Theory and Practice

Garry J. Schinasi

INTERNATIONAL MONETARY FUND

SAFEGUARDING FINANCIAL STABILITY

Theory and Practice

Garry J. Schinasi

IMF

“The economic and institutional transformation of central banking that has

taken place over the past four decades has been driven mainly by mone-

tary policy issues. However, it has profoundly affected another historical

mission of central banks—the preservation of financial stability. Financial

stability is gradually emerging as a distinct policy function, requiring its

own body of scholarship, not to be confused with monetary policy on the

one side, and supervision on the other side, although it is related to both.

“Building an analytical approach and a policy paradigm consistent with this

new setting as well as with the changing landscape of financial markets

and institutions is one of the tasks of today’s research and policy agenda.

“Garry Schinasi takes us a big step forward in the fulfilment of this task.

His book Safeguarding Financial Stability represents a brilliant attempt to

provide solid and updated foundations to policies aiming at financial stability.

The book is based on a thorough acquaintance with the literature, under-

standing of the real world, analytical skill, sense of the policy issues,

familiarity with the diversity of country situations, and good judgment.

“The book can already be considered required reading for anyone interested

in the subject of financial stability. Its clarity makes it accessible to policy-

makers as well as practitioners. At the same time the book will stir debate

and further research in academic circles.”

—Tommaso Padoa-Schioppa,

Executive Board Member (1998–2005),

European Central Bank

SAFEGUARDING FINANCIAL STABILITY

Theory and Practice

More endorsements of Safeguarding Financial Stability may be found inside (p. v–vi).

Theory and Practice

Garry J. Schinasi

INTERNATIONAL MONETARY FUND

© 2006 International Monetary Fund

All rights reserved.

Production: IMF Multimedia Services Division

Cover design: Lai Oy Louie

Cover photo: Bruno Budrovic, © Images.com/CORBIS

Cataloging-in-Publication Data

Schinasi, Garry J.

Safeguarding financial stability : theory and practice / Garry J.

Schinasi — Washington, D.C. : International Monetary Fund, 2005.

p. cm.

Includes bibliographical references and index.

ISBN 1-58906-440-2

1. Finance. 2. Banks and banking, Central. 3. Risk. I. International

Monetary Fund.

HG101.S35 2005

Disclaimer: The views expressed in this work are those of the author and

do not necessarily represent those of the IMF or IMF policy.

Price: $28.00

Please send orders to:

International Monetary Fund, Publication Services

700 19th Street, NW

Washington, DC 20431 USA

Te lephone: (202) 623-9730 Telefax: (202) 623-7201

Internet: http://www.imf.org

I dedicate this book to my parents,

Jack (deceased) and Josephine Schinasi.

Here’s what the experts are saying about

Safeguarding Financial Stability

Theory and Practice

By Garry J. Schinasi

“Safeguarding Financial Stability explicates why financial stability matters,

what it means, and the challenges in securing it....[It is] a thoughtful

and thought-provoking volume that is a must read not just for central

bankers but for all concerned with financial stability—and if you are not

concerned about the latter, you soon will be!”

—Gerard Caprio, Jr., World Bank

“Garry Schinasi provides a unique and comprehensive framework for

understanding financial stability and for assessing the risks posed by new

financial instruments in increasingly unregulated markets in an increas-

ingly globalized world. The channels of monetary policy management

have changed tremendously, as anyone who follows the striking stability of

long-term bond yields in the face of rising short-term interest rates will

attest. The global business cycle is maturing, entering into a period of high

financial risk, as discussed by Dr. Schinasi. Anyone who does not read this

book today will regret not doing so, as the next financial shock and test of

the stability of the global financial system is not long in coming.”

—Gail D. Fosler, The Conference Board

“The economic and institutional transformation of central banking that

has taken place over the past four decades has been driven mainly by

monetary policy issues. However, it has profoundly affected another his-

torical mission of central banks—the preservation of financial stability.

Financial stability is gradually emerging as a distinct policy function,

requiring its own body of scholarship, not to be confused with monetary

policy on the one side, and supervision on the other side, although it is

related to both.

“Building an analytical approach and a policy paradigm consistent with

this new setting as well as with the changing landscape of financial markets

and institutions is one of the tasks of today’s research and policy agenda.

“Garry Schinasi takes us a big step forward in the fulfilment of this

task. His book Safeguarding Financial Stability represents a brilliant

attempt to provide solid and updated foundations to policies aiming at

financial stability. The book is based on a thorough acquaintance with the

literature, understanding of the real world, analytical skill, sense of the

policy issues, familiarity with the diversity of country situations, and

good judgement.

“The book can already be considered required reading for anyone

interested in the subject of financial stability. Its clarity makes it accessible

to practitioners as well as policymakers. At the same time, the book will

stir debate and further research in academic circles.”

—Tommaso Padoa-Schioppa, European Central Bank

“...this is a great book. It synthesizes a large literature on financial stabil-

ity,...and it fills in a number of crucial holes....I think it will be

remembered as the first concrete attempt to analyze, define, and move

toward operationalizing assessment of financial stability.”

—R. Todd Smith, University of Alberta

vii

Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . xi

Acknowledgements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . xiii

Abbreviations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . xv

1Introduction and Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Part I: Foundations

2Money, Finance, and the Economic System . . . . . . . . . . . . . . . . 27

3Public Policy Aspects of Finance . . . . . . . . . . . . . . . . . . . . . . . . 43

4 Efficiency and Stability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

Part II: Toward a Framework for Financial Stability

5Defining Financial Stability . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

6A Framework for Financial Stability . . . . . . . . . . . . . . . . . . . . . 98

7The Role of Central Banks in Ensuring Financial Stability . . . . 134

Part III: The Benefits and Challenges of Modern Finance

8Challenges Posed by the Globalization of Finance and Risk . . . 153

9Systemic Challenges Posed by Greater Reliance on

Over-the-Counter Derivatives Markets . . . . . . . . . . . . . . . . . . . 181

10 The Market for Credit Risk Transfer Vehicles: How Well

Is It Functioning and What Are the Future Challenges? . . . . . . 228

11 Systemic Implications of the Financial Market Activities

of Insurance and Reinsurance Companies . . . . . . . . . . . . . . . . . 245

12 Ongoing National and Global Challenges . . . . . . . . . . . . . . . . . 271

Glossary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 277

Bibliography . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 285

Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 303

About the Author . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 311

List of Tables

1.1 Changes in Key Financial Aggregates . . . . . . . . . . . . . . . . . . . 4

1.2 Distribution of Financial Sector Mergers

and Acquisitions, 1991–1999 . . . . . . . . . . . . . . . . . . . . . . . . . . 9

1.3 Cross-Border Transactions in Bonds and Equities . . . . . . . . . 10

1.4 Outstanding International Debt Securities

by Nationality of Issuer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

1.5 Exchange-Traded Derivative Financial Instruments: Notional

Principal Amounts Outstanding and Annual Turnover . . . . . 12

1.6 Market Turbulence and Crises in the 1990s

and Early 2000s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

2.1 Finance as a Temporary Exchange of Services . . . . . . . . . . . . 33

2.2 Relative Values of Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

3.1 Typology of Benefits from Goods, Based on

Characteristics of the Goods . . . . . . . . . . . . . . . . . . . . . . . . . . 52

6.1 Source of Risk to Financial Stability . . . . . . . . . . . . . . . . . . . . 107

6.2 IMF Financial Soundness Indicators:

Core and Encouraged . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 112

6.3 Policy Instruments for Financial Stability . . . . . . . . . . . . . . . . 116

8.1 Cross-Border Transactions in Bonds and Equities . . . . . . . . . 154

8.2 International Equity Issues by Selected Industrial

and Developing Countries and Regions . . . . . . . . . . . . . . . . . 156

8.3 Outstanding International Debt Securities

by Nationality of Issuer for Selected Industrial

and Developing Countries and Regions . . . . . . . . . . . . . . . . . 158

8.4 Major Industrial Countries:

Bank Deposits of Commercial Banks . . . . . . . . . . . . . . . . . . . 161

8.5 Major Industrial Countries: Bank Loans

of Commercial Banks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 161

8.6 Major Industrial Countries: Tradable Securities Holdings

of Commercial Banks Assets . . . . . . . . . . . . . . . . . . . . . . . . . . 161

