CommittedtoYourSuccess

January18,2017

USGFinancialReporting

Background

ReportingEntity

AsdefinedbyOfficialCodeofGeorgiaAnnotated(O.C.G.A)§20‐3‐

50,theInstitutionispartoftheUniversitySystemofGeorgia

(USG),anorganizationalunitoftheStateofGeorgia(theState)

underthegovernanceoftheBoardofRegents(Board).TheBoard

hasconstitutionalauthoritytogovern,controland

managethe

USG.

TheInstitutiondoesnothavetherighttosue/besuedwithout

recoursetotheState.TheInstitution’spropertyisthepropertyof

theStateandsubjecttoallthelimitationsandrestrictionsimposed

uponotherpropertyoftheStatebytheConstitutionandlawsof

theState.

Inaddition,theInstitutionisnotlegallyseparatefrom

theState.Accordingly,theInstitutionisincludedwithintheState’s

basicfinancialstatementsaspartoftheprimarygovernment

CreatingAMoreEducatedGeorgia

2

Statewide/SystemReporting

•StatewideReporting

• ComprehensiveAnnualFinancialReport(CAFR)

• StatewideSingleAuditReport

• BudgetaryComplianceReport

• SalaryandTravelCompilation

•SystemReporting

• USGConsolidatedAnnualFinancialReport

• IndividualInstitutionAnnualFinancialReports

GAAP‐ FinancialReporting(AFR)

CollegesandUniversitiesgenerallysubscribeto

specializedaccountingandfinancialreporting

principlessetforthbyGASB34/35andguidelines

establishedbytheNationalAssociationof College

andUniversityBusinessOfficers’(NACUBO).

GAAP‐ FinancialReporting(AFR)

BecauseCollegescoveramajorportionoftheir

coststhroughexternalusercharges(tuitionand

fees)fortheirservices,CollegesandUniversities

haveselectedtoreportasspecialpurpose

governmentsengagedsolelyinBusinessType

Activites (BTA).

BudgetBasisFinancialStatements(BCR)

TheConstitutionoftheStateofGeorgiarequires

thatthestateoperateunderabalancedbudget.

Thismeansthatthestatecannotlegallyincura

deficitandcannotborrowmoneyforoperating

funds.Noexpensescanbeincurredforwhichfunds

arenotavailable,andnostatefundscanbespent

unlesstheyareauthorizedinanappropriationsbill

approvedbytheGeneralAssemblyofGeorgiaand

signedbytheGovernor.

GAAPACCOUNTING (AFR)VS

STATEBUDGETARYACCOUNTING(BCR)

GAAPAccounting

• InstitutionsundertheUniversitySystemofGeorgiaarerequiredto

presentfinancialstatementsinaccordancewithGenerallyAccepted

AccountingPrinciples(GAAP)forinclusionintheStateConsolidated

AnnualFinancialReport(CAFR).

• GAAPaccounting requiresfinancialstatementstobepresentedonthe

accrualbasisofaccounting whichmeansincomeis

reportedwhenearned

andexpensesarereportedwhenincurred.Also,capitalassetsmustbe

subjecttodepreciation.

OfficialCodeofGeorgia45‐12‐89:Fundsappropriatedforaspecificfiscalyearmustbe

expendedorobligatedinthatfiscalyearorlapsetotheSta teTreasury

Obligated – Obligatedfundsarecommonlyreferredtoasencumbrances. Thismeansthatthe

institutionhasissuedapurchaseorderforgoodsandservicesorhassignedacontract.

AlthoughencumbrancesarenotexpensesforGAAPpurposes,theyrepresentanexpenseof

Statefundsforthatparticularbudgetyear,andthereforerepresentanexpenseforbudgetbasis

reportingontheBudgetaryComplianceReport

Obligated(Encumbered)–POorContractIssued

• ThesearenotexpensesforGAAPpurposes

• Theseareexpensesforbudgetbasisreporting

Surplus(Lapse) –Unlesseligibletobekeptasreserves,currentfundsthatarenotcontractually

obligated;i.e.,notencumbered,andprioryearfundsthatareunencumberedlapseandmust

bereturnedtotheOfficeoftheStateTreasuryasaportionofsurplusasdeterminedbythe

DepartmentofAuditsandAccounts.Eachinstitutionreturnsits surplusfundstotheUniversity

SystemOffice;theUniversitySystemOfficereturnsthesefundstotheOfficeoftheState

Treasury.

GAAPACCOUNTING(AFR)VSSTATEBUDGETBASIS

ACCOUNTING(BCR)

DOAA‐ EducationAuditDivision’s

Objectives

• Toconductworksufficienttorenderanopiniononthe

HigherEducationcomponentoftheConsolidatedAnnual

FinancialReport(CAFR)encompassingtheFinancial

StatementsoftheBoardofRegentsanditsrelatedunits

andtheStatewideSingleAudit.

• Conductworksufficienttoev aluatethebudgetary

FinancialStatementsoftheHigher

Educationcomponent

oftheBudgetaryCompliance Report– “surplus”

CreatingAMoreEducatedGeorgia

9

TypesofEngagementsPerformedby

DOAA

ForCollegesandUniversities,DOAAconductsthe

followingindividualtypesofengagements:

•Audits

•FullDisclosureManagementReports(By‐Product

Report)forre‐accreditationpurposes

•AgreedUponProceduresReports(Attestation

Engagement)

CreatingAMoreEducatedGeorgia

10

AUDITS

Assesstheriskofmaterialmisstatementby

performingproceduresthatinclude:(1)information

gatheringprocedures toensureanadequate

understandingoftheindustry,theentityandits

environmentincludinginternalcontrolsand(2)

analyticalproceduresandtestofdetailtransactions

tounderstandthenatureofaccountbalancesonthe

financialstatements

andtoidentifyanyanomaliesor

additionalriskfactors.

CreatingAMoreEducatedGeorgia

11

AUDITS

• Oncetheriskofmaterialmisstatementisassessed,determinetheextentof

furtherproceduresnecessary.Wherethereisaheightenedlevelofrisk,

additionalproceduresmaybenecessarytodeterminewhetherthefinancial

statementsaremateriallycorrect.

• DeterminewhethertheBoardofRegentstogetherwithitsrelatedunits,

takenas

awhole,havecompliedinallmaterialrespectswithstateandfederal

laws,regulations,andprovisionsofcontractsandgrantagreements.

• DeterminewhethertheScheduleofExpendituresofFederalAwardsisfairly

presented.

• Determinewhethertheprogramexpendituresofeachorganizationfairly

presenttheiractualexpenditurescomparedtotheeachorganization’s

annual

budget.

CreatingAMoreEducatedGeorgia

12

FULLDISCLOSUREMANGEMENT

REPORTS

• TheManagementReportcontainsselectedfinancialstatement

informationpertinenttothefinancial andcomplianceactivitiesof

theindividualentity.

• TheManagementReportisforreaccreditationpurposes.

• Auditorsverifythatdocumentationsupportsthefinancial

statements.

• Additionaltestingisconductedinordertoexpressanopinionon

theHigherEducation componentof

theCAFRandStatewideSingle

Audit.

• BudgetaryComplianceTesting

• StudentFinancialAidCompliance

CreatingAMoreEducatedGeorgia

13

AGREEDUPONPROCEDURESREPORTS

TheseAgreedUponProceduresEngagementswillincludethefollowingprocedures:

ReviewofBalanceSheetItemsreportedontheAFR–Confirmthattheyare

adequatelydocumentedandproperlyreconciledtotheInstitution’sgeneralledger.

ReviewtheInstitution’sStatement ofNetPosition,StatementofRevenues,Expenses

andChangesinNetPosition,andStatement

ofCashFlowstoensurethatthe

financialstatementspr operlyreflecttheactivitywithintheaccountingrecords.

ReviewtheInstitution’sNotestotheFinancialStatementsforaccuracyand

completeness.

ReviewtheInstitution’syear‐endGAAPbasisjournalentriestodetermineifthe

entrieswereaccuratelyandappropriatelydocumented.

ConfirmState

Appropriationsrevenues,StateAppropriationsreceivablesandthe

remittanceofPYsurplus.

ReviewthelistingofAccountsReceivableWrite‐Offsduringtheyearforappropriate

duediligenceandSAOapproval.

ReviewtheyearendBudgetBasisFinancialStatementsincludingtheBudget

ComparisonandSurplusAnalysisReportsforaccuracyandtodetermine

ifany

budgetaryoverexpendituresexist.

CreatingAMoreEducatedGeorgia

14

AGREEDUPONPROCEDURESREPORTS

• ReviewBudgetBasisReservestodeterminethattheyareproperly

documented,validandappropriate.

• ConfirmthatinformationreportedtotheGeorgiaStudentFinance

CommissionhasbeenreconciledwiththeH.O.P.E.Scholarshipactivityonthe

Institution’sfinancialrecords.

• ReviewtheScheduleofExpendituresofFederalAwards.Confirmthat the

informationpresented

intheschedulesupportstheactivityreportingwithin

theInstitution’saccountingrecords

• Reviewcapitalassetsrecordstoensurethat(1)anannualphysicalinventory

isbeingconducted,(2)issuesnotedduringphysicalinventoryareev aluated

andcapitalassetsrecordsareproperlyadjusted,and(3)capitalization

thresholdsarebeingfollowed.

• Bankreconciliations

arebeingperformedandallreconcilingitemsarebeing

addressedinatimelymanner.

CreatingAMoreEducatedGeorgia

15

AuditReport

• SECTIONI‐ FINANCIAL

• INDEPENDENTAUDITOR'SREPORT

• REQUIREDSUPPLEMENTARYINFORMATION‐MANAGEMENT'SDISCUSSIONANDANALYSIS

• BASICFINANCIALSTATEMENTS

• EXHIBITS

• STATEMENTOFNETPOSITION

• STATEMENTOFREVENUES,EXPENSESANDCHANGESINNETPOSITION

• STATEMENTOFCASHFLOWS

• NOTESTOTHEFINANCIALSTATEMENTS

• SCHEDULES

• REQUIREDSUPPLEMENTARYINFORMATION

• SCHEDULEOFPROPORTIONATESHAREOFTHENETPENSIONLIABILITY–TEACHERSRETIREMENTSYSTEMOFGEORGIA

• SCHEDULEOFPROPORTIONATESHAREOFTHENETPENSIONLIABILITY–EMPLOYEES'RETIREMENTSYSTEMOFGEORGIA

• SCHEDULEOFCONTRIBUTIONS–TEACHERSRETIREMENTSYSTEMOFGEORGIA

• SCHEDULEOFCONTRIBUTIONS–EMPLOYEES'RETIREMENTSYSTEMOFGEORGIA

• NOTESTOTHEREQUIREDSUPPLEMENTARY

INFORMATION

• SUPPLEMENTARYINFORMATION

CreatingAMoreEducatedGeorgia

16

AuditReport

• SUPPLEMENTARYINFORMATION

• BALANCESHEET(NON‐GAAPBASIS)BUDGETFUND

• SUMMARYBUDGETCOMPARISONANDSURPLUSANALYSISREPORT(NON‐GAAPBASIS)

BUDGETFUND

• STATEMENTOFFUNDSAVAILABLEANDEXPENDITURESCOMPAREDTOBUDGETBY

PROGRAMANDFUNDINGSOURCE(NON‐GAAPBASIS)BUDGETFUND

• STATEMENTOFCHANGESTOFUNDBALANCEBYPROGRAMANDFUNDINGSOURCE(NON‐

GAAPBASIS)BUDGETFUND

• SECTIONII‐ COMPLIANCEANDINTERNALCONTROLREPORTS

• INDEPENDENTAUDITOR'SREPORTONINTERNALCONTROLOVERFINANCIALREPORTING

ANDONCOMPLIANCEANDOTHERMATTERSBASEDONANAUDITOFFINANCIAL

STATEMENTSPERFORMEDINACCORDANCEWITHGOVERNMENTAUDITINGSTANDARDS

• SECTIONIIIFINDINGSANDQUESTIONEDCOSTS

• SCHEDULEOFFINDINGSANDQUESTIONEDCOSTS

CreatingAMoreEducatedGeorgia

17

IndependentAuditor’sReport

Inouropinion,basedonourauditandthereportofother

auditors,the financialstatementsreferredtoabovepresent

fairly,inallmaterialrespects,therespectivefinancial

positionofthebusiness‐typeactivitiesanddiscretely

presentedcomponentunitofGeorgiaStateUniversityasof

June30,2016,andtherespectivechangesinfinancial

positionand,whereapplicable,cashflowsthereofforthe

yearthenendedinaccordancewithaccountingprinciples

generallyacceptedintheUnitedStatesofAmerica.

CreatingAMoreEducatedGeorgia

18

Management’sDiscussionandAnalysis

(MD&A)

FinancialmanagersofCollege/Universitiesareknowledgeableaboutthe

transactions,events,andconditionsthatarereflectedintheirfinancialreport

andofthefiscalpoliciesthat governitoperations.Thosefinancialmanagersare

askedtosharetheirinsightsintheMD&Abygivingreadersanobjectiveand

easilyreadableanalysisoftheCollege/University’sfinancial performancefor

theyear.Thisanalysisshouldprovideuserswiththeinformationtheyneedto

helpthemassesswhetherthegovernment’sfinancialpositionhasimprovedor

deterioratedasaresultoftheyear’soperations.

CommittedtoYourSuccess

19

Management’sDiscussionandAnalysis

(MD&A)

RequiredComponents:

• Overview:Abriefdiscussionofthebasicfinancialstatements,includingtherelationshipsof

thestatementstoeachother,andthesignificantdifferencesintheinformationtheyprovide.

Thisdiscussionshouldincludeanalysesthatassistinunderstandingmeasurementsand

resultsreportedinfinancialstatements

• CondensedFinancialInformation‐ SNP,SRECNPandCashFlowStatements

• Descriptionofsignificantcapitalassetandlongtermdebtactivityduringtheyear

• CurrentyearresultsincomparisonwiththeprioryearwithemphasisonCY

• Discussespositivesandnegativetrends

• Discussesothersignificantorunusualactivityreflectedonthefinancialstatements

• Mayusecharts,graphsandtablestoenhanceunderstandabilityoftheinformation

• Shouldavoid“boilerplate”discussion

• EconomicOutlook– Descriptionofcurrentlyknownfacts,decisionsorconditionsthatare

expectedtohav easignificanteffectonfinancialpositionorresultsof operations– Nota

platformtopontificate

CommittedtoYourSuccess

20

Management’sDiscussionandAnalysis

(MD&A)

PollsoffinancialstatementusershavesuggestedthefollowingabouttheMD&A:

• Speduptheprocessofidentifyingkeyissuesandpotentialredflags

• Whenwellwritten,theMD&Acanmaketheirjobseasierbyansweringthe

questionsthattheyoftenhavetocallagovernmenttogetanswersto

• “

MD&A’sbeenahugevalue…whenit’sdonewell…becauseitsavesan

analyst…aphonecalloritshortensthephonecallthatthey’vegottomake.If

it’swrittenwellandwrittenwithin…thespiritofthestandard.”

