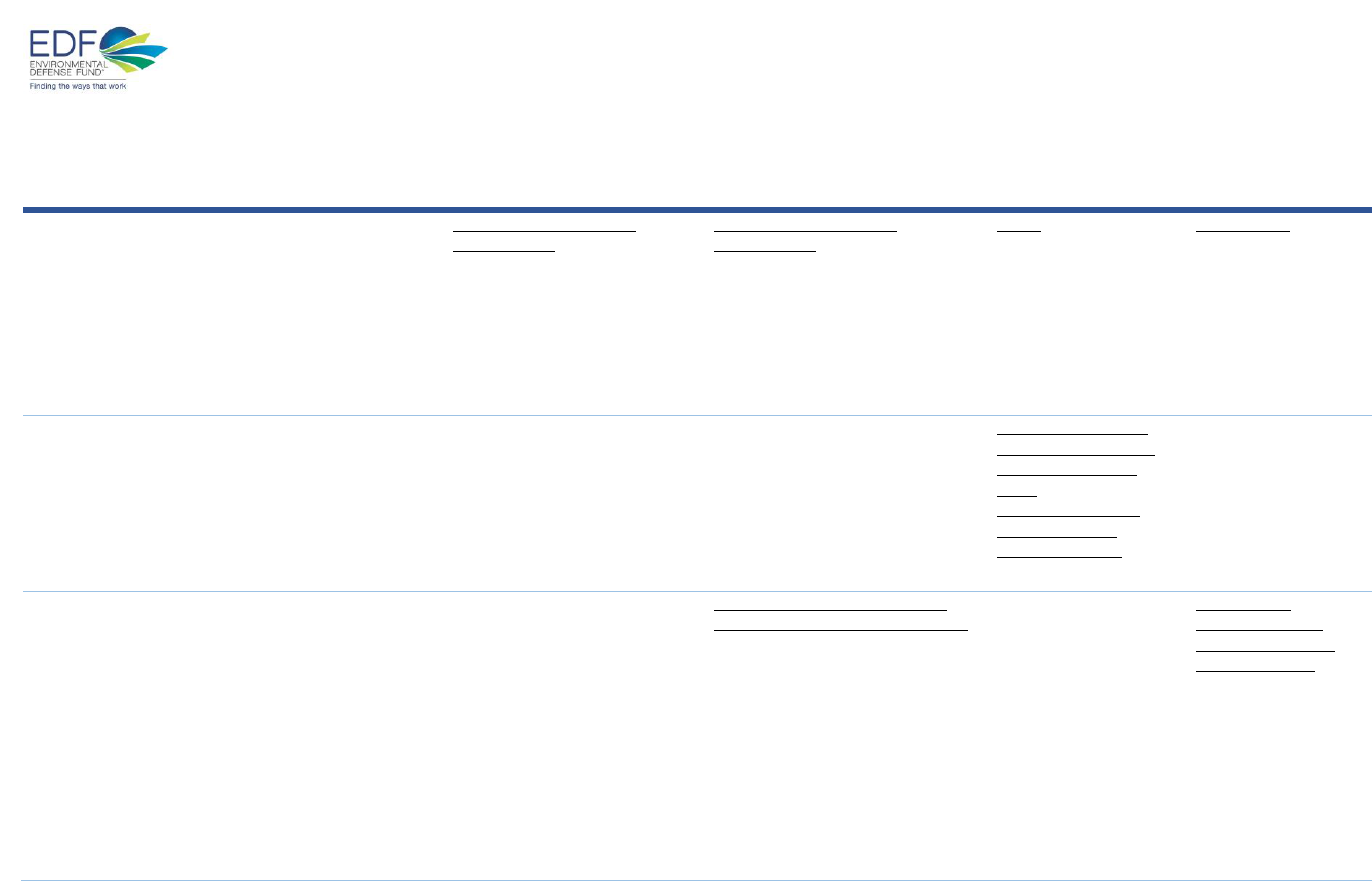

Comparison of regulations and rules between China national carbon market and other carbon markets

China National carbon

market

EU 2005-2012

EU after 2013

California

RGGI

Legislation

Interim Regulations on the

Administration of Carbon

Emission Trading (Revised

Draft);

Measures for the

Administration of National

Carbon Emissions Trading

(Trial)

