INVESTMENT ROADMAP – FREQUENTLY ASKED QUESTIONS

Table of Contents

What is the motivation and purpose of this investment roadmap collaboration between the

Standards Coordination Group members (FpML, FIX, SWIFT, ISITC, FISD, and XBRL)? ...... 1

What is the overall role of each of the standard bodies / organizations involved in this

collaboration? ................................................................................................................................ 2

How is the investment roadmap organized? .............................................................................. 3

What are the definitions for each of the functions as well as the sub functions in the detail

slides? ............................................................................................................................................ 4

Issuer – Pre-Investment Decision ............................................................................................ 4

Front Office - Pre-Trade ............................................................................................................ 4

Front Office - Trade ................................................................................................................... 5

Middle Office - Post-Trade ........................................................................................................ 5

Middle Office - Clearing / Pre-Settlement................................................................................ 6

Back Office - Asset Servicing .................................................................................................. 6

Back Office – Reconciliation .................................................................................................... 7

Back Office - Collateral Management ...................................................................................... 7

Back Office - Settlement ........................................................................................................... 7

Back Office - Pricing, Risk and Reporting .............................................................................. 8

Investor Supervision – Regulatory Reporting ........................................................................ 8

Why is there usage of multiple standards in some of the cells? ............................................. 9

Why is FIX and ISO represented in the Post-Trade space for Cash Equities, Fixed

Income, Forex and Listed Derivatives? .................................................................................. 9

Why is FIX and ISO represented in the Clearing / Pre-Settlement space for Listed

Derivatives? ............................................................................................................................... 9

Why is ISO and XBRL represented in the Asset Servicing space for Cash Equities &

Fixed Income and Funds? ...................................................................................................... 10

Why is FIX and ISO represented in the Collateral Management space for Cash Equities &

Fixed Income and Listed Derivatives and FpML and ISO for OTC Derivatives? .............. 10

Why is FpML, ISO and XBRL represented in the Pricing / Risk / Reporting space for

Cash Equities & Fixed Income and Funds and FpML and ISO for Forex, Listed

Derivatives and OTC Derivatives? ......................................................................................... 11

Why is FIX and ISO represented in the Investor Supervision – Regulatory Reporting

space for Cash Equities & Fixed Income, Forex and Listed Derivatives? ........................ 11

What is the plan going forward? ................................................................................................ 11

1. What is the motivation and purpose of this investment roadmap collaboration between

the Standards Coordination Group members (FpML, FIX, SWIFT, ISITC, FISD, and

XBRL)?

Because the financial community is a vast one, encompassing institutions across the globe that

deal with diverse asset classes, different organizations have traditionally been responsible for

developing their own messaging schemes. Today, financial firms often combine a great range of

trading activities. Therefore, the messaging standards from different organizations often

intersect, but remain incompatible.

Investment Roadmap FAQ November 2018

2

Within the financial services industry, there are multiple standards being used, hence the desire

to ensure some level of interoperability. It is clear that the FIX Protocol is the de facto standard

for pre-trade and trading, that FpML is the de facto standard for OTC Derivatives and that ISO is

the de facto standard for settlement. We need an approach that leverages and includes these

standards into a broader framework without reinventing and creating redundant messages that

increase implementation costs and cause confusion for the industry.

This collaboration affirms the commitment of each organization to the ISO 20022 standard by

laying the groundwork for defining a common underlying financial model. The model allows for

20022 based messages to be created to support the business processes, while at the same time

provides in certain circumstances for existing independent protocols to be maintained in order to

protect the investments of market participants.

The purpose of the collaboration between these organizations is to produce a consistent direction

for financial services messaging standards and communicate that direction clearly. This will allow

the industry to spend its money more wisely.

2. What is the overall role of each of the standard bodies / organizations involved in this

collaboration?

FISD

The Financial Information Services Division (FISD) of the Software and Information Industry

Association (SIIA) is a global neutral forum that has been serving the financial information

industry for more than 20 years. FISD is comprised of 140 member companies that recognize

that market data distribution and efficient trade execution require a high level of consistent and

predictable service - all of which are dependent on the close cooperation of many independent

organizations and systems, which is why industry stakeholders support FISD as the forum of

choice to identify and resolve the business and technical issues that affect the administration,

distribution and utilization of market data. For more information, see www.fisd.net.

FPL

FIX Protocol Limited (FPL) is the not-for-profit industry association that owns, develops and

promotes the FIX Protocol messaging standard. Nearly 250 firms from across the global buy-side,

sell-side, exchange/ATS/MTF, regulatory, association and service provider communities are

members of FPL. The Financial Information eXchange ("FIX") Protocol is the de-facto messaging

standard for pre-trade and trade communication globally. Having achieved significant levels of

adoption within the Equity markets, it is now experiencing horizontal expansion across the

Derivatives, Foreign Exchange and Fixed Income markets. Further to this, it has expanded

vertically into the post trade space, supporting Straight-Through-Processing (STP) from

Indication-of-Interest (IOI) to Allocations, Confirmations, and Regulatory and other reporting. For

more information, see www.fixprotocol.org.

FpML

FpML (Financial products Markup Language) is the freely licensed business information

exchange standard for electronic dealing and processing of privately negotiated derivatives and

structured products. It establishes the industry protocol for sharing information on, and dealing in,

financial derivatives and structured products over the Internet. It is based on XML (Extensible

Markup Language), the standard meta-language for describing data shared between applications.

The standard is developed under the auspices of ISDA, using the ISDA derivatives

documentation as the basis. For more information, please visit www.fpml.org.

