REPORT TO CONGRESS

Prescription Drug Pricing Report

August 6, 2019

U.S. Department of Health and Human Services

Prepared by:

Office of the Assistant Secretary for Planning and Evaluation (ASPE)

2

Table of Contents

Page

Section 1. Introduction

5

Section 2. Medicare Part B

9

Section 3. Medicare Part D

18

Section 4. Medicaid

27

Section 5. Drugs Benefiting from Government Grants or Research Subsidies

35

Appendix. Top 10 Drugs by Total Cost, Spending per Unit, and Prescription

Frequency in Medicare Part B, Medicare Part D, and Medicaid

41

3

Tables

Table 2-1 Medicare Fee-for-Service Part B Program Spending for Drug Benefits, 2006-2017

Table 2-2 Medicare Fee-for-Service Part B Program Spending per Enrollee and User for Drug

Benefits, 2006-2017

Table 2-3 Top 10 Highest-Cost Prescribed Drugs, Medicare Part B, Ranked by Total Spending

(2008, 2011, 2014, 2017)

Table 2-4 Top 10 Highest-Cost Prescribed Drugs, Medicare Part B, Ranked by Spending per

Unit (2011, 2014, 2017)

Table 2-5 Top 10 Most Frequently Prescribed Drugs, Medicare Part B, Ranked by Total Number

of Services (2008, 2011, 2014, 2017)

Table 3-1 Medicare Part D Total Program Spending and Benefit Spending, 2006-2017

Table 3-2 Medicare Part D Prescription Gross Drug Costs (GDC): 2007-2017

Table 3-3 Top 10 Highest-Cost Drugs, Medicare Part D, Ranked by Total Spending (2008,

2011, 2014, 2017)

Table 3-4 Top 10 Highest-Cost Drugs, Medicare Part D, Ranked by Spending per Unit (2008,

2011, 2014, 2017)

Table 3-5 Top 10 Most Frequently Prescribed Drugs, Medicare Part D, Ranked by Number of

Claims (2008, 2011, 2014, 2017)

Table 4-1 Medicaid Prescription Drug Gross Spending, 2006-2017

Table 4-2 Top 10 High-Cost Prescribed Drugs, Medicaid, Ranked by Total Spending (2008,

2011, 2014, 2017)

Table 4-3 Top 10 High-Cost Prescribed Drugs, Medicaid, Ranked by Spending per Unit (2014,

2017)

Table 4-4 Top 10 Most Frequently Prescribed Drugs, Medicaid, Ranked by Number of Claims

(2008, 2011, 2014, 2017)

Table 5-1 Prescription Drugs Approved for Sale by the Food and Drug Administration from

2013 to 2017, and 2017 Spending by Program Where Applicable

Table A-1 Top 10 High-Cost Prescribed Drugs, Medicare Part B, Ranked by Total Spending

(All years)

4

Table A-2 Top 10 Highest-Cost Prescribed Drugs, Medicare Part B, Ranked by Spending per

Unit (All years)

Table A-3 Top 10 Most Frequently Prescribed Drugs, Medicare Part B, Ranked by Total

Number of Services (All years)

Table A-4 Top 10 High-Cost Prescribed Drugs, Medicare Part D, Ranked by Total Spending

(All years)

Table A-5 Top 10 Highest-Cost Drugs, Medicare Part D, Ranked by Spending per Unit (All

years)

Table A-6 Top 10 Most Frequently Prescribed Drugs, Medicare Part D, Ranked by Number of

Claims (All years)

Table A-7 Top 10 High-Cost Prescribed Drugs, Medicaid, Ranked by Total Spending (All years)

Table A-8 Top 10 High-Cost Prescribed Drugs, Medicaid, Ranked by Spending per Unit (All

years)

Table A-9 Top 10 Most Frequently Prescribed Drugs, Medicaid, Ranked by Number of Claims

(All years)

