159

REVOCABLE LIVING TRUSTS

Submitted by J. Mark Fisher

160

161

IX. REVOCABLE LIVING TRUSTS

A. Traditional Estate Planning vs. Revocable Trust Planning:

IN GENERAL:

Traditional estate planning, to me, includes both the option to draft either a Will or a

Revocable Living Trust. I have always offered both vehicles to my clients since I began limiting

my practices to estate planning. Routinely, I will see articles titled something like, Revocable

Living Trusts, No Longer Just for the Rich. These articles discuss everything from the cost of the

Trust compared to a Will, the subsequent cost of a probate, to the similarities and differences of

the two testamentary instruments. It generally concludes by arguing a cost benefit analysis that

includes saving both time and money when administering a Revocable Living Trust rather than a

Will. What this tells me, is that the Revocable Living Trust has become the norm in many cases

and with many estate planning attorneys.

To truly contrast traditional estate planning and Revocable Living Trust planning, we need

to define the terms. Traditional estate planning: I will submit to the notion that a traditional estate

plan will consist of a client and a qualified professional, generally an attorney, sitting down and

deciding where and to whom the client wants his assets to go, upon his death. This will include

the drafting of a Will, deciding who is to get the assets titled in the client’s name only at death and

who will be the fiduciary in charge of carrying out the client’s wishes. A traditional estate plan is

not complete without a comprehensive review of all of the client’s assets. Remember, the Will is

only going to control an asset in the client’s name only at death, it will NOT control: a joint bank

account with rights of survivorship, or made POD or TOD; a piece of property owned as joint

tenants with rights of survivorship; nor a life insurance policy, IRA, 401k, with a beneficiary

designation. As part of the traditional estate plan, each of these assets must be reviewed and

162

continuously updated so the client’s intentions are carried out, and we don’t run into the case where

an unintended beneficiary receives 50% of the client’s assets at death because he forgot to update

his life insurance beneficiary.

Note that in Florida, statutes are in place to curb an unintended beneficiary if it is the

decedent’s former spouse. In 1951, Florida enacted a statute automatically cutting divorced

spouses out of each other’s Wills (currently at Fla. Stat. § 732.507(2)). In 1989, Florida enacted a

similar statute for Revocable Living Trusts (currently at Fla. Stat. § 736.1105). In addition, new

Fla. Stat. § 732.703 voids the designation of a former spouse as a beneficiary of an interest in an

asset that will be transferred or paid upon the death of the decedent if: [1] The decedent’s marriage

was judicially dissolved or declared invalid before the decedent’s death; and [2] The designation

was made before the dissolution or order invalidating the marriage.

Revocable Living Trust Planning: We want to create a plan to distribute assets of the client

to his named beneficiaries upon his death. Sound familiar? While the core principal is the same,

the major difference is going to be procedural. A Trust document is going to be drafted essentially

creating a separate legal entity. It will appoint a fiduciary to carry out the client’s wishes, and it

will also name beneficiaries to receive assets upon a certain point in the future, usually the client’s

death. Drafting the document is step one. A comprehensive review of the client’s assets will also

need to take place. (See attached Asset Checklist) The end goal is to make sure the client’s assets

are either titled to the Trust or made payable to the Trust upon death. (See attached Trust Funding

Instructions and Notices to Financial Institutions).

Since the client generally appoints himself as Trustee during his life, there are provisions

and instructions upon the client’s incapacity. While a Power of Attorney will have similar

authority, a successor Trustee assuming title to the assets of the Trust for the benefit of the client

for the remainder of his life is a truly seamless transition. (See attached Trustee Instructions).

163

IRS TREATMENT:

IRS Treatment of a Revocable Living Trust: under IRC §678(a), a Grantor (Trustor) is

treated as the owner of the Trust if someone can revoke, terminate, alter, amend, appoint, or modify

the Trust and thereby re-vest title to the Trust property in the Grantor or the Grantor’s spouse. (See

also IRC §§ 674, 677).

SIMILARITIES:

There are similarities between the two planning techniques that are worth noting. Most

plans involving Revocable Living Trusts also involve Wills with pour-over clauses. A Pour-Over

Will generally serves as a safety-net, and if there was an asset in the client’s name only at his death

requiring administration, the Will directs the asset to the Trust. A pour-over clause is invalid

unless the recipient Trust is evidenced by written instrument. (See Sample Pour-Over Will), (See

Fla. Stat. § 732.513).

The other similarity is in the manner these documents are brought into existence, or

executed, (signed). Testamentary aspects of the Revocable Living Trust are void unless the Trust

is executed with the formalities of a Will. (See Fla. Stat. § 736.0403).

THE CO-TRUSTEE:

A Revocable Living Trust has important planning implications during the Trustor’s

lifetime. The majority of the conversation has to do with the transfer of assets at death, but just as

important is the succession of title and care of the assets upon incapacity or disability. It is routine

for a client to come in and inform the estate planner they have put one of their children on their

account so they can help to pay bills. The caveat here, is the client has put their child on as a co-

owner. As a co-owner, the child will: receive the money at death; has the right to withdraw the

money during life; and subject that money to the child’s creditors. To contrast, if we keep the

accounts titled to the Trust, we can create the same level of convenience by adding a co-Trustee.

