8-810-2019 Rev. 1-2022

Supersedes 8-810-2019 Rev. 12-2020

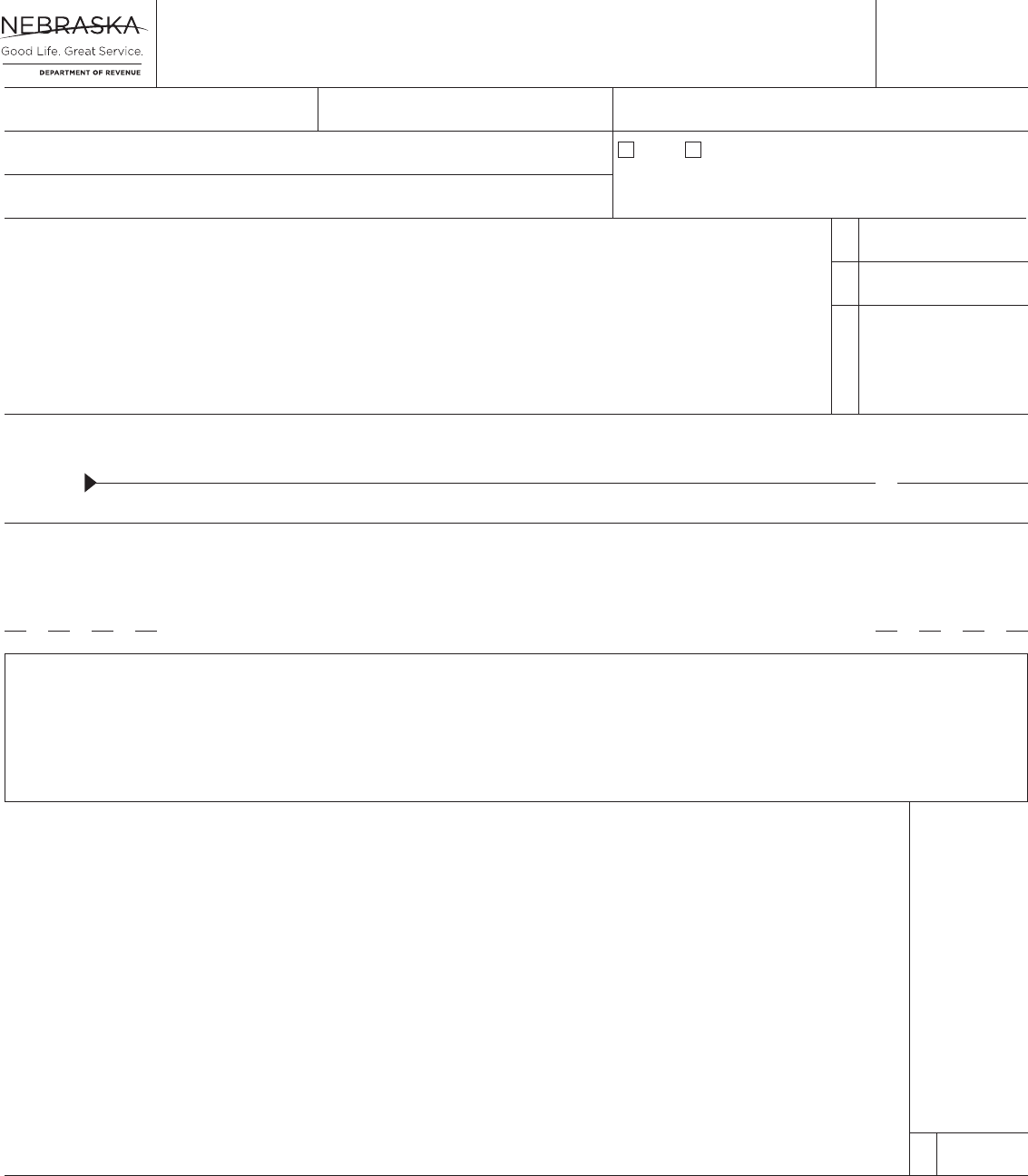

Nebraska Withholding Allowance Certificate

• Whether you are entitled to claim a certain number of allowances or exemption from withholding

is subject to review by the Nebraska Department of Revenue (DOR).