8.7 Major Industrial Countries: Financial Assets

of Institutional Investors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 162

9.1 Top 20 Derivatives Dealers in 2004

and Their Corresponding Ranks in 2003 . . . . . . . . . . . . . . . . 186

9.2 Global Over-the-Counter Derivatives Markets: Notional

Amounts and Gross Market Values of Outstanding Contracts

by Counterparty, Remaining Maturity, and Currency . . . . . . 188

11.1 Life Insurance: Premium Growth Rates . . . . . . . . . . . . . . . . . 256

11.2 Profitability Decomposition

of Major Nonlife Insurance Markets . . . . . . . . . . . . . . . . . . . . 258

viii CONTENTS

List of Figures

1.1 Composition of Key Financial Aggregates in 1970

and 2000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

1.2 Growth of Key Financial Assets, 1970–2004 . . . . . . . . . . . . . . 7

1.3 Financial Sector Mergers and Acquisitions, 1990–1999 . . . . . 8

2.1 Evolution of Modern Finance . . . . . . . . . . . . . . . . . . . . . . . . . 41

4.1 Private Demand and Supply Equal

to Social Demand and Supply . . . . . . . . . . . . . . . . . . . . . . . . . 68

4.2 Private Marginal Benefit Below Social Marginal Benefit . . . . 69

4.3 Private Marginal Cost Below Social Marginal Cost . . . . . . . . 70

4.4 Stable Disequilibrium . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

6.1 Stylized View of Factors Affecting

Financial System Performance . . . . . . . . . . . . . . . . . . . . . . . . . 103

6.2 Framework for Maintaining Financial System Stability . . . . . 105

9.1 Structure of OTC Derivatives Markets,

End-December 2003 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 202

10.1 Global Credit Derivatives Market Size and Structure . . . . . . . 229

10.2 Key Characteristics of Credit Derivatives Markets . . . . . . . . . 230

10.3 Spread Between Credit Derivatives Premium

and Underlying Bond Spread . . . . . . . . . . . . . . . . . . . . . . . . . 241

11.1 Shares of Total Financial Assets of Institutional Investors

and Banks: United States and Japan . . . . . . . . . . . . . . . . . . . . 247

11.2 Shares of Total Financial Assets of Institutional Investors

and Banks: Selected Euro Area Countries

and the United Kingdom . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 248

11.3 Holdings of Financial Securities

by Insurance Companies and Banks . . . . . . . . . . . . . . . . . . . . 249

11.4 Holdings of Securities Relative to Market Size . . . . . . . . . . . . 250

11.5 United States: Corporate and Foreign Bonds . . . . . . . . . . . . . 252

11.6 Balance Sheet Assets of Insurance Companies:

United States and Japan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 253

11.7 Balance Sheet Assets of Insurance Companies:

Selected Euro Area Countries and the United Kingdom . . . . 254

11.8 Global Insurance Industry Results . . . . . . . . . . . . . . . . . . . . . 255

11.9 Nonlife Insurance: Combined Ratios

in the Industrial Countries . . . . . . . . . . . . . . . . . . . . . . . . . . . 259

List of Boxes

3.1 Prisoner’s Dilemma . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

3.2 Sources of Market Failure in Finance . . . . . . . . . . . . . . . . . . . 49

Contents ix

3.3 Samuelson’s Store of Value as a “Social Contrivance”

Providing a Public Good . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

6.1 Remedial Action: Dutch Housing Market Boom

in the 1990s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 117

6.2 Crisis Resolution: Terrorist Attacks on September 11, 2001 . . 119

9.1 The Role of OTC Currency Options

in the Dollar-Yen Market . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 192

9.2 Long-Term Capital Management and Turbulence

in Global Financial Markets . . . . . . . . . . . . . . . . . . . . . . . . . . . 196

9.3 The Role of Derivatives in Crises in Emerging Markets . . . . . 198

9.4 Sources of Legal Uncertainty

in the U.S. Regulatory Environment . . . . . . . . . . . . . . . . . . . . 218

10.1 Financial Implications of Enron’s Bankruptcy . . . . . . . . . . . . 236

x CONTENTS

Preface

T

his book was written because I could not find one like it in bookstores

or in central bank libraries. In effect, it fills a gap—albeit imperfectly—

in the existing policy, academic, and commercial literatures on financial

stability issues.

The motivation for undertaking this project came to me in early 2003,

after having spent nearly 10 years engaging in international capital market

surveillance—first in the IMF’s Research Department (both as Deputy

Chief and Chief of the Capital Market and Financial Studies Division) and

then in the newly created International Capital Markets Department (as

Chief of the Financial Markets Stability Division). Part of the challenge of

the job was to understand the implications of structural changes in

finance (including financial institutions, markets, and infrastructures),

which required talking to market participants and the relevant authori-

ties (including central banks and supervisory authorities). The job always

entailed keeping management and colleagues well informed about capi-

tal market developments, prospects, issues, and most important, sources

of risks and vulnerabilities.

The time spent searching for potential risks and vulnerabilities (or “pot-

holes” as we called them) in the international monetary and financial sys-

tem, especially in the more mature markets, challenged my colleagues and

me to search continuously for new ways of understanding how calm mar-

ket conditions can lead to turbulence, why changes in market sentiment

often occur without much warning, and how the private and official sec-

tors can adapt and learn to prevent and better cope with financial difficul-

ties and crises. By mid-2003 I felt it was time to step back from the events

as they were occurring and to reflect more systematically—and with less

pressure—on what kind of framework would advance the understanding

of financial stability issues, how to communicate the importance of these

issues, and how to encourage and energize a greater focus on optimizing

the benefits of finance for societies at large.

Before actually reaching the decision to take a one year sabbatical from

the IMF, I challenged myself to produce an outline of a study on financial

stability issues that I was fairly certain I could write, if given sufficient free

xi

time. Instead, I produced an outline of a book that I wanted to read, but

which I was uncertain I was capable of writing. I will leave it to the reader

to decide whether the outcome was worth the effort. My only hope in pub-

lishing this study is that practitioners—that is, those who safeguard finan-

cial stability—will be motivated to think about these issues in a new and

more productive way and that the relevant professions will be encouraged

to develop useful, policy-oriented frameworks for achieving and maintain-

ing national and international financial stability.

xii

PREFACE

xiii

Acknowledgements

T

his study was researched and partly written during a one-year sabbati-

cal from the International Monetary Fund (IMF). I gratefully acknowl-

edge the IMF’s generous financial support under its Independent Study

Leave Program.

I also gratefully acknowledge the support and encouragement of the

European Central Bank (ECB) and De Nederlandsche Bank (DNB) while

visiting them in 2003 and 2004, and would like to thank especially Tom-

maso Padoa-Schioppa, Mauro Grande, and John Fell at ECB and Henk

Brouwer, Jan Brockmeijer, Aerdt Houben, and Jan Kakes at DNB.

Chapters 2, 3, 5, and 6 are based, in part, on material researched and pre-

sented in various drafts of several papers (which were later revised and

repackaged and issued as IMF Working Papers WP/04/101, WP/04/120,

and WP/04/187). These and other related papers benefited from discus-

sions with, and comments from, many colleagues both within and outside

the IMF. These include Bill Alexander, Ivan Alves, Michael Bordo, Burkhard

Drees, Christine Cumming, Udaibir Das, Phil Davis, Charlie Kramer,

Myron Kwast, John Fell, Bob Flood, Andy Haldane, Aerdt Houben, Jan

Kakes, Russell Kincaid, Donald Mathieson, Leena Mörttinen, Tommaso

Padoa-Schioppa, Lars Pedersen, Eric Peree, and James R. White. I also

received useful comments during seminars at ECB, DNB, the European

Investment Bank, the University of Hong Kong, and from other IMF col-

leagues during the review process for IMF working papers.