164

The co-Trustee will be a signor on the account to be able to act for the benefit of the Trustor, but

the issues of joint ownership are not present.

CONTESTING THE PLAN:

Both plans can be contested by a party with standing. The validity of the document will

be attacked based on lack of capacity, fraud, duress, or undue influence. There is no drafting

technique that can be used to prevent a party from hiring an attorney and contesting the document.

In fact, a provision limiting a party to contest the document is per se invalid and unenforceable.

(See Fla. Stat. §§ 732.517 and 736.1108).

COMMON PURPOSE OF REVOCABLE LIVING TRUST:

Generally, a testator creates a Revocable Living Trust to keep the administration of the

assets outside of probate. In contrast, traditional estate planning, such as a Will, is your ticket to

probate, and will govern the administration of the assets owned in the client’s name only, at death.

EXAMPLE OF A TRUST PLAN NOT AVAILABLE TO A TRADITIONAL ESTATE PLAN:

“Elective Share Trust” means a Trust under which the surviving spouse is entitled for life

to the use of the property or to all of the income payable at least as often as annually; the surviving

spouse has the right under the terms of the Trust or state law to require the Trustee either to make

the property productive or to convert it within a reasonable time; and, during the spouse’s life, no

person other than the spouse has the power to distribute income or principal to anyone other than

the spouse.

By drafting this Trust, you can create the source on which an elective share is payable,

eliminating ongoing litigation over which asset shall be used to satisfy the share. The following

is the schedule on the factors determining what percentage of interest the spouse will have in the

Elective Share Trust. The value of the spouse’s interest is a percentage of the value of the principal

165

of the Trust, or Trust portion, on the applicable valuation date as follows (see Fla. Stat. §

732.2095):

1. One hundred percent if the Trust instrument includes both a qualifying invasion

power and a qualifying power of appointment.

2. Eighty percent if the Trust instrument includes a qualifying invasion power but no

qualifying power of appointment.

3. Fifty percent in all other cases.

(See also Fla. Stat. § 732.2025).

(See also the Consumer Pamphlets from the Florida Bar: Do You Have A Will?; Probate in

Florida; The Revocable Trust in Florida).

B. Credit Shelter Trusts:

GENERAL DEFINITION:

A Credit Shelter Trust, also known as a Bypass or A/B Trust, is used to reduce or eliminate

federal estate taxes. It is generally used by married couples with estates exceeding amounts exempt

from federal estate tax. Upon the death of the first spouse, the Credit Shelter Trust establishes a

separate, irrevocable Trust with the deceased spouse’s share of the Trust’s assets. The surviving

spouse becomes the beneficiary of this Trust, with the children as beneficiaries of the remaining

interest. This irrevocable Trust is funded to the extent of the first spouse’s exemption, meaning the

amount in the irrevocable Trust is not subject to estate taxes on the death of the first spouse. In

effect, the Credit Shelter Trust takes full advantage of the first spouse’s estate tax credit.

The new IRS regulations that became effective at the beginning of 2013, made the tax

exemption an individual can die with, portable between a husband and wife. This new regulation

has directly impacted the necessity to draft a Trust preserving an individual’s credit for their

spouse.

There are still practical reasons this type of planning is relevant. It will avoid the filing of

a 706 estate tax return on the first spouse’s death. The plan will also “lock” in the distribution of

the Trust on at least half of the assets. This is relevant to some couples due to the fear the surviving

166

spouse will remarry and completely change the established plan. While the surviving spouse will

be able to amend the Trust, the amendment will only affect the assets not titled to the deceased

spouse’s Trust.

C. Marital Deduction Trusts:

A Marital Deduction Trust is a Trust in which transfers of property

between married partners are free of federal transfer tax. A Marital Deduction Trust can take one

of two forms, either a life estate coupled with a general power of appointment given to the spouse

or a Qualified Terminable Interest Property (QTIP) trust.

The effect of the Marital Deduction Trust is that it shields both spouse's assets and estates

from federal estate taxes because when the first spouse dies, the assets indicated by the Trustor

(the spouse who created the Trust) pass to the marital Trust free and clear of any and all federal

estate taxes. Neither the Trustor-spouse nor the surviving spouse pay taxes on the

property. Moreover, when the surviving spouse dies, the assets under the Trust are not included

as part of her estate, thus her federal taxes are not as high as they would have been had there not

been a Trust.

NEW IRC § 2056: A married individual can give an unlimited amount of assets, either by

gift or bequest, to his or her spouse without any federal gift or estate taxes being imposed. This

allows married couples to delay the payment of estate taxes at the passing of the first spouse

because when the surviving spouse dies, all assets in the estate over the applicable exclusion

amount will be included in the survivor’s taxable estate. The unlimited marital deduction is

available solely to surviving spouses who are citizens of the United States.

167

D. Qualified Terminable Interest Trusts (QTIPs)

The Q-TIP Election, commonly known as the Q-TIP Trust, is used primarily for spouses

in a second marriage. Its primary purpose is to ensure that the new spouse is provided for

financially and the children of the first marriage, if any, inherit the assets from the estate after the

death of the new spouse.

The general rule is that all property passing from one spouse to another will not be

subject to any gift or estate taxes.

