Schedule F: Profit or

Loss From Farming

A Line-by-Line Discussion

info@RuralTax.org

RuralTax.org

• Website hosted by Utah State University

• Material developed, managed, and owned

by the National Farm Income Tax

Committee

• Informational Material on Ag, Timber, and

Rural Tax topics include but not limited to:

• Disaster/Weather Losses

• Treatment of Government Payments

• Farm Losses and Hobby Rules

• Self-Employment Taxes

• Estate and Gift Taxes

• Like Kind Exchanges

• Depreciation

• Etc...

Rural Tax Education

info@RuralTax.org

RuralTax.org

RuralTax.org

This material is based upon work supported by the U.S. Department of Agriculture, under

agreement number FSA21CPT0012032. Any opinions, findings, conclusions, or

recommendations expressed in this publication are those of the author(s) and do not necessarily

reflect the views of the U.S. Department of Agriculture. In addition, any reference to specific

brands or types of products or services does not constitute or imply an endorsement by the U.S.

Department of Agriculture for those products or services. USDA is an equal opportunity provider,

employer, and lender. Rural Tax Education is part of the National Farm Income Tax Extension

Committee. In their programs and activities, the land-grant universities involved in this project do

not discriminate based on race, color, religion, sex, national origin, age, genetic information,

sexual orientation or gender identity/expression, disability, status as a protected veteran, or any

other status protected by University policy or local, state, or federal law.

Disclaimer

info@RuralTax.org

RuralTax.org

Topics Addressed

• Farmer, Farm, Farming

• Schedule F Farmer info

• Schedule F Income

• Schedule F Expenses

info@RuralTax.org

RuralTax.org

Tax definition of a farm

• A business with a profit motive

• I.R.C. § 2032A(e)(4) “A farm includes livestock, dairy, poultry, fish, fur, fruit and truck farms. It

also includes plantations, ranches, ranges, and orchards and groves.”

• Crop farms

• Cattle ranches

• Truck farms

• Orchards/vineyards

info@RuralTax.org

RuralTax.org

Who is a Farmer or Rancher?

• IRS Publication 225, The Farmer’s Tax Guide, defines a farmer or rancher as an

individual “…in the business of farming if you cultivate, operate, or manage a farm for

profit, either as an owner or tenant.”

• This definition also applies to:

• Partnerships (LLCs)

• Corporations

• Estates and Trusts

info@RuralTax.org

RuralTax.org

Not Farming …

• Providing agricultural operations as a service

• Custom harvesting

• Custom farming

• Trucking of farm commodities to markets

• Processing of farm commodities into value-added wholesale or retail products:

• Cheese

• Cuts of meat

• Wine

info@RuralTax.org

RuralTax.org

Examples of Farming Activity

• John operates a traditional row crop farm having gross receipts of $950,000. John is a

farmer.

• Maria has specially constructed greenhouses in which she raises mushrooms. Maria

earns $30,000 in gross farm receipts yielding $10,000 in net profit. Maria is a farmer.

Implicit is Maria’s profit motive, thus, scale (as compared to John) is not a factor.

• Roberto raises Nile perch (tilapia) in ponds. The fish are harvested and go to market

as live fish shipped in special tanker trucks. Roberto files Schedule F to report his

income and expenses.

• Jin rents all the land upon which he raises his crops. Jin is engaged in the business of

farming even though he does not own any land. Jin uses Schedule F to report his

income and expenses.

info@RuralTax.org

RuralTax.org

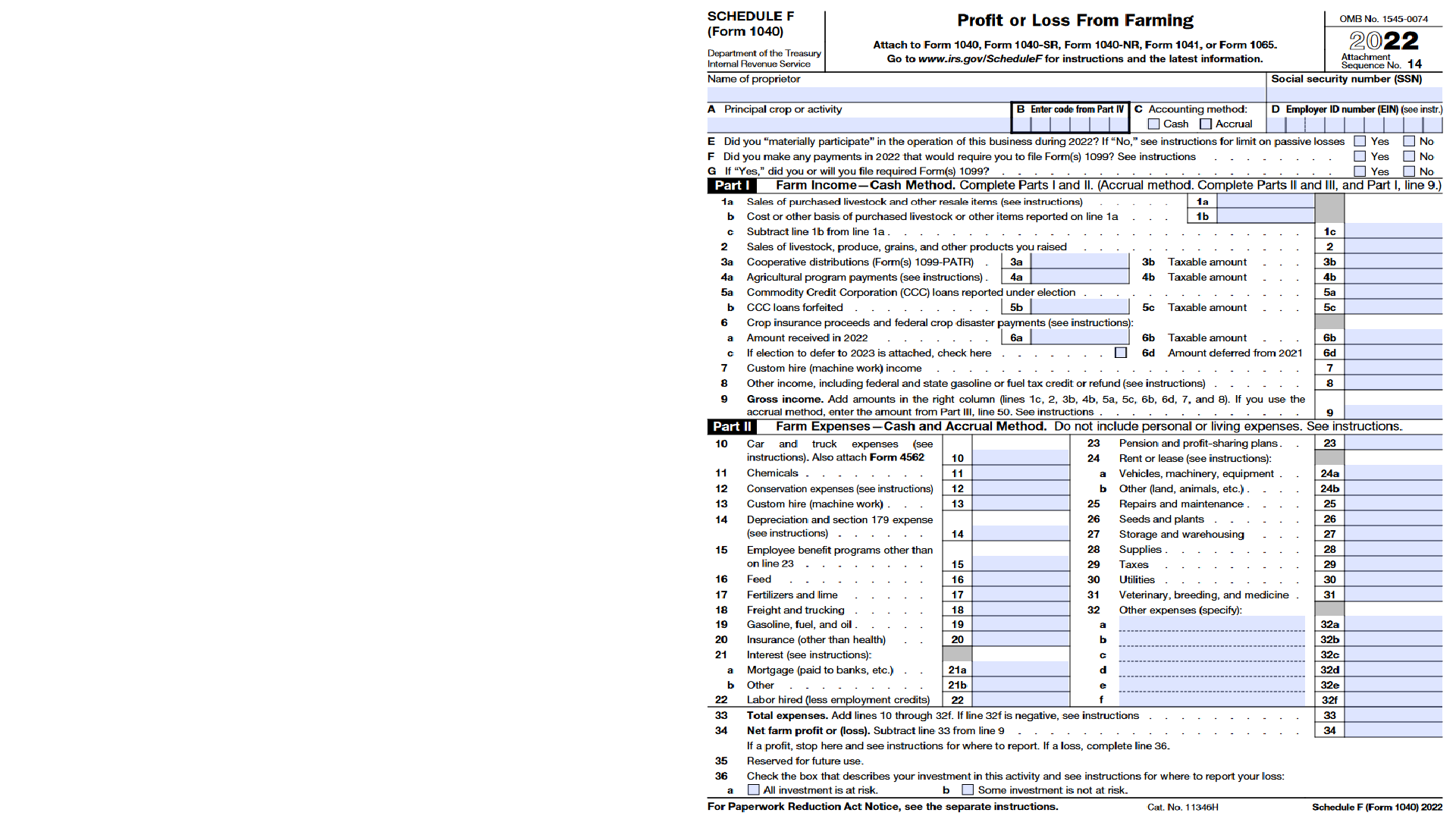

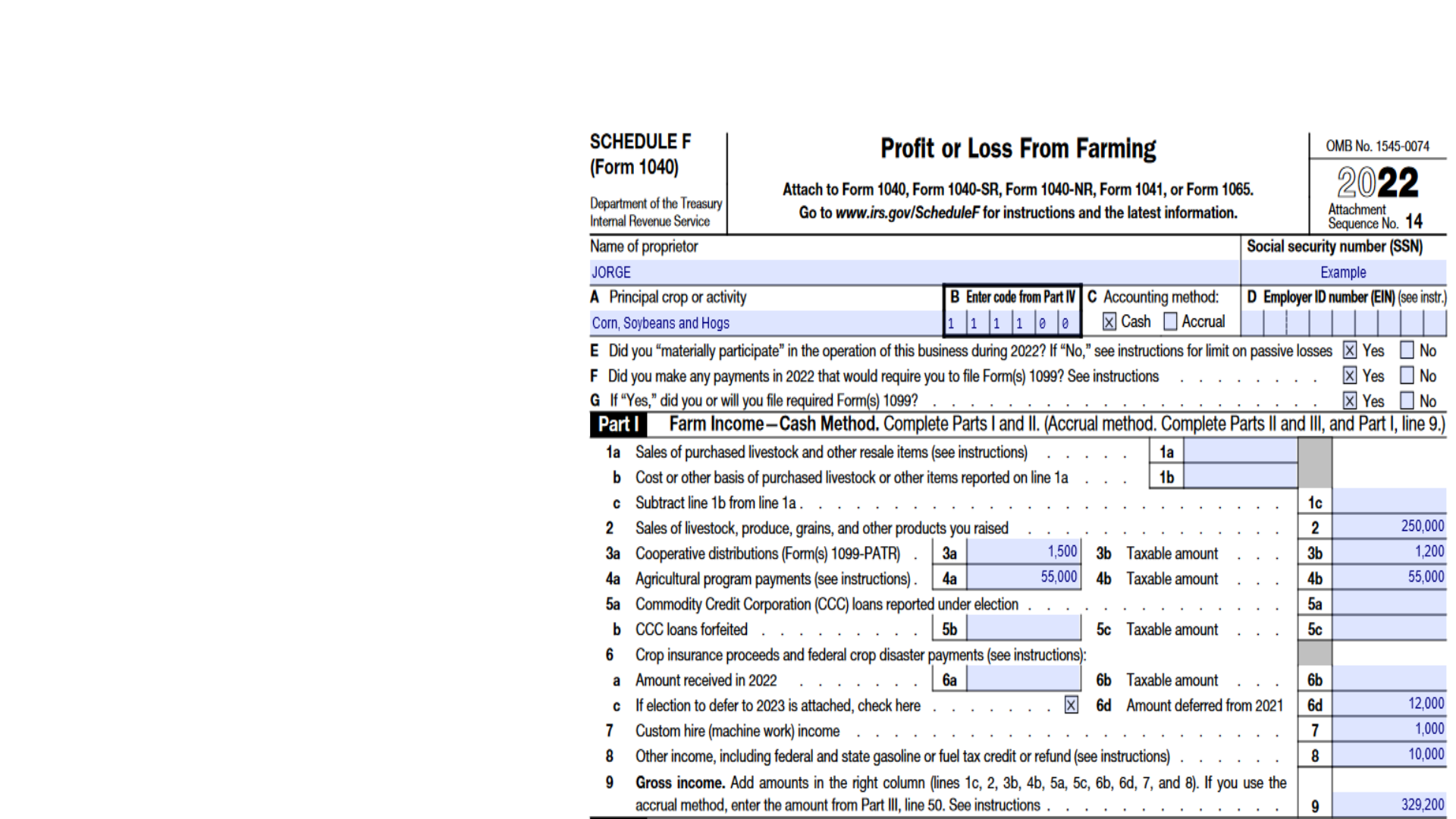

Part I: Farm Income (Cash Method)

info@RuralTax.org

RuralTax.org

IRS Reporting of

Farm Businesses

• Sole proprietor farming

businesses use IRS

Schedule F, Profit or Loss

from Farming to report

income and expenses of

the farming business.

• Schedule F can be used

by partnerships,

Corporations, Trusts and

Estates to report farming

activities.

Schedule F

Information Block

• Name of business owner/proprietor

• Social Security Number

• A: Principal Crop or activity

• B: Farm Activity Code

• C: Accounting Method

• D: Employer ID Number

• E: Material participation question

• F: Payments requiring an IRS Form 1099

• E: Will the Forms 1099 be issued question

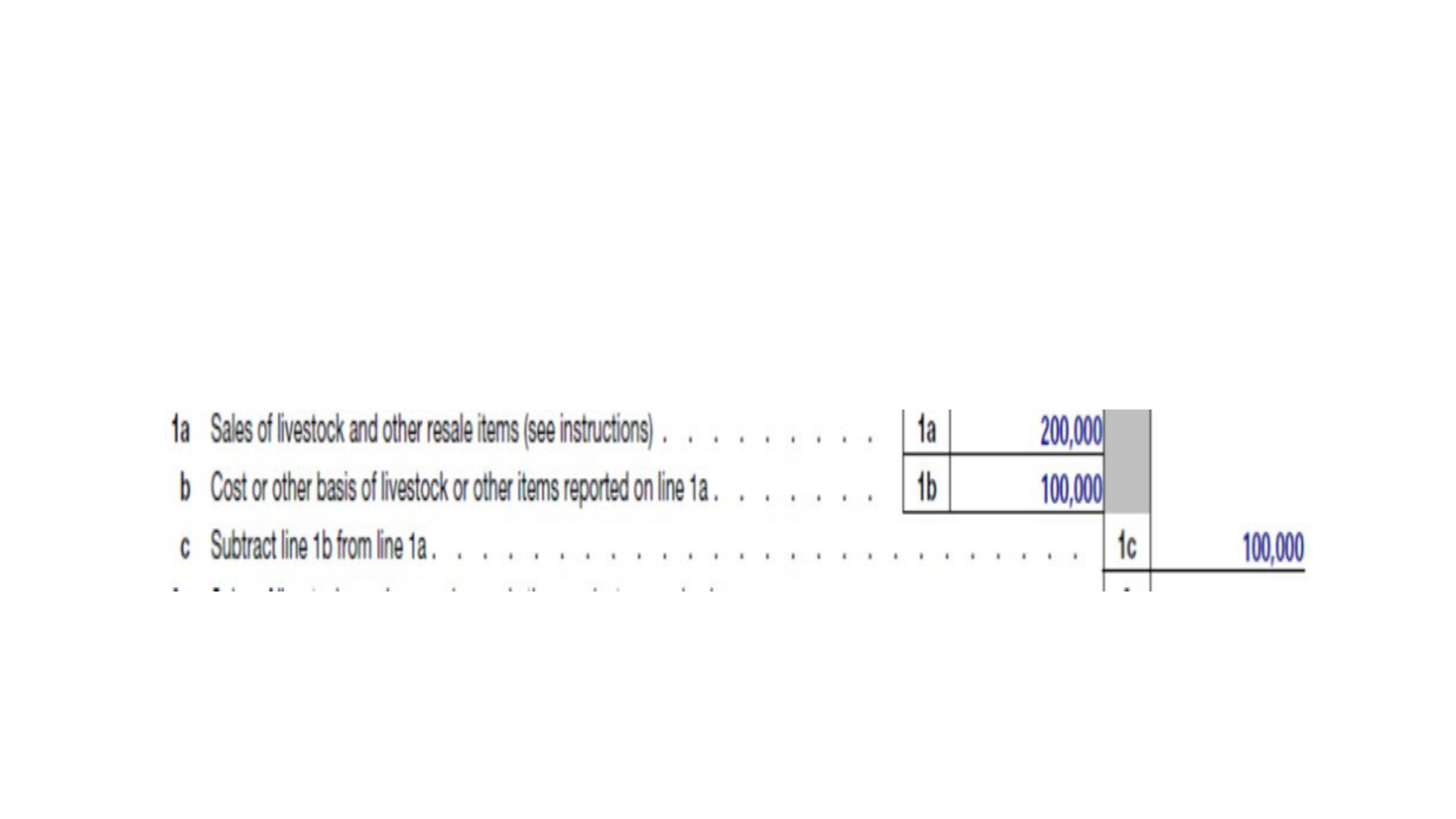

Lines 1a, b, and c

• Lines 1a, b, and c are used to report the sale and cost of items

which are purchased by a farmer and subsequently resold.

• Example: Rob purchases 100 feeder pigs for $5,000 and then

sells them when at market weight receiving $22,550, thus,

netting $17,550 gross margin.

• Jill sells corn and soybean seed to reduce her personal seed

inputs costs.

Line 2: Livestock, produce, grains raised

• Amal raises figs and dates on her farm in California. She sells her annual production under a contract to a

cooperative. This year her total production generated $500,000. Amal reports this income as part of her

total value on Line 2.

• Jerome is diversified farmer in Kansas, he grows wheat and grain sorghum (milo) as well as having a 300

head commercial cow herd and sells light feeder cattle in the late autumn. This year Jerome sold $150,000

of wheat, $250,000 of grain sorghum, and $200,000 of market calves. Jerome uses Line 2 to report his total

raised farm production sales of $600,000.

• Renaldo harvests and bales pine straw for landscaping companies. Renaldo rents several hundred acres of

Long Leaf Pine forests from local landowners. Pine straw is an annual crop generated by the trees. This year

Renaldo sold $600,000 of pine straw bales. He reports his income on Line 2 of Schedule F.

Consider two cautions regarding Line 2

• An all-too-common error on farm income tax returns is that raised

breeding, dairy, or draft animals are reported on Schedule F using

Line 2.

• Jose operates a dairy as a single-member LLC reporting his income and

expenses on Schedule F. His milking herd averages about 1,000 cows. He has

on average 600 baby to springing heifers and replaces about 200 – 250 milk

cows per year from his replacement herd. Thus, at a long-term average of

$750 per cull dairy cow, Jose generates $150,000 to $187,500 in cull cow

sales. These animals, though raised on Jose’s farm, are not reported on

Schedule F, but rather on Part I of IRS Form 4797.

Caution number 2

• Although a farmer “raises” an agricultural product, reporting of the

income may not be found on Line 2. In the case of raising pigs or

poultry as part of an integrated production system, the income

received may best be reported on Schedule F, Line 8, Other Income.

• Al operates a farrow-to-wean operation for a national integrator. Al owns the

farrowing barns, provides labor, utilities and repairs to his buildings and

equipment. The integrator owns the sows and piglets which the sows bear

and birth. The integrator also provides feed and veterinary supplies. Al is paid

on a “piglet delivered” basis with possibilities for premiums based on feed

conversion and number of live pigs per sow delivered above the contracted

target. Al is paid every two weeks based on piglets. Al receives a 1099-NEC for

$425,000. Since he does not own the sows or the piglets, Line 8 made

accounting easy for the DPAD when it was available prior to 2018.

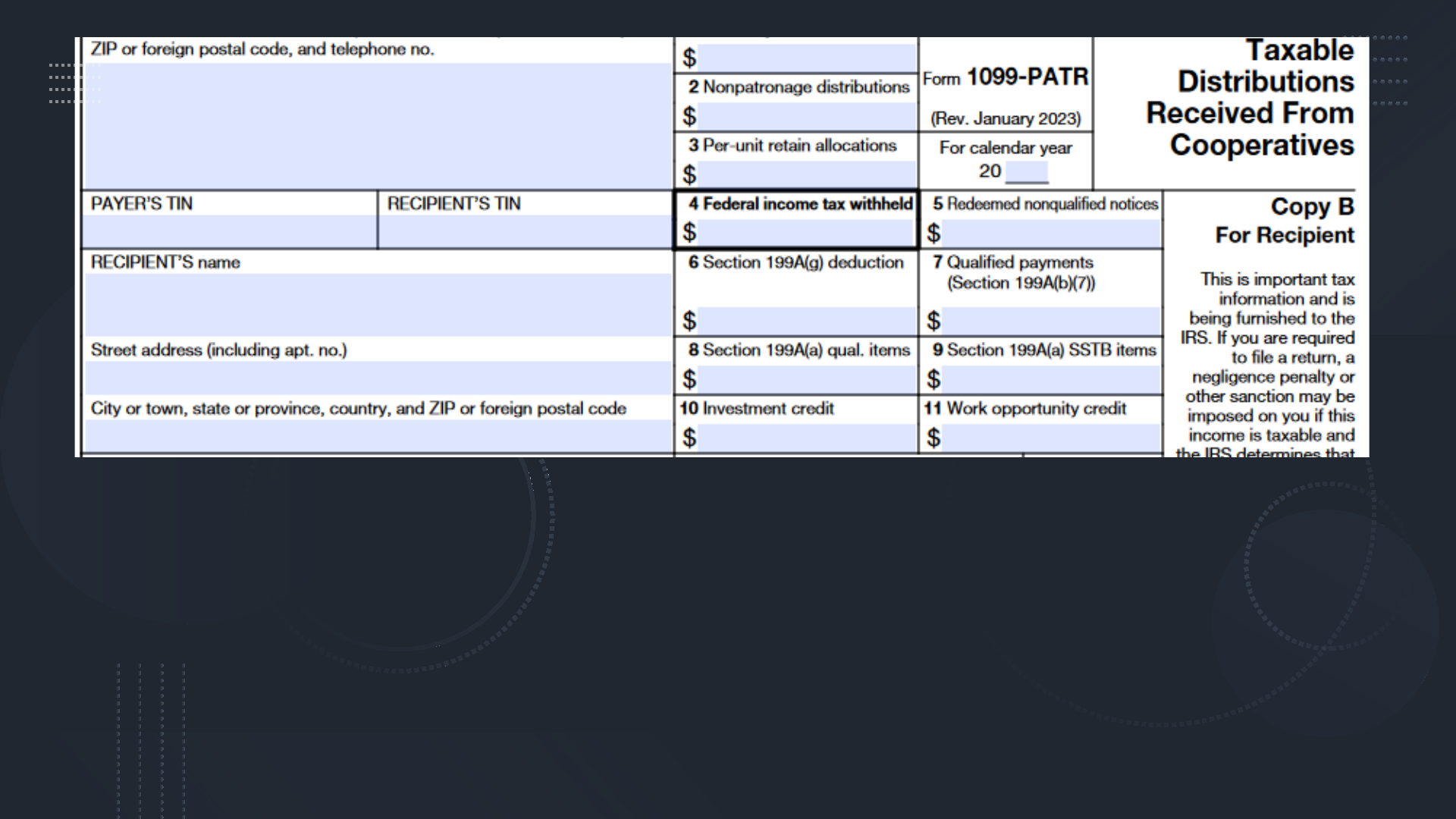

Lines 3a and b:

Patronage

Dividends

• Farmers and ranchers may be members of a cooperative. If

the coop is profitable, it may issue a dividend to the

members. These dividends are part of farming income.

• Boxes 1, 2, 3, and 5 are of importance and used to correctly

calculate the income of the farming or ranching business.

These values represent the “pass-through” income from the

cooperative to unique members based on the amount of

business the member conducted with the cooperative.

Patronage Dividend Examples

• Ralph operates a dairy. He sells his milk to a cooperative. This year the cooperative reports Ralph’s

patronage dividend of $1,000; $300 of which is in cash and $700 is in retained earnings in Box 1.

Additionally, the cooperative reports per-unit retain allocations of $5,000. The total taxable

amount is $6,000, however, Ralph received only $300 in cash. He reports this $6,000 on his

Schedule F using lines 3a and 3b.

• Ralph, from the example above, also received $5,500 from the cooperative which was a payment

for previously held capital retained earnings which had been credited to Ralph’s account. Because

the $5,500 was taxed in the past, this revenue is not taxable in the current year. Ralph’s records

should reflect the non-taxable nature of the payment; the cooperative generally issues a notation

that the payment is not taxable. A payment for past retained earnings being distributed should not

be reported on a 1099-PATR.