• BoilerplateMD&A’sthatarenottailoredtothespecificgovernmentinquestion

arenot

veryuseful

• ThequalityoftheMD&Aalsoappearedtobeanindicatortosomeofthe

qualityofagovernment’smanagement

CommittedtoYourSuccess

21

CommittedtoYourSuccess

StatementofNetPosition

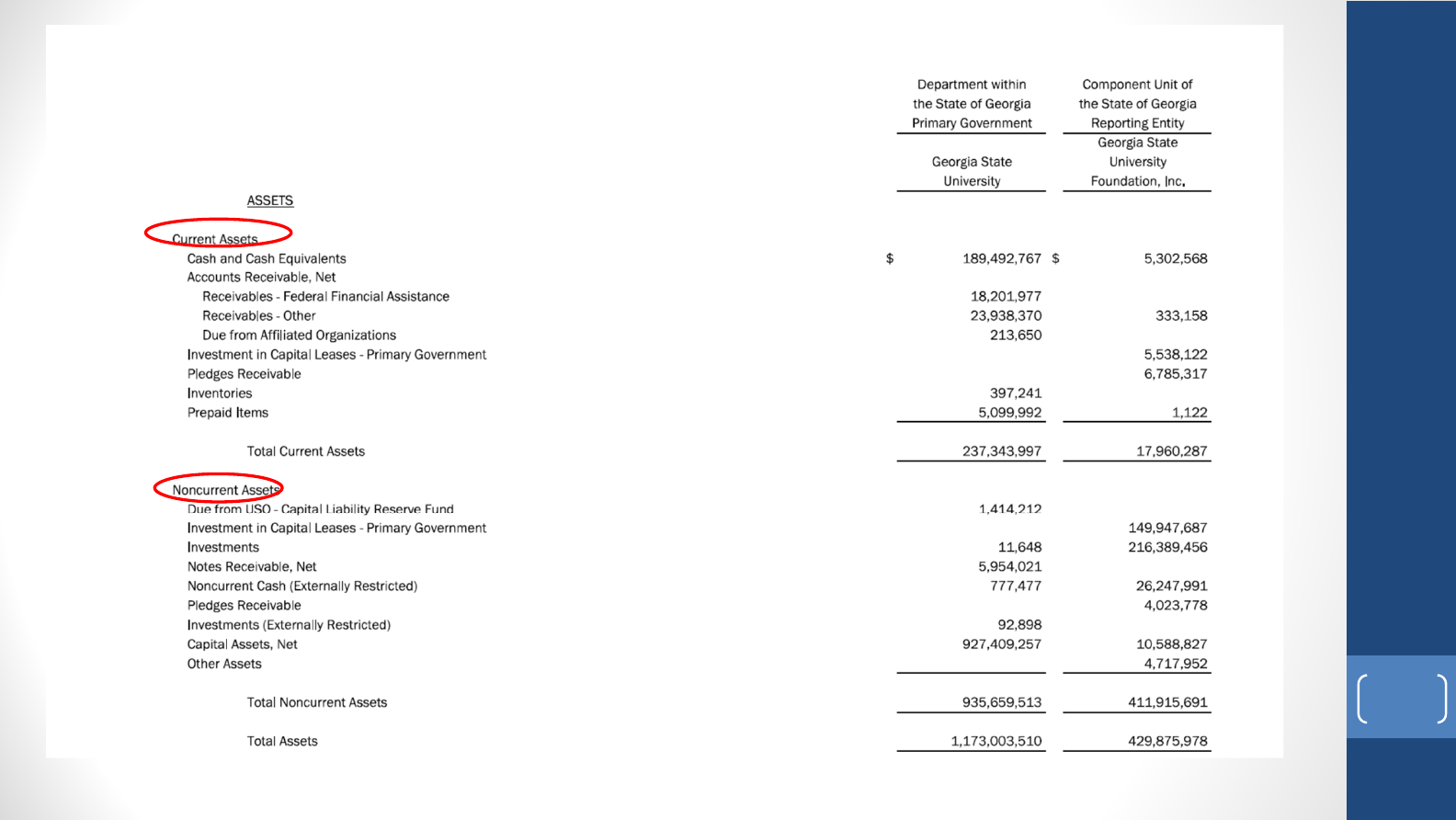

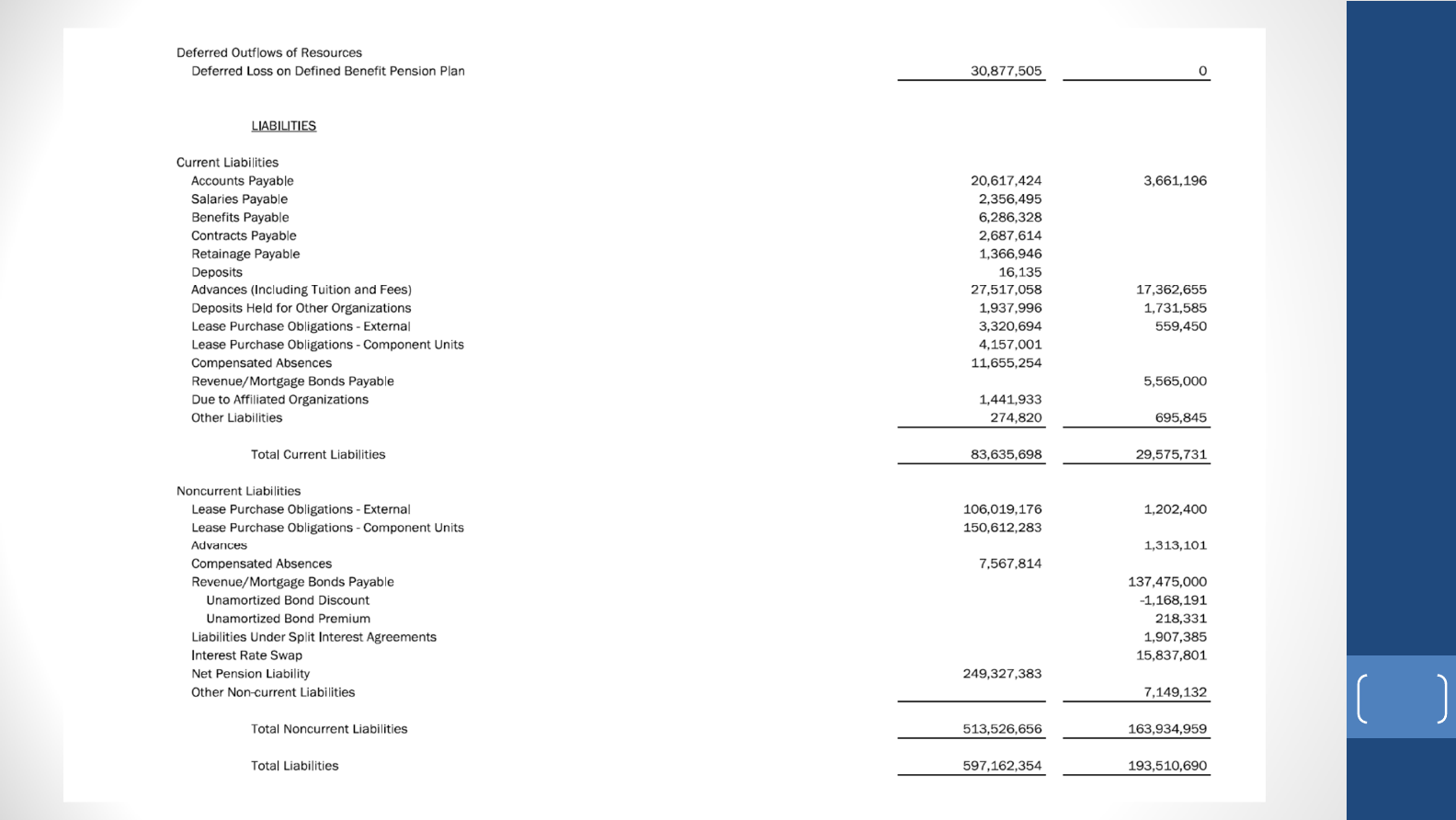

StatementofNetPosition

TheStatementofNetPositionisafinancialconditionsnapshotasof

June30,2016andincludesallassetsandliabilities,bothcurrent

andnoncurrent.Thedifferencesbetweencurrentandnon‐current

assetsarediscussedintheNotestotheFinancial Statements.The

StatementofNetPositionispreparedundertheaccrualbasisof

accountingwhichrequiresrevenueandassetrecognitionwhenthe

serviceisprovided,andexpenseandliabilityrecognitionwhen

goodsorservicesarereceiveddespitewhencashisactually

exchanged.

CreatingAMoreEducatedGeorgia

23

StatementofNetPosition

Statements of Net Position

June 30, 2016

ASSETS

Current Assets

Cash and Cash Equivalents 20,604,905$

Accounts Receivable, net

Receivables - Federal Financial Assistance 259,160

Receivables - Other 3,793,748

Due From Affiliated Organizations 192,976

Due From Other Funds

Inventories 255,279

Prepaid Items 962,453

Total Current Assets 26,068,521

Non-Current Assets

Non-current Cash (Externally Restricted) 166,002

Investments (Externally Restricted) 5,208,122

Due From Affiliated Organizations 2,132,289

Due From USO - Capital Liability Reserve Fund 1,081,968

Investments 2,085,578

Notes Receivable, net 2,010,676

Capital Assets, net 175,258,328

Total Non-Current Assets 187,942,963$

TOTAL ASSETS 214,011,484$

DEFERRED OUTFLOWS OF RESOURCES

Deferred Loss on Defined Benefit Pension Plan 5,912,854

TOTAL DEFERRED OUTFLOWS OF RESOURCES 5,912,854$

LIABILITIES

Current Liabilities

Accounts Payable 2,298,094

Salaries Payable 300,993

Benefits Payable 1,246,553

Contracts Payable 1,406,496

Retainage Payable 295,670

Deposits 307,778

Advances (Including Tuition and Fees) 1,882,349

Other Liabilities 693,191

Deposits Held for Other Organizations 931,152

Lease Purchase Obligations 2,505,465

Compensated Absences 2,094,994

Due to Affiliated Organizations 297

Total Current Liabilities 13,963,032$

Non-Current Liabilities

Lease Purchase Obligations 121,852,181

Compensated Absences 652,502

Net Pension Liability 40,292,642

Total Non-Current Liabilities 162,797,325$

TOTAL LIABILITIES 176,760,357$

DEFERRED INFLOWS OF RESOURCES

Deferred Gain on Debt Refunding 1,483,686

Deferred Gain on Defined Benefit Pension Plan 3,746,987

Deferred Inflows - Other 3,753,443

TOTAL DEFERRED INFLOWS OF RESOURCES 8,984,116$

NET POSITION

Net Investment in Capital Assets 52,534,272

Restricted for

Nonexpendable 3,785,471

Expendable 4,790,028

Unrestricted Deficit (26,929,906)

TOTAL NET POSITION 34,179,865$

CreatingAMoreEducatedGeorgia

24

CreatingAMoreEducatedGeorgia

25

CreatingAMoreEducatedGeorgia

26

CreatingAMoreEducatedGeorgia

27

CreatingAMoreEducatedGeorgia

28

Statements of Net Position

Increase/(Decrease)

June 30, 2016 June 30, 2015 FY 2016/2015

ASSETS

Current Assets

Cash and Cash Equivalents 189,492,767$ 199,963,095$ ($10,470,328)

Accounts Receivable, net

Receivables - Federal Financial Assistance 18,201,977 16,854,218 $1,347,759

Receivables - Other 23,938,370 25,594,187 ($1,655,817)

Due From Affiliated Organizations 213,650 465,890 ($252,240)

Due From Other Funds - 93,395 ($93,395)

Inventories 397,241 388,874 $8,367

Prepaid Items 5,099,992 4,877,880 $222,112

Other Assets - 25,777 ($25,777)

Total Current Assets 237,343,997$ 248,263,316$ ($10,919,319)

Non-Current Assets

Non-current Cash (Externally Restricted) 777,477$ 97,536$ $679,941

Investments (Externally Restricted) 92,898 90,611 $2,287

Due From Affiliated Organizations - 222,703 ($222,703)

Due From USO - Capital Liability Reserve Fund 1,414,212 1,414,211 $1

Investments 11,648 11,457 $191

Notes Receivable, net 5,954,021 6,212,994 ($258,973)

Capital Assets, net 918,087,132 906,401,768 $11,685,364

Total Non-Current Assets 926,337,388$ 914,451,280$ $11,886,108

TOTAL ASSETS 1,163,681,385$ 1,162,714,596$ $966,789

GEORGIA STATE UNIVERSTY

Source:AFRExcelFile

CashandInvestments

CreatingAMoreEducatedGeorgia

29

CashandCashEquivalents

CreatingAMoreEducatedGeorgia

30

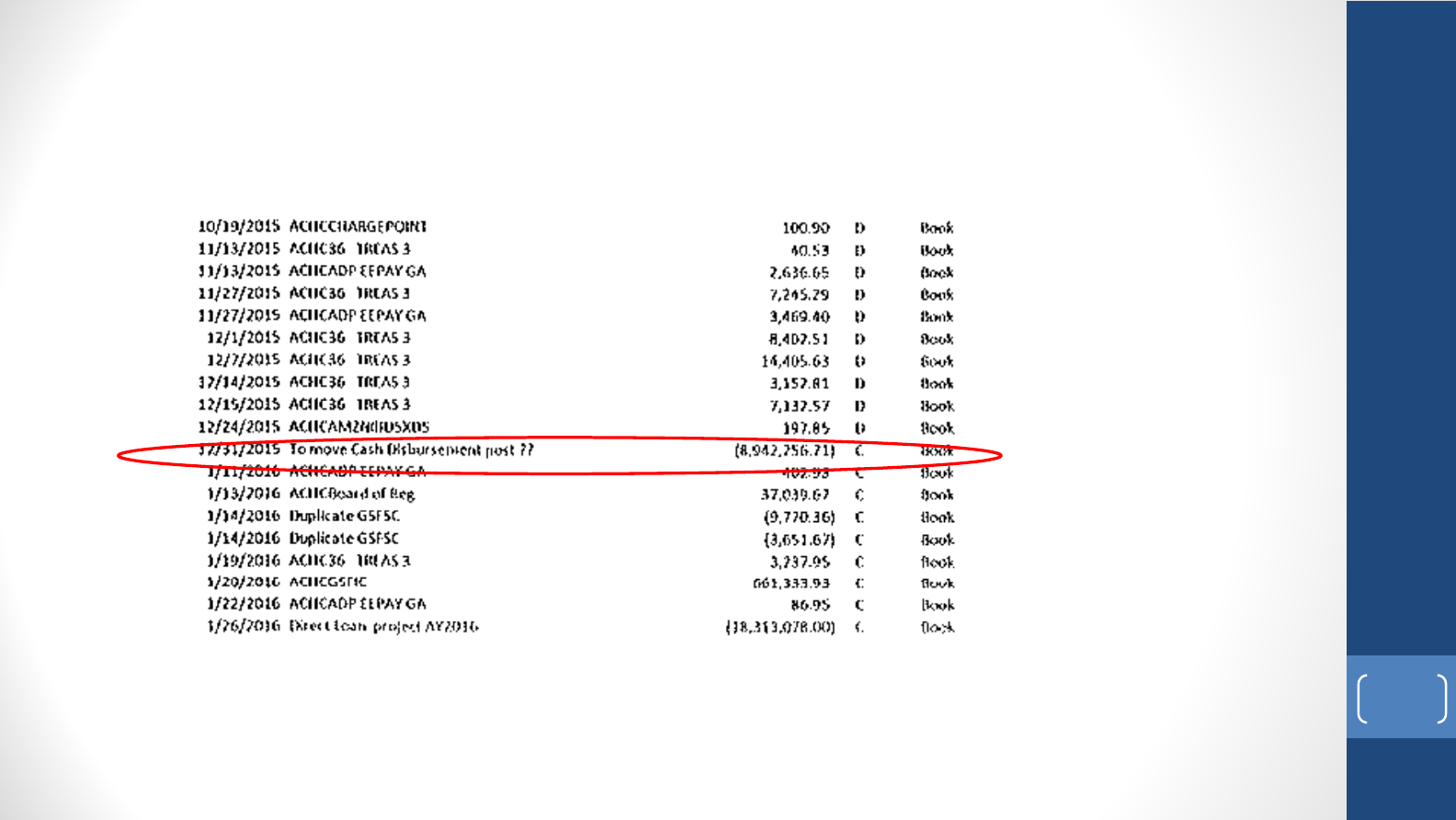

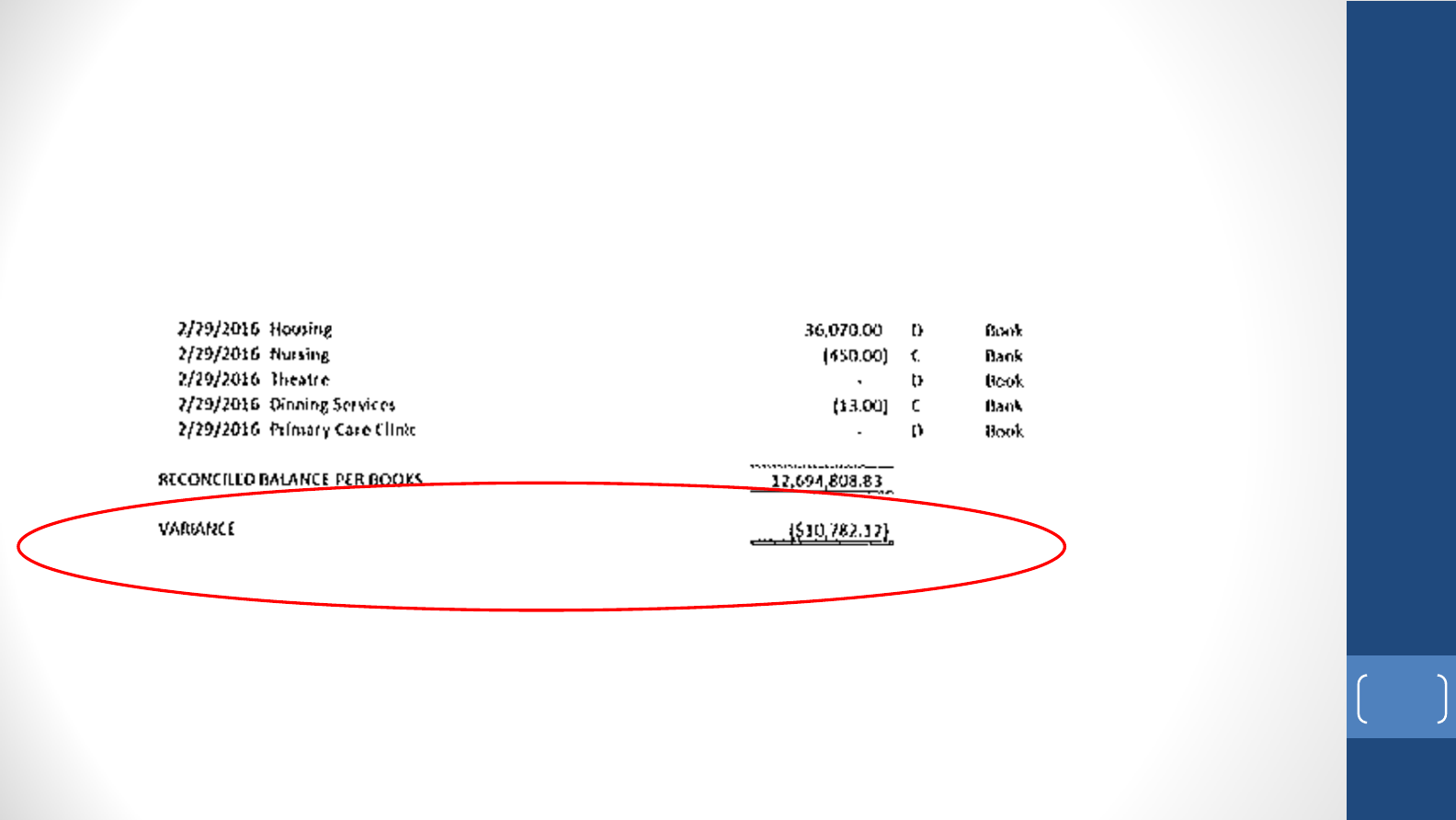

BankReconciliationReview

• PerBankBalanceagreestobank

• Perbookbalanceagreestogeneralledgertrialbalance

• Reconciliationperformedtimely

• Documentationavailabletosupportallreconcilingitems

noted

• Evidenceofsupervisoryreview

• Reconcilingitemscarriedforextendedperiodoftime

• Unusualreconcilingitems

• OutstandingChecklist

• OutstandingItemscanbetracedinto

subsequentperiod

CreatingAMoreEducatedGeorgia

31

BankReconciliationReview

CreatingAMoreEducatedGeorgia

32

BankReconciliationReview

CreatingAMoreEducatedGeorgia

33

BankReconciliationReview

CreatingAMoreEducatedGeorgia

34

Investments

CreatingAMoreEducatedGeorgia

35

R estrictedCash,ShortTermIn vestmentsand

In vestments

ASSETS

Current Assets

Cash and Cash Equivalents 19,104,684$

Accounts Receivable, net

Receivables - Federal Financial Assistance 765,385

Receivables - Other 3,833,500

Due From Affiliated Organizations 27,347

Prepaid Items 335,322

Total Current Assets 24,066,238

Non-Current Assets

Noncurrent Cash 155,586$

Investments (Externally Restricted) 2,821,104

Due from USO - Capital Liability Reserve Fund 220,862

Investments 270,525

Capital Assets, net 108,303,935

Total Non-Current Assets 111,772,012

TOTAL ASSETS 135,838,250

CommittedtoYourSuccess

36

NET POSITION

Net Investment in Capital Assets 65,673,442$

Restricted for

Nonexpendable 2,936,644

Expendable 346,904

Deficit (8,724,375)

TOTAL NET POSITION 60,232,615$

R estrictedC ash,ShortTermIn vestments

andIn vestments

CommittedtoYour

Success

YearEndEntries:YE#34and#34a

Toreclassifyexternallyrestrictedcash,shorttermInvestmentsandinvestmentstonon‐currentcash,

noncurrentshortterminvestmentsandinvestments(externallyrestricted)ontheStatementofNet

Position.Examples:Endowments,RestrictedGrantsandContracts,CashGifts,Auxiliary,etc.

