THEUNIVERSITYOFTEXASSYSTEM

CONSOLIDATEDFINANCIALSTATEMENTSFORTHE

YEARSENDEDAUGUST31,2023AND2022

ANDINDEPENDENTAUDITOR’SREPORT

TheUniversityofTexasatArlington♦TheUniversityofTexasatAustin♦TheUniversityofTexasatDallas♦TheUniversity

ofTexasatElPaso♦TheUniversityofTexasPermianBasin♦TheUniversityofTexasRioGrandeValley♦TheUniversityof

Texas at San Antonio ♦ The University of Texas at Tyler ♦ The University of Texas Southwestern Medical Center ♦ The

University of Texas Medical Branch at Galveston ♦ The University of Texas Health Science Center at Houston ♦ The

UniversityofTexasHealthScienceCenteratSan Antonio♦TheUniversityofTexasM. D.AndersonCancerCenter♦The

UniversityofTexasSystemAdministration

THEUNIVERSITYOFTEXASSYSTEM

TABLEOFCONTENTS

Page

THEUNIVERSITYOFTEXASSYSTEMBOARDOFREGENTS 1

THEUNIVERSITYOFTEXASSYSTEMEXECUTIVEADMINISTRATIVEOFFICIALS 2

INDEPENDENTAUDITOR'SREPORT 3

MANAGEMENT'SDISCUSSIONANDANALYSIS 6

CONSOLIDATEDFINANCIALSTATEMENTSFORTHEYEARSENDEDAUGUST31,2023AND2022

ConsolidatedStatementsofNetPosition–BusinessTypeActivities

17

ConsolidatedStatementsofRevenues,ExpensesandChangesinNetPosition–BusinessTypeActivities

19

ConsolidatedStatementsofCashFlows–BusinessTypeActivities

20

ConsolidatedStatementsofFiduciaryNetPosition

22

ConsolidatedStatementsofChangesinFiduciaryNetPosition

23

NotestotheConsolidatedFinancialStatements

24

REQUIREDSUPPLEMENTARYINFORMATION 143

THEUNIVERSITYOFTEXASSYSTEM

BOARDOFREGENTS

AsofAugust31,2023

Officers

KevinP.Eltife,Chairman

JanieceLongoria,ViceChairman

JamesC.“Rad”Weaver,ViceChairman

FrancieA.Frederick,GeneralCounseltotheBoardofRegents

Members

TermsscheduledtoexpireFebruary1,2025*

ChristinaMeltonCrain Dallas

JodieLeeJiles Houston

KelcyL.Warren Dallas

TermsscheduledtoexpireFebruary1,2027*

KevinP.Eltife Tyler

NolanPerez Houston

StuartW.Stedman Houston

TermsscheduledtoexpireFebruary1,2029*

JanieceLongoria Houston

JamesC.“Rad”Weaver SanAntonio

RobertP.Gauntt Austin

TermscheduledtoexpireMay31,2024*

JohnMichaelAustin(StudentRegent) SanAntonio

*EachRegent’stermexpireswhenasuccessorhasbeenappointed,qualified,andtakentheoathofoffice.The

StudentRegentservesaone-yearterm.

1

THEUNIVERSITYOFTEXASSYSTEM

EXECUTIVEADMINISTRATIVEOFFICIALS

AsofAugust31,2023

JamesB.Milliken,Chancellor

JonathanC.Pruitt,ExecutiveViceChancellorforBusinessAffairs

ArchieL.Holmes,Jr.,ExecutiveViceChancellorforAcademicAffairs

JohnM.Zerwas,ExecutiveViceChancellorforHealthAffairs

DavidL.Lakey,ViceChancellorforHealthAffairsandChiefMedicalOfficer

StaceyNapier,ViceChancellorforGovernmentalRelations

RandaS.Safady,ViceChancellorforExternalRelations,Communications,andAdvancementServices

DanielH.Sharphorn,ViceChancellorandGeneralCounsel

RichHall,President,ChiefExecutiveOfficer,andChiefInvestmentOfficer–UTIMCO

2

3

4

5

THEUNIVERSITYOFTEXASSYSTEM

MANAGEMENT’SDISCUSSIONANDANALYSIS

FortheYearEndedAugust31,2023

INTRODUCTION

The University of Texas System (the System) was

established by the Texas Constitution of 1876. In 1881,

Austin was designated the site of the main academic

campus and Galveston as the location of the medical

branch.TheUniversityofTexasatAustinopenedin1883,

and eight years later, the John Sealy Hospital in

Galveston established a program for university-trained

medical professionals. In addition to the original

academic campus of The University of Texas at Austin,

the System now includes seven additional academic

institutions:

• TheUniversityofTexasatArlington

• TheUniversityofTexasatDallas

• TheUniversityofTexasatElPaso

• TheUniversityofTexasPermianBasin

• TheUniversityofTexasRioGrandeValley

• TheUniversityofTexasatSanAntonio

• StephenF.AustinStateUniversity(9/1/23)

• TheUniversityofTexasatTyler

Health institutions for medical education and research

have expanded beyond The University of Texas Medical

BranchatGalvestontoinclude:

• TheUniversityof Texas M. D. Anderson Cancer

Center

• The University of Texas Southwestern Medical

Center

• TheUniversityofTexasHealthScienceCenterat

Houston

• TheUniversityofTexasHealthScienceCenterat

SanAntonio

TheSystem’sthirteeninstitutionsare,collectively,oneof

thenation’slargesteducationalenterprises.Theyprovide

instruction and learning opportunities to approximately

255,000 undergraduate, graduate, and professional

school students from a wide range of social, ethnic,

cultural, and economic backgrounds. The System is

governedbyanine-memberBoardofRegentsappointed

by the Governor of Texas and confirmed by the Texas

Senate. In addition, the Governor appoints a Student

Regentforaone-yearterm.

OVERVIEWOFTHEFINANCIALSTATEMENTS

ANDFINANCIALANALYSIS

The objective of Management’s Discussion and Analysis

(MD&A) is to provide an overview of the financial

positionand activitiesof the Systemfor theyearended

August31,2023,withselectedcomparativeinformation

for the years ended August 31, 2022 and 2021. The

completesetoffinancialstatementsincludes:

6

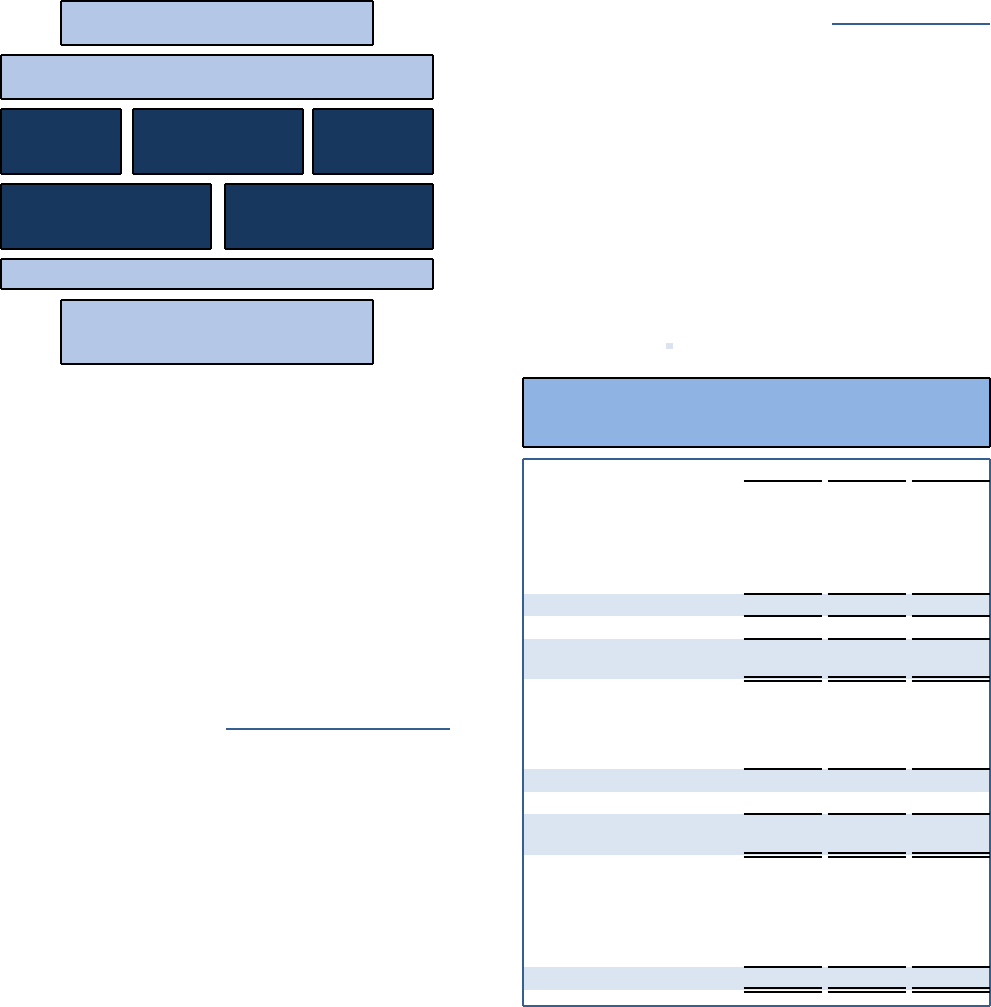

Management’s

Discussion&Analysis

PrimaryFinancialStatements–

ProprietaryandFiduciaryFunds

Statementsof

NetPosition

Statementsof

Revenues,Expenses&

ChangesinNetPosition

Statementsof

CashFlows

StatementsofFiduciary

NetPosition

StatementsofChangesin

Fiduciary

NetPosition

NotestotheFinancialStatements

RequiredSupplementaryInformation

PensionPlansand

OtherPostemploymentBenefits

The System’s financial statements were prepared in

accordancewithaccountingprinciplesgenerallyaccepted

in the United States of America as prescribed by the

Governmental Accounting Standards Board (GASB). The

System’s financial records are reported as a business-

typeactivityintheStateofTexas’AnnualComprehensive

FinancialReportandtheSystem’scustodialfundfinancial

records are reported as fiduciary funds in the State of

Texas’ Annual Comprehensive Financial Report. For

purposesofthe MD&A,referencestotheSysteminthe

discussion of financial results relate to the System's

business-typeactivity.

FINANCIALHIGHLIGHTS

TheSystemcontinuestomaintainandprotectitsstrong

financialcondition,withnetpositionof$70.7billionasof

August 31, 2023. Revenues totaled $31.4 billion and

expenses totaled $27.1 billion in 2023. Net patient care

revenues and sponsored program revenues were the

largest contributors to the revenues of the System in

2023. Net investment income and the change in fair

value of investments often drive the year to year

fluctuationinSystemrevenues,asthosevaluesvaryfrom

year to year based on market conditions and other

factors. Compensation and benefits, including the

Teacher Retirement System of Texas pension and other

postemployment benefits (OPEB) continue to be the

largestexpenseoftheSystem.TheSystemiscommitted

torecruitingandretainingoutstandingfacultyandstaff,

andthecompensationpackageisonewaytosuccessfully

compete with peer institutions and nonacademic

employers.

TheStatementofNetPosition

The statement of net position presents the assets,

deferred outflows, liabilities, deferred inflows, and net

positionoftheSystemasoftheendoftheyear.Thisisa

pointintimefinancialpresentationofthefinancialstatus

asofAugust31,2023,withcomparativeinformationfor

the previous years. Net position is the residual value of

theSystem’s assetsanddeferred outflowsofresources,

after liabilities and deferred inflows of resources are

deducted. Changes in net position are one indicator of

the improvement or decline of the System’s financial

strength. A summarized comparison of the System’s

statement of net position as of August 31, 2023, 2022

and2021follows:

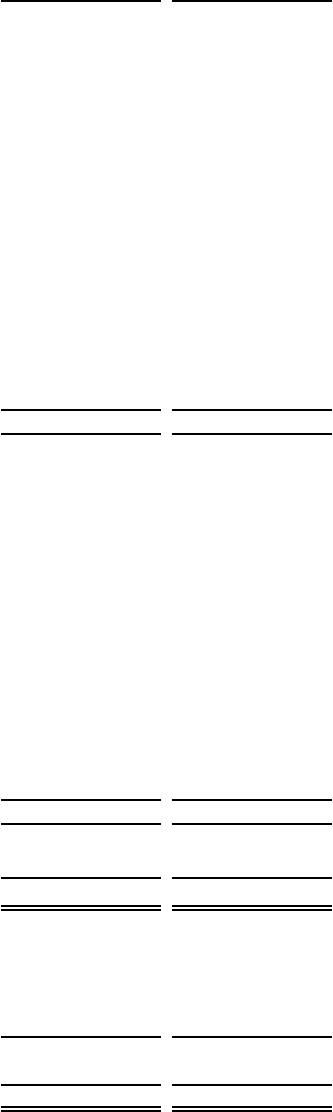

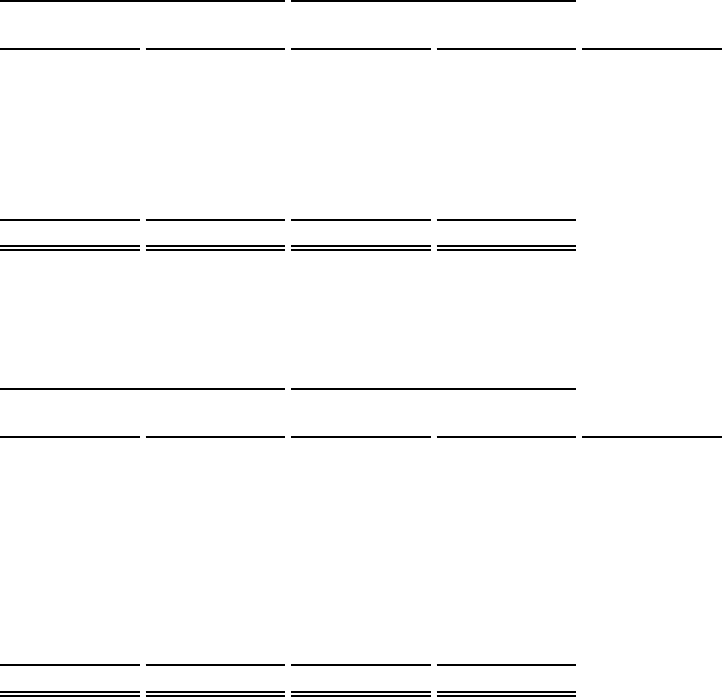

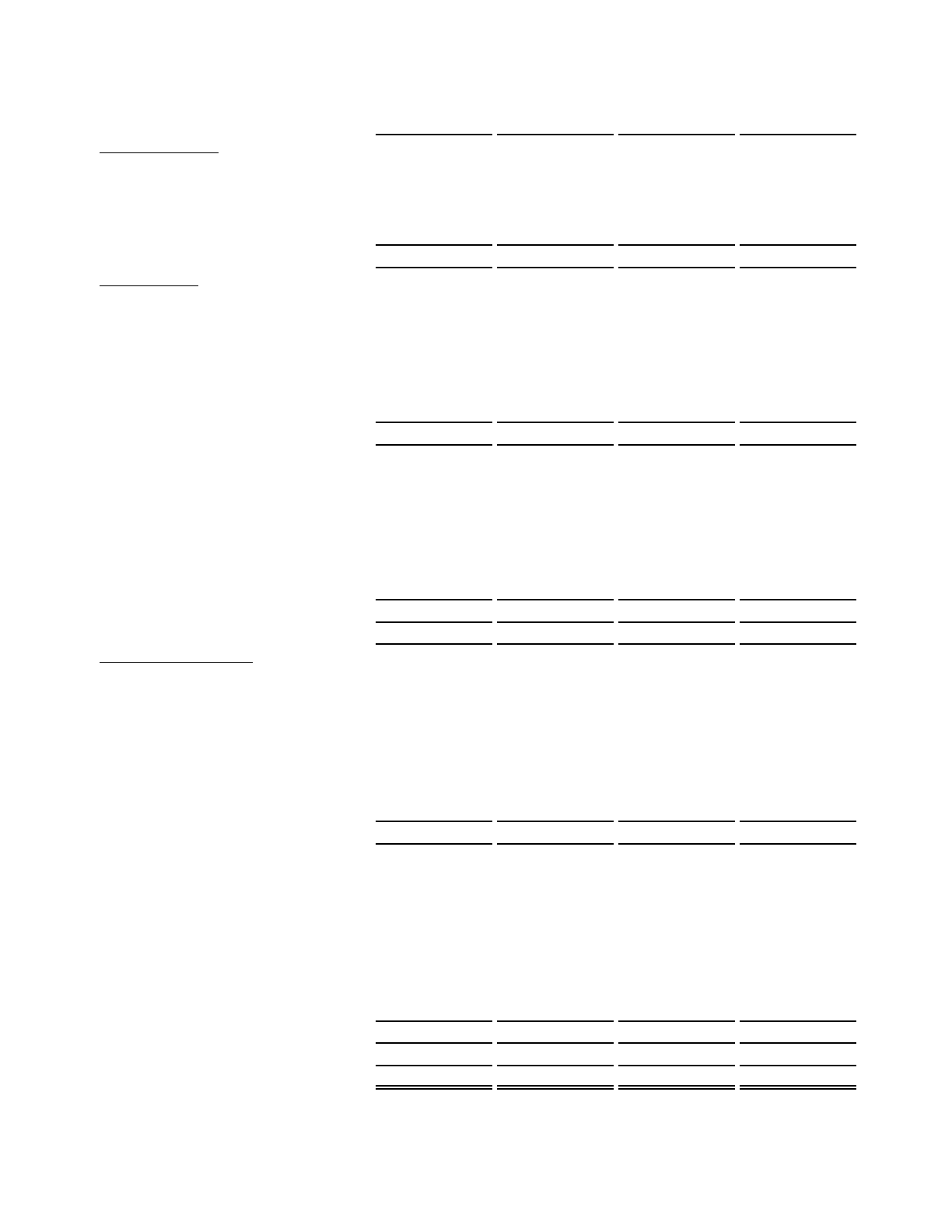

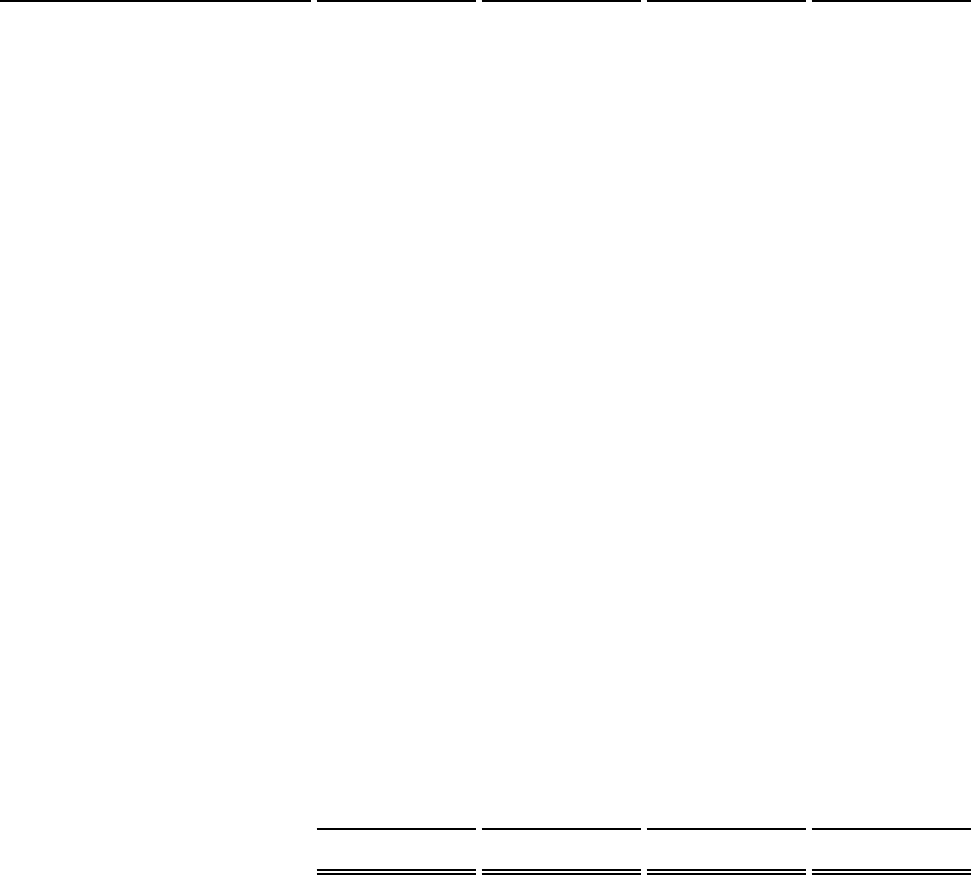

CondensedStatementsofNetPosition

($inmillions)