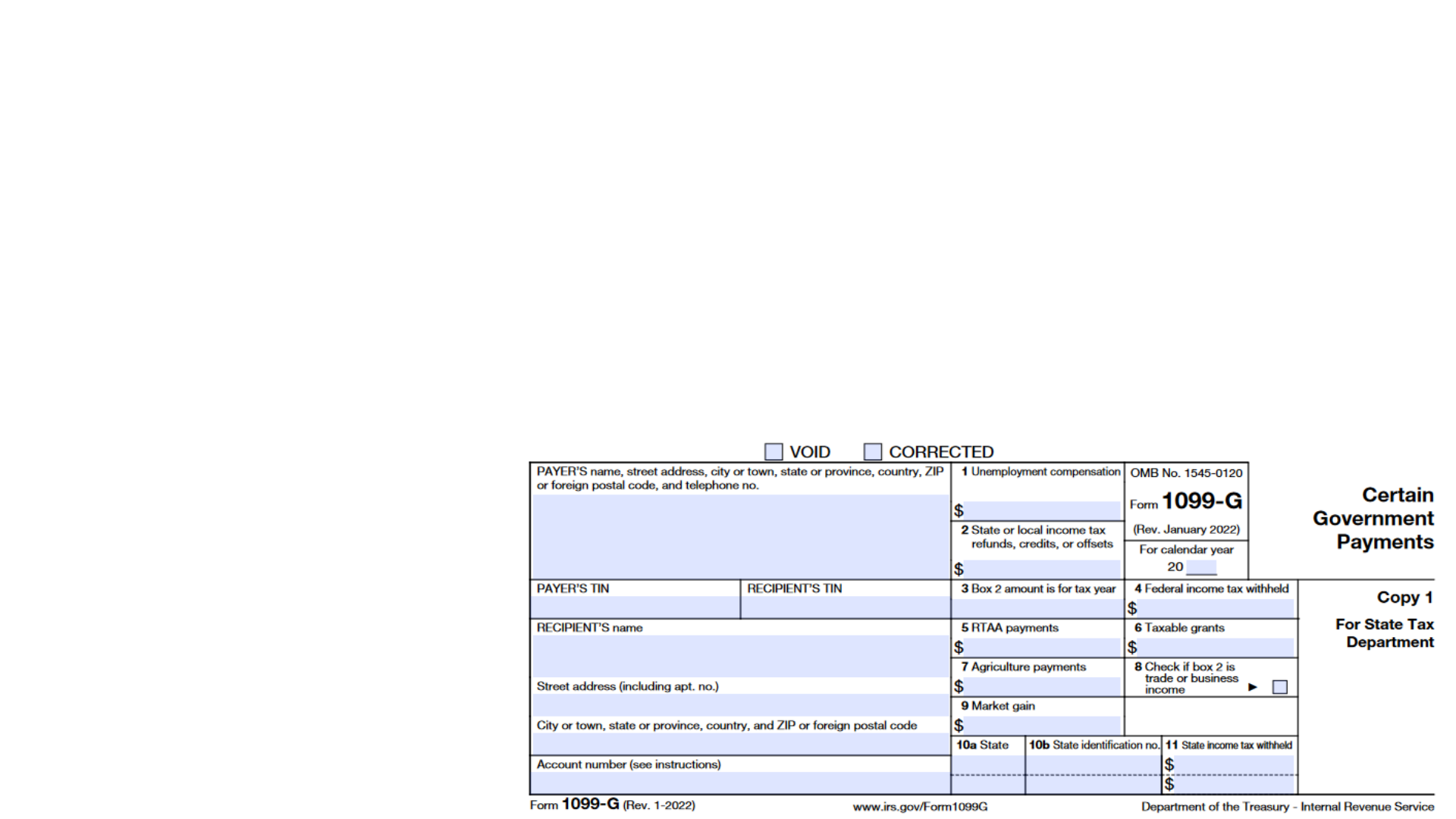

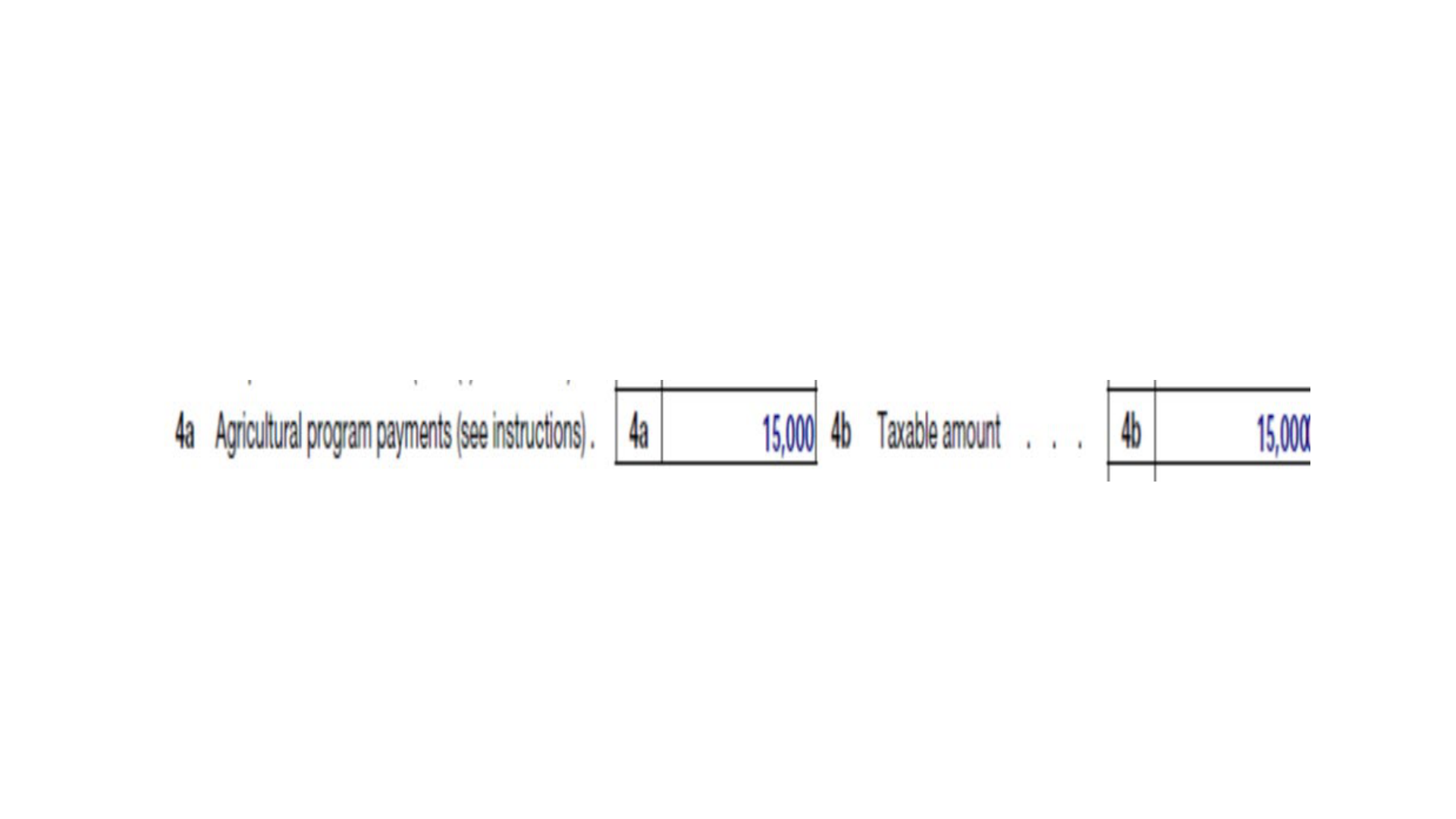

Lines 4a and b: Government Payments

• Farmers and ranchers often receive various payments from USDA or

state agencies as part of their farming operations. These payments

are reported on Lines 4a and b.

• Boxes 6, 7 and 9 of IRS Form 1099-G, Certain Government Payments

are often used.

Government Payment Examples

• Louisa grows many types of vegetables which she markets to local and regional restaurants and

grocery chains. In the current year, she received an ad hoc government payment of $15,000 to

assist with a pandemic recovery and to sustain her business. Louisa’s 1099-G Box 7 showed the

$15,000 payment and she received an attachment explaining the nature of the program payment.

Louisa reports this payment on Schedule F, Lines 4a and 4b.

• Richard farms corn and soybeans on his 3,000-acre farm. Richard received $20,000 in risk-

coverage payments, $10,000 in cost-share payments for a conservation project on his farm,

$25,000 in Market Facilitation Program payments, and lastly, $15,000 in Conservation Reserve

Program payments to divert highly erodible land into permanent cover crops. Thus, his Box 7,

Agriculture Payments, reports $70,000, all of which is subject to tax in the current year and

reportable on Schedule F, Lines 4a and 4b.

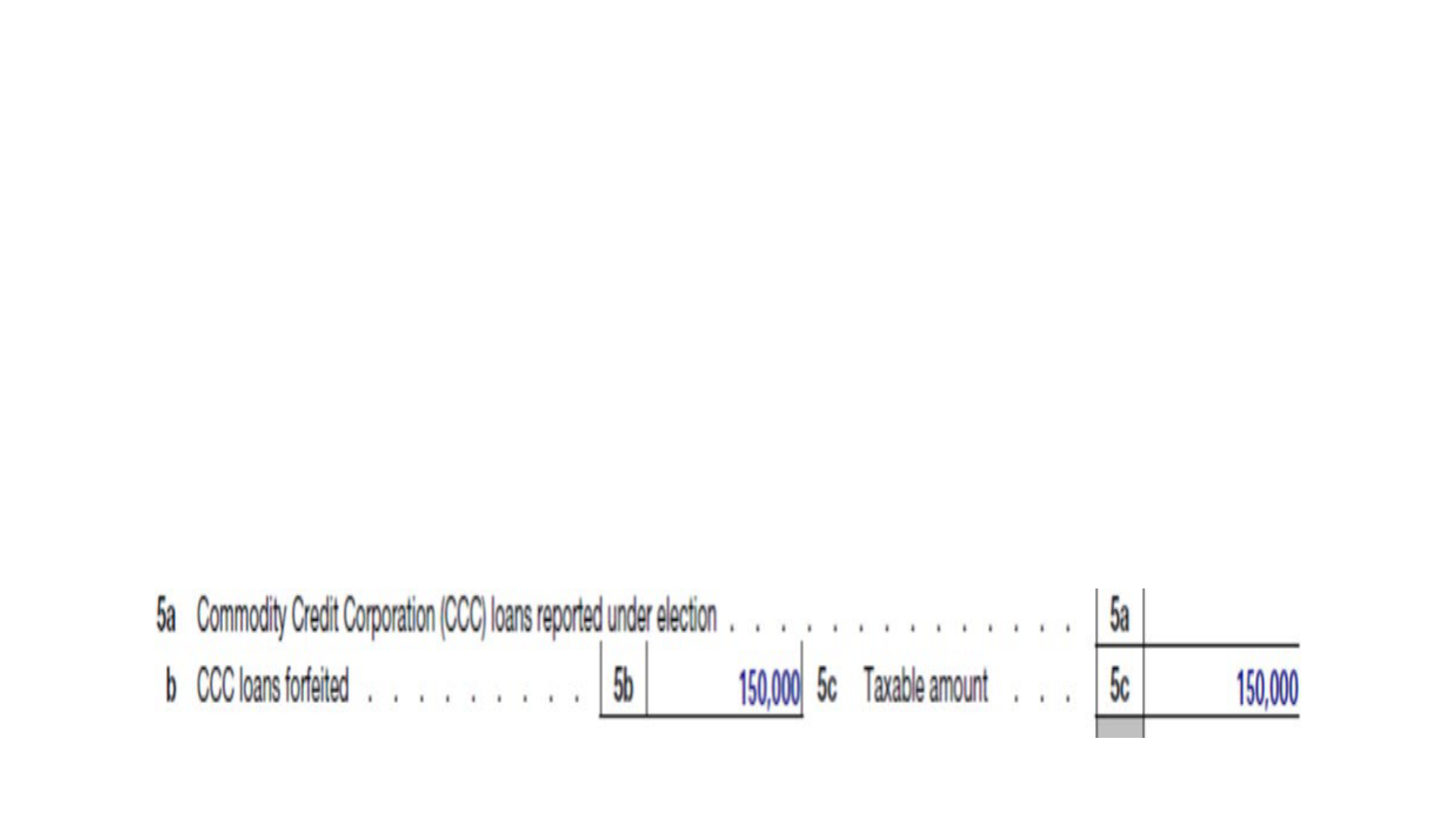

Lines 5a, b, and c: CCC Loans

• General principles of accounting provide that loan proceeds received are not treated as income of

the borrower. However, farmers and ranchers may make an election [I.R.C. § 77] to treat CCC

loans as income.

• The election and subsequent revocation of the election could be made repeatedly, and farmers

and ranchers have another tool to manage farm income. [Rev. Proc. 2011-14, 2011-4 I.R.B. 330]

• George and his tax preparer decide that for the current year, making the election to treat his

$100,000 CCC loan as income is a good option to accomplish George’s long-run business goals.

Lines 5a, b, and c continued

• George in the earlier example, repays his loan in March of the following year.

Since he took out his CCC loan, the commodity price increased so that when

George sold, he received $200,000. Because George made the election to treat

his $100,000 as income, he now has basis of $100,000 in the commodity and

reports the sale on Lines 1a, b, and c, thus treating this as a “purchased for resale

item”.

• Communicate clearly with the preparer to avoid double taxing the $100,000

Lines 5a, b, and c (continued)

• Treating “CCC loans as loans”

• Lisa uses the cash method of accounting, and she treats CCC loans as a loan; at harvest she places

corn she raised under CCC loan and received $150,000. Lisa anticipated the price of corn to

increase several months after harvesting her corn, however, that did not happen. Subsequently,

Lisa’s local corn price was under the per bushel loan value, thus it made economic sense to forfeit

on the loan and release the corn to the CCC as payment of the loan. Lisa now reports the

$150,000 as fully taxable as if it were a corn sale; she uses Lines 5b and 5c on her Schedule F.

Frequently this type of transaction occurs over two tax years, the loan is created in the year of

production and the repayment of the loan is in the subsequent year.

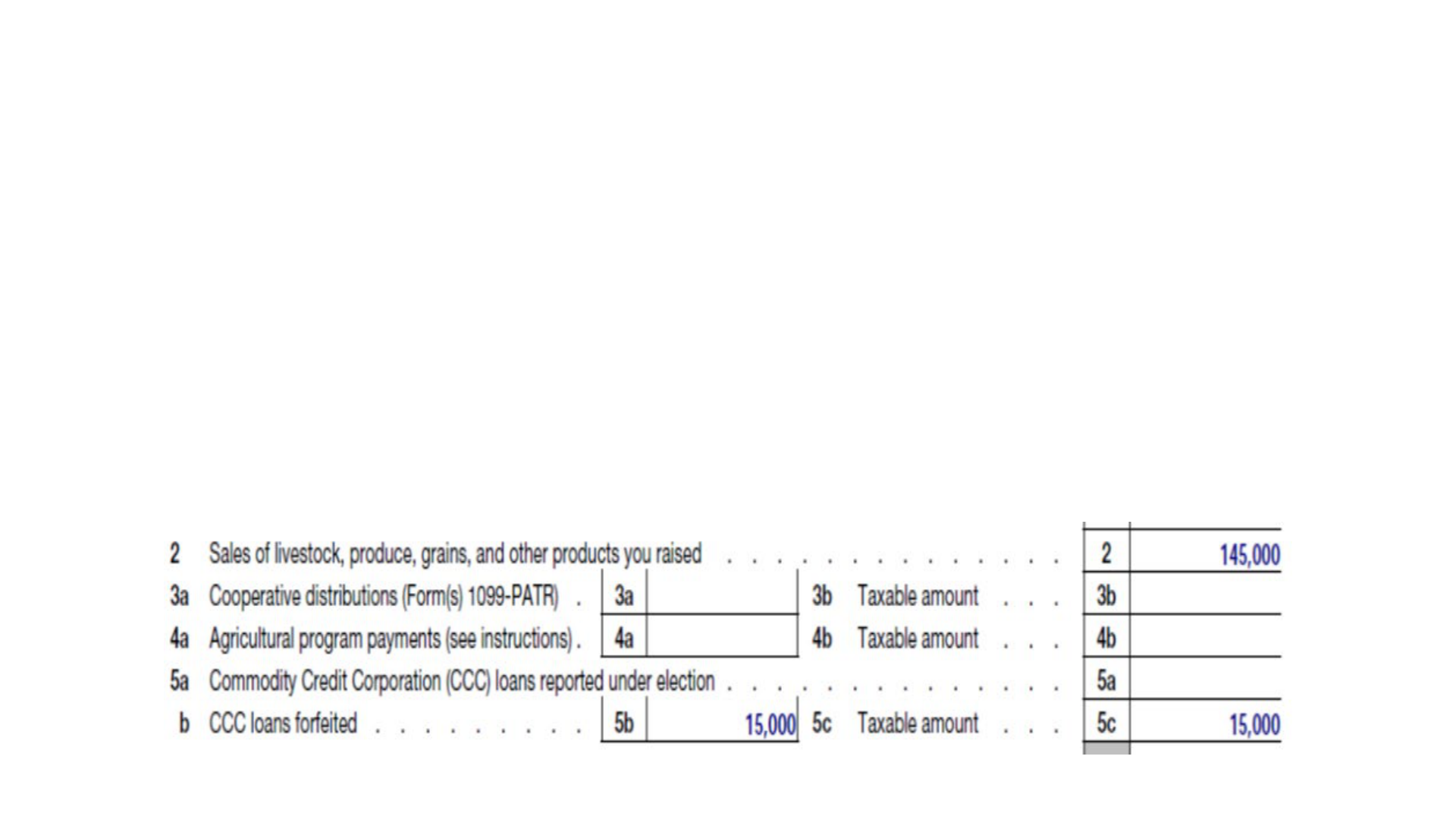

Lines 5a, b, and c (continued)

• Repaying a CCC loan at the Posted County Price (PCP)

• Jerome goes under a CCC loan on corn for $150,000 but does not make the election to treat the loan as

income. When the PCP in Jerome’s county was $3.25, he repays the loan to CCC with $135,000 and then

sells the corn for $145,000. Jerome will receive a CCC-1099-G from CCC for $15,000 [$150,000 - $135,000}

and he must report this difference on his Schedule F as shown below. Jerome’s total income for his corn is

$160,000 [$145,000 + $15,000]

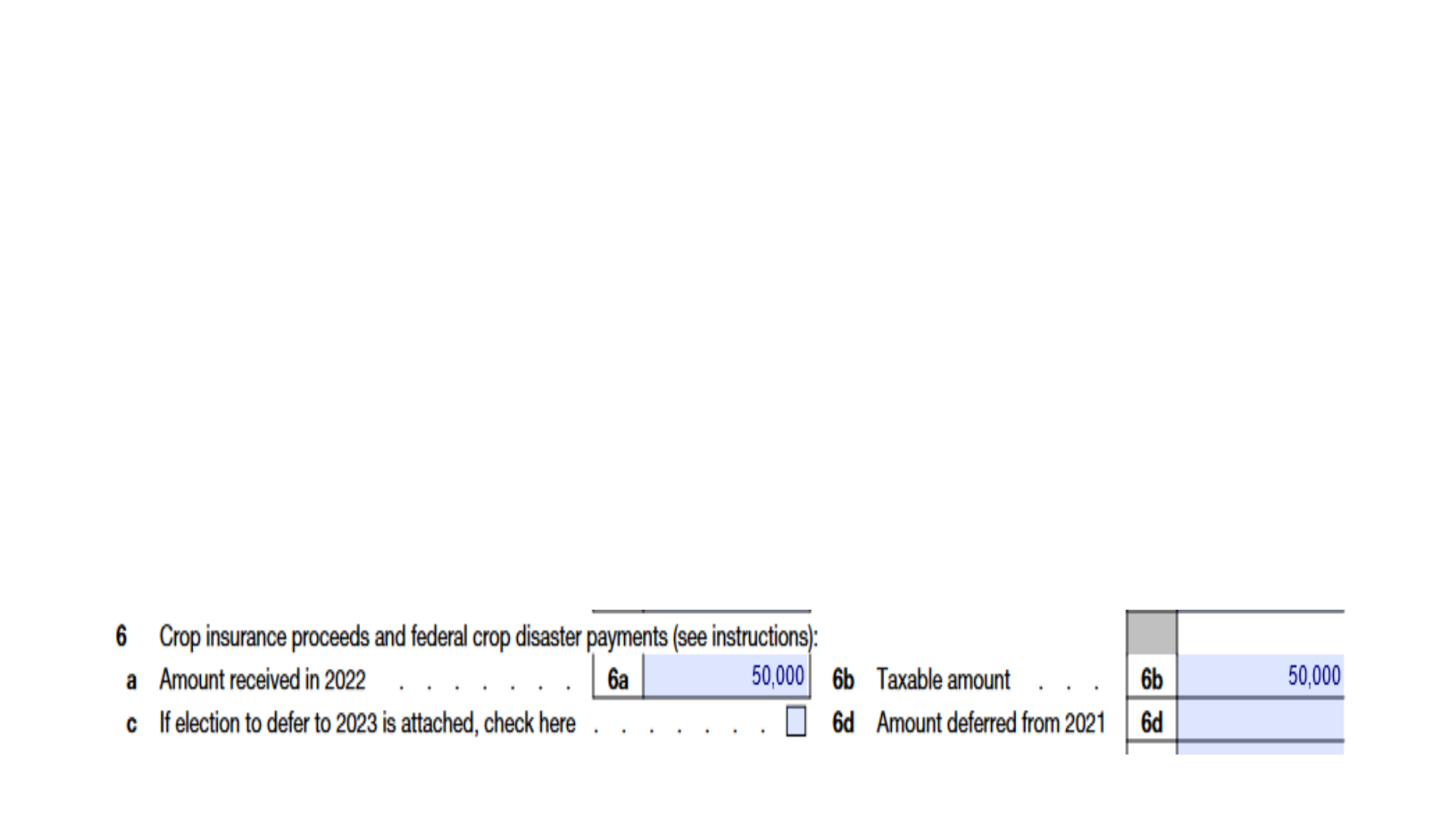

Lines 6a, b, c, and d: Crop Insurance and

Federal Disaster Payments

• Crop insurance and federal disaster payments are treated as farm

income. These payments can be reported several ways on Schedule F

using Line 6.

• Generally, under “constructive receipt” rules, crop insurance and

disaster payments are recognized in the year of receipt.

• However, such payments can be deferred if the farmer’s or rancher’s

business practice was to sell 50 percent or more of their crop

production in the year following that production.

• Thus, it is important to clearly understand the business model of the

farm.

Lines 6a, b, c, and d: Crop Insurance and

Federal Disaster Payments

• Roberto grows wheat, corn, and soybeans on his farm. In 2022 a

hailstorm ruins his wheat crop and Roberto experiences a 75 percent

reduction in yield. Roberto typically sells his wheat a few months

after harvesting. Roberto receives a crop insurance check for the hail

damage in the amount of $50,000. Roberto receives an IRS Form

1099-MISC from the crop insurance company with Box 9 showing

$50,000. Roberto reports the crop insurance on his Schedule F as

illustrated below using Lines 6a and 6b.

