AT A GLANCE

EPRS | European Parliamentary Research Service

Author: Gisela Grieger, Members' Research Service

PE 729.290 – March 2022

US Congress and trade policy tackling China

In the first year of the 117th US Congress (2021-2022), members of both the House and the Senate saw an urgent

need both for a trade policy offensive specifically for the Indo-Pacific region to maintain US leadership in setting

international standards and norms, and for an upgrade of defensive trade policy tools to address China's unfair

trade practices. Congressional initiatives have coincided with debates in the European Parliament on the EU's

Indo-Pacific strategy and on legislative proposals set to expand the EU's toolbox of autonomous trade measures.

Background

US Congress exercises trade policy authority by authorising preferential trade programmes (e.g. the

Generalized System of Preferences (GSP)) and by enacting laws on trade remedies to unfair trade practices.

Members' letters to the executive and public statements, including in hearings, shape trade policy and add

to Congressional oversight. In the past, Congress has granted the President Trade Promotion Authority

(TPA), under the 1974 Trade Act, to negotiate trade agreements that, once submitted to Congress, would

be 'fast-tracked', meaning they could neither be amended nor filibustered. TPA compels the executive to

comply with strict timelines and keep Congress updated on negotiations. The last such authority expired in

July 2021, and the Biden administration has not sought renewal, as its policy focuses on upgrading the US's

innovative and competitive edge under a

'worker-centred' Build Back Better framework, rather than

engaging in talks on new free trade agreements (often associated with job losses in the USA).

Congress position on US trade strategy

Congress continues to see US trade strategy through the lens of US-China strategic competition. Members

on both sides of the aisle have admitted publicly that the 2017 US withdrawal from the then Transpacific

Partnership (TPP) trade agreement was a strategic mistake that left a vacuum, now being filled by others,

possibly even by China. They have called on the Biden administration to reassert US trade leadership and

re-engage US allies in the Indo-Pacific on trade. Congressional backing does not appear to be strong for the

US to join the TPP successor deal, perceived as lacking strict labour and environmental rules similar to those

in the model US-Mexico-Canada Agreement (USMCA), in force since 2020. There is more support for the

launch of negotiations on digital trade with US allies and partners in Asia and for a focus on digital trade,

technology and decarbonisation under the new Indo-Pacific Economic Framework, announced by

President Biden at the 2021 East Asia Summit.

The proposed Trade Act of 2021, as part of the

bipartisan omnibus US Innovation and

Competition Act (

USICA) of 2021, advocates

digital trade deals with like-minded partners,

and contains provisions on trade in essential

supplies and on preventing imports, including

seafood, produced using forced labour;

reinforced Buy American clauses; and a

reformed GSP. USICA also includes

funding for

the already enacted 2020 CHIPS for America

Act. USICA was adopted by the Senate in 2021,

but (as of March 2022) is not yet reconciled with the House companion bill: the America Creating

Opportunities for Manufacturing, Pre-Eminence in Technology and Economic Strength Act, or America

COMPETES Act of 2022. Passed in February 2022, the act

focuses on trade policy tools, including a novel

outward investment screening mechanism and a reform of the GSP and of trade remedies (see Table 2). In

addition, House Republicans introduced the US Trade Leadership in the Indo-Pacific and China

Act of 2021,

calling for a robust trade vision for the Indo-Pacific and a follow-up plan on the US-China Phase One deal.

