EIOPA-BoS-13/116

28 June, 2013

Background Note on Payment Protection Insurance

2

Contents

Part I – Comparative analysis of consumer protection issues regarding PPI........ 4

1. Some characteristics of PPI products .................................................... 4

1.1. Risk coverage and underlying loan products ..................................................... 4

1.2. Use and some characteristics of PPI ..................................................................... 5

2. Consumer protection issues with PPI .................................................... 6

2.1. Issues in the distributor$customer relationship (mis$selling) ..................... 6

2.2. Market imperfections ................................................................................................... 7

2.2.1. Distorted consumer choice due to cross$selling ....................................... 7

2.2.2. Group insurance contracts ................................................................................ 8

2.2.3. Information asymmetry ..................................................................................... 9

2.2.4. Product design issues .......................................................................................... 9

3. Examples of regulatory and supervisory actions for better functioning

markets in PPI ......................................................................................... 11

3.1. Types of market intervention ................................................................................. 11

3.2. General measures against mis$selling ................................................................ 12

3.2.1. Measures against selling to unsuitable consumers ............................... 12

3.2.2. Measures against misleading information ................................................. 13

3.3. Measures against market power arising from cross$selling ....................... 14

3.4. Comparability of information.................................................................................. 16

3.4.1. Comparability of offers ..................................................................................... 16

3.4.2. Comparison tools ................................................................................................ 16

3.5. Product regulatory measures ................................................................................. 17

Part II –Case studies ................................................................................ 18

4. Rules affecting PPI in the Consumer Credit Directive ............................ 18

5. PPI in France ................................................................................... 18

5.1. PPI market specialities in France .......................................................................... 18

5.2. Regulatory and supervisory action in France ................................................... 19

6. PPI in Hungary ................................................................................ 20

7. PPI in Ireland .................................................................................. 20

7.1. PPI market specialities in Ireland ......................................................................... 20

7.2. Market problems in Ireland ..................................................................................... 21

3

7.3. Regulatory and supervisory actions regarding PPI ........................................ 22

7.3.1. Consumer Protection Code .............................................................................. 22

7.3.2. Supervisory reviews of PPI in Ireland ......................................................... 22

7.3.3. Consumer Complaints ....................................................................................... 24

8. PPI in Italy ...................................................................................... 24

8.1. PPI market specialties in Italy ............................................................................... 24

8.2. Market problems in Italy .......................................................................................... 24

8.3. Regulatory and supervisory actions regarding PPI ........................................ 25

9. PPI in the Netherlands ...................................................................... 27

9.1. Market issues in the Netherlands ......................................................................... 27

9.2. Regulatory and supervisory action in the Netherlands ................................ 28

9.2.1. Thematic work on PPI in 2009$2010 ........................................................... 28

9.2.2. AFM investigation on advisor fees for consumer loan PPI .................. 29

10. PPI in Portugal ................................................................................. 30

10.1. Guidelines on PPI compliance ................................................................................ 30

10.2. Expected effects and planned steps .................................................................... 31

11. PPI in Spain .................................................................................... 32

11.1. PPI market specialities in Spain ............................................................................ 32

11.2. Regulatory and supervisory actions regarding PPI ........................................ 32

11.2.1. PPI requirements for consumer credits ...................................................... 32

11.2.2. PPI related to mortgages ................................................................................. 33

11.2.3. Self regulation by the Insurance Association (UNESPA) ..................... 34

11.2.4. Supervisory actions ............................................................................................ 34

12. PPI in the United Kingdom ................................................................ 35

12.1. PPI market in the United Kingdom ...................................................................... 35

12.2. Description of market problems ............................................................................ 35

12.3. Regulatory / Supervisory responses ................................................................... 36

12.4. Recent market developments ................................................................................ 37

References .............................................................................................. 39

4

Part I – Comparative analysis of consumer protection

issues regarding PPI

1. Some characteristics of PPI products

1.1. Risk coverage and underlying loan products

1. Risks covered: Accident, Sickness, Unemployment, Life. Payment

Protection Insurance (PPI) is an insurance product designed to provide coverage

for the consumer of a financial obligation in case they are unable to fulfil a

payment. The risks covered by PPI generally include accident, sickness and

unemployment, and for certain products often life.

1

2. Related ‘damage to property’ coverage. PPI generally covers risks that

are related to the person having a financial obligation; however, it is sometimes

combined with coverage that is related to the underlying property. Thus,

although generally PPI is understood to provide coverage for the risks listed

above, in some cases a more general coverage is understood under payment

protection. However, it is worth mentioning that in Italy and Spain mortgages

are often sold together with insurance covering damage to the property as well.

3. Underlying loan products. The payment obligation PPI provides

coverage for is generally associated to a loan product.

2

Loan products that are

most frequently associated with PPI are different types of consumer credit (most

notably credit cards and personal loans) or mortgage loans.

4. Alternative PPI products. There might be products that have different

names but serve very similar purposes, with some products appearing as

contractual clauses instead of a separate insurance product. To the extent they

share some of the same characteristics as PPI, these newer products could pose

some of the same risks, unless undertakings take particular care with their

product design and sales practices.

3

5. This background note generally covers both mortgages and

consumer credits. This background note covers both mortgages and unsecured

loans (consumer credits). It must be pointed out that mortgage$PPI has in

certain aspects different characteristics than PPI providing coverage for

consumer credit (CC$PPI). However, these characteristics might differ from

country to country and also from product to product in a given country. The

table below is an indication of likely differences; these differences are reflected

in the analysis and country case studies as well.

1

PPI providing life coverage differs from general life insurance in being adjusted to the loan contract; contracts

often have banks as beneficiaries. Mortgage insurance generally includes life coverage.

2

There are some products that provide coverage for other type of payments. (e.g. utility payments.)

3

This issue has been addressed most extensively in the UK; see chapter 12.

5

Table 1. Differences between PPI related to mortgage and consumer credit (CC)

Mortgage

!

PPI

CC

!

PPI

Accident, Sickness,

Unemployment Coverage

Likely Core part of the product

Life coverage

Very likely

Unlikely

Benefits

Likely to be full amount

of the loan

Likely to be a lump sum

Duration of coverage

Very likely to adjust to

loan

Likely to be fixed in a

certain number of moths

Premiums paid

Monthly

, sometimes

single

Monthly, often single

Takes consumer

differences into account

Possibly Unlikely

1.2. Use and some characteristics of PPI

6. PPI can serve legitimate consumer needs. EIOPA acknowledges that

PPI products, when properly designed and sold, serve legitimate consumer

needs. Yet, EIOPA also acknowledges that, in a number of jurisdictions,

significant cases of misselling have occurred, to the detriment of consumers and

negatively affecting the reputation of the insurance sector as a whole.

7. Product complexity and differentiation. PPI combines coverage for a

number of different risks and the numerous limitations and exclusions may prove

challenging for consumers.

4

A part of this complexity is sometimes not reflected

in offers for the consumers. Although consumers may represent very different

risks, and may only need coverage against certain risks, (especially in the case

of consumer credit) PPI tends to be sold as a “onesizefitsall” product, without

any differentiation regarding the consumer. In the case of mortgages a more

differentiated product structure and individualised offers are more likely.

8. Advised vs. non%advised sales. Given the complexity of the coverage

and the sometimes extensive lifetime of the product (especially in the case of

mortgages), some countries may only allow the distribution of certain PPI

products on an advised basis. However, given that sometimes the products

manifest in rather simple offers, some jurisdictions also allow for non$advised

sales.

9. PPI issues must be assessed on a product%by%product basis.

Whereas this note lists the most common issues that have arisen around PPI, it

is generally true that any PPI intervention must take into consideration the

specific characteristics of the local products concerned, i.e it must happen on a

case$by$case basis.

4

There is a unique understanding of coverage for certain products in Spain, as PPI for unemployment or

temporary disability only provides coverage for either unemployment or temporary disability, depending on

the labor situation of the policyholder (see more in the chapter about Spain)

6

2. Consumer protection issues with PPI

10. Overview. Payment protection insurance has been on the agenda for

many different reasons in different jurisdictions. An issue that certainly drew a

lot of public and media attention is mis$selling, where breaches of business

conduct rules resulted in significant consumer detriment, most notably in the UK.