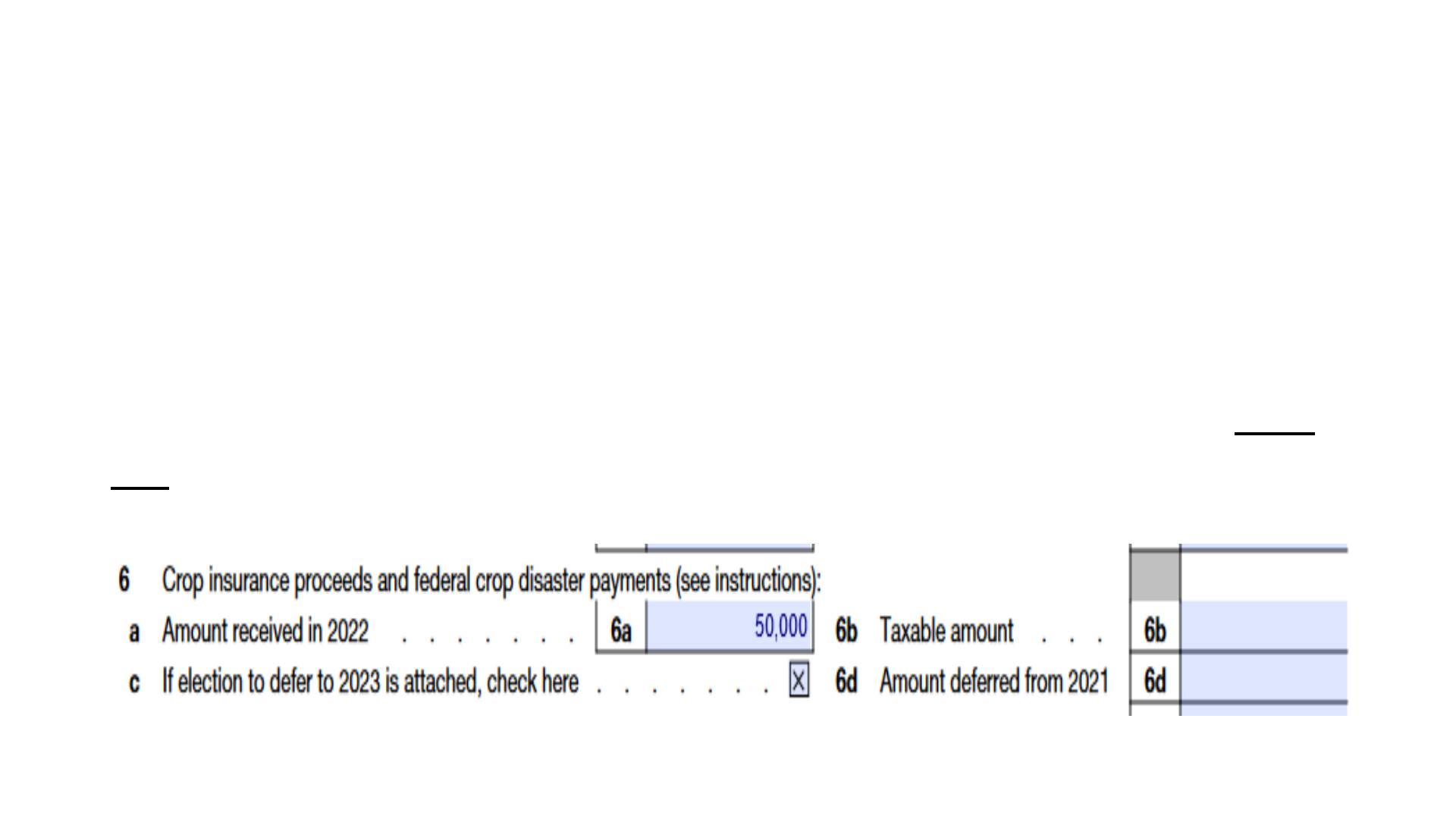

Lines 6a, b, c, and d: Crop Insurance and

Federal Disaster Payments

• If Roberto’s business practice was to sell his wheat crop in the year

after it was produced, he could make the election to defer the crop

insurance until the following year. In this example, Roberto reports the

crop insurance on Line 6a but also checks the box on Line 6c and

does

not

recognize the income on Line 6b as illustrated below.

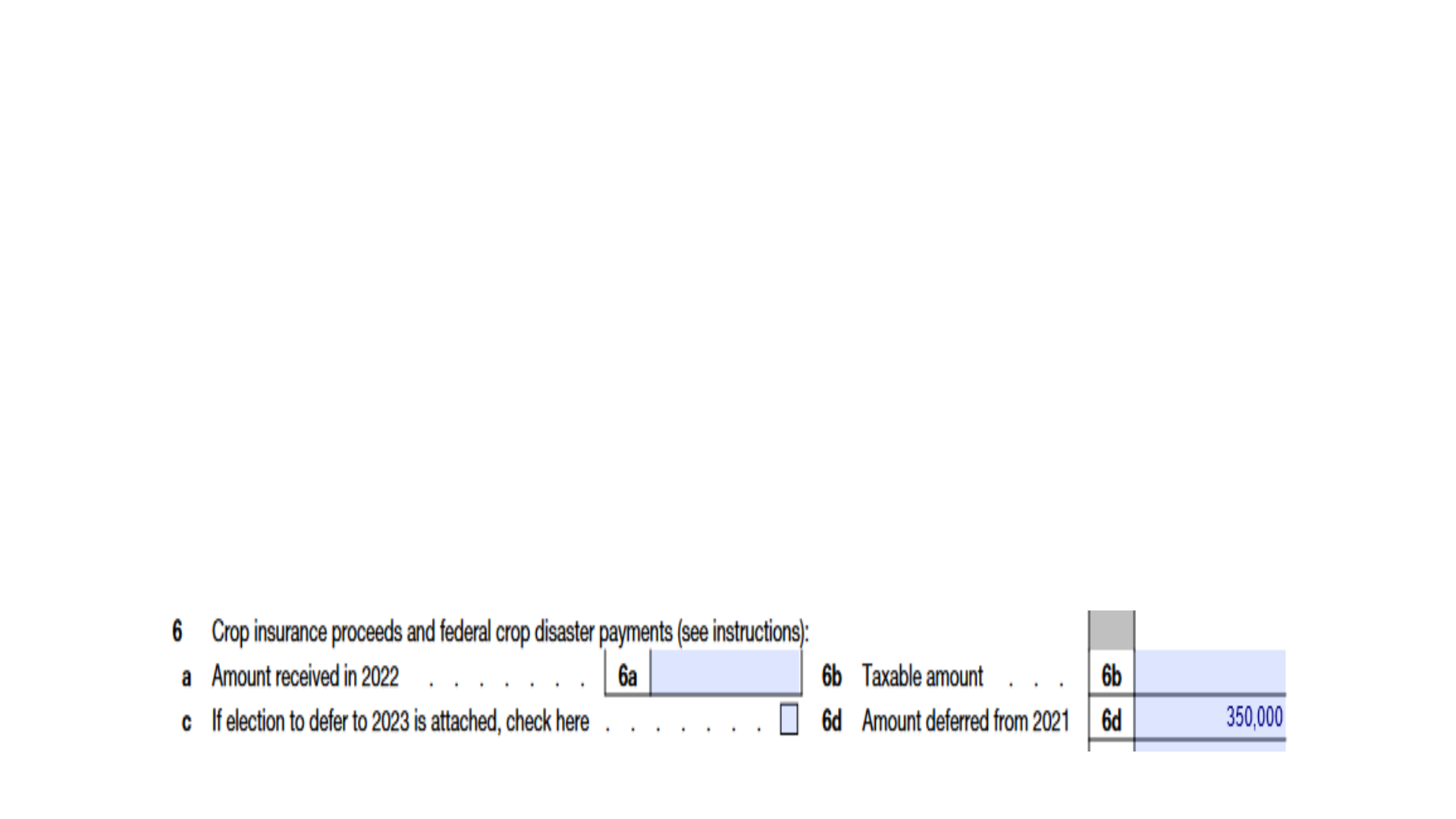

Lines 6a, b, c, and d: Crop Insurance and

Federal Disaster Payments

• Amanda raises milo, alfalfa, and soybeans. In 2021 her milo and soybean crops were flooded out

and completely lost. She received $200,000 in crop insurance and an additional $150,000 in federal

disaster relief because her farm was in a federally declared disaster area. Her longtime business

practice was to sell her milo and soybean crops in the year following harvest. To prevent having to

report two years of crop sales (her 2020 crop carried into 2021 and the insurance and disaster

payments received in the fall of 2021) Amanda elected to defer these payments into 2022 to

maintain her business income. Amanda makes an entry in her 2021 accounting records of the

$350,000 of deferred income and makes a copy of her 2021 IRS Form 1099-MISC to include with her

2022 papers. She reports this income as illustrated below on her 2022 Schedule F using Line 6d.

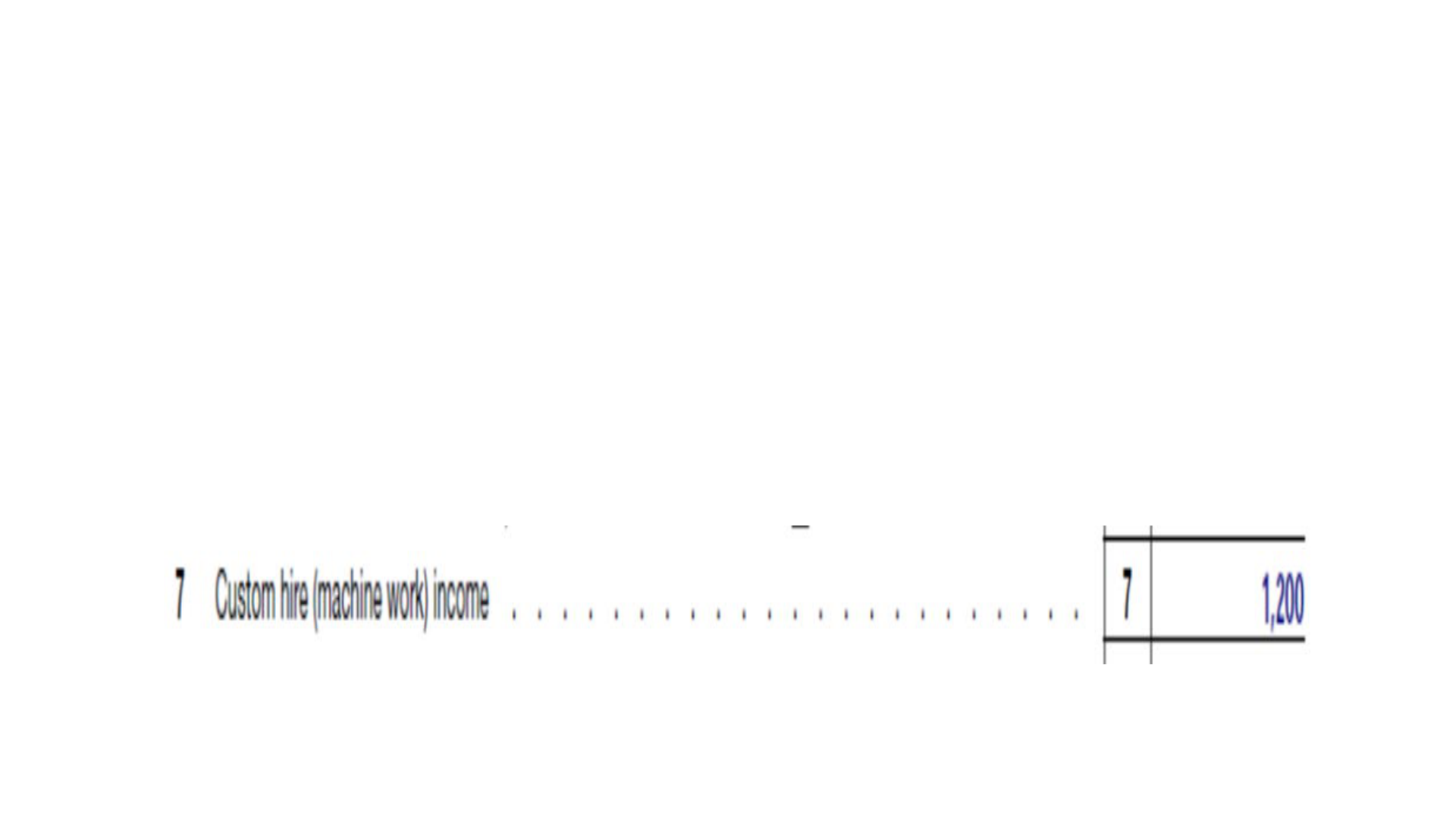

Line 7: Custom Hire Income

• Frequently, farmers will help neighbors and be paid for that help. This

is custom work or machine hire income which is reported on Line 7 of

Schedule F.

• As a favor, Ted bales hay for his elderly neighbor, Tom. Tom pays Ted

for his work, machinery time, and fuel; this year the amount was

$1,200. Tom issued Ted a Form 1099-NEC for amount of $1,200. Ted

reports the income on Line 7 of Schedule F as illustrated.

Line 7: Custom Hire Income

• Georgia contracts with the township in which she lives to mow road

ditches with her tractor and shredder (bush hog). The township pays

Georgia a flat fee of $2,000 per mowing and Georgia mowed 4 times this

year. The township issues Georgia a Form 1099-NEC in the amount of

$8,000 [4 x $2,000]. Georgia also farms vegetables which she sells at local

farmer’s markets. Like Ted above, Georgia uses Line 7 on her Schedule F to

report her custom hire income.

• Jose manages and operates a poultry farm. He has a pair of backhoes and

trailers which he uses to custom dig foundations for local contractors. This

year Jose generated $200,000 of custom work digging foundations in three

nearby counties. He generated $50,000 of income from his poultry

business.

• The volume of Jose’s income may indicate that he farms part-time and has a backhoe

business.

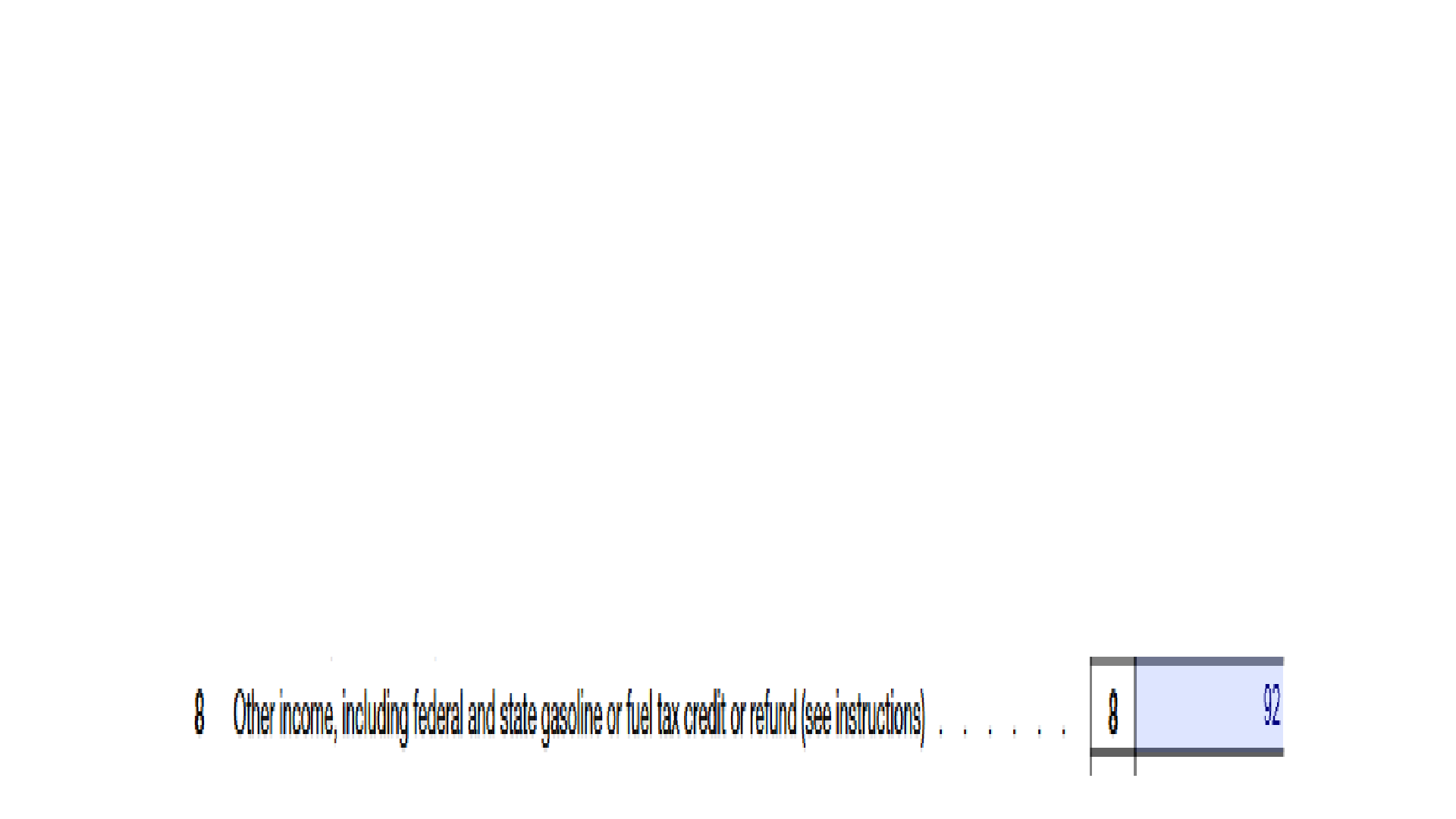

Line 8: Other Income

• Line 8 of Schedule F is a “catch all” or miscellaneous income line for

reporting this type of income. Some examples are:

• Bartering income

• State gasoline or fuel tax refunds received

• Federal fuel tax credit claimed on a prior year’s income tax return

• Breeding fees, occasional fees from renting draft teams or farm machinery

Line 8: Other Income

• Bill farms part-time and growing row crops and vegetables. Bill uses

two gasoline powered tractors which he inherited from his

grandfather. Bill keeps records on how many gallons of gasoline he

uses over the course of his farming activity; he purchases gasoline

from pumps in town and pays the federal excise tax of $0.184 per

gallon. During 2021 Bill bought 500 gallons of gasoline which he

burned through his two tractors. Thus, the federal excise tax credit he

claimed on his 2021 income tax return, filed in March of 2022, is $92

[$0.184 x 500]. Bill will report the $92 as “other income” on his 2021

Schedule F, Line 8 as illustrated below.

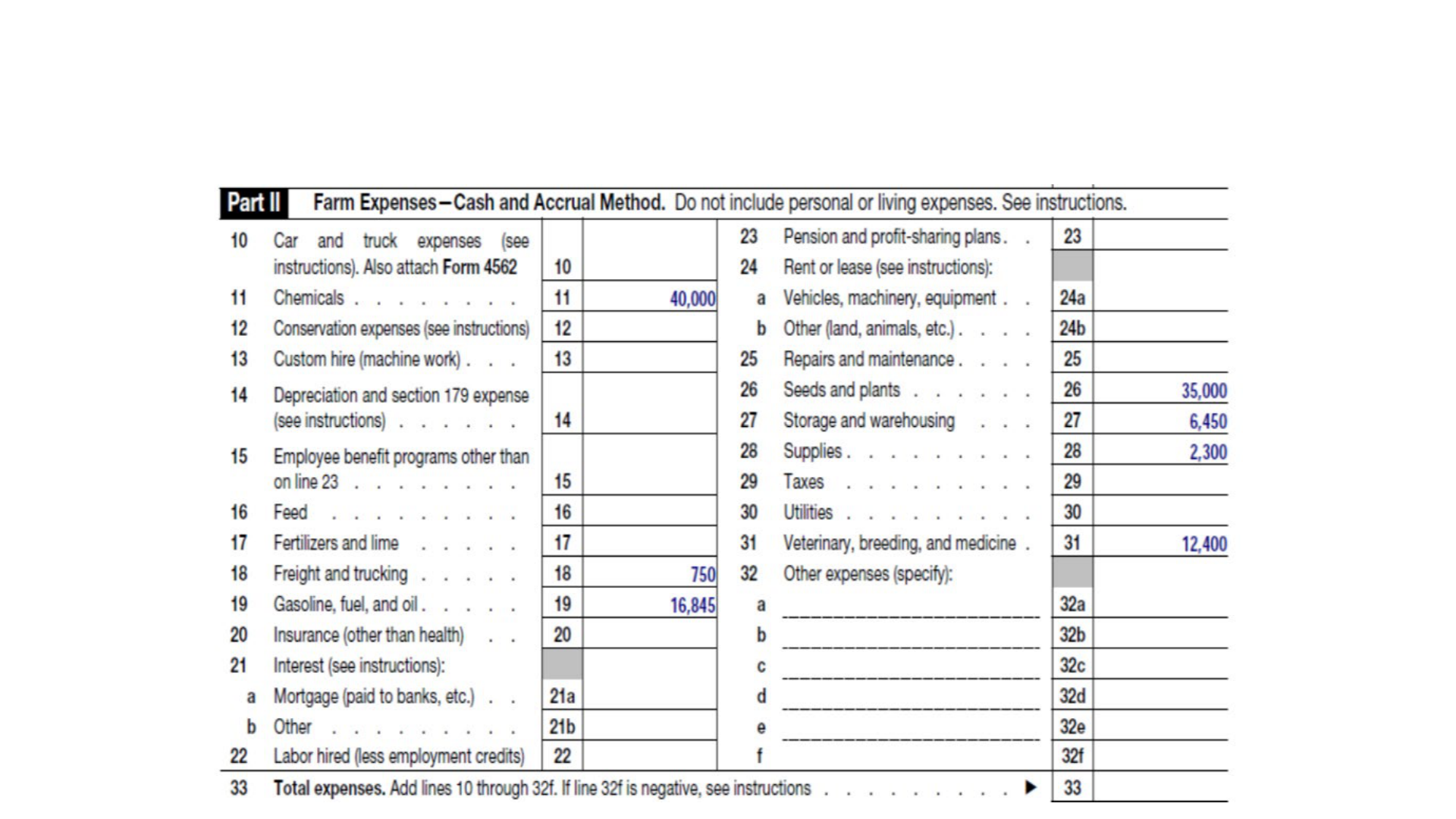

Line 9: Gross Income from Farming

• Line 9 is the total of

Lines 1-8

• If 2/3rds of total gross

income is farm income,

filing date is March 1,

no estimated tax

payments need to be

made.

• Conservation expenses

are limited to 25% of

Line 9, in Jorge’s case

$82,300 this year.

