www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b429

COMPARATIVE STUDY OF SBI MUTUAL

FUND AND HDFC MUTUAL FUND

Bhakhar Deep

*1

, Bhagat Utsav

*2

Parul University, Parul Institute of Management & Research

ABSTRACT

This study looks at the evolution of two of India's leading mutual fund companies, SBI Mutual Fund and

HDFC Mutual Fund. The analysis uses secondary data to estimate risk and return indicators using various

metrics: standard deviation, alpha, beta, Sharpe ratio, and Treynor ratio. The objective of the study is to

identify which fund house offers better risk-adjusted returns based on historical data. The main objective of

this study is to identify which fund house offers better risk-adjusted returns based on historical data and

selected measurements By analyzing these metrics, the study aims to provide insight into the risk-return

characteristics of each fund house and their investment strategies..

INTRODUCTION

Mutual Fund of the State Bank of India (SBI):

SBI Mutual Fund is one of the largest and most well-known mutual fund companies in India. It is managed

by SBI Funds Management Private Limited, a joint venture between the State Bank of India, the biggest bank

in India, and Amundi, a well-known global asset management company with its headquarters situated in

France. SBI Mutual Fund offers a wide range of investment products, including debt funds, hybrid funds,

equity funds, and other expert funds, to meet the diverse financial needs of its clients. The fund company is

well-versed in research techniques, has a strong nationwide distribution network, and prioritizes its clients.

• HDFC Mutual Fund

Managed by HDFC Asset Management Limited, HDFC Mutual Fund is another prominent mutual fund

provider in India. It is a branch of the Housing Development Finance Corporation (HDFC), one of the

leading financial institutions in India. HDFC Mutual Fund offers a wide range of mutual funds, including

debt, hybrid, equity, and solution-oriented funds. This fund provider has a stellar reputation for its innovative

fund offerings, attentive customer care, and methodical approach to investing. HDFC Mutual Fund has a

significant market share and is renowned for its fund expertis

www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b430

LITERATURE REVIEW

1. 1. In her paper "Comparative Analysis on Performance of SBI and HDFC Equity, Balanced, and Gilt

Mutual Funds," Ms. Dhanalakshmi K. (2013) compared and examined the performance of SBI and HDFC

mutual funds, with an emphasis on equities, gilt, and balanced mutual funds.

2. Money in the connection between Treynor, Jensen, and Sharpe. Just three years of operating

finance—from January 2010 to December 2012—are covered by the study. He concluded that the funds'

returns changed according to the state of the market; that is, in 2010 and 2011, the return was impacted by

market volatility, but in 2012, scheme performance improved. Research has demonstrated that, in the long

run, investing in HDFC (Equity, Balanced, Gilt) mutual funds performs better than SBI funds.

3. In a 2013 study titled "A. A Comparative Study of Mutual Fund Performance SBI Mutual Funds V/S

Others," Dr. Rajesh Manikraoji Naik and MR Senapathy compared the 2011–2012 performance of the

SBI Magnum Equity mutual fund and the top 100 mutual funds from HDFC using standard deviation, beta,

and Sharpe ratio. Ultimately, the authors concluded that there is little difference between SBI and HDFC

mutual funds and that both are excellent mutual funds.

4. In a 2014 study titled "A Comparative Study of Diversified Mutual Fund Schemes of Selected Public

and Private Equity Funds in India," Dr. Vinay Kandpal and Prof. P. C. Kavi Dayal included HDFC

Premier Multi-Cap, HDFC Growth, and HDFC Core and Satellite funds. Examine the results for the private

sector mutual fund category during five years (2008–2013). chosen mutual funds for the public sector based

on the Jensen, Sharpe, standard deviation, and beta

5. In a study titled "Analysis and Comparative Study of SBI and HDFC Mutual Fund," Babasaheb Patil

(2012) evaluated the risk and return of the growth of the SBI Magnum Equity Fund and the HDFC Growth of

the share fund over one year (2.4.2007 - 31.3. 2008) using a variety of statistical techniques, including

variance, standard deviation, covariance, and correlation. He concluded that the SBI Magnum Equity fund

offered greater risk and returns than HDFC Equity, although both funds performed poorly when the author

took investor expectations into account.

www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-

2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b431

6. In a study titled "Comparison of Endowment Funds especially for SBI Mutual Funds," Mrinal

Manish (2010) examined the risk and returns of a few carefully chosen private sector mutual funds by

contrasting their five-year performance with that of SBI Magnum Equity and SBI Magnum Against. Upon

analysis of all statistical characteristics, Magnum Contra was confirmed to be the best foundation within its

class.

