Tax Transcript Decoder©

COMPARISON OF 2019 TAX RETURN AND TAX TRANSCRIPT DATA

2021-22 Award Year (Version 1.0)

© 2020 NASFAA. All rights reserved.

©

2020 by National Association of Student Financial Aid Administrators (NASFAA). All rights reserved.

NASFAA has prepared this document for use only by personnel, licensees, and members. The information contained herein is protected by copyright.

No part of this document may be reproduced, translated, or transmitted in any form or by any means, electronically or mechanically, without prior written

permission from NASFAA.

NASFAA SHALL NOT BE LIABLE FOR TECHNICAL OR EDITORIAL ERRORS OR OMISSIONS CONTAINED HEREIN; NOR FOR INCIDENTAL OR

CONSEQUENTIAL DAMAGES RESULTING FROM THE FURNISHING, PERFORMANCE, OR USE OF THIS MATERIAL.

This publication contains material related to the federal student aid programs under Title IV of the Higher Education Act and/or Title VII or Title VIII of the

Public Health Service Act. While we believe that the information contained herein is accurate and factual, this publication has not been reviewed or

approved by the U.S. Department of Education, the Department of Health and Human Services, or the Department of the Interior.

The Free Application for Federal Student Aid (FAFSA

®

) is a registered trademark of the U.S. Department of Education.

NASFAA reserves the right to revise this document and/or change product features or specifications without advance notice.

November 2020

Informati

on in this publication is current as of November 19, 2020.

2

Tax Transcript Decoder©

Comparison of 2019 Tax Return and Tax Transcript Data

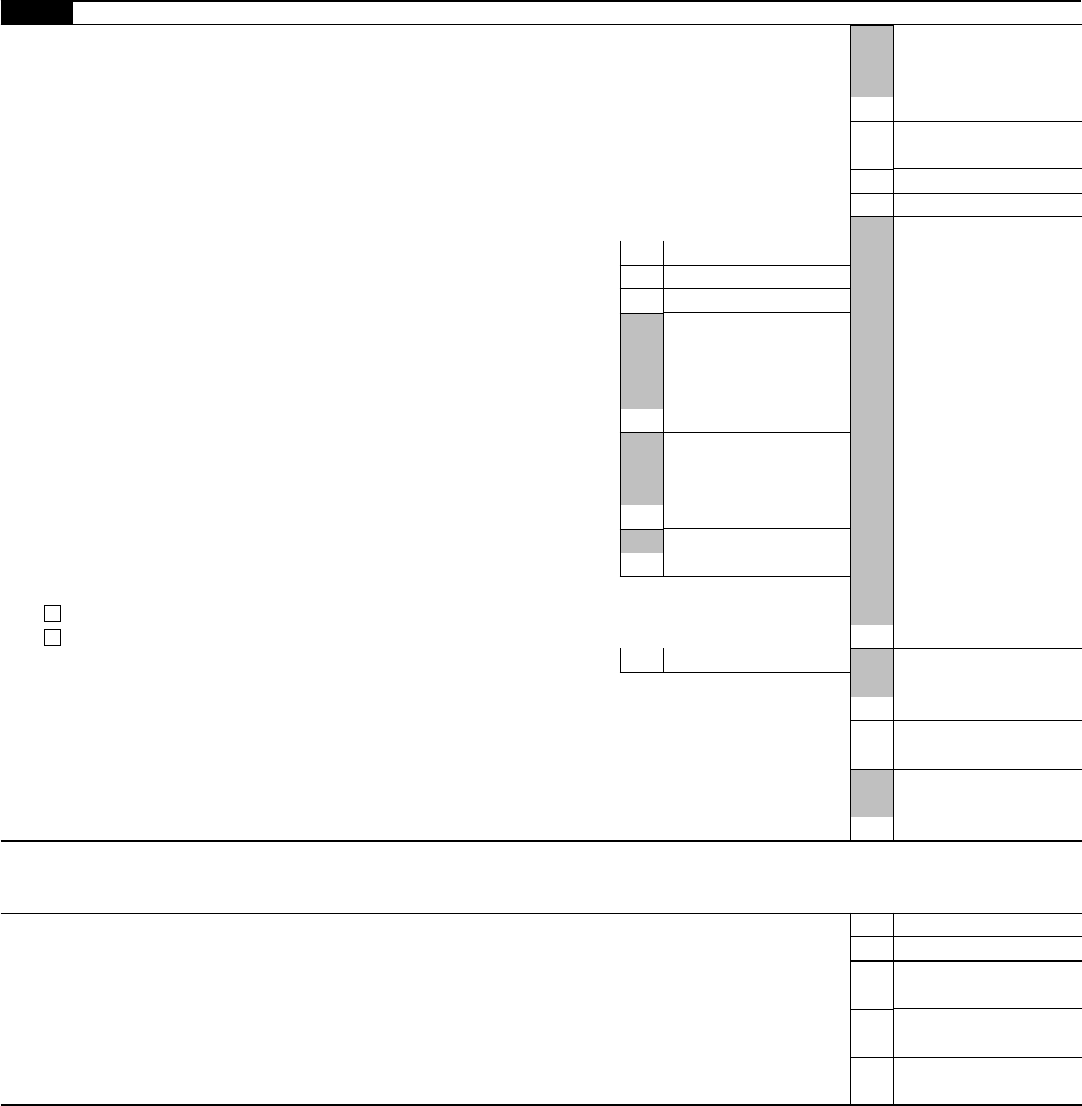

FAFSA instructions direct applicants to obtain information from certain lines on IRS income tax returns and schedules. For

the most part, the instructions identify the relevant lines on the tax form by line number. These line item numbers do not

appear on IRS tax transcripts. Instead, each item is identified by name. When verifying FAFSA data using tax transcripts, it is

important to identify the correct answer.