2023 2022 2021

Assets

Currentassets $ 13,443.4 11,471.7 10,538.3

Noncurrentinvestments 78,468.0 74,289.5 74,707.9

Capital/intangibleassets,net 19,541.1 19,063.6 18,569.2

Othernoncurrentassets 1,546.5 1,858.0 1,153.5

Totalassets 112,999.0 106,682.8 104,968.9

Totaldeferredoutflows 6,088.9 5,546.1 4,644.2

Totalassetsanddeferred

outflows $119,087.9 112,228.9 109,613.1

Liabilities

Currentliabilities $ 13,149.2 11,153.4 10,897.4

Noncurrentliabilities 26,001.1 29,572.3 29,013.8

Totalliabilities 39,150.3 40,725.7 39,911.2

Totaldeferredinflows 9,273.7 4,814.1 2,829.5

Totalliabilitiesanddeferred

inflows $ 48,424.0 45,539.8 42,740.7

NetPosition

Netinvestmentincapitalassets $ 6,963.7 6,571.0 6,383.5

Restricted 59,514.7 57,175.1 57,151.7

Unrestricted 4,185.5 2,943.2 3,337.2

Netposition $ 70,663.9 66,689.3 66,872.4

7

AssetsandDeferredOutflows

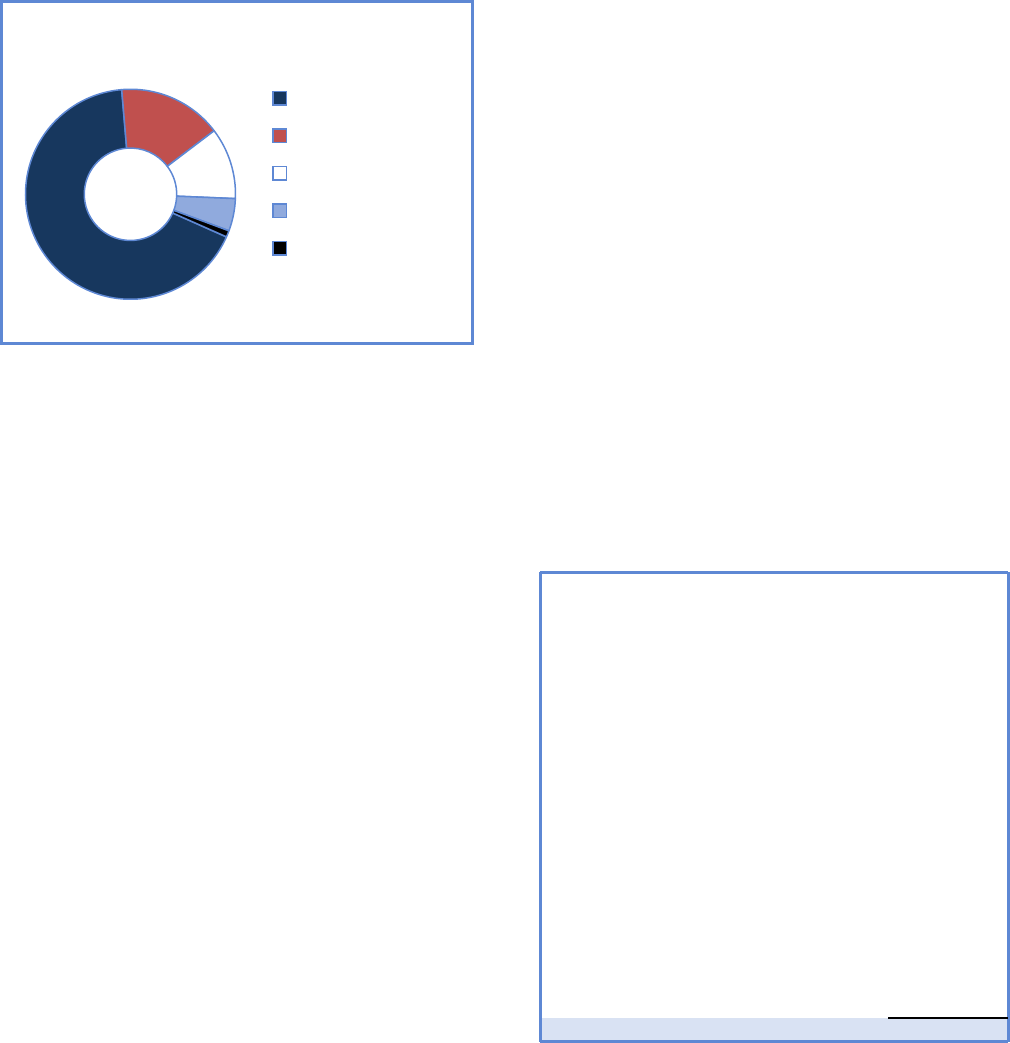

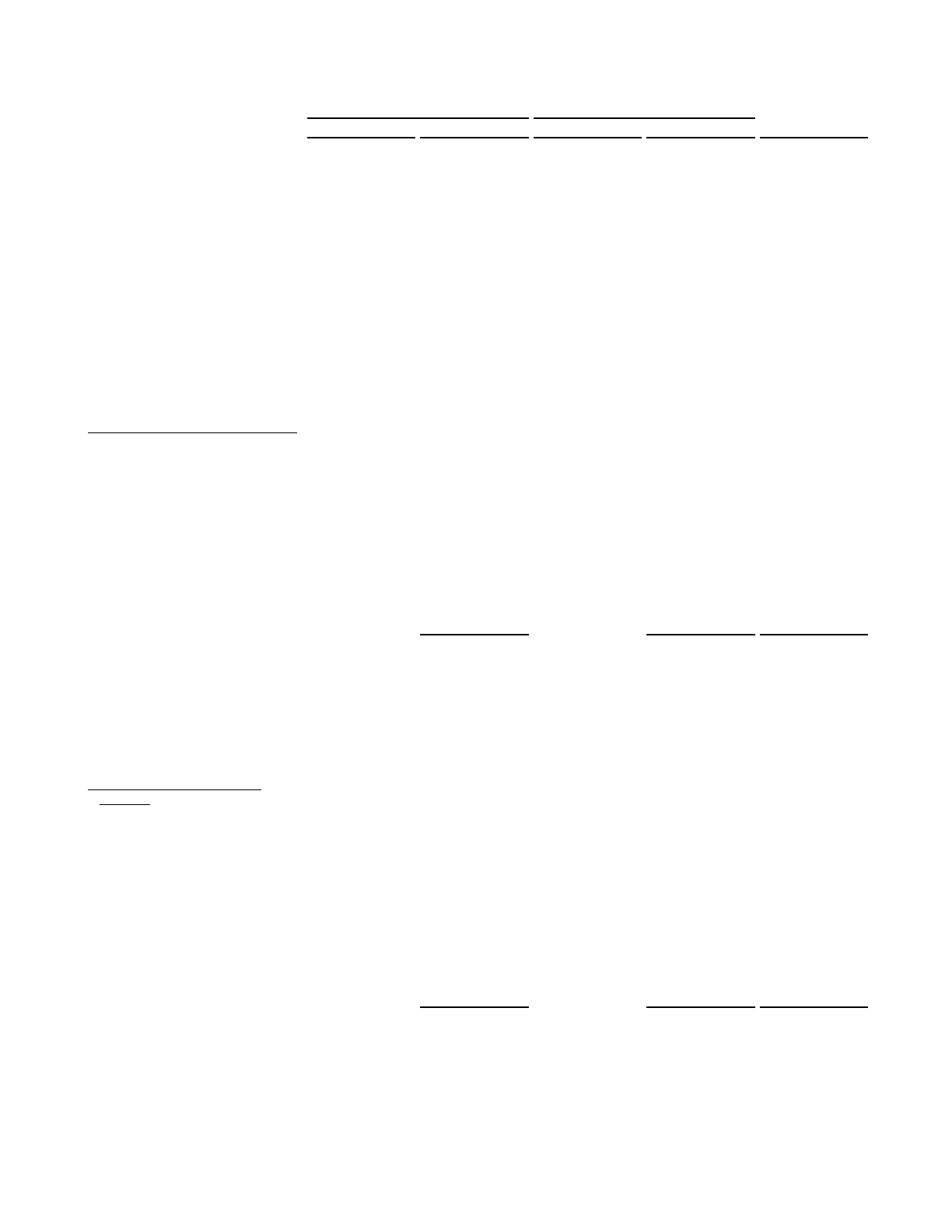

The chart below depicts the makeup of the System’s

assetsanddeferredoutflowsasofAugust31,2023.

AssetsandDeferredOutflows

NoncurrentInvestments67%

CapitalAssets16%

CurrentAssets11%

DeferredOutflows5%

OtherNoncurrentAssets1%

Assets and deferred outflows increased $6.9 billion, or

6.1%,to$119.1billionin2023primarilyduetoincreases

incurrentassetsanddeferredoutflows.

CurrentAssets

Currentassetsarecomprisedofassetsthatareavailable

or can be made readily available to meet the cost of

operations or to pay current liabilities including cash,

temporary investments and receivables. These assets

increased $1,971.7 million in 2023 largely due to

increases in cash and equivalents and balances in State

appropriations,offsetbyadecreaseinsecuritieslending

collateral.

Cash and cash equivalents increased due to increased

collectionsonpatientchargesandtuitionandfeesasthe

populationbegantoreverttopre-pandemiclevelsalong

with higher liquidity levels being maintained due to the

fluctuating market. Securities lending collateral

decreased due to less securities on loan at the end of

2023comparedto2022.Thebalanceinsecuritieslending

collateral, which is exactly offset by the balance in

securities lending obligations in current liabilities,

fluctuates from year to year as the System manages

securitylendingtransactionstomaximizeearnings.

NoncurrentInvestments

Noncurrent investments are comprised of permanent

endowments,fundsfunctioningasendowments,annuity

and life income funds, and other investments including

investment derivative instruments. These assets

increased $4,178.5 million in 2023 largely due to

investmentandmineralincomeearnedandincreasesin

thefairvalueofPermanentUniversityFund(PUF)lands.

Theseincreaseswerepartiallyoffsetbynetdecreasesin

thefairvalueofinvestments.

ThePermanentUniversityFund(PUF),whichincludesthe

fairvalueofthePUFinvestmentfundandthefairvalue

ofPUFlands,increased$1.5billionin2023primarilydue

to significant investment income partially offset by net

decreases in fair value of investments. The increases in

the PUF investments in 2023 can be broken down as

follows:(1)$1.8billionPUFlandsmineralincomeearned

that was added to the endowment in accordance with

requirements of the Texas Constitution; (2) $2.3 billion

decrease in the fair value of the PUF lands due to an

increase in the forecasted price of oil and gas; (3) $1.4

billioninvestmentincomeearnedinthePUFinvestment

fund. These increases were partially offset by a $123

millionincreaseinthefairvalueofthePUFinvestments.

CapitalandIntangibleAssets

Acritical factorin sustainingthe qualityof theSystem’s

academic and research programs and residential life is

the development and maintenance of its capital assets.

Capital additions totaled $2.4 billion in 2023, of which

$1.1billionconsistedofnewprojectsunderconstruction.

Capital additions were comprised of replacement,

renovation,andnewconstructionofacademic,research

and healthcare facilities, as well as significant

investmentsinequipmentandsoftware.Thetablebelow

depicts the System’s capital improvement program for

thenextsixyears.

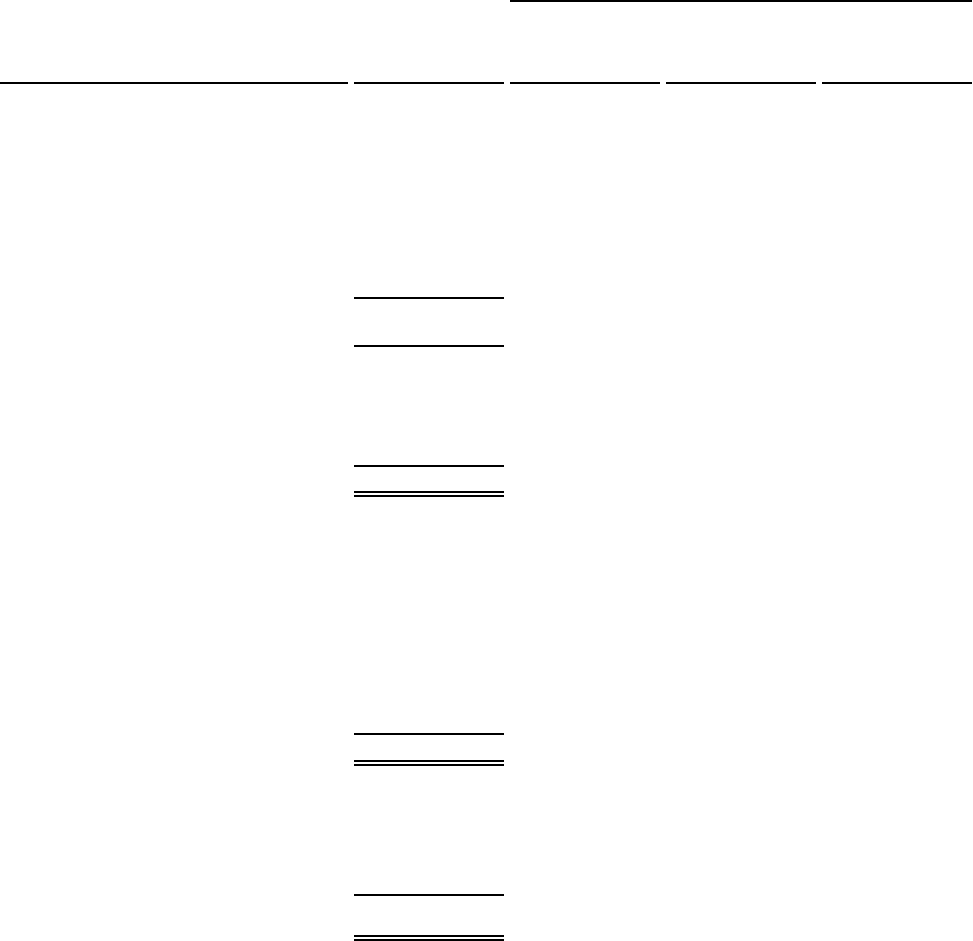

CapitalImprovementProgram

2024-2029

Institution: ($inbillions)

UTArlington $ 0.4

UTAustin 1.5

UTDallas 0.5

UTElPaso 0.2

UTPermianBasin 0.1

UTRioGrandeValley 0.2

UTSanAntonio 0.2

UTTyler 0.1

StephenF.AustinStateUniversity 0.1

UTSouthwesternMedicalCenter 0.4

UTMBGalveston 0.3

UTHSCHouston 0.3

UTHSCSanAntonio 0.8

UTHSC-Tyler 0.3

UTMDAndersonCancerCenter 3.1

Total $ 8.6

DeferredOutflows

Totaldeferredoutflowsincreased$542.8millionin2023

primarilyduetodifferencebetweenprojectedandactual

investmentearningsandchangesinassumptionsrelated

toTRS.

8

LiabilitiesandDeferredInflows

The chart below depicts the makeup of the System’s

liabilitiesanddeferredinflowsasofAugust31,2023.

LiabilitiesandDeferredInflows

OPEBLiability17%

Debt-RelatedLiabilities27%

OtherCurrentLiabilities17%

DeferredInflows19%

PensionLiabilities14%

OtherNoncurr.Liabilities6%

Liabilitiesand deferredinflows increased$2.9 billion,or

6.3%,to$48.4 billionin 2023primarilydue toincreases

in the pension liabilities and deferred inflows of

resources and partially offset by decreases in the OPEB

liability.

Debt-RelatedLiabilities

Debt-related liabilities consist of both the current and

noncurrent portions of short-term debt, or commercial

paper,aswellasleases,notes,loans,andbondspayable.