Led

g

e

r

Account Fund Dept ID

P

ro

g

ra

m

Class Budget Pro

j

ect/ Amount Amount

Ref Grant Debit Credit

GAAP Non-current Cash

1581xx xxxxxxx 2016 150,000.00

GAAP Cash

111xxx xxxxxxx 2016 150,000.00

150,000.00 150,000.00

Led

g

e

r

Account Fund Dept ID

P

ro

g

ra

m

Class Budget Pro

j

ect/ Amount Amount

Ref Grant Debit Credit

GAAP Non-current Cash

1581xx xxxxxxx 2016 150,000.00

GAAP Cash

111xxx xxxxxxx 2016 150,000.00

150,000.00 150,000.00

Led

g

e

r

Account Fund Dept ID

P

ro

g

ra

m

Class Budget Pro

j

ect/ Amount Amount

Ref Grant Debit Credit

GAAP Non-current S-T Investments

1582xx xxxxxxx 2016 250,000.00

GAAP S-T Investments

1198xx xxxxxxx 2016 250,000.00

250,000.00 250,000.00

Led

g

e

r

Account Fund Dept ID

P

ro

g

ra

m

Class Budget Pro

j

ect/ Amount Amount

Ref Grant Debit Credit

GAAP Non-current S-T Investments

1582xx xxxxxxx 2016 250,000.00

GAAP S-T Investments

1198xx xxxxxxx 2016 250,000.00

250,000.00 250,000.00

AccountsReceivables

CreatingAMoreEducatedGeorgia

38

AccountsReceivableIssues

• AllowanceforDoubtfulA ccountsnotproperlyreported

• Banner/GeneralLedgerReconciliationnotcompleted

• AccountsReceivablesnotbeingactivelymanaged

• Failuretoprovideaccuratelisting

• DueDiligencedocumentationnotavailable

• UncollectibleAccountsReceivableReservebalance

growingrapidlycomparetoinstitution’ ssector

CreatingAMoreEducatedGeorgia

39

AccountsReceivables

BPM‐ AccountsReceiv ables

• Alluncollectibleaccountswillbereservedasspecificaccountsareaged

andconsequentlydeemedtobeuncollectible.Generally,debtsagedmore

thanonehundredeighty(180)daysfromtheduedatearenolonger

probableforcollection.Circumstancesmayarisewhenspecificaccounts

becomeuncollectibleearlierthan

onehundredeighty(180)days.

• Note: Duedateisdefinedasfollows:

• Forstudentaccounts,theduedateisthefirstdayofclassesfortheterm.

• Fornon‐studentaccounts,theduedateisgenerallythirty(30)daysafterthe

invoicedate.

• Astudentaccountduedatemaybemodifiedtothedatethatfinancial aidis

withdrawninordertogivethestudentandinstitutionanopportunitytolocate

otherpaymentarrangements.

• Accountsreceivableshouldbeanalyzedandaccountedformonthlyas

appropriate,nolessthanquarterly.

CreatingAMoreEducatedGeorgia

40

AccountsReceivables

BPM‐ AccountsReceiv ables

• Accountsreceivableshouldbeanalyzedandaccountedfor

monthlyasappropriate,nolessthanquarterly.

• Alluncollectibleaccountsagedmorethanonehundred

eighty(180)daysfromtheduedateshouldbereservedas

anuncollectibleaccount.Thisisthetimebywhich

collectionagencyeffortsshouldcommence.

• Oncean

invoiceisdeterminedtobeuncollectible,either

beforeorbytheone hundredeighty(180)daypastdue

date,allinvoiceswithinthataccountshouldbereserved

asanuncollectibleaccount.

CreatingAMoreEducatedGeorgia

41

AccountsReceivables

BPM‐ AccountsReceivables

• Whenuncollectibleaccountsarereserved,afundingsourcemustbeidentifiedtofund

thereserve.GASBrequiresthatrevenue‐generatedtransactions,whichgenerate

accountsreceivablethataredeemeduncollectible,shouldbereversed.This

methodologyisthecorrectmethodforbothbudgetaryandGAAPfinancialreporting.

GeorgiaAnnotated

Code50‐16‐18allowsfortruewrite‐offofuncollectiblereceivables

for$3,000orless.

• Inordertoaccomplishtheappropriaterecognitionofrevenue,thefollowingmethod

willbeused:TheAllowanceforDoubtfulRevenue(ContraRevenue)accountshould

bedebitedandtheAllowanceforDoubtfulAccountsReceivable(ContraAccounts

Receivable)accountshouldbecredited.Thiseff ectivelyreversestherevenuefrom

currentyearoperationsforbothbudgetaryaccountingandGAAPreporting.

• TheContra‐Revenueentryensuresthattheuncollectibleaccountamountisnotspent.

Forbudgetaryreportingpurposes,theAllowanceforDoubtfulAccountsReceivable

(ContraReceivable)isreportedasa

NetAssetreserveandnotasareductionto

AccountsReceivable.

• Thismethodwillbeusedregardlessoftheamountofeachuncollectibleaccount.As

approvedbythestateauditorsunderProceduralDirective17(July21,1992),“fund

integritymustbemaintained atalltimeswithregardtotheuncollectibleaccounts”.

CreatingAMoreEducatedGeorgia

42

FY2016Deficiencies

AccountsReceivables

CreatingAMoreEducatedGeorgia

43

Category of Entry Closing/Year-End

Enter all chart fields marked with xxxxxx

Sample Entry # YE-7c

Date Entered Journal #

Ledger Account Fund Dept ID Program Class Budget Pro

j

ect/ Amount Amount

Ref Grant Debit Credit

Actuals

Allowance for Doubtful Revenue

4xxx98 xxxxx xxxxxxx xxxxx xxxxx 2016 2,000.00

Actuals

Allowance for Doubtful Accounts Receivable

12xx99 xxxxx xxxxxxx xxxxx xxxxx 2016 2,000.00

or (See Note Below)

Accounts Receivable (See Note Below)

12xxxx xxxxx xxxxxxx xxxxx xxxxx 2016 xxxx.xx

2,000.00 2,000.00

0.00

To reserve uncollectible accounts aged more than one hundred eighty days from the invoice due date as defined. (See BPM Section 10.4.1)

At the point one invoice is determined uncollectible, the respective account balance should be reserved.

Note:

Uncollectible accounts (<= $3,000) may be written directly off vs. reserved first if all collection efforts have been made and approval

is received from State Accounting Office. (per BPM 10.4)

Source of Information

A/R Aging Report

JOURNAL ENTRY FORM

Descri

p

tion/Ob

j

ective:

Type of Entry Manual

PEACHTREE STATE UNIVERSITY

AccountsReceivables

BPM‐ AccountsReceivables

• Whenaccountsreceivableof$3,000orlessareultimatelydetermineduncollectibleand

duediligenceforcollectionhastakenplace,theAccountsReceivableaccountshouldbe

creditedandtheAllowanceforDoubtfulAccountsReceivableaccountshouldbedebited.

ThiseliminatesthereceivablefromthebooksofthecampusincompliancewithGeorgia

law.

• Note: Duediligenceisdefinedastheperformanceofboth:

• Collectioneffortsbytheinstitutionaccordingtotheminimumguidelines inSection

10.7.4,and

• Collectionagencyefforts,subjecttocostvs.benefitassessmentbytheinstitution.

• Write‐offofreceivablesisbasedupontheaggregateofthedebtor,notonindividual

transactions.Forexample,astudentmayowe$4,000inaggregate,withtentransactionsof

whichnosingletransactionexceeds$3,000.Inthiscase,

the$4,000cannotbewritten‐off.

• Theaccountsreceivableshouldbeanalyzedtodetermineifallreceivablesagedmorethan

onehundredeighty(180)daysfromtheduedatearecollectible.Afterduediligence

collectioneff orts,thebaddebts(lessthanorequalto$3,000)shouldbewrittenoffas

follows:

• AgainstexistingAllowanceforDoubtfulAccountsReceivableaccount,asdescribedin

item#6above,or

• Againstthecontra‐revenueaccountiftheaccountwasnotpreviouslyreserved.

CreatingAMoreEducatedGeorgia

44

AccountsReceivables

BPM‐ AccountsReceiv ables

• TheentriesforuncollectibleAccountsReceivableandthefundingsource

forthoseamountscanbesummarizedinthefollowingtable:Uncollectible

AccountsReceivable

• Foraccountsreceivablewrite‐offsresultingfromnon‐revenue

transactions,suchascashadvances,thereisnooffsettingrevenue.

Therefore,theaccountingentryshoulddebitthebaddebtsexpense

accountandcreditthereceivableaccount.

CreatingAMoreEducatedGeorgia

45

Category of Entry Year-End/Closing

Enter all chart fields marked with xxxxxx

Sample Entry #7a

Date Entered

Ledger Account Fund Dept ID Class Budget Pro

j

ect/ Amount Amount

Ref Grant Debit Credit

Actuals

Allowance for Doubtful Accounts Receivable

12xx99 xxxxx 2016 2,500.00

Actuals

Accounts Receivable

12xxxx xxxxx 2016 2,500.00

2,500.00 2,500.00

0.00

To write-off uncollectible account ($3,000.00 or less). See BPM Section 10.4.1.

Must have documentation (Specific identification) and must have exercised due diligence in collection efforts

Must have approval documentation from State Accounting Office.

Source of Information

Analysis of A/R and A/R Aging Report

PEACHTREE STATE UNIVERSITY

JOURNAL ENTRY FORM

Type of Entry Manual

Descri

p

tion/Ob

j

ective:

CreatingAMoreEducatedGeorgia

46

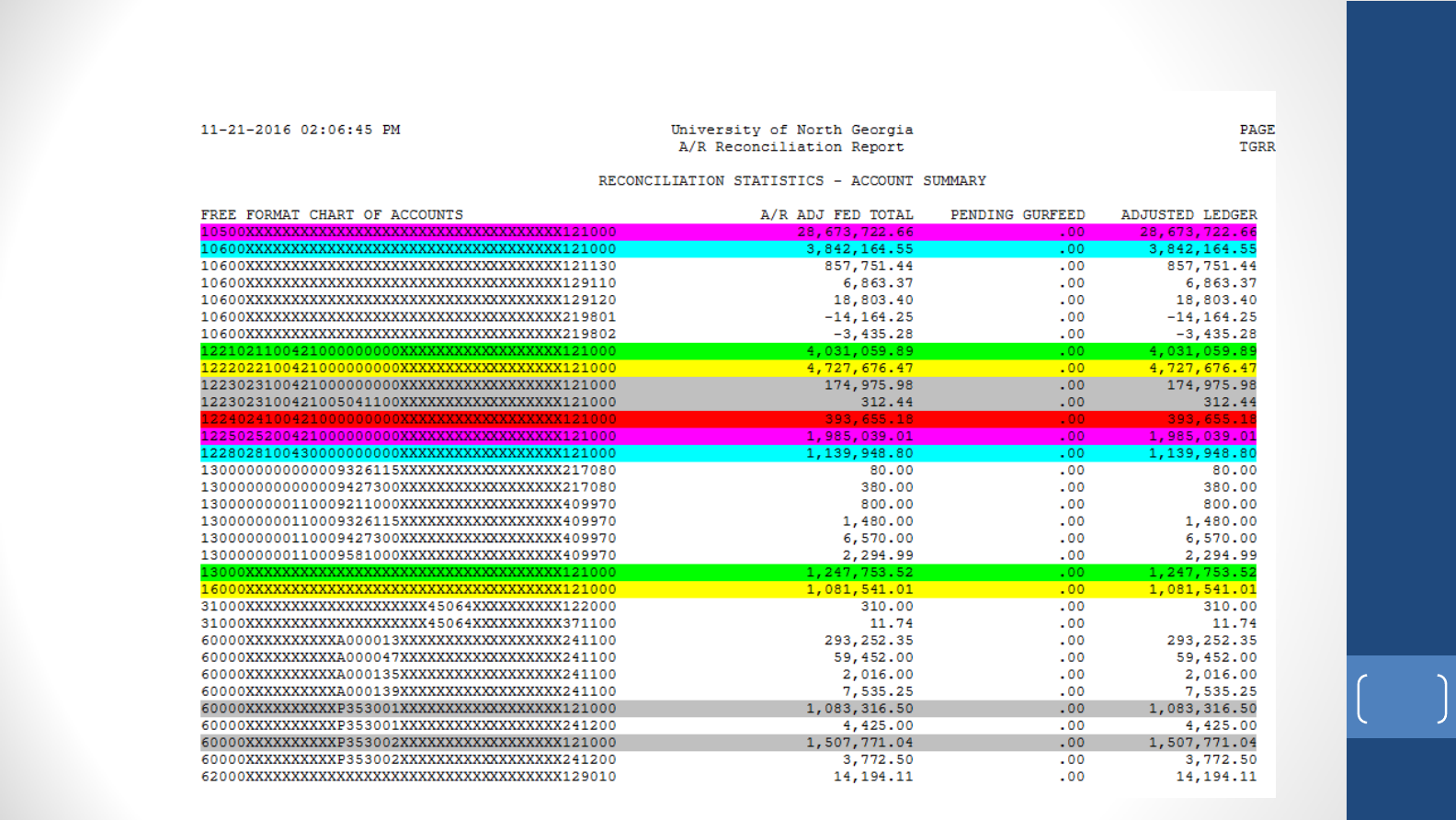

StatementofNetPosition‐ A/R

Information

DataSubmissiontoUSO:

TGRRGON

• Quarterly(StartingwithJune30,2016)

• June30–DueAugust1

• Sept30–DueOctober31

• December31–DueJanuary31

• March31–DueMay1

• InstitutionswillbeaskedtosubmitthroughMoveIT:

TGRRGON

PSTrialBalance

Exceltemplateusedtoreconcile

AgedAccountsReceivableListing

• InstitutionswillcontinuetosubmitthroughDataWarehouse ‐ December/June

• InstitutionswillbeaskedtosubmitreconciliationbetweenDWHsubmissionandgeneral

ledgerthroughMoveIt

CommittedtoYourSuccess

47

Reviewing Accounts Receivable

Banner‐ TGRRCON

• Banner is a subsidiary ledger

• Detail for General Ledger balances

• Record of who owes what

• Cash receipting system

• Required monthly – BPM Section 1.9

What is needed?

• Reconciliation Spreadsheet

• Banner – TGRRCON

• PeopleSoft –Trial Balance Report

48

R econciliationSpreadsheet

49

Banner‐ TGRRCON

50

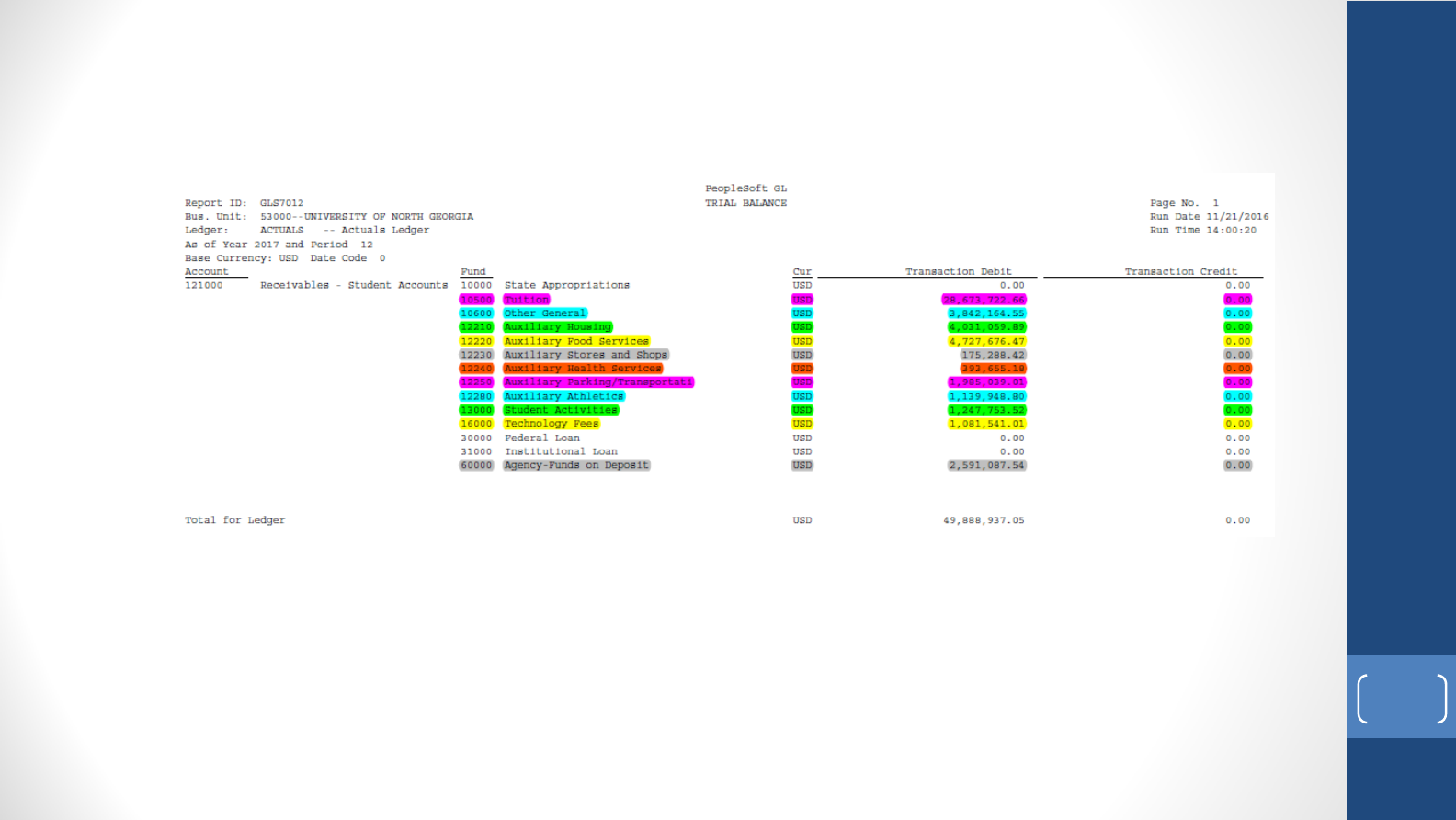

PeopleSoft– TrialBalance

51

BannerAgingAccountsReceivableReport

StudentID Name Fund Acct 30-Jan 31-60 61-90 91-120 121-180 181-364 <1 yr 1-3 yrs 3-5 yrs >5 yrs Future Tot A/R

900000067 Darth Vader 10600 121000 193.81 193.81

900000101 Chewbacca 12250 121000 10 10

900000101 Chewbacca 10600 121000 676.62 676.62

900000101 Chewbacca 10500 121000 60.48 60.48

900000513 Obi-Wan Kenobi 10600 121000 474.71 474.71

900000513 Obi-Wan Kenobi 12250 121000 20 20

900000513 Obi-Wan Kenobi 13000 121000 268 268

900000513 Obi-Wan Kenobi 16000 121000 35 35

900000513 Obi-Wan Kenobi 10500 121000 726.96 726.96

900000615 Han Solo 10500 121000 21.28 21.28

900000615 Han Solo 10600 121000 1.76 1.76

900000856 Princess Leia 10600 219802 -100 -100

900000856 Princess Leia 10500 219801 -142.27 -142.27

900000983 Luke Skywalker 10600 121000 90 90

CreatingAMoreEducatedGeorgia

52

AgencyFunds

CommittedtoYourSuccess

53

Category of Entry Year-End/Closing

xxxxx = Required Chart Field

Sample Entry # YE-33a

Date Entered Journal #

Ledger Account Fund Dept ID Program Class Budget Pro

j

ect/ Amount Amount

Ref Grant Debit Credit

GAAP Receivables - Other

1271xx 60000 xxxxxxx 2016 100,000.00

GAAP Funds Held for Others

241100 60000 xxxxxxx 2016 40,000.00

241100 60000 xxxxxxx 2016 20,000.00

241100 60000 xxxxxxx 2016 10,000.00

241100 60000 xxxxxxx 2016 15,000.00

241100 60000 xxxxxxx 2016 15,000.00

100,000.00 100,000.00

0.00

To establish a receivable account for any Agency Account (that is a true receivable) that has a negative balance at year end.

