1

Prepared by Indian Institute of Entrepreneurship

SELECTED PROJECT REPORT ON

SELF EMPLOYMENT PROGRAMME

(INDIVIDUAL) UNDER (NULM)

FOR

Assam Urban Livelihood Mission

(ASULMS), Government of Assam

Prepared by: Indian Institute of Entrepreneurship (IIE),

Lalmati, Guwahati, Near NH – 37.

Pin- 7781039.

Assam.

2

Prepared by Indian Institute of Entrepreneurship

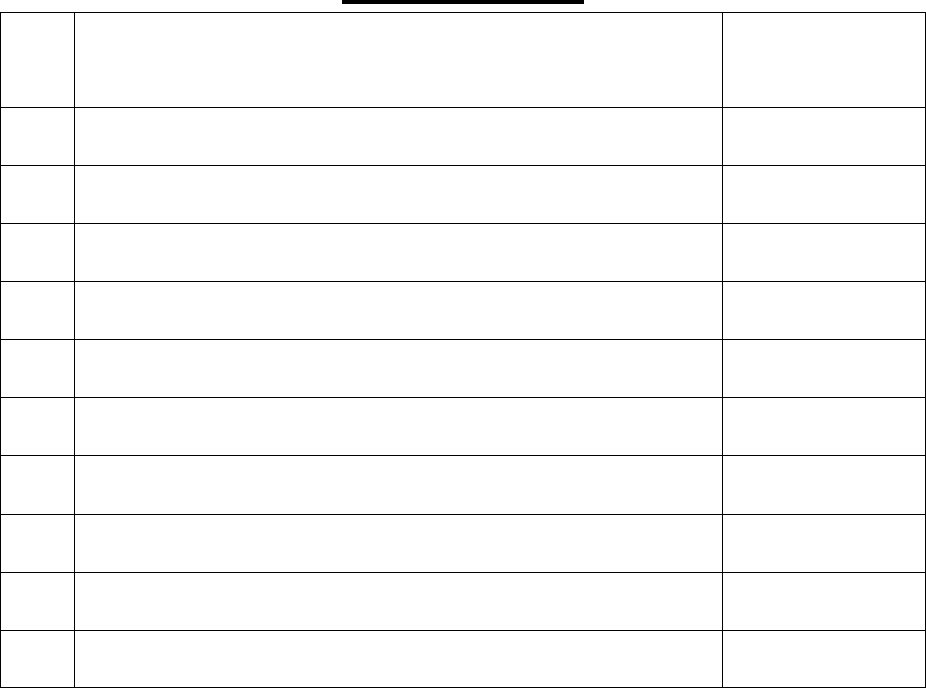

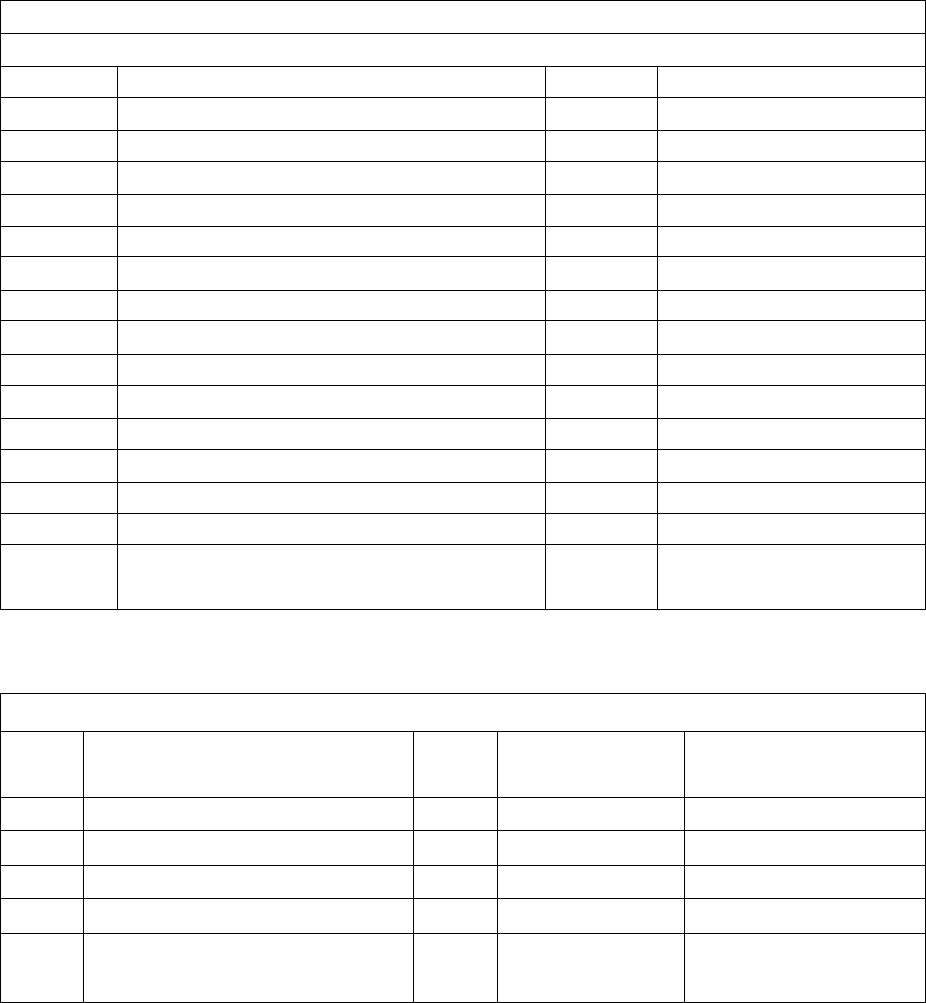

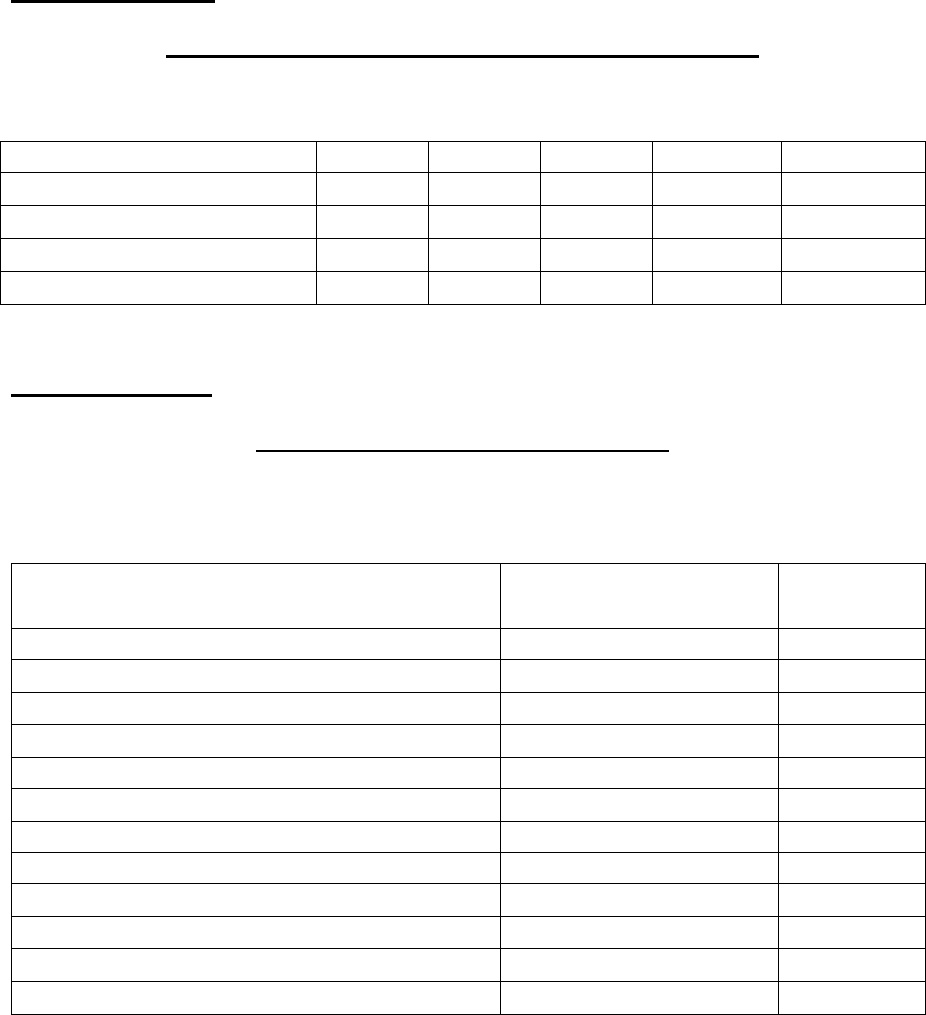

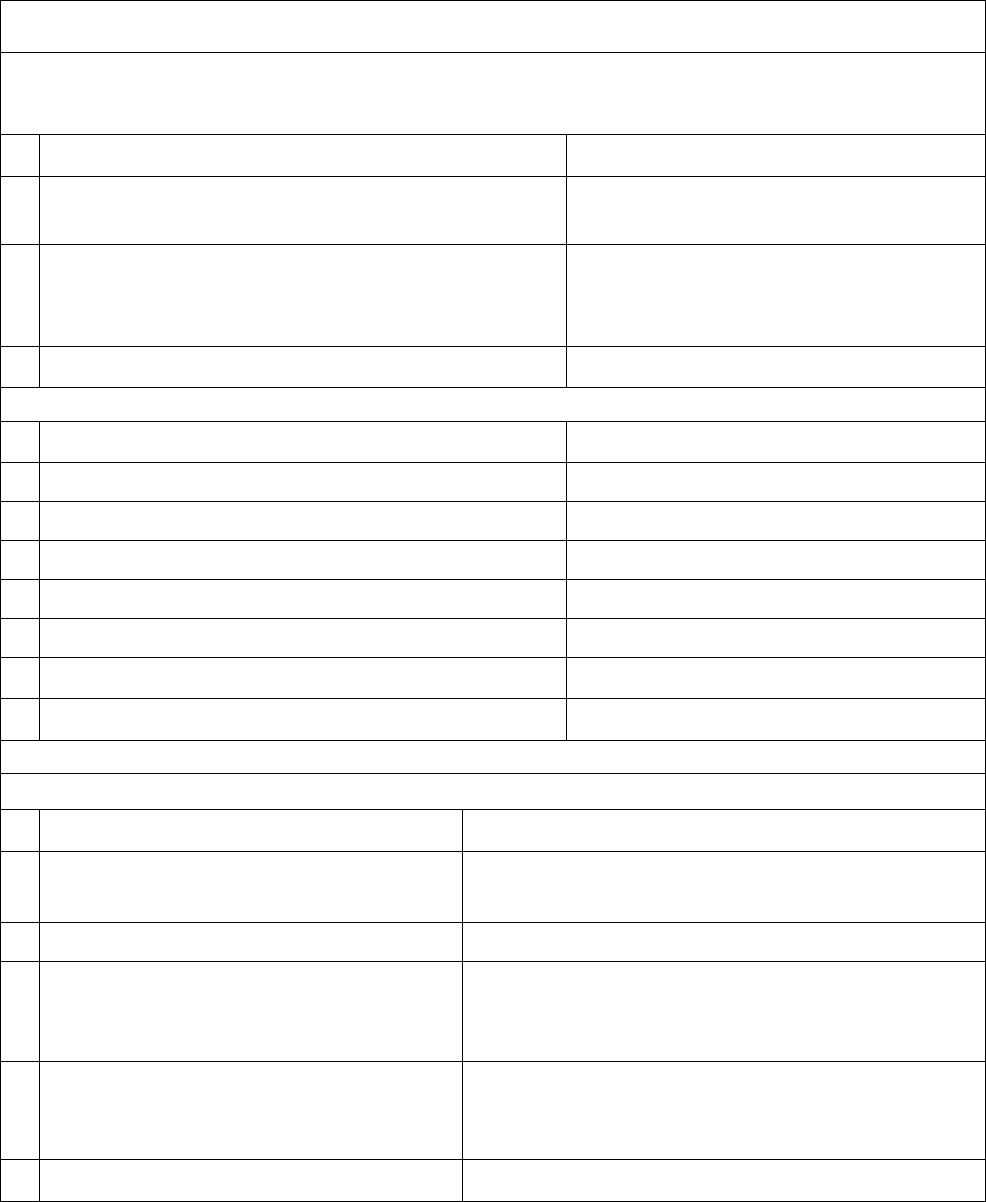

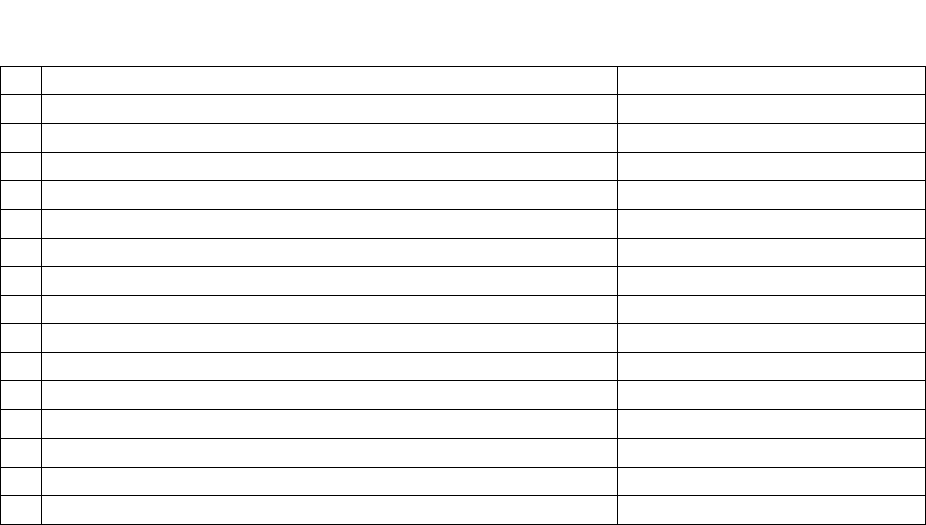

