Renee Campion

Commissioner

Daniel Pollak

First Deputy Commissioner

General Counsel

Office of Labor Relations

E

MPLOYEE

B

ENEFITS

P

ROGRAM

22 Cortlandt Street, 12th Floor, New York, NY 10007

nyc.gov/olr

Georgette Gestely

Director, Employee Benefits Program

Beth Kushner

Deputy Director, Administration

Sang Hong

Deputy Director, Operations

Michael Babette

Director, Financial Management Unit

Important Information Concerning Coverage Under COBRA in the State of New York

The attached information concerns coverage that may be available to you through the Federal

Consolidated Omnibus Reconciliation Act (“COBRA”) which provides access to continuing

health coverage for a period of 18 months to 36 months depending on the reason for COBRA

eligibility.

The State of New York enacted legislation intended to provide continued access to group

health insurance for all persons eligible for COBRA or state continuation (“mini-COBRA”)

coverage up to a total of 36 months of coverage. For more information concerning how this

may impact your coverage under COBRA please use the following link:

http://www.dfs.ny.gov/consumer/cobra_ext_36.htm

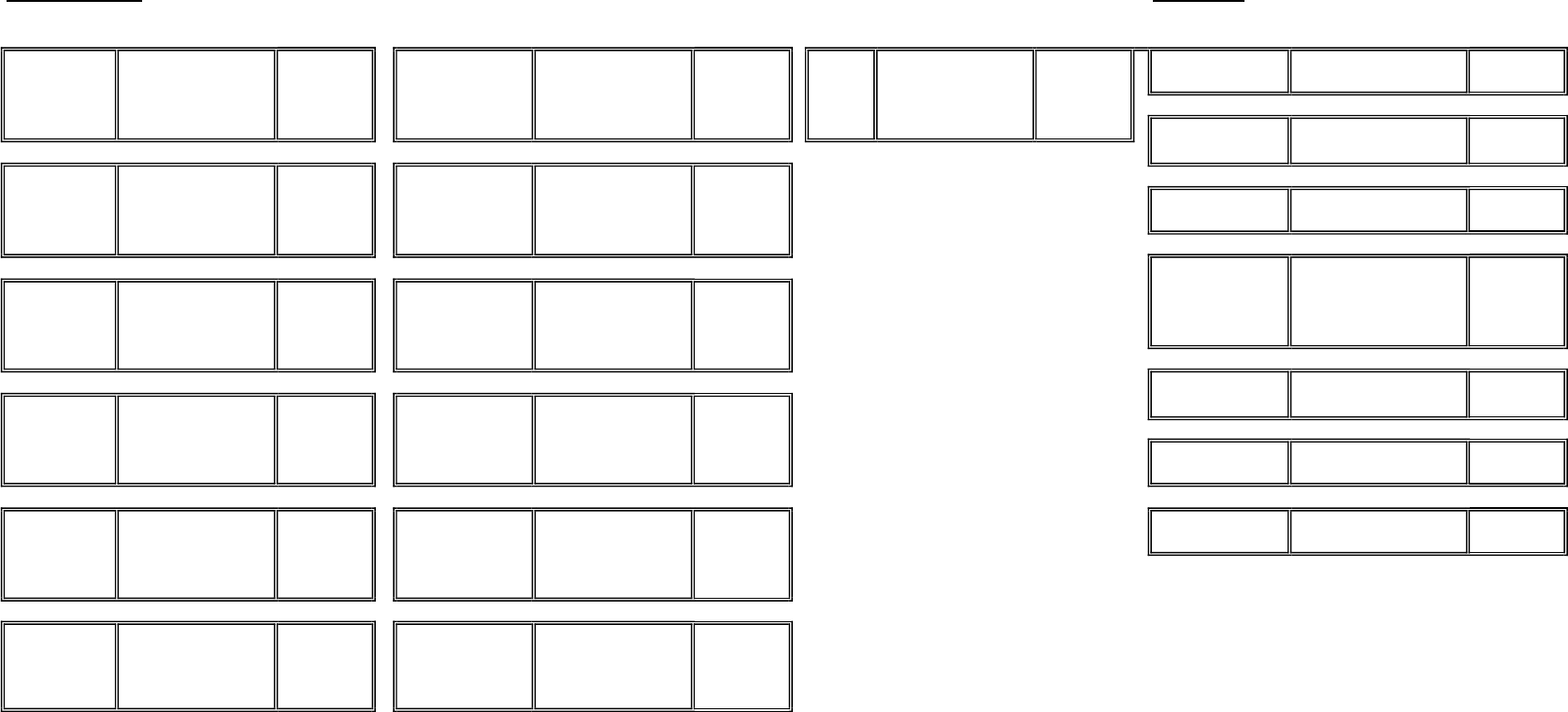

CITY OF NEW YORK EMPLOYEE BENEFITS PROGRAM

CONTINUATION OF COVERAGE APPLICATION

REASON

FOR

SUBMISSION

(PLEASE

PRINT

CLEARLY)

(CHECK ONE)

Date of Qualifying Event

/ /

Termination of Employment/Member Reduction of Work Schedule Divorce or Legal Separation Termination of Domestic Partnership

Death of Employee/Retiree

Present

or

former

Contract

Loss of Eligibility as a Dependent Child

Present

or

Former

Social

Secruity

Number:

Holder’s

Name:

Health

Plan:

Relationship to

Present or

Former Contract

Holder

Self

Spouse (former or current)

Domestic Partner

Son

Daughter

Present or Former City

Employee’s Welfare Fund:

APPLICANT

INFORMATION

(PLEASE

PRINT)

Last Name:

First Name:

M.I.:

Social Security Number:

Home Telephone #:

( )

Mailing Address:

Apt.:

Date of Birth:

Sex: Male

Female

City:

State:

Zip Code:

Marital Status: Married Single Widowed

