SECURITIES AND FUTURES ACT

(CAP. 289)

NOTICE ON MINIMUM ENTRY AND EXAMINATION

REQUIREMENTS FOR REPRESENTATIVES OF HOLDERS OF

CAPITAL MARKETS SERVICES LICENCE AND EXEMPT

FINANCIAL INSTITUTIONS

Monetary Authority of Singapore

2

Notice No : SFA 04-N09

Issue Date : 11 August 2010 [Last revised on 4 June 2012]

NOTICE ON MINIMUM ENTRY AND EXAMINATION

REQUIREMENTS FOR REPRESENTATIVES OF HOLDERS OF

CAPITAL MARKETS SERVICES LICENCE AND EXEMPT

FINANCIAL INSTITUTIONS

1 This Notice is issued pursuant to section 101 of the Securities and

Futures Act (Cap. 289) (the ―Act‖) to the holders of a capital markets services

(―CMS‖) licence, exempt financial institutions (―exempt FIs‖) and appointed

representatives. The earlier Notice (SFA 04-N06) issued on 1 August 2008 on

the same subject is cancelled.

[SFA 04-N09 (Amendment) 2010]

[SFA 04-N09 (Amendment) 2011]

2 This Notice sets out the following:

(a) minimum entry requirements for appointed representatives under

the Act;

[SFA 04-N09 (Amendment) 2010]

(b) application of the Capital Markets and Financial Advisory

Services Examination (the ―CMFAS Exam‖) requirements to

individuals intending to conduct regulated activities as appointed

representatives under the Act;

[SFA 04-N09 (Amendment) 2010]

(c) circumstances under which the CMFAS Exam requirements do not

apply;

(d) obligations of CMS licence holders and exempt FIs; and

(e) continuing education requirements for appointed representatives.

[SFA 04-N09 (Amendment) 2010]

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

3

DEFINITIONS

3 For the purposes of this Notice:

―accredited investor‖ has the same meaning as in section 4A of the Act;

[SFA 04-N09 (Amendment) 2011]

―appointed representative‖ has the same meaning as section 2(1) of the Act;

[SFA 04-N09 (Amendment) 2010]

―associated person‖, for the purposes of paragraph 25(b), has the same meaning

as in the Rules and Regulations of the Singapore Commodity Exchange Ltd;

―CMFAS Exam requirement‖ means the requirement to pass the relevant

modules of the CMFAS Exam;

―CTA‖ means the Commodity Trading Act (Cap. 48A, 1993 Ed.) in force

immediately before 27 February 2008;

―Excluded Investment Products‖ has the same meaning as in paragraph 4 of the

SFA Notice on the Sale of Investment Products (SFA 04-N12);

[SFA 04-N09 (Amendment) 2011]

―exempt FI‖ refers to a financial institution exempted from holding a CMS

licence under section 99(1)(a), (b), (c) and (d) of the Act;

―principal‖ has the same meaning as under section 2(1) of the Act;

[SFA 04-N09 (Amendment) 2010]

―qualifying corporation‖ has the same meaning as under regulation 2 of the

Securities and Futures (Provision for Persons and Matters Previously Regulated

under Commodity Trading Act) Regulations 2007;

―REIT management‖ means real estate investment trust management;

―specific representative‖ means an individual who is subject to CMFAS Exam

requirements, namely:

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

4

(a) a person proposed to be an appointed representative to carry out

any of the regulated activities listed in sub-paragraphs (a), (b), (c),

(d), (e) and (f) of paragraph 9 of this Notice on behalf of the holder

of a CMS licence; and

(b) a person proposed to be an appointed representative, whether

employed by or acting for an exempt FI in respect of regulated

activity listed in sub-paragraphs (a), (b), (c), (d), (e) and (f) of

paragraph 9 of this Notice, where applicable;

[SFA 04-N09 (Amendment) 2010]

―Specified Investment Products‖ has the same meaning as in paragraph 4 of the

SFA Notice on the Sale of Investment Products (SFA 04-N12).

[SFA 04-N09 (Amendment) 2011]

MINIMUM ENTRY REQUIREMENTS

4 Deleted.

[SFA 04-N09 (Amendment) 2010]

5 Any person who acts as or holds himself out to be an appointed

representative must:

(a) be at least 21 years old;

(b) satisfy the minimum academic qualification requirements set out

under paragraph 7 of this Notice; and

(c) comply with the examination requirements of this Notice.

[SFA 04-N09 (Amendment) 2010]

6 In addition, the principal shall certify and ensure that its representatives

meet the minimum entry requirements stipulated in paragraph 5 of this Notice.

[SFA 04-N09 (Amendment) 2010]

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

5

[SFA 04-N09 (Amendment) 2011]

7 For the purposes of paragraph 5(b) of this Notice, the minimum academic

qualifications are:

(aa) in the case of a representative in respect of providing credit rating

services on or after 17 January 2012, a Bachelor’s degree in a

discipline that is relevant to him acting as a representative of his

principal in respect of providing credit rating services, as

determined by his principal;

[SFA 04-N09 (Amendment) 2012]

(a) in the case of a representative who sat for GCE ―O‖ Level

Examinations before or in the year 1980 -

(i) qualifications higher than or equal to at least 4 GCE ―O‖

Level credit passes; or

(ii) qualifications higher than or equal to at least 2 GCE ―O‖

Level credit passes and at least 3 years of relevant and

continuous working experience over the past 5 years in

respect of the regulated activity as defined in section 2(1) of

the Act;

(b) in any other case, qualifications higher than or equal to at least 4

GCE ―O‖ Level credit passes.

[SFA 04-N09 (Amendment) 2010]

7A The requirement in sub-paragraph (aa) of paragraph 7 shall not apply to

any individual who had been carrying out any activity immediately before 17

January 2012 which would have amounted to acting as a representative in

respect of providing credit rating services and who continued to act as a

representative in respect of providing credit rating services from that date.

