INSTRUCTIONS FOR COMPLETING FORM EC-1

Please print clearly or type. If the Form EC-1 is unreadable, incomplete, or does not contain all information required, it may be sent back to you

without action.

Submit the Form EC-1 to your Personnel Office or Department Personnel Officer (DPO) for verification, signature and routing to EUTF within

30 days (180 days for newborns) of the event date. For DOE Employee, you must submit your EC-1 form to the DOE EBU Office at PO Box

2360, Honolulu, HI 96804.

SECTION 1 – EMPLOYEE DATA

1. Enter your Last Name, First Name, and Middle Initial.

2. Enter your contact information. Home phone number, Mobile phone number, Work phone number and email address.

3. Enter your address information. If your residence address differs from your mailing address, you must enter both addresses to ensure

that correspondence reaches you.\

4. Mark the New Hire/Newly Eligible box if:

A. You are a new employee; and enter the effective date you were hired, or

B. Your employment status is changing from part time (25% FTE) to full time (50% - 100% FTE) employment; and enter the effective

date you will become full time.

5. Mark the Open Enrollment box only during the annual or special Open Enrollment period.

6. Mark the Termination box if you are terminating your employment and enter your last day of employment.

7. If you are enrolling with the EUTF for the first time, you are required to provide your Social Security Number and your dependent(s) SSN.

8. Enter your gender and birth date. If enrolling for the first time, EUTF is unable to process your paperwork without a gender and birthdate.

9. Mark the Mid-Year Qualifying Event box if you have any changes during the year and enter the date of the event.

The following are the most common events: Address Change, Birth, Divorce, Lost of Coverage, Acquisition of Coverage, Marriage,

Retirement, Death, Change in Public Employer, Transfer In/Transfer Out, etc. If there are simultaneous events, please describe the most

prevalent event; for example, if the event is a birth and an address change, enter Birth in the event section.

10. If you are Married, in a Civil Union, or Domestic Partnership, please be sure to check the appropriate box and include the date you were

Married, entered into a Civil Union, or entered into a Domestic Partnership. You must attach a copy of your civil union certificate received

from the Department of Health or your marriage certificate. If you do not receive the certificate within 60 days of the date of the event,

contact EUTF. A notarized Declaration of Domestic Partnership form is required (form is available on the EUTF website).

11. Special Note: If you have a Spouse, Civil Union Partner or Domestic Partner please provide his/her Name, Date of Birth and Social

Security Number on the corresponding line. Dual enrollment in EUTF plans is not allowed under EUTF Administrative Rule 4.03. No

person may be enrolled in any EUTF benefit plan as both an employee-beneficiary and dependent-beneficiary, nor may children be

enrolled by more than one employee-beneficiary (dual enrollment). In addition, if you and your spouse, domestic partner or civil union

partner are both employee-beneficiaries, the employer contribution cannot exceed a family plan contribution in accordance with Chapter

87A-32(3), Hawaii Revised Statutes (HRS). However, both employee-beneficiaries are able to select EUTF Self-only plans. If your

Spouse/Civil Union Partner/Domestic Partner has coverage outside of the EUTF that provides family coverage, this rule does not

preclude you from also enrolling in a EUTF family coverage plan to cover your Spouse/Civil Union Partner/Domestic Partner. The dual

enrollment rule does not apply if your other coverage is not provided by the EUTF.

SECTION 2 – COVERAGE AND CONTRIBUTION START SELECTION

1. If the “Qualifying Event” that applies to you is listed in Section 2, you have three choices of when your coverage and premium

contributions begin. Select one of the three.

2. If no selection is made, the first option will be the default option selected.

SECTION 3 – PLAN SELECTION

1. Mark all plans you are enrolled in/want to enroll in.

2. Carefully review each selection that you make. You can choose one medical/prescription drug plan, one dental plan, and one vision plan.

The prescription drug plan is bundled with the medical plan and will depend on the medical plan that you select.

3. If you do not want any plan coverage, mark the “Cancel/Waive” box. If you have other health plan coverage and do not want to

participate in the EUTF plans, mark the “Cancel/Waive” box for each plan that you choose not to select. If no selection is made and you

currently have coverage, EUTF will assume no changes are being made.

4. To be eligible for the Royal State Supplemental plan coverage, you must have other medical coverage from another source, not including

this employer.