7. Investment policy, portfolio turnover rate, mutual fund performance, and stock market effects were

all examined by Irwin, Brown, and FE (1965). Research revealed that mutual funds significantly

influenced the movement of stock market prices. The study concludes that there was no consistent

correlation between portfolio turnover and fund performance and that on average, funds did not outperform

the composite markets.

8. Treynor (1965) employed the 'characteristic line' to establish a relationship between the predicted

rate of return of a fund and the rate of return of a representative market average. He developed a fund

performance metric that considered investment risk. The most prominent study is by sharp ratio.

Research Methodology

Research design: quantitative research and type is a comparative study

Sources of data: Financial news websites, company websites, research reports

Data collection: both funds 10 years of NAV data collected through websites. For yearly NAV I have

taken the difference between

31 December to 31 December each year.

Data collection instruments: Historical Performance Data: Get historical performance data directly from

official sources such as mutual fund company websites, financial news websites, or financial databases.

Focus on metrics or annual returns over some time.

METHOD OF CALCULATION

(1)

STANDARD DEVIATION = it is calculated after calculating the return of mutual funds.

RETURNS = NAV CURRENT CLOSE – NAV PREVIOUS CLOSE

(2)

return of portfolio; N = number of years

(3)

CORRELATION COEFFICIENT

It shows the linear dependency between fund returns and returns of the benchmark index. The

correlation coefficient is calculated here using MS Excel.

If 0.5 < r < 1, then there is a high positive correlation between the fund returns and the benchmark

returns.

If 0<r<0.5, then there is a low positive correlation between the fund returns and the benchmark

returns.

www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-

2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b432

(5)

BETA

Beta, also known as the "beta coefficient," is a measure of the value, or systematic risk, of a security

or fund compared to the market as a whole.

Beta here is calculated as (p,b). S.D.p/S.Db

r(p,b) = correlation coefficient between the returns of the concerned portfolio and the returns of the

benchmark index. (BSE 100)

S.D.p =Standard Deviation of the concerned portfolio , S.D.b = Standard Deviation of the

benchmark index (BSE 100)

ALPHA

Alpha measures the difference between a fund's actual returns and its expected performance, given

its level of risk. A fund's alpha is often considered to represent the value that a portfolio manager adds to or

subtracts from a fund's return above and beyond a relevant index's risk/reward profile.

Alpha (α) is calculated here as =X - β(Y) where,

X = average return to NAV returns; Y = average return to market

index,β=Be

SHARPE RATIO

The Sharpe ratio formula is:

Where,

Ra= Concerned portfolio return , Rf = Risk Free Rate , σ = Standard Deviation

Sharpe ratio can be used to rank the desirability of a fund or portfolio.

TREYNOR RATIO

The Treynor ratio is a measurement of the returns earned more than that which could have been

earned on an investment that has no diversifiable risk, per each unit of market risk assumed.

The higher the Treynor ratio, the better the performance of the portfolio under analysis.

Formula: T = Ri-Rf/Bi Where,

T= Treynor ratio , Ri= Portfolio I’s return , Rf = Risk Free Rate , β= Portfolio I’s Beta

Problem statement

The need to thoroughly examine and compare the investment strategies, performance indicators, and

operational frameworks of SBI Mutual Fund and HDFC Mutual Fund is the central challenge of this

comparative study. The study specifically aims to answer the following important question.

www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-

2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b433

What are the differences in the investment philosophies, asset allocation plans, and portfolio development

techniques of SBI Mutual Fund and HDFC Mutual Fund?

What past performance patterns have SBI Mutual Fund and HDFC Mutual Fund shown throughout many

mutual fund schemes and market cycles?

How are investment risks, including market, credit, and liquidity concerns, managed by SBI and HDFC

mutual funds within their separate portfolios?

objective

2.