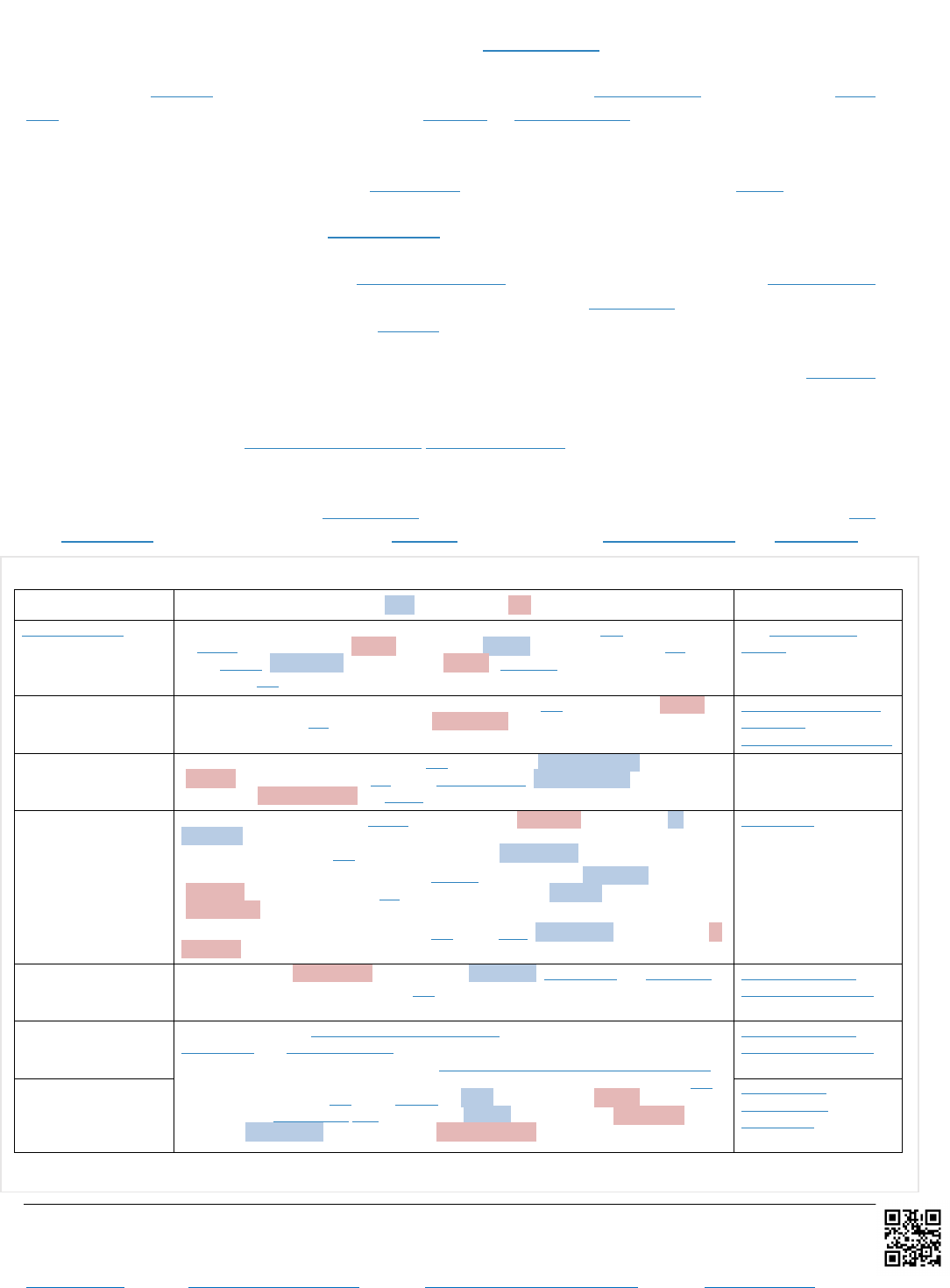

Table 1 – Recent US Congress strategic trade bills

Senate Trade Act of 2021 included in the US Innovation and

Competition Act (USICA

) of 2021; bipartisan, passed.

House America COMPETES Act of 2022; Democrat-led, passed.

House U.S. Trade Leadership in the Indo-Pacific and China Act of

2021, Republican-led.

Source: EPRS; situation as of February 2022.

EPRS

US Congress and trade policy tackling China

This document is prepared for, and addressed to, the Members and staff of the European Parliament as background material to assist them in their

parliamentary work. The content of the document is the sole responsibility of its author(s) and any opinions expressed herein should not be taken

to represent an official position of the Parliament. Reproduction and translation for non-commercial purposes are authorised, provided the source

is acknowledged and the European Parliament is given prior notice and sent a copy. © European Union, 2022.

[email protected] (contact) http://www.eprs.ep.parl.union.eu (intranet) http://www.europarl.europa.eu/thinktank (internet) http://epthinktank.eu (blog)

Selected trade bills introduced in Congress in 2021 to sharpen US trade policy tools

Strengthening US trade remedy law to address China's circumvention of tariff barriers and subsidisation

of business activities in third countries was raised as an important bipartisan objective at a House Trade

Subcommittee

hearing late in 2021. If Congress passes the proposed amendments to the 1930 US Tariff

