470-5170 (Rev. 04/24) Cover Page

Application for Health Coverage

and Help Paying Costs

Use this application to see what coverage choices you qualify for

▪ Affordable private health insurance plans that offer comprehensive coverage to help you stay well

▪ A new tax credit that can immediately help pay your premiums for health coverage

▪ Free or low-cost insurance from Medicaid or the Children’s Health Insurance Program (CHIP)

You may qualify for a free or low-cost program even if you earn as much as $94,000 a year

(for a family of 4).

Who can use this application?

▪ Use this application to apply for anyone in your family.

▪ Apply even if you or your child already has health coverage. You could be eligible for lower-cost or

free coverage.

▪ Families that include immigrants can apply. You can apply for your child even if you aren’t eligible for

coverage. Applying won’t affect your immigration status or chances of becoming a permanent

resident or citizen.

▪ If someone is helping you fill out this application, you may need to complete Step 6.

Apply faster online

Apply faster online at dhsservices.iowa.gov.

What you may need to apply

▪ Social Security Numbers (or document numbers for any legal immigrants who need insurance)

▪ Employer and income information for everyone in your family (for example, from paystubs, W-2

forms, or wage and tax statements)

▪ Policy numbers for any current health insurance

▪ Information about any job-related health insurance available to your family

Why do we ask for this information?

We ask about income and other information to let you know what coverage you qualify for and if you

can get any help paying for it. We’ll keep all the information you provide private and secure, as

required by law.

470-5170 (Rev. 04/24) Cover Page

What happens next?

Send your complete, signed application to the address on page 16. If you don’t have all the

information we ask for, sign and submit your application anyway. We’ll follow-up with you

within 30 days. You’ll get instructions on the next steps to complete your health coverage. If you don’t

hear from us within 30 days, call the HHS Contact Center at 1-855-889-7985.

Get help with this application

▪ Online: dhsservices.iowa.gov

▪ Phone: Call our Help Center at 1-855-889-7985.

▪ In person: There may be counselors in your area who can help. Visit our website or call 1-855-

889-7985 for more information.

▪ En Español: Llame a nuestro centro de ayuda gratis al 1-855-889-7985.

▪ If you need help in a language other than English, call 1-855-889-7985 and tell the customer service

representative the language you need. We’ll get you help at no cost to you.

▪ TTY users should call 1-800-735-2942.

470-5170 (Rev. 04/24) Page 1 of 27

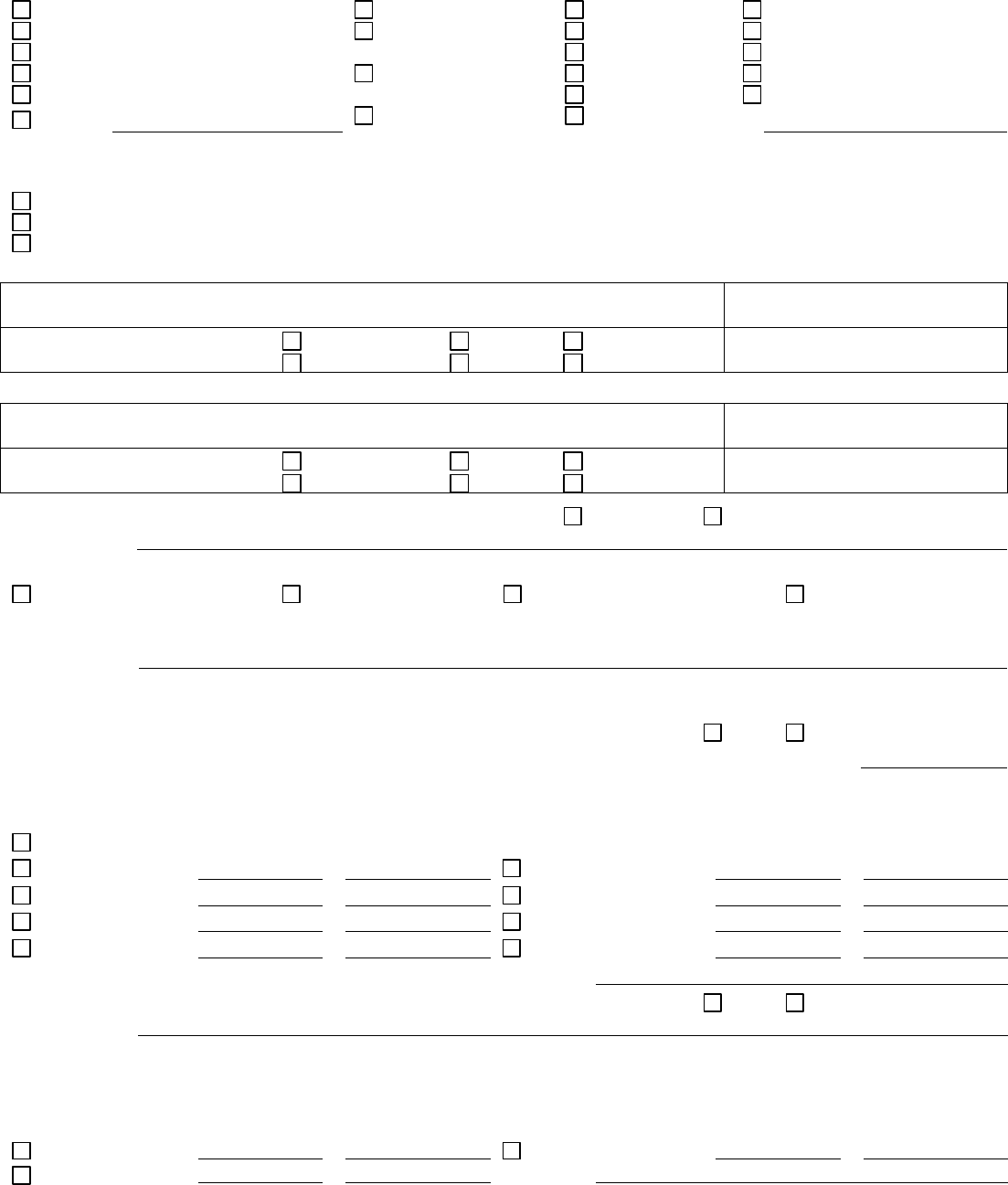

Step 1. Tell us about yourself.

We need one adult in the family to be the contact person for your application.

First name, middle name, last name, and suffix

Home address (If you leave blank because you don’t have one, you must give us a mailing

address below.)

Apartment or suite number

City

State

ZIP code

County

Mailing address (if different from home address)

Apartment or suite number

City

State

ZIP code

County

Phone number

Other phone number

Do you want to get information about this application by email? Yes No

Email address:

Preferred spoken or written language (if not English)

Step 2. Tell us about your family.

Who do you need to include on this application?

Tell us about all the family members who live with you. If you file taxes, we need to know about everyone on your tax return.

(You don’t need to file taxes to get health coverage.)

DO include:

▪ Yourself

▪ Your spouse

▪ Your children under 21 who live with you

▪ Your unmarried partner who needs health coverage

▪ Your unmarried partner who lives with you when

you have a child or children together

▪ Anyone you include on your tax return, even if they

don’t live with you

▪ Anyone else under 21 who you take care of and

lives with you

You DON’T have to include:

▪ Your unmarried partner who lives with you and

doesn’t need health insurance unless you have a child or

children together

▪ Your unmarried partner’s children

▪ Your parents who live with you, but file their own

tax return (if you’re over 21)

▪ Other adult relatives who file their own tax return

The amount of assistance or type of program you qualify for depends on the number of people in your family and their

incomes. This information helps us make sure everyone gets the best coverage they can.

Complete Step 2 for each person in your family. Start with yourself, then add other adults and children. If you have

more than five people in your family, you’ll need to make a copy of the pages and attach them. You don’t need to provide

immigration status or a Social Security Number (SSN) for family members who don’t need health coverage. We’ll keep all the

information you provide private and secure as required by law. We’ll use personal information only to check if you’re eligible

for health coverage.