ISITC

ISITC (International Securities Association for Institutional Trade Communication) is a non-profit

industry group in which securities market participants (broker/dealers, investment fund managers,

banks, market infrastructures and vendors) collaborate to develop common approaches for

Investment Roadmap FAQ November 2018

3

communication to process financial transactions (for example, buying and selling securities.) This

collaboration includes defining how the adoption and use of industry-wide standards and

consistent data can facilitate this communication. For more information, please visit

www.isitc.org.

SWIFT

SWIFT is a member-owned cooperative that provides the communications platform, products and

services to connect over 9,000 banking organizations, securities institutions and corporate

customers in 209 countries. SWIFT enables its users to exchange automated, standardized

financial information securely and reliably, thereby lowering costs, reducing operation risk and

eliminating operational inefficiencies. SWIFT brings the financial community together to work

collaboratively to shape market practice, define standards and debate issues of mutual interest.

SWIFT is also a recognized leader in the area of financial message standards and is the

Registration Authority for the ISO 20022 standard, the agreed methodology used by the financial

industry to create consistent message standards. These standards and their related messages

cover all financial market transactions including payments, cash management, foreign exchange,

loans, securities, collateral, derivatives and trade finance. For more information, please visit

www.swift.com.

XBRL US

XBRL US is the independent non-profit consortium for XML business reporting standards such as

XBRL, a "tagging" language that standardizes financial statements in a way that makes them

accurate, consistent and comparable. All publicly traded companies are required by new SEC

rules to tag their 10-K and 10-Q filings using a digital XBRL dictionary (also called a taxonomy)

based on US GAAP accounting standards. For more information, please visit www.xbrl.us.

3. How is the investment roadmap organized?

The Investment Roadmap is broken down into a grid by two types of criteria – functional category

areas (vertical axis) and asset classes (horizontal axis). The map is color coded for each

messaging standard (blue for FIX, green for ISO, yellow for FpML and orange for XBRL), or

combination thereof. For example, FIX is a recognized standard for the pre-trade area in

equities; therefore the corresponding cell in the Roadmap grid is colored blue.

Prior to being able to allocate specific business functions to messaging protocols / standards

within asset classes, it is necessary to first define the specific functional categories and the

specific functions within them. The functional category tables that follow the next few pages aim

to provide clarification on the specific functional categories and their sub-categories. The

functional categories which are defined are:

Issuer:

o Pre-Investment Decision

Front Office

o Pre-Trade

o Trade

Middle Office

o Post-Trade

o Clearing/Pre-Settlement

Back Office

o Asset Servicing

o Collateral Management

o Settlement

o Pricing/Risk/Reporting

Investor Supervision:

o Regulatory Reporting

Investment Roadmap FAQ November 2018

4

Issuer Supervision:

