PREMIUM CONVERSION PLAN

PLAN DOCUMENT

FOR EMPLOYEES OF THE STATE OF HAWAII

Administered by the

Department of

Human Resources

Development

Attachment #2

INTRODUCTION

The State of Hawaii’s ("State") Premium

Conversion Plan ("PCP" or "Plan")

provides an opportunity to most health

benefits plan participants to save some tax

dollars and make the most of their

paychecks. It is being offered pursuant to

HRS chapter 78, and within the meaning of

Section 125 of the Internal Revenue Code

of 1986 ("Code"), as amended, relating to

“cafeteria plans”.

To retain this benefit, the State must

administer the Plan in strict compliance

with the Hawaii PCP Administrative Rules

14-51 (“Rules”). It is important to read this

Plan Document thoroughly. Carefully weigh

the Plan’s effect on your social security

benefits. You may want to consult with a

tax advisor to help determine whether this

Plan will benefit you.

Please keep in mind that this is only a

summary of HRS chapter 14-51, “Premium

Conversion Plan”, and is not the complete

text. In all cases where a question arises,

the Rules will govern. The Rules may be

examined, or a copy may be obtained by

contacting:

Director of Human Resources

Development

PCP Administrator

235 S. Beretania St., 14

th

Floor

Honolulu, Hawaii 96813

Or, visit the DHRD website at:

http://dhrd.hawaii.gov/administrative-rules/

This Plan Document sets forth the

material features of the Plan in a question

and answer format.

1. WHAT ARE THE BENEFITS OF

THIS PLAN?

When you enroll in this Plan, your

income will be taxed after your health

benefits contributions are deducted, so

your take-home pay should be greater than

if you do not enroll.

2. WHO IS ELIGIBLE FOR THIS

PLAN?

You are eligible to participate in the Plan

if you are an employee of the State and

enrolled in any health benefits plan offered

through the Hawaii Employer-Union Health

Benefits Trust Fund ("EUTF") and your

payroll deductions are processed through

the Department of Accounting and General

Services.

3. HOW DOES THE PLAN WORK?

When you enroll in this Plan:

You authorize the State to reduce your

gross salary (before federal, State, and

social security taxes are calculated) by

the total amount of your health benefits

plan contributions; and

The result is that your take-home pay is

likely to increase since you will pay less

federal income, State income, and

FICA taxes.

