www.duanemorris.com

©2014 Duane Morris LLP. All Rights Reserved. Duane Morris is a registered service mark of Duane Morris LLP.

Duane Morris – Firm and Affiliate Offices | New York | London | Singapore | Philadelphia | Chicago | Washington, D.C. | San Francisco | Silicon Valley | San Diego | Boston | Houston | Los Angeles | Hanoi | Ho Chi Minh City |

Atlanta | Baltimore | Wilmington | Miami | Boca Raton | Pittsburgh | Newark | Las Vegas | Cherry Hill | Lake Tahoe | Myanmar | Oman | Mexico City | Duane Morris LLP – A Delaware limited liability partnership

Introduction to Fund Formation

David A. Sussman

August 2014

www.duanemorris.com

Agenda

• Types of funds

• Structural issues

• Key documents

• Regulatory issues

1

www.duanemorris.com

Types of Funds

• Hedge Funds

– Typically invest in liquid, publicly-traded securities

– Investors make capital contributions upon

subscription

– Usually feature a one year lock-up, after which

investors may withdraw from the Fund

– Allocates profits and losses based on realized and

unrealized gains

2

www.duanemorris.com

Types of Funds

• Private Equity Funds

– Make long-term, illiquid investments

– Investors make “capital commitments” upon

subscription

– Fund manager makes “capital calls” from the

investors’ commitments

– Allocates profits and losses based on realized

gains

3

www.duanemorris.com

Types of Funds – Fee Structures

• Hedge Funds:

– Manager typically collects an annual management

fee:

Set fee as an annual rate as a percentage of the

total amount of the net asset value of the

investments owned by the Fund (the “AUM Fee”)

– Manager also collects an Incentive Allocation:

Percentage of the Fund’s net realized and

unrealized profits

4

www.duanemorris.com

Types of Funds – Fee Structures

• Private Equity Funds

– Manager receives an annual Management Fee

Early Investment Period: percentage of the Fund’s

total capital commitments

Post-Investment Period: percentage of the Fund’s

invested capital

– Manager also receives a Carried Interest

Percentage of the Fund’s realized profits

5

www.duanemorris.com

Structure

• Formed as a limited partnership

– Fund investors are the Limited Partners

• Sponsor forms one or two separate limited

liability companies

• Three-party structure vs. two-party structure

6

www.duanemorris.com

The Limited Partnership

• General Partner

– Often a limited liability company (”GP Entity”)

– Responsible for overall Fund management

• Limited Partners

– Passive investors

– Limited liability

– Partnership interests are considered “securities”