o Regulatory Reporting

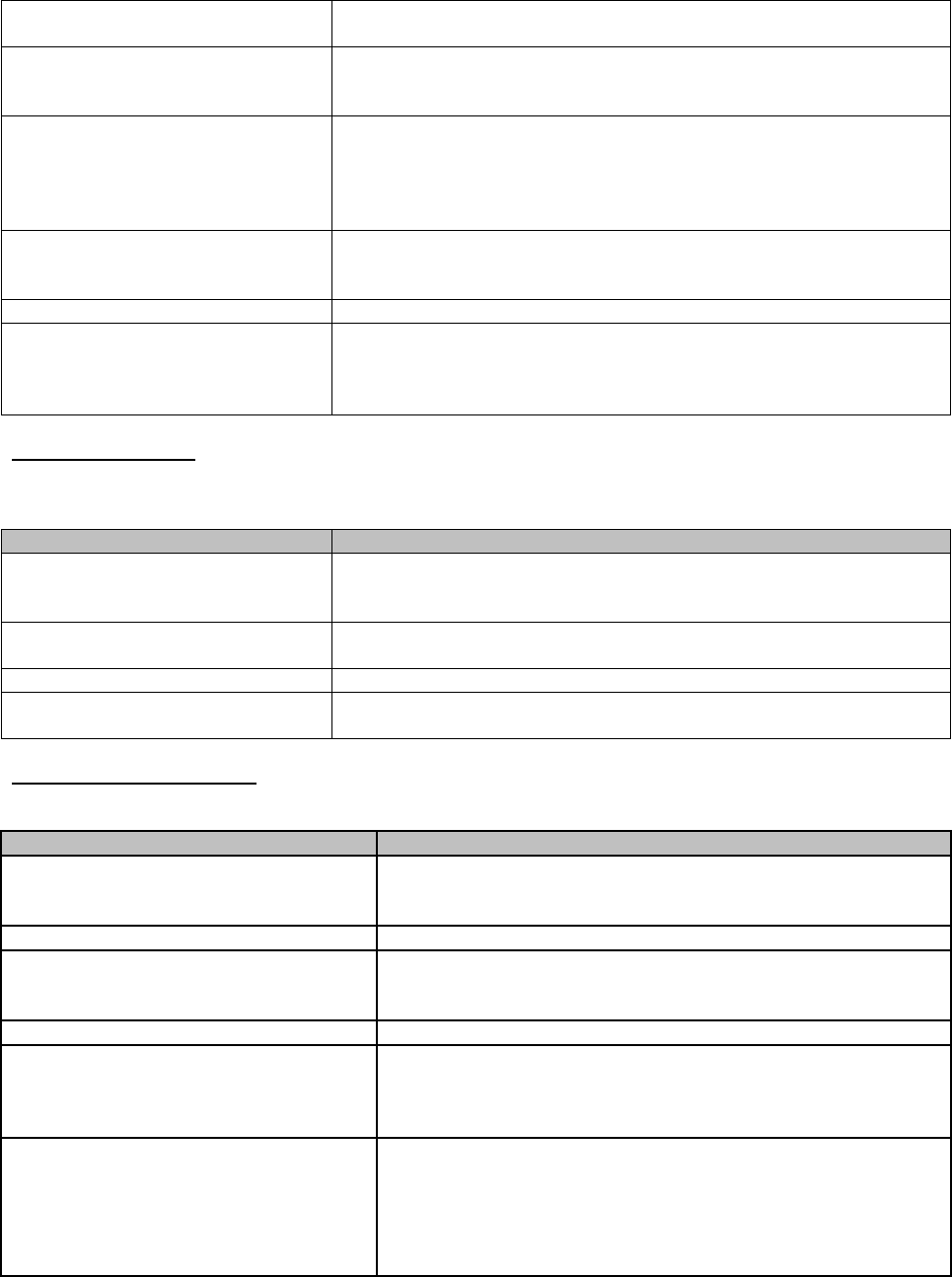

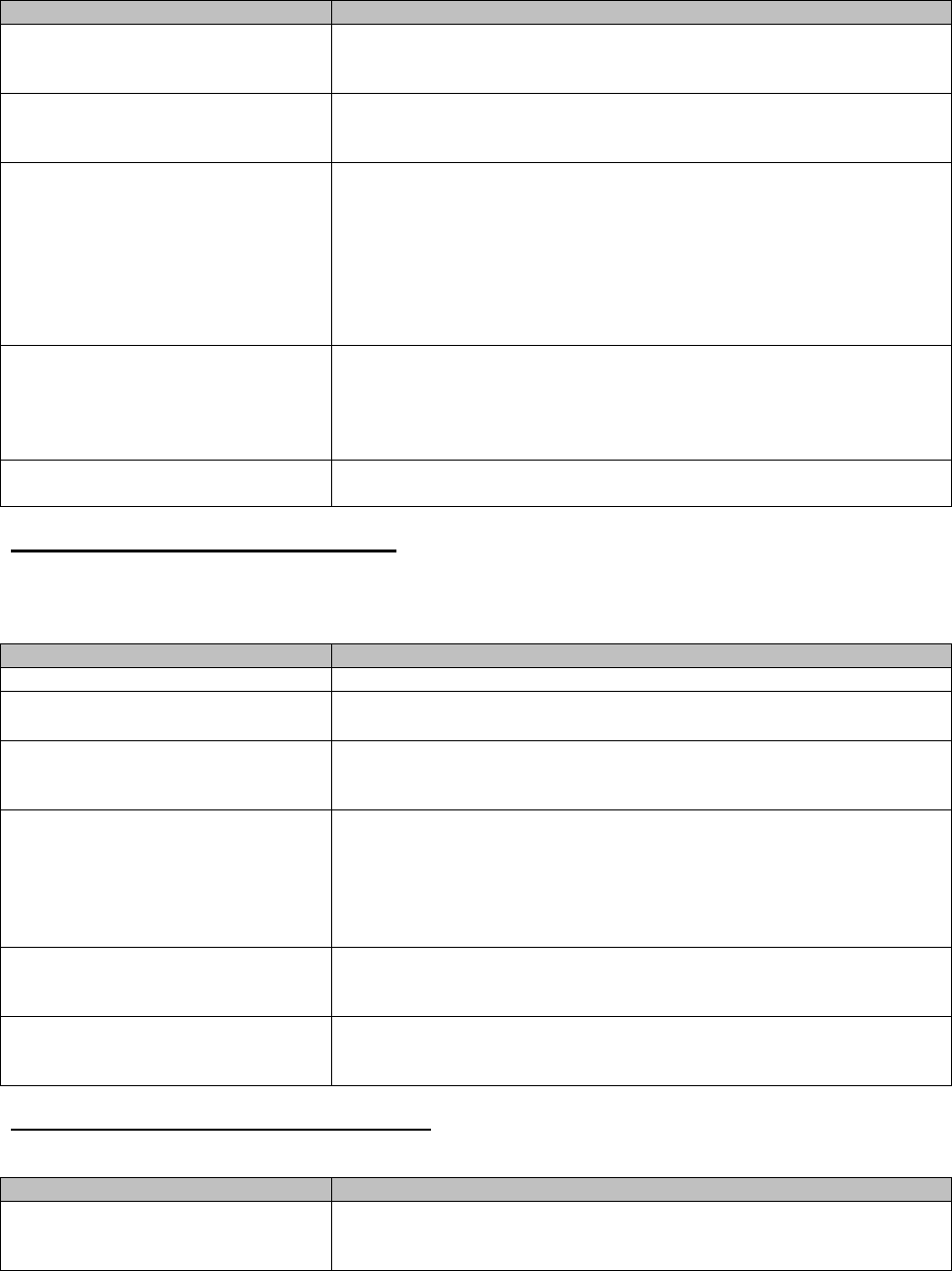

The table below reflects the asset classes that have been identified for inclusion in the investment

roadmap. Any asset class notations have been included below each of the functional category

tables.

Asset class

Description

Equities &

Fixed Income

Equities - Common and preferred stock, large and small

cap stock, rights, warrants, etc.

Fixed Income - Government and corporate debt, agency

issues, floaters, callable/puttable bonds, zero coupons,

convertibles, bank loans, ABS, MBS, CDO’s, revolving

credit, CMO’s, CBO’s, CLO’s, etc.

Foreign Exchange

FX Swaps, FX Forwards, NDF’s, FX Options, FX hedge,

etc.

Listed Derivatives

Equity options, IRS, etc.

OTC Derivatives

Derivative contracts off exchange on the different asset

classes:

- Interest rate

- equities

- credit (fixed income)

- commodities (physical and financial)

- FX

- Real estate

Funds

Corporate Pensions, mutual funds, hedge funds,

investment funds, trust funds, ETF’s, insurance funds,

supra-national funds, collective investment funds, etc.