This is only an example. Each department ID must have a separate amount.

Type of Entry Manual

Descri

p

tion/Ob

j

ective:

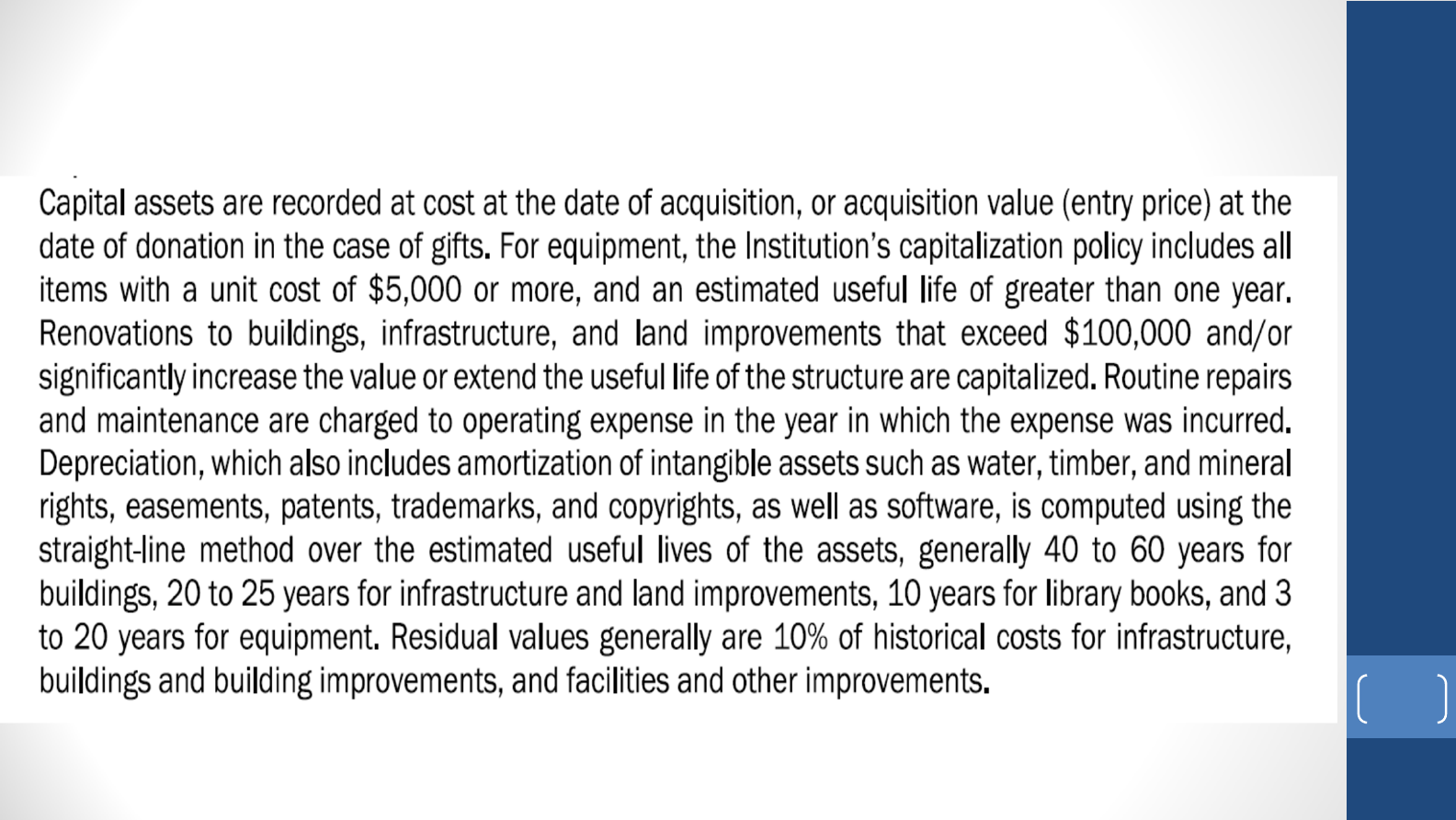

CapitalAssets

CreatingAMoreEducatedGeorgia

54

CreatingAMoreEducatedGeorgia

55

CreatingAMoreEducatedGeorgia

56

StatementofNetPosition

All balancesheetactivitymusthavesupportingdocumentation.

Supportingdocumentat ion:

Account

Name

Amount

Onlyex ceptionisaccountsreceivableactivitythroughBanner.TheTGRRGONprovides

thedetailedinformationbystudenttosupportthegeneralledger.

CommittedtoYourSuccess

57

ContractsandRetainagesPayable

YearEndEntries29,29aand29b:

Objective:

YE29–

Torecordtheliabilityforthe10%retainageamountwithheldfromthe

paymentvoucherwhichshouldrepresent10%oftheprojecttodateexpense

thataresubjecttoretainage(211950)

YE29a‐ Torecordcontactspayableforcampusmanagedprojectswere

contractamountshavebeenearnedandbilled bythecontr actor

orarchitectat

June30(211900)

YE‐29b –Tomatchtherevenuetotheretainagepayable ifreimbursable

project.

CommittedtoYourSuccess

58

ContractsandRetainagesPayable

Date Entered Journal #

Account Fund Dept ID Pro

g

ra

m

Class Bud

g

et Pro

j

ect/Grant Amount Amount

Ref Debit Credit

Construction Work in Progress

1690xx xxxxx 2016 833,333.33

Contracts/Retainage Payable

2119xx xxxxx 2016 833,333.33

Investment in Plant

311100 xxxxx 2016 833,333.33

Unallocated Net Asset - Current Year

342100 xxxxx 2016 833,333.33

1,666,666.66 1,666,666.66

0.00

This entry is to book the liability in the GAAP Ledger for the 10% retainage amount withheld from the payment voucher. The retainage amount

should represent 10% of project-to-date expenses that are subject to retainage.

An adjustment to Invested in Plant and Unrestricted Net Assets is also required. Investment in Plant must be increased by the amount of

Capital Asset increase. This entry should be reversed in the next fiscal year.

Descri

p

tion/Ob

j

ective:

CommittedtoYourSuccess

59

Advances

CreatingAMoreEducatedGeorgia

60

SummerTuitionandFees

CommittedtoYourSuccess

61

Category of Entry: Year-End Entry

Enter all chart fields marked with xxxxxx

Sample Entry # YE-52

Date Entered Journal #

Ledger Account Fund Dept ID Program Class Budget Pro

j

ect/ Amount Amount

Year Grant Debit Credit

ACTUALS Student Tuition & Fees xxxxxx xxxxx 2016 155,000.00

ACTUALS Advances (Including Tuition and Fees) xxxxxx xxxxx 2016 155,000.00

155,000.00 155,000.00

Description/Objective:

The purpose of this entry is to accurately reflect results of operations to account for summer school revenues and expenses

based on approved allocation methodology. Note: This should be in the fiscal year for which tuition applies.

Type of Entry: Manual

ThisentryisforinstitutionsthatdonotprocesssummersplitthroughBanner.Note:Ifaninstitution

calculatedbasedondatesviaJE,theinstitutionmustprovidetheadvanceslistingbystudentfrombannerfor

theentiresummertermtoauditorswiththesplitpercentagecalculation.

LongTermDebt

CreatingAMoreEducatedGeorgia

62

NetPosition

CreatingAMoreEducatedGeorgia

63

ChangesinNetPosition(GAAPBasis)

Increase/(Decrease)

June 30, 2016 June 30, 2015 FY 2016/2015

NET POSITION

Net Investment in Capital Assets 641,611,725$ 627,938,660$ $13,673,065

Restricted for

Permanent Trus

t

Nonexpendable

Permanent Endowment 97,689 96,860 $829

Expendable

Restricted E&G and Other

Organized Activities 1,736,634 15,800,512 ($14,063,878)

Federal Loans - 6,663,197 ($6,663,197)

Institutional Loans - 31,540 ($31,540)

Quasi-Endowments - 11,416 ($11,416)

Capital Projects 1,200,000 1,200,000 $0

Sub-Total 2,936,634$ 23,706,665$ ($20,770,031)

Unrestricted

Auxiliary Operations 38,349,286$ 31,839,486$ $6,509,800

R & R Reserve 24,048,585 23,552,126 $496,459

Reserve for Encumbrances 37,662,306 25,049,541 $12,612,765

Reserve for Inventory 323,807 349,139 ($25,332)

Other Unrestricted (193,506,655) (197,233,112) $3,726,457

USO Reserve Fund 1,414,211 1,414,211 $0

Sub-Total (91,708,460)$ (115,028,609)$ $23,320,149

TOTAL NET POSITION 552,937,588$ 536,713,576$ 16,224,012$

CreatingAMoreEducatedGeorgia

64

ChangesinFundBalance(BudgetBasis)

FYE2014

FYE 2015

Reserved

304 CapitalOutlay 0.00

305 DepartmentalSalesandServices (555.47)

(623.87) 68.40

306 IndirectCostRecoveries (4,267.32)

(39,980.50) 35,713.18

307 TechnologyFees (166,111.22)

(115,022.75) (51,088.47)

308 RestrictedFunds (136,877.26)

(128,819.52) (8,057.74)

309 UncollectibleAccountsReceivable (106,141.43)

(108,534.67) 2,393.24

310 Inventories (33,175.00)

(33,175.00) 0.00

311 Carry‐Over"PerStateAccountingOffic

e

0.00

0.00

312 Ea rlyRetirementProgram 0.00

0.00

312a TuitionCarryForward (345,079.14)

(340,615.19) (4,463.95)

313a Unreserved(Surplus)‐Unrestricted (16.09)

(318.03) 301.94

313b Unreserved(Surplus)‐Unrestricted (1,117.84)

(1,117.84)

313c Unreserved(Surplus)‐Unrestricted (254.73)

(254.73)

313d Unreserved(Surplus)‐Unrestricted 0.00

0.00

313e Unr eserved(Surplus)‐Unrestricted 0.00

0.00

313f Unreserved(Surplus)‐Unrestricted 0.00

0.00

313g Unreserved(Surplus)‐Unrestricted 0.00

0.00

313h Unreserved(Surplus)‐Unrestricted (7,280.21)

(7,280.21)

Unreserved(Surplus)‐Restricted

0.00

0.00

(800,875.71) (767,089.53) (33,786.18)

CreatingAMoreEducatedGeorgia

65

NetInvestmentinCapitalAssets

CommittedtoYourSuccess

66

Capital Assets, net

Less: Lease Purchase Obligations (current portion)

Less: Lease Purchase Obligations (noncurrent portion)

Less: Notes and Loans Payable (current portion)

Less: Notes and Loans Payable (noncurrent portion)

Less: Contract/Retainage Payable (Capital Asset Related)

Less: Deferred Loss on Debt Refunding

Less: Contracts Payable (Capital)

Less: Retainage Payable (Capital)

Add: Deferred Gain on Debt Refunding

Equal: Net Investment in Capital Assets

Deferred‐ GainFromDebtRefunding(298100)shouldbeincludedinthecalculationofNetInvestedin

CapitalAssets(NICA).GASBQ&Aspecificallyaddressesthisissueanditshould beincludedinthe

calculation.

YE‐8&8aRenewalsandReplacement

Reserve

Objective:

TobookcurrentyearnetassetsallocatedforRenewalsandReplacement.The

increasetorenewalsandreplacementsshouldagreewiththecurrentyear

depreciationassociatedwiththosebuildings/facilities.

Note: PPVprojectsdonotrequireadditionalRRReserves.TheRRReserveforPPVsareincludedinthe

annualrentalpaymentstotheFoundationarebeingheldinarestrictedaccountbytheTrustee.

CommittedtoYourSuccess

67

Residence Stores & Food Parking/ Health ntercollegiate

Halls Shops Services

T

ransportatio

n

Services Athletics Other Total

Fund Codes 12210 12230 12220 12250 12240 12280 12260; 12270

Beginning R & R

-$ -$ -$ -$ -$ -$ -$

-$

Add: Current Year Depreciation

- - - - - - -

-

Less: Current Year Depreciation PPV, GHEFA

- - - - - - -

- Journal Entry # YE-8

Less: Current Year Expenditures (1)

- - - - - - -

- Journal Entry #YE- 8a

Add/(Less): Adj. to Reserve for Deferred

Gift Revenue from Auxiliary Vendors (if

applicable)

- - - - - - -

-

Add: Inventory Reserve from prior years

- - - - - - -

- Journal Entry #YE- 32 or YE-32a

Calculated Value of Current Year R & R (2) -$ -$ -$ -$ -$ -$ -$ -$

YE‐8&8aRenewalsandReplacement

Reserve

Calculateindividuallyforeachnon‐PPVAuxiliaryProject

BeginningR&RReserve

Add:CurrentYearDepreciation

Less:CurrentYearExpendituresfromR&R

ValueofCurrentYearR&RReserve

CommittedtoYourSuccess

68

Stores & Food Parking/ Health ntercollegiate

Shops Services

T

ransportatio

n

Services Athletics Other Total

Fund Codes 12230 12220 12250 12240 12280 12260; 12270

Riden Hall Arnold Hall

Beginning R & R

-$ -$ -$ -$ -$ -$ -$ -$

-$

Add: Current Year Depreciation

- - - - - - - -

-

Less: Current Year Expenditures (1)

- - - - - - - -

-

Calculated Value of Current Year R & R (2) -$ -$ -$ -$ -$ -$ -$ -$ -$

Residence Halls

12210

• RenewalsandReplacements(R&R)Reserve

• ShouldbemaintainedforUniversityownedpropertyfundedbyAuxiliary.

• DoesanyonehaveanyUniversitypropertyfundedbyStudentActivitiesor

anyotherinternalfundingsource?

• IfyouhaveolderexistingR&RreservebalancesforUniversityownedbuildings

thathavebeendemolished,youmayreduceyourR&Rreservebythat

amount.

R enew alsandReplacementReserve

YE‐32and32aVendorGiftRevenue

CommittedtoYourSuccess

70

Category of Entry - Closing/Year-End

xxxxx = Required Chart Field

Sample Closing/Year-End J.E. # YE-32 Year 1 of multi-year agreement

Date Entered Journal #

Ledger Account Fund Dept ID

P

ro

g

ra

m

Class Budget Pro

j

ect/ Amount Amount

Ref Grant Debit Credit

GAAP Private Gifts Capitalized

4858xx 12220 xxxxx xxxxx xxxxx 2016 1,600,000.00

Advances (Including Tuition and Fees) - Other Current

2170xx 12220 xxxxx xxxxx xxxxx 2016 400,000.00

Advances (Including Tuition and Fees) - Other Noncurrent

2913xx 12220 xxxxx xxxxx xxxxx 2016 1,200,000.00

Investment in Plant

311100 12220 2016 1,600,000.00

Unallocated Net Asset - Current Year

3211xx 12220 2016 1,600,000.00

Unallocated Net Assets-Current Year (Unrestricted) 12220 xxxxx xxxxx xxxxx 2016 1,600,000.00

