Information on recent changes

to New York State unemployment insurance benefits

Dear neighbor:

Over the past week, millions have suddenly found themselves unemployed due to the COVID-19

public health emergency. While losing one’s job is frightening and disruptive, everyone should

rest assured that their needs will be met throughout and after this crisis. The state and federal

government have taken swift action to ensure that individuals who have lost work because of

COVID-19 will receive the pay and protection they need to weather this crisis, remain in their

homes, and revitalize the economy.

Below you will find information that I have compiled for the benefit of the recently

unemployed. If you have any questions, please reach out to my office at 716-686-0080 or by

email at [email protected].

Stay home, stay healthy, and stay strong. We will get through this together.

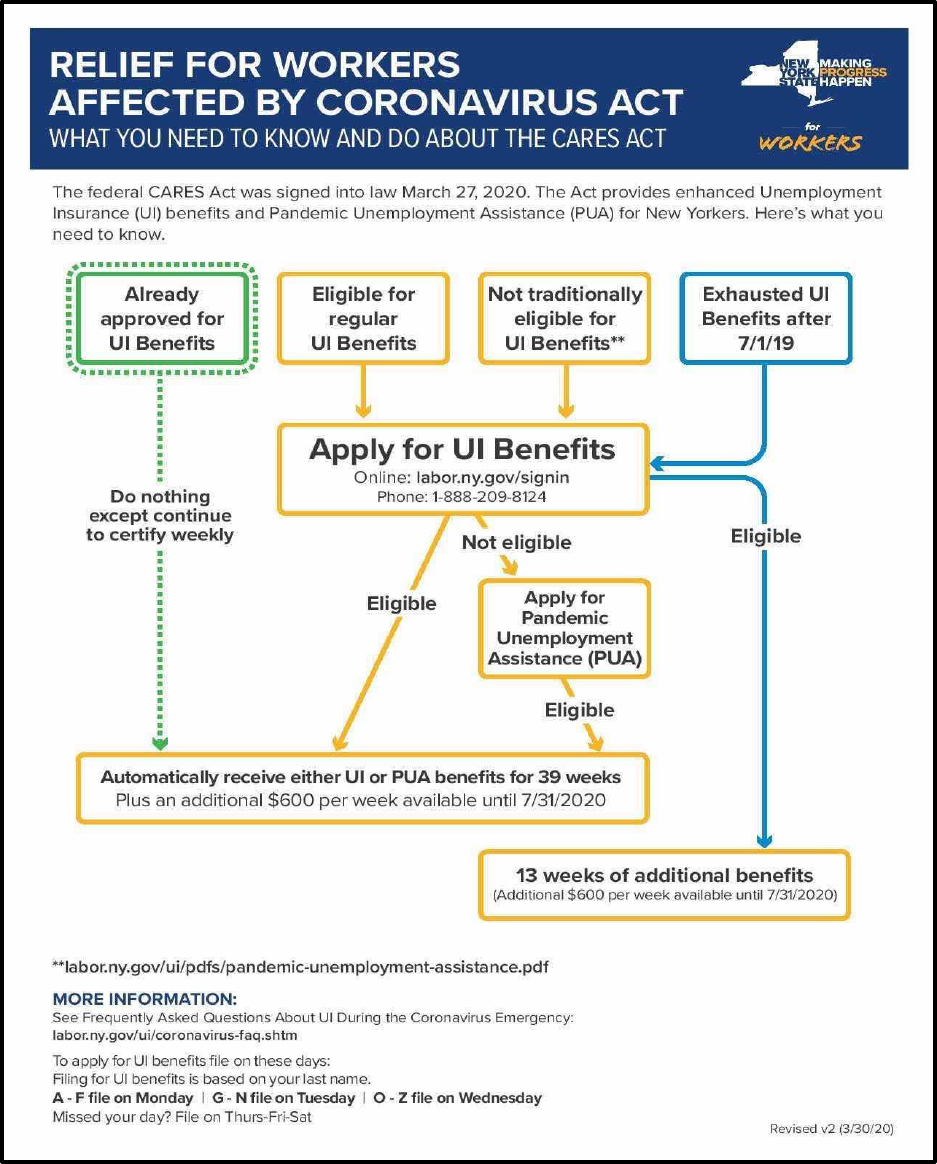

How much unemployment benefits will I receive?