4. What are the definitions for each of the functions as well as the sub functions in the

detail slides?

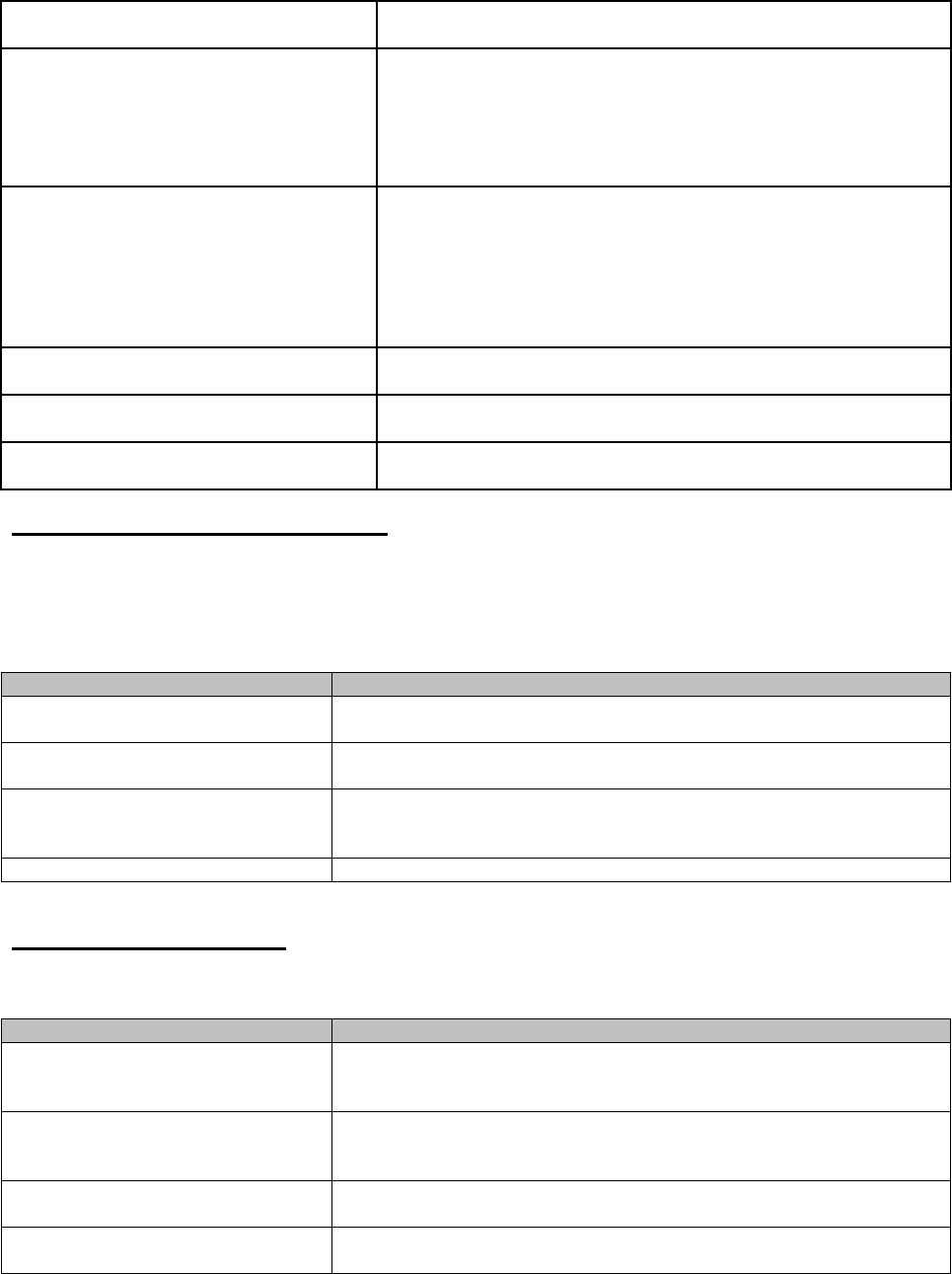

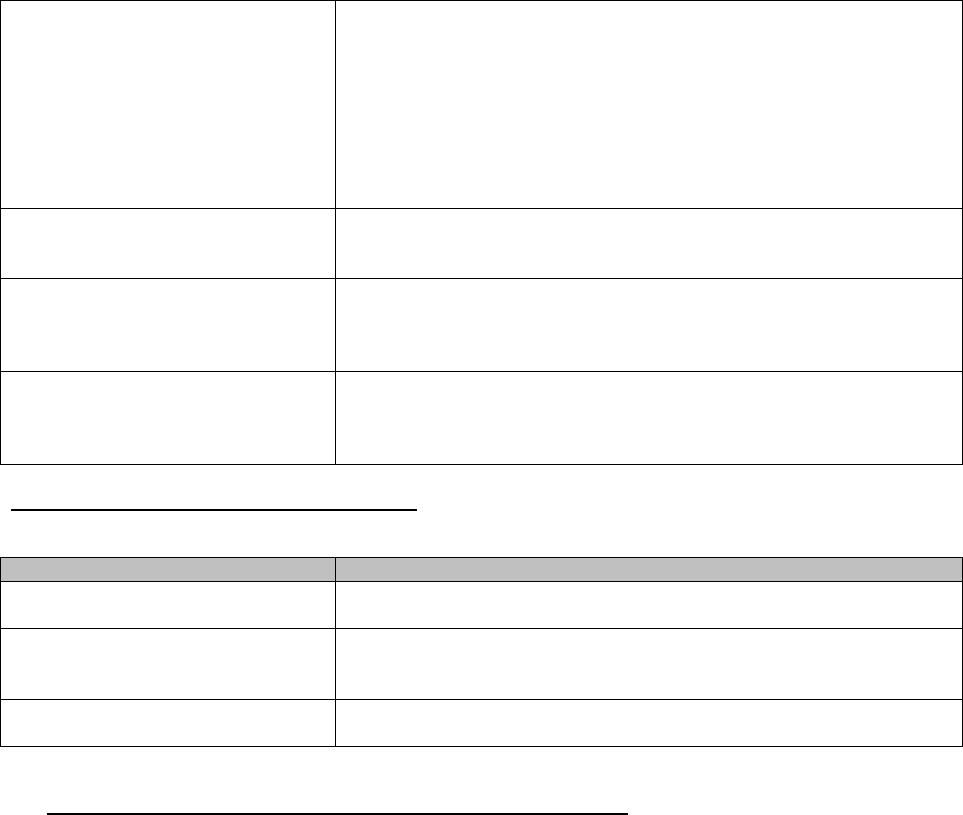

Issuer – Pre-Investment Decision

This covers the information from the issuer to Edgar, etc. which is used by the analysts in making

their investment decision.

Sub-function

Description

Filing Fundamental Data with the

Regulator

An Issuer reports financial statement data that describes the

economic fundamentals of the investment. This data can then be

processed by automated processes that enhance the accuracy and

speed of investment decisions.

Analytical Models

Fundamental evaluation frameworks define evaluation metrics

whose value is derived from financial statement data. i.e. Free Cash

Flow from Operations, etc.

Front Office - Pre-Trade

Pre-Trade covers all activity which occurs prior to a trade. Examples of pre-trade activity are

indications of interest (IOI), trade advertisements, quotes and market data (in support of trade

through post-trade functions, i.e. market data dissemination, instrument identifiers, descriptive

data, attributes, rates, codes and contact data, etc.).

Sub-function

Description

Indications of Interest (IOIs)

A buyer or seller communicating to others an interest in finding the

opposite side to a trade. For equities, this typically is a broker

Investment Roadmap FAQ November 2018

5

communicating to its customers while representing another

customer's order.

Trade advertisements

An executing party (broker) publicly disclosing that (when and how

much) they have executed large block trades in an effort to publicize

their role and volume in a particular security.

Quotes

The bid or ask quotes are the most current prices and quantities at

which the shares can be bought or sold. The bid quote shows the

price and quantity at which a current buyer is willing to purchase the

shares, while the ask shows what a current participant is willing to

sell the shares for.

Market Data

Refers to numerical price data, reported from trading venues, such

as stock exchanges. The price data is attached to a ticker symbol

and additional data about the trade.

Short Sale Locate

Location of stock prior to the execution of short sale.

Reference Data

Includes securities reference data (instrument identifiers, descriptive

data, attributes, rates / codes, calendars and taxes), entity reference

data (counterparty data, entity identifiers, client data, contact data)

and ancillary reference data (location of trading).

Front Office - Trade

The trade area includes the order and execution processes, including order management, order

routing and trade execution.

Sub-function

Description

Order Routing

Order routing and execution for single instruments and multi-leg

instruments; crossing order routing and execution; and basket and

list order processing.

Trade Execution

The process in which a trade is executed. The trade may be a

single, multi-leg, cross, basket, list, etc.

Trade Date Position Reporting

Management of traded and tradable positions on trade date.

Reference Data

Client data, credit profiles, account numbers, commission rates,

place of trade, etc.