3211xx

Reserve for Deferred Gift Revenue Auxiliary Vendor

329200 12220 xxxxx xxxxx xxxxx 2016 1,600,000.00

4,800,000.00 4,800,000.00

JOURNAL ENTRY FORM

Type of Entry - Manual

PEACHTREE STATE UNIVERSITY

StatementofRevenues,

ExpenseandChangesinNet

Position

CreatingAMoreEducatedGeorgia

71

SRECNP

CreatingAMoreEducatedGeorgia

72

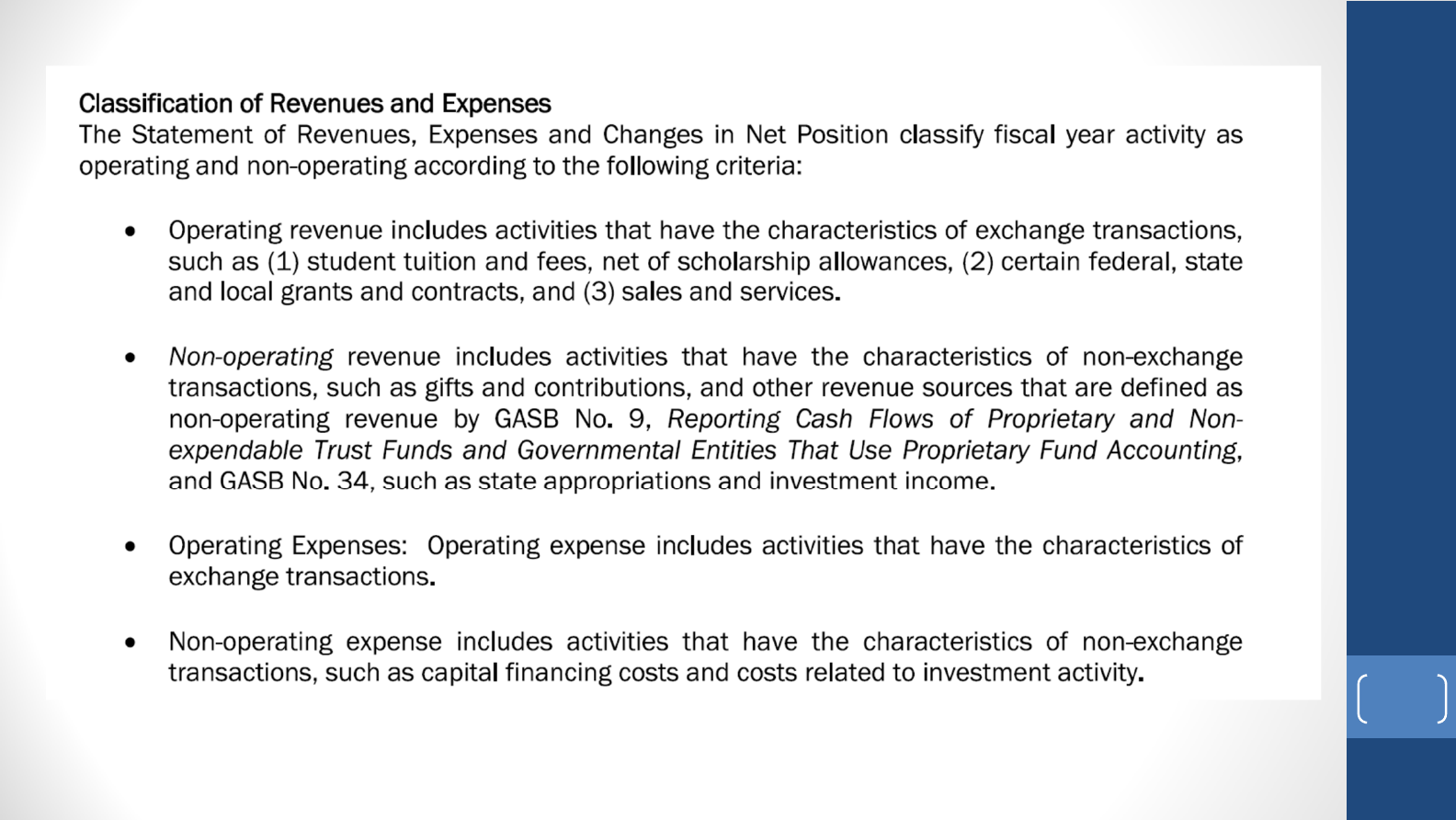

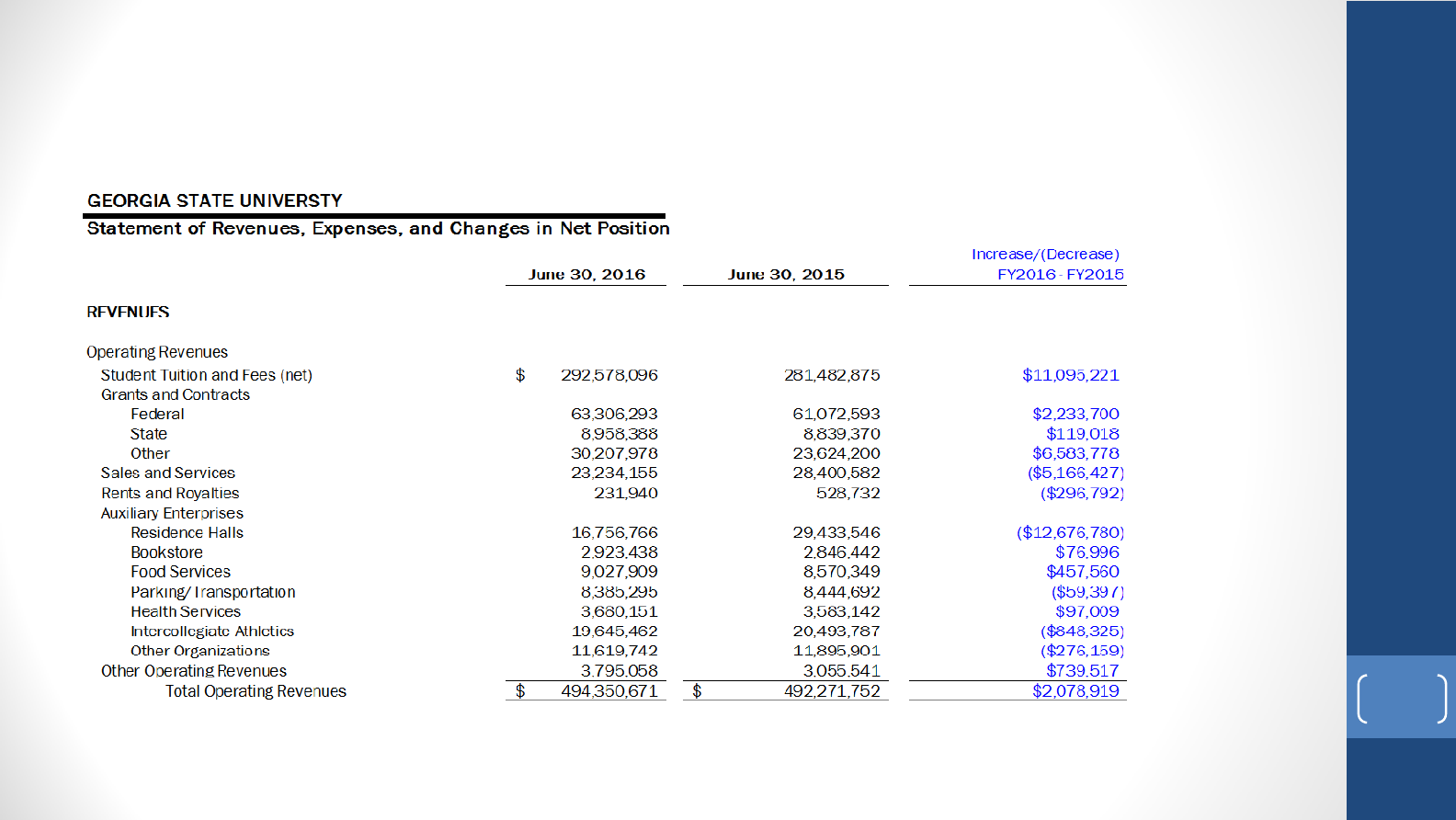

StatementofRevenues,ExpensesandChangesinNetPosition

CreatingAMoreEducatedGeorgia

73

June 30, 2016

REVENUES

Operating Revenues

Student Tuition and Fees (net) 56,847,486$

Federal Appropriations

Grants and Contracts

Federal 698,165

State 20,860

Other 182,076

Sales and Services 2,232,936

Rents and Royalties 52,133

Auxiliary Enterprises

Residence Halls 15,038,942

Bookstore 1,036,584

Food Services 7,574,688

Parking/Transportation 1,509,071

Health Services 1,376,142

Intercollegiate Athletics 2,477,273

Other Organizations 329,877

Other Operating Revenues 336,765

Total Operating Revenues 89,712,998

EXPENSES

Operating Expenses

Salaries:

Faculty 28,143,288$

Staff 31,373,553

Employee Benefits 18,447,378

Other Personal Services 291,494

Travel 1,129,480

Scholarships and Fellowships 2,907,575

Utilities 3,229,584

Supplies and Other Services 29,844,635

Depreciation 8,951,830

Total Operating Expenses 124,318,817

Operating Income (loss) (34,605,819)

NONOPERATING REVENUES (EXPENSES)

State Appropriations 31,536,964$

Grants and Contracts

Federal 6,639,799

State 100,468

Other 1,385,843

Gifts 328,422

Investment Income (endowments, auxiliary and other) 205,303

Interest Expense (capital assets) (6,362,123)

Other Nonoperating Revenues (Expenses) (798)

Net Nonoperating Revenues 33,833,878

Income (Loss) Before Other Revenues, Expenses,

Gains, or Losses (771,941)

Capital Grants and Gifts

Federal

State 1,427,504

Other 254,075

Additions to permanent endowments 46,290

Special Item

Total Other Revenues, Expenses, Gains or Losses,

and Special Item 1,727,869

Increase (Decrease) in Net Position 955,928

NET POSITION

Net Position-Beginning of Year, As Originally Reported 33,223,937

Prior Year Adjustments

Net Position-Beginning of Year, Restated 33,223,937

Net Position-End of Year 34,179,865$

CreatingAMoreEducatedGeorgia

74

RevenueAnalysis

CreatingAMoreEducatedGeorgia

75

Expense

Analysis

EXPENSES

Operating Expenses

Salaries:

Faculty 157,366,779$ 153,087,711$ $4,279,068

Staff 261,229,713 250,290,466 $10,939,247

Employee Benefits 105,290,102 98,044,095 $7,246,007

Other Personal Services 2,407,189 2,401,274 $5,915

Travel 6,851,458 6,850,412 $1,046

Scholarships and Fellowships 60,101,950 57,968,778 $2,133,172

Utilities 20,872,409 21,714,624 ($842,215)

Supplies and Other Services 159,029,327 166,553,517 ($7,524,190)

Depreciation 51,616,165 54,101,959 ($2,485,794)

Total Operating Expenses 824,765,092$ 811,012,836$ $13,752,256

Operating Income (loss) (330,414,421)$ (318,741,084)$ ($11,673,337)

NONOPERATING REVENUES (EXPENSES)

State Appropriations 244,170,135$ 239,977,179$ $4,192,956

Grants and Contracts

Federal 100,037,860 104,650,105 ($4,612,245)

Other 4,255,069 3,364,783 $890,286

Gifts 6,649,537 7,556,345 ($906,808)

Investment Income (endowments, auxiliary and other) 743,705 770,576 ($26,871)

Interest Expense (capital assets) (17,392,678) (24,124,485) $6,731,807

Other Nonoperating Revenues (Expenses) (6,103,984) (6,995,924) $891,940

Net Nonoperating Revenues 332,359,644$ 325,198,579$ $7,161,065

Income (Loss) Before Other Revenues,

Expenses, Gains, or Losses 1,945,223$ 6,457,495$ ($4,512,272)

Capital Grants and Gifts

CreatingAMoreEducatedGeorgia

76

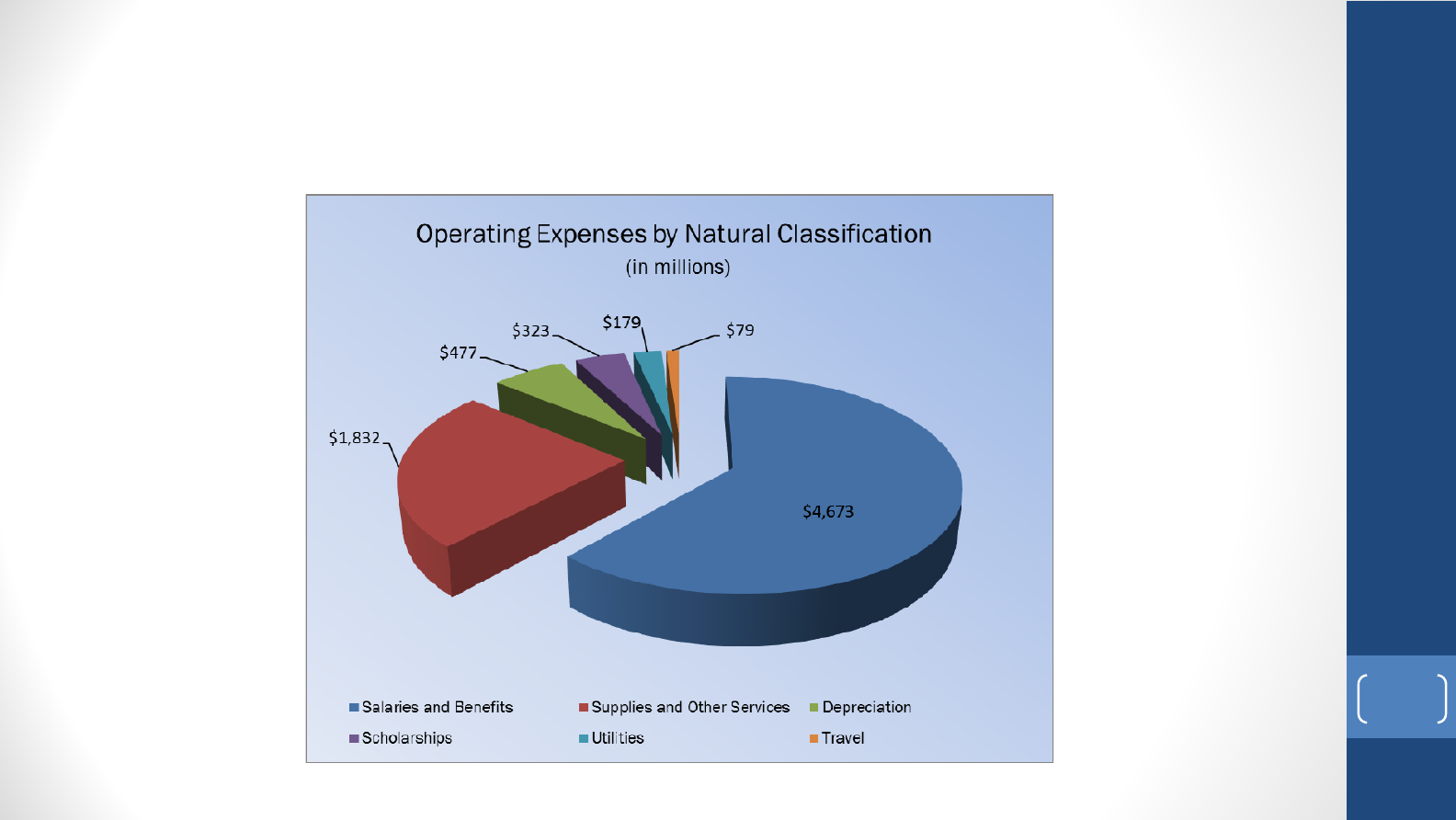

ExpenseAnalysisbyNaturalClassification

CreatingAMoreEducatedGeorgia

77

ExpenseAnalysis

CreatingAMoreEducatedGeorgia

78

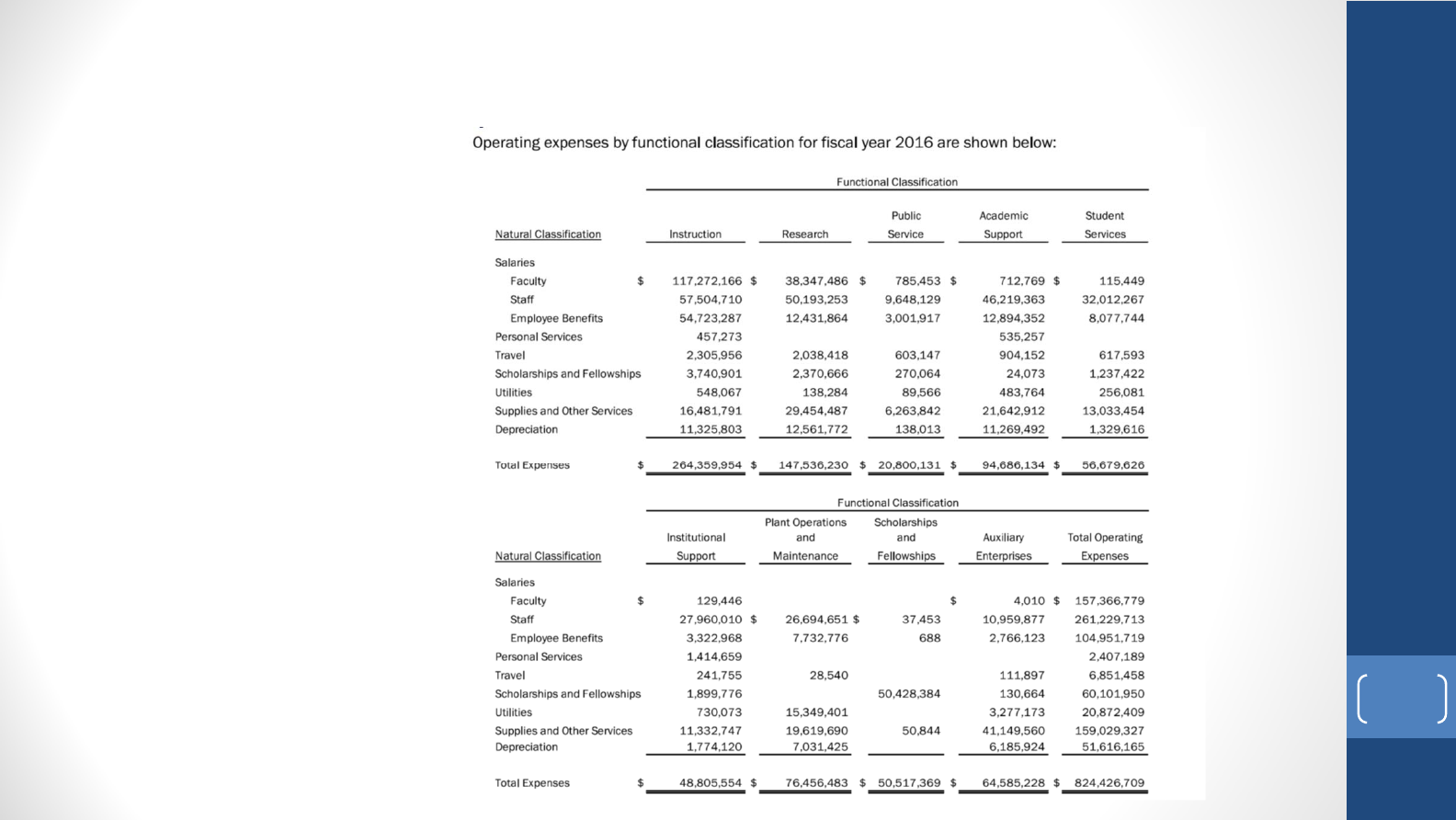

ExpenseAnalysisbyFunctional

Classification

CreatingAMoreEducatedGeorgia

79

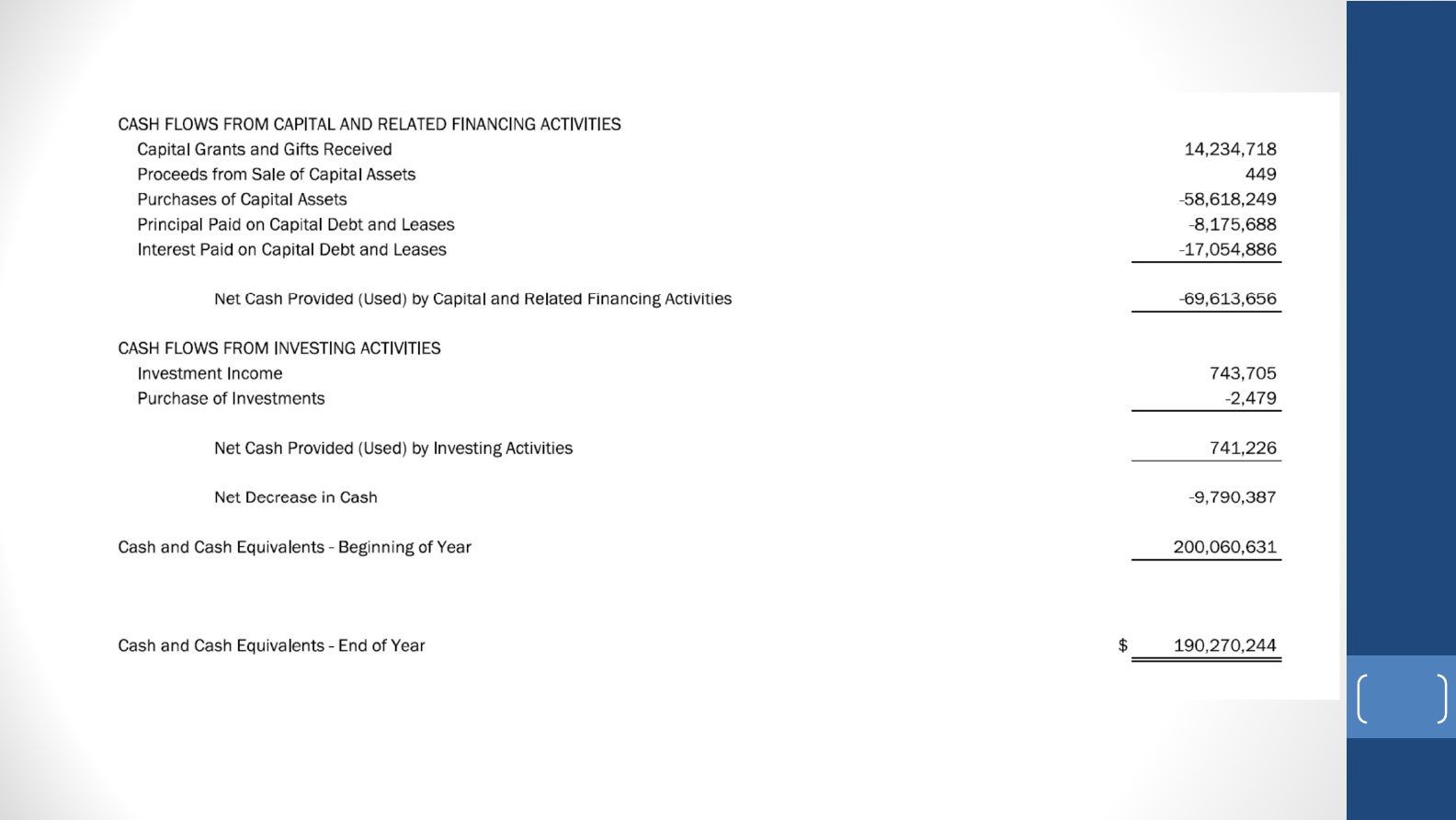

CashFlowStatement

CreatingAMoreEducatedGeorgia

80

SectionsoftheCashFlowStatement

• CashFlowsfromOperatingActivities

• CashFlowsfromNoncapitalFinancingActivities

• CashFlowsfromCapitalandRelatedFinancing

Activities

• CashFlowsfromInvestingActivities

• ReconciliationofOperatingLosstoNetCashUsedby

OperatingActivities

• Non‐CashInvesting,Non‐CapitalFinancing,and

CapitalandRelatedFinancingTransactions

CreatingAMoreEducatedGeorgia

81

CashFlowStatement

CreatingAMoreEducatedGeorgia

82

June 30, 2016

CASH FLOWS FROM OPERATING ACTIVITIES

Payments from Customers 89,162,777$

Federal Appropriations

Grants and Contracts (Exchange) 1,086,603

Payments to Suppliers (53,868,983)