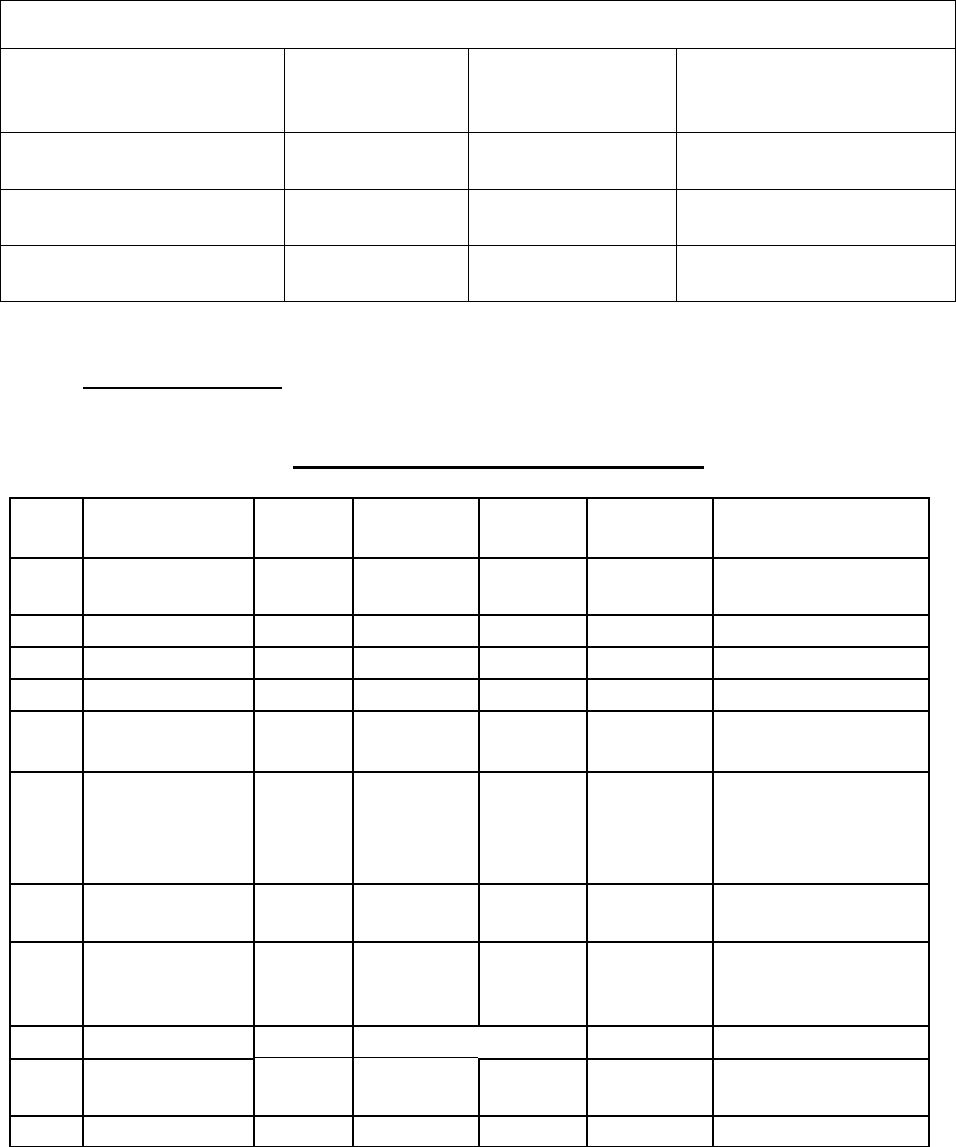

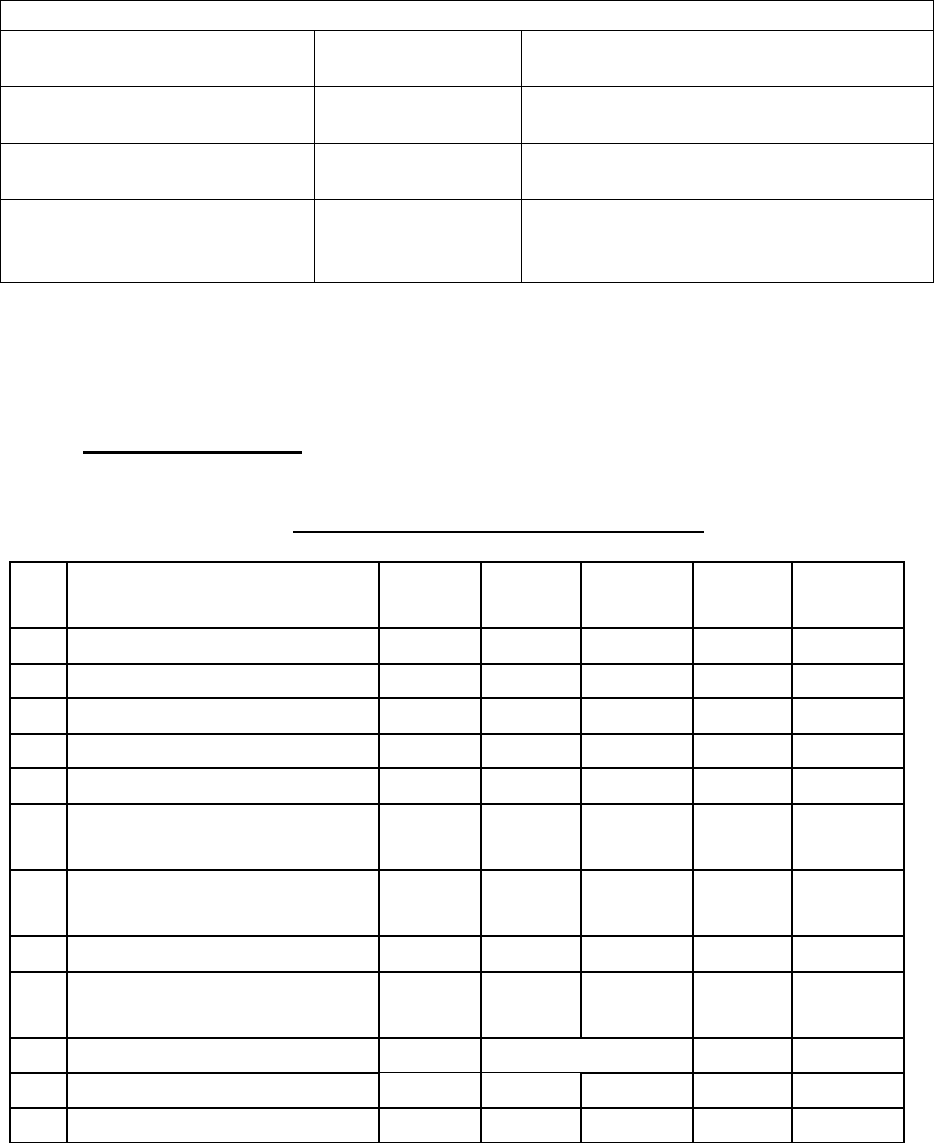

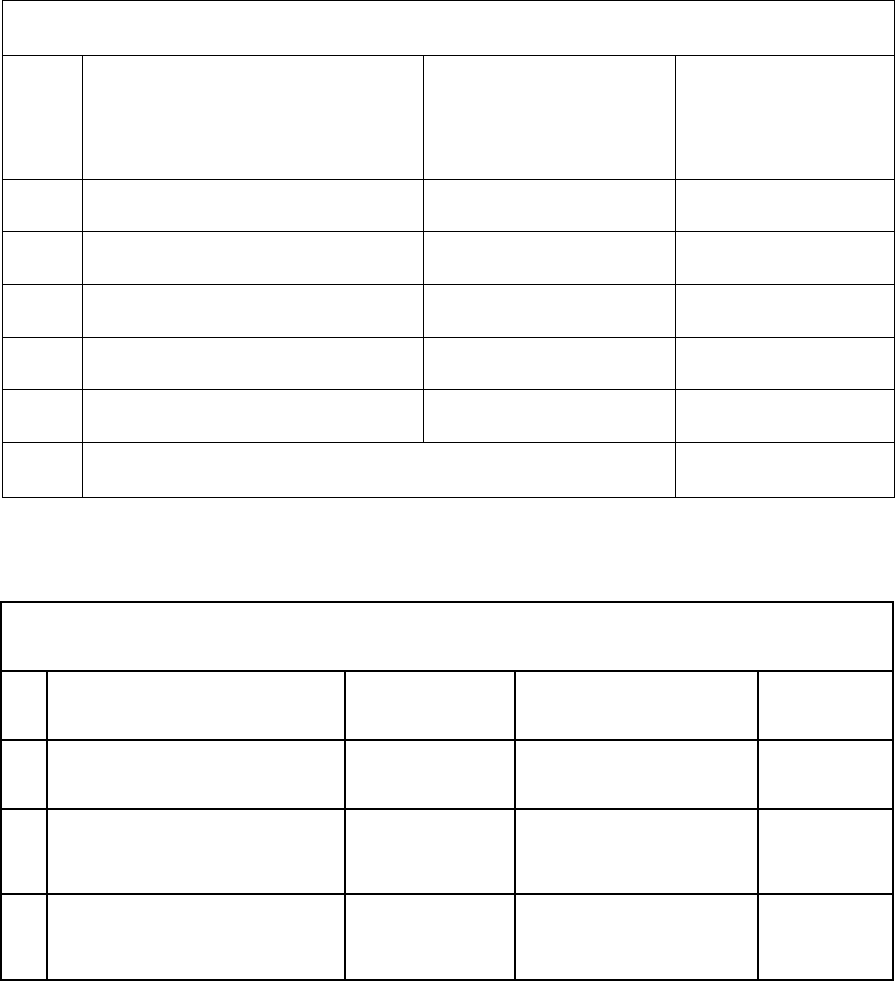

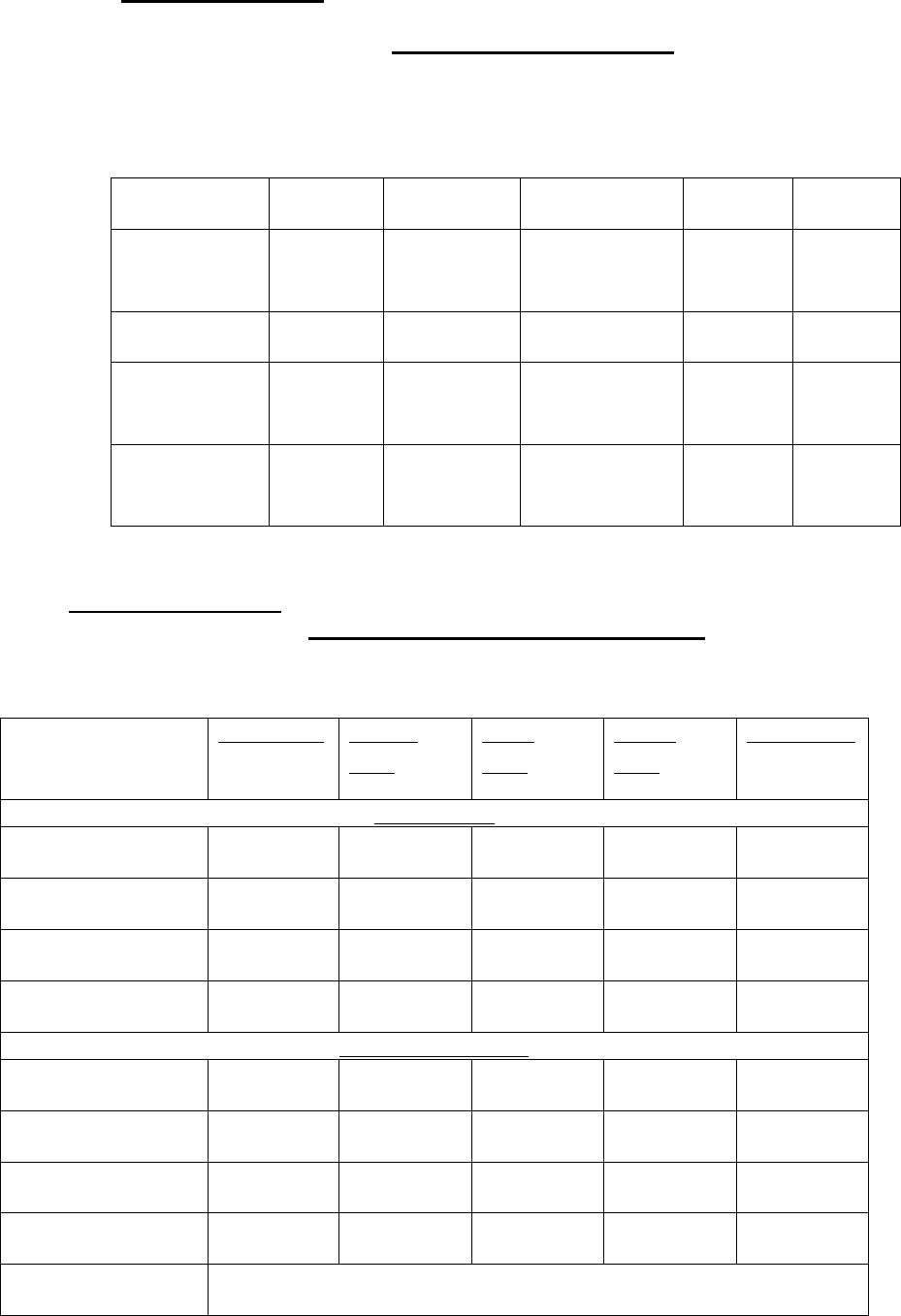

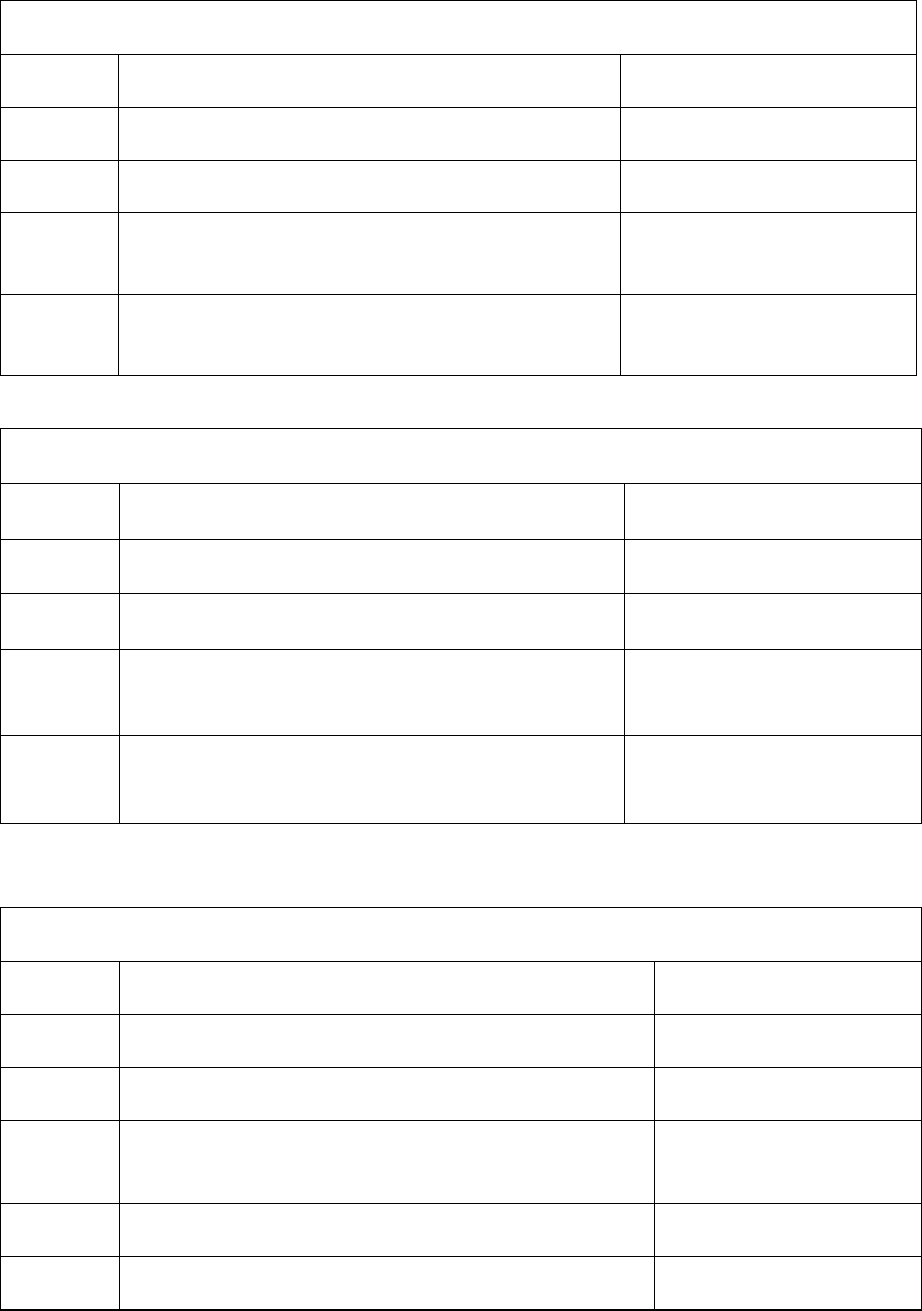

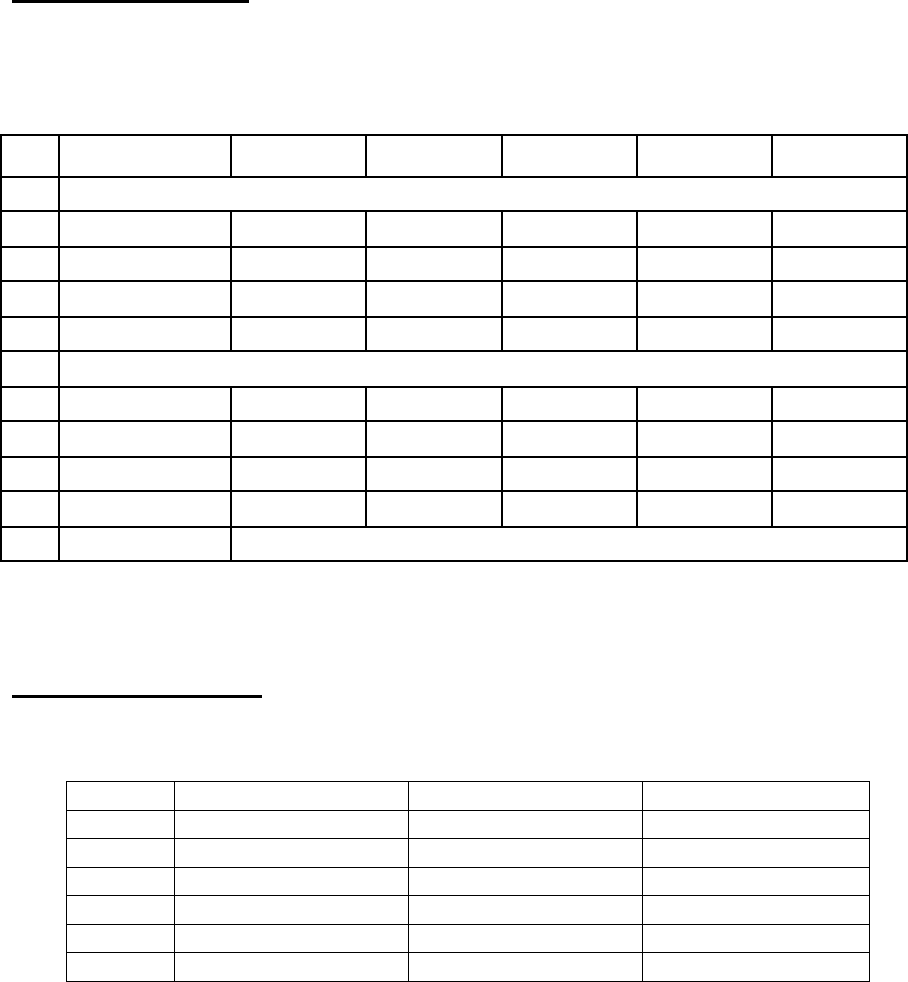

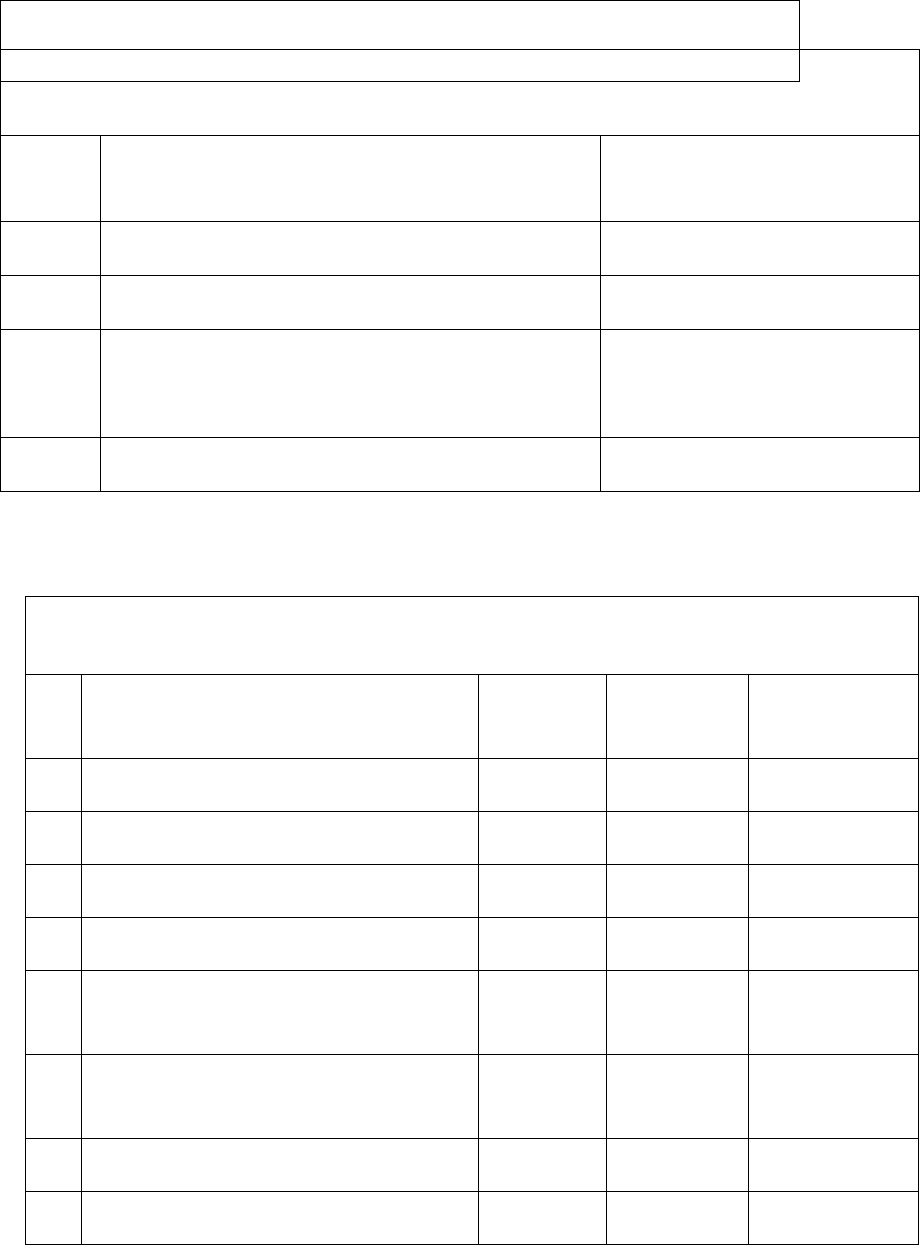

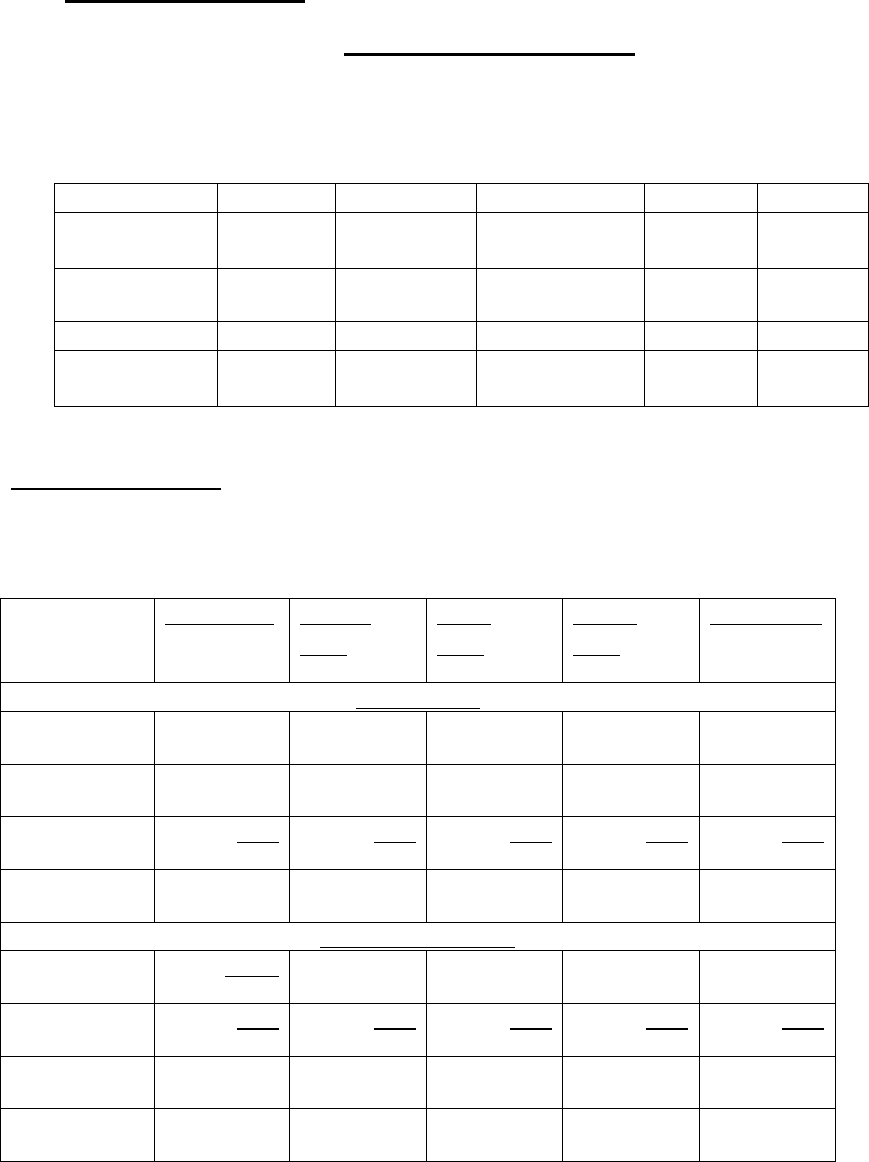

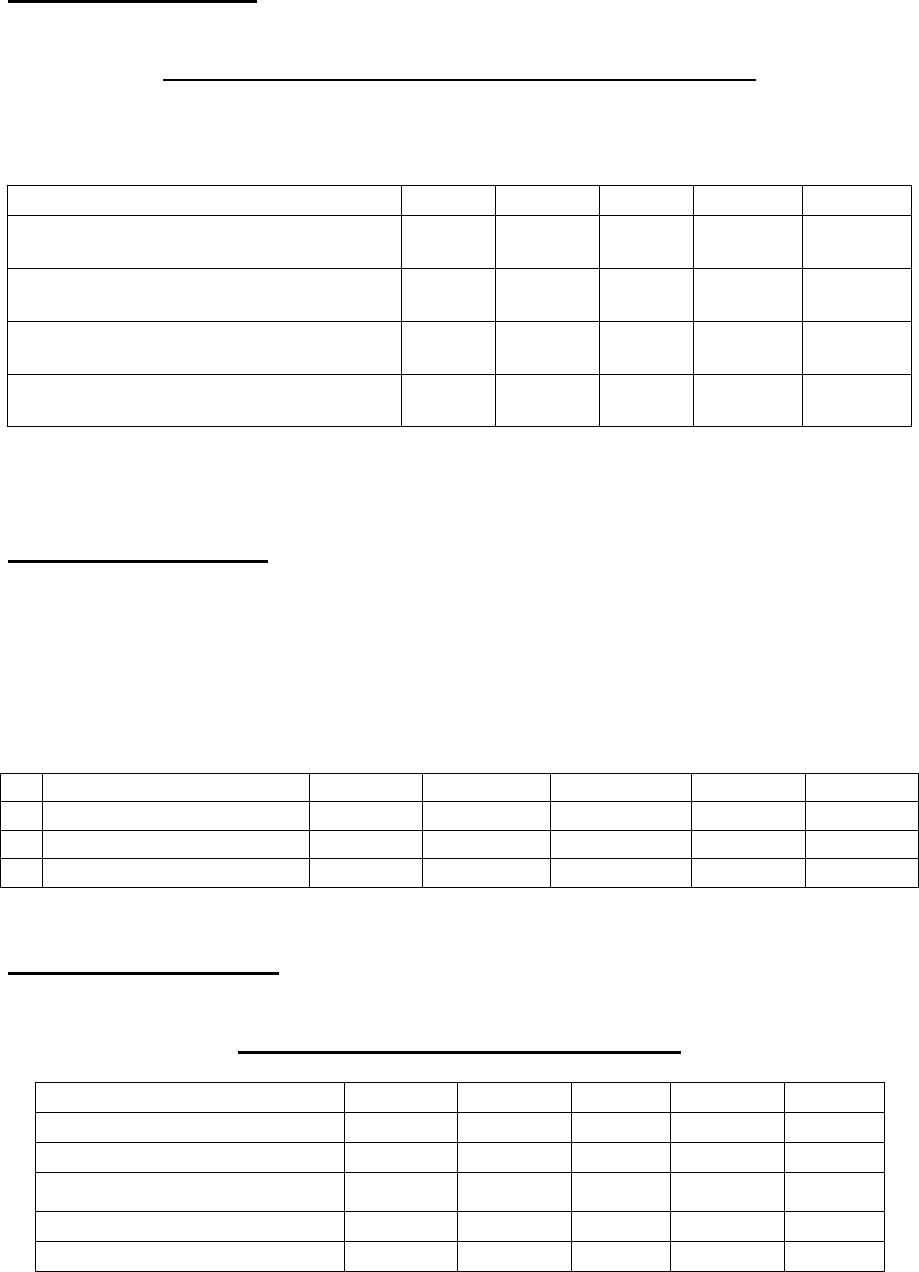

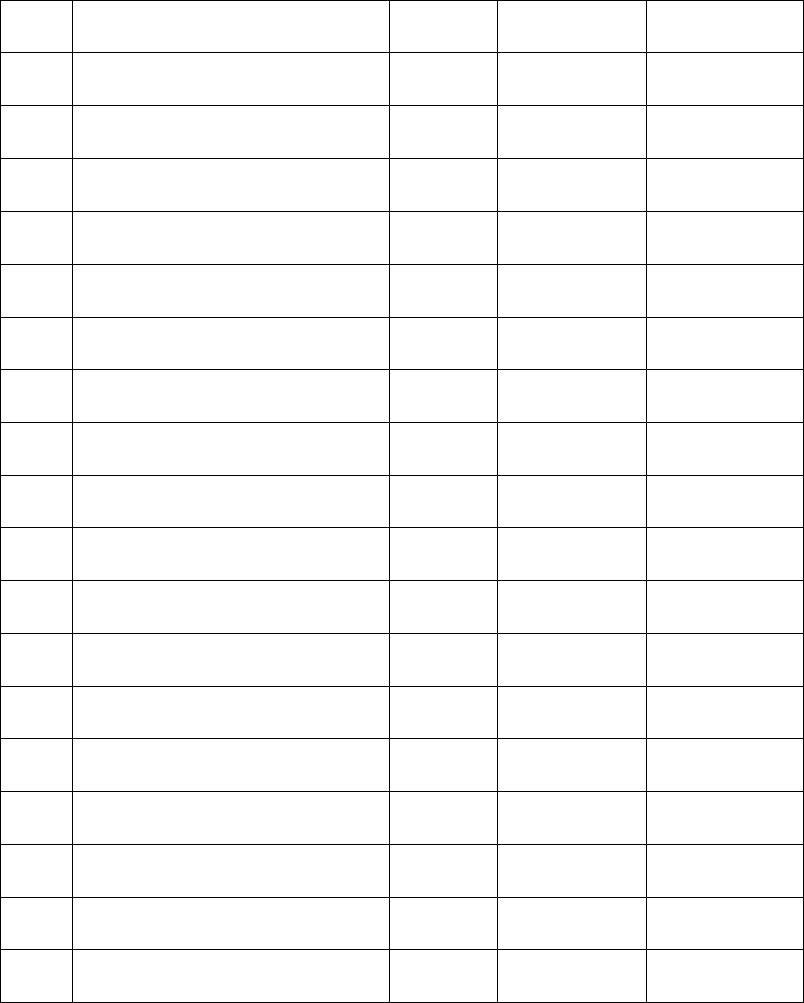

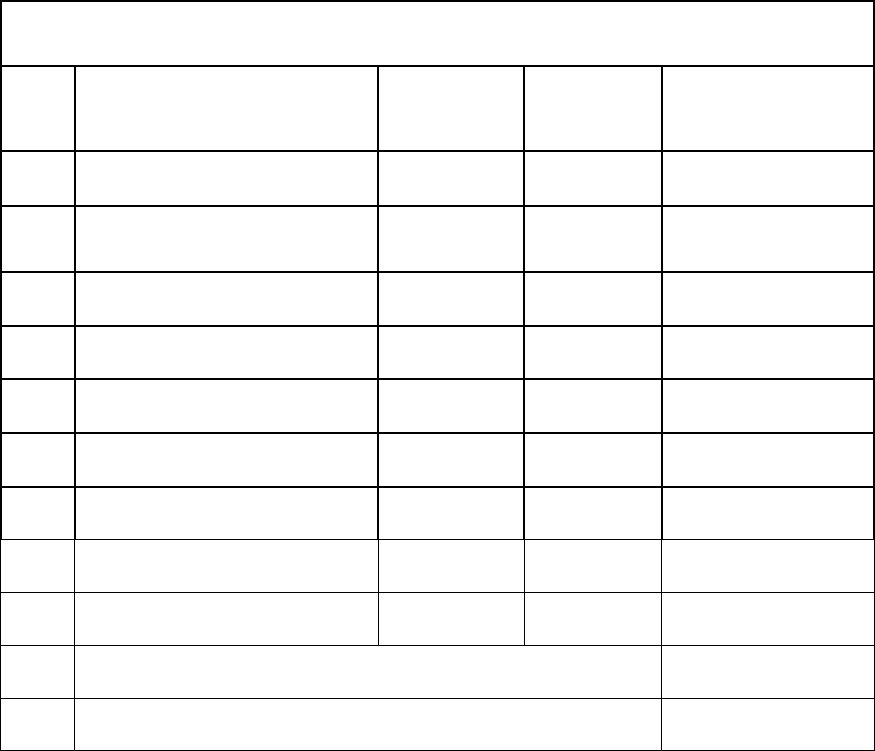

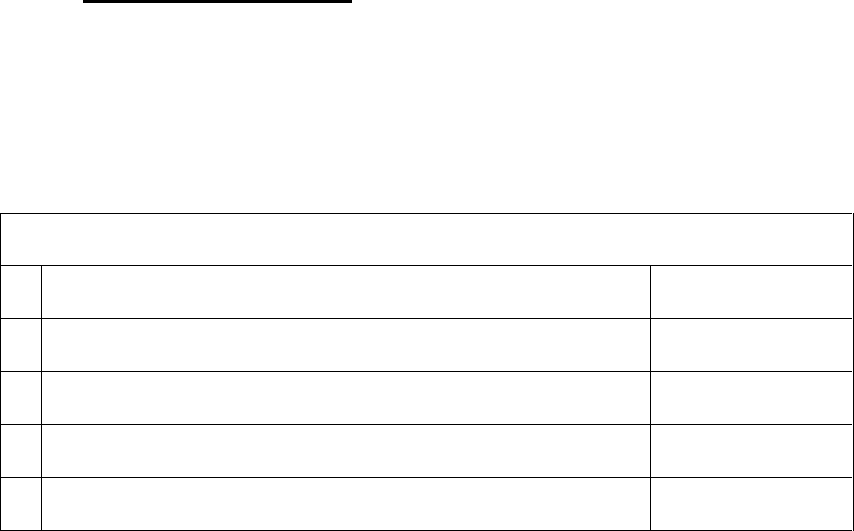

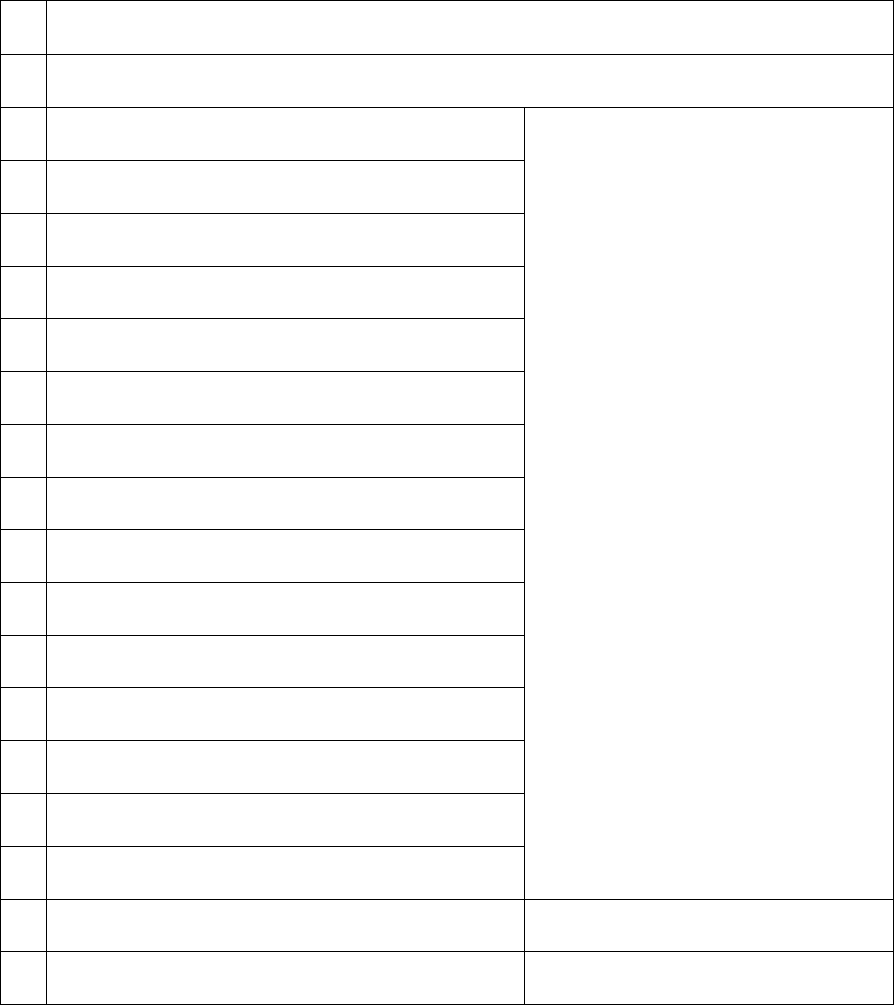

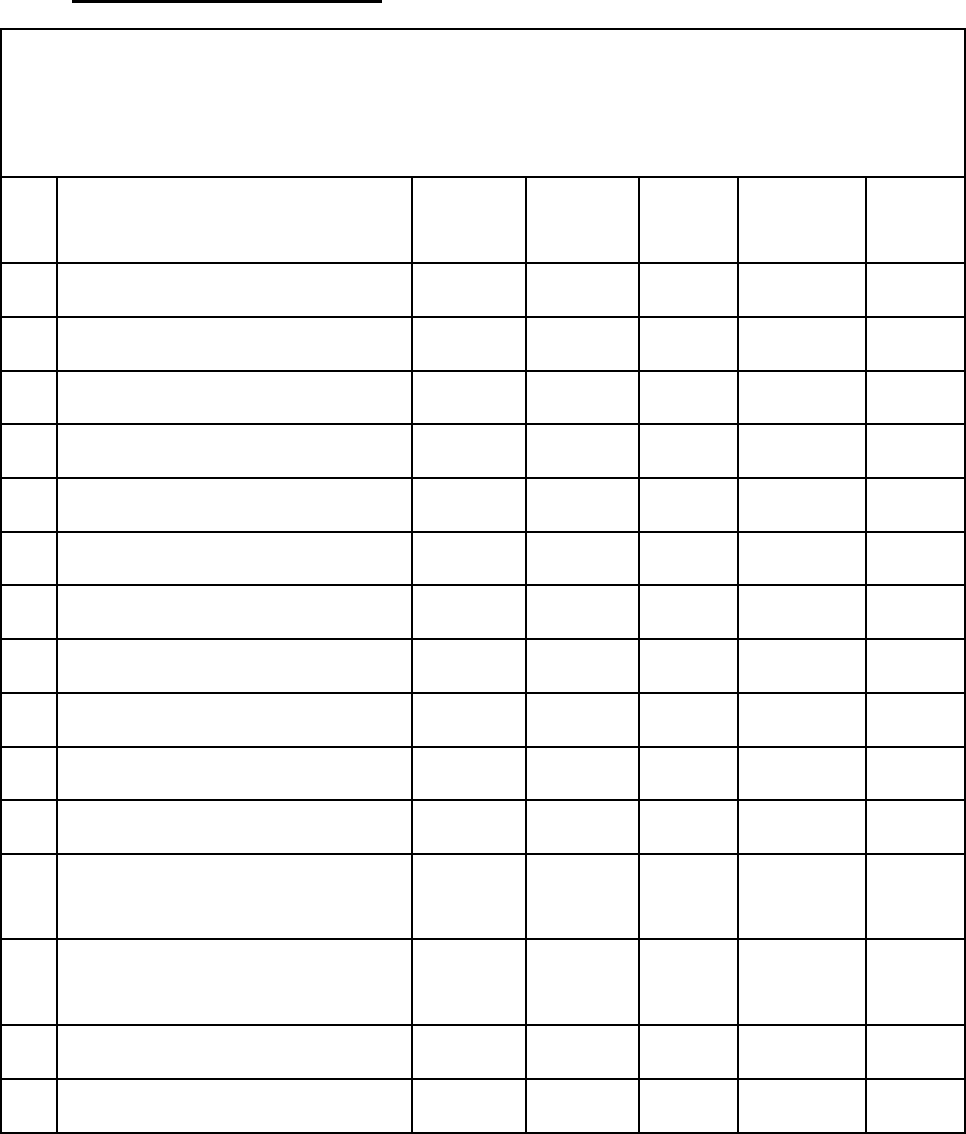

CONTENTS

Sl

No.