The chapters presented in Part III of this study are based, at least in part,

on material that was originally cowritten with IMF colleagues and pub-

lished in various editions of the IMF’s International Capital Markets—

Develop

ments, Prospects and Key Policy Issues during 1995–2001, and Global

Financial Stability Report during 2002–2003. I would like to acknowledge the

following coauthors for their contributions to this earlier work and the more

recent manifestations of it presented in this study: Charlie Kramer (Chapters

9, 10, and 11); Burkhard Drees (Chapter 9); Todd Smith (Chapter 10); Peter

Breuer (Chapter 11); and Oksana Khadarina provided essential assistance

in preparing the quantitative part of Chapter 8. I am also grateful to my

coauthors Aerdt Houben and Jan Kakes (of DNB) for allowing me to use

material from our joint IMF Working Paper WP04/101 and DNB Occasional

Paper, “Toward a Framework for Safeguarding Financial Stability,” which we

jointly researched, brainstormed, and drafted during a four-month period

ending in mid-February 2004, and which makes up part of Chapter 6. I am

grateful to my coauthor John Fell for allowing me to use material from our

joint paper, “Assessing Financial Stability: Exploring the Boundaries of

Analysis,” published in a special financial-stability edition of National Insti-

tute Economic Review (April 2005). I am especially grateful to John Fell for

providing a fertile environment at ECB for the early stages of my work and

for his persistent encouragement to complete this project. In all other

instances in which I use material drawn from the work of colleagues both

within and outside the IMF it is acknowledged in footnotes. I am grateful to

Oksana Khadarina for untiring efforts in producing and updating the tables

and charts and also to Yoon Kim for assisting in a part of this effort. Special

thanks to Margo and Tom Vuicich for providing a sunny environment for

thinking and writing part of this study.

Thanks are due also to Jeanette Morrison, Anne Logue, and Sherrie

Brown for their editorial and publishing expertise. I am particularly grate-

ful to Sean M. Culhane for providing expert professional advice and

encouragement during each phase of the editorial and production process.

I owe thanks to Michael Mussa (IMF Economic Counsellor and Director

of Research, 1993–2001) and David Folkerts-Landau (Assistant Director of

Research until 1998) for providing me with the opportunity to be a part of

the IMF’s international capital markets surveillance team in 1994–95.

Finally, I thank Katherine, Jack, and Sarah for their loving support

throughout these and many other efforts.

xiv

ACKNOWLEDGEMENTS

Abbreviations

ART alternative risk transfer

CDO collateralized debt obligation

CDS credit default swaps

CFTC Commodity Futures Trading Commission

CLS Continuous Linked Settlement

ERISA Employee Retirement Income Security Act

FA funding arrangements

FSAP Financial Sector Assessment Program

GDP gross domestic product

GIC guaranteed investment contracts

GKO ruble-denominated discount instrument

HKMA Hong Kong Monetary Authority

IAIS International Association of Insurance Supervision

ISDA International Swaps and Derivatives Association

LIBOR London Inter-Bank Offer Rate

LTCM Long-Term Capital Management

NDF nondeliverable forward (market)

OCC Office of the Comptroller of the Currency

OFZ ruble-denominated coupon bonds

OTCover the counter

SAR Special Administrative Region (Hong Kong)

SEC Securities and Exchange Commission

SPV special purpose vehicle

TARGET Trans-European Automated Real-Time Gross Settlement

Express Transfer System

xv

1

Introduction and Summary

T

he objective of this book is to develop and present a framework for safe-

guarding financial stability. Part I reviews important logical founda-

tions that show how the process of finance is related to real economic

processes and why finance can and should be viewed as providing public

goods and requiring forms of private-collective and public policy action. Part

II proposes and develops a comprehensive and practical framework for safe-

guarding financial stability encompassing both the prevention and the reso-

lution of financial imbalances, problems, and crises. Part III examines

ongoing real world challenges to financial stability posed by recent structural

financial changes such as the globalization of finance, the growing reliance

on over-the-counter derivative instruments and markets, the growth of credit

derivatives markets, and the capital market activities of insurance and rein-

surance companies.

This Book and the Financial Stability Questions

Does financial stability require the soundness of institutions, the stability

of markets, the absence of turbulence, and low volatility—or something

even more fundamental? Can stability be achieved and maintained through

individual private actions and unfettered market forces alone? If not, what is

the role of the public sector, as opposed to private-collective action, in fos-

tering financial stability? Should the public sector just make way for the pri-

vate sector to achieve an optimum on its own, or is a more proactive role

necessary for achieving the full private and social benefits of finance? Is there

aconsensus on how to achieve and maintain financial stability?

The role of the public sector is not likely to be clear and appropriately

focused without an understanding of the requirements for financial stabil-

ity in the first place. Likewise, the requirements for financial stability are not

1

likely to be well understood without an analytical framework that can rig-

orously consider the questions above, individually and collectively. Unfor-

tunately, there is no single, widely accepted framework for monitoring,

assessing, and safeguarding financial stability; in fact, there is not even a

widely accepted definition of financial stability. Perhaps this is the root of

the problem, because without a good working definition of financial stabil-

ity, the quickly growing financial-stability profession will continue to have

difficulties developing useful analytical frameworks for examining policy

issues, for monitoring and assessing the financial-stability performance of

financial systems, and for dealing with financial systemic problems should

they arise.

The core objective of this study is to develop a practical framework for

safeguarding financial stability. As anyone who has tried to engage in

financial-stability analysis knows, there are few if any widely accepted

models or analytical frameworks for monitoring and assessing financial-

system stability and for examining policy issues, as there are for economic

systems and in other disciplines. The practice of financial-stability analysis

is still in its infancy when compared with, for example, the analysis of mon-

etary stability or macroeconomic stability. In the rare cases in which finan-

cial systems are expressed rigorously, they constitute one or two equations

in much larger macroeconomic models possessing most of the usual macro-

equilibrium and macro-stability conditions. In addition, there are reasons

to doubt strongly that a single measurable target variable can be found for

defining and achieving financial stability, as there is believed to be for defin-

ing and achieving monetary stability (such as an inflation target), although

many doubt that a single target variable approach accurately represents

actual practice in monetary policymaking.

Lacking a framework for financial stability, a set of models for analyzing

and understanding it, or even a concept of financial-system equilibrium and

stability, it is difficult to envision a framework for safeguarding financial sta-

bility (including a practical definition) akin to what economists normally

demand and use. Nevertheless, it would be useful to have a framework that

not only encompasses, but also requires, the continuous development and

use of both analytical tools and policy analyses.

This study develops and proposes such a framework. The approach

developed here is not a final blueprint, however, and it should be seen as

one further step in the evolution of the practice of safeguarding financial

stability. In researching and writing about many of the issues the book

addresses, the choice often had to be made to be practical and policy rele-

vant rather than scientific and rigorous, in part because assessing financial

stability is still more of an art form than a rigorous discipline or science.

2

INTRODUCTION AND SUMMARY

Accordingly, there is great scope for more scientific and rigorous efforts, as

will be discussed later in the study.

The Increasing Importance of Financial Stability Issues

Since the early 1990s, safeguarding financial stability has become an

increasingly dominant objective in economic policymaking. This is illus-

trated by the periodic financial stability reports launched by more than a

dozen central banks and several international financial institutions

(including the IMF, the Bank for International Settlements [BIS], and the

World Bank), as well as by the more prominent place given to financial sta-

bility in the organizational structures and mandates of many of these insti-

tutions. The greater emphasis on financial stability is related to several major

trends in financial systems during the past few decades. These trends reflect

the expansion, liberalization, and subsequent globalization of financial sys-

tems—all of which have increased the possibility of larger adverse conse-

quences of financial instability on economic performance (see Chapter 8 of

this volume on the potential effects of globalization).

First, financial systems expanded at a significantly higher pace than the

real economy. In advanced economies, total financial assets now represent a

multiple of annual economic production. Table 1.1 illustrates this expansion

over the period 1970–2004 for a heterogeneous group of advanced economies

with relatively mature financial systems. For example, while currency

remained relatively steady as a percentage of GDP over the period, total assets

in financial institutions grew from 110 percent of GDP in 1980 to 377 per-

cent in 2000 in the United Kingdom, from 182 percent in 1980 to 353 percent

in 2000 in Germany, and from 111 percent in 1980 to 257 percent in 2000 in

the United States. The growth of assets in the equity and bond markets is

just as phenomenal. While differences between countries reflect their more

market- or bank-oriented financial systems, most aggregates have increased.