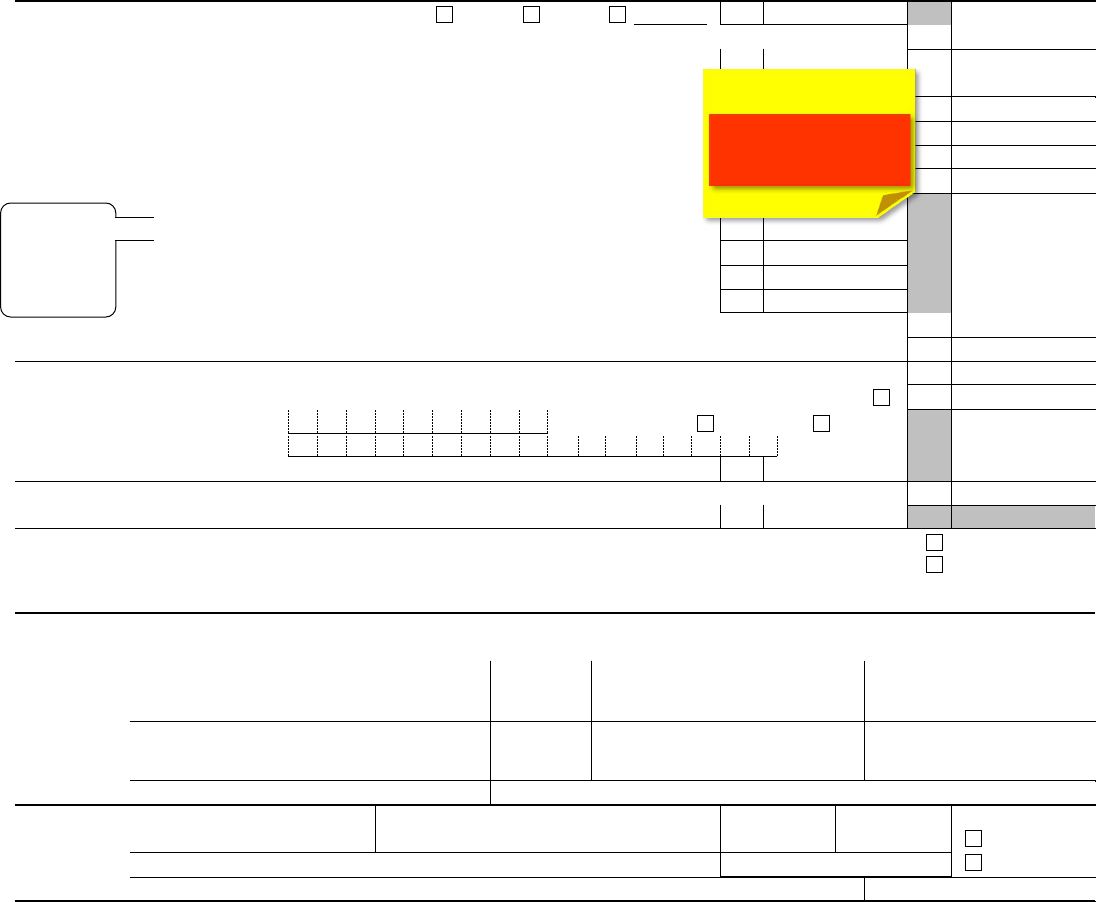

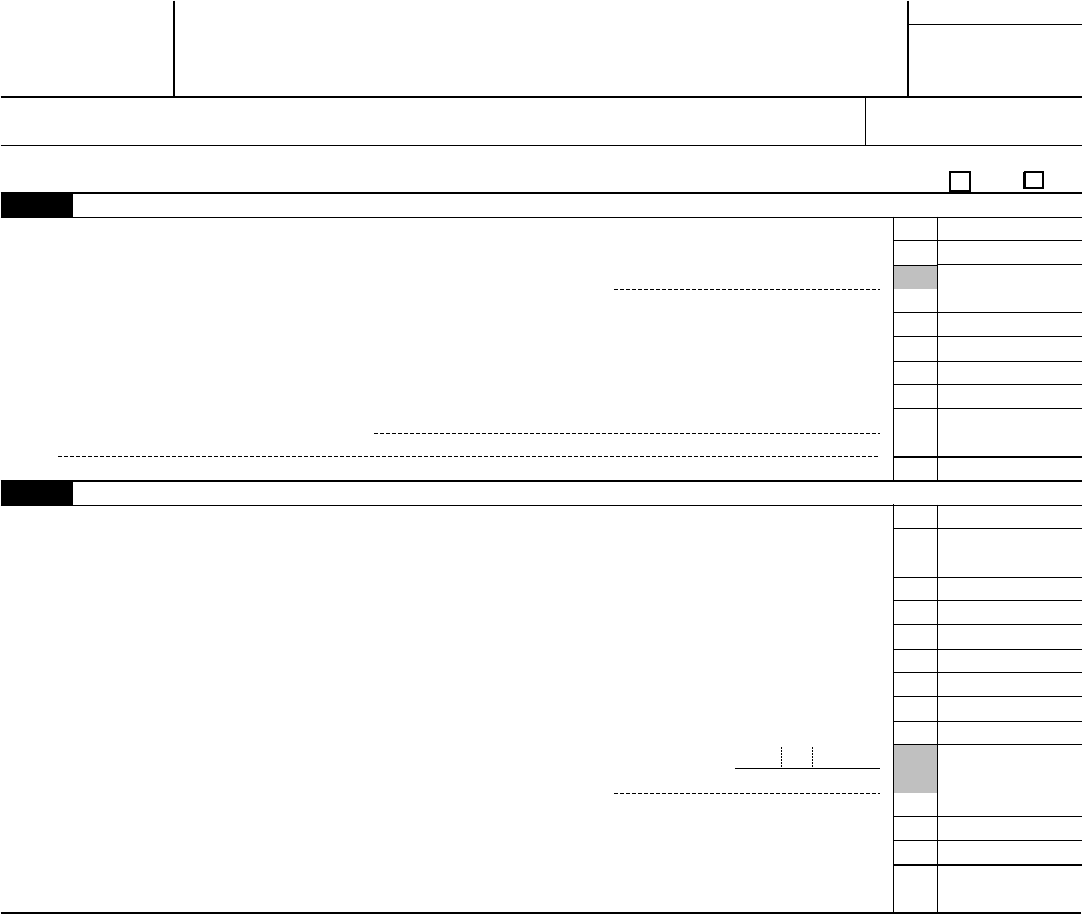

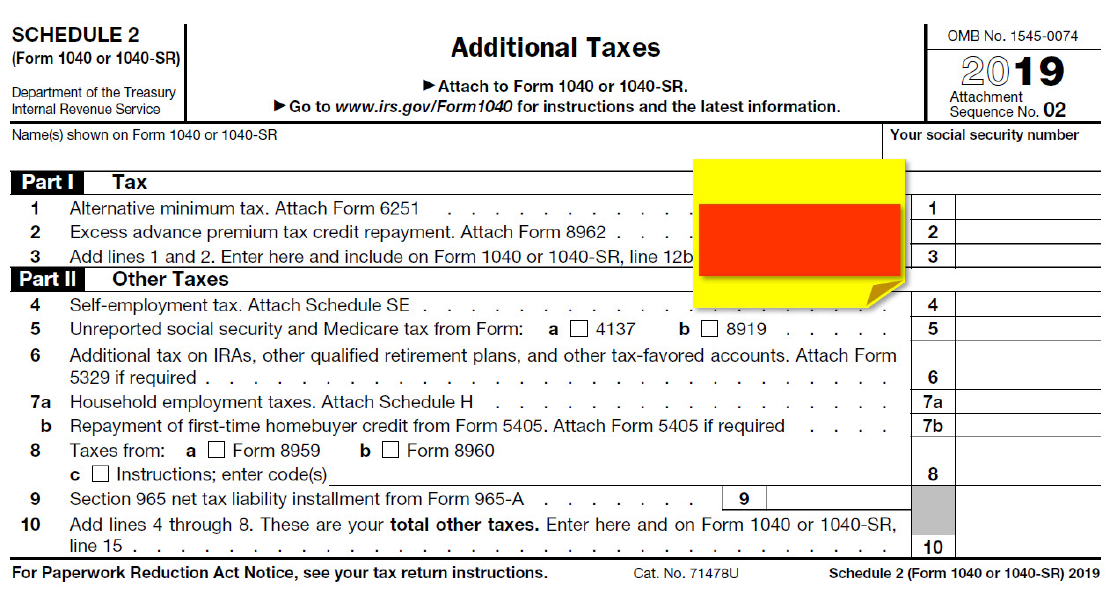

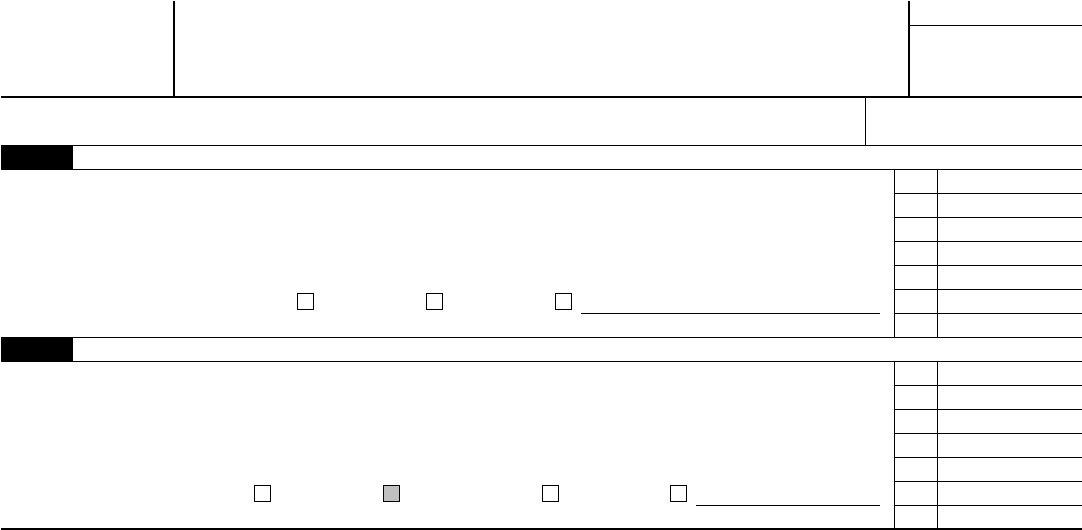

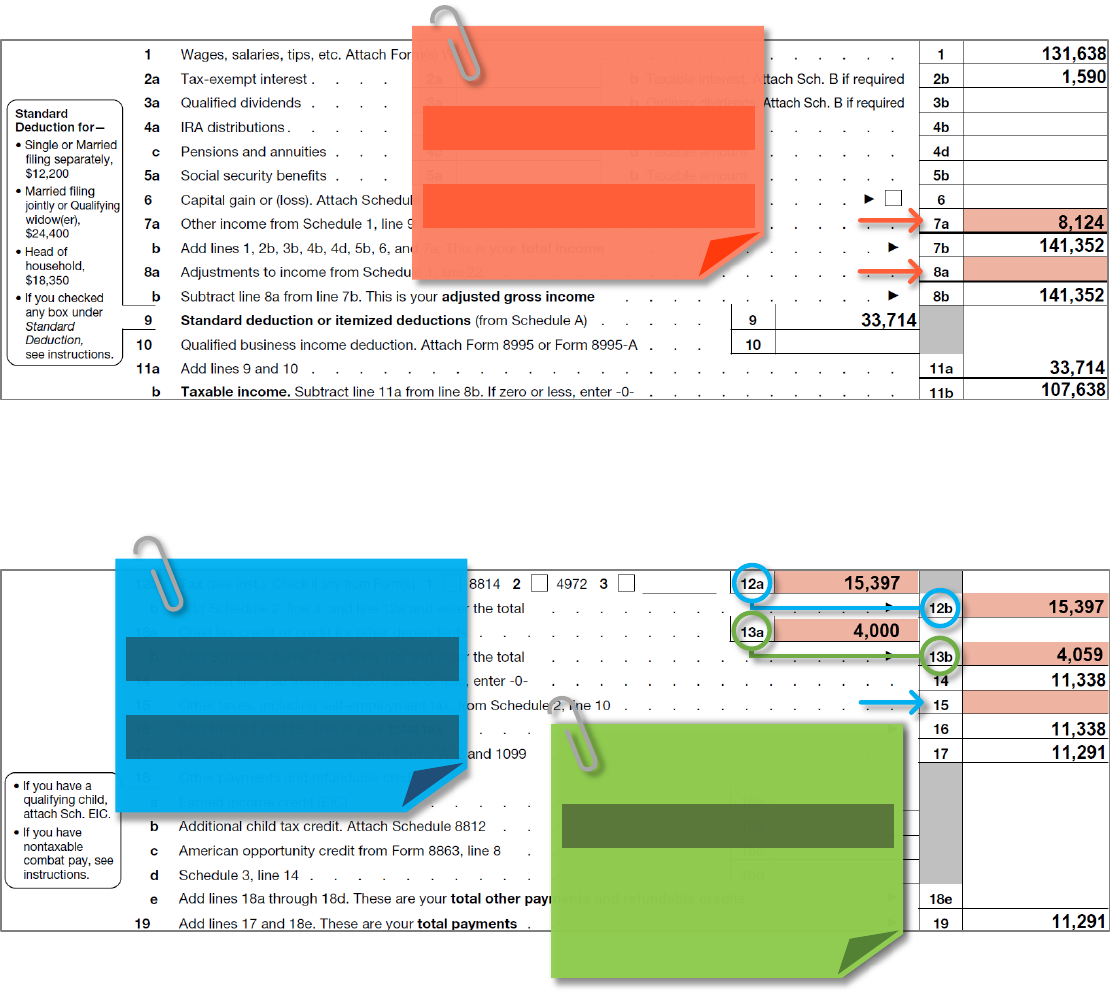

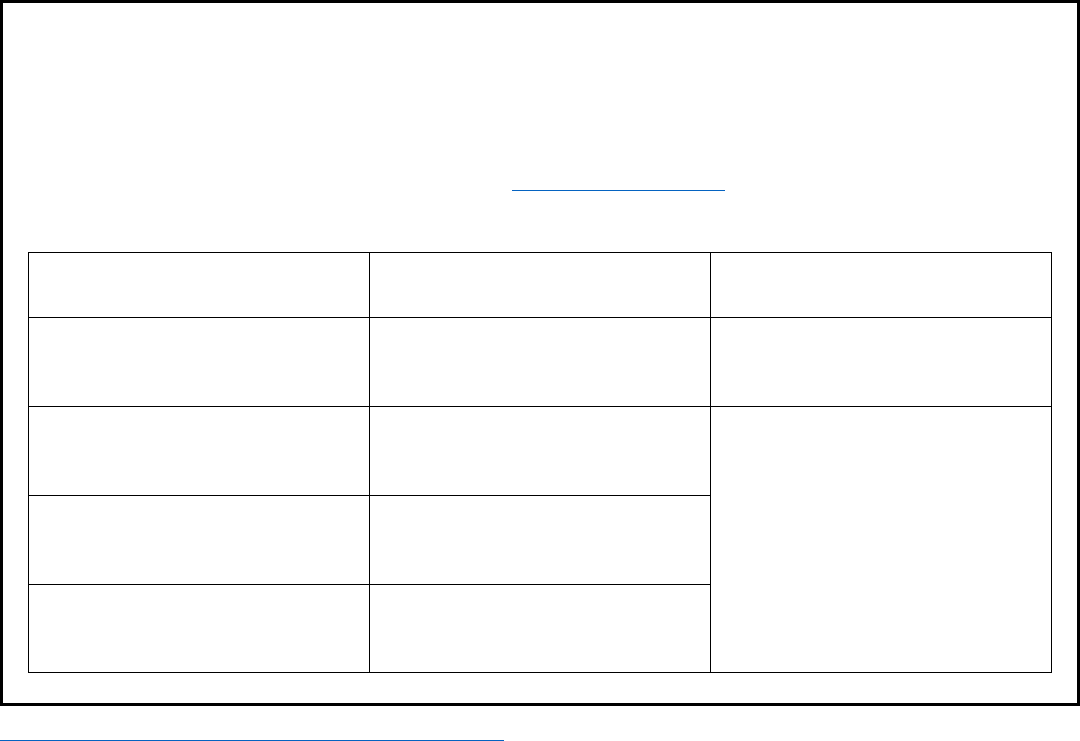

The following pages contain a sample tax return and corresponding tax return transcript. Relevant line items have been

highlighted as follows:

Red: information to help cross-reference tax return line items with corresponding data on the tax return transcript.

Yellow: tax return line items that are required verification data elements for the 2021-22 award year.

Blue: tax return line items listed in the FAFSA instructions, which should be reviewed for potential conflicting information.

2019 Tax Return Line Items for 2021-22 Verification

1040 and Schedules

2021-22

FAFSA Question

AGI 1040 Line 8b 36 (S) and 84 (P)

Income tax paid* 1040 Line 14 minus Schedule 2, Line 2 37 (S) and 85 (P)

Education credits

1040 Schedule 3, Line 3

43a (S) and 91a (P)

IRA deductions and payments 1040 Schedule 1, Line 15 + Line 19 44b (S) and 92b (P)

Tax-exempt interest income 1040 Line 2a 44d (S) and 92d (P)

Untaxed portions of IRA, pension, and

annuity distributions (withdrawals)*

1040 Lines (4a + 4c) minus (4b + 4d)

(exclude rollovers)

44e (S) and 92e (P)

2019 Tax Return Transcript Line Items for 2021-22 Verification

Tax Transcript

2021-22

FAFSA Question

AGI “ADJUSTED GROSS INCOME PER COMPUTER” 36 (S) and 84 (P)

Income tax paid*

“INCOME TAX AFTER CREDITS PER COMPUTER”

minus

“EXCESS ADVANCE PREMIUM TAX CREDIT

REPAYMENT AMOUNT”

37 (S) and 85 (P)

Education credits “EDUCATION CREDIT PER COMPUTER” 43a (S) and 91a (P)

IRA deductions and payments

“KEOGH/SEP CONTRIBUTION DEDUCTION”

plus

“IRA DEDUCTION PER COMPUTER”

44b (S) and 92b (P)

Tax-exempt interest income “TAX-EXEMPT INTEREST” 44d (S) and 92d (P)

Untaxed portions of IRA, pension, and

annuity distributions (withdrawals)*

“TOTAL IRA DISTRIBUTIONS” plus

“TOTAL PENSIONS AND ANNUITIES”

minus

“TAXABLE IRA DISTRIBUTIONS” plus

“TAXABLE PENSION/ANNUITY AMOUNT”

(exclude rollovers)

44e (S) and 92e (P)

3

*If negative, enter zero.

© 2020 NASFAA. All rights reserved.