FORM

W-4N

Your First Name and Initial Last Name Your Social Security Number

Current Mailing Address (Number and Street or PO Box)

City State Zip Code

1 Total number of allowances you are claiming (from line 4f on the worksheet below). ...................... 1

2 Additional amount, if any, you want withheld from each check for Nebraska income tax withheld ............ 2

3 I claim exemption from withholding and I can provide satisfactory evidence to my employer that I meet both

of the following conditions for exemption.

• Last year I had a right to a refund of all Nebraska income tax withheld because I had no tax liability, and

• This year I expect a refund of all Nebraska income tax withheld because I expect to have no tax liability.

If you can provide evidence that you can meet both conditions, write “Exempt” here ..................... 3

Single Married Filing Jointly or Qualifying Widow(er)

Note: If married, filing separately, or spouse is a nonresident alien,

check the “Single” box. Individuals filing income tax returns with a “Head

of Household” status check the "Single" box.

sign

here

Employee's or Other Payee's Signature Date

Under penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief, it is correct and complete.

Personal Allowances Worksheet

• Keep for your records.

Allowances approximate tax deductions that may reduce your tax liability. The number of allowances is determined by many factors

including, but not limited to, filing status, how many jobs you have, and how many children or dependents that you claim on your income

tax return.

Allowances claimed on the Form W-4N are used by your employer or payor to determine the Nebraska state income tax withheld from

your wages, pension, or annuity to meet your Nebraska state income tax obligation.

4 a Enter “1” for yourself if no one else can claim you as a dependent............................... 4a _______

b Enter “1” if:

• You are single and have only one job;

• You are single and have only one pension;

• You are married, have only one job, and your spouse does not work; or

• Your wages from a second job, or your spouse’s wages (or the total of both for the year) are $1,500

or less, or you have more than one pension............................................... 4b _______

c Enter “1” for your spouse. But, you may choose to enter “-0-” if you are married and have either a

working spouse, more than one pension or more than one job. (Entering “-0-” may help you avoid

having too little tax withheld) ............................................................ 4c _______

d Enter number of Nebraska personal exemptions (other than your spouse or yourself) you will claim on

your Nebraska income tax return. This is the number of children and dependents you will list on your

Nebraska income tax return that qualify for either the child or dependent tax credit on the federal

income tax return...................................................................... 4d _______

e Enter “1” if you will file as head of household on your income tax return .......................... 4e _______

f Enter total of lines a through e here and on line 1 above. (Note: This may be different from the number of

exemptions you claim on your Nebraska income tax return) .............................................. 4f

Separate here and give Form W-4N to your employer or payor. Keep the bottom part for your records.

RESET

PRINT

Instructions

Purpose. The Nebraska WIthholding Allowance Certicate, Nebraska Form W-4N, was developed due to signicant

differences between the federal and Nebraska laws regarding standard deductions and because personal exemption

credits are allowed on the Nebraska income tax return.

The Nebraska Form W-4N will be used by your employer in conjunction with the Nebraska Circular EN to determine

the correct Nebraska income tax withholding. For every federal Form W-4 employers receive, after January 1,2020

a Nebraska Form W-4N must be completed. If you did not complete a federal Form W-4 prior to January 1, 2020

or beginning January 1, 2020 completed a federal Form W-4 but did not submit a Nebraska Form W-4N, your

employer must withhold as if you were single and claimed no withholding allowances.

Nebraska taxpayers that receive pension or annuity payments may also use a Nebraska Form W-4N to determine the

correct withholding for those payments. Beginning January1,2022, the Nebraska Form W-4N will be used by your

pension or annuity payor in conjunction with the Nebraska Circular EN to determine the correct Nebraska income

tax withholding when the federal Form W-4P is completed on or after January 1, 2022.

Withholding allowances directly affect how much money is withheld. The amount withheld is reduced for each

allowance taken. Depending on your personal circumstances, you may not want to claim every allowance you are

eligible to take. If you do not have enough state income tax withheld, you may incur a penalty for underpayment of

estimated tax.