Law (see Table 2), the US will follow the EU in its practice of countervailing subsidies provided by foreign

governments to exporting producers located in third countries. Moreover, Republican lawmakers

introduced a bill aimed at bringing green field investments from China under the scope of inbound foreign

direct investment (FDI) screening by the

Committee on Foreign Investment in the US (CFIUS). Currently,

green field investments are not screened in the US, since they concern the creation, rather than acquisition

of existing, businesses, although they

may implicate the CFIUS rules for real estate transactions. In addition,

House and Senate lawmakers introduced bipartisan bills advocating a novel outbound investment review

mechanism ('CFIUS in reverse'). Despite a

targeted approach, these proposals have remained controversial,

but are now included in HACA. As China's economic coercion is expanding in scope and scale, US

lawmakers debated policy responses at a hearing in 2021, and introduced bills aimed at inter-agency

capacity-building for monitoring and providing support to affected third countries. Since China has so far

not coerced the USA, the US approach is distinct from the EU's, where China employed economic

coercion

against Lithuania. There is no US legislation (yet) mirroring the EU proposal for a regulation to address

market distortions linked to foreign acquisitions of EU firms subsidised by third countries. However, a

2021 House bill, based on a

US-China Commission recommendation, would require pre-merger notification

of subsidies under US anti-trust law. Unlike the EU, the US does not currently appear to seek to open access

to closed foreign public procurement markets like China for US firms through legislation matching the EU

proposal. Unlike the EU, the US has a

long history of protecting its market, with the 1933 Buy American Act

and similar laws, which are regularly updated through a combination of executive orders and legislation.

Table 2 – US Congress/EU autonomous trade measures

Trade measure US Congress (blue = Democrats, red = Republicans) EU

Trade remedies (anti-

dumping and

counter-vailing duties

and safeguards)

Eliminating Global Market Distortions To Protect American Jobs Act (not included

in USICA), Sens. Portman (R-Ohio) and Brown (D-Ohio), House companion bill,

Reps. Sewell (D-Alabama) and Johnson (R-Ohio); included in the House America

COMPETES Act (HACA)

The two-pronged

reform of the EU trade

defence instruments

(TDIs) is completed.

Inbound investment

review mechanism

Exposing China's Belt and Road investment in America Act, Rep. Stewart (R-Utah),

Senate companion bill, Sen. Kennedy (R-Louisiana); neither in USICA nor in HACA

EU framework for FDI

screening, 2021

implementation report

Outbound

investment review

mechanism

National Critical Capabilities Defense Act, Sens. Casey (D-Pennsylvania) and Cornyn

(R-Texas), House companion bill, Reps. Rosa DeLauro (D-Connecticut) and

Fitzpatrick (R-Pennsylvania); in HACA, not in USICA

No matching EU

legislative proposal

published or planned

Policy to push back

against economic

coercion

Economic defense response teams, Sens. Portman (R-Oregon) and Cardin (D-

Maryland); included in the House Ensuring American Global Leadership and

Engagement or EAGLE Act, Rep. Gregory Meeks (D-New York); in USICA and HACA;

China Censorship Monitor and Action Groups, Sens. Merkley (D-Oregon) and Rubio

(R-Florida), House companion bill, Reps. Joaquin Castro (D-Texas) and Peter Meijer

(R-Michigan); in USICA and HACA

Countering China Economic Coercion Act, Reps. Bera (D-California) and Wagner (R-

Missouri); in HACA, not in USICA

Instrument to deter

and counteract

coercive actions by

third countries (under

debate)

Foreign subsides for

acquisitions of EU/US

companies

Reps. Fitzgerald (R-Wisconsin) and Stanton (D-Stanton) introduced the bipartisan

Foreign Merger Subsidy Disclosure Act of 2021; neither in USICA nor in HACA

Distortive foreign

subsidies regulation

(under debate)

Foreign subsidies for

public tenders in the

EU/USA

Buy American rules limit access to the US market based on domestic content

restrictions and price preference. Waivers are granted to third countries based on

US commitments (e.g. WTO plurilateral Agreement on Government Procurement)

under international law. Bills recently introduced: Build America, Buy America Act

and BuyAmerican.gov Act, Sens. Brown (D-Ohio) and Portman (R-Ohio), both in

USICA; House companion bills: Reps. Ryan (D-Ohio) and Aderholt (R-Alabama); and

Delgado (D-New York) and Fitzpatrick (R-Pennsylvania), not in HACA

Distortive foreign

subsidies regulation

(under debate)

Approach to third

countries with closed

public procurement

markets

International

procurement

instrument (IPI) (under

debate)

Source: EPRS; situation as of February 2022.