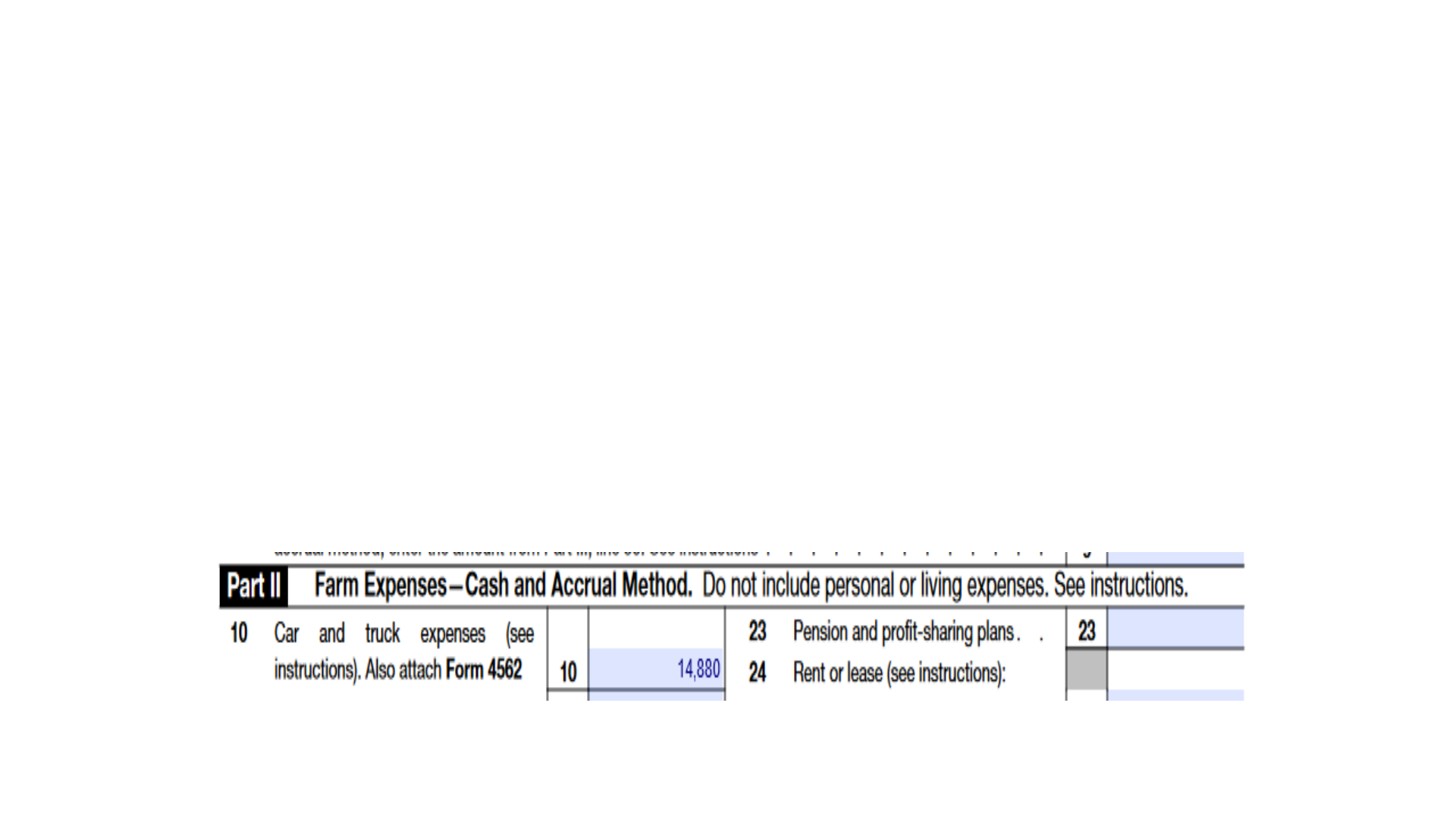

Part II: Farm Expenses (Cash)

• Items to include

• Planning pointers to consider

info@RuralTax.org

RuralTax.org

Line 10: Car and truck expenses

• Line 10 of Schedule F is used to report expenses of cars and light

pickups that are used in farming businesses.

• Actual business expenses can be deducted as allocated to the business;

records are needed for substantiation.

• Alternatively, the standard mileage rate (SMR) can be used; $0.655 per mile

for 2023, $0.27 of which is the depreciation component.

• Mileage logs are required.

• A temporary Treasury Regulation allows farmers to deduct 75 percent of auto and truck

expenses without records.

Line 10: Example: Actual Expenses

• Jeremy uses his ¾-ton pickup for both personal and business use. Jeremy

kept a mileage log over the course of the year which documents 75

percent of the miles were business miles. Thus, 75 percent of all actual

expenses related to the use of this pickup are deductible on Schedule F,

Line 10. Jeremy reports the allowed business costs for fuel, repairs, and

miscellaneous expenses of $7,012.50 (rounded to $7,013) on Line 10.

After he makes an adjustment to depreciation to accurately reflect

allowable business depreciation, he reports $8,640 as part of his

depreciation expense on Line 14.

Annual Costs

Allowable Bus.

Use at 75 %.

Total Miles

40,000

Fuel

$7,600

$5,700.00

Bus. Miles

30,000

Repairs

$1,500

$1,125.00

Bus.

Percent

75

Misc

$250

$187.50

Depreciation

$11,520

$8,640.00

Total costs

$20,870

$15,652.50

Line 10 Example: SMR

• Jeremy, from Example 1, purchased a new crew-cab pickup to

use in his business as well as for personal use. To simplify

record keeping, Jeremy chooses to use the SMR on this vehicle,

which is the third vehicle he owns. Keeping a mileage log

Jeremy can document that he drove this pickup 22,500 miles

and he paid $150 in tolls for business purposes during the year.

Jeremey, therefore, reports $14,880 as his auto expense on

Line 10. [(22,500 x $0.655) + $150]

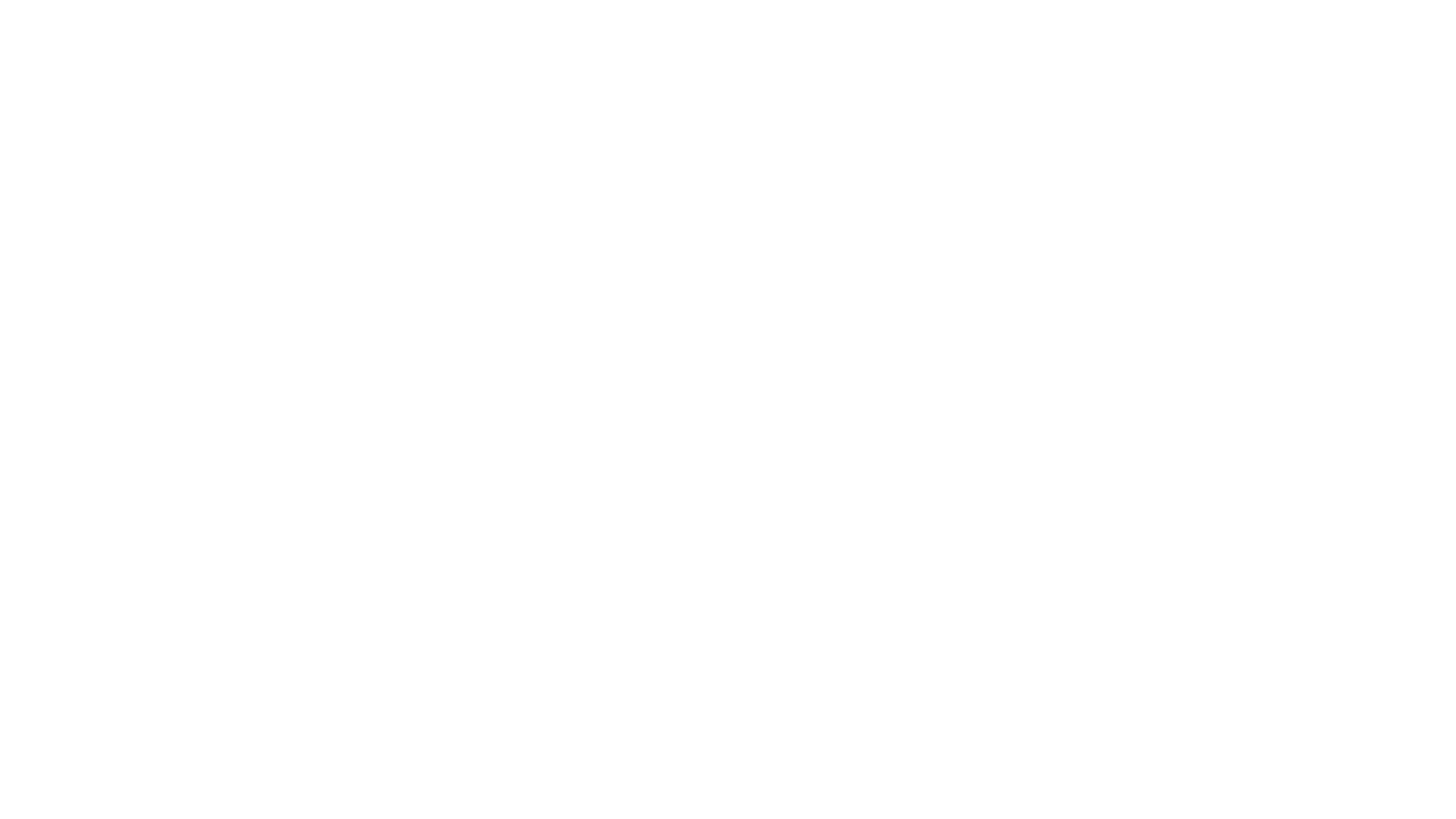

Self-explanatory Lines: 11, 18, 19, 26, 27, 28,

and 31

• Line 11: Chemicals. Used for pesticides

• Line 18: Freight and Trucking. Used to deduct freight charges for received goods

as well as delivered goods

• Line 19: Gasoline, Fuel and Oil. Used to deduct liquid or gas energy supplies

• Line 26: Seeds and Plants. Used to deduct the costs of seeds or seedlings (e.g.,

sweet potato slips)

• Line 27: Storage and Warehousing. Used to deduct commercial storage of crops

• Line 28: Supplies. Used to deduct items which are consumed: Twine, nails, bags,

etc.

• Line 31: Veterinary, Breeding, and Medicine. Used to deduct livestock health

costs

Illustrated “self-explanatory” lines

Line 12: Conservation Expenses

• Conservations expenses which are part of a conservation plan

approved by a NRCS or state department for environment are

allowed to be deducted subject to a 25% of gross farm income

limitation. Such expenses are:

• Earthmoving for leveling, grading, terracing, contour furrowing, and

restoration of soil productivity

• Construction of diversion channels, drainage ditches, irrigation ditches,

earthen dams, ponds, water way outlets, watercourses, and other similar

land features

• Eradication of brush (recovery of pasture or field borders)

• Planting of windbreaks

• Meeting the needs of a site-specific management action recommended in

recovery plans approved pursuant to the Endangered Species Act of 1973

(ESA)

Line 12: Conservation Expenses

• Reggie lives in the low country and implements a soil and water

conservation plan to help manage spring flooding and protect

water resources for the future. Reggie’s conservation plan is

approved by NRCS and his state’s Department of Environmental

Quality. He receives $65,000 in cost-share funds to implement

his plan. Reggie spends $92,000 and completes his plan this

year. Due to the 25 percent limitation, Reggie is only able to

deduct $81,250 this year, ($325,000 * 0.25), the balance of

$10,750 is carried forward.

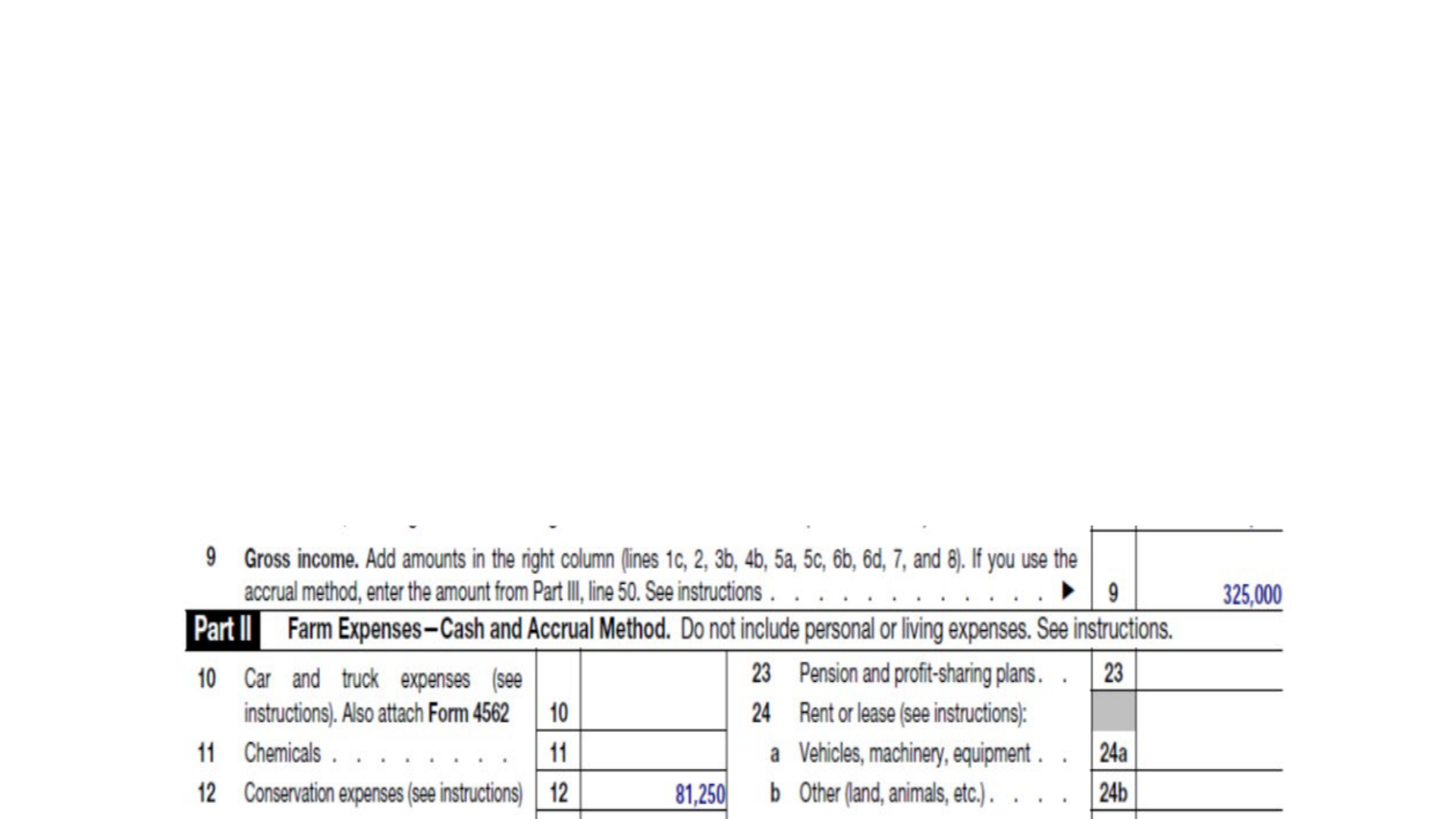

Line 13: Custom Hire (Machine Work)

• Custom hire is an expense incurred when a farmer/rancher hires a

contractor to complete work needed on the farm or ranch. Line 13,

Schedule F is used to report and deduct.

• Sydney hires a custom harvest crew to combine her wheat crop.

Even though Sydney has a combine, she cannot cover all the planted

acres in a timely manner. To keep landlords happy, hiring a custom

harvest crew minimizes the potential to suffer weather damage or

loss; and the custom cutter gets the crop into storage so that

marketing decisions can be made by the landlords. Sydney pays the

custom harvest crew $25,000 for their services. This expense is

reported on Line 13, Schedule F, and if the contractor is not

incorporated, Sydney must issue a 1099-NEC.

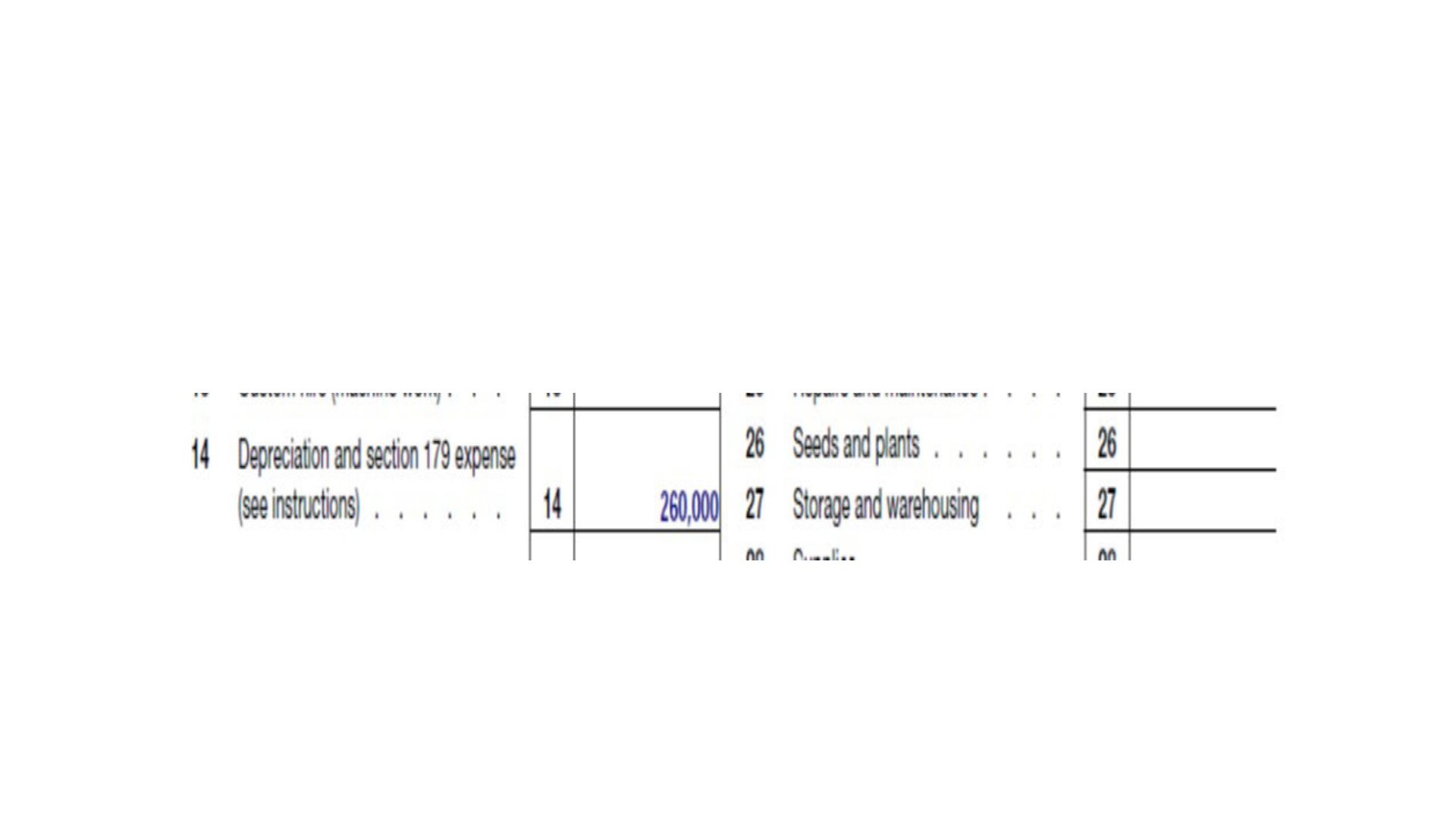

Line 14: Depreciation

• Line 14 is used to report the recovery of depreciable asset costs.

Several allowable methods can be chosen to manage “the number”.

• Bonus depreciation [I.R.C. § 168(k)]

• Expense election [I.R.C. § 179]

• MACRS GDS over 3-, 5-, 7-, 10-, 15-, and 20-years

• MACRS ADS can alternatively be used to lengthen recovery periods

• IRS Form 4562 is used to report the annual depreciation deduction

Line 14: Depreciation Examples

• George operates a diversified crop farm, in 2022 he purchases a new

tractor for $175,000. George has $85,000 of depreciation which is

the allowable depreciation on assets purchased prior to 2021. Thus,

assuming George does not elect out of bonus depreciation, his total

depreciation is $260,000 which is reported on Line 14, Schedule F.

• George would have the same outcome if he elected to expense the

tractor.

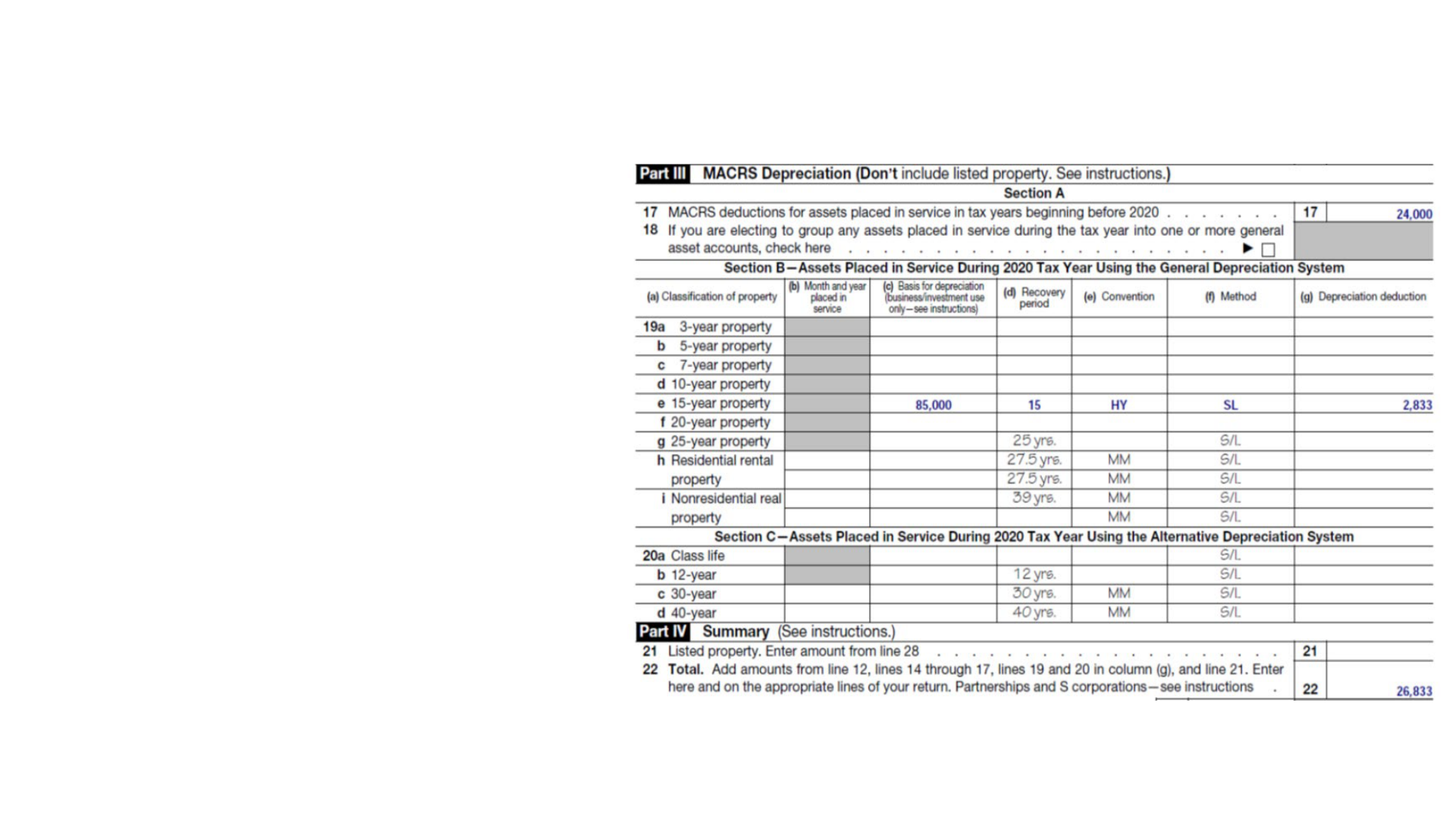

Line 14: Depreciation Examples

• Maria constructs a new greenhouse for

her cut-flower business at a cost of

$85,000. The greenhouse is a “single-

purpose horticultural structure” which

has a 10-year recovery period under

MACRS GDS or 15-year recovery period

under MACRS ADS. Maria elects to use

the longer recovery period under the

ADS method which uses straight line; in

doing so, the greenhouse no longer

qualifies for bonus depreciation. Maria

makes the election to use ADS on IRS

Form 4562, Line 19e. Maria has $24,000

of depreciation from assets purchased in

prior years, this year’s depreciation is

$26,833.