Payments to Employees (60,602,808)

Payments for Scholarships and Fellowships (2,907,575)

Loans Issued to Students 280,254

Collection of Loans to Students

Other Payments

Net Cash Provided (Used) by Operating Activities (26,849,732)

CASH FLOWS FROM NON-CAPITAL FINANCING ACTIVITIES

State Appropriations 31,536,964$

Agency Funds Transactions (374,395)

Gifts and Grants Received for Other Than Capital Purposes 8,500,822

Other Noncapital Financing Receipts 2,705

Other Noncapital Financing Payments

Net Cash Flows Provided by Non-capital Financing Activities 39,666,096

CASH FLOWS FROM CAPITAL AND RELATED FINANCING ACTIVITIES

Capital Gifts and Grants Received 764,670$

Proceeds from Sale of Capital Assets

Purchases of Capital Assets (3,588,612)

Principal Paid on Capital Debt and Leases (2,227,841)

Interest Paid on Capital Debt and Leases (6,324,733)

Net Cash used by Capital and Related Financing Activities (11,376,516)

CASH FLOWS FROM INVESTING ACTIVITIES

Proceeds from Sales and Maturities of Investments 969,269$

Investment Income 305,092

Purchase of Investments (822,487)

Net Cash Provided (used) by Investing Activities 451,874

Net Increase/Decrease in Cash 1,891,722

Cash and Cash Equivalents - Beginning of year 18,879,185

Cash and Cash Equivalents - End of Year 20,770,907$

RECONCILIATION OF OPERATING LOSS TO

NET CASH PROVIDED (USED) BY OPERATING ACTIVITIES:

Operating Income (loss) (34,605,819)$

Adjustments to Reconcile Net Income (Loss) to Net Cash

Provided (Used) by Operating Activities

Depreciation 8,951,830

Operating Expenses Related to Noncash Gifts

Change in Assets and Liabilities:

Receivables, net 912,197

Inventories (28,045)

Prepaid Items (42,521)

Other Assets

Notes Receivable, Net 280,254

Accounts Payable (618,522)

Salaries Payable 78,100

Benefits Payable

Contracts Payable 297,941

Retainage Payable 88,746

Deposits (15,000)

Advances (Including Tuition & Fees) (367,722)

Other Liabilities 41,076

Funds Held for Others

Compensated Absences (27,386)

Due to Affiliated Organizations (17,299)

Pollution Remediation

Claims and Judgments

Net Pension Liability 7,797,046

Other Post-Employment Benefit Liability

Change in Deferred inflows/outflows of resources:

Deferred Inflows of Resources (7,962,306)

Deferred Outflows of Resources (1,612,302)

Net Cash Provided (used) by Operating Activities (26,849,732)$

WhatisCashFlow?

• GASB Q&A2.15.1.Q—Whatconstitutesacashflow?(Q&A9‐22)

• A—Sometimestheremaybeaquestionastowhetheracashtransactionhas

occurred.Itmaybeconfusingtoidentifyacashflowinabankingenvironment.

Generally,cashflowsonlyifitchangeshands;thatis,ownershipofcashlegally

changes.Inaninternalexchangetransactionconductedtotallywithinabank,a

cashtransactionoccursonlyifadebitorcreditismadetoagovernmental

enterprise'sbankaccount.Forexample,aservicechargeorinterestincomeis

consideredtobeacashtransactiononthedatethebankpoststheamountto

theaccount.Afterthatdate,theinterestamountisavailableforwithdrawalor

theamountpostedfortheservicechargeisnolongeravailableforwithdrawal.

Anotherexampleisaloangrantedbyabank.Iftheloanproceedsarecreditedto

theborrower'sbankaccount,acashflowoccurred.Ifthebankremittedthe

proceedsdirectlytothevendor,anoncashfinancingactivityoccurred.(See

Question2.32.1foradiscussionofnoncashtransactions.)

CreatingAMoreEducatedGeorgia

83

CreatingAMoreEducatedGeorgia

84

CreatingAMoreEducatedGeorgia

85

CreatingAMoreEducatedGeorgia

86

CashFlowRefresher

• CashflowactivityforUSGinstitutionsshouldbe

reportedgross.

• Studentloanactivityshouldnotbereportednet.Loans

issuedshouldbereportedseparatefromloanscollected.

• Year‐endjournalentryaddedtobreakoutactivityforcashflow

reporting

• Investmentactivityshouldnotbereportednet.Investment

purchasesshouldbereportedseparatefrominvestment

sales.Exception:Repurchaseagreementreoccurringtransactions.

• Year‐endjournalentryaddedtobreakoutactivityforcashflow

reporting

CreatingAMoreEducatedGeorgia

87

CashFlowRefresher

CreatingAMoreEducatedGeorgia

88

Category of Entry - Cash Flow Reporting

xxxxx = Required Chart Field

Sample Closing/Year-End J.E. #YE-56

Date Entered Journal #

Ledger Account Fund Dept ID Program Class Budget Project/ Amount Amount

Ref Grant Debit Credit

GAAP Loans Issued During CY for Cash Flow

122998 3xxxx 25,000.00

GAAP Loans Issued During CY for Cash Flow (Contra Acct)

122997 3xxxx 25,000.00

25,000.00 25,000.00

0.00

To report student loans issued during the current fiscal year separately from student loans collected during the current fiscal year.

Source of Information:

Analysis of student notes receivable

PEACHTREE STATE UNIVERSITY

JOURNAL ENTRY FORM

Type of Entry - Manual

Description/Objective:

CashFlowRefresher

CreatingAMoreEducatedGeorgia

89

Category of Entry - Cash Flow Reporting

xxxxx = Required Chart Field

Sample Closing/Year-End J.E. #YE-57

Date Entered Journal #

Ledger Account Fund Dept ID Program Class Budget Project/ Amount Amount

Ref Grant Debit Credit

GAAP For Cash Flow - Purchase of investments

495109 xxxxx 25,000.00

GAAP For Cash Flow - Purchase of investmentsContra Account

495110 xxxxx 25,000.00

25,000.00 25,000.00

0.00

To report investment purchases separate from proceeds from sales and maturities of investments for cash flow reporting.

Source of Information:

Analysis of investment activity

PEACHTREE STATE UNIVERSITY

JOURNAL ENTRY FORM

Type of Entry - Manual

Description/Objective:

CashFlowRefresher

• OperatingActivity– Operatingactivitiesgenerally

resultfromprovidingservicesandproducingand

deliveringgoods,andincludealltransactionsand

othereventsthatarenotdefinedascapitaland

relatedfinancing,noncapitalfinancing,orinvesting

activities(GASB Codification2450.113)

CreatingAMoreEducatedGeorgia

90

CashFlowRefresher

• OperatingActivityisaresidualcategoryforcash

flowsthatcannotbeproperlyclassifiedasNoncapital

FinancingActivity,CapitalFinancingActivity,and

InvestingActivity.

• Areasonablenesstestshouldbeadequatefor

verificationandreview(i.e.comparisontothe

SRECNP).

CreatingAMoreEducatedGeorgia

91

CashFlowRefresher

• Noncapitalfinancingactivitiesincludeborrowing

moneyforpurposesotherthantoacquire,construct,

orimprov ecapitalassetsandrepayingthose

amountsborrowed,includinginterest.Thiscategory

includesproceedsfromallborrowings(such as

revenueanticipationnotes)notclearlyattributable

toacquisition,construction,orimprovementof

capitalassets,regardlessoftheformofthe

borrowing.Alsoincludedarecertainotherinterfund

andintergovernmentalreceiptsandpayments(GASB

Codification2450.117)

CreatingAMoreEducatedGeorgia

92

CashFlowRefresher

• Capitalandrelatedfinancingactivitiesinclude(a)

acquiringanddisposingofcapitalassetsusedin

providingservicesorproducinggoods,(b)borrowing

moneyforacquiring,constructing,orimproving

capitalassetsandrepayingtheamountsborrowed,

includinginterest,and(c)payingforcapitalassets

obtainedfromvendorsoncredit.(GASB Codification

2450.120)

CreatingAMoreEducatedGeorgia

93

CashFlowRefresher

• Investingactivitiesincludemakingandcollecting

loans(exceptstudentloanprograms,whichare

includedinoperatingactivities)andacquiringand

disposingofdebtorequityinstruments.(GASB

Codification2450.120)

CreatingAMoreEducatedGeorgia

94

CashFlowRefresher

• Entityshouldfocusonmakingthelineitemswithin

theNoncapita lFinancing Activity,CapitalFinancing

Activity,andInvestingActivitycategoriesas preciseas

possible.

• Theselineitemsgenerallyareafocusofauditprocedures.

• DetailedreconciliationstoSRECNP accountsshouldbe

performed.

• CashflowworksheetswereaddedtotheAFR excelfile

toassistwithreconciliation.

CreatingAMoreEducatedGeorgia

95

CreatingAMoreEducatedGeorgia

96

Cash Flow Worksheet

Gifts and Grants Received for Other Than Capital Purposes

Fiscal Year Ended June 30, 2016

Reconciliation of gifts and grants received for other than capital purposes:

From SRECNP:

Non-operating Grants and Contracts

Federal (4911xx, 4941xx) 5

1

State (4912xx,4942xx)

Other (4913xx,4914xx,4943xx,4944xx)

3

Non-operating Gifts (4851xx,4853xx,4855xx,4857xx, 4859xx for all funds except 40000) 4

1

Additions to Permanent Endowments (4859xx Fund 40000 only)

Operating Expenses Related to NonCash Gifts (727198) (Enter as Negative) (3

1

Change in SNP Accounts:

Change in Accounts Receivable:

Non-operating Grants and Contracts Federal AR (124998) (Determined Manually)

Prior Year Ending Balance 772,570.77

Current Year Ending Balance 750,000.00

Non-operating Grants and Contracts State AR (Determined Manually)

Prior Year Ending Balance -

Current Year Ending Balance -

Non-operating Grants and Contracts Other AR (Determined Manually)

Prior Year Ending Balance

Current Year Ending Balance

250 000 00

1. Below, provide a reconciliation between amounts reported on the Statement of Revenues, Expenses, and Changes in Net Position and Gifts and Grants Received for Othe

r

reported on the Statement of Cash Flows. Enter amounts within the cells highlighted yellow.

Non‐CashInvesting,Non‐Capital

Financing,Capital&RelatedFinancing:

CreatingAMoreEducatedGeorgia

97

What’sRequiredtobereported?SeeGASB Q&A2.32.1

•

Ifnoncashitemsmeetthef ollowthreecriteria,theyarerequiredtobe

disclosed.

•

Thetransactionisnoncash.GASB Q&A2.15.1–2.15.6provideguidanceonidentifying

acashflow.

•

Thetransactionaff ectsrecognizedassets/liabilities/deferredinflows/deferred

outflows.Noncashtransactionsthatresultintherecognitionof

assets/liabilities/deferredinflows/deferredoutflowsshouldbeanalyzed.Changesin

thebalanceofanasset/liability/deferredinflow/deferredoutflowthatarenot

at tributabletocashtransactions

shouldbeconsiderednoncashtransactions.

•

Thetransactionisaninvesting,capital,orfinancingactivity.Anoncashtransaction

shouldbedisclosedonlywhenit(haditbeenacashtransaction)meetsthedefinition

oftheinvesting,capitalandrelatedfinancing,ornoncapitalfinancingactivities

category.

Non‐CashInvesting,Non‐Capital

Financing,Capital&RelatedFinancing:

CreatingAMoreEducatedGeorgia

98

GASB Q&A2.32.1.Q—Whenisdisclosureofnoncashinformationrequir ed?(Q&A9‐28)[Amended2012and2013]

A— Paragraph37ofStatement9requiresthat“informationaboutallinvesting,capital,andfinancingactivitiesofa

governmentalenterpriseduringaperiodthataffectrecognizedassetsorliabilitiesbutdonotresultincashreceiptsor

cash

paymentsintheperiodshouldbereported.”Disclosureofnoncashinformationisrequiredifatransactionmeetsallofthese

threecharacteristics:

a. Isthetransactionnoncash?Questions2.15.1–2.15.6provideguidanceonidentifyingacashflow.Sometransactionsincludecash

andnoncashcomponents.Onlythecashportionofthetransactionshouldbepresentedinthestatementofcashflows.Thenoncash

portionshouldbeevaluatedfurther.

b. Doesthetransactionaffectrecognizedassetsorliabilities?Noncash

transactionsthatresultintherecognitionofassetsand

liabilitiesshouldbeanalyzed.Changesinthebalanceofanassetoraliabilitythatarenotattributabletocashtransactions shouldbe

considerednoncashtransactions.Forexample,whenanenterprisefundentersintoacapitalleaseforabuilding,anoncash

transactionoccursbecauseacapitalleaseobligationandthebuildingarerecordedinthestatementofnetposition.Theinceptionof

anoperatinglease,ontheotherhand,requiresnodisclosurebecausethereisnoeffectonthestatementofnetposition.

c. Isthetransactionaninvesting,capital,orfinancingactivity?

Anoncashtransactionshouldbedisclosedonlywhenit(haditbeen

acashtransaction)meetsthedefinitionoftheinvesting,capitalandrelatedfinancing,ornoncapitalfinancingactivitiescategory.For

example,acapitalleasetransactionmeetsthedefinitionofacapitalandrelatedfinancingactivity.However,acustomeraccount

receivable

balancethatwasusedtooffsetanaccountpayabletothatcustomerisanoperatingactivityandisnotrequiredtobe

disclosed.(SeeExamplesA–DandG–IinAppendix2‐1.)

Examplesofnoncashtransactionsincludeacquiringcapitalassetsbyassumingdirectlyrelatedliabilities,suchaspurchasinga

buildingbyincurringamortgagetothesellerorpurchasingoncreditandtakingdeliveryofvehiclesinthecurrentperiodand

payingfortheminafutureperiod,obtainingacapitalassetby

enteringintoacapitallease,refundingbondproceedsdelivered

directlytoanirrevocabletrust,changesinfairvalueofinvestmentsorderivativeinstruments,receivingdonatedcapitalassets

andtransfersofcapitalassetsbetweenfunds.

CreatingAMoreEducatedGeorgia

99

C

as

h Fl

ow

W

or

k

s

h

ee

t

Gifts and Grants Received for Other Than Capital Purposes

Fiscal Year Ended June 30, 2016

Change in Accounts Receivables:

227,429.23

Gifts and Grants Received for Other Than Capital Purposes Current Year Ending Receivable 1,000,000.00

N

Allowance for Uncollectible Accounts Receivable & Write-offs -

N

Prior Year Receivables Presumed Collected (772,570.77)

C

Other (Explain)

E

227,429.23

-

Change in Advances:

-

Recognition of Prior Year Ending Gifts and Grants Received for Other Than Capital Purposes Advances

N

Cash On-hand from Current Year Ending Advances

C

Other (Explain)

E

-

-

Change in Deferred Inflows of Resources - Service Concession Arrangement - Non-capital Asset Related

(3,400,000.00)

Amortization of Non-capital Asset Related Service Concession Arrangement Gifts 600,000.00

N

Cash Received in Current Year on New Non-capital Asset Related Service Concession Arrangements (4,000,000.00)

C

Other

(

Ex

p

lain

)

E

2. Change in net position accounts (balance sheet) should be further evaluated to determine if non-cash transcations are required to be disclosed in the Non-Cash Investing, Non-Capital Fin

a

And Capital And Related Financing Transactions section of the Statement of Cash Flows. Break out the cash and noncash items that make up the change in each balance sheet category by

e

amounts in the yellow highlighted cells.

CashFlowStatement

ComparetheCashFlowStatementtotheSRECNP

Thefollowingitemsshouldbecloseinamountsreported:

• TuitionandFees–NetofT&FandScholarshipAllowance

• Sales&Services–S&SRevenue

• GrantsandContracts– OperatingGrants/Contracts

• Paymentstosuppliers‐ sumofEmployeeBenefits,Travel,Utilities,andSuppliesandOtherServices

•

PaymentstoEmployees–sumofSalariesandOtherPersonalServices

• Scholarships/Fellowships– UsuallytiestoScholarship/FellowshipExpense

• StateAppropriations–ties100%toSRECNP,unlessareceivableissetup.