42

This is known as the "unlimited marital deduction." Any

amount of property or assets may be transferred from one spouse to another, either while the

spouses are living or at the death of one spouse with no estate or gift tax consequences for the

surviving spouse. In order for this transfer to be valid, it must be outright with no strings

attached. The rights and property transferred to your spouse cannot be what is called a

"terminable interest." Terminable interest means the interest will end or fail as a result of: (1) the

passing of time, (2) the occurrence of an event or contingency, or (3) the failure of an event or

contingency to occur. There are, however, a number of exceptions to the terminable interest

rule, and these are critical to the use of Trusts for transfers to your spouse, including the A/B

Trust.

The Q-TIP Trust Election is the most important exception to the rule denying a marital

deduction for a property interest that may terminate. The advantage of the Q-TIP technique is

that your estate can qualify for the estate tax marital deduction without your having to give

complete control of the ultimate disposition of your assets to your spouse. The rules are as

follows:

42

Florida Statute § 736.0505

168

• Your spouse is given a life-interest in particular property.

• Your spouse has a right to the income from that property payable at least annually.

• The property must pass from you.

• No person has a power to appoint any of the property to any person other than the

surviving spouse.

• The necessary election is made by your executor to have the property qualified.

Upon the death of the surviving spouse, the entire value of the Q-TIP property is included

in the surviving spouse's gross estate. The assets will be taxed at the top marginal tax brackets.

If this is not a first marriage, the use of a Q-TIP Trust can help provide financially for a current

spouse and ensure that your children from a previous marriage will be able to inherit assets.

This Trust is a primary estate planning tool for people in second marriages. It prevents

the tragedy that occurs where unintended heirs inherit property and children of first marriages

and other original family members are completely disinherited. This occurs because simple

techniques for proper estate planning are not used. The following is an example of the wrong

way to manage an estate:

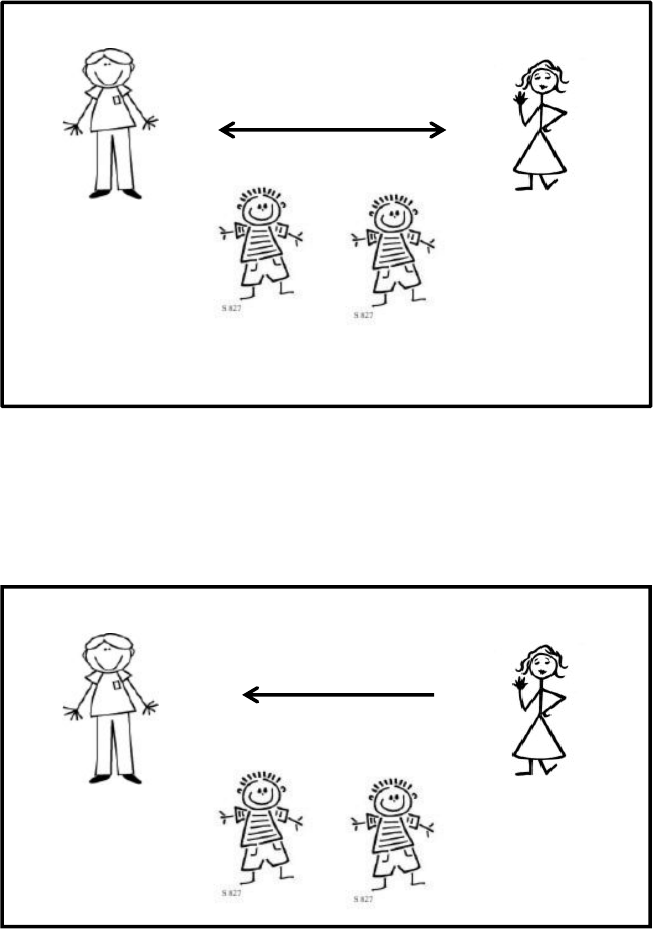

John and Mary are married for many years and have two children who are now over the

age of eighteen years. John and Mary own all their property together as husband and wife. (Fig.

1).

169

Mary is killed in a car accident and all jointly-owned property passes directly to

the surviving spouse, John, with no probate and no inheritance taxes due. (Fig. 2.)