[SFA 04-N09 (Amendment) 2012]

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

6

APPLICATION OF THE CMFAS EXAM REQUIREMENTS

8 The CMFAS Exam, which commenced on 1 December 2002, comprises

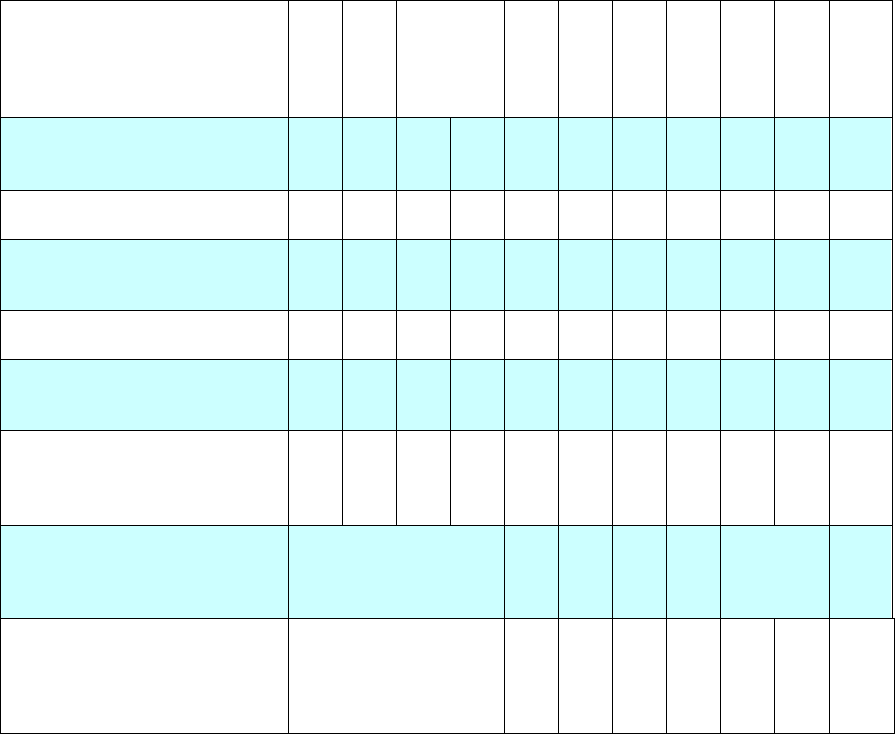

16 modules as follows:

Module

Examination

Rules & Regulations

1A

Rules and Regulations for Dealing in Securities (for members of the

Singapore Exchange Securities Trading Limited (―SGX-ST‖)

1B

Rules and Regulations for Dealing in Securities (Non SGX-ST members)

2A

Rules and Regulations for Trading in Futures Contracts (for members of the

Singapore Exchange Derivatives Trading Limited (―SGX-DT‖)

2B

Rules and Regulations for Trading in Futures Contracts (for members of the

Singapore Mercantile Exchange (―SMX‖)

3

Rules and Regulations for Fund Management

4A

Rules and Regulations for Advising on Corporate Finance

4B

Rules and Regulations for Advising on Corporate Finance (Solely Debt

Securities)

5

Rules and Regulations for Financial Advisory Services

10

Rules and Regulations for REIT Management, with Product Knowledge and

Analysis

Product Knowledge & Analysis

6

Securities Products and Analysis

6A

Securities and Futures Product Knowledge

7

Futures Products and Analysis [to be discontinued with effect from

1 January 2012]

8

Collective Investment Schemes

8A

Collective Investment Schemes II

9

Life Insurance and Investment-Linked Policies

9A

Life Insurance and Investment-Linked Policies II

[SFA 04-N09 (Amendment) 2011]

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

7

9 The CMFAS Exam requirements apply to individuals who wish to

conduct any of the following regulated activities as an appointed representative

under the Act:

(a) dealing in securities;

(b) trading in futures contracts;

(c) advising on corporate finance;

(d) fund management;

(e) REIT management;

(f) leveraged foreign exchange trading.

[SFA 04-N09 (Amendment) 2010]

10 A specific representative is required to pass the relevant modules of the

CMFAS Exam pertaining to the regulated activity that he intends to conduct.

The applicable modules for each regulated activity are set out below:

REGULATED

ACTIVITY

MODULE

Rules & Regulations

Product

Knowledge &

Analysis

1A

1B

2A

2B

3

4A

4B

10

6

7

1

6A

Dealing in Securities

- SGX-ST members

√

√

√

Dealing in Securities

- Non SGX-ST members

√

(Either

Module)

√

√

Trading in Futures

Contracts

- SGX-DT members

√

√

√

Trading in Futures

Contracts

- SMX members

√

√

√

1

To be discontinued with effect from 1 January 2012.

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

8

Trading in Futures

Contracts

- Non SGX-DT and Non

SMX members

√

(Either

Module)

√

√

Fund Management

- Solely Securities Funds

√

√

Fund Management

- Solely Futures Funds

√

√

√

Fund Management

- Both Securities and

Futures Funds

√

√

REIT Management

√

Advising on Corporate

Finance

√

Advising on Corporate

Finance

- Solely Debt Securities

√

Leveraged Foreign

Exchange Trading (prior to

1 January 2012)

√

(Any of these

Modules)

√

(Either

Module)

Leveraged Foreign

Exchange Trading (with

effect from 1 January

2012)

√

(Any of these

Modules)

√

[SFA 04-N09 (Amendment) 2011]

10A Module 7 will be discontinued and replaced with Module 6A with effect

from 1 January 2012. With effect from 1 January 2012, every specific

representative who has been required to pass or otherwise exempted from

Module 7 immediately before that date, is required to pass Module 6A in

accordance with paragraph 39 of this Notice.