470-5170 (Rev. 04/24) Page 2 of 27

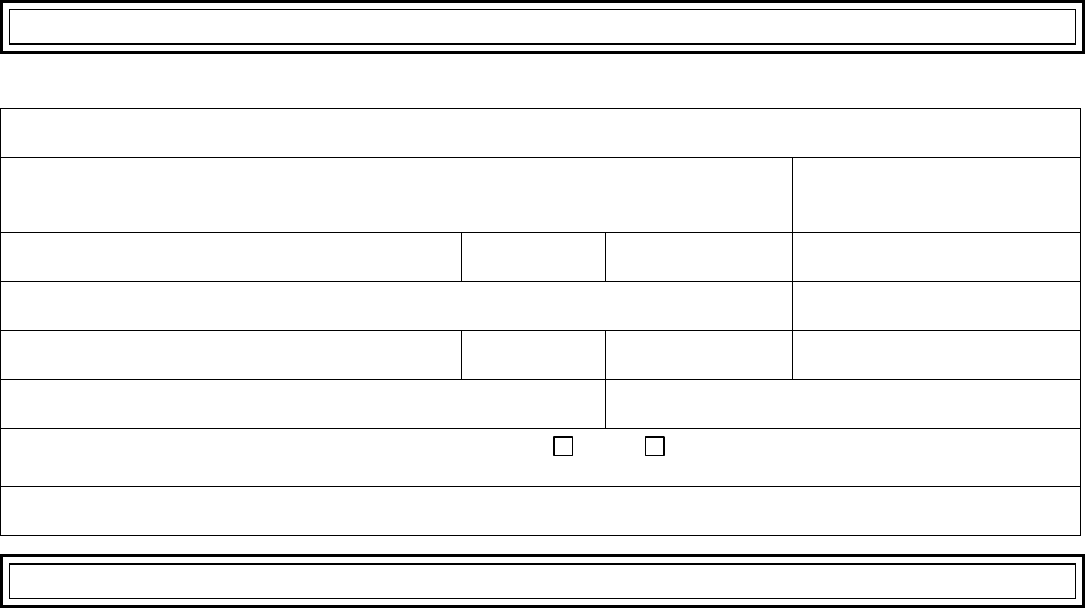

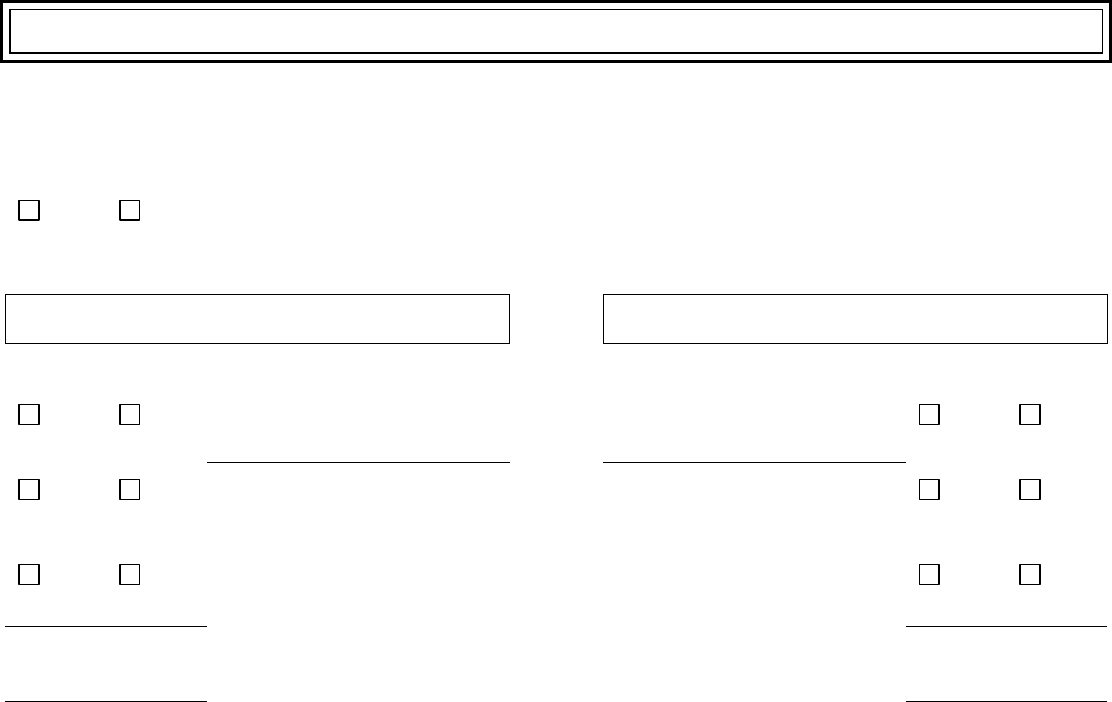

Step 2. Person 1 (start with yourself)

Complete Step 2 for yourself, your spouse or partner and children who live with you and anyone on your same federal

income tax return if you file one. See page 1 for more information about who to include. If you don’t file a tax return,

remember to still add family members who live with you.

First name, middle name, last name, and suffix

Relationship to you?

SELF

Date of birth (mm/dd/yyyy)

Sex: Male Female

Social Security Number (SSN)

We need your SSN if you want health coverage and have a SSN. Providing your SSN can be helpful if you don’t want

health coverage too since it can speed up the application process. We use SSNs to check income and other information to

see who’s eligible for help with health coverage costs. If someone wants help getting an SSN, call 1-800-772-1213 or visit

www.socialsecurity.gov/. TTY users should call 1-800-325-0778.

Do you plan to file a federal income tax return THIS YEAR?

(You can still apply for health insurance even if you don’t file a federal income tax return.)

Yes. If yes, please answer questions 1-3. No. If no, skip to question 3.

Yes

No

1. Will you file jointly with a spouse?

If yes, name of spouse:

Yes

No

2. Will you claim any dependents on your tax return?

If yes, list names of dependents:

Yes

No

3. Will you be claimed as a dependent on someone’s tax

return? If yes, list the name of the tax filer:

How are you related to the tax filer?

Yes

No

Are you pregnant? If yes, how many babies are expected

during this pregnancy? What is the due date?

Yes

No

Are you currently incarcerated?

Yes

No

Are you currently assigned to a work release program?

If yes, what is the start date?

Do you need health coverage?

(Even if you have insurance, there might be a program with better coverage or lower costs.)

Yes. If yes, answer all the questions below. No. If no, skip to the income questions on page 3. Leave the

rest of this page blank.

Yes

No

Do you have a physical, mental, or emotional health condition that causes limitations in activities (like

bathing, dressing, daily chores, etc.) or live in a medical facility or nursing home?

Yes

No

Are you a U.S. citizen or U.S. national?

Yes

No

If you aren’t a U.S. citizen or U.S. national, do you have eligible immigration status?

If yes, fill in your document type and ID number below.

Document type:

Document ID number:

Yes

No

Have you lived in the U.S. since before August 22, 1996?

Yes

No

Are you or your spouse or parent an honorably discharged veteran or an active-duty member of the

U.S. military?

Yes

No

Are you a resident of Iowa?

Yes

No

Do you need help paying for medical bills from the last three calendar months? If you answer yes and

you fall into a category that allows for retroactive approval, we will determine if you are eligible for

coverage during those months.

Yes

No

Are you an adult who is a main person taking care of a child under the age of 19 living in the home?

Yes

No

Are you a full-time student?

Yes

No

Were you in foster care at age 18 or older?

Yes

No

If you are under age 19, do you want help with child support?

470-5170 (Rev. 04/24) Page 3 of 27

The following ethnicity and race questions are optional. Check all that apply.

If Hispanic or Latino, ethnicity:

Race:

Mexican

Mexican American

Chicano/a

Puerto Rican

Cuban

White

Black or African

American

American Indian or

Alaska Native

Asian Indian

Chinese

Filipino

Japanese

Korean

Vietnamese

Other Asian

Native Hawaiian

Guamanian or Chamorro

Samoan

Other Pacific Islander

Other:

Other:

Current Job and Income Information: You must tell us about the income of the people in your household. If

someone has more than one job, tell us about all jobs. If you leave a space blank, we will assume that you have no income of

this kind.

Employed. If you’re currently employed, tell us about your income. Start with Current Job 1.

Not employed. Skip to the Other Income This Month section.

Self-employed. Skip to the Self-Employment section.

Current Job 1:

Employer name and address

Employer phone number

Wages and tips (before taxes)

$

Hourly Weekly Every 2 weeks

Twice a month Monthly Yearly

Average hours worked each

month:

Current Job 2: If you have more jobs and need more space, attach another sheet of paper.

Employer name and address

Employer phone number

Wages and tips (before taxes)

$

Hourly Weekly Every 2 weeks

Twice a month Monthly Yearly

Average hours worked each

month:

Will the amount of money from jobs stay about the same? Yes No

If no, explain:

In the past three months, did you:

Change jobs Stop working Start working fewer hours None of these

Self-Employment: If self-employed, answer the following questions.

Type of work

How much net income (profits once business expenses are paid) will you get from this self-employment

this month?

$

Will the amount of monthly income from self-employment stay about the same? Yes No

If no, how much do you expect to average over a 12 month period?

$

Other Income This Month: Check all that apply, and give the amount and how often you get it. NOTE: You don’t need

to tell us about child support, veteran’s payment, or Supplemental Security Income (SSI).

None

How often?

How often?

Unemployment

$

Alimony received

$

Pensions

$

Net farming/fishing

$

Social Security

$

Net rental/royalty

$

Retirement

accounts

$

Other income

$

Type

Will the amount of money from other income stay about the same? Yes No

If no, explain:

Deductions: If you pay for certain things that can be deducted on a federal income tax return, check all that apply and give

the amount and how often you pay. This information can be found on the Adjusted Gross Income section of your Federal

1040 form. NOTE: You shouldn’t include a cost that you already considered in your answer to net self-employment.

How often?

How often?

Alimony paid

$

Other deductions

$

Student loan

interest

$

Type

470-5170 (Rev. 04/24) Page 4 of 27

Step 2. Person 2

Complete Step 2 for your spouse or partner and children who live with you and anyone on your same federal income tax return if

you file one. See Page 1 for more information about who to include. If you don’t file a tax return, remember to still add family

members who live with you.

First name, middle name, last name, and suffix

Relationship to you?

Date of birth (mm/dd/yyyy)

Sex: Male Female

Social Security Number (SSN)

We need your SSN if you want health coverage and have a SSN. Providing your SSN can be helpful if you don’t want

health coverage too since it can speed up the application process.

Yes

No

Does Person 2 live at the same address as you? If no, list address:

Does Person 2 plan to file a federal income tax return THIS YEAR?

(You can still apply for health insurance even if you don’t file a federal income tax return.)

Yes. If yes, please answer questions 1-3. No. If no, skip to question 3.