• Flow-through tax treatment

• Flexibility in management

– Broad authority for GP Entity

7

www.duanemorris.com

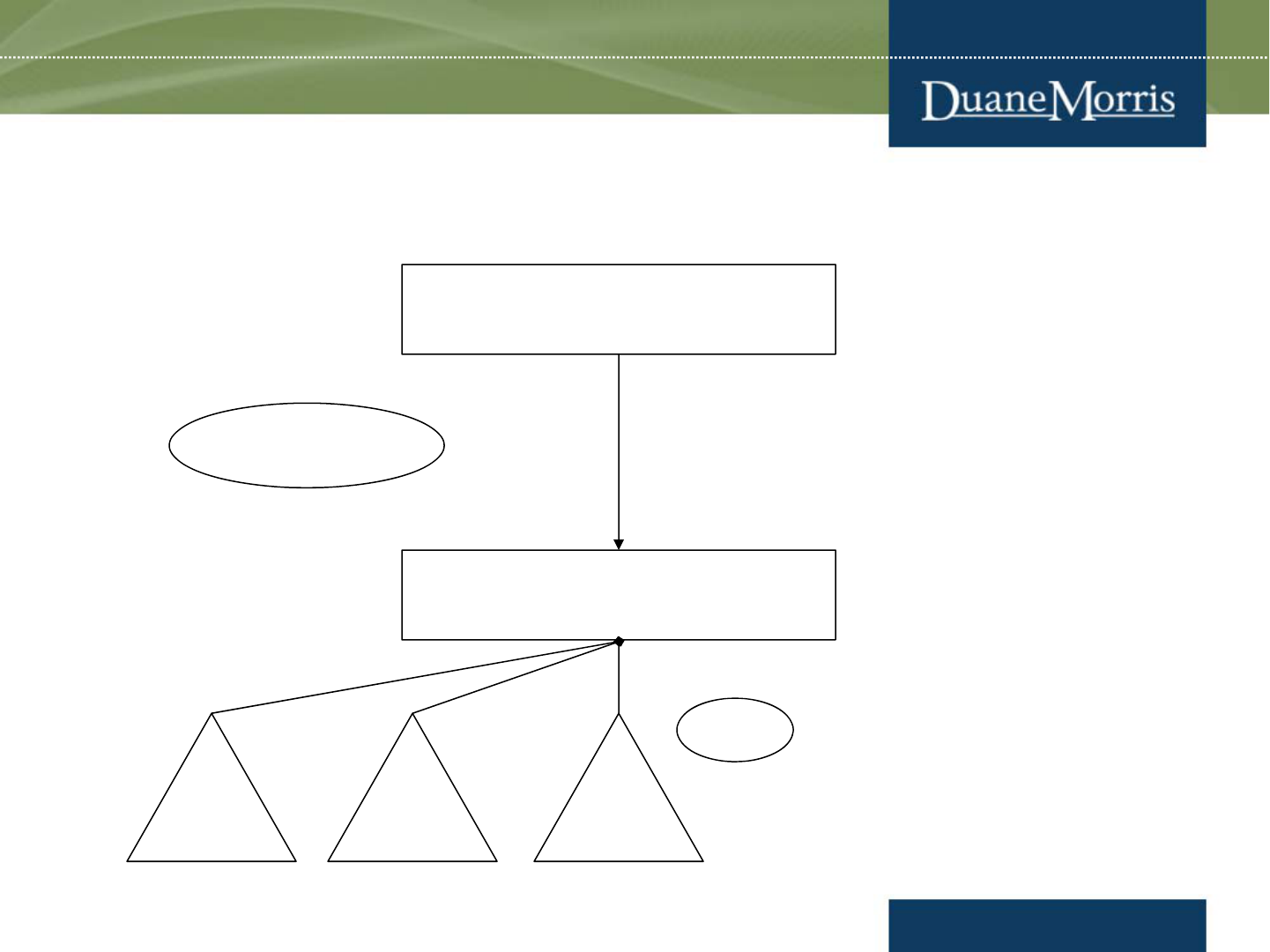

Three-Party Structure

General Partner

(Limited Liability Company)

Management Company

(Limited Liability Company)

Invests in/administers

Fund

FUND

(Limited Partnership)

Manages investments

for Fund

Invest

in Fund

Investor

(LP)

Investor

(LP)

Investor

(LP)

8

www.duanemorris.com

Three Party Structure

• GP Entity receives Incentive Allocation/Carried

Interest

• Management Company of a Private Equity

Fund:

– Receives the Management Fee

• Management Company of a Hedge Fund:

– Receives the AUM Fee

9

www.duanemorris.com

Two-Party Structure

Invest

in Fund

Investor

(LP)

Investor

(LP)

Investor

(LP)

10

General Partner

(Limited Liability Company)

Invests in, administers

and manages

investments for Fund

FUND

(Limited Partnership)

www.duanemorris.com

Two-Party Structure

• Hedge Fund:

– GP Entity collects Incentive Allocation and AUM

Fee

• Private Equity Fund:

– GP Entity collects Incentive Allocation and

Management Fee

11

www.duanemorris.com

Key Documents

• Private Placement Memorandum

• Limited Partnership Agreement

• Subscription Booklet

• GP Entity LLC Agreement

• Management Company LLC Agreement

• Investment Management Agreement

12

www.duanemorris.com

Private Placement Memorandum (“PPM”) –

Sets forth key information about the Fund

• Investment strategy

• Risk factors

• Information about GP Entity and Management Company

• Management Fee/AUM Fee/Incentive Allocation/Carried

Interest

• Other fees/expenses

• Conflicts of Interest

• Tax matters

• Synopsis of Limited Partnership Agreement

13

www.duanemorris.com

Limited Partnership Agreement –

Parties: GP Entity and Limited Partners

• Features:

–Term

– Object/purpose

– Limitation of liability

– Management

– Indemnification

– Fees

– Fund expenses

– Tax matters

– Valuation of Assets

– Assignment and transfer

14

www.duanemorris.com

Limited Partnership Agreement –

Parties: GP Entity and Limited Partners

– Hedge Funds:

Capital accounts

Allocations

Distributions

– Private Equity Funds:

Capital contributions

Capital commitments

Capital calls

Distributions

Defaulting Limited Partners

– Hedge Funds: admission/withdraw provisions

– “Key Man” provisions

– GP Entity removal

– Books & records/Periodic reporting

15

www.duanemorris.com

Subscription Documents –

Confirm Investor’s obligation to purchase fund interests - Provides

important information about an Investor

• Importance of Subscription Documents

– Exemptions

– Duty to update

• Investor Information

– Identifying information

– Amount of commitment

16

www.duanemorris.com

Subscription Documents –

Confirm Investor’s obligation to purchase fund interests - Provides

important information about an Investor

– Representations and warranties

Type of investor (individual or entity); Net worth

NASD New Issues Rule

Acknowledgements (receipt of documents, questions

answered, etc.)

Accredited investor, qualified purchaser and/or qualified

eligible person status

Acknowledgement of unregistered/restricted status of Fund

Indemnification provisions

– Investors that are private funds or “benefit plan

investors” – 1940 act and ERISA exemptions

– Confidentiality

17

www.duanemorris.com

Regulatory Issues

• Securities Act of 1933

• Investment Advisers Act of 1940

• Investment Company Act of 1940

• Securities Exchange Act of 1934

18

www.duanemorris.com

Registration of Offer and Sale of Fund

Securities Under the 1933 Act

• Interests in a Fund are “securities” under 1933

Act

• Exemptions

– Section 4(2) of the 1933 Act

Private placement exemption

– Regulation D

Safe harbor that qualifies offerings for exemption

under Section 4(2)

Reduces uncertainty and specifies objective criteria

19

www.duanemorris.com

Regulation D

Accredited Investors

• Rule 506 is most relevant for Funds

• Exemptions for offerings made exclusively to “accredited investors”

• Accredited Investor Criteria Generally:

– Natural person with net worth in excess of $1 million. The “net worth” test: (i)

excludes the value of the investor’s primary residence; and (ii) provided that such

indebtedness was incurred prior to 60 days before the investor’s investment into

the fund, excludes the amount of liabilities secured by the investor’s primary

residence unless and to the extent that such liabilities exceed the value of the

investor’s primary residence.

– Natural person with an annual income of:

Individually: $200,000; Jointly: $300,000

– Trust with assets in excess of $5,000,000

– Any entity beneficially owned exclusively by accredited investors

20

www.duanemorris.com

Regulation D

General solicitation or advertising

• Prior to the enactment of the Jumpstart Our Business Startups Act (the “Jobs Act”), general

solicitation was prohibited in connection with Regulation D offerings.

• The Jobs Act amended the general solicitation rules and, in July, 2013, the SEC issued final rules

allowing for the general solicitation in Regulation D offerings provided that the investors are all

accredited investors and the issuer takes reasonable steps to verify each of the investor’s accredited

investor status.