[SFA 04-N09 (Amendment) 2011]

11 A specific representative who conducts corporate finance activities is

required to pass Module 4A or 4B depending on the scope of his corporate

finance activities. Such representative is not required to pass Modules 1A, 1B,

or 6 to conduct dealing in securities in connection with his corporate finance

activities.

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

9

[SFA 04-N09 (Amendment) 2011]

12 In the case where a specific representative deals in securities for a

principal in the principal’s capacity as a member of the SGX-ST, such

representative is required to pass Modules 1A and 6. In the case where a

specific representative deals in securities for a principal who is not a member of

the SGX-ST (―non SGX-ST Member‖), such representative is required to pass

either Modules 1A or 1B, and Module 6.

12A With effect from 1 January 2012, in addition to paragraph 12, in the case

where a specific representative deals in securities that are Specified Investment

Products, such representative is also required to pass Module 6A.

[SFA 04-N09 (Amendment) 2011]

12B A specific representative who conducts fund management in respect of

futures funds is required to pass Modules 3 and 7. With effect from 1 January

2012, such representative is required to pass Module 6A in lieu of Module 7.

[SFA 04-N09 (Amendment) 2011]

13 In the case where a specific representative trades in futures contracts for

a principal in the principal’s capacity as a member of the SGX-DT, such

representative is required to pass Modules 2A and 7. In the case where a

specific representative trades in futures contract for a principal in the principal’s

capacity as a member of the SMX, such representative is required to pass

Modules 2B and 7. In the case where a specific representative trades in futures

contract for a principal in the principal’s capacity as a member of the SGX-DT

and a member of the SMX, such representative is required to pass Modules 2A,

2B and 7. With effect from 1 January 2012, the specific representative is

required to pass Module 6A in lieu of Module 7.

[SFA 04-N09 (Amendment) 2011]

14 In the case where a specific representative trades in futures contracts for

a principal who is neither a member of the SGX-DT nor a member of the SMX,

such representative is required to pass either Modules 2A or 2B, and Module 7.

With effect from 1 January 2012, such representative is required to pass

Module 6A in lieu of Module 7.

[SFA 04-N09 (Amendment) 2011]

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

10

15 A specific representative who deals in securities and trades in single

stock futures contracts is required to pass Modules 1A and 6. With effect from

1 January 2012, such representative is also required to pass Module 6A.

[SFA 04-N09 (Amendment) 2011]

16 A specific representative who conducts only leveraged foreign exchange

trading is required to pass Module 1A, 1B, 2A or 2B and Module 6 or 7. A

specific representative who conducts leveraged foreign exchange trading in

addition to dealing in securities or trading in futures contracts is required to

pass the applicable rules and regulation modules relevant to dealing in

securities or trading in futures contracts. With effect from

1 January 2012, such representative is required to pass Module 1A, 1B, 2A or

2B and Module 6A.

[SFA 04-N09 (Amendment) 2011]

17 Deleted.

[SFA 04-N09 (Amendment) 2010]

CIRCUMSTANCES UNDER WHICH THE CMFAS EXAM

REQUIREMENTS DO NOT APPLY

18 A specific representative who possesses specified qualifications and

experience or who confines his regulated activities to a limited segment of the

market is not required to pass certain modules of the CMFAS Exam. Details of

the circumstances under which the CMFAS Exam requirements do not apply

are set out in the following paragraphs.

SPECIFIED QUALIFICATIONS OR WORK EXPERIENCE

18A Prior to 19 October 2011, a specific representative who possesses any of

the qualifications or work experience listed in Annexes 1 and 2 respectively is

not required to pass Modules 6 and 7 respectively. With effect from 19 October

2011, a specific representative who possesses any of the qualifications, where

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

11

such qualification was obtained by way of passing the required examination(s),

2

or work experience listed in Annexes 1A and 2A respectively, will not be

required to pass Modules 6 and 7 respectively.

[SFA 04-N09 (Amendment) 2010]

[SFA 04-N09 (Amendment) 2011]

18B With effect from 19 October 2011, a specific representative who

possesses any of the qualifications or work experience listed in Annexes 1 and

2 respectively is not required to pass Modules 6 and 7 respectively, if:

(a) he has been conducting relevant regulated activities as a

representative immediately before 19 October 2011 and continues

to conduct such regulated activities on and after 19 October 2011;

(b) his principal has lodged with the Authority documents under

section 99H of the Act, in relation to his appointment as an

appointed representative before 1 January 2012; or

(c) there is no break in service of more than 6 months between his last

working experience as a representative conducting relevant

regulated activities and the date of his principal’s lodgment with

the Authority of documents under section 99H of the Act, in

relation to his appointment as an appointed representative.

[SFA 04-N09 (Amendment) 2011]

18C A specific representative who possesses any of the following

qualifications, is not required to pass Module 6A:

(a) a degree or higher qualification in finance, financial engineering

or computational finance; or

(b) Chartered Financial Analyst (CFA) by the CFA Institute, USA.

[SFA 04-N09 (Amendment) 2011]

19 With effect from 1 July 2005, the Authority will only recognise the

qualifications listed in Annexes 1, 1A, 2 and 2A where such qualification was

2

Except for item 8 of Annex 1A.

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

12

obtained by way of passing the required examination(s) for the award of such

qualification.