The $626.6 million increase in debt-related liabilities in

2023wasprimarilydrivenbyanincreaseinleases,notes

andloanspartiallyoffsetbyadecreaseinbondspayable

and commercial paper. Bonds payable relate to the

financing of the System’s capital needs. Commercial

paper notes are issued periodically to provide interim

financing for capital improvements and to finance the

acquisition of capital equipment. The System typically

refundsaportionoftheseoutstandingnotesthroughthe

issuance of long-term debt to provide permanent

financing for projects. The table below depicts the

change in the System’s debt-related liabilities over the

pastthreeyears:

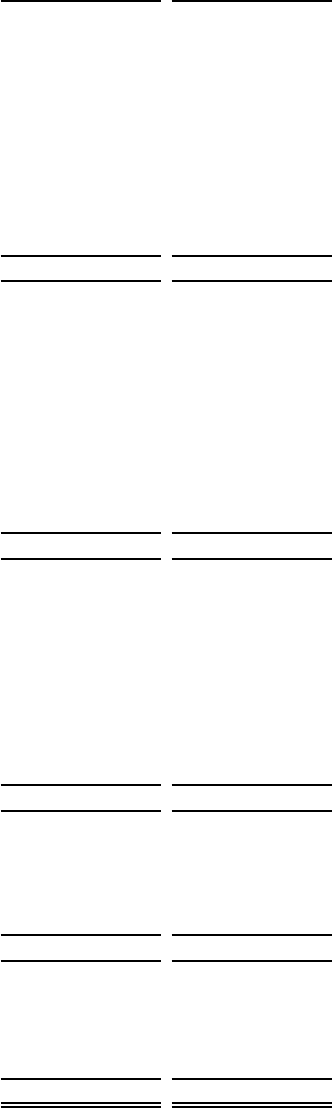

Current&NoncurrentDebt

2023 2022 2021

($inmillions)

BondsPayable $ 9,836.4 9,408.6 9,686.8

CommercialPaper 2,341.1 1,788.8 1,891.1

Leases,Notes&Loans 1,172.1 1,525.6 925.0

TotalDebt-RelatedLiabilities $ 13,349.6 12,723.0 12,502.9

OPEBLiabilities

The State provides certain health and life insurance

benefits for retired employees which are guaranteed in

accordance with State statutes. Other postemployment

benefitsareprovidedtotheSystem’sretireesunderthe

U. T. System Employee Group Insurance Program. The

EmployeeGroupInsuranceProgramisasingle-employer

defined benefit OPEB plan; however, because State

statute requires funding for the plan from State

appropriations,theState’s governmental fund reports a

proportionate share of the OPEB liability. The System

reported a total OPEB liability of $8.1 billion in 2023

compared to $14.7 billion in 2022. $6.6 billion of the

decrease in 2023 was related to benefit changes (and

resulting actuarial assumption changes made) to the

OPEB Plan that reduced the Total OPEB Liability (TOL)

quitesignificantly.Inaddition,thediscountraterequired

by GASB 75 increased from the prior year which also

reduced the TOL. In combination, these two factors

reducedthetotalOPEBPlan’sTOLbyapproximately50%.

This TOL reduction also had large impacts on the OPEB

ExpenseandDeferredInflowsandOutflows.

PensionLiabilities

The System participates in a cost-sharing multiple-

employer defined benefit pension plan with a special

funding arrangement administered by the Teacher

RetirementSystemofTexas(TRS).TheSystemreceivesa

proportional share of the net pension liability, pension-

related deferred outflows and pension-related deferred

inflows,andpensionexpensefromtheTexasComptroller

of Public Accounts. The System’s proportion of the

State’s collective net pension liability was based on its

contributions to the pension plan relative to the

contributions of all the employers to the plan. The

Systemreported a netpensionliability of $5.6billionin

2023 compared to $2.3 billion in 2022. The change is

drivenbyadecreaseinthediscountrateandinvestment

earningsbelowprojections.TheUniversityofTexasM.D.

Anderson Cancer Center has established, primarily for

the physicians of its Physicians Referral Service, the

Physicians Referral Service SRP/RBP Plans. The System

reported a total pension liability of $0.9 billion in 2023

comparedto$1.0billionin2022relatedtotheSRP/RBP

Plans.

DeferredInflows

Total deferred inflows increased $4.5 billion in 2023

primarily driven by changes to OPEB deferred inflows.

OPEBdeferredinflowsincreased$6.5billionin2023due

to benefit changes (and resulting actuarial assumption

changesmade)totheOPEBPlan.

9

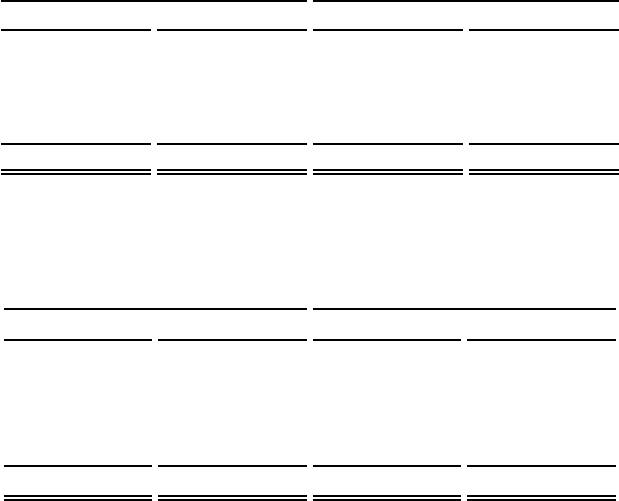

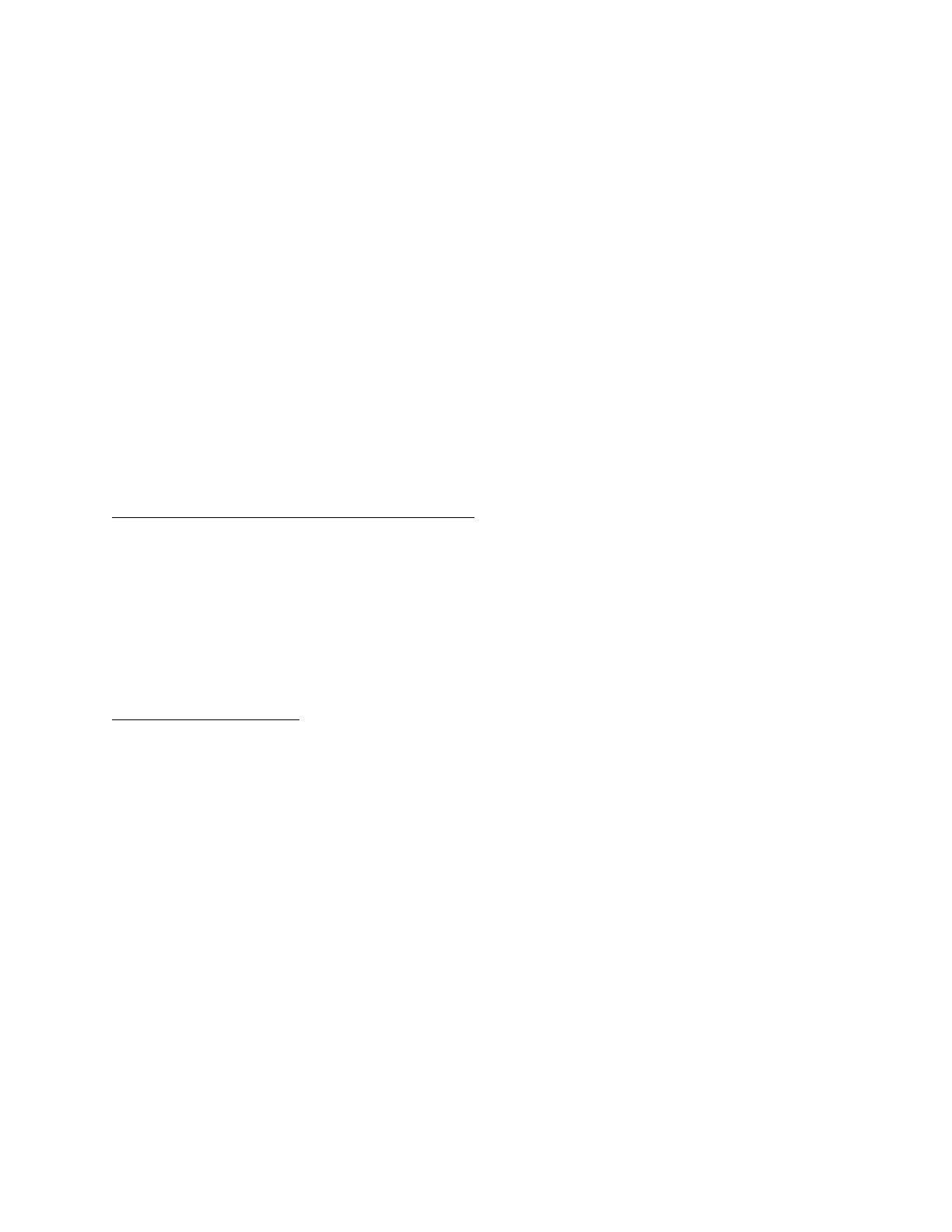

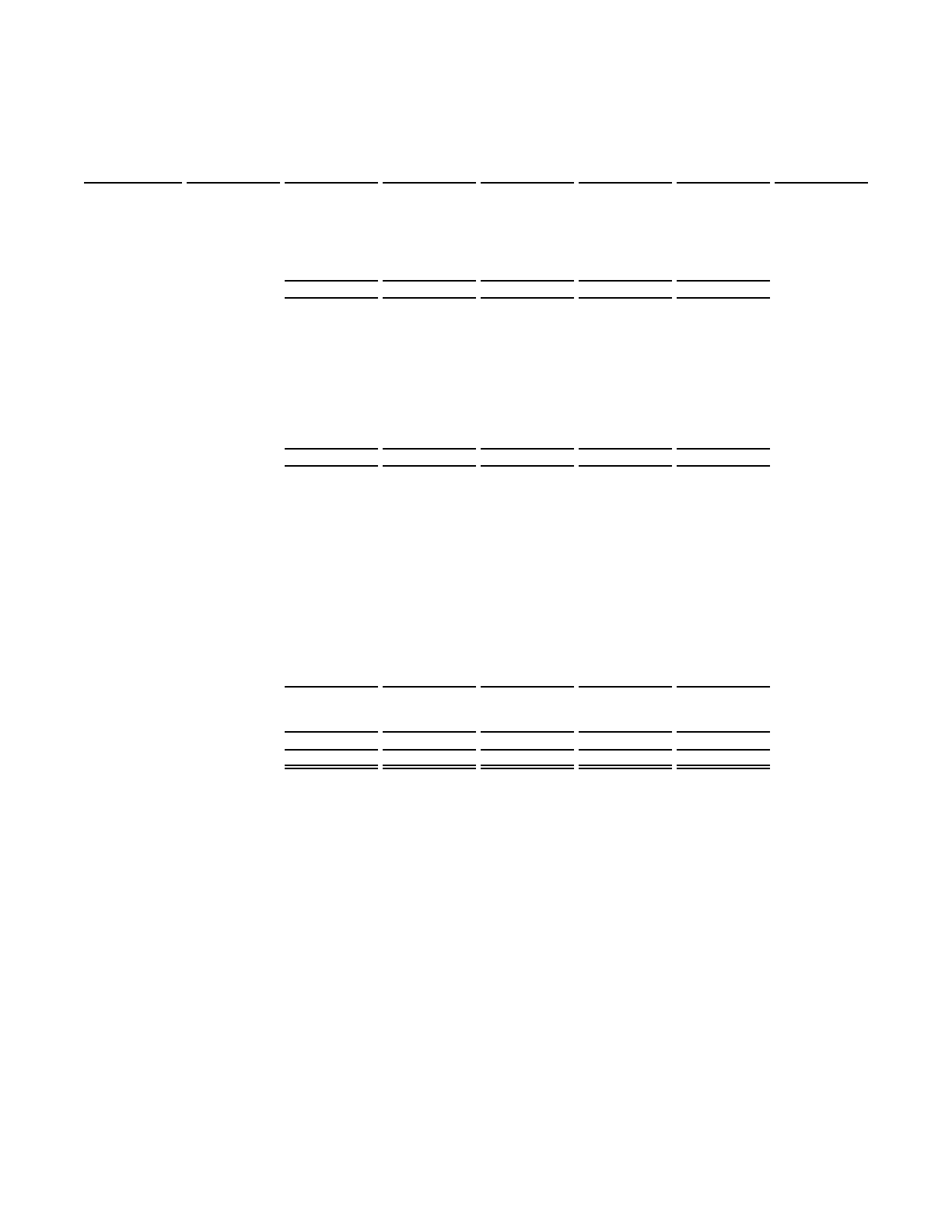

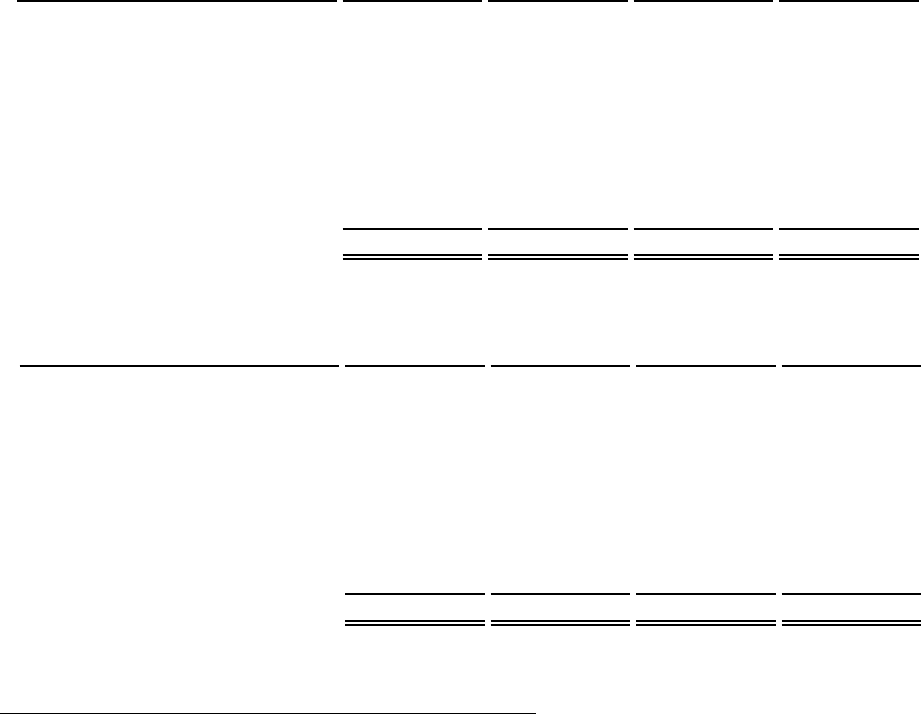

Thefollowingchartcomparestheliabilitiesanddeferred

inflows with or without OPEB and pension to illustrate

these items’ significant impact on the System’s total

liabilitiesanddeferredinflows.

Liabilities&DeferredInflowsComparison

Excluding/Including

OPEB&PensionBalances

($inbillions)

25.3

23.5

22.5

48.4

45.5

42.7

ExcludingOPEB&Pension IncludingOPEB&Pension

2023 2022 2021

0

5

10

15

20

25

30

35

40

45

50

NetPosition

Netpositionincreased$4.0billionin2023comparedtoa

$0.2billion decreasein 2022.Thesignificant increasein

net position was primarily due to the increase in

investmentincome.In2023,therewasanincreaseinfair

value of investment of $0.5 billion compared to a

decreaseof$5.0billionin2022,ayearoveryearincrease

of$5.5billion.ThePUFaccountedfor$1.5billionofthis

year over year increase. The three-year trend of the

classificationsofnetpositionisdepictedhere:

NetPosition

($inbillions)

59.5

57.2 57.2

7.0

6.6 6.4

4.2

2.9 3.3

Restricted NetInvestmentinCapitalAssets Unrestricted

2023 2022 2021

0

10

20

30

40

50

60

70

NetInvestmentinCapitalAssets

NetinvestmentincapitalassetsrepresentstheSystem’s

capital and intangible assets, net of accumulated

depreciation and amortization and outstanding debt

obligations attributable to the acquisition, construction,

orimprovementofthoseassets.

RestrictedNetPosition

Restricted net position primarily includes the System’s

permanent endowment funds subject to externally

imposedrestrictionsgoverningtheiruse.Theyinclude:

• Permanent University Fund (PUF) - supports

boththeSystemandTAMUS,

• Permanent Health Fund endowments (PHF) -

established in 1999 from tobacco-related

litigation funds which support programs that

benefit medical research, health education or

treatmentathealth-relatedinstitutions,and

• Donor restricted endowments - income

generatedis used to fund various endeavors in

accordancewiththedonors’restrictions.

Restrictednetpositionalsoincludescurrentpurposegifts

and grants. System’s restricted net position was $59.5

billionin2023comparedto$57.2billionin2022.

UnrestrictedNetPosition

System’s unrestricted net position was $4.2 billion in

2023ascomparedto$2.9billionin2022.Theincreasein

unrestricted net position between 2022 and 2023 was

primarily due to long term funds, investments, general

designatedandpracticeplanfunds,andimprovementin

income/loss before other revenue, expenses,

gains(losses),andtransfers.

2022Highlights–StatementofNetPosition

The System’s assets and deferred outflows increased

$2.6 billion to $112.2 billion in 2022 primarily due to

increases in deferred outflows and current assets.

Liabilities and deferred inflows increased $2.8 billion to

$45.5billion in2022 primarilydue toan increasein the

OPEB liability and the related deferred inflows mainly

duetochangesinassumptionsandotherinputs.

10

Restatements

Therestatementinfiscalyear2021resultedfromOPEB

errorcorrectionsandtheimplementationofGASB

StatementsNo.87,Leases,andNo.97,Certain

ComponentUnitCriteria,andAccountingandFinancial

ReportingforInternalRevenueCodeSection457Deferred

CompensationPlans.Fiscalyear2022wasrestatedasa

resultoftheimplementationofGASBStatementsNo.94,

Public-PrivateandPublic-PublicPartnershipsand

AvailabilityPaymentArrangements,andNo.96,

Subscription-BasedInformationTechnology

Arrangements.Theimplementationofthesenew

accountingstandardshadnoaffectonopeningnet

positionforfiscalyear2022.SeeNote1forfurther

informationontheimpactsofthesestandards.Fiscal

year2021informationhasnotbeenrestatedtoreflect

theeffectsofGASBStatementsNo.94and96.