Analysis of risk and return through using statistical methods with special reference to small-cap and

mid- and large-cap funds.

3.

To compare schemes' return and risk with benchmark i.e. S&P BSE 250

Hypothesis

The null hypothesis (H₀) states that the overall returns of Mutual Funds A and B do not differ significantly

from one another.

The alternative hypothesis, H₁, states that mutual funds A and B have significantly different total returns.

Data collection & analysis

BSE 250 TRI

year

S&P BSE TRI

2014

8324

2015

7786

2016

8082.4

2017

10333.25

2018

10888.35

2020

13529.1

2021

17511.3

2022

18609.35

This is the market return index BSE 250 TRI for comparison of mutual fund return with the market.

Standard deviation is calculated using this data for the beta calculation of selected mutual funds.

www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-

2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b434

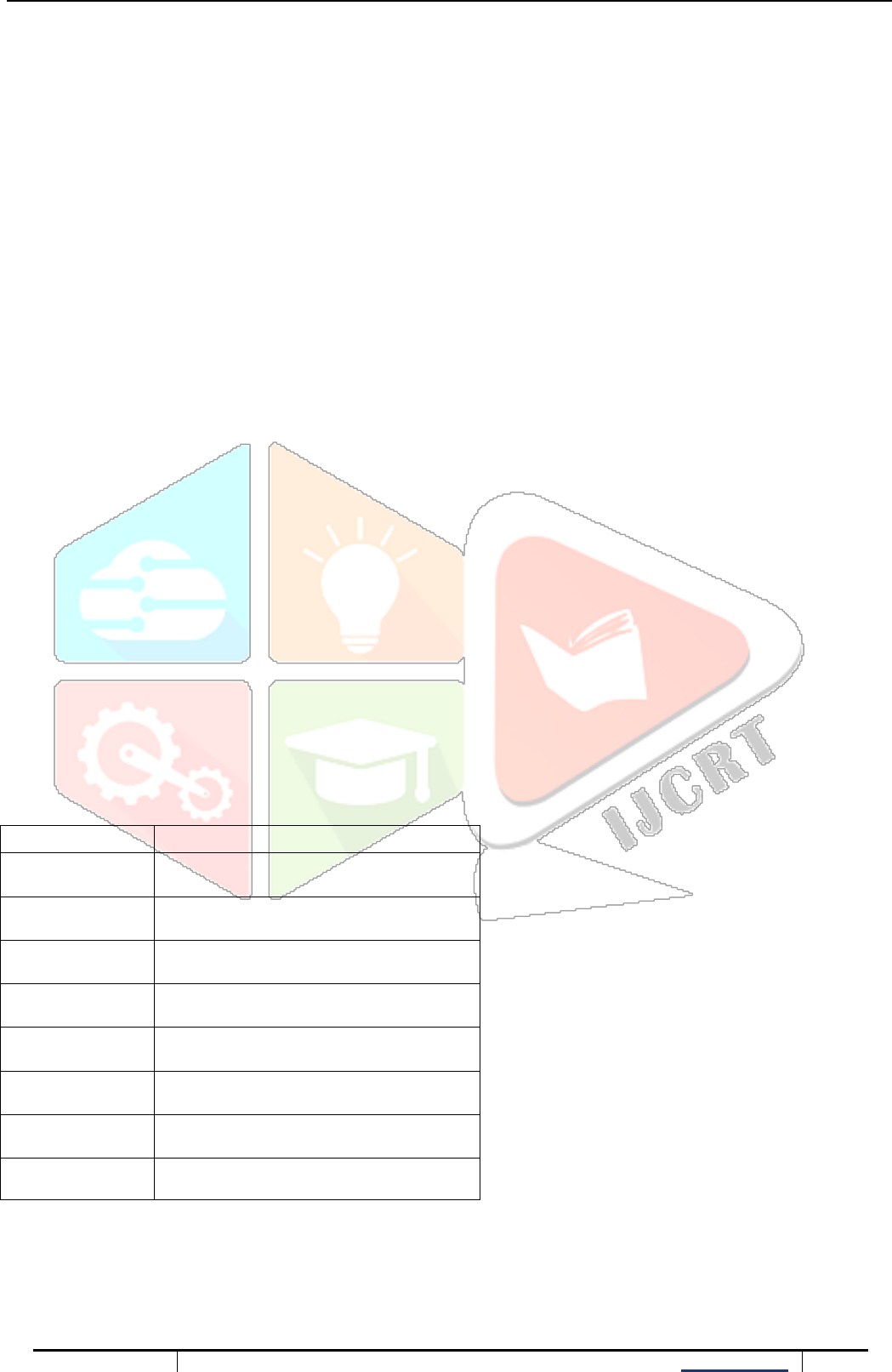

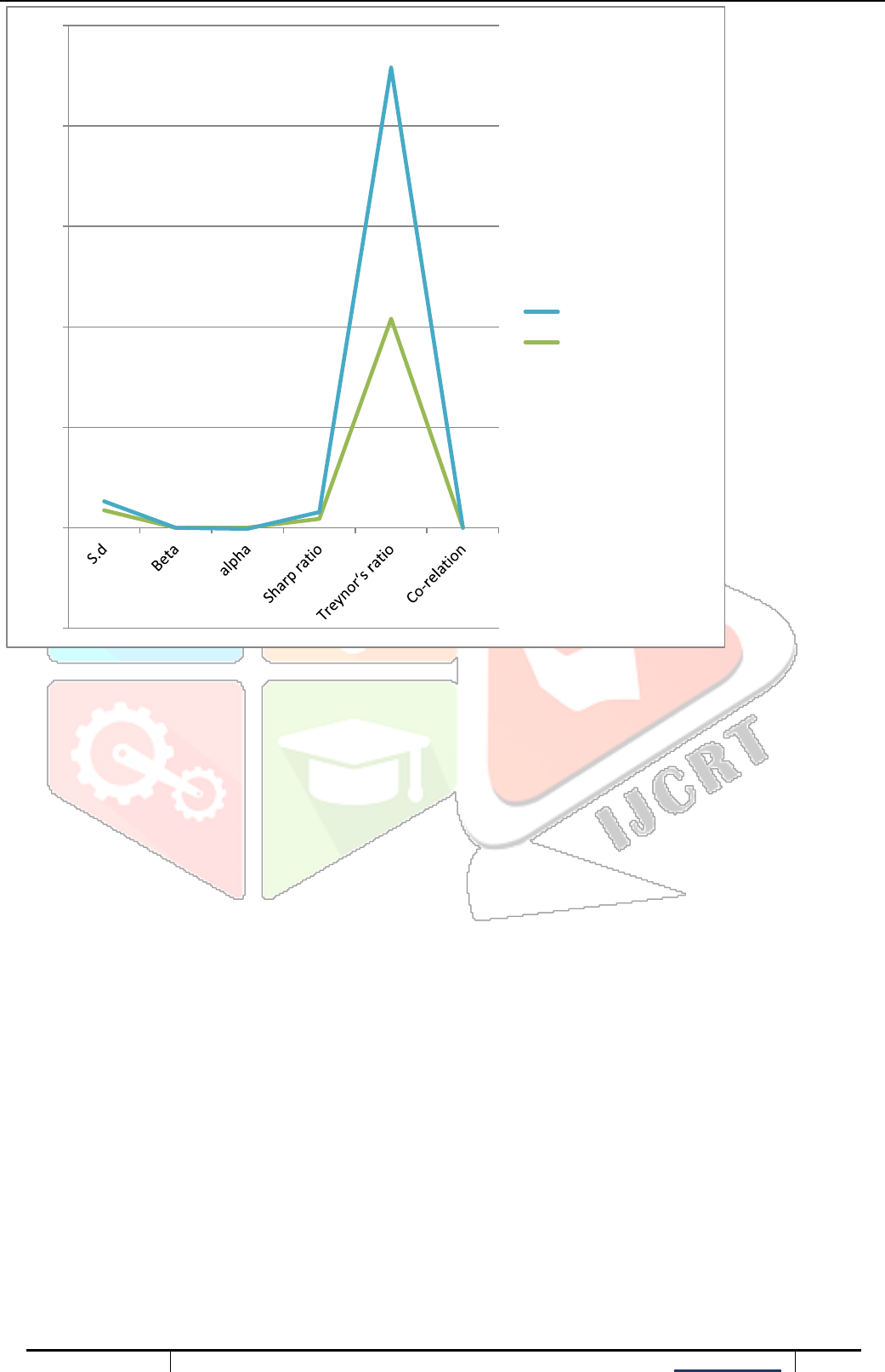

SBI AND HDFC SMALL-CAP FUND

TABLE: 1 CALCULATION

S.D

Beta

Alpha

Sharp ratio

Treynor ratio

Correlation

coefficient

SBI small

cap fund

13.26

0.000092

0.1167

1.5180

21880.43

0.00961686

HDFC

small cap

fund

11.69

0.000072

0.0920

1.2275

19930.55

0.008542636

S&P BSE

250 (market

return )

1368.43

SBI SMALL CAP FUND

HDFC SMALL CAP FUND

Year( 1 Jan to 30

dec)