Figures

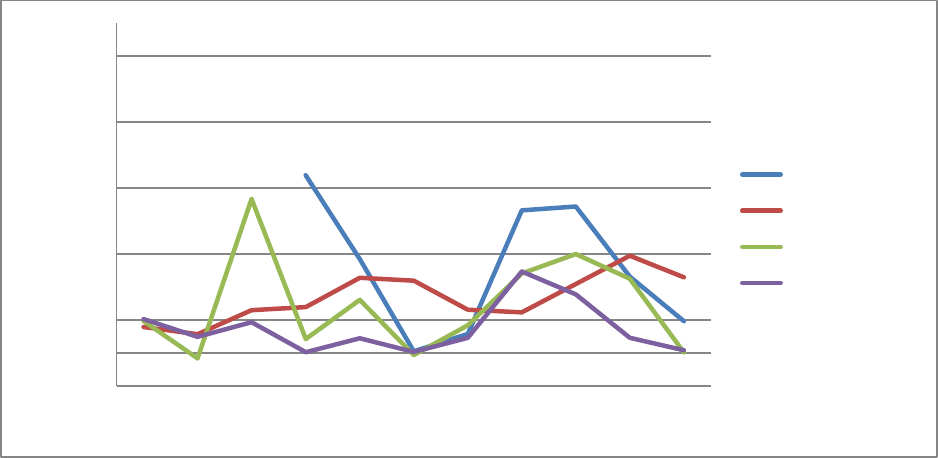

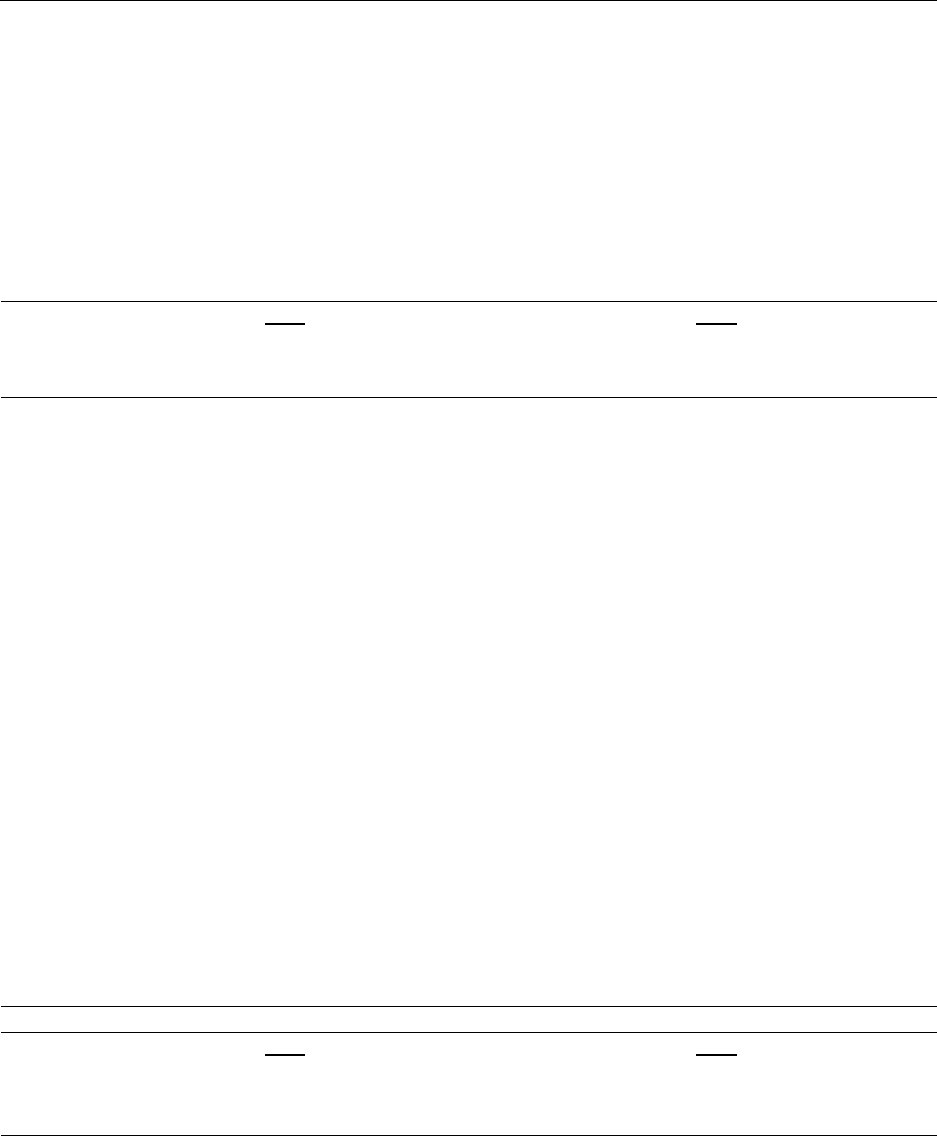

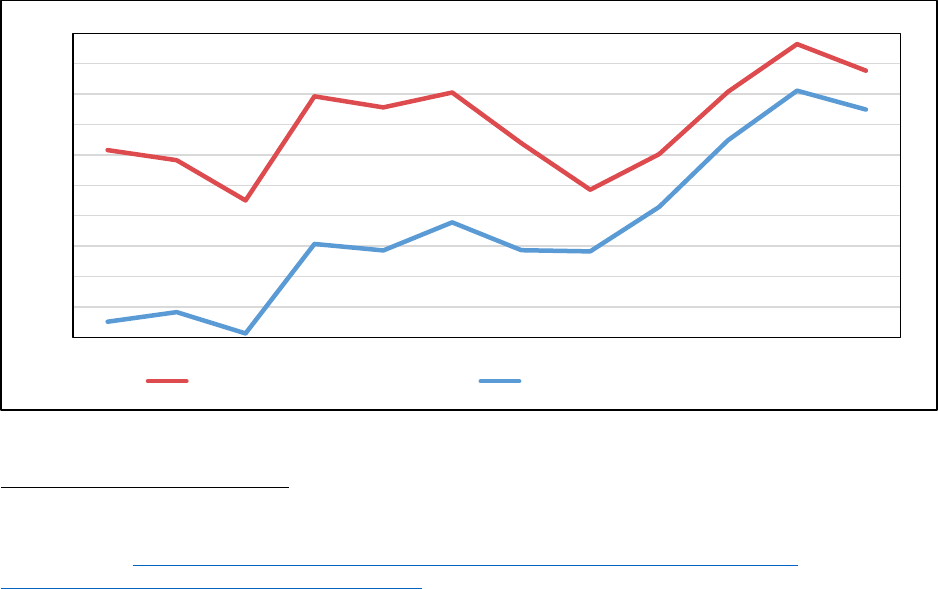

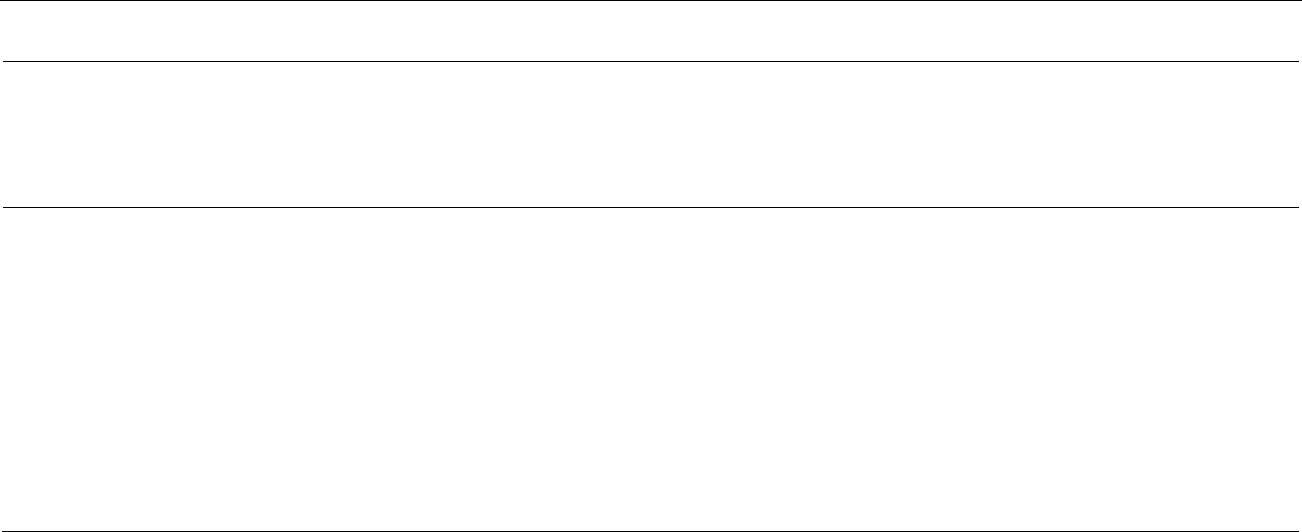

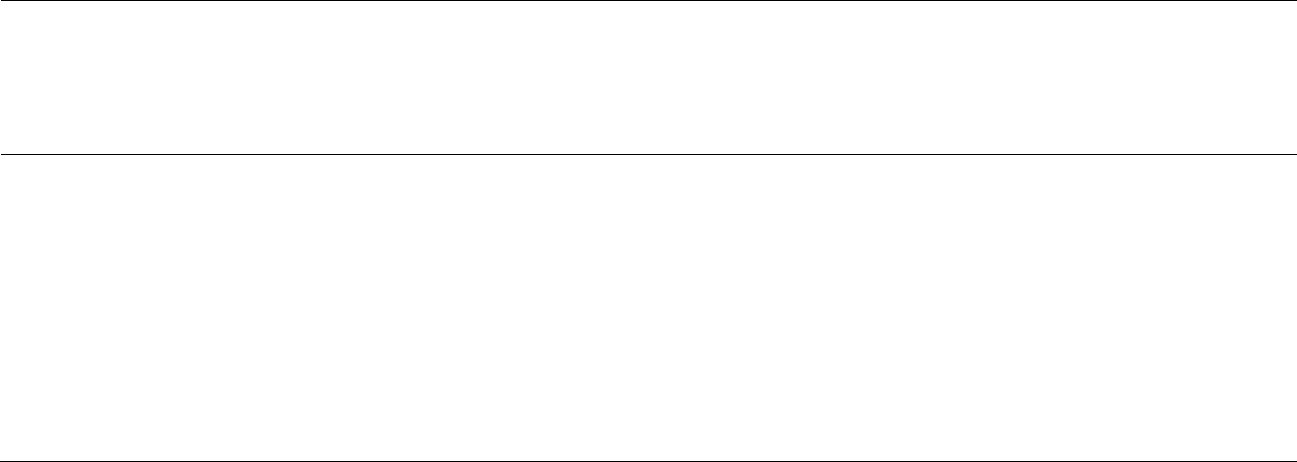

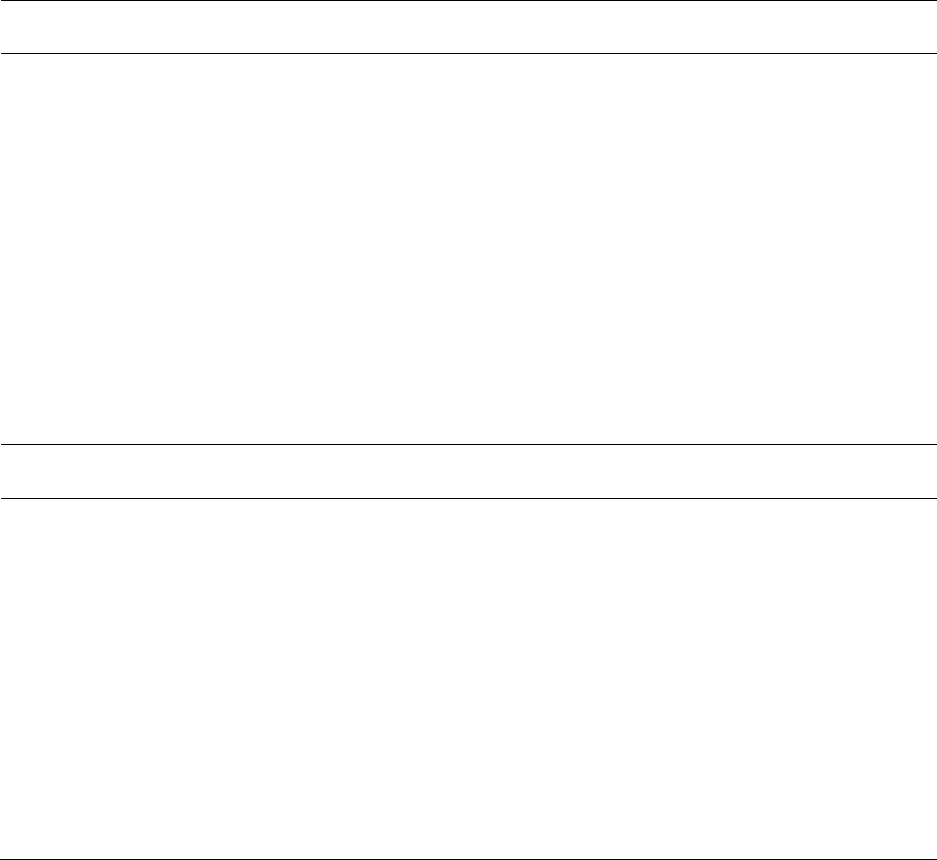

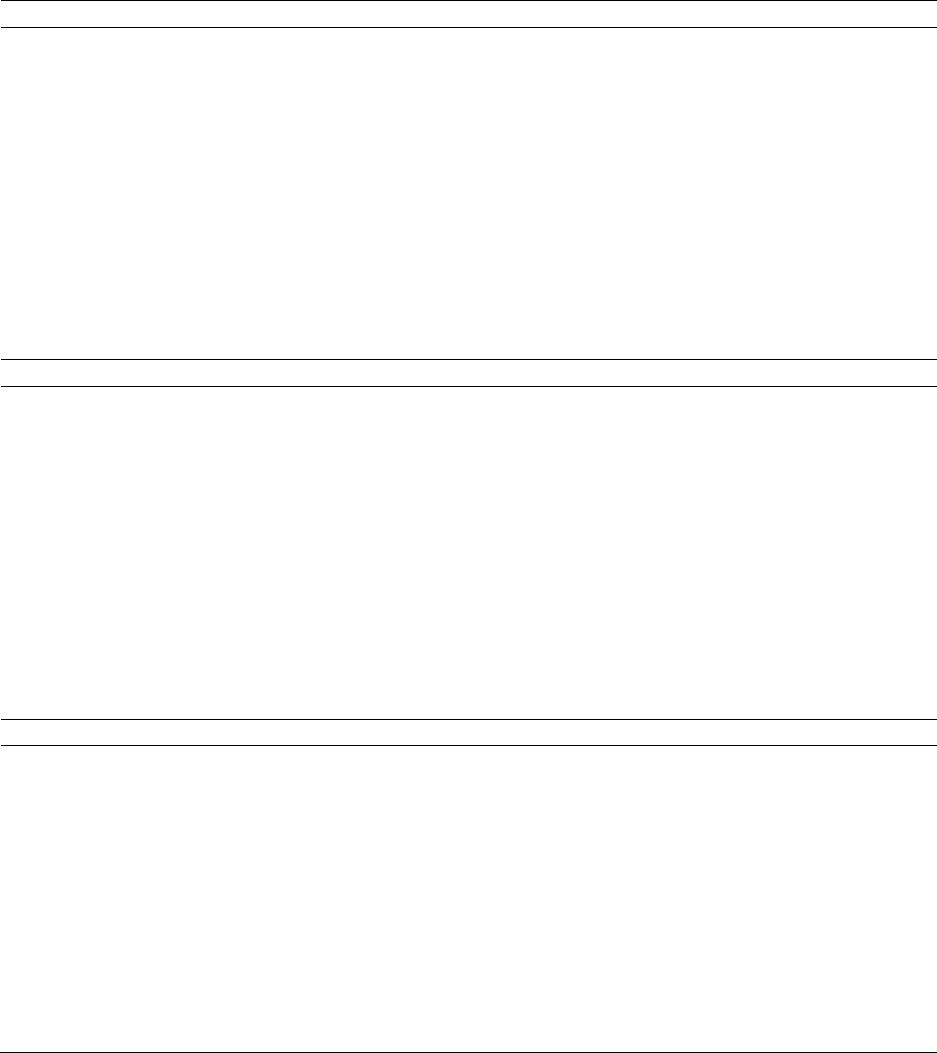

Figure 1-1 Annual Percentage Change in Prescription Drug Spending by Program, 2007-2017

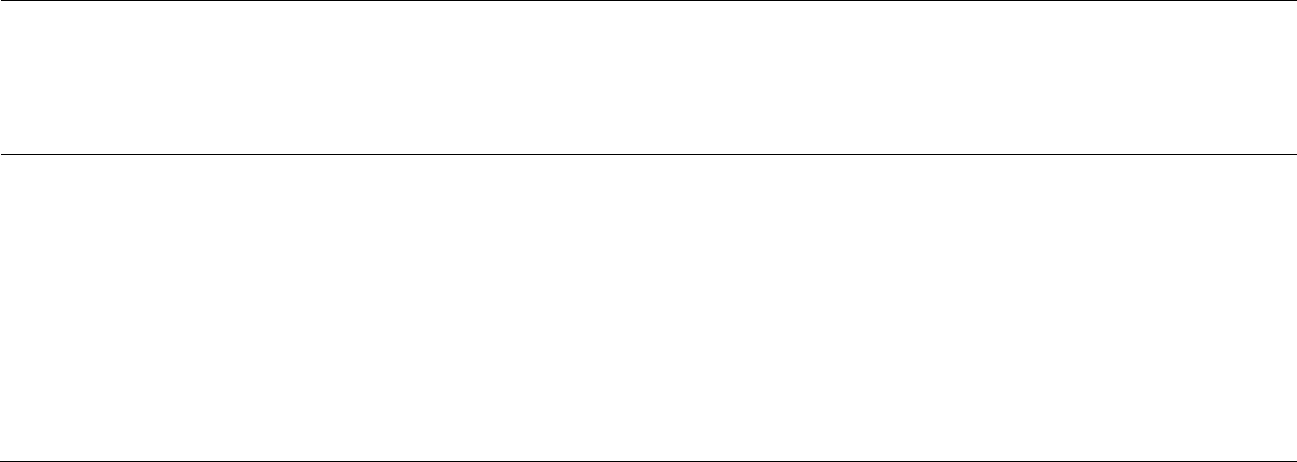

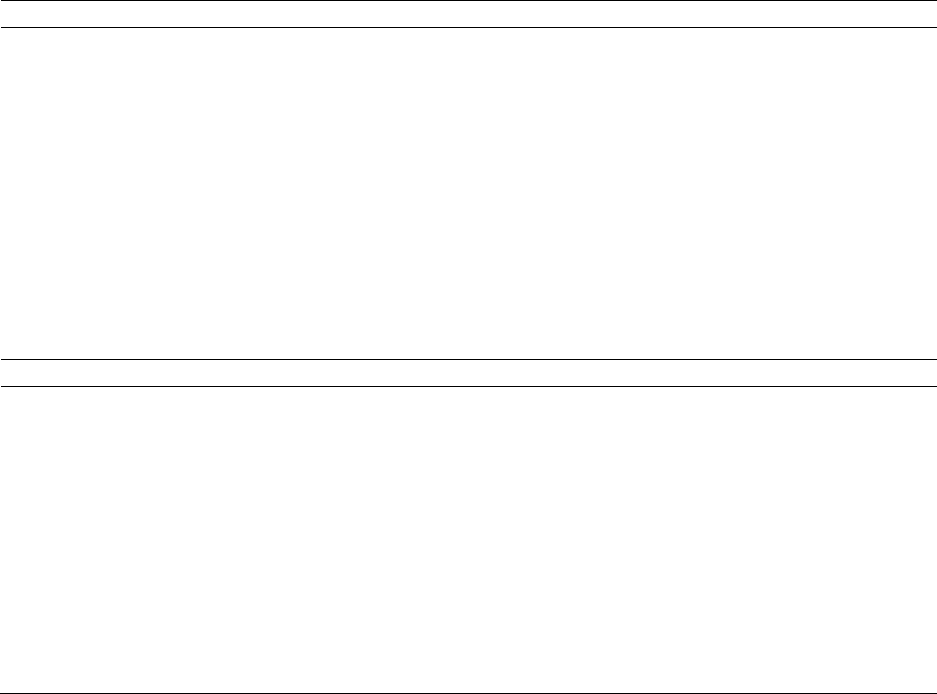

Figure 3-1 Medicare Part D Total Spending per Enrollee and Per User, 2006-2017

5

SECTION 1: INTRODUCTION

The Secretary of Health and Human Services (HHS) has been directed to submit a drug pricing

report containing information requested by the House Committee on Appropriations. In

response, the Assistant Secretary for Planning and Evaluation (ASPE) developed this report

containing data and analyses related to prescription drug spending between 2006

1

and 2017 as

well as on prescription drugs benefiting from public funding for biomedical research since 2013.

The sections on prescription drug spending provide comparative gross prescription drug

spending and prices as well as the top 10 highest-cost drugs and the top 10 most frequently

prescribed drugs for each of the following: (1) The Medicare program under part B of title XVIII

of the Social Security Act; (2) The Medicare prescription drug program under part D of title

XVIII of the Social Security Act; (3) The Medicaid program under title XIX of the Social

Security Act. The section on public funding for biomedical research provides the list of drugs

that have been approved for sale by the Food and Drug Administration (FDA) in the past five

years that have benefited significantly from government grants or research subsidies in either the

pre-clinical or clinical stages of development, as well as spending in Medicare and Medicaid for

each of those drugs.

This report does not include: (1) prescription drug spending or prices pertaining to programs of

the Department of Veterans Affairs; (2) spending and prices net of rebates for individual drugs

within Medicare Part D or Medicaid, or spending net of rebates in aggregate for Medicaid; or (3)

a breakdown of the comparative prices net of rebates for each of the 10 most frequently

prescribed drugs or the 10 highest-cost drugs between ambulatory settings and retail settings.

Rebate data and prices net of rebates are excluded because this information is generally

considered proprietary and is subject to a variety of disclosure restrictions under Federal law.

Prescription Drug Spending in Medicare Part B, Medicare Part D, and Medicaid

Prescription drug spending continues to increase in the United States.

2

The Office of the Actuary

within the Centers for Medicare and Medicaid Services (CMS) estimates that in 2019, $360.3

billion will be spent on retail prescription drugs, rising from $265.2 billion in 2013.

3

The May

2018 Trump Administration blueprint for lower drug prices described a new, more transparent

drug pricing system that would lower high prescription drug prices and bring down out-of-pocket

1

The committee request data on drug pricing back to 2008. In several analyses, this report presents data starting

with 2006; several policy changes began in 2006 including the implementation of Medicare Part D and the first year

that most hospital outpatient departments began using ASP methodology for payments under Medicare Part B.

2

According to IQVIA, the outlook to 2022 is for 2–5% net spending growth, with 1–4% growth in retail and mail-

order prescription drugs. This growth, driven primarily by the large number of new medicines, many of which will

be specialty and orphan drugs, will be offset by the impact of losses of brand exclusivity. Available from:

https://www.iqvia.com/institute/reports/medicine-use-and-spending-in-the-us-review-of-2017-outlook-to-2022

3

Sisko AM, Keehan SP, Poisal JA, et al. National Health Expenditure Projections, 2018–27: Economic And

Demographic Trends Drive Spending And Enrollment Growth. Health Affairs. 3 (2019). Available from:

https://www-healthaffairs-org.ezproxyhhs.nihlibrary.nih.gov/doi/pdf/10.1377/hlthaff.2018.05499. The $360.3

billion estimate for 2019 includes $116.0 billion for Medicare (including Part B and Part D) and $35.8 billion for

Medicaid. Both estimates are net of rebates. See Table 11 in https://www.cms.gov/Research-Statistics-Data-and-

Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/Downloads/Proj2018Tables.zip.