TheStatementofRevenues,Expensesand

ChangesinNetPosition

Thestatementofrevenues,expensesandchangesinnet

position details the changes in total net position. The

following table summarizes the System’s revenues,

expensesandchangesinnetpositionfortheyearsended

August31,2023,2022and2021:

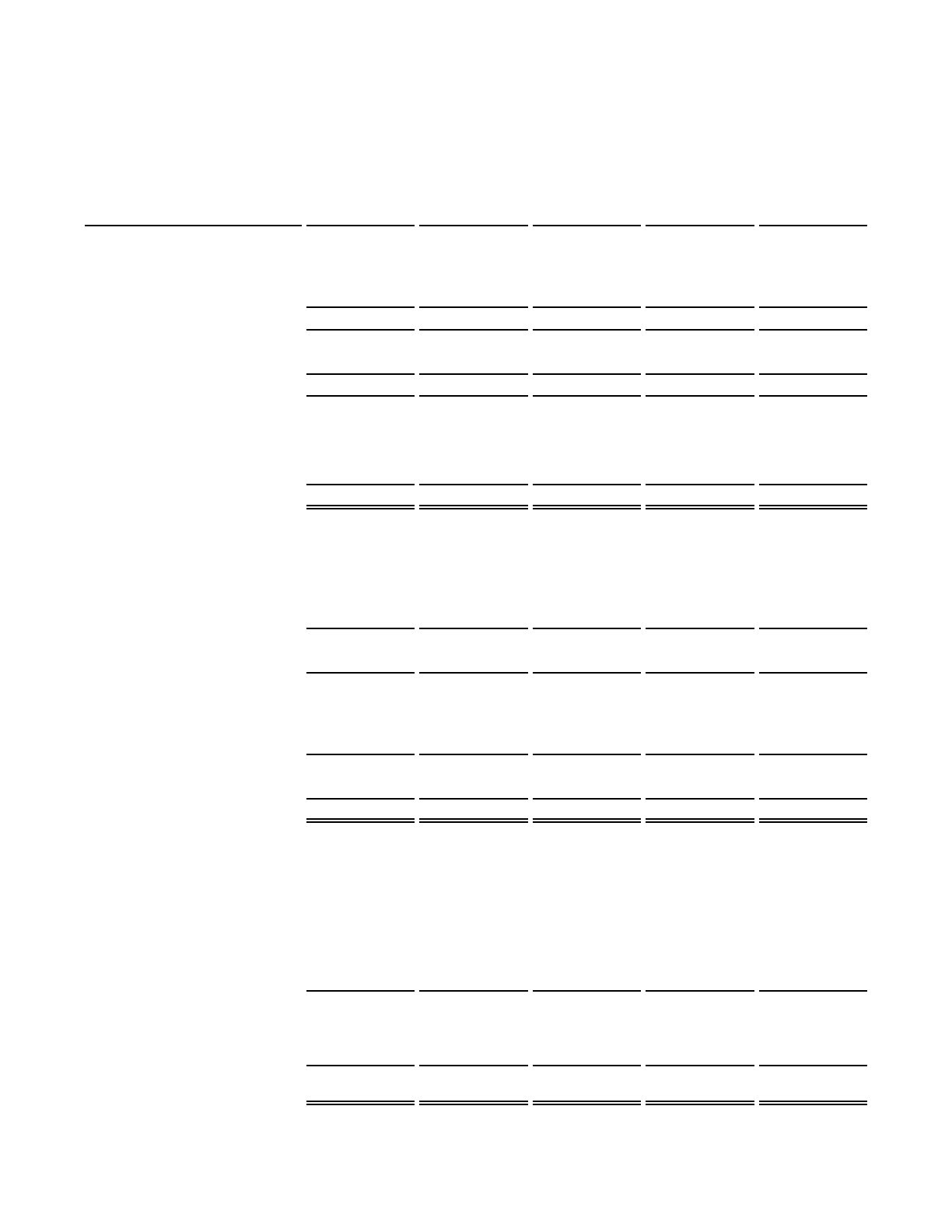

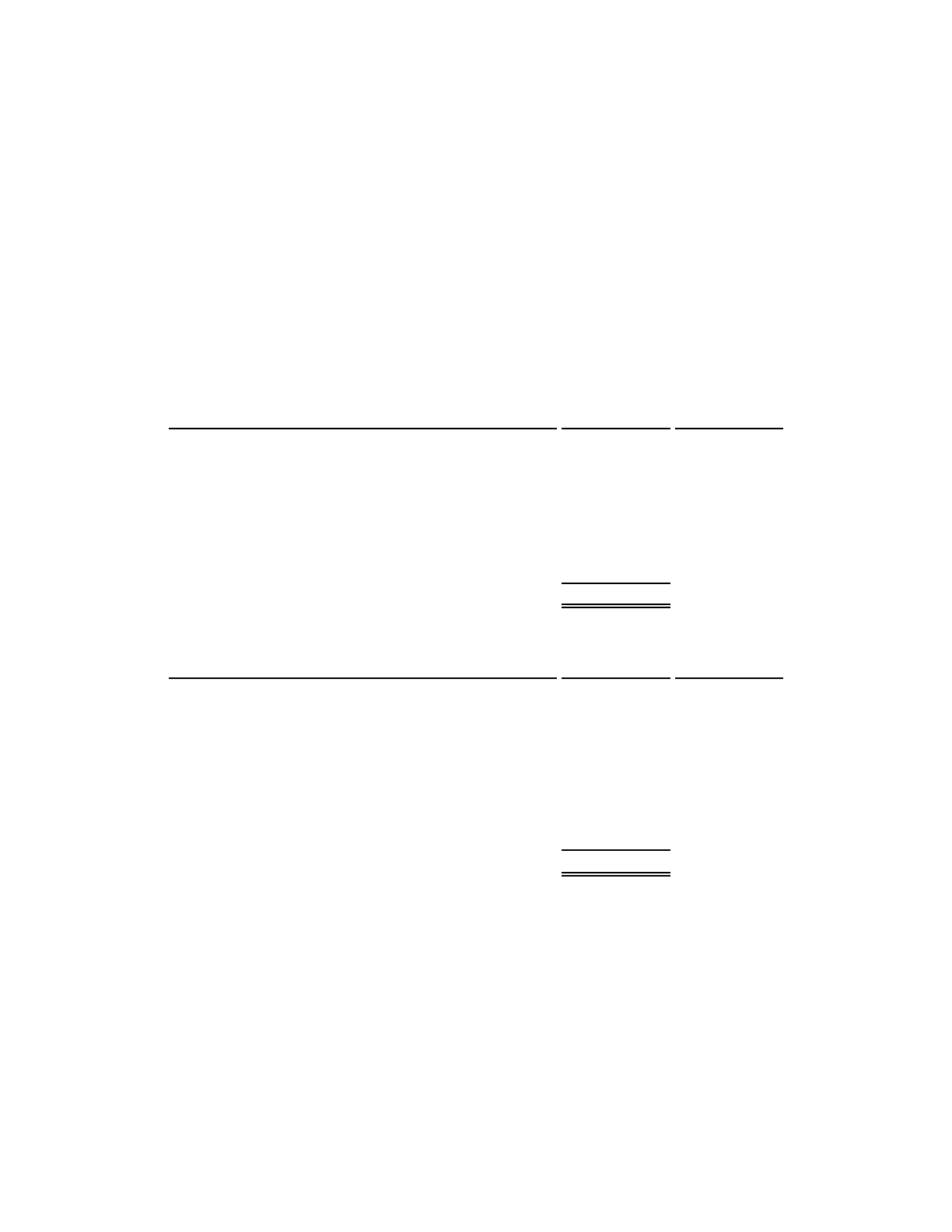

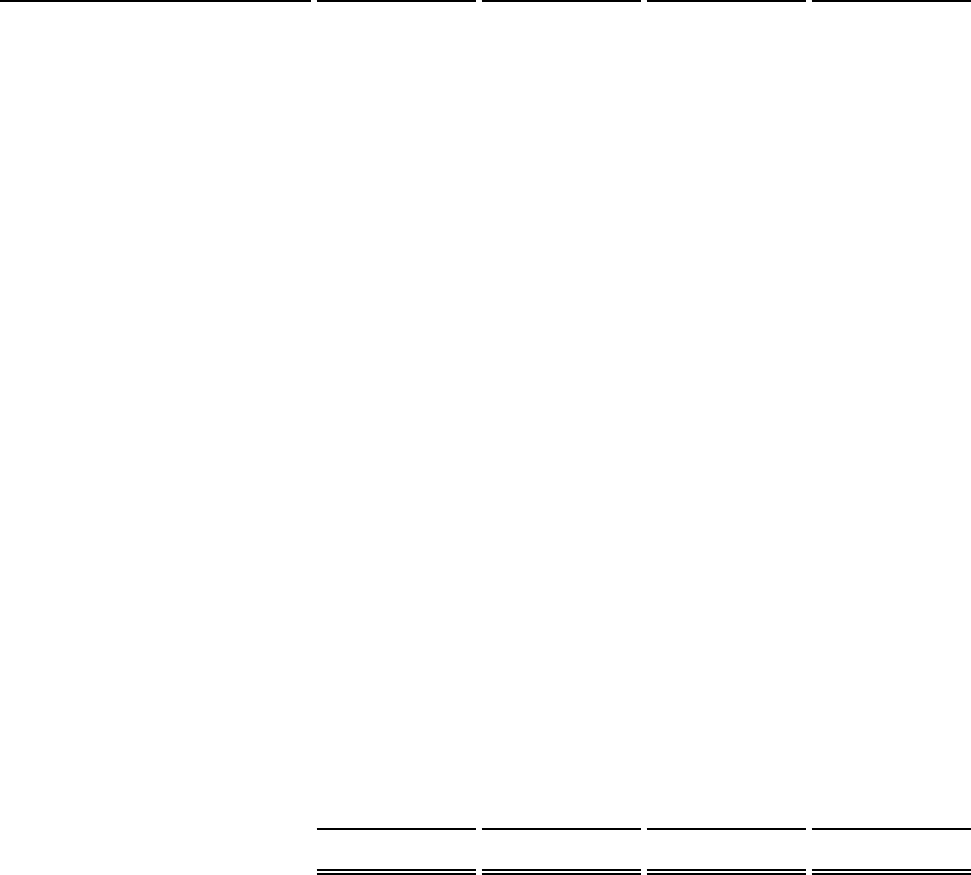

CondensedStatementsofRevenues,Expensesand

ChangesinNetPosition

($inmillions)

2023 2022 2021

Operatingrevenues:

Netstudenttuitionandfees $ 2,162.3 2,124.3 2,006.9

Sponsoredprograms 5,114.9 4,711.9 4,280.4

Netsalesandservicesofhospitals 9,638.1 8,737.1 7,849.9

Netprofessionalfees 2,577.5 2,354.7 2,204.2

Netauxiliaryenterprises 723.2 646.0 377.8

Other 1,275.8 1,279.9 1,104.9

Totaloperatingrevenues 21,491.8 19,853.9 17,824.1

Totaloperatingexpenses (26,720.6) (24,577.4) (22,670.8)

Operatingincome(loss) (5,228.8) (4,723.5) (4,846.7)

Nonoperatingrevenues(expenses):

Stateappropriations 3,052.8 2,529.9 2,194.3

Nonexchangesponsoredprograms 621.7 958.5 1,247.9

Giftcontributionsforoperations 684.0 634.2 618.6

Netinvestmentincomeexcluding

thechangeinfairvalueof

investments 4,744.2 5,619.3 8,807.4

Netincrease(decrease)infairvalue

ofinvestments 479.2 (5,017.2) 8,905.7

Interestexpenseoncapitalasset

financings (379.4) (338.2) (332.0)

Netothernonoperatingrevenues

(expenses) 139.5 36.9 (25.0)

Income(loss)beforeotherchanges

innetposition 4,113.2 (300.1) 16,570.2

Capitalgiftsandgrantsand

additionstoendowments 347.4 563.1 356.0

NettransferstootherState

agencies (485.9) (446.3) (272.6)

Changeinnetposition 3,974.7 (183.3) 16,653.6

Netposition,beginningoftheyear 66,689.1 66,872.4 48,663.7

Restatement — — 1,555.1

Netposition,beginningoftheyear

(asrestated) 66,689.1 66,872.4 50,218.8

Netposition,endoftheyear $ 70,663.8 66,689.1 66,872.4

RevenuesSupportingCoreActivities

Revenues to support the System’s core activities,

including those classified as nonoperating revenues,

were $30.9 billion, $30.2 billion, and $31.0 billion in

2023, 2022, and 2021, respectively. These diverse

sourcesofrevenuesincreasedby$783.0millionin2023

primarilyduetoincreasesinnetinvestmentincome.

11

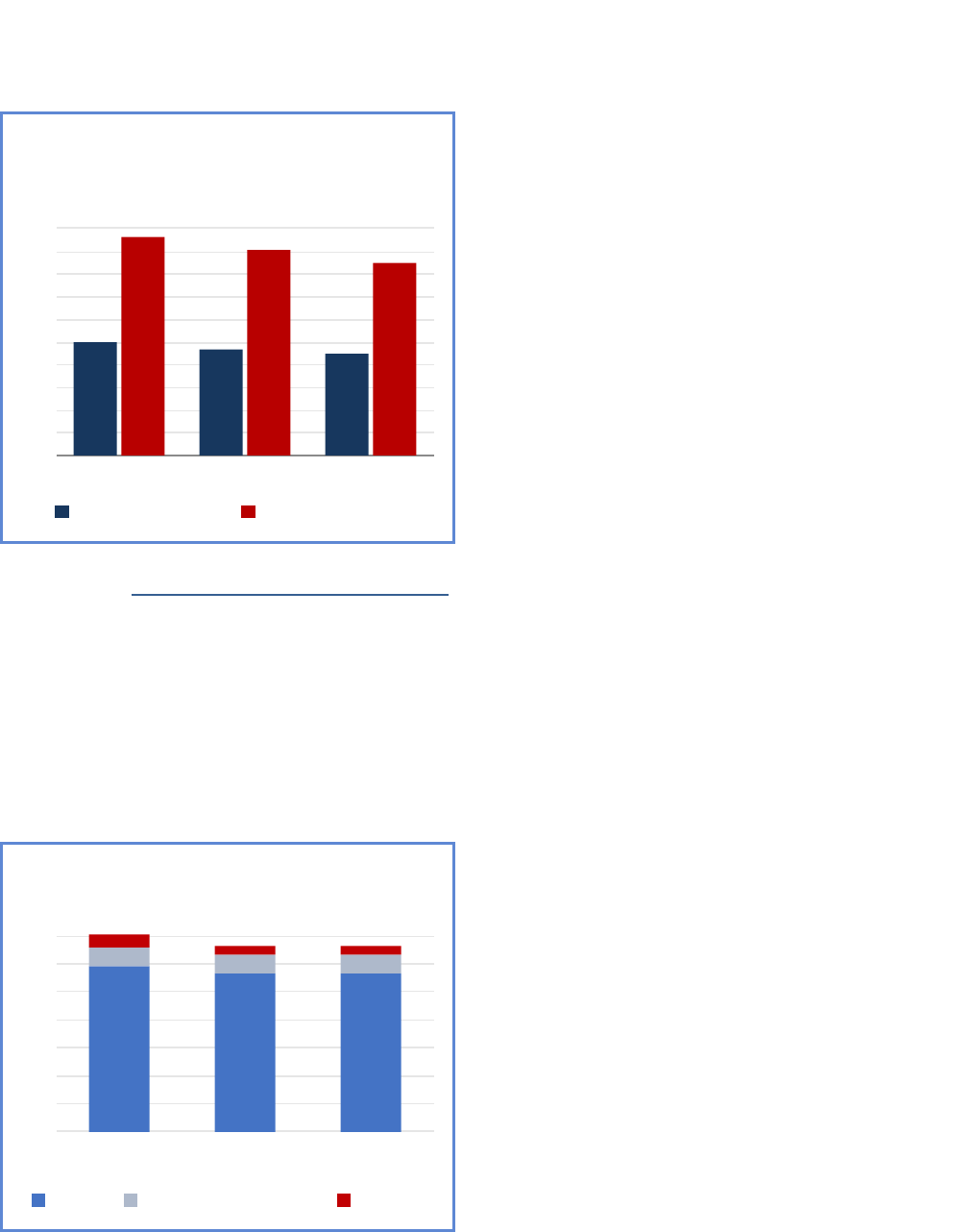

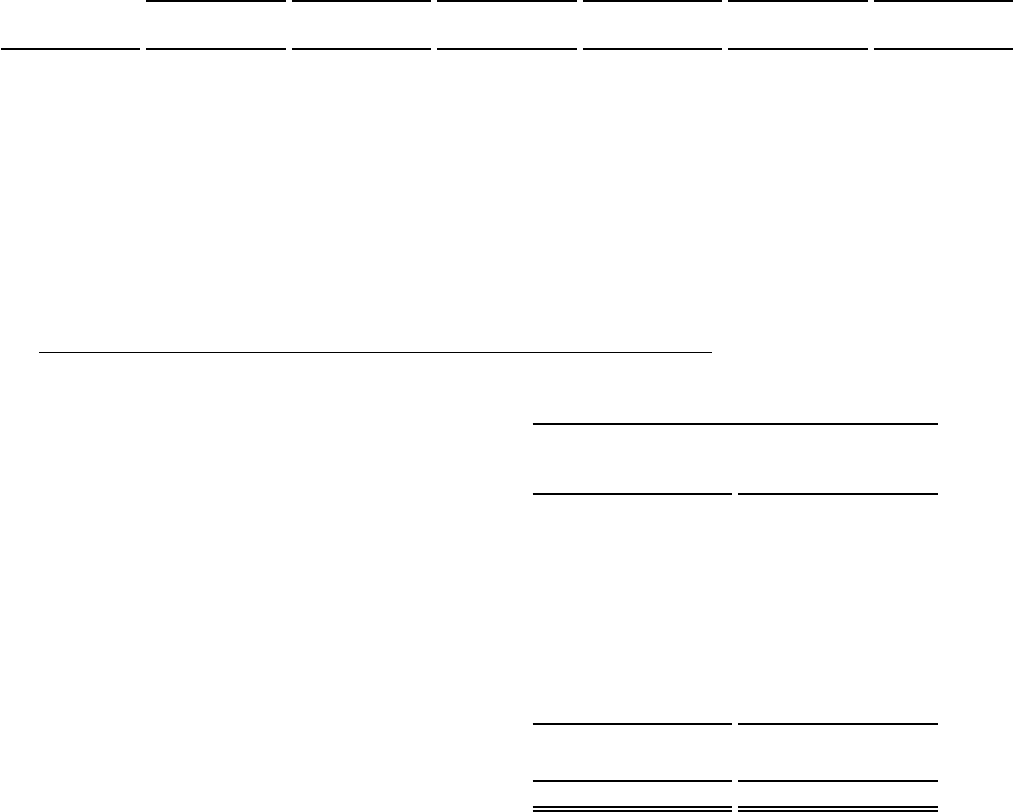

The chart below shows a three-year comparison of the

componentsofrevenuesthatsupportthecoreactivities

oftheSystem:

RevenuesSupportingCoreActivities

($inbillions)

2023 2022 2021

NetPatientCare

NetInvestmentIncome

SponsoredPrograms

StateAppropriations

NetTuition&Fees

Gifts

Other

AuxiliaryEnterprises

0 1 2 3 4 5 6 7 8 9

10 11 12

NetStudentTuitionandFees

Student tuition and fees, net of scholarship allowances,

are a primary source of funding for the System’s

academicprograms.Scholarship allowances, or financial

aid, are the differences between the stated charge for

tuition and fees and the amount that is paid by the

student and third parties on behalf of the student.