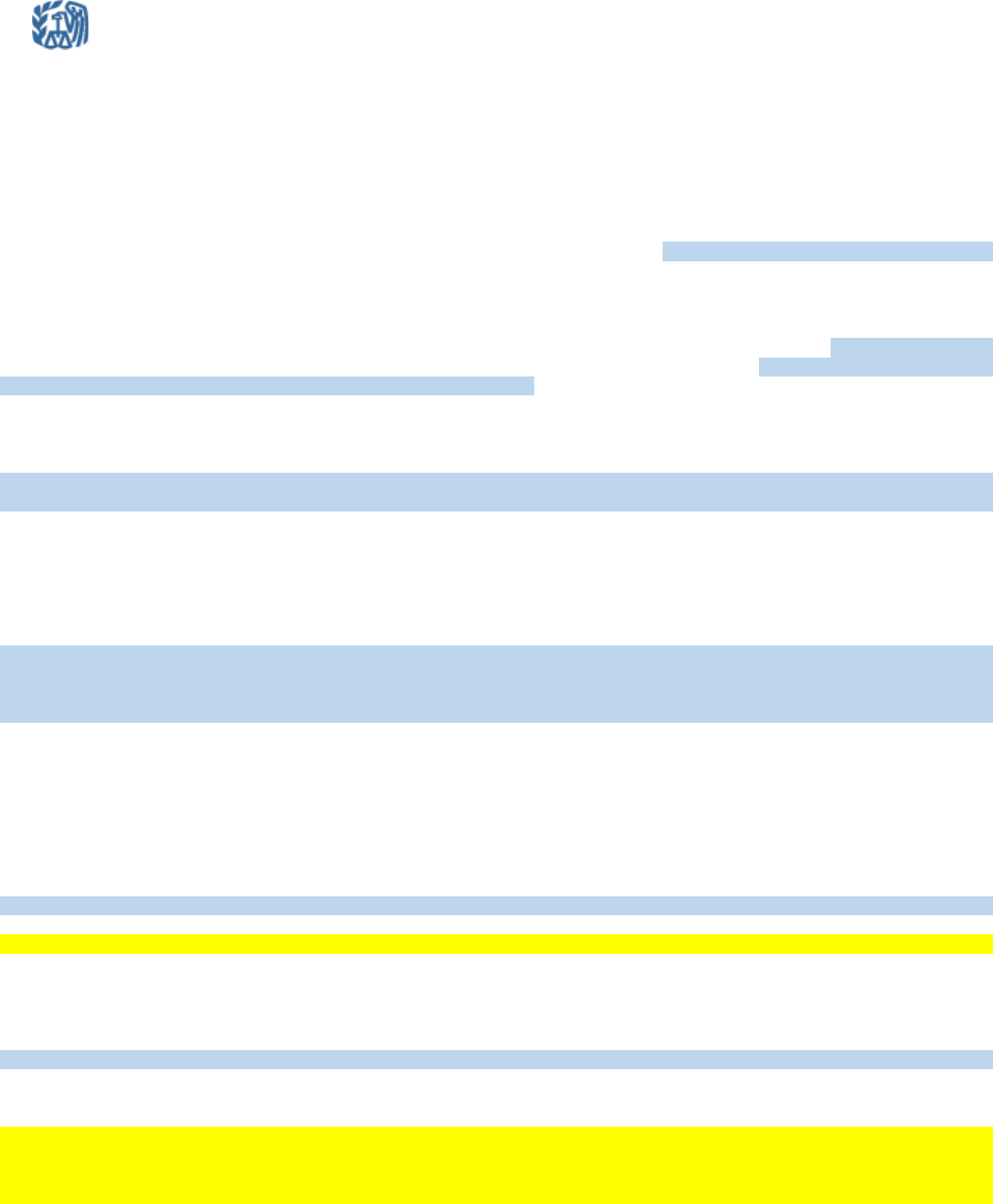

Form

1040

(99)

U.S. Individual Income Tax Return

2019

OMB No. 1545-0074

IRS Use Only—Do not write or staple in this space.

Filing Status

Check only

one box.

Single Married filing jointly

Married filing separately (MFS)

Head of household (HOH)

Qualifying widow(er) (QW)

If you checked the MFS box, enter the name of spouse. If you checked the HOH or QW box, enter the child’s name if the qualifying person is

a child but not your dependent.

▶

Last name Your social security number

Last name

Spouse’s social security number

Apt. no.

Foreign country name Foreign province/state/county

Foreign postal code

Presidential Election Campaign

Check here if you, or your spouse if filing

jointly, want $3 to go to this fund.

Checking a box below will not change your

tax or refund.

You

Spouse

Standard

Deduction

Someone can claim: You as a dependent Your spouse as a dependent

Spouse itemizes on a separate return or you were a dual-status alien

Age/Blindness

You:

Were born before January 2, 1955

Are blind

Spouse: Was born before January 2, 1955 Is blind

If more than four dependents,

see instructions and ✓ here

▶

Dependents (see instructions):

(2) Social security number (3) Relationship to you (4) ✓ if qualifies for (see instructions):

(1) First name Last name

Child tax credit Credit for other dependents

1 Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . . . . . . . 1

2a Tax-exempt interest . . . . 2a b

Taxable interest. Attach Sch. B if required

2b

3a Qualified dividends . . . . 3a b

Ordinary dividends. Attach Sch. B if required

3b

4a IRA distributions . . . . . 4a b Taxable amount . . . . . . 4b

c Pensions and annuities . . . 4c d Taxable amount . . . . . . 4d

5a Social security benefits . . . 5a b Taxable amount . . . . . . 5b

6 Capital gain or (loss). Attach Schedule D if required. If not required, check here . . . . . . .

▶

6

7a Other income from Schedule 1, line 9 . . . . . . . . . . . . . . . . . . . . 7a

b Add lines 1, 2b, 3b, 4b, 4d, 5b, 6, and 7a. This is your total income . . . . . . . . . . .

▶

7b

8 a Adjustments to income from Schedule 1, line 22 . . . . . . . . . . . . . . . . . 8a

b Subtract line 8a from line 7b. This is your adjusted gross income . . . . . . . . . . .

▶

8b

9 Standard deduction or itemized deductions (from Schedule A) . . . . .

Standard

Deduction for—

• Single or Married

filing separately,

$12,200

• Married filing

jointly or Qualifying

widow(er),

$24,400

• Head of

household,

$18,350

• If you checked

any box under

Standard

Deduction,

see instructions.

9

10 Qualified business income deduction. Attach Form 8995 or Form 8995-A . . . 10

11a Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . 11a

b Taxable income. Subtract line 11a from line 8b. If zero or less, enter -0- . . . . . . . . . . .

11b

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 11320B

Form 1040 (2019)

TAMEZxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

1,590

107,638

33,714

xxxxxxxx141,352

SAMUEL J TAMEZxxxxxxxxxxxxxxxxxxxxxxxx

AMOS J TAMEZxxxxxxxxxxxxxxxxxxxxxxxxxx

TAMEZxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxx131,638

✔

✔

8,124

xxxxxxxx141,352

SON

SON

33,714

✔

Your first name and middle initial

CAROLINA Mxxxxxxxxxxxxxxxxxxxxxxx

If joint return, spouse’s first name and middle initial

MARCOS Sxxxxxxxxxxxxxxxxxxxxxxxxx

Home address (number and street). If you have a P.O. box, see instructions.

87412 W POLTAVA WAY

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

SPRINGFIELD, OR 99999

XXX | XX | 2230

XXX | XX | 4672

XXX | XX | 6772

XXX | XX | 8534

xxxxxxxx131,638

xxxxxxxx131,638

xxxxxxxxx131,638

xxxxxxxx131,638

xxxxxxxx131,638

Sample IRS Form 1040, Page 1: Marcos and Carolina Tamez

4

Department of the Treasury—Internal Revenue Service

© 2020 NASFAA. All rights reserved.

*Income earned from work: IRS Form 1040–Line 1 , Schedule 1–Lines 3 and 6 , Schedule K-1 (IRS Form 1065)–Box 14 (Code A). If any individual earning item is

negative, do not include that item in your calculation.

*

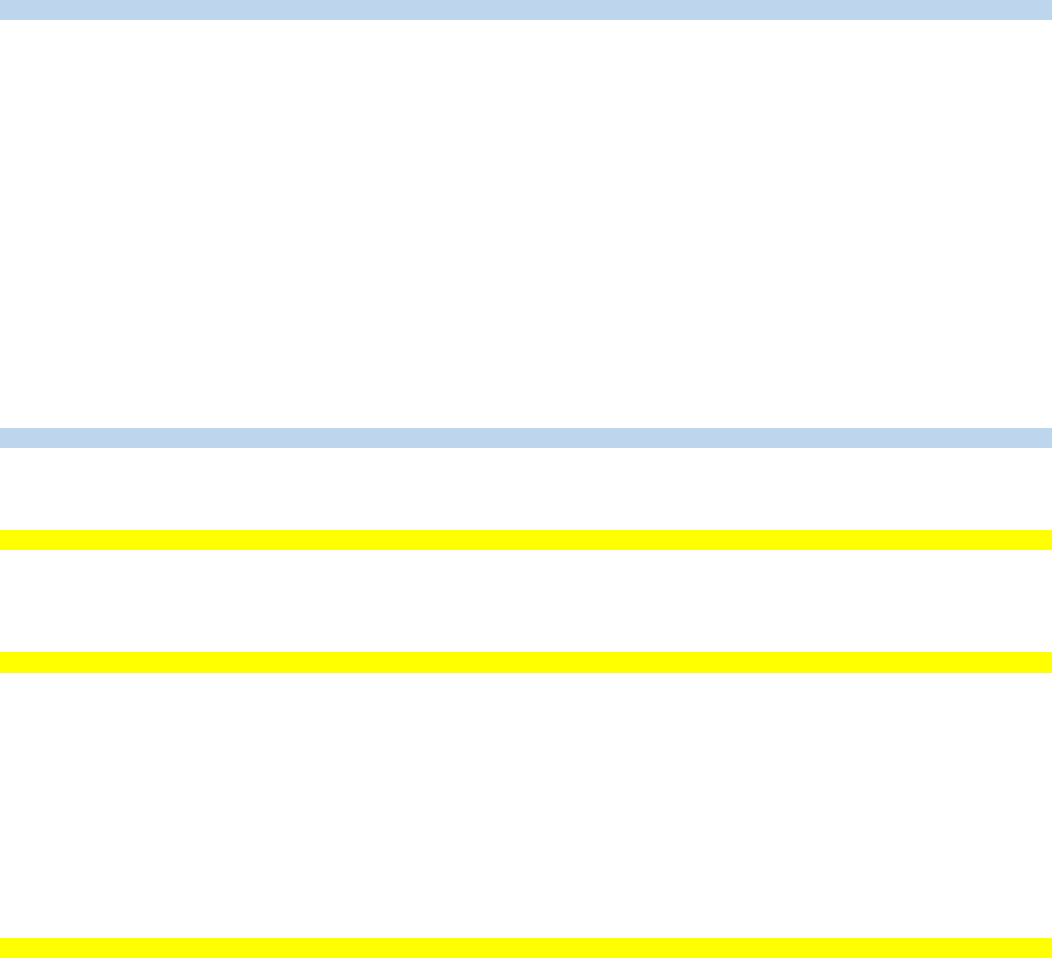

Form 1040 (2019)

Page 2

12a

Tax (see inst.)

Check if any from Form(s):

1 8814 2 4972 3 12a

b Add Schedule 2, line 3, and line 12a and enter the total . . . . . . . . . . . . . .

▶

12b

13

a Child tax credit or credit for other dependents . . . . . . . . . .

13a

b Add Schedule 3, line 7, and line 13a and enter the total . . . . . . . . . . . . . .

▶

13b

14 Subtract line 13b from line 12b. If zero or less, enter -0- . . . . . . . . . . . . . . . 14

15 Other taxes, including self-employment tax, from Schedule 2, line 10 . . . . . . . . . . . . 15

16 Add lines 14 and 15. This is your total tax . . . . . . . . . . . . . . . . . .

▶

16

17 Federal income tax withheld from Forms W-2 and 1099 . . . . . . . . . . . .

.

. . 17

18 Other payments and refundable credits:

a Earned income credit (EIC) . . . . . . . . . . . . . . .

• If you have a

qualifying child,

attach Sch. EIC.

• If you have

nontaxable

combat pay, see

instructions.

18a

b Additional child tax credit. Attach Schedule 8812 . . . . . . . . . 18b

c American opportunity credit from Form 8863, line 8 . . . . . . . . 18c

d Schedule 3, line 14 . . . . . . . . . . . . . . . . . 18d

e

Add lines 18a through 18d. These are your total other payments and refundable credits . . . . .

▶

18e

19 Add lines 17 and 18e. These are your total payments . . . . . . . . . . . . . . .

▶

19

Refund

20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid . . . . . . 20

21a Amount of line 20 you want refunded to you. If Form 8888 is attached, check here . . . . . .

▶

21a

Direct deposit?

See instructions.