3

[SFA 04-N09 (Amendment) 2011]

20 Paragraph 19 shall not apply to a specific representative who –

(a) has attained the qualification listed in Annex 1 or 2 before

1 July 2005 –

(i) by passing any examination which is recognised by the

respective tertiary institution, institute, board, association or

other body listed in Annex 1 or 2, to be equivalent to

passing the specific examination(s) for the attainment of the

respective qualifications listed in Annexes 1 and 2; or

(ii) by fulfilling such other criteria specified by the respective

tertiary institution, institute, board, association or other body

listed in Annex 1 or 2, as prerequisites for the attainment of

the respective qualifications listed in Annexes 1 and 2; and

(b) has been conducting regulated activity as a representative

immediately before 1 July 2005 and continues to conduct such

regulated activity after 1 July 2005 whether on behalf of the same

holder of a CMS licence or exempt FI or any other holder of a

CMS licence holder or exempt FI.

[SFA 04-N09 (Amendment) 2010]

21 Paragraph 19 shall apply to an individual who would otherwise satisfy

paragraph 20 if he ceases to be a representative of any holder of a CMS licence

or exempt FI any time after 1 July 2005.

[SFA 04-N09 (Amendment) 2010]

22 Deleted.

[SFA 04-N09 (Amendment) 2010]

3

Except for item 34 of Annex 1 and item 8 of Annex 1A.

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

13

Modules for Dealing in Securities – Modules 1A, 1B, 6 and 6A

23 A specific representative who meets the following criteria in respect of

dealing in securities is not required to pass Modules 1A, 1B, 6 and 6A:

(a) a person who meets the conditions and restrictions specified in

paragraph 2 of the Second Schedule to the Securities and Futures

(Licensing and Conduct of Business) Regulations (the ―SFR‖);

(b) a person who confines his dealing in securities to Singapore

Government securities; or

(c) a person who works in a specialised unit serving high net worth

individuals exempted under section 100(2) of the Financial

Advisers Act (Cap. 110) [the ―FAA‖].

[SFA 04-N09 (Amendment) 2011]

23A A specific representative who trades in futures contracts and deals in

securities is not required to pass Modules 1A, 1B and 6 if his dealing in

securities is confined to the securities prescribed in regulation 3(1)(iv) of the

Securities and Futures (Prescribed Securities) Regulations 2012.

[SFA 04-N09 (Amendment) (02) 2012]

23B A specific representative referred to in paragraph 23A who has not

passed Module 1A or 1B, and who only deals in the securities prescribed in

regulation 3(1)(iv) of the Securities and Futures (Prescribed Securities)

Regulations 2012 that are listed for quotation or quoted on the SGX is required

to pass the Qualifying Assessment for Dealing in Options on Equity Indices

administered by the SGX.

[SFA 04-N09 (Amendment) (02) 2012]

Modules for Trading in Futures Contracts – Modules 2A, 2B, 6A and 7

24 A specific representative who meets the following criteria in respect of

trading in futures contracts is not required to pass Modules 2A, 2B, 6A and 7:

(a) a person whose trading in futures contracts is confined to the

clearing of futures contracts;

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

14

(b) a person who meets the conditions and restrictions specified in

paragraph 3 of the Second Schedule to the SFR; or

(c) a person who works in a specialised unit serving high net worth

individuals exempted under section 100(2) of the FAA.

[SFA 04-N09 (Amendment) 2011]

25 A specific representative who meets the following criteria in respect of

trading in futures contracts is not required to pass Module 2A:

(a) a person who has at least 3 years of relevant and continuous

working experience in Singapore in respect of trading in futures

contracts as a licensed commodity futures broker’s representative

under section 13 of the CTA in relation to a qualifying corporation

prior to 27 February 2008, without any break-in-service of more

than 6 months between the person’s last working experience in

trading in futures contracts and the date of his -

(i) lodgment of Form 2 under Regulation 7(1)(a) of the

Securities and Futures (Provisions for Persons and Matters

Previously Regulated under Commodity Trading Act)

Regulations 2007;

(ii) licence application prior to 26 November 2010; -

(iii) entry into the industry prior to 26 November 2010; or

(iv) principal’s lodgment with the Authority of documents under

section 99H of the Act, in relation to his appointment as an

appointed representative,

as the case may be;

(b) a person who, prior to 27 February 2008, -

(i) has at least 3 years of relevant and continuous working

experience in Singapore in respect of trading in futures

contract as an associated person in relation to a qualifying

corporation and registered with the Singapore Commodity

Exchange Ltd; and

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

15

(ii) does not hold a commodity futures broker’s representative’s

licence under section 13 of the CTA in relation to that

corporation;

and there is no break-in-service of more than 6 months between

the person’s last working experience in trading in futures contracts

and the date of his licence application prior to

26 November 2010, entry into the industry prior to

26 November 2010, or his principal’s lodgment with the Authority

of documents under section 99H of the Act in relation to his

appointment as an appointed representative, as the case may be;

(c) a person who, prior to 27 February 2008, —

(i) has at least 3 years of relevant and continuous working

experience in Singapore in respect of trading in futures

contracts as a licensed commodity futures broker’s

representative under section 13 of the CTA in relation to a

corporation which, prior to 27 February 2008 , is the holder

of a commodity futures broker’s licence under the CTA and

a CMS licence; and

(ii) is not the holder of a representative’s licence under section

87 of the Act, in force immediately before 27 February

2008;

and there is no break-in-service of more than 6 months between

the person’s last working experience in trading in futures contracts

and the date of his –

(i) lodgment of Form 2 under Regulation 8(i) of the Securities

and Futures (Provisions for Persons and Matters Previously

Regulated under Commodity Trading Act) Regulations 2007;

(ii) licence application prior to 26 November 2010;

(iii) entry into the industry prior to 26 November 2010; or

(iv) principal’s lodgment with the Authority of documents under

section 99H of the Act, in relation to his appointment as an

appointed representative,

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

16

as the case may be; or

(d) a person who, prior to 27 February 2008, —

(i) is exempted from holding a commodity futures broker’s

representative licence under the CTA;

(ii) is employed by or acting for a bank licensed under the

Banking Act (Cap. 19) or a merchant bank approved under

the Monetary Authority of Singapore Act (Cap. 186); and

(iii) has at least 3 years of relevant and continuous working

experience in Singapore in respect of trading in futures

contracts,

and there is no break-in-service of more than 6 months between the

person’s last working experience in trading in futures contracts and

the date of his licence application prior to 26 November 2010, entry

into the industry prior to 26 November 2010, or his principal’s

lodgment with the Authority of documents under section 99H of the

Act in relation to his appointment as an appointed representative, as

the case may be.