The broad measures of an economy’s total financial assets invariably involve

some double counting due to claims between financial institutions, but even

these mutual holdings are relevant for financial stability because they repre-

sent the links, interactions, and complexities in the financial system.

Second, this process of financial deepening has been accompanied by

changes in the composition of the financial system, with a declining share

of monetary assets (aggregates), an increasing share of nonmonetary assets,

and, by implication, greater leverage of the monetary base. The amount of

currency relative to GDP has been broadly stable or decreased in all coun-

tries except Japan. In the United States, even the sizes of both M1 and M2

have fallen as financial innovation has progressed. For outlier Japan, the

The Increasing Importance of Financial Stability Issues

3

4 INTRODUCTION AND SUMMARY

Ta ble 1.1. Changes in Key Financial Aggregates

(In percent of GDP)

1970 1980 1990 2000 2004 1970 1980 1990 2000 2004

United States Germany

1 Currency 65566 1 Currency 5676 7

2 M1 21 15 14 11 11 2 M1 15 17 22 28 30

3 M2 60 57 56 50 53 3 M2 25 29 39 . . . 65

4 M3 65 72 72 73 79 4 M3 42 48 59 68 70

5 Total bank assets

1

54 54 53 58 53 5 Total bank assets

1

121 160 216 303 146

6 Total financial . . . 111 171 257 . . . 6 Total financial . . . 182 259 353 . . .

institution assets institution assets

7 Equity 34 25 35 132 114 7 Equity 11 7 17 48 38

8 Bonds 47 53 108 157 159 8 Bonds 26 37 67 112 70

6+7+8 ... 189 314 546 . . . 6+7+8 ... 226 343 513 . . .

United Kingdom Japan

1 Currency 8 5 3 4 3 1 Currency 8 9 10 13 15

2 M4 52 50 86 93 110 2 M1 29 29 27 48 71

3 Total bank assets

1

51 47 108 156 262 3 M2 74 86 114 127 137

4 M3 127 136 180 219 227

4 Total financial 5 Total bank assets

1

66 77 134 127 168

institution assets . . . 110 242 377 . . .

5 Equity 41 23 57 167 133 6 Total financial 122 157 269 260 . . .

6 Bonds 52 31 33 74 70 institution assets

7 Equity 41 25 76 70 71

4+5+6 ... 164 332 618 . . . 8 Bonds 23 60 78 124 141

6+7+8 186 242 423 454 . . .

The Increasing Importance of Financial Stability Issues

5

France Italy

1 Currency 105436 1 Currency 10767 6

2 M1 29 24 25 23 30 2 M1 44 42 35 18 43

3 M2 44 51 44 44 58 3 M2 76 79 67 . . . 60

4 M3 62 69 74 65 78 4 M3 76 89 88 . . . 73

5 Total bank assets

1

... ... ... ... 255 5 Total bank assets

1

... ... ... ... 149

6 Total financial . . . . . . . . . . . . . . . 6 Total financial . . . . . . . . . . . . . . .

institution assets institution assets

7 Equity 6 4 14 84 65 7 Equity 7 3 10 57 42

8 Bonds 14 19 42 55 86 8 Bonds . . . 39 65 108 120

6 + 7 + 8 ... ... ... ... ... 6+7+8 ... ... ... ... ...

Canada Netherlands

1 Currency 43333 1 Currency 8675 6

2 M1 11 9 7 11 13 2 M1 23 21 25 35 40

3 M2 38 47 56 48 49 3 M2 . . . . . . . . . . . . 100

4 M3 46 63 64 65 69 4 M3 53 60 77 92 105

5 Total bank assets

1

... ... ... ... 152 5 Total bank assets

1

71 129 184 254 362

6 Total financial . . . . . . . . . . . . . . . 6 Total financial 116 191 285 431 . . .

institution assets institution assets

7 Equity 9 18 26 87 89 7 Equity 41 16 38 185 97

8 Bonds 33 52 68 76 67 8 Bonds 11 25 73 85 98

6+7+8 ... ... ... ... ... 6+7+8 168 232 396 701 . . .

Sources: Thomson Financial, IMF, Bank for International Settlements, Merrill Lynch, Salomon Smith Barney, and various national sources.

Note:Currency is coins and bank notes in circulation; M1, M2, M3, and M4 are national definitions. Total assets of financial institutions consist of total bank assets and

(depending on data availability) assets of insurers, pension funds, and mutual funds.

1

Figure in 2004 column is from 2003.

increasing importance of narrow money in the 1990s may be attributable

to greater incentives to hold money due to the Japanese financial sector’s

fragile state and enduring deflationary pressures.

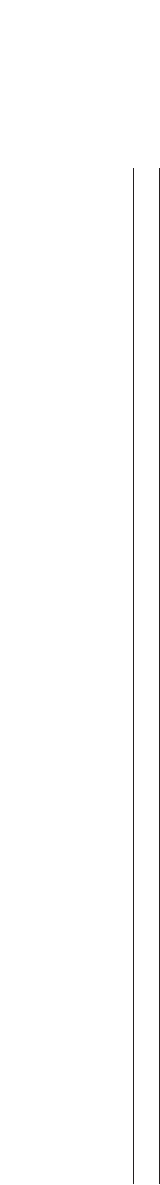

The simple average expansion of the financial systems shown in Table 1.1

is illustrated in Figure 1.1, in which total assets of financial institutions are

reflected by the triangle’s surface. Figure 1.1 shows rather dramatically that

between 1970 and 2000 the size of these assets almost tripled relative to

GDP. Note also how the average of the financial systems has become more

highly leveraged, in the sense that the broader monetary and financial assets

represent a much greater share of the triangle in 2000 than in 1970 relative

to central bank money (or currency).

6

INTRODUCTION AND SUMMARY

Figure 1.1 Composition of Key Financial Aggregates in 1970 and 2000

(In percent of GDP, average of the United States, Germany, the United Kingdom, Japan, France,

Italy, Canada, and the Netherlands)

1970 2000

100% of GDP

50% of GDP

200% of GDP

Total assets of banks, pension funds, and insurance companies

Total bank assets

M3

M1

Currency

Source: Table 1.1.

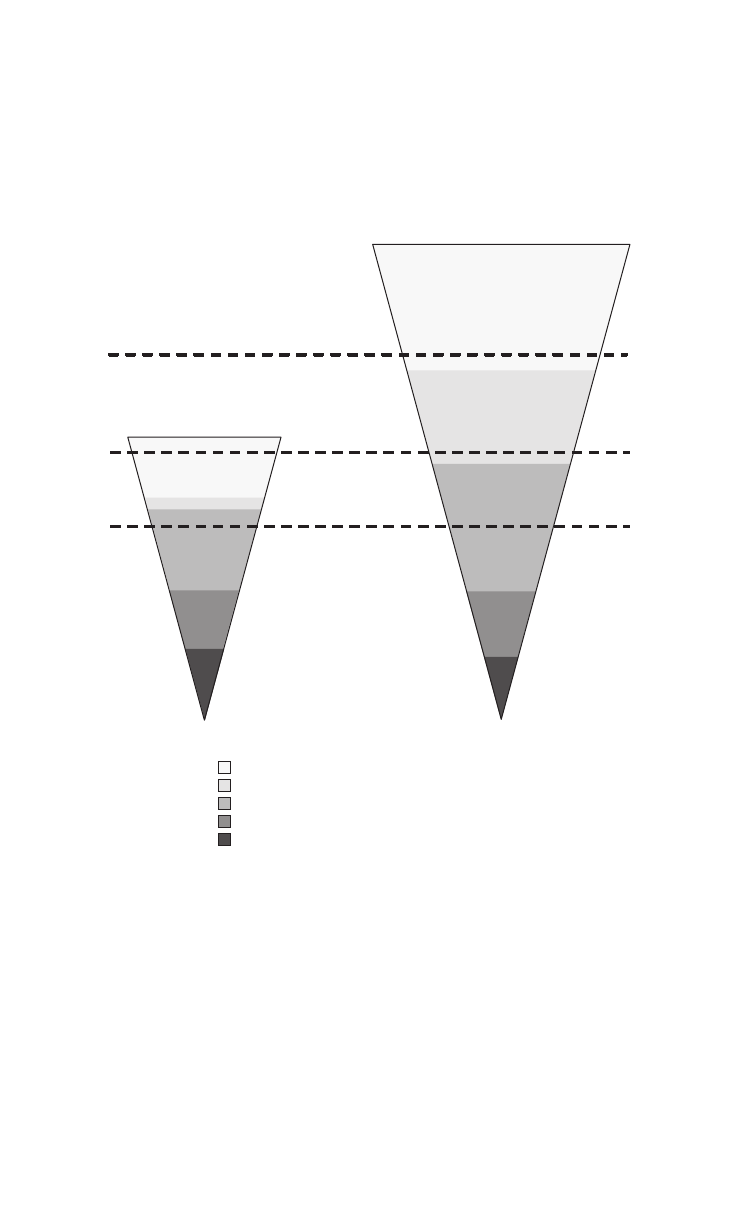

Figure 1.2 shows the change in composition of the financial system over

the past decades by expressing key financial aggregates as a percentage of

their value in 1970 (all deflated by GDP). Clearly, the relative importance

of monetary aggregates has decreased, while nonmonetary components

have increased rapidly.