▶

b Routing number

▶

c Type: Checking Savings

▶

d Account number

22 Amount of line 20 you want applied to your 2020 estimated tax . . . .

▶

22

Amount

You Owe

23 Amount you owe. Subtract line 19 from line 16. For details on how to pay, see instructions . . . . .

▶

23

24 Estimated tax penalty (see instructions) . . . . . . . . . . .

▶

24

Third Party

Designee

(Other than

paid preparer)

Do you want to allow another person (other than your paid preparer) to discuss this return with the IRS? See instructions.

Yes. Complete below.

No

Designee’s

name

▶

Phone

no.

▶

Personal identification

number (PIN)

▶

Sign

Here

Joint return?

See instructions.

Keep a copy for

your records.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true,

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature Date Your occupation

If the IRS sent you an Identity

Protection PIN, enter it here

(see inst.)

Spouse’s signature. If a joint return, both must sign. Date Spouse’s occupation

If the IRS sent your spouse an

Identity Protection PIN, enter it here

(see inst.)

Phone no.

Email address

▲

Paid

Preparer

Use Only

Preparer’s name

Preparer’s signature Date

PTIN

Check if:

3rd Party Designee

Self-employed

Firm’s name

▶

Phone no.

Firm’s address

▶

Firm’s EIN

▶

Go to www.irs.gov/Form1040 for instructions and the latest information.

Form 1040 (2019)

ADMINISTRATOR

xxxxxxxx11,338

11,291

11,291

xxxxxxxx11,338

15,397

47

MANAGER

4,000

4,059

Carolina M. Tamez

04/15/2020

04/15/2020

15,397

Income Tax Paid*

1040 Line 14

minus

Schedule 2, Line 2

*If negative, enter zero

Sample IRS Form 1040, Page 2: Marcos and Carolina Tamez

5

© 2020 NASFAA. All rights reserved.

Additional Income and Adjustments to Income

▶

Attach to Form 1040 or 1040-SR.

▶

Go to www.irs.gov/Form1040 for instructions and the latest information.

OMB No. 1545-0074

2019

Attachment

Sequence No.

01

Name(s) shown on Form 1040 or 1040-SR Your social security number

At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any

virtual currency? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

Part I Additional Income

1 Taxable refunds, credits, or offsets of state and local income taxes . . . . . . . . . . . . 1

2a Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

b

Date of original divorce or separation agreement (see instructions)

▶

3 Business income or (loss). Attach Schedule C . . . . . . . . . . . . . . . . . . . 3

4 Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . . . . . . 4

5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E . . . . . 5

6 Farm income or (loss). Attach Schedule F . . . . . . . . . . . . . . . . . . . . 6

7 Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . 7

8

Other income. List type and amount

▶

8

9 Combine lines 1 through 8. Enter here and on Form 1040 or 1040-SR, line 7a . . . . . . . .

9

Part II Adjustments to Income

10 Educator expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11

Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach

Form 2106 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Health savings account deduction. Attach Form 8889 . . . . . . . . . . . . . . . . 12

13 Moving expenses for members of the Armed Forces. Attach Form 3903 . . . . . . . . . . 13

14 Deductible part of self-employment tax. Attach Schedule SE . . . . . . . . . . . . . . 14

15 Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . . . . . . . 15

16 Self-employed health insurance deduction . . . . . . . . . . . . . . . . . . . . 16

17 Penalty on early withdrawal of savings . . . . . . . . . . . . . . . . . . . . . 17

18a Alimony paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18a

b Recipient’s SSN . . . . . . . . . . . . . . . . . . . . .

▶

c

Date of original divorce or separation agreement (see instructions)

▶

19 IRA deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Student loan interest deduction . . . . . . . . . . . . . . . . . . . . . . . 20

21

Tuition and fees. Attach Form 8917 . . . . . . . . . . . . . . . . . . . . . .

21

22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040 or

1040-SR, line 8a . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 71479F Schedule 1 (Form 1040 or 1040-SR) 2019

✔

FORM 1099 MISC INCOME 8124

8,124

8,124

xxxxxxx131,638

xxxxxxx131,638

xxxxxxx131,638

xxxxxxx131,638

xxxxxxx131,638

xxxxxxx131,638

Sample IRS Form 1040 Schedule 1: Marcos and Carolina Tamez

SCHEDULE 1

(Form 1040 or 1040-SR)

Department of the Treasury

Internal Revenue Service

6

© 2020 NASFAA. All rights reserved.

*Income earned from work: IRS Form 1040–Line 1 , Schedule 1–Lines 3 and 6, Schedule K-1 (IRS Form 1065)–Box 14 (Code A). If any individual earning item is

negative, do not include that item in your calculation.

*

*

Sample IRS Form 1040 Schedule 2 (not filed by Carolina and Marcos)

7

Income Tax Paid*

1040 Line 14

minus

Schedule 2, Line 2

*If negative, enter zero

© 2020 NASFAA. All rights reserved.

Part I

SCHEDULE 3

(Form 1040 or 1040-SR)

Department of the Treasury

Internal Revenue Service

Additional Credits and Payments

▶

Attach to Form 1040 or 1040-SR.

▶

Go to www.irs.gov/Form1040 for instructions and the latest information.

OMB No. 1545-0074

2019

Attachment

Sequence No.

03

Name(s) shown on Form 1040 or 1040-SR

Your social security number

Part I Nonrefundable Credits

1 Foreign tax credit. Attach Form 1116 if required . . . . . . . . . . . . . . . . . . 1

2 Credit for child and dependent care expenses. Attach Form 2441 . . . . . . . . . . . . 2

3 Education credits from Form 8863, line 19 . . . . . . . . . . . . . . . . . . . . 3

4 Retirement savings contributions credit. Attach Form 8880 . . . . . . . . . . . . . . 4

5 Residential energy credit. Attach Form 5695 . . . . . . . . . . . . . . . . . . . 5

6 Other credits from Form: a 3800 b 8801 c 6

7 Add lines 1 through 6. Enter here and include on Form 1040 or 1040-SR, line 13b . . . . . . .

7

Part II Other Payments and Refundable Credits

8 2019 estimated tax payments and amount applied from 2018 return . . . . . . . . . . . 8

9 Net premium tax credit. Attach Form 8962 . . . . . . . . . . . . . . . . . . . . 9

10 Amount paid with request for extension to file (see instructions) . . . . . . . . . . . . . 10

11 Excess social security and tier 1 RRTA tax withheld . . . . . . . . . . . . . . . . . 11

12 Credit for federal tax on fuels. Attach Form 4136 . . . . . . . . . . . . . . . . . . 12

13 Credits from Form: a 2439 b Reserved c 8885 d 13

14 Add lines 8 through 13. Enter here and on Form 1040 or 1040-SR, line 18d . . . . . . . . .

14

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 71480G Schedule 3 (Form 1040 or 1040-SR) 2019

59

59

xxxxxxxxx131,638

Sample IRS Form 1040 Schedule 3: Marcos and Carolina Tamez

8

© 2020 NASFAA. All rights reserved.

2019

Itemized Deductions

SCHEDULE A

(Form 1040 or 1040-SR)

(Rev. January 2020)

Department of the Treasury

Internal Revenue Service (99)

▶

Go to www.irs.gov/ScheduleA for instructions and the latest information.

▶

Attach to Form 1040 or 1040-SR.

Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16.

OMB No. 1545-0074

Attachment

Sequence No.

07

Name(s) shown on Form 1040 or 1040-SR

Medical

and

Dental

Expenses

Caution: Do not include expenses reimbursed or paid by others.

1 Medical and dental expenses (see instructions) . . . . . . . 1

2

Enter amount from Form 1040 or 1040-SR, line 8b

2

3 Multiply line 2 by 7.5% (0.075) . . . . . . . . . . . . . 3

4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- . . . . . . . . . 4

Taxes You

Paid

5 State and local taxes.

a

State and local income taxes or general sales taxes. You may include

either income taxes or general sales taxes on line 5a, but not both. If

you elect to include general sales taxes instead of income taxes,

check this box . . . . . . . . . . . . . . . . .

▶

5a

b

State and local real estate taxes (see instructions) . . . . . . .

5b

c

State and local personal property taxes . . . . . . . . . .

5c

d

Add lines 5a through 5c . . . . . . . . . . . . . . .

5d

e Enter the smaller of line 5d or $10,000 ($5,000 if married filing

5e

separately) . . . . . . . . . . . . . . . . . . .

6

Other taxes. List type and amount

▶

6

7 Add lines 5e and 6 . . . . . . . . . . . . . . . . . . . . . . .

7

Interest

You Paid

Caution: Your

mortgage interest

deduction may be

limited (see

instructions).

8 Home mortgage interest and points. If you didn’t use all of your home

mortgage loan(s) to buy, build, or improve your home, see

instructions and check this box . . . . . . . . . . .

▶

a Home mortgage interest and points reported to you on Form 1098.

See instructions if limited . . . . . . . . . . . . . .

8a

b

Home mortgage interest not reported to you on Form 1098. See

instructions if limited. If paid to the person from whom you bought the

home, see instructions and show that person’s name, identifying no.,

and address . . . . . . . . . . . . . . . . . . .

▶

8b

c Points not reported to you on Form 1098. See instructions for special

rules . . . . . . . . . . . . . . . . . . . . .

8c

d Mortgage insurance premiums (see instructions) . . . . . . . 8d

e Add lines 8a through 8d . . . . . . . . . . . . . . . 8e

9 Investment interest. Attach Form 4952 if required. See instructions . 9

10 Add lines 8e and 9 . . . . . . . . . . . . . . . . . . . . . . .

10

Gifts to

Charity

Caution: If you

made a gift and

got a benefit for it,

see instructions.

11 Gifts by cash or check. If you made any gift of $250 or more, see

instructions . . . . . . . . . . . . . . . . . . .

11

12 Other than by cash or check. If you made any gift of $250 or more,

see instructions. You must attach Form 8283 if over $500. . . .

12

13 Carryover from prior year . . . . . . . . . . . . . . 13

14 Add lines 11 through 13 . . . . . . . . . . . . . . . . . . . . . .

14

Casualty and

Theft Losses

15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified

disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See

instructions . . . . . . . . . . . . . . . . . . . . . . . . . .

15

Other

Itemized

Deductions

16

Other—from list in instructions. List type and amount

▶

16

Total

Itemized

Deductions

17

Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on

17

Form 1040 or 1040-SR, line 9 . . . . . . . . . . . . . . . . . . . .

18

If you elect to itemize deductions even though they are less than your standard deduction,

check this box . . . . . . . . . . . . . . . . . . . . . . . .

▶

For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and 1040-SR.

Cat. No. 17145C Schedule A (Form 1040 or 1040-SR) 2019

10,000

784

21,726

6,206

14,736

545

230

315

23,169

23,169

10,601

33,714

141,352

10,000

23,169

Your social security number

9

© 2020 NASFAA. All rights reserved.

Note: Besides Schedules 1, 2, and 3, the school does not need to collect copies of IRS schedules of forms attached to the tax return, unless

there is conflicting information in the student’s file that needs to be resolved.

SCHEDULE B

(Form 1040 or 1040-SR)

Department of the Treasury

Internal Revenue Service (99)

Interest and Ordinary Dividends

▶

Go to www.irs.gov/ScheduleB for instructions and the latest information.

▶

Attach to Form 1040 or 1040-SR.

OMB No. 1545-0074

2019

Attachment

Sequence No.

08

Your social security number

Part I

Interest

(See instructions

and the

instructions for

Forms 1040 and

1040-SR, line 2b.)

Note: If you

received a Form

1099-INT, Form

1099-OID, or

substitute

statement from

a brokerage firm,

list the firm’s

name as the

payer and enter

the total interest

shown on that

form.

1

List name of payer. If any interest is from a seller-financed mortgage and the

buyer used the property as a personal residence, see the instructions and list this

interest first. Also, show that buyer’s social security number and address

▶

1

Amount

2 Add the amounts on line 1 . . . . . . . . . . . . . . . . . . . 2

3 Excludable interest on series EE and I U.S. savings bonds issued after 1989.

Attach Form 8815 . . . . . . . . . . . . . . . . . . . . . . 3

4

Subtract line 3 from line 2. Enter the result here and on Form 1040 or 1040-SR,

line 2b . . . . . . . . . . . . . . . . . . . . . . . .

▶

4

Note: If line 4 is over $1,500, you must complete Part III.

Amount

Part II

Ordinary

Dividends

(See instructions

and the

instructions for

Forms 1040 and

1040-SR, line 3b.)

Note: If you

received a Form

1099-DIV or

substitute

statement from

a brokerage firm,

list the firm’s

name as the

payer and enter

the ordinary

dividends shown

on that form.

5

List name of payer

▶

5

6

Add the amounts on line 5. Enter the total here and on Form 1040 or 1040-SR,

line 3b . . . . . . . . . . . . . . . . . . . . . . . .