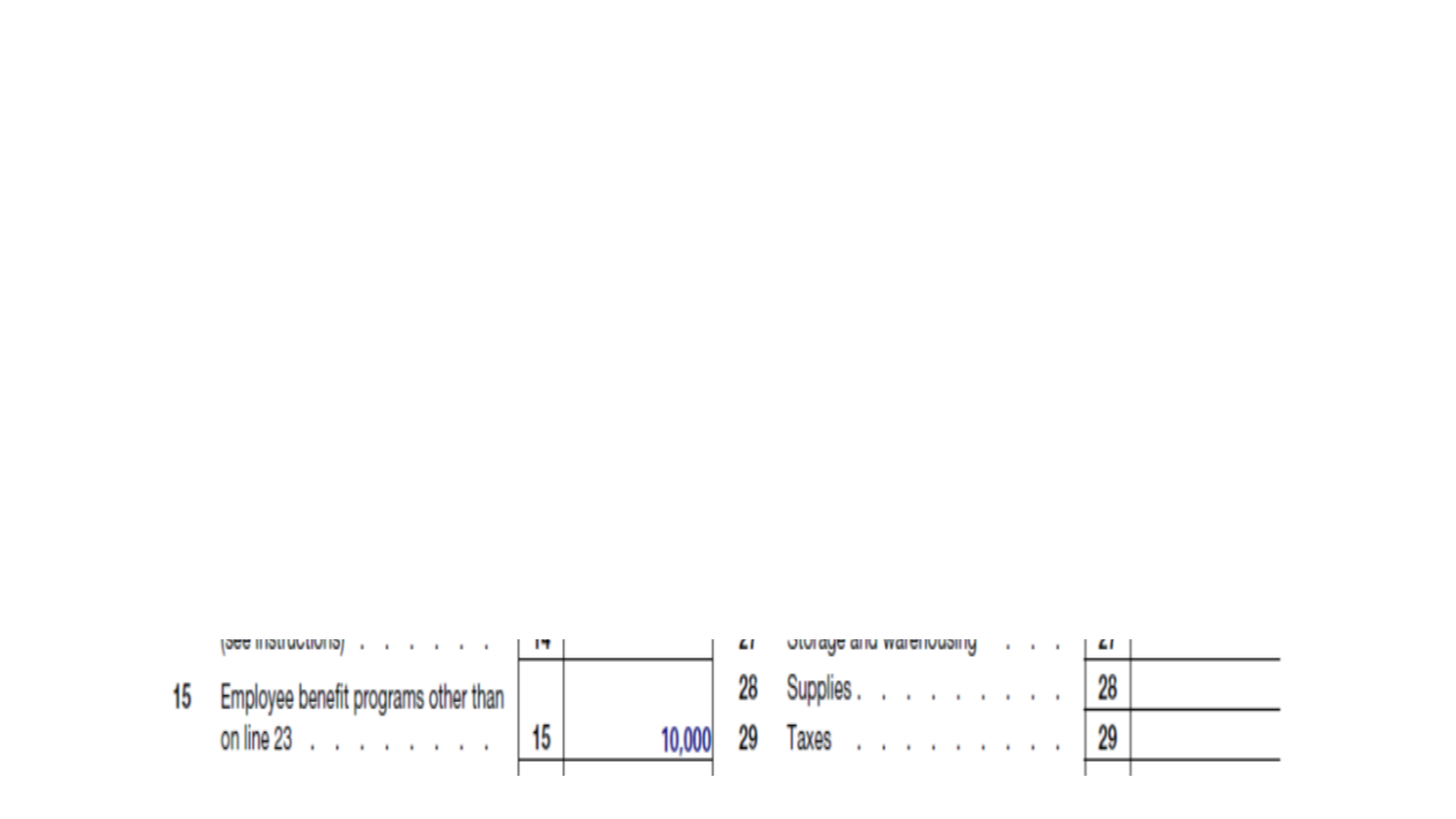

Line 15: Employee Benefit Programs

• To attract and retain employees, farmers may offer benefits to

employees. These are deductible business expenses and reported

on Line 15, Schedule F.

• Amal operates a mushroom farm. She provides subsidized children’s

daycare to her employees who harvest, grade, and package the

various types of mushrooms. The daycare operates from 6:30 am

until 6:30 pm in an independent separate facility. Amal contributes

$200 per month per employee; Amal’s employees who participate in

this benefit pay an additional $400 per month. This year Amal had 5

employees who participated for an average of 10 months of the

year. Thus, Amal incurred $10,000 in daycare benefits paid on behalf

of her employees. (5 x $200/mo. x 10 months) Amal uses Line 15,

Schedule F to report and deduct this expense.

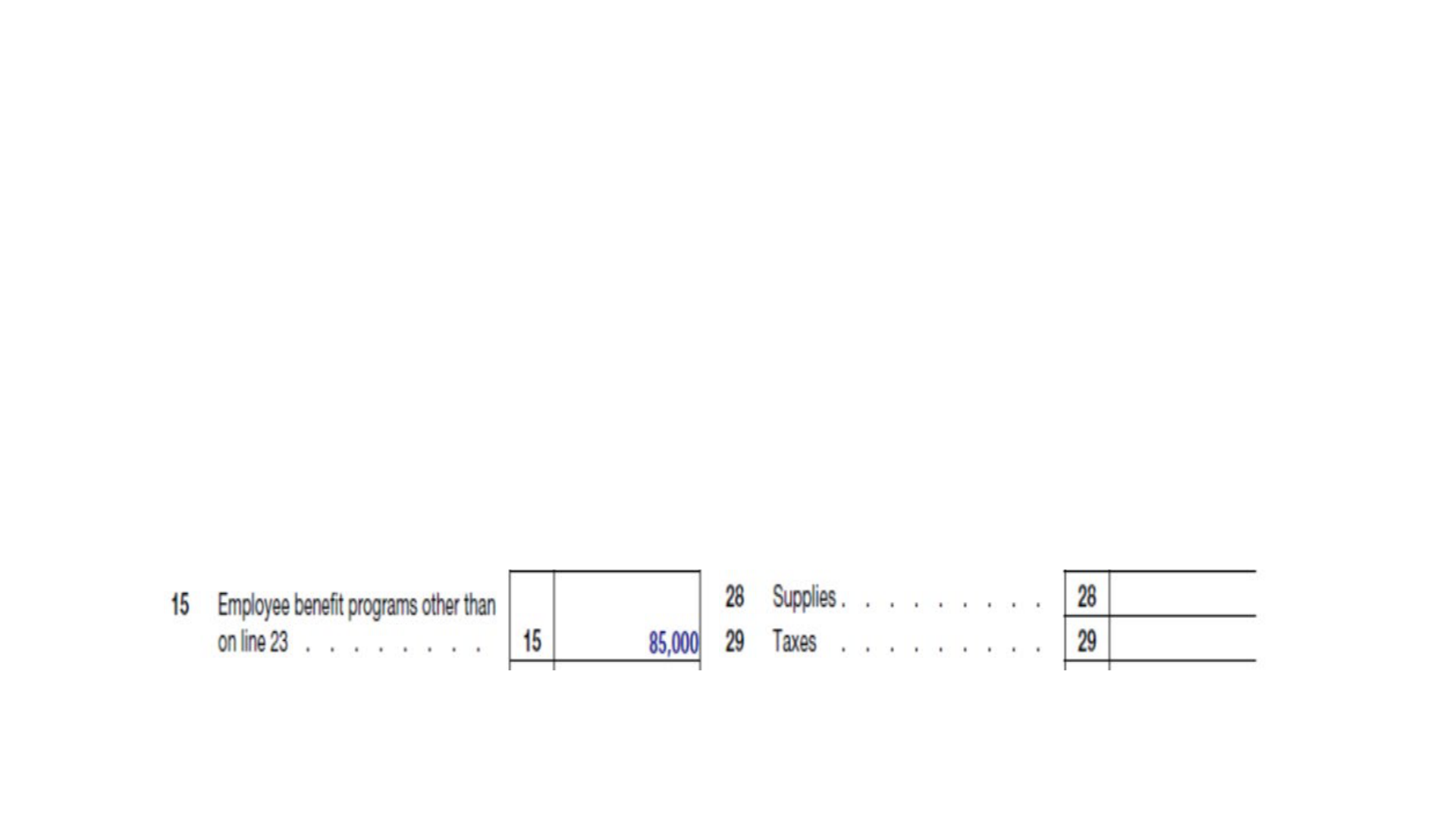

Line 15: Employee Benefit Programs

• Suzy owns a fruit orchard with 10 full-time employees. Suzy

provides a group accident and health care plan to her

employees which Suzy can acquire through her membership in

a national fruit packer’s association. She pays for the

employee’s insurance; the employee pays for the spouse and

any other dependents. This year Suzy’s cost for this employee

benefit is $85,000. Suzy reports and deducts the expense on

Line 15, Schedule F.

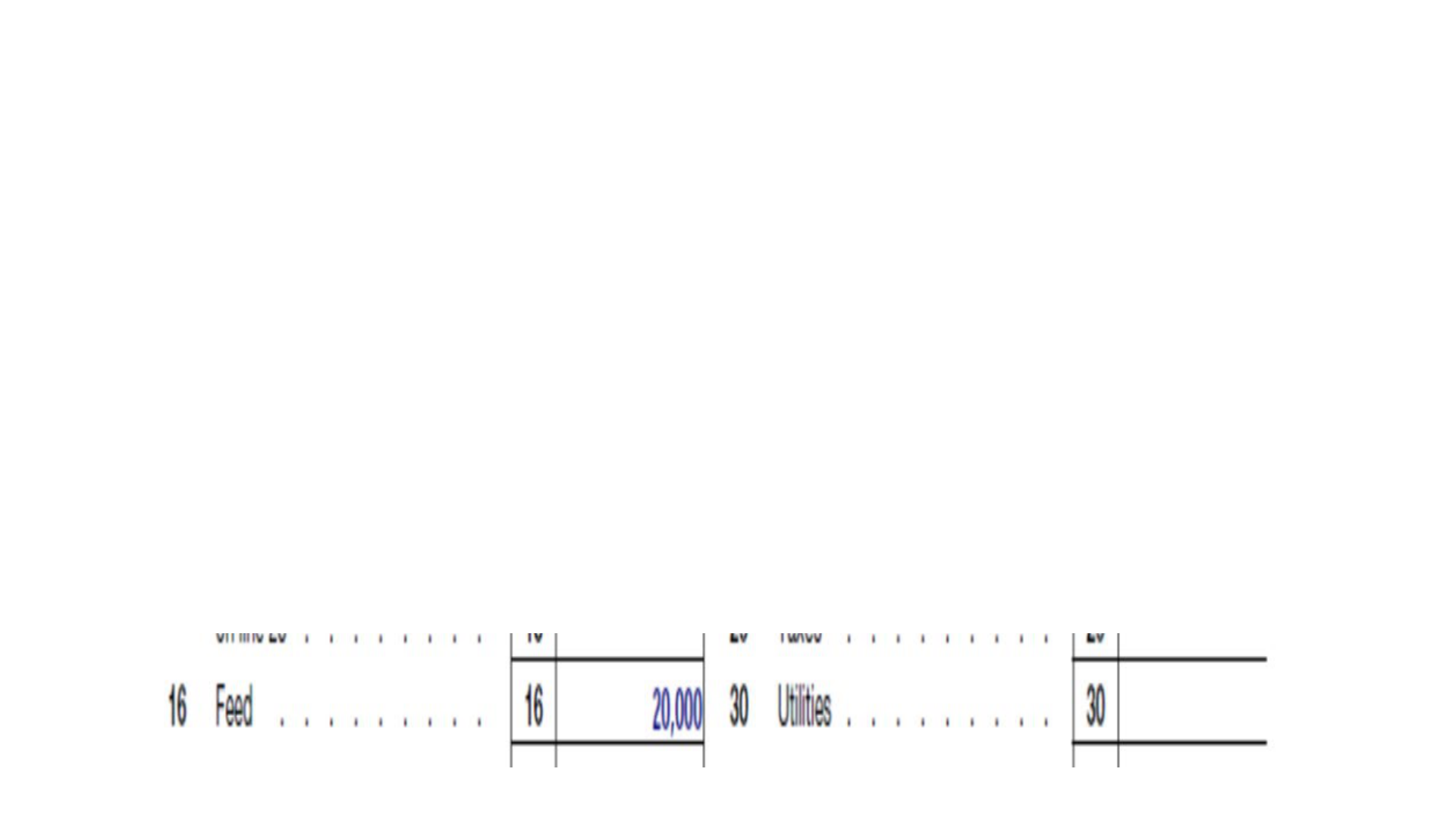

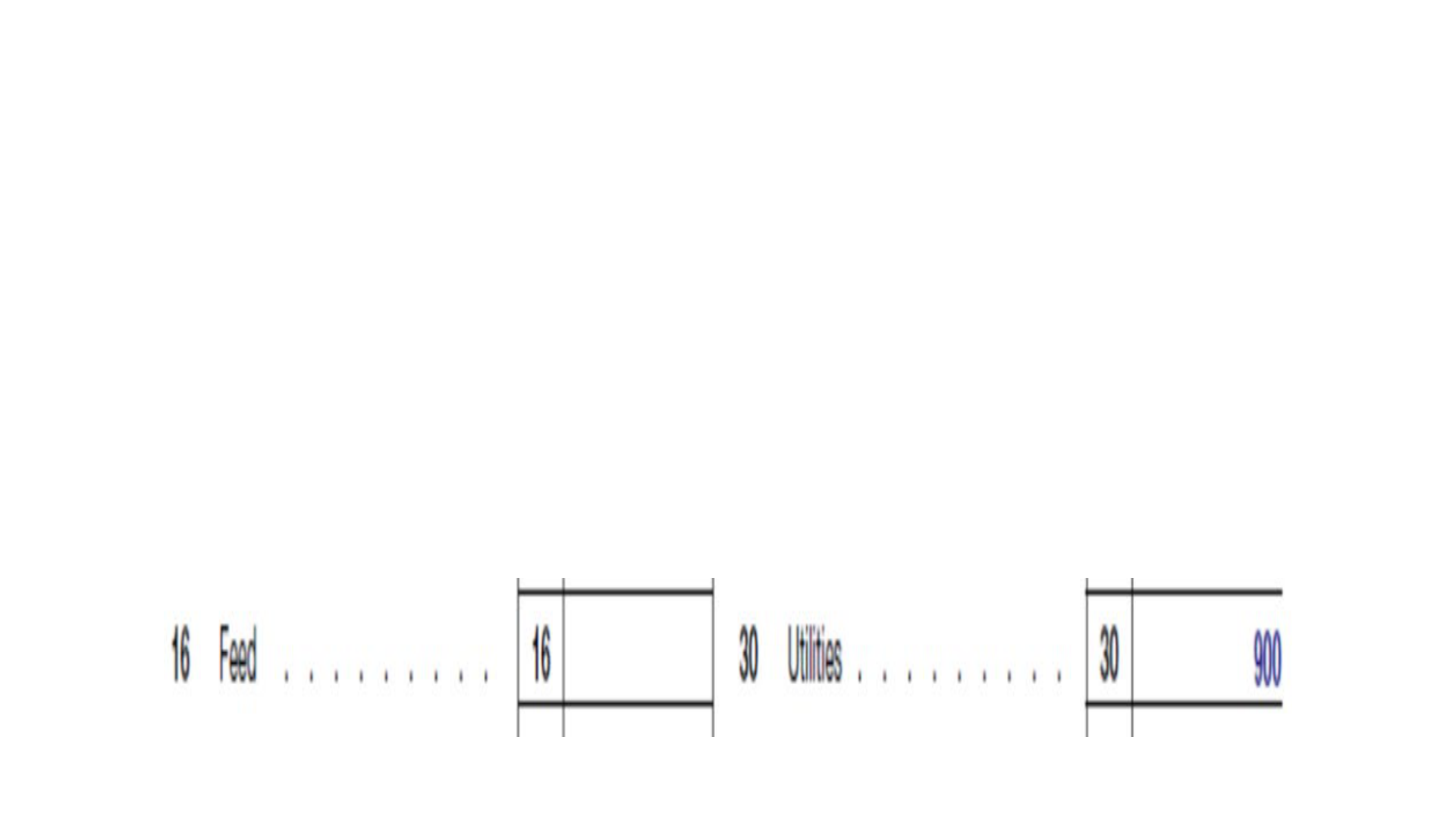

Line 16: Feed

• Farmers and ranchers purchase feed, vitamins and minerals for their

livestock. This expense is deducted on Line 16, Schedule F.

• Robert operates a commercial cow-calf herd as a production

enterprise on his farm. This year Robert bought supplemental feed

and minerals to pre-condition his cows prior to breeding in the

spring. Additionally, he bought mineral supplements for the grazing

season and creep feed for the calves as they were weaned from

their mothers and began the process of bunk feeding. All this feed

was consumed within the tax year. Robert spent $20,000 for these

feed items this tax year. Robert reports this on Line 16, Schedule F.

Line 16: Feed that is not deductible

• Everett raises heritage breeding hogs using a pasture-based plan. In

the winter he has covered shelter which the hogs can access and in

which they are fed. On November 1 Everett issues a check for $10,000

to Tasty Livestock Feeds on his account from which he can make

draws as he picks up feed on a weekly basis. The weekly feed price is

determined by fluctuations in market conditions.

• This payment is a deposit and not allowed as a deduction in full on

Everett’s Schedule F. However, Everett will be allowed a current

deduction for the weekly feed purchases for November and

December based on the receipts and respective draws for these

weeks.

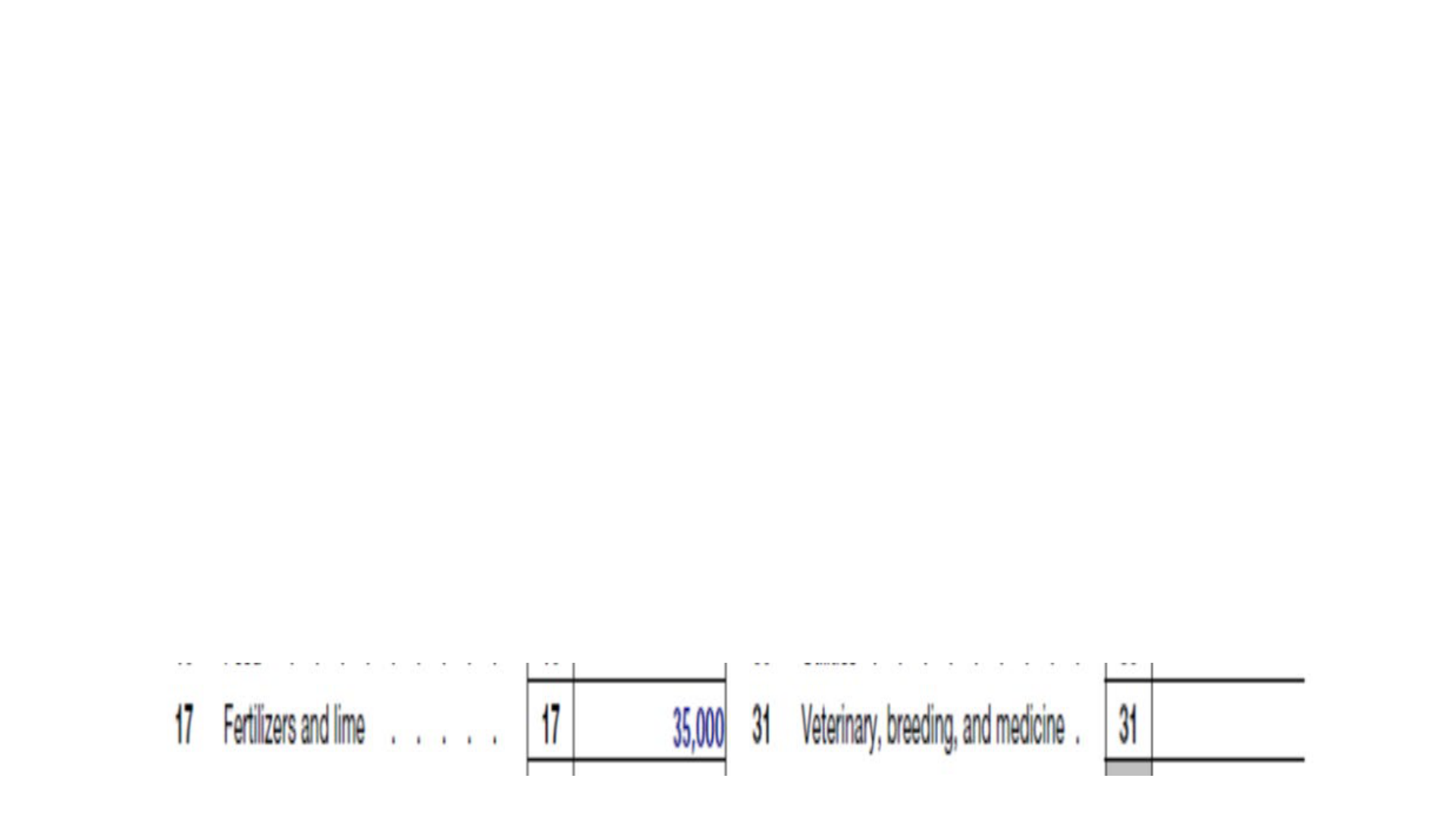

Line 17: Fertilizers and Lime

• The costs of fertilizers, lime, and other soil amendments are allowable

deductions; however, they are subject to IRC § 180 and are amortized

over a useful period. However, commonly, annual elections are made

to deduct the expense by reporting on Schedule F, Line 17.