Domestic Partner Legally Separated Divorced

Date of Marital Status Event:

/ /

Is

Applicant

or

Any

Dependent

Covered by

Medicare?

Yes

No

If

Yes, a

COPY

of

the

Medicare

Card

MUST

be attached.

FAMILY

INFORMATION

(PLEAS

E

LIST

ALL

PERSONS

TO

BE

CO

VERED,

INCLUDING

EMPLOYE

E

IF

APPLICABLE

(PLEASE

PRINT)

First Name

Last Name

Social Security

Number

Date of

Birth

Check if Applicable

Relationship

Full

Time

Student

Perm-

anently

Disabled

Covered by

Other Group

Insurance

Self

Spouse

Dom.

Partner

Son

Daughter

Aetna

EPO

Cigna

Health

DC

37

Med-Team

Empire

EPO

-

Nationwide

Empire

HMO

-

New

York

GHI-

CBP/EBCBS

GHI

HMO

HIP Prime

HMO

HIP

Prime

POS

MetroPlus

Vytra

Health

Plan

OTHER

Optional

Benefits

(Please

check

one):

Yes

No

WELFARE

FUND

- COBRA

Contact your your union or welfare fund directly for the necessary forms, available options and costs. You will pay

the union welfare fund directly for the

cost of these benefits.

AUTHORIZATION

I certify

that the above information is correct.

I fully

understand that I am responsible

for the full cost of my continuance of coverage and will be subject to the terms and

condictions of the group contract.

/ /

Applicant’s Signature Date

I choose to waive my rights to extend my current health coverage under COBRA.

I wish to convert to a direct payment policy.

Please send me a conversion contract.

/ /

Applicant’s Signature Date

ebpcobraform06302017.indd

THIS

NOTICE

MUST

BE

MAILED

DIRECTLY

TO

YOUR

HEALTH

PLAN

FOR

COBRA

CONTINUATION

COVERAGE

OR

FOR

DIRECT

PAYMENT

CONVERSION

(See

Plan

Description

for

address)

HEALTH PLAN REQUESTED (check the box before the plan you want and you must check “yes or no” for the optional rider benefits).

}

City of New York

Office of Labor Relations

Health Benefits Program

COBRA Premiums

Under the Federal Consolidated Omnibus Budget Reconciliation Act (COBRA), you have the opportunity to continue

health benefits coverage through the City of New York group.

