Member FDIC P.O. Box 195115 San Juan PR 00919-5115

Right to Draw Against Deposited Items (Regulation CC) / Funds Availability Policy.

This policy establishes the time it will take for deposits to your account to be available to you for withdrawal. All capitalized

terms not defined herein have the meanings ascribed to such terms in the Personal Banking Services Agreement

.su dna uoy neewteb dna yb detucexe

Your Ability to Withdraw Funds

Our policy is to delay the availability of certain funds deposited in your account. During the delay period, you may not

withdraw the funds in cash, and the Bank will not use such funds to pay the checks you have written. Details of the fund's

availability are explained below.

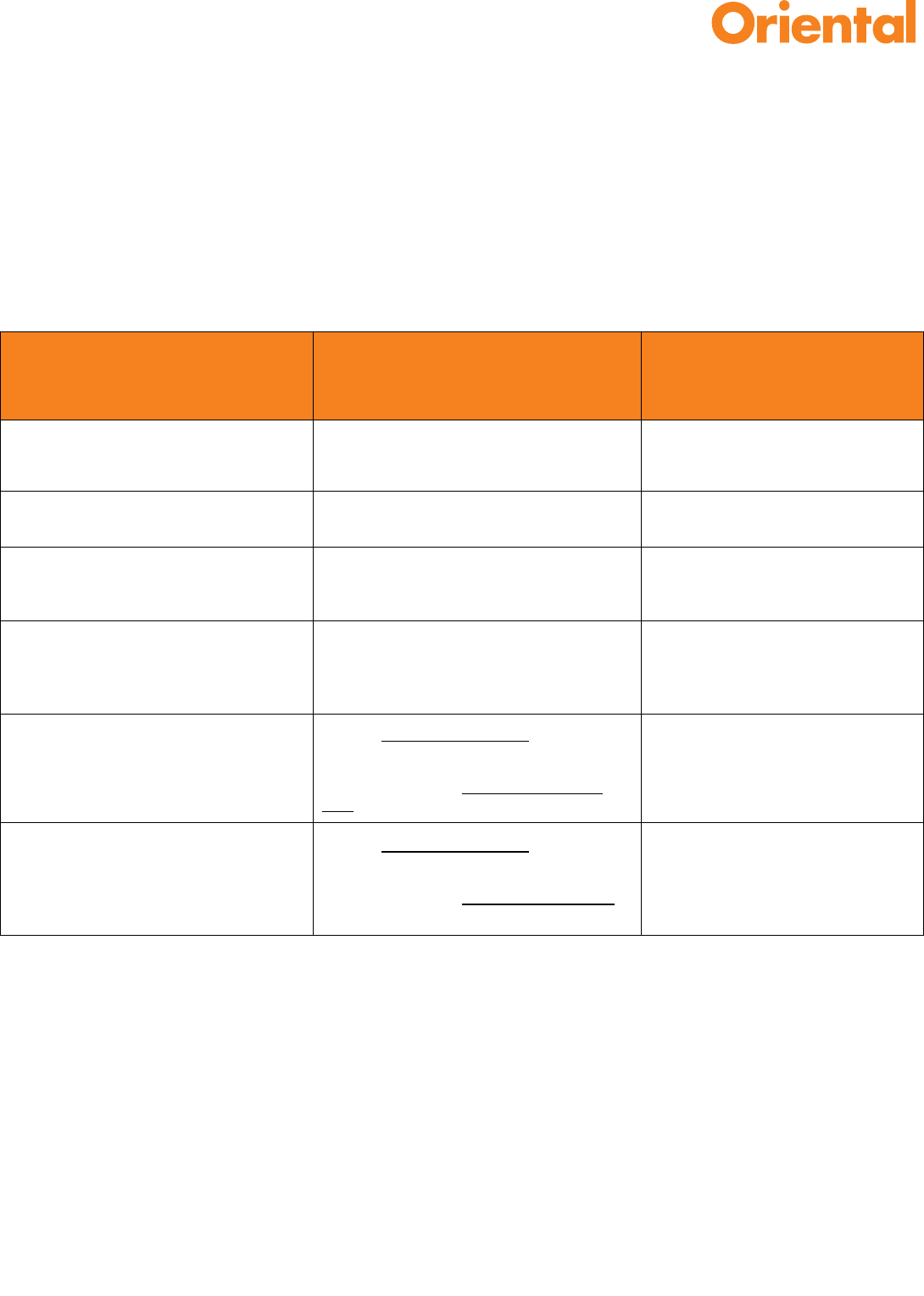

TYPE OF DEPOSIT

WHEN FUNDS WILL BE AVAILABLE

WHEN FUNDS ARE AVAILABLE,

IF THE DEPOSIT IS MADE ON

MONDAY, WITH NO HOLIDAYS

Cash, electronic transfers, electronic direct

deposits to your account, and checks

drawn on Oriental Bank

Funds are available on the same day we

receive the deposit.