5. The RSN Chiro Plan is included with all medical plans, including the Royal State Supplemental plan.

6. Life insurance is provided for the employee only.

7. FOR STATE EMPLOYEES ONLY: Premium Conversion Plan (PCP) – PCP is a voluntary benefit plan, administered by the Department of

Human Resources Development (DHRD) that allows employees to purchase their health benefit plans on a pretax basis and is being

offered pursuant to Section 125 of the Internal Revenue Code. Please inquire with your DPO or DHRD on completing a PCP-2 form.

Mark one of the following boxes, Enroll or Do Not Enroll.

FOR COUNTY EMPLOYEES ONLY: Premium Conversion Plan (PCP) – PCP is administered by the Budget and Fiscal Services

Department. Please contact your DPO for more information on available options.

INSTRUCTIONS FOR COMPLETING FORM EC-1 (continued)

Please print clearly or type your name in the top right corner of page 2 of 2.

SECTION 4 – DEPENDENT INFORMATION AND PLAN SELECTIONS

1. Enter your dependent(s) data. If enrolling your dependent for the first time, enter his/her birth date and Social Security Number (SSN). SSN

is not a required field when submitting an initial EC-1 for new birth. Please be sure to submit an EC-1 to update our records for your

newborn once the information is received/issued by the Social Security Administration. Otherwise you may leave the SSN blank and list

your dependent’s EUTF ID number. If making changes to your dependent’s data, enter the corrected item. If listing more than 6

dependents, write/type “Continued” on the last line of the Dependent section. Attach a separate sheet of white letter sized paper to your

EC-1.

2. Use the following Relationship codes:

SP = Spouse CH = Child SC = Step Child

DP = Domestic Partner

DPCH = Domestic Partner’s Child GC = Guardianship or Foster Child

CU = Civil Union Partner

CUCH = Civil Union Partner’s Child DC = Disabled Child

3. For Relationship codes with a or or or or , please see below for other required forms.

Other EUTF and/or DRHD forms to include with EC-1 (if applicable)

Marriage or Civil Union Certificate issued by the State of Hawaii Department of Health (printed copies of the temporary on-

line certificate are acceptable) and Affidavit of “Dependency” for Tax Purposes for Civil Unions

Legal documents for guardianship or foster child

EUTF Declaration of Domestic Partnership and Affidavit of “Dependency” for Tax Purposes

Disability Certification for Dependent Children (Form D-1) for enrolling a disabled child

Student Certification if enrolling dependent age 19-23 in dental and/or vision plans

4. If you are enrolling a Civil Union Partner (and Civil Union Partner’s children) or Domestic Partner (and Domestic Partner’s children), you are

required to complete all required forms in accordance with the instructions for Civil Union Partner or Domestic Partner. You are responsible

to obtain, complete and submit all necessary documentation to the EUTF through your employer within 30 days from your event date.

Failure to do so will result in no action taken on your Civil Union Partner or Domestic Partner coverage. Additions of a Civil Union Partner

or a Domestic Partner are permitted outside of Open Enrollment. For a New Civil Union submitted within 30 days from the date of the civil

union, the effective date of coverage is based on the event date. For a New Domestic Partner submitted within 30 days from the date of

notarized signature, the effective date of coverage is based on the date of the notary. Visit the EUTF website at eutf.hawaii.gov for detailed

instructions regarding Civil Union Partnership or Domestic Partnership.

5. Gender – M or F

6. Plan Selections. YOUR DEPENDENTS CAN BE ENROLLED ONLY IN THE SAME PLANS IN WHICH YOU ARE CURRENTLY

ENROLLED. If you do not want any plan coverage for any of your dependents, mark the “Self” box in Section 3.

7. Dependents and Student Certification. You must provide a copy of your child(ren)’s birth certificate and/or social security card if requested

by the EUTF. You also must provide a copy of your child(ren)’s student verification letter on school letterhead, signed by the registrar, as

required by the EUTF.

SECTION 5 – OTHER INSURANCE INFORMATION

1. If you or your dependent(s) are covered under another health plan, or if you selected the Royal State Supplemental plan, you are required

to complete this section.

2. The information that you provide does not determine how your benefits are coordinated. COB rules are determined by the health benefit

plans and follow the guidelines of the National Association of Insurance Commissioners (www.naic.org)

3. If you have ever been or are currently covered as a dependent under a state or county employee or retiree plan, please provide the state

or county employee or retiree’s Name, Date of Birth, and Social Security Number (SSN optional) on the corresponding line.