You are responsible for paying the full premium for your plan and coverage. The premium levels indicated on the back of

this page reflect 102% of the current rate (because these rates are subject to change, you should check with the plan to

determine the premium at the time of your COBRA enrollment). Payments may be made monthly on the first of the

month. There is usually a 30 day grace period. The City will not "carve out" benefits provided through your Welfare Fund

that are similar to those available in your plan's Optional Rider. If you decide to purchase the Optional Rider, you must

pay for the entire Optional Rider offered by your chosen plan. If you decide to purchase any of your Welfare Fund

benefits, you should contact the Welfare Fund to determine what benefits are available, and the associated cost.

Health Plan Addresses

Payment should be mailed directly to the plan chosen for COBRA continuation coverage. The plan addresses are:

Aetna HealthCare

151 Farmington Ave.

Hartford, CT 06156

Attn: Michele Wrenn

CIGNA Healthcare

140 East 45th Street, 9th Fl

New York, NY 10017

Attn: Erika Larson

Engagement Consultant

DC 37 Med-Team

55 Water Street, 23

rd

Fl.

New York, NY 10041

Attn: Magaly Mendez-Bravo

Accounting Department

Empire BlueCross BlueShield

3 Huntington Quadrangle, 3 Fl.

Melville, NY 11747

Attn: Lashern Pendergast

GHI CBP\EBCBS*

GHI HMO

EmblemHealth

55 Water Street

New York, NY 10041

Attn: Membership Department

HIP HMO

HIP POS

EmblemHealth

55 Water Street

New York, New York 10041

Attn: Membership Department

MetroPlus Health Plan

50 Water Street, 7

th

Fl.

New York, NY 10004

Attn: COBRA/Finance Dept.

Vytra

EmblemHealth

55 Water Street

New York, NY 10041

Attn: Membership Department

*The GHI CBP/EBCBS is offered as package under COBRA. The premium should be sent to the EmblemHealth

address indicated above.

CONVERSION CONTRACTS - City Health Plan Benefits

If you do not wish to continue coverage under COBRA you may use the same application to request direct payment

conversion contracts from all plans. Conversion contract payments will be due quarterly. Upon receipt of an application

for conversion, the health plan will send you a direct payment contract and a bill. Generally, conversion contracts will be

more expensive than COBRA for the same benefits or will offer benefits less comprehensive than COBRA, with the

exception of certain Medicare supplemental contracts. Optional benefits are not available under conversion. You may

purchase either Group Health Inc. or Empire BlueCross BlueShield direct payment plan separately. Decide whether direct

payment conversion or COBRA continuation coverage is best to meet your needs. If you decide to continue coverage

under COBRA, you will again be eligible to obtain direct payment contracts when COBRA terminates. Contact the health

plan for more information concerning direct payment contracts.

Welfare Fund Benefits

Contact your welfare fund directly for COBRA rates. If you do not wish to continue coverage of benefits provided by your

welfare fund under COBRA, conversion to private coverage may be available for medical and life insurance benefits within

45 days of termination of coverage. If you intend to obtain welfare fund benefits under COBRA, please so indicate on the

COBRA Continuation of Coverage application.