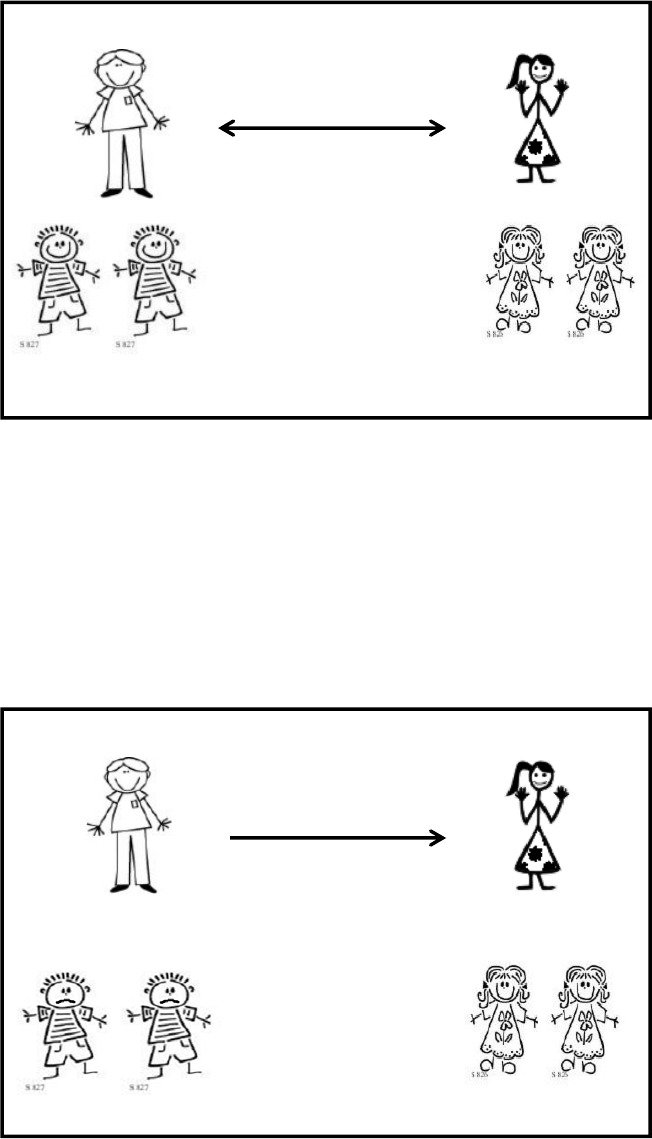

The surviving husband then meets and marries another woman. The new spouse, Sue,

has children of her own. John, who owned all property jointly with his first wife prior to her

death, then retitles his assets so that they now reflect the ownership of John and his new spouse,

Sue, as husband and wife. (Fig. 3.)

JOHN MARY

All property jointly owned

as husband and wife

Children of John and Mary

Fig. 1

JOHN MARY

Dies; leaves

all to John

Fig. 2

X

170

John passes away leaving a Will which directs that everything shall go to his children.

Unfortunately, all the assets in the estate are now owned jointly with his second spouse, Sue.

These jointly-owned assets will pass directly to Sue, nullifying John's Will with regard to these

assets, in effect disinheriting John's children. (Fig. 4.)

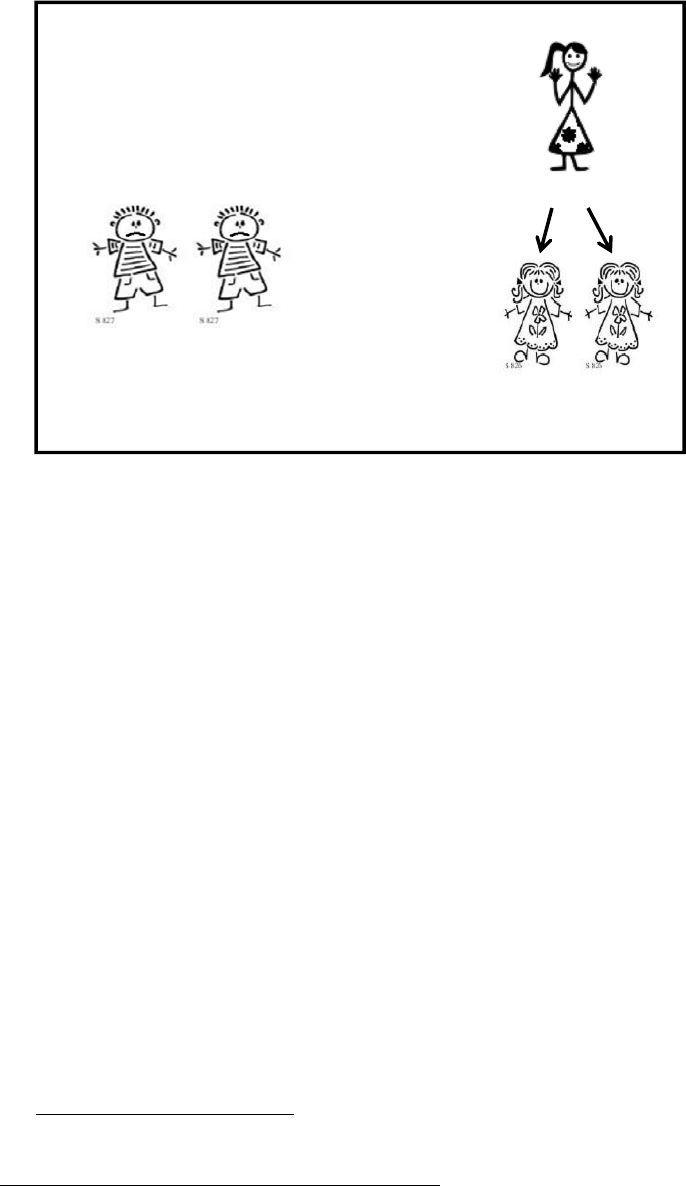

This lack of estate planning bars the original children from inheriting altogether and

allows unintended heirs to inherit the entire estate property. (Fig 5.)

JOHN SUE

All property

jointly owned

New spouse

Children of Sue

Fig. 3

X

JOHN SUE

John dies; all

goes to second spouse

Fig. 4

171

Including the Q-TIP election as an estate planning tool will allow John, in this example,

to provide financially for his new spouse without unintentionally disinheriting his children. The

Q-TIP Trust will be funded with assets John designates to be placed into the Trust. These funds

will be managed by a Trustee and all the income will pass annually to John's new spouse. She

will have the right to invade the principal of the Trust if she needs it for emergency medical

reasons. Any assets remaining in the Trust after Sue passes away will then be distributed

directly to John's children and will not pass to Sue's estate or her children.