NOTE: To be eligible for coverage under the Royal State Supplemental plan, you and your eligible dependent(s) must have health coverage

through another source, not including this employer.

SECTION 6 – EMPLOYEE AUTHORIZATION AND SIGNATURE

Your signature certifies that the information provided in this application is true and complete. You also agree to abide by the terms and

conditions of the benefit plans selected. You are authorizing your employer or finance officer to make the pre-tax or after tax deductions,

adjustments or cancellations from your salary, wages, or other compensation for the monthly employee contribution in accordance with

applicable laws, rules and regulations.

You must submit the EC-1 through your personnel office. Your personnel office confirms that you are a current employee and are eligible for

health benefits through the EUTF. Your personnel office will forward your EC-1 to EUTF.

For DOE Employees: You must submit your EC-1 form to the DOE-EBU Office at PO Box 2360, Honolulu, HI 96804

EMPLOYER VALIDATION [FOR EMPLOYER USE ONLY]

1. Department ID#: Please enter your appropriate Department ID code; for example, 010021 for DOE, 010022 for University of Hawaii,

010053 for Budget and Finance, etc.

2. Department and Division/School: Please enter the appropriate information

3. Bargaining Unit Number: Please enter the appropriate bargaining unit for this employee

4. Enter the date the EC-1 was received from the employee. The date recorded should be the date that the employer received the EC-1

form, not the date the DPO/employer designee received it.

5. Please provide contact phone and fax numbers

6. DPO/employer designee signature certifies that the employee-beneficiary is eligible for coverage through the EUTF as defined in Chapter

87A, Hawaii Revised Statutes.

7. Enter date the EC-1 was signed by the DPO/employer designee.

EC-1 Rev. 4/2017

EC-1

Rev. 04/2017

Hawaii Employer-Union Health Benefits Trust Fund

Please submit this form to

your personnel office.

DOE employees submit to:

DOE-EBU

PO Box 2360

Honolulu HI 96804

EC-1: Enrollment Form for Active Employees

DUE DATE: This form must be submitted to your Personnel Officer or Departmental Personnel

Office within 30 days (180 days for newborns) of the event date.