• Whether the issuer has taken “reasonable steps” to verify accredited investor status is a facts and

circumstances analysis. However, the SEC has issued a non-exclusive and non-mandatory list of

ways in which issuers will be deemed to satisfy the verification requirement as long as the issuer

does not have knowledge that the investor is not an accredited investor. The list includes the

following: (i) review of the investor’s tax return for 2 years and also receive a written statement that

the investor expects to reach the income necessary to qualify, (ii) review 3 months’ worth of financial

statements and also receive a representation that the investor has disclosed all liabilities necessary

to make a net worth determination, (iii) the issuer may receive 3

rd

party verification from a registered

broker-dealer, a registered investment advisor, a licensed attorney, or a licensed accountant; and (iv)

the issuer may receive written certification from an existing investor that such investor still qualifies

as an accredited investor.

• Based upon these rules and verification requirements, most funds are well advised NOT to

engage in general solicitation.

21

www.duanemorris.com

Regulation D –

Other considerations

• Investors must not invest with a view to

distribute interests to the public

• Form D filing

• Exemption from State Registration/Blue Sky

Laws

– National Securities Markets

Improvement Act of 1996

– Notice filings

22

www.duanemorris.com

Advisers Act

Small Adviser Exemption Before Dodd-Frank Act

• Prior to the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection

Act in 2010 (the “Dodd-Frank Act”), the GP Entity and/or Management Company:

Was required to register with the SEC if it had $30 million or more of “assets

under management”

Was allowed to register with the SEC if it had at least $25 million or more of

“assets under management”

Small Adviser Exemption: However, small advisers were not required to

register with the SEC even if they had $30 million or more of assets under

management. “Small Advisers” were investment advisers that: (i) had fewer

than 15 clients in preceding 12 months, (ii) did not advise registered

investment companies or business development companies, and (iii) did not

“hold itself out to the public” as an investment adviser. The Management

Company typically satisfied this exemption because the Fund qualified as a

single client.

23

www.duanemorris.com

Advisers Act

Registration Requirements Post-Dodd-Frank Act

• New Thresholds for SEC Registration: The Dodd-Frank Act significantly changed the landscape for investment

advisers. Generally, investment advisers are subject to the new threshold amounts for registration: (i) investment

advisers with less than $25 million of assets under management (“small advisers”) are generally prohibited from

registering with the SEC and must register with the state regulators unless an exemption applies, (ii) investment

advisers with $25 million to $110 million of assets under management (“mid-sized advisers”) are generally prohibited

from registering with the SEC and must register with the state regulators unless an exemption applies but there is a

buffer for advisers between $100 million and $110 million, and (iii) advisers with $110 million are required to register

with the SEC.

• Exemptions from Registration with the SEC:

Advisers only to Venture Capital Funds

Advisers only to Private Funds with less than $150 million in assets under management

Advisers that are Foreign Private Advisers

Advisers only to Small Business Investment Companies (“SBICs”)

Advisers only to Family Offices

Intrastate Advisers

• Obligations of Investment Advisers that are Exempt from Registering with the SEC: Notwithstanding that an

investment adviser may not be required to register with the SEC, such advisers may be subject to certain SEC rules,

relating to: (i) the anti-fraud provisions, (ii) the pay-to-play rules, (iii) certain supervisory requirements, and (iv)

principal transactions rules. Further, investment advisers relying on the Venture Capital Funds or Private Fund’s

exemptions from registration, such advisers will be considered “Exempt Reporting Advisers” and required to a subset

of the Advisers Act rules, including, submitting a truncated version of the Form ADV and be subject to SEC

examinations.