Yes

No

1. Will Person 2 file jointly with a spouse?

If yes, name of spouse:

Yes

No

2. Will Person 2 claim any dependents on Person 2’s tax return? If

yes, list names of dependents:

Yes

No

3. Will Person 2 be claimed as a dependent on someone’s tax

return? If yes, list the name of the tax filer:

How is Person 2 related to the tax filer?

Yes

No

Is Person 2 pregnant? If yes, how many babies are expected during

this pregnancy? What is the due date?

Yes

No

Is Person 2 currently incarcerated?

Yes

No

Is Person 2 currently assigned to a work release program?

If yes, what is the start date?

Does Person 2 need health coverage?

(Even if they have insurance, there might be a program with better coverage or lower costs.)

Yes. If yes, answer all the questions below. No. If no, skip to the income questions on page 5. Leave the

rest of this page blank.

Yes

No

Does Person 2 have a physical, mental, or emotional health condition that causes limitations in activities

(like bathing, dressing, daily chores, etc.) or live in a medical facility or nursing home?

Yes

No

Is Person 2 a U.S. citizen or U.S. national?

Yes

No

If Person 2 isn’t a U.S. citizen or U.S. national, does Person 2 have eligible immigration status?

If yes, fill in their document type and ID number below.

Document type:

Document ID number:

Yes

No

Has Person 2 lived in the U.S. since before August 22, 1996?

Yes

No

Is Person 2 or their spouse or parent an honorably discharged veteran or an active-duty member in the

U.S. military?

Yes

No

Is Person 2 a resident of Iowa?

Yes

No

Does Person 2 need help paying for medical bills from the last three calendar months? If you answer yes

and this person falls into a category that allows for retroactive approval, we will determine if this person is

eligible for coverage during those months.

Yes

No

Is Person 2 an adult who is a main person taking care of a child under the age of 19 living in the home?

Yes

No

Was Person 2 in foster care at age 18 or older?

Yes

No

If Person 2 is under age 19, do you want help with child support?

Please answer the following questions if Person 2 is 22 or younger:

Yes

No

Did Person 2 have insurance through a job and lose it within the past three months?

If yes, end date:

Reason insurance ended:

Yes

No

Is Person 2 a full-time student?

470-5170 (Rev. 04/24) Page 5 of 27

The following ethnicity and race questions are optional. Check all that apply.

If Hispanic or Latino, ethnicity:

Race:

Mexican

Mexican American

Chicano/a

Puerto Rican

Cuban

White

Black or African

American

American Indian or

Alaska Native

Asian Indian

Chinese

Filipino

Japanese

Korean

Vietnamese

Other Asian

Native Hawaiian

Guamanian or Chamorro

Samoan

Other Pacific Islander

Other:

Other:

Current Job and Income Information: You must tell us about the income of the people in your household. If someone

has more than one job, tell us about all jobs. If you leave a space blank, we will assume that you have no income of this kind.

Employed. If you’re currently employed, tell us about your income. Start with Current Job 1.

Not employed. Skip to the Other Income This Month section.

Self-employed. Skip to the Self-Employment section.

Current Job 1:

Employer name and address

Employer phone number

Wages and tips (before taxes)

$

Hourly Weekly Every 2 weeks

Twice a month Monthly Yearly

Average hours worked each

month:

Current Job 2: If you have more jobs and need more space, attach another sheet of paper.

Employer name and address

Employer phone number

Wages and tips (before taxes)

$

Hourly Weekly Every 2 weeks

Twice a month Monthly Yearly

Average hours worked each

month:

Will the amount of money from jobs stay about the same? Yes No

If no, explain:

In the past three months, did Person 2:

Change jobs Stop working Start working fewer hours None of these

Self-Employment: If self-employed, answer the following questions.

Type of work

How much net income (profits once business expenses are paid) will you get from this self-employment this

month?

$

Will the amount of monthly income from self-employment stay about the same? Yes No

If no, how much do you expect to average over a 12 month period?

$

Other Income This Month: Check all that apply, and give the amount and how often you get it. NOTE: You don’t need to

tell us about child support, veteran’s payment, or Supplemental Security Income (SSI).

None

How often?

How often?

Unemployment

$

Alimony received

$

Pensions

$

Net farming/fishing

$

Social Security

$

Net rental/royalty

$

Retirement

accounts

$

Other income

$

Type

Will the amount of money from other income stay about the same? Yes No

If no, explain:

Deductions: If Person 2 pays for certain things that can be deducted on a federal income tax return, check all that apply and give

the amount and how often Person 2 pays. This information can be found on the Adjusted Gross Income section of Person 2’s Federal

1040 form. NOTE: You shouldn’t include a cost that you already considered in your answer to net self-employment.

How often?

How often?

Alimony paid

$

Other deductions

$

Student loan

interest

$

Type

470-5170 (Rev. 04/24) Page 6 of 27

Step 2. Person 3

Complete Step 2 for your spouse or partner and children who live with you and anyone on your same federal income tax return if

you file one. See Page 1 for more information about who to include. If you don’t file a tax return, remember to still add family

members who live with you.

First name, middle name, last name, and suffix

Relationship to you?

Date of birth (mm/dd/yyyy)

Sex: Male Female

Social Security Number (SSN)

We need your SSN if you want health coverage and have a SSN. Providing your SSN can be helpful if you don’t want

health coverage too since it can speed up the application process.

Yes

No

Does Person 3 live at the same address as you? If no, list address:

Does Person 3 plan to file a federal income tax return THIS YEAR?

(You can still apply for health insurance even if you don’t file a federal income tax return.)

Yes. If yes, please answer questions 1-3. No. If no, skip to question 3.

Yes

No

1. Will Person 3 file jointly with a spouse?

If yes, name of spouse:

Yes

No

2. Will Person 3 claim any dependents on Person 3’s tax return? If

yes, list names of dependents:

Yes

No

3. Will Person 3 be claimed as a dependent on someone’s tax

return? If yes, list the name of the tax filer:

How is Person 3 related to the tax filer?

Yes

No

Is Person 3 pregnant? If yes, how many babies are expected during

this pregnancy? What is the due date?

Yes

No

Is Person 3 currently incarcerated?

Yes

No

Is Person 3 currently assigned to a work release program?

If yes, what is the start date?

Does Person 3 need health coverage?

(Even if they have insurance, there might be a program with better coverage or lower costs.)

Yes. If yes, answer all the questions below. No. If no, skip to the income questions on page 7. Leave the

rest of this page blank.

Yes

No

Does Person 3 have a physical, mental, or emotional health condition that causes limitations in activities

(like bathing, dressing, daily chores, etc.) or live in a medical facility or nursing home?

Yes

No

Is Person 3 a U.S. citizen or U.S. national?

Yes

No

If Person 3 isn’t a U.S. citizen or U.S. national, does Person 3 have eligible immigration status?

If yes, fill in their document type and ID number below.

Document type:

Document ID number:

Yes

No

Has Person 3 lived in the U.S. since before August 22, 1996?

Yes

No

Is Person 3 or their spouse or parent an honorably discharged veteran or an active-duty member in the

U.S. military?

Yes

No

Is Person 3 a resident of Iowa?

Yes

No

Does Person 3 need help paying for medical bills from the last three calendar months? If you answer yes

and this person falls into a category that allows for retroactive approval, we will determine if this person is

eligible for coverage during those months.

Yes

No

Is Person 3 an adult who is a main person taking care of a child under the age of 19 living in the home?

Yes

No

Was Person 3 in foster care at age 18 or older?

Yes

No

If Person 3 is under age 19, do you want help with child support?

Please answer the following questions if Person 3 is 22 or younger:

Yes

No

Did Person 3 have insurance through a job and lose it within the past three months?

If yes, end date:

Reason insurance ended:

Yes

No

Is Person 3 a full-time student?

470-5170 (Rev. 04/24) Page 7 of 27

The following ethnicity and race questions are optional. Check all that apply.

If Hispanic or Latino, ethnicity:

Race:

Mexican

Mexican American

Chicano/a

Puerto Rican

Cuban

White

Black or African

American

American Indian or

Alaska Native

Asian Indian

Chinese

Filipino

Japanese

Korean

Vietnamese

Other Asian

Native Hawaiian

Guamanian or Chamorro

Samoan

Other Pacific Islander

Other:

Other:

Current Job and Income Information: You must tell us about the income of the people in your household. If someone

has more than one job, tell us about all jobs. If you leave a space blank, we will assume that you have no income of this kind.

Employed. If you’re currently employed, tell us about your income. Start with Current Job 1.

Not employed. Skip to the Other Income This Month section.

Self-employed. Skip to the Self-Employment section.

Current Job 1:

Employer name and address

Employer phone number

Wages and tips (before taxes)

$

Hourly Weekly Every 2 weeks

Twice a month Monthly Yearly

Average hours worked each

month:

Current Job 2: If you have more jobs and need more space, attach another sheet of paper.

Employer name and address

Employer phone number

Wages and tips (before taxes)

$

Hourly Weekly Every 2 weeks

Twice a month Monthly Yearly

Average hours worked each

month:

Will the amount of money from jobs stay about the same? Yes No

If no, explain:

In the past three months, did Person 3:

Change jobs Stop working Start working fewer hours None of these

Self-Employment: If self-employed, answer the following questions.

Type of work

How much net income (profits once business expenses are paid) will you get from this self-employment this

month?

$

Will the amount of monthly income from self-employment stay about the same? Yes No

If no, how much do you expect to average over a 12 month period?