Using the Q-TIP election allows the twin goals of providing financially for a new spouse

and satisfying the natural desire to provide for your children. The new spouse is cared for and

John's children receive the estate assets at some point in the future instead of being left out.

E. Drafting Tips and Samples

Joint Representation Agreement for Couples. When representing a married couple in their

joint Trust, include a Joint Representation Agreement in their documents. In essence, it will state

that your firm represents the two of them together, not separately, and that confidentiality applies

Sue dies

All goes to children

Fig. 5 of second spouse

Children of John

and Mary are

completely disinherited

172

to you as a group. In other words, husband cannot ask you to change his testamentary disposition

of property and keep this information from his wife. Having the agreement in your file will

prevent and protect you from any misunderstanding a client may have about their attorney-client

confidentiality privilege. See Sample Consent Letter.

Deeds. Upon creating a Living Revocable Trust, the Trustors’ initial task is funding their

Trust. As discussed previously, different types of assets require different methods for retitling the

asset to the Trust. Include a checklist for your clients to ensure they do not forget an asset. Also,

you can provide forms they can fill out and provide their bank, broker, etc., for retitling assets.

See Sample Checklist, attached.

If you are preparing deeds transferring real property into the Trust for your clients, ensure

you are preparing deeds in conformity with the state requirements, Alabama deeds require the

following “General Acknowledgement” rather than a general notary block:

STATE OF ______________

COUNTY OF _____________ General Acknowledgment

I, ____________, a Notary Public in and for said County, in said State, hereby certify

that John Doe, whose name is signed to the foregoing conveyance, and who is known to me, acknowledged

before me on this date, that, being informed of the contents of the conveyance they executed the same

voluntarily on the day the same bears date. Given under my hand and official seal on ______.

Notary Public Signature and Seal

Simultaneous Death and Survival. Every Will and Trust should have a survival clause

providing for distribution if all of the beneficiaries predeceases the testator. While it seems

unlikely, it is not far-fetched for a close family to travel together and all be killed in a car

accident together.

If both Trustors should die under circumstances which render it doubtful as to which

Trustor died first, it shall be conclusively presumed that the Husband survived the Wife. If any

non-Trustor beneficiary and a Trustor should die under circumstances which would render it

173

doubtful as to which died first, the Trustor or the non-Trustor beneficiary, it shall be conclusively

presumed that said non-Trustor beneficiary predeceased such Trustor.

In all other cases, a non-Trustor beneficiary shall not be deemed to have survived the

Trustors or another person if he or she dies within sixty (60) days of the Trustors' death or of the

death of such other person.

Ask about the Four Generations. When meeting with a typical client, leaving everything to

their children per stirpes, ask about the clients’ parents, the clients’ children, and grandchildren.

Ask questions about whether anyone has special needs, medical issues (bipolar disorder), drug

abuse, tax liens, or bad marriages. These are all things to consider before leaving a large estate to

someone.

Minor Children. A client with minor children will have more issues to consider in their estate

planning. For example, who will be the guardian if both parents are gone? Who will take care of

the money, how can it be used, and at what age can the child receive their share? Another issue is

The Florida Homestead Law. The Florida Constitution places restrictions on devising the

homestead – one simply cannot do it if survived by a minor child. Therefore, typically you would

not transfer a client’s homestead into their Trust if he/she has minor children.

F. Common Mistakes to Avoid

Not funding the Trust. A Trustor who has a complicated distribution scheme but leaves

certain assets titled jointly to himself and one child, probably the successor Trustee, has in

effect, left that asset outright to the one child. The asset could be of great value, creating an

unintended unequal distribution of assets. A similar mistake of Trustors having this effect

include not changing the life insurance beneficiary to the Trust.

Not having a Pour-Over Will. If as Trustor leaves an asset out of the Trust, whether on

purpose or on accident, and that asset is subject to probate, the Will controls it. If a Trustor

174

has an outdated Will from years prior to creating a Trust, but did not execute a new Will

leaving everything to the Trust, the older Will controls the probate and the asset will not

make it to the Trust.

Having a Will with different terms. Not drafting a Pour-Over Will may keep an outdated

Will in effect, which may have different terms and different beneficiaries. Any asset left out

of the Trust will have a different distribution scheme than the Trust.

Not communicating with Trustees. A Trustor should at least inform the successor Trustee

of the location of the Trust agreement. The Trustor should also leave a list of his assets so the

successor Trustee can find them.

Not planning for beneficiaries with special needs. A beneficiary with a disability or other

special need who relies on social programs, such as Medicaid or SSI, can become unqualified

for programs when he inherits substantial assets. It is important to question your clients and

identify any of these potential special needs and draft language to protect them from

disqualifying from the programs they may rely on.

Not using full legal names. Many people go by names that are not their legal names.

Make sure you ask. Also, oftentimes clients forget to tell you they are a “Jr.” or a “III.” Also,

if your client has gone by different names, account for it. Some clients may have a slight

difference on their social security card, state ID, which may be different from how he holds

title to certain assets. You can cover all names with a simple “AKA paragraph,” stating that

the Trustor is, or has been known by certain other names.