However, apart from mis$selling, there are further market imperfections that

resulted in regulatory and supervisory intervention in a number of countries.

2.1. Issues in the distributor!customer relationship (mis!

selling)

11. Providing misleading information at the point of sale. When buying

PPI, consumers often receive a lot of misleading information that distort their

choice. This distortion may materialize in consumers purchasing PPI in cases

where they did not have to; or consumers purchasing PPI policies that represent

a suboptimal choice for them.

12. Examples of misleading information. There might be very different

pieces of information that influence a decision by the consumer. Some examples

of misleading information are: (the list being obviously not exhaustive):

a) Misleading the consumer into believing that taking out PPI is compulsory

by law, where applicable

b) Misleading the consumer into believing that PPI is an integral part of the

loan product

c) Making the false impression that taking out PPI improves the chances of

obtaining the loan

d) Not disclosing the main features of the policy to the customer on time (or

not disclosing it at all)

e) Misleading the consumer about whether the fees paid are in relation to the

insurance or credit product

13. Eligibility issues. Distributors have often not checked whether the given

policy is suitable for the customer given their demands and needs. PPI

distributors often marketed policies to consumers who were not eligible to claim

benefits at all. These issues frequently involved selling unemployment cover for

self$employed or medical insurance to people who were not able to claim

benefits because of some pre$existing medical condition.

14. Suitability issues. Further, even if being eligible to claim benefits, the

product was not always suitable for the consumer, and thus undertakings have

not acted in the best interest of the consumer. This might have included selling

7

PPI for very small loans or credit card users who generally repay the outstanding

balance in full every month.

5

2.2. Market imperfections

15. Market imperfections. Although there is limited information available to

make general statements on Europe, PPI markets seem to be a highly profitable

in a number of countries. It seems that some market imperfections

6

are quite

frequent for PPI, and they might result in consumers being unable to take

advantage of a properly functioning market.

2.2.1. Distorted consumer choice due to cross!selling

16. Tying. PPI is generally distributed together with a credit product.

Sometimes distributors require that the consumer purchasing the loan purchases

the insurance product from a designated (often the same) company (or group).

The situation where the acquisition of a given insurance product with the credit

product is made mandatory by the loan provider is generally referred to as a

tying practice.

7

17. Potential effects of tying. Tying practices result in a situation where

consumers have no choice between different insurance policies – if they wish to

obtain the loan from a given company, they have to purchase an insurance

policy chosen by that loan provider. This is likely to leave consumers ending up

with a product that is not best suited for their needs, as the policy may offer

suboptimal coverage or may prove to be too expensive.

8

18. Bundling. There might be other forms of packaged distribution where the

packaged services are available separately, but not necessarily on the same

terms. This practice is generally referred to as bundling. This could mean for

example a price reduction for credit products if purchased together with PPI, as

credit risk is reduced with the purchase of an insurance product.

19. Potential effects of bundling. Bundling practices may have the same

harmful effects as tying practices. They are generally considered less harmful, as

they necessarily leave some choice for the consumers, however, they might have

the same distorting effects for consumer choice.

5

Eligibility and suitability issues have been examined e.g. in Ireland, the Netherlands and the UK, see the

respective case studies.

6

The terms ‘market imperfections’ and ’market failure’ are generally used to describe where the allocation of

goods and services by the free market is not efficient, and could potentially be improved by regulatory

intervention.

7

Insurance with a loan may also be obligatory by law.

8

These detrimental effects could theoretically be offset by fierce competition for the packaged product (credit

+insurance), however market developments indicate that this is unlikely to be the case.

8

20. Cross%selling with no rebates. Even when there is no difference

between the conditions for the packaged product and the same products sold

separately, cross$selling can have an effect on consumer choice. Market

characteristics, especially the lack of transparency may result in a situation

where the mere fact of selling two or more products together creates

considerable market power for distributors.

21. Market power in distribution for loan providers. Market power is the

economic concept of the ability of a firm to profitably raise the market price of a

good or service over marginal cost and thus has a great effect on consumer

choice. The most obvious distribution channel for underwriters is through loan

providers and this is likely to result in considerable market power (economic

strength) for loan providers. This market power is likely to be further

strengthened with the application of tying or bundling practices. In PPI markets

consumers are often mainly engaging with the loan product offered and not with

the accompanying PPI product or its cost. This can lead to loan providers having

a potentially captive audience who do not shop around for alternative insurance

cover and thus do not drive down costs through competition. Loan providers are

thus potentially able to exert market power and charge excessive prices for PPI

and make super$normal profits from it.

9

22. Competition for distributors puts an upward pressure on

commissions. Market power for loan providers results in a situation where PPI

underwriters are more likely to compete for distributors and not directly for

consumers. This is often reflected in a business model where a loan provider

issues a tender for PPI underwriters. Among other factors, the profitability for

the banks is an important factor in these tenders, which have exerted an upward

pressure for commission levels.

10

2.2.2. Group insurance contracts

23. Group insurance contracts may have an effect on market power.

There is evidence that some distributors (credit providers) enter into a general

agreement with insurance providers. This might have an effect on the market

power described above, as in certain cases the insurance element becomes a

part of the credit contract, leaving consumers no choice in choosing PPI. On the

other hand, group contracts may result in more favourable offers from insurers,

but the pass through of these benefits to consumers is not confirmed.

24. The effect of vertical integration. Credit providers, the most important

distributors of PPI sometimes sell insurance coverage from a company belonging

9

Market power of economic strength is a key concept in competition law (antitrust). However, antitrust

intervention is likely only when market power amounts to a dominant position in the market; on the other

hand, market power may have a considerable distorting effect on consumer decisions also in cases where the

intervention thresholds for competition law are not met.

10

UK Competition Commission (2009).

9

to the same group. This may lead to higher commissions, although a market

study in the UK found that vertical integration was a less important element in

the very high market power distributors have enjoyed in the PPI market.

25. Uncertainties around beneficiaries. Group insurance may result in a

situation when there is no contractual relationship between the consumer and

the insurance company at the time of contract signing, and as a result of this,

consumers might be deprived of their choice whether they want to take out PPI

at all. Further these uncertainties may make claims more burdensome for

consumers as well.

11

2.2.3. Information asymmetry

26. Lack of information on PPI prices level and comparability. A further

issue making consumer choice more difficult is the fact that consumers do not

receive, or only receive relatively late their personal quote, i.e. the individual

price information. The lack of individual price information makes the comparison

of offers from different providers very difficult.

26. Limited financial literacy on PPI. Generally, consumers showed limited

financial capability when purchasing PPI. Many consumers often do not realize

that PPI is an independent product and separate to the loan. Consumers were

therefore not engaging with or understanding the PPI product because they were

focusing on the loan product. Consumers often believe that purchasing the

insurance policy is compulsory, or that doing so would improve their chances of

obtaining credit.

2.2.4. Product design issues

27. Selling PPI with single premium. In some countries, many firms have

sold PPI with a single premium, meaning that the consumers had to pay a fixed

amount at the beginning of the credit contract. Consumers sometimes were not

aware that the premium will be added to the loan amount, and interest would be

payable on that. The single premium design caused further problems with early

termination of the underlying credit products, as a refund for the insurance

policy was difficult to obtain.

28. Refund issues. A lot of uncertainties have arisen around cancellation of

the policies, where consumers should be entitled to a certain refund.

Undertakings tend to follow diverging policies when determining rate of refunds.

Consumers also often found the refund process very burdensome.

29. Limitations in coverage. In many instances, product design issues made

consumer detriment more likely. PPI products were often designed to provide

11

Consumer protection issues around group insurance have been experienced in France, Hungary and

Portugal; see the respective case studies.

10

only very limited coverage, which are likely to have contributed to frequent

occurrence of poor consumer choice.