$

Other Income This Month: Check all that apply, and give the amount and how often you get it. NOTE: You don’t need to

tell us about child support, veteran’s payment, or Supplemental Security Income (SSI).

None

How often?

How often?

Unemployment

$

Alimony received

$

Pensions

$

Net farming/fishing

$

Social Security

$

Net rental/royalty

$

Retirement

accounts

$

Other income

$

Type

Will the amount of money from other income stay about the same? Yes No

If no, explain:

Deductions: If Person 3 pays for certain things that can be deducted on a federal income tax return, check all that apply and give

the amount and how often Person 3 pays. This information can be found on the Adjusted Gross Income section of Person 3’s Federal

1040 form. NOTE: You shouldn’t include a cost that you already considered in your answer to net self-employment.

How often?

How often?

Alimony paid

$

Other deductions

$

Student loan

interest

$

Type

470-5170 (Rev. 04/24) Page 8 of 27

Step 2. Person 4

Complete Step 2 for your spouse or partner and children who live with you and anyone on your same federal income tax return if

you file one. See Page 1 for more information about who to include. If you don’t file a tax return, remember to still add family

members who live with you.

First name, middle name, last name, and suffix

Relationship to you?

Date of birth (mm/dd/yyyy)

Sex: Male Female

Social Security Number (SSN)

We need your SSN if you want health coverage and have a SSN. Providing your SSN can be helpful if you don’t want

health coverage too since it can speed up the application process.

Yes

No

Does Person 4 live at the same address as you? If no, list address:

Does Person 4 plan to file a federal income tax return THIS YEAR?

(You can still apply for health insurance even if you don’t file a federal income tax return.)

Yes. If yes, please answer questions 1-3. No. If no, skip to question 3.

Yes

No

1. Will Person 4 file jointly with a spouse?

If yes, name of spouse:

Yes

No

2. Will Person 4 claim any dependents on Person 4’s tax return? If

yes, list names of dependents:

Yes

No

3. Will Person 4 be claimed as a dependent on someone’s tax

return? If yes, list the name of the tax filer:

How is Person 4 related to the tax filer?

Yes

No

Is Person 4 pregnant? If yes, how many babies are expected during

this pregnancy? What is the due date?

Yes

No

Is Person 4 currently incarcerated?

Yes

No

Is Person 4 currently assigned to a work release program?

If yes, what is the start date?

Does Person 4 need health coverage?

(Even if they have insurance, there might be a program with better coverage or lower costs.)

Yes. If yes, answer all the questions below. No. If no, skip to the income questions on page 9. Leave the

rest of this page blank.

Yes

No

Does Person 4 have a physical, mental, or emotional health condition that causes limitations in activities (like

bathing, dressing, daily chores, etc.) or live in a medical facility or nursing home?

Yes

No

Is Person 4 a U.S. citizen or U.S. national?

Yes

No

If Person 4 isn’t a U.S. citizen or U.S. national, does Person 4 have eligible immigration status?

If yes, fill in their document type and ID number below.

Document type:

Document ID number:

Yes

No

Has Person 4 lived in the U.S. since before August 22, 1996?

Yes

No

Is Person 4 or their spouse or parent an honorably discharged veteran or an active-duty member in the U.S.

military?

Yes

No

Is Person 4 a resident of Iowa?

Yes

No

Does Person 4 need help paying for medical bills from the last three calendar months? If you answer yes and

this person falls into a category that allows for retroactive approval, we will determine if this person is

eligible for coverage during those months.

Yes

No

Is Person 4 an adult who is a main person taking care of a child under the age of 19 living in the home?

Yes

No

Was Person 4 in foster care at age 18 or older?

Yes

No

If Person 4 is under age 19, do you want help with child support?

Please answer the following questions if Person 4 is 22 or younger:

Yes

No

Did Person 4 have insurance through a job and lose it within the past three months?

If yes, end date:

Reason insurance ended:

Yes

No

Is Person 4 a full-time student?

470-5170 (Rev. 04/24) Page 9 of 27

The following ethnicity and race questions are optional. Check all that apply.

If Hispanic or Latino, ethnicity:

Race:

Mexican

Mexican American

Chicano/a

Puerto Rican

Cuban

White

Black or African

American

American Indian or

Alaska Native

Asian Indian

Chinese

Filipino

Japanese

Korean

Vietnamese

Other Asian

Native Hawaiian

Guamanian or Chamorro

Samoan

Other Pacific Islander

Other:

Other:

Current Job and Income Information: You must tell us about the income of the people in your household. If someone

has more than one job, tell us about all jobs. If you leave a space blank, we will assume that you have no income of this kind.

Employed. If you’re currently employed, tell us about your income. Start with Current Job 1.

Not employed. Skip to the Other Income This Month section.

Self-employed. Skip to the Self-Employment section.

Current Job 1:

Employer name and address

Employer phone number

Wages and tips (before taxes)

$

Hourly Weekly Every 2 weeks

Twice a month Monthly Yearly

Average hours worked each

month:

Current Job 2: If you have more jobs and need more space, attach another sheet of paper.

Employer name and address

Employer phone number

Wages and tips (before taxes)

$

Hourly Weekly Every 2 weeks

Twice a month Monthly Yearly

Average hours worked each

month:

Will the amount of money from jobs stay about the same? Yes No

If no, explain:

In the past three months, did Person 4:

Change jobs Stop working Start working fewer hours None of these

Self-Employment: If self-employed, answer the following questions.

Type of work

How much net income (profits once business expenses are paid) will you get from this self-employment this

month?

$

Will the amount of monthly income from self-employment stay about the same? Yes No

If no, how much do you expect to average over a 12 month period?

$

Other Income This Month: Check all that apply, and give the amount and how often you get it. NOTE: You don’t need to

tell us about child support, veteran’s payment, or Supplemental Security Income (SSI).

None

How often?

How often?

Unemployment

$

Alimony received

$

Pensions

$

Net farming/fishing

$

Social Security

$

Net rental/royalty

$

Retirement

accounts

$

Other income

$

Type

Will the amount of money from other income stay about the same? Yes No

If no, explain:

Deductions: If Person 4 pays for certain things that can be deducted on a federal income tax return, check all that apply and give

the amount and how often Person 4 pays. This information can be found on the Adjusted Gross Income section of Person 4’s Federal

1040 form. NOTE: You shouldn’t include a cost that you already considered in your answer to net self-employment.

How often?

How often?

Alimony paid

$

Other deductions

$

Student loan

interest

$

Type

470-5170 (Rev. 04/24) Page 10 of 27

Step 2. Person 5

Complete Step 2 for your spouse or partner and children who live with you and anyone on your same federal income tax return if

you file one. See Page 1 for more information about who to include. If you don’t file a tax return, remember to still add family

members who live with you.

First name, middle name, last name, and suffix

Relationship to you?

Date of birth (mm/dd/yyyy)

Sex: Male Female

Social Security Number (SSN)

We need your SSN if you want health coverage and have a SSN. Providing your SSN can be helpful if you don’t want

health coverage too since it can speed up the application process.

Yes

No

Does Person 5 live at the same address as you? If no, list address:

Does Person 5 plan to file a federal income tax return THIS YEAR?

(You can still apply for health insurance even if you don’t file a federal income tax return.)

Yes. If yes, please answer questions 1-3. No. If no, skip to question 3.

Yes

No

1. Will Person 5 file jointly with a spouse?

If yes, name of spouse:

Yes

No

2. Will Person 5 claim any dependents on Person 5’s tax return? If

yes, list names of dependents:

Yes

No

3. Will Person 5 be claimed as a dependent on someone’s tax

return? If yes, list the name of the tax filer:

How is Person 5 related to the tax filer?

Yes

No

Is Person 5 pregnant? If yes, how many babies are expected during

this pregnancy? What is the due date?

Yes

No

Is Person 5 currently incarcerated?

Yes

No

Is Person 5 currently assigned to a work release program?

If yes, what is the start date?

Does Person 5 need health coverage?

(Even if they have insurance, there might be a program with better coverage or lower costs.)

Yes. If yes, answer all the questions below. No. If no, skip to the income questions on page 11. Leave the

rest of this page blank.

Yes

No

Does Person 5 have a physical, mental, or emotional health condition that causes limitations in activities (like

bathing, dressing, daily chores, etc.) or live in a medical facility or nursing home?

Yes

No

Is Person 5 a U.S. citizen or U.S. national?

Yes

No

If Person 5 isn’t a U.S. citizen or U.S. national, does Person 5 have eligible immigration status?

If yes, fill in their document type and ID number below.

Document type:

Document ID number:

Yes

No

Has Person 5 lived in the U.S. since before August 22, 1996?

Yes

No

Is Person 5 or their spouse or parent an honorably discharged veteran or an active-duty member in the U.S.

military?

Yes

No

Is Person 5 a resident of Iowa?

Yes

No

Does Person 5 need help paying for medical bills from the last three calendar months? If you answer yes and

this person falls into a category that allows for retroactive approval, we will determine if this person is

eligible for coverage during those months.

Yes

No

Is Person 5 an adult who is a main person taking care of a child under the age of 19 living in the home?

Yes

No

Was Person 5 in foster care at age 18 or older?

Yes

No

If Person 5 is under age 19, do you want help with child support?

Please answer the following questions if Person 5 is 22 or younger:

Yes

No

Did Person 5 have insurance through a job and lose it within the past three months?

If yes, end date:

Reason insurance ended:

Yes

No

Is Person 5 a full-time student?