Naming a Trustee not qualified to serve. Do not forget to have your clients confirm

whether their named Successor Trustees have a felony conviction.

175

Naming two people to serve together. No matter how well two siblings get along, they

are going to argue when having to make important decisions together, and this can be even

worse if you have a child and new spouse serve together.

Having one child in charge of another. A Trustor may have one responsible child and one

irresponsible child, and want to stretch out inheritance payments for the irresponsible one. It

is better for an aunt, uncle, or family friend to be Trustee for the irresponsible child’s share,

rather than the sibling who is receiving their share all at once.

176

IX. REVOCABLE LIVING TRUSTS

Schedule of Attachments

1. Sample Asset Checklist

2. Trust Funding Instructions

3. Funding, Bank & Broker Notices

4. Trustee Instructions

5. Pour-Over Will

6. Fla. Bar Consumer Pamphlet- Do You Have a will

7. Fla. Bar Consumer Pamphlet-Probate in Florida

8. Fla. Bar Consumer Pamphlet-The Revocable Trust in Florida

9. Sample Consent Letter

177

CHECKLIST FOR TRANSFERRING CERTAIN ITEMS INTO THE TRUST

1. BANK ACCOUNTS:

CHECKING:

All bank accounts currently owned jointly or individually should be transferred into the Trust. Take

your Certificate of Trust and the Bank Notification to your bank and they will change your signature cards.

The checks you currently use will not change.

SAVINGS ACCOUNTS:

All savings accounts held jointly or individually should be changed into the name of the Trust.

CDs:

All CDs held jointly or individually should be changed into the name of the Trust.

MONEY MARKET:

All money market accounts held jointly or individually should be changed into the name of the

Trust.

2. STOCK BROKERAGE ACCOUNTS AND STOCK CERTIFICATES:

BROKERAGE ACCOUNTS:

All Brokerage Accounts currently held jointly or individually should be transferred into the name

of the Trust. Use the Broker Notification found in Section 14 of your Trust book along with the Certificate

of Trust, and present these documents to your Broker. He/she will change the account title into the name

of the Trust.

STOCK CERTIFICATES:

If you hold the Stock Certificate, you will need to contact the transfer agent where you purchased

the certificate and request they send you the form(s) that they require to reissue the stock certificate in the

name of the Trust.

3. LIFE INSURANCE:

Depending on the type of Trust, financial position and other circumstances, (Mark Fisher will

evaluate these circumstances with you), life insurance should typically be payable first to your spouse, then

to the Trustees of your Living Revocable Trust. (Example: First beneficiary: LESLIE O. SAMPLE;

Second beneficiary: LESTER O. SAMPLE and LESLIE O. SAMPLE, TRUSTEES OF THE

SAMPLE LIVING TRUST DATED DECEMBER 9, 2014).

178

4. ANNUITIES:

Annuities should be payable first to your spouse, then to the Trustees of your Living Revocable

Trust upon death of the annuitant. Most annuities have a designated beneficiary so that annuities will not

go through Probate. (Example: First beneficiary: LESLIE O. SAMPLE; Second beneficiary: LESTER

O. SAMPLE and LESLIE O. SAMPLE, TRUSTEES OF THE SAMPLE LIVING TRUST

DATED DECEMBER 9, 2014).

5. TAX DEFERRED ANNUITIES, IRAs, 401K and other TAX DEFERRED INSTRUMENTS:

If the investment is a tax deferred investment where you have never paid taxes on the money placed

in the investment such as an IRA or 401K Plan then these investments shall not be retitled to the name of

the Trust. The first beneficiary listed for these investments should be the spouse. The contingent or back-

up beneficiary should be changed to reflect the Trust. (Example: First beneficiary: LESLIE O. SAMPLE;

Second beneficiary: LESTER O. SAMPLE and LESLIE O. SAMPLE, TRUSTEES OF THE

SAMPLE LIVING TRUST DATED DECEMBER 9, 2014.

6. REAL ESTATE:

All real estate deeds (photo copy) should be given to J. Mark Fisher in order for him to create new

deeds which transfer the property from yourselves individually to yourselves as Trustees of the Trust.

These deeds will be signed by you at the same time you execute your Trust documents and then will be

recorded in the various counties or states where the property is located. After a period of time, usually

between 4 to 6 weeks for Florida Deeds, the original deeds will have been recorded in the respective

counties and will be sent back to you for placement in Section 15 of your Trust Book. We record deeds in

the state of Florida and Alabama only. The client is responsible for recording deeds to property in all other

states. We pay ordinary recording fees in Florida and the client is responsible for recording fees in all other

states, including the Alabama deed tax of $1 per $1,000 on value of property conveyed.

7. PERSONAL PROPERTY:

Section 4 of your Trust Book contains Schedule A. Schedule A reflects all the property transferred

to your Trust. The last page in Section 4 contains a statement that says "All personal property held by us

(including but not limited to all personal items, jewelry and household furnishings) is transferred to our

Trust". This statement is signed by you at the time you execute the Trust documents, and it effectively

transfers all of your personal property to your Trust without the necessity of identifying each separate item

of personal property.

8. U.S. SAVING BONDS:

There is a particular form (PD F 1851) which can be obtained from the Office of J. Mark Fisher or

found online at www.treasurydirect.gov/forms/sav1851.pdf. The form requests that the U.S. Government

reissue the bond in the name of your Trust. Once the bond has been reissued, it will reflect that the bond is

owned by husband and wife as Trustees of the Living Revocable Trust.