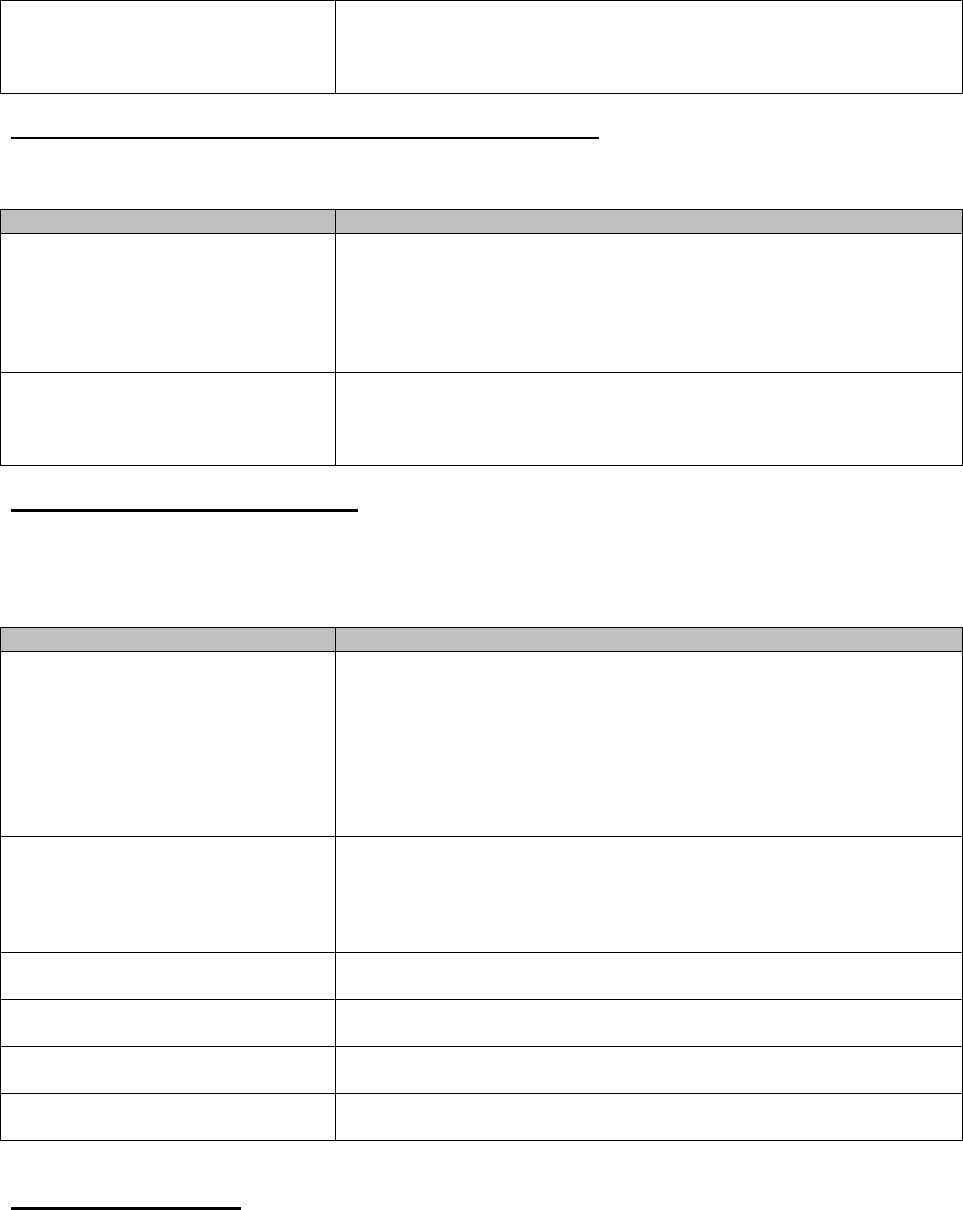

Middle Office - Post-Trade

Post-trade covers all activity after execution up until clearing and pre-settlement begins.

SUB-FUNCTION

DESCRIPTION

Trade Capture & Validations

The process in which trades (block and or allocations) are

captured by a central counterparty or locally, for purposes of

trade matching and confirmation.

Allocation

Allocation of trades from both two and three party models.

Matching

Trade and allocation level matching. May be performed locally

(two party) or centrally (three party). Matching may occur prior

to and also after allocation.

Confirmation/Affirmation

The process of confirming and affirming trades executed.

Position Management

Affects start of day positions, positions created through trading

activity, deliveries, transfers, and end of day position

management. Depending on the type, position may be

liquidated, adjusted, exercised, and marked to the market.

Novation/Assignment Process (OTC

Derivatives Post Trade Processing)

The full or partial transfer of the rights and obligations defined

by an OTC derivative contract to other consenting counterpart.

A fee may be payable between the parties (actual payments

are part of the settlement function) to account for the contract

value. The novated and remaining contracts maybe

subsequently confirmed (see confirmation sub-function). Note:

Investment Roadmap FAQ November 2018

6

FpML uses FIX messages to carry FpML data (trade

messages).

Amendments / Modifications (OTC

Derivatives Post Trade Processing)

The process by which one or several economic parameters in

an OTC contract is changed. The process typically includes a

confirmation part (see confirmation sub-function) and fee

payments between the parties (actual payments are part of the

settlement function), to account for the change in the contract

value.

Termination (OTC Derivatives Post

Trade Processing)

The full or partial reduction of the notional amount or number of

options defined in an OTC derivatives contract prior to the

scheduled termination date (swaps) or the last exercise date

(options); the process typically involves a confirmation part

(see confirmation sub-function) and fee payments between the

parties. Note: FpML uses FIX messages to carry FpML data

(trade messages).

Increases (OTC Derivatives Post Trade

Processing)

Process by which the notional amount or number of options of

an OTC contract increases.

Affirmation (OTC Derivatives Post Trade

Processing)

Exercise (OTC Derivatives Post Trade

Processing)

The full or partial exercise of an option.

Middle Office - Clearing / Pre-Settlement

This denotes all activities from the time confirmation is made for a transaction until settlement

begins. In theory, this includes the management of post-trading, pre-settlement credit exposure,

ensuring trades are settled in accordance with market rules.

It is important to note that clearing may occur either bi-laterally or through a central party.

SUB-FUNCTION

DESCRIPTION

Matching

The process of “pre-matching” in order to alleviate issues (fails) in

the settlement process, prior to instruction of settlement.

Netting

The process of netting trading obligations (cash, securities or other),

with a goal to reduce the number of settlement transactions.

Funding

The process in which a party, individual corporate or central

counterparty is responsible for ensuring that trades are properly

funded, prior to settlement process initiating.

Reference Data

Settlement location, clearing account numbers, CSD identifiers, etc.

Back Office - Asset Servicing

Administration activities performed for others, e.g. processing of corporate actions, tax reclaims

and portfolio valuation.

SUB-FUNCTION

DESCRIPTION

Issuance

The process in which securities are created/issued. Also referred to

as underwriting. Includes the IPO process and activities of the

agent, registrar, transfer agent, etc

Corporate Actions

An event issued by a company that effects the securities issued by

the company, ie, dividends, stock splits, coupon payments, factor

updates, etc.

Proxy Voting

The process of voting by members or shareholders and the related

management of this process.

Securities Lending

Transfer of ownership of securities from the lender to the borrower

for a specified period of time against fees. The transfer of ownership

Investment Roadmap FAQ November 2018

7

of the securities is not a sale. The borrower assumes all rights of

ownership and receives interest, dividend, bonus, rights and any

other corporate actions due from the securities, but is obliged to pay

these to the lender (original owner).

Back Office – Reconciliation (Note: this is not in the roadmap)

The process of reconciling with counterparties details of some or all transaction data such as

positions or cash flows.

SUB-FUNCTION

DESCRIPTION

Portfolio Reconciliation

Automated process for reconciling with counterparties

details of some or all of the positions outstanding between them. A

position includes the transaction details and may include valuation

information as well. The need to reconcile portfolios may be met

either through bilateral arrangements or through the use of vendors

providing centralised matching services.