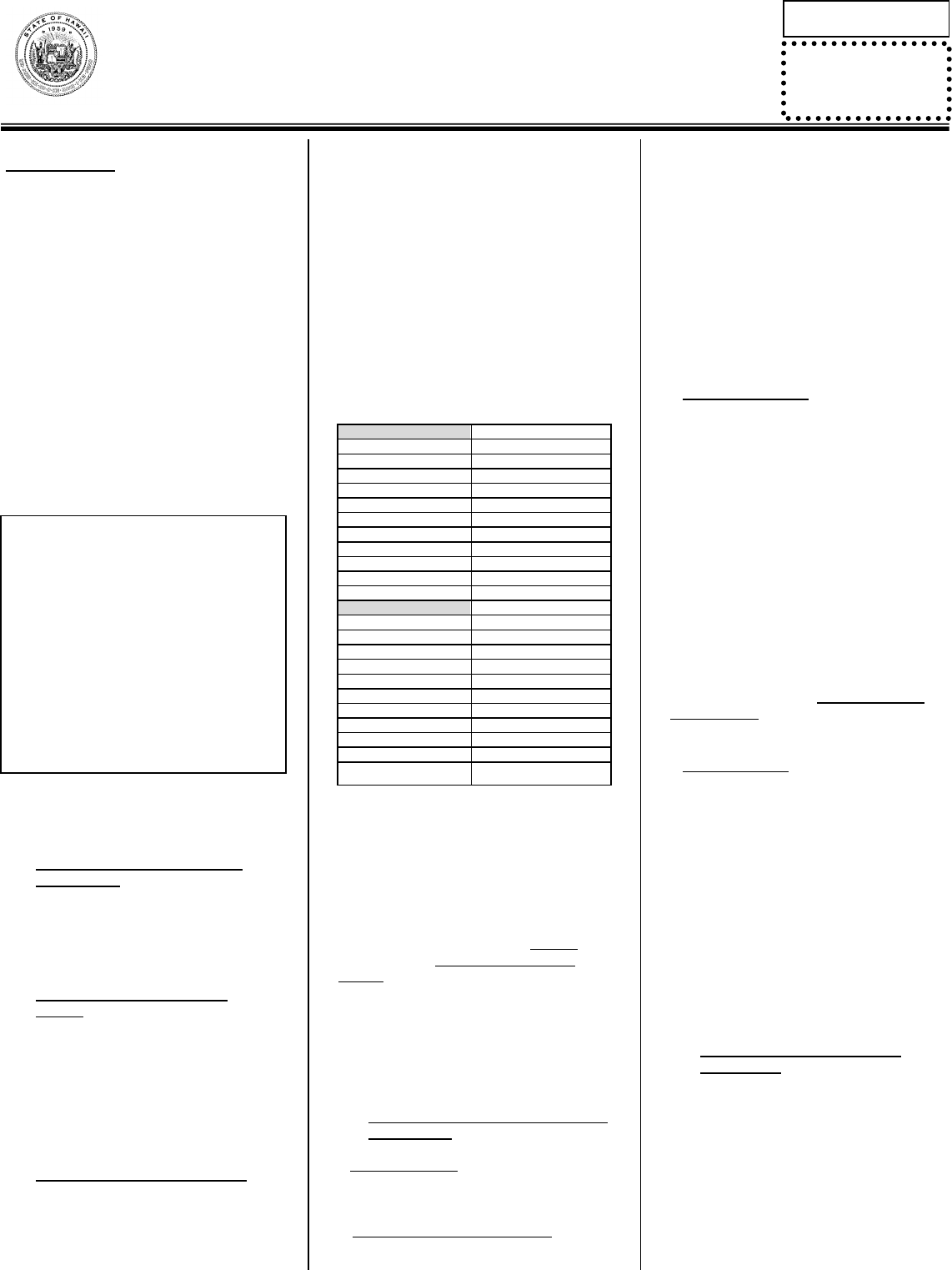

Let’s look at a hypothetical example to

show how the Plan would increase the

take-home pay of an employee: this

employee earns a gross pay of $2,000.00

per semi-monthly pay period, is married,

claims zero exemptions, and enrolled in

two-party health plans requiring a total

employee contribution of $283.00 per

semi-monthly pay period:

In this example, take-home pay will be

$68.06 more per pay period, or $1633.44

more per year if this employee enrolled in

the PCP. (Calculations based on 2019

State and Federal Income Tax Withholding

Table).

Please note that the above example was

based on an employee who is married. If

you cover your domestic or civil union

partner under your health plan, there may

be other tax liabilities in connection with

your domestic or civil union partner's

coverage, such that the tax savings benefit

of enrolling in the PCP may be minimal.

Therefore, you may want to consult with a

tax advisor prior to enrolling in the Plan.

4. HOW AND WHEN CAN I ENROLL IN

THIS PLAN?

New Employees- If you are a new

employee, you may enroll in the Plan when

you become eligible to enroll in any of the

eligible health benefits plans. Normally, this

is within ninety (90) calendar days of the

date you were hired. If you do not enroll

during this 90-day eligibility period or you

elected not to enroll at the time you

completed your new hire paperwork, you

will not be able to enroll in the Plan until

the following Plan year, unless you are

permitted under the Rules to enroll.

Employees wishing to enroll in PCP,

shall make their selection in the “Plan

Selection” section of the EUTF’s EC-1 or

EC-1H (for HSTA VB members only)

enrollment form and submit it to your

Human Resources Office (HRO) designee

or the Department of Education- Employee

Benefits Unit (DOE-EBU) for those working

for the Department of Education.

Current Employees- If you are a current

employee and do not enroll before the Plan

year begins, you will have to wait until the

following Plan year to enroll. The only

exception to this rule occurs in the case

where you are permitted under the Rules

to change from an election of no health

benefits plan coverage to an election for

such coverage.