470-5170 (Rev. 04/24) Page 11 of 27

The following ethnicity and race questions are optional. Check all that apply.

If Hispanic or Latino, ethnicity:

Race:

Mexican

Mexican American

Chicano/a

Puerto Rican

Cuban

White

Black or African

American

American Indian or

Alaska Native

Asian Indian

Chinese

Filipino

Japanese

Korean

Vietnamese

Other Asian

Native Hawaiian

Guamanian or Chamorro

Samoan

Other Pacific Islander

Other:

Other:

Current Job and Income Information: You must tell us about the income of the people in your household. If someone

has more than one job, tell us about all jobs. If you leave a space blank, we will assume that you have no income of this kind.

Employed. If you’re currently employed, tell us about your income. Start with Current Job 1.

Not employed. Skip to the Other Income This Month section.

Self-employed. Skip to the Self-Employment section.

Current Job 1:

Employer name and address

Employer phone number

Wages and tips (before taxes)

$

Hourly Weekly Every 2 weeks

Twice a month Monthly Yearly

Average hours worked each

month:

Current Job 2: If you have more jobs and need more space, attach another sheet of paper.

Employer name and address

Employer phone number

Wages and tips (before taxes)

$

Hourly Weekly Every 2 weeks

Twice a month Monthly Yearly

Average hours worked each

month:

Will the amount of money from jobs stay about the same? Yes No

If no, explain:

In the past three months, did Person 5:

Change jobs Stop working Start working fewer hours None of these

Self-Employment: If self-employed, answer the following questions.

Type of work

How much net income (profits once business expenses are paid) will you get from this self-employment this

month?

$

Will the amount of monthly income from self-employment stay about the same? Yes No

If no, how much do you expect to average over a 12 month period?

$

Other Income This Month: Check all that apply, and give the amount and how often you get it. NOTE: You don’t need to

tell us about child support, veteran’s payment, or Supplemental Security Income (SSI).

None

How often?

How often?

Unemployment

$

Alimony received

$

Pensions

$

Net farming/fishing

$

Social Security

$

Net rental/royalty

$

Retirement

accounts

$

Other income

$

Type

Will the amount of money from other income stay about the same? Yes No

If no, explain:

Deductions: If Person 5 pays for certain things that can be deducted on a federal income tax return, check all that apply and give

the amount and how often Person 5 pays. This information can be found on the Adjusted Gross Income section of Person 5’s Federal

1040 form. NOTE: You shouldn’t include a cost that you already considered in your answer to net self-employment.

How often?

How often?

Alimony paid

$

Other deductions

$

Student loan

interest

$

Type

470-5170 (Rev. 04/24) Page 12 of 27

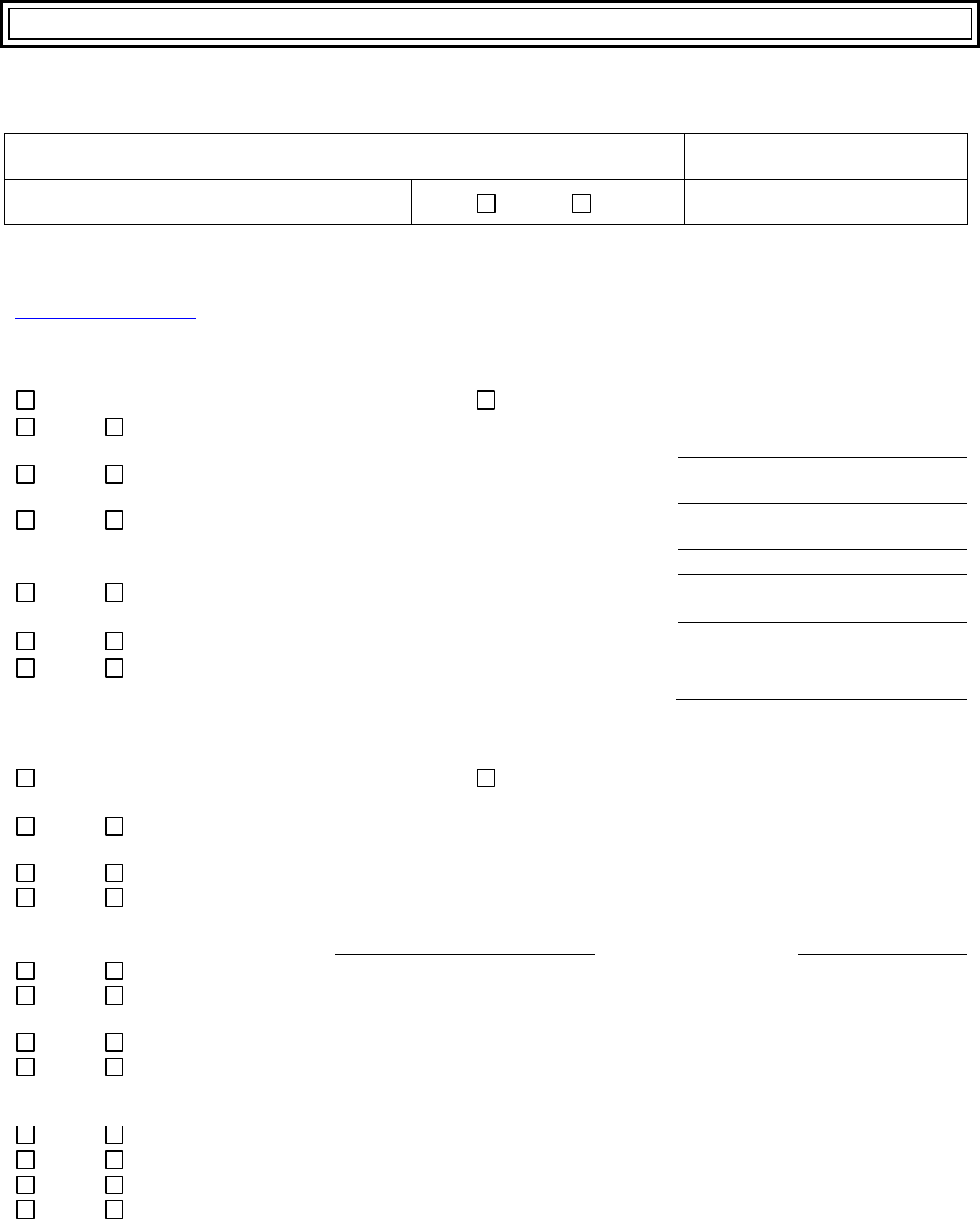

Step 3. American Indian or Alaska Native (AI/AN) Family Members

American Indians and Alaska Natives can get services from the Indian Health Services, tribal health programs, or urban Indian

health programs. They also may not have to pay cost sharing and may get special monthly enrollment periods. Answer the

following questions to make sure your family gets the most help possible.

NOTE: If you have more people to include, make a copy of this page and attach.

Yes

No

Are you or is anyone in your family an American Indian or Alaska Native?

If yes, fill in the information below. If no, skip to Step 4.

AI/AN Person 1:

AI/AN Person 2:

Name (first, middle, last)

Name (first, middle, last)

AI/AN Person 1:

AI/AN Person 2:

Yes

No

Member of a federally recognized tribe? If yes, tribe name:

Yes

No

Yes

No

Has this person ever gotten a service from the Indian Health Service, a tribal

health program, or urban Indian health program or through a referral from

one of these programs?

Yes

No

Yes

No

If no, is this person eligible to get any of these services?

Yes

No

$

Certain money received may not be counted for Medicaid or the Children’s

Health Insurance Program (CHIP). List any income (amount and how often)

reported on your application that includes money from these sources:

▪ Per capita payments from a tribe that come from natural resources, usage

rights, leases, or royalties.

▪ Payments from natural resources, farming, ranching, fishing, leases, or

royalties from land designated as Indian trust land by the Department of

Interior (including reservations and former reservations).

▪ Money from selling things that have cultural significance.

$

How often?

How often?

470-5170 (Rev. 04/24) Page 13 of 27

Step 4. Your Family’s Health Coverage

Answer these questions for anyone who needs health coverage.

Yes

No

Is anyone enrolled in health coverage now from the following? If yes, check the type of coverage and

write the persons’ names next to the coverage they have.

Medicaid

CHIP

Medicare

TRICARE (Don’t check if you have

direct care or Line of Duty)

VA health care programs

Peace Corps

Employer Insurance

Name of health insurance

Policy number

Is this COBRA coverage?

Yes No

Is this a retiree health plan?

Yes No

Other

Name of health insurance

Policy number

Is this a limited-benefit plan (like a school accident policy?)

Yes No

Yes

No

Has anyone moved in or out of your home in the past three months?

If yes, answer the following questions.

Name

Date of birth (mm/dd/yyyy)

Social Security Number (SSN)

Relationship to you?

Date moved in?

Date moved out?

Yes

No

Is anyone listed on this application offered health coverage from a job? Check yes even if the coverage

is from someone else’s job, such as a parent or spouse.

If yes, answer the following question and the questions in Step 5.

If no, skip to Step 6.

Yes

No

Is this a state employee benefit plan?