The exact amount of unemployment insurance you are entitled to depends upon your previous

earnings. In addition to state unemployment benefits, you are eligible for an additional $600 per

week, which will be added to your state unemployment benefits from now until July 31st.

Who is eligible to receive unemployment insurance?

All employees in New York State are eligible for unemployment insurance benefits. In addition,

under the recently-enacted CARES Act, individuals who would not normally qualify for state

unemployment benefits can receive benefits, including the self-employed, gig-workers,

independent contractors, and those with an irregular work history.

When can I apply for benefits?

New York State has waived the one-week waiting period for individuals who have lost work due

to the COVID-19 outbreak, allowing individuals to receive unemployment insurance benefits

immediately.

How long will I receive unemployment benefits?

Unemployment benefits are typically limited to 26 weeks, or roughly six months, per year. If

individuals are still unemployed after their state employment insurance benefits are exhausted,

the federal government will fund up to 13 weeks of additional unemployment benefits.

How do I file for unemployment insurance?

You can file a claim by visiting labor.ny.gov. You can also call the Telephone Claim Center at

888-783-1370. However, due to unprecedented call volume, the New York State Department of

Labor is strongly encouraging individuals who wish to file a claim to first visit the website, if

possible.

Due to enormous volume, the New York State Department of Labor systems are slow. Millions

of people have been flooding the phones and website in recent days. The department is doing its

best to serve each and every New Yorker. Please be patient. I have heard that individuals have

had more success in getting through if they try very early in the morning.

If you are filing a new unemployment insurance claim, the day you should apply is based on the

first letter of your name. A-F file on Monday, G-N file on Tuesday, O-Z file on Wednesday. If

you missed your day, file on Thursday through Saturday. Any claim you file will be backdated to

the date you became unemployed. If you are eligible, you will be paid all benefits due.

To file an unemployment insurance claim, you will need:

● Your Social Security Number.

● Your driver license or Motor Vehicle ID card number.

● Your complete mailing address and zip code.

● A phone number where you can be reached from 8 a.m. to 5 p.m. Monday through

Friday.

● The names and addresses of all your employers for the last 18 months.

● Employer Registration number or Federal Employer Identification Number (FEIN) of

your most recent employer (FEIN is on your W-2 forms)

● Your copies of forms SF8 and SF50, if you were a federal employee.

● Your most recent separation form (DD 214), for military service.

● Your Alien Registration card number (if you are not a U.S. citizen and have a card).