30. Duration mismatch. Some PPI products had a duration mismatch, i.e.

the duration of the insurance cover was shorter than the duration of the

underlying credit product. This is less frequently the case for mortgages,

however occurs very frequently for consumer loans.

31. Unfair terms. An example of unfair terms in the contract is when

consumers are given a very limited time period after an event (for example, 6

months after an accident, illness or unemployment) in which they can make a

claim. Another example is terms that prevent consumers from receiving any

refund of the premium if they want to cancel the PPI policy for any reason, for

example if they repay the associated loan early

12

, and they are no longer able to

claim under the insurance, or simply do not want to have the cover any more.

32. Overview. The following picture gives an overview about the causes of

potentially distorted consumer choice in PPI, and gives an overview about the

potential consequences.

Causes for distorted consumer choice in PPI

12

Some insurance contracts terminate with the repayment of the loan. However, in many cases insurance

contracts require further action from consumers to terminate after loan repayment.

11

3. Examples of regulatory and supervisory actions for

better functioning markets in PPI

33. Overview. This chapter gives an overview about regulatory and

supervisory action for better functioning PPI markets. It lists the types of market

intervention and then discusses the measures applied according to the market

problems discussed previously.

3.1. Types of market intervention

34. Supervisory enforcement action. Generally, non$compliance with the

rules governing consumer relations are best tackled by enforcement actions

targeting the poor behaviour of the supervised undertakings. Failings in the

distributor$consumer relationship have been targeted by supervisory action.

35. Sector legislation or guidance. Some of the issues around PPI were so

widespread and amounted to such level of complexity, that in order to achieve

clarity, a supervisory guidance or normative action was necessary.

36. Legislative action. The large number of market imperfections made PPI

an area where regulatory intervention became frequent. Legislative actions on

different levels have been introduced to correct for market imperfections.

37. Industry self%regulation. There have been examples of industry self$

regulation, where undertakings decided to impose restraints on their activities by

themselves, in order to ensure to compliance and the better functioning of

markets.

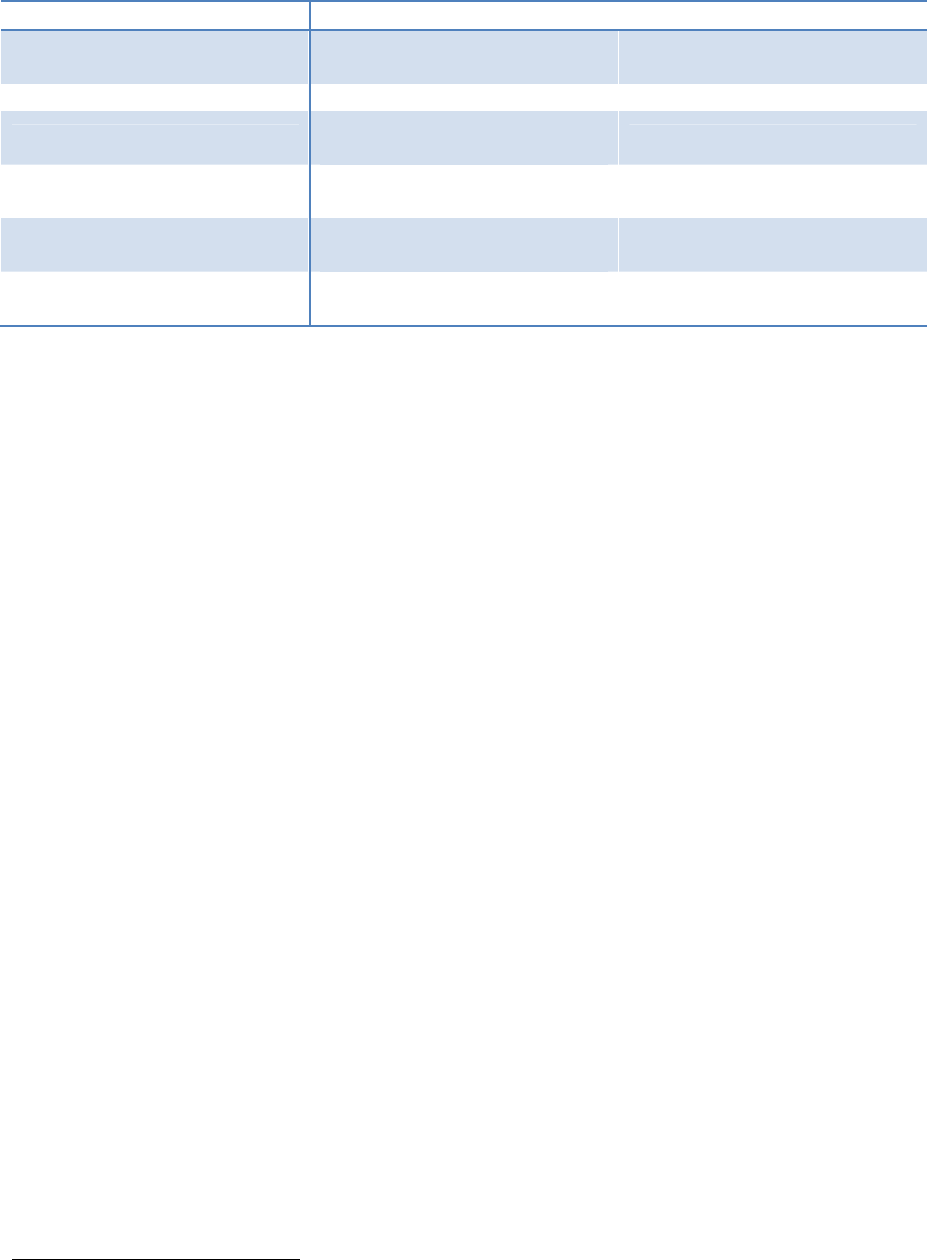

38. Consumer protection intervention and NCA role. The following picture

gives an overview about types and levels of consumer protection intervention,

and gives an indication of what roles NCAs could probably play in different types

of interventions.

12

Levels of consumer protection intervention in PPI

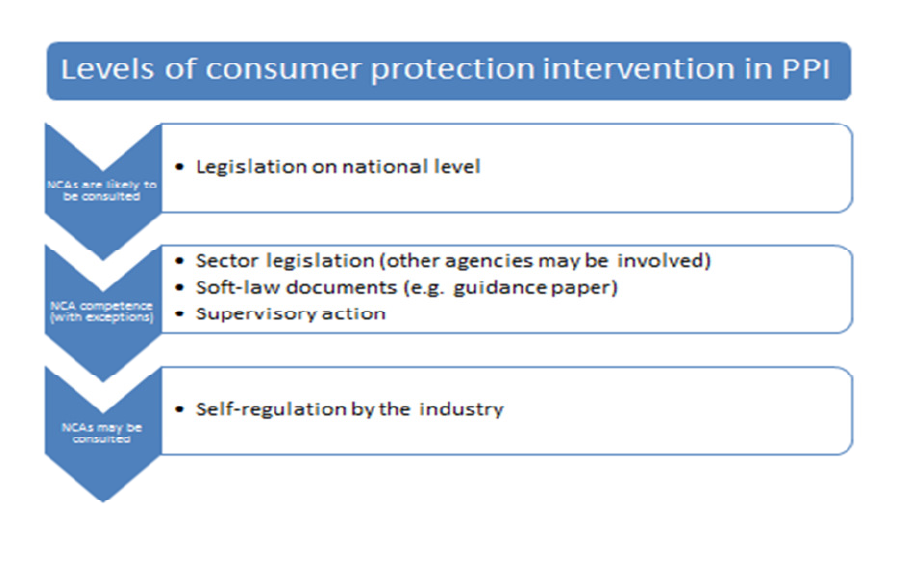

3.2. General measures against mis!selling

39. Supervisory actions enforcing compliance. The most common tools to

tackle any kind of mis$selling issues are increased supervisory actions. However

it must be borne in mind that this is a very resource$intensive measure, and that

certain problems may justify the use of more general measures.