6

costs. The blueprint includes four strategies for putting American patients first: bringing down

out-of-pocket-costs, boosting competition, strengthening negotiation, and creating incentives for

lower list prices.

Trends in prescription drug utilization and spending vary across the Medicare Part B, Medicare

Part D, and Medicaid programs. Differences in utilization and spending reflect underlying

variation in eligibility for each program, including age, disability, income, and medical need. The

Medicare Program provides health insurance coverage for individuals aged 65 years and older as

well as certain younger individuals with disabilities or with End-Stage Renal Disease. The

Medicaid program is a joint Federal-State program that provides coverage for disabled

individuals and individuals and families with low incomes; some individuals with incomes above

these limits may also qualify due to high medical expenses.

In addition to populations served, these programs and different parts of these programs also vary

in the coverage offered for prescription drugs. Medicare Part D and Medicare Part B provide

coverage for different types of prescription drugs based on site of service: in general, Medicare

Part D provides coverage for self-administered prescription drugs and Medicare Part B covers

drugs that are administered in physician’s offices or hospital outpatient departments. In

Medicaid, prescription drug coverage is an optional benefit, currently offered across sites of

service by all states and the District of Columbia.

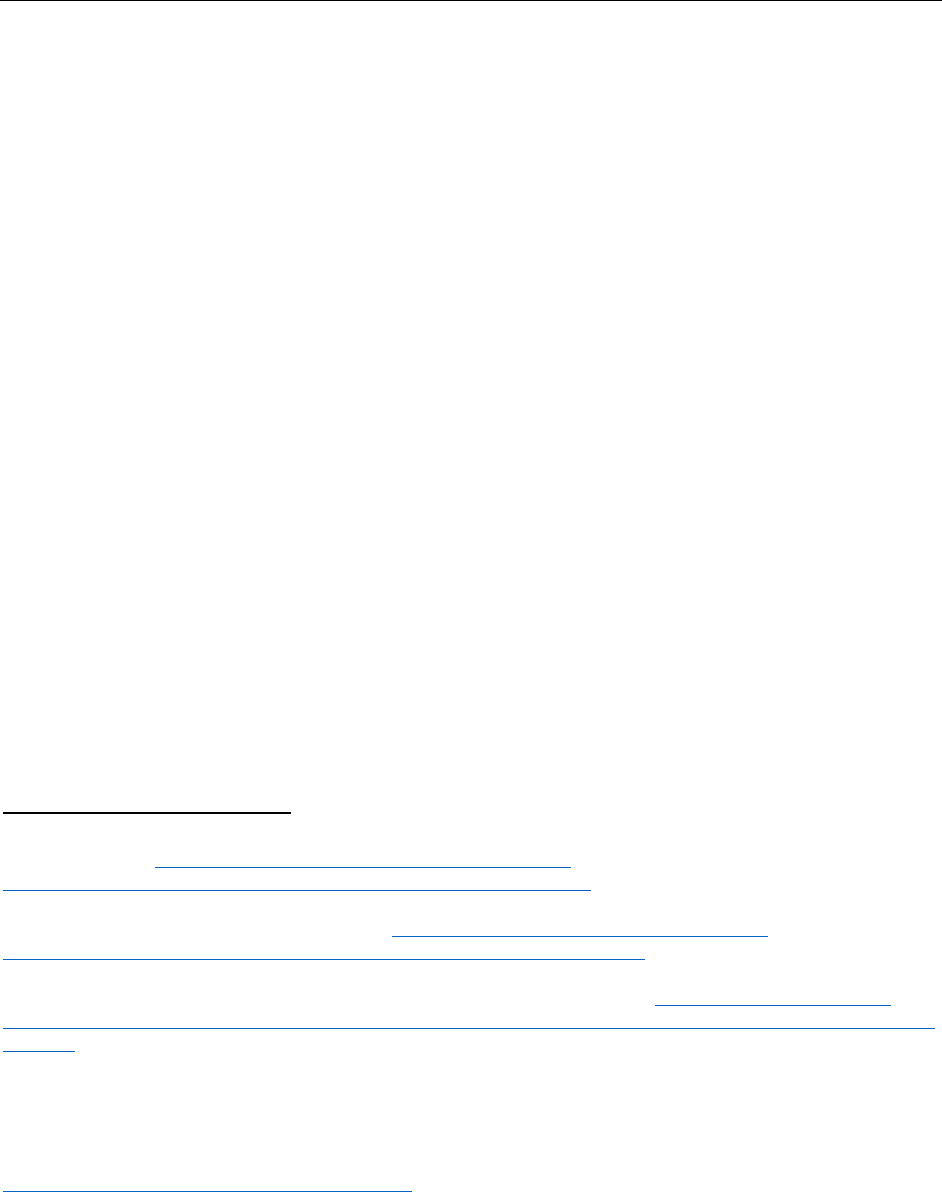

Prescription drug expenditures are projected to continue rising during the coming decade,

placing increasing fiscal pressures on commercial, federal, and state budgets.

4

,

5

Despite the

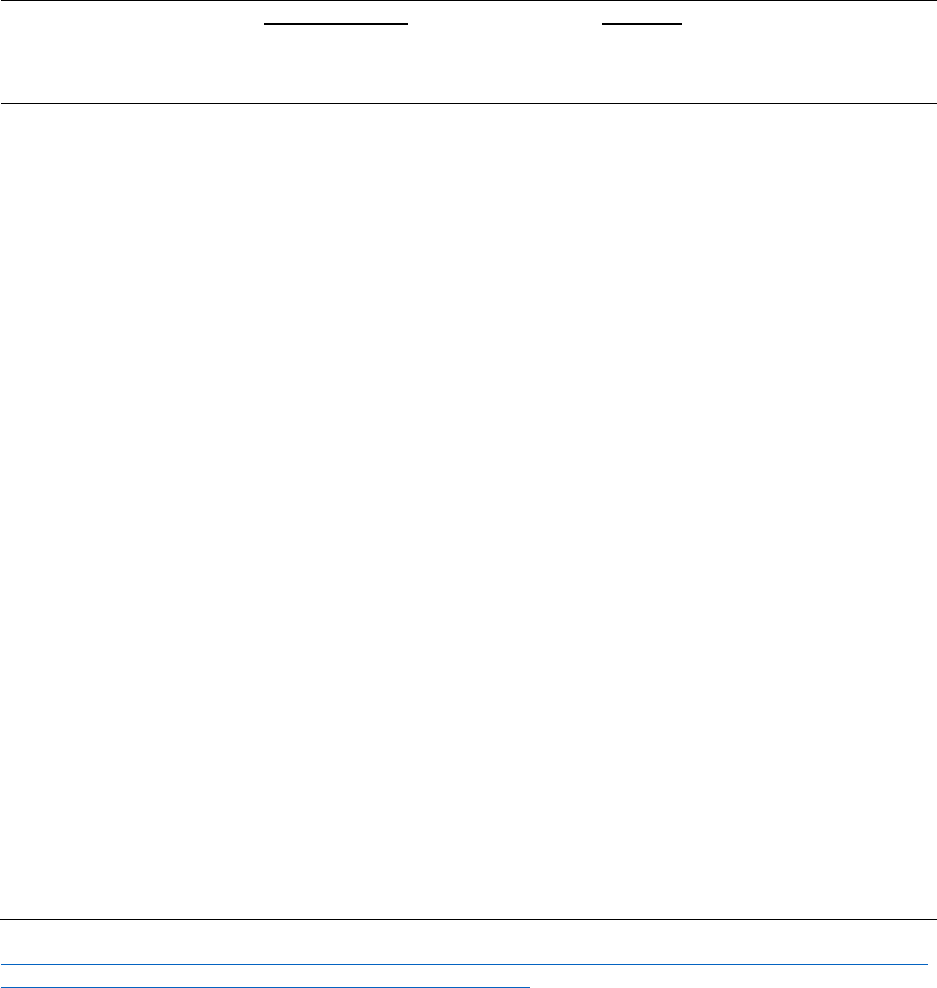

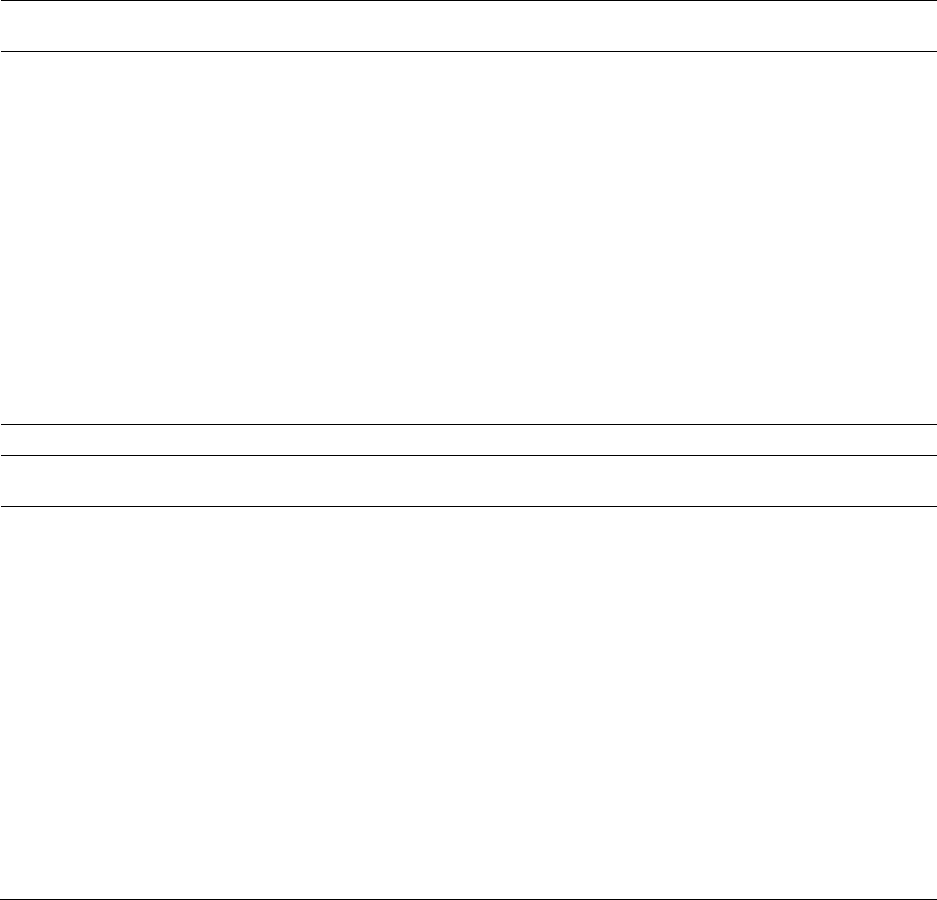

slowdown in the last 2 years as shown in Figure 1-1, over the longer period from 2006 to 2017,

program spending for prescription drug has been growing annually at 7 percent for Medicare Part

D, 8 percent for Medicare Part B, and 17 percent for Medicaid.

6

Increases in prescription drug

spending are not expected to be uniform across government programs, however, in part due to

differences in eligibility and coverage across programs. Another important factor underlying

differential projected increases in prescription drug spending is variation in use of purchasing

arrangements, utilization management strategies, and value-based approaches by the different

government programs.

4

Observations on trends in prescription drug spending. ASPE Issue Brief (3/8/2016). https://aspe.hhs.gov/pdf-

report/observations-trends-prescription-drug-spending

5

Sisko AM, Keehan SP, Poisal JA, et al. National Health Expenditure Projections, 2018–27: Economic And

Demographic Trends Drive Spending And Enrollment Growth. Health Affairs. 3 (2019). Available from:

https://www-healthaffairs-org.ezproxyhhs.nihlibrary.nih.gov/toc/hlthaff/0/0

6

Medicaid data for years before 2010 are not shown in Figure 1-1 because they do not include spending by

Managed Care Organizations and may be subject to data errors. The high rate of increase in Medicaid spending in

2014 and 2015 is associated with Medicaid expansion under the Affordable Care Act and the launch of expensive

new drugs such as Sovaldi and Harvoni for hepatitis C.

7

Figure 1-1 Annual Percentage Change in Prescription Drug Spending by Program, 2007-2017

Prescription Drug Development and Public Funding

Prescription drugs can effectively treat many acute and chronic diseases leading to improvements

in quality of life, life expectancy, and overall population health. However, development of new

prescription drugs is expensive, uncertain, and slow. The high costs of new drug development

require the prospect of financial returns to encourage sponsors to continue investing in

innovation. To encourage investment, sponsors of certain drugs approved by the Food and Drug

Administration (FDA) are granted exclusive rights to market their drug for a period of time. In

addition, new drugs may benefit significantly from government grants or research subsidies in

either the pre-clinical or clinical stages of development. For example, the Orphan Drug Act

provides incentives, including grants, tax credits, and an additional period of market exclusivity

to encourage investment in treatments for rare diseases or conditions. Because new medicines

can improve the health of individuals and the population more broadly, the incentives for

innovation described above are important. At the same time, policy makers must balance these

incentives with assuring that the new medicines are affordable and reflect their value in terms of

improving patient health outcomes.