Tuition and fees are generated from students enrolled

primarily in the System’s academic institutions as

illustratedinthechartbelow:

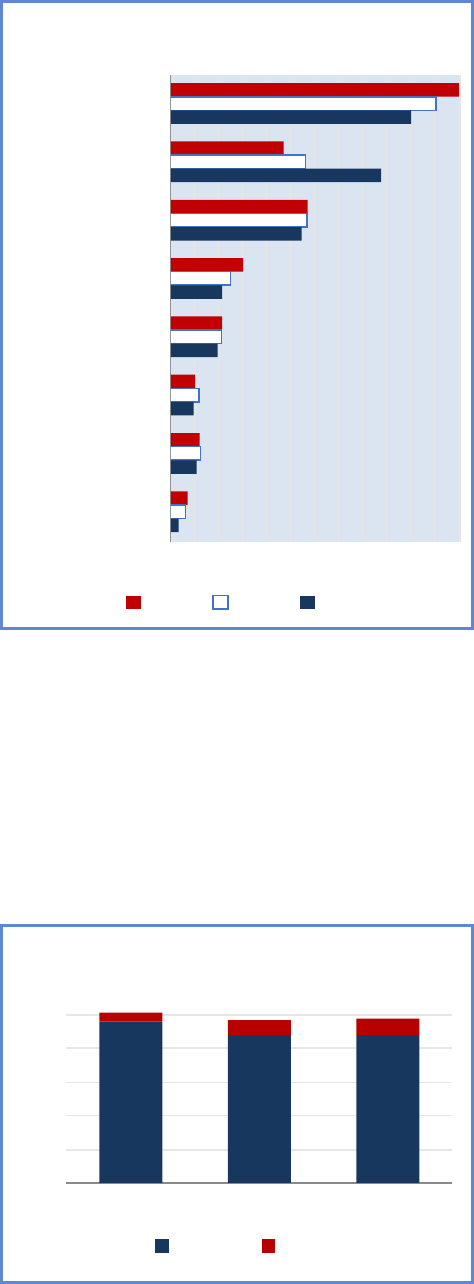

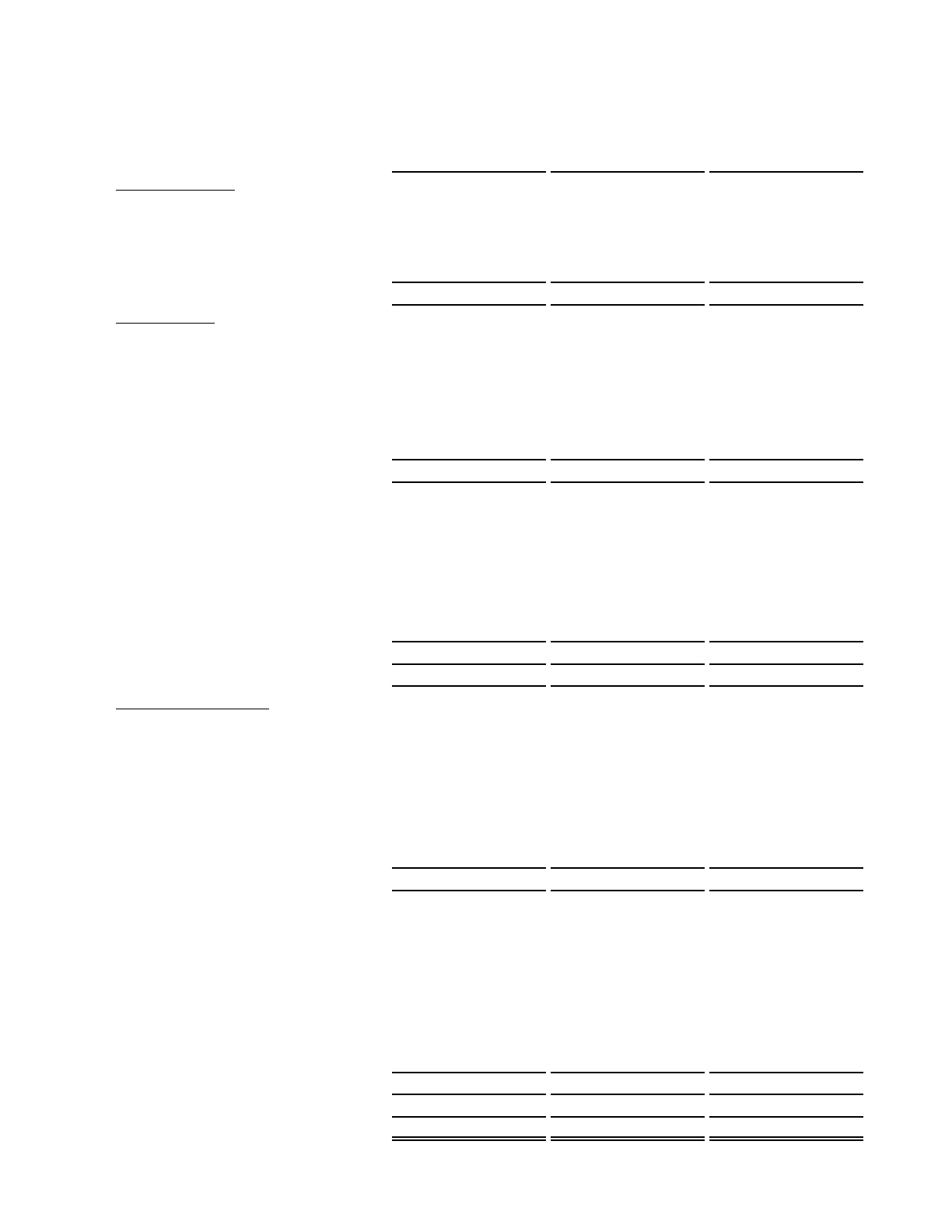

Academic&HealthEnrollment(Fall)

(headcountinthousands)

254

243

244

Academic Health

2023 2022 2021

0

50

100

150

200

250

The System’s academic institutions enroll 35.9% of the

State’spubliccollegestudents,andtheSystem’shealth-

related institutions enroll 54.2% of the students

attendingtheState’spublichealthinstitutions.

SponsoredPrograms

Sponsored program revenues are primarily generated

from governmental and private sources related to

researchprogramsthattypicallyprovidefortherecovery

ofdirectandindirectcosts.Sponsoredprogramsinclude

student financial aid and contracts with affiliated

hospitals for clinical activities. Sponsored programs

revenueswere$5.7billion,$5.7billion,and$5.5billionin

2023,2022,and2021,respectively.

NetPatientCareRevenues

Netpatientcarerevenues,whichconsistofnetsalesand

services of hospitals and net professional fees, are

principally generated within the System’s hospitals and

physicians’ practice plans under contractual

arrangements with governmental payors and private

insurers.Theserevenuesarereportednetofcontractual

allowances, bad debt expense, and unreimbursed

chargesforfinanciallyormedicallyindigentpatients.Net

patient care revenues were $12.2 billion, $11.1 billion,

and $10.1 billion in 2023, 2022, and 2021, respectively.

Net patient care revenues increased $1.1 billion, or

10.1%, in 2023, primarily because of increased patient

volumes.

NetAuxiliaryEnterprises

Net auxiliary enterprise revenues were earned from a

host of activities such as athletics, housing and food

services, bookstores, parking, student health, and other

activities. Net auxiliary enterprises were $723.2 million,

$646.0 million, and $377.8 million in 2023, 2022, and

2021, respectively. Net auxiliary enterprise revenues

increased $77.2 million or 12.0% in 2023 due to

normalizationofauxiliaryactivitiespostCOVID-19.

StateAppropriations

Stateappropriations,inconjunctionwithstudenttuition

and fees, are core components that support the

instructionalmissionoftheSystem.Stateappropriations

were $3.1 billion, $2.5 billion, and $2.2 billion in 2023,

2022,and2021,respectively.Theincreaseof$0.6billion

was primarily due to $440 million given to UT Austin in

SenateBill30(2023-2024,88thLegislature)forforward-

looking technology research and establishing and

operating a research and development fabrication

facility.

12

Net Investment Income Excluding the Change in Fair

ValueofInvestments

The System carefully navigates the investment

environmentandworksdiligentlytomanageitsfinancial

resources.Netinvestmentincome,excludingthechange

infairvalueofinvestments,was$4.7billion,$5.6billion,

and $8.8 billion in 2023, 2022, and 2021, respectively.

Net investment income includes realized gains of $1.9

billion in 2023 and $2.7 billion in 2022. Net investment

income, excluding the change in the fair value of

investments, decreased $0.9 billion from 2022 to 2023,

primarily due to decreases in net realized gains and

investmentincomeinthePUF.

NetIncrease(Decrease)inFairValueofInvestments

Net increase (decrease) in fair value of investments

reportedanincreaseof$0.5billionin2023,adecreaseof

$5.0 billion in 2022, and an increase of $8.9 billion in

2021.In2023,therewas anincreasefrom2022of$5.5

billionprimarilyduetofavorablemarketconditions.

Gifts

The System receivesgiftcontributionsfor operations as

wellasnonoperatinggiftsandgrantsofcapitalandgifts

that are held in perpetuity which are added to the

System’s endowment holdings. In 2023, gifts for

operations totaled $684.0 million, an increase of $49.8

million or 7.9% over 2022. Capital gifts and grants and

additions to permanent endowments totaled $347.4

millionfor2023,adecreaseof$215.7millionover2022

primarilyduetodecreasedgiftsforcapitalacquisitionsin

2023. The System continues its fundraising efforts to

address facilities expansion and renovation, and the

establishment of endowments for instruction, research,

andpatientcareactivities.

ExpensesSupportingCoreActivities

Expenses associated with the System’s core activities,

including interest expense classified as nonoperating,

were $27.1 billion, $24.9 billion, and $23.0 billion in

2023, 2022, and 2021, respectively. The changes, by

category,forthethreeyearsaredepictedbelow:

ExpensesAssociatedwithCoreActivities

($inbillions)

2023 2022 2021

Compensation&

Benefits

Materials/Supplies/Cost

ofGoodsSold

ProfessionalFees/

ContractedServices

Depreciation/Amortization

Other

OPEB

Utilities/Maintenance

Pension

Scholarships/Fellowships

Interest

0 2 4 6 8 10 12 14

Operatingexpensesincreasedby$2.1billionin2023and

increased by $1.9 billion in 2022 primarily due to the

growing cost of providing support for the institution’s

primarymissionsofinstruction,research,publicservice,

patientcare,andstudentsupportactivities.Additionally,

operatingexpenses in2023include $0.5billionof OPEB

expense and $795.6 million of pension expense.

Nonoperating expenses include interest expense which

increasedslightlyto$379.4millionin2023.

The following charts illustrate the makeup of operating

expenses by functional classification for the year ended

August31,2023:

FunctionalClassification

Hospitals&Clinics36%

Instruction21%

Research14%

Depreciation/Amortization7%

AcademicSupport5%

InstitutionalSupport5%

Operations/Maint.ofPlant4%

AuxiliaryEnterprises3%

Scholarships&Fellowships2%

PublicService2%

StudentServices1%

13

Income(Loss)BeforeOtherChangesinNetPosition

Income(Loss)beforeotherchangesinnetpositionisthe

sum of the operating loss plus nonoperating revenues

(expenses).Itisanindicationofrecurringrevenues and

expensesfortheSystemanddoesnottakeintoaccount

capital and endowment-related additions, discussed

above, or transfers. The income (loss) before other

changes in net position totaled $4.1 billion in 2023, an

increase of $4.4 billion over 2022. This increase was

largelyaresultoftheincreaseinnetinvestmentincome

discussedabove.

NetTransferstoOtherStateAgencies

Net transfers to other State agencies totaled $485.9

million in 2023, an increase of $39.6 million over 2022.

These transfers primarily include $485.9 million and

$446.3 million for 2023 and 2022, respectively, for the

AUF distribution to TAMUS for its one-third share of

distributions from the PUF endowment and PUF land

surface income, in accordance with the Texas

Constitution. In addition to the transfers of the current

yearearnings,thenetchangeinPUFdebtoutstandingat

TAMUSisreflectedasatransfertootherStateagencies.

In2022,thePUFdebtatTAMUSincreased$68.2million,

whereas in 2023 the debt increased $86.4 million

contributing to the increase in net transfers to other

Stateagenciesin2023.

2022Highlights–StatementofRevenues,Expensesand

ChangesinNetPosition

System’s change in net position was a decrease of $0.2

billionin2022comparedtoanincreaseof$16.7billionin

2021.Thesignificantdecreaseinchangeinnetposition

in2022wasduetothefluctuatingvalueofthefairvalue

ofinvestments.In2022therewasadecreaseinfairvalue

ofinvestmentsof$5.0billioncomparedtoanincreaseof

$8.9 billion in 2021, a year over year decrease of $13.9

billion. The PUF accounted for $5.6 billion of this

decreasein2022.

TheStatementofCashFlows

TheStatementofCashFlowsprovidesinformationabout

the System’s financial results by reporting the major

sourcesandusesofcashandcashequivalentsduringthe

fiscal year. Ending cash and cash equivalents were $6.5

billion, $5.5 billion, and $4.9 billion in 2023, 2022, and

2021,respectively.Asummarizedthree-yearcomparison

of the System’s changes in cash and cash equivalents

follows:

CondensedStatementsofCashFlows

($inmillions)

2023 2022 2021

Netcashprovidedby(usedfor):

Operatingactivities $ (2,392.4) (2,357.8) (2,316.4)

Noncapitalfinancingactivities 3,637.6 3,750.6 3,882.8

Capitalandrelatedfinancing

activities (1,619.4) (2,160.5) (1,634.2)

Investingactivities 1,390.0 1,355.5 992.0

Netincrease(decrease)incashand

cashequivalents 1,015.8 587.8 924.2

Beginningcashandcashequivalents 5,508.8 4,921.0 3,996.8

Endingcashandcashequivalents $ 6,524.6 5,508.8 4,921.0

In 2023, cash and cash equivalents increased $1,015.8

million.

Cashincreasesduring2023wereprimarilydueto(1)$3.6

billion providedbynoncapitalfinancingactivities,which

includescashinflowsrelatedtostateappropriationsand

nonexchangesponsoredprograms,offsetbytransfersto

other agencies and (2) $1.4 billion of cash provided by

investing activities, which includes cash inflows for

interestandinvestmentincome.

Cash decreases during 2023 were primarily due to (1)

$2.4 billion used by operating activities, which includes

cash payments to employees and suppliers, partially

offset by collection of cash related to tuition and fees,

patient charges, and sponsored program activities and

(2) $1.6 billion used by capital and related financing

activitiesprimarilyforthepurchaseofcapitalassetsand

the net activity associated with issuing and retiring

capitalrelateddebt.

14

ECONOMICOUTLOOK

The mission of the System is to leverage scientific and

academicinsightsandinnovation,educationandtraining

and the delivery of clinical health care for the common

good,inTexasandaroundtheworld.Itisamissionthat

dependsupontheSystem’sabilitytoattractandsupport

students from backgrounds with various goals and

talents; to recruit and retain a broadly skilled and

respectedfacultyofvariousviewpointsandexpertise;to

employ and appropriately recognize dedicated

administratorsandstaffmembers;tobuildandmaintain

physical environments and facilities that enhance and

complement these other goals; and to encourage

ongoing public and private sector support of higher

education, creating a virtuous cycle of investment and

returnforallofTexas.

Incarryingoutthismission,theSystemhasavast,deep

andpositiveimpactonsocietythroughthegenerationof

a thoughtful, skilled and engaged citizenry and the

dissemination of knowledge, ideas and inventions that

influence public policy and society’s shared economic

success.

TheSystemisoneofthelargestandmostcomprehensive

institutionsofhighereducationinthecountry,aswellas

one of the largest employers in Texas. The System’s

operating budget provides a wide range of services for

Texans. Budgeted revenues of the System include both

operating and nonoperating revenues. Budgeted

revenuesfor 2024increased11.3% to$29.1 billion. The

largest area of growth is net sales and services of

hospitals and clinics. Budgeted expenses for 2024

increased 11.5% to $28.1 billion. The most significant

areaofgrowthispersonnelcostswhichincludesthecost

of the benefits provided to its employees and retirees.

The State provides certain health and life insurance

benefits for retired employeesin accordancewith State

statutes.InadditiontoOPEB,theSystemalsoreceivesa

proportional share of the State’s net pension liability,

which is also guaranteed in State statute. These

significant costs will continue to be a challenge to both

theSystemandthestateofTexasasawhole.TheSystem

continues to sustain the highest credit ratings of Fitch

Ratings (AAA), Moody’s Investors Service (Aaa) and

Standard & Poor’s Global Ratings (AAA). The System’s

ongoing efforts toward revenue diversification and cost

containmentwillenabletheSystemtoachieveitsgoals

andrealizeitsmission.

Public support for this mission, and the resulting

economichealthoftheSystem,isvitaltoourcontinued

success.TheU.T.Systemgreatlyappreciatesthesupport

of the Texas Legislature, which made historic

investments in funding for public institutions and

affordabilityduringthe88thRegularSession,whichwill

result in more than over $1 billion in new funding for

System institutions in the 2024-2025 biennium.

Legislativesupportforanaffordabilityplandevelopedby

thestate’spublicuniversitysystemspriortothesession

resulted in $700 million included in the appropriations

actthatwillallowUTinstitutionstokeeptuitionflatfor

thenexttwoyears.