Topics

Page No

1

Beauty Parlour / Saloon

3 – 16

2

E - Rickshaw

17 – 22

3

Grocery Shop

23 – 31

4

Retail Stationery Shop

32 - 41

5

Small Retail Garment Shop

42 – 52

6

Tailor Shop

53 – 63

7

Tea Stall

64 – 74

8

Two wheeler Motor Garage

75 – 83

9

Weaving Unit

84 – 96

10

Fast Food Unit

97 - 110

3

Prepared by Indian Institute of Entrepreneurship

Project Report on

BEAUTY PARLOUR / SALOON

4

Prepared by Indian Institute of Entrepreneurship

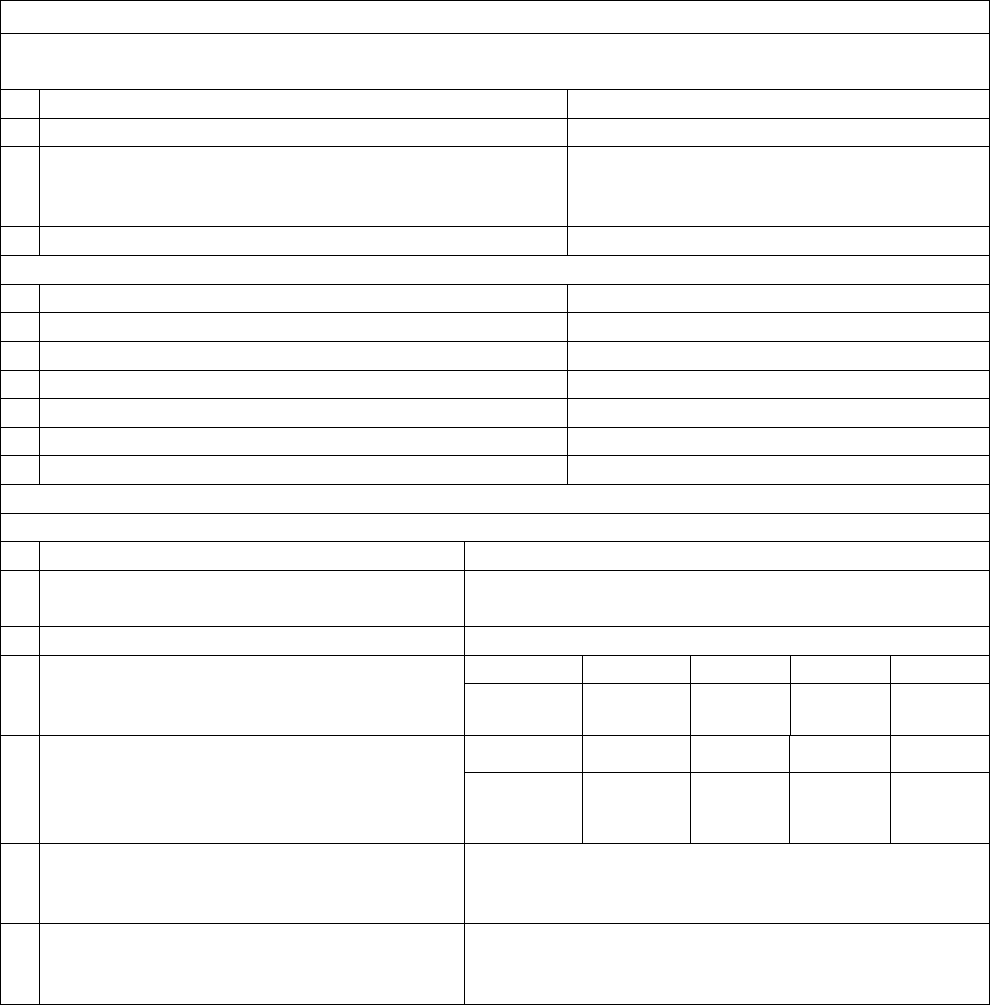

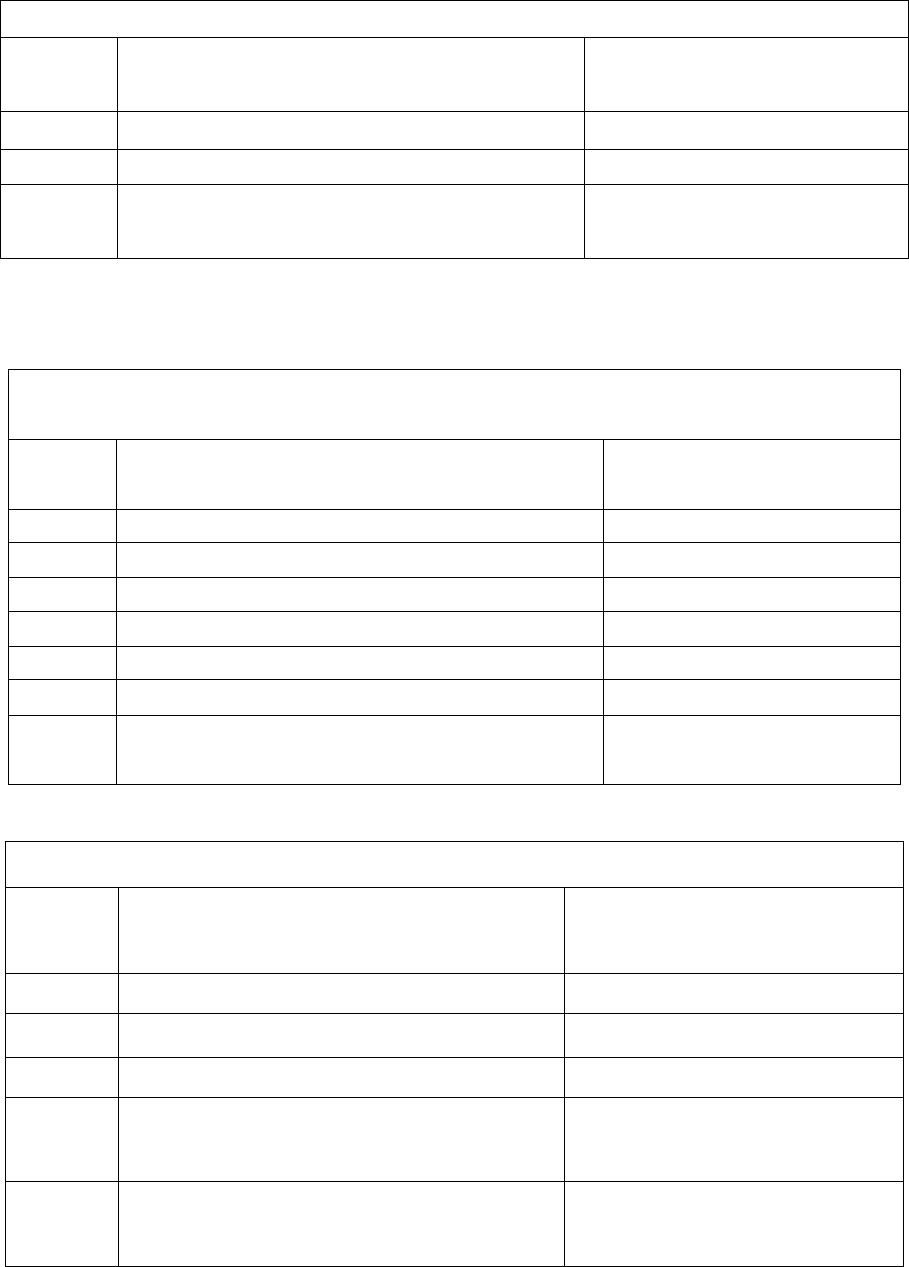

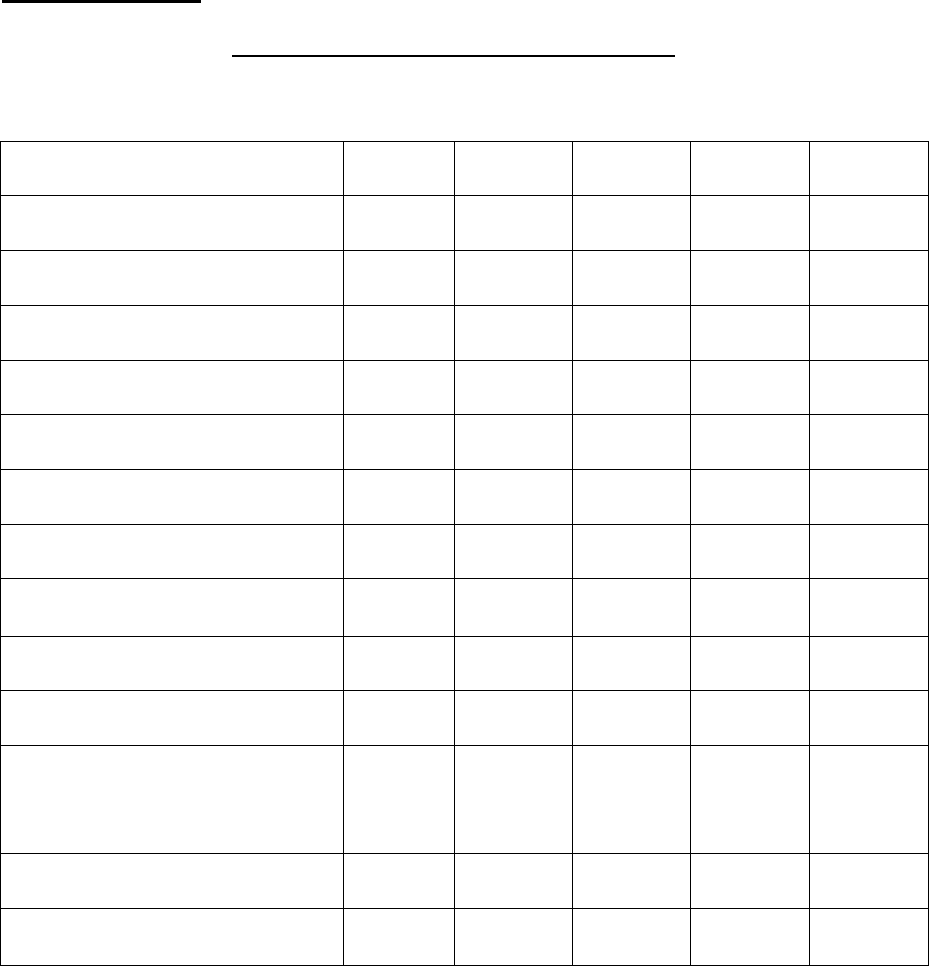

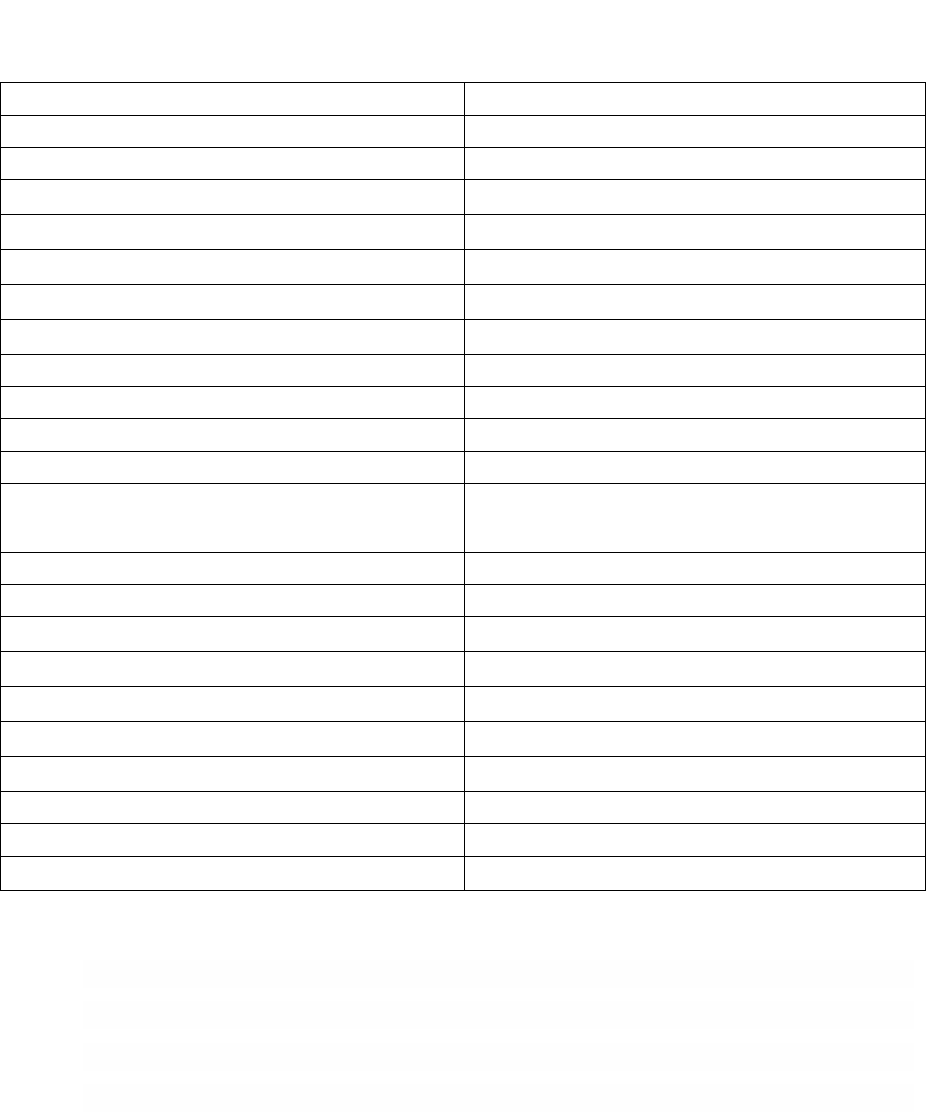

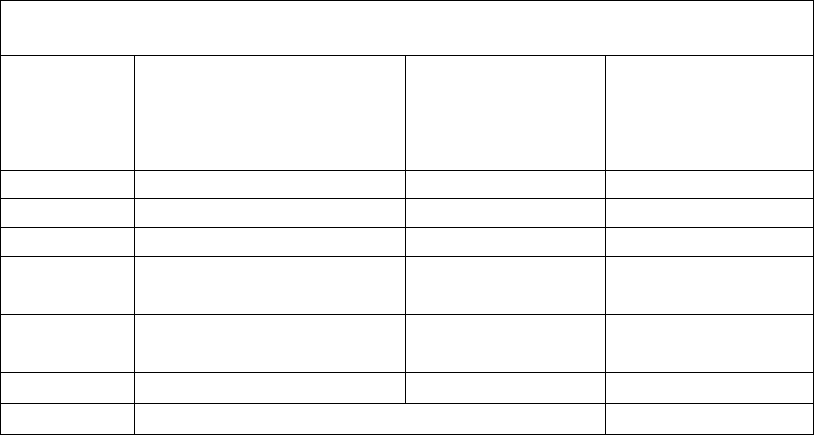

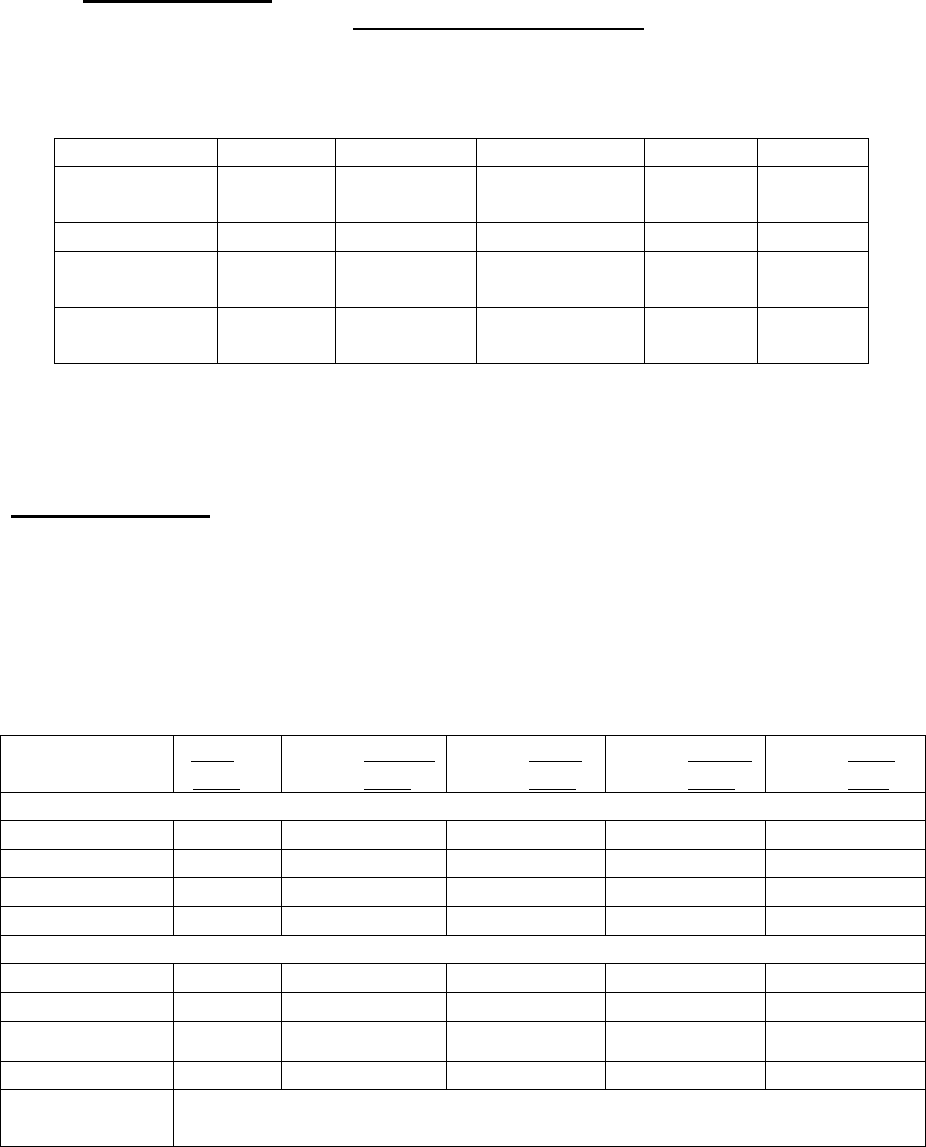

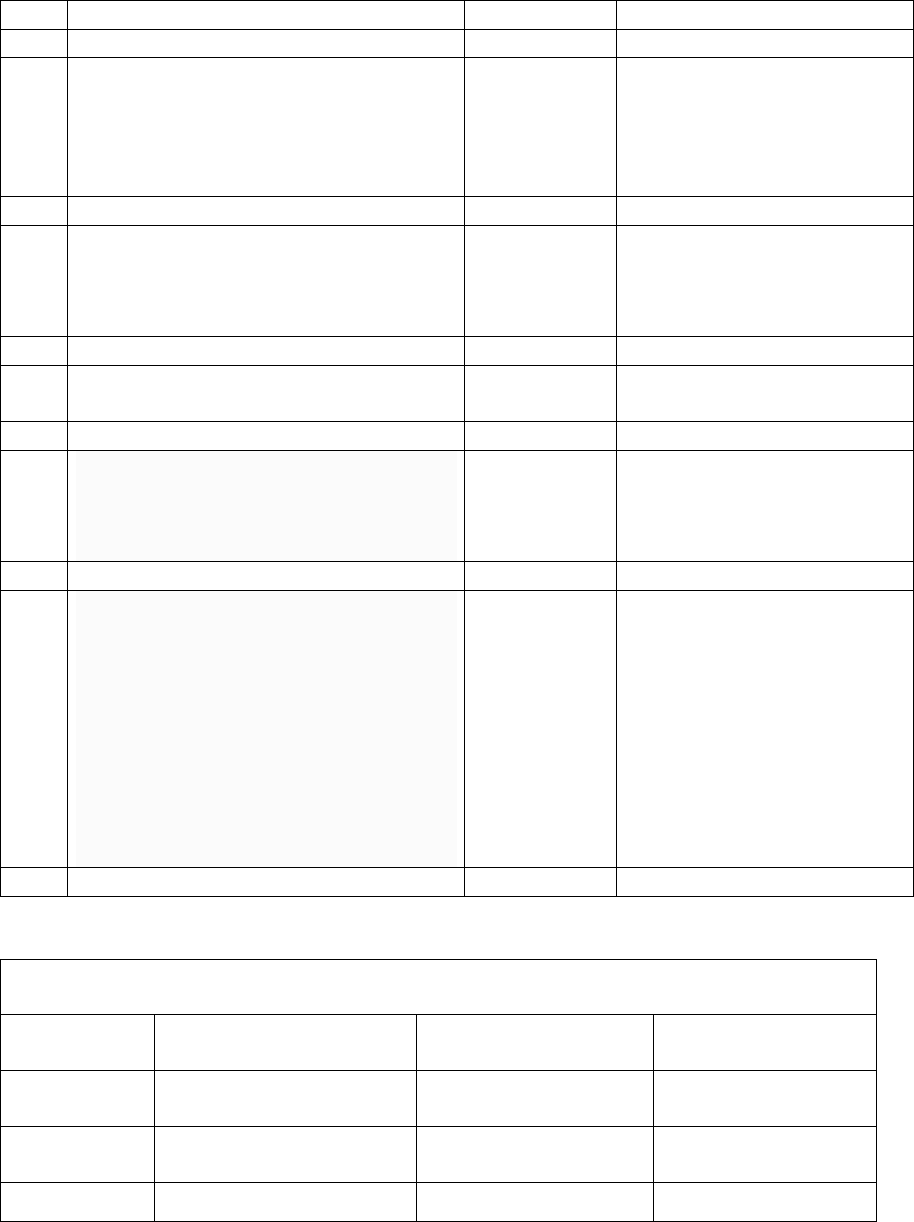

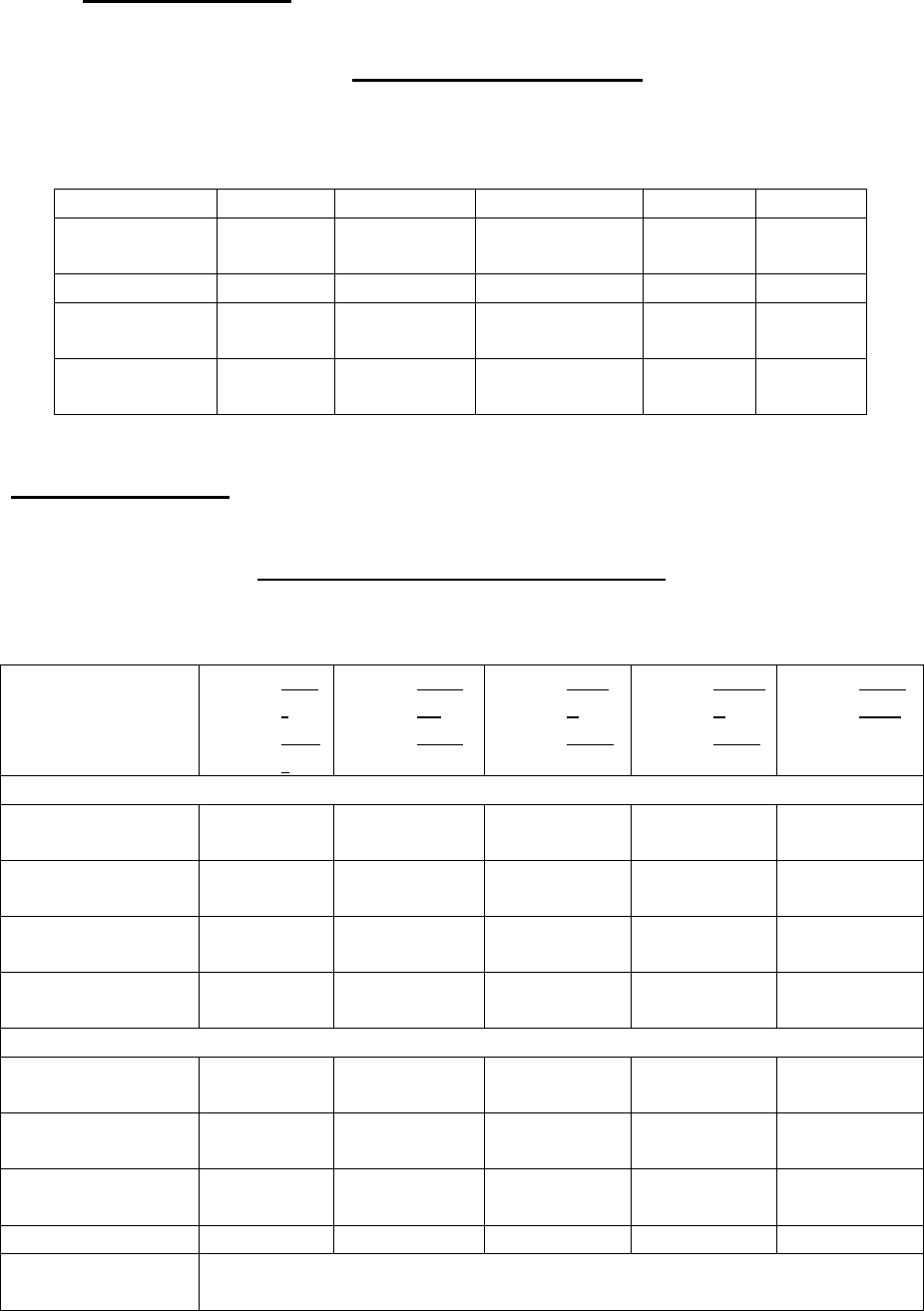

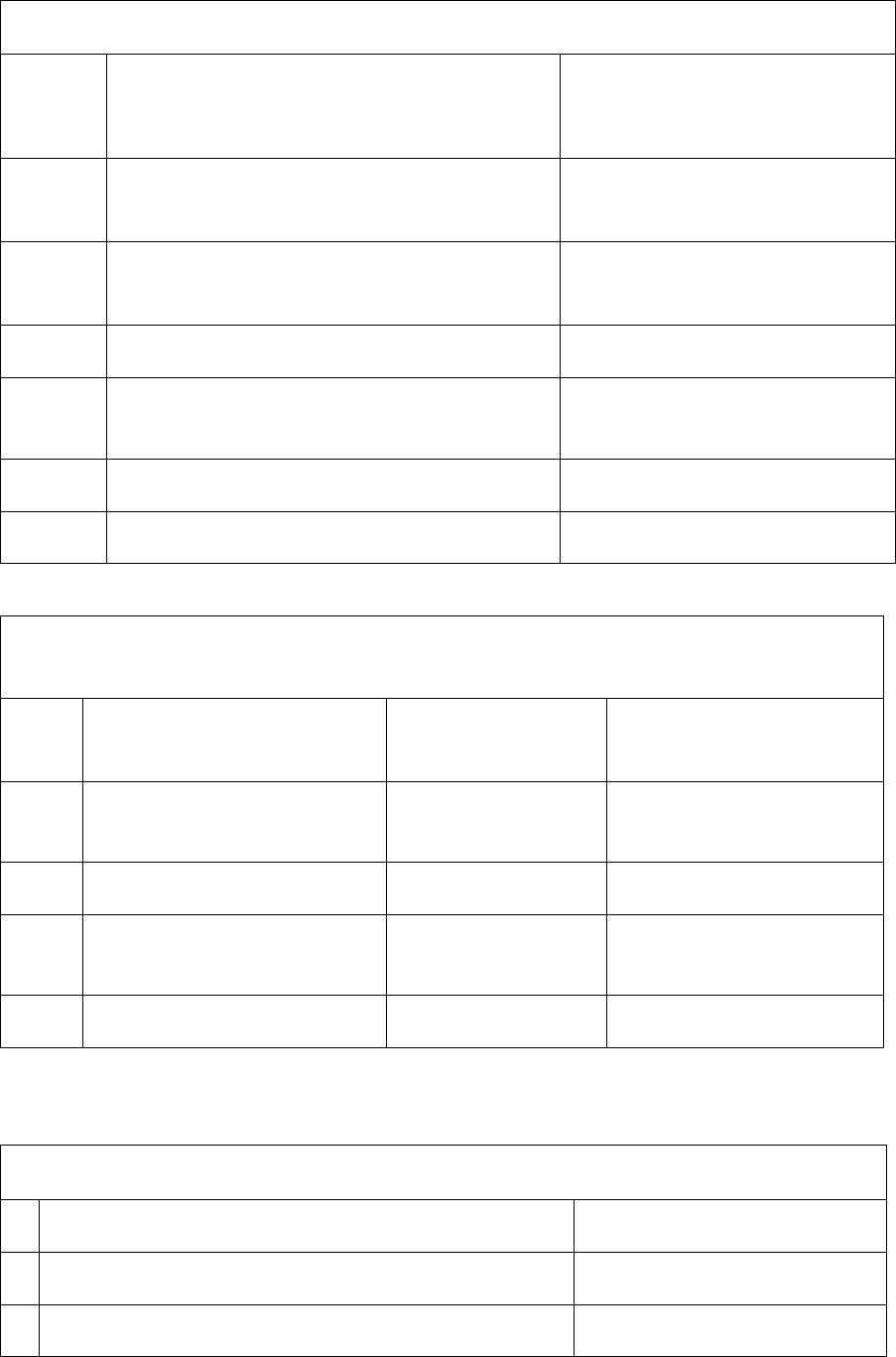

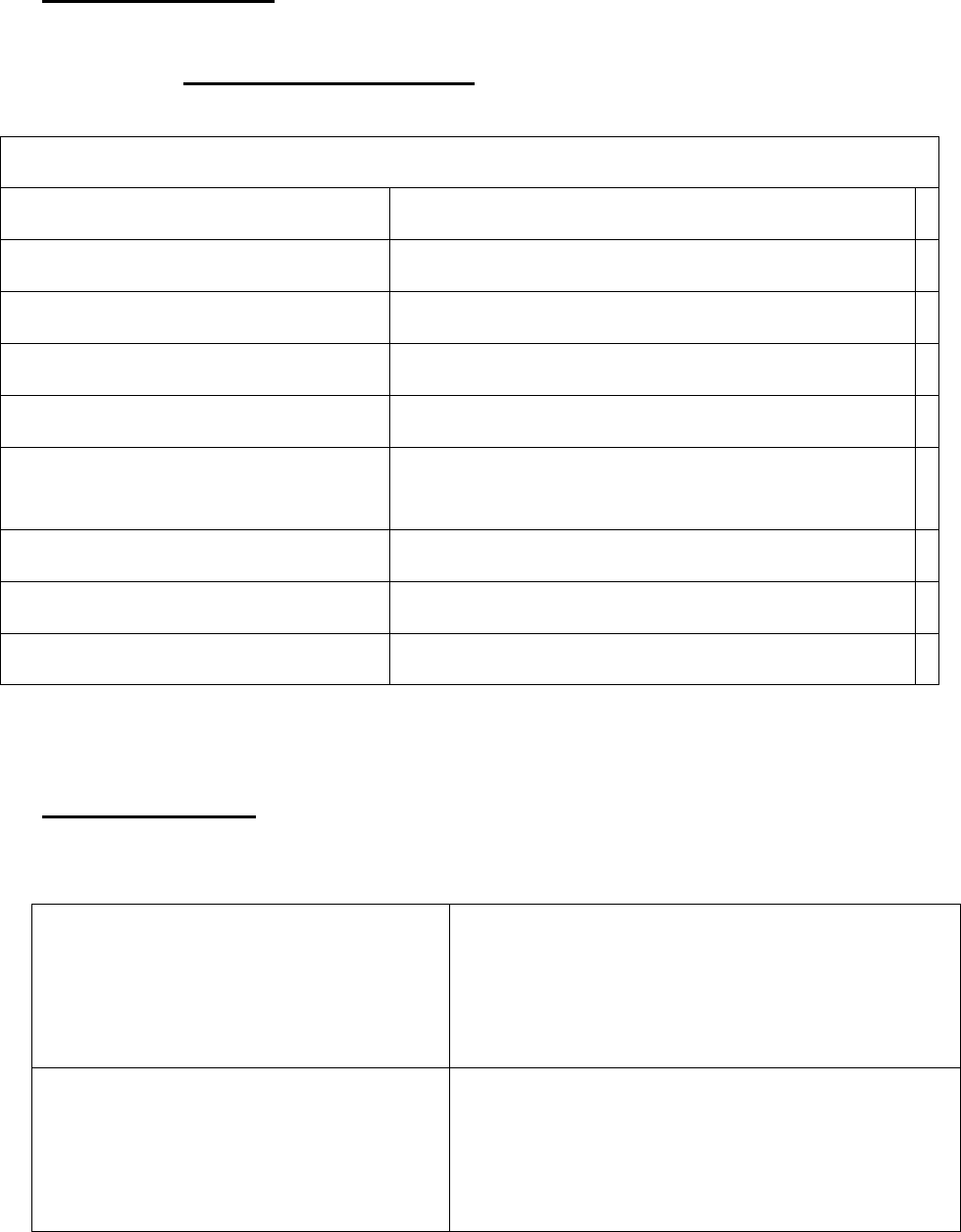

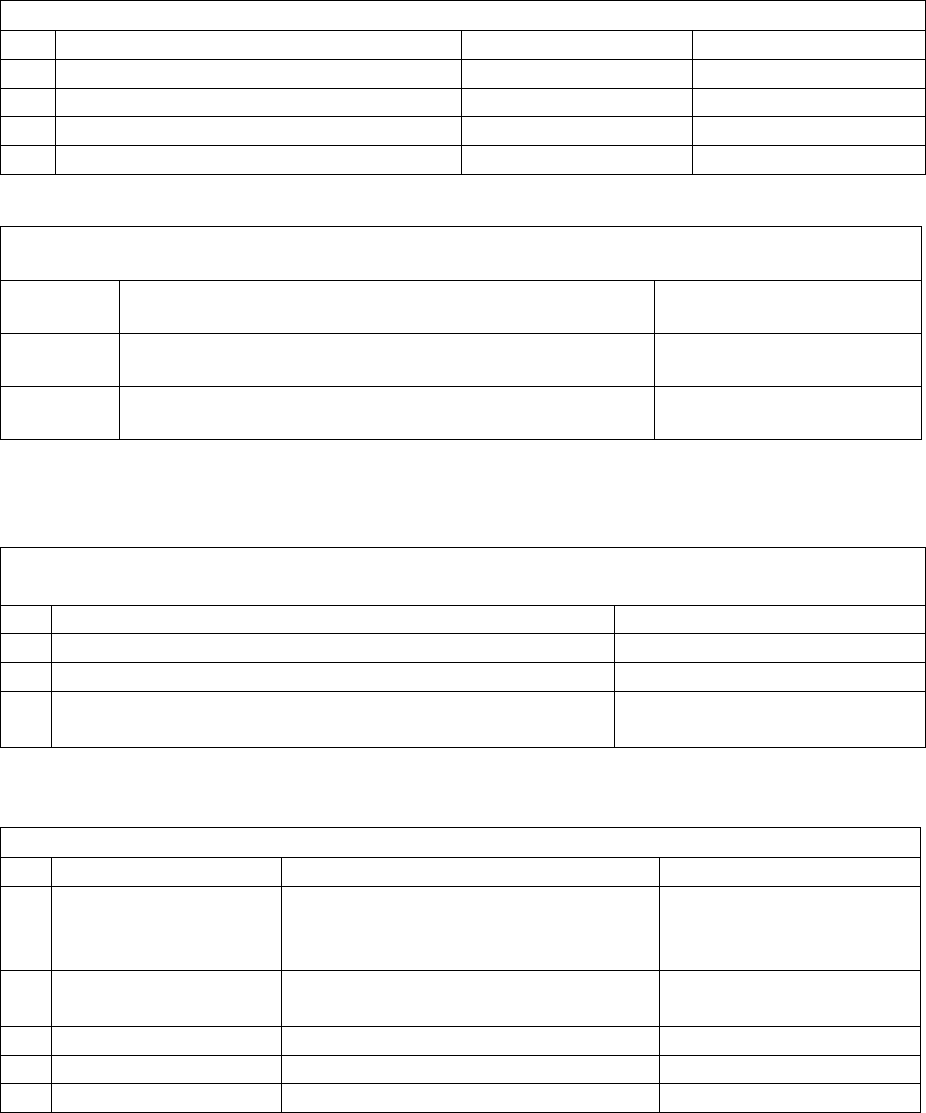

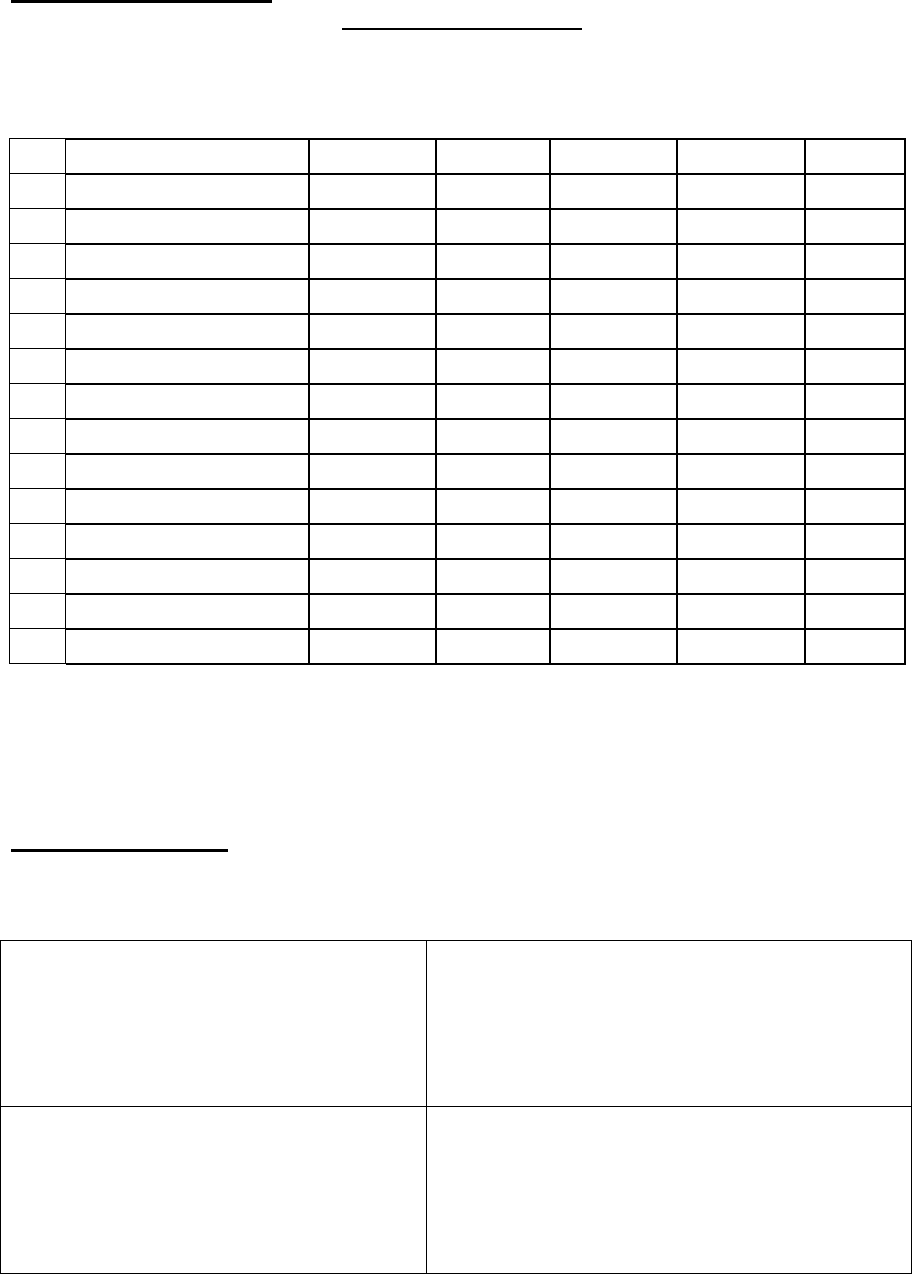

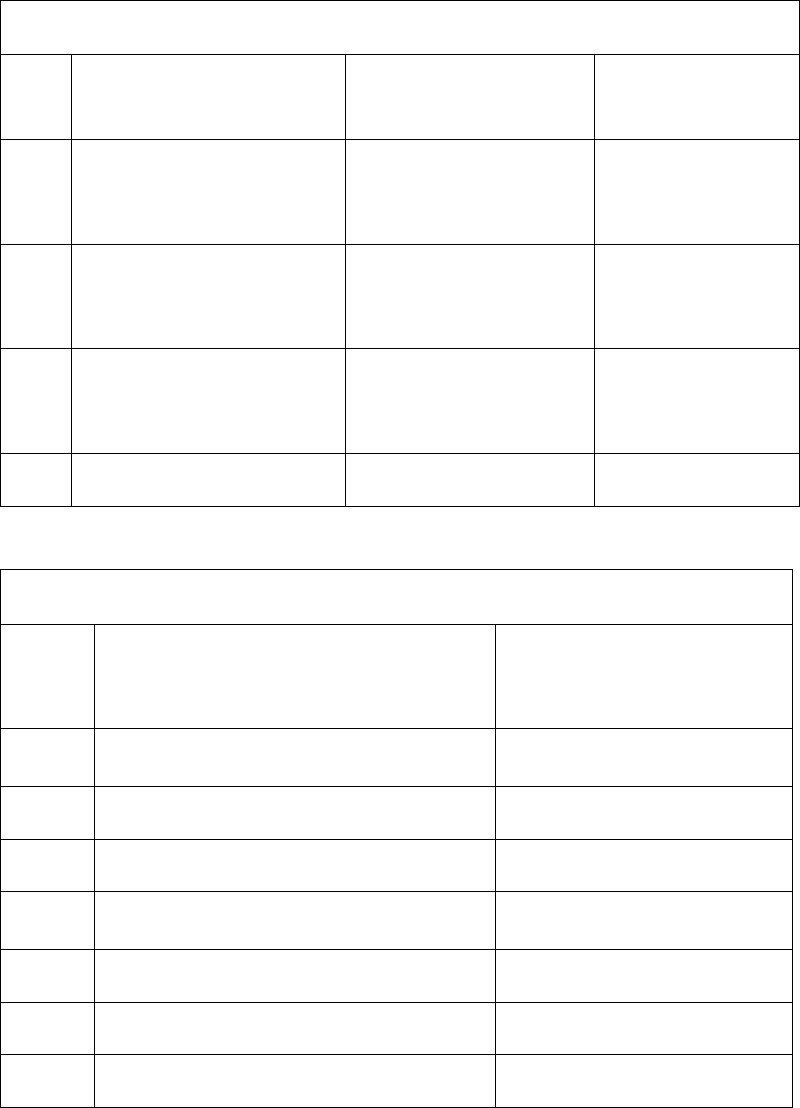

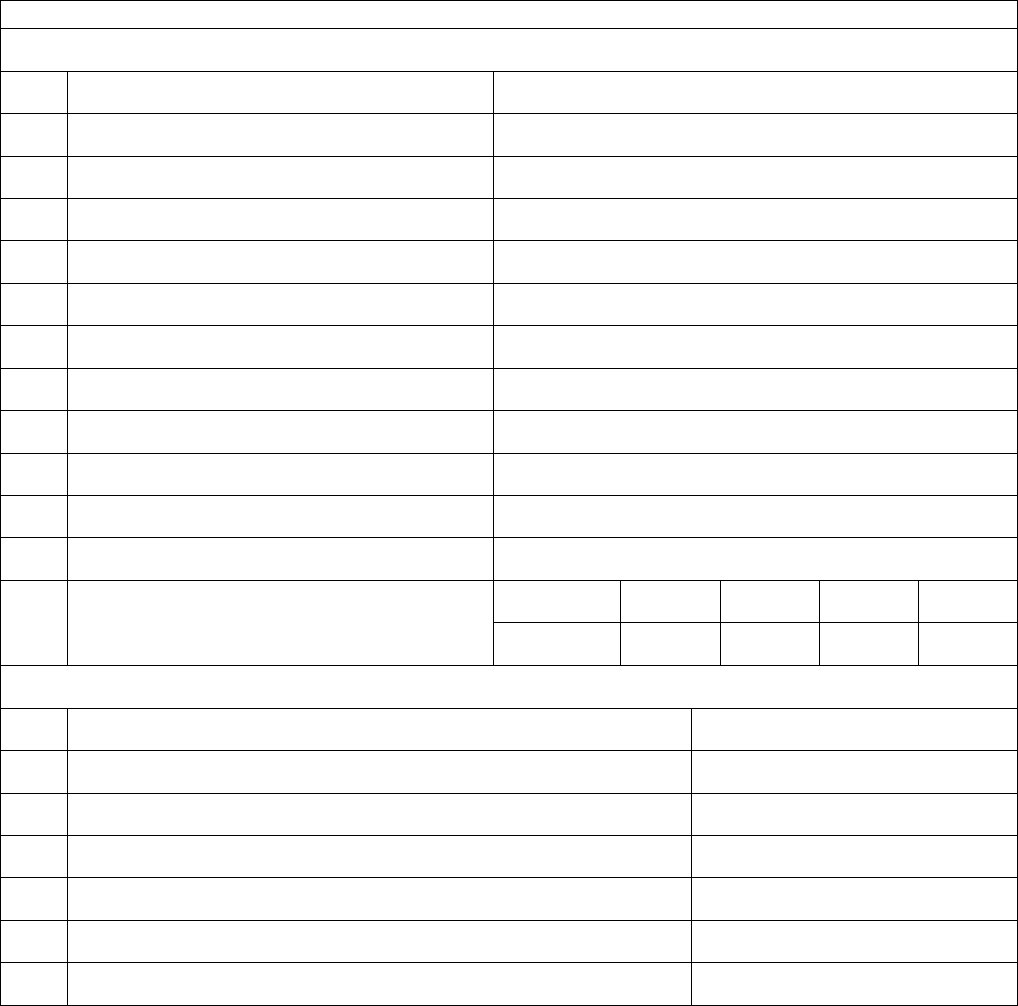

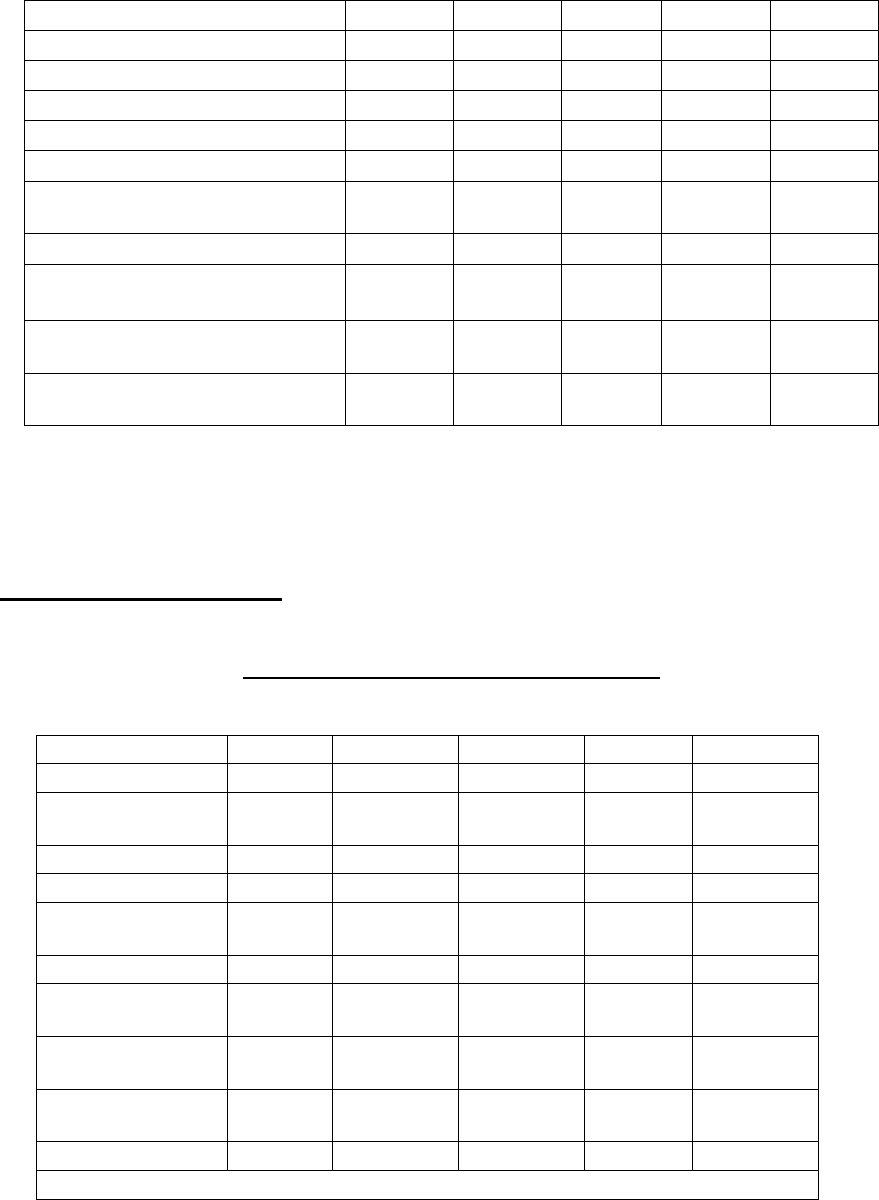

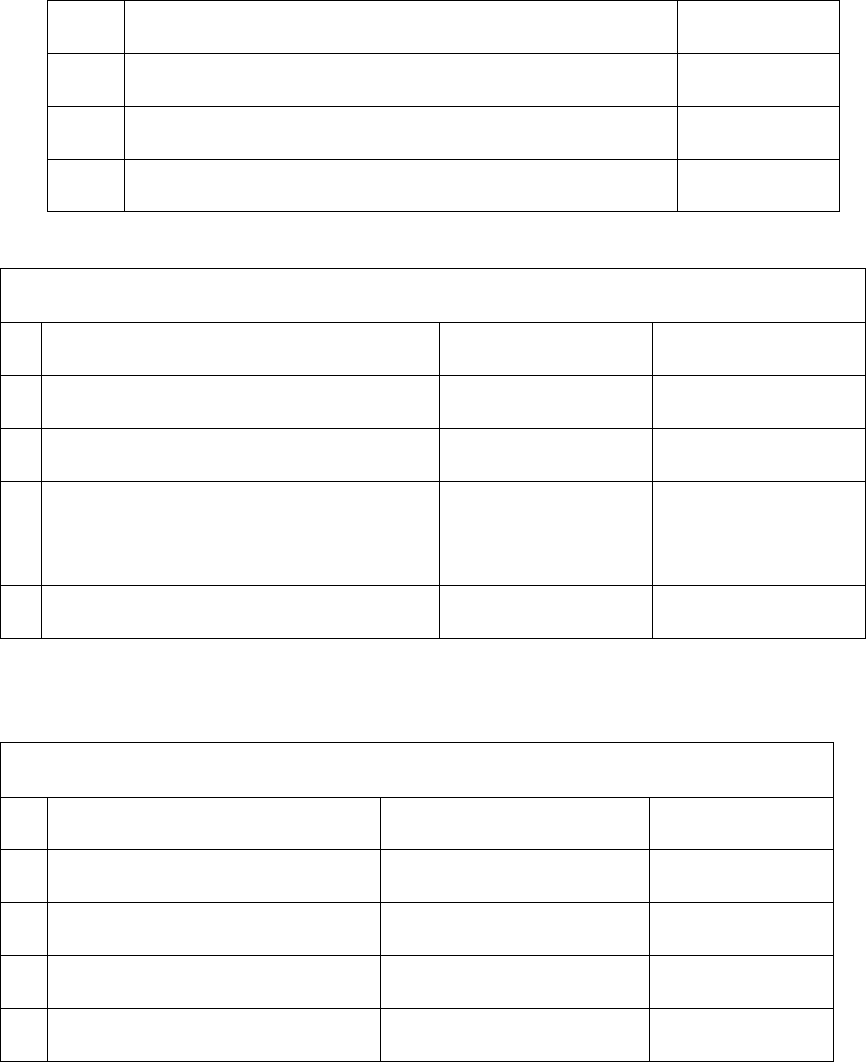

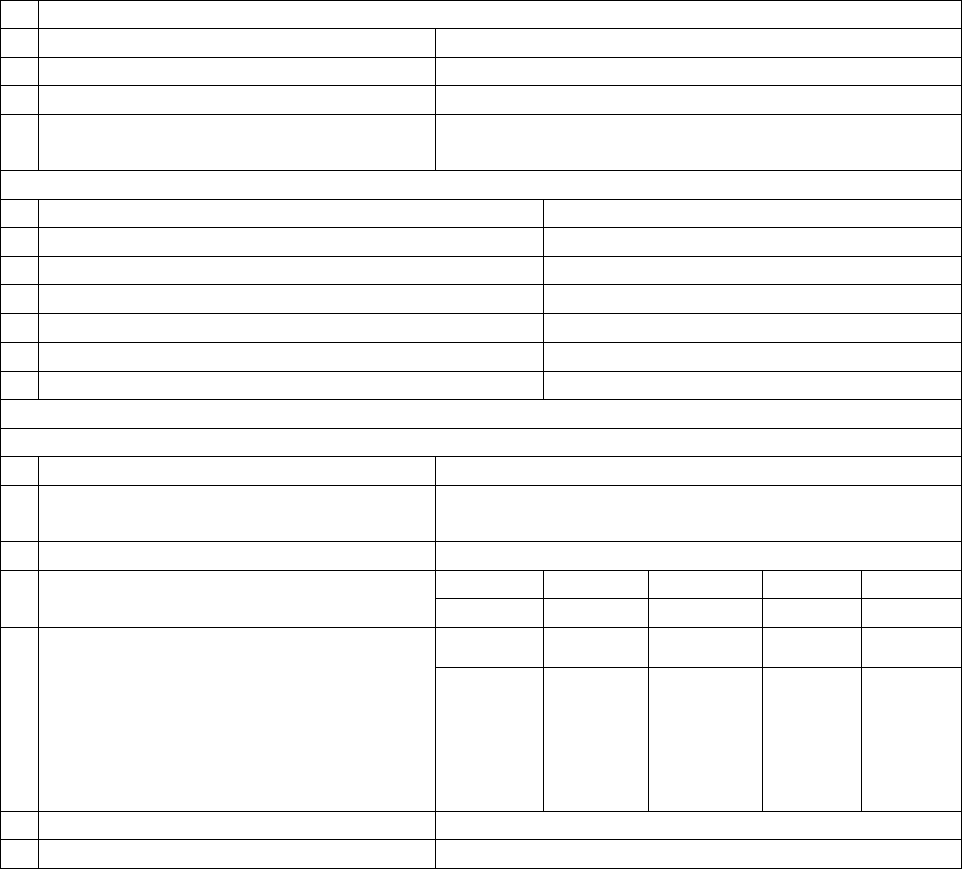

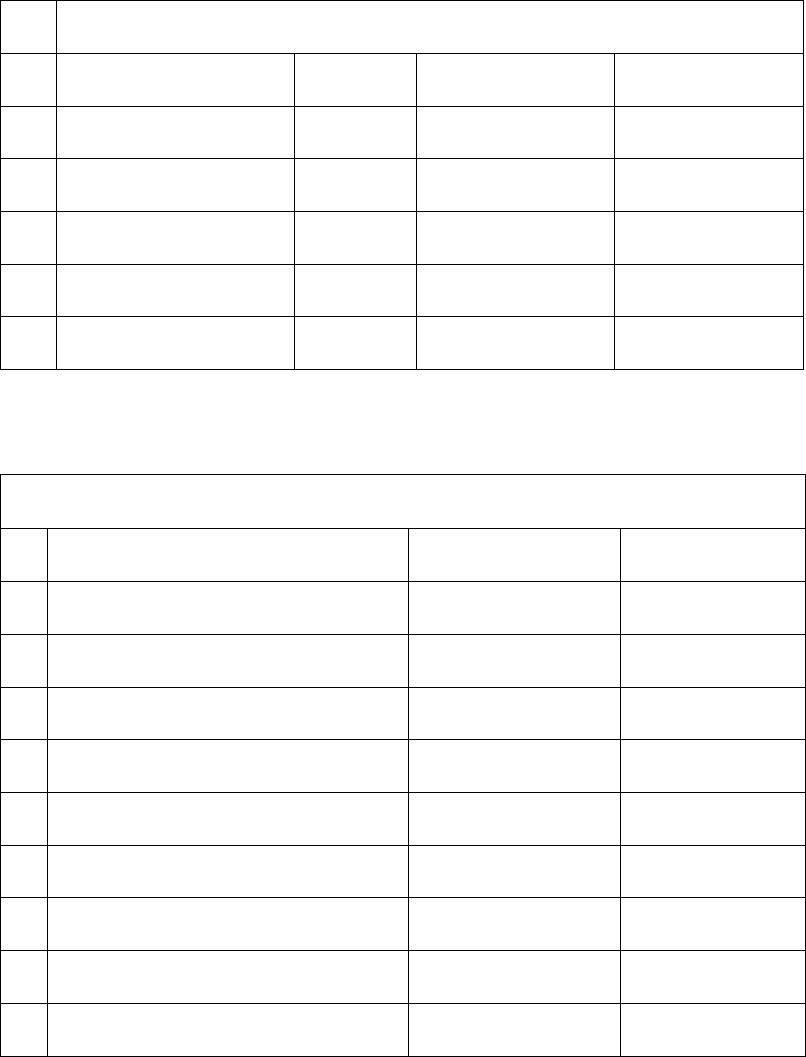

PROJECT REPORT ON BEAUTY PARLOUR/SALOON under SEP-I

HIGHLIGHT OF THE PROJECT

Name of the Unit

As per Adhar of MSME

Constitution

Proprietorship

Name of the Promoter

Trainee with Skill Knowledge on

respective Project

Proposed Location

Urban/ Semi Urban

Total Project Investment

Fixed Capital

Rs. 1, 25,500.00

Working Capital

Rs. 74,500.00

Total

Rs. 2, 00,000.00

Means of Finance

Promoters’ Contribution @ 25%

Rs. 50,000.00

Bank Loan @ 75%

Rs.1, 50,000.00

Total

Rs. 2, 00,000.00

FINANCIAL ANYLASIS

Loan Repayment Period

05 Years

Percentage of Profit on Total Investment:

92.56 %

Percentage of Profit on Total Sales

15.52%

BEP (on Sales)

1

st

year

2

nd

year

3

rd

year

4

th

year

5

th

year

57.89%

49.55%

46.47%

42.03%

40.87%

Projected Yearly Profit

(Rs, 000)

1 Year

02 Year

03 Year

04 Year

05 Year

99.43

142.83

185.83

228.55

233.84

Average DSCR

1:4.04

Debt Equity Ratio:

3:1

5

Prepared by Indian Institute of Entrepreneurship

1. INTRODUCTION:

The urge to look beautiful has always been there in women. But recent trend is such that men

are also becoming conscious about their look. Earlier natural herbs were used to look

beautiful but with modernization, came make up and beauty parlour culture. Beauty parlours

have not only given women a self-employment opportunity but also have satisfied their urge

to look beautiful. Though men and women have exclusive beauty parlours, these can be

established under one roof but with different segments altogether.

The clientele of the beauty parlour would include two divisions, one for men and the other for

women. Women clientele would include young girls, working women and housewives who

go to beauty parlour at least once a month. Bridal make-up and personalized services for

special occasions also enhance business of beauty parlours. Men clientele would include

young boys and working men. Besides training other women in the profession could also be

yet another source of income.

2. BASIS AND PRESUMPTION:

The unit will remain open for 8 hours a day for 300 working days in a calendar year.

The price of raw materials and equipments is as per present market price.

Non-refundable deposits, feasibility study fees, trial production, establishment

expenses are considered under pre-operative expenses.

6

Prepared by Indian Institute of Entrepreneurship

3. PROJECT COST ESTIMATES & MEANS OF FINANCE:

FIXED CAPITAL

(Land & Building): Rental basis

Shed of 1200 sq.ft area will be served the purposes, a monthly rent of which would be

approximately Rs. 5,000.00.

Equipments:

SlNo

Particulars

No.

Cost (Rs.)

Amount (Rs.)

1

Saloon Chair

4

3,000.00

12,000.00

2

Hydro Dryer

1

6,000.00

6,000.00

4

Massage Machine

1

5,000.00

5000

6

Mirrors

4

2,000.00

8,000.00

8

Shampoo station chairs

2

6,500.00

13,000.00

11

Wax Heater

3

1,000.00

12,000.00

12

Hair Dryer

2

1,500.00

3,000.00

13

Cutting Scissor

5

500.00

2,500.00

16

Facial Bed

2

6,000.00

12000.00

17

Cutting Comb

6

1,500.00

9,000.00

18

Brushes

6

400.00

2,400.00

19

Facial Gown

3

1,000.00

3,000.00

20

Crochet

4

500.00

2,000.00

21

Others accessories

N/A

N/A

5,000.00

TOTAL

94,900.00

7

Prepared by Indian Institute of Entrepreneurship

Other Fixed Assets:

SlNo

Particulars

Amount (Rs.)

1.

Electrification

15,000.00

2.

Office Furniture

6,000.00

3.

Office Equipments

5,000.00

TOTAL

Rs.26, 000.00