▶

6

Note: If line 6 is over $1,500, you must complete Part III.

Part III

Foreign

Accounts

and Trusts

Caution: If

required, failure

to file FinCEN

Form 114 may

result in

substantial

penalties. See

instructions.

You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a

foreign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign trust.

Yes No

7

a

At any time during 2019, did you have a financial interest in or signature authority over a financial

account (such as a bank account, securities account, or brokerage account) located in a foreign

country? See instructions . . . . . . . . . . . . . . . . . . . . . . . .

If “Yes,” are you required to file FinCEN Form 114, Report of Foreign Bank and Financial

Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114

and its instructions for filing requirements and exceptions to those requirements . . . . . .

b

If you are required to file FinCEN Form 114, enter the name of the foreign country where the

financial account is located

▶

8 During 2019, did you receive a distribution from, or were you the grantor of, or transferor to, a

foreign trust? If “Yes,” you may have to file Form 3520. See instructions . . . . . . . . .

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 17146N

Schedule B (Form 1040 or 1040-SR) 2019

0

1,590

CAROLINA M TAMEZ

MARCOS S TAMEZ

0

1,590

910

680

Name(s) shown on return

10

© 2020 NASFAA. All rights reserved.

Form 2441

Department of the Treasury

Internal Revenue Service (99)

Child and Dependent Care Expenses

▶

Attach to Form 1040, 1040-SR, or 1040-NR.

▶

Go to www.irs.gov/Form2441 for instructions and the

latest information.

. . . . . . . . . .

1040

1040-SR

2441

◀

1040-NR

OMB No. 1545-0074

2019

Attachment

Sequence No.

21

Name(s) shown on return

Your social security number

You cannot claim a credit for child and dependent care expenses if your filing status is married filing separately unless you meet the

requirements listed in the instructions under “Married Persons Filing Separately.” If you meet these requirements, check this box.

Part I

Persons or Organizations Who Provided the Care—You must complete this part.

(If you have more than two care providers, see the instructions.)

1

(a) Care provider’s

name

(b) Address

(number, street, apt. no., city, state, and ZIP code)

(c) Identifying number

(SSN or EIN)

(d) Amount paid

(see instructions)

Did you receive

dependent care benefits?

No

▶

Complete only Part II below.

Yes

▶

Complete Part III on the back next.

Caution: If the care was provided in your home, you may owe employment taxes. For details, see the instructions for Schedule 2

(Form 1040 or 1040-SR), line 7a; or Form 1040-NR, line 59a.

Part II Credit for Child and Dependent Care Expenses

2 Information about your qualifying person(s). If you have more than two qualifying persons, see the instructions.

(a) Qualifying person’s name

First Last

(b) Qualifying person’s social

security number

(c) Qualified expenses you

incurred and paid in 2019 for the

person listed in column (a)

3 Add the amounts in column (c) of line 2. Don’t enter more than $3,000 for one qualifying person

or $6,000 for two or more persons. If you completed Part III, enter the amount from line 31 . .

3

4 Enter your earned income. See instructions . . . . . . . . . . . . . . . . . 4

5 If married filing jointly, enter your spouse’s earned income (if you or your spouse was a student

or was disabled, see the instructions); all others, enter the amount from line 4 . . . . . .

5

6 Enter the smallest of line 3, 4, or 5 . . . . . . . . . . . . . . . . . . . . 6

7 Enter the amount from Form 1040 or 1040-SR, line 8b; or Form

1040-NR, line 35 . . . . . . . . . . . . . . . .

7

8 Enter on line 8 the decimal amount shown below that applies to the amount on line 7

If line 7 is:

Over

But not

over

Decimal

amount is

$0—15,000 .35

15,000—17,000 .34

17,000—19,000 .33

19,000—21,000 .32

21,000—23,000 .31

23,000—25,000 .30

25,000—27,000 .29

27,000—29,000 .28

If line 7 is:

Over

But not

over

Decimal

amount is

$29,000—31,000 .27

31,000—33,000 .26

33,000—35,000 .25

35,000—37,000 .24

37,000—39,000 .23

39,000—41,000 .22

41,000—43,000 .21

43,000—No limit .20

8

X .

9 Multiply line 6 by the decimal amount on line 8. If you paid 2018 expenses in 2019, see the

instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Tax liability limit. Enter the amount from the Credit Limit Worksheet

in the instructions . . . . . . . . . . . . . . . .

10

11 Credit for child and dependent care expenses. Enter the smaller of line 9 or line 10 here and

on Schedule 3 (Form 1040 or 1040-SR), line 2; or Form 1040-NR, line 47 . . . . . . . .

11

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 11862M

Form 2441 (2019)

EUGENE, OR 99999

CHILDREN'S LEARNING CTR

15,397

59

1234 LINCOLN AVE.

TAMEZ

TAMEZ

294

53,688

77,950

294

141,352

0.20

294.00

59

XXX | XX | 6772

SAMUEL

AMOS

XXXXXXXXX

294

0

XXX | XX | 8534

11

© 2020 NASFAA. All rights reserved.

Note: Besides Schedules 1, 2, and 3, the school does not need to collect copies of IRS schedules of forms attached to the tax return, unless

there is conflicting information in the student’s file that needs to be resolved.

Form 2441 (2019)

Page 2

Part III Dependent Care Benefits

12

Enter the total amount of dependent care benefits you received in 2019. Amounts you received as

an employee should be shown in box 10 of your Form(s) W-2. Don’t include amounts reported as

wages in box 1 of Form(s) W-2. If you were self-employed or a partner, include amounts you

received under a dependent care assistance program from your sole proprietorship or partnership .

12

13 Enter the amount, if any, you carried over from 2018 and used in 2019 during the grace period.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Enter the amount, if any, you forfeited or carried forward to 2020. See instructions . . . . . 14

( )

15 Combine lines 12 through 14. See instructions . . . . . . . . . . . . . . . . . 15

16 Enter the total amount of qualified expenses incurred in 2019 for the

care of the qualifying person(s) . . . . . . . . . . . .

16

17 Enter the smaller of line 15 or 16 . . . . . . . . . . . . 17

18 Enter your earned income. See instructions . . . . . . . . 18

19 Enter the amount shown below that applies to you.

• If married filing jointly, enter your spouse’s

earned income (if you or your spouse was

a student or was disabled, see the

instructions for line 5).

• If married filing separately, see

instructions.

• All others, enter the amount from line 18.

}

. . . . . . .

19

20 Enter the smallest of line 17, 18, or 19 . . . . . . . . . . 20

21 Enter $5,000 ($2,500 if married filing separately and you were

required to enter your spouse’s earned income on line 19) . . .

21

22 Is any amount on line 12 from your sole proprietorship or partnership?

No. Enter -0-.

Yes. Enter the amount here . . . . . . . . . . . . . . . . . . . . . . 22

23 Subtract line 22 from line 15 . . . . . . . . . . . . .

23

24 Deductible benefits. Enter the smallest of line 20, 21, or 22. Also, include this amount on the

appropriate line(s) of your return. See instructions . . . . . . . . . . . . . . . .

24

25 Excluded benefits. If you checked “No” on line 22, enter the smaller of line 20 or 21. Otherwise,

subtract line 24 from the smaller of line 20 or line 21. If zero or less, enter -0- . . . . . . .

25

26

Taxable benefits. Subtract line 25 from line 23. If zero or less, enter -0-. Also, include this amount

on Form 1040 or 1040-SR, line 1; or Form 1040-NR, line 8. On the dotted line next to Form 1040

or 1040-SR, line 1; or Form 1040-NR, line 8, enter “DCB” . . . . . . . . . . . . . .

26

To claim the child and dependent care

credit, complete lines 27 through 31 below.

27 Enter $3,000 ($6,000 if two or more qualifying persons) . . . . . . . . . . . . . . 27

28 Add lines 24 and 25 . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 Subtract line 28 from line 27. If zero or less, stop. You can’t take the credit. Exception. If you paid

2018 expenses in 2019, see the instructions for line 9 . . . . . . . . . . . . . . .

29

30 Complete line 2 on the front of this form. Don’t include in column (c) any benefits shown on line

28 above. Then, add the amounts in column (c) and enter the total here . . . . . . . . .

30

31 Enter the smaller of line 29 or 30. Also, enter this amount on line 3 on the front of this form and

complete lines 4 through 11 . . . . . . . . . . . . . . . . . . . . . . .

31

Form 2441 (2019)

0

0.00

0.00

0

294

0

53,688

77,950

0

5,000

0

0

0

0

0

6,000

0

6,000

294

294

12

© 2020 NASFAA. All rights reserved.

Note: Besides Schedules 1, 2, and 3, the school does not need to collect copies of IRS schedules of forms attached to the tax return, unless

there is conflicting information in the student’s file that n

eeds to be resolved.

This page intentionally left blank.

13

Internal Revenue Service

United States Department of the Treasury

This Product Contains Sensitive Taxpayer Data

Request Date: 08-30-2020

Response Date: 08-30-2020

Tracking Number: XXXXXXXXXXXX

Tax Return Transcript

SSN Provided: XXX-XX-4672

Tax Period Ending: Dec. 31, 2019

The following items reflect the amount as shown on the return (PR), and the amount as adjusted

(PC), if applicable. They do not show subsequent activity on the account.

SSN: XXX-XX-4672

SPOUSE SSN: XXX-XX-2230

NAME(S) SHOWN ON RETURN: CARO MARCO TAME

ADDRESS: 8741 W

FILING STATUS: Married Filed Joint

FORM NUMBER: 1040

CYCLE POSTED: 20201602

RECEIVED DATE: Apr.15, 2020

REMITTANCE: $0.00

EXEMPTION NUMBER: 04

OTHER DEPENDENT CREDIT TOTAL ELIGIBLE PER COMPUTER: 00

OTHER DEPENDENT CREDIT TOTAL ELIGIBLE VERIFIED: 00

EXEMPTION NUMBER: 4

DEPENDENT 1 NAME CTRL: TAME

DEPENDENT 1 SSN: XXX-XX-6772

DEPENDENT 2 NAME CTRL: TAME

DEPENDENT 2 SSN: XXX-XX-8534

DEPENDENT 3 NAME CTRL:

DEPENDENT 3 SSN:

DEPENDENT 4 NAME CTRL:

DEPENDENT 4 SSN:

PTIN:

PREPARER EIN:

Income

WAGES, SALARIES, TIPS, ETC:...........................................................$131,638.00

TAXABLE INTEREST INCOME: SCH B:.........................................................$1,590.00

TAX-EXEMPT INTEREST:........................................................................$0.00

ORDINARY DIVIDEND INCOME: SCH B:............................................................$0.00

QUALIFIED DIVIDENDS:........................................................................$0.00

REFUNDS OF STATE/LOCAL TAXES:...............................................................$0.00

ALIMONY RECEIVED:...........................................................................$0.00

BUSINESS INCOME OR LOSS (Schedule C):.......................................................$0.00

BUSINESS INCOME OR LOSS: SCH C PER COMPUTER:................................................$0.00

CAPITAL GAIN OR LOSS: (Schedule D):.........................................................$0.00

CAPITAL GAINS OR LOSS: SCH D PER COMPUTER:..................................................$0.00

OTHER GAINS OR LOSSES (Form 4797):..........................................................$0.00

TOTAL IRA DISTRIBUTIONS:....................................................................$0.00

TAXABLE IRA DISTRIBUTIONS:..................................................................$0.00

TOTAL PENSIONS AND ANNUITIES:...............................................................$0.00

TAXABLE PENSION/ANNUITY AMOUNT:.............................................................$0.00

ADDITIONAL INCOME:......................................................................$8,124.00

ADDITIONAL INCOME PER COMPUTER:.........................................................$8,124.00

REFUNDABLE CREDITS PER COMPUTER:............................................................$0.00

REFUNDABLE EDUCATION CREDIT PER COMPUTER:...................................................$0.00

Sample Tax Return Transcript: Marcos and Carolina Tamez

*Income earned from work: IRS Form 1040–Line 1 , Schedule 1–Lines 3 and 6 , Schedule K-1 (IRS Form 1065)–Box 14 (Code A). If any individual earning item is

negative, do not include that item in your calculation.

14

1040: p.1

1040: p.1

1040: 1

1040: 2a

Sch 1: 3

1040: 4a

1040: 4b

1040: 4c

1040: 4d

*

*

© 2020 NASFAA. All rights reserved.