15

CONSOLIDATEDFINANCIALSTATEMENTS

FORTHEYEARSENDED

AUGUST31,2023AND2022

16

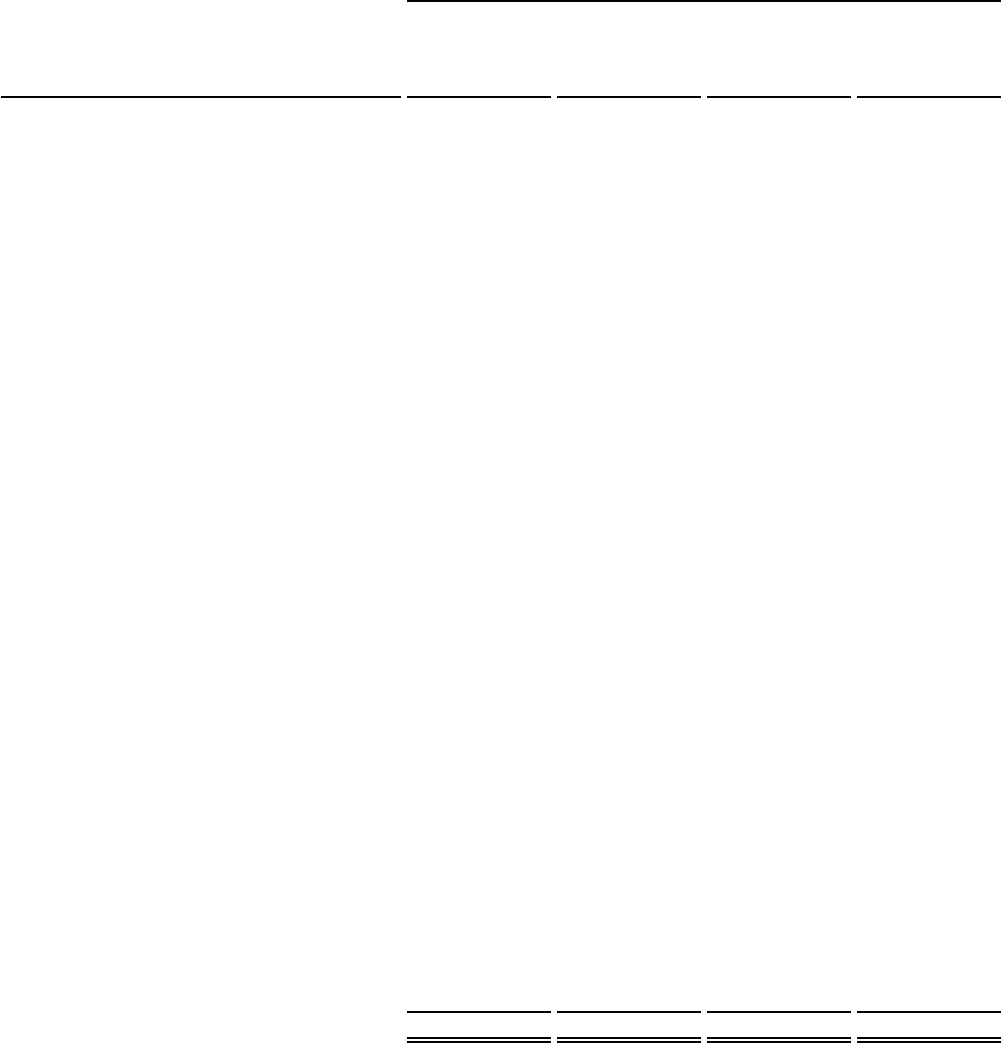

ASSETSANDDEFERREDOUTFLOWS

CURRENTASSETS

Cashandcashequivalents $ 5,473,784,479 4,551,818,565

Restrictedcashandcashequivalents 973,964,277 857,752,653

BalanceinStateappropriations 664,215,443 141,809,722

Accountsreceivable,net:

Federal(netofallowancesof$3,957,160and$3,910,665,respectively) 665,841,688 665,076,836

Otherintergovernmental(netofallowancesof$4,100,301and$3,541,020,respectively) 298,835,897 274,813,104

Student(netofallowancesof$55,300,637and$52,792,914,respectively) 379,514,971 376,161,655

Patientandhealthcare(netofallowancesof$695,773,699and$439,178,955,respectively) 1,486,945,600 1,369,175,589

Interestanddividends 101,155,887 81,983,222

Contributions(netofallowancesof$4,097,475and$1,820,620,respectively) 181,084,910 173,286,539

Investmenttrades 703,501,548 345,148,156

Other(netofallowancesof$15,168,682and$16,594,440,respectively) 883,400,303 751,444,363

Leasereceivable 13,959,036 18,637,142

P3receivable 3,237,578 4,202,465

Duefromotheragencies 112,433,174 131,237,557

Inventories 238,891,148 229,590,521

Restrictedloansandcontracts(netofallowancesof$23,081,990and$21,797,065,respectively) 41,343,207 41,067,421

Securitieslendingcollateral 704,550,572 988,091,640

Othercurrentassets 516,703,972 470,420,594

Totalcurrentassets 13,443,363,690 11,471,717,744

NONCURRENTASSETS

Cashandcashequivalents(noncurrentrestricted) 76,865,502 99,203,976

Restrictedinvestments 61,363,454,138 58,114,854,780

Depositwithbrokersforderivativecontracts 292,613,399 141,074,033

Restrictedloansandcontracts(netofallowancesof$13,004,090and$20,048,387,respectively) 29,510,591 34,259,142

Contributionsreceivable(netofallowancesof$3,014,444and$2,682,258,respectively) 377,070,059 433,198,505

Unrestrictedinvestments 17,104,572,735 16,174,609,398

Hedgingderivativeasset 130,779,738 125,007,462

Leasereceivable 215,032,962 230,438,676

P3receivable 36,421,649 380,129,263

Othernoncurrentassets 388,191,302 414,831,068

Grosscapital/intangibleassets 41,388,735,830 39,520,152,343

Lessaccumulateddepreciation/amortization (21,847,634,137) (20,456,594,152)

Netcapitalassets 19,541,101,693 19,063,558,191

Totalnoncurrentassets 99,555,613,768 95,211,164,494

TOTALASSETS 112,998,977,458 106,682,882,238

Deferredoutflowsofresources 6,088,895,030 5,546,067,549

TOTALASSETSANDDEFERREDOUTFLOWS $ 119,087,872,488 112,228,949,787

Seeaccompanyingnotestoconsolidatedfinancialstatements

(Continued)

2023 2022

THEUNIVERSITYOFTEXASSYSTEM

CONSOLIDATEDSTATEMENTSOFNETPOSITION—BUSINESS-TYPEACTIVITIES

AUGUST31,2023AND2022

17

LIABILITIESANDDEFERREDINFLOWS

CURRENTLIABILITIES

Accountspayableandaccruedliabilities $ 1,714,244,380 1,639,769,344

Salariespayable 937,064,048 850,799,344

Investmenttradespayable 1,645,273,366 736,872,733

Incurredbutnotreportedself-insuranceclaims 199,965,066 187,951,915

Totalotherpostemploymentbenefitsliability 208,395,911 243,697,144

Pensionliabilities 72,533,114 —

Securitieslendingobligations 704,550,572 988,091,640

DuetootherStateagencies 258,790,763 153,619,664

Statewideinterfundpayable 65,215,901 58,042,824

Unearnedrevenue 2,202,202,631 1,982,271,942

Employees'compensableleave 523,251,766 445,635,293

Short-termdebt 2,341,061,000 1,788,750,000

Notes,loans,andleasespayable 384,724,163 173,827,855

Bondspayable 1,671,517,223 1,699,296,681

Othercurrentliabilities 220,436,207 204,858,805

Totalcurrentliabilities 13,149,226,111 11,153,485,184

NONCURRENTLIABILITIES

Incurredbutnotreportedself-insuranceclaims 37,936,609 33,767,326

Employees'compensableleave 393,281,192 409,789,419

Assetsheldforothers 145,578,487 135,662,470

Liabilitytobeneficiaries 13,491,033 13,079,769

Totalotherpostemploymentbenefitsliability 7,881,338,444 14,451,897,162

Pensionliabilities 6,485,446,939 3,346,763,840

Notes,loansandleasespayable 787,359,337 1,351,805,344

Bondspayable 8,164,839,316 7,709,342,982

Statewideinterfundpayable 1,502,731,182 1,423,609,953

Hedgingderivativeliability 39,388,655 87,510,811

Payabletobrokersforcollateralheld 204,889,560 223,503,673

Investmentderivatives-liabilitypositions 144,154,033 183,196,878

Assetretirementobligation 20,268,251 19,508,940

Othernoncurrentliabilities 180,421,005 182,866,512

Totalnoncurrentliabilities 26,001,124,043 29,572,305,079

TOTALLIABILITIES 39,150,350,154 40,725,790,263

Deferredinflowsofresources 9,273,707,418 4,814,067,890

TOTALLIABILITIESANDDEFERREDINFLOWS $ 48,424,057,572 45,539,858,153

NETPOSITION

Netinvestmentincapitalassets $ 6,963,671,907 6,570,970,880

Restricted:

Nonexpendable 38,161,618,752 36,029,323,644

Expendable 21,353,034,539 21,145,744,390

Totalrestricted 59,514,653,291 57,175,068,034

Unrestricted 4,185,489,718 2,943,052,720

TOTALNETPOSITION $ 70,663,814,916 66,689,091,634

Seeaccompanyingnotestoconsolidatedfinancialstatements (Concluded)

2023 2022

THEUNIVERSITYOFTEXASSYSTEM

CONSOLIDATEDSTATEMENTSOFNETPOSITION—BUSINESS-TYPEACTIVITIES(Continued)

AUGUST31,2023AND2022

18

OPERATINGREVENUES

Netstudenttuitionandfees(netofdiscountsandallowancesof$920,673,147and$871,777,535,

respectively)

$ 2,162,269,633 2,124,295,749

Sponsoredprograms 5,114,905,185 4,711,876,833

Netsalesandservicesofeducationalactivities(netofdiscountsandallowancesof$363,083and

$77,302,respectively)

668,820,587 590,119,778

Netsalesandservicesofhospitals(netofdiscountsandallowancesof$14,613,104,666and

$12,876,923,014,respectively)

9,638,135,140 8,737,119,023

Netprofessionalfees(netofdiscountsandallowancesof$7,174,634,375and$6,598,098,913,

respectively)

2,577,503,943 2,354,663,591

Netauxiliaryenterprises(netofdiscountsandallowancesof$21,638,531and$20,123,708,

respectively)

723,247,145 645,955,901

Other 606,940,322 689,783,082

Totaloperatingrevenues 21,491,821,955 19,853,813,957

OPERATINGEXPENSES

Instruction 5,638,164,384 5,199,819,819

Research 3,640,738,442 3,194,183,886

Publicservice 511,503,631 429,348,663

Hospitalsandclinics 9,676,906,898 8,744,934,586

Academicsupport 1,414,239,637 1,255,690,025

Studentservices 306,673,392 298,348,467

Institutionalsupport 1,279,734,313 1,276,182,991

Operationsandmaintenanceofplant 1,070,710,379 1,017,726,879

Scholarshipsandfellowships 535,517,010 655,962,518

Auxiliaryenterprises 818,920,278 719,059,025

Depreciationandamortization 1,827,434,267 1,786,126,507

Totaloperatingexpenses 26,720,542,631 24,577,383,366

Operatingloss (5,228,720,676) (4,723,569,409)

NONOPERATINGREVENUES(EXPENSES)

Stateappropriations 3,052,789,252 2,529,939,818

Nonexchangesponsoredprograms 621,739,519 958,497,034

Giftcontributionsforoperations 684,013,267 634,248,452

Netinvestmentincome 5,223,373,475 602,130,522

Interestexpenseoncapitalassetfinancings (379,417,070) (338,180,900)

Gain(loss)onsaleofcapitalassets 11,829,051 (14,276,880)

Other 127,629,171 51,133,270

Netnonoperatingrevenues 9,341,956,665 4,423,491,316

Income(loss)beforeotherchangesinnetposition 4,113,235,989 (300,078,093)

OTHERCHANGESINNETPOSITION

Capitalgiftsandgrants 91,953,165 265,383,743

Additionstopermanentendowments 255,404,287 297,645,918

NettransferstootherStateagencies (491,344,254) (439,263,990)

Legislativeappropriationslapsed 5,474,096 (7,034,920)

Changeinnetposition 3,974,723,283 (183,347,342)

NETPOSITION

Netposition,beginningofyear 66,689,091,633 66,872,438,976

Restatement — —

Netposition,beginningofyear(asrestated) 66,689,091,633 66,872,438,976

Netposition,endofyear $ 70,663,814,916 66,689,091,634

Seeaccompanyingnotestoconsolidatedfinancialstatements

2023 2022

THEUNIVERSITYOFTEXASSYSTEM

CONSOLIDATEDSTATEMENTSOFREVENUES,EXPENSESANDCHANGESINNETPOSITION—BUSINESS-TYPEACTIVITIES

YEARSENDEDAUGUST31,2023AND2022

19

CASHFLOWSFROMOPERATINGACTIVITIES

Proceedsfromtuitionandfees $ 2,186,521,845 2,104,420,809

Proceedsfrompatientsandcustomers 12,166,305,616 10,917,142,878

Proceedsfromsponsoredprograms 5,135,503,295 4,718,184,684

Proceedsfromauxiliaries 1,086,757,122 638,529,604

Proceedsfromotherrevenues 1,214,105,473 1,242,747,015

Paymentstosuppliers (8,867,196,287) (8,153,067,866)

Paymentstoemployees (15,323,924,275) (13,835,044,914)

Paymentsforloansprovided (74,703,244) (66,946,084)

Proceedsfromloanprograms 84,196,551 76,275,350

Netcashusedforoperatingactivities (2,392,433,904) (2,357,758,524)

CASHFLOWSFROMNONCAPITALFINANCINGACTIVITIES

ProceedsfromStateappropriations 2,535,857,628 2,533,285,114

Proceedsfromoperatinggifts 723,224,391 606,108,141

Proceedsfromprivategiftsforendowmentpurposes 234,256,142 252,687,057

Proceedsfromothernoncapitalfinancingactivities 279,803,519 623,920,373

Receiptsfortransfersfromotheragencies 864,245,229 737,380,761

Paymentsfortransferstootheragencies (1,243,892,349) (1,436,193,978)

Paymentsforotheruses (513,081,650) (478,789,861)

Proceedsfromnonexchangesponsoredprograms 757,207,336 912,221,027

Netcashprovidedbynoncapitalfinancingactivities 3,637,620,246 3,750,618,634

CASHFLOWSFROMCAPITALANDRELATEDFINANCINGACTIVITIES

Proceedsfromissuanceofcapitaldebt 2,490,240,538 1,168,139,785

Paymentsofothercostsondebtissuance (5,928,851) (2,818,969)

Proceedsfromcapitalappropriations,grantsandgifts 64,318,637 135,289,571

Proceedsfromsaleofcapitalassets 53,986,387 10,309,988

Paymentsforadditionstocapitalassets (1,685,940,404) (1,843,867,656)

Paymentsofprincipaloncapitalrelateddebtandotherlong-termobligations (2,066,421,131) (1,216,650,988)

Paymentsofinterestoncapitalrelateddebtandotherlong-termobligations (469,704,889) (410,898,328)

Netcashusedforcapitalandrelatedfinancingactivities (1,619,449,713) (2,160,496,597)

CASHFLOWSFROMINVESTINGACTIVITIES

Proceedsfromsalesofinvestments 51,076,535,789 40,952,830,872

Proceedsfrominterestandinvestmentincome 2,820,206,156 3,109,959,169

Paymentstoacquireinvestments (52,506,639,510) (42,707,356,676)

Netcashprovidedbyinvestingactivities 1,390,102,435 1,355,433,365

Netincreaseincashandcashequivalents 1,015,839,064 587,796,878

Cashandcashequivalents,beginningofyear 5,508,775,194 4,920,978,316

Cashandcashequivalents,endofyear $ 6,524,614,258 5,508,775,194

Seeaccompanyingnotestoconsolidatedfinancialstatements (Continued)

2023 2022

THEUNIVERSITYOFTEXASSYSTEM

CONSOLIDATEDSTATEMENTSOFCASHFLOWS—BUSINESS-TYPEACTIVITIES

YEARSENDEDAUGUST31,2023AND2022

20

Reconciliationofoperatinglosstonetcashprovidedby(usedfor)operatingactivities:

Operatingloss $ (5,228,720,676) (4,723,569,409)

Adjustmentstoreconcileoperatinglosstonetcashprovidedby(usedfor)operatingactivities:

Depreciationandamortizationexpense 1,827,434,267 1,786,126,507

Baddebtexpense 519,888,573 510,724,894

Otherpostemploymentbenefitsobligationexpense 462,609,141 1,150,530,177

Pensionexpense 795,557,940 196,300,549

Changesinassetsandliabilities:

Accountsreceivable (973,734,899) (786,540,416)

Lessor-relatedbalances (1,602,714) (2,610,002)

P3RelatedBalances

344,561,998.47

9,561,867

Inventories (9,300,627) (24,278,731)

Loansandcontracts 9,499,354 9,341,378

Othercurrentandnoncurrentassets (17,874,611) (102,644,463)

Deferredoutflows-otherpostemploymentbenefits 387,358,832 (1,469,676,692)

Deferredoutflows-pensionrelated (983,743,005) 353,819,451

Accountspayable 355,733,608 215,096,547

Unearnedrevenue 213,149,901 69,030,025

Employees'compensableleave 61,108,247 35,614,998

Otherpostemploymentbenefitsobligation (7,068,469,092) 1,613,646,315

Pensionrelatedobligations 2,415,658,273 (2,681,321,506)

Assetretirementobligations 328,392 1,438,430

Deferredinflows-otherpostemploymentbenefits 6,485,154,252 (347,967,009)

Deferredinflows-pensionrelated (2,000,162,951) 1,832,923,932

Othercurrentandnoncurrentliabilities 13,131,894 (3,305,364)

Totaladjustments 2,836,286,773 2,365,810,887

Netcashusedforoperatingactivities $ (2,392,433,903) (2,357,758,522)

Noncashtransactions:

Netincrease(decrease)infairvalueofinvestments $ 479,219,230 (5,017,196,360)

Donatedcapitalassets 41,182,030 78,065,085

Capitalassetsacquired/adjustedunderleasepurchasesordirectborrowings 308,284,799 272,745,940

Miscellaneousnoncashtransactions 32,851,542 11,183,512

CapitalAssetsreceivedfromP3arrangement 347,652,000 —

Seeaccompanyingnotestoconsolidatedfinancialstatements (Concluded)

2023 2022

THEUNIVERSITYOFTEXASSYSTEM

CONSOLIDATEDSTATEMENTSOFCASHFLOWS—BUSINESS-TYPEACTIVITIES(Continued)

YEARSENDEDAUGUST31,2023AND2022

21

ASSETS

Cashandcashequivalents $ — 1,928,948 1,928,948 — 1,888,492 1,888,492

Accountsreceivable,net:

Interestanddividends 220,472 — 220,472 217,355 — 217,355

Investmenttrades 2,964,301 — 2,964,301 1,505,074 — 1,505,074

Other 528,881 4,735 533,616 1,757,072 4,735 1,761,807

Totalaccountsreceivable,net 3,713,654 4,735 3,718,389 3,479,501 4,735 3,484,236

Investmentsatfairvalue:

Investmentderivatives-asset

positions 496,874 — 496,874 719,630 — 719,630

Otherinvestments 293,885,919 — 293,885,919 285,878,283 — 285,878,283

Totalinvestments 294,382,793 — 294,382,793 286,597,913 — 286,597,913

Securitieslendingcollateral 3,234,769 — 3,234,769 4,333,856 — 4,333,856

Depositwithbrokersforderivative

contracts 1,156,668 — 1,156,668 622,586 — 622,586

Otherassets 121,334 — 121,334 3,314 — 3,314

Totalassets 302,609,218 1,933,683 304,542,901 295,037,170 1,893,227 296,930,397

LIABILITIES

Accountspayableandaccrued

liabilities 295,079 46,705 341,784 312,171 23,031 335,202

Investmenttradespayables 6,859,987 — 6,859,987 2,987,464 — 2,987,464

Securitieslendingobligations 3,234,769 — 3,234,769 4,333,855 — 4,333,855

Investmentderivatives-liability

positions 576,154 — 576,154 726,153 — 726,153

Payabletobrokersforcollateralheld 129,286 — 129,286 417,944 — 417,944

Totalliabilities 11,095,275 46,705 11,141,980 8,777,587 23,031 8,800,618

NETPOSITION

Restrictedfor:

Poolparticipants 291,513,943 — 291,513,943 286,259,583 — 286,259,583

Individuals,organizations,andother

governments — 1,886,978 1,886,978 — 1,870,196 1,870,196

TOTALNETPOSITION $ 291,513,943 1,886,978 293,400,921 286,259,583 1,870,196 288,129,779

Seeaccompanyingnotestoconsolidatedfinancialstatements

2023 2022

CustodialFunds

Total

Fiduciary

Activities

CustodialFunds

Total

Fiduciary

Activities

External

InvestmentPool

Fund

CustodialFunds,

Other

External

InvestmentPool

Fund

CustodialFunds,

Other

THEUNIVERSITYOFTEXASSYSTEM

CONSOLIDATEDSTATEMENTSOFFIDUCIARYNETPOSITION

AUGUST31,2023AND2022

22

ADDITIONS

Contributions:

Contributionsfromstudent

organizations $ — 302,097 302,097 — 55,903 55,903

Contributionsfromfoundationsor

associations 5,480,078 681,873 6,161,951 2,827,924 633,813 3,461,737

Contributionsfaculty/staff

organizations — — — — — —

Contributionsfromparticipants — — — — 10,340 10,340

Othercontributions — 85,651 85,651 — 66,266 66,266

Totalcontributions 5,480,078 1,069,621 6,549,699 2,827,924 766,322 3,594,246

Investmentearnings:

Interest,dividends,andother 6,209,747 — 6,209,747 4,353,736 — 4,353,736

Realizedgain(loss)onsaleof

investments 400,316 — 400,316 1,074,039 — 1,074,039

Netincrease(decrease)infairvalue

ofinvestments (1,409,739) — (1,409,739) (33,768,703) — (33,768,703)

Totalinvestmentearnings 5,200,324 — 5,200,324 (28,340,928) — (28,340,928)

Miscellaneous — 131,995 131,995 — 138,294 138,294

Totaladditions 10,680,402 1,201,616 11,882,018 (25,513,004) 904,616 (24,608,388)

DEDUCTIONS

Paymentstostudentorganizations — 248,345 248,345 — 37,880 37,880

Paymentstofoundationsor

associations 5,426,043 62,795 5,488,838 4,542,672 119,466 4,662,138

Paymentstofaculty/staff

organizations — 1,432 1,432 — 605 605

Paymentstoparticipants — 2,008 2,008 — 81,744 81,744

Otherexpenses — 870,253 870,253 — 565,799 565,799

Totaldeductions 5,426,043 1,184,833 6,610,876 4,542,672 805,494 5,348,166

Netincrease(decrease)infiduciary

netposition

5,254,359 16,783 5,271,142 (30,055,676) 99,122 (29,956,554)

Beginningnetposition

286,259,584 1,870,196 288,129,779 316,315,259 1,771,074 318,086,333

Endingnetposition

$ 291,513,943 1,886,979 293,400,921 286,259,583 1,870,196 288,129,779

Seeaccompanyingnotestoconsolidatedfinancialstatements

2023 2022

CustodialFunds

Total

Fiduciary

Activities

CustodialFunds

Total

Fiduciary

Activities

External

InvestmentPool

Fund

CustodialFunds,

Other

External

InvestmentPool

Fund

CustodialFunds,

Other

THEUNIVERSITYOFTEXASSYSTEM

CONSOLIDATEDSTATEMENTSOFCHANGESINFIDUCIARYNETPOSITION

YEARSENDEDAUGUST31,2023AND2022

23

THEUNIVERSITYOFTEXASSYSTEM

NOTESTOTHECONSOLIDATEDFINANCIALSTATEMENTS

YEARSENDEDAUGUST31,2023AND2022

1. TheFinancialReportingEntity

ThefinancialrecordsofTheUniversityofTexasSystem(theSystem)reflectcompliancewithapplicableStatestatutes

andGovernmentalAccountingStandardsBoard(GASB)pronouncements.TheSystem’sfinancialrecordsarereported

as a business-typeactivityin the State of Texas’ Annual Comprehensive Financial Report and the System’scustodial

fundfinancial recordsare reportedas fiduciaryfunds inthe Stateof Texas’Annual ComprehensiveFinancial Report.

The significant accounting policies followed by the System in maintaining accounts and in the preparation of the

consolidatedfinancial statementsare inaccordance withthe TexasComptrollerof PublicAccounts’ AnnualFinancial

ReportingRequirementsandwithgenerallyacceptedaccountingprinciplesintheUnitedStatesofAmerica(GAAP).

TheconsolidatedfinancialstatementsincludeTheUniversityofTexasSystemAdministrationandallinstitutionsofthe

System.Amountsduebetweenandamonginstitutions,amountsheldforinstitutionsbyTheUniversityofTexasSystem

Administrationandotherduplicationsinreportingareeliminatedinconsolidatingthefinancialstatements.

TheSystemiscomposedofthirteeninstitutionsofhighereducation,aswellastheSystemadministrativeoffices.The

thirteen institutions are as follows: The University of Texas at Arlington, The University of Texas at Austin, The

UniversityofTexasatDallas,TheUniversityofTexasatElPaso,TheUniversityofTexasPermianBasin,TheUniversity

ofTexasRioGrandeValley,TheUniversityofTexasatSanAntonio,TheUniversityofTexasatTyler(whichincludestwo

state agencies – The University of Texas at Tyler and The University of Texas Health Science Center at Tyler), The

UniversityofTexasSouthwesternMedicalCenter,TheUniversityofTexasMedicalBranchatGalveston,TheUniversity

of Texas Health Science Center at Houston, The University of Texas Health Science Center at San Antonio, and The

University of Texas M. D. Anderson Cancer Center. The System is governed by a ten-member Board of Regents

(includingonenon-votingstudentmember)appointedbytheGovernor.

BLENDEDCOMPONENTUNITS

Thefollowingcomponent unitsare includedintheconsolidatedfinancial statementsbecausethe Systemappointsa

voting majority of the component units’ boards and the System is able to impose its will on the component units.

Blendedcomponentunitfinancialinformationisavailableuponrequest.

U. T. Southwestern Health Systems is governed by a three-member board appointed by the president of U. T.

SouthwesternMedicalCenter.U.T.SouthwesternHealthSystemsprovidessupportofhealthcareservicesandgrants

to conduct research and provide educational programs to accomplish the mission of U. T. Southwestern Medical

Center. The corporation is blended rather than discretely presented because it is organized as a not-for-profit

corporationandU.T.SouthwesternMedicalCenteristhesolecorporatemember.Thecorporation’sfiscalyearendis

August 31. Separate financial statements may be obtained by contacting U. T. Southwestern Health Systems, 5323

HarryHinesBoulevard,Dallas,Texas75390.

U.T.SouthwesternMoncriefCancerCenterisgovernedbyafour-memberboardappointedbythepresidentofU.T.

SouthwesternMedicalCenter.U.T.SouthwesternMoncriefCancerCenterprovidesresourcesforcancerprevention,

earlydetectionandsupportservicestocancerpatientsandtheirfamilieswithinTarrantCountyandsurroundingareas.

Thecorporationisblendedratherthandiscretelypresentedbecauseitisorganizedasanot-for-profitcorporationand

U. T. Southwestern Medical Center is the sole corporate member. The corporation’s fiscal year end is August 31.

Separatefinancialstatements maybe obtainedbycontactingU.T. SouthwesternMoncriefCancerCenter,400 West

MagnoliaAvenue,FortWorth,Texas76104.

Moncrief Cancer Foundation is governed by a six-member board appointed by the president of U. T. Southwestern

MedicalCenter.MoncriefCancerFoundationsupportscomprehensive,multidisciplinarycancertreatmentprogramsin

Tarrant County and surrounding areas. The foundation is blended rather than discretely presented because it is

organized as a not-for-profit foundation and U. T. Southwestern Medical Center is the sole corporate member. The

foundation’s fiscal year end is August 31. Separate financial statements may be obtained by contacting Moncrief

CancerFoundation,5323HarryHinesBlvd.,Dallas,Texas75390.

24

UTMBHealthCareSystems,Inc.isgovernedbyaneight-memberboardappointedbyU.T.MedicalBranch-Galveston.

UTMB HealthCare Systems, Inc. provides temporary staffing and leased property, and manages the Medicare Select

insuranceproductin selectedmarketsfor U.T. Medical Branch- Galveston.The corporationis blended ratherthan

discretelypresentedbecauseitisorganizedasanot-for-profitcorporationandU.T.MedicalBranch–Galvestonisthe

solecorporatemember.Thecorporation’sfiscalyearendisAugust31.Separatefinancialstatementsmaybeobtained

bycontactingUTMBHealthCareSystems,Inc.,301UniversityBoulevard,Galveston,Texas77555.

TheUniversityMedicalBranchStudentBookStore,Inc.isgovernedbyafive-memberboardappointedbyU.T.Medical

Branch-Galveston.Thecorporationisblendedratherthandiscretelypresentedbecauseitoperatesthebookstorefor

U.T.MedicalBranch-GalvestonandprovidesservicesentirelyoralmostentirelytoU.T.MedicalBranch-Galveston.

The corporation’s fiscal year end is August 31. Separate financial statements may be obtained by contacting The

UniversityMedicalBranchStudentBookStore,Inc.,301UniversityBoulevard,Galveston,Texas77555.

MedicalBranchInnovations,Inc.isgovernedbyathree-memberboardappointedbyU.T.MedicalBranch–Galveston.

Thecorporationisblendedratherthandiscretelypresentedbecauseitisorganizedasanot-for-profitcorporationand

U.T.MedicalBranch–Galvestonisthesolecorporatemember.Thecorporation’sfiscalyearendisAugust31.Separate

financial statements may be obtained by contacting Medical Branch Innovations, Inc., 301 University Boulevard,

Galveston,Texas77555.

U. T. Physicians is governed by a nine-member board appointed by its sole corporate member. The corporation is

blended rather than discretely presented because it is organized as a not-for-profit corporation and Giuseppe N.

Colasurdo,asPresidentofU.T.HealthScienceCenter-Houston,isthesolecorporatemember.Thecorporation’sfiscal

year end is August 31. Separate financial statements may be obtained by contacting U. T. Physicians, 7000 Fannin

Street,Suite860,Houston,Texas77030.

UniversityPhysiciansGroupisgovernedbyafive-memberboard.TheDeanoftheSchoolofMedicineistheChairman

of the Board, and four board members are members of and elected by the physician practice plan board. The

corporationisblendedratherthandiscretelypresentedbecauseitisorganizedasanot-for-profitcorporationandU.T.

Health Science Center - San Antonio is the sole corporate member. The corporation’s fiscal year end is August 31.

SeparatefinancialstatementsmaybeobtainedbycontactingUniversityPhysiciansGroup,8431FredericksburgRoad,

Suite500,SanAntonio,Texas78229.

U.T.HealthSanAntonioRegionalPhysicianNetworkisgovernedbyaseven-memberboard.TheDeanoftheSchoolof

Medicineis the Chairof the Boardof Directors. Thecorporation owns, operates,and managesanAccountable Care

OrganizationinaccordancewiththerequirementsoftheMedicareSharedSavingsProgram,assetforthinsection1899

oftheSocialSecurityActandrelatedregulations.Thecorporationisblendedratherthandiscretelypresentedbecause

it is organized as a not-for-profit corporation and U. T. Health Science Center - San Antonio is the sole corporate

member.Thecorporation’sfiscalyearendisAugust31.Separatefinancialstatementsmaybeobtainedbycontacting

U.T.HealthSanAntonioRegionalPhysicianNetwork,8431FredericksburgRoad,Suite503,SanAntonio,Texas78229.

M. D. Anderson Physician’s Network is governed by a nine-member board appointed by the president of M. D.

Anderson. M. D. Anderson Physicians Network transfers programs representative of M. D. Anderson to the broad

community. The corporation is blended rather than discretely presented because it is organized as a not-for-profit

corporationandM.D.Andersonisthesolecorporatemember.Thecorporation’sfiscalyearendisAugust31.Separate

financial statements may be obtained by contacting M. D. Anderson Physician’s Network, 1515 Holcomb Blvd., Unit

1670,Houston,TX77030-4009.

M. D. Anderson Services Corporation is governed by a seven-member board appointed by the president of M. D.

Anderson.M.D.AndersonServicesCorporationservesasaninstrumentofM.D.Andersoninitseffortstoachieveits

missionbeyondtheM.D.Andersonmaincampus.Thecorporationisblendedratherthandiscretelypresentedbecause

itisorganizedasanot-for-profitcorporationandM.D.Andersonisthesolecorporatemember.Thecorporation’sfiscal

year end is August 31. Separate financial statements may be obtained by contacting M. D. Anderson Services

Corporation,1515HolcombBlvd.,Unit1670,Houston,TX77030-4009.

EastTexasQualityCareNetwork,Inc.isgovernedbyafour-memberboardappointedbyU.T.HealthScienceCenter-

Tyler. The corporation is blended rather than discretely presented because it is organized as a not-for-profit

corporationandU.T.HealthScienceCenter-Tyleristhesolecorporatemember.Thecorporation’sfiscalyearendis

August31.SeparatefinancialstatementsmaybeobtainedbycontactingEastTexasQualityCareNetwork,Inc.,11937

USHighway271,Tyler,Texas75708-3154.

25

TheUniversityofTexas/TexasA&MInvestmentManagementCompany(UTIMCO)isgovernedbyanine-memberboard

consistingofatleastthreemembersoftheU.T.SystemBoardofRegents,fourmembersappointedbytheU.T.System

BoardofRegents(oneofwhommaybetheChancelloroftheSystem),andtwomembersappointedbytheTexasA&M

SystemBoard ofRegents. Atleast threemembers appointedby theU. T.System Boardof Regentsandat leastone

memberappointedby the Texas A&M System Board of Regents must have substantial background and expertise in

investments.Thecorporationisblendedratherthandiscretelypresentedbecauseitprovidesinvestmentmanagement

services entirely or almost entirely to the System. The corporation’s fiscal year end is August 31. Separate financial

statements may be obtained by contacting The University of Texas/Texas A&M Investment Management Company

(UTIMCO),210West7thStreet,Suite1700,Austin,Texas78701.

TheUniversityofTexasCommunicationFoundationisgovernedbyathree-memberboardappointedbyU.T.Austin.

TheUniversityofTexasCommunicationFoundationprovidesservicestotheU.T.AustinCollegeofCommunicationto

facilitatethe participationby students,faculty andothersin professionalcommunication projects.The foundationis

blendedratherthandiscretelypresentedbecauseitprovidesservicesentirelytoU.T.Austin.Thefoundation’sfiscal

year end is August 31. Separate financial statements may be obtained by contacting The University of Texas

CommunicationFoundation,U.T.Austin,P.O.Box7322,Austin,Texas78713.

TheUniversityof Texas at Austin – Mexico Institute, A.C.,Centrode Ciencias de la Complejidad (Edificio C3), Planta

Baja,UnidadInternacionaldeSedesUniversitarias,CircuitoCulturalc/n,ZonaCultural,CiudadUniversitaria,Ciudadde

México,México,CP.04510,isgovernedbyafour-memberboardappointedbyU.T.Austin.TheUniversityofTexasat

Austin–MexicoInstitute,A.C.advancescollaborativecross-disciplinaryacademicandscientificresearchpartnerships

in science, technology, engineering, and mathematics, and scholarly and cultural studies between The University of

TexasatAustinandMexico’sacademicinstitutions.Theinstituteisblendedratherthandiscretelypresentedbecauseit

isorganizedasanot-for-profitcorporationandU.T.Austinisthesolecorporatemember.TheMexicoInstitute’sfiscal

year end is December 31. Separate financial statements may be obtained by contacting The University of Texas at

AustinJ.Pinon,DirectorofInstitutionalRelations–Mexico,2275Speedway,Austin,TX,78712.

TheCrow Museumof AsianArt -Foundation isgoverned bya boardof fivedirectorsappointedby U.T. Dallas.The

foundationisblendedratherthandiscretelypresentedbecauseitisorganizedasanot-for-profitcorporationandU.T.

Dallasisthesolecorporatemember.Thefoundation’sfiscalyearendisDecember31.Infiscalyear2021,substantially

allassetsandoperationsofthefoundationtransferredtoU.T.Dallasinaccordancewithaunanimousconsentletter

executed by the board of directors. Assets distributed to U. T. Dallas will be managed in accordance with the

memorandumofunderstandingassociatedwiththe2018donationoftheCrowMuseumofAsianArt.Thefoundation

willcontinueitscorporateexistenceasdeemedadvisablebytheboardofdirectors.