• GrantsandContractsReceivedforOtherthanCapitalPurposes– Nonoperating Grants/Contracts

• CapitalGifts– shouldequalthesumofCapitalGiftsandGrantsand

“Non‐CashGiftsofCapitalAssets”

• PurchasesofCapitalAssetsshouldagreetoadditionstoCapitalAssetsinthenotedisclosure,lessCapitalAssetsacquiredby

capitallease,lessgiftofCapitalAssets,alsoconsidereffectsofchangesinContractsPayable

• Proceedsfromthesaleofcapitalassetsshouldbea

truesourceofcash

• PrincipalPaidoncapitaldebtandleasesshouldagreetoreductionsofLeaseObligationsinnotedisclosurenetofanynon‐

cashactivity

• Interestpaidagreestointerestexpense

• InterestagreestointerestincomeplusorminustheeffectofFMVadjustment

• Exceptionwouldbeif

thegainorlossonsaleofinvestmentsreportedininvestmentincomeontheSRECNPisreportedas

ProceedsfromSalesandMaturitiesofInvestmentsontheCashFlowStatement

CommittedtoYourSuccess

100

CashFlowStatement

CommonErrorsontheCashFlowStatement:

• ProceedsandpurchasesforInvestingActivitiesnetted

• GiftsandGrantsreceivedforNon‐capitalpurposesreflectedasGiftsandGrants

receivedforCapitalPurposes

• Non‐CashCapitalgiftsincludedincashflowcapitalpurchases

• BeginningCashnotagreeingwithprioryearendingcashand

cashequivalents

CommittedtoYourSuccess

101

NoteDisclosures

CreatingAMoreEducatedGeorgia

102

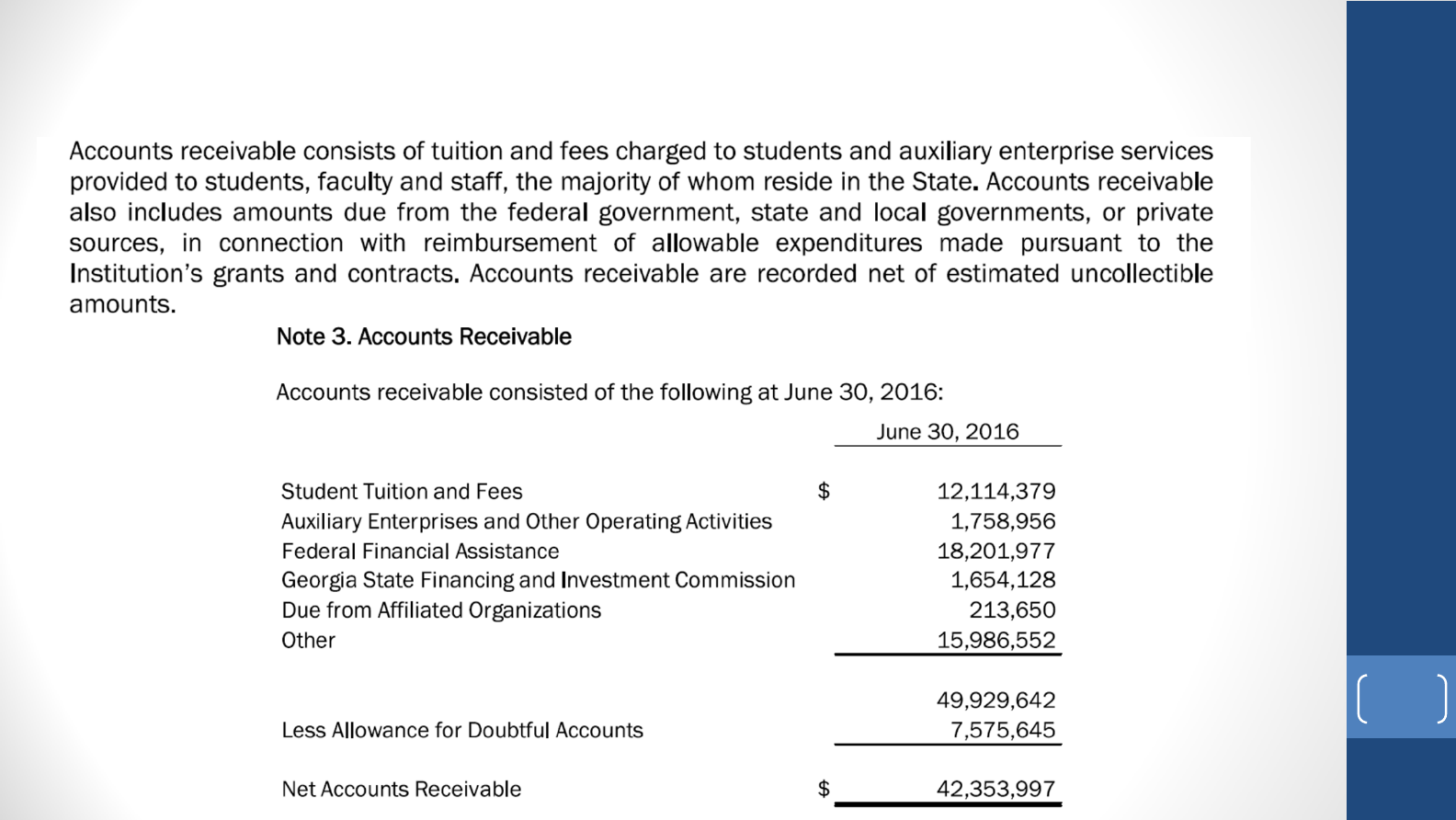

NoteDisclosures

• Note1– SummaryofSignificantAccountingPolicies

• NatureofOperations

• ReportingEntity

• BasisofAccountingandPresentation

• Definitions/DescriptionofAccounts

• Note2–DepositsandInvestments

• Note3–AccountsReceivables

• Note4– Inventories

• Note5–NotesReceivables

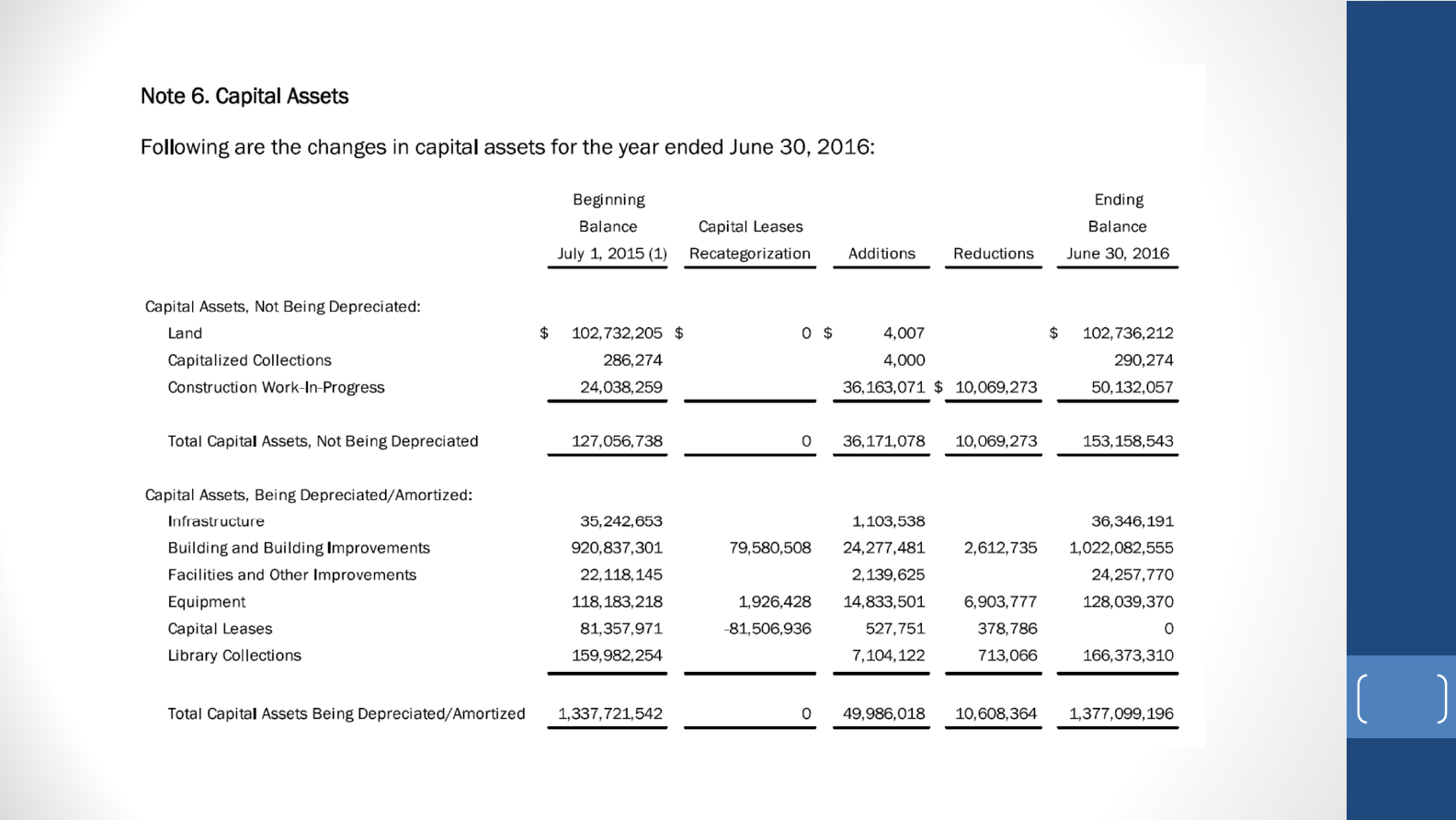

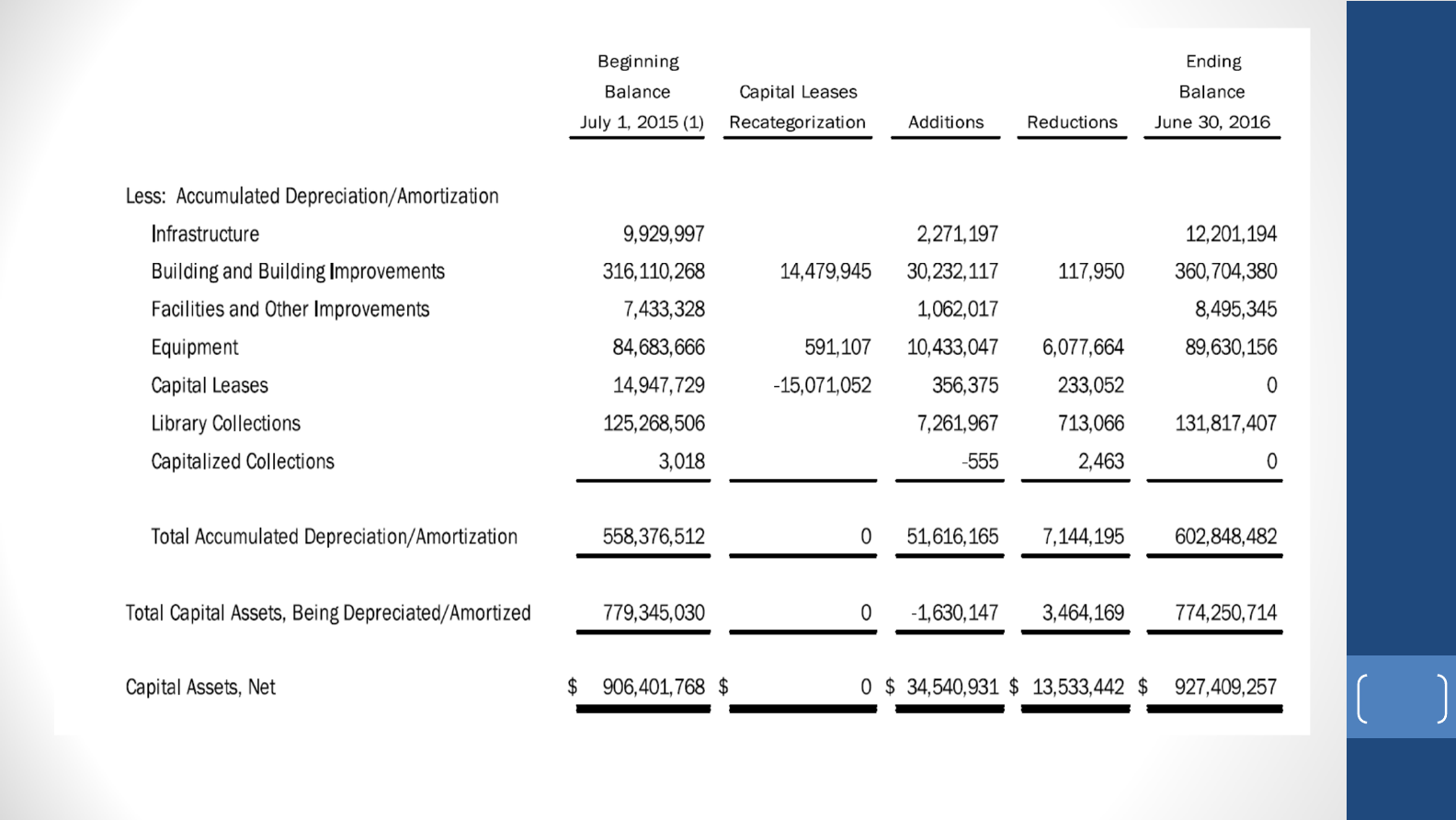

• Note6–CapitalAssets

• Note7–Advances

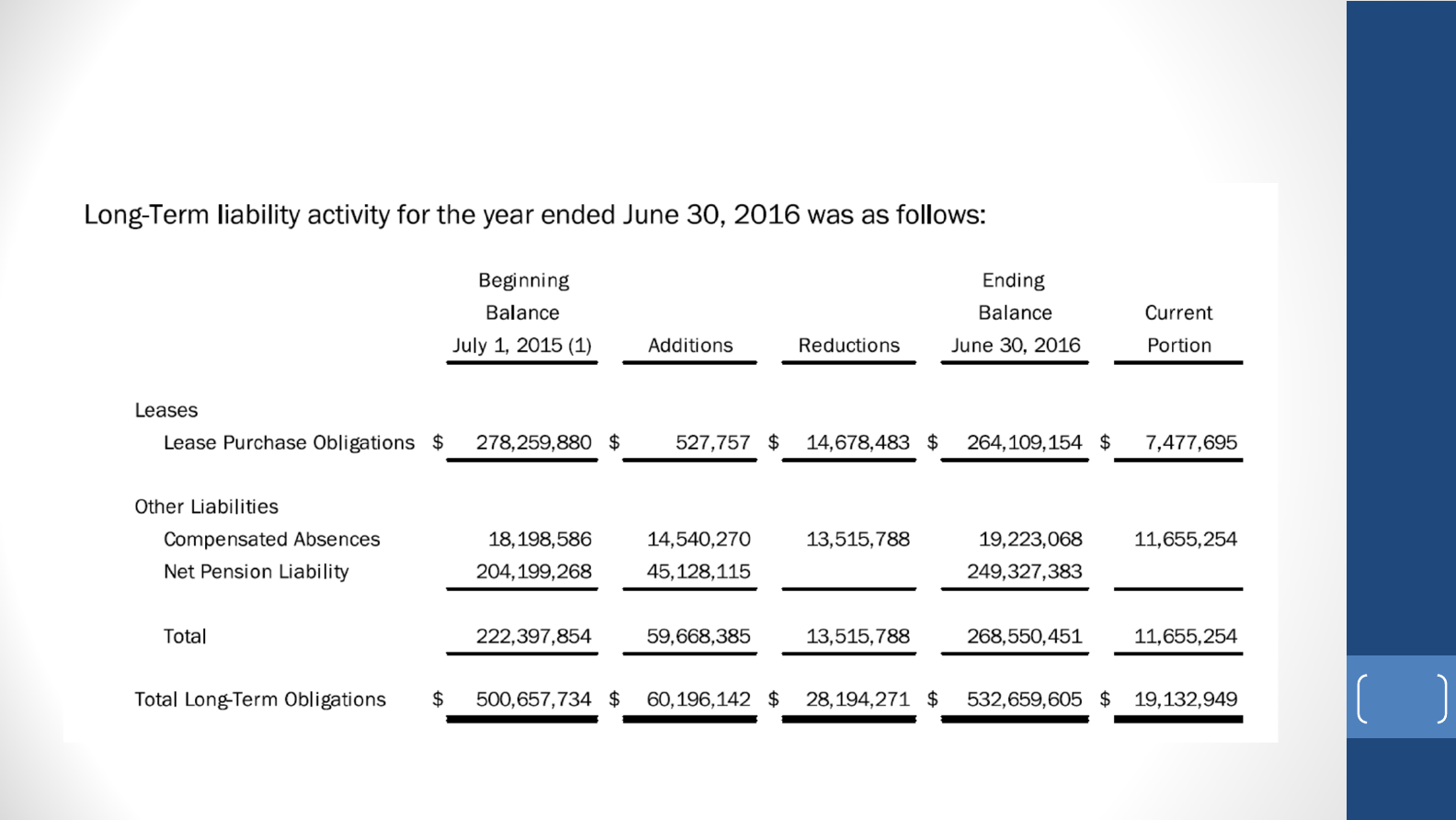

• Note8–LongTermLiabilities

CreatingAMoreEducatedGeorgia

103

NoteDisclosures

• Note9NetPosition

• Note10– E ndowments

• Note11–SignificantCommitments

• Note12–Leases

• Note13– RetirementPlans

• Note14–RiskManagement

• Note15– Contingencies

• Note16–OPEB

• Note17–NaturalversesFunctionalClassification

CreatingAMoreEducatedGeorgia

104

RequiredSupplementary

Informationand

SupplementaryInformation

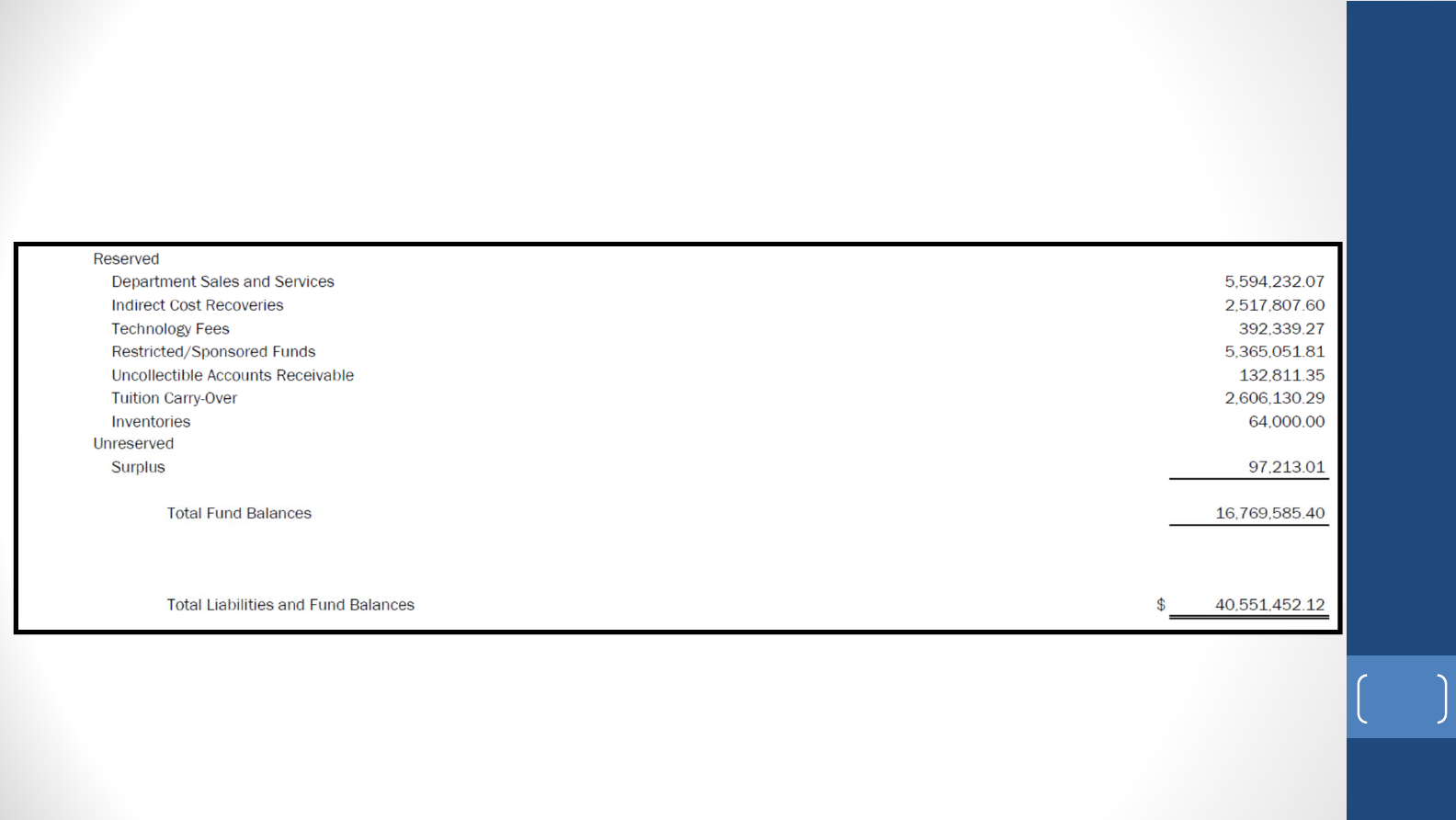

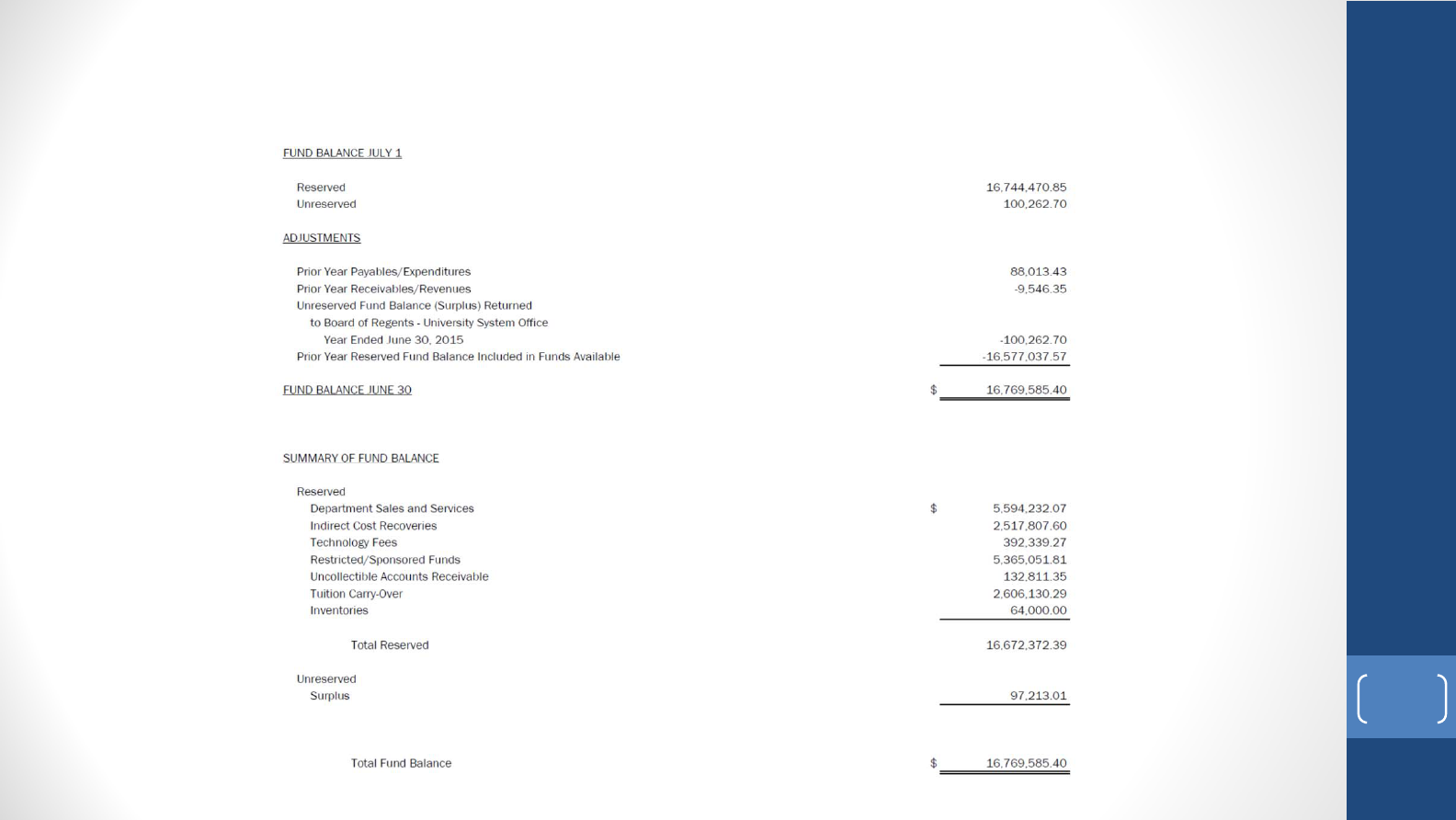

BudgetBasisFinancialStatements

FourBudgetBasisFinancialStatements

• BalanceSheet(Non‐GAAPBasis)– BudgetFund

• SummaryBudgetComparisonandSurplusAnalysisReport(Non‐GAAPBasis)

• StatementofFundsAvailableandExpendituresComparedtoBudgetbyProgram

andFundingSource(Non‐GAAPBasis)BudgetFund

• StatementofChangestoFundBalancebyProgramandFunding

Source(Non‐GAAP

Basis)BudgetFund

EnsurethatBudgetBasisStatementsaresupportedbyfinancialrecords.

106

BudgetBasisFinancialStatements

BalanceSheet(Non‐GAAPBasis)– BudgetFund

107

BudgetBasisFinancialStatementsBalanceSheet

(Non‐GAAPBasis)– BudgetFund

108

BudgetBasisFinancialStatements

SummaryBudgetComparisonandSurplusAnalysisReport(Non‐GAAPBasis)

109

BudgetBasisFinancialStatements

SummaryBudgetComparisonandSurplusAnalysisReport(Non‐GAAPBasis)

110

nVision reportproducesareportthatlooksliketheexcelspreadsheetpopulatingthe

firstcolumnwithactualsandencumbranceledgerinformation:

BCRnVision Report

ABC

ACTUALSandDETAIL_EN

Ledgers

BCRADJLedger

BudgetBasisAdjustments

June30,2015 TOTAL Mapping(ForColumnA)

BALANC E SHEETsectionofworksheet:

BS1 CashandCashEquivalents 11,726,166.55 0.00 11,726,166.55 Acct11xxxx(Excluding1198xx),158xxx

BS2 Investments 672,750.57 0.00 672,750.57 Acct1198xx,15xxxx(Excluding158xxx)

BS3 AccountsReceivable

BS4 StateAppropriation 0.00 0.00 0.00 Acct123xxx

BS5 FederalFinancialAssistance 484,225.20 0.00 484,225.20 Acct124xxx

BS6 Other 2,188,789.17 62,669.76 2,251,458.93 Acct12xxxx(Excluding123xxx,124xxx,126xxx)

BS7 MarginAllocation 0.00

BS8 PrepaidExpenditures 409,614.69 0.00 409,614.69 Acct

13xxxx

PeachtreeStateUniversity

BudgettoActualsReport‐FY2015

ASSETS

TuitionCarry‐ForwardCalculation

Add: PriorYearTuitionCarryForward

Add: CurrentYearRevenue

Subtract: CurrentYearExpenses

Add/Subtract: Adjustments

Add/Subtract: Transfers

Equals: CurrentYearFundBalance(CYFB)

IfCYFB<or=3%ofCYRevenue,thenCYFY=CYTuitionCarry‐Forward

IfCYFB>3%ofCYRevenue,then3%of

CYRev=TuitionCarry‐Forward;the

remainderofCYFBisSurplus

Note:Amountmaynotbeabletobecarriedforwardinentiretyifthereisadeficit

inanotherbudgetaryfund.

Encumbrances

Avalidobligationshouldbesupportedbythefollowing

information:

• ConfirmedVendor

• SpecificProject/Services/Goods

• SpecificPriceforProject/Services/Goods

• StateTimeorRangeofTimeofDelivery/Completion

DepartmentofAuditsand

Accounts

113

Encumbrances

Documentationofthistypeshouldbeavailablefromappropriatelyexecuted

purchaseorders,contracts,etc.Thepresenceoftheseconditionscorrespondto

theelementsofanenforceablecontractinthattheysupporttheconceptof

mutualassent,thatis,thepartieshaveagreedonthespecificproductor

serviceatthegivenpriceandtime.

Theseprinciplesshouldbeappliedwhenreviewingobligations,whichsupport

amountsforencumbrancepayablesappearingonthegeneralledgeratJune30.

Auditorswillreviewsubsidiarylistingforvalidity,payingparticularattentionto

obligationsover1yearold,individuallysignificantPOsorrecordedviamanual

journalentry.

DepartmentofAuditsand

Accounts

114

SurplusRules

LapsableFunds:

CancellationofPriorYearPurchaseOrdersautomaticallyrevertstosurplusunlessthe

cancellationwasassociatedwitha“likeandkind”situation

PartialliquidationofPriorYearPurchaseOrderautomaticallyrevertstosurpluswhere

vendorhasreceivedpaymentinfull

PreviouslywrittenoffA/Rcollectedinsubsequentperiodrevertstosurplus

Tuition

reservelimitationis3%ofCYRevenues.Reservesarenotcumulative.Any

cancelledPYPOsorPYcollectedwrittenoffA/RcanbereviewedinTuitionreserve

calculationifinstitutionwasnotatthe3%maximuminthepreviousyears

DepartmentofAuditsand

Accounts

115

FundGroups

CollegesandUniversities

• StateAppropriations(Fund10000)

• Tuition(Fund10500)

• OtherGeneral(Fund10600)

• DepartmentalSalesandServices/ContinuingEducation(Fund14000)

• IndirectCostRecoveries(Fund15000)

• TechnologyFeesFund(Fund16000)

• UnexpendedPlantFunds(Fund50000)

• OtherOrganizedActivities(Funds11XXX)

• RestrictedFunds(Funds20XXX)

• AuxiliaryEnterprises(Fund12XXX)

• StudentActivities(Fund13000)

• LoanFunds(Funds3XXXX)

• EndowmentFunds(Funds4XXXX)

• AgencyFunds(Funds6XXXX)

GAAPACCOUNTINGVSSTATEBUDGETBASISACCOUNTING

FundssubjecttoBudgetBasisAccounting

CollegesandUniversities

• StateAppropriations(Fund10000)

• Tuition(Fund10500)

• OtherGeneral(Fund10600)

• DepartmentalSalesandServices/ContinuingEducation(Fund14000)

• IndirectCostRecoveries(Fund15000)

• TechnologyFeesFund(Fund16000)

• RestrictedFunds(Fund20000)