Preliminary & Pre-operative Expenses:

SlNo

Particulars

Amount (Rs.)

1.

Market survey

1,000.00

2.

Travelling & Conveyance

1,000.00

3.

Misc. Expenses/ Legal Expenses

3,000.00

TOTAL

Rs.5, 000.00

Total Fixed Capital:

SlNo

Particulars

Amount (Rs.)

1.

Machines & Equipments

94,900.00

2.

Fixed Assets

26,000.00

3.

Preliminary & Pre-operative Expenses

5,000.00

TOTAL

1, 25,500.00

8

Prepared by Indian Institute of Entrepreneurship

WORKING CAPITAL:

Raw Material & Consumables (Per Month):

Sl.No.

Particulars

Qty.

Amount (Rs.)

1.

Different types of Cosmetics

LS

7,000.00

2.

Make-Up Kit

2

8,000.00

3.

Hair Colour

10

2,000.00

4.

Bleaching Materials

LS

1,500.00

5.

Wax Materials

LS

2,000.00

6.

Hair Crème

LS

2,000.00

7.

Massage Oil

LS

2,000.00

8.

Different Facials

LS

3,000.00

9.

Perming Gel

LS

2,000.00

10.

Different Shaving Cream

LS

2,000.00

11.

Different Hair Gel

LS

2,000.00

12.

Different Henna Powder

LS

2,000.00

13.

Different Shampoos

LS

2,000.00

14.

Others

LS

2,500.00

TOTAL

Rs.40, 000.00

Manpower (Per Month):

Sl no

Personnel

No.

Salary

Amount (Rs.)

1.

Supervisor (Self)

1

4,500.00

4,500.00

2.

Beautician (Self)

1

6,000.00

6,000.00

3.

Trainee

1

4,000.00

4,000.00

4.

Assistant (Trainee)

1

2,500.00

2,500.00

TOTAL

Rs.17, 000.00

9

Prepared by Indian Institute of Entrepreneurship

Utilities (Per Month):

Sl no

Particulars

Amount (Rs.)

1.

Electricity

2,000.00

2.

Water

500.00

TOTAL

Rs.2, 500.00

Administrative Expense (Per Month):

Sl no

Particulars

Amount (Rs.)

1.

Rent

5,000.00

2.

Postage & Stationery

1,000.00

3.

Insurance

2,000.00

4.

Repair & Maintenance

1,000.00

5.

Contingency

2,000.00

6.

Misc. Expenses

2,000.00

TOTAL

Rs.13, 000.00

Total Working Capital:

Sl no

Particulars

Amount (Rs.)

1.

Raw Material

36,500.00

2.

Manpower

17,000.00

3.

Utilities

2,500.00

4.

Administrative Expenses

13,000.00

TOTAL

Rs.69, 000.00

10

Prepared by Indian Institute of Entrepreneurship

Working Capital Required:

Slno

Particulars

Stock Period

Amount (Rs.)

1.

Raw Material

15 days

24,000.00

2.

Operating Expenses

1 Month

32,500.00

3.

Bills Receivables

05 Days

18,000.00

TOTAL

74,500.00

SL

Total Project Cost: Amount (Rs)

A

Fixed Capital

1, 25,500.00

B

Working Capital Requirement

74,500.00

Total:

2, 00,000.00

Means of Finance: (Debt Equity: 3:1)

Under SEP- I

Amount ( Rs)

1

Promoter’s Contribution (25%)

50,000.00

2

Bank Loan under (75%)

1, 50,000.00

TOTAL

2, 00,000.00

(Interest subsidy @ 7% pa on loan amount under National Urban Livelihoods Mission

(NULM)

11

Prepared by Indian Institute of Entrepreneurship

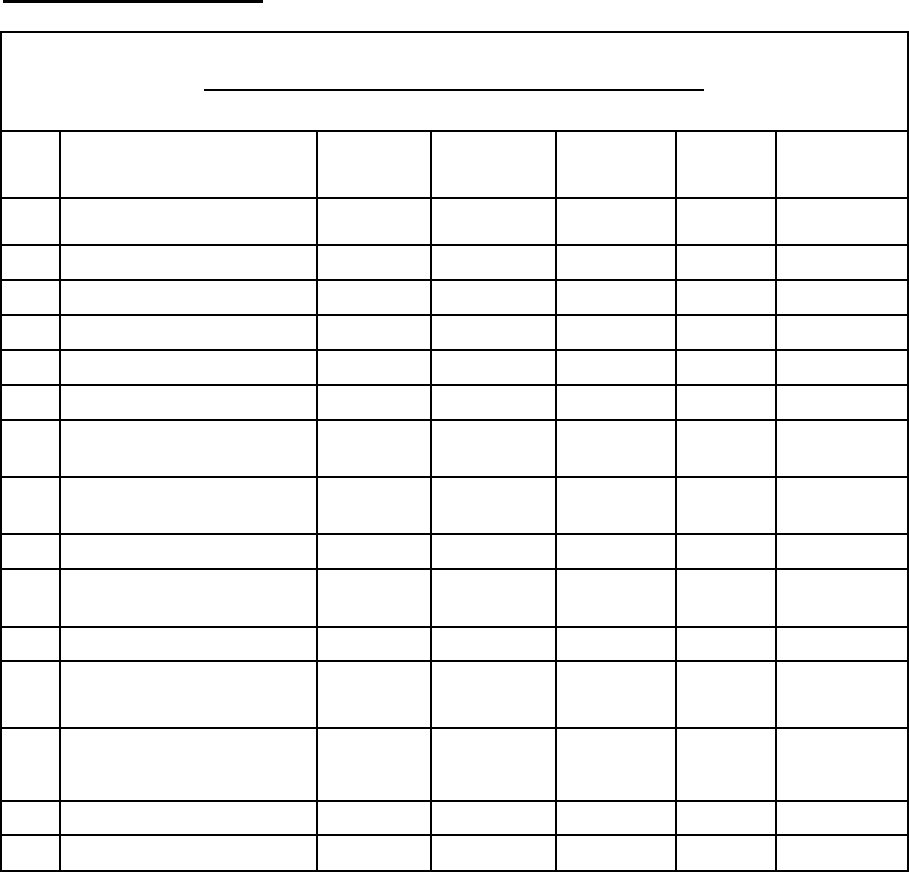

ANNEXURE - I

SALES REALIZATION

First Year:

Slno

Particulars

Number of

persons (PM)

Rate

Amount (Rs.)

(PM)

1.

Threading

30

100.00

3,000.00

2.

Manicure

30

100.00

3,000.00

3.

Pedicure

25

100.00

2,500.00

4.

Head Massage

30

120.00

3,600.00

5.

Hair Bleaching

30

150.00

4,500.00

6.

Arm Bleaching

10

200.00

2000.00

7.

Face Bleaching

30

200.00

6000.00

8.

Stomach Bleaching

05

150.00

750.00

9.

Waxing

10

300.00

3,000.00

10.

Facial

20

450.00

9,000.00

11.

Hair Style

25

150.00

7,500.00

12.

Synthetic Dye

10

100.00

1,000.00

13.

Bridal make up

05

5000.00

25,000.00

14.

Hair Cutting

40

100.00

4,000.00

16.

Make up

4

2000.00

8,000.00

TOTAL

82,850.00

Annual Sales 9, 94,200.00

12

Prepared by Indian Institute of Entrepreneurship

ANNEXURE - II

LOAN REPAYMENT SCHEDULE @12 % ANNUALLY

(Rs. In Thousands)

ITEM

01

02

03

04

05

Opening Balance

150.00

120.00

90.00

60.00

30.00

Repayment Principal

30.00

30.00

30.00

30.00

30.00

Interest @12% PA

18.00

14.40

10.80

7.20

3.60

Closing Balance

120.00

90.00

60.00

30.00

-

ANNEXURE-III

DEPRECIATION SCHEDULE @ 15 %

(Rs. In Thousands)

WRITTEN DOWN VALUE METHOD:

Year

Total Fixed Asset

Amount

(Rs.)

WDB at the beginning of the year

125.25

125.25

Depreciation

18.75

18.75

First Year WDB

106.50

106.50

Depreciation

15.98

15.98

Second Year WDB

90.52

90.52

Depreciation

13.58

13.58

Third Year WDB

76.94

76.94

Depreciation

11.54

11.54

Fourth Year WDB

65.40

65.40

Depreciation

9.80

9.80

Fifth Year WDB

55.60

55.60

Depreciation

8.34

8.34

13

Prepared by Indian Institute of Entrepreneurship

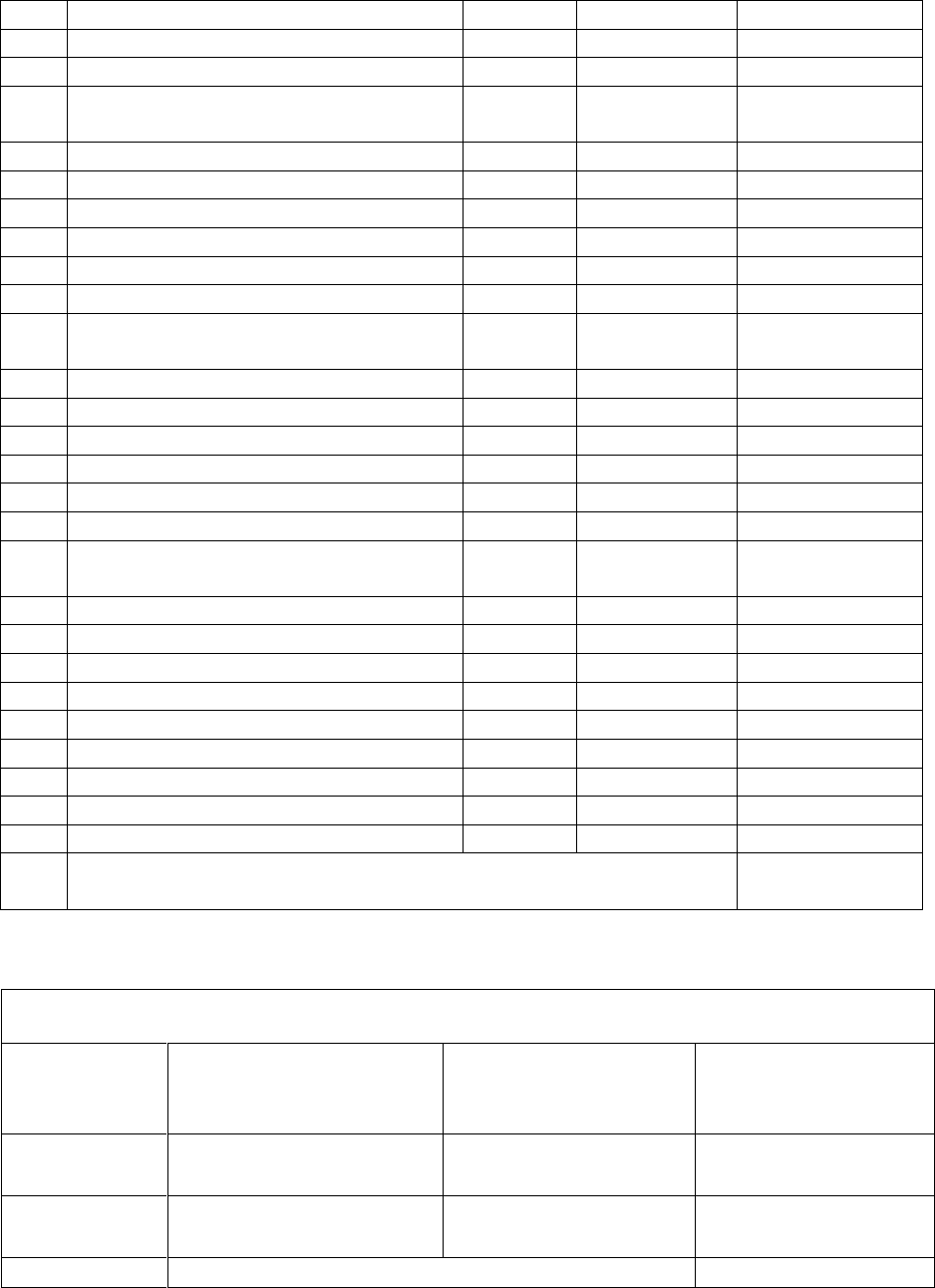

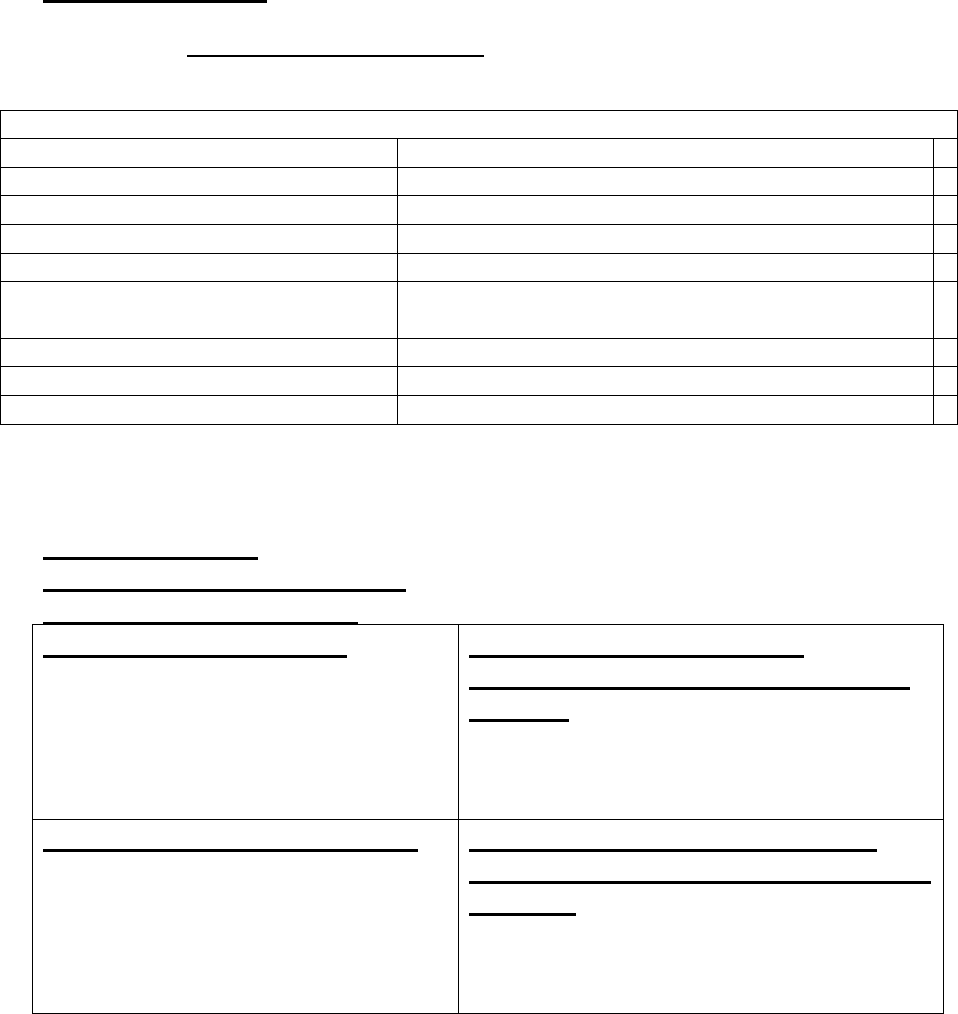

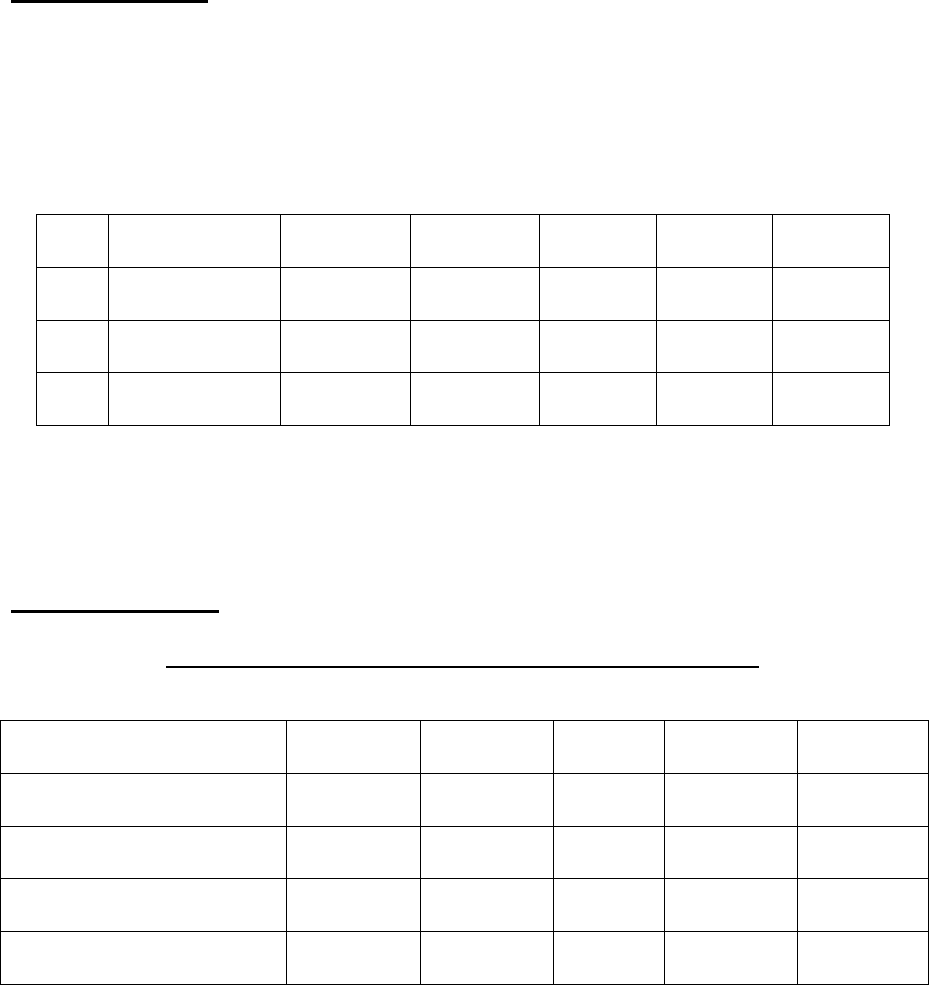

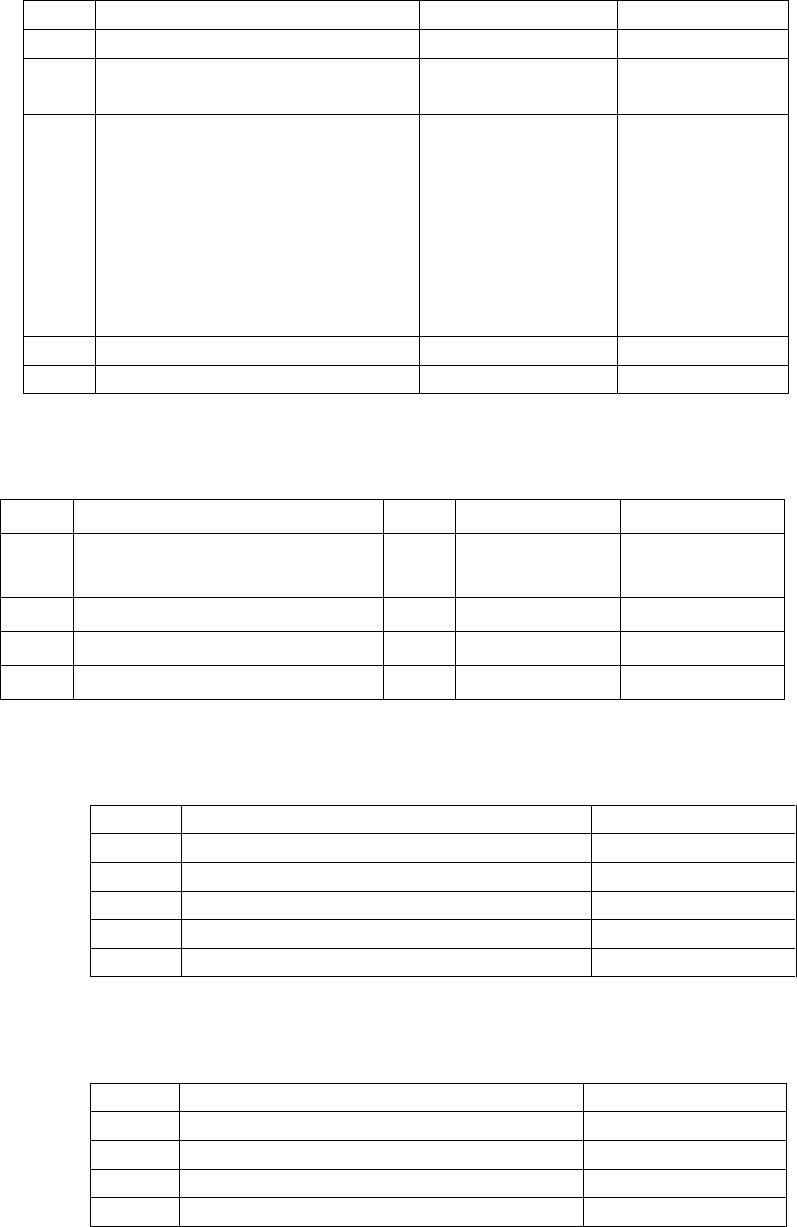

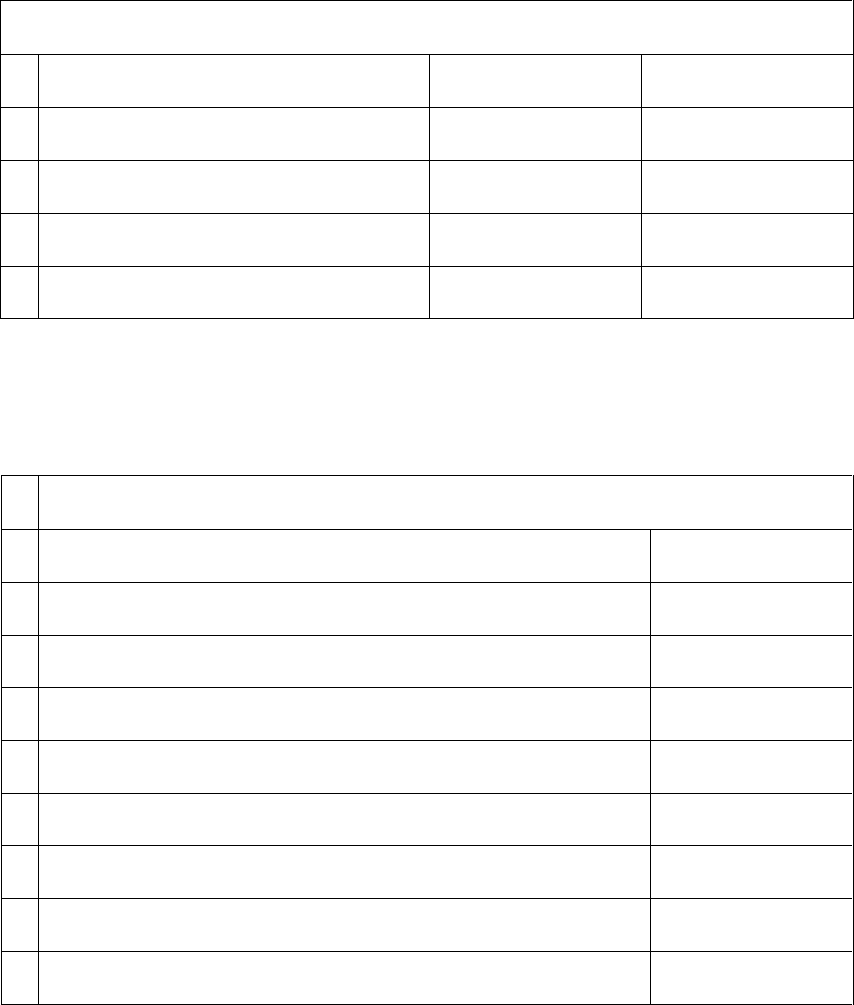

ANNEXURE-IV

COST & PROFITABILITY ESTIMATES:

(Rs. In Thousands)