NAV

year

NAV

2014

29.37

2014

26.13

2015

35.72

2015

28.02

2016

36.33

2016

29.56

2017

66.2

2017

48.63

2018

53.83

2018

45.07

2019

57.8

2019

41.30

2020

78.16

2020

50.43

2021

115.11

2021

83.13

2022

126.24

2022

88.03

www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-

2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b435

mid &large cap fund of SBI And HDFC

0

5000

10000

15000

20000

25000

S.D Beta Alpha Sharp ratio Treynor

ratio

Co-relation

coefficient

SBI small cap fund

HDFC small cap fund

www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-

2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b436

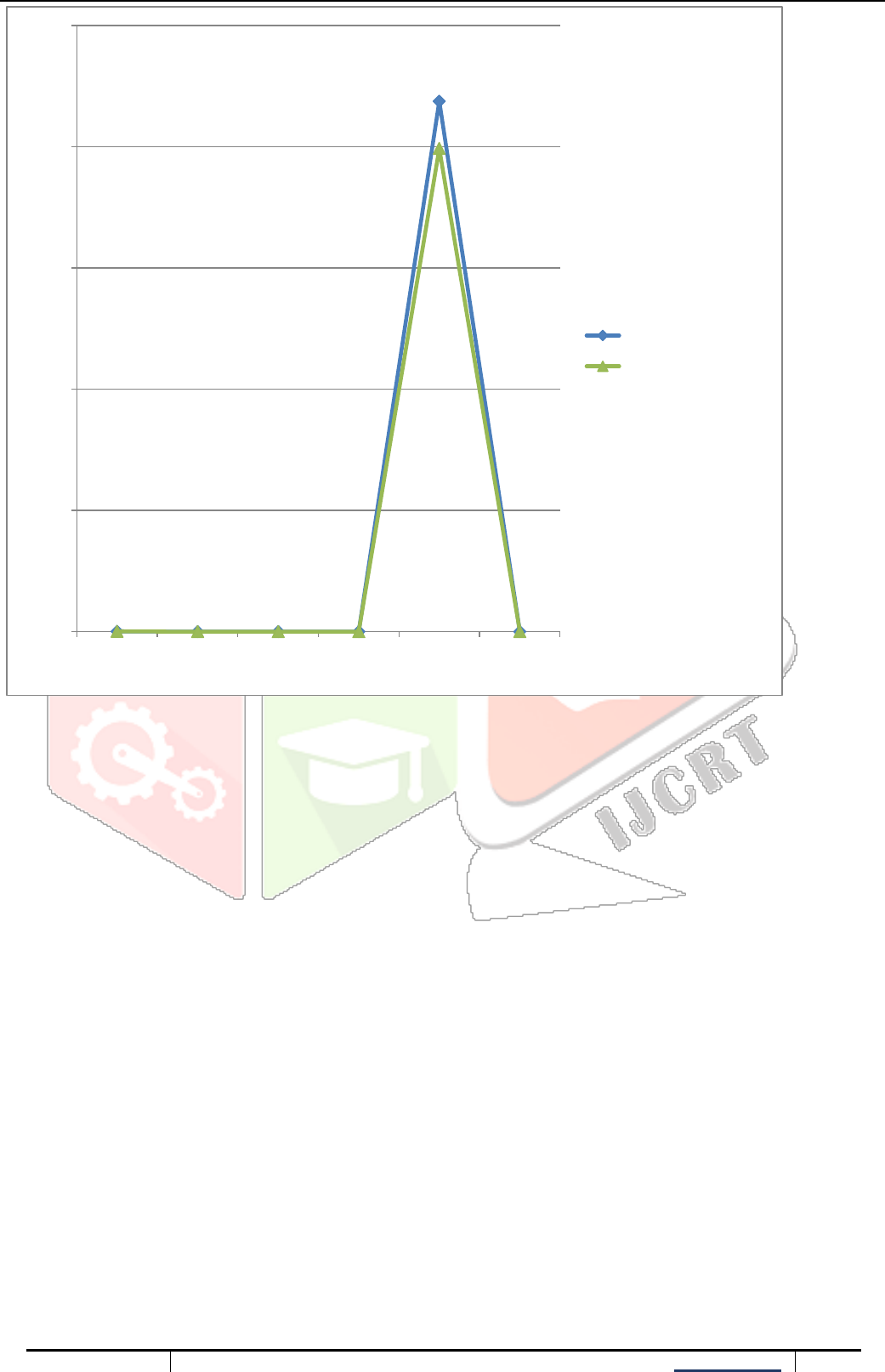

MID &LARGE CAP FUND OF SBI

MID &LARGE CAP FUND OF HDFC

year

NAV

year

NAV

2013

96.78

2013

69.64

2014

142.06

2014

88.73

2015

161.18

2015

84.56

2016

160.30

2016

87.39

2017

229.36

2017

114.26

2018

217.36

2018

110.02

2019

234.76

2019

117.69

2020

271.70

2020

131.07

2021

382.73

2021

187.01

2022

418.04

2022

206.14

Table 2 CALCULATION

Funds

S.d

Beta

Alpha

Sharp ratio

Treynor ratio

Co-relation

Co-efficient

SBI mid

&large cap

35.125

0.000658851

0.570555556

17.84989324

416.0806442

0.02566810

1

HDFC mid

&large cap

17.61

0.000165605

-2.443333333

13.40091993

500.4360865

0.01286876

2

www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-

2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b437

FINDINGS&RESULT

FOR SMALL-CAP FUND

1. Since HDFC's S.D. is lower than SBI's, the HDFC small-cap fund's return is more consistent than that of

the SBI small-cap fund.

2. Both funds have very low market movement sensitivity because their betas are close to zero. The overall

market fluctuation has little effect on the performance of any fund.