Congressional Request for this Drug Pricing Report

“The Committee directs the Secretary of Health and Human Services to submit a report to the

Committee on Appropriations of the House of Representatives not later than 120 days after the

date of the enactment of the Bill to which this Committee Report pertains regarding price

changes of prescription drugs since 2008. The report should include comparative prescription

drug prices (net of rebates) paid by the following programs for the 10 most frequently prescribed

drugs and the 10 highest-cost drugs for each of the following: (1) The Medicare program under

part B of title XVIII of the Social Security Act. (2) The Medicare prescription drug program

under part D of title XVIII of the Social Security Act. (3) The Medicaid program under title XIX

of the Social Security Act. (4) The Department of Veterans Affairs. The report should also

provide a breakdown of the comparative prices (net of rebates) for each of the 10 most frequently

-0.05

0.05

0.15

0.25

0.35

0.45

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Percentage Change

Medicaid

Medicare Part B

Medicare Part D

NHE Rx

8

prescribed drugs and the 10 highest-cost drugs between ambulatory settings and retail settings.

Under Medicare Part D, the report should detail gross Part D drug costs and net Part D drug costs

and the Direct and Indirect Remuneration for the 10 most frequently prescribed drugs and the 10

highest-cost drugs. In addition, the report should include total annual costs due to prescription

drugs to the Medicare program under part B of title XVIII of the Social Security Act, the

Medicare prescription drug program under part D of title XVIII of such Act, and the Medicaid

program under title XIX of such Act. Finally, the report should list the drugs that have been

registered for sale by the Food and Drug Administration (FDA) in the past five years that have

benefited significantly from government grants or research subsidies in either the pre-clinical or

clinical stages of development, as well as the price (net of rebates) and total spending in

Medicare and Medicaid for each of those drugs.”

9

SECTION 2: MEDICARE PART B

This section presents information about prescription drugs in Medicare Part B between 2006 and

2017. It presents data pertaining to trends in overall spending for prescription drugs and the top

10 highest-cost drugs and top 10 most frequently prescribed drugs in Medicare Part B. The data

presented in this section include only spending in fee-for-service Medicare Part B and exclude

Medicare Advantage spending.

Program Overview

Medicare is a federal health insurance program created in 1965 for people ages 65 and older; it

was expanded in 1972 to cover people under age 65 with permanent disabilities and end-stage

renal disease (ESRD). Medicare Part B, also known as the Supplementary Medical Insurance

(SMI) program, helps pay for physician, outpatient, some home health, and preventive services.

Part B is financed through a combination of general revenues, premiums paid by beneficiaries,

interest and other sources. Premiums are automatically set to cover 25 percent of spending in the

aggregate, while general revenues subsidize 73 percent and the remaining 2 percent is financed

through interest and other sources. Higher-income beneficiaries pay a larger share of spending,

ranging from 35 percent to 80 percent of Part B costs.

Certain types of drugs including infusible and injectable drugs and biologics administered in

physician offices and hospital outpatient departments, as well as certain other drugs provided by

pharmacies and suppliers (e.g., inhalation drugs and certain oral anticancer, oral antiemetic, and

immunosuppressive drugs) are covered by Part B.

7

Providers purchase these Part B drugs and

Medicare payments are made directly to these providers.

Through the passage of the Medicare Prescription Drug, Improvement, and Modernization Act of

2003 (MMA)

8

, beginning in 2005 payments for Part B drugs generally are tied to health care

providers’ acquisition costs by paying for a drug’s average sales price (ASP) plus a 6 percent

add-on (106 percent of ASP) as computed by CMS using quarterly sales price and volume of

sales data.

9

The Secretary was provided discretion for drugs administered in hospital outpatient

settings, to determine payment based on average acquisition costs or similarly to how payment is

made in a physician’s office. The Secretary has used ASP based pricing for most Part B drugs

provided in hospital outpatient departments since 2006.

7

Steven Sheingold, Elena Marchettie-Bowick, Nguyen Nguyen and Robin Yabroff, Medicare Part B Drugs:

Pricing and Incentives, ASPE, March 8, 2016. Available from:

https://aspe.hhs.gov/system/files/pdf/187581/PartBDrug.pdf

8

Medicare Prescription Drug, Improvement, and Modernization Act of 2003. 2003. retrieved from:

https://www.congress.gov/108/plaws/publ173/PLAW-108publ173.pdf

9

Medicare payments on the claims data reflect the 2 percent reduction due to the sequester in effect during the

period from April 2013 through September 2027.

10

Medicare Part B Spending and Spending Trends

Overall spending and spending trends

In Calendar Year (CY) 2017, total Medicare expenditures were $710 billion, of which, $314

billion were for total Part B benefit.

10

The total fee-for-service Part B benefit was $193.5 billion

after netting out spending for Medicare Advantage and administrative expenses (Table 2-1). As

shown in Table 2-1, fee-for-service Part B drug program spending grew from $10.1 billion in

2006 to $24.3 billion in 2017, representing an average annual growth rate of 8.3 percent.

11

Comparatively, total fee-for-service Part B benefit spending grew at 3.4 percent annually over

the same period. Part B drug spending has particularly increased since 2014, with annual average

growth of 11.9 percent compared to 5.6 percent for total Part B benefit spending.

Table 2-1 Medicare Fee-for-Service Part B Program Spending for Drug Benefits, 2006-2017

12

Total Part B Benefit

Part B Drug Program

Year

Spending

($B)

Annual Growth

Spending

($B)

Annual Growth

Part B Drugs' Share of

Part B Benefit

2006

134.4

-

10.1

-

7.5%

2007

137.5

2.3%

10.5

3.3%

7.6%

2008

132.2

-3.9%

10.8

3.7%

8.2%

2009

149.2

12.9%

11.5

6.5%

7.7%

2010

154.5

3.6%

12.3

6.8%

8.0%

2011

162.6

5.2%

13.7

11.3%

8.4%

2012

170.5

4.9%

15.2

10.7%

8.9%

2013

171.3

0.5%

16.2

6.8%

9.5%

2014

176.3

2.9%

17.2

6.2%

9.8%

2015

182.1

3.3%

19.0

10.2%

10.4%

2016

186.1

2.2%

21.8

14.6%

11.7%

2017

193.5

4.0%

24.3

11.3%

12.6%

Average

Annual

2006-17

3.4%

8.3%

Source: Total Part B benefit spending from Trustees Reports 2007-2018 (Table III. C5 for 2007-2011 and Table III.

C1 for 2012-2018) netting out spending in Medicare Advantage (MA numbers provided by the Office of the CMS

Office of the Actuary The data presented in this table include only spending in fee-for-service Medicare Part B and

exclude Medicare Advantage spending.

10

Table II.B1, p. 11. Medicare Trustees Report (2018). 2018 Annual Report Of The Boards Of Trustees Of The

Federal Hospital Insurance And Federal Supplementary Medical Insurance Trust Funds. Retrieved from:

https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-

Reports/ReportsTrustFunds/Downloads/TR2018.pdf

11

Program spending excludes beneficiary liability and third party payments. Total FFS Part B spending (Medicare

program, beneficiary liability and third party payments) grew from $12.7 B. in 2006 to $30.6 B. in 2017.

12

Medicare payments on the claims data reflect the 2 percent reduction due to the sequester in effect during the

period from April 2013 through September 2027.

11

Table 2-2 Medicare Fee-for-Service Part B Program Spending per Enrollee and User for Drug

Benefits, 2006-2017

Total Part B Benefit

Part B Drug Program

Year

Fee-for-Service

Enrollees (M)

Spending per

Enrollee ($)

Annual

Growth

Payment per

Enrollee ($)

Annual

Growth

2006

33.1

4,064

-

305

-

2007

32.4

4,240

4.3%

324

6.0%

2008

32.0

4,136

-2.5%

338

4.3%

2009

31.8

4,691

13.4%

362

7.0%

2010

32.2

4,800

2.3%

382

5.7%

2011

32.5

4,998

4.1%

421

10.2%

2012

32.9

5,184

3.7%

462

9.8%

2013

33.1

5,174

-0.2%

489

5.9%

2014

33.2

5,315

2.7%

519

6.0%

2015

33.3

5,475

3.0%

571

10.2%

2016

33.7

5,528

1.0%

648

13.3%

2017

33.6

5,762

4.2%

724

11.8%

Source: Total Part B benefit spending from Trustees Reports 2007-2018 (Table III. C5 for 2007-2011 and Table III.

C1 for 2012-2018); Enrollment from Trustees Report 2018 Table V. B3. The data presented in this section include

only spending in fee-for-service Medicare Part B and exclude Medicare Advantage spending.

Spending concentration for top ten drugs

A relatively small number of Part B drugs account for a significant share of the spending.

13

Table

2-3

14

presents the top 10 drugs in term of Medicare Part B drug program payment over the last

ten years. For brevity, we present only 2008, 2011, 2014, and 2017 here, with tables for all years

included in Appendix Table A-1. Concentrated spending for a relatively small number of drugs

has been consistent for the past decade with the top 10 highest-cost drugs accounting for 45 to 50

percent of total Part B spending on drugs.

In 2017, the top 10 highest-cost drugs accounted for $14.0 billion in Part B payments including

beneficiary cost-sharing, or 46 percent of $30.3 billion in total Part B spending for all drugs. At

nearly $2.5 billion in Medicare Part B payments, aflibercept accounted for more spending than

any other drug in 2017. Medicare Part B payments including beneficiary cost-sharing for

aflibercept was $961.29 per unit in 2017, or $1,922.58 for a standard adult dose of 2 mg. We

defined unit based on the Healthcare Common Procedure Coding System (HCPCS) billing unit,

which, in many cases, is the lowest dispensable amount or the lowest denomination (e.g., one pill

or a standardized volume for liquids) and may not be the common dose.

15

Rituximab, which has

13

Spending numbers presented are program spending, net of beneficiary cost sharing, and include sequester.

14

The drug spending presented in Table 2-3 includes claims by critical access hospitals, Maryland hospitals and

third party claims that were excluded in the data underlying the CMS dashboard even without imposing the

restriction that a drug must have been present in two consecutive years (for calculating annual change). Source:

CMS Office of Enterprise Data and Analytics (OEDA).

15

Per the above example, a unit of aflibercept is 1mg, although the common dose for aflibercept is 2mg. On the

claims data the unit is the MTUS_CNT.

12

historically been in the top two of the top ten list over the last decade, accounts for the second

most Medicare Part B payments with approximately $1.8 billion. Table 2-4 presents the top 10

highest-cost prescribed drugs in Medicare Part B ranked by spending per unit for 2011, 2014,

and 2017 with all years 2011-2017 presented in Appendix Table A-2

As displayed in Table 2-5, the top 10 most frequently prescribed drugs in Medicare Part B, are

relatively inexpensive and typically account for less than 10 percent of total Part B drug

spending. In 2017, spending on the top 10 most frequently prescribed drugs was $2.6 billion, or

9% of $30.3 billion in total Part B spending for all drugs, although aflibercept, the 10

th

most

prescribed drug accounted for $2.5 billion in Part B spending. The remaining nine drugs each

accounted for at most $25.0 million in spending and had average per unit spending of less than

$11. Spending and pricing data for all years are included in Appendix Table A-3.

Table 2-3 Top 10 Highest-Cost Prescribed Drugs, Medicare Part B, Ranked by Total Spending

2008

2011

Rank

Description

Spending

per Unit

($)

Total

Spending

($M)

Description

Spending

per Unit

($)

Total

Spending

($M)

1

Rituximab cancer

treatment (Rituxan)

516.88

1,151.1

Ranibizumab injection

(Lucentis)

405.36

1,428.9

2

Bevacizumab

injection (Avastin)

57.40

944.7

Rituximab injection

(Rituxan)

611.58

1,373.0

3

Infliximab injection

(Remicade)

55.85

814.8

Bevacizumab injection

(Avastin)

60.45

1,012.5

4

Injection,

pegfilgrastim

(Neulasta) 6mg

2,206.63

798.8

Injection, pegfilgrastim

(Neulasta) 6mg

2,643.78

1,020.5

5

Ranibizumab injection

(Lucentis)

397.09

735.8

Infliximab injection

(Remicade)

61.49

960.5

6

Darbepoetin alfa, non-

esrd (Aranesp)

2.91

676.7

Oxaliplatin (Eloxatin)

9.42

498.3

7

Oxaliplatin (Eloxatin)

9.42

457.5

Pemetrexed injection

(Alimta)

53.07

464.4

8

Epoetin alfa, non-esrd

(Epogen/Procrit)

9.26

462.3

Darbepoetin alfa, non-

esrd (Aranesp)

3.15

435.4

9

Docetaxel (Taxotere)

327.85

396.7

Trastuzumab injection

(Herceptin)

70.60

410.7

10

Gemcitabine HCl

(Gemzar)

132.43

330.8

Docetaxel injection

(Taxotere)

18.70

395.9

Medicare Part B Spending, Top 10

6,769.2

8,000.1

Medicare Part B Spending, All Drugs

13,614.3

17,191.6

2014

2017

Rank

Description

Spending

per Unit

($)

Total

Spending

($M)

Description

Spending

per Unit

($)

Total

Spending

($M)

1

Rituximab injection

(Rituxan)

693.39

1,552.5

Aflibercept injection

(Eylea)

961.29

2,473.4

2

Ranibizumab injection

(Lucentis)

390.64

1,336.0

Rituximab injection

(Rituxan)

819.18

1,815.3

13

3

Aflibercept injection

(Eylea)

964.44

1,302.0

Injection, nivolumab

(Opdivo)

25.95

1,516.5

4

Injection,

pegfilgrastim

(Neulasta) 6mg

3,312.87

1,235.7

Injection, pegfilgrastim

(Neulasta) 6mg

4,188.25

1,461.7

5

Infliximab injection

(Remicade)

71.72

1,223.5

Infliximab not biosimil

(Remicade) 10mg

85.01

1,413.9

6

Bevacizumab injection

(Avastin)

65.17

1,091.4

Denosumab injection

(Prolia)

16.75

1,296.6

7

Denosumab injection

14.30

799.3

Bevacizumab injection

(Avastin)

73.26

1,100.2

8

Trastuzumab injection

(Herceptin)

80.78

581.0

Inj pembrolizumab

(Keytruda)

46.15

1,062.2

9

Pemetrexed injection

(Alimta)

59.50

575.4

Ranibizumab injection

(Lucentis)

372.44

1,039.1

10

Bortezomib injection

(Velcade)

$36.00

489.3

Trastuzumab injection

(Herceptin)

94.87

814.1

Medicare Part B Spending, Top 10

10,186.1

13,993.0

Medicare Part B Spending, All Drugs

21,597.8

30,294.0

Source: Analysis of carrier, durable medical, and outpatient claims data 2006-2017. Data include Part B covered

drugs administered in physicians' offices and furnished by suppliers, covered drugs in hospital outpatient

departments; and reflect only Part B drugs paid under the average sales price plus 6 percent (ASP). HCPCS codes

and prices for carrier and DM were obtained from the CMS ASP file, those for OP come from the CMS Addendum

B file. Lines with denied payments or Medicare as secondary payer were dropped. Total Spending and Spending per

Unit are net of beneficiary cost-sharing and include the sequester.