Third, as a result of increasing cross-industry and cross-border inte-

gration, financial systems are more integrated, both nationally and inter-

nationally. Financial institutions now encompass a broader range of

activities than that of a traditional bank, which takes deposits and extends

loans. This is reflected in the rise in financial conglomerates, which provide

avast array of banking, underwriting, brokering, asset-management, and

insurance products and services.

1

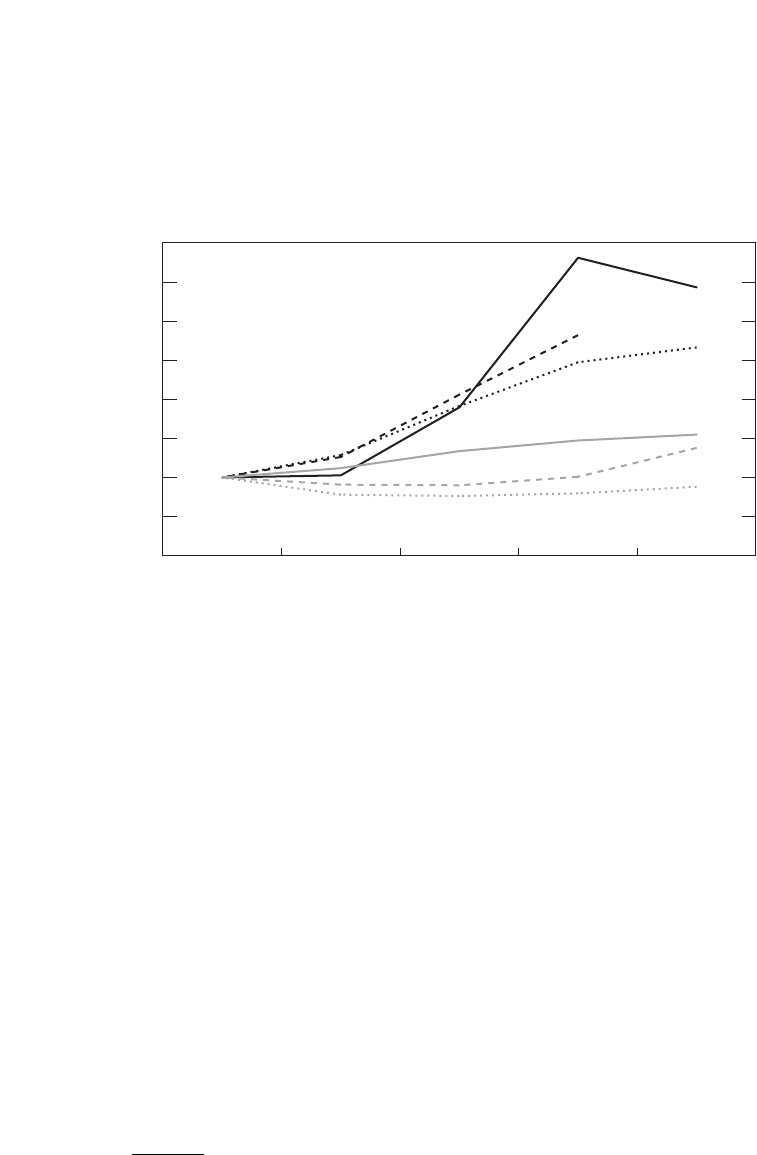

In the 1990s, the number of mergers and

acquisitions within the financial sector soared (Figure 1.3). Some of these

transactions involved different industries or countries, especially in Europe

where roughly half the deals in this period were either cross-border, cross-

industry, or both (Table 1.2). In addition, cooperation between financial

institutions intensified through joint ventures and strategic alliances. The

greater international orientation of financial systems is also reflected in the

The Increasing Importance of Financial Stability Issues

7

1

See the various issues of the IMF’s International Capital Markets report and Group of

Te n (2001).

0

50

100

150

200

250

300

350

400

Securities

Financial institution assets

Bank assets

M3

M1

Currency

20042000199019801970

(1970 = 100)

Figure 1.2. Growth of Key Financial Assets, 1970–2004

(Average for the United States, Germany, the United Kingdom, Japan, France, Italy, Canada, and

the Netherlands)

Source: Table 1.1.

increasing size of cross-border transactions in bonds and equity relative

to GDP (see Table 1.3). On this score, the amount of outstanding inter-

national debt securities surged over the past decades (Table 1.4).

Fourth, the financial system has become more complex in terms of the

intricacy of financial instruments, the diversity of activities, and the concomi-

tant mobility of risks. Deregulation and liberalization created scope for finan-

cial innovation and enhanced the mobility of risks. In general, this greater

complexity, especially the increase in risk transfers (see Chapter 10), has

made it more difficult for market participants, supervisors, and policymakers

alike to track the development of risks within the system and over time. To

illustrate the higher mobility of risks, Table 1.5 presents the worldwide devel-

opment of several types of derivatives since the mid-1980s. In nominal terms,

total notional amounts outstanding have increased more than 40 times, while

the number of derivative contracts has increased fivefold. (Chapter 9 pro-

vides a description of the potential risks to financial stability introduced by

the widespread and more active use of over-the-counter derivatives.)

These trends and developments reflect important advances in finance

that have contributed substantially to economic efficiency, both nationally

and internationally. They evidently also have had implications for the

nature of financial risks and vulnerabilities and the potential impact of risks

and vulnerabilities on real economies, as well as implications for the role of

policymakers in promoting financial stability. Consider financial system

and market developments in the 1990s and early 2000s—a period during

which global inflation pressures subsided and in many countries were elim-

inated. During this period, reflecting in part the above-mentioned trends,

national financial systems around the world either experienced, or were

8

INTRODUCTION AND SUMMARY

0

200

400

600

800

1,000

Cross border/cross industry

Cross border/within industry

Within border/cross industry

Within border/within industry

9998979695949392911990

Figure 1.3. Financial Sector Mergers and Acquisitions, 1990–1999

(Number of mergers and acquisitions in Group of Ten countries)

Source: Group of Ten, 2001.

exposed to, repeated episodes of unpleasant financial-market dynamics

including asset-price volatility and misalignments; volatile if not unsustain-

able financial and capital flows; extreme market turbulence, at times leading

to concerns about potential systemic consequences; and a succession of

costly country crises in 1994–95, 1997, 1998, 1999, and in the early 2000s

(Table 1.6). The experiences of, and fallout from, these financial stresses and

strains occurred within both advanced countries with highly sophisticated

financial markets and developing countries with financial systems of vary-

ing degrees of immaturity and dysfunction.

As these developments were occurring, economic and financial policy-

makers became increasingly concerned that global financial stability was

becoming more difficult to safeguard.

The Need for an Analytical Framework

While dealing with the urgencies of financial-market and country crises

in the 1990s, those situated at the front lines of financial-system policy-

making—including at the major central banks and supervisory authorities,

and at the IMF—searched widely and intensively for ways to advance their

understanding of the ongoing problems and to reform national and inter-

national “financial architectures” to prevent and better cope with the

potential for financial distress and crises. Some lessons were learned and

efforts made to reform the rules of the game of international finance, many

of which are documented in case studies and review articles.