QUALIFIED BUSINESS INCOME DEDUCTION:........................................................$0.00

RENT/ROYALTY/PARTNERSHIP/ESTATE (Schedule E):...............................................$0.00

RENT/ROYALTY/PARTNERSHIP/ESTATE (Schedule E) PER COMPUTER:..................................$0.00

RENT/ROYALTY INCOME/LOSS PER COMPUTER:......................................................$0.00

ESTATE/TRUST INCOME/LOSS PER COMPUTER:......................................................$0.00

PARTNERSHIP/S-CORP INCOME/LOSS PER COMPUTER:................................................$0.00

FARM INCOME OR LOSS (Schedule F):...........................................................$0.00

FARM INCOME OR LOSS (Schedule F) PER COMPUTER:..............................................$0.00

UNEMPLOYMENT COMPENSATION:..................................................................$0.00

TOTAL SOCIAL SECURITY BENEFITS:.............................................................$0.00

TAXABLE SOCIAL SECURITY BENEFITS:...........................................................$0.00

TAXABLE SOCIAL SECURITY BENEFITS PER COMPUTER:..............................................$0.00

OTHER INCOME:...........................................................................$8,124.00

SCHEDULE EIC SE INCOME PER COMPUTER:........................................................$0.00

SCHEDULE EIC EARNED INCOME PER COMPUTER:....................................................$0.00

SCH EIC DISQUALIFIED INC COMPUTER:..........................................................$0.00

QUALIFIED BUSINESS INCOME DEDUCTION:........................................................$0.00

F8995 QUALIFIED BUSINESS INCOME DEDUCTION COMPUTER:.........................................$0.00

F8995 NET CAPITAL GAINS COMPUTER:...........................................................$0.00

TOTAL INCOME:.........................................................................$141,352.00

TOTAL INCOME PER COMPUTER:............................................................$141,352.00

Adjustments to Income

EDUCATOR EXPENSES:..........................................................................$0.00

EDUCATOR EXPENSES PER COMPUTER:.............................................................$0.00

RESERVIST AND OTHER BUSINESS EXPENSE:.......................................................$0.00

HEALTH SAVINGS ACCT DEDUCTION:..............................................................$0.00

HEALTH SAVINGS ACCT DEDUCTION PER COMPTR:...................................................$0.00

MOVING EXPENSES: F3903:.....................................................................$0.00

SELF EMPLOYMENT TAX DEDUCTION:..............................................................$0.00

SELF EMPLOYMENT TAX DEDUCTION PER COMPUTER:.................................................$0.00

SELF EMPLOYMENT TAX DEDUCTION VERIFIED:.....................................................$0.00

KEOGH/SEP CONTRIBUTION DEDUCTION:...........................................................$0.00

SELF-EMP HEALTH INS DEDUCTION:..............................................................$0.00

EARLY WITHDRAWAL OF SAVINGS PENALTY:........................................................$0.00

ALIMONY PAID SSN:................................................................................

ALIMONY PAID:...............................................................................$0.00

IRA DEDUCTION:..............................................................................$0.00

IRA DEDUCTION PER COMPUTER:.................................................................$0.00

STUDENT LOAN INTEREST DEDUCTION:............................................................$0.00

STUDENT LOAN INTEREST DEDUCTION PER COMPUTER:...............................................$0.00

STUDENT LOAN INTEREST DEDUCTION VERIFIED:...................................................$0.00

TUITION AND FEES DEDUCTION:.................................................................$0.00

TUITION AND FEES DEDUCTION PER COMPUTER:....................................................$0.00

DOMESTIC PRODUCTION ACTIVITIES DEDUCTION:...................................................$0.00

DOMESTIC PRODUCTION ACTIVITIES DEDUCTION PER COMPUTER:......................................$0.00

OTHER ADJUSTMENTS:..........................................................................$0.00

ARCHER MSA DEDUCTION:.......................................................................$0.00

ARCHER MSA DEDUCTION PER COMPUTER:..........................................................$0.00

TOTAL ADJUSTMENTS:..........................................................................$0.00

TOTAL ADJUSTMENTS PER COMPUTER:.............................................................$0.00

ADJUSTED GROSS INCOME:................................................................$141,352.00

ADJUSTED GROSS INCOME PER COMPUTER:...................................................$141,352.00

Tax and Credits

65-OR-OVER:....................................................................................NO

BLIND:.........................................................................................NO

SPOUSE 65-OR-OVER:.............................................................................NO

SPOUSE BLIND:..................................................................................NO

STANDARD DEDUCTION PER COMPUTER:............................................................$0.00

ADDITIONAL STANDARD DEDUCTION PER COMPUTER:.................................................$0.00

TAX TABLE INCOME PER COMPUTER:........................................................$107,638.00

EXEMPTION AMOUNT PER COMPUTER:..............................................................$0.00

TAXABLE INCOME:.......................................................................$107,638.00

TAXABLE INCOME PER COMPUTER:..........................................................$107,638.00

TOTAL POSITIVE INCOME PER COMPUTER:...................................................$141,352.00

TENTATIVE TAX:.........................................................................$15,397.00

TENTATIVE TAX PER COMPUTER:............................................................$15.397.00

*Income earned from work: IRS Form 1040–Line 1 , Schedule 1–Lines 3 and 6 , Schedule K-1 (IRS Form 1065)–Box 14 (Code A). If any individual earning item is

negative, do not include that item in your calculation.

© 2020 NASFAA. All rights reserved.

15

Sch 1: 6

Sch 1: 12

Sch 1: 15

Sch 1: 19

1040: 8b

*

FORM 8814 ADDITIONAL TAX AMOUNT:............................................................$0.00

TAX ON INCOME LESS SOC SEC INCOME PER COMPUTER:.............................................$0.00

FORM 6251 ALTERNATIVE MINIMUM TAX:..........................................................$0.00

FORM 6251 ALTERNATIVE MINIMUM TAX PER COMPUTER:.............................................$0.00

FOREIGN TAX CREDIT:.........................................................................$0.00

FOREIGN TAX CREDIT PER COMPUTER:............................................................$0.00

FOREIGN INCOME EXCLUSION PER COMPUTER:......................................................$0.00

FOREIGN INCOME EXCLUSION TAX PER COMPUTER:..................................................$0.00

EXCESS ADVANCE PREMIUM TAX CREDIT REPAYMENT AMOUNT:.........................................$0.00

EXCESS ADVANCE PREMIUM TAX CREDIT REPAYMENT VERIFIED AMOUNT:................................$0.00

CHILD & DEPENDENT CARE CREDIT:.............................................................$59.00

CHILD & DEPENDENT CARE CREDIT PER COMPUTER:................................................$58.80

CREDIT FOR ELDERLY AND DISABLED:............................................................$0.00

CREDIT FOR ELDERLY AND DISABLED PER COMPUTER:...............................................$0.00

EDUCATION CREDIT:...........................................................................$0.00

EDUCATION CREDIT PER COMPUTER:..............................................................$0.00

GROSS EDUCATION CREDIT PER COMPUTER:........................................................$0.00

RETIREMENT SAVINGS CNTRB CREDIT:............................................................$0.00

RETIREMENT SAVINGS CNTRB CREDIT PER COMPUTER:...............................................$0.00

PRIM RET SAV CNTRB: F8880 LN6A:.............................................................$0.00

SEC RET SAV CNTRB: F8880 LN6B:..............................................................$0.00

TOTAL RETIREMENT SAVINGS CONTRIBUTION: F8880 CMPTR:.........................................$0.00

RESIDENTIAL ENERGY CREDIT:..................................................................$0.00

RESIDENTIAL ENERGY CREDIT PER COMPUTER:.....................................................$0.00

CHILD AND OTHER DEPENDENT CREDIT:.......................................................$4,000.00

CHILD AND OTHER DEPENDENT CREDIT PER COMPUTER:..........................................$4,000.00

ADOPTION CREDIT: F8839:.....................................................................$0.00

ADOPTION CREDIT PER COMPUTER:...............................................................$0.00

FORM 8396 MORTGAGE CERTIFICATE CREDIT:......................................................$0.00

FORM 8396 MORTGAGE CERTIFICATE CREDIT PER COMPUTER:.........................................$0.00

F3800, F8801 AND OTHER CREDIT AMOUNT:.......................................................$0.00

FORM 3800 GENERAL BUSINESS CREDITS:.........................................................$0.00

FORM 3800 GENERAL BUSINESS CREDITS PER COMPUTER:............................................$0.00

PRIOR YR MIN TAX CREDIT: F8801:.............................................................$0.00

PRIOR YR MIN TAX CREDIT: F8801 PER COMPUTER:................................................$0.00

F8936 ELECTRIC MOTOR VEHICLE CREDIT AMOUNT:.................................................$0.00

F8936 ELECTRIC MOTOR VEHICLE CREDIT PER COMPUTER:...........................................$0.00

F8910 ALTERNATIVE MOTOR VEHICLE CREDIT AMOUNT:..............................................$0.00

F8910 ALTERNATIVE MOTOR VEHICLE CREDIT PER COMPUTER:........................................$0.00

OTHER CREDITS:..............................................................................$0.00

TOTAL CREDITS:..........................................................................$4,059.00

TOTAL CREDITS PER COMPUTER:.............................................................$4,059.00

INCOME TAX AFTER CREDITS PER COMPUTER:.................................................$11,338.00

*** “Income Tax After Credits Per Computer” $11,338.00

‒ ** “Excess Advance Premimum Tax Credit Repayment Amount” ‒ $0.00

= **** Income Tax Paid = $11,338.00

Other Taxes

SE TAX:.....................................................................................$0.00

SE TAX PER COMPUTER:........................................................................$0.00

SOCIAL SECURITY AND MEDICARE TAX ON UNREPORTED TIPS:........................................$0.00

SOCIAL SECURITY AND MEDICARE TAX ON UNREPORTED TIPS PER COMPUTER:...........................$0.00

TAX ON QUALIFIED PLANS F5329 (PR):..........................................................$0.00

TAX ON QUALIFIED PLANS F5329 PER COMPUTER:..................................................$0.00

IRAF TAX PER COMPUTER:......................................................................$0.00

TP TAX FIGURES (REDUCED BY IRAF) PER COMPUTER:.........................................$11,338.00

IMF TOTAL TAX (REDUCED BY IRAF) PER COMPUTER:..........................................$11,338.00

TOTAL OTHER TAXES PER COMPUTER:.............................................................$0.00

UNPAID FICA ON REPORTED TIPS:...............................................................$0.00

F8959-8960 OTHER TAXES:.....................................................................$0.00

TOTAL OTHER TAXES:..........................................................................$0.00

RECAPTURE TAX: F8611:.......................................................................$0.00

HOUSEHOLD EMPLOYMENT TAXES:.................................................................$0.00

HOUSEHOLD EMPLOYMENT TAXES PER COMPUTER:....................................................$0.00

HEALTH CARE RESPONSIBILITY PENALTY:.........................................................$0.00

HEALTH CARE RESPONSIBILITY PENALTY VERIFIED:................................................$0.00

HEALTH COVERAGE RECAPTURE: F8885:...........................................................$0.00

RECAPTURE TAXES:............................................................................$0.00

TOTAL ASSESSMENT PER COMPUTER:.........................................................$11,338.00

Sch 2: 2

Sch 3: 3

1040: 14

Sch 2: 2

**

***

****If Income Tax Paid is negative, enter zero.

© 2020 NASFAA. All rights reserved.