179

9. PROMISSORY NOTES or MORTGAGES OWED TO YOU:

All promissory notes payable to you and your spouse, or mortgages payable to you and your

spouse, shall be assigned from the two of you individually to the two of you as Trustees of your Trust. If

you are a single person, you will assign the promissory note or mortgage from yourself individually to

yourself as Trustee of your Trust. J. Mark Fisher prepares the assignments for you that will be executed at

the time the Trust documents are signed.

10. AUTOMOBILES, BOATS, and other VEHICLES:

It is generally recommended that the automobile not be placed in the Trust at the time the Trust

documents are signed. If the automobile or boat in question is extremely valuable and owned free and

clear, then it should be placed in the Trust. The process of placing a motor vehicle in the Trust requires that

the husband and wife go to the Division of Motor Vehicles, request that a new title be issued in the following

manner: Husband and wife individually transfer the ownership to husband and wife individually and

husband and wife as Trustees of their Living Trust.

As a small form of asset protection, the title to cars should not be held jointly between husband

and wife. The husband's car should be titled in his name and the wife's car should be titled in her name.

If either is involved in a major accident with hundreds of thousands of dollars in damages, then only the

driver (husband or wife) will be held responsible. This may serve to protect at least 1/2 if not all of the

assets in the estate.

180

FUNDING INSTRUCTIONS

These funding instructions are written to assist you in funding and administering your Revocable

Living Trust.

YOU MUST FUND YOUR TRUST TO AVOID PROBATE!

WARNING: To avoid probate, your Living Trust must be funded, i.e., the title of your property

retitled to the name of your Living Trust. If the Trust is not funded, then it, just like a Will, will not

avoid probate. Transferring property and assets into your Living Trust is the process of funding the

Trust. Also, as owner and Trustee of your Living Trust, you will ALWAYS retain total control and

flexibility over your property and assets.

WHAT DOES IT MEAN TO FUND A TRUST?

Funding a Revocable Living Trust is the process of transferring your assets to the Trust. Like a

container, your Living Revocable Trust holds your assets.

When you have completely funded your Living Revocable Trust, you as Trustee own your

property. Of course, you are the owner, Trustee and beneficiary, so you still control all of your assets, just

as you do now.

The process of funding is fairly easy; however, it is an ongoing process. As you acquire new

property, such as stocks, bonds, mutual funds or real property, you must place that property into your Trust

by titling it in your name, as Trustee of your Trust.

HOW DO I TRANSFER PROPERTY TO TRUST?

Since you signed your Trust in the presence of two witnesses and a notary, you have created a

Living Revocable Trust.

You can express your intent to transfer your tangible assets to your Trust by signing the form in

Section 4 of your Trust package.

Some assets have titles recorded with the county or state. For example, real estate is called real

property, and you probably have recorded a deed listing you or you and your spouse as owners.

To transfer these assets to your Trust, you simply record a new quit-claim deed or warranty deed,

with the county where the property is located. List yourselves as Trustees of the Revocable Living Trust

dated August 26, 2014, as the Grantee.

The county government may charge a modest filing fee (typically $20.00 in most counties in

Florida), but a transfer of your real property to your Revocable Living Trust will not trigger any reappraisal

of your property for taxes or incur any taxation as a result.

181

SEPARATE PROPERTY AND MARITAL PROPERTY

In funding your Trust, you will become the "Trustee" of your property, or, if you and your spouse

own marital property, or co-owned property, you and your spouse will both become "Trustees" of such

property.

In either case, title to your property must be transferred to your Trust as "John Doe, Trustee" or

"John and Jane Doe, Trustees." Separate property should be titled "Separate Property of Jane Doe, Jane

Doe, Trustee."

By transferring property to your Living Revocable Trust, you do not give up any control over your

property. You may still sell your property or use it as collateral for a loan.

ASSETS WITH A BENEFICIARY

Generally, your spouse should be the first beneficiary of all life insurance policies, IRAs, Keogh,

Pension Plans, Annuities and other tax deferred assets. The second beneficiary or contingent beneficiary

should be your Trust. Contingent beneficiaries would be the recipients of the insurance upon the

simultaneous death of both the husband and the wife. In every instance, the named beneficiary in these

instruments takes precedence over any Will or Trust and avoids probate. *If you have a large estate (over

$5 million) and a large insurance policy, consult your estate planning attorney about ownership and

beneficiary designations.

1. The beneficiary designation for Whole Life and Universal Life Policies should be changed so

that the spouse is the first beneficiary and the Trust is the contingent beneficiary.

2. The beneficiary designation for IRAs, Keogh, Pension Plans, Annuities and other tax deferred

assets should be changed so that the spouse is the first beneficiary and the Trust is the contingent beneficiary

or second beneficiary. To transfer such assets (IRAs, Keogh Plans, 401K Plans, Life Insurance, etc.),

simply request transfer forms from the appropriate institution. Usually the insurance company (or other

institution) will send you one of their own forms to be signed and witnessed (i.e. notarized). Not every

company will handle it in the same manner.

Caution: Sometimes personnel in financial institutions are not as knowledgeable as you might expect.