2

Monitoring

efforts were stepped up considerably, both nationally and internationally.

Most notable are the IMF’s efforts to strengthen its ongoing surveillance

The Need for an Analytical Framework

9

Ta ble 1.2. Distribution of Financial Sector Mergers and Acquisitions, 1991–1999

(In percent)

North America Europe Japan and Australia

Within border/within industry 80 53 64

Within border/cross industry 12 19 16

Cross border/within industry 6 21 14

Cross border/cross industry 2 8 5

Total 100 100 100

Source: Group of Ten, 2001.

2

Much of this material can be found on the Web sites of the Bank for International Settle-

ments, the Financial Stability Forum, the IMF, and the World Bank. Also see the Web site of

the RGEMonitor at http://www.stern.nyu.edu/globalmacro/.

10 INTRODUCTION AND SUMMARY

Ta ble 1.3. Cross-Border Transactions in Bonds and Equities

(In percent of GDP)

1975–79 1980–84 1985–89 1990–94 1995–99 2000–2003 2001 2002 2003

United States

Bonds 4.0 9.4 63.6 93.9 139.0 188.0 161.4 208.4 262.1

Equities 1.9 3.6 9.9 14.7 45.0 90.8 87.4 85.0 82.1

Japan

Bonds 2.2 9.8 115.3 72.9 63.7 70.2 73.7 73.8 77.8

Equities 1.1 4.4 14.9 9.6 17.2 36.5 36.7 33.1 35.3

Germany

Bonds 5.3 9.7 37.8 86.5 208.7 350.5 378.7 351.1 394.0

Equities 1.9 3.4 11.7 14.9 48.6 132.6 133.6 115.6 112.2

France

Bonds . . . 6.8 21.9 108.6 233.5 293.9 288.1 299.3 362.0

Equities . . . 2.4 12.1 16.9 56.1 150.7 140.2 138.1 154.0

Canada

Bonds 1.2 3.9 29.3 104.5 216.6 149.5 135.6 157.0 175.8

Equities 3.3 6.5 14.8 19.2 52.3 122.8 101.9 151.5 132.1

Italy

1

0.9 1.4 9.4 114.7 518.8 1,126.5 821.9 1,197.0 1,705.2

Sources: Bank for International Settlements; and national balance of payments data.

Note:Gross purchases and sales of securities between residents and nonresidents.

1

No breakdown between bonds and equities is available.

over member countries’ macroeconomic policies, to assess national finan-

cial systems’ compliance with international financial standards and codes

(under the new and voluntary Financial Sector Assessment Program imple-

mented jointly with the World Bank), and to enhance its multilateral sur-

veillance of the global economy and financial system. Moreover, there is also

now a general sense that policy responses in the future are likely to require

coordination between a greater number of authorities from a greater num-

ber of countries.

As a result of these experiences and lessons, safeguarding financial stabil-

ity is widely recognized as important to maintaining macroeconomic and

monetary stability, and to achieving sustainable growth. Many advanced-

country central banks (including under the auspices of the Bank for Inter-

national Settlements), as well as the IMF, devote considerable resources to

monitoring and assessing financial stability and to publishing financial-

stability reports. A casual reading of these publications would suggest that

financial-stability practitioners share some common understandings:

• Finance is fundamentally different from other economic functions such

as exchange, production, and resource allocation.

• Finance contributes importantly to other economic functions and facil-

itates economic development, growth, efficiency, and ultimately

social

prosperity.

• Financial stability is an important social objective—a public good—

even if it is not widely seen as being on par with monetary stability.

•Monetary and financial stability are closely related, if not inextricably

intertwined, even though there is no consensus on why this is so.

The Need for an Analytical Framework

11

Ta ble 1.4. Outstanding International Debt Securities by Nationality of Issuer

(In percent of GDP)

1970 1980 1990 2000 2003 2004

United States 0.1 0.7 3.1 17.8 27.9 28.6

Japan

1

0.0 1.5 10.5 6.0 6.3 6.4

Germany

2

0.1 0.4 4.5 47.9 80.5 86.4

France

1

0.1 2.1 7.8 24.0 42.2 45.9

Italy 0.1 0.5 4.6 19.4 35.8 40.6

United Kingdom

1

0.2 2.3 14.9 40.8 63.0 68.0

Canada 0.2 13.4 18.6 27.9 31.0 29.9

Netherlands 0.6 2.4 13.0 79.4 112.6 118.6

Sweden

1

0.3 7.5 20.1 44.5 52.4 52.4

Switzerland

2

0.5 1.7 4.5 41.2 49.0 72.9

Belgium 0.4 2.1 15.0 57.3 82.5 85.9

Sources: Bank for International Settlements; and IMF, Wor ld Economic Outlook database.

1

Figure in 1970 column is from 1971.

2

Figure in 1970 column is from 1972.

12 INTRODUCTION AND SUMMARY

Ta ble 1.5. Exchange-Traded Derivative Financial Instruments: Notional Principal Amounts Outstanding and Annual Turnover

1986 1990 1995 2000 2001 2002 2003 2004

Notional principal amounts

outstanding (In billions of U.S. dollars)

Interest rate futures 370.0 1,454.8 5,876.2 7,907.8 9,269.5 9,955.6 13,123.8 18,191.5

Interest rate options 144.0 595.4 2,741.8 4,734.2 12,492.8 11,759.5 20,793.8 24,605.0

Currency futures 10.2 17.0 33.8 74.4 65.6 47.0 80.1 104.5

Currency options 39.2 56.5 120.4 21.4 27.4 27.4 37.9 60.8

Stock market index futures 13.5 69.1 172.2 371.5 333.9 325.5 501.9 634.9

Stock market index options 37.8 93.6 337.7 1,148.3 1,574.9 1,700.8 2,202.3 3,024.8

Total 614.8 2,286.4 9,282.1 14,257.7 23,764.1 23,815.7 36,739.8 46,621.5

North America 514.6 1,264.4 4,852.3 8,167.9 16,203.2 13,693.8 19,504.0 27,612.3

Europe 13.1 461.4 2,241.3 4,197.4 6,141.3 8,800.4 15,406.1 16,307.9

Asia and Pacific 87.0 560.5 1,990.2 1,606.2 1,308.5 1,192.4 1,613.2 2,452.4

Other 0.1 0.1 198.3 286.2 111.1 129.1 216.5 248.9

Annual turnover (In millions of contracts traded)

Interest rate futures 91.0 219.1 561.0 781.2 1,057.5 1,152.0 1,576.8 1,902.6

Interest rate options 22.2 52.0 225.5 107.6 199.6 240.3 302.2 361.0

Currency futures 19.9 29.7 99.6 43.6 49.1 42.7 58.7 83.8

Currency options 13.0 18.9 23.3 7.1 10.5 16.1 14.3 13.1

Stock market index futures 28.4 39.4 114.8 225.2 337.1 530.2 725.7 804.3

Stock market index options 140.4 119.1 187.3 481.4 1,148.2 2,235.4 3,233.9 2,980.1

Total 314.9 478.2 1,211.6 1,646.1 2,802.0 4,216.8 5,911.7 6,144.6

North America 288.7 312.3 455.0 461.3 675.7 912.2 1,279.7 1,633.6

Europe 10.3 83.0 354.7 718.5 957.8 1,074.8 1,346.4 1,412.6

Asia and Pacific 14.3 79.1 126.4 331.3 985.1 2,073.1 3,111.5 2,847.5

Other 1.6 3.8 275.5 135.0 183.4 156.7 174.1 250.9

Source: Bank for International Settlements.

The academic literature also continues to grow, much of it covering spe-

cific financial-stability topics in considerable depth and some of it provid-

ing rigorous anchors for debating substantive and policy issues. For

example, the extensive literature on banking covers the special role and

fragility of banks in finance; the costs and benefits of deposit insurance;

and the causes, consequences, and remedies for bank failures. Moreover,

recent empirical studies have highlighted the rising incidence of banking

crises,

3

as well as their considerable costs.

4

At the same time, central bank

concerns with financial stability are as old as central banks themselves,

given their ultimate responsibility for confidence in the national currency.

5

For example, the principal reason for the founding of the U.S. Federal

Reserve System in 1913 was to assure stable and smoothly functioning

financial and payments systems.