16

TOTAL TAX LIABILITY TP FIGURES:........................................................$11,338.00

TOTAL TAX LIABILITY TP FIGURES PER COMPUTER:...........................................$11,338.00

Payments

FEDERAL INCOME TAX WITHHELD:...........................................................$11,291.00

HEALTH CARE: INDIVIDUAL RESPONSIBILTY:......................................................$0.00

HEALTH CARE FULL-YEAR COVERAGE INDICATOR:.......................................................0

ESTIMATED TAX PAYMENTS:.....................................................................$0.00

OTHER PAYMENT CREDIT:.......................................................................$0.00

REFUNDABLE EDUCATION CREDIT:................................................................$0.00

REFUNDABLE EDUCATION CREDIT PER COMPUTER:...................................................$0.00

REFUNDABLE EDUCATION CREDIT VERIFIED:.......................................................$0.00

REFUNDABLE CREDITS:.........................................................................$0.00

EARNED INCOME CREDIT:.......................................................................$0.00

EARNED INCOME CREDIT PER COMPUTER:..........................................................$0.00

EARNED INCOME CREDIT NONTAXABLE COMBAT PAY:.................................................$0.00

SCHEDULE 8812 NONTAXABLE COMBAT PAY:........................................................$0.00

EXCESS SOCIAL SECURITY & RRTA TAX WITHHELD:.................................................$0.00

SCHEDULE 8812 TOT SS/MEDICARE WITHHELD:.....................................................$0.00

SCHEDULE 8812 ADDITIONAL CHILD TAX CREDIT:..................................................$0.00

SCHEDULE 8812 ADDITIONAL CHILD TAX CREDIT PER COMPUTER:.....................................$0.00

SCHEDULE 8812 ADDITIONAL CHILD TAX CREDIT VERIFIED:.........................................$0.00

AMOUNT PAID WITH FORM 4868:.................................................................$0.00

FORM 2439 REGULATED INVESTMENT COMPANY CREDIT:..............................................$0.00

FORM 4136 CREDIT FOR FEDERAL TAX ON FUELS:..................................................$0.00

FORM 4136 CREDIT FOR FEDERAL TAX ON FUELS PER COMPUTER:.....................................$0.00

HEALTH COVERAGE TX CR: F8885:...............................................................$0.00

SEC 965 TAX INSTALLMENT:....................................................................$0.00

SEC 965 TAX LIABILITY:......................................................................$0.00

PREMIUM TAX CREDIT AMOUNT:..................................................................$0.00

PREMIUM TAX CREDIT VERIFIED AMOUNT:.........................................................$0.00

PRIMARY NAP FIRST TIME HOME BUYER INSTALLMENT AMT:..........................................$0.00

SECONDARY NAP FIRST TIME HOME BUYER INSTALLMENT AMT:........................................$0.00

FIRST TIME HOMEBUYER CREDIT REPAYMENT AMOUNT:...............................................$0.00

FORM 5405 TOTAL HOMEBUYERS CREDIT REPAYMENT PER COMPUTER:...................................$0.00

SMALL EMPLOYER HEALTH INSURANCE PER COMPUTER:...............................................$0.00

SMALL EMPLOYER HEALTH INSURANCE PER COMPUTER (2):...........................................$0.00

FORM 2439 AND OTHER CREDITS:................................................................$0.00

TOTAL PAYMENTS:........................................................................$11,291.00

TOTAL PAYMENTS PER COMPUTER:...........................................................$11,291.00

Refund or Amount Owed

AMOUNT YOU OWE:............................................................................$47.00

APPLIED TO NEXT YEAR’S ESTIMATED TAX:.......................................................$0.00

ESTIMATED TAX PENALTY:......................................................................$0.00

TAX ON INCOME LESS STATE REFUND PER COMPUTER:...............................................$0.00

BAL DUE/OVER PYMT USING TP FIG PER COMPUTER:...............................................$47.00

BAL DUE/OVER PYMT USING COMPUTER FIGURES:..................................................$47.00

FORM 8888 TOTAL REFUND PER COMPUTER:........................................................$0.00

Third Party Designee

THIRD PARTY DESIGNEE ID NUMBER:..................................................................

AUTHORIZATION INDICATOR:........................................................................0

THIRD PARTY DESIGNEE NAME:.......................................................................

Schedule A--Itemized Deductions

MEDICAL/DENTAL

MEDICAL AND DENTAL EXPENSES:................................................................$0.00

ADJUSTED GROSS INCOME PERCENTAGE:......................................................$10,601.00

ADJUSTED GROSS INCOME PERCENTAGE PER COMPUTER 10 PERCENT:...................................$0.00

ADJUSTED GROSS INCOME PERCENTAGE PER COMPUTER 7.5 PERCENT:.............................$10,601.00

NET MEDICAL DEDUCTION:......................................................................$0.00

NET MEDICAL DEDUCTION PER COMPUTER:.........................................................$0.00

© 2020 NASFAA. All rights reserved.

17

TAXES PAID

STATE AND LOCAL INCOME OR SALES TAXES:..................................................$6,206.00

STATE INCOME OR SALES TAX:..................................................................$0.00

REAL ESTATE TAXES:.....................................................................$14,736.00

PERSONAL PROPERTY TAXES:..................................................................$784.00

OTHER TAXES AMOUNT:.........................................................................$0.00

SCH A TAX DEDUCTIONS:..................................................................$10,000.00

SCH A TAX PER COMPUTER:................................................................$10,000.00

INTEREST PAID

MORTGAGE INTEREST (FINANCIAL):.........................................................$23,169.00

MORTGAGE INTEREST (INDIVIDUAL):.............................................................$0.00

DEDUCTIBLE POINTS:..........................................................................$0.00

QUALIFIED MORTGAGE INSURANCE PREMIUMS:......................................................$0.00

DEDUCTIBLE INVESTMENT INTEREST:.............................................................$0.00

TOTAL INTEREST DEDUCTION:..............................................................$23,169.00

TOTAL INTEREST DEDUCTION PER COMPUTER:.................................................$23,169.00

CHARITABLE CONTRIBUTIONS

CASH CONTRIBUTIONS:.......................................................................$230.00

OTHER THAN CASH: Form 8283:...............................................................$315.00

CARRYOVER FROM PRIOR YEAR:..................................................................$0.00

SCH A TOTAL CONTRIBUTIONS:................................................................$545.00

SCH A TOTAL CONTRIBUTIONS PER COMPUTER:...................................................$545.00

CASUALTY AND THEFT LOSS

CASUALTY OR THEFT LOSS:.....................................................................$0.00

JOBS AND MISCELLANEOUS

UNREIMBURSED EMPLOYEE EXPENSE AMOUNT:.......................................................$0.00

TOTAL LIMITED MISC EXPENSES:................................................................$0.00

NET LIMITED MISC DEDUCTION:.................................................................$0.00

NET LIMITED MISC DEDUCTION PER COMPUTER:....................................................$0.00

OTHER MISCELLANEOUS

OTHER THAN GAMBLING AMOUNT:.................................................................$0.00

OTHER MISC DEDUCTIONS:......................................................................$0.00

TOTAL ITEMIZED DEDUCTIONS

TOTAL ITEMIZED DEDUCTIONS:.............................................................$33,714.00

TOTAL ITEMIZED DEDUCTIONS PER COMPUTER:................................................$33,714.00

RECOMPUTED TOTAL ITEMIZED DEDUCTIONS PER COMPUTER:..........................................$0.00

ELECT ITEMIZED DEDUCTION INDICATOR:..............................................................

SCH A ITEMIZED PERCENTAGE PER COMPUTER:.....................................................$0.00

Interest and Dividends

GROSS SCHEDULE B INTEREST:..............................................................$1,590.00

TAXABLE INTEREST INCOME:................................................................$1,590.00

EXCLUDABLE SAVINGS FROM BOND INT:...........................................................$0.00

GROSS SCHEDULE B DIVIDENDS:.................................................................$0.00

DIVIDEND INCOME:............................................................................$0.00

FOREIGN ACCOUNTS IND:........................................................................None

REQUIRED TO FILE FINCEN FORM 114:............................................................None

© 2020 NASFAA. All rights reserved.

18

Form 2441--Child and Dependent Care Expenses

PROV NAME CNTRL:.............................................................................CHIL

CARE PROV SSN:........................................................................XXX-XX-2619

DEPENDENT CARE EMPLOYER BENEFITS AMT:.......................................................$0.00

QUALIFIED EXPENSES EMPLOYER INCURRED AMT:.................................................$294.00

DEPENDENT CARE EXCLUSION AMOUNT:............................................................$0.00

PART II CREDIT FOR CHILD AND DEPENDENT CARE EXPENSES

NUMBER OF QUALIFYING PERSONS:...................................................................2

SSNS NOT REQ’D IND:.............................................................................0

CHILD 1 NAME CONTROL:........................................................................TAME

CHILD 1 SSN:..........................................................................XXX-XX-6772

CHILD 1 QUALIFIED EXPENSE:................................................................$294.00

CHILD 2 NAME CONTROL:........................................................................TAME

CHILD 2 SSN:..........................................................................XXX-XX-8534

CHILD 2 QUALIFIED EXPENSE:..................................................................$0.00

AMOUNT OF QUALIFIED EXPENSES:.............................................................$294.00

EARNED INCOME-PRIMARY:.................................................................$53,688.00

EARNED INCOME-SECONDARY:...............................................................$77,950.00

PRIOR YEAR CHILD CARE EXPENSES:.............................................................$0.00

PRIOR YEAR CHILD CARE EXPENSES PER COMPUTER:................................................$0.00

CHILD AND DEPENDENT CARE BASE AMOUNT PER COMPUTER:........................................$294.00

PART III DEPENDENT CARE BENEFITS

DEPENDENT CARE EMPLOYER BENEFITS:...........................................................$0.00

QUALIFIED EXPENSES EMPLOYER INCURRED:.....................................................$294.00

DEPENDENT CARE EXCLUDED BENEFITS:...........................................................$0.00

GROSS CHILD CARE CREDIT PER COMPUTER:......................................................$58.80

TOTAL QUALIFYING EXPENSES PER COMPUTER:...................................................$294.00

Form 8863 – Education Credits (Hope and Lifetime Learning Credits)

PART III – ALLOWABLE EDUCATION CREDITS

GROSS EDUCATION CR PER COMPUTER:............................................................$0.00

TOTAL EDUCATION CREDIT AMOUNT:..............................................................$0.00

TOTAL EDUCATION CREDIT AMOUNT PER COMPUTER:.................................................$0.00

This Product Contains Sensitive Taxpayer Data

© 2020 NASFAA. All rights reserved.

19

This page intentionally left blank.

20

Appendices

Appendix A

Sample 2019 W-2 Form, Reference Guide for Box 12 Codes, and Sample Wage and Income Statement

Appendix

B

Criteria for 2021-22 Simplified Needs Formulas and Automatic Zero EFC Calculation

Appendix C

2019 IRS Form 1040 – Indicators That Schedule 1, 2 or 3 was Required

Appendix D

Current Year Transcript Availability

Appendix E

Current, Resources and Websites – Tax Returns and Transcripts

21

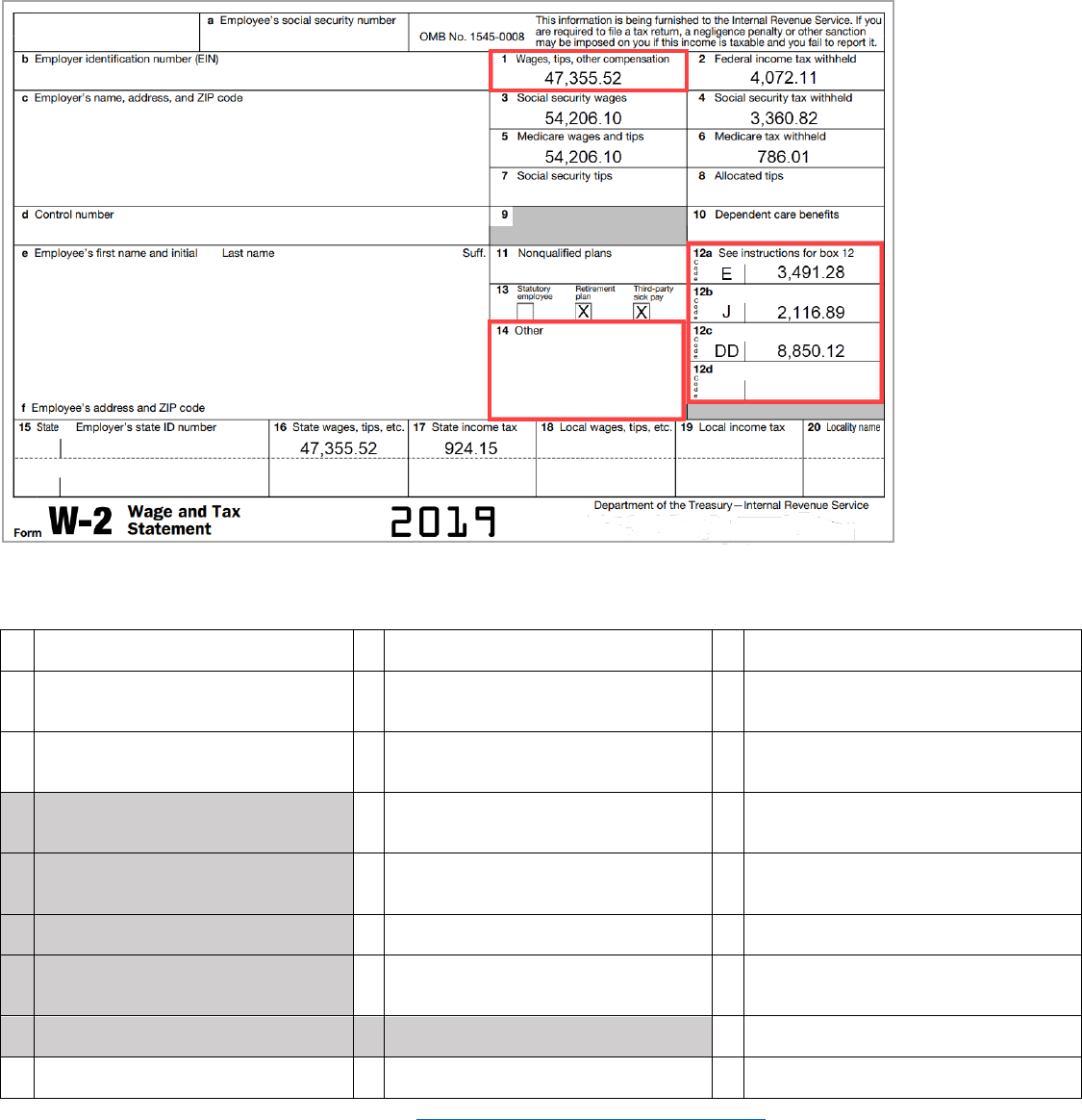

Appendix A

Sample 2019 W-2 Form

In addition to wages earned, the W-2 form may reveal sources of untaxed income, such as payments to tax-deferred pension and

savings plan amounts reported in boxes 12a through 12d, code D, E, F, G, H and S.