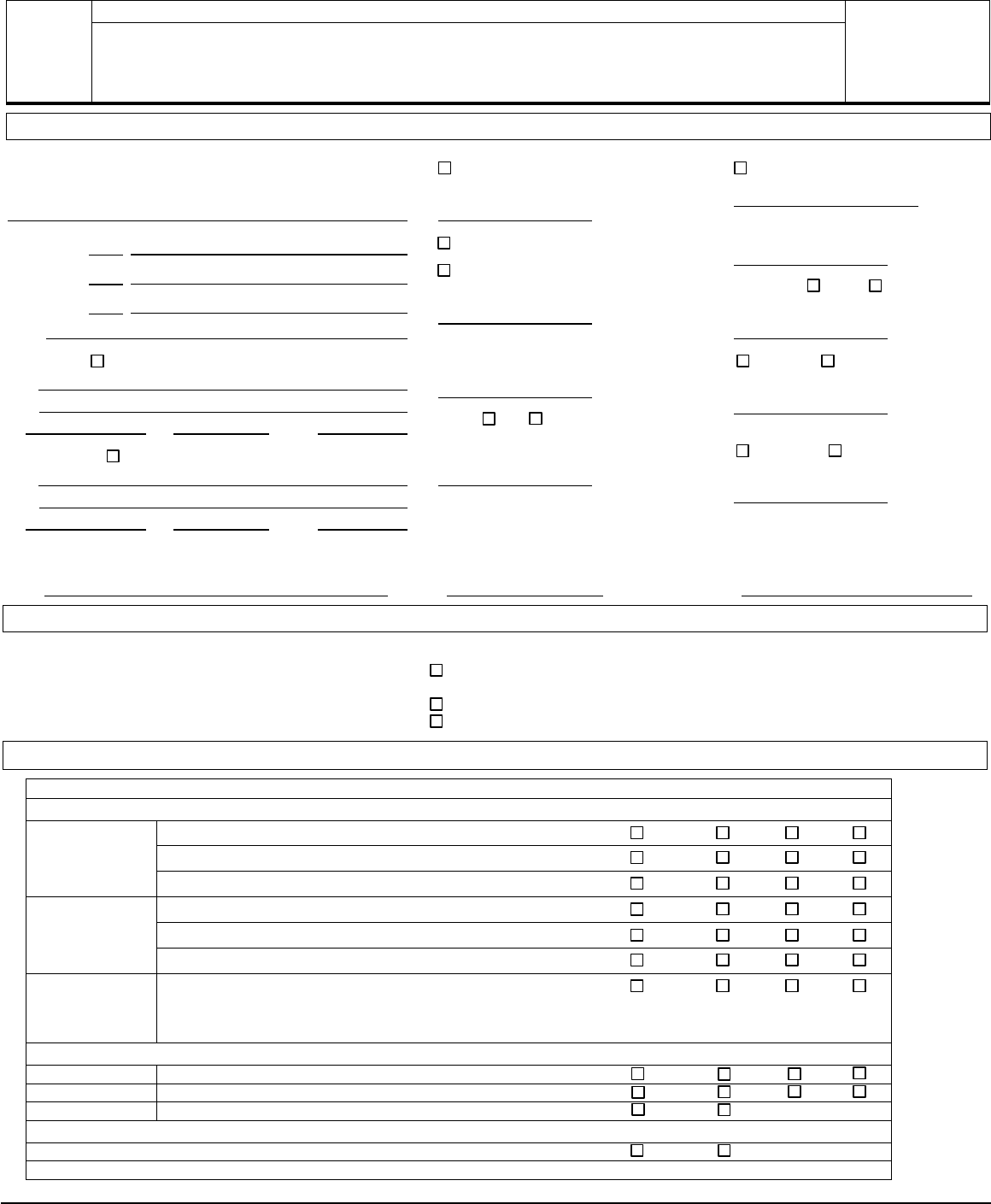

SECTION 1: EMPLOYEE DATA

Please complete all applicable fields below. Social security numbers are required to process new hires.

Name (Last Name, First Name, Middle Initial)

Home Phone ( )

Mobile Phone ( )

Work Phone ( )

Email

Mailing Address ( Check if your address has changed)

Street

Line 2

City State Zip Code

Residence Address ( Check if address is different from above)

Street

Line 2

City State Zip Code

New Hire/Newly Eligible

Date of Hire/Newly Eligible: (MM/DD/YYYY)

/ /

Open Enrollment (effective 07/01/2017)

Termination of Employment

Date of Termination: (MM/DD/YYYY)

/ /

Employee’s Social Security Number (SSN) or EUTF ID

Number

Gender: Male Female

Birth Date: (MM/DD/YYYY)

/ /

Mid-Year Qualifying Event (describe)

Mid-Year Qualifying Event Date: (MM/DD/YYYY)

/ /

Marital Status: Married Single

Marriage Date: (MM/DD/YYYY)

/ /

Civil Union ( Check if status changed)

Civil Union Date: (MM/DD/YYYY)

/ /

Domestic Partner (SP Status)

IRS Qualified Not Qualified

Notary Date: (MM/DD/YYYY)

/ /

Special Note: If you are married, in a civil union or domestic partnership, please provide your spouse/partner’s Name, Date of Birth, and SSN:

Name: DOB: / / SSN:

SECTION 2: COVERAGE AND CONTRIBUTION START SELECTION

If your event is listed below, please select one of the three options, otherwise skip this section.

Some events allow for a selection of the Coverage and Premium Contribution Start Dates.

Qualifying Events for this Section

Adoption, Birth, Guardianship, New Eligible Student, Marriage, Domestic

Partner, Civil Union, New Hire, Newly Eligible, Reinstatement in

Employment, Return from Authorized Leave of Absence (if not currently

enrolled)

Available Options for this Section

Coverage starts day of the event & premium contributions start 1

st

day of the pay period in which the effective

date of coverage occurs (if no selection is made, this option will be used)

Coverage and premium contributions start 1

st

day of the first pay period following event

Coverage and premium contributions start 1

st

day of the second pay period following event

SECTION 3: PLAN SELECTION

Make your selection by checking all the boxes of the appropriate bene it plans below. Select Self, 2-Party, Family or Cancel/Waive coverage.

You may only choose one medical/prescription drug plan. If no selection is made, EUTF will assume no changes are being made.