[SFA 04-N09 (Amendment) 2010]

26 A person who is:

(a) an appointed representative in respect of dealing in securities; and

(b) exempt from section 99B(1) of the Act when acting as a

representative in respect of the regulated activity of trading in

extended settlement contracts under regulation 3(1) of the

Securities and Futures (Exemption from Section 99B) Regulations

2010,

is not required to pass Modules 2A, 2B and 7, provided that he has passed an

examination administered by the SGX-ST on the relevant rules and regulations

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

17

applicable to trading in extended settlement contracts. With effect from 1

January 2012, such a specific representative is required to pass Module 6A.

[SFA 04-N09 (Amendment) 2010]

[SFA 04-N09 (Amendment) 2011]

27 A specific representative who has been trading in futures contracts as at

31 August 2010 and wishes to trade in futures contracts for a principal in the

principal’s capacity as a member of the SMX is not required to pass Module

2B, provided that he has completed a non-examinable course administered by

the SMX on the rules and regulations applicable to trading on the SMX by 1

March 2011.

Modules for Leveraged Foreign Exchange Trading – Modules 1A, 1B, 2A,

2B, 6A and 7

27A A specific representative who as at 15 April 2005 already conducts the

regulated activity of leveraged foreign exchange trading for a holder of a CMS

licence or an exempt FI and continues to conduct such regulated activity after

15 April 2005 is not required to pass any of the modules of the CMFAS Exam.

With effect from 1 January 2012, such representative is required to pass

Module 6A in accordance with paragraph 39 of this Notice.

[SFA 04-N09 (Amendment) 2010]

[SFA 04-N09 (Amendment) 2011]

Modules for Fund Management – Modules 3, 6, 6A and 7

28 A specific representative who meets the following criteria in respect of

fund management is not required to pass Modules 3, 6, 6A and 7:

(a) a person who conducts venture capital fund management;

(b) a person who manages funds only for accredited investors (within

the meaning as that defined in section 4A of the Act); or

(c) a person who works in a specialised unit serving high net worth

individuals exempted under section 100(2) of the FAA.

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

18

[SFA 04-N09 (Amendment) 2011]

Modules for Advising on Corporate Finance – Modules 4A and 4B

29 A specific representative who advises solely on matters concerning

raising funds and other corporate finance projects where such projects are in

countries other than Singapore is not required to pass Modules 4A or 4B.

30 As at 1 July 2005, a specific representative who advises on matters

concerning raising funds and other corporate finance projects, whether such

projects are in Singapore or elsewhere, is not required to pass Modules 4A or

4B, provided that, prior to 30 June 2005, such person –

(a) has at least 3 years of relevant and continuous working experience,

whether in Singapore or elsewhere, in providing advice on matters

in relation to corporate finance which does not require a CMS

licence or a representative’s licence under the Act immediately in

force prior to 26 November 2010 (―relevant advice‖), without any

break-in-service of more than 6 months between such person’s last

working experience in providing such relevant advice and the date

of his licence application prior to 26 November 2010, entry into

the industry prior to 26 November 2010, or his principal’s

lodgment with the Authority of documents under section 99H of

the Act in relation to his appointment as an appointed

representative, as the case may be; and

(b) has completed a non-examinable course, conducted by the Institute

of Banking and Finance (the "IBF") or an in-house non-

examinable course conducted by a qualified person, on the rules

and regulations for advising on corporate finance. Such in-house

non-examinable course must cover at least the contents of the

study guides of Module 4A and/or Module 4B issued by the IBF.

A qualified person refers to a person who has at least passed

Module 4A and/or Module 4B administered by the IBF or

otherwise possesses the relevant expertise and experience in

relation to the course.

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

19

[SFA 04-N09 (Amendment) 2010]

31 With effect from 1 July 2005, there is no option of a non-examinable

course for modules 4A and 4B.

[SFA 04-N09 (Amendment) 2010]

Module for REIT Management – Module 10

32 A specific representative who has been conducting REIT management as

at 1 August 2008 is not required to pass Module 10. However, he is required

to:

(a) complete a non-examinable course on the relevant rules and

regulations applicable to REIT management, within six months

from 1 August 2008. The course is available at IBF; or

(b) attend an in-house course conducted by their principals which

meet the following conditions:

(i) each course must be based on the contents of the IBF study

guides/textbooks for the relevant rules and regulations; and

(ii) the person conducting the training course must be proficient

in the subject-matter i.e. he must have passed the

examination of Module 10 administered by IBF, or

otherwise possesses the relevant expertise and experience in

relation to REIT management.