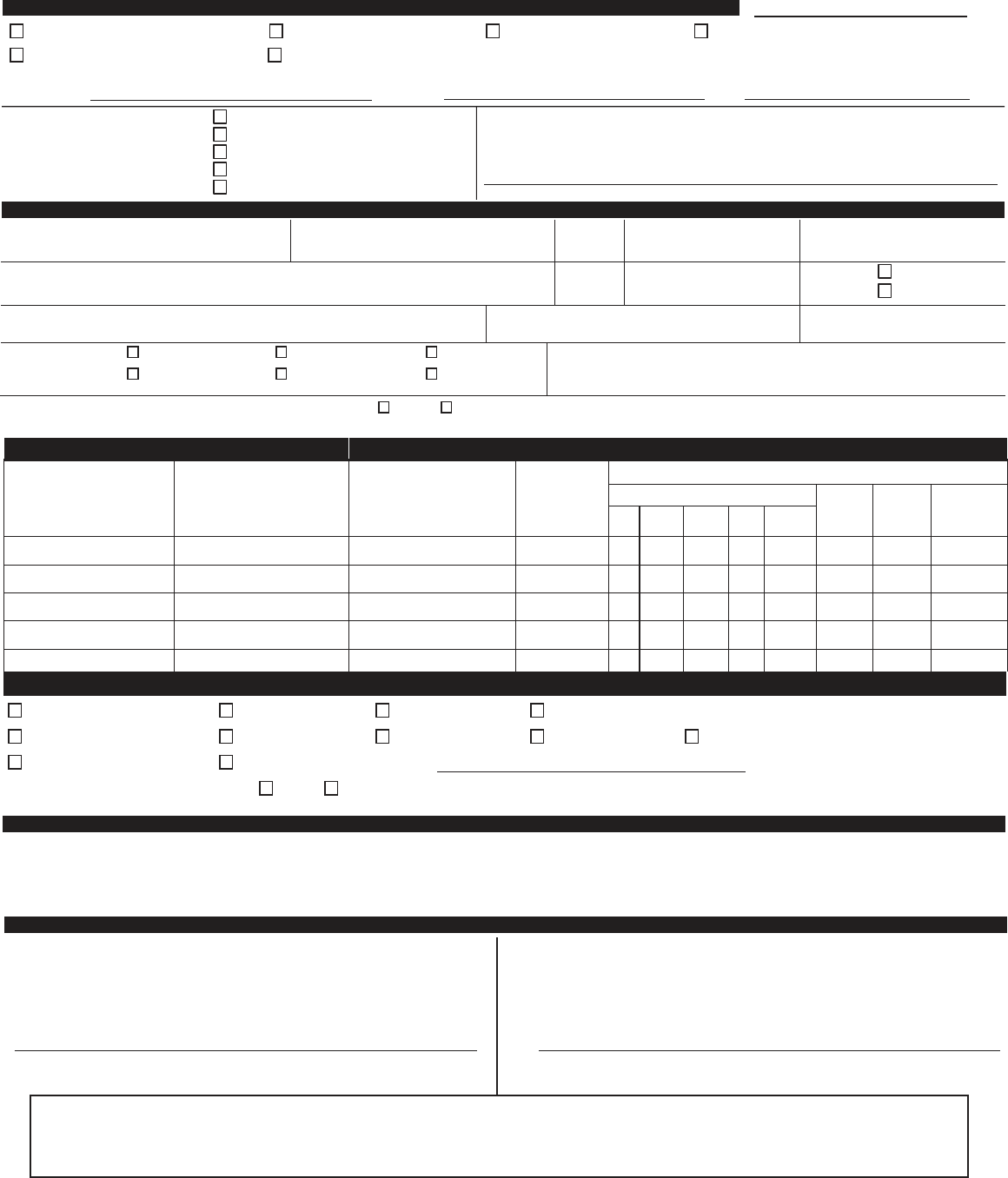

NON-MEDICARE

Monthly COBRA Rates for Effective October 2022

MEDICARE

Plans Monthly COBRA Rates for Effective January 2023

PLAN Coverage COBRA RATE PLAN Coverage COBRA RATE PLAN Coverage COBRA RATE PLAN Coverage COBRA RATE

INDIVIDUAL BASIC $1,395.85 INDIVIDUAL BASIC $937.68 INDIVIDUAL BASIC $1,147.38 PER PERSON BASIC $208.18

FAMILY BASIC $4,179.98 FAMILY BASIC $2,299.85 FAMILY BASIC $3,014.03 PER PERSON with RIDER $339.00

INDIVIDUAL with RIDER

$3,563.69

INDIVIDUAL with RIDER

$1,289.49

INDIVIDUAL with RIDER

$1,550.56

FAMILY with RIDER $10,311.34 FAMILY with RIDER $3,161.83 FAMILY with RIDER $4,062.95 PER PERSON BASIC $874.53