Table 2-4 Top 10 Highest-Cost Prescribed Drugs, Medicare Part B, Ranked by Spending per

Unit

2011

2014

Rank

Description

Spending

per Unit

($)

Total

Spending

($M)

Description

Spending

per Unit

($)

Total

Spending

($M)

1

Sipuleucel-t,

minimum of 50

million autologous

cd54+ cells activated

with pap-gm-csf,

including

leukapheresis and all

other preparatory

procedures, per

infusion

32,857.47

89.9

Sipuleucel-t, minimum

of 50 million

autologous cd54+ cells

activated with pap-gm-

csf, including

leukapheresis and all

other preparatory

procedures, per

infusion (Provenge)

33,864.70

173.2

2

Fluocinolone

acetonide, intravitreal

implant

16,253.07

1.4

Injection, pegaspargase,

per single dose vial

(Oncaspar)

5,952.34

1.1

3

Injection, porfimer

sodium, 75 mg

5,041.82

0.9

Injection, pegfilgrastim,

6 mg (Neulasta)

3,270.26

1,172.9

4

Leuprolide acetate

implant, 65 mg

4,378.09

0.3

Histrelin implant

(vantas), 50 mg

(Vantas)

2,915.55

5.9

5

Ganciclovir, 4.5 mg,

long-acting implant

3,485.88

0.4

Injection, basiliximab,

20 mg (Simulect)

2,525.33

0.7

14

6

Histrelin implant

(vantas), 50 mg

2,945.12

17.1

Injection, crotalidae

polyvalent immune fab

(ovine), up to 1 gram

(Crofab)

2,409.87

1.7

7

Injection,

pegaspargase, per

single dose vial

2,680.69

0.3

Injection, vincristine

sulfate liposome, 1 mg

(Marqibo)

1,849.51

1.2

8

Injection,

pegfilgrastim, 6 mg

2,615.20

972.0

Injection, digoxin

immune fab (ovine),

per vial (Digifab)

1,490.59

0.7

9

Injection, denileukin

diftitox, 300

micrograms

1,585.58

7.0

Injection, carmustine,

100 mg (Bicnu)

1,431.81

1.3

10

Injection, reteplase,

18.1 mg

1,425.91

0.5

Injection, pentostatin,

10 mg (Nipent)

1,425.10

0.8

Medicare Part B Spending, Top 10

1,089.9

1,359.5

Medicare Part B Spending, All Drugs

17,191.6

21,597.8

2017

Rank

Description

Spending

per Unit

($)

Total

Spending

($M)

1

Sipuleucel-t,

minimum of 50

million autologous

cd54+ cells activated

with pap-gm-csf,

including

leukapheresis and all

other preparatory

procedures, per

infusion (Provenge)

38,716.24

202.5

2

Injection,

pegaspargase, per

single dose vial

(Oncaspar)

9,666.53

2.3

3

Injection,

pegfilgrastim, 6 mg

(Neulasta)

4,142.60

1,400.1

4

Injection, basiliximab,

20 mg (Simulect)

3,309.41

1.1

5

Injection, carmustine,

100 mg (Bicnu)

3,278.80

1.9

6

Histrelin implant

(vantas), 50 mg

(Vantas)

3,127.67

3.0

7

Injection, digoxin

immune fab (ovine),

per vial (Digifab)

2,933.29

0.9

8

Injection, crotalidae

polyvalent immune

fab (ovine), up to 1

gram (Crofab)

2,766.58

1.3

9

Injection, vincristine

sulfate liposome, 1 mg

(Marqibo)

2,325.16

1.1

15

10

Injection, pentostatin,

10 mg (Nipent)

1,925.04

0.8

Medicare Part B Spending, Top 10

1,399.3

Medicare Part B Spending, All Drugs

30,294.0

Note: Medicare Part B Spending per Unit data only available for years 2011-2017.

Source: Analysis of carrier, durable medical, and outpatient claims data 2006-2017. Data include Part B covered

drugs administered in physicians' offices and furnished by suppliers, covered drugs in hospital outpatient

departments; and reflect only Part B drugs paid under the average sales price plus 6 percent (ASP). HCPCS codes

and prices for carrier and DM were obtained from the CMS ASP file, those for OP come from the CMS Addendum

B file. Lines with denied payments or Medicare as secondary payer were dropped. Total Spending and Spending per

Unit include beneficiary cost-sharing and include the sequester.

Table 2-5 Top 10 Most Frequently Prescribed Drugs, Medicare Part B, Ranked by Total Number

of Services

2008

2011

Rank

Description

Spending

per Unit

($)

Total

Spending

($M)

Description

Spending

per Unit

($)

Total

Spending

($M)

1

Vitamin b12 injection

(Cobal-1000, Cobolin-

M)

0.28

0.9

Vitamin b12 injection

(Cobal-1000, Cobolin-

M)

0.36

1.0

2

Dexamethasone

sodium phos

(Hexadrol)

0.09

1.9

Triamcinolone acet inj

NOS (Kenalog)

1.62

17.1

3

Ondansetron hcl

injection (Zofran)

0.43

7.8

Dexamethasone sodium

phos (Hexadrol)

0.09

1.8

4

Triamcinolone

acetonide inj

(Kenalog)

1.44

13.3

Albuterol non-comp unit

0.06

28.2

5

Albuterol ipratrop

non-comp (Duoneb)

0.66

157.8

Albuterol ipratrop non-

comp (Duoneb)

0.24

45.0

6

Normal saline solution

infus

0.29

0.8

Methylprednisolone 40

MG inj (Medrol)

2.76

6.7

7

Methylprednisolone

40 MG inj (Medrol)

4.40

10.1

Methylprednisolone 80

MG inj (Depo-Medrol)

6.91

11.9

8

Epoetin alfa, non-esrd

(Epogen/Procrit)

9.26

462.3

Normal saline solution

infus

0.26

0.5

9

Albuterol non-comp

unit

0.04

15.7

LOCM 300-399mg/ml

iodine,1ml

0.17

15.3

10

Methylprednisolone

80 MG inj (Depo

Medrol)

8.54

14.2

Epoetin alfa, non-esrd

(Epogen/Procrit)

9.96

354.8

Medicare Part B Spending, Top 10

684.8

482.3

Medicare Part B Spending, All Drugs

13,614.3

17,191.6

2014

2017

Rank

Description

Spending

per Unit

($)

Total

Spending

($M)

Description

Spending

per Unit

($)

Total

Spending

($M)

1

Triamcinolone acet inj

nos (Kenalog)

1.75

19.5

Triamcinolone acet inj

nos(Kenalog)

1.80

24.1

16

2

Dexamethasone

sodium phos

(Hexadrol)

0.13

2.6

Dexamethasone sodium

phos (Hexadrol)

0.12

2.3

3

Vitamin b12 injection

(Cobal-1000)

2.02

4.7

Vitamin b12 injection

(Cobal-1000)

2.83

6.8

4

Methylprednisolone

40 mg inj (Medrol)

2.94

7.8

Methylprednisolone 40

mg inj (Medrol)

5.70

16.2

5

Albuterol non-comp

unit

0.05

18.1

Albuterol non-comp unit

0.05

13.6

6

Albuterol ipratrop

non-comp (Duoneb)

0.18

26.9

Methylprednisolone 80

mg inj (Medrol)

10.88

18.8

7

Methylprednisolone

80 mg inj

5.60

9.7

Albuterol ipratrop non-

comp (Duoneb)

0.15

19.9

8

Locm 300-399mg/ml

iodine,1ml

0.18

15.8

Locm 300-399mg/ml

iodine,1ml

0.12

11.2

9

Betamethasone

(Celestone Soluspan)

acet&sod phosp

5.59

14.6

Betamethasone

acet&sod phosp

6.74

20.1

10

Ceftriaxone sodium

injection (Rocephin)

0.67

2.6

Aflibercept injection

(Eylea)

961.29

2,473.4

Medicare Part B Spending, Top 10

122.3

2,606.4

Medicare Part B Spending, All Drugs

21,597.8

30,294.0

Source: Analysis of carrier, durable medical, and outpatient claims data 2006-2017. Data include Part B covered

drugs administered in physicians' offices and furnished by suppliers, covered drugs in hospital outpatient

departments; and reflect only Part B drugs paid under the average sales price plus 6 percent (ASP). HCPCS codes

and prices for carrier and DM were obtained from the CMS ASP file, those for OP come from the CMS Addendum

B file. Lines with denied payments or Medicare as secondary payer were dropped. Total Spending and Spending per

Unit include beneficiary cost-sharing and include the sequester.

Data and Methods

The Medicare claims data used in the analyses of spending and trends in spending include Part

B

16

covered drugs administered in physicians’ offices and furnished by suppliers (carrier and

durable medical equipment (DME) claims files) and covered drugs in hospital outpatient

departments (outpatient claims files) from 2006 to 2017. Many of the analyses start with

calendar year 2006 because it is the first year that most hospital outpatient departments were paid

using the ASP methodology.

Medicare Part B drugs are identified by the HCPCS codes in the claims data. Analyses are

restricted to Part B drugs paid under the methodology described in section 1847A of the Social

Security Act.

17

As a result, the analyses exclude vaccines; blood products with P* codes (but

16

Part B drugs that are separately paid, i.e., not bundled and paid under a bundled system.

17

Typically, this means ASP, but may also include WAC or AMP based payments. In fact, WAC-based payment

occurs in limited situations, like when a drug is new, and AMP-based payment occurs infrequently when AMP

exceeds ASP by a threshold percentage and other safeguards are met. The pricing files do not always indicate which

source is used for a payment amount.

17

include blood clotting with J & Q codes); claims in the DME file with an AWP flag

18

; and

enteral and parenteral drugs that have B* codes.

Claims with HCPCS codes that represent ESRD

19

drugs as well as claims with HCPCS codes

that do not represent drugs were dropped from the analyses. Codes and prices for carrier and

DME were obtained from the CMS ASP files, while those for hospital outpatient departments

come from the CMS Addendum B files. Claim lines with denied payments or Medicare as

secondary payer were dropped from the analyses. Medicare payments include Medicare

program payments and beneficiary cost sharing, and include the effects of the budget

sequestration beginning in 2013, which reduced Medicare spending rates by a fixed 2 percent per

year.

20

The top 10 highest cost drugs and top 10 most frequently prescribed drugs present average

spending per billing unit. We define unit based on the combination of HCPCS unit per

beneficiary per date, which, in many cases, is the lower of the lowest dispensable amount or the

lowest denomination (e.g., one pill or a standardized volume for liquids) and may not be the

common dose.

21

18

Claims in the durable medical equipment (DME) file with an AWP flag include infusion drugs which used to

appear in the ASP Drug Pricing Files. This indicator was not maintained in the ASP Drug Pricing files and its use

has been discontinued (because of the change in DME infusion payment resulting from the Cures Act).

19

ESRD drugs were mostly bundled into the ESRD facility composite rates by 2014.

20

The budget sequestration in 2013 refers to the automatic spending cuts to United States federal government

spending in particular categories of outlays that were initially set to begin on January 1, 2013, as an austerity fiscal

policy as a result of Budget Control Act of 2011 (BCA), and were postponed by two months by the American

Taxpayer Relief Act of 2012 until March 1 when this law went into effect. The nine-year cuts (2013-2021) are split

evenly (by dollar amounts, not by percentages) between the defense and non-defense categories. Some major

programs like Social Security, Medicaid, federal pensions and veteran's benefits are exempt. By a special provision

in the BCA, Medicare spending rates were reduced by a fixed 2 percent per year. That is providers and health

insurance plans will be paid 98 cents on the dollar under Medicare for the entire nine-year period 2013-2021.

As the sequester applies to federal payment only (80 percent of total payment while beneficiaries still pay the full 20

percent copay), the effective federal payment under ASP+6% is ASP+(1.06*(1-2%*80%))) or ASP+4.3%., The bi-

partisan budget package that keeps the government funded through March 23, 2018 approved by Congress and

signed into law on February 9, 2018 extended the mandatory Medicare sequestration cut until 2027.

21

An example where the billing unit is lower than the dispensable amount is bevacizumab. This drug is available in

100mg and 400mg vials, so the lowest dispensable amount (without pharmacy/outsourcer repackaging) is 100mg.

The lowest denomination is 10mg, hence the HCPCS billing unit is 10mg. Payment in Oct 2017 was about $75 per

10mg, and Medicare’s share was about $60; these figures correspond to the unit being equal to the HCPCS code

descriptor amount.