RE-TAKING OF RULES AND REGULATIONS MODULES

33 The following individuals are required to re-take the applicable modules

on rules and regulations if they wish to carry out the relevant regulated activity:

(a) a person who has passed the applicable rules and regulations of the

CMFAS Exam but did not commence that regulated activity with a

holder of a CMS licence or an exempt FI within 3 years of the date

of passing that module;

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

20

(b) a person who was subject to the requirement of completing the

applicable non-examinable course by the stipulated deadlines in

this Notice or cancelled Notice No: SFA 04-N01 (Notice on

Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence

and Exempt Financial Institutions) issued on 1 October 2002 and

cancelled on 16 January 2004, and had completed the relevant

non-examinable course after he has ceased carrying out the

applicable regulated activity he was previously licensed to carry

out, but did not re-commence that regulated activity with a holder

of a CMS licence or an exempt FI within 3 years from the date of

completion of the relevant non-examinable course; or

(c) a person who has ceased carrying out any regulated activity with a

holder of a CMS licence or an exempt FI subsequent to his passing

of the relevant rules and regulations of the CMFAS Exam or

completion of the relevant non-examinable course by the stipulated

deadlines in this Notice or cancelled Notice No. SFA 04-N01

(Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence

and Exempt Financial Institutions) issued on 1 October 2002 and

cancelled on 16 January 2004, and wish to act as an appointed

representative with a holder of a CMS licence or an exempt FI for

that regulated activity 3 years after his cessation of that regulated

activity.

[SFA 04-N09 (Amendment) 2010]

OBLIGATIONS OF HOLDERS OF A CMS LICENCE AND EXEMPT

FIs

34 A holder of a CMS licence or an exempt FI is required to maintain a

register stating whether its representative is subject to the CMFAS Exam

requirements or the non-examinable course(s), where applicable, relevant to the

regulated activities of the representative. A holder of a CMS licence or exempt

financial institution shall enter in the register the type of regulated activities

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

21

conducted by its representative, the date on which its representative completed

the examinations or non-examinable course(s), where applicable, and in respect

of such representative who is not required to pass certain modules of the

CMFAS Exam under this Notice, to state the details thereof, if any.

[SFA 04-N09 (Amendment) 2010]

35 In addition, a holder of a CMS licence or exempt FI shall ensure that its

specific representatives comply with the examination requirements of this

Notice. A holder of a CMS licence or exempt FI shall not allow its specific

representatives who are subject to the examination requirements to commence

any regulated activity unless they have passed the applicable modules of the

CMFAS Exam or completed the relevant non-examinable course, where

applicable.

ADMINISTRATION OF CMFAS EXAM

36 The Institute of Banking and Finance (―IBF‖) administers Modules 1A,

1B, 2A, 2B, 3, 4A, 4B, 6, 6A, 7 and 10. Details of the syllabus, examination

format and duration of these modules can be obtained from the IBF.

[SFA 04-N09 (Amendment) 2011]

CONTINUING EDUCATION REQUIREMENTS FOR APPOINTED

REPRESENTATIVES OF CMS LICENCE HOLDERS AND EXEMPT

FIs

37 As set out in the Guidelines on Fit and Proper Criteria (Guideline No.

FSG-G01), competence and capability is a criterion which the Authority will

take into account in considering whether a person is fit and proper. The

Authority expects representatives of CMS licence holders and exempt FIs to

undergo continuing education so as to keep abreast of developments in the

industry and update skills and knowledge relevant to the activities they conduct.

In this regard, principals should review and follow up on their appointed

representatives' continuing education needs on an annual basis, and document

this assessment and attendance at any training in a Continuing Education

Register. Principals should include continuing education undertaken by

appointed representatives in its assessment and that its appointed

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

22

representatives remain fit and proper in the conduct of the relevant regulated

activities, for the purposes of certification to the Authority

4

.

[SFA 04-N09 (Amendment) 2010]

37A A holder of a CMS licence or an exempt FI is expected to ensure that its

representatives have undergone adequate relevant training in the new Specified

Investment Products, prior to their acting as a representatives in respect of such

products.

[SFA 04-N09 (Amendment) 2011]

38 A holder of a CMS licence or an exempt FI is expected to ensure that its

representatives observe the requirements stipulated in paragraph 37 of this

Notice.

[SFA 04-N09 (Amendment) 2010]

TRANSITIONAL ARRANGEMENTS FOR IMPLEMENTATION OF

MODULE 6A OF THE CMFAS EXAM REQUIREMENTS

Existing Representatives

39 Subject to paragraph 18C, a specific representative who is conducting

any of the following regulated activities in respect of a Specified Investment

Product on 1 January 2012 and continue to conduct such regulated activities

after that date, is required to pass Module 6A by 30 June 2013:

(a) dealing in securities;

(b) trading in futures contracts; or

(c) leveraged foreign exchange trading.

[SFA 04-N09 (Amendment) 2011]

4

Under regulations 14A(1)(b) and 14A(2)(a)(ii) of the Securities and Futures (Licensing and Conduct of

Business) Regulations (Rg. 10), holders of CMS licence and exempt FIs are respectively required to ensure that

their representatives are fit and proper persons in relation to the carrying out of regulated activities as

representatives. Pursuant to section 99M of the Act, the Authority may revoke or suspend an appointed

representative if he or his principal fails to satisfy the Authority that he remains a fit and proper person to be

such a representative.

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

23

Outstanding Notifications with the Authority on 1 January 2012

40 Subject to paragraph 18C, a specific representative whose notification to

act as an appointed representative has been lodged with the Authority by his

principal on or before 1 January 2012 to conduct any of the following regulated

activities in respect of a Specified Investment Product is required to pass

Module 6A by 30 June 2013:

(a) dealing in securities;

(b) trading in futures contracts; or

(c) leveraged foreign exchange trading.

[SFA 04-N09 (Amendment) 2011]

Notifications Submitted after 1 January 2012

41 Subject to paragraph 18C, a specific representative whose notification to

act as an appointed representative is lodged with the Authority by his principal

after 1 January 2012 to conduct any of the following regulated activities in

respect of a Specified Investment Product for any customer:

(a) dealing in securities;

(b) trading in futures contracts; or

(c) leveraged foreign exchange trading,

must have passed the relevant CMFAS exams applicable to the specific

representative concerned prior to lodgment of the notification by his principal.