Make it understood to the institution that you are not transferring ownership, only the beneficial interest.

E X A M P L E

How to change names on Deeds, Titles, Accounts, Etc.

Before the Trust, they were probably titled as:

LESTER O. SAMPLE and LESLIE O. SAMPLE

Tenants in Common or Joint Tenants

To fund the Trust, change names on Deeds and Titles to:

182

LESTER O. SAMPLE and LESLIE O. SAMPLE,

TRUSTEES OF THE SAMPLE LIVING TRUST

DATED DECEMBER 9, 2014

STOCK CERTIFICATES

Changing the title on your stock certificates is all that is required to transfer stock to your Revocable

Living Trust. If your stock is held by a brokerage firm, contact the firm to have your brokerage account

changed to reflect your status as Trustee of your Living Revocable Trust. Each certificate does not need to

be changed when you have a brokerage account. S corporations (close corporations), family farming

corporations and professional corporations normally require special language in the Trust to hold that stock.

AUTOMOBILES

Most people do not own automobiles of sufficient value to require transfer to a Trust. However,

when a very expensive RV or classic car is purchased, list the vehicle owner as you and your spouse as

Trustees for your Living Revocable Trust.

OTHER PERSONAL PROPERTY

Much of what you own does not have any title or certificate of ownership to be registered with a

government agency. Household belongings, jewelry, and other such property can be transferred to your

Trust by listing it on your "Schedule of Trust Assets" (Section 4).

TAX RETURNS

Since your Trust is revocable and you are its Trustee, no special tax returns are required. Your

annual 1040 Federal Income Tax Return is filed normally each year in April. See Treasury Regulations

[Regs. Sec. 1.671-3(a)(1)].

Also, remember that transferring your property to a Living Revocable Trust, of which you are

Trustee, is not a taxable event. It does not trigger any reappraisals for property taxes in states, including

Florida, which require taxes to be paid on property.

BANK AND SAVINGS ACCOUNTS

1. A letter or visit to your bank, savings bank, or savings and loan may include a request to have

your accounts changed to reflect your Living Revocable Trust ownership. Banks are familiar with Trusts;

however, be sure to inform your bank that your Trust is "revocable," with you as Trustee (See forms in

Section 14 or attached to the Certificate of Trust).

2. If a Trust I.D. number is requested, use either the husband or wife's social security

number.

3. FDIC Rule - Coverage for each account owner with combined revocable Trust deposit balances

of $1.25 million or less would be determined by multiplying the number of different beneficiaries by

$250,000. Other highlights are as follows:

183

a. The concept of “qualifying” beneficiaries based on certain family relationships has been

eliminated. A beneficiary must be a person, charity or another non-profit organization (as recognized by

the Internal Revenue Service). All other beneficiaries are not eligible for separate coverage as revocable

Trust deposits.

b. The beneficiary must become entitled to his or her interest in the Trust when the last

owner dies - coverage would be based on the beneficiaries who meet this requirement at the time the bank

fails. Example: A living Trust names the owners’ two children as beneficiaries but states that each

beneficiary’s share will pass to the beneficiary’s children if the beneficiary dies before the owner.

Assuming both children are alive at the time the bank fails, only the children - not the grandchildren - would

be beneficiaries for insurance purposes. (That’s because the grandchildren are not entitled to any Trust

assets while their parent is alive.) Coverage up to $1,000,000 ($250,000 per beneficiary, per owner) would

be available on the Trust’s deposit accounts.

c. The account title at the bank must indicate that the account is held by a Trust. This rule

can be met by using “Living Trust”, “Family Trust”, or similar terms in the account title.

d. These rules are subject to change by the FDIC. The above is an example of how the

FDIC rules work. Please review the FDIC website www.fdic.gov for more specific details and possible

changes. Credit union accounts are federally insured by the National Credit Union Association (NCUA)

in the same manner as bank accounts under the FDIC rules. More information can be obtained from their

website at www.ncua.gov.

SAFETY DEPOSIT BOXES

To transfer your safety deposit box into your Living Trust, show the bank representative your

Certificate of Trust and have him/her rewrite your file card in the name of your Living Trust. As a practical

matter, you should add your Successor Trustee as an owner of the safety deposit box at the time the account

is retitled.

MINUTES OF TRUST

In each Living Revocable Trust, a schedule called "Minutes of Trust" is included. The minutes

section of your Trust package is used to provide specific instructions to the Successor Trustees, those

individuals you included in your Trust to manage your Trust and distribute your assets following your

death.

The "minutes" can be used to leave personal instructions to the Trustee. These instructions are not

binding, but are merely guidance. For example, you might state in the minutes that your son, who is

identified in the Trust to receive 20% of the Trust assets, be given certain assets of yours as part of his 20%.

Your successor has a specific direction, signed by you, on how you would like your assets allocated.

SUMMARY

Execute the Documents - Sign the Trust, Pour-Over Will and the Durable Family Power of

Attorney. Have the proper witnesses and a notary public acknowledge the execution of the documents.

184

Fund the Trust - Transfer assets, i.e., real property, bank accounts, stocks and personal property,

to the Trust. An unfunded Trust will NOT avoid probate! Use warranty or quit claim deeds to transfer

real property to your Trust, and record the deeds in the county where the property is located. List your

personal property in "Schedule A" of the Trust. (Section 4).