40. Ensuring proper complaint%handling by firms. Since consumers are

likely to address firms with their issues first, it might prove very useful to ensure

that their complaints are handled properly at this level. Some jurisdictions have

addressed complaints$handling explicitly for PPI, with the UK issuing supervisory

guidance on the issue.

41. Requesting firms to review their sales. Given that the number of

contracts affected by a certain problem may be enormous, some countries

requested their PPI providers to review their sales for a given period, according

to certain criteria. This is a still on$going process in Ireland, for example.

3.2.1. Measures against selling to unsuitable consumers

42. Guidance on identifying suitability of consumer. As mis$selling

problems often involved sales to unsuitable consumers, supervisors might

improve the functioning of the market by issuing guidance on this topic based on

the experience available. There has been a supervisory guidance on this topic by

the Netherlands.

13

3.2.2. Measures against misleading information

43. Mandatory information requirement on certain topics. The fact that

consumers are presented with certain misleading information often stems from

certain omissions, e.g. distributors not mentioning that PPI may not be

compulsory or that PPI is a separate product. These issues can be tackled with

requiring mandatory information on certain topics. For example, in the UK an

offer now must explicitly state that PPI is not mandatory, and that it is available

from other providers as well. French and Italian regulation also requires to

provide general information on risks and payoffs.

13

44. Including references to information sources. A further measure

enhancing the effect of mandatory information requirement is to include

references to other information sources. This is likely to be the case for

information that may not be available at the point$of$sale, such as information

on other offers or comparison measures.

45. Raising consumer awareness by separate application forms. To

ensure that consumers easily realise that the loan and PPI are separate

products, the use of a separate application form is required in Ireland and Italy.

Overview of measures against misselling

13

ISVAP Regulation 40 (2012), Lagarde law France (2010)

14

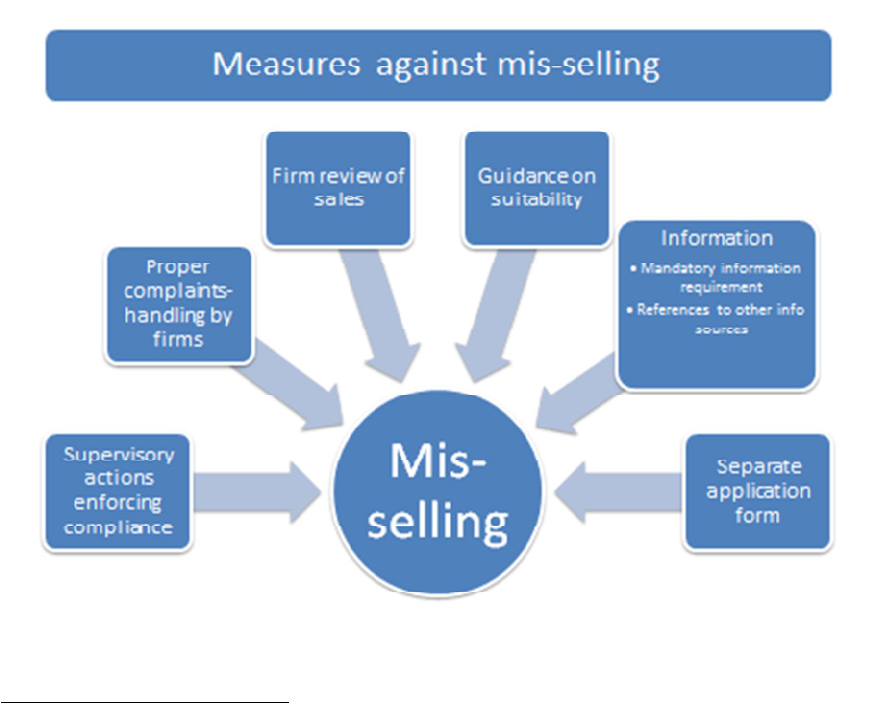

3.3. Measures against market power arising from cross!

selling

46. There have been several types of measures that are aimed to help

consumer choice by limiting market power arising from several types of cross$

selling.

47. Prohibition of tying. The mandatory purchase of PPI from a given

provider in some jurisdictions triggered special regulation that explicitly

prohibited these tying practices for PPI and loan products. The 2010 changes in

the French legislation made sure that loan providers are not allowed to request

mandatory purchase of insurance from the same provider or group.

14

Furthermore, Portuguese law

15

prohibits certain exclusive agreements as

insurance intermediaries (such as banks, which may act as tied agents) are not

allowed to impose a condition on the consumers to enter into an insurance

contract with a specific insurance undertaking in order to gain access to another

offered good or service. This provision tackles exclusive agreements (i.e. the

imposition of the provider for an additional product)

16

.

48. Ensuring equal assessment of independent PPI policies. To ensure

that consumers may take advantage of their search for PPI, regulators may

prescribe that loan providers must grant equal conditions for the loan

irrespective of the PPI provider. An example for that is a recent Italian regulation

that, in the case of life insurance, allows 10 days for consumers after receiving a

loan and PPI combined offer to come up with an alternative offer; the loan

provider has to accept this alternative coverage without changing the conditions

of the offer. The recent French legislation provides that lenders cannot refuse

equivalent offers from other PPI providers.

17

49. Introducing alternative offers at the loan point%of%sale. A measure

of improving consumer choice at the point of sale is the requirement on loan

providers to present two or more competing offers to the consumer there. This

obviously allows for more choice, however it still may allow for some distortion

by distributors as they may steer customers towards a given offer by not

presenting the most competitive alternative offers. The relative popularity of this

measure could be explained by the limited number of PPI providers.

50. Prohibiting conflicts of interest. Another potential way of influencing

the availability of offers at the point of sale is to put a prohibition on certain

14

France “Code de la consummation” Consolidated version (changes introduced in 2010)

15

Portuguese law on taking-up and pursuit of insurance mediation (Decree-Law no. 144/2006, of 31 July, as

amended). Other specific provisions governing the sale of consumer credit and mortgage loan are also relevant

in this context

16

Please note that the mentioned rule is not only applicable in market power leverage situations; it has the

broader purpose of consumer protection.

17

ISVAP Regulation 40 (2012), Lagarde law France (2010)

15

conflicts of interest. In Italy, for example loan providers are not allowed to be

the beneficiary and distributor of the insurance contract at the same time,

because it conflicts with the distributor’s duty to act in the best interest of the

consumer. However, sales commissions are often high both when selling PPI

products of firms that belong to the same group or not. For the UK, a study

found that vertical integration did not influence commission and price levels.

18

51. Prohibiting PPI sales at the loan point%of%sale. To ensure a proper

“unbundling” of the loan and the insurance products, the UK has introduced a

prohibition of selling PPI at the loan point$of$sale, and requires that PPI is not

sold until after seven days after the loan was sold. This measure certainly limits

the market power on behalf of the loan providers. However it may have a

negative effect on sales, as consumers’ willingness to enter into an insurance

contract may deteriorate with time after signing the loan contract.

Overview of measures against market power from crossselling

18

UK Competition Commission (2009)

16

3.4. Comparability of information

3.4.1. Comparability of offers

52. Obtaining a personal quote. To ensure that consumers can compare

the available offers, an obvious measure is to ensure that they receive personal

information. In the case of PPI, the actual financial obligation is often challenging

to calculate and assess, which is why considerable emphasis is put on ensuring

that consumers receive personal quotes in due time. Italy and the UK are

examples of this practice.

53. Price disclosure. To ensure the comparability of individualized

information, there might be rules that prescribe that the information must be

presented in a standardized format. Generally these rules require providers to

disclose the price of PPI in “monthly euros” (or other currency). These rules may

complement the use of a personal quote or may stand alone by themselves –

price disclosure in a standardized format may in itself help comparability (see

rules in France).

54. Other standardized information. Apart from price, a standard format

for other types of information could obviously further contribute to comparability.

Italy applies a standardised format for presenting price and product

characteristics making it easier for consumers to compare alternative offers.