3. Based on beta and the market as a whole, alpha calculates an investment's excess return about its

projected return. The positive alpha values in both funds show that they have both fared better than

predicted.

4. In this comparison, the HDFC Mid-Cap Fund has a Sharpe Ratio of 1.2275, whereas the SBI Mid-Cap

Fund's is 1.5180.

In comparison to HDFC Mid-Cap Fund, SBI Mid-Cap Fund has a higher Sharpe ratio, which suggests that

it has delivered superior risk-adjusted returns. SBI Mid- and Large-cap funds are worth considering by

investors because they have demonstrated superior risk-weighted returns in this situation.

The risk-adjusted return on systematic risk is measured by the Treynor ratio. When comparing the Treynor

ratios of the two funds, the HDFC small cap fund has a greater risk-adjusted return (1993.55) than the SBI

(2188.43).

-200

0

200

400

600

800

1000

HDFC mid &large cap

SBI mid &large cap

www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-

2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b438

In summary, the HDFC Small Cap Fund exhibits superior stability in returns and a higher risk-adjusted

return in comparison to systematic risk, as demonstrated by its larger Treynor ratio and smaller standard

deviation. However, the SBI Small Cap Fund offers a higher risk-adjusted return based on the Sharpe ratio,

indicating a better balance between risk and return, despite likewise having consistent returns and little

market sensitivity. HDFC Small Cap Fund may be the choice of investors wanting stability, while SBI

Small Cap Fund may appeal to those seeking a balance between risk and return.

www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b439

FOR MID&LARGE CAP FUND

1. Since HDFC's S.D. is lower than SBI's, the HDFC small-cap fund's return is more consistent than SBI's

small-cap fund's.