There are penalties for not paying enough Nebraska income tax during the year, either through withholding or

estimated tax payments. You may want to complete the worksheet in the Nebraska Individual Estimated Income Tax

Payment Vouchers booklet to compute an estimated tax liability.

For Employees

Complete the Nebraska Form W-4N so your employer can withhold the correct Nebraska income tax from your

wage payment. When your personal or nancial situation changes, consider completing a new Nebraska Form W-4N.

If you are an employee claiming exemption from withholding, skip lines 1 and 2, write “exempt” on line 3, and

sign the form to validate it. An exemption is valid for only 1 year. You must give your employer a new Nebraska

Form W-4N by February 15 each year to continue your exemption.You cannot claim exemption from withholding if

another person can claim you on their tax return; and your total income exceeds $1,100 and includes more than $350

of unearnedincome.

If your employer is subject to the special withholding procedures specied in the Nebraska Circular EN, you may be

required to submit documentation to your employer to support your claim for exemption from withholding.

For Employers

An employer may withhold an amount that is less than 1.5% of the employee’s taxable wages if the employee provides

sufcient documentation to verify that a lesser amount of income tax withholding is justied in the employee’s

particular circumstance. Documentation may include:

• Verication of the number of children/dependents;

• Marital status; or

• The amount of itemized deductions.

Without documentation, the employee’s income tax withholding must be set either at 1.5% or within the non-shaded

area of the income tax withholding tables in the Nebraska Circular EN for the employee's taxable wage.

Penalties. An employer may be subject to a penalty of up to $1,000 for each employee under-withheld if the

employee’s low income tax withholding is not substantiated.

A taxpayer who intentionally claims an excessive number of exemptions is guilty of a Class II misdemeanor.

Any person who willfully attempts to evade the Nebraska income tax is guilty of a Class IV felony.

Any person who willfully fails to withhold, deduct, and truthfully account for and pay over any income tax withheld

is guilty of a Class IV felony.

Pensions and Annuities

For periodic payments of employer-provided pensions and annuities, the income tax withholding is determined in

the same manner as income tax withholding from wages. Payees with periodic payments from employer-provided

pensions and annuities are subject to Nebraska income tax withholding when the payee (recipient) has elected the

payor to withhold federal income tax from the payments. Payors must use the same number of allowances and the

marital status as claimed by the payee on the Withholding Certicate for Pension or Annuity Payments, Federal

FormW-4P, led with the payor if the federal Form W-4P was completed prior to January 1, 2022. If the payee

completes a federal Form W-4P on or after January 1, 2022, a Nebraska Form W-4N must be completed for Nebraska

income tax withholding purposes.

Payees that chose not to have federal income tax withheld on the federal Form W-4P may elect to be exempt from

withholding income tax for Nebraska on the Nebraska Form W-4N. Payees completing the Nebraska Form W-4N

may skip lines 1 and 2 and write “exempt” on line 3 of the Nebraska Form W-4N. If you change the federal Form W-4P

to withhold federal income tax, you must complete a new Nebraska Form W-4N to withhold Nebraska incometax.

For pension and annuity payments, the Nebraska Form W-4N exemption stays in effect until you change the federal

FormW-4P to withhold federal income tax or you change the Form W-4N to withhold Nebraska income tax without

changing the federal Form W-4P to withhold federal income tax.

Note: Nonperiodic payments or eligible rollover distributions are subject to Nebraska income tax to be withheld at a

rate of 5% of the distributions and cannot be exempt from income tax withholding.

For nonperiodic payments or eligible rollover distributions subject to either the 10% or 20% federal income tax

withholding rate, Nebraska income tax will be withheld at a rate of 5% of the distribution. A taxpayer may request

to have additional Nebraska income tax withheld by completing a Nebraska Form W-4N. Do not give a federal

FormW-4P to your payor unless you want an additional amount withheld for Nebraska income tax. Also payees who

are not required to have federal income tax withheld, may request to have state income tax withheld by completing a

Nebraska FormW-4N.