3.4.2. Comparison tools

55. Comparing at the point of sale. Given that selling PPI with a loan

product is a major way of distribution, it makes sense to introduce competition

at this stage. As already presented among measures against cross$selling, some

jurisdictions (Italy for life insurance)

19

require undertakings to present at least

two competing offers on PPI for the consumer. Again, the fact that this

information covers only a part of the market may allow for some distortion in

consumer choice.

56. Online tools. Online tools play an ever increasing role in ensuring market

transparency, and some countries explicitly targeted improved disclosure

through these channel. The UK has ordered PPI providers to populate a

comparison website run by the FSA, and Italy ordered companies marketing life

insurance linked to loan to have a free online quotation service on their website;

further IVASS lists all these products at its website.

20

19

Decree law N.1 of 24.1.2012 in Italy

20

Competition Commission (2011), ISVAP (2012) Regulation n. 40 of 3 may 2012

17

3.5. Product regulatory measures

57. Minimum content. Uncertainties around the scope of coverage can be

reduced if regulation actually determines some aspects of the product. In Italy,

recent regulation prescribes the minimum content of life insurance contracts

related to mortgages and personal loan products.

21

58. Prohibition of single premium policies. The information uncertainties

(additional interest on premium) and the early termination difficulties led

countries to explicitly prohibit the selling of these types of products. Currently,

the UK has an explicit prohibition on selling single premium policies.

59. Regulating refund process. As early termination issues have resulted in

many uncertainties, some countries decided to focus on the refund process

22

to

ensure a more favourable outcome for consumers. Refund regulations may allow

for deduction of certain administration costs, but generally they aim at a full pro

rata refund of the premium.

60. Price maximum on PPI advice fee. Based on a very special regulatory

environment, there has been a self$regulatory price cap negotiated on PPI advice

fee in the Netherlands. This was largely based on the fact that intermediaries

tried to circumvent the ban on consumer credit advice fee bans by charging

excessive fees on PPI advice.

21

ISVAP (2012) Regulation n. 40 of 3 may 2012

22

There are detailed self-regulatory rules set by UNESPA in Spain, for example.

18

Part II –Case studies

61. The following country case studies are set out in the alphabetical order of

the names of the countries.

4. Rules affecting PPI in the Consumer Credit Directive

62. Rules on PPI for consumer credits. The Consumer Credit Directive

23

adopted in 2008 contained several rules that affect certain ancillary products

which are distributed together with credit products. PPI, as an insurance product

is seen as one of these products, so the rules of the directive carry relevance for

PPI linked to consumer credit. It must be pointed out, that some countries

decided to apply some special (usually stricter) rules regarding PPI when

transposing the directive.

63. Pre%contractual information on whether PPI is necessary. According

to the Consumer Credit Directive, credit providers must give adequate pre$

contractual information if purchasing insurance is necessary. The information

shall specify if there is “an obligation, if any, to enter into an ancillary service

contract relating to the credit agreement, in particular an insurance policy, where

the conclusion of such a contract is compulsory in order to obtain the credit or to

obtain it on the terms and conditions marketed.”

24

64. Total cost for credit includes premiums for mandatory insurance as

well. In cases where insurance is mandatory for obtaining credit (or obtaining it

on the conditions marketed), the indicators depicting the total cost of credit

should include insurance premiums in their calculation as well.

25

If the cost of

that service cannot be determined in advance, the obligation to enter into that

contract shall also be stated in a clear, concise and prominent way, together with

the annual percentage rate of charge.

26

5. PPI in France

5.1. PPI market specialities in France

65. Mortgages. Mortgage protection insurance is not legally mandatory but is

often made mandatory by credit institutions in France. Mortgages have been sold

23

CCD Directive: Directive 2008/48/EC of the European Parliament and of the Council of 23 April 2008 on

Credit agreements for consumers and repealing Council Directive 87/102/EEC

24

CCD Directive Article 5 (1) (k)

25

CCD Article 3 (g) reads as follows: ‘total cost of the credit to the consumer’ means all the costs … the

consumer is required to pay in connection with the credit agreement … costs in respect of ancillary services

relating to the credit agreement, in particular insurance premiums, are also included if, in addition, the

conclusion of a service contract is compulsory in order to obtain the credit or to obtain it on the terms and

conditions marketed;

26

CCD Article 4 (3)

19

together with insurance as a package until recently, where new measures have

been introduced to improve consumer choice.

66. Coverage. Mortgage protection insurance is very closely related to life

insurance as it pays off the whole debt in case of death. Mortgage protection

insurance is a differentiated product, where price may vary according to the

borrower’s status and condition.

5.2. Regulatory and supervisory action in France

67. Case law. Some case law decisions have set out requirements in the area

of consumer protection in relation to PPI. When distributing PPI, credit

institutions have to check the adequacy of the insurance contract to the

consumer’s needs.

68. Rules in the French Insurance Code. The French Insurance Code

provides that insurance intermediaries have the duty to give an advice to their

customers, in the form of a personal recommendation taking into account the

demands and needs of consumers, when distributing insurance products, which

includes PPI.

69. Rules in the French Consumer Code. The French Consumer Code

contains important provisions on mortgage protection insurance. Key elements

of the regulatory framework include:

• Prohibition of tying / Freedom of choice: Lenders are not allowed to

refuse equivalent cover by any insurer even when it does not belong to

the same group as the bank providing the loan. All refusals must be

justified. Moreover, lenders are not allowed to offer more favourable credit

conditions to creditors who choose PPI contract from the same group

where the bank belongs.

27

• Information on freedom of choice: The Consumer Code requires

explicit information that consumers have the freedom to choose the

insurer: the law requires lenders to make a written offer to natural

persons, also stating that the borrower is free to choose his insurance

company.

28

• General information requirement for PPI: A standardised information

document must be provided together with the loan offer listing all

potential risks and the main terms and conditions of the insurance.

27

“Code de la consommation” Consolidated version 01/01/ 2013 Articles L312-9. Le prêteur ne peut pas

refuser en garantie un autre contrat d'assurance dès lors que ce contrat présente un niveau de

garantie équivalent au contrat d'assurance de groupe qu'il propose. and Le prêteur ne peut pas

modifier les conditions de taux du prêt prévues dans l'offre définie à l'article L. 312-7, que celui-ci soit

fixe ou variable, en contrepartie de son acceptation en garantie d'un contrat d'assurance autre que le

contrat d'assurance de groupe qu'il propose.

28

“Code de la consommation” Consolidated version 01/01/ 2013 Articles L312-7 and L312-8

20

Subsequent modifications to these are only possible with the consent of

the borrower.

29

•

Price disclosure in monthly euros: When offering PPI with a consumer

loan, the lender or credit intermediary must inform the borrower of the

standard cost of insurance, using a numerical example in euros per

month.

30

More detailed provisions on price disclosure for mortgage loans

are set out in a report from the Consultative Commission of the Financial

Sector (CCSF) providing for a standardized information sheet

31

.

70. The Lagarde legislation. The current framework is a result of the

Lagarde law

32

, which was aimed at transposing the Consumer Credit Directive

with further consumer protection measures. The relevant provisions of the law

entered into force from September 2010. Some provisions were already a

widespread practice according to a publication by the French Banking

Association.

33

6. PPI in Hungary

71. Group insurance contracts. The Hungarian Financial Services Authority

has highlighted a potential concern for consumers in its 2010 Consumer

Protection Risk Report. According to the report, most of the existing PPI

agreements in Hungary were concluded in the form of group insurance contracts,

where the insurance contract is established between the insurance company that

assumes the risk and the financial institution that grants the loan.

72. This results in a situation when there is no contractual relationship

between the consumer and the insurance company at the time of contract

signing, and since the participation in the group coverage is incorporated to the

loan agreement between the consumer and the bank, consumers might be

deprived of their choice whether they want to take out PPI at all.

34

7. PPI in Ireland

7.1. PPI market specialities in Ireland

73. Size of the market and products affected. It is estimated that around

340,000 Payment Protection policies were sold between 2007$2012 in Ireland.

These policies are sold in connection with personal loans, car finance, credit

29

“Code de la consommation” France Consolidated version 01/01/ 2013 Articles L312-9.