[SFA 04-N09 (Amendment) 2011]

Representatives referred to in the Securities and Futures (Prescribed

Securities)(Exemption) Regulations

42 A specific representative referred to in paragraph 39 or 40 in respect of

the regulated activity of trading in futures contracts and whose notification to

act as an appointed representative to conduct dealing in securities will be

lodged to the Authority in accordance with regulation 5 or 6, as the case may

be, of the Securities and Futures (Prescribed Securities)(Exemption)

Regulations 2012, is required to pass Module 6A by 30 June 2013.

Notice on Minimum Entry and Examination Requirements for

Representatives of Holders of Capital Markets Services Licence and Exempt

Financial Institutions

________________________________________________________________

24

[SFA 04-N09 (Amendment) (02) 2012]

(ho

*Note on History of Amendment

1. SFA 04-N09 (Amendment) 2010 with effect from 26 November 2010.

2. SFA 04-N09 (Amendment) 2011 with effect from 19 October 2011.

3. SFA 04-N09 (Amendment) 2012 with effect from 17 January 2012.

4. SFA 04-N09 (Amendment) (02) 2012 with effect from 4 June 2012.

Note:

Under section 101(3) of the Act, any person who contravenes any

requirement specified in a direction issued by the Authority shall be guilty of

an offence and shall be liable on conviction to a fine not exceeding $50,000

and, in the case of a continuing offence, to a further fine of $5,000 for every

day or part thereof during which the offence continues after conviction.

1

ANNEX 1

Persons possessing any of the following qualifications (which must be

attained through passing the specific respective examination(s)) or

working experience are not required to pass Module 6

1. Degree or higher qualification with emphasis on accountancy,

actuarial science, business/business administration/business

management/business studies, capital markets, commerce, economics,

finance, financial engineering, financial planning or computational

finance;

2. Trading Representatives’ Examination Paper II (previously conducted

by IBF);

3. Investment Representatives’ Examination Paper II (previously

conducted by IBF);

4. Diploma in Investment (previously conducted by IBF);

5. Diploma in Investment Analysis (previously conducted by the

Singapore Securities Research Institute);

6. Diploma in Investment conducted by The Singapore Human

Resources Institute (―SHRI‖);

7. Diploma in Banking and Finance (previously conducted by IBF);

8. Diploma in Banking and Finance conducted by SHRI;

9. Diploma in Financial Planning from IBF/Singapore College of

Insurance (―SCI‖);

10. Diploma in Financial Planning from the Financial Planning

Association of Australia;

11. Diploma in banking, finance, accountancy, business or business

administration from all polytechnics in Singapore;

12. Diploma in Business Administration from University of Singapore;

2

13. Graduate Diploma in Financial Management from Singapore Institute

of Management (―SIM‖);

14. Royal Melbourne Institute of Technology’s Diploma of Financial

Services conducted by SIM;

15. Banking or Financial Studies Diploma from ifs School of Finance

(previously known as the Chartered Institute of Bankers), UK;

16. Skills Certificate – Investment (previously awarded by IBF);

17. Skills Certificate – Investment awarded by SHRI;

18. Certificate in Private Banking awarded by Wealth Management

Institute Pte Ltd, Singapore;

19. Certificate in Financial Needs Analysis & Plan Construction awarded

by Singapore College of Insurance;

20. Chartered Financial Analyst Level 1 Examination conducted by the

CFA Institute, USA;

21. Associate Financial Consultant awarded by Insurance and Financial

Practitioners Association of Singapore (previously known as Life

Underwriters Association of Singapore);

22. Associate Financial Planner or Associate Wealth Planner awarded by

the Financial Planning Association of Singapore;

23. Series 6 or Series 7 of the National Association of Securities Dealers,

USA;

24. Investment Management Certificate of the UK Society of Investment

Professionals (previously known as UK Institute of Investment

Management & Research Examinations);

25. Chartered Life Underwriter by the American College, USA; or

Chartered Life Underwriter Singapore by the SCI;

3

26. Chartered Financial Consultant by the American College, USA; or

Chartered Financial Consultant Singapore by SCI;

27. Certified Financial Planner by the Certified Financial Planners Board

of Standards;

28. Certificate in Securities, Derivatives or Securities and Financial

Derivatives by the Securities & Investment Institute, recognised by

the UK Financial Services Skills Council and Financial Services

Authority (previously known as the Registered Persons Examination

by the Financial Services Authority, UK)

5

;

29. The Association of Chartered Certified Accountants (ACCA)

Qualifications;

30. The Chartered Accountant (ACA) Qualifications;

31. Associate/Fellow of the Institute of Actuaries, England;

32. Associate/Fellow of the Faculty of Actuaries, Scotland;

33. Associate/Fellow of the Society of Actuaries, USA;

34. Associate/Fellow of the Institute of Actuaries of Australia;

35. Associate/Fellow of the Casualty Actuarial Society, USA;

36. Associate Member of CPA Australia

6

;

37. Module 1 of the Investor Contact Competency Examination (ICCE

Module 1) administered by the Securities and Exchange Commission,

Thailand

7

;

5

Persons who possess the qualification of the Registered Persons Examination by the Financial

Services Authority, UK, by no later than 1 December 2001, shall be deemed to possess the qualification of

the Certificate in Securities, Derivatives or Securities and Financial Derivatives by the Securities &

Investment Institute, recognised by the UK Financial Services Skills Council and Financial Services

Authority, for the purposes of Annex 1 of this Notice.

6

Qualification attained by membership is recognised.

4

38. Three years’ relevant and continuous working experience in respect of

the regulated activity to be conducted provided there is no break-in-

service of more than three years between the specific representative’s

last working experience in the regulated activity and the date of his

licence application prior to 26 November 2010, or entry into the

industry prior to 26 November 2010, or his principal’s lodgment with

the Authority of documents under section 99H of the Act in relation to

his appointment as an appointed representative, as the case may be.

