Toolkit

for Third-Party

Fundraisers

2

Thanks again for choosing to support The 519 and the LGBTQ2S communities we serve.

This toolkit aims to guide the online and offline promotional strategies for your event.

Please note that to host a fundraiser you must already have a formal agreement with

The 519. To request an agreement, visit:

https://the519.formstack.com/forms/third_party_event_application

For any questions regarding third-party fundraisers, contact:

Rafael Glass Machado (he/him) [email protected]

3

Contents

Part I: Fundraiser Promotion ............................................................................................... 4

1. Promoting your Fundraiser on Social Media ............................................................. 4

2. Language Tips for your Posts ................................................................................... 4

3. Getting The 519 to Share your Social Media Posts .................................................. 5

4. The 519 Logo Usage ................................................................................................ 6

5. Offline Promotions: Posters and Flyers ..................................................................... 7

6. Important to Note ...................................................................................................... 7

7. Resources ................................................................................................................. 8

Part II: Charitable Tax Receipts .......................................................................................... 9

1. Corporate Fundraising via Sales of Products or Services ......................................... 9

2. Donation Raised by a Group of People at an In-person Fundraising Event .............. 9

3. Donation Raised by a Group of People at a Virtual Fundraising Event ................... 10

4. Auctions Hosted by External Fundraiser(s) ............................................................. 11

4

Part I: Fundraiser Promotion

1. Promoting your Fundraiser on Social Media:

We encourage you to promote your third-party fundraising event on all your social media

platforms. Some best practices for promotions on Facebook, Twitter, and Instagram:

A) Facebook:

a. Events: A Facebook event helps your audience RSVP and set reminders if they are

interested. You can also answer their questions in the event’s ‘discussion’ section.

b. Posts: Provide all event details in your post (name, description, venue, time),

and mention that it is a third-party fundraiser for The 519.

c. If you are uploading a poster or image with important event information, please

transcribe the details in the image word-for-word in the image description section for it to

be accessible on screen readers. If you are using The 519’s logo in your poster, refer to

The 519 Logo Usage: section in this document.

d. Stories: You can also use the stories feature to spread word closer to the event.

B) Twitter:

a. Provide all the basic details in your post. Use 2-3 appropriate hashtags to increase

chances of your post being noticed.

b. When you upload an image with your post, please add alt text for accessibility.

C) Instagram:

a. This is a platform for visuals, so posters and 60-second videos could be good options.

Add all poster descriptions in the image caption for accessibility. 11+ relevant hashtags

could get your post more attention.

b. On Instagram too, stories are a good way to promote the event and post updates.

Tag us “@The519” in all your social media posts.

2. Language Tips for your Posts:

A) Keep your posts concise, but provide all basic details. Have a clear contact or call to

action.

B) Always use language that is simple and inclusive. For more tips, download our

Reference Guide to Discussing Trans and Gender-diverse People

(https://www.the519.org/media/download/3555) and our Media Tip Sheet

(https://www.the519.org/media/download/3556).

5

C) The 519 uses the acronym “LGBTQ2S” in our communication.

D) In verbal communications, The 519 is known as “The Five Nineteen” (not The Five

One Nine).

3. Getting The 519 to Share your Social Media Posts:

A) Facebook and Twitter:

• For third-party fundraisers, The 519 can only re-share a post or event that you

have already created. Fundraisers are encouraged to create their own posts so that we

can re-share them. See examples 1, 2, and 3 (page 6).

• The post copy would need to mention your fundraiser being in support of

The 519.

• Please tag us (@The519) in your posts so that we know when they are up and can

be re-shared.

B) Instagram: The 519 can only re-share stories about third-party fundraiser events.

When you post a story about the event, tag us (@The519) in your story. See example 4

on page 6.

Ex. 1: Re-sharing an original video Ex. 2: Re-sharing a Facebook event

6

Ex. 3: Sharing of event on Twitter Ex. 4: Re-sharing of original

Instagram stories

4. The 519 Logo Usage:

• If you are creating any visual designs using our logo for your promotions, our brand

and logo tips (https://www.the519.org/public/img/press/the-519-logo.zip) can help

you.

• You will also find high-resolution .eps and .png versions of our primary, black, and

white logos ready for use.

. Snapshot of our logo and brand tips Our primary, black,

and white logos

7

5. Offline Promotions: Posters and Flyers:

A) Just like your social media posts or events, posters and flyers need to have all the

basic event details – name, day, date, time, venue, and appropriate visuals. It is a

good idea to think about representation and diversity in selecting images. A free stock

photo resource for LGBTQ2S communities is: https://genderphotos.vice.com/

B) These tips will help you create accessible poster/graphic designs.

C) Email the poster to RGlassMachado@The519.org for review and approval.

D) You can also put up your third-party fundraiser poster on The 519’s community

notice

board by submitting a hard copy at the Front Desk.