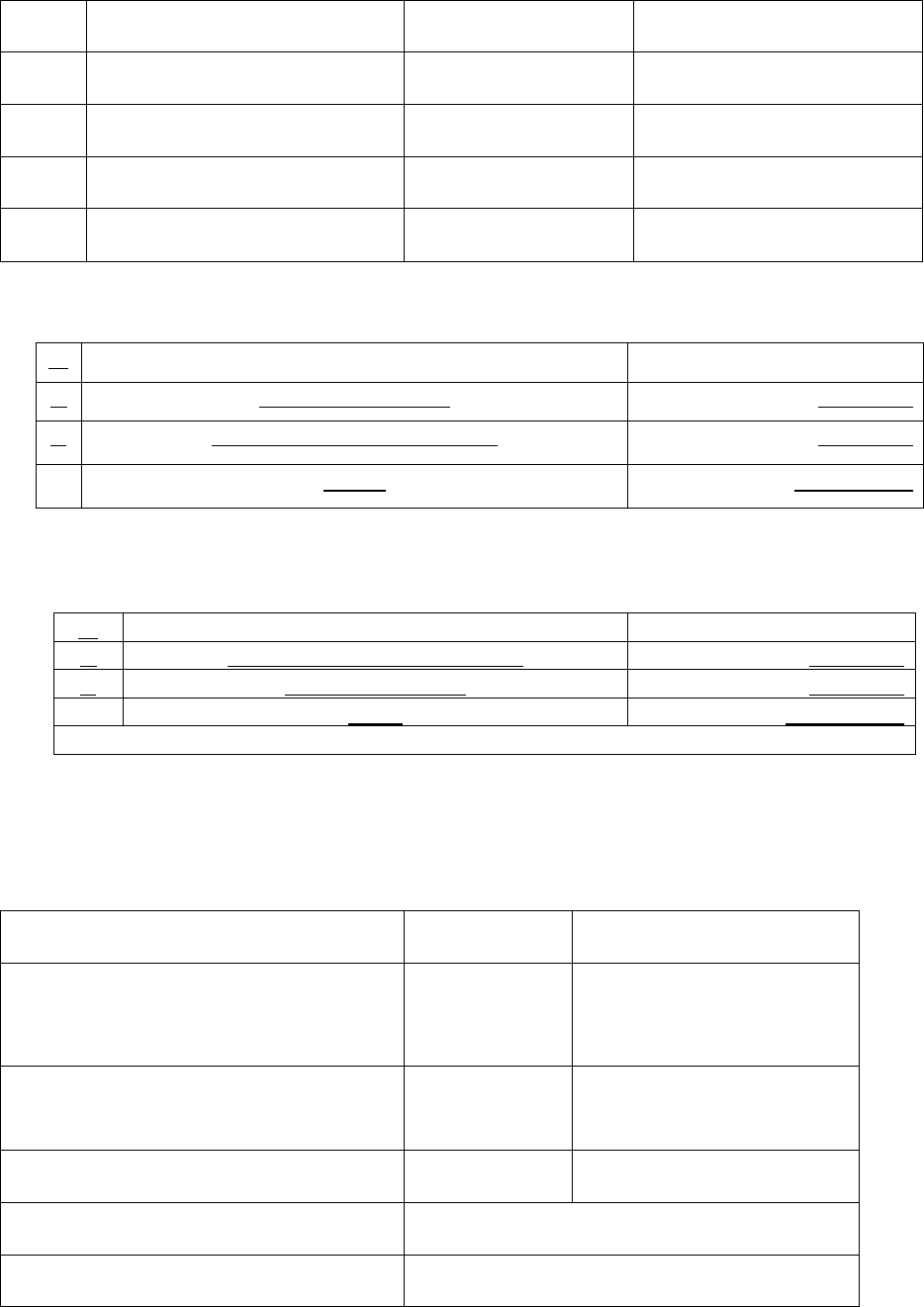

Item/Year

1

2

3

4

5

Utilization

50%

55%

60%

65%

65%

Sales Realization

994.00

1093.00

1193.00

1292.00

1292.00

Expenditure

Raw Material

438.00

482.00

526.00

569.00

569.00

Operating Expense

390.00

405.00

421.00

437.00

437.00

Cost of Goods Sold

828.00

887.00

947.00

1006.00

1006.00

Operating Profit

166.00

206.00

246.00

286.00

286.00

Depreciation

18.75

15.98

13.58

11.54

9.80

Interest

18.00

14.40

10.80

7.20

3.60

PAID

129.25

175.62

221.62

267.26

272.60

Marketing Expense @3% on

Sales

29.82

32.79

35.79

38.76

38.76

Net Profit

99.43

142.83

185.83

228.50

233.84

Cash Inflow

118.18

158.81

199.41

240.04

243.64

14

Prepared by Indian Institute of Entrepreneurship

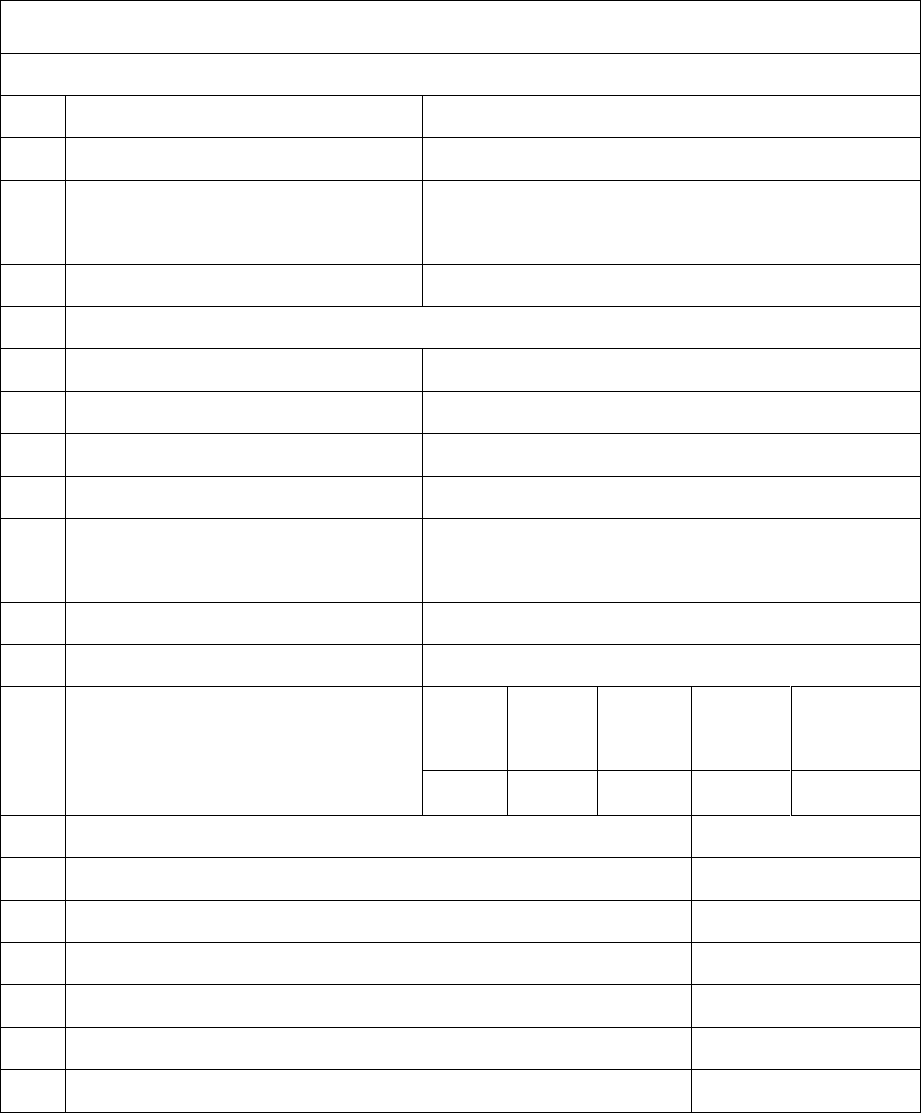

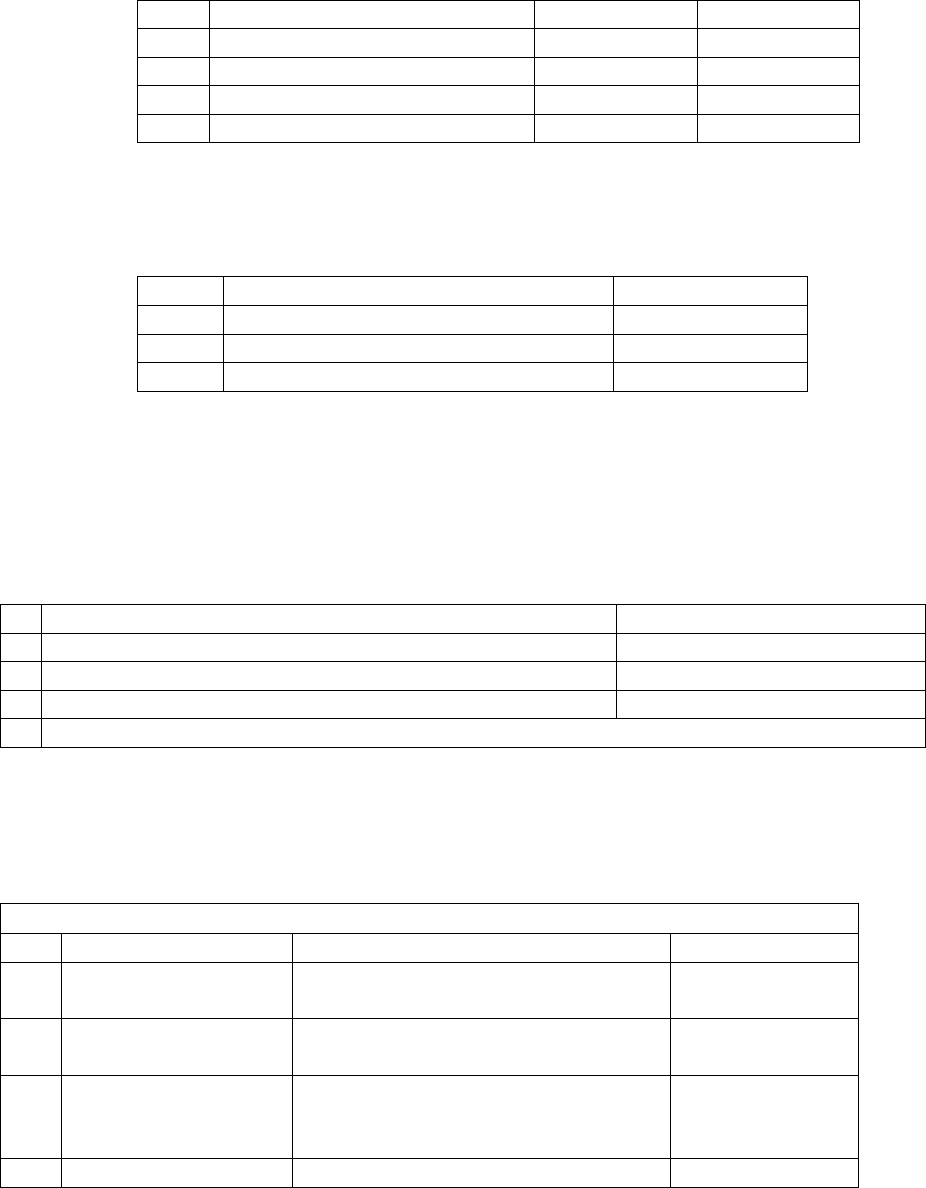

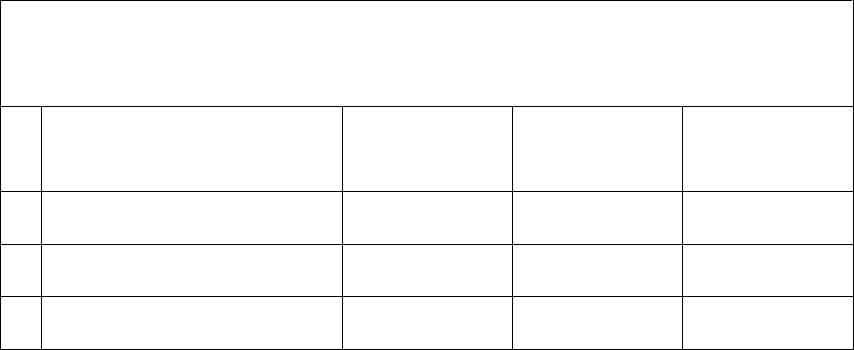

ANNEXURE-V

DEBT-SERVICE COVERAGE RATIO:

(Rs. In Thousands)

Year

01

02

03

04

05

A. Income

Net Profit

99.43

142.83

185.83

228.50

233.84

Depreciation

18.75

15.98

13.58

11.54

9.80

Interest

18.00

14.40

10.80

7.20

3.60

Total

104.12

138.14

172.14

205.16

205.16

B. Commitment

Principal

30.00

30.00

30.00

30.00

30.00

Interest

18.00

14.40

10.80

7.20

3.60

Total

48.00

44.40

40.80

37.20

33.60

DSCR

2.17

3.11

4.21

5.08

5.63

Average DSCR= 1:4.04

ANNEXURE-VI

CALCULATION OF SIMPLE PAY BACK PERIOD

(In Rs.Thousand)

Year

Cash Outflow

Cash Inflow

Cumulative C.I

00

200.00

-

-

01

-

86.12

86.12

02

-

123.74

209.86

03

-

161.34

371.20

04

-

197.96

569.16

05

-

201.56

770.72

Simple Payback Period of the project is 2.0Years

15

Prepared by Indian Institute of Entrepreneurship

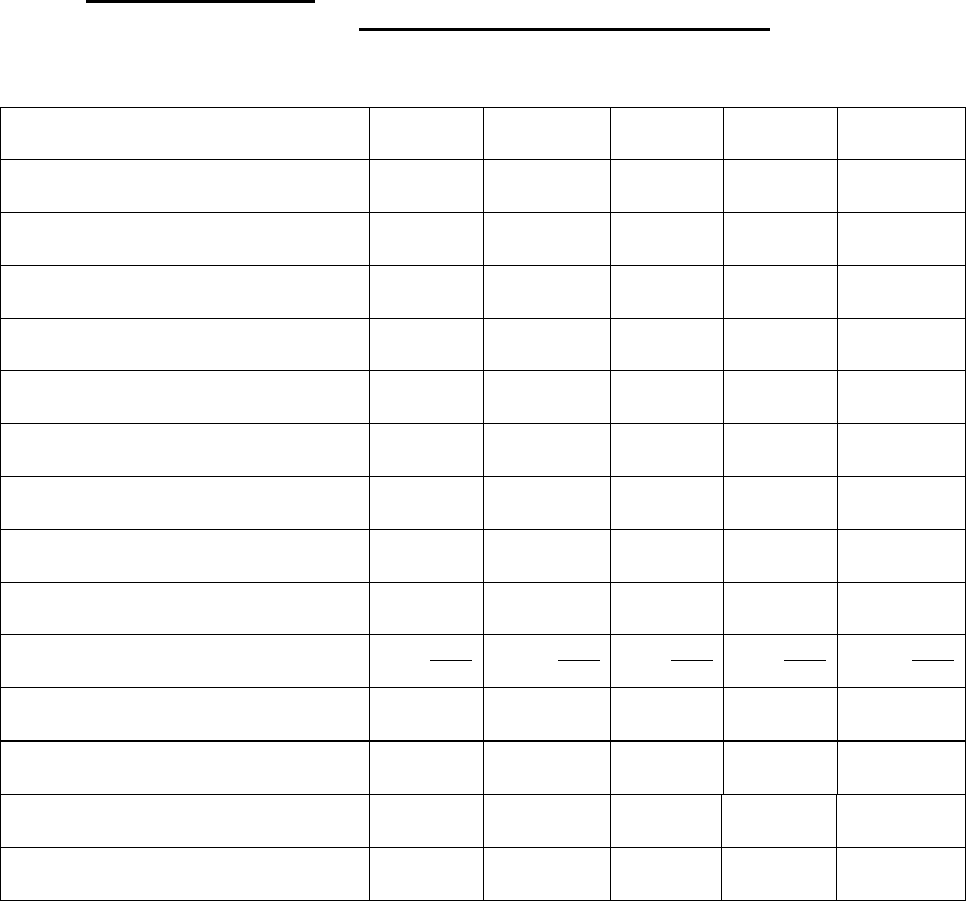

ANNEXURE-VII

BREAK EVEN POINT

(Based on 3

th

Year of operation)

(Rs. In Thousands)

Sl

Year

1

2

3

4

5

Capacity

50

55

60

65

65

A. Sales

994

1093

1193

1292

1292

B. Variable Cost

(i)Raw materials

438

482

526

569

569

(ii)Variable Overheads

234

243

253

262

262

Total (B)

672

725

779

831

831

C. Contribution:

322

368

414

461

461

D. Fixed Cost

(i)Depreciation

18.75

15.98

13.58

11.54

9.80

(ii) Interest

18.00

14.40

10.80

7.2

3.6

(iii) Fixed Overheads

140.00

152.00

168.00

175.00

175.00

Total (D)

176.75

182.38

192.38

193.75

188.4

BEP

57.89%

49.55 %

46.47%

42.03%

40.87 %

16

Prepared by Indian Institute of Entrepreneurship

ANNEXURE-VIII

PERCENTAGE OF PROFIT

(Based on 3

rd

Year of Operation)

(Rs. In Thousands)