18

SECTION 3: MEDICARE PART D

This section presents information about prescription drugs in Medicare Part D between 2006 and

2017. Specifically, in response to the information requested by the House Committee on

Appropriations, this section presents data pertaining to trends in overall spending for prescription

drugs and the top 10 highest-cost drugs and top 10 most frequently prescribed drugs in Medicare

Part D.

22

For many of the analyses contained in this chapter, measures of drug spending are constructed

from Part D Prescription Drug Event (PDE) records to include payments to the pharmacy by the

Part D plan sponsor and the beneficiary’s out-of-pocket liability. These measures are referred to

as gross drug costs (GDC). In some cases we estimate Medicare program spending for Part D,

which differs from gross drug costs to the extent that rebates and other price concessions affect

plan premiums but are not reflected in prices paid at the pharmacy.

23

Program Overview

The Medicare Modernization Act of 2003 (MMA) authorized Medicare Part D as a voluntary

drug benefit for Medicare beneficiaries, and the Part D program was implemented in January

2006. Private plans compete for enrollees by providing and managing the drug benefit.

24

Each

enrollee in either Part A or Part B is also entitled to enroll in a Part D prescription drug plan. In

addition, some Medicare Advantage plans also cover the Part D benefit. These plans are known

as MA-PDs. Similar to Part B, enrollment in Part D is voluntary and the enrollee pays a monthly

premium.

25

In 2017, total enrollment in Medicare was 58.0 million, of which enrollment in Part

D was 44.5 million.

26

Enrollees in Part D pay a monthly premium, in addition to cost sharing and

typically costs up to a deductible for their drugs. Low-income beneficiaries (LIS) pay lower or

no premiums, cost sharing, or deductibles. Under Part D, private plan sponsors submit annual

premium bids for providing the benefit. Medicare subsidizes 74.5 percent of the national average

22

Rebate data at the drug level and even at the therapeutic class level are considered proprietary data and therefore

not available for this report.

23

Total Government payment is estimated as the sum of Premium Subsidies (PG), Reinsurance (RI), Low-Income

Premium Subsidies (LIPS), and Low-Income Cost Sharing (LICS), with the government paying 74.5% of premiums

and beneficiaries paying 25.5%.

24

The Medicare Part D drug benefit is administered through private prescription drug plans, which each separately

design and manage benefits and pay claims. Private prescription drug plans use purchasing arrangements and

utilization management, including negotiation of prices with manufacturers and pharmacies, formularies, step

therapy, quantity limitations, and prior authorization. All formularies must include “all (with specified exceptions)”

drugs in the immunosuppressant, antidepressant, antipsychotic, anticonvulsant, antiretroviral, and antineoplastic

classes to ensure patient access to these protected classes of drugs. The current exceptions are that the formulary

does not have to include all therapeutic equivalents (i.e., generics) and can use safety edits to limit quantities (see 42

CFR 423.120(b)(2)(vi)).

25

Starting in 2011, higher income enrollees pay higher premiums, as in Part B.

26

Medicare Trustees Report 2018 Table II.B.1, p. 11 Medicare Trustees Report (2018). 2018 Annual Report Of The

Boards Of Trustees Of The Federal Hospital Insurance And Federal Supplementary Medical Insurance Trust Funds.

Retrieved from: https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-

Reports/ReportsTrustFunds/Downloads/TR2018.pdf

19

premium and provides additional assistance for premiums and out-of-pocket costs to LIS

beneficiaries. In CY 2017, total Medicare benefit payment is $710 billion, of which, $100

billion (or 14 percent) is for the Part D benefit.

27

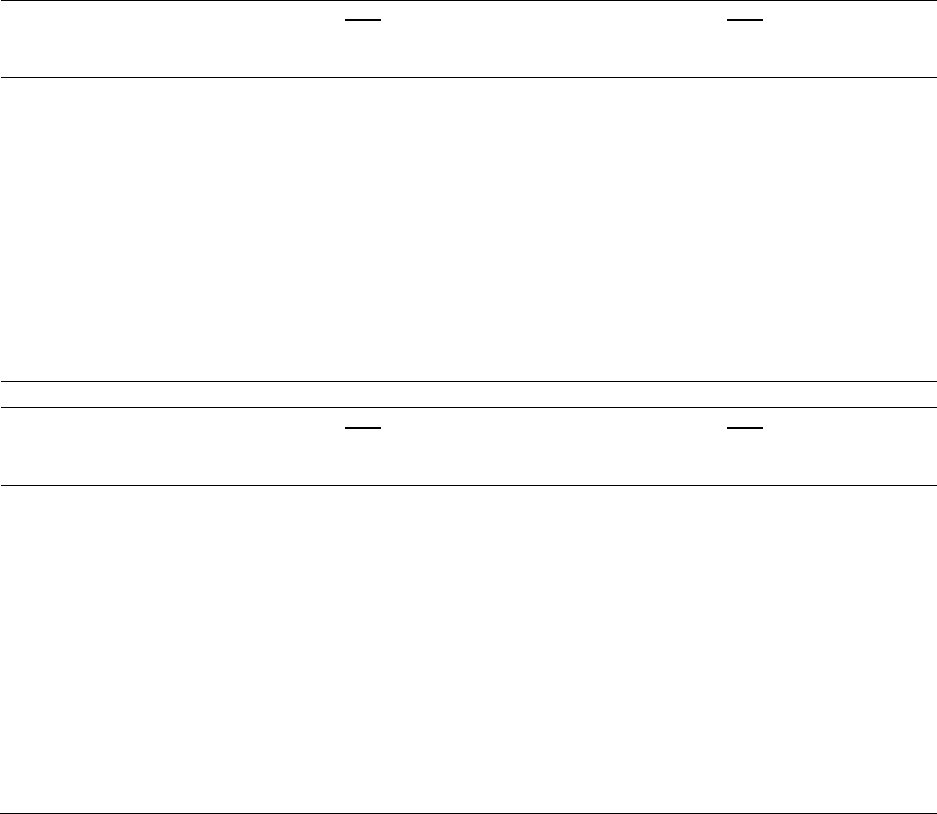

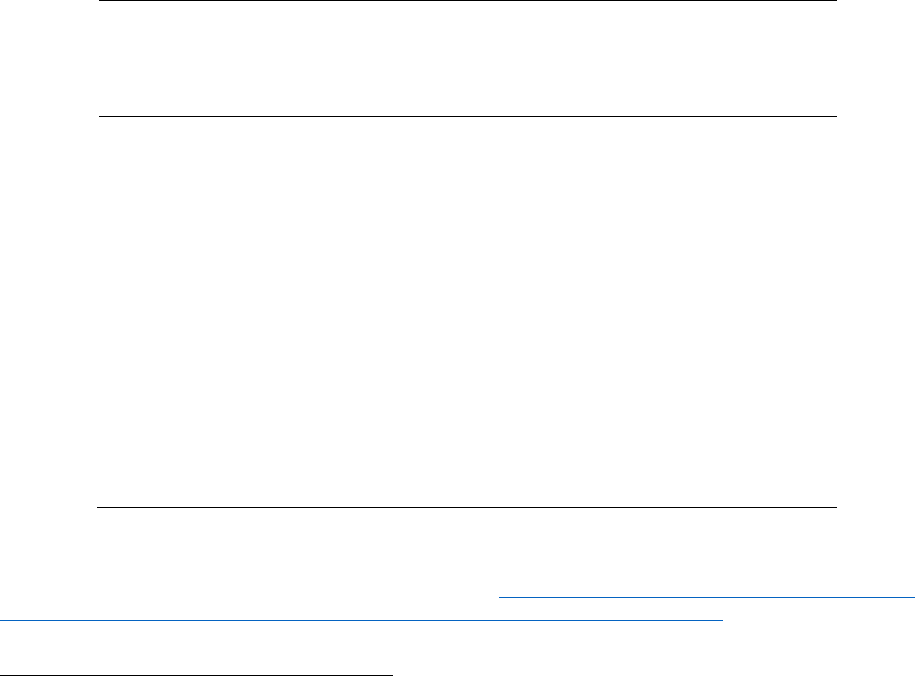

Medicare Part D Program Spending and Program Spending Trends

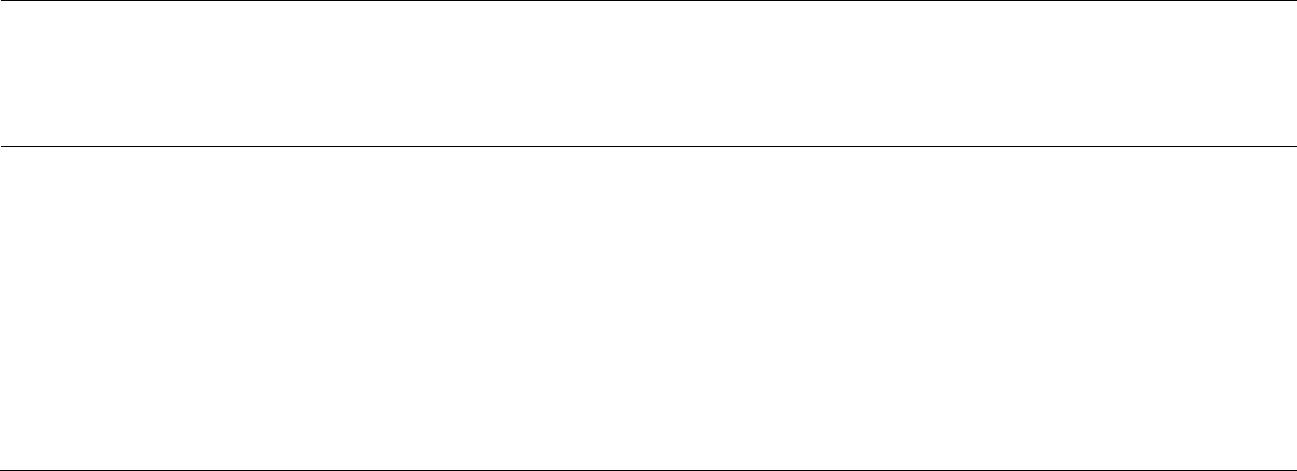

Medicare Part D program spending per enrollee

28

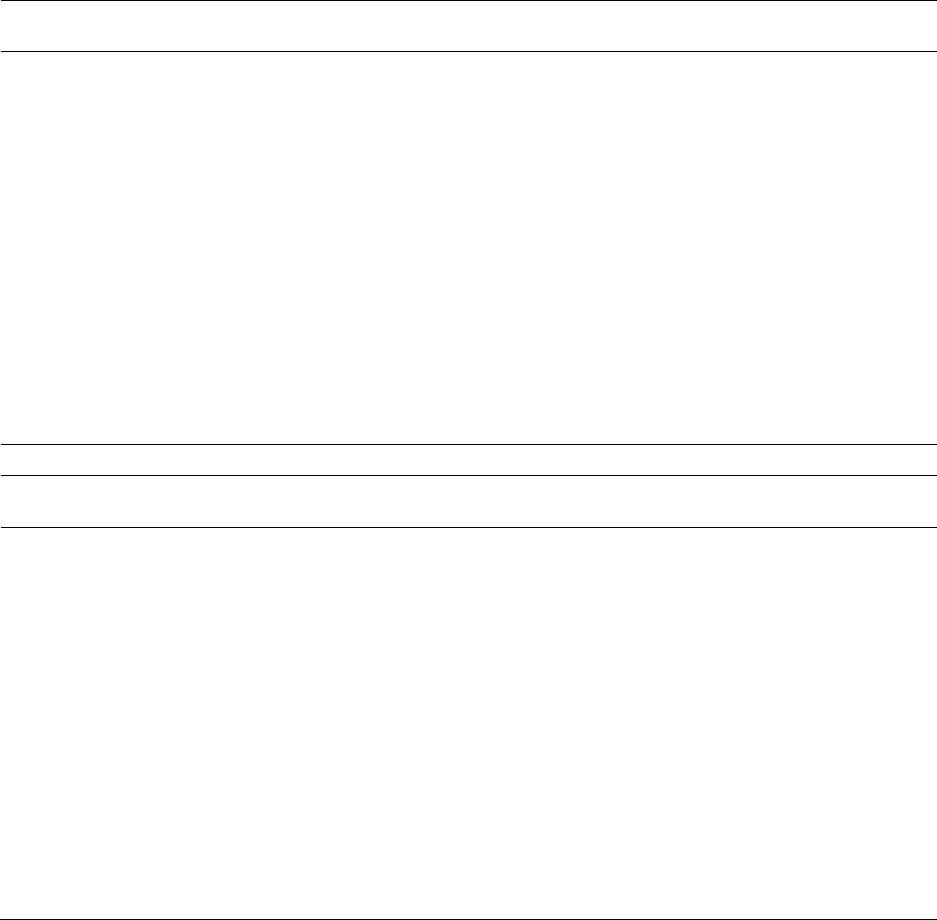

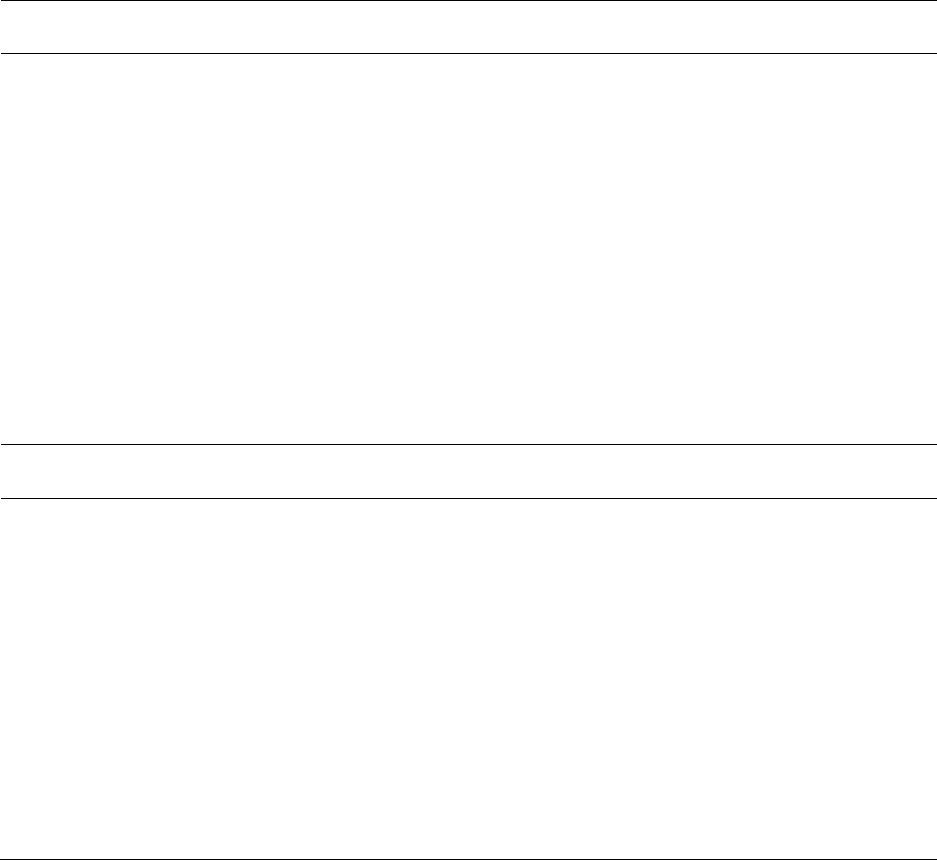

rose about 3.4 percent annually between CY

2006 to CY 2017.