26

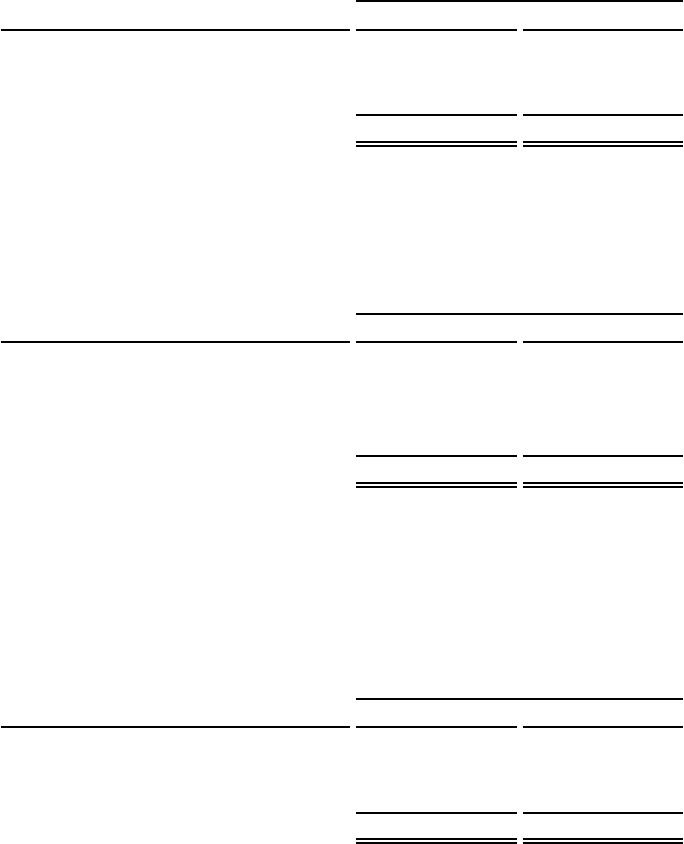

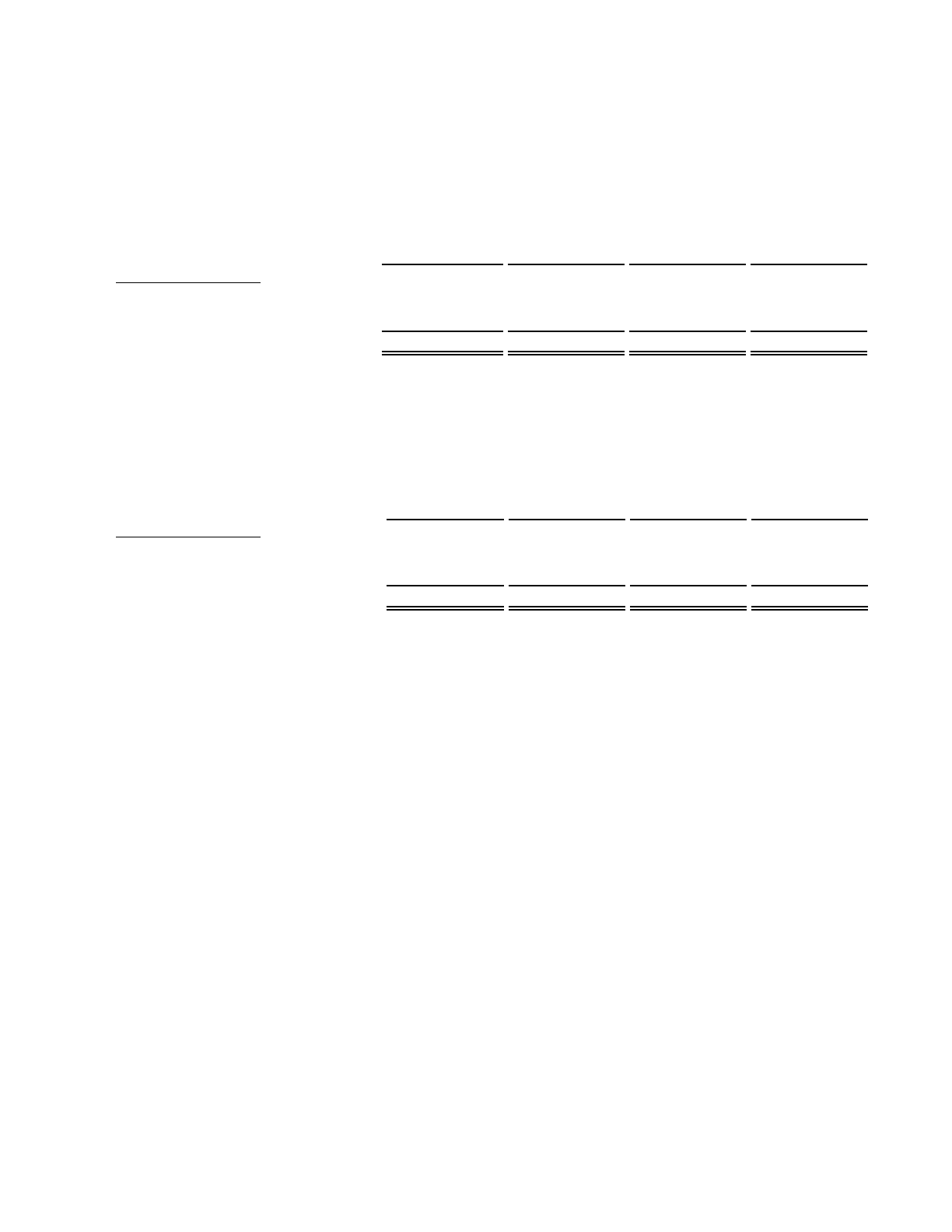

Condensed financial statement information related to the System’s blended component units for the year ended

August31,2023isasfollows:

AsofAugust31,2023

UT

Southwestern

Health

Systems

UT

Southwestern

Moncrief

Cancer

Center

Moncrief

Cancer

Foundation

UTMB

HealthCare

Systems,Inc.

TheUniversity

MedicalBranch

Student

BookStore,Inc.

CondensedStatementofNet

Position

CurrentAssets $ 2,357,970 5,407,990 828,935 22,752,805 740,195

NoncurrentAssets 7,442,775 31,620,298 91,552,701 21,644,699 1,641,209

TotalAssets 9,800,745 37,028,288 92,381,636 44,397,504 2,381,404

CurrentLiabilities — 9,064,197 1,462,473 4,683,999 70,981

NoncurrentLiabilities — — — 255,322 —

TotalLiabilities — 9,064,197 1,462,473 4,939,321 70,981

NetInvestmentinCapitalAssets — 24,793,977 — 1,338,896 —

RestrictedNonexpendable — 1,704,801 — — —

RestrictedExpendable — — 90,919,163 — —

Unrestricted 9,800,745 1,465,313 — 38,119,287 2,310,423

TotalNetPosition $ 9,800,745 27,964,091 90,919,163 39,458,183 2,310,423

CondensedStatementofRevenues,

ExpensesandChangesinNet

Position

OperatingRevenues $ 45,661 8,778,368 25 99,546,414 972,066

OperatingExpenses (24,004) (13,182,645) (509,680) (92,152,575) (906,564)

OperatingIncome(Loss) 21,657 (4,404,277) (509,655) 7,393,839 65,502

NonoperatingRevenues(Expenses) 2,406,197 3,556,408 6,145,765 1,234,555 71,502

Income(Loss)BeforeOther

ChangesinNetPosition 2,427,854 (847,869) 5,636,110 8,628,394 137,004

OtherChangesinNetPosition (2,743,000) 1,115,690 (3,384,310) — —

ChangeinNetPosition (315,146) 267,821 2,251,800 8,628,394 137,004

NetPosition-August31,2022 — — 88,667,363 30,829,789 2,173,419

NetPosition-August31,2023 $ (315,146) 267,821 90,919,163 39,458,183 2,310,423

CondensedStatementofCash

Flows

NetCashprovidedby(usedfor):

OperatingActivities $ (167,404) 1,311,183 3,492,178 2,161,864 53,097

NoncapitalFinancingActivities — — (19,000,000) — —

CapitalandRelatedFinancing — — — — —

InvestingActivities 45,661 (324,326) 11,827,561 (583,369) 5,945

NetIncrease(Decrease)inCashand

CashEquivalents (121,743) 986,857 (3,680,261) 1,578,495 59,042

CashandCashEquivalents-

August31,2022 — — 4,410,506 9,946,116 270,649

CashandCashEquivalents-

August31,2023 $ (121,743) 986,857 730,245 11,524,611 329,691

27

(Continued)

AsofAugust31,2023

MedicalBranch

Innovations,Inc.

U.T.

Physicians

University

Physicians

Group

U.T.HealthSan

AntonioRegional

Physician

Network

M.D.

Anderson

Physician's

Network

CondensedStatementofNet

Position

CurrentAssets $ 1,363,303 117,093,675 — — 89,554,248

NoncurrentAssets 4,587,569 249,895,512 1,935,622 — 219,554,928

TotalAssets 5,950,872 366,989,187 1,935,622 — 309,109,176

CurrentLiabilities 532,068 85,811,908 — — 8,500,361

NoncurrentLiabilities 7,409,137 200,009,007 — — —

TotalLiabilities 7,941,205 285,820,915 — — 8,500,361

NetInvestmentinCapitalAssets — 39,741,361 — — 704,035

RestrictedNonexpendable — — — — —

RestrictedExpendable — — — — —

Unrestricted (1,990,333) 41,426,912 1,935,622 — 299,904,780

TotalNetPosition $ (1,990,333) 81,168,273 1,935,622 — 300,608,815

CondensedStatementofRevenues,

ExpensesandChangesinNet

Position

OperatingRevenues $ 560,952 119,303,470 — — 45,852,423

OperatingExpenses (1,026,670) (122,643,132) — (1,537,778) (17,905,689)

OperatingIncome(Loss) (465,718) (3,339,662) — (1,537,778) 27,946,734

NonoperatingRevenues(Expenses) 221,418 5,255,345 — — 11,995,439

Income(Loss)BeforeOther

ChangesinNetPosition (244,300) 1,915,683 — (1,537,778) 39,942,173

OtherChangesinNetPosition — — — 1,537,778 —

ChangeinNetPosition (244,300) 1,915,683 — — 39,942,173

NetPosition-August31,2022 (1,746,033) 79,252,590 1,935,622 — 260,666,642

NetPosition-August31,2023 $ (1,990,333) 81,168,273 1,935,622 — 300,608,815

CondensedStatementofCash

Flows

NetCashprovidedby(usedfor):

OperatingActivities $ (251,504) 7,069,906 — — 26,419,670

NoncapitalFinancingActivities — — — — —

CapitalandRelatedFinancing — (16,821,357) — — (208,191)

InvestingActivities 40,572 28,451,833 — — (4,315,529)

NetIncrease(Decrease)inCashand

CashEquivalents (210,932) 18,700,382 — — 21,895,950

CashandCashEquivalents-

August31,2022 1,382,440 88,035,192 — — 62,450,374

CashandCashEquivalents-

August31,2023 $ 1,171,508 106,735,574 — — 84,346,324

28

(Continued)

AsofAugust31,2023

M.D.

Anderson

Services

Corporation

EastTexas

Quality

Care

Network,Inc. UTIMCO

TheUniversityof

Texas

Communication

Foundation

CondensedStatementofNet

Position

CurrentAssets $ 84,750,530 197,289 43,750,144 2,042

NoncurrentAssets 809,177,475 — 4,720,620 177,911

TotalAssets 893,928,005 197,289 48,470,764 179,953

CurrentLiabilities 107,457,087 (230,090) 22,148,608 121,528

NoncurrentLiabilities 56,453,369 — 4,244,466 39,052

TotalLiabilities 163,910,456 (230,090) 26,393,074 160,580

NetInvestmentinCapitalAssets 24,679 — 224,226 —

RestrictedNonexpendable 50,000,000 — — —

RestrictedExpendable 638,085,173 — — —

Unrestricted 41,907,697 427,379 21,853,464 19,373

TotalNetPosition $ 730,017,549 427,379 22,077,690 19,373

CondensedStatementofRevenues,

ExpensesandChangesinNet

Position

OperatingRevenues $ 1,722,666 19,437 67,943,364 —

OperatingExpenses (1,465,614) (26,068) (60,906,770) —

OperatingIncome(Loss) 257,052 (6,631) 7,036,594 —

NonoperatingRevenues(Expenses) 37,117,793 — 1,750,535 —

Income(Loss)BeforeOther

ChangesinNetPosition 37,374,845 (6,631) 8,787,129 —

OtherChangesinNetPosition — — — —

ChangeinNetPosition 37,374,845 (6,631) 8,787,129 —

NetPosition-August31,2022 — 434,010 13,290,561 19,373

NetPosition-August31,2023 $ 37,374,845 427,379 22,077,690 19,373

CondensedStatementofCash

Flows

NetCashprovidedby(usedfor):

OperatingActivities $ 924,919 (200,973) 6,847,008 —

NoncapitalFinancingActivities (28,051,423) — — —

CapitalandRelatedFinancing (4,633) — (1,357,280) —

InvestingActivities 30,926,795 — 2,141,957 —

NetIncrease(Decrease)inCashand

CashEquivalents 3,795,658 (200,973) 7,631,685 —

CashandCashEquivalents-

August31,2022 — 472,913 34,166,841 2,042

CashandCashEquivalents-

August31,2023 $ 3,795,658 271,940 41,798,526 2,042

29

(Concluded)

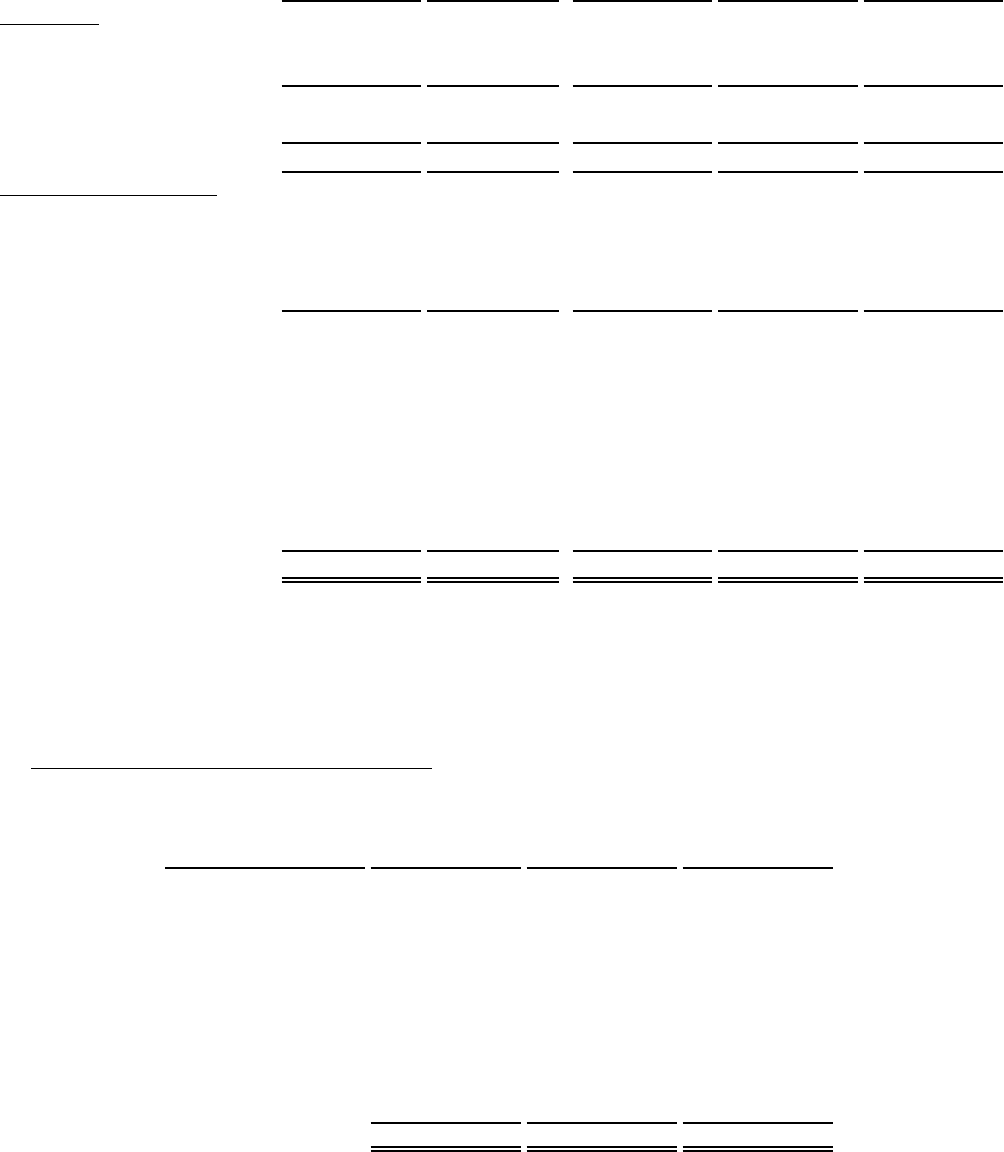

AsofAugust31,2023

TheUniversityof

TexasatAustin-

MexicoInstitute

A.C.

TheCrow

Museumof

AsianArt-

Foundation

Combined

Blended

ComponentUnit

Total

CondensedStatementofNet

Position

CurrentAssets $ 20,070 45,872 368,865,068

NoncurrentAssets — — 1,443,951,319

TotalAssets 20,070 45,872 1,812,816,387

CurrentLiabilities — — 239,623,120

NoncurrentLiabilities — — 268,410,353

TotalLiabilities — — 508,033,473

NetInvestmentinCapitalAssets — — 66,827,174

RestrictedNonexpendable — — 51,704,801

RestrictedExpendable — — 729,004,336

Unrestricted 20,070 45,872 457,246,604

TotalNetPosition $ 20,070 45,872 1,304,782,915

CondensedStatementofRevenues,

ExpensesandChangesinNet

Position

OperatingRevenues $ 150,468 — 344,895,314

OperatingExpenses (177,599) (1,453) (312,466,241)

OperatingIncome(Loss) (27,131) (1,453) 32,429,073

NonoperatingRevenues(Expenses) — — 69,754,957

Income(Loss)BeforeOther

ChangesinNetPosition (27,131) (1,453) 102,184,030

OtherChangesinNetPosition — — (3,473,842)

ChangeinNetPosition (27,131) (1,453) 98,710,188

NetPosition-August31,2022 47,201 47,325 475,617,862

NetPosition-August31,2023 $ 20,070 45,872 574,328,050

CondensedStatementofCash

Flows

NetCashprovidedby(usedfor):

OperatingActivities $ 35,812 (1,453) 47,694,303

NoncapitalFinancingActivities — — (47,051,423)

CapitalandRelatedFinancing — — (18,391,461)

InvestingActivities — — 68,217,100

NetIncrease(Decrease)inCashand

CashEquivalents 35,812 (1,453) 50,468,519

CashandCashEquivalents-

August31,2022 47,201 47,325 201,231,599

CashandCashEquivalents-

August31,2023 $ 83,013 45,872 251,700,118

30