• Unex pendedPlantFunds(Fund50000)

• OtherOrga nizedActivities(Fund11XXX)

• RestrictedFunds–OtherOrganizedActivities(Fund21XXX)

COLLEGEANDUNIVERSITYFUNDS

DESCRIPTIONSANDPURPOSES

StateAppropriations(Fund10000)

ConsideredoneoftheGeneralOperatingFunds,thisfundistobeusedonlyforstate

appropriatedrevenuesandexpensesrelatedtothecurrentoperationsofeducational

programsoftheCollegeorUniversity.

TuitionFund(Fund10500)

ConsideredoneoftheGeneralOperatingFunds,thisfundistobeusedonlyfortuition

revenuesandexpensesrelatedtothecurrentoperationsofeducationalprogramsofthe

CollegeorUniversity.Non‐lapsingfundsupto3%oftuitioncollected.

OtherGenera l (Fund10600)

ConsideredoneoftheGeneralOperatingFunds,thisfundistobeusedonlyforany

studentfeesnotreportedinanotherfund.

COLLEGEANDUNIVERSITYFUNDS

DESCRIPTIONSANDPURPOSES

OtherOrganizedActivities(Fund11XXX)

ThesefundsarespecifictotheUniversityofGeorgia,GeorgiaTech,Augusta

UniversityandtheBoardofRegentsCentralOffice.Revenuesand

Expensesforthesefundsaregearedtowardspecifictypesofresearch.

ExampleswouldbeAgriculturalResearch,ForestryResearch,Cooperative

ExtensionServicesandVeterinaryMedicineResearch.

COLLEGEANDUNIVERSITYFUNDS

DESCRIPTIONSANDPURPOSES

AuxiliaryEnterprises(Fund12XXX)

AuxiliaryEnterprisesarebasically“self‐supporting,forprofitbusiness

operationsoftheCollege/University”.Themostcommonauxiliary

operationswouldbeabookstoreoperation,cafeteriaservices,parking,and

campushousing.Revenues,expenditures,andbalancesofthevarious

businessoperationsconductedonacampushaveastheirexpressed

purposetheprovisionof

providingservicestostudents,faculty,andstaff.

Revenuesaredirectlyrelatedtocostsbutnotnecessarilyequalper

operatingunit.However,revenuesmustbesufficienttocovercostsonan

overallbasis.Inotherwords,thesefundsaretobeselfsupportingandare

notintendedtobesupplementedfromgeneral

operatingfunds.

Nostateappropriatedrevenuesarerecordedinthisfund,andbecausethis

fundisfor“self‐supporting”activities,balancesatyearendarenotsubject

tostatelapserules.

COLLEGEANDUNIVERSITYFUNDS

DESCRIPTIONSANDPURPOSES

StudentActivities(Fund13000)

FundusedtorecordactivityforStudentActivityPrograms.

StudentActivityfeesarerecordedasrevenuestothisfund.

ExamplesofStudentActivityfundsare:

StudentGovernment

StudentNewspaper

SocialandEnte rtainmentPrograms

Allexpenditureofthesefundsshouldbemadeinaccordancewith

theprovisionoftheStudentActivitiesBudgetwhichisprepared

annually.

Becausethesefundsaredesignatedforstudentprograms,they

arenotsubjecttostatelapserules.

COLLEGEANDUNIVERSITYFUNDS

DESCRIPTIONSANDPURPOSES

ContinuingEducationFund(Fund14000)

GeorgiaCode20‐3‐86allowsforContinuingEducationyear‐endfund

balancestobeexemptfromthestatelawconcerninglapsablefunds.

ThisfundisnotsubjecttosurplusunderthiscodesectionoftheGeorgia

Law.

RevenuesfortheContinuingEducationfundshallincludeonlythosefees

collected

forthepurposeofprovidingnon‐creditinstructionalcourses

andprogramsdesigned;primarilytomeettheeducationalneedsof

professionalandnon‐traditionalstudents.

COLLEGEANDUNIVERSITYFUNDS

DESCRIPTIONSANDPURPOSES

IndirectCostRecoveryFund(Fund15000)

TheOfficialCodeofGeorgia20‐3‐86alsoprovidesthatthefundbalancesinthisfund

arenotsubjecttolapseassurplusunderStatelaw.

RevenuesfortheIndirectCostRecoveryFundincludereimbursementstoinstitutions

thatrepresenta percentageof directcostschargedtofederal,state,andothergrants

andcontractsforadministrativeexpensesincludingdepreciationanduseallowances,

operationsandmaintenance,generaladministration,departmentaladministration,

libraryandstudentservices.

Thegrantsthatthesecostrecoveriesarebasedonaregenerallyhousedinthe

RestrictedFund.

CostRecoveriesthatrelatetoFederalGrantsshouldbeincludedinthegrantexpenses

reportedintheScheduleofFederalFinancialAssistance.

COLLEGEANDUNIVERSITYFUNDS

DESCRIPTIONSANDPURPOSES

TechnologyFeesFund(Fund16000)

Esta blishedtoaccountforactivityoffeesthatarenotsubjecttoState

surplusunderGa.Law20‐3‐86.

Therevenuesrecordedinthisfundareonlyfeescollectedfrom

mandatorytechnologyfeesprovidedforundersection704.021ofthe

BoardofRegentspolicymanual.

TheColleges/Universitiesmustpreparean

annualreporttotheBoardof

Regentsonhowthebalancesinthesefunds willbespent.

Balancescarriedforwardmustbespenttomeetinstitutional

technologicalneeds.

COLLEGEANDUNIVERSITYFUNDS

DESCRIPTIONSANDPURPOSES

RestrictedFunds(Fund2XXXX)

RestrictedfundsaregenerallycomprisedofFederal,State,Localand

othergrantsandcontractswhicharerestrictedforspecificpurposes.

Restrictedfundsshouldbeseparatelymanagedbyprojectsothat

revenuesandexpensesforeachgrantcanbeproperlyidentified.

Anyexcessfunds(revenueslessexpenses)leftatyearendarenot

subjecttobelapsedasStatesurplusbecausethesefundsareforspecific

purposesasdesignatedbythegrantorandanyfundsleftaftertheendof

thegrantorcontractmayhavetobereturnedtothegrantor.

TheUniversityofGeorgia,GeorgiaTech,AugustaUniversityandthe

RegentsCentralOfficemayhaverestrictedfundsrelatedtotheirOther

Organizedresearchactivities.

COLLEGEANDUNIVERSITYFUNDS

DESCRIPTIONSANDPURPOSES

LoanFunds(Fund3XXXX)

Housesfunds thataretobeloanedtostudentswhoneedfundstofinance

theireducation.

FederalLoanfundsaregenerallymadeupofPerkinsLoanfundsand

NursingLoanfunds.

Colleges/Universitiesalsoha veinstitutionalloanswhicharepredominately

fundedbyinstitutionalresources

Loanfundsarepredominatelybalancesheetactivitywithonlygiftsfor

principleandinterestchargesshownasrevenueandadministrativefees

andcollectioncostsshownasexpenses.

COLLEGEANDUNIVERSITYFUNDS

DESCRIPTIONSANDPURPOSES

EndowmentFunds40000(andSimilarFunds41000,42000)

GenerallyEndowmentfundsarefundswhichhavehadstipulationsputonthegift

instrumentwherebyprincipalistoremainintactandonlytheincomederivedfrom

investmentof thegiftmaybeexpended.

TheEndowmentFundmaybecomprisedofPermanentEndowments,Term

EndowmentsandQuasiEndowments.

PermanentEndowments areoneswhicharegivenbyoutsidedonorsandasaconditionofthegift,theprinciple

(corpus)mustremainintactpermanentlyandonlytheincomemaybespent.

TermEndowments aregivenbyoutsidedonorsbuttheexpendabilityoftheoriginalgiftisrestrictedonlyfora

period

oftime.Whenthetimerestrictionhasbeensatisfiedthecorpusalongwiththeearningsmaybespent.

Untilthattimeonlytheearningsmaybespent.

QuasiEndowment Fundsare InstitutionfundsthatthegoverningboardoftheInstitution,ratherthananoutside

donor,hasdeterminedthataportionofInstitutional

fundsaretobetreatedasanendowmentfund.The

principalisnotpermanentlyrestrictedortemporarilyrestrictedasisthecasewithendowmentfunds,andthe

Institutioncanchangethestatusofthesefundswhentheysochoose.

COLLEGEANDUNIVERSITYFUNDS

DESCRIPTIONSANDPURPOSES

PlantFunds(Funds50000and52000)

FundsreceivedfromStaterevenuesandothersourcesthatareutilizedforconstruction,