Medical/Prescription Drug Plan

You may only choose one medical/prescription drug plan

Type

Carrier Selection

Cancel/Waive

Self

2-Party

Family

PPO

PPO-90/10 HMSA Medical, CVS Prescription Drug, RSN Chiro

PPO-80/20 HMSA Medical, CVS Prescription Drug, RSN Chiro

PPO-75/25 HMSA Medical, CVS Prescription Drug, RSN Chiro

HMO

HMO-HMSA, CVS Prescription Drug, RSN Chiro

HMO-Kaiser Standard, Prescription Drug, RSN Chiro

HMO-Kaiser Comprehensive, Prescription Drug, RSN Chiro

Supplemental

Supplemental – Royal State National Insurance Company (includes Supplemental

Drug Coverage), Chiro

*** To be eligible for coverage under the Royal State Supplemental plan, you and your eligible dependent(s) must be covered under a non-EUTF health plan. See

Section 5 on “Instructions for Completing Form EC-1”

Other Plans

Cancel/Waive

Self

2-Party

Family

Dental

Hawaii Dental

If enrolling new dependent ages 19-23, attach student verification

Vision

Vision Service Plan

If enrolling new dependent ages 19-23, attach student verification

Life

USAble Life

For STATE Employees ONLY*

Do NOT Enroll

Enroll

Premium Conversion Plan

*The State allows its employees to pay for health premiums on a pre-tax basis. For more information please visit www.dhrd hawaii.gov

For County Employees: Please contact your DPO for more information on Premium Conversion or Flex Plan options.