For example, if you previously did not

take medical coverage through the State

because you were covered under your

spouse’s medical plan, and your spouse

dies or loses his/her job, you would be

eligible to obtain medical coverage through

the State, and you would also be eligible to

enroll in the PCP. You must, however, file

the appropriate forms with your HRO

designee or DOE-EBU within ninety (90)

calendar days of the event giving rise to

your eligibility to enroll.

Open Enrollment-Employees may enroll,

make changes to, or cancel their existing

enrollment without experiencing a

qualifying change in status event during

this designated time period. Employees

wishing to enroll, change, or cancel their

PCP enrollment shall make their selection

in the “Plan Selection” section of the

EUTF’s EC-1 or EC-1H (for HSTA VB

members only) enrollment form and submit

it to their HRO designee or DOE-EBU no

later than the end of the Open Enrollment

period.

The Plan Year normally runs from July 1

to June 30 each year.

5. HOW CAN I CHANGE MY PCP

ELECTION?

Your PCP election will be automatically

renewed each Plan year. If you wish to

change your election, you can only do so

during a designated Open Enrollment

period. The only exception is if a change in

your status has occurred for which the

Rules permit a PCP election change, such

as, but not limited to:

❖ Your marriage, divorce, or marriage

annulment.

NOT enrolled in PCP

Gross Pay

$2,000

PCP Reduction

0

Gross Taxable

$2,000

Federal Tax withheld

$101.60

State Tax withheld

$88

FICA Tax withheld

$153

Health Insurance

$267

Vision Care

$3

Dental Insurance

$13

Other

$100

Take-home pay

$1274.40

Enrolled in PCP

Gross Pay

$2,000

PCP Reduction

$283

Gross Taxable

$1717

Federal Tax withheld

$73.30

State Tax withheld

$69.88

FICA Tax withheld

$131.36

Health Insurance

0

Vision Care

0

Dental Insurance

0

Other

$100

Take-home pay

$1342.46

❖ Birth, adoption, or placement for

adoption of a child or addition of a

foster child.

❖ Death of your spouse or dependent.

❖ Employment or loss of employment by

you, your spouse, or dependent.

❖ Start or return from an (authorized)

unpaid leave of absence.

❖ Loss of eligibility by you or your

spouse under a health benefits plan.

❖ Your last dependent child becoming

ineligible for coverage under your

health benefits plan.

To make a change, it must be consistent

with your change in status, and you must

file the appropriate PCP change forms with

your HRO designee or DOE-EBU within

ninety (90) calendar days of the date of

your qualified change in status. Approved

changes will take effect after your forms

are received, usually the following pay

period, if administratively possible. For a

complete list of IRS-qualifying change in

status events, see §14-51-24 of the PCP

Administrative Rules.

If, during the Plan year, premium rates

increase and there is a change in the

employee contributions, the PCP Plan

Administrator will make the appropriate

adjustments.

6. HOW CAN MY PCP BE

CANCELLED?

Generally, you cannot cancel your PCP

election during a Plan year unless you

transfer to a non-eligible employment

classification, you marry and obtain

coverage under your spouse’s plan, or

your spouse gets a new job and you

receive health benefits plan coverage

through the new employer’s plan. You

must submit the required cancellation

forms within ninety (90) calendar days of

your qualified change in status. Approved

cancellations shall become effective as

soon as administratively possible, on a

prospective (not retroactive) basis, after

your forms are received (e.g., next pay

period following receipt of your forms).

There may be other situations in which

cancellations can be allowed. However,

you must write to the PCP Plan

Administrator for prior written approval.

Otherwise, you must wait until the next

designated Open Enrollment period to

cancel your PCP election.

Your PCP election will be cancelled if

you should involuntarily lose eligibility for

the health benefits plan you selected, as

provided in the Rules.

7. CAN I LOSE MONEY UNDER THE

PCP?

Usually, you will not lose money by

enrolling in the PCP. However, if you

change/cancel your health benefits plan

coverage but your PCP change/

cancellation is not permissible under the

Rules, your PCP election will continue, and

your premium payments will be forfeited.