Cash Flow Matching

Automated process for reconciling with counterparties details of

some or all of the pre-settlement OTC Derivatives cash flows

between them. A pre-settlement cash flow may include its

calculation details to facilitate its reconciliation.

Back Office - Collateral Management

The process used to control counterparty assets against the exposure calculated as part of the

risk management process. Management of risk via collateral, margin, positions, voting rights, etc.

This includes repo collateral management associated positions resulting from trading activities -

includes assignments, substitutions, inquiries, and request of collateral.

SUB-FUNCTION

DESCRIPTION

Initial Margining

The process of assessing the risk of a position based on volatility

and market conditions, calculating a performance bond based on

these factors, and comparing the requirement to the assets that are

currently on deposit. A margin requirement that is greater than what

is on deposit is referred to as a margin deficit. A margin

requirement that is less than what is on deposit is referred to as a

margin surplus. The clearing house is responsible for collecting

more collateral in the case of a deficit.

Margin Call

End to end process of collateral call, including collateral call

issuance, collateral call issuance responses, collateral assignment

and responses to proposed collateral assignment, and notification

of collateral to be moved. It also includes dispute resolution in case

of rejection of collateral call.

Substitution

End to end process from initial request for a collateral substitution

and expected responses.

Recall

End to end process from initial request for a collateral recall and

expected responses.

Transfer

The process of requesting the transfer of collateral between clearing

member sub-accounts

Interest Payment

Process that support the interest payment notifications and the

dispute resolution in case there is no matching of the notifications.

Back Office - Settlement

Settlement can be simply defined as the actual exchange of obligations (cash, securities, others).

Settlement is the next step in the trade lifecycle after clearing / pre-settlement.

Investment Roadmap FAQ November 2018

8

SUB-FUNCTION

DESCRIPTION

Pre-advisement

The process whereby a party prevents its transactions from settling

on a temporary basis. This can be, for example, for pre-matching

purposes without committing for settlement.

Settlement Notification

The process in which a trading party, ie, an investment manager,

notifies, or instructs, their settlement agent of settlement instructions

for a trade.

Settlement

The process in which obligations are settled between counterparties

to fulfill contractual obligations of a trade. The settlement process

includes the process of pre-settlement matching, in that settlement

instructions are matched prior to actual settlement being initiated in

the local market.

The settlement process includes settlements of financial

instruments, physical or non physical and the cash payments.

Transaction Management

The process in which transactions related to settlement are

managed. The process includes advice of settlement status,

pending transactions, allegements, intra-position instructions, etc.

The transaction management process also includes the

reconcilement of settlement transactions.

Fail and Claim Management

The process in which failed trades and their associated claims are

tracked, communicated and reconciled.

Back Office - Pricing, Risk and Reporting

Pricing, Risk and Reporting covers all processes across products related to the pricing and

valuation of securities and derivatives, series of risk measures (or values), and all types of

reporting including position management and regulatory reporting.

SUB-FUNCTION

DESCRIPTION

Tax Management

Tax Payments, reclaims, repatriations, etc.

Income Collection

The process in which income due on an investment or otherwise, is

tracked, collected and paid to an account.

Risk Management

The process of monitoring and controlling the financial exposure

created by a collection of financial obligations with respect to

fluctuating risk factors (e.g. market price, credit worthiness, etc).

Pricing & Valuation

The determination of a financial instrument’s ‘fair value’ by

theoretically valuing the current and future financial behaviour.

Financial measures other than just price/NPV may also be

calculated such as the ‘greeks’ for derivatives or duration/convexity

for fixed income products. Valuations are in general considered for

books and records, not for trading.

Reporting

The process of reporting on transactions, positions, currency

accounts, etc. The reporting process includes general ledger and

accounting statements.

Position Management

The process in which positions (interests) in financial instruments

are managed by an account servicing institution on behalf of an

account owner.

Investor Supervision – Regulatory Reporting

This includes the functions listed below.

Sub-function

Description

Short Sale Reporting

The practice of selling assets, usually securities, that have been

borrowed from a third party (usually a broker) with the intention of

buying identical assets back at a later date to return to the lender.

Investment Roadmap FAQ November 2018

9

The short seller hopes to profit from a decline in the price of the

assets between the sale and the repurchase, as the seller will pay

less to buy the assets than the seller received on selling them.

Conversely, the short seller will incur a loss if the price of the assets

rises. Other costs of shorting may include a fee for borrowing the

assets and payment of any dividends paid on the borrowed assets.

Shorting and going short also refer to entering into any derivative or

other contract under which the investor profits from a fall in the

value of an asset.

Trade Surveillance Reporting

Designed to assist with surveillance and investigations of member

firms by regulators and exchanges for potential violations of federal

securities laws and related rules.

Position Management Reporting

Affects start of day positions, positions created through trading

activity, deliveries, transfers, and end of day position management.

Depending on the type, position may be liquidated, adjusted,

exercised, and marked to the market.

Tax Lot Reporting

The process of reporting (from custodian to authorities) or

transporting tax lot information (from custodian to custodian). Tax

lots can be defined as a breakdown of position per historical

purchase.

Issuer Supervision – Regulatory Reporting

This includes short interest reporting for example.

Sub-function

Description

Short Interest Reporting

Reporting short positions to the regulator including the value and

details of the short positions held.

Financial Statement Reporting

Reporting of financial statement information such as a 10Q or 10K.

Investment Reporting

Reporting investment positions to the regulator including the value

and details of the investments held.