Page 1 of 2

Clear Form

EC-1 Rev. 4/2017

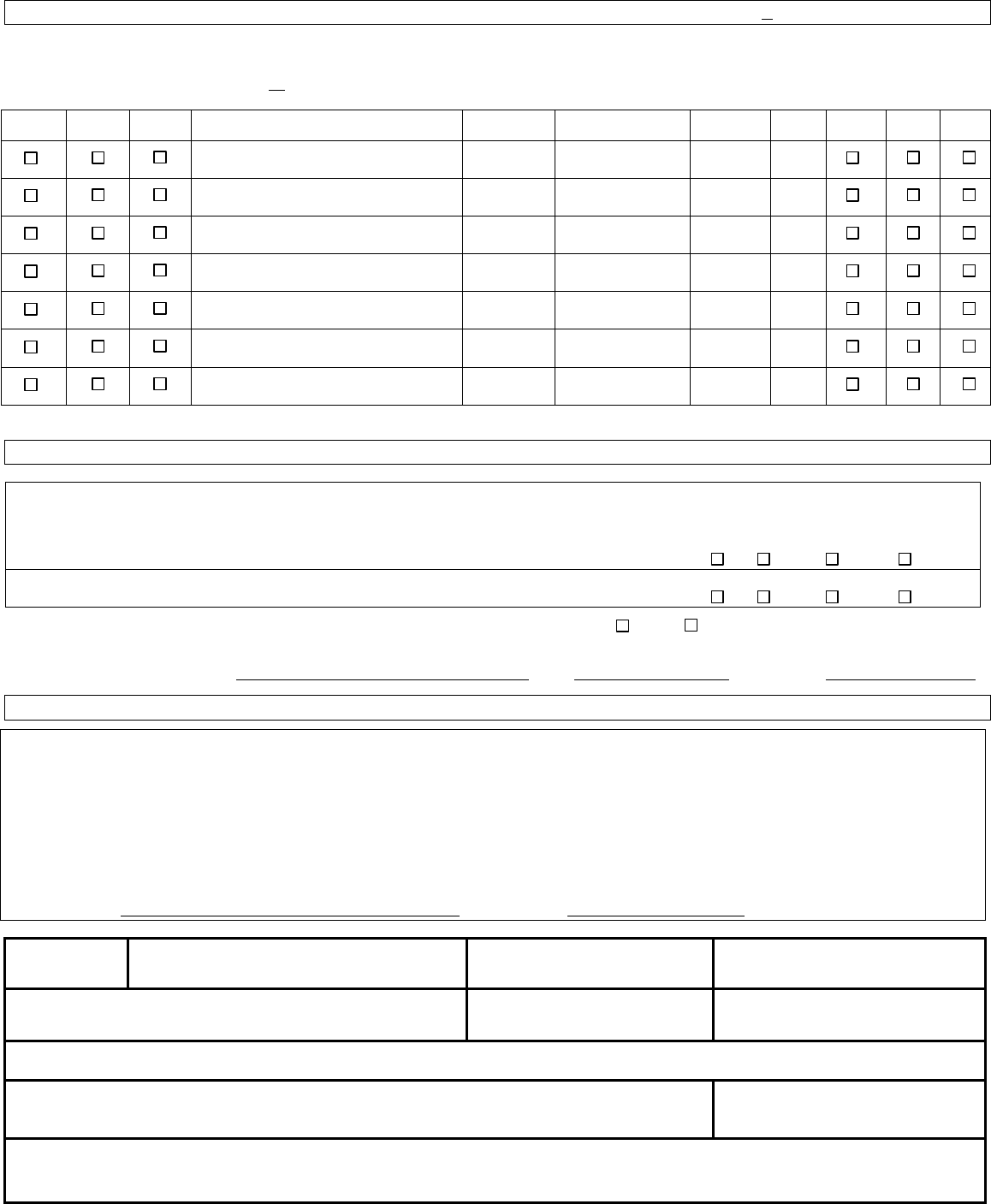

Employee’s Name:

SECTION 4: DEPENDENT INFORMATION AND PLAN SELECTIONS

Please list all dependents you want enrolled

List all eligible dependents you wish to cover and check the plan selections desired.

*Relationship Key: SP=Spouse, DP=Domestic Partner, CU=Civil Union Partner, CH=your

Child or your Spouse’s Child, DPCH=Domestic Partner’s Child, CUCH=Civil Union Partner’s Child, SC=Step

Child, GC=Guardianship/Foster child, DC=Disabled Child if your child

is age 19 or over and is also disabled.

**Social Security Number: Social Security Number is not a required field when submitting an initial EC-1 for new birth. Please be sure to submit an EC-1 to update our records for your newborn once

the information received/issued by the SSA.

Continue

Coverage

Add

Delete

Dependent

Last Name, First Name, Middle Initial

Birth Date

(MM/DD/YYYY)

Social Security Number**

Relationship*

Gender

Medical/

Drug

Dental

Vision

Detailed eligibility information is available at http://eutf.hawaii.gov in the EUTF Administrative Rules & Chapter 87A, Hawaii Revised Statutes.

Dependent Certification and Student Certification – See Section 4 item 8 on “Instructions for Completing Form EC-1” for more information.

SECTION 5: OTHER INSURANCE INFORMATION

If you or any of your dependents are covered under another non-EUTF health plan(s), provide the type of plan, name of the plan, subscriber’s name, and dependents on the plan.

Type of Plan

Name of Plan (Carrier’s Name)

Subscriber’s Name

Are you on this

plan?

Are all dependents listed in

Section 4 on this plan?

If no, list below which dependents

are on this plan.

Yes No

Yes No

Yes No

Yes No

Have you ever been or are you currently covered as a dependent under a state or county employee or retiree plan? Yes No

If “Yes”, please provide the information as requested below of the state or county employee or retiree:

Name: (Last Name, First Name, Middle Initial) DOB: / / SSN: (Optional)

SECTION 6: EMPLOYEE AUTHORIZATION AND SIGNATURE

I am eligible for the coverage requested and declare that the individuals listed on this enrollment form also meet the eligibility requirements for enrollment in the EUTF plans. I understand that the

benefit elections made on this application are in effect for as long as I continue to meet EUTF’s eligibility requirements, or until I elect to change them subject to the provisions of EUTF’s plan rules.

I have read the benefit materials, understand the limitations and qualifications of the EUTF benefits program and agree to abide by the terms and conditions of the benefit plans selected. I

authorize my employer or finance officer to make the pre-tax or after tax deductions, adjustments or cancellations from my salary, wages, or other compensation for the monthly employee

contribution in accordance with applicable laws, rules and regulations.

A person who knowingly makes a false statement in connection with an application for any benefit may be subject to imprisonment and fines. Additionally, knowingly making a false statement may

subject a person to termination of enrollment, denial of future enrollment, or civil damages. This form supersedes all forms and submissions I previously made for EUTF coverage. I hereby

declare that the above statements are true to the best of my knowledge and belief, and I understand that I am subject to penalty for perjury.

Employee: Signature: Date Signed:

Department ID#

Department

Division/School

Bargaining Unit

Date EC-1 Received in Employing Office:

DPO Phone Number

DPO Fax Number

DPO (or employer designee’s) Printed Name:

DPO (or employer designee’s) Signature:

Date of DPO (or employee designee’s) Signature:

By signing this EC-1 form, I am attesting that this employee is eligible for EUTF benefits as per Chapter 87A, Hawaii Revised Statutes

Remarks:

Page 2 of 2

001-011

AGRICULTURE

973-9480

973-9494