Monday

US Treasury checks

On the first business day after the day of

your deposit.

Tuesday

Federal Reserve Bank checks, Federal

Home Loan Bank checks, and US Postal

Service Money Orders

On the first business day after the day of

your deposit, if the deposit was made with the

special deposit slip available at the Branch.

Tuesday

State and local government checks from

PR or USVI or any governmental agencies

or municipalities, Cashier's, Certified and

Teller's checks.

On the first business day after the day of

your deposit, if the deposit was made with the

special deposit slip available at the Branch.

Tuesday

Checks

PR: Route/Transit Numbers 0215, 2215

USVI: Route/Transit Numbers 0216, 2216

$225 on the first business day after the day

of your deposit.

Remaining funds on the second business

day after the day of your deposit.

Tuesday

Wednesday

Other checks

(Not detailed above)

$225 on the first business day after the day

of your deposit.

Remaining funds on the third business day

after the day of your deposit.

Tuesday

Thursday

Determining the Availability of Funds

The delay period depends on the type of deposit you make and is counted in business days from the day of your deposit.

Every day is a business day except Saturdays, Sundays, and federal holidays (business day).

If your deposit consists of several checks, only $225 will be made available on the first business day after the day of your

deposit, not $225 from each check deposited. Longer delays may apply. *

If you make a deposit at one of our branch tellers during our banking hours on a business day, we will consider your

deposit as received on that same business day.

Rev. 11/22

Member FDIC P.O. Box 195115 San Juan PR 00919-5115

Right to Draw Against Deposited Items (Regulation CC) / Funds Availability Policy.

Deposits Made Through our Automated Teller Machines (ATMs) or Live Tellers (ITMs)

Deposits Larger Than $5,525

Oriental Bank can delay the availability of any amount exceeding $5,525. If the sum of all deposits made on one day exceeds

$5,525, the first $5,525 will be available according to the table above. Any excess over $5,525 will be available as detailed

herein:

• Checks with next business day availability: funds will be available on the first business day after the day of deposit.

• PR checks route and transit 0215 / 2215 and USVI checks route and transit 0216 / 2216: funds will be available on

the second (2nd) business day after the day of deposit.

• Other checks (not detailed above): funds will be available on the third (3rd) business day after the day of deposit.

These rules do not apply to cash deposits, electronic transfers, direct deposit payments, and checks drawn on an Oriental

Bank account.

Special Rules for New Accounts

If you are a new customer, the following special rules will apply during the first 30 days your Account is open:

• Funds received through direct deposit will be available the same business day these are received.

• Funds from cash deposits, wire transfers, and the first $5,525 of deposits made on cashier's, certified, teller's,

travelers, and state and local government checks from PR or USVI or any governmental agencies or municipalities

will be available on the first business day after the day of your deposit if you comply with certain conditions, for

example, your deposit is completed using the special deposit slip. The excess of over $5,525 will be made available

by the sixth (6th) business day after the day of your deposit.

• If these check(s), except for a US Treasury check, are not deposited in person, through one of our branch tellers,

using the special deposit slip, the first $5,525 may be available on the second (2nd) business day after the day of

your deposit.

• The funds of all remaining checks will be available no later than the sixth (6th) business day after the day of your

deposit.

*Longer Delays May Apply

Funds you deposit by check may be delayed for a longer period under the following circumstances:

• We believe a check you deposit will not be paid.

• You deposit checks totaling more than $5,525 on any day; the exception applies to the portion of your deposit in

excess of the first $5,525.

• You deposit a check that has been returned unpaid.

• You have overdrawn your account repeatedly in the last six months; or

• There is an emergency, such as a failure of communications/computer equipment or an emergency beyond Oriental

Bank's control. We will notify you if we delay your ability to withdraw funds for any of the reasons detailed above,

and we will tell you when the funds will be available. Generally, the funds may be available no later than the sixth

(6th) business day after the day of your deposit.

Check deposits made on or before 9:00 PM on a business day will be considered as received on the same business day.

Check deposits made after 9:00 PM on a business day, or on a Saturday, Sunday, or federal holiday, will be considered as

received on the next business day. Longer delays may apply.*

Rev. 11/22