2. The beta coefficient calculates how sensitive a stock's price movement is to the market's general

movement. A beta of less than one suggests that the stock is less volatile than the market, whereas a beta of

more than one denotes higher volatility. With a beta of 0.000658851, the SBI MID & LARGE CAP is less

volatile in this instance than the HDFC MID & LARGE CAP fund, which has a beta of 0.000165605. Given

that both funds' betas are much below 1, they are both comparatively steady and have less volatility when

compared to the overall market.

3. After considering risk, alpha evaluates a fund manager's capacity to beat the benchmark index. In this

instance, HDFC Mid-Cap's negative alpha (-2.443333333) means that it underperformed its benchmark,

while SBI Mid-Cap's positive alpha (0.57055556) indicates that it has exceeded it. Consequently, in terms of

alpha, the SBI Mid-Cap Fund performed better than the HDFC Mid-Cap Fund.

4. The risk-adjusted return on an investment is measured by the Sharpe ratio. A greater Sharpe ratio

indicates a greater risk-adjusted return.

In this comparison, the Sharpe ratio of the SBI Mid-Cap Fund is 17.84989324 while the Sharpe ratio

of the HDFC Mid-Cap Fund is 13.40091993.

In comparison to HDFC Mid-Cap Fund, SBI Mid-Cap Fund has a higher Sharpe ratio, indicating

that it has delivered superior risk-adjusted returns.

Based on systematic risk (beta), the Treynor ratio calculates the risk-adjusted return on an investment. For

the amount of risk taken, a greater Treynor ratio indicates a better risk-adjusted return.

5. In this comparison, the HDFC Mid-Cap Fund has a Treynor ratio of 500.436, whilst the SBI Mid-Cap

Fund has a Treynor ratio of 416.080.

6. The Treynor ratio shows that the HDFC Mid-Cap Fund has outperformed the SBI Mid-Cap Fund in terms

of risk-adjusted return, suggesting that it has provided superior returns when taking systemic risk into

account.

www.ijcrt.org © 2024 IJCRT | Volume 12, Issue 4 April 2024 | ISSN: 2320-2882

IJCRT2404161

International Journal of Creative Research Thoughts (IJCRT)

www.ijcrt.org

b440

LIMITATION OF THE STUDY

1. This study has only looked at small, medium, and large mutual fund schemes. If additional scheme

types were included, including debt funds and sector-specific funds, a comparable analysis might be

performed.

2. A few statistical techniques have been used to analyze the performance of mutual funds. It could be

raised to get an exact outcome.

The performance and returns of the mutual fund schemes have only been contrasted with those of the S&P

BSE 100. The rate on Indian government 10-year bonds serves as a representative of risk-free returns, but

the same can be done with a range of alternative benchmarks

CONCLUSION

SBI mid-cap and large-cap funds have outperformed the other in terms of alpha and Sharpe ratio, indicating

superior risk-adjusted returns, even though both funds have low volatility and stable returns. However,

despite a greater Treynor ratio and a smaller standard deviation, HDFC Mid-Cap Fund exceeded Alpha and

Sharpe. Investors considering SBI's mid- and large-cap stocks may find stability and somewhat greater risk-

adjusted returns. Before making a decision, investors must take into account their own risk tolerance and

investing objectives.

REFERENCES

"A Comparative Analysis On Performance Of SBI And HDFC Equity, Balanced And Gilt Mutual Fund,"

Ms. Dhanalakshmi K - Vidyaniketan Journal of Management and Research, July–December 2013, Volume

1, Issue 2.

[2]. "A Project Report On The Analysis and Comparative Study Of SBI and HDFC Mutual Fund," written

by Babasaheb Patil

[3]. "Comparative Analysis of Mutual Funds with Special Reference to SBI Mutual Funds," by Mrinal

Manish

[4]. "A Comparative Study of Selected Public & Private Sector Equity Diversified Mutual Fund Schemes in

India," by Dr. Vinay Kandpal and Prof. P. C. Kavidayal - IOSR Journal of Business and Management,

February 2014, Volume 16, Issue 1, Ver. V, pp. 92–101

[5]. "A Comparative Study On The Performance Of Mutual Funds Sbi Mutual Funds V/S Others," by Dr.

Rajesh Manikraoji Naik and M R Senapathy -Global