6

The literature on market sources of

financial fragility and systemic risk more generally also continues to grow.

7

The Need for an Analytical Framework

13

Ta ble 1.6. Market Turbulence and Crises in the 1990s and Early 2000s

1992 Exchange rate crises involving Italy and the United Kingdom

1994 Bond market turbulence in Group of Ten countries

1994–95 Mexican (tesobono) crisis

Failure of Barings

1996 Bond market turbulence in United States

1997 U.S. equity market correction

1997–98 Asian crises (Thailand, Indonesia, Republic of Korea)

1998 Russian default

Long-Term Capital Management crisis and market turbulence

1999 Argentina and Turkey crises

2000 Global bursting of equity price bubble

2001 Corporate governance problems—Enron, WorldCom, Marchoni,

Global Crossing, and so forth

September 11 terrorist attacks

2001–2002 Argentina crisis and default

Parmalat

3

Bordo and others, 2001.

4

Lindgren, Garcia, and Saal, 1996; Caprio and others, 1997, 2000, and 2003; Hoggarth and

Saporta, 2001.

5

Padoa-Schioppa, 2003; Schinasi, 2003.

6

Volcker, 1984.

7

For examples see Acharya, 2001; Allen and Gale, 2004; Allen, 2005; and Bernardo and

We lch, 2004.

Despite this practical and intellectual progress in financial-stability

analysis in recent years, it is still in a formative stage when compared with

macroeconomic and monetary analysis. The various literatures taken

together do not yet provide cohesive and practical toolkits useful for think-

ing about and analyzing systemic financial-stability issues and controversies,

for monitoring and assessing financial stability in real time, for preventing

problems from becoming potentially systemic, for resolving them when

they do occur, and for designing policies more broadly to optimize the net

social benefits of finance. Even the now ubiquitous phrase “financial stabil-

ity” has no widely understood and accepted definition.

In short, the discipline lacks a generally accepted and useful “frame-

work.” To use a nautical metaphor—and to exaggerate somewhat—the

profession is sailing on the high and at times turbulent seas with neither a

well-conceived and time-tested map nor a reliable compass. The fact that

many advanced-country financial markets and the international financial

system remained resilient and that financial resilience (if not stability) has

been reasonably well maintained in the early 2000s—especially in the

mature markets—may have as much to do with good luck as with success-

ful preventive policy design and market surveillance.

8

That this is so is no fault of the relevant professions. It is an occupational

hazard that financial crises are difficult to foresee, even when they are closely

upon us. The financial world has changed rapidly, the problems requiring

solutions are complicated, and stresses and strains arise within a poorly

understood set of dynamic financial markets and institutions. In short, the

challenges have been and still are daunting, even with important progress

in understanding specific financial-stability issues.

Although the movement toward greater attention for financial-stability

issues is clear, the point of focus of this attention is not. Consensus has yet to

be reached on how to define the concept of financial stability, how to assess

developments under this objective, and what role public policy should play.

Nevertheless, the practice of assessing and safeguarding financial stabil-

ity is ongoing.

Specific Objectives of This Study

In this light, this study proposes a basic framework for financial-stability

analysis and policy. At its core, the study develops both a working defini-

14

INTRODUCTION AND SUMMARY

8

Stock and Watson (2003) provide arguments and evidence for this view for macro-

economic policymaking during the fight in the 1990s against inflation. It seems to apply

equally to financial-system policymaking.

tion of financial stability and a broad practical framework for monitoring,

assessing, and maintaining it. Although most financial systems are still ana-

lyzed at the national level, the scope of this framework can be easily

extended to international financial-stability issues.

One possible reason for the lack of a widely accepted definition of finan-

cial stability and a framework is that there is no widely accepted or articu-

lated logical foundation for why private finance should be the purview of

collective action, including public policy action and involvement. Modern

finance is often portrayed to nonspecialists as a purely private activity hav-

ing little to do with, or need for, private-collective or government involve-

ment. Likewise, the benefits of finance are seen primarily, if not exclusively,

as conveying to private counterparts engaged in specific financial activities

and markets.

While there is some truth in the characterization of finance as primarily

a private affair, it would be an illusion to evaluate the effectiveness of private

finance and its enormous real economic benefits either entirely as private or

exclusively as the result of individual private actions and unrestrained mar-

ket forces. Regardless of what is thought about the necessity and efficacy of

collective action and public policies, obtaining the full extent of the private

net benefits of modern finance requires, at a minimum, the existence and

effectiveness of many private-collective, publicly sanctioned, publicly man-

dated, and taxpayer-financed conventions, arrangements, and institutions.

Although finance would no doubt exist and bestow private and collec-

tive benefits without the particular social arrangements that have actually

emerged and evolved, there would most likely be significantly fewer such

benefits. Moreover, finance would most likely be significantly less efficient

and supportive of economic activity, wealth accumulation, growth, and

ultimately social prosperity. Is this not the case in many (if not most) devel-

oping countries in which financial systems have yet to reach a critical point

of effectiveness and efficiency?

In short, the enormous and pervasive private benefits of modern finance

and financial systems result from the existence of an effective financial sys-

tem that has long been understood and supported as a public good. This is

not meant to imply that all public policy involvement in private finance is

appropriate, beneficial, or acceptable. Nor should this be taken to mean

that all citizens benefit equally or have equal access to these private and

social benefits. But the social benefits are there for the taking, especially in

the more democratic societies with liberalized economies.

Although there now seems to be a consensus that many of the social

conventions and arrangements that have developed over time are essential

prerequisites for effective finance, this reflects a relatively new and modern

Specific Objectives of This Study

15

understanding of the role of finance. Less than 75 years ago, society’s mis-

management of both money and finance played an important and devas-

tating role in the Great Depression. More recently, some of these lessons

are being learned again, in both mature markets and in an increasing

number of emerging- and less-developed-market countries. For example,

in the aftermath of recent corporate scandals in some mature markets in

the early 2000s, improvements are being advocated and implemented—

with accounting standards and their enforcement and the efficacy of exist-

ing corporate governance procedures and accountability, for instance.

Likewise, as the result of recent financial crises in emerging-market coun-

tries, many of these social arrangements are being aggressively advocated

for adoption in both less advanced and least developed economies and

financial systems.

The obvious private and social benefits of finance as well as the some-

times disturbing events of the current era and their relationship to finan-

cial stability can be understood either to be the result of, or as at least

reflecting, important strengths and weaknesses of finance. As discussed in

Chapter 3, finance inherently embodies uncertainty and is associated with

several other market imperfections:

•Some financial services provide positive externalities while others pro-

vide negative externalities.

•Some financial services are public goods.

•There are information failures in the provision of financial services.

• Financial contracts and markets are incomplete.

•Competition is not always perfectly balanced.

The practical import is that some market imperfections in finance can lead

to the underconsumption and underproduction of some socially desirable

financial activities, and the overconsumption and overproduction of some

socially undesirable ones. In addition, these market imperfections can, at

times, lead to the creation and accumulation of both economic and finan-

cial imbalances, which if not corrected could threaten financial stability.

As in other economic policy areas, it would seem reasonable to think

that private-collective and public actions could be designed and imple-

mented to address each source of market imperfection in finance, depend-

ing on how significant the efficiency losses associated with each might be.

For example, for cases in which the presence of a market imperfection

inhibits consumption and production of desirable financial activities, the

challenge would be to provide incentives to supply and consume more of

the activities that provide public benefits and positive externalities, that

tend to open up new markets, and that increase competition unless there

16

INTRODUCTION AND SUMMARY

are natural monopolies. For cases in which a market imperfection encour-

ages consumption and production of undesirable goods, the challenge

would be to minimize the production and consumption of financial activ-

ities that result from these market failures. In considering this approach,

the effectiveness of policies could be improved if they were designed and

implemented in a cohesive fashion so that a policy designed to eliminate

the negative impact of one kind of market imperfection does not offset the

benefits of a policy designed to deal with another.