PER PERSON with RIDER $961.23

INDIVIDUAL BASIC $2,015.00 INDIVIDUAL BASIC $937.68

FAMILY BASIC $5,207.31 FAMILY BASIC $2,299.85 PER PERSON BASIC $220.72

INDIVIDUAL with RIDER

$2,351.49

INDIVIDUAL with RIDER

$1,047.87 RIDER NOT AVAILABLE

FAMILY with RIDER $6,225.70 FAMILY with RIDER $2,501.86

ONE PERSON BASIC $353.34

INDIVIDUAL BASIC $1,929.33 INDIVIDUAL BASIC $2,082.33 TWO PERSONS BASIC $498.49

FAMILY BASIC $4,824.32 FAMILY BASIC $5,104.24 ONE PERSON with RIDER $558.31

INDIVIDUAL with RIDER

$2,333.34

INDIVIDUAL with RIDER

$2,461.94 TWO PERSONS w/RIDER $908.43

FAMILY with RIDER $5,814.77 FAMILY with RIDER $6,034.30

PER PERSON BASIC $7.65

INDIVIDUAL BASIC $1,342.28 INDIVIDUAL BASIC $966.84 PER PERSON with RIDER $117.81

FAMILY BASIC $3,485.53 FAMILY BASIC $2,371.29

INDIVIDUAL with RIDER

$1,746.29 PER PERSON BASIC $28.05

FAMILY with RIDER $4,475.98 PER PERSON with RIDER $108.63

INDIVIDUAL BASIC $1,202.15 INDIVIDUAL BASIC $937.68 PER PERSON BASIC $7.65

FAMILY BASIC $3,062.14 FAMILY BASIC $2,299.85 PER PERSON with RIDER $188.79

INDIVIDUAL with RIDER

$1,674.99

INDIVIDUAL with RIDER

$1,222.23

FAMILY with RIDER $4,268.01 FAMILY with RIDER $3,011.22

Rates are Subject to Change

INDIVIDUAL BASIC $957.86 INDIVIDUAL BASIC $937.68

FAMILY BASIC $2,514.09 FAMILY BASIC $2,299.85

INDIVIDUAL with RIDER

$1,067.83

INDIVIDUAL with RIDER

$1,079.38

FAMILY with RIDER $2,715.68 FAMILY with RIDER $2,558.73

NOTE: If you were enrolled in a Medicare HMO you MUST

contact your health plan DIRECTLY for benefit and cost

information regarding continuation of coverage.

Return the completed COBRA form to your chosen plan. Addresses are listed on the front of this pamphlet. Wait for notification from the plan before

mailing in your first payment. Checks and/or money orders must be made payable to the health plan and mailed DIRECTLY to the plan. Enrollees of all

plans not listed must contact the plan DIRECTLY for enrollment options.

Aetna PPO/ESA

(NY/NJ/PA)

Aetna PPO/ESA

(All other areas)

GHI-CBP/BCBS

METROPLUS

(Grandfathered)

HIP VIP

METROPLUS

(Standard)

AETNA EPO

CIGNA

EMPIRE EPO

EMPIRE Blue

Access Gated

EPO

GHI HMO

GHI SENIOR CARE

GHI HMO Medicare

Senior Supplement

HIP HMO Gold

Preferred Plan

(Grandfathered)

HIP PRIME POS

DC 37 MED TEAM

(no rider available)

DC37 MED TEAM

EMPIRE

MEDICARE

RELATED

HIP HMO Gold

Preferred Plan

(Standard)

VYTRA

City of New York

Office of Labor Relations

Health Benefits Program

Notice of Rights

WHEN YOUR HEALTH BENEFITS TERMINATE

The Consolidated Omnibus Budget Reconciliation Act (Public Law 99-2721, Title X), also known as

COBRA, was enacted April 7, 1986. This law requires that, effective July 1, 1987, in addition to offering

normal conversion opportunities, the City and the union welfare funds must offer employees and their

families the opportunity for a temporary extension of group health and welfare fund coverage (called

“continuation of coverage”) at 102% of the group rates, in certain situations in which benefits under either

City basic or the applicable welfare fund would be reduced or terminated. This notice is intended to inform

you of your rights and obligations under the continuation coverage provisions of this law as well as your

normal conversion option.