470-5170 (Rev. 04/24) Page 14 of 27

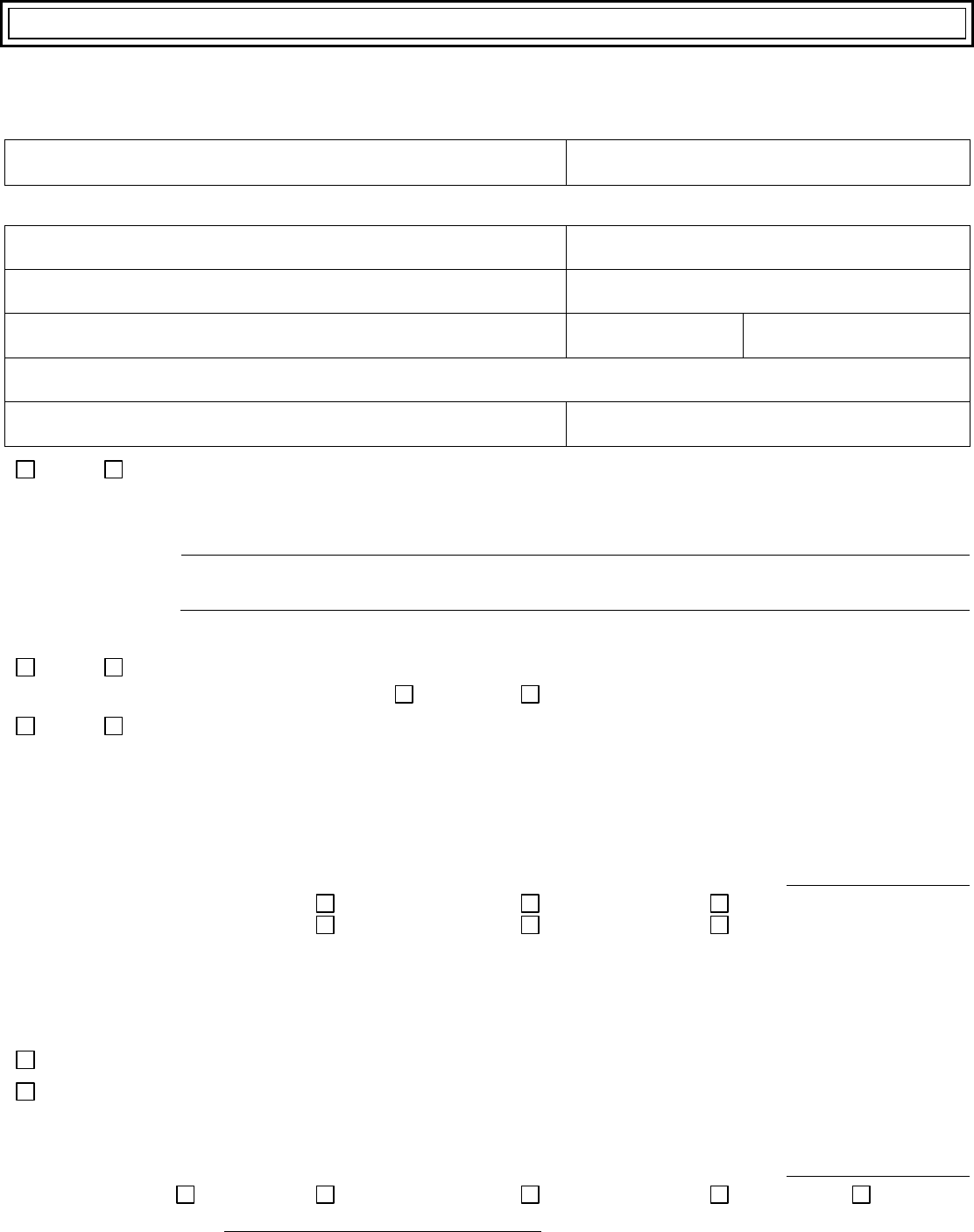

Step 5. Health Coverage from Jobs

You don’t need to answer these questions unless someone in the household is eligible for health coverage from a job. Attach

a copy of this page for each job that offers coverage. Tell us about the job that offers coverage.

Employee Information. The employee needs to fill out this section.

Employee name (first, middle, last)

Social security number

Employer Information. Ask the employer for this information.

Employer name

Employer identification number (EIN)

Employer address (the Marketplace will send notices to this address)

Employer phone number

City

State

ZIP code

Who can we contact about employee health coverage at this job?

Phone number (if difference from above)

Email address

Yes

No

Are you currently eligible for coverage offered by this employer, or will you become eligible in the

next three months? If yes, fill out the information below. If no, skip to Step 6.

If you’re in a waiting or probationary period, when can you enroll in coverage?

List the names of anyone else who is eligible for coverage from this job.

Health Plan. Tell us about the health plan offered by this employer.

Yes

No

Does the employer offer a health plan that covers an employee’s spouse or dependent?

If yes, which people? Spouse Dependents

Yes

No

Does the employer offer a health plan that meets the minimum value standard*?

For the lowest-cost plan that meets the minimum value standard* offered only to the employee

(don’t include family plans):

If the employer has wellness programs, provide the premium that the employee would pay if the

employee received the maximum discount for any tobacco cessation programs, and did not receive

any other discounts based on wellness programs.

How much would the employee have to pay in premiums for this plan?

$

How often? Weekly Every two weeks Twice a month

Once a month Quarterly Yearly

* An employer-sponsored health plan meets the “minimum value standard” if the plan’s share of the

total allowed benefit costs covered by the plan is no less than 60 percent of such costs. (Section

36B(c)(2)(C)(ii) of the Internal Revenue Code of 1986)

Employer Changes. What change will the employer make for the new plan year (if known)?

Employer won’t offer health coverage

Employer will start offering health coverage to employees or change the premium for the lowest-cost plan available

only to the employee that meets the minimum value standard. (Premium should reflect discount for wellness

programs.)

How much will the employee have to pay in premiums for that plan?

$

How often? Weekly Every two weeks Twice a month Quarterly Yearly

Date of change:

470-5170 (Rev. 04/24) Page 15 of 27

Step 6. Assistance with Completing this Application

You can choose an authorized representative.

You can give a trusted person permission to talk about this application with us, see your information, and act for you on

matters related to this application, including getting information about your application and signing your application on

your behalf. This person is called an “authorized representative.” If you ever need to change your authorized

representative, let us know. If you’re a legally appointed representative for someone on this application, submit proof

with the application.

Name of authorized representative (first name, middle name, last name)

Address

Apartment or suite number

City

State

ZIP code

Phone number

Organization name

ID number (if applicable)

By signing, you allow this person to sign your application, get official information about this application, and act for you

on all future matters with this agency.

NOTE: Your signature here does not complete the application. You must sign and date on page 16 to complete this

application.

Your signature

Date (mm/dd/yyyy)

For certified application counselors, navigators, agents, and brokers only.

Complete this section if you’re a certified application counselor, navigator, agent, or broker filing out this application for

somebody else.

Application start date (mm/dd/yyyy)

First name, middle name, last name, and suffix

Organization name

ID number (if applicable)

Step 7. Read and Sign this Application

Renewal of coverage in future years

To make it easier to determine eligibility for health coverage in future years, your income data, including information

from tax returns, can be verified electronically. You can also change your mind and not allow the Department of Health

and Human Services to check this information.

Do you want this information to be verified in the future and used to automatically renew your eligibility?

Yes, renew my eligibility automatically.

How long? 5 years 4 years 3 years 2 years 1 year

No, don’t use my information from tax returns to renew my coverage.

470-5170 (Rev. 04/24) Page 16 of 27

Estate Recovery

Federal law requires Iowa to have an estate recovery program. If you get Medicaid, you may be subject to estate

recovery. This means any Medicaid funds used to pay for your healthcare, including the full monthly fee paid to a

Managed Care Organization (MCO), including medical and dental, even if the plan did not pay for any services, will need

to be paid back from your estate after your death. Estate recovery applies if you get Medicaid and are:

▪ Age 55 or older, or

▪ Are under age 55 and live in a medical facility and cannot reasonably be expected to return home.

For more information, call the Iowa Medicaid Estate Recovery Program at 1-877-463-7887 or go online to

http://hhs.iowa.gov/sites/default/files/Comm123.pdf (English) or http://hhs.iowa.gov/sites/default/files/Comm123S.pdf

(Spanish).

Sign this application

The person who filled out Step 1 should sign this application. If you’re an authorized representative, you may sign here

as long as you have provided the information required in Step 6.

If I leave a question on this application blank, I am reporting that the question does not apply to me and all persons listed

on this application.

I agree to allow my information to be used and retrieved from data sources, including an asset verification system

database, for this application. I have consent for all people I will list on the application that allows their information to be

retrieved and used from data sources for this application.

I acknowledge that I have read and agree to the contents of Rights and Responsibilities, Comm. 233. Rights and

Responsibilities, Comm. 233 is pages 23 to 27 of this application.

By signing this application, I certify under penalty of perjury and false swearing that my answers are correct and

complete to the best of my knowledge, including information provided about the citizenship or alien status for each

household member applying for benefits. I know I may be subject to penalties under federal law if I provide false or

untrue information.

I declare under penalty of perjury under the laws of the United States of America that the information

contained in this statement of facts is true, correct, and complete.

Signature

Date (mm/dd/yyyy)

Step 8. Provide the Completed Application

▪ In-person – Bring to your local HHS office.

▪ Fax – Send to (515) 564-4017

▪ Email – Send to imaging[email protected]tate.ia.us

▪ By mail – Send your signed application to:

Imaging Center 4

PO Box 2027

Cedar Rapids, Iowa 52406

If you want to register to vote, you can complete a voter registration form at:

https://hhs.iowa.gov/sites/default/files/Voter_Registration. Applying to register or declining to register to vote will not

affect the amount of assistance that you will be provided by this agency.