13/10/2003 - Directive

2003/87/EC of the European

Parliament and of the Council

establishing a scheme for

greenhouse gas emission

allowance trading within the

Community and amending

Council Directive 96/61/EC

13/10/2003 - Directive

2003/87/EC of the European

Parliament and of the Council

establishing a scheme for

greenhouse gas emission

allowance trading within the

Community and amending

Council Directive 96/61/EC

AB32

RGGI MOU

Covered

Entities

Name List of 2019-2020 Major

Emitting Entities in Power

Generation Sector

Decided by Each Member

State

Decided by Each Member State

CALIFORNIA CAP

ON GREENHOUSE

GAS EMISSIONS

AND

MARKET-BASED

COMPLIANCE

MECHANISMS

NA

Auction

NA

NA

COMMISSION DELEGATED

REGULATION (EU) 2019/1868

amending Regulation (EU) No

1031/2010 to align the

auctioning of allowances with

the EU ETS rules for the period

2021 to 2030 and with the

classification of allowances as

financial instruments pursuant

to Directive 2014/65/EU of the

European Parliament and of the

Council

REGIONAL

GREENHOUSE

GAS INITIATIVE

MODEL RULE

Environmental Defense Fund

Allowance

Allocation

“2019-2020 National Carbon

Emission Trading Cap Setting

and Allowance Allocation

Implementation Plan, (Power

Generation Industry)”

national allocation plans for

the allocation of greenhouse

gas emission allowances in

accordance with Directive

2003/87/EC

COMMISSION DELEGATED

REGULATION (EU) 2019/331

determining transitional Union-

wide rules for harmonized free

allocation of emission

allowances pursuant to Article

10a of Directive 2003/87/EC of

the European Parliament and of

the Council

NA

MRV

Guidelines for Enterprise

Greenhouse Gas Emission

Accounting and Reporting,

(Power Generation Industry);

Guidelines for Enterprise

Greenhouse Gas Verification

(Trial)

2004/156/EC: Commission

Decision of 29 January 2004

establishing guidelines for the

monitoring and reporting of

greenhouse gas emissions

pursuant to Directive

2003/87/EC of the European

Parliament and of the Council

Corrigendum to Commission

Regulation (EU) No 601/2012 of

21 June 2012 on the monitoring

and reporting of greenhouse gas

emissions pursuant to Directive

2003/87/EC of the European

Parliament and of the Council;

COMMISSION

IMPLEMENTING

REGULATION (EU) 2018/2067

on the verification of data and

on the accreditation of verifiers

pursuant to Directive

2003/87/EC of the European

Parliament and of the Council

REGIONAL

GREENHOUSE

GAS INITIATIVE

MODEL RULE

Trading and

Compliance

"Rules for the Registration and

Management of Carbon

Emission Rights (Trial)", "Rules

for the Management of Carbon

Emission Rights Trading

(Trial)" and "Rules for the

Settlement and Management of

Carbon Emission Rights

(Trial)"; Measures for the

Administration of National

Carbon Emission Trading

(Trial) (Draft for comment)

13/10/2003 - Directive

2003/87/EC of the European

Parliament and of the Council

establishing a scheme for

greenhouse gas emission

allowance trading within the

Community and amending

Council Directive 96/61/EC

13/10/2003 - Directive

2003/87/EC of the European

Parliament and of the Council

establishing a scheme for

greenhouse gas emission

allowance trading within the

Community and amending

Council Directive 96/61/EC

REGIONAL

GREENHOUSE

GAS INITIATIVE

MODEL RULE

Environmental Defense Fund

Environmental Defense Fund’s Work

EDF introduced the concept of using market-based mechanisms to solve environmental

problems into China in the 1990s. Cooperating with the State Environmental Protection

Administration of China, EDF launched China's first pilot project for sulphur dioxide

emissions trading.

Since 2011, EDF has assisted the competent government authorities in the design, training,

and testing of the pilot carbon markets and the national carbon market, which has provided

strong support for opening the fully operational national carbon market. For example, EDF

participated in a series of trainings organized by the Ministry of Ecology and Environment

for the allocation and management of national carbon market allowances from October to

December 2019. More than 7,000 people participated in the trainings, using CarbonSim, a

simulation trading software developed by EDF, to run through practical simulations for a

deeper understanding of the carbon market operation. EDF’s assistance enhanced the

communication, exchange and publicity of carbon market experience between Chinese and

foreign governments, and strengthened Chinese government's capacity to further improve

the carbon market design, build the industry’s capacity for participating in the carbon

market, and deepen the international community’s understanding of China’s carbon market.

EDF's rich experience on market-based mechanisms for environmental issues provided

solutions and support in the construction of China's carbon market, and helped China

achieve its ambitious climate goals of carbon peaking and carbon neutrality as early as

possible.