As a result of collective bargaining agreements, Medicare-eligible enrollees and/or their Medicare-

eligible dependents will be offered continuation benefits similar to COBRA if a COBRA event should occur.

(See Medicare-Eligible Section.)

Employees

All City group health benefits including the optional benefits riders are available under COBRA

continuation coverage. Welfare fund benefits eligible for continuation under COBRA are dental, vision,

prescription drugs and other related medical benefits. Welfare funds offer core benefits (prescription drugs

and major medical plans) and non-core benefits (dental and vision) which may be purchased separately or

combined with City core benefits.

If you are a non-Medicare-eligible employee covered by the City program, you have the right, in

certain situations, to continue benefits if you lose your coverage because of a reduction in your hours of

employment; or upon the termination of your employment (for reasons other than gross misconduct on your

part); or if you take an unpaid leave of absence. If you are Medicare-eligible, you may be entitled to

continuation of coverage as is described in the Medicare-eligible section below.

Retirees

You and your dependents are eligible to receive City-paid health care coverage if you have, at the

time of retirement:

a.

Ten (10) years of credited service as a member of a retirement or pension system maintained by

the City (if you were an employee of the City on or before December 27, 2001, then at the time of your

retirement you must have at least five (5) years of credited service as a member of a retirement or pension

system maintained by the City). This requirement does not apply if you retire because of accidental disability;

and

b.

You have been employed by the City immediately prior to retirement as a member of such

system, and have worked regularly for at least 20 hours per week; and

c.

You receive a pension check from a retirement system maintained by the City.

If you do not meet these eligibility requirements, you and your dependents (if not Medicare-eligible)

may continue under COBRA the benefits you received as an active employee, for a period of 18 months at

102% of the City’s cost. If your welfare fund benefits are reduced at retirement, you are eligible to continue

those benefits that were reduced under the welfare fund as a COBRA enrollee for a period of 18 months at

102% of the cost to the union welfare fund. You should contact your union welfare fund for the premium

amounts and benefits available.

Spouse/Domestic Partners and Dependents

If you are the non-Medicare-eligible spouse/domestic partner of an eligible employee or a retiree,

you have the right to continue coverage under any of the available NYC health benefits plans and the

applicable welfare funds if your health insurance or welfare fund benefits are reduced or terminated for any

of the following reasons:

1)

The death of your spouse/domestic partner;

2

2)

The termination of your spouse/domestic partner's employment (for reasons other than gross

misconduct) or reduction in your spouse/domestic partner's hours of employment;

3)

Divorce or legal separation from your spouse.

In the case of an eligible dependent child of an employee or retiree (including a newborn child who

was born to the covered beneficiary or an adopted child who is placed for adoption with the covered

beneficiary during a period of COBRA continuation coverage) he or she has the right to continue coverage

under any of the available NYC health benefits plans and the applicable welfare fund if coverage is reduced

or terminated for any of the following reasons:

1)

The death of the covered parent;

2)

The termination of the covered parent’s employment (for reasons other than gross

misconduct) or reduction in the parent’s hours of employment;

3)

The dependent ceases to be a “dependent child” under the terms of the Employee

Benefits Program;

4)

Retirement of the covered parent (see “Retiree” above).

If you are a Medicare-eligible spouse/domestic partner or dependent, see section on Medicare-eligible's.

Disabled Persons

If a disability has led to Medicare eligibility, see section on Medicare-eligibles below.

Covered persons who are disabled, under the definition established by the Social Security law, up to

60 days after the COBRA qualifying event of termination of employment or reduction of hours, are entitled to

continue coverage for up to a total of twenty-nine (29) months from the date of the initial qualifying event.

The cost of coverage during the last eleven (11) months of this extended period is one hundred and fifty

percent (150%) of the City cost for the benefit. Persons so disabled must inform the health plan within sixty

(60) days of the disability determination and within thirty (30) days of disability ceasing.