• Bonnie raises eggplant and squash varieties on her farm. She regularly

conducts soil fertility tests and follows the advice and guidance of the

soils laboratory. This year, Bonnie applied $35,000 of fertilizer and

lime to her fields. She chooses to currently deduct this expense by

making the IRC § 180 election and reports the $35,000 on Line 17,

Schedule F.

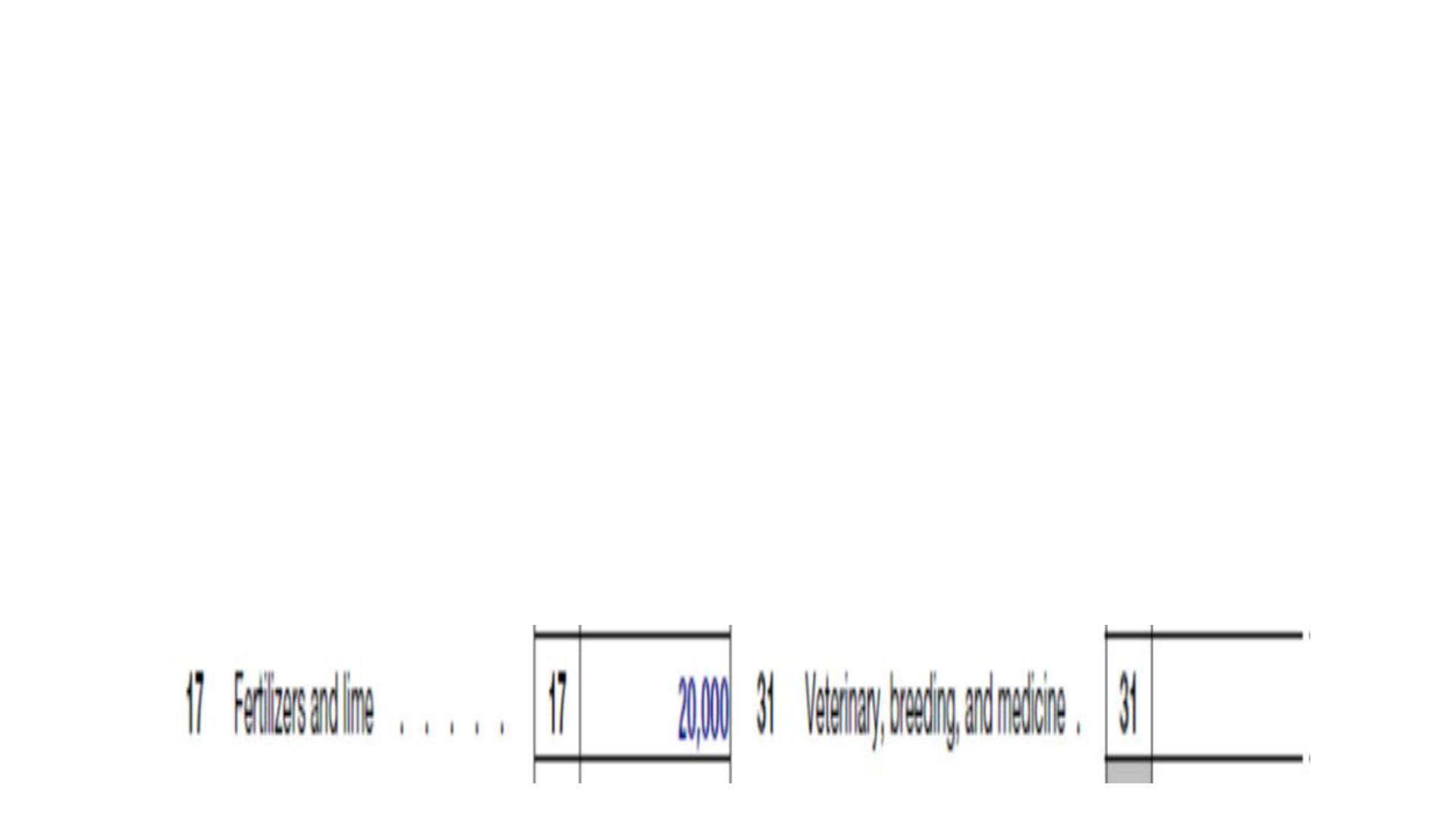

Line 17: Fertilizers and Lime

• Jakob has a diversified crop farm. He typically spends $100,000 on

fertilizer and lime annually and deducts this cost by making the

election under IRC § 180. This year, because of adverse weather

conditions Jakob is facing a farm loss due to no or low crop yields.

One way to increase income on the farm is to not make the annual

election to deduct all the fertilizer and lime expense in the current

year. In consultation with his tax preparer, Jakob capitalizes and

amortizes his $100,000 expense over 5 years and thus, deducts

$20,000 this year and defers $80,000 to be taken ratably over the

next four years. Therefore, Jakob’s farm income is increased by

$80,000 (the deferred expense) and he does not have a farm loss

which may allow him to access other tax benefits, e.g., Earned

Income Credit or not lose the standard deduction amount of his

filing status.

Jakob’s Amortization Table

Year

Deduction Amount

Remaining Amount

Year One

$20,000

$80,000

Year Two

$20,000

$60,000

Year Three

$20,000

$40,000

Year Four

$20,000

$20,000

Year Five

$20,000

$0

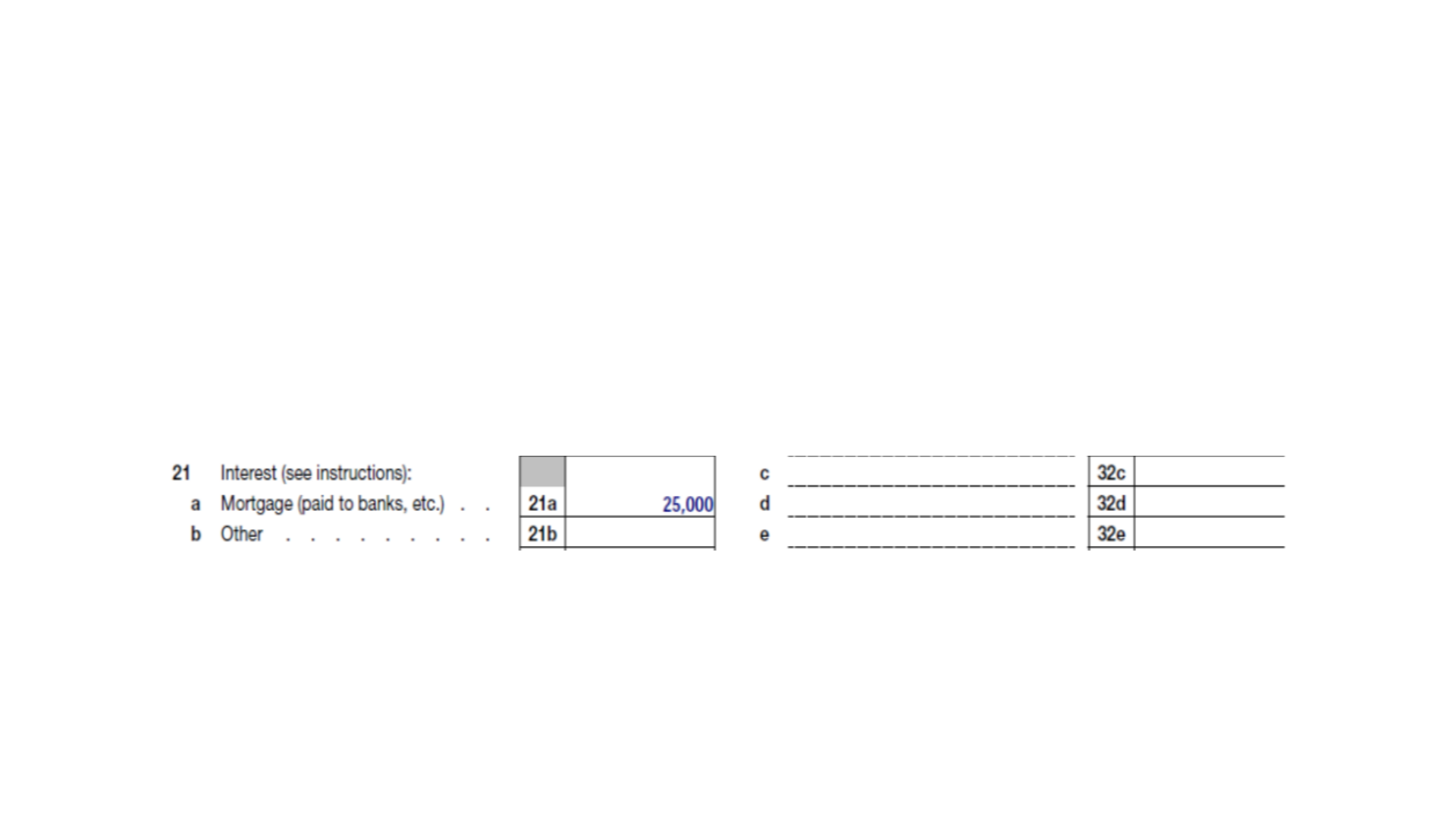

Lines 21a and b: Interest

• Modern agriculture is capital intensive and requires farmers and

ranchers to borrow money for operations, machinery and equipment,

livestock and land. Interest paid can be a significant business expense.

• Line 21a is used to report interest on mortgages reported to the farmer on an

IRS Form 1098, Mortgage Interest Statement.

• Line 21b is used to report interest from other sources.

Interest Examples

• Freida has a loan with Farm Credit on farmland she purchased. This

year Freida paid $25,000 in interest which was reported to her on

Form 1098 issued by Farm Credit. Freida reports and deducts this

interest on Line 21a, Schedule F. IRS will match the deduction with

the Form 1098.

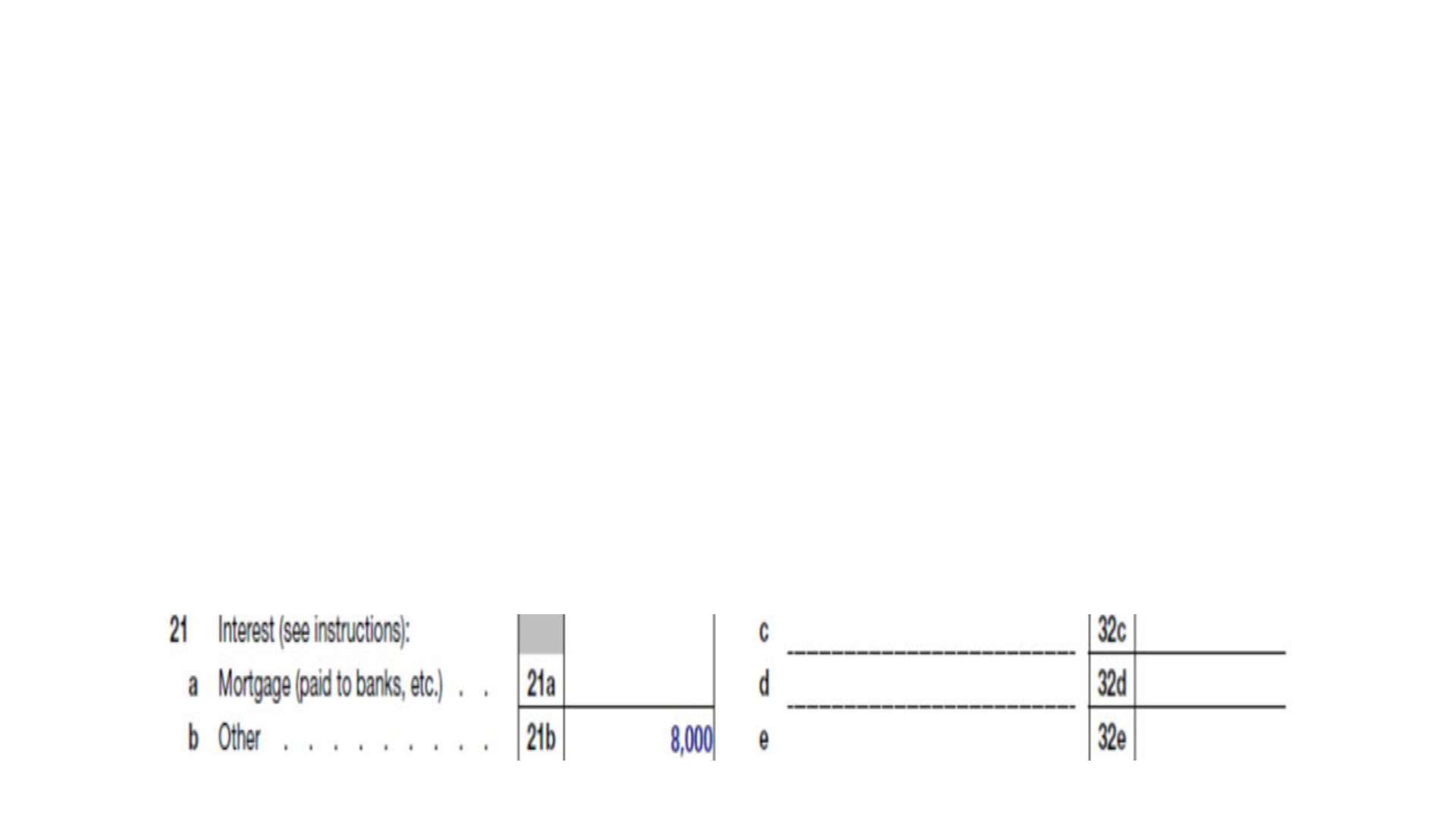

Interest Examples

• Ken operates a diversified farm. This year he paid $15,000 interest on

his operating loan, $5,500 interest on his pickup loan and $27,000

interest on machinery and cattle loans. None of these interest

amounts were reported to Ken on a Form 1098. However, these are

all business loans, thus, Ken uses Line 21b, Schedule F, to report the

$47,500 of interest paid.

Interest Examples

• Rosita has a large vegetable and cut-flower business. This year has

been exceptionally profitable and provides for a significant cash

reserve. Rosita negotiates with her lender to prepay three years of

projected interest expense at a locked-in rate for her operating loan.

She pays $45,000 of interest. $8,000 of interest is allocable to her

current year’s operating loan and brings her current as of December

31, 20xx. The remaining $37,000 is credited to her account as prepaid

interest which the bank will draft quarterly over the next three years.

This year, Rosita is allowed to report and deduct only $8,000 of

interest on her operating loan.

Interest Examples

• Carlos paid off the mortgage on his home three years ago. He wants

to expand his farming operation to go full-time and resign at the

foundry where he currently works. Carlos can borrow $200,000

against his house which will provide him with funds to purchase

needed equipment and give him operating funds. This year his

interest expense was $6,000 which was reported to him on a Form

1098. Carlos makes the election to treat this interest as business

interest and deduct it on his Schedule F; thus, it is not only a

deduction against income tax but also self-employment tax. The

$6,000 is reported and deducted on Line 21a, Schedule F.

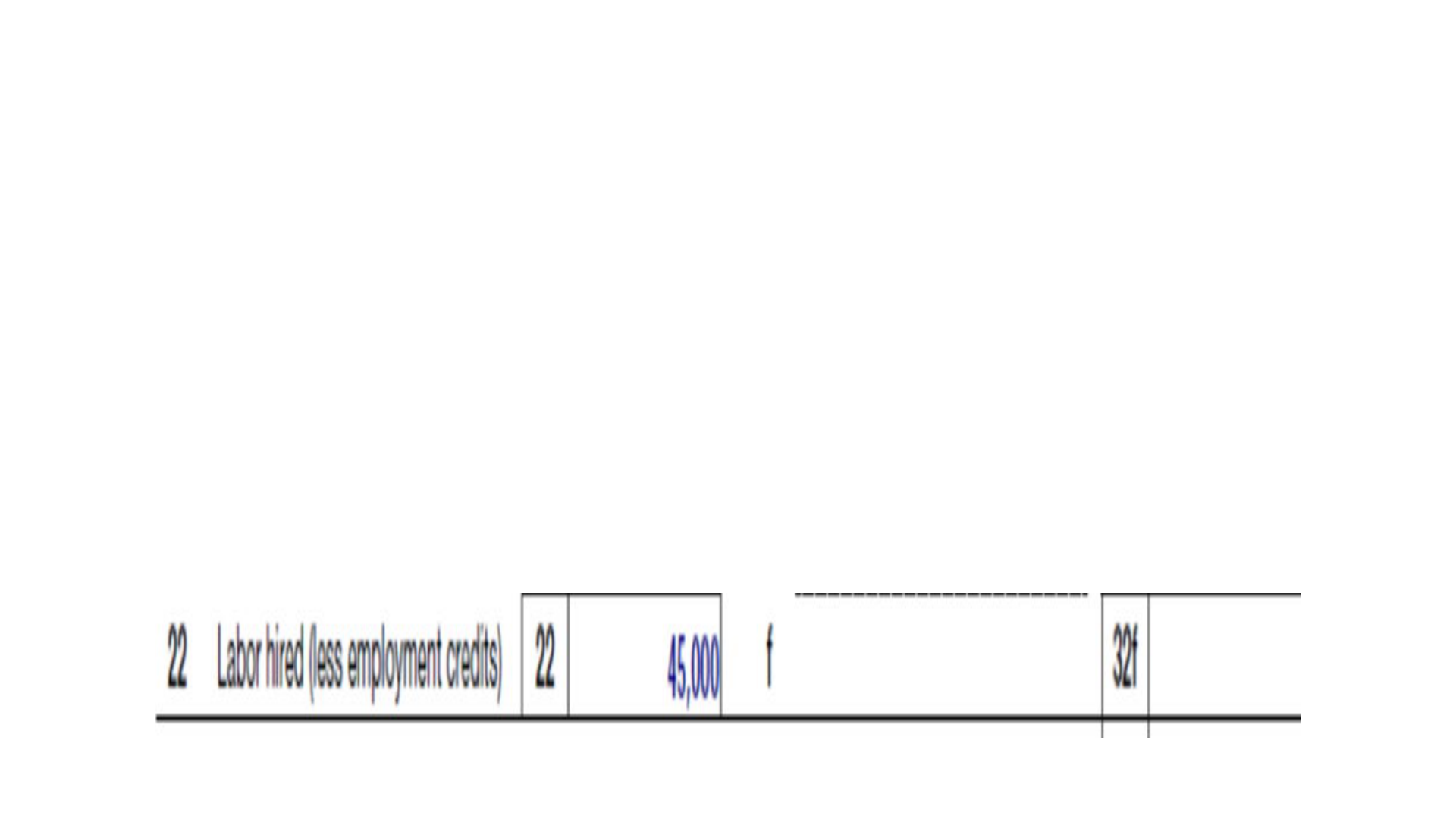

Line 22: Labor

• Paid labor is used on farms to get the jobs done. Labor expenses are

deducted on Line 22, Schedule F.

• Tomas hires two employees to work on his farm. This year he paid

them $30,000 each in cash wages. Tomas reports and deducts

$60,000 on Line 22, Schedule F.

Line 22: Labor

• Carla has 5 part-time employees who work in her farming business.

This year, she pays them, on average, $10,000 each, thus $50,000 in

total cash wages. Carla is eligible to claim the Work Opportunity

Credit in the amount of $2,000 on two of her employees.

Additionally, Carla claims $3,000 in Employer Credit For Paid Family

and Medical Leave. Because Carla enjoys a tax benefit (the two

credits) she must reduce her cash wages paid by these two credit

amounts and thus, reports and deducts $45,000 in labor expense.

[$50,000 - $5,000]

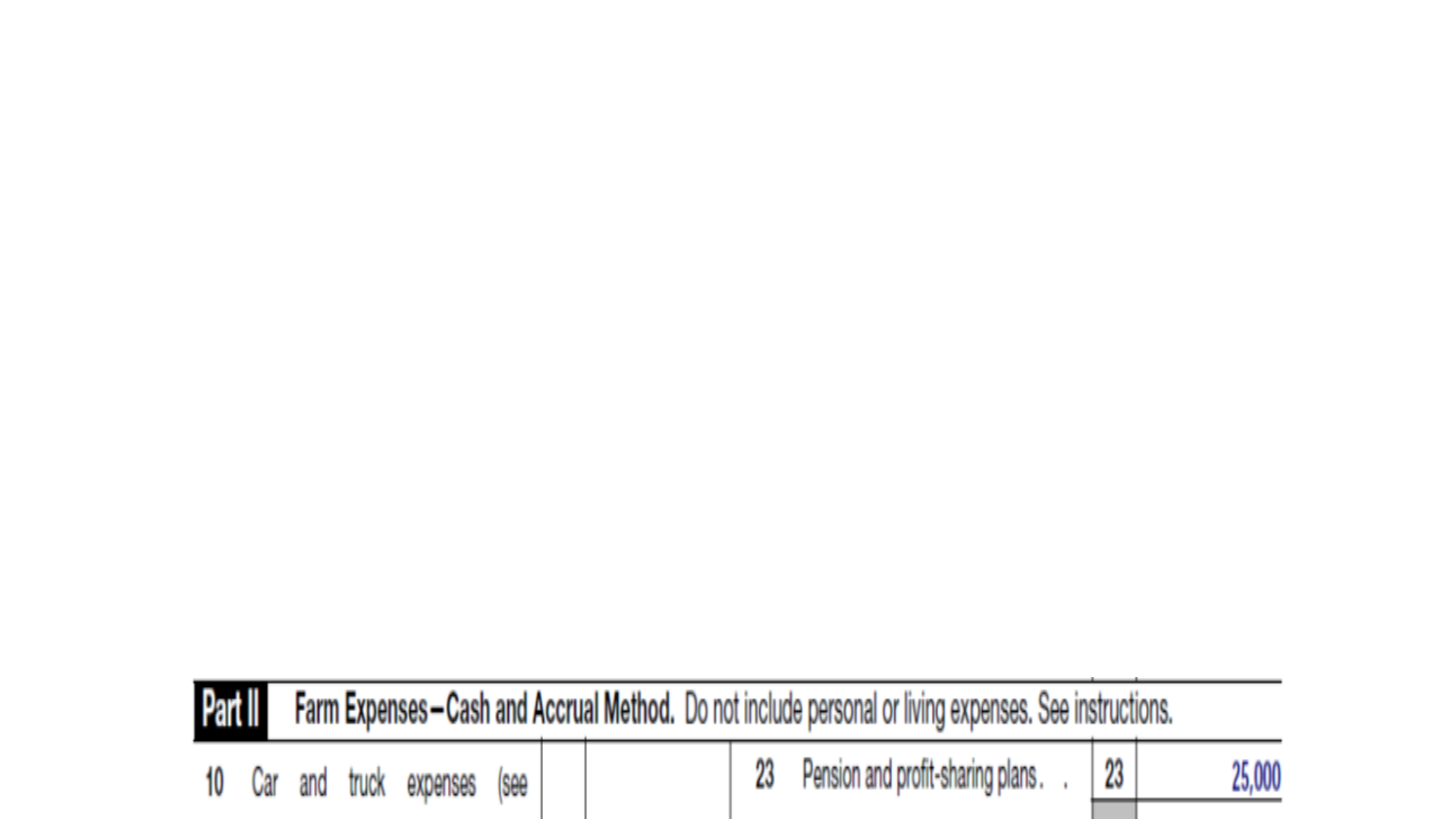

Line 23: Pensions and Profit Sharing

• An additional incentive to attract and retain employees is to offer

retirement benefits. Line 23, Schedule F is used to report and deduct

this expense.