However, this does not apply to persons who fall within paragraph

7(a)(ii) of this Notice.

[SFA 04-N09 (Amendment) 2011]

7

Person has to be licensed by the Securities and Exchange Commission of Thailand. His/her

principal company in Singapore shall maintain proper records of documentary evidence certifying his

licensing or authorisation status in Thailand.

5

ANNEX 1A

Persons possessing any of the following qualifications (which must be

attained through passing the specific respective examination(s)) or

working experience are not required to pass Module 6

1. Degree or higher qualification, with emphasis on accountancy,

actuarial science, business/business administration/business

management/business studies, capital markets, commerce, economics,

finance, financial engineering, financial planning, or computational

finance;

2. Chartered Financial Analyst (CFA) by the CFA Institute, USA;

3. The Association of Chartered Certified Accountants (ACCA)

Qualifications;

4. Associate Chartered Accountant (ACA) of the Institute of Chartered

Accountants in England and Wales

8

;

5. Associate/Fellow of the Institute of Actuaries, England;

6. Associate/Fellow of the Faculty of Actuaries, Scotland;

7. Associate/Fellow of the Society of Actuaries, USA;

8. Associate/Fellow of the Institute of Actuaries of Australia;

9. Associate/Fellow of the Casualty Actuarial Society, USA;

10. Associate/Fellow of CPA Australia

9

;

11. Investment Company Products/Variable Contracts Limited

Representative Examination (Series 6) or General Securities

Representative Examination (Series 7) administered by the Financial

Industry Regulatory Authority (FINRA), USA;

8

Qualification attained by membership is recognised.

9

Qualification attained by membership is recognised.

6

12. Module 1 of the Investor Contact Competency Examination (ICCE

Module 1) administered by the Securities and Exchange Commission,

Thailand

10

;

13. Three years’ relevant and continuous working experience in respect of

the regulated activity to be conducted provided there is no break-in-

service of more than three years between the specific representative’s

last working experience in the regulated activity and the date of his

licence application prior to 26 November 2010, or entry into the

industry prior to 26 November 2010, or his principal’s lodgment with

the Authority of documents under section 99H of the Act in relation to

his appointment as an appointed representative, as the case may be.

However, this does not apply to persons who fall within paragraph

7(a)(ii) of this Notice.

[SFA 04-N09 (Amendment) 2011]

10

Person has to be licensed by the Securities and Exchange Commission of Thailand. His/her

principal company in Singapore shall maintain proper records of documentary evidence certifying his

licensing or authorisation status in Thailand.

1

ANNEX 2

Persons possessing any of the following qualifications (which must be

attained through passing the specific respective examination(s)) or

working experience are not required to pass Module 7

1 Degree in finance-related disciplines with at least 50% coverage on

futures and derivatives products;

2. Futures Trading Test (previously conducted by IBF);

3. Futures Examination Paper II (previously conducted by IBF);

4. Futures Examination Paper III (previously conducted by IBF);

5. Series 3 of the National Association of Securities Dealers, USA;

6. Futures and Options Representative’s Examination conducted by the

Securities & Futures Authority Ltd, UK;

7. Certificate in Derivatives by the Securities & Investment Institute,

recognised by the UK Financial Services Skills Council and Financial

Services Authority

11

;

8. Diploma in Investment (previously conducted by IBF);

9. Diploma in Investment conducted by SHRI;

10. Certified Financial Planner by the Certified Financial Planners Board

of Standards, USA;

11. Chartered Financial Analyst Level 1 Examination conducted by the

CFA Institute, USA;

11

Persons who possess the qualification of a Level 3 Certificate in Investments (Derivatives) by the

Securities & Investment Institute, recognised by the UK Financial Services Skills Council and Financial

Services Authority, by no later than 1 November 2004, shall be deemed to possess the qualification of a

Certificate in Derivatives by the Securities & Investment Institute, recognised by the UK Financial Services

Skills Council and Financial Services Authority, for the purposes of Annex 2 of this Notice.

2

12. Chartered Financial Consultant by the American College, USA; or

Chartered Financial Consultant Singapore by SCI;

13. Advanced Certification in Investment conducted by the Nanyang

Polytechnic;

14. Three years’ relevant and continuous working experience in respect of

the regulated activity to be conducted provided there is no break-in-

service of more than three years between the specific representative’s

last working experience in the regulated activity and the date of his

licence application prior to 26 November 2010, or entry into the

industry prior to 26 November 2010, or his principal’s lodgment with

the Authority of documents under section 99H of the Act in relation to

his appointment as an appointed representative, as the case may be.

However, this does not apply to persons who fall within paragraph

7(a)(ii) of this Notice.

3

ANNEX 2A

Persons possessing any of the following qualifications (which must be

attained through passing the specific respective examination(s)) or

working experience are not required to pass Module 7

1 Degree or higher qualification with emphasis on accountancy,

actuarial science, business/business administration/business

management/business studies, capital markets, commerce, economics,

finance, financial engineering, financial planning or computational

finance;

2. Chartered Financial Analyst (CFA) by the CFA Institute, USA;

3. National Commodity Futures Examination (Series 3) administered by

the Financial Industry Regulatory Authority (FINRA), USA;

4. Three years’ relevant and continuous working experience in respect of

the regulated activity to be conducted provided there is no break-in-

service of more than three years between the specific representative’s

last working experience in the regulated activity and the date of his

licence application prior to 26 November 2010, or entry into the

industry prior to 26 November 2010, or his principal’s lodgment with

the Authority of documents under section 99H of the Act in relation to

his appointment as an appointed representative, as the case may be.

[SFA 04-N09 (Amendment) 2011]