Medicare-

Eligibles

Employees, retirees, spouses/domestic partners and dependents who are eligible for Medicare may

be eligible to receive continued coverage, similar to COBRA, under the City’s Medicare-Supplemental plans.

Periods of eligibility shall date from the original qualifying event up to eighteen (18) months in the case of

loss of coverage because of termination of employment or reduction in hours, or up to thirty-six (36) months

in the case of loss of coverage for all other reasons.

If a COBRA qualifying event occurs and you lose coverage, but you and/or your dependents are

Medicare-eligible, you may continue coverage by using the COBRA Continuation of Coverage application

form. You should indicate your Medicare claim number and effective dates where indicated on the form for

Medicare-eligible family members. If you and/or your dependents are about to become eligible for

Medicare, and are already continuing coverage under COBRA, inform the carrier of Medicare eligibility for

you and/or your dependents, at least thirty (30) days prior to date of Medicare eligibility. COBRA-

enrolled dependents of the person who becomes Medicare eligible will be able to continue their COBRA

coverage, whether or not the Medicare-eligible person enrolls in the Medicare-Supplemental coverage. The

COBRA continuation period for dependents will be unaffected by the decision of the Medicare-eligible

employee or retiree.

NOTE: You should contact your carrier for information about other Medicare-Supplemental plans which are

offered; some other plans may be better suited to your needs and/or less costly than the plan which is

provided under the City’s contract.

3

Notice

Under the law you have sixty (60) days from the date you receive this notice to elect continuation

coverage for your City basic and/or optional benefits. Contact your welfare fund administrator for further

instructions on how to continue your welfare fund benefits. Payments of the initial monthly premium may

accompany the enclosed Continuation of Coverage Application opting for continuation. However, under the

law you have a grace period of 45 days from the date you applied for COBRA coverage to pay the premium.

You will receive a partial bill for any remaining portion of the following calendar month to bring your billing

date to the first of the month. All subsequent bills will be charged from the first day of the month during your

COBRA continuation period. Payment shall be on a monthly basis. There is a 30-day grace period for

subsequent late payments.

If you choose COBRA continuation coverage, and you are not Medicare-eligible, the City is required to

offer you the same coverage which is provided to similarly situated employees, retirees or family members.

The law requires that you be afforded the opportunity to maintain continuation coverage for a maximum of

thirty-six (36) months unless you lost coverage because of a termination of employment or reduction in

hours. In the latter case, the required continuation coverage period is a maximum of 18 months. The

maximum period of continuation begins on the first day of the month following the month in which the initial

qualifying event occurred, regardless of when any additional events may take place. However, the law also

provides that your continuation of coverage may be cut short for any of the following reasons:

1)

The premium for continuation coverage is not paid in a timely fashion;

2)

The continuation enrollee becomes covered as an employee or dependent under another

group health or welfare plan (under this occurrence the spouse and dependents may

continue their COBRA coverage for the remaining months of eligibility).

NOTE: If the new plan contains any exclusion or limitation for a pre-existing condition of the continuation

enrollee, then coverage may not be terminated.

You do not have to show that you are insurable to choose continuation coverage. However, under

the law, you have to pay 102% of the cost of benefits for the continuation coverage. Also, at the end of the

continuation period you are allowed to convert to a self-paid direct payment policy.

Conversion Options

If you do not choose continuation, your City group coverage will end. You will still be offered the

opportunity to convert your City health insurance benefits to a non-City direct payment health insurance

policy and, where applicable, convert certain welfare fund benefits. Benefits offered under the non-City group

direct payment health insurance policy are offered on a quarterly basis for an indefinite period of time,

provided premiums are paid on time. These benefits may vary from the City's "basic" health benefits package

in terms of scope of benefits and cost. Benefits available from welfare funds that may be converted to direct

payment are insured medical/ surgical/ hospital and life insurance coverage. Such benefits may be

converted within 45 days of termination of coverage.

In order to receive continuation coverage for welfare fund benefits or to convert to direct payment,

you must contact your welfare fund directly.

For further information about this law, employees should contact their agency benefits representative

and retirees should e-mail the Health Benefits Program at healthbenefits@olr.nyc.gov

4