Because tendencies to underproduce and overproduce financial activi-

ties exist simultaneously, financial-system policies would be more effective

if they strove to strike a socially optimal balance between maximizing the

net social benefits of the positive externalities and public goods and mini-

mizing the net social costs of the other market imperfections in finance. To

what extent such policy cohesiveness and coordination is actually achieved

in practice by countries or across borders is not clear. Striving to achieve

the social optimum will undoubtedly entail difficult choices, including

trading off some of the individual private benefits for the greater good, if

and when this can be justified.

The public policy discussion in Part I deals first with the efficiency loss

associated with market imperfections. However, each and every loss of effi-

ciency does not require intervention. The desirability or necessity of some

form of collective intervention is much clearer when a market imperfection

in finance leads to an inefficiency that poses a significant threat to financial

stability, because of the impact on either financial institutions or markets

or both. Unfortunately, the financial-system policy literature rarely makes

a clear distinction between sources of market imperfections that threaten

stability and those that do not. Likewise, no framework exists now either

for measuring the efficiency losses associated with market imperfections in

finance or for assessing the risks to financial stability associated with mar-

ket imperfections. These are some of the challenges in the period ahead, for

which an analytical framework for financial stability would be useful for

policy purposes. But this, too, is an enormous challenge.

In sum, while finance provides tremendous private and social benefits,

important aspects of finance are associated with market imperfections and

inherently hold the potential (although not necessarily a high likelihood)

for fragility, instability, systemic risk, and adverse economic consequences.

When private incentives and actions alone do not lead to an efficient pric-

ing and allocation of capital and financial risks, it is possible that some

combination of private-collective action and public policy could provide

incentives to encourage the private sector to obtain a more efficient and

desirable outcome.

Specific Objectives of This Study

17

Whether something can or should be done about this is the subject of

active debate, but practically depends on the social net benefits of taking

action. If the private and social benefits of taking action and providing

incentives outweigh the private and social costs, they are worthy of consid-

eration. A rule to consider, although difficult to implement, is that only poli-

cies that provide clear and measurable net benefits should be implemented.

This calculus most often involved both spatial and intertemporal trade-

offs. While immediate benefits might be associated with specific private-

collective or public sector policies, there may be greater future costs

associated with private market reactions and adjustments to the policies.

Examples include the costs of moral hazard and regulatory arbitrage.

Ultimately, it is a social and political decision whether private-collective

and public sector involvement and intervention are appropriate. These cost-

benefit, intertemporal, and social and political considerations are key rea-

sons that financial-system policies are so difficult to devise and implement

successfully.

In sum, this book addresses these and other closely related issues of

immediate relevance to global finance. The study is divided into three some-

what separable parts:

•Part I presents foundations for thinking about financial-stability

issues.

•Part II develops a working definition of financial stability and a broad

framework for monitoring, assessing, and ensuring it.

•Part III examines ongoing challenges to financial stability posed by

relatively recent structural financial changes, drawing on parts of the

framework presented.

Organization of the Book

The remainder of this chapter lays out the organization of the study in

somewhat more detail and summarizes some of its main findings.

The chapters in Part I provide a logical foundation for thinking about

financial-stability issues. Chapter 2 lays out the essence of modern

finance—the temporary transfer of the liquidity and payment services of

money (legal tender and its very close substitutes) in return for a promise

to return a greater amount of money to its original owner. The element of

human trust in financial relationships and contracts is the source of both

finance’s strengths (efficiency gains) and weaknesses (fragility). In princi-

ple, both these strengths and weaknesses can be defined and measured in

18

INTRODUCTION AND SUMMARY

terms of the manner in which finance does or does not enhance the effi-

ciency and effectiveness of other real economic processes, particularly

intertemporal economic processes such as production, wealth accumula-

tion, economic development and growth, and ultimately social prosperity.

In reality, precise measurement is extremely difficult if not impossible.

After developing and examining this simple logic—drawn from dis-

parate literatures—Chapter 3 applies some of the concepts from the eco-

nomics of the public sector to finance. The chapter identifies sources of

market imperfections in finance, justifies a role for both private-collective

and public policy involvement, and argues that both fiat money and

finance have the potential to convey significant positive externalities and

the characteristics of a public good.

Chapter 4 briefly clarifies what is meant by efficiency and stability from

an economic perspective. The implicit and practical import of this dis-

tinction is that not all market imperfections in finance may necessitate a

private-collective or public policy response; whether intervention is desir-

able or necessary depends on the size and importance of the imperfection

with regard to its impact on efficiency. While difficult to measure in prac-

tice, in principle the deviation from the efficient outcome should be part of

the decision to intervene. The chapter distinguishes between volatility,

fragility, and instability by drawing on the experience in the 1990s and early

2000s with market turbulence and country crises.

Part II then develops a broad policy-oriented framework for assessing

and safeguarding financial stability and for resolving problems when they

arise. The framework can be applied in a wide variety of existing ways of

managing financial system policies in various countries. Chapter 5 develops

a working definition of financial stability in terms of economic processes—

in principle, measurable ones—and identifies several practical implications

of the definition for financial-stability work. Based on this definition,

Chapter 6 proposes a generic framework for financial-stability monitoring,

assessment, and policy. The framework proposed is generic in three senses:

it encompasses all the important aspects of financial systems (institutions,

markets, and infrastructure); its implementation entails monitoring, ana-

lytical assessments, and policy adjustments when necessary; and it remains

at a general level that allows it to be an umbrella framework for most exist-

ing frameworks. This chapter also identifies remaining analytical and meas-

urement challenges. Chapter 7 discusses the role of central banks in

ensuring financial stability, which in many countries might be a natural or

special role.

Part III identifies and analyzes ongoing challenges to financial efficiency

and stability posed by relatively recent structural changes in national and

Organization of the Book

19

global finance. Each of these structural changes is no doubt improving

financial and, it is hoped, economic efficiency, but may also be posing new

risks or redistributing existing risks in ways that are poorly understood.

The chapters in this part of the study are sequenced so that they progress

from the general and broad in scope, to the more specific. Chapter 8

examines the stability implications of the globalization of finance and

financial risk for both national financial systems and the international

financial system. Chapter 9 examines the potential for instability in

national and global financial markets related to the growing reliance on

over-the-counter derivatives instruments and markets. Chapter 10 exam-

ines the implications for financial stability of the increased reliance on

efficiency-enhancing risk transfer mechanisms, and focuses in particular

on credit derivatives. Chapter 11 examines the supervisory, regulatory, and

perhaps systemic challenges raised by the now greater role of insurance

companies (and implicitly of other institutional investors) in financial and

capital market activities.

Chapter 12 collects the main challenges to financial stability that are dis-

cussed in the book and that are likely to be faced in the future. Each of the

areas identified in Part III taken separately, and certainly all of them taken

together, lead to the strong conclusion that further and continuous reforms

are desirable and should be aimed at striking a better balance between relying

on market discipline and relying on official or private-collective action. In

some countries—most of them advanced countries with mature markets—a

rebalancing toward relying more on market discipline is desirable. In other

countries—many of them with poorly developed markets—strong efforts

need to be made to improve the financial infrastructure through private-

collective and government expenditures and commitments and to target

the role of government to enhance the effectiveness and efficiency of mar-

ket mechanisms for finance. Specific areas where reforms are most needed

include

•a realignment of private market incentives, including within firms—

to improve internal governance at the board level, to improve man-

agement and risk controls, and to improve the alignment of incentives

at the board, management, and staff levels;

•a reevaluation of regulatory incentives and their consistency with pri-

vate market incentives—to reduce moral hazard;

•enhancements to disclosure by a wide range of financial and even

nonfinancial entities—to improve the potential for effective market

discipline and to improve private-collective and official monitoring

and supervision;

20

INTRODUCTION AND SUMMARY

• improvements to market transparency—to reduce asymmetries in

markets and the tendency toward adverse selection;

• an enhancement to legal certainty where it is still ambiguous, such as

with close-out procedures for swaps, credit derivatives, and other

complex structured financial instruments;

• the development and implementation of comprehensive and appro-

priately targeted frameworks for monitoring, assessing, and safe-

guarding financial stability to better ensure financial stability and

restore it when this fails;

• an increase in international cooperation and coordination in financial-

system regulation, surveillance, and supervision—to eliminate inter-

national gaps in information and analysis and to reduce, if not

eliminate, opportunities for regulatory arbitrage.

Organization of the Book

21