30

“Code de la consommation” France Consolidated version 01/01/ 2013 Articles L311-6 III.

31

http://www.banque-france.fr/ccsf/fr/telechar/publications/rapport_annuel_2008_2009/CCSF_2008-

09_ichapitre_4.pdf

32

LOI n

o

2010-737 du 1er juillet 2010 portant réforme du crédit à la consummation (Consumer credit law)

33

Federation Bancaire Francaise (2011) Fiche 13/04/2011

34

PSZAF (2010) The HFSA’s Consumer Protection Risk Report, H2 2010 p. 37-38.

21

cards and mortgages

35

. In Ireland, life insurance is sold separately to Mortgage

PPI; therefore Mortgage PPI does not include life coverage. However, typically

CC$PPI does include life coverage. For benefits, PPI benefits include the payment

of a number of monthly credit repayments. It is only in the case of death that a

lump sum is paid as a benefit in CC$PPI

7.2. Market problems in Ireland

74. Recent issues. PPI insurance has been subject to a number of

supervisory reviews, regulatory actions and some complaints in Ireland. These

mostly have focused on the sales process, with the most recent issues being the

following:

a) Focusing on eligibility instead of suitability – Undertakings did not

always use the information gathered from consumers to assess the

suitability of PPI to the consumers. Instead they focused only on assessing

consumers’ eligibility for PPI.

b) Timing of information provision – key information such as terms and

conditions were not given to consumers until after they had purchased

PPI.

c) Scope of key information – Key information was not brought to the

attention of consumers, for example, policy restrictions regarding

employment cover for contract workers were not brought to the attention

of consumers.

75. Earlier issues. Other, more historic issues that were addressed prior to

the current Consumer Protection Code include the following:

d) Sales practices: In addition to suitability and information disclosure

issues, there were several other issues around sales practices such as the

provision of explicit information on PPI as an insurance product.

(Undertakings sometimes did not reveal that the purchase of PPI was

optional, or the price of the product was not disclosed.)

e) Refund in case of cancellation – If the underlying loan was repaid or the

insurance policy itself was repaid, the rules of refund were not sufficiently

clear

f) Trainings – Sales personnel lacked sometimes lacked the sufficient

training

These issues are further elaborated below in the section describing regulatory

and supervisory actions.

35

In Ireland Mortgage PPI does not include life cover. Borrowers purchase a separate life insurance policy

when taking out a mortgage, for example, a mortgage protection policy.

22

7.3. Regulatory and supervisory actions regarding PPI

7.3.1. Consumer Protection Code

76. Codes of conduct in Consumer Protection. The Central Bank of Ireland

has a number of statutory codes of conduct. The Consumer Protection Code

2006 set out the requirements that regulated firms must comply with when

dealing with consumers.

36

The Consumer Protection Code 2006 has been revised,

and the Consumer Protection Code 2012 came into effect on 1 January 2012.

37

77. Legal nature of the Consumer Protection Code in Ireland. The

provisions of the Consumer Protection Code are binding on regulated entities and

must, at all times, be complied with, when providing financial services. When

finding contravention, the Central Bank of Ireland has the power to administer

sanctions.

38

78. PPI Rules in the Consumer Protection Code. Ireland’s Consumer

Protection Code contains a lot of provisions that apply regardless of the type of

financial services provided. The rules on information provision, knowing the

consumer, suitability and record keeping have proven to be very relevant for

PPI.

39

79. The Consumer Protection Code also includes some provisions specifically

on Payment Protection Insurance.

40

These rules target two areas:

a) Premiums disclosure: the payment protection premium must be

excluded from the initial repayment estimate of the loan advised to the

consumer, which provision was kept in 2012 as well.

b) Application forms: while the 2006 Code allowed for combined

application form (with requiring a tick box that PPI was optional), the 2012

Code specifically requires separate application forms for the payment

protection insurance and for the loan.

7.3.2. Supervisory reviews of PPI in Ireland

80. 2007 Payment Protection Insurance Review. The Financial

Regulator’s review of PPI in 2007 focused on three key areas, namely sales

practices, refund procedures, and staff training. The review found that

41

:

36

Central Bank of Ireland (2012) Consumer Protection Code 2006

37

Central Bank of Ireland (2012) Consumer Protection Code 2012

38

Central Bank of Ireland (2012) Consumer Protection Code 2012 p. 3.

39

These rules are in Chapters 4, 5 and 11 of the 2012 Consumer Protection Code.

40

Chapter 4 points 6-8 in the Consumer Protection Code 2006 and 3.24 in Consumer Protection Code 2012

41

Central Bank of Ireland (Financial Regulator) (2007) Letter

23

a) Sales practices: There were several issues around sales practices,

among others suitability, information disclosure, the provision of explicit

information on PPI as an insurance product

b) Refund process: It was not sufficiently clear in which cases and to what

extent a refund was due in case the policy was cancelled

c) Training: Staff was not provided adequate training to ensure they are

fully aware of product features

81. 2009 Review of claims processing did not indicate serious issues. A

Central Bank

42

review of claims processing for PPI policies undertaken in 2009

indicated that, where a claim was declined, this was generally in accordance with

the terms and conditions of the PPI policy.

43

82. 2011 review focusing on unemployment / redundancy claims. The

latest review carried out by the Central Bank of Ireland on sales files for PPI

policies aimed to determine compliance with the provisions of the 2006

Consumer Protection Code. The study is focusing in particular on instances

where the consumer has made an unsuccessful

44

claim under the policy for

reasons of unemployment/redundancy. A letter in July 2012 identified issues of

concern in this respect the following way.

45

1) Suitability for consumers: While the consumer may have been eligible for

PPI by virtue of criteria such as age, residency, and employment status,

this does not mean that the PPI was a suitable product for their needs.

2) Execution only sales: For sales to be made on an execution only basis,

the consumer must have specified the product, the product provider and

must not have received any advice. If these conditions are not met, firms

must meet the requirements set out in the Consumer Protection Code on

assessing the suitability of the product for the consumer.

3) Timing of key information: Key information was provided to the

consumers only after the consumers have agreed to purchase the policies

4) Key information should be explicitly drawn to the attention of individual

consumers

5) Record keeping: Firms are often unable to provide key documentation of

their relationship with a consumer

6) Other general principles: Other issues mentioned include the

requirement to act with due skill, care and diligence in the best interests

42

The Irish Financial Services Regulatory Authority (Financial Regulator) was the single regulator of all financial

institutions in Ireland from May 2003 until October 2010 and was a "constituent part" of the Central Bank of

Ireland. It was re-unified with the Central Bank of Ireland on 1 October 2010.

43

Central Bank of Ireland (2009) Financial Regulator concludes examination of claims handling for PPI policies

44

More precisely the claim appears to have been declined in accordance with the terms and conditions of the

relevant policy.

45

Central Bank of Ireland (2012) Letter p.1.

24

of customers; the requirement to seek from customers information which

is relevant to the product or service requested; the requirement on firms

to make full disclosure of all relevant material information, including all

charges, in a way that seeks to inform the customer; and the requirement

that firms do not exert undue pressure or undue influence on a customer.

83. Review of sales by firms. The Central Bank of Ireland expects the firms

to conduct a comprehensive review of their sales processes and procedures in

place since the introduction of the 2006 Code. Currently, six credit institutions

have commenced a review of their sales of PPI policies; these are due to be

completed by the end of 2013.

7.3.3. Consumer Complaints

84. Moderate number of complaints. The Financial Services Ombudsman

received 218 complaints about mis$sold PPI in the last 6 months of 2011. Of

these – just 115 were investigated further and only 20 were upheld in favour of

the consumer, (19 partly upheld) and 78 were not upheld. That is less than 10%

of PPI complaints that were upheld. In the first 6 months of 2012 – PPI

complaints to the FSO totalled 410.

8. PPI in Italy

8.1. PPI market specialties in Italy

85. The Italian PPI market was 2.4 billion euros in 2010.

46

In addition to PPI,

property insurance is often subject to cross$selling in Italy.