6. Important to Note:

• The 519 reserves the right to not re-share third-party fundraiser original posts in

case of a conflict of interest or other consideration(s).

• If you are collecting any (related) personal information of individuals prior, during,

or after your event, you would not be doing so on behalf of The 519.

• Any press releases/media advisories/media engagement about your event that

mentions The 519 need pre-approval from our Director, Strategic Communications

and Executive Planning (M[email protected]).

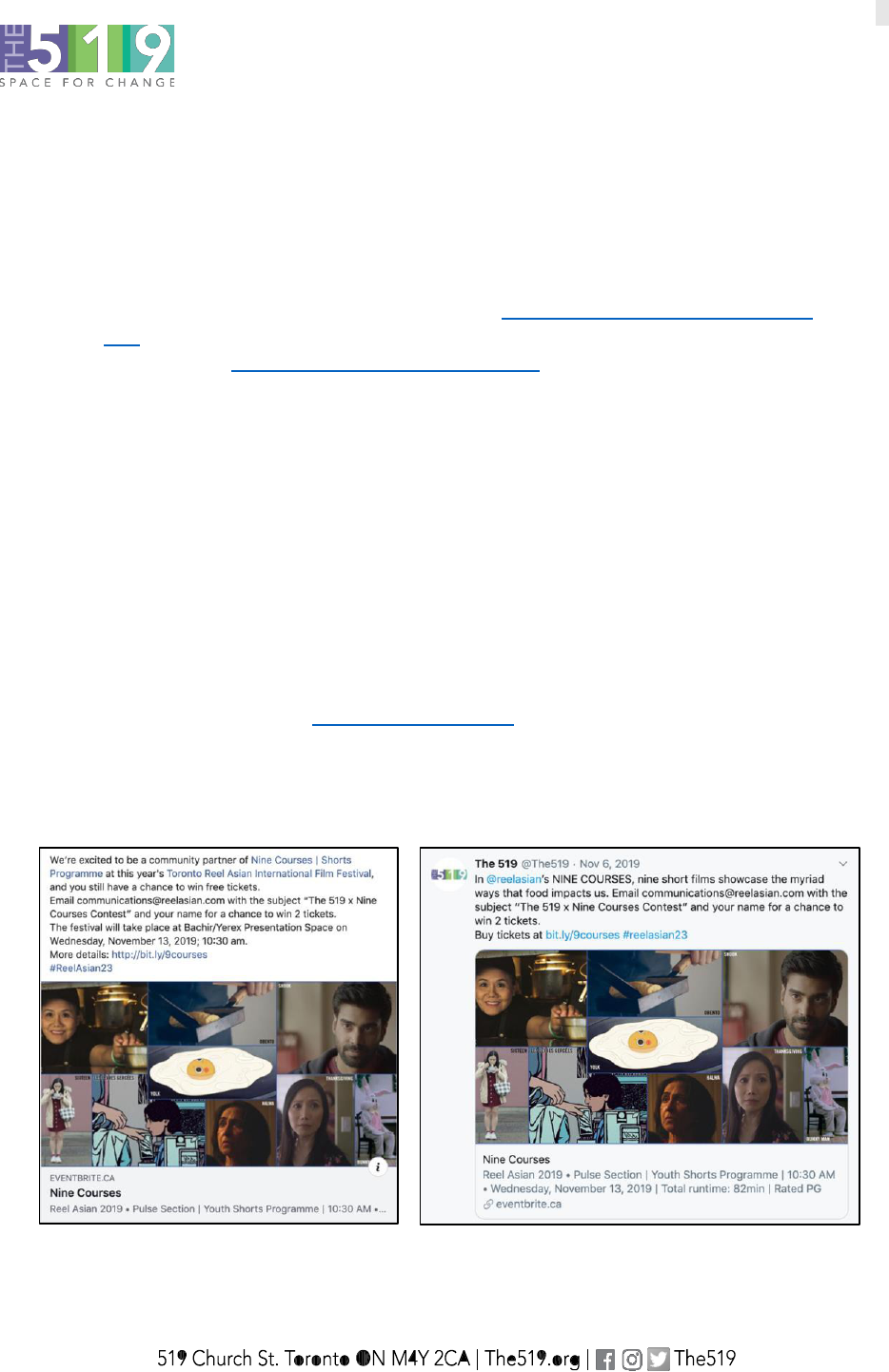

• The 519 does not run third-party contests. Contests would have to be conducted by

the fundraiser. We can at most re-share details about the contest. See examples

on the next page.

Examples of how we share third-party contest details on Facebook and Twitter

8

7. Resources:

• Media Tip Sheet (https://www.the519.org/media/download/3556)

• Discussing Trans and Gender-diverse People

(https://www.the519.org/media/download/3555)

• If you need images of The 519 for your event promotional material, high-resolution

pictures are available for download at: https://www.the519.org/about/media

• High-resolution logos of The 519 are available for download at:

https://www.the519.org/public/img/press/the-519-logo.zip

For any other questions related to promoting your event on social media and

offline, contact Communications@The519.org.