Net Profit X 100

On Total Sales = ---------------------------

Total Sales

185.13 X 100

= -----------------------------

1193.00

= 15.52 %

Net Profit X 100

2.) On Total Investment = ----------------------------

Total Investment

185.13 X 100

= ----------------------------

200.00

= 92.56 %

17

Prepared by Indian Institute of Entrepreneurship

Project Report on

E - RICKSHAW

18

Prepared by Indian Institute of Entrepreneurship

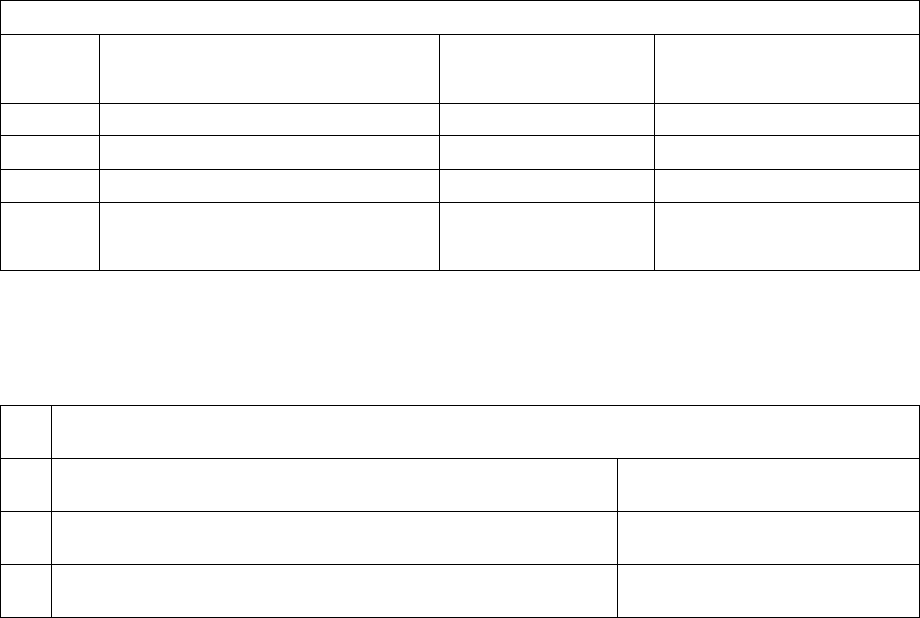

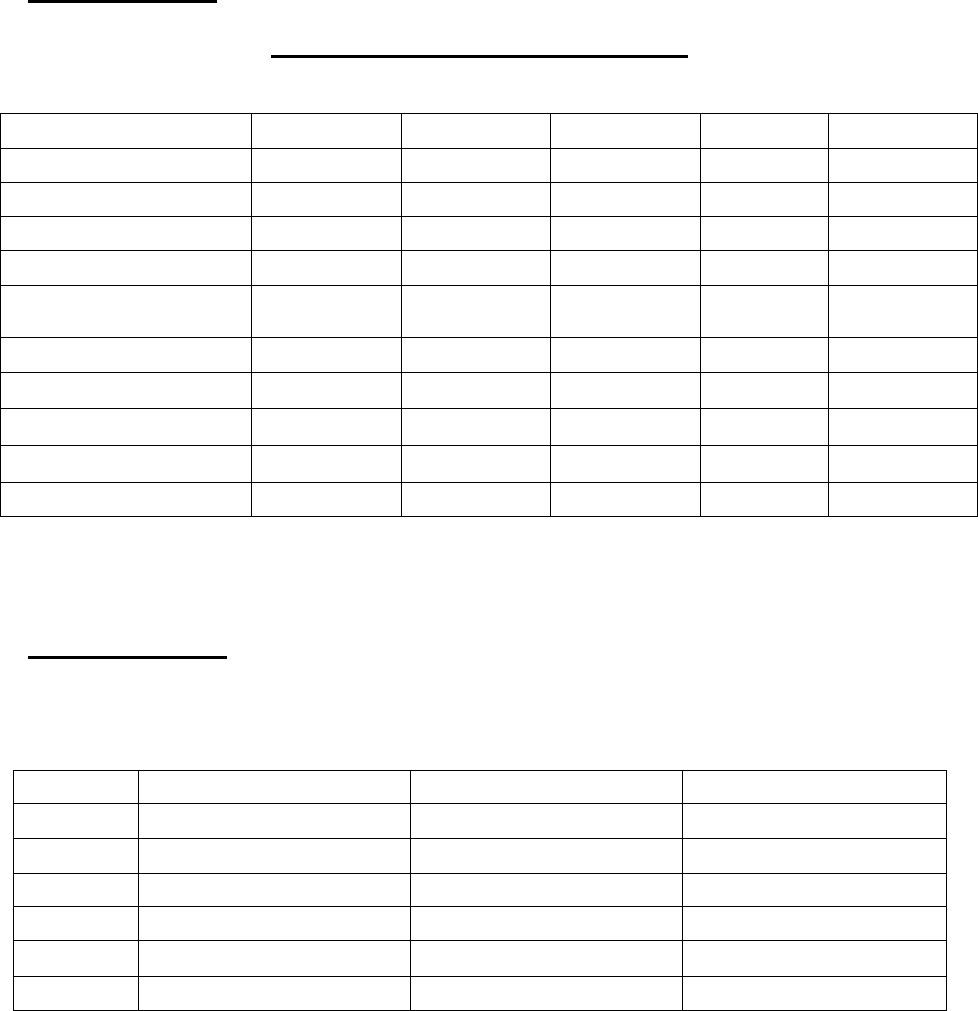

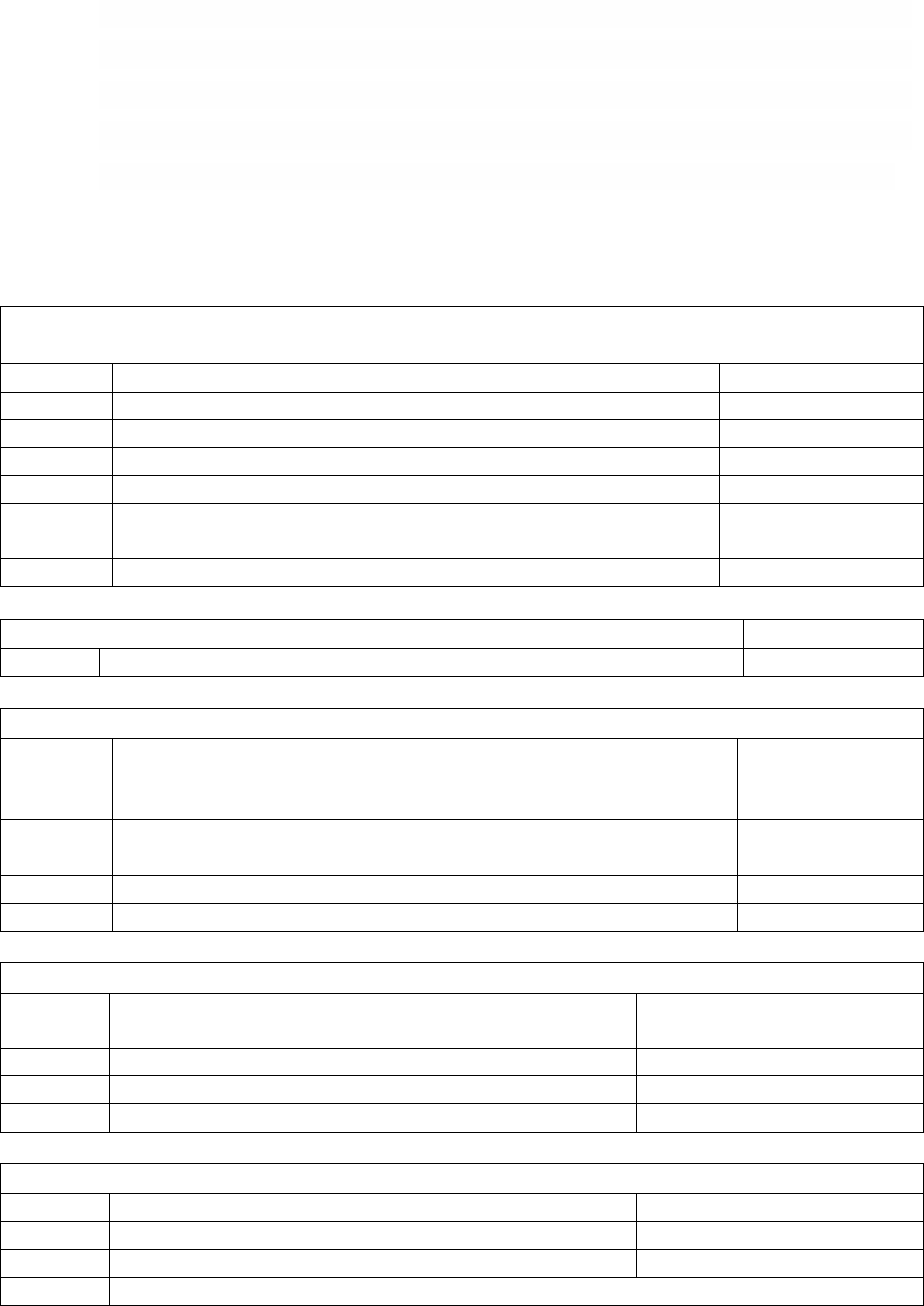

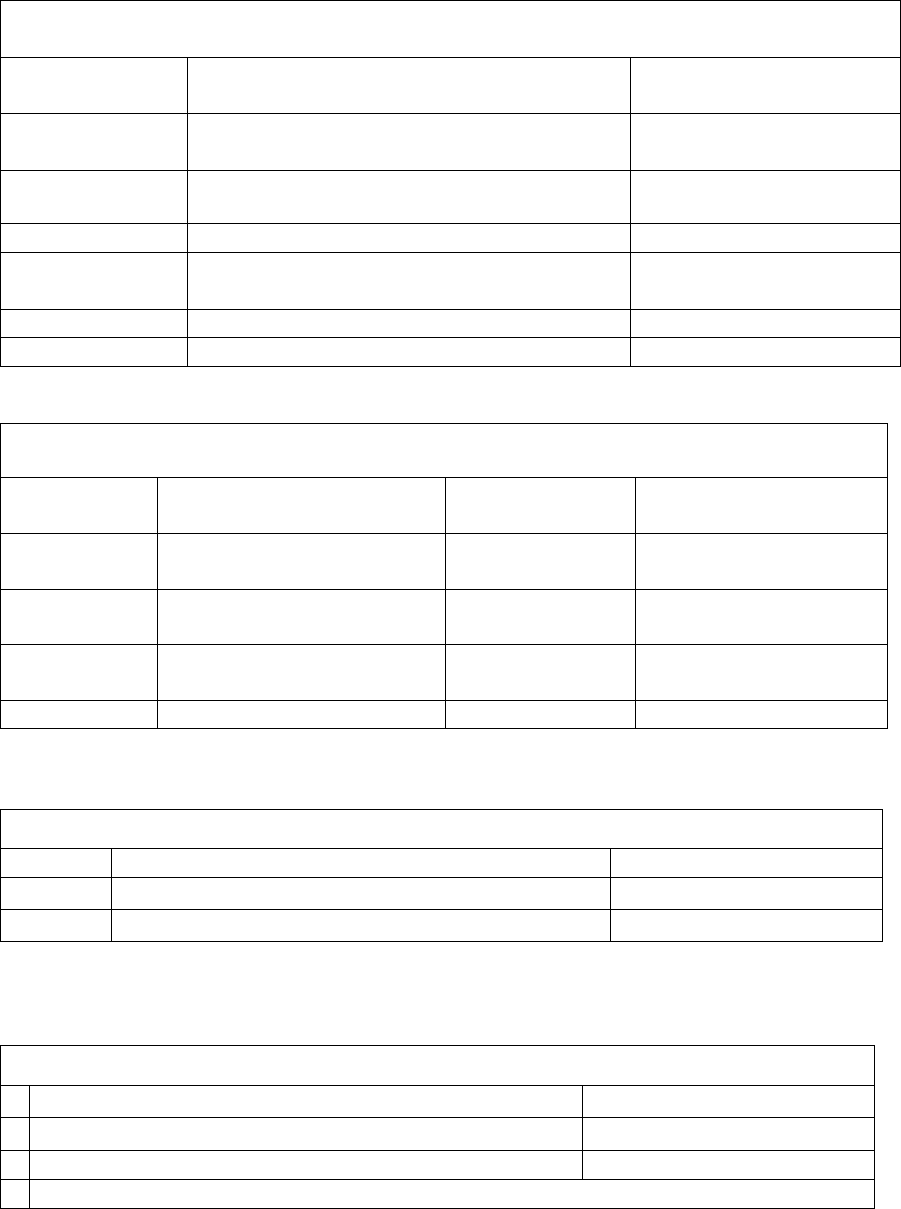

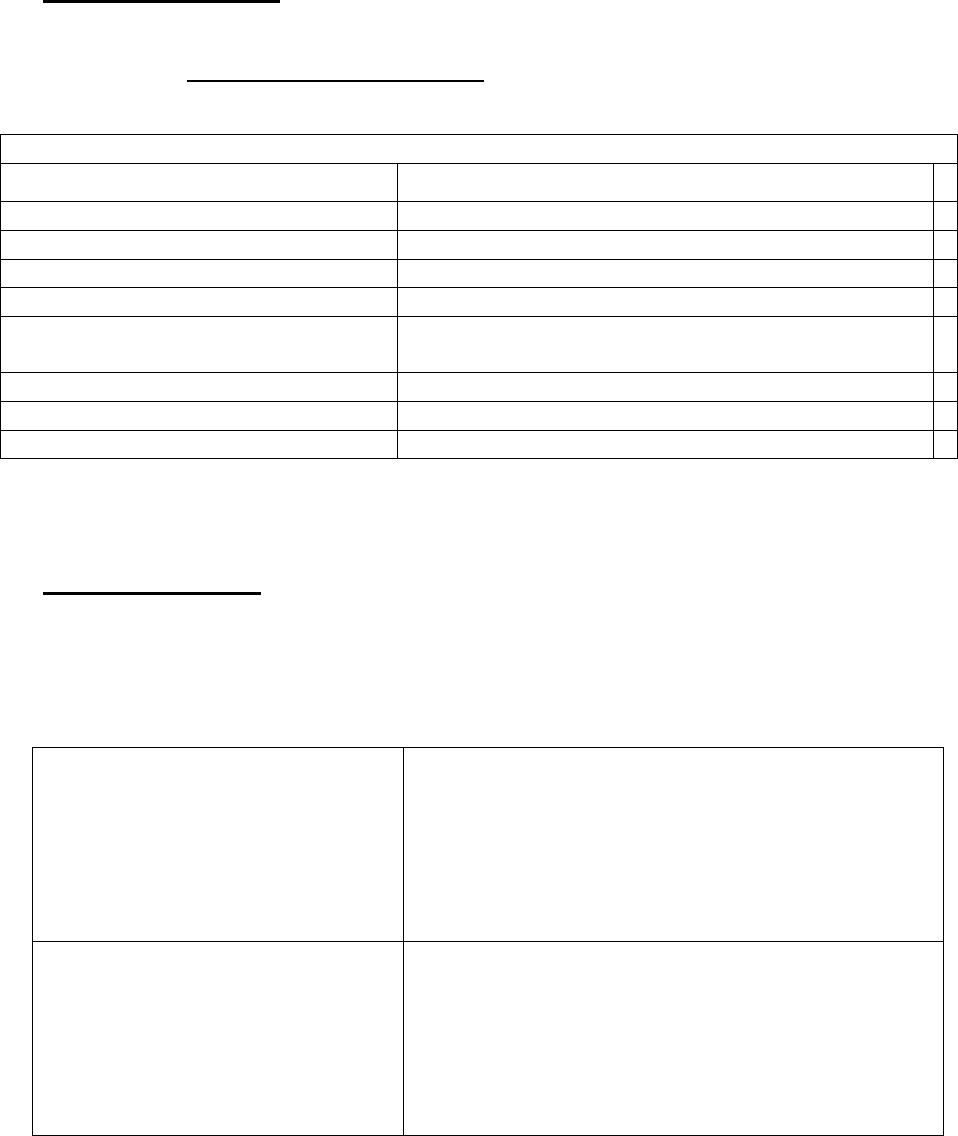

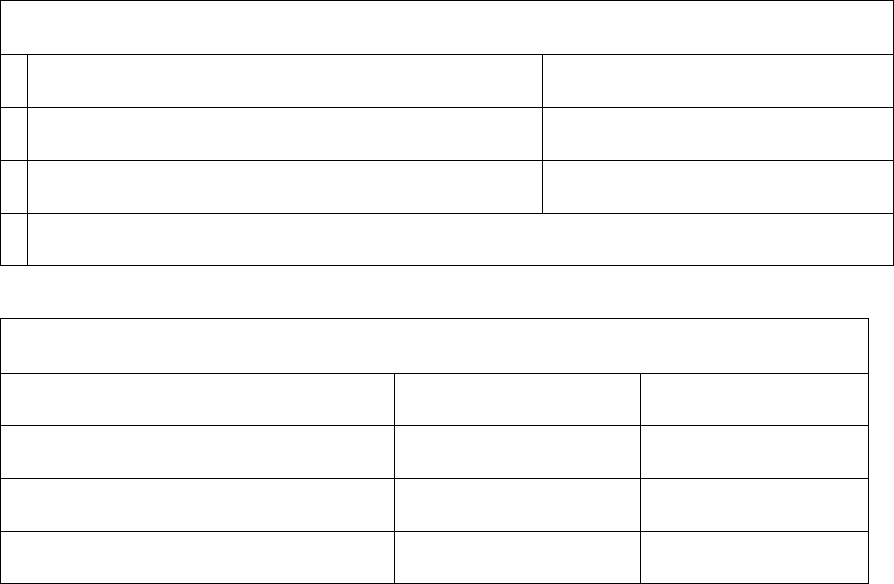

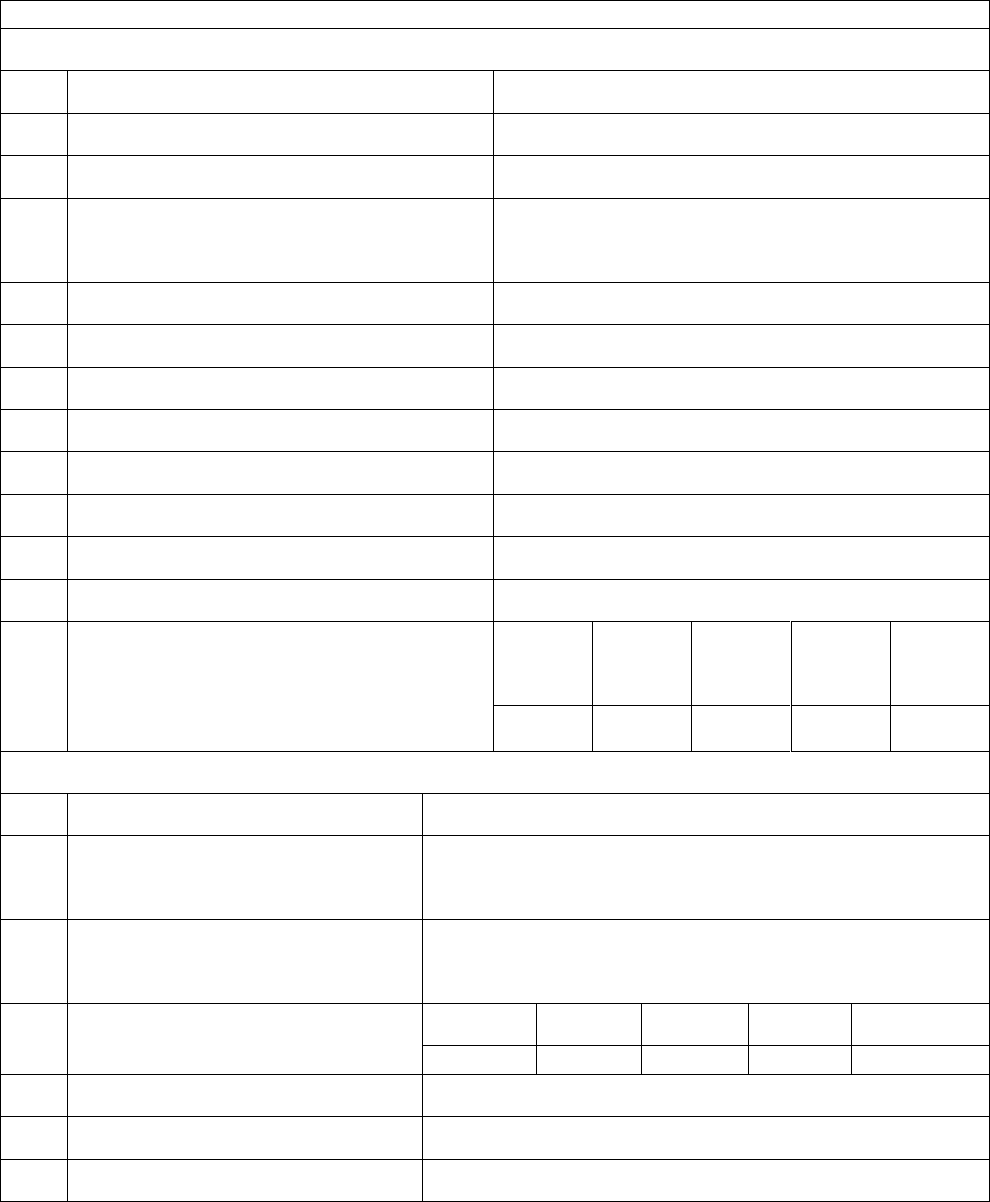

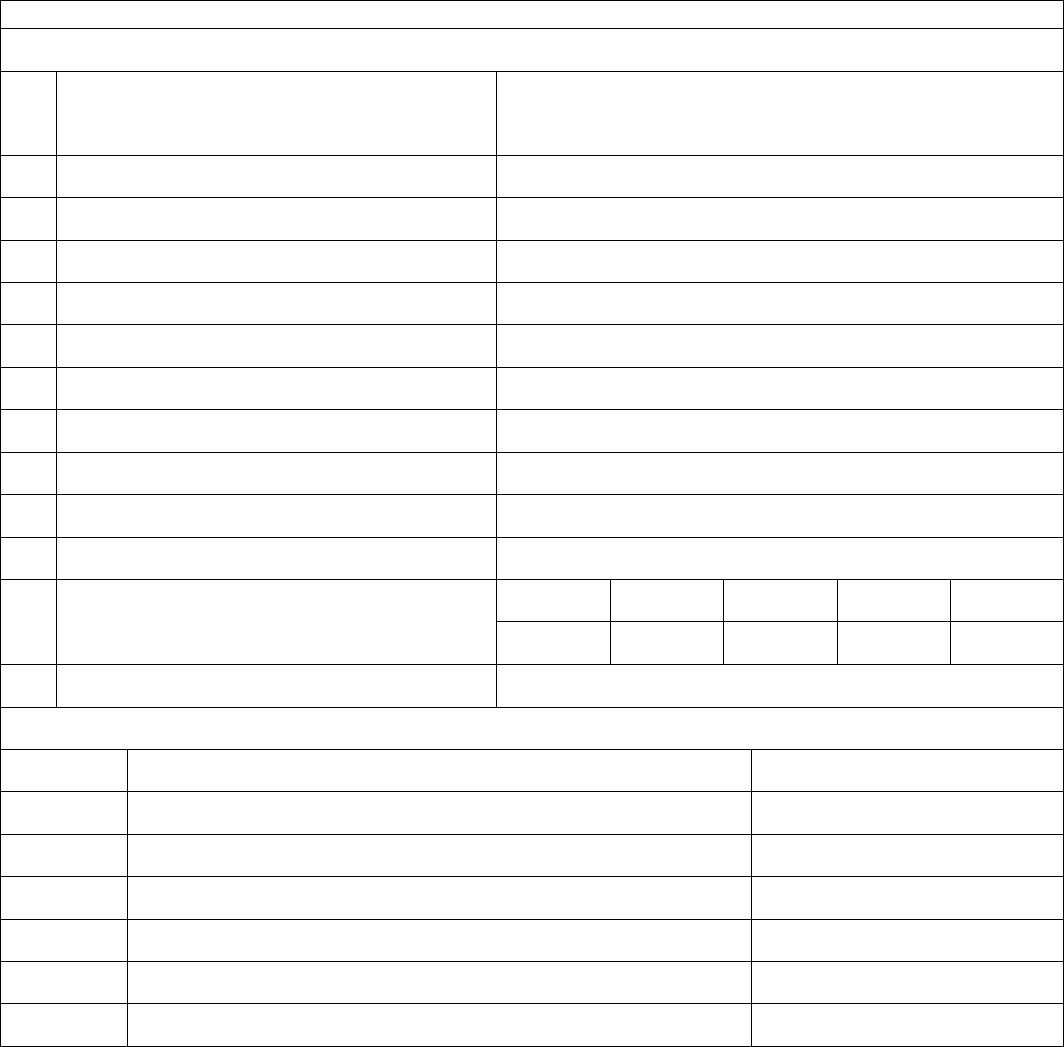

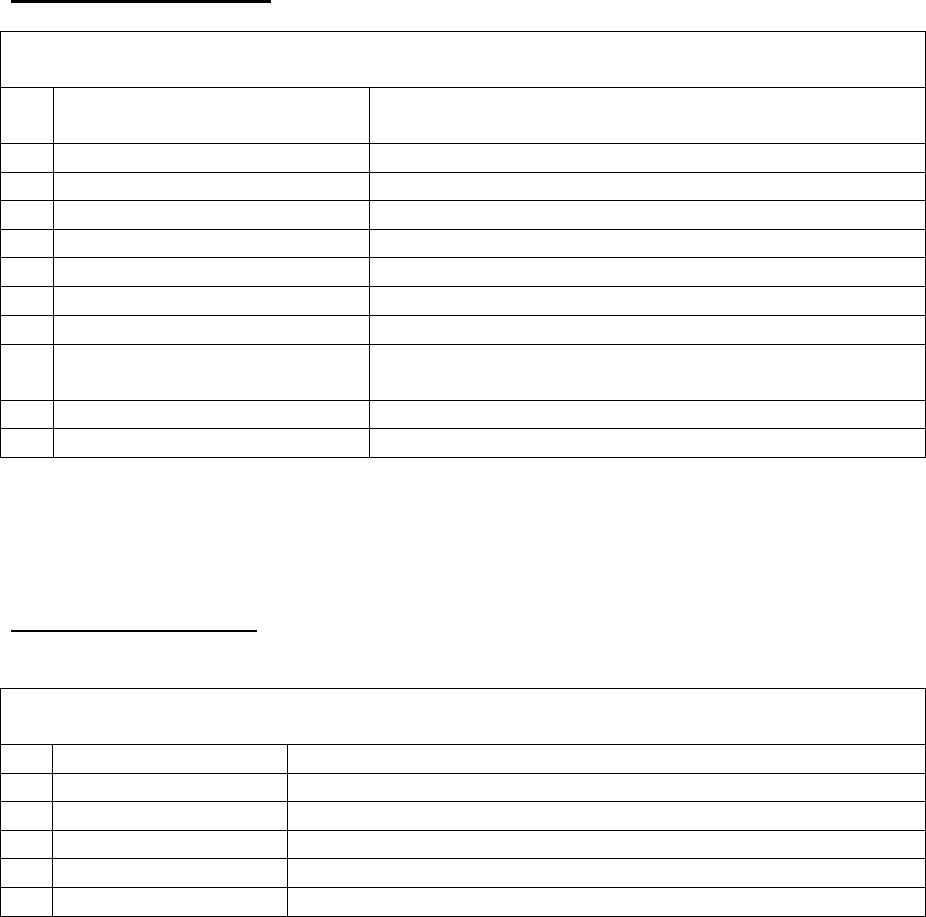

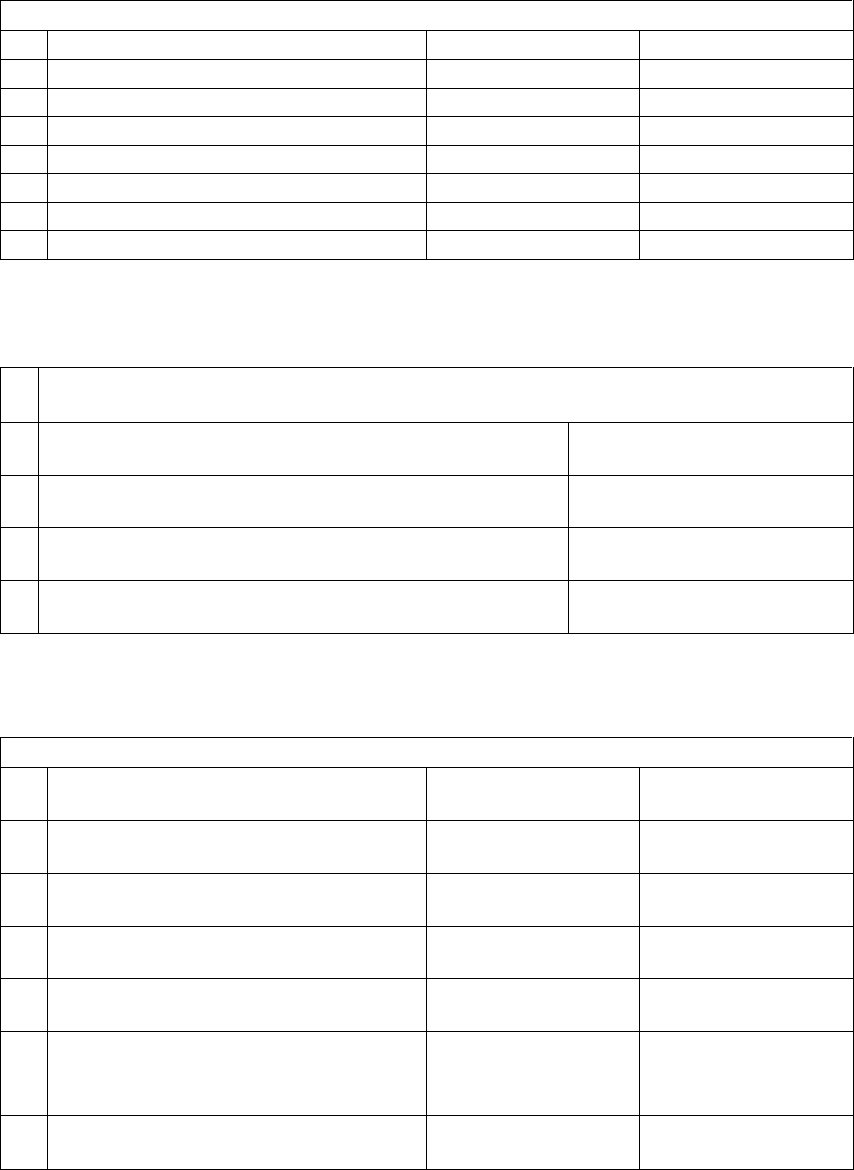

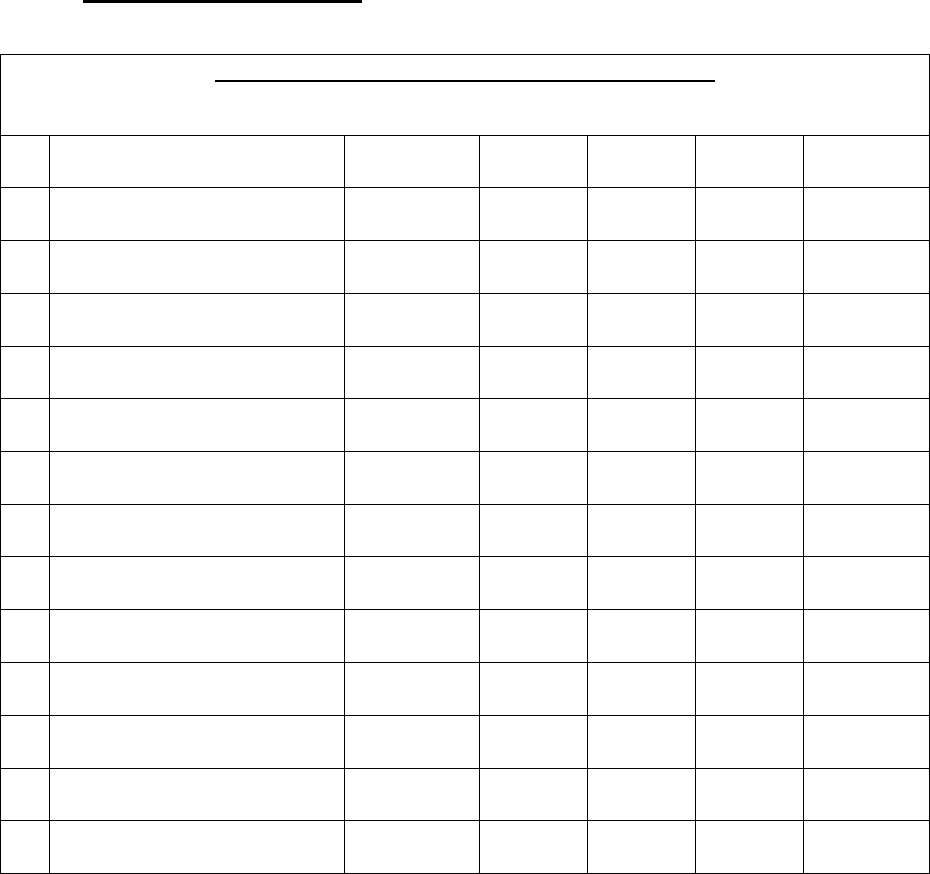

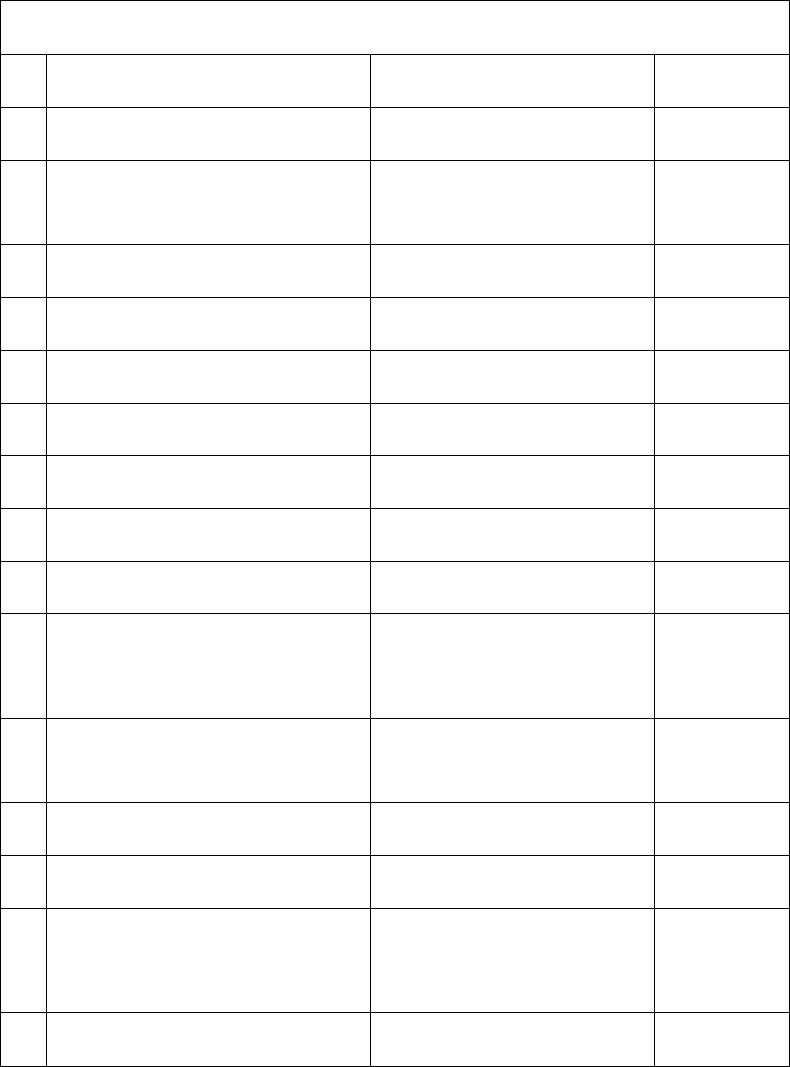

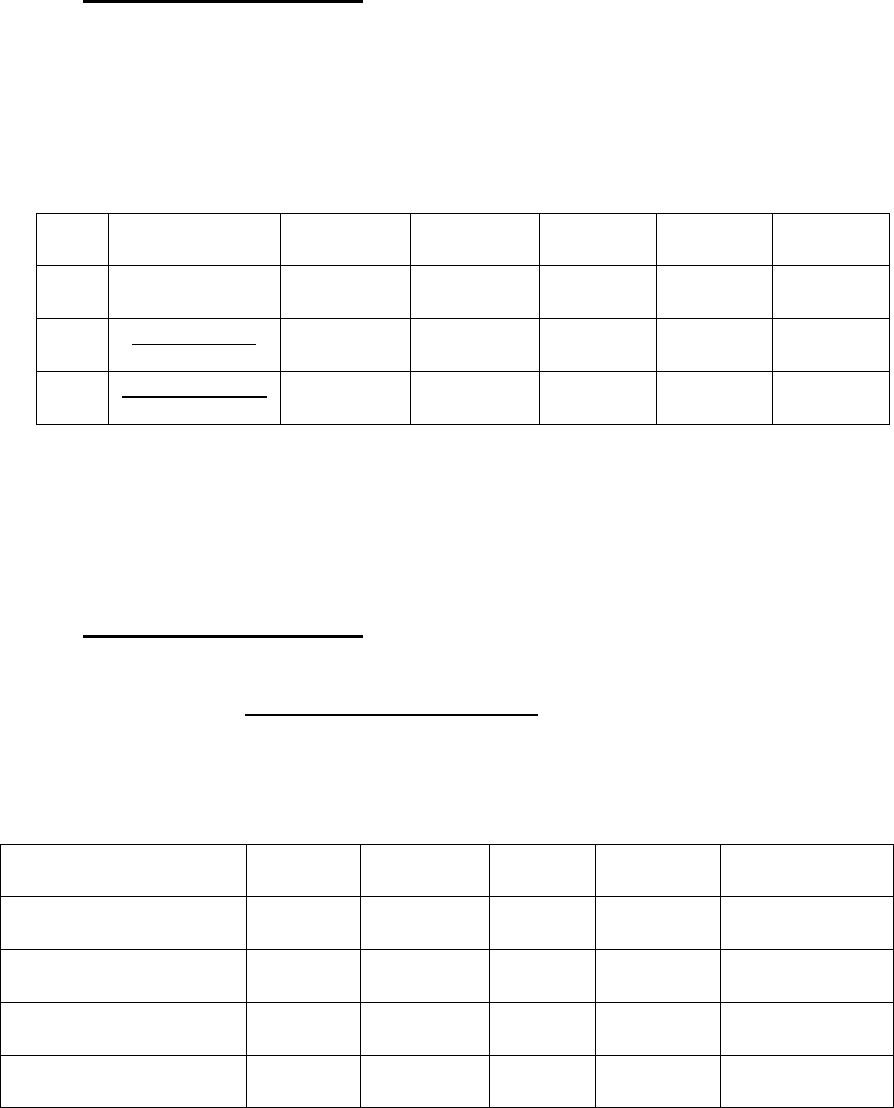

PROJECT REPORT ON E- RICKSHAW, under SEP-I

HIGHLIGHT OF THE PROJECT

Name of the Unit

-----------

Constitution

Proprietorship

Name of the Promoter

Trainee with Skill Knowledge on

respective Project ( Driving)

Proposed Location

Urban/ Semi Urban

Total Project Investment

Fixed Capital

Rs. 1, 63,000.00

Recurring Expenditures (One week)

Rs. 6,000.00

Total

Rs. 1, 69,000.00

Yearly Net Profit:

Rs. 1, 42,000.00

Means of Finance

Promoters’ Contribution @ 25%

Rs. 42,375.00

Bank Loan @ 75%

Rs.1, 27,125.00

Total

Rs. 1, 69,000.00

FINANCIAL ANYLASIS

Loan Repayment Period

04 Years

Percentage of Profit on Total Investment:

92.56 %

Percentage of Profit on Total Sales

15.52%

BEP (on Sales)

43.57%

Pay Back Period

1.2 Years

Debt Equity Ratio

3:1

19

Prepared by Indian Institute of Entrepreneurship

PROJET ON E- RICKSHAW

1. INTRODUCTION

The E-rickshaw is an important means of transportation contributing to the huge

percentage in public transport. With a need for a motorized system of transportation,

the rickshaw has evolved over the years. It has evolved from hand-pulled rickshaw to

electric rickshaw that is e-rickshaw. It is a cheap and environment-friendly source of

transport in the times of urbanization and when pollution rates are alarmingly high. E-

rickshaw is slowly becoming more popular in some cities in India. It can be referred

to as the best option for pocket-friendly transportation. Still, the e-vehicle market

share is less than 1 percent. Adding to this it has become a highly dependable mode of

communication in the years to come and has established itself as a lucrative

profession choice for people of rural India or people in cities belonging to the low-

income category. "Petrol and diesel are past , e-rickshaw is the future "Thus observing

the shift towards technology with more efficiency and being eco-friendly that is the

"e-technology " and with taking a relook on past, going with present, socio-economic

impact of e-rickshaw and giving a thought for future study of this paper is done in

different manner.

The Rickshaw is an important means of transportation contributing to the huge

percentage in public transport. With a need for motorized system of transportation the

rickshaw has evolved over the years. It has evolved from hand pulled rickshaw to

electric rickshaw that is e-rickshaw. It is a cheap and environment friendly

source of transport in the times of urbanization and when pollution rates are

alarmingly high. Study of socio-economic impact of e-rickshaw on the industry and

society is done which includes the present system, its structure and also the earning

data with some statistics is taken into consideration. Along with that environmental

impact are also given a view .Some of the government initiatives and laws are also

been highlighted- E rickshaw with its evolution resulting features with some issues

are also given weight age in the study. E-rickshaw is slowly becoming more popular

in some cities of India. It can be referred as a best option for a pocket friendly

transportation. Still e-vehicle market share is less than 1 percent. Adding to this it has

20

Prepared by Indian Institute of Entrepreneurship

become a highly dependable mode of communication in the years to come and has

established itself as a lucrative profession choice for people of rural India or people in

cities belonging to low income category. ”Petrol and diesel are past, e-rickshaw is the

future”Thus observing the shift towards technology with more efficiency and

being eco-friendly that is the “e- technology “ and with taking a relook on past ,

going with present, socio-economic impact of e-rickshaw.

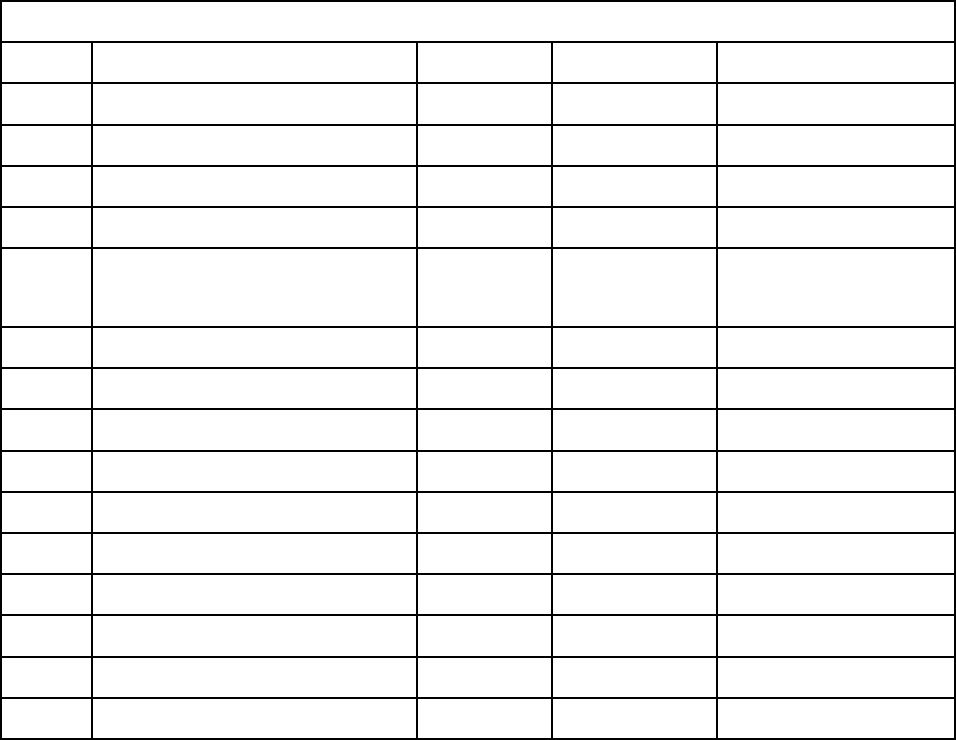

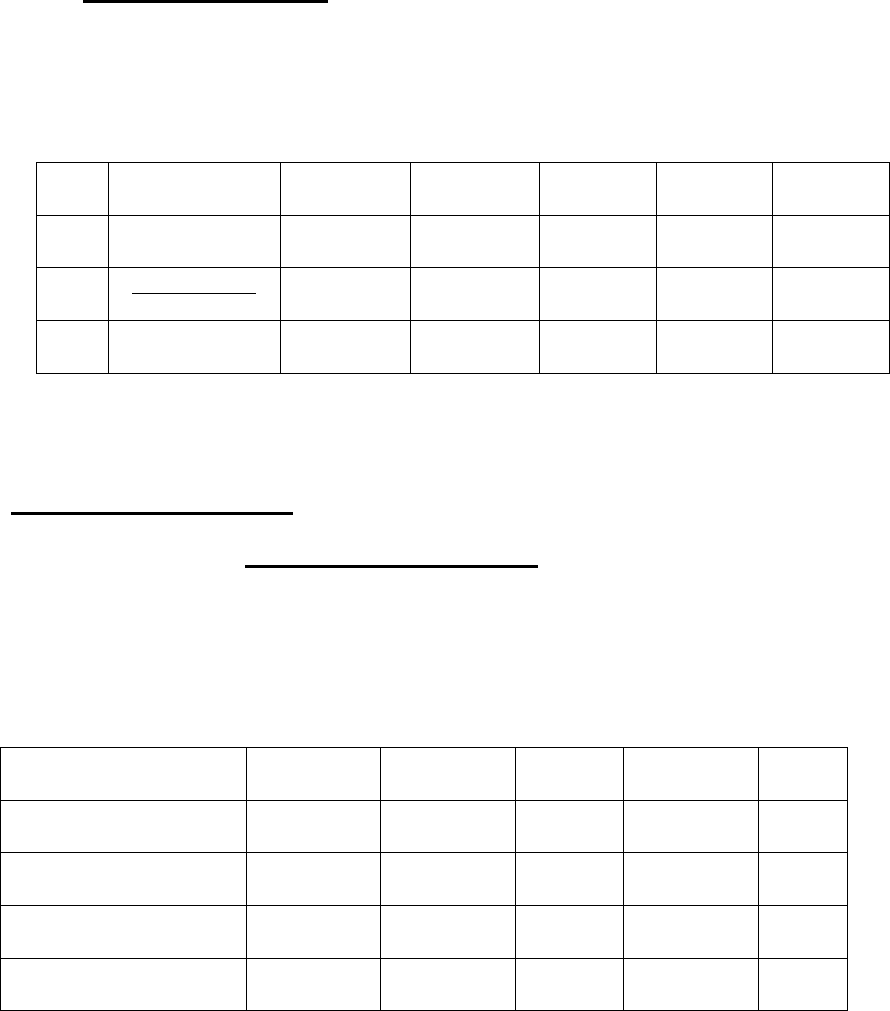

2. TECHNICAL SPECIFICATION OF E-RICKSHAW

Parameters

Specifications

Motor type

DC series excitation brushless

Maximum overall dimensions

2.8m x 1m x 1.8m

Motor efficiency

Motor efficiency 85 % or above

Motor efficiency 85 % or above

4 passenger + driver

Max power of motor

2KW

Maximum speed (Unlade Condition)

25 km/hr

Maximum load of luggage

40 kg

Battery Voltage

48V Battery capacity

Battery capacity

80Ah

Charge voltage

220 V(50Hz)

Transmission Mode Gear Range

85 km(minimum)

Validity of e-rickshaw driving license

3 Years

Technical Parameters

Mean Values Motor Power

850-1950 W

Battery voltage

48V

Single battery capacity

80-120 Ah

Maximum load capacity

300-450 kg

Vehicle weight (approximate)

215 kg(with battery)

Maximum speed

33 kmph

Charging time

4-8 Hrs

Seating capacity

4+1 people

Ground clearance

180-300 mm

3. MARKET POTENTIALITY OF E RICKSHAW

Beginning from human-powered cycle rickshaws to auto-rickshaws, era is now

drifting towards most recent modification E-rickshaws. These battery operated three

wheelers are undoubtedly an integral part of transport. E-Rickshaws dovetail

beautifully as the last mile public conveyance with zero pollution in this entire

21

Prepared by Indian Institute of Entrepreneurship

equation. E-rickshaws approved by the Union Ministry of Road Transport and

Highways have a maximum width of 1 metre and maximum length of 2.8 meters and

are permitted to carry four passengers. Urbanization is at its peak in India. The

introduction of Metro in the last decade has made commuting easier for longer

distances. However, e-rickshaw can provide last mile connectivity to the passengers.

4. PROJECT COST ESTIMATES & MEANS OF FINANCE:

Capital Investment:

A

Fixed Capital;

i

Garage: ( 5 m X 5 m = 25Sq Mtrs. @ 700/- per sqm

17,500.00

ii

Cost of E-Rickshaw:

120,000.00

iii

Extra Battery

7,000.00

iv

Battery charging device

7,000.00

v

Price escalation, freight, contingencies, preoperative

@ 10% of cost of vehicle

12,000.00

vi

Total:

1,63,500.00

Manpower

i

Driver ( Self)

6000.00

Other Expenditures Per Month

i

Electricity Cost @ Rs2/- Per Km( daily on road

approximately 200 Km

Rs. 400/- daily X 25 days

10,000.00

ii

Repairing & Maintenance @ Rs..1/- Per Km X 25 days

* 200 Km daily

5,000.00

iii

Misc. Expenditures ( Parking fess, taxes, octopi)

2,000.00

Total:

17,000.00

Total Investment

A

Total Fixed Capital

1,63,000.00

B

recurring expenditures for one week

6,000.00

C

Other Expenditures

Total:

1,69,500.00

Sources of Finance

A

75% Loan from Financial

1,27,125.00

B

25% Own Contribution

42,375.00

Total:

1,69,500.00

(7% interest subsidy on loan amount under ANULM, Government) )

22

Prepared by Indian Institute of Entrepreneurship

REVENUE:

E - Rickshaw will operate mainly in urban, Semi Urban or in Rural area in short distance,

where other road public communication is not available, its operational area is minimum of

two to five Km. The proposed E-Ricksw’s operational area is 2-5 KM, hardly 5 to 10 hrs

Journey. Total daily on roads 30 KM

Daily 30 KM trip : Average passenger 03 per X Rs.10/-X 25 trip = Rs.1500/- per day

Monthly Revenue Rs.1500/- X 25 working days = Rs. 37,500.00

Yearly Revenue: Rs. 4,50,000.00

PROFITABILITY

Amount

A.

Yearly Revenue

4,50,000.00

B

Expenditures :

Manpower:

72,000.00

Electricity Cost

1,20,000.00

Maintenance

cost/Miscellaneous

84,000.00

Depreciation (straight line

method)

32,000.00

C

Total Expenditures

308,000.00

D

Gross Profit

2,26,000.00

E

Interest on Loan on Rs 1,27,

125/- @ 12 %

15,255.00

F

Net Profit

1,42,000.00

G

Cash Flow

1,74,000.00

FINANCIAL ANYLASIS

G

Payback period:

1.20 months

H

BEP

Fixed Cost

Fixed Overheads

62,400.00

Depreciation

32,000.00

Interest @ 12% Per annum

15,255.00

I

Total:

109655.00

Fixed Cost X100/Fixed Cost +

Net profit

Rs.109655 X100/Rs.251655.00

43.57% on

Sales

J

By Return of ( Yearly)

Rs,196875/-

((Interest subsidy @ 7% pa on loan amount under National Urban Livelihoods Mission

(NULM)

23

Prepared by Indian Institute of Entrepreneurship

Project Report on

GROCERY SHOP

24

Prepared by Indian Institute of Entrepreneurship

PROJECT ON GROCERY SHOP ( Under SEP-I)

HIGHLIGHT OF THE PROJECT

A.

NAME OF THE UNIT

M/S( As per Udyog Adhar Registration)

I

CONSTITUTION

PROPRIETORSHIP

II

PROMOTER

Trainee with Skill Knowledge on respective

Project

III

PROPOSED LOCATION

URBAN/SEMI URBAN AREA

B

TOTAL PROJCT

INVESTMENT

I

FIXED CAPITAL

Rs.41,5000.00

II

WORKING CAPITAL

Rs.1,58,500.00

III

TOTAL

Rs. 2,00,000.00

IV

MEANS OF FINANCE

V

PROMOTERS

CONTRIBUTION @25%

Rs. 50,000.00

VI

BANK LOAN @75%

Rs. 1,50,000.00

VI

TOTAL

Rs. 2,00,000.00

VII

PROJECTED YEARLY

PROFIT ( Rs. 000)

01 Year

02 Year

03 Year

04 Year

05 Year

55.42

84.26

113.10

142.94

146.54

BESIDES THE NULM, GOVT. OF ASSAM PROVIDED NECESSARY EQUITY

SUPPORT

C

FINANCIAL ANYLASIS

I

PERCENTAGE OF PROFIT ON SALES

5.79%

II

PERCENTAGE OF PROFIT ON TOTAL INVESTMENT

47.93%

III

BEP

31.29%

IV

AVERAGE DSCR

1:3.43

V

DEBT EQUITY RATIO

3:1

VI

LOAN REPAYMENT PERIOD

05 Years

25

Prepared by Indian Institute of Entrepreneurship

1. Introduction: The grocery business in India is distinctive in many ways, primarily

due to the diversity of consumers and the unique distribution models of the retail sector. From

mom and pop stores to giant supermarkets to online grocery stores, the grocery business in

India operates across channels. However, most of India's grocery business happens through

the unorganized sector, which mainly comprises of small stores, also known as kiranas. There

are over 12 million small stores in India and account for over 90% share of the Indian F&G

market, which is predicted to reach USD 810 Billion by 2020.

Indians have traditionally relied on mom and pop stores for their monthly food & grocery

needs. These stores have a personal connection with their customers and are well versed in

customer preferences, which in turn enables them to stock locally relevant products. Indians

prefer buying their monthly supplies from these local stores for various reasons such as

proximity, availability of credit, and the option to return/exchange products...