8.2. Market problems in Italy

86. Market investigations by the Italian Authority. The Italian Authority

(ISVAP, now IVASS) has carried out an initial investigation on the distribution of

payment protection insurance related to mortgages and personal loans in 2008$

2009.

47

ISVAP revisited the issue with a second survey on PPI in 2011

48

. The

investigation concluded the following

49

:

• Tying: Although PPI is not mandatory in Italy, banks practically treat it as

a precondition to obtain the credit product.

• Single premium: Almost all PPI policies are sold as single premium

policies, where the premium is often added to the loan, generating further

interests for the benefit of the credit grantor.

46

ISVAP Press release 6

th

December 2011

47

The data submission was requested by the ISVAP Circular Letter of 23 July, 2008.

48

The data submission was requested by the ISVAP Circular Letter of 29 April, 2011.

49

ISVAP Press release 6

th

December 2011

25

• Not in the best interest of the consumers: Banks (or financial

intermediaries) use PPI almost exclusively at their own interest, while

requiring their clients to bear the costs and the “exorbitant” commissions.

• High commissions: Policies that are distributed by banks or financial

intermediaries have higher commission rates (44% on average with a

maximum of 79%) compared to policies distributed by agents (20%).

8.3. Regulatory and supervisory actions regarding PPI

87. Requirements on suitable sales. The ISVAP Regulation No 5/2006

50

laying down rules for insurance intermediation contained some general rules on

advised sales that are important for PPI as well. These include detailed

requirements for gathering in$depth information on the consumer needs and

requirements on proposing suitable products, which means that from 2006

onwards the following rules apply in this respect.

[Intermediaries, before concluding an insurance contract, must] acquire from

customers any information useful to evaluate the adequacy of the contract with

regard to the [customer’s]… disclosed insurance and pension needs and his risk

propensity.

Intermediaries shall be required to propose or recommend contracts adequate to

meet the policyholder’s insurance and pension needs. To that end, before

concluding an insurance contract they shall acquire from the policyholder any

information they deem useful in relation to the features and complexity of the

contract offered, and record and keep such information.

51

88. Disclosure regulation. ISVAP Regulation 35/2010 regulating information

obligation and advertisement for insurance contracts contained special provisions

for PPI policies regarding cost disclosure and refund.

52

89. Cost (including commission) disclosure. According to these rules both

in the pre$contractual Information Note, and in the policy itself “the undertaking

shall show all the costs to be borne by the debtor/insured, with the indication of

the average part paid to the intermediary as commission.”

90. Refunds. For single premium policies, there is a special rule governing

refund in the case of early termination or switching of the underlying

loan/mortgage. The regulation orders that “…undertakings shall return to the

debtor/insured the part of the premium paid relating to the remaining period of

insurance with respect to the original expiry.” It allows for the right to “…retain

only the administrative costs actually sustained for the issue of the contract and

50

Regulation N. 5 of 16 October 2006 regulation laying down provisions on insurance and reinsurance

mediation referred to under title ix (insurance and reinsurance intermediaries) and article 183 (rules of

conduct) of legislative decree n. 209 of 7 September 2005 – code of private insurance.

51

ISVAP Regulation N. 5 Article 52 (1)-(2)

52

ISVAP Regulation N. 35 Articles 49-50

26

the premium refund, on condition that these are identified and quantified in the

proposal, in the policy and in the insurance application form. Those costs must

not be such to represent a limit to the portability of loans/mortgages or an

unjustified charge in case of repayment.”

91. Preventing conflicts of interests. The ISVAP regulation No. 5

53

of 2006

contained a general conflict of interest provision in its original form, stating that

intermediaries shall avoid operations that will lead to conflicts of interests,

including “those deriving from group relations, own business relations or from

relations with companies of the group”.

54

This provision was further enhanced by

the ISVAP in December 2011

55,56

, as an explicit prohibition was added, stating

that “it shall be prohibited for intermediaries to directly or indirectly become,

(…) at the same time beneficiary and intermediary of the relevant individual

or collective contract”.

57

92. Competing offers on PPI. Recent national legislation adopted in 2012

58

contained provisions to stimulate competition regarding life insurance linked to

mortgages and consumer credit. The new rules prescribe that if the banks or

others financial intermediaries take out a life insurance policy to obtain a

mortgage or a consumer credit, they must give the client at least two

additional free estimates of two different undertakings (independent from the

loan provider). Customers may also choose another life insurance from a

different undertaking which the banks or financial intermediaries have to accept

without changing the originally offered conditions for the mortgage or consumer

credit.

59

93. Minimum content and standardised format for information.

Implementing the above mentioned national legislation, ISVAP has adopted

another regulation (Regulation 40/2012) on the minimum content of life

insurance contracts related to mortgages and personal loans. Apart from

setting the minimum content, ISVAP also prescribed that information must be

presented in a standardised format to foster comparability. Consumers must

also be informed that if a life insurance contract is required for obtaining a

mortgage or consumer credit, they have 10 days to present an offer from an

alternative insurer. Should the alternative offer meet the necessary content, it

53

Regulation N. 5 of 16 October 2006

54

Article 48 of Regulation N. 5 of 16 October 2006 1

55

ISVAP (2011) Order N. 2946 of 6 December 2011

Provisions on the conflict of interests of insurance

intermediaries $ amendments to ISVAP Regulation n. 5 of 16 October 2006

56

ISVAP first attempt to modify Regulation 5 by Regulation 35 was annulled in 2010 by the Court for

procedural reasons.

57

Article 48 of Regulation N. 5 of 16 October 2006 Para 1bis

58

The decree law N.1 of 24.1.2012, converted into law N.27 of 24.3.2012.

59

Ibid, Article 28.

27

should be accepted by the loan provider without changing any of the conditions

in the initial offer.

60

94. Online comparison tools. Further to these, the same regulation also

envisaged that from September 1st, 2012, the companies marketing these life

insurance products should introduce a free online quotation service on their

website. Insurance undertakings shall also notify IVASS on the products they

market, and these products are then listed on IVASS’s website to further

facilitate consumer choice.

95. Cross%selling regulation in the Consumer Code. The Italian Consumer

Code considers an unfair trade practice any practice by a financial intermediary

requiring the customer to subscribe to an insurance policy sold by the same

intermediary or to open an account with the same intermediary in order to grant

a loan.

61

96. Complaints. Complaints concerning mis$selling practices are under

investigation, with particular reference to policies sold to consumers who are not

entitled to claim for compensation. These issues frequently involved selling

unemployment cover for self$employed or medical insurance to people who were

not able to claim for benefits because of some pre$existing medical conditions.

9. PPI in the Netherlands

9.1. Market issues in the Netherlands

96. Distorted consumer choice. The Netherlands Authority for the Financial

Markets (AFM) observed that consumer in PPI markets are not always able to

differentiate between good and poor quality in products and services. Reasons

for distorted consumer choice included information asymmetry between product

providers (and developers) and consumers and limited financial literacy, that did

not allow consumers to understand and assess the product taking into account

personal risks.

97. Poor market outcomes. As a result of the consumers’ inability to

differentiate between good$quality and poor$quality products and services,

product providers have opportunity to develop poor$quality products and

services. Examples for poor market outcomes are the misselling of single

premium mortgage PPI and general failings in PPI sales by intermediaries.

60

ISVAP (2012) Regulation n. 40 of 3 may 2012 Regulation concerning the definition of the minimum contents

of the life assurance contract referred to under article 28 (1) of Decree-law n. 1 of 24 January 2012, converted

into law n. 27 of 24 March 2012.

61

Italian Consumer Code Law Decree 206/2005 Article 21 para 3

28

9.2. Regulatory and supervisory action in the Netherlands

9.2.1. Thematic work on PPI in 2009!2010

97. AFM thematic work on PPI. In 2009 and 2010 the Netherlands

Authority for the Financial Markets (AFM) has carried out thematic work on the

sale of payment protection insurance. The AFM reviewed several cases of

consumer credit and mortgage credit in which payment protection insurance was

advised.