To ensure that your forfeitures are stopped

at the end of the Plan year (i.e., June 30

th

),

you must file the required PCP

change/cancellation forms during the next

Open Enrollment period.

Reminder: Mid-Plan year changes and

cancellations that are allowable take effect

on a prospective basis after you file the

required forms. The longer you take to file,

the more money (premium payments) you

are likely to lose. To avoid this, file in a

timely manner.

8. IF MY DOMESTIC OR CIVIL UNION

PARTNER IS COVERED UNDER MY

HEALTH PLAN, CAN I ENROLL IN

THE PCP?

If you cover your domestic or civil union

partner under your health plan and your

domestic or civil union partner meets the

definition of a "qualified dependent" under

Section 152 of the Code and qualifies as

your dependent for federal income tax

purposes, you may deduct the entire

premium contribution on a pre-tax basis.

Otherwise, the contribution amount for your

domestic or civil union partner shall be

done on an after-tax basis. You must

submit the PCP Domestic/Civil Union

Partnership Acknowledgement Form (PCP-

DP/CU), which can be obtained from your

HRO designee or DOE-EBU or the DHRD

website at http://dhrd.hawaii.gov.

For PCP enrollment changes, refer to

Q&A # 5.

9. WILL MY SOCIAL SECURITY

BENEFITS BE AFFECTED IF I

ENROLL IN THIS PLAN?

If you participate in the PCP, your Social

Security benefits may be slightly reduced

because your Social Security benefits and

taxes will be calculated on your reduced

salary amount.

10. WILL MY RETIREMENT PENSION

BE AFFECTED IF I ENROLL IN THIS

PLAN?

No, your retirement pension will not be

affected by your participation in the PCP.

11. WILL MY DEFERRED

COMPENSATION PLAN

CONTRIBUTIONS BE AFFECTED IF

I ENROLL IN THE PCP?

Participating in the PCP may affect your

deferred compensation plan contributions if

your contributions are based on a

percentage of your pay rather than a fixed

dollar amount.

12. WHAT HAPPENS IF I GO ON LEAVE

WITHOUT PAY?

While you are on an authorized leave

without pay ("LWOP"), out-of-pocket

employee contributions that you pay to

continue your health benefits plan

coverage cannot be applied for PCP

purposes. This is because these payments

are made outside of the State’s payroll

system and do not qualify for the tax

savings available under the Plan.

When you return from a LWOP, your

PCP election will automatically continue if

you continued your health benefits plan

coverage during your leave by making the

required out-of-pocket contributions.

If your health benefits coverage was

cancelled because you did not make the

required out-of-pocket contributions while

you were on a LWOP, your PCP election

will likewise be cancelled as of the same

effective date.

However, you will be permitted to re-

enroll in the PCP when you return to work,

provided you have filed the appropriate

PCP forms with your HRO designee or

DOE-EBU within ninety (90) calendar days

of your return.

13. WHAT APPEAL RIGHTS DO I

HAVE?

If your PCP change or cancellation

request is denied, you may file an appeal

by writing to the PCP Plan Administrator

within thirty-one (31) calendar days after

receiving notice of the denial. Your letter

must set forth all your reasons for

appealing the denial. (address under Q&A

# 14.)

The PCP Plan Administrator shall act

upon your appeal within sixty (60) calendar

days after either receipt of your request or

receipt of any additional materials

reasonably requested from you, whichever

occurs later.

You shall be provided a written notice of

the final decision on your appeal within one

hundred twenty (120) calendar days of the

date your appeal was filed.

The decision of the PCP Plan

Administrator shall be final and conclusive

upon all persons.

14. WHERE CAN I GET MORE

INFORMATION?

If you have additional questions, please

contact your HRO designee or DOE-EBU.

Written requests may be sent to:

Director of Human Resources

Development

PCP Administrator

235 S. Beretania St., 14

th

Floor

Honolulu, Hawaii 96813

*************************************************

This Plan Document can be made

available to individuals who have special

needs or who need auxiliary aids for

effective communication (i.e., large print

or audiotape), as required by the

Americans with Disabilities Act of 1990,

by contacting the DHRD Employee

Assistance Office at 587-1050.

Revised: January 2021