9

Part II: Charitable Tax Receipts

The 519 is a Canadian registered charity, and as so, we can issue tax receipts for

donations made directly to The 519. Depending on the type of fundraiser event you are

holding, this will affect the tax receipt eligibility and the way to donate the funds.

1. Corporate Fundraising via Sales of Products or Services

A) Overview

When organizations donate the full amount or a portion of the funds raised via sales of

products or services, The 519 can issue a charitable tax receipt for the amount

donated.

B) Ways to donate

• Make an online donation on our secure portal (The519.org/donate)

• Mail a cheque to The 519

ATTN: Lili Rathgeb, Coordinator, Philanthropy & Donor Relations

519 Church Street, Toronto, ON M4Y 2C9

• Do an Electronic Funds Transfer (EFT) - EFT information available upon request.

Contact Rafael: RGlassMachado@The519.org

2. Donation Raised by a Group of People at an In-person

Fundraising Event

A) Overview

If you are donating funds that have been collected from multiple individuals at an in-

person event, please inform us if each individual requires a charitable tax receipt. If

yes, please inform us prior to the event date and we will provide you with a template of

the information you are required to collect from each person donating. The 519 cannot

issue charitable tax receipts to the organization/person donating the collected funds. All

donations of 20 CAD or more are eligible for a tax receipt.

B) Ways to donate

• Mail a cheque to The 519

ATTN: Lili Rathgeb, Coordinator, Philanthropy & Donor Relations

519 Church Street, Toronto, ON M4Y 2C9

10

• Do an Electronic Funds Transfer (EFT) - EFT information available upon request.

Contact Rafael: RGlassMachado@The519.org

3. Donation Raised by a Group of People at a Virtual

Fundraising Event

A) Overview

For virtual fundraising events, there are many options for folks to solicit and gather

donations. Please note that donations made through external platforms, such as

Facebook, Canada Helps, or AKA Raisin, are not eligible for a charitable tax receipt

from The 519.

B) Ways to Donate via Virtual Fundraising Events

• Direct individuals to The 519’s secured online portal or request The 519 to create a

personalized fundraising event page for your organization or event (see sample

image example below). All online donations of 20 CAD made directly to The 519 or

more will immediately receive an electronic tax receipt to the email they provided at

the time of their donation.

• Create a Giving Page on an external platform (Canada Helps, AKA raisin,

Facebook, Luminate Online, etc.) and collect donations. These platforms may or

may not be able to issue a charitable tax receipt. We encourage you to contact

11

4. Auctions Hosted by External Fundraiser(s)

A) Overview

When it comes to tax receipts, auctions can be quite complex. You are strongly

encouraged to contact us at Giving@The519.org for our guidance. Below is a basic

overview of receipting information as it pertains to auction events – auction

organizer/fundraisers, auction suppliers, and winning bidder.

• Auction Organizer/Fundraiser - The 519 cannot issue charitable tax receipts to the

organization/person donating the collected funds from the Auction Event.

• Auction Suppliers – These are the organizations that provide items for the auction

you are hosting. Organizations providing items for your Auction Event are not

eligible for a charitable tax receipt.

• Winning Bidder – These are individuals who make a winning bid on an auction item.

Charitable tax receipts for these individuals are based on the Fair Market Value

(FMV) of the item they won at the auction. The tax receipt is calculated as the

difference between the FMV (advantage) and the winning bid amount.

• Fair Market Value (FMV) is what a consumer would pay if the gift is bought in the

open market.

• The winning bid must meet the intention to make a gift threshold: the posted FMV of

the lot item cannot exceed 80% of the winning bid. This means that a winning bid

that is over 80% of the posted FMV is not eligible for a charitable tax receipt.

Example: Bike Bought at Auction

The FMV of the bike posted at the auction is declared to be 400 CAD. The winning

bid for the bike at the auction is 550 CAD.

Calculation of eligible amount for tax receipt:

o Winning bid of 550 CAD less the FMV (advantage to donor) of 400 CAD =

Eligible tax receipt amount of 150 CAD

o However, if the FMV of the bike was not made known to bidders in advance

of the auction, a receipt could not be issued to the winning bidder.

B) Ways to Donate Proceeds of Your Auction

These are the ways that the Auction Organizer/Fundraiser can donate the funds

collected:

• Mail a cheque to The 519

ATTN: Lili Rathgeb, Coordinator, Philanthropy & Donor Relations

519 Church Street, Toronto, ON M4Y 2C9

• Do an Electronic Funds Transfer (EFT) - EFT information available upon request.

Contact Rafael: RGlassMachado@The519.org