Globally, India is the sixth-largest grocery market and has a humongous potential for growth

due to the rising population as well as disposable incomes. The Indian grocery market, which

accounts for 69% of India's total retail market, offers plenty of opportunities to retailers.

Many retail players have tried tapping into this potential without substantial results. The local

retailers still the epicentre of Indian grocery business with 90% of distribution under its belt.

Even as retail giants battle against each other to become the consumer's habit when it comes

to buying grocery, the small stores have held their ground.

In Assam mainly in Urban area Grocery shop keep various stores to satisfied customers

according to their needs

2. Requirement of grocery items per week, per family members in urban areas

is as follows:

Sl

List

Quantity

Sugar

1 Kgs

Turmeric powder

100 grm

Jaggery

½ kgs

Rice

05 Kgs

High Quality Rice

1 kgs

Basmati Rice

1 kgs

flour

2 kgs

Maida

1 Kgs

Besan

½ Kgs

Tumeri

½ kgs

Red Chilly

¼ Kgs

Bread

1 pes

Packet items Biscuit

04 pkt

Butter

01 pes

Milk Packet

02 Litre

26

Prepared by Indian Institute of Entrepreneurship

3. Basis And Presumptions:

The project is based on single shift basis and 300 days of working schedule in a

Year, the working hrs per day is 10/12 hours a day, 25 days in a month.

The cost of equipment / materials indicated refer to a particular make and the

Prices are approximate to these prevailing at the time of preparation of the

profile

Non- refundable deposits, project report preparation fees etc are considered under

pre- operative expenses.

Interest on total investment has been calculated @ 12%per annum. ( 7%, Interest

subsidy on loan will provided by ASURM, Govt of Assam.)

Depreciation has been taken on straight line method

Manpower & Administrative expenditure has been calculated as per capacity

Utilisation.

4. PROJECT COST ESTIMATES AND MEANS OF FINANCE:

FIXED CAPITAL ESTIMATES:

Land & Building: The promoter has taken a room on rent for the proposed project

against monthly rent of Rs. 4000 (Two thousand) The room size is around 600 square

feet which will be repaired with the materials available locally . The showroom will

be a well- ventilated covered hall, and will also include rooms for storing raw

materials, finished product, and cash counter.

Total Fixed Capital:

Sl.

No

Particulars

Number

/unit Price

(Rs)

Amount

(Rs)

1.

Furniture’s

--

15,000.00

2.

Electrification

--

4,000.00

3.

Decoration

--

5000.00

4.

Misc. Fixed

Asset

5000.00

Other

Miscellaneous

01

2500.00

Fridge

10,000.00

Total

41,500.00

27

Prepared by Indian Institute of Entrepreneurship

WORKING CAPITAL ESTIMATES:

Consumables Stores for Sale:

Sl

Items

Qty

Amount

Highly perishable items

Biscuits ( different brand)

3 Doz

500.00

Potato

50 kgs

bags

1500.00

Bread/Bakery items local brand

5 doz

350.00

Onion

50 kgs

1500.00

Egg

1 cartoon

1800.00

Soup & caned products

2 Doz

500.00

Butter( Small & big size)

10 pieces

2500.00

Non Perishable items

Rice( different qualities ) 04 different

qualities

25 kgs

each

4000.00

Joha Rice

15 kgs

780.00

Basmati Rice

05 pkt

450.00

Parboiled Rice

25 kgs

875.00

Soup & Caned Products.

05 doz

100.00

Frozen Food

2 doz

250.00

Spices Pkt

2 doz

250.00

Local Spices (turmeric, Jaluk, )

02 ks

each

450.00

Dry Chilly, long, tezpata etc

1000.00

Dairy, cheese

10 pkt

350.00

Sugar

50 kgs

2400.00

Dal ( three varities)

50 kgs

7,500.00

Atta ( 1 kgs /2 Kgs)

2 Doz

950.00

Maida

2 Doz

960.00

Rice Power

05 pkt

375.00

Besan power ( paket)

05 kgs

460.00

misc items

20,000.00

Total:

49,800.00

Manpower (per Month)

Sl No

Personnel’s

Nos. Salary

(Rs)

Amount (Rs)

1.

Manager (self)

1 Nos

Self

3.

Helper

1 Nos @

Rs.5000/-

5,000.00

Total

5000.00

28

Prepared by Indian Institute of Entrepreneurship

Administrative Expenses (Per Month) :

Sl No

Description

Amount

(Rs. )

1.

Utility (Electricity / Water

800.00

2.

Rent /Office Stationary

4,000.00

3.

Travelling Expenses

500.00

4.

Advertisement

/Publicity/packaging

700.00

5.

Insurance

500.00

Total

6,500.00

Total Working capital required

Sl

No.

Description

Stock

Period

Amount (

Rs. )

1.

Consumable

stores for sale

-----

1,48,500.00

2.

Manpower

30 Days

5,000.00

3.

Administrative

Expenses

30 Days

5,500.00

Total

1,58,500.00

Total Capital Investment of the project :

A

Total Fixed Capital

41,500.00

B

Working Capital

1,58,500.00

Total:

2,00,000.00

Means of Finance

Promoters Contribution:

50,000.00

Loan from Bank

1,50,000.00

2,00,000.00

(Besides 7% Subsidy on Loan under SEP-I under NULM, Govt. of

Assam)

29

Prepared by Indian Institute of Entrepreneurship

Projected Sales Realisation: (Expected sale of Consumable stocks: )

Projected

daily

Sales

Amount

approximately

average margin

10.68%

Projected daily

sales of stock

Rs

6000/-

6,000.00

640.00

Projected monthly

sales of stock

------

1,50,000.00

16,000.00

Projected Yearly

sales turn over

------

1,80,000.00

1,92,000.00

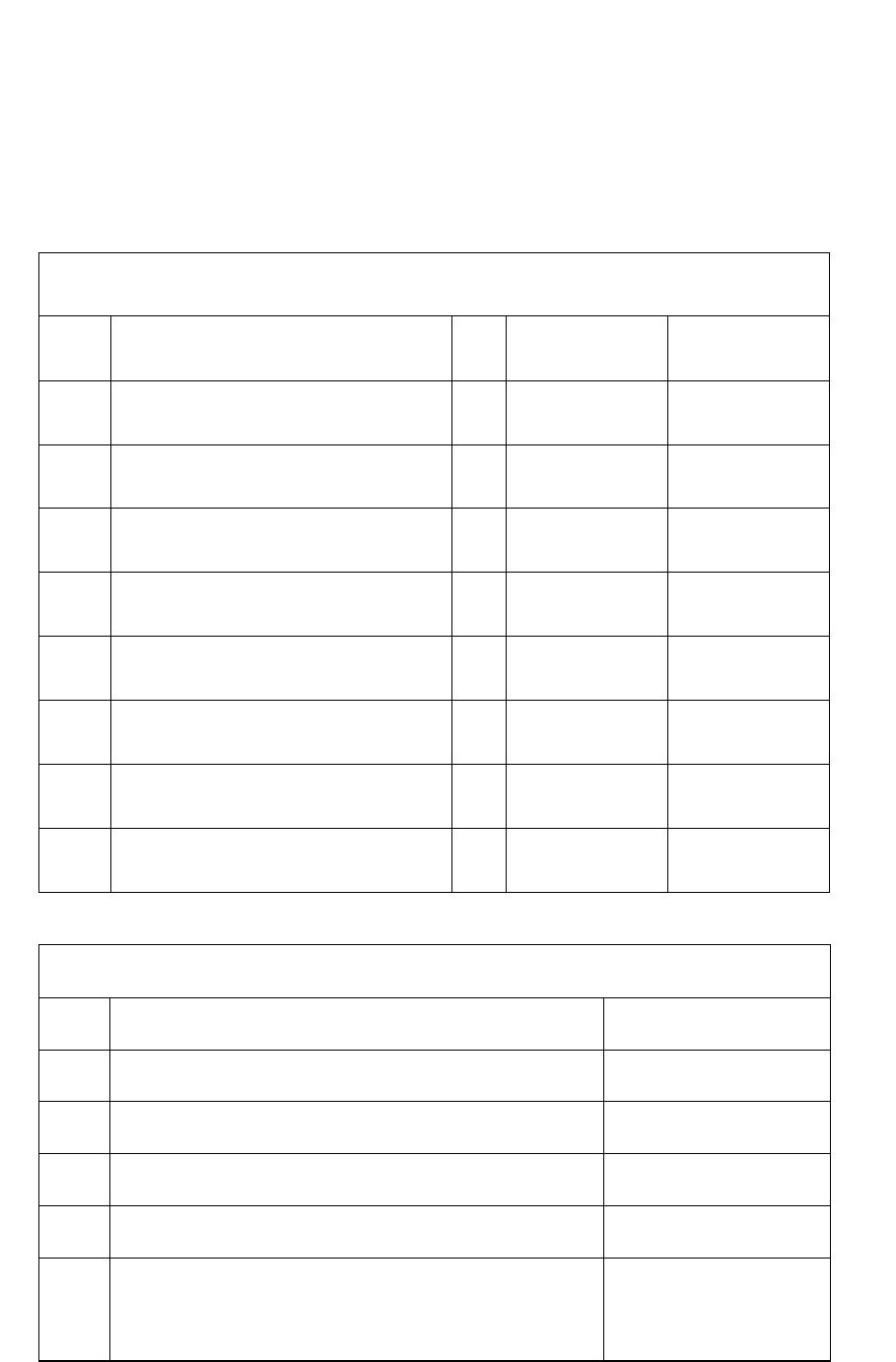

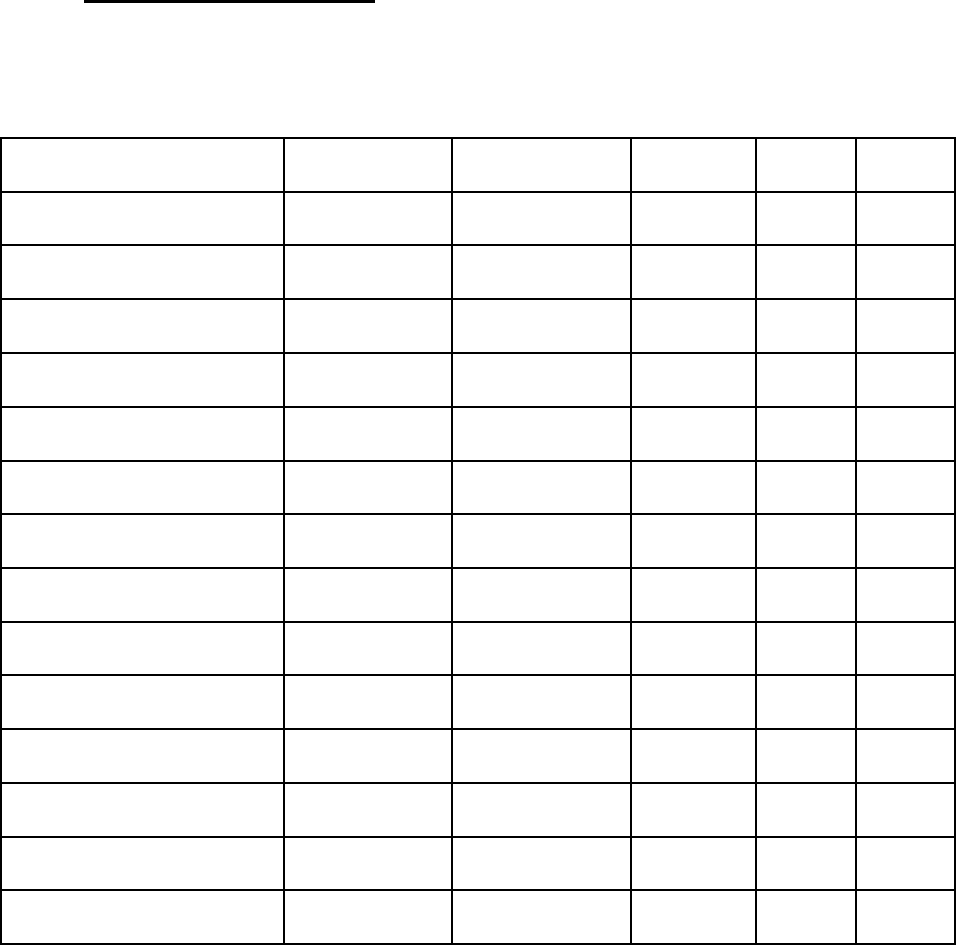

ANNEXURE-IX

COST PROFITABILTY STATEMENT

(Rs .In Thousands ‘000)

Item /Year

1

2

3

4

5

A

Capacity

Utilisation

50%

60%

70%

80%

90%

B

Sales turn over

192.00

230.40

268.80

307.20

345.60

C

Expenditures

Manpower

60.00

65.00

69.00

72.00

72.00

Administrative

Expenses

66.00

70.00

75.00

80.00

80.00

D

Total

Operating

Expenses(Total

of C)

126.00

135.00

144.00

152.00

152.00

E

Operating

Profit

66.00

95.40

124.80

156.14

156.14

F

Depreciation (

straight line

method))

6.00

6.00

6.00

6.00

6.00

G

Interest

18.00

14.40

10.8

7.20

3.60

H

Net Profit (E-

F-G))

55.42

84.26

113.10

142.94

146.54

K

Cash Flow

61.42

90.26

119.10

148.94

152.54

30

Prepared by Indian Institute of Entrepreneurship

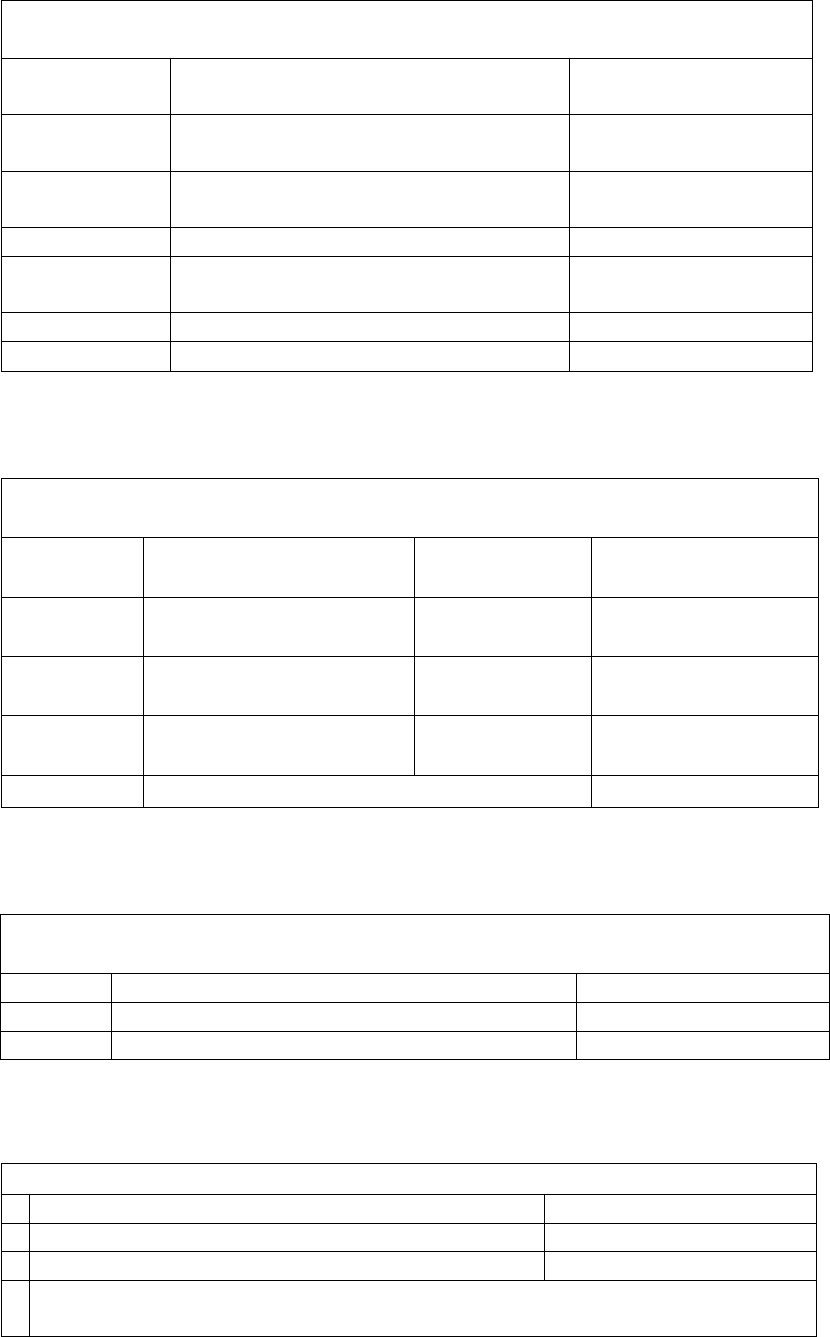

ANNEXURE-X

REPATMENT SCHEDULE

Interest rate @ 7%

( Rs. In Thousands, 000)

Year

01

02

03

04

05

Opening

Balance

150.00

120.00

90.00

60.00

30.00

Principal

30.00

30.00

30.00

30.00

30.00

Interest @

12% P/A

18.00

14.40

10.80

7.20

3.60

Closing

Balance

120.00

90.00

60.00

30.00

NIL

ANNEXURE-XI

DEBT-SERVICE COVERAGE RATIO

(Rs In Thousand ‘000)

Particulars

First

Year

Second

Year

Third

Year

Fourth

Year

Fifth

year

A. INCOME

Net Profit

55.42

84.26

113.10

142.94

146.54

Depreciation

6.00

6.00

6.00

6.00

6.00

Interest

18.00

14.40

10.8

7.20

3.60

Total

79.42

104.66

129.90

156.14

156.14

B. COMMITMENT

Principal

30.00

30.00

30.00

30.00

30.00

Interest

18.00

14.40

10.8

7.20

3.60

Total

38.00

34.40

40.80

37.20

33.60

DSRC

2.09

3.04

3.18

4.20

4.65

Average

DSCR

1:3.43

31

Prepared by Indian Institute of Entrepreneurship

ANNEXURE - XII

BREAK –EVEN ANALYSIS

A.FIXED COST

Depreciation

6000.00

Interest

18,000.00

Fixed administrative overhead

12500.00

Fixed manpower

15,000.00

TOTAL

51,500.00

B.TOTAL OF NET PROFIT 3

rd

Year of Operation)

1,13,100.00

BEP

Fixed Cost X100/ Fixed Cost + Net Profit

51,500X 100/ 51,500 + 113,100

31.29% ( on Sales)

ANEXURE - XIII

RETURN ON INVESTMENT

(Third Year of Operation)

(a)Return on Sales Ratio:

Net Profit X100/ Total Sales

Rs. 1,13,100.00 X 100.00/ Rs.2,05,420

=7.67 %

(b) Return on Total Investment

Net Profit X100/ Total Investment

Rs. 102610.00 X 100.00/Rs. 2,00,000.00

=51.31%

32

Prepared by Indian Institute of Entrepreneurship

Project Report on

RETAIL STATIONERY SHOP

33

Prepared by Indian Institute of Entrepreneurship

PROJECT ON STATIONERY SHOP ( Under SEP-I)

HIGHLIGHT OF THE PROJECT

A.

NAME OF THE UNIT

M/S( As per Udyog Adhar Registration)

I

CONSTITUTION

PROPRIETORHIP

II

PROMOTER

Trainee with Skill Knowledge on respective

Project

III

PROPOSED LOCATION

URBAN/SEMI URBAN AREA

B

TOTAL PROJCT INVESTMENT

I

FIXED CAPITAL

Rs.41,5000.00

II

WORKING CAPITAL

Rs.1,58,500.00

III

TOTAL

Rs. 2,00,000.00

IV

MEANS OF FINANCE

V

PROMOTERS CONTRIBUTION

@25%

Rs. 50,000.00

VI

BANK LOAN @75%

Rs. 1,50,000.00

VI

TOTAL

Rs. 2,00,000.00

VII

PROJECTED NET PROFIT

(Rs. 000)

01

Year

02

Year

03

Year

04 Year

05 Year

55.42

84.26

113.10

142.94

146.54

C

FINANCIAL ANYLASIS

I

PERCENTAGE OF PROFIT ON SALES

5.79%

II

PERCENTAGE OF PROFIT ON TOTAL INVESTMENT

47.93%

III

BEP

31.29%

IV

AVERAGE DSCR

1:3.43

V

DEBT EQUITY RATIO

3:1

VI

LOAN REPAYMENT PERIOD

05 Years

34

Prepared by Indian Institute of Entrepreneurship

RETAIL STATIONERY SHOP

1. Introduction:

Stationery items like notebooks, exercise books, logbooks, pen, pencil, high lighter, marker,

sharpener, file, folder, papers, eraser, stapler, items required for various project, pencil box

etc. are compulsory items for students. The stationery business is a customer’s driven The

Stationery ha historically means a wide range materials, papers, and officials supplies,

writing implements, greeting cards, glue, pencils case etc.

2. Market Potential:

In the global market in writing instruments is estimated about USD 38 billion of which global

pen market accounts for nearly USD 30 billion. In India market consists of around 15

largescale, 100 medium scale, and 1000 small scale manufacturing units. These units have a

combined production capacity of over 10 million pieces a day. About 80% of revenue of the

pen industries in India comes with a price range of up to Rs. 15/-. A small percentage of pens

is priced in the range of Rs. 100/- to Rs.300/- and miniscule of the market is contributed by

the super premium segments in which the price tag goes high as Rs. 1,00,000/-or more. While

the market for lower price range (up to Rs. 15/-) is growing a rate of 7% to 8% annually, the

market for the pen is growing at 8% to 10%. Besides the global Stationery products market

size was valued at USD 90.6 billion in 2018 and expecting to expand at 5.1% over the

forecast period. Growing literacy rate across the country and the increasing numbers of youth

inclining towards higher education are among the prominent factor for the market growth. In

India the stationery industry is worth Rs. 4000 core, comprising of wide verities of products

and categories. It can right be classified in to paper products, writing instruments,

computers stationeries, school stationery, and office stationery. Though the Indian

stationery industries are dominated by the local stationery players, and a large numbers of

players are now entering in the industry.

In India, major demand for stationery products is generated from education sector due to

increasing enrolment of students in schools and higher educational institutions. Further,

growing e-commerce industry in the country is also contributing to rising sales of stationery

products. Office segment is the second highest consumer of stationery products and is

anticipated to register healthy growth during the forecast period due to growing demand for

stationery products in the service sectors. Amongst all, paper stationery accounted for the

35

Prepared by Indian Institute of Entrepreneurship

major revenue share in the overall India stationery market. Exercise notebooks, copier paper

and premium paper stationery are the key revenue generating segments. Furthermore,

exercise notebook segment has captured highest share in paper stationery market. Amongst

all the regions, the Northern region accounted for highest revenue share in 2017. Market is

expected to flow on account of growing youth population and literacy rate across the country.

In large offices you often have a stationery cupboard you can pull stuff from. In your home or

small office you need to think ahead.

3. Stationery stores for sale

Pens – blue, black, red

Highlighter Permanent marker (Text / Sharpie)

Pencil and pencil sharpener

Colour pencils

Colour pens

Colour markers

Eraser

Correction tape / fluid / Liquid Paper

Mechanical pencil and spare leads

Plain paper (for printer)

Notebooks, ruled paper, binder books

Scrapbook, art book

Ruler

Glue

Sticky tape + dispenser

Packing tape + dispenser

Bulldog / Fold back clips

Stapler and staples

Rubber bands

Paper clips

Hole punch: 2 hole, 3 hole, 4 hole

Drawing pins

Plastic file, paper file

Manila folders

Storage pockets

Arch folders: 2 ring? 3 ring? 4 ring?

Folder divider

36

Prepared by Indian Institute of Entrepreneurship

4. BASIS AND PRESUMPTIONS:

The project is based on single shift basis and 300 days of working schedule in a

Year, the working hrs per day is 10/12 hours a day, 25 days in a month.

The cost of equipment / materials indicated refer to a particular make and the

Prices are approximate to these prevailing at the time of preparation of the

profile

Non- refundable deposits, project report preparation fees etc are considered under

Pre- operative expenses.

Interest on total investment has been calculated @ 12%per annum. Besides 7%

interest subsidy

Depreciation has been taken on straight line method

Manpower & Administrative expenditure has been calculated as per capacity

utilisation.

5. ROJECT COST ESTIMATES ANDMEANS OF FINANCE:

FIXED CAPITAL ESTIMATES:

5.1 Land & Building: The promoter has taken a room on rent for the proposed

project against monthly rent of Rs. 4000 (Two thousand) the room size is around 600

square feet which will be repaired with the materials available locally. The showroom

will be a well- ventilated covered hall, and will also include storing 0f consumable

materials with cash counter.

Total Fixed Capital:

Sl.

No

Particulars

Number

/unit

Price

(Rs)

Amount

(Rs)

1.

Stores Furniture’s

(Racks)

--

25,000.00

2.

Electrification

--

4,000.00

3.

Front Rack

--

5000.00

4.

Misc. Fixed Asset

7,500.00

Total

41,500.00

37

Prepared by Indian Institute of Entrepreneurship

WORKING CAPITAL ESTIMATES:

Consumables Stores for Sale:

Sl

Items

Consumption

Amount

Paper & Paper products

Exercise Books of various size ( plain,

rolled, drawing books, computer

printing paper, full scrape papers ,

colour paper, drawing sheet, Text

Books etc.

High Sale

Item

Writing instruments

Writing instruments( pen- blue, black,

red, green,- highlighter, permanent

marker, verities grade of pencil,

colour pencil, etc.

High Sale

Item

Computer Stationeries

computer paper, pen drive, computer

cover etc.

Low Sale

Item

School Stationeries:

sharpener, Erase, Mechanical pencil,

Correction tape, Scrapbook, spare

leads, Scrapbook, art book, Ruler,

Glue etc.

Medium Sale

Item

Office Stationeries.

Notebooks, ruled paper, binder books,

Sticky tape + dispenser, Packing tape

+ dispenser, Bulldog / Fold back clips,

Stapler and staples, Rubber bands,

Paper clips, Hole punch ( 2 hole, 3

hole, 4 hole), Drawing pins, Plastic

file, paper file, Manila folders, Storage

pockets, Enveloped ( different size),

Arch folders ( 2 ring, 3 ring, 4 ring),

Folder divider etc.

High Sale

Item

Total

Rs. 1,48,500.00

Manpower (per Month)

Sl No

Personnel’s

Nos. Salary

(Rs)

Amount

(Rs)

1.

Manager (self)

1 Nos

Self

3.

Helper

1 Nos @

Rs.5000/-

5,000.00

5000.00

38

Prepared by Indian Institute of Entrepreneurship

Administrative Expenses (Per Month)

Sl No

Description

Amount

(Rs. )

1.

Utility (Electricity / Water

800.00

2.

Rent /Office Stationary

4,000.00

3.

Travelling Expenses

500.00

4.

Advertisement /Publicity/packaging

700.00

5.

Insurance

500.00

6,500.00

Total Working capital required

Sl No.

Description

Stock

Period

Amount ( Rs. )

1.

Consumable stores

for sale

-----

1,48,500.00

2.

Manpower

30 Days

5,000.00

3.

Administrative

Expenses

30 Days

5,500.00

1,58,500.00

Total Capital Investment of the project :

A

Other Fixed Asset

41,500.00

B

Working Capital

1,58,500.00

Total:

2,00,000.00

Means of Finance

Promoters Contribution:

50,000.00

Loan from Bank

1,50,000.00

2,00,000.00

(Besides 7% Subsidy on Loan under SEP-I under NULM, Govt. of Assam)

39

Prepared by Indian Institute of Entrepreneurship

Projected Sales Realisation: (Expected sale of Consumable stocks: )

Stock Sales

Average margin on sales 16%

on sales volume. (amount)

Projected daily

average Sales

4000/-

Rs. 640.00

Projected monthly

average Sales

1,00,000.00

Rs. 16,000.00

Projected Yearly

average sales turn

over

Rs. 1,92,000.00

ANNEXURE-XIV

COST PROFITABILTY STATEMENT

(Rs .In Thousands ‘000)

Item /Year

1

2

3

4

5

A

Capacity Utilisation

50%

60%

70%

80%

90%

B

Sales turn over

192.00

230.40

268.80

307.20

345.60

C

Expenditures

Manpower

60.00

65.00

69.00

72.00

72.00

Administrative Expenses

66.00

70.00

75.00

80.00

80.00

D

Total Operating

Expenses(Total of C)

126.00

135.00

144.00

152.00

152.00

E

Operating Profit

66.00

95.40

124.80

156.14

156.14

F

Depreciation ( straight line

method))

6.00

6.00

6.00

6.00

6.00

G

Interest

18.00

14.40

10.8

7.20

3.60

H

Net Profit (E-F-G))

55.42

84.26

113.10

142.94

146.54

K

Cash Flow

61.42

90.26

119.10

148.94

152.54

40

Prepared by Indian Institute of Entrepreneurship

ANNEXURE-XV

REPATMENT SCHEDULE

Interest rate @ 7%

( Rs. In Thousands, 000)

Year

01

02

03

04

05

Opening

Balance

150.00

120.00

90.00

60.00

30.00

Principal

30.00

30.00

30.00

30.00

30.00

Interest @

12% P/A

18.00

14.40

10.80

7.20

3.60

Closing

Balance

120.00

90.00

60.00

30.00

NIL

ANNEXURE-XVI

DEBT-SERVICE COVERAGE RATIO

(Rs In Thousand ‘000)

Particulars

Firs

t

Yea

r

Seco

nd

Year

Thir

d

Year

Fourt

h

Year

Fifth

year

A. INCOME

Net Profit

55.4

2

84.26

113.

10

142.

94

146.

54

Depreciati

on

6.00

6.00

6.00

6.00

6.00

Interest

18.0

0

14.40

10.8

7.20

3.60

Total

79.4

2

104.6

6

129.

90

156.

14

156.

14

B. COMMITMENT

Principal

30.0

0

30.00

30.0

0

30.0

0

30.0

0

Interest

18.0

0

14.40

10.8

7.20

3.60

Total

38.0

0

34.40

40.8

0

37.2

0

33.6

0

DSRC

2.09

3.04

3.18

4.20

4.65

Average

DSCR

1:3.43

41

Prepared by Indian Institute of Entrepreneurship

ANNEXURE- XVII

BREAK –EVEN ANALYSIS

(Rs. in Thousands, 000)

A.FIXED COST

Depreciation

6000.00

Interest

18,000.00

Fixed administrative overhead

12500.00

Fixed manpower

15,000.00

TOTAL

51,500.00

B.TOTAL OF NET PROFIT 3

rd

Year of Operation)

1,13,100.00

BEP

Fixed Cost X100/ Fixed Cost + Net Profit

51,500X 100/ 51,500 + 113,100

31.29% ( on Sales)

ANEXURE XVIII

RETURN ON INVESTMENT

( Third Year of Operation)

(Rs. in Thousands, 000)

(a)Return on Sales Ratio:

Net Profit X100/ Total Sales

Rs. 1,13,100.00 X 100.00/ Rs.2,05,420

=7.67 %

(b) Return on Total

Investment

Net Profit X100/ Total Investment

Rs. 102610.00 X 100.00/Rs. 2,00,000.00

=51.31%

42

Prepared by Indian Institute of Entrepreneurship

Project Report on

SMALL RETAIL GARMENT SHOP

43

Prepared by Indian Institute of Entrepreneurship

PROJECT ON SMALL RETAIL GARMENT SHOP( Under SEP-I)

HIGHLIGHT OF THE PROJECT

A.

NAME OF THE UNIT

M/S( As per Udyog Adhar Registration)

I

CONSTITUTION

PROPRIETORHIP

II

PROMOTER

Trainee with Skill Knowledge on respective

Project

III

PROPOSED LOCATION

URBAN/SEMI URBAN AREA

B

TOTAL PROJCT INVESTMENT

I

FIXED CAPITAL

Rs.31,500.00

II

WORKING CAPITAL

Rs.1,68,500.00

III

TOTAL

Rs. 2,00,000.00

IV

MEANS OF FINANCE

V

PROMOTERS CONTRIBUTION @25%

Rs. 50,000.00

VI

BANK LOAN @75%

Rs. 1,50,000.00

VI

TOTAL

Rs. 2,00,000.00

VII

PROJECTED NET PROFIT

(Rs. 000)

01

Year

02

Year

03

Year

04

Year

05

Year

105.34

124.34

134.55

162.87

166.41

BESIDES THE NULM, GOVT. OF ASSAM PROVIDED NECESSARY EQUITY SUPPORT

C

FINANCIAL ANYLASIS

I

PERCENTAGE OF PROFIT ON SALES

5.39%

II

PERCENTAGE OF PROFIT ON TOTAL INVESTMENT

52.67%

III

BEP

32.88%

IV

AVERAGE DSCR

1:3.97

V

DEBT EQUITY RATIO

3:1

VI

LOAN REPAYMENT PERIOD

05 Years

44

Prepared by Indian Institute of Entrepreneurship

1. INTRODUCTION :

The textile industry occupies a unique place in our country. one of the earliest to come

into existence in India, it accounts for 14% of the total Industrial production , contributes

to nearly 30% of the total exports and is the second largest employment generation after

agriculture. Textile industry is providing one of the most basic needs of people and the

holds importance; maintaining sustained growth for improving quality of life. It has a

unique Position as a self – reliant industry, from the production of raw materials to the

delivery of finished products with substantial value-addition at each stage of processing;

it is a major contribution to the country’s economy.

The textile industry in India roughly employs around 35 million people (in 2000-2001),

making it the Second largest employer in the country after agriculture. The economic

significance of the industry is further established by the fact that it contributes about 18

percent of the industrial production in the country and about 30 percent of its of its export

earnings.

The Textile-sector has two board segments. The first are the unorganised- sector,

consisting of handloom, handicrafts and sericulture, which are operated on small scale

and through traditional tools and methods. The second is the organised sector consisting

of spinning, apparel and garments segments which apply modern machineries and

techniques such as economic of scale.

The Indian domestic apparel market is one of the world fastest-growing market and offer

significant potentiality for apparel retailers and manufacturers. The domestic market is

expected to become one of the major consumption bases in near future. Key growth

driver of the industry include rising income level, increasing preference for branded

apparel and rapid growth of organized retail. Further, factors such as changing fashion

trends, increasing share of the designer wear, growing consumer class and rising

urbanization have further led to the growth of the apparel industry. The Indian apparel

market is fairly fragmented in nature and comprises a significant number of retailers and

manufacturers. The apparel market has experienced strong growth in recent few years,

attracting many new players, as it is low berries to entry and affordable capital

requirement allow even small players to enter in the market.

45

Prepared by Indian Institute of Entrepreneurship

The business of garments is now a developed business in its own right. Peoples

inclination towards the readymade cloths is rising day by day. This inclination can be

attributed to their busy schedules and the attractive designs as well as variety of

readymade cloths. Although there is considerably big range under “readymade’ cloths but

their we shall deals with the children’s wears & ladies wears, and gens pants shirts. The

market of such cloth is quite wide and materials required for making such cloths is also

not problems even in local levels.

The IIE , Guwahati, has prepared this model economy sized Ready-made Garment

selling centre . Considering the demand prospects, locational advantages, capital

investment vis-à-vis incentives and concessions offered by the Govt. for promoting

industries in this part of the country, the proposed unit is found to be a techno

economically viable proposition

2. BASIS AND PRESUMPTIONS:

2.1: The project is based on single shift basis and 300 days of working schedule in a

Year, the working hrs per day is 8 hours a day, 25 days in a month.

2.2: The cost of equipment / materials indicated refer to a particular make and the

Prices are approximate to these prevailing at the time of preparation of the profile

2.3: Non- refundable deposits, project report preparation fees etc are considered under

pre- operative expenses.