Schools are not required to review income listed in box 14, however if you are aware that a box 14 item should be reported (i.e. clergy

parsonage allowances) then you would count that amount as untaxed income.

Form W-2 Reference Guide for Box 12 Codes

A Uncollected social security or RRTA tax on tips

K

20% excise tax on excess golden parachute

payments

V

Income from exercise of nonstatutory stock

option(s)

B Uncollected Medicare tax on tips L

Substantiated employee business expense

reimbursements

W

Employer contributions (including amounts

employee elected to contribute using a cafeteria

plan) to employee’s health savings account

C

Taxable cost of group-

term life insurance over

$50,000

M

Uncollected social security or RRTA tax on

taxable cost of group-term life insurance over

$50,000 (former employees only)

Y

Deferrals under a section 409A nonqualified

deferred compensation plan

D

Elective deferrals to a section 401(k) cash or

deferred arrangement (including deferrals

under a SIMPLE 401(k) arrangement)

N

Uncollected Medicare tax on taxable cost of

group-

term life insurance over $50,000 (former

employees only)

Z

Income under a nonqualified deferred

compensation plan that fails to satisfy section

409A

E

Elective deferrals under a section 403(b)

salary reduction agreement

P

Excludable moving expense reimbursements

paid directly to a member of the U.S. Armed

Forces

AA

Designated Roth contributions under a section

401(k) plan

F

Elective deferrals under a section 408(k)(6)

salary reduction SEP

Q Nontaxable combat pay BB

Designated Roth contributions under a section

403(b) plan

G

Elective deferrals and employer contributions

(including nonelective deferrals) to a section

457(b) deferred compensation plan

R Employer contributions to an Archer MSA DD Cost of employer-sponsored health coverage

H

Elective deferrals to a section 501(c)(18)(D)

tax-exempt organization plan

S

Employee salary reduction contributions under

a section 408(p) SIMPLE plan

EE

Designated Roth contributions under a

governmental section 457(b) plan

J Nontaxable sick pay T Adoption benefits FF

Permitted benefits under a qualified small

employer health reimbursement arrangement

(For additional codes and complete descriptions, visit https://www.irs.gov/pub/irs-pdf/fw2_19.pdf)

© 2020 NASFAA. All rights reserved.

22

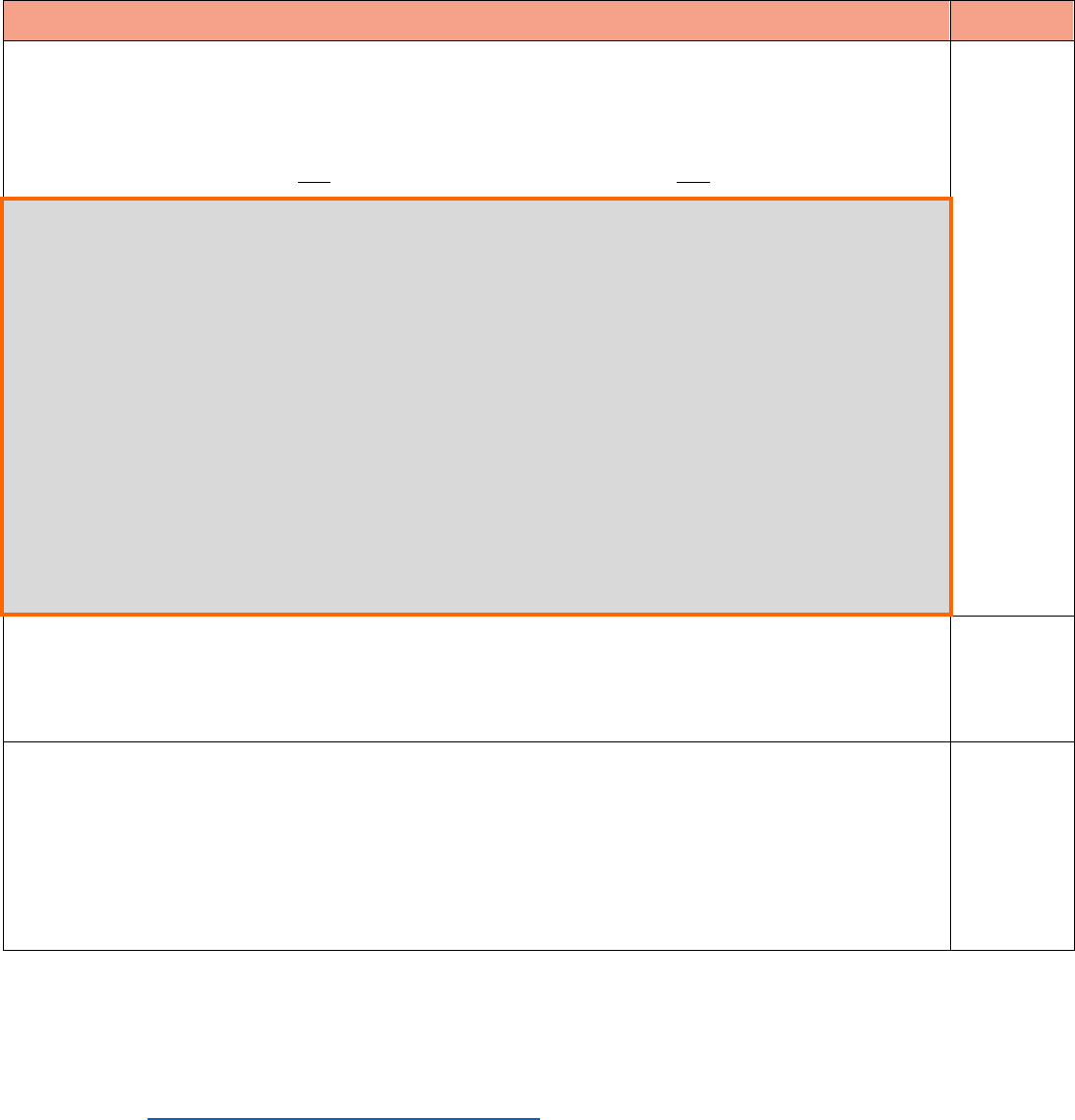

Sample 2019 Wage and Income Statement

Internal Revenue Service

United States Department of the Treasury

This Product Contains Sensitive Taxpayer Data

Request Date: 08-30-2020

Response Date: 08-30-20

20

Tracking Number: XXXXXXXXXXXX

*

Wage and Income Transcript

SSN Provided: XXX-XX-4672

Tax Period Ending: December 2019

Form W-2 Wage and Tax Statement

Employer:

Employer Identification Number (EIN):

Employee:

Employee’s Social Security Number: XXX-XX-4672

CARO MARY TAME

1234 W

Submission Type:................................................Original document

Wages, Tips and Other Compensation:....................................$47,355.00 - - - - - Box 1

Federal Income Tax Withheld:............................................$4,072.00

- - Box 2

Social Security Wages:.................................................$54,206.00

- - - - - Box 3

Social Security Tax Withheld:...........................................$3,360.00

- - Box 4

Medicare Wages and Tips:...............................................$54,206.00

- - - - - Box 5

Medicare Tax Withheld:....................................................$786.00

- - Box 6

Social Security Tips:.......................................................$0.00

- - - - - Box 7

Allocated Tips:.............................................................$0.00

- - Box 8

Dependent Care Benefits:....................................................$0.00

- - - - - Box 10

Deferred Compenensation:................................................$3,491.00

- - Box 12a-d (D, E, F, G, H)

Code “Q” Nontaxable Combat Pay:.............................................$0.00

Code “W” Employer Contributions to a Health Savings Account:................$0.00

Code “Y” Deferrals under a section 409A nonqualified Deferred Compensation

plan:.......................................................................$0.00

Code “Z” Income under section 409A on a nonqualified Deferred Compensation

plan:.......................................................................$0.00

Code “R” Employer’s Contribution to MSA:....................................$0.00

Code “S” Employer’s Contribution to Simple Account:.........................$0.00

- - - - - Box 12a-d (S)

Code “T” Expenses Incurred for Qualified Adoptions:.........................$0.00

Code “V” Income from exercise of non-statutory stock options:...............$0.00

Code “AA” Designated Roth Contributions under a Section 401(k) Plan:........$0.00

Code “BB” Designated Roth Contributions under a Section 403(b) Plan:........$0.00

Code “DD” Cost of Employer-Sponsored Health Coverage:...................$8,850.00

Code “EE” Designated ROTH Contributions Under a Governmental Section 457(b)

Plan:.......................................................................$0.00

Code “FF” Permitted benefits under a qualified small employer health

reimbursement arrangement:..................................................$0.00

* Current tax year information may not be available until July.

Note: Payments to tax-deferred pension and retirement savings plans under “Deferred Compensation” and “Code ‘S’ Employer’s Contribution to Simple

Account” are not required to be verified unless there is conflicting information. “Deferred Compensation” is assumed to include W-2 Box 12a to 12d,

Codes D, E, F, G, and H. If the total for this line plus the line for Code ‘S’ do not match the amount reported on the FAFSA, the school will need to collect

additional documentation from the student or parent, as applicable. Schools may obtain a signed statement indicating the correct amounts or some

other documentation the school deems appropriate to resolve the conflict.

© 2020 NASFAA. All rights reserved.

23

This page intentionally left blank.

24

Appendix B

Criteria for 2021-22 Simplified Needs Formulas and Automatic Zero EFC Calculation

The following criteria is used to determine if students qualify to have their EFCs calculated using a simplified formula.

Simplified

(assets not considered)

Automatic Zero EFC

Formula A

Dependent student

Parents had a 2019 AGI of $49,999 or less (for tax

filers), or if non-filers, income earned from work in

2019 is $49,999 or less; and

Either

- Parents filed a 2019 IRS Form 1040, but did not

file a Schedule 1

1

, filed a tax form from a Trust

Territory

2

, or were not required to file any

income tax return or

- Anyone in the parents’ household size (as

defined on the FAFSA) received any designated

means-tested federal benefits

3

during 2019 or

2020, or

- Parent is a dislocated worker.

Parents had a 2019 AGI of $27,000 or less (for tax

filers), or if non-filers, income earned from work in

2019 is $27,000 or less; and

Either

- Parents filed a 2019 IRS Form 1040, but did not

file a Schedule 1

1

, filed a tax form from a Trust

Territory

2

, or were not required to file any

income tax return or

- Anyone in the parents’ household size (as

defined on the FAFSA) received any designated

means-tested federal benefits

3

during 2019 or

2020, or

- Parent is a dislocated worker.

Formula B

Independent student

without dependents

(other than a spouse)

Student (and spouse, if any) had a 2019 AGI of

$49,999 or less (for tax filers), or if non-filers,

income earned from work in 2019 is $49,999 or

less; and

Either

- Student (and spouse, if any) filed a 2019 IRS

Form 1040, but did not file a Schedule 1

1

, filed a

tax form from a Trust Territory

2

, or were not

required to file any income tax return or

- Anyone in the student’s household size (as

defined on the FAFSA) received any designated

means-tested federal benefits

3

during 2019 or

2020, or

- Student (or spouse, if any) is a dislocated worker.

Not applicable.

Formula C

Independent student

with dependents

(other than a spouse)

Student (and spouse, if any) had a 2019 AGI of

$49,999 or less (for tax filers), or if non-filers,

income earned from work in 2019 is $49,999 or

less; and

Either

- Student (and spouse, if any) filed a 2019 IRS

Form 1040, but did not file a Schedule 1

1

, filed a

tax form from a Trust Territory

2

, or were not