• Jim operates a large dairy farm as a single member LLC which uses

Schedule F to report farm income and expenses. Employees are

eligible to participate in a retirement plan, Jim, through the LLC

contributes up to $3,000 per employee in a matching contribution to

the retirement plan of each employee. This year, $25,000 was

contributed for all participating employees as the farm’s matching

contributions. The SMLLC uses Line 23, Schedule F to report and

deduct this expense.

Lines 24a and b: Rents

• Farmers and ranchers rent land, lease equipment and breeding

animals to gain scale in their farming and ranching businesses. These

expenses are deducted on Lines 24a or b depending on asset rented.

• Antonin farms 1,500 acres, 1,000 acres from three landlords, and 500

acres of owned property. Antonin pays an average of $235 per acre

cash rent to his landlords. Using Schedule F, Line 24b, Antonin reports

$235,000 in land rents. He issues three IRS Forms 1099-MISC to each

of his landlords; one for $100,000, a second for $67,500 and a third

also for $67,500. IRS will match his rental 1099s with his return and

those of his landlords.

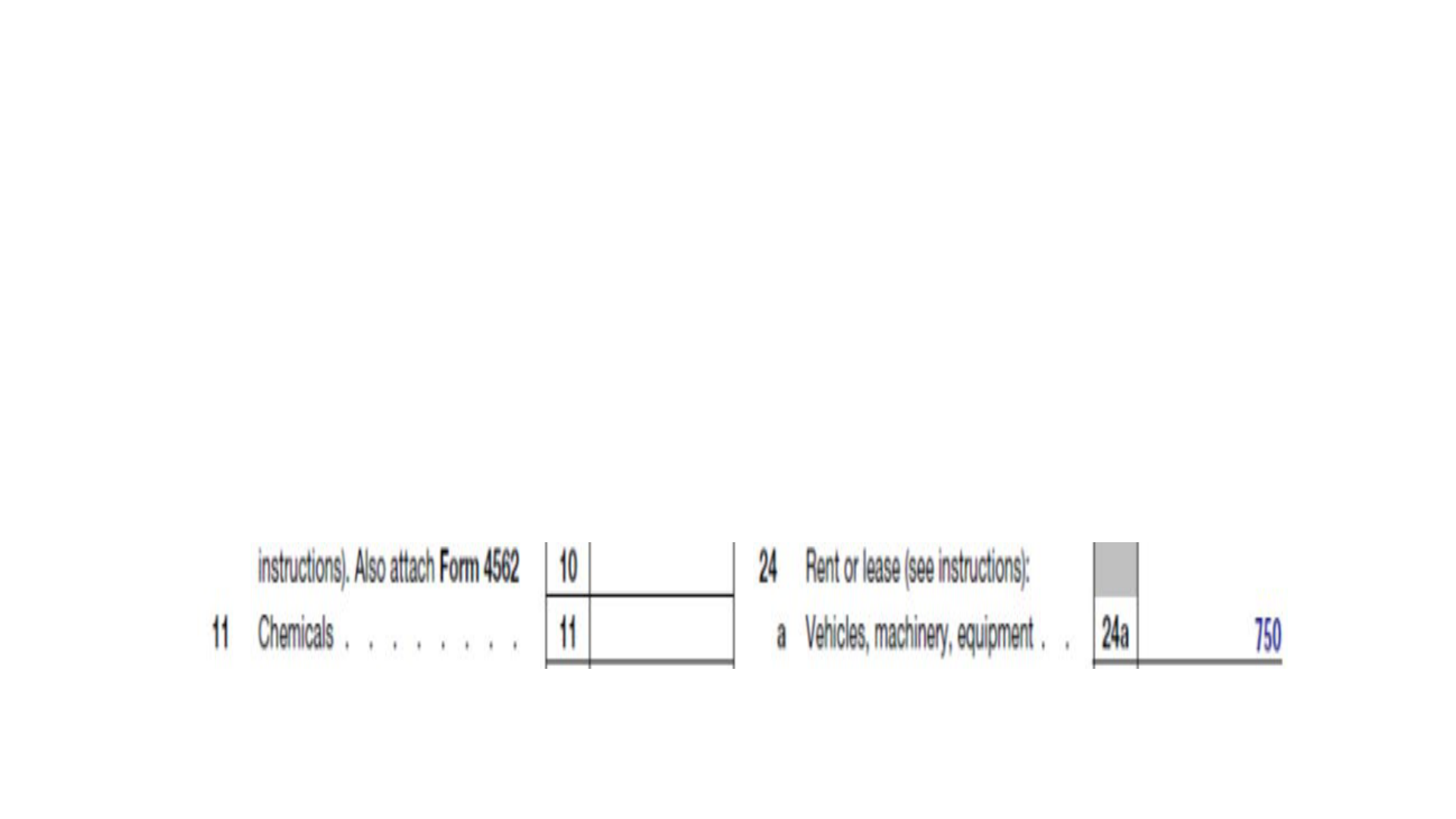

Line 24a: Rent of a machine

• Izabella rents a backhoe to dig out a waterline across one of her

fields. She rents from ABC Equipment, Inc. and pays them $75 per

engine hour. Her employee, Roberto, operated the machine and

when he was finished with the job, the hour meter showed 10 hours

of engine time. Therefore, Izabella pays ABC Equipment, Inc. $750.

She uses Line 24a, Schedule F to report and deduct the rent of the

backhoe. Isabella does not need to issue a Form 1099-MISC because

the ABC Equipment is incorporated.

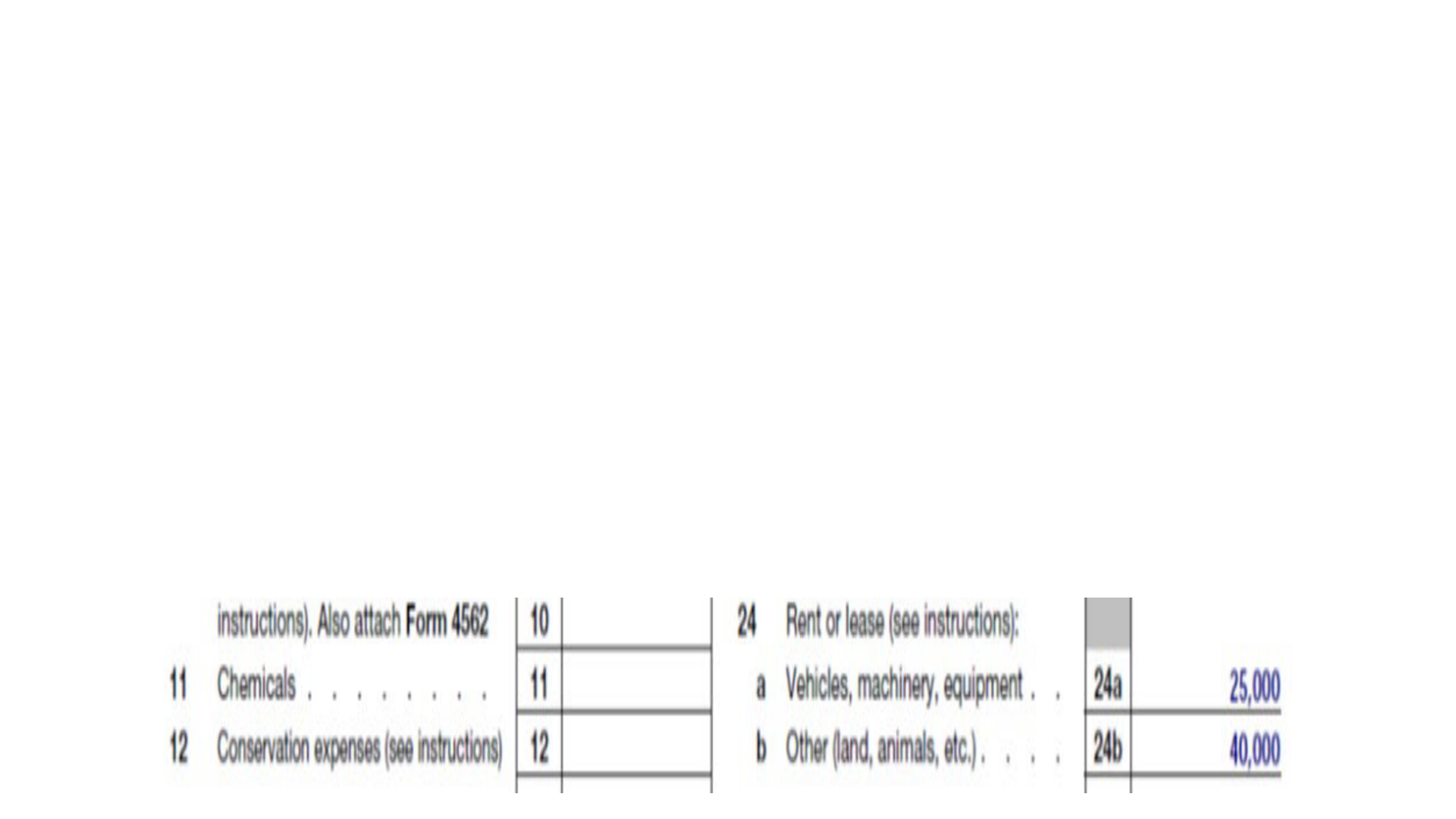

Line 24a and b: Rent of land and machinery together

• Grandpa Joe rents his farm and equipment to his granddaughter Emily. The land

and the equipment are rented together as Emily is a beginning farmer and needs

the equipment to operate. Additionally, Grandpa Joe wants the land to be

maintained and having the machinery and equipment available, as well as being

a condition of renting the land, Emily can keep her Grandpa Joe’s land as

required. Emily pays Grandpa Joe $65,000 for the land and the equipment as a

lump-sum rental payment. The rental arrangement is $40,000 for land rent and

$25,000 for machinery and equipment rented with the land. Emily can report

these two amounts on Lines 24a and 24b as illustrated below. However, she will

issue one Form 1099-MISC for $65,000 to Grandpa Joe and tick questions F and

G in the affirmative.

Machinery rental examples

• Geraldo enters a three-year operational lease for a new tractor with PDQ

Leasing Partnership. The terms of the lease are such that at the end of the

lease Geraldo must return the tractor to the leasing company. The lease

allows 500 hours of engine time per year (1,500 hours in total) at a cost of

$50 per hour. If Geraldo uses the tractor more than the 1,500 hours, he

pays $85 per hour for the overage. Geraldo is required to cover the tractor

with insurance, but the maintenance and repair costs are covered by the

leasing company. This year, Geraldo pays $25,000 to lease the tractor. He

must issue a Form 1099-MISC to PDQ Leasing because it is a partnership

and not a corporation. Geraldo uses Line 24a, Schedule F to report and

deduct this true operational lease.

• Bernadette enters a three-year lease for a combine. The lease agreement

requires Bernadette to pay $175,000 each year and then provides the

option purchase the combine for $15,000 at the end of the lease.

Bernadette is required to insure, maintain, and repair the combine over

the lease term. Because of the construction of the lease terms and the

very low purchase price at the end of the lease, this lease is a capital lease

and IRS will likely treat it as a combine purchase which should be

depreciated.

Line 25: Repairs and Maintenance

• Repairs can be a large total item. Repairs which are costly should be

examined to see if they ought to be capitalized under the IRS repair

regulations.

• If the expense which is incurred leads to a “betterment” or improvement of the

asset, then the cost is to be capitalized.

• If the expense is a restoration of the asset to continue in service, then the cost is to

be capitalized. Examples are replacement of major components or structural parts

which are substantial to a building keeping it in working condition.

• If the expense adapts or changes the use or purpose of the asset, then the cost is

to be capitalized. For example, adding walls in an open barn’s interior to create a

birthing area for cattle or a “sick pen”.

Repair examples

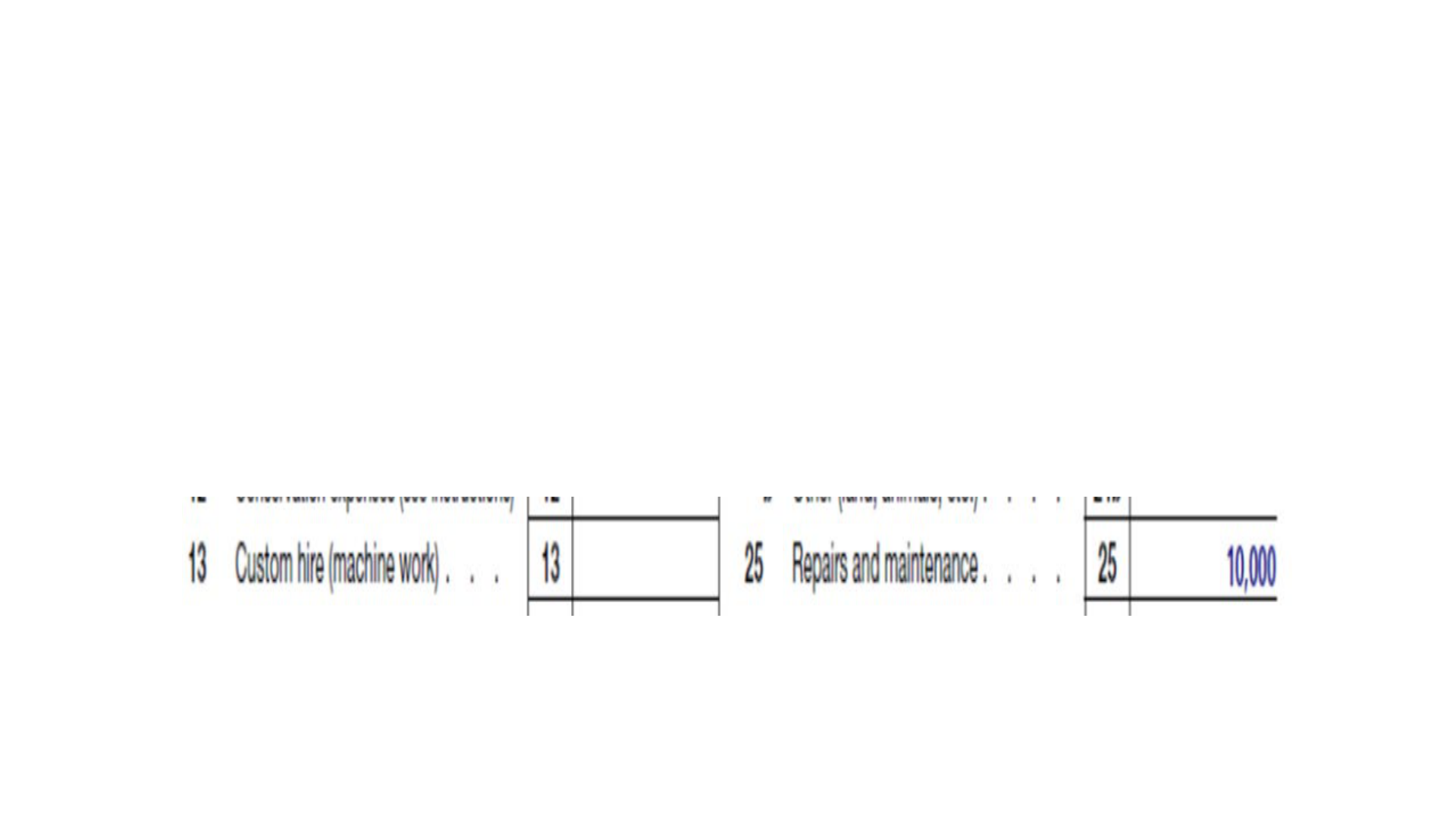

• Bob performs routine maintenance on all his tractors, combines,

heavy-duty trucks and pickups based on the manufacturer's

recommended service intervals. This maintenance includes fluid

changes (oil, antifreeze, and hydraulic oil), filter changes, and greasing

articulating parts. This year Bob’s maintenance costs were $10,000.

Bob uses Line 25, Schedule F to report and deduct this expense.

Repair examples

• Armando purchases an old set of grain bins and scales which are

adjacent to his farm. Before he can use the grain bins, he must put

new flighting in the augers which move grain from one bin to another,

additionally, most of the roofing panels have pin holes allowing

moisture and insects to enter the bin; Armando decides to replace all

the roof panels. The scales need to have new dampers installed so

that trucks do not override the weighing arms. Armando spends

$45,000 to bring the grain bins and scales back into service. This is an

example of restoration before the units can be placed into service.

Therefore, the $45,000 must be capitalized and added to basis of the

grain bins and scales. Armando, with the help of his tax preparer, can

make depreciation decisions relative to the unique assets he acquired

with the purchase and the restoration costs.

Repair example: capitalize or not

• Theodore operates a large crop farm. During the tillage and planting

season in the spring, a temperature gauge on one of Theodore’s

tractors malfunctioned causing the tractor to overheat and

ultimately the engine seized. Theodore spends $25,000 to replace

the engine and return the 5-year-old tractor to service. Two

arguments might be made regarding this expense.

• First, this is a repair, which occurred just outside of the manufacturer's

warranty (doesn’t it often happen this way?) but before the tractor was fully

depreciated over its 7-year recovery period. The value of the tractor

($150,000) was not greatly enhanced with the replacement of the engine as

the tractor’s value returned to a 3 percent marginally higher value. The

engine replacement was 16.67% of the tractor’s value. Therefore, he can

deduct this on Line 25, Schedule F.

• A second, perhaps more conservative position is to recognize this as a

“betterment” and capitalize the new engine’s $25,000 cost and use bonus

depreciation to recover the cost in full if the expense occurred between

September 27, 2017, and December 31, 2022.

Line 29: Taxes

• Line 29, Schedule F, is used to report and deduct various tax

obligations of the farm business.

• Social Security and Medicare taxes the farmer or rancher pays to match the

withholdings from employees’ wages.

• Federal unemployment tax.

• Federal highway use tax.

• State unemployment fund contributions if under state law the contributions

are treated as a tax.

• Property tax on farmland used in the trade or business of farming.

• Property tax on farm machinery, livestock, and vehicles subject to such tax

Line 29: Taxes examples

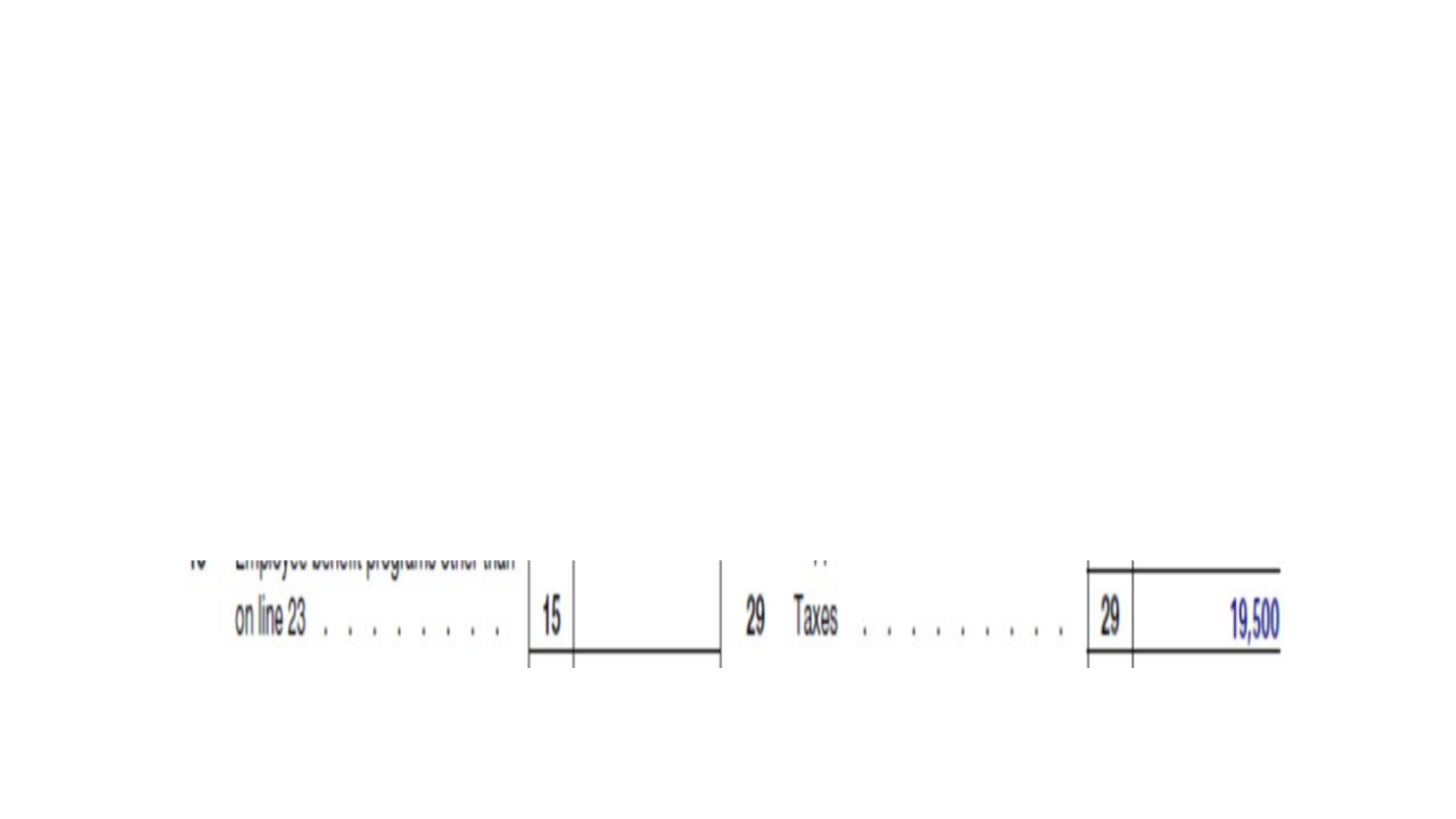

• Louisa has two employees; as an employer she matches the withholdings

from her employees, which this year totaled $7,500. Additionally, Louisa

paid $8,500 in real estate property tax on her farmland and buildings, and

$3,500 on her farm machinery and farm vehicles. Therefore, Louisa uses

Line 29, Schedule F to report and deduct a total of $19,500 tax paid in the

current year. [$7,500 + $8,500 + $3,500] Louisa, in this case, is exempt from

federal or state unemployment tax due to not meeting the wage threshold

or number of employees.

Taxes which are not a business deduction

• Federal income taxes (which include self-employment tax). Self-employed

farmers and ranchers may deduct one-half of their self-employment tax

on Schedule 1, Form 1040.

• Property taxes on the principal residence and personal property not used

in business (although these may be eligible as an itemized deduction on

Schedule A, Form 1040.

• Taxes assessed for improvements such as road improvements or sewers in

the locality of the farmer’s residence. (Typically, these tax payments are

added to the basis of the property)

• State and local sales taxes on items purchased for the farming business;

these taxes are added to the cost of the property, and if depreciable,

recovered over the allowed period.

• Any other taxes not related to the farming business.