5. Why is there usage of multiple standards in some of the cells?

The goal in supporting this redundancy at the message syntax level is to create an environment

where users predominately using one of the syntaxes, do not have to adopt an additional

standard and the resulting infrastructure costs for a subset of business processes. The ultimate

success in terms of improving efficiencies and driving out costs will come from the commitment

by these roadmap participants in creating a single model from which the various messaging

syntaxes and supporting technologies can be derived.

a) Why is FIX and ISO represented in the Post-Trade space for Cash Equities, Fixed

Income, Forex and Listed Derivatives?

For buy-side to sell-side, whether post-trade will be FIX or ISO largely depends on who within the

buy-side firm is driving STP (Straight Through Processing) initiatives. If the initiative is driven by

the front-office they will likely already have an investment in FIX and it will be easier to implement

post-trade functions via FIX. If the initiative is driven by the back-office (as is the case with some

investment managers) they will likely be using ISO 15022 and eventually ISO 20022, making it

less expensive to automate post-trade using ISO messaging.

b) Why is FIX and ISO represented in the Clearing / Pre-Settlement space for Listed

Derivatives?

Investment Roadmap FAQ November 2018

10

FIX has been used in the clearing space for listed derivatives for a number of years by US based

exchanges and clearinghouses. FIX is increasingly being adopted by other non-US exchanges

and clearinghouses for clearing in listed derivatives due to FPL's collaboration with FIA/FOA.

ISO has been used in Europe and in the US between trading parties or their customers and

clearing members to communicate deals mostly for accounting purposes but also for give up,

take up and other derivative related process notifications. A SMPG market practice has been

defined with the support of ISITC to clarify the usage of ISO standards in that field. ISO 20022

messages are also currently being developed for communication between clearing members and

CCPs. ISO support also exists for communication between exchanges and CCPs.

The choice between FIX and ISO will be driven the same way than for Post-trade, that is,

depending on who will be driving STP initiatives.

c) Why is ISO and XBRL represented in the Asset Servicing space for Cash Equities &

Fixed Income and Funds?

XBRL has aligned with the ISO 20022 standard in the Asset Servicing space by developing

a Corporate Actions taxonomy. The Concepts (the XBRL term for data elements) used in the

taxonomy are based on the elements available in ISO 20022 common model and corporate

action messages. The corporate actions taxonomy is composed of roughly 200 concepts covering

over 40 different actions. Each separate action may use 20-40 of these concepts.

A unique identifier, equivalent to the ISO official corporate actions event reference, also is

included in the taxonomy so that each corporate action can be more easily tracked by

intermediaries and investors alike. For each corporate actions event tagged using XBRL, a style

sheet (XSLT) will be made publicly available to execute message conversion (rearrange

elements) from an XBRL instance to create an ISO 20022 Corporate Action Notification message

in a matter of seconds.

The first implementation of the taxonomy will be in the US based on a pilot among DTCC (the

US central securities depository), SWIFT and XBRL US as the initial implementation of ISO

20022 corporate actions messages for the US market.

d) Why is FIX and ISO represented in the Collateral Management space for Cash Equities

& Fixed Income and Listed Derivatives and FpML and ISO for OTC Derivatives?

The FIX standard has support for collateral management, used in the market primarily for listed

derivatives. Similarly, ISO 15022 also has some coverage for collateral management but with

very limited adoption.

In response to a recent Fed-Letter commitment by the major dealers to improve levels of

automation around OTC related collateral, the Standards Coordination Group decided that the

industry would be best served by a common underlying ISO 20022 model for collateral

management covering a wide range of exposure types. SWIFT, FIX, FpML, and ISITC

collaborated to create this model.

From a syntax perspective, ISO 20022 XML, FIX, and FpML will co-exist.

a. The FIX collateral management messages will be mapped into the model and,

following completion of what is required by ISO 20022, will become ISO 20022

compliant using a domain specific syntax.

b. ISDA/FpML will build messages in FpML syntax based on the model specifically for

the OTC derivatives community.

Investment Roadmap FAQ November 2018

11

c. The ISO 20022 XML syntax is broadly defined to cover all exposure types, and so

can be used for collateral relating to OTC products, repos, securities lending, and

others.

e) Why is FpML and ISO represented in the Pricing / Risk / Reporting space for Cash

Equities & Fixed Income, Forex, Listed Derivatives, OTC Derivatives and Funds?

FpML has coverage for pricing, risk, and reporting definitions for Forex, Listed Derivatives and

OTC Derivatives including valuation reporting, market data (Yield Curves, FX spot rates), and

Market risk reporting (Delta Risk vs. Curve Inputs, FX exposures) for trades. There is also

support for position and activity reporting.

Part of this coverage also exists in ISO. It includes, among others, tri-party and bilateral valuation

reporting, position and activity reporting,

f) Why is FIX and ISO represented in the Investor Supervision – Regulatory Reporting

space for Cash Equities & Fixed Income, Forex and Listed Derivatives?

With the emergence of new regulations such as MiFID in Europe, the Industry has been

confronted to modified or new reporting requirements. The very same way than for post-trade,

whether regulatory reporting will be FIX or ISO largely depends on who is driving STP (Straight

Through Processing) initiatives. If the initiative is driven by the front-office they will likely already

have an investment in FIX and it will be easier to implement regulatory functions via FIX. If the

initiative is driven by the back-office (as is the case with some investment managers and certainly

if outsourced to a service provider such as a custodian) they will likely be using ISO 15022 and

eventually ISO 20022, making it less expensive to automate regulatory reporting using ISO

messaging.

6. What is the plan going forward?

The organizations will continue to meet on a consistent basis going forward to ensure the

roadmap continues to accurately depict the current as well as future standards environment.

Note: A plan to update the roadmap is being drafted (Nov 2018).

We will continue to build onto this list of FAQs as queries come through so please send any

questions through to roadmap@fixprotocol.org. This will be sent to all parties from the Standards

Coordination Group that were involved in the overall effort.