29

In recent years, program spending per enrollee grew from $1,782 per

enrollee in 2013 to $2,312 per enrollee in 2016, before decreasing to $2,249 in 2017 (Figure 3-

1). As the number of enrollees increased about 3.5 percent annually, or 45 percent in total from

2006 to 2017, total spending increased 7.0 percent annually from 2006 to 2017 (Table 3-1).

Figure 3-1 Medicare Part D Total Spending per Enrollee and Per User, 2006-2017

Source: Spending and Enrollment from Trustees Report 2018, Tables III. D3 and V.B3; Users from Acumen

analysis of claims data for ASPE

27

Medicare Trustees Report 2018, Table II.B1, p. 10. Medicare Trustees Report (2018). 2018 Annual Report Of The

Boards Of Trustees Of The Federal Hospital Insurance And Federal Supplementary Medical Insurance Trust Funds.

Retrieved from: https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-

Reports/ReportsTrustFunds/Downloads/TR2018.pdf Medicare benefit payment is program payment for the benefits

net of rebates.

28

Federal spending (Medicare Part D net program spending) is based on a percent of premiums which in turn reflect

the rebates plans expect to receive. Federal spending is estimated as the sum of Premium Subsidies, Reinsurance,

Low-Income Premium Subsidies, Low-Income Cost Sharing, and, risk corridor payments. CMS pays plans a

monthly prospective payment for each enrollee (the direct subsidy). This payment is first adjusted by the enrollee’s

case mix and other subsidy factors, namely low-income status and longterm institutionalized status. A second

adjustment to the plan’s approved bid is the subtraction of the enrollee’s premium. (See the following section on

how premiums are calculated.) CMS also provides plans with interim prospective payment adjustments for

individual reinsurance and low-income subsidies. The agency reconciles actual levels of enrollment, risk factors,

levels of incurred allowable drug costs (after rebates and other discounts), reinsurance amounts, and low-income

subsidies after the end of each year.

29

Annual compound growth rate of total program spending per enrollee and enrollment growth computed from

United States Centers for Medicare & Medicaid Services. Medicare Trustees Reports, 2018. June 2018. Part D total

spending from Table III.D3 (p. 105) and Part D enrollment from Table V.B3 (p. 181).

2,116

2,083

1,950

2,293

2,257

2,305

2,139

1,986

2,103

2,308

2,465

2,377

1,551

1,583

1,513

1,807

1,786

1,878

1,786

1,782

1,928

2,148

2,312

2,249

1,500

1,600

1,700

1,800

1,900

2,000

2,100

2,200

2,300

2,400

2,500

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Total D Spending per User ($) Total D Spending per Enrollee ($)

20

In 2017, total program spending was estimated to be $100.0 billion, while net benefit spending

was $100.1 billion (Table 3-1). The difference reflects federal administrative costs.

30

Table 3-1 Medicare Part D Total Program Spending and Benefit Spending, 2006-2017

Total Part D Enrollees

(M)

Part D Total Program Spending

($B)

Part D Benefits Spending

($B)

Year

Enrollment

(M)

Annual

Growth

Spending ($B)

Annual

Growth

Spending

($B)

Annual

Growth

2006

30.6

47.4

47.1

2007

31.4

2.7%

49.7

4.9%

48.8

3.6%

2008

32.6

3.8%

49.3

-0.8%

49.0

0.4%

2009

33.6

3.2%

60.8

23.3%

60.5

23.5%

2010

34.8

3.4%

62.1

2.1%

61.7

2.0%

2011

35.7

2.7%

67.1

8.1%

66.7

8.1%

2012

37.4

4.8%

66.9

-0.3%

66.5

-0.3%

2013

39.1

4.4%

69.7

4.2%

69.3

4.2%

2014

40.5

3.6%

78.1

12.1%

77.7

12.1%

2015

41.8

3.2%

89.8

15.0%

89.5

15.2%

2016

43.2

3.4%

99.9

11.2%

99.5

11.2%

2017

44.5

2.9%

100.0

0.1%

100.1

0.6%

Average Annual

2006-17

3.5%

7.0%

7.1%

Source: Spending and Enrollment from Trustees Report 2018, Tables III. D3 and V. B3

Given that the total drug cost obtained from the 2017 claims data was over $154.2 billion (Table

3-2); this implies that Medicare spending ($100.0 billion) was about 65 percent of the gross drug

cost in 2017. This difference reflects primarily beneficiary cost sharing and rebates, and to a

lesser extent administrative cost and profits of plan sponsors, low-income subsidies, net risk

corridor payment, coverage gap discount, and the timing of reconciliation payments, among

other factors.

Medicare Part D Gross Drug Costs and Costs Trends

In CY 2017, total gross drug costs (GDC) for the Medicare Part D drugs is estimated to be

$154.2 billion (Table 3-2).

31

This reflects a 6.0 percent increase from the previous year’s $145.4

billion in GDC. In recent years, the growth in GDC has slowed from its peak in 2013 through

2015, when GDC exhibited double digit growth each year. The higher rates of growth in 2013 to

2015 in total GDC were primarily the result of increases in both utilization (number of users,

claims, and days) and unit cost (per user, per script, and per day) driven in large part because of

spending for drugs used to treat hepatitis C and even faster growth in prices for existing brand-

30

For 2017, total program spending is lower than benefit payments because of a larger-than-usual downward

adjustment of $0.3 billion for prior-year allocations among Part A, Part B, and Part D (2018 Trustees, Table III.D3)

31

Estimate based on Medicare Part D events (PDE) 2007-17 files by Acumen for ASPE

21

name drugs.

32

Over the entire 2007-17 period, total gross drug cost increased by 9.6 percent

annually, while Medicare benefit spending (net of rebates and cost-sharing) grew at 7.4 percent

(Table 3-1). The divergence likely reflects the growth in manufacturer rebates over time.

33

Moreover, the period from 2007 to 2017 encompasses two sub-periods: the period from 2007 to

2012 saw increasing entry of generic drugs into the market, while the subsequent period from

2013 to 2017 experienced the arrivals of expensive drugs such as the hepatitis C and specialty

drugs. As shown in Table 3-2, although the annual average growth of GDC over the whole

2007-17 period was 9.6 percent, the annual rate during 2007-12 was 7.7 percent, increasing to

11.5 percent during 2012 to 2017.

Table 3-2 Medicare Part D Prescription Gross Drug Costs (GDC): 2007-2017

Total Gross Drug Cost

Users

Drug Cost Per User

Year

Gross Drug

Cost ($B)

Annual

Growth

Users (M)

Annual

Growth

Cost per User ($)

Annual

Growth

2007

$61.9

-

23.9

-

$2,594

-

2008

$68.2

10.2%

25.3

5.9%

$2,699

4.1%

2009

$73.5

7.8%

26.5

4.9%

$2,773

2.7%

2010

$77.4

5.3%

27.5

3.8%

$2,813

1.5%

2011

$84.6

9.3%

29.1

5.8%

$2,908

3.4%

2012

$89.5

5.8%

31.3

7.5%

$2,862

-1.6%

2013

$103.3

15.4%

35.1

12.2%

$2,944

2.9%

2014

$121.0

17.1%

37.1

5.8%

$3,258

10.7%

2015

$136.8

13.1%

38.9

4.7%

$3,517

8.0%

2016

$145.4

6.3%

40.5

4.2%

$3,589

2.0%

2017

$154.2

6.0%

42.1

3.8%

$3,666

2.2%

Average Annual

2007-17

9.6%

5.8%

3.5%

2007-12

7.7%

5.6%

2.0%

2012-17

11.5%

6.1%

5.1%

Source: Analysis of Medicare Part D Events data 2007-2017 by Acumen for HHS/ASPE.

32

IQVIA Institute for Human Data Science. Medicine use and spending in the U.S.: a review of 2017 and outlook to

2022. Parsippany (NJ): IQVIA Institute for Human Data Science; 2018 Apr.

33

IMS Institute. Medicine Use and Cost Trends: Overall Market and Oncology. Discussion with ASPE. July 11,

2016.

22

Top 10 Drugs by Total Spending and by Number of Claims

Over the last 10 years, the top 10 highest-cost drugs in Part D account for approximately 20

percent of total Part D GDC. Table 3-3 presents the top 10 drugs in term of Medicare Part D

GDC over the last ten years. For brevity, we present only 2008, 2011, 2014, and 2017 here, with

tables for all years included in Appendix Table A-4.

In 2017, the top 10 highest-cost drugs accounted for $25.5 billion in Part D GDC, or 17 percent

of $154.2 billion in total Part D GDC. At $3.3 billion in Medicare Part D GDC, Revlimid, used

to treat blood cancers, accounted for more spending than any other drug in 2017. Medicare Part

D GDCs for Revlimid was $626.98 per unit in 2017 (Table A-4 shows that the GDC per user for

Revlimid was $88,442 in 2017). A unit refers to the lowest dispensable amount (e.g. one pill or a

standardized volume for liquids). In addition, Medicare beneficiaries using these high cost drugs

face high patient liabilities despite the catastrophic coverage provisions of Part D. More detailed

spending and pricing data for the top highest-cost drugs for all years are included in Appendix

Table A-4. Table 3-4 presents the top 10 highest-cost prescribed drugs in Medicare Part D

ranked by spending per unit for 2008, 2011, 2014, and 2017 with all years 2008-2017 presented

in Appendix Table A-5

As shown in Table 3-5, the top 10 most frequently prescribed drugs in Medicare Part D (as

calculated by number of claims), are relatively inexpensive and typically account for less than 10

percent of total Part D GDC. In 2017, spending on the top 10 most frequently prescribed drugs

was $4.1 billion, or 3% of $154.2 billion in total Part D GDC. Spending and pricing data for all

years are included in Appendix Table A-6.

23

Table 3-3 Top 10 Highest-Cost Drugs, Medicare Part D, Ranked by Total Spending

2008

2011

Rank

Drug Name

GDC Per

Unit ($)

GDC ($M)

Drug Name

GDC Per

Unit ($)

GDC ($M)

1

Lipitor

$2.95

$2,397.8

Plavix

$6.18

$3,656.7

2

Plavix

$3.83

$2,305.1

Lipitor

$4.57

$2,672.9

3

Nexium

$4.73

$1,487.0

Seroquel

$7.28

$2,045.3

4

Seroquel

$4.78

$1,462.2

Nexium

$5.89

$1,970.1

5

Aricept

$5.18

$1,326.1

Advair Diskus

$3.81

$1,664.9

6

Zyprexa

$12.65

$1,229.0

Zyprexa

$19.88

$1,625.3

7

Advair Diskus

$2.94

$1,213.3

Abilify

$18.97

$1,469.6

8

Actos

$4.82

$1,063.0

Crestor

$4.44

$1,416.3

9

Prevacid

$4.58

$947.2

Actos

$7.01

$1,294.1

10

Abilify

$14.13

$837.1

Spiriva

$7.48

$1,288.4

Medicare Part D GDC, Top 10

$14,267.8

$19,103.6

Medicare Part D GDC, All Drugs

$68,223.6

$84,639.2

2014

2017

Rank

Drug Name

GDC Per

Unit ($)

GDC ($M)

Drug Name

GDC Per

Unit ($)

GDC ($M)

1

Sovaldi

$1,016.87

$3,102.2

Revlimid

$626.98

$3,312.8

2

Nexium

$7.82

$2,658.3

Eliquis

$6.41

$3,078.9

3

Crestor

$6.07

$2,541.2

Januvia

$12.86

$2,786.1

4

Abilify

$28.67

$2,524.9

Lantus Solostar

$24.82

$2,632.4

5

Advair Diskus

$4.94

$2,273.8

Xarelto

$12.76

$2,611.8

6

Spiriva

$9.43

$2,156.2

Harvoni

$1,119.62

$2,555.8

7

Lantus

Solostar

$21.74

$2,014.7

Lyrica

$6.66

$2,516.9

8

Januvia

$9.67

$1,773.8

Advair Diskus

$6.22

$2,374.8

9

Lantus

$21.52

$1,724.2

Humira Pen

$2,235.96

$2,015.7

10

Revlimid

$450.86

$1,670.5

Spiriva

$12.15

$1,662.0

Medicare Part D GDC, Top 10

$22,439.8

$25,547.2

Medicare Part D GDC, All Drugs

$121,001.4

$154,229.6

Source: Analysis of Medicare claims data (carrier, outpatient, and Prescription Drug Event) by Acumen for ASPE.