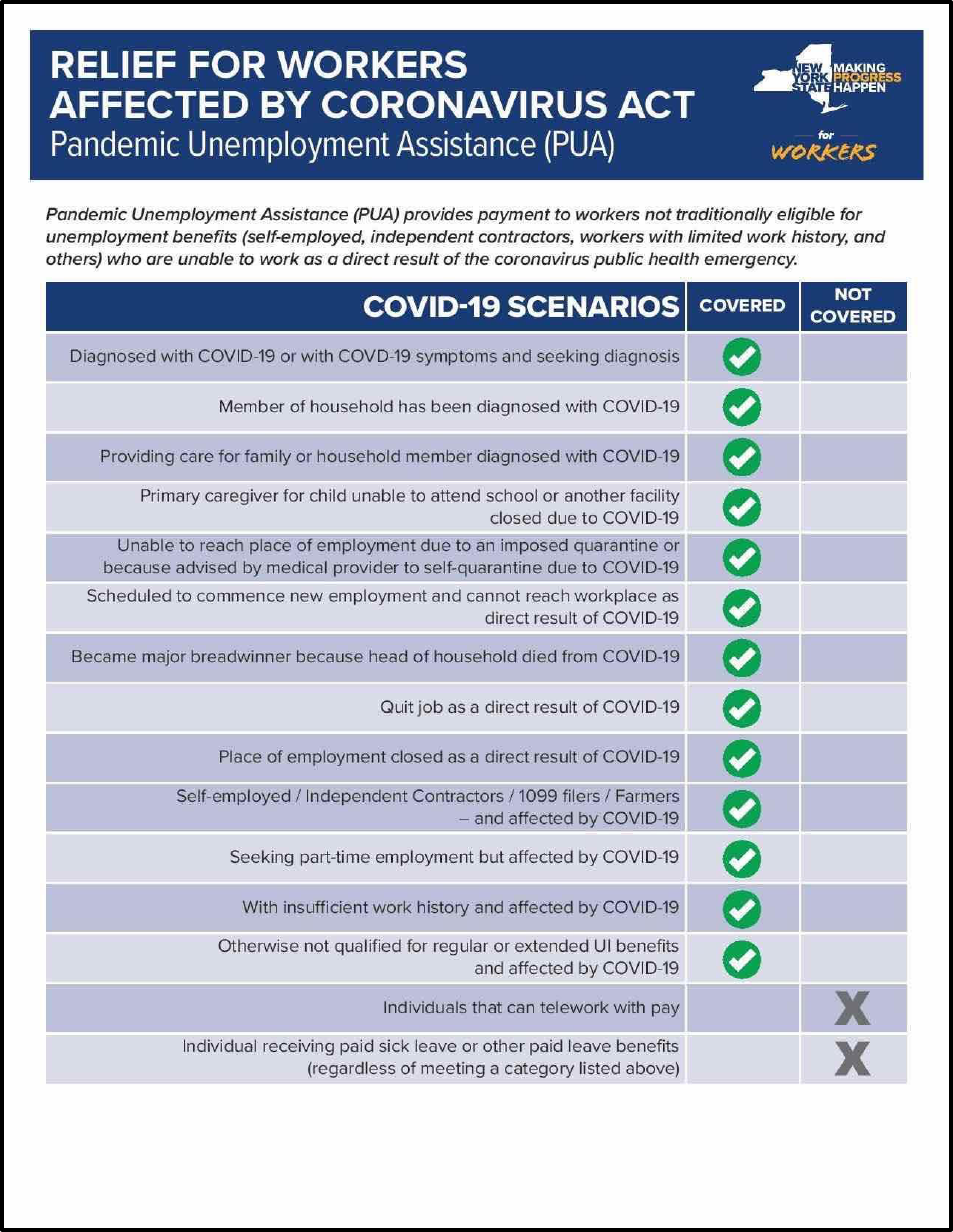

What is the Expansion of Unemployment Benefits I’ve heard about?

As mentioned above, a recently-passed federal law called the CARES Act creates a temporary

Federal Pandemic Unemployment Compensation (FPUC) of $600 a week for any worker eligible

for state unemployment compensation benefits. The FPUC of $600 is paid in addition to regular

state unemployment compensation benefits and is provided beginning April 5, 2020 through July

31, 2020.

The CARES Act also expands unemployment insurance to workers who are not normally

eligible for benefits, as long as the unemployment is the result of the COVID-19 pandemic. This

Pandemic Unemployment Assistance (PUA) provides benefits to self-employed individuals,

independent contractors, “gig economy” employees, individuals who were unable to start a new

job due to the pandemic, and individuals who do not have a sufficient work history.. The weekly

benefit will be calculated using recent information about their wages, but will be no lower than

half the state’s minimum regular unemployment compensation payment. In addition, PUA

recipients are also eligible for the $600 FPUC supplement.

To qualify for PUA, an individual must be unemployed, partially unemployed, or unable to work

because of any of the following circumstances:

● The individual has been diagnosed with COVID-19 or is experiencing symptoms of

COVID-19 and is seeking a medical diagnosis;

● A member of the individual’s household has been diagnosed with COVID-19;

● The individual is providing care for a family member or household member who has been

diagnosed with COVID-19;

● The individual is the primary caregiver for a child or other person in the household who

is unable to attend school or another facility that has been closed as a direct result of

COVID-19 and such school or facility care is required for the individual to work;

● The individual is unable to reach the place of employment because of a quarantine

imposed as a direct result of COVID-19;

● The individual is unable to reach the place of employment because a health care provider

has advised the individual to self-quarantine due to COVID-19 concerns;

● The individual was scheduled to begin employment and does not have a job or is unable

to reach the job as a direct result of COVID-19;

● The individual has become the breadwinner or major support for a household because the

head of household has died as a direct result of COVID-19;

● The individual has been forced to quit a job as a direct result of COVID-19;

● The individual’s place of employment is closed as a direct result of COVID-19.

Tips are considered part of compensation for unemployment benefits. Tipped workers who

qualify for unemployment compensation will receive the additional $600 FPUC on top of

their unemployment compensation payment like any other worker receiving benefits.