470-5433 (Rev. 06/23)

Iowa Department of Health and Human Services

Appendix A for Health Coverage

Case Number:

Complete this section if you or someone in the household is aged (65 and older), blind, or

disabled.

Name of Person Requesting

Services

Marital Status

Date of Birth

Social Security

Number

Please indicate if you or someone in the household is in need of any of the following coverage:

Help paying your facility costs (nursing facility, PMIC, skilled facility)

Services to remain in your home (includes assisted living)

AIDS/HIV waiver – No age limit and diagnosis of AIDS or infected with HIV

Brain Injury waiver – At least 1 month old and diagnosis of brain injury

Children’s Mental Health waiver - Under age 18 and diagnosis of serious emotional disturbance

Elderly waiver – Age 65 or older and in need of nursing or skilled level of care

Health and Disability waiver – Under 65 and determined disabled

Intellectual Disability waiver – No age limit and diagnosis of an intellectual disability

Physical Disability waiver – Between 18 and 64 with a Physical disability

Program for All-Inclusive Care for the Elderly (PACE) – Age 55 or older, live in a PACE county and

meet Level of Care

Assistance paying Medicare premiums

State Supplementary Assistance (residential care facility, in-home health-related care, dependent person)

Help paying for a hospital stay of 30 days or more.

Other

PLEASE PROVIDE VERIFICATION OF ALL ITEMS YOU MARK BELOW

(copies, not originals).

If you have more information to report, please use an additional sheet of paper.

1. Income – Tell us about any additional sources of income for each individual in your household, such as

child support, veteran’s payments, Black Lung, Railroad, Supplemental Security Income (SSI), worker’s

compensation, interest, alimony, and dividends, etc.

Name of Person with Income

Income Type

Amount

How often

received?

470-5433 (Rev. 06/23)

2. Resources – Tell us about all resources for each individual in your household, including cash on-hand,

checking and savings accounts, social security debit card, stocks, bonds, mutual funds, annuities, safe

deposit box, 401ks, IRAs, CDs, etc.

Name of Owner of

Resource

Resource

Type

Name/Location of Financial

Institution

Account

Current

Value

3. Motor Vehicles – Tell us about all the vehicles owned for each individual in your household, even if the

vehicle is not in working condition.

Owner

Year/Make/Model

Fair Market

Value

Amount Owed

4. Unmet Medical Expenses – Tell us about all medical expenses for each individual in your household

not being reimbursed by a third party.

Name of Person with

Unmet Medical

Expenses

Type of Medical Expense

Amount

How often

incurred?

5. Burial/Funeral – Tell us about all burial plots, burial or funeral funds, or burial contracts for each

individual in your household.

Type

Location

How Many/

For Whom

Current Value

470-5433 (Rev. 06/23)

6. Life Insurance – Tell us about all life insurance policies owned by each individual in your household.

Policy Owner

Company Name and Address

Policy #

Do you intend to use your life insurance for burial expenses? Yes No

7. Property – Tell us about all property for each individual in your household including homestead (the

home you live in) and non-homestead (other property such as vacation home, rental home, vacant lots,

buildings, etc.).

Property Owner

Property Address

Property Value

8. Do you or anyone in your household have a life estate?

Yes No

If yes, who:

9. Do you or anyone in your household have a trust?

Yes No

If yes, who:

10. Have you or anyone in your household not accepted an inheritance in the past

five years?

Yes No

If yes, who:

11. Have you or anyone in your household transferred, sold or given away

resources for less than their value in the past five years?

Yes No

If yes, who/what:

Date this occurred:

12. Does anyone applying for benefits live in a medical institution (nursing facility,

hospital, PMIC, etc.)?

Yes No

If yes, who:

Date of entry:

Name of facility:

Phone:

13. Do you or anyone in your household receive Long-Term Care insurance?

Yes No

Name of company:

14. If you are currently living in a medical institution and own your home, do you

intend to return home?

Yes No

15. Does anyone who is applying have a pending application for Social Security

Disability?

Yes No

If yes, who:

470-5433 (Rev. 06/23)

To speed up the processing of your application, you may provide verification of the following with your

application. If verification is not submitted with the application, you may receive a letter indicating what we

need before we can process your application.

For anyone who is applying and is not a U.S. citizen:

▪ Immigration status

Proof can be an alien identification card (green card, I-551, I-94), visa, passport, or documents from

Immigration Services

Send verification for those individuals who are:

▪ Working

Pay stubs from the last 30 days or a written statement of earnings from your employer if you do not have

pay stubs.

▪ Self-employed

Most recent income tax returns and all related schedules or business records if taxes are not filed.

▪ Getting other income

(This includes child support, veteran’s payments, Black Lung, Railroad, worker’s compensation, interest and

dividends, cash received from friends or relatives, pension, etc.) A statement from the person or company

that issues the income, copy of checks (showing gross income amount), award letter, tax forms, court

order, or other documents from the last 30 days or most current received.

Send verification for anyone who is 19 or older for the last 90 days from the date you are completing the

application:

▪ Bank accounts

Recent bank statements or written statement from bank showing current balance or value of accounts.

▪ Property

Property tax statement. Include documents showing amount owed against the property.

▪ Burial/funeral contracts

Burial contract and statement of goods and services from the company or funeral home that holds the

contract.

▪ Other resources

Includes stocks, bonds, mutual funds, annuities, safe deposit box, 401ks, IRAs, CDs, vehicles, etc.

▪ Life insurance policies

Face and cash value, bonds, annuities, trusts, stock ownership statements, or other documents showing

value of asset. Include documents showing current loan balance owed against the asset.

▪ Unmet medical expenses

Billing statements, pharmacy statements, medical transportation.

Send copies of proofs. Do not send original documents.

470-4670 (Rev. 06/23)

Iowa Department of Health and Human Services

Addendum to Application and Review Forms for Release of Information

OPTIONAL Release of Information

Help Us Help You!

You do not have to sign this, but it will help us get information we need to help you,

without having to get your signature on specific requests.

You should know that:

▪ We may need more information to decide if you can get assistance.

▪ If more information is needed from you, you will get a letter telling you what we need and the date you must

get it to us.

▪ You are responsible to get the information or to ask us for help to get it.

▪ If you do not give us the information or ask for help by the due date, your application may be denied or your

assistance may stop.

▪ We may be able to use the release below to get the information we need. But you still have to provide

information we request or ask us for help.

▪ We may attach a copy of this release to a form that asks other people or organizations (like your employer)

for specific information needed about you or others in your household.

Print and sign your name below to give us permission to get needed information.

RELEASE OF INFORMATION

I hereby authorize any person or organization to give the Iowa Department of Health and

Human Services requested information about me or other members of my household.

A copy of this release is as valid as the original.

This release does not apply to protected health information.

This release is good for 12 months from the date signed.

________________________________ ________________________________

Your Name (please print clearly) Other Adult Name (please print clearly)

________________________________ ________________________________

Signature or Mark Signature or Mark

________________________________

Date

470-4670 (Rev. 06/23)

This page intentionally left blank

Please keep this page for your information.

Comm. 233 (Rev. 04/24)

Rights and Responsibilities

When you get Medicaid from the Department of Health and Human Services (HHS), you have the following rights

and responsibilities.

Note: “Medicaid” on this form means any HHS medical assistance program including Medicaid, Healthy and Well Kids

in Iowa (Hawki), Iowa Health and Wellness Program (IHAWP), State Supplementary Assistance (SSA), and Refugee

Medical Assistance (RMA).

What Are My Rights?

You have the right to:

▪ Apply for any program.

▪ File an application online, by phone, by mail, by fax, or in person at your county HHS office.

▪ Have someone help you apply.

▪ Have all of your questions answered.

▪ Get information about the programs you applied for and any other HHS program that you may be able to get.

▪ Be sent a notice within 45 days of the day we get your application telling you if your application was approved.

▪ Have information about you and your family kept private as required by law.

▪ Have your expenses used to figure your eligibility or the amount of assistance you get by reporting your

expenses, and giving proof if we ask you to. If you do not report or give proof of your expenses when asked, you

choose not to claim the expense. You can report and give proof later to have an expense used for future

months.

▪ Be treated equally without regard to race, color, national origin, sex, sexual orientation, gender identity, religion,

age, disability, political belief, or veteran status. If you feel we have discriminated against or harassed you, send a

letter detailing your complaint to: HHS, Office of Human Resources, Hoover Building – 1st Floor, 1305 E.

Walnut, Des Moines IA 50319-0114 or via email at contactdhs@dhs.state.ia.us.

▪ Appeal any decision you do not agree with by following the directions on the last page of this form.

What Are My Responsibilities?

▪ You must tell us the truth.

• Section 1128B of the Social Security Act provides federal penalties for fraudulent acts and false reporting in

connection with Medicaid programs.

• Anyone who gets, tries to get, or helps any other person get assistance to which they are not entitled, is

guilty of violating the laws of the State of Iowa. This includes, but is not limited to, Iowa Code Chapters 249,

249A, 249N, and 514I.

• Giving wrong information on purpose may result in us taking criminal or civil legal action against you.

• You will have to pay back any benefits paid in error for you or anyone you apply for. You may be liable for

the full amount of any payments made, including payments made to the health and dental plan in which the

person was enrolled.

▪ You must tell us within 10 days about any changes that may affect your eligibility. This includes changes such as:

• Mailing or living address.

Please keep this page for your information.