24

Table 3-4 Top 10 Highest-Cost Drugs, Medicare Part D, Ranked by Spending per Unit

2008

2011

Rank

Drug Name

GDC Per

Unit ($)

GDC ($M)

Drug Name

GDC Per

Unit ($)

GDC ($M)

1

Retisert

19784.33

0.1

Lucentis

38985.58

1.1

2

Somatuline Depot

7648.06

0.3

Eylea

37720.00

0.0

3

Animas 2020

5663.20

0.0

Ilaris

16278.40

0.8

4

Arcalyst

5198.06

1.1

Stelara

10756.61

31.7

5

Viadur

4905.50

0.1

Somatuline Depot

8342.85

3.5

6

Vantas

4738.90

0.5

Neulasta

5952.62

28.3

7

H.P. Acthar

4547.26

6.9

Mozobil

5703.27

1.1

8

Fabrazyme

3443.73

1.4

Sylatron 4-Pack

5567.04

0.1

9

Neulasta

3399.84

19.5

Jevtana

5528.20

1.2

10

Herceptin

2728.76

2.3

H.P. Acthar

5303.69

49.5

Medicare Part D GDC, Top 10

$32.2

$117.4

Medicare Part D GDC, All Drugs

$68,223.6

$84,639.2

2014

2017

Rank

Drug Name

GDC Per

Unit ($)

GDC ($M)

Drug Name

GDC Per

Unit ($)

GDC ($M)

1

Eylea

38360.36

2.9

Eylea

38341.55

13.0

2

Lucentis

36442.45

2.7

Lucentis

37542.48

3.2

3

Gattex

28077.72

46.7

Gattex

35331.78

164.8

4

Ilaris

16381.65

4.1

Spinraza

25650.18

1.2

5

Stelara

14510.12

156.9

Krystexxa

19152.45

13.6

6

Jetrea

11850.00

0.0

Lemtrada

18062.64

7.7

7

Somatuline Depot

11421.89

10.2

Jetrea

16868.29

0.0

8

Krystexxa

7744.50

0.8

Ilaris

16621.41

8.1

9

Neulasta

7384.42

57.8

Somatuline Depot

15515.58

25.7

10

H.P. Acthar

6497.68

391.1

Signifor Lar

11541.03

2.7

Medicare Part D GDC, Top 10

$673.1

$239.9

Medicare Part D GDC, All Drugs

$121,001.4

$154,229.6

Source: Analysis of Medicare claims data (carrier, outpatient, and Prescription Drug Event) by Acumen for ASPE.

25

Table 3-5 Top 10 Most Frequently Prescribed Drugs, Medicare Part D, Ranked by Number of

Claims

2008

2011

Rank

Drug Name

GDC Per

Unit ($)

GDC ($M)

Drug Name

GDC Per

Unit ($)

GDC ($M)

1

Lisinopril

$0.25

$345.0

Simvastatin

$0.31

$594.3

2

Simvastatin

$0.57

$694.1

Lisinopril

$0.19

$322.3

3

Furosemide

$0.11

$131.8

Hydrocodone-

Acetaminophen

$0.18

$430.1

4

Hydrocodone-

Acetaminophen

$0.18

$312.5

Amlodipine Besylate

$0.30

$383.1

5

Levothyroxine Sodium

$0.24

$207.8

Omeprazole

$0.50

$674.7

6

Amlodipine Besylate

$0.45

$401.5

Levothyroxine

Sodium

$0.22

$256.5

7

Lipitor

$2.95

$2,397.8

Furosemide

$0.11

$133.5

8

Omeprazole

$0.86

$695.6

Metformin Hcl

$0.12

$214.4

9

Hydrochlorothiazide

$0.12

$94.1

Metoprolol Tartrate

$0.09

$126.1

10

Atenolol

$0.11

$111.7

Hydrochlorothiazide

$0.12

$95.2

Medicare Part D GDC, Top 10

$5,391.9

$3,230.2

Medicare Part D GDC, All Drugs

$68,223.6

$84,639.2

2014

2017

Rank

Drug Name

GDC Per

Unit ($)

GDC ($M)

Drug Name

GDC Per

Unit ($)

GDC ($M)

1

Lisinopril

$0.13

$281.4

Atorvastatin Calcium

$0.28

$808.9

2

Levothyroxine Sodium

$0.33

$631.5

Levothyroxine

Sodium

$0.36

$836.1

3

Amlodipine Besylate

$0.16

$303.6

Amlodipine Besylate

$0.11

$267.1

4

Simvastatin

$0.19

$346.5

Lisinopril

$0.10

$256.2

5

Hydrocodone-

Acetaminophen

$0.26

$676.2

Omeprazole

$0.21

$394.3

6

Omeprazole

$0.29

$527.6

Gabapentin

$0.14

$494.5

7

Atorvastatin Calcium

$0.44

$747.2

Furosemide

$0.09

$139.7

8

Furosemide

$0.10

$135.6

Simvastatin

$0.13

$219.2

9

Metformin Hcl

$0.08

$203.8

Hydrocodone-

Acetaminophen

$0.24

$498.4

10

Gabapentin

$0.20

$491.2

Metformin Hcl

$7.41

$188.2

Medicare Part D GDC, Top 10

$4,344.5

$4,102.6

Medicare Part D GDC, All Drugs

$121,001.4

$154,229.6

Source: Analysis of Medicare claims data (carrier, outpatient, and Prescription Drug Event) by Acumen for ASPE.

26

Data and Methods

Medicare Part D PDE data were used from 2007 to 2017 to calculate annual total gross drug

costs, price, and utilization. Although the Medicare Part D program started in 2006, data in the

initial year are not considered reliable for analyses. As a result, 2007 was the first year used for

evaluating trends.

The analysis is based on all drugs reported in the PDE data, excluding non-covered claims and

compound drugs. Additional information was obtained from the Health Plan Management

System (HPMS), Medispan, and First Data Bank.

34

The unit of analysis for the study is the National Drug Code (NDC), a unique product identifier.

The NDC is a unique 10-digit, 3-segment numeric identifier assigned to each medication

identifying the labeler or vendor, product (specific strength, dosage form, and formulation for a

particular firm), and trade package (package forms and sizes).

The top 10 highest cost drugs and top 10 most frequently prescribed drugs present average

spending per dosage unit. Units refer to both the number of claims or the quantity dispensed in

the PDE data. Quantity dispensed describes how many dosage units of the medication were

dispensed in the current drug event (normally, it is the number of units, grams, milliliters, other.

If compounded item, total of all ingredients will be supplied as Quantity Dispensed). Since drugs

are available in multiple strengths and dosage forms, the average spending per dosage unit at the

brand name and generic name level is weighted to account for variation in claims volume for

specific brand name, generic name, strength, dosage form, routes of administration, and

manufacturer levels.

34

The Health Plan Management System (HPMS) provides such information as plan type, cost share tier level, and

utilization management (quantity limit, prior authorization, step therapy). The First Data Bank (FDB) and Medispan

provide such information as generic and brand name, dosage form, strength, and route of administration. In

addition, Medispan provides information on drug class and protected class.

27

SECTION 4: MEDICAID

This section presents information about prescription drugs in Medicaid between 2006 and 2017.

It presents data pertaining to trends in overall spending for prescription drugs and the top 10

highest-cost drugs and top 10 most frequently prescribed drugs in Medicaid.

Program overview

Medicaid, created alongside Medicare in 1965, provides comprehensive health coverage,

including prescription drug benefits, to disabled and low-income individuals and families. Unlike

Medicare, Medicaid is administered by states in accord with federal statutes and regulations.

Financial responsibility for Medicaid is apportioned between the federal government and the

states according to the applicable Federal Medical Assistance Percentage (FMAP). Although

prescription drug coverage is legally an optional rather than a mandatory Medicaid benefit, all

states and the District of Columbia have elected to provide this coverage.

About 74 million people were enrolled in Medicaid in 2017.

35

Most enrollees receive services

under some form of managed care.

36

States can carve prescription drugs out of managed care but

fewer do so since the Affordable Care Act (ACA) extended Medicaid prescription drug rebates

to cover Managed Care Organizations (MCOs) as well as Fee for Service (FFS) utilization,

allowing states to receive full rebates under either type of utilization

More than half of the gross cost of Medicaid prescription drugs comes back to the federal

government and the states through rebates.

37

Since the Omnibus Budget Reconciliation Act of

1990, manufacturers have been required to provide rebates on prescription drugs as a condition

of state Medicaid coverage for their products. For single source/innovator multiple source (brand

name) drugs, rebate amounts are based on the greater of a percentage of the Average

Manufacturer Price (AMP) or the difference between AMP and the “best price” available to

other purchasers.

38

Additional rebates that apply when the cost of a branded drug increases

faster than inflation now account for about half of total rebate amounts on these drugs.

39

The

35

Department of Health and Human Services [HHS]. 2017 Actuarial Report on the Financial Outlook for Medicaid.

2018. Available at https://www.cms.gov/Research-Statistics-Data-and-

Systems/Research/ActuarialStudies/Downloads/MedicaidReport2017.pdf

36

Centers for Medicare & Medicaid Services [CMS]. Medicaid Managed Care Enrollment and Program

Characteristics, 2016 Spring 2018. Available at https://www.medicaid.gov/medicaid/managed-

care/downloads/enrollment/2016-medicaid-managed-care-enrollment-report.pdf

37

MACPAC. MACStats: Medicaid and CHIP Data Book. EXHIBIT 28. Medicaid Gross Spending and Rebates for

Drugs by Delivery System, FY 2017 (millions).December 2018. Available from: https://www.macpac.gov/wp-

content/uploads/2015/11/EXHIBIT-28.-Medicaid-Gross-Spending-and-Rebates-for-Drugs-by-Delivery-System-FY-

2017.pdf

38

“Best price” is defined at section 1927(c)(1)(C) of the Social Security Act, and 42 CFR 447.505. Exclusions from

the prices used in this calculation include the prices charged to Medicare Part D Plans and to the Veterans Health

Administration.

39

U.S. Department of Health and Human Services, Office of Inspector General. Medicaid rebates for brand-name

drugs exceeded Part D rebates by a substantial margin. Publication number OEI-03-00650. April 2015. Available at

http://oig.hhs.gov/oei/reports/oei-03-13-00650.pdf.

28

Bipartisan Budget Act of 2015 (Public Law 114-74) amended the Social Security Act to provide

for the payment of additional inflation-based rebates for non-innovator multiple source drugs

(generic drugs).

The ACA made several important changes to Medicaid prescription drug rebates. The minimum

rebate percentage for single source/innovator multiple source (brand name) drugs was raised

from 15.1 percent to 23.1 percent of AMP for most drugs, with a lower rate of 17.1 percent for

blood clotting factors and drugs approved by the FDA exclusively for pediatric indications. The

minimum rebate percentage for non-innovator (generic) drugs was increased from 11.0 to 13.0

percent of AMP. A line extension of a single source drug or an innovator multiple source drug

that is an oral dosage was made subject to an additional penalty that discourages manufacturers

from making trivial changes to avoid inflation rebates.

40

The ACA also provided for a maximum

rebate amount (or cap) with respect to each dosage form and strength of a brand drug for a rebate

period (basic plus additional inflation-based) at 100 percent of AMP; this maximum rebate

amount or cap applies to rebates for generic drugs (basic plus additional inflation-based) as

well.

41

Medicaid Spending and Spending Trends

Overall spending and spending trends

Medicaid gross spending on prescription drugs in CY 2017 totaled $67.6 billion (Table 4-1).

However, more than half of that spending came back to the federal government and the states as

rebates. Table 4-1 shows estimates of Medicaid prescription drug gross and net spending. In

2014, the combination of new, expensive drugs for hepatitis C and other conditions, price

increases in existing drugs, a relatively low number of patent expirations, and increased

enrollment due to Medicaid expansion under the ACA increased gross prescription drug

spending by 21.6 percent to $47.3 billion. From 2006 to 2017, Medicaid gross spending on

prescription drugs grew from $13.0 billion to $67.6 billion with an average annual growth rate of

16.2 percent. The Medicaid Drug Rebate Program, however, substantially reduced spending in

all years, and pushed net spending below half of gross spending in 2016 and 2017. Due to the

expansion of rebates, the average annual growth for net spending, 5.1 percent was much lower

than the gross growth rate over this period.

40

Line extension is defined in statute at section 1927(c)(2)(C) of the Social Security Act to mean, with respect to a

drug, a new formulation of the drug, such as an extended release formulation, but does not include an abuse-

deterrent formulation of the drug (as determined by the Secretary), regardless of whether such abuse-deterrent

formulation is an extended release formulation.

41

The President’s FY 2020 budget proposes elimination of the cap. See Department of Health and Human Services,

Budget in Brief (https://www.hhs.gov/sites/default/files/fy-2020-budget-in-brief.pdf), p. 15.

29

Table 4-1 Medicaid Prescription Drug Gross and Net Spending, 2006-2017

Year

Total

Gross

Medicaid

Spending

($B)

Annual

Growth

Total

Net

Medicaid

Spending

($B)

Annual

Growth

2006

13.0

-

19.1

-

2007

16.7

28.5%

18.3

-4.1%

2008

24.7

47.5%

19.2

4.9%

2009

26.0

5.6%

20.3

5.8%

2010

33.0

26.8%

20.4

0.4%

2011

37.7

14.2%

21.0

2.6%

2012

37.8

0.2%

21.4

2.3%

2013

38.9

3.0%

22.1

2.9%

2014

47.3

21.6%