Line 30: Utilities

• Farmers and ranchers have various utility expenses incurred in the

operation of their agricultural businesses. These expenses are

deducted on Line 30, Schedule F.

• Billy operates a farm and has a landline which goes to his farm home

which he shares with his wife Milly. The base rate is $15 per month,

and he averages a phone bill of $150 per month of which $75 are

business calls. Billy can deduct $900 [$75 x 12] of his phone bill

against his farm income. He uses Line 30, Schedule F to report and

deduct this expense.

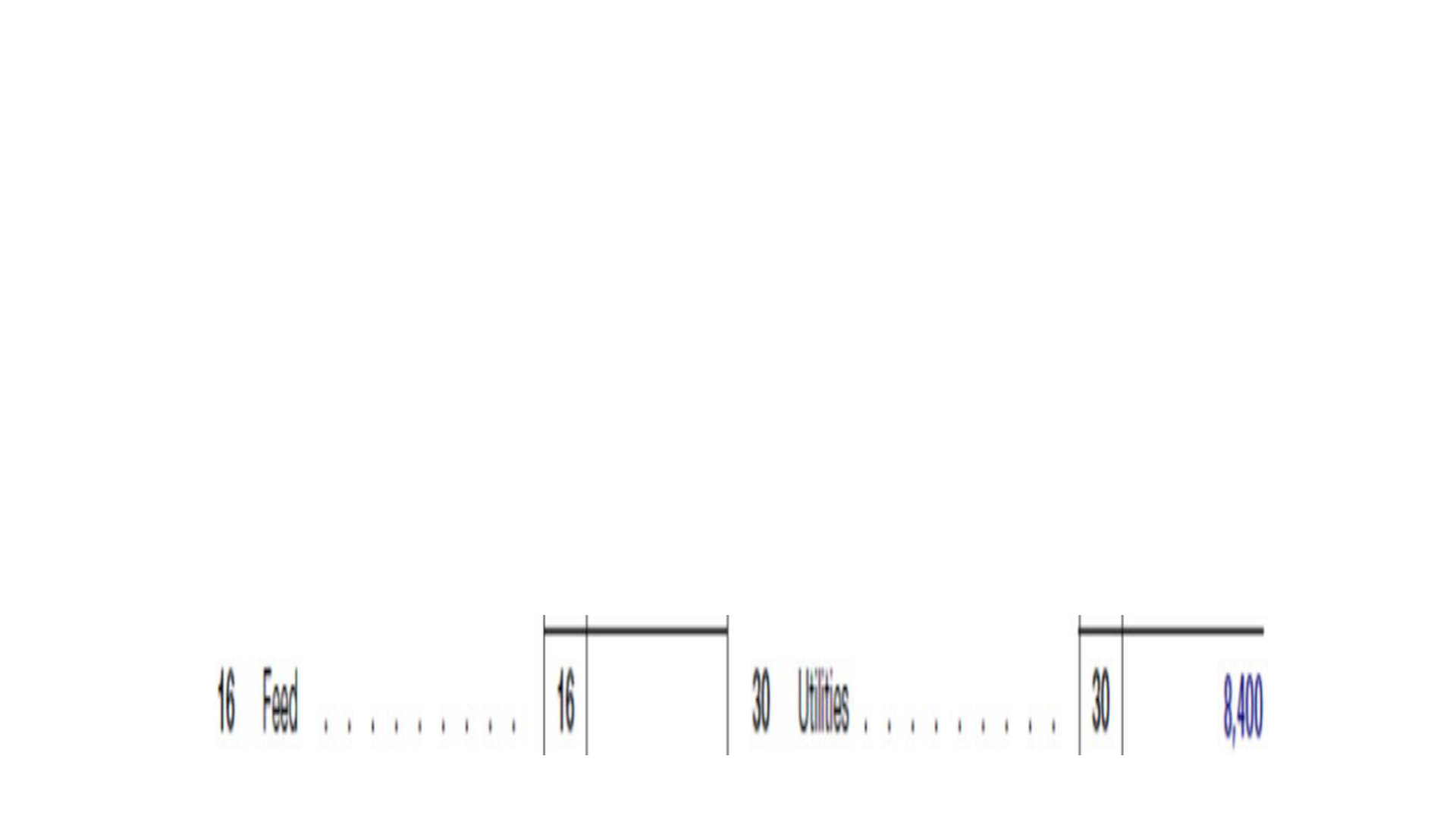

Line 30: Utilities farm vs personal

• Jose and Rosa operate a diverse crop and livestock farm. They use

propane to heat their house and the livestock barns, however, there are

unique propane tanks for each building and the billing is separated

between the home and the farm. They have a single meter each for

water and electricity which run to the house and to the farm buildings and

livestock water tanks. Based on the utility companies estimates, Jose and

Rosa allocated $100 a month for personal electricity and $75 per month

for water. The remaining balance over these allocations is for farm

utilities. This year they paid $6,000 for electricity and $4,500 for water.

Therefore, $4,800 of the electricity bill is for the farm business [$6,000 -

$1,200] and $3,600 is for watering livestock. [$4,500 - $900] Jose reports

and deducts $8,400 as allowable farm utility expense on Line 30,

Schedule F.

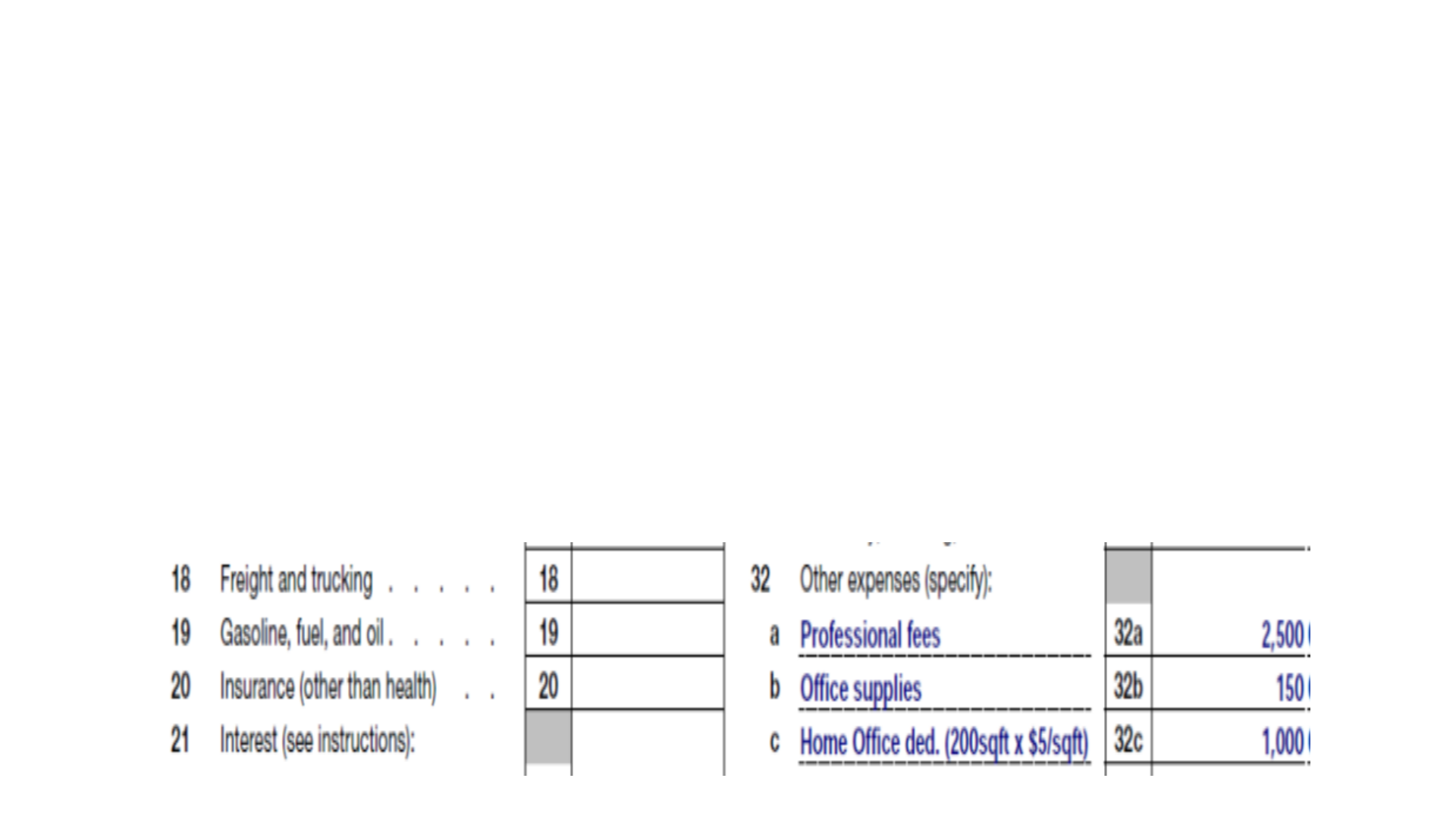

Line 32 a-f: Other expenses

• Farm expenses which do not fit into other categories are reported

and deducted on Line 32, Schedule F as farmer-identified business

costs.

• Ricardo farms and has the following expenses which are farm

business related but do not have a “home” other than on Lines 32a

– f, Schedule F, Professional fees of $2,500 for accounting and

payroll services, $150 for office supplies and home office deduction

of $1,000 for his 200 square feet office space using the $5 per

square foot safe harbor. Ricardo uses Lines 32 a – c, Schedule F to

report and deduct these expenses.

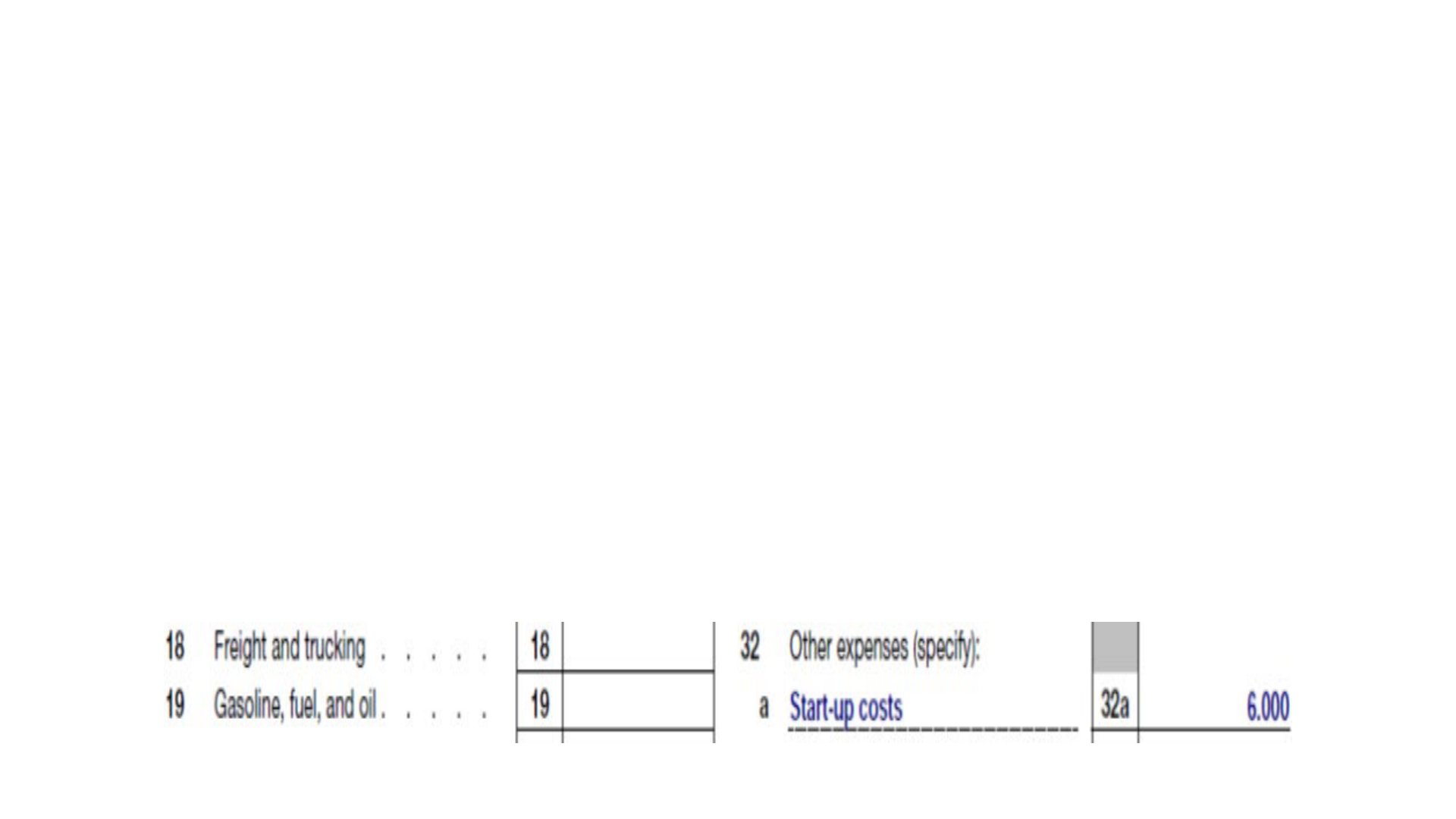

Line 32: Other Expenses, Start up

• On January 1 of this year, Amal began her pick-your-own berry farm

on land she inherited from her parents which had mature berry

plants. Since this is a new business, Amal needs to calculate her

start-up costs and deduct them subject to rule limitations. Amal,

spent $20,000 in allocable start-up expenses, $5,000 of which she

may deduct currently, but she must amortize the remaining $15,000

over 180 months ($83.33/mo.). Thus, Amal’s total start-up

deduction allowed this year is $6,000 [$5,000 + (12 x $83.33)],

reported and deducted on Line 32a, Schedule F. Then, over the

subsequent 14 years, Amal will annually deduct $1,000 of the

remaining start-up costs.

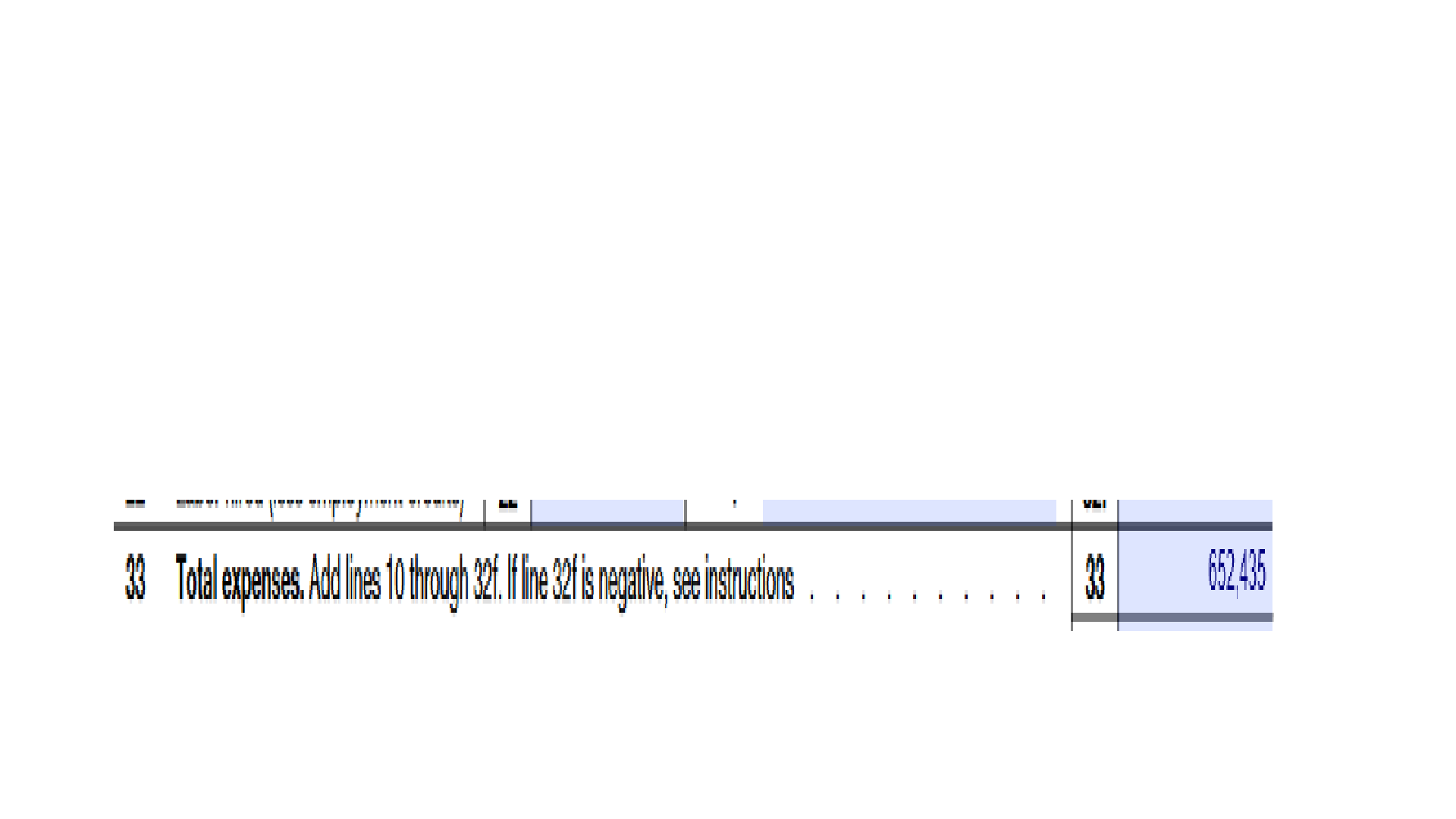

Lines 33 – 36: Wrapping up

• Line 33 is the summation of all expenses: Lines 10 – 32f

• Georgia has $652,435 of total allowable farm expenses which she

incurred this year in the conduct of her peach orchard. She used Line

33, Schedule F to report this total.

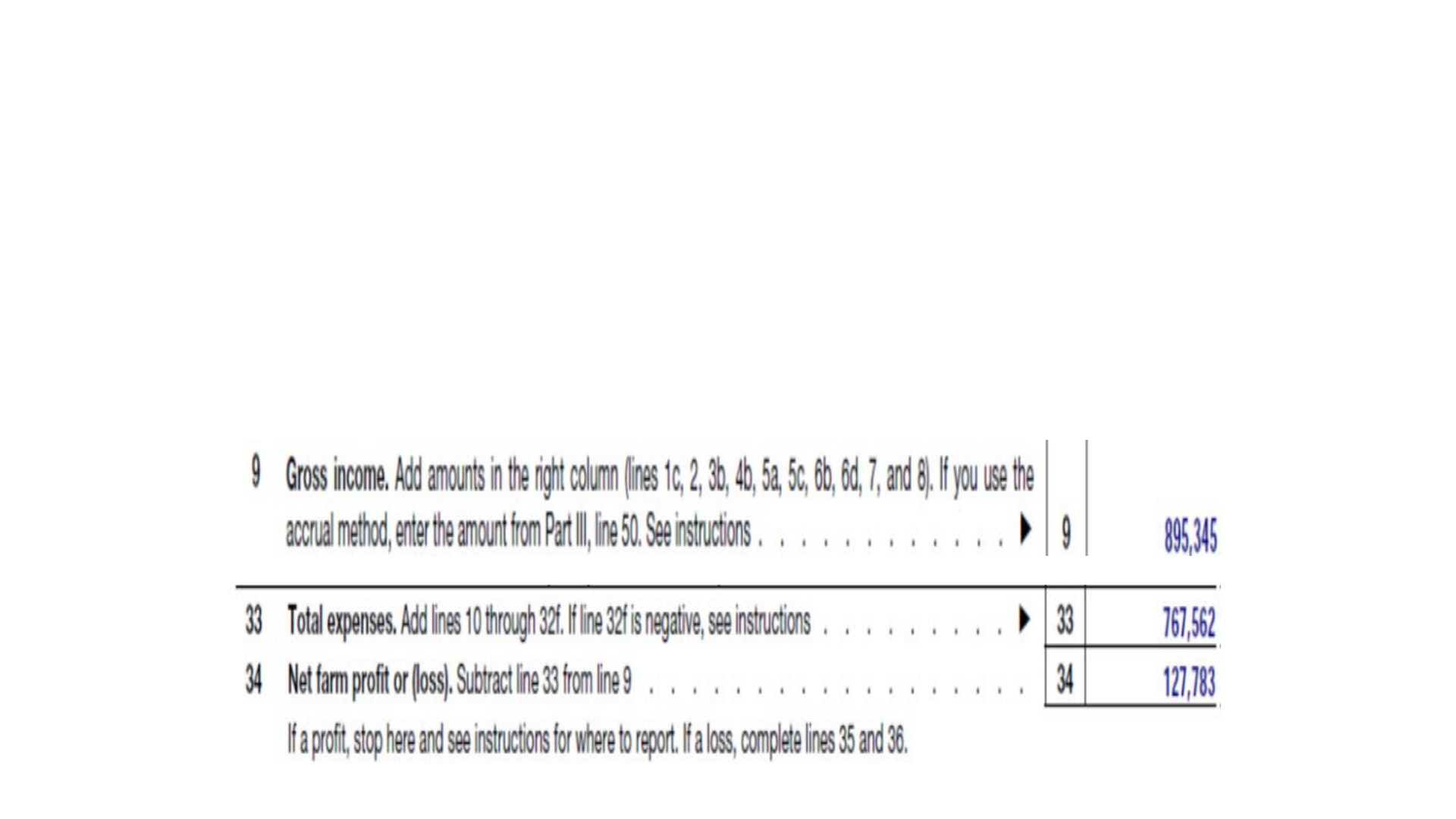

Net farm profit or loss, Line 34

• Alfredo reports $895,345 of Gross Income from farming on his Line 9,

Schedule F and reports $767,562 of Total Expenses on Line 33,

Schedule F resulting in a Net Farm Profit of $127,783 reported on

Line 34, Schedule F.

Line 36: At Risk Question

• Susanna’s fruit orchard generated a farm loss this year due to a spring

freeze which reduced her harvestable crops by 75 percent. All her

loans are recourse loans with her farm assets being the collateral. Her

loss is $135,891 as reported on Line 34, Schedule F, she ticks Line 36,

Box a indicating that all the investment in her orchard business is at

risk. Thus, she answers the “at risk rule question” in the affirmative. If

one or more of Susanna’s loans were a non-recourse loan, then not all

of Susanna’s investment is at risk, thus she ticks Box b of Line 36.

Summary: to ensure accurate and complete

Schedule F

• A cash-basis Schedule F is complete when the following are

appropriately enumerated and prepared to be filed.

• Responses and details are reported in the information block at the top of

the schedule and answering Questions A – G,

• The farm income is correctly and accurately reported on Lines 1a through

8 in Part 1 of Schedule F,

• Gross farm income calculated on Line 9,

• The allowable farm expenses are accurately and correctly reported on

Lines 10 through 32f, and finally

• Total expenses tabulated, Line 33, net farm profit (or loss) derived, Line

34, and if a loss answering the applicable question on Line 36.

Thank you for your

attention!

info@RuralTax.org

RuralTax.org