98. Failings in the advice process. The review concluded that there have

been the following failings in the advice process:

• Suitability of products. Financial service providers have failed to assess

whether PPI was in the interest of the client at all. They failed to assess

whether the client was capable and willing to bear the risk. In some cases

the product was not in the interest of the client at all, for example PPI for

a small credit; or, in other cases, existing covers had not been taken into

account.

• Lack of information. Information provided to the client was not

adequate. For example calculations were not based on the personal

situation of the client and the costs of the premium were not made clear

to the client. Further, the relevant information often had not been laid

down in the advice file.

• Illegal commissions. The commission paid by the product provider were

in breach of the inducement rules and thus not in the interest of the client.

99. Guidance on PPI. The AFM has published guidance with regard to

payment protection insurance. In the guidance the AFM has indicated what steps

have to be taken by a financial service provider to end up with a suitable advice.

The AFM has provided examples of a good advice process. For example the AFM

has indicated that in the case of small consumer credits a payment protection

insurance is usually not in the interests of the client. The reason is that the costs

of such an insurance (costs of advice and the premium) are not in relation to the

risk that is being covered by the product. Furthermore the rules for responsible

lending ensure that consumers are capable of bearing small loses with respect to

small consumer credits. Also the AFM has indicated that a service provider must

do the following: check the existing covers, base the calculation on the personal

situation of the client, check what risk the client is willing and capable to take,

base the advice on the risk appetite, calculations and interests of the client, and

motivate whether the client should choose a premium or a purchase price.

100. Administrative fines. The AFM imposed administrative fines on

companies for providing unsuitable advice to clients wishing to enter into credit

protection insurance policies. The Financial Supervision Act (Wft) requires

financial enterprises to provide consumers with suitable advice. They must

29

therefore obtain information concerning the consumer and take this into account

when providing advice. This means they must act in the interests of the client.

9.2.2. AFM investigation on advisor fees for consumer loan PPI

101. Further AFM work in 2013 on cost of advice. In 2012 and in the first

half of 2013 the AFM has looked at the fees charged by independent advisors for

PPI advice. The study focused on PPI sold with consumer loans through advisors;

AFM found that in some cases the fees were significant and not in the interest of

the consumer.

102. Background on Dutch rules for remuneration. As from the 1

st

of

January 2013 a ban on commissions has been introduced. This ban applies to

financial service providers advising and mediating in complex financial products,

for example unit$linked insurances, annuities, mortgage credit and payment

insurance products to consumers. Further as from 1

January 2012, a regulation

is in place with respect to adviser charging stating that adviser charges should

not be deemed unreasonable given the nature and scope of the financial service

that is rendered. For PPI this means that a fee has to be charged to the

consumer for advising on the PPI. With respect to the consumer credit the

adviser is paid by the product provider on the basis of a monthly commission.

103. Excessive PPI advice fee when mediating in consumer loans. AFM

found that advisors used the fees earned in PPI advice as a tool to safeguard

their business model. This was done by advising consumers on PPI and (in a

relatively limited percentage of cases) mediating in the purchase of one or

several PPI’s. For these activities related to PPI’s the advisors charged very

substantial fees (the market average seemed to vary between €1.000 and

€1.500 with some intermediaries going as high as €3.000 or even €4.000).

Extensive talks with individual market players confirmed that the fees charged

were disproportionate to the effort on advice and mediation of PPI and as such

had to be seen as a disguised (and illegal) fee for advice and mediation in

consumer loans.

104. Misleading consumers into thinking that the advisor fee is linked

to the loan. In most cases consumers were directly or indirectly led to believe

that the fee that the advisor was due was related to his or her effort in advising

and mediating a suitable loan. Consumers appear to be unaware that the fee

payable is only related to the work the advisor has carried out with respect to

the advice on PPI’s.

105. Limited or absent added value of PPI for consumers. Since PPI was

merely used to charge a disguised fee for mediation in consumer loans, PPI is

actually often not purchased by consumers. In these cases consumers merely

pay a fee for the advice and as such do not receive any added value. In a

substantial amount of cases were PPI is actually purchased, the relatively limited

loan amount means that the benefits of the PPI are smaller than the costs.

30

106. Maximum fees on PPI. The AFM work on the cost of advice in 2012$

2013 has resulted in significant reductions in the fee levels that consumers are

charged for advice and mediation in PPI. At the end of 2012 the largest trade

organisation for advisors of consumer loans has lowered the maximum fee in

their code of conduct from €1.500 to €500. By actively engaging in one$on$one

dialogue with numerous of the most active advisors in the field of consumer

loans the AFM has convinced these parties that it is of great importance that any

fee charged for activities performed in relation to PPI is directly correlated to the

actual time spend on those activities and cannot be a disguised means of

obtaining compensation for work done with respect to the actual consumer loan.

Most of the advisors have since confirmed to AFM that they have changed their

business model.

10. PPI in Portugal

10.1. Guidelines on PPI compliance

107. Guideline on compliance. Given the importance and economic and

social function of the product, and based on the findings of an analysis carried

out regarding this matter, the Portuguese authority (ISP) issued a guideline

(“Circular”) in March 2012 on the legal obligations regarding PPI.

62

The guideline

contains recommendations addressed to insurers

63

, which focus on four main

areas: (i) product design, (ii) pre$contractual information and clarification, (iii)

drafting (language) of the policies and (iv) underwriting practices.

108. Suitability and switching (refund) in product design. The guideline

stresses that insurers should take the target market characteristics into account

when designing the product. The profile and needs of consumers should be

reflected in the eligibility criteria

64

as well as on the contractual clauses (notably

the ones concerning coverage limitations and exclusions, deductibles, grace

periods and maximum compensation limits). Also, the guideline points out that

sometimes there are undue obstacles to switching coverage to another insurer

(especially by means of the specific content of certain termination clauses, or

when the contractual terms do not provide adequate clarification on the

customer’s right to get a pro rata refund from the original provider).

109. Pre%contractual information and clarification. The Portuguese

guideline highlights the necessity of sufficient, adequate and clear pre$

contractual information (notably for the policyholder to assess if the offered

62

ISP (2012) Circular no. 2/2012. The guideline (Portuguese version) is accessible at:

http://www.isp.pt/winlib/cgi/winlibimg.exe?key=&doc=21346&img=5190

63

The guideline is aimed at drawing special attention to the legal obligations already imposed on insurers

which are particularly implied when designing and marketing PPI contracts. Furthermore, it also highlights the

potential legal consequences (on insurers) associated with unsound market conduct regarding PPI.

64

For product underwriting / adhesion.

31

product matches his needs and to become aware of the type of risks the product

actually provides coverage for). Standard contractual clauses must be advised in

full to the parties accepting them; failure to do so results in the inexistence of

the given contractual clause. Given that PPI provides complex coverage, specific

clarification duties apply as insurers shall bring to the policyholders’ attention the

exact scope of the proposed coverage (for example, exclusions), taking into

consideration the needs of the policyholder/insured person.

110. Drafting (language used) of insurance policies. Generally, the

Portuguese law on insurance contracts

65

requires that insurance policies are

drafted “in a comprehensible, concise and rigorous manner and in highly legible

print using words and expressions used in everyday language provided that the

use of legal or technical terms is not essential”, and they should avoid the use of

vague or ambiguous expressions (specifically in risk exclusion or limitation

clauses). In fact, the Portuguese authority suggests that coverage and risk

limitation clauses should be drafted with greater care. In particular, ISP

recommends that the coverage concerning employment and incapacity for work

situations should be determined positively (and not by means of exclusions or

limitations).

111. Suitability check at contracting. Insurers are requested to carry out

66

a

proper suitability check before selling the product to the consumer (namely

regarding the type of labour agreement, employment background and prior

periods of incapacity for work). The guideline recommends that this exercise

should be carried out in due time, instead of postponing this assessment to the

moment when the customer makes a claim.

10.2. Expected effects and planned steps

112. Expected effects. In order to assess the degree of compliance with the

applicable legal framework, including the aforementioned recommendations, ISP

conducted an ex post monitoring exercise using a questionnaire addressed at