24

www.duanemorris.com

Advisers Act

Compliance Requirements for SEC Registered Investment Advisers

• Investment advisers that are registered with the SEC, generally, will become subject to

the full scope of the Advisers Act. These include:

Filing current disclosures on Form ADV

Satisfying certain record-keeping requirements

Being subject to SEC Office of Compliance examinations

Establishing, maintaining, and implementing compliance programs (including

written policies and procedures reasonably designed to prevent violations of

the Advisers Act or other securities laws, proxy voting policy, insider trading

policy, and code of ethics, designating a Chief Compliance Officer tasked for

administrating the firm’s policies and procedures, performing periodic training

on policies and procedures, and performing compliance reviews at least

annually)

Satisfying the SEC’s Custody Requirements

Complying with advertising rules

Remaining subject to restrictions on performance fees

25

www.duanemorris.com

Investment Company Act

• Most Common Exemptions:

– Section 3(c)(1) Funds

Not making or proposing to make a public offering

Beneficial ownership is limited to fewer than

100 persons

– Section 3(c)(7) Funds

Not making or proposing to make a public offering

All owners must be “qualified purchasers”

26

www.duanemorris.com

Investment Company Act – 3(c)(1) Funds

• 100 Beneficial Owner Limit

– Natural persons:

Individuals

Spouses holding interests jointly

Involuntary transfers do not increase the number of

beneficial owners

– Entities:

Companies that own 10% or more of the Fund

Look-through to beneficial owners

Only applies to other Funds and Investment Companies

27

www.duanemorris.com

Investment Company Act – 3(c)(1) Funds

• Prohibition Against Public Offerings

– Generally satisfied by complying with

Regulation D prohibitions

28

www.duanemorris.com

Investment Company Act – 3(c)(7) Funds

• Exclusive ownership by “Qualified Purchasers”

– Natural persons who own not less than $5 million in

investments

– Family companies that own not less than $5 million in

investments

– Trusts with a trustee and settlor who are qualified

purchasers

– Institutional buyers that own and invest on a

discretionary basis not less than $25 million in

investments

– Companies in which each beneficial owner of the

company’s securities is a qualified purchaser

29

www.duanemorris.com

Investment Company Act – 3(c)(7) Funds

• Prohibition Against Public Offerings

– Generally satisfied by complying with

Regulation D prohibitions

30

www.duanemorris.com

Exchange Act

• Broker-Dealer Registration

– Broker: any person engaged in the business of

effecting transactions for the account of others

Funds are not brokers because any trading activity is

done for their own account

– Dealer: any person engaged in the business of buying

or selling securities for such person’s own account

through a broker or otherwise

Funds are not dealers because they are not considered

to be “in the business” of buying and selling securities

– Funds are considered to be “traders” that buy and sell

for investments generally

31

www.duanemorris.com

Exchange Act

• Section 12 of the Exchange Act

Prior to the enactment of the Jobs Act, Section 12(g)

required issuers to register a class of equity securities with

the SEC if, on the last day of the issuer’s fiscal year, such

class of securities was held of record by 500 or more record

holders and the issuer had total assets of more than $10

million.

Title V of the Jobs Act amended Section 12(g) of the

Exchange Act which now provides that an issuer will

become subject to the Exchange Act requirements within

120 days after the last day of its fiscal year on which the

issuer has total assets in excess of $10 million and a class

of equity securities (other than exempted securities) held of

record by either: (i) 2,000 persons, or (ii) 500 person who

are not accredited investors

.

32

www.duanemorris.com

Further information

David Sussman, Partner, Newark, NJ

+1 (973) 424-2011

33

www.duanemorris.com

©2014 Duane Morris LLP. All Rights Reserved. Duane Morris is a registered service mark of Duane Morris LLP.

Duane Morris – Firm and Affiliate Offices | New York | London | Singapore | Philadelphia | Chicago | Washington, D.C. | San Francisco | Silicon Valley | San Diego | Boston | Houston | Los Angeles | Hanoi | Ho Chi Minh City |

Atlanta | Baltimore | Wilmington | Miami | Boca Raton | Pittsburgh | Newark | Las Vegas | Cherry Hill | Lake Tahoe | Myanmar | Oman | Mexico City | Duane Morris LLP – A Delaware limited liability partnership

Introduction to Fund Formation

David Sussman

August 2014