Comm. 233 (Rev. 04/24)

• Starting or stopping a job or any other income (including lump sum payments, past due child support,

inheritances, settlements, or cash medical support).

• Someone moving in or out of your home.

• Resources or assets, including getting an inheritance.

• Changes in any other health insurance coverage (including employer-sponsored insurance, Medicare, etc.).

• Filing an insurance claim or getting an attorney to recover bills paid by Medicaid.

To report a change:

▪ Call 1-877-347-5678, or

▪ Email IMCustomerSC@dhs.state.ia.us, or

▪ Fax information to 1-877-238-0015.

▪ You must apply for and accept any other benefits and medical assistance coverage that you may be able to get.

▪ You must give us information and give us proof when we ask for it.

▪ You must fill out review forms when you are asked to.

▪ You must cooperate with Quality Control (QC) and the Department of Inspections and Appeals (DIA). They

may contact other people or organizations to get proof of your information. By signing the application, you give

permission to release confidential information to QC or DIA.

▪ If any child applying for or receiving Medicaid has a parent living outside the home, you must cooperate with the

agency that collects medical support from an absent parent. If you think that cooperating to get medical support

will harm you or your children, you can tell us and you may not have to cooperate.

▪ You must cooperate with the Health Insurance Premium Payment (HIPP) Program and enroll in a health plan

through your employer, if we ask you to. Visit https://hhs.iowa.gov/programs/welcome-iowa-medicaid/fee-

service/hippfor explanation.

▪ You must agree to assign medical payments from a third party to the Medicaid agency for yourself and others

who are eligible for Medicaid for whom you can legally assign benefits, cooperate in getting medical payments

from third parties, give the Medicaid agency rights to pursue and get medical support from a spouse, and give the

Medicaid agency rights to pursue and get money from other health insurance, legal settlements, or other third

parties.

▪ If you get money from another person or an insurance company to pay your medical bills, you must give that

money to HHS if Medicaid paid the bill. This will be used to repay bills that Medicaid paid for you.

This permission ends when your Medicaid stops.

Please keep this page for your information.

Comm. 233 (Rev. 04/24)

Other Things You Need to Know

▪ HHS will provide documents or claim forms describing the services paid by Medicaid upon your request or the

request of an attorney acting on your behalf. Such documents may also be provided to a third party, when

necessary, to establish the extent of the HHS’s claim for reimbursement.

▪ If the State of Iowa was made the remainder beneficiary on an annuity in order for you to qualify for Medicaid

payment of long-term care, the State of Iowa will get any benefits remaining in the annuity, up to the amount of

the Medicaid benefits paid.

▪ If you become enrolled in a managed health care plan, you consent to disclosure of medical information, including

any clinical mental health or substance abuse information, by your medical providers to the PCP, other managed

care providers, or to the authorized administrative body contracted by the managed care provider to determine

appropriateness, quality, or utilization of services you received while enrolled in managed health care. A medical

certification from Iowa Medicaid is needed for certain medical programs. Payments on any future unpaid medical

services will be paid directly to the doctors and medical suppliers under the Medicare Insurance Program

(Medicare Part B).

We Check What You Tell Us

The information you give us may be checked by federal, state, and local officials to make sure it is true. Things we

might check include any listed person’s: social security number, job and pay, bank account amount, immigration or

alien status, and amounts received from other sources like Social Security or unemployment. If any information you

give us is not correct, we may ask you to send us proof or we may deny or cancel your benefits.

We may check records from other states to see if any person in your household can get benefits in Iowa. This may

be because a person was disqualified from a program in another state.

As part of the eligibility determination process, we may need to retrieve your information from sources like the

Internal Revenue Service (IRS), Social Security Administration (SSA), the Department of Homeland Security, Asset

Verification System (AVS), and the state Income and Eligibility Verification System. If something you told us is

different from what the computer systems tells us, we will check to find out what is correct. We might check your

information by contacting your employer, your bank, or other people. To do this kind of checking with your

employer, bank, or other people, we will ask you first. Such information may affect your household’s eligibility and

level of benefits.

The authorization to use AVS database is in effect for as long as the Department is determining eligibility, the

individual is a Medicaid recipient, or the applicant or recipient revokes the authorization. If refusal or revocation of

the authorization is submitted, the Department may, on that basis, determine the applicant or recipient ineligible for

medical assistance.

Information About Requiring a Social Security Number

We can give help only to people who give us their social security number (SSN) or proof of application from the

Social Security office, and we will deny assistance to the people for whom you do not give us a SSN. There are some

exceptions to this. Please ask us if you have questions.

You don’t have to give us the SSN for people in your household who you do not want help for, but you can choose

to give us their SSN to speed up processing your case. We will use any SSN given to us in the same way we use the

SSN of people getting assistance. As required by Section 1137(a)(1) of the Social Security Act and 42 CFR 435.910,

we use SSNs to check income/eligibility/payments, determine a person’s right to Medicaid, comply with federal law,

and match records with other agencies.

Please keep this page for your information.

Comm. 233 (Rev. 04/24)

Information About Immigration Status

You can apply for part of your household even if some members do not have lawful immigration status. For example,

parents who do not have lawful immigration status may apply for their children who are U.S. citizens or qualified

aliens. You may need to give proof of immigration status or U.S. citizenship for each person in your household for

whom you apply.

When you tell us a person applying has eligible immigration status, that person’s immigration status is checked with

the Department of Homeland Security, and this will require submission of certain information from your application

or review form. Any information we get from the Department of Homeland Security may affect your household’s

eligibility and level of benefits. We will not contact the Department of Homeland Security about people you do not

apply for. However, we may use their income and assets to see if the rest of the household can get help.

Information About Estate Recovery

Federal law requires Iowa to have an estate recovery program. If you get Medicaid, you may be subject to estate

recovery. This means any Medicaid funds used to pay for your healthcare, including the full monthly fee paid to a

Managed Care Organization (MCO), including medical and dental, even if the plan did not pay for any services, will

need to be paid back from your estate after your death. Estate recovery applies if you get Medicaid and are:

▪ Age 55 or older, or

▪ Are under age 55 and live in a medical facility and cannot reasonably be expected to return home.

For more information, call the Iowa Medicaid Estate Recovery Program at 1-877-463-7887 or go online to:

http://dhs.iowa.gov/sites/default/files/Comm123.pdf (English) or http://dhs.iowa.gov/sites/default/files/Comm123S.pdf

(Spanish).

By signing an application/review form, you give your permission for HHS to share:

▪ Your medical and other health care records with federal and state officials.

▪ The status of your Medically Needy case, the amount of your spend down, and the bills used to meet your spend

down with the provider whose bills are being used.

▪ The premium due date for Medicaid for Employed People with Disabilities (MEPD), IHAWP, DWP, and Hawki

with your medical provider.

▪ The information on your application for Home- and Community-Based Services (HCBS) waivers with the chosen

case management agency or with the Iowa Department of Health and Human Services (HHS) Brain Injury

Services Program manager (for HCBS brain injury waiver applications).

▪ The filing date of your application with your nursing facility.

By signing an application/review form you:

▪ Give permission for your medical provider to share your medical history with a PCP, other managed care

providers, or the authorized administrative body contracted by the managed care provider to determine

appropriateness, quality, or utilization of services you received while enrolled in managed health care.

▪ Give permission for your medical provider to share information with IME Medical Services Unit to certify a

medical need for certain medical assistance programs or services.

Please keep this page for your information.

Comm. 233 (Rev. 04/24)

Information for those Applying for WIC or Maternal and Child Health Services

▪ A declaration of income and persons in your family and living in your household is necessary to ensure that

federal and state funds are directed to those persons least able to secure services from other sources.

▪ The Maternal and Child Health Director of the Iowa Department of Health and Human Services, the WIC

Director, or their designees shall have access to all information available from records maintained by the agency

providing maternal health, child health, or WIC services.

Information for those Applying for Presumptive Medicaid Services

▪ Your answers to some questions will not impact the presumptive Medicaid eligibility decision. These answers are

needed for HHS to make a decision for ongoing Medicaid only.

▪ If you are only applying for presumptive Medicaid, not all of your information will be checked against data in

computer systems.

▪ If you choose to have your application forwarded to HHS for an ongoing Medicaid determination, HHS will verify

income, citizenship, immigration status, identity, and other information as necessary.

▪ All presumptive Medicaid is granted on a daily basis and may be terminated on any given day, without notice,

once it is determined that the individual is no longer presumptively eligible.

▪ Appeal hearings are not granted for presumptive Medicaid.

How to Appeal

You, or the person helping you, may request an appeal hearing if you do not agree with any action taken on your

case. You can appeal in person, by phone, or in writing. To appeal in writing do one of the following:

▪ Fill out an appeal electronically at https://secureapp.dhs.state.ia.us/dhs_titan_public/appeals/appealrequest, or

▪ Write a letter telling us why you think a decision is wrong, or

▪ Fill out an Appeal and Request for Hearing form. You can get this form at your county HHS office.

Send or take your appeal to the HHS, Appeals Section, 5th Floor, 1305 E Walnut Street, Des Moines, IA 50319-0114.

If you need help filing an appeal, ask your county HHS office. You can represent yourself. Or, you can have a friend,

relative, lawyer, or someone else act on your behalf.

You may contact your county HHS office about legal services. You may have to pay for these legal services. If you do,

your payment will be based on your income. You may also call Iowa Legal Aid at

1-800-532-1275. If you live in Polk County, call (515) 243-1193.