2.4: Interest on total investment has been calculated @ 12%per annum, besides interest

subsidy will provided @ 7% per annum by Assam urban livelihood mission.

2.5: Depreciation has been taken on straight line method

2.6: Manpower & Administrative expenditure has been calculated as per capacity

Utilisation.

46

Prepared by Indian Institute of Entrepreneurship

3. PROJECT COST ESTIMATES ANDMEANS OF FINANCE:

FIXED CAPITAL ESTIMATES:

3.1: Land & Building: The promoter has taken a room on rent for the proposed project

against monthly rent of Rs. 2,000 (Two thousand) The room size is around 500 square feet

which will be repaired with the materials available locally . The showroom will be a well-

ventilated covered hall, and will also include rooms for storing raw materials, finished

product, and cash counter.

Total Fixed Capital:

Sl.

No

Particulars

Number /unit Price

(Rs)

Amount (Rs)

1.

Furniture’s

--

15,000.00

2.

Electrification

--

4,000.00

3.

Decoration

--

5000.00

4.

Misc. Fixed Asset

5000.00

Other Miscellaneous

2500.00

TOTAL

31,500.00

4. WORKING CAPITAL ESTIMATES:

Consumable stores for sale:

Sl

products

Quantities

Average Rate

Amount

1

Jeans pants ( for children)

2 doz

4800/- per doz

9,600.00

2

Gabardine pants ( for

children)

2

3600/-

7,200.00

3

Teri coat pants & shirts ( for

children)

2 doz

4000/-

8,000.00

47

Prepared by Indian Institute of Entrepreneurship

4

Cotton pants & Shirts ( for

children)

4 Doz

5,000.00

20,000.00

5

Baba suits

5 doz

1200/-

6,000.00

6

Frock/ Solo- war for

Children

5 doz

7200/-

36,000.00

7

Newborn babies wear

10 doz

800/-

8,000.00

8

Gens pants & shirts

2 doz

5000/-

10,000.00

9

Gens T shirts

2 doz

5500/-

11,000.00

10

Ladies formal dress

04 doz

4000/--

16,000.00

11

ladies gowns

5 doz

2000/-

10,000.00

12

Handkerchiefs/ musk

30 doz

120/-

3600

13

others miscellaneous

20

1000/-

12,100.00

TOTAL

1,57,500.00

Manpower (per Month)

Sl No

Personnel’s

Nos. Salary (Rs)

Amount (Rs)

1.

Manager (self)

1 Nos

Self

3.

Helper

1 Nos @

Rs.5000/-

5,000.00

TOTAL

5000.00

48

Prepared by Indian Institute of Entrepreneurship

Administrative Expenses (Per Month) :

Sl No

Description

Amount

(Rs. )

1.

Utility (Electricity / Water

1,000.00

2.

Rent /Office Stationary

2.500.00

3.

Travelling Expenses

500.00

4.

Advertisement /Publicity

1,000.00

5.

Insurance

500.00

TOTAL

5,500.00

Total Working capital required

Sl No.

Description

Stock Period

Amount ( Rs. )

1.

Consumable stores for sale

-----

157,500.00

2.

Manpower

30 Days

5,000.00

3.

Administrative Expenses

30 Days

5,500.00

1,68,000.00

Total Capital Investment of the project :

A

Total Fixed Capital

31,500.00

B

Working Capital

1,68,500.00

Total:

2,00,000.00

49

Prepared by Indian Institute of Entrepreneurship

Projected Sales Realisation: (Expected sale of Consumable stocks)

Stock Sales (Monthly)

15%( approximately)

Projected Monthly Sales

Rs. 120,000/-

18,000.00

Projected Yearly sales turn over

Rs. 14,40,000/-

2,16,000.00

Means of Finance

Promoters Contribution:

50,000.00

Loan from Bank

1,50,000.00

2,00,000.00

(Besides 7% Subsidy on Loan under SEP-I under NULM, Govt. of Assam)

50

Prepared by Indian Institute of Entrepreneurship

ANNEXURE-XIX

COST PROFITABILTY STATEMENT

(Rs .In Thousands ‘000)

Item /Year

1

2

3

4

5

A

Capacity Utilisation

50%

55%

60%

65%

65%

B

Sales turn over

2160.00

2376.00

2592.00

2808.00

2808.00

C

Expenditures

Consumable stores

1890.00

2079.00

2268.00

2457.00

2457.00

Manpower

60.00

65.00

69.00

72.00

72.00

Administrative Expenses

66.00

70.00

75.00

80.00

80.00

D

Total Operating Expenses(Total of C)

2016.00

2214.00

2412.00

2609.00

2609.00

E

Operating Profit

144.00

162.00

180.00

199.00

199.00

F

Depreciation ( straight line method))

6.30

6.30

6.30

6.30

6.30

G

Interest

18.00

14.40

10.8

7.20

3.60

H

Gross Profit( D-E-F)

119.70

141.30

152.90

185.50

189.10

I

Tax Provision (12%)

14.36

16.96

18.35

23.03

22.69

J

Net Profit

105.34

124.34

134.55

162.47

166.41

K

Cash Flow

111.64

130.64

140.85

168.77

172.71

51

Prepared by Indian Institute of Entrepreneurship

ANNEXURE-XX

REPATMENT SCHEDULE

( Rs. In Thousands, 000)

@ 15%

Year

01

02

03

04

05

Opening

Balance

150.00

120.00

90.00

60.00

30.00

Principal

30.00

30.00

30.00

30.00

30.00

Interest @

12% P/A

18.00

14.40

10.80

7.20

3.60

Closing

Balance

120.00

90.00

60.00

30.00

NIL

ANNEXURE-XXI

DEBT-SERVICE COVERAGE RATIO

(Rs In Thousand ‘000)

Particulars

First Year

Second

Year

Third

Year

Fourth

Year

Fifth year

A. INCOME

Net Profit

105.34

124.34

134.55

168.87

166.41

Depreciation

6.30

6.30

6.30

6.30

6.30

Interest

18.00

14.40

10.8

7.20

3.60

Total

129.64

145.04

151.65

182.37

176.31

B. COMMITMENT

Principal

30.00

30.00

30.00

30.00

30.00

Interest

18.00

14.40

10.8

7.20

3.60

Total

48.00

44.00

40.80

37.20

33.60

DSRC

2.70

3.30

3.72

4.90

5.25

Average DSCR

1:3.97

52

Prepared by Indian Institute of Entrepreneurship

ANNEXURE- XXII

BREAK –EVEN ANALYSIS

A.FIXED COST

Depreciation

6300.00

Interest

18,000.00

Fixed administrative overhead

36,400.00

Fixed manpower

24,000.00

TOTAL

54,700.00

B.TOTAL OF NET PROFIT 1st

Year of Operation)

111,64.00

BEP

Fixed Cost X100/ Fixed Cost + Net Profit

54,700/X 100/ 54,700/- + 111640/-

32.88% ( on Sales)

ANEXURE XXIII

RETURN ON INVESTMENT ( 1

st

Year of Operation)

(a)Return on Sales Ratio:

Net Profit X100/ Total Sales

Rs11, 640.00. /- X 100/ Rs. 2,160,00/-

=5.39 %

(b) Return on Total Investment

Net Profit X100/ Total Investment

Rs. 1,05,340/- X 100/Rs. 2,00,000.00

=52.67%

53

Prepared by Indian Institute of Entrepreneurship

Project Report on

TAILOR SHOP

54

Prepared by Indian Institute of Entrepreneurship

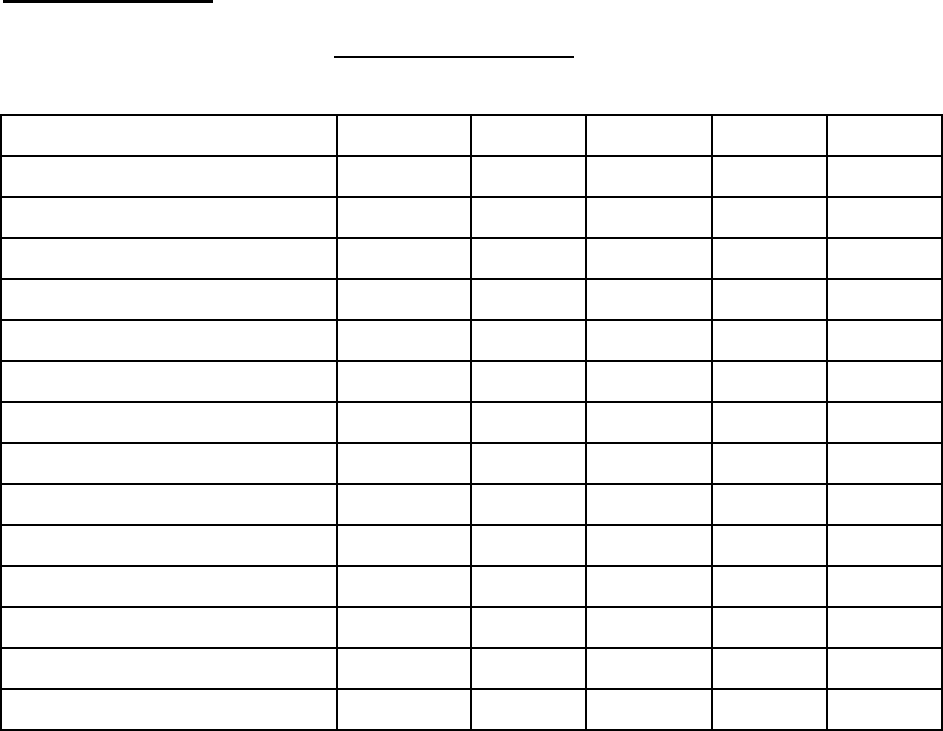

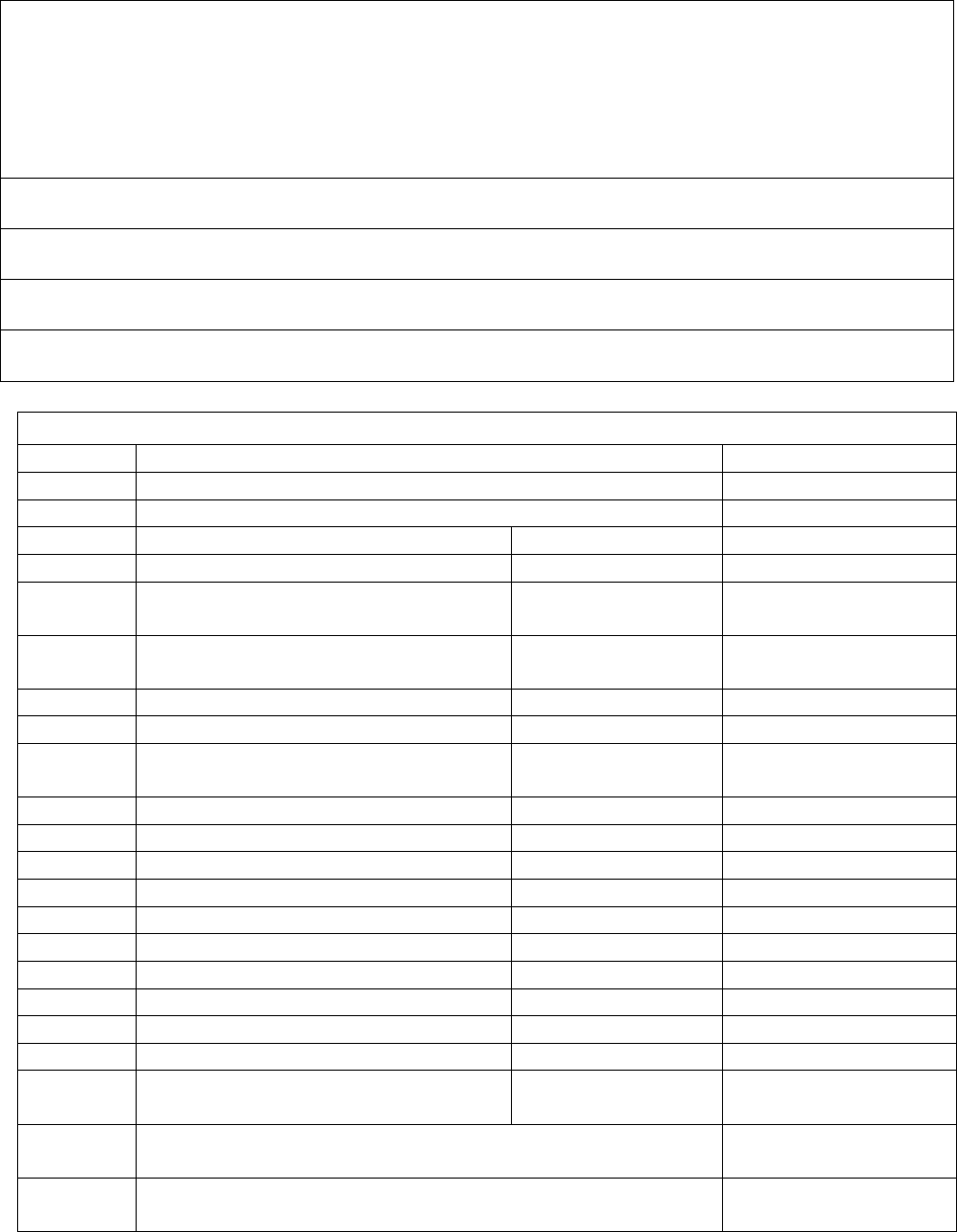

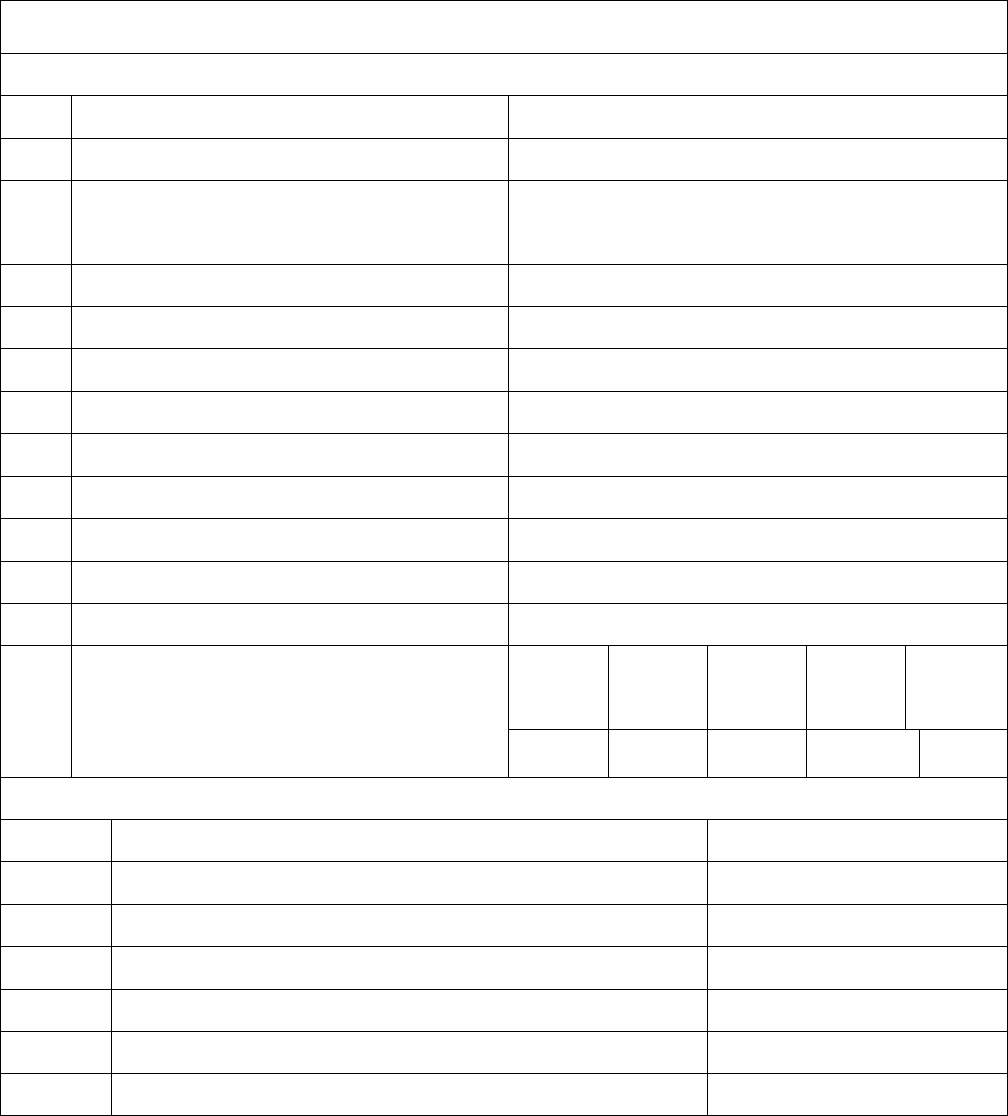

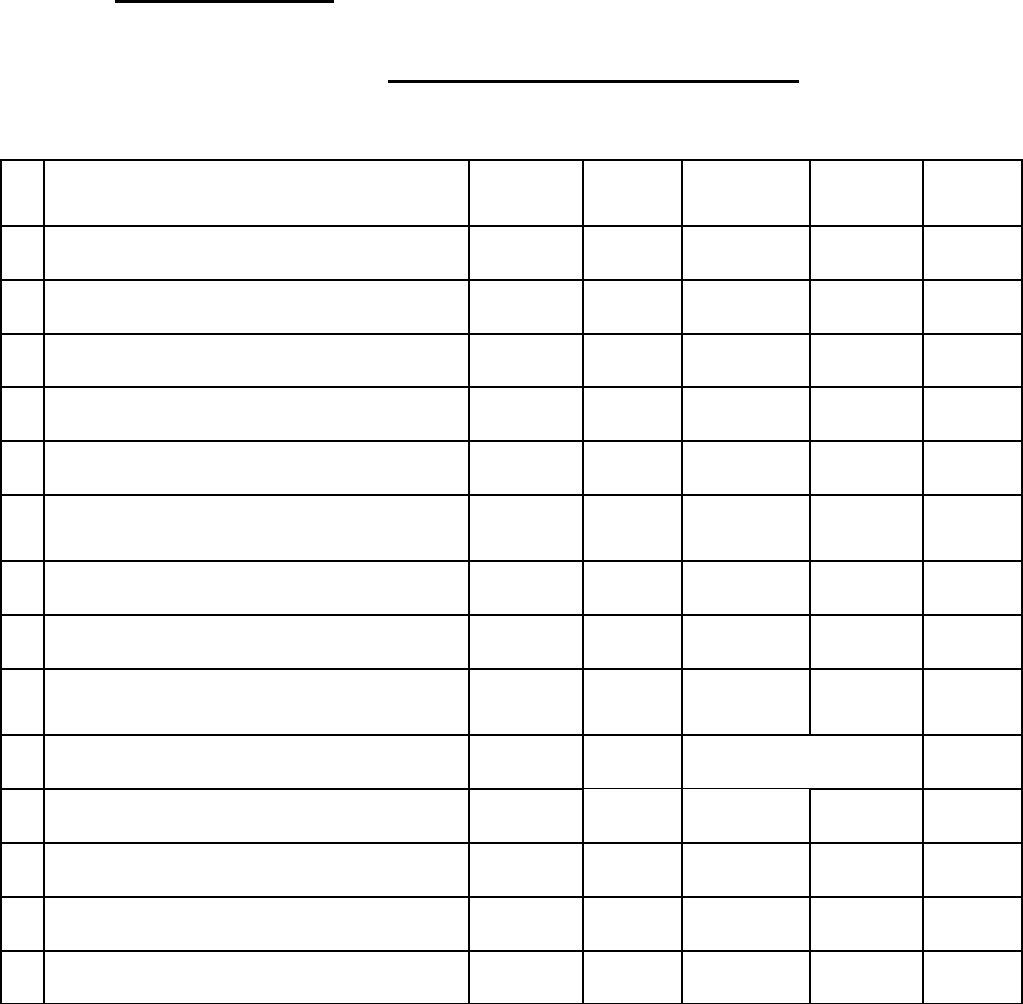

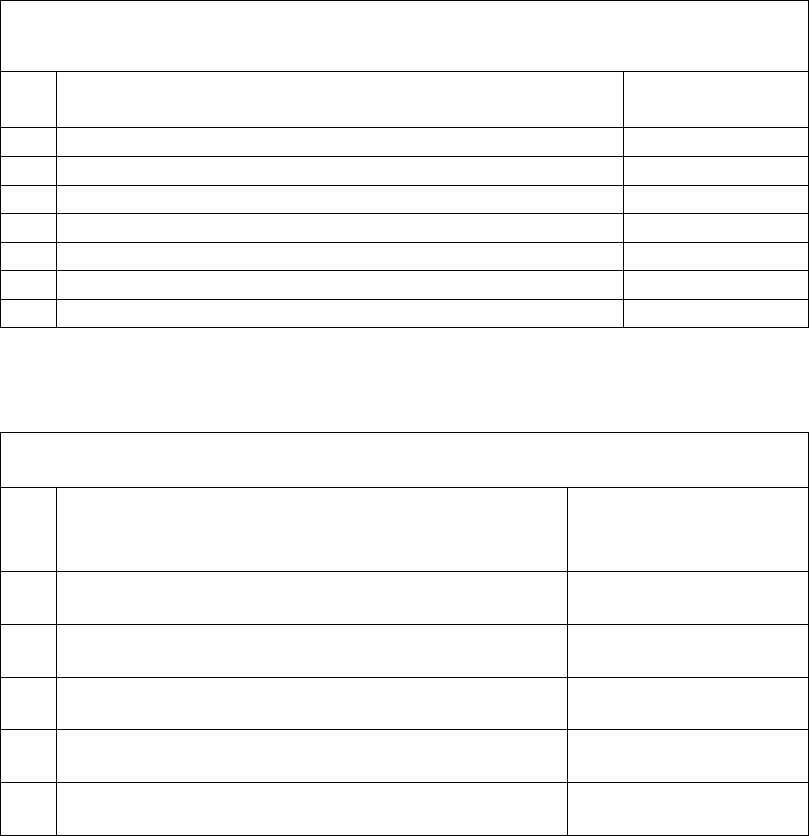

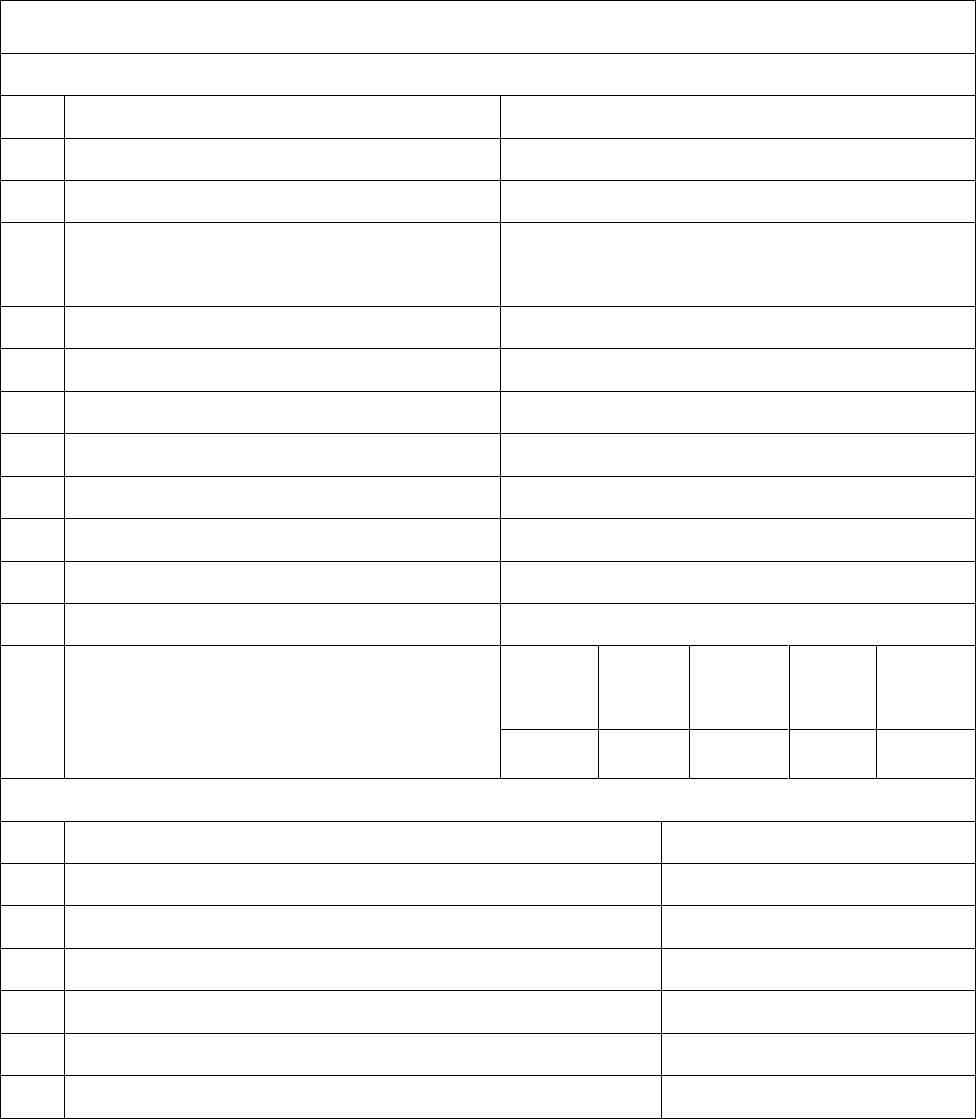

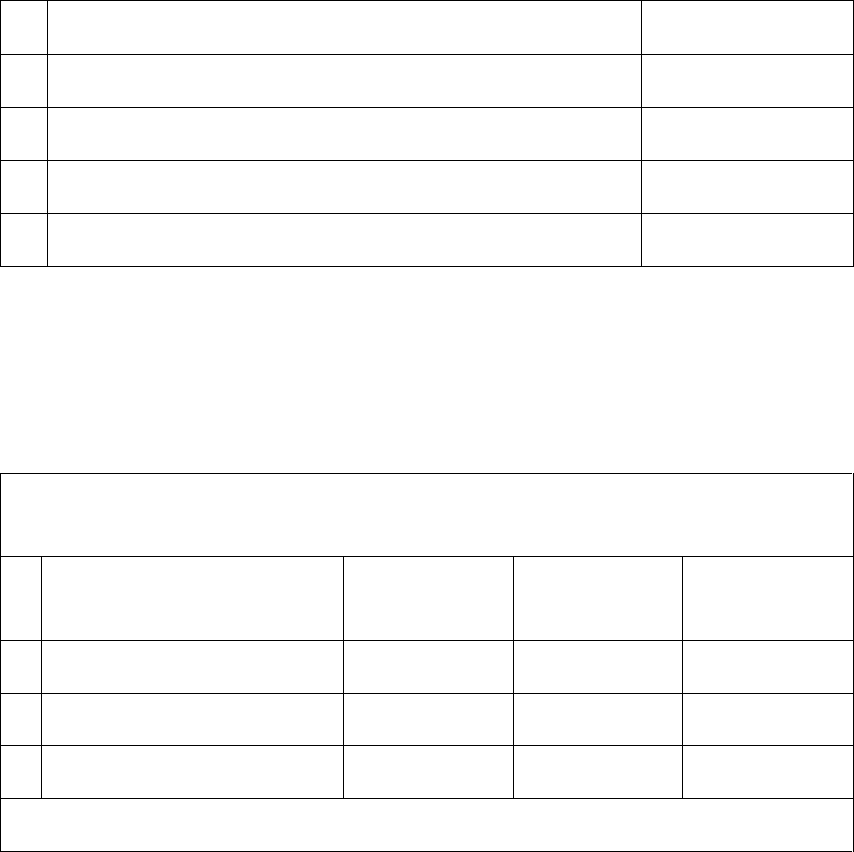

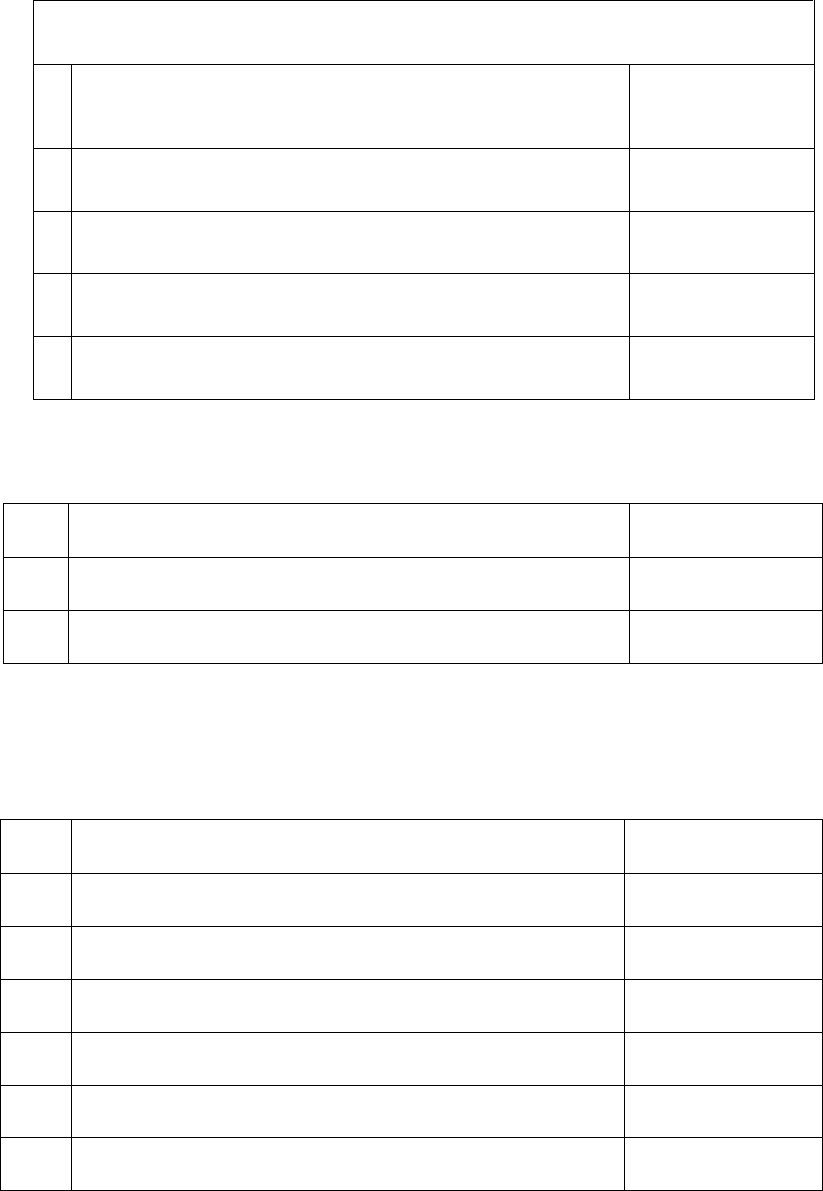

PROJECT ON TAILORING ( Under SEP-I)

HIGHLIGHT OF THE PROJECT

A.

NAME OF THE UNIT

As per Udyog Adhar

I

CONSTITUTION

Proprietorship

II

PROMOTER

Skill on Tailoring

III

PROPOSED LOCATION

May Home Scale/Urban/Semi Urban area near to

market

B

TOTAL PROJCT INVESTMENT

I

FIXED CAPITAL

Rs.72,000.00

II

WORKING CAPITAL

Rs. 1,28,0000.00

III

TOTAL

Rs. 2,00,000.00

IV

MEANS OF FINANCE

V

PROMOTERS CONTRIBUTION @25%

Rs. 50,000.00

VI

BANK LOAN @75%

Rs. 1,50,000.00

VI

TOTAL

Rs. 2,00,000.00

VII

PROJECTED NET PROFIT

(Rs. 000)

01

Year

02

Year

03

Year

04

Year

05

Year

102.61

143.59

166.56

220.54

224.13

BESIDES THE NULM, GOVT. OF ASSAM PROVIDED NECESSARY EQUITY SUPPORT

C

FINANCIAL ANYLASIS

I

PERCENTAGE OF PROFIT

ON SALES

7.67%

II

PERCENTAGE OF PROFIT

ON TOTAL INVESTMENT

51.31%

III

BEP

1

st

year

2

nd

year

3

rd

year

4

th

year

5

th

year

65.74%

63.01%

48.96%

43.29%

42.31%

IV

AVERAGE DSCR

1:4.51

V

DEBT EQUITY RATIO

3:1

VI

LOAN REPAYMENT PERIOD

05 Years

55

Prepared by Indian Institute of Entrepreneurship

1. INTRODUCTION:

It is an age long practice to stitch clothes by a tailor as per the sizes and orders and delivers

to the customers. This tailoring and embroidery can be an excellent self-employment

opportunity for the persons who have experience in tailoring and design of apparels. A small

shop can be opened with a modest investment in securing machines having embroidery

attachments. Since this is a made to order and more or less a service centre business the

working capital requirements are small compared to a ready-made garment unit. Besides, this

gives an employment to other persons also either on part time or full time basis. The tailoring

shop can cater to the stitching requirements and needs of blouses, Salwar kameez for ladies,

pants, shirts, half pants and children garments. Embroidery can be done on saris, blouses and

on apparels of children. An extra income can also be earned by undertaking repairing of the

clothes. All the machines and materials needed for stitching are available easily in every nook

and corner of the country and there will not be any difficulty in starting such a unit. The dress

is part of our lifestyle, when it comes to ladies; mainly there dress was stitched by buying

materials. This project report for stitching tuning / tailoring unit explains the viability of the

project in this locality. As the fashion changes, population increases, the demand for stitching

unit will also increase. Prompt delivery and affordable price are the key elements to success

here. The sector also created newer avenues for many businesses and entrepreneurs based in

the locality. Though there are a lot of stitching units, the demand for another stitching unit is

also very high. This profession gives the entrepreneur a decent income and opportunity to

provide employment to multiple ladies.

2. Product / Services & process

Under this project the promoter may stitch all type of dresses such as:( shirts, trousers,

Churidars, Blouses, Skirts, Lining etc works) An increasing number of women now prefer to

work and therefore need formal clothing. The Ladies suit offers good look, physical comfort

and perfect functionality in office as well as industrial duties. It can also be worn on all

outdoor occasions. Also women needed dress according to their shape. The best positioning

of a tailoring shop is to offer the dress on time and charge very affordable price. Besides local

advertisement and paper inserts were very effective

56

Prepared by Indian Institute of Entrepreneurship

3.PROJECT COST ESTIMATES & MEANS OF FINANCE:

3.1. FIXED CAPITAL:

Land & Building:

The rental for the shed of area 800 sq. ft. = Rs. 2000 /- (Per month).

Machinery & Equipment:

SlNo

Particulars

No

Amount (Rs.)

Amount (Rs.)

1.

Foot operated Sewing Machine

4

6,000.00

24,000.00

2.

Overlook Machine with motor

2

3,000.00

6,000.00

3

Interlock Machine

1

10,000.00

10,000.00

3.

Electric Irons

3

1,200.00

3,600.00

4.

Pressing table, cutting table, etc

8,000.00

5

Almirah / rack

---

3,400.00

3,400.00

6.

Scissors, Button Holders, etc

2000.00

TOTAL

57,000.00

Other Fixed Assets:

SlNo

Particulars

Amount (Rs.)

1.

Office Furniture

5,000.00

2.

Office Equipments

2,000.00

3.

Electrification

2,600.00

4.

Misc Expenses

2,000.00

TOTAL

11,600.00

57

Prepared by Indian Institute of Entrepreneurship

Preliminary & Pre-operative Expense:

SlNo

Particulars

Amount (Rs.)

1.

Preparation of Project Report

3,000.00

2.

Traveling & Conveyance

1,500.00

3.

Misc. Expense/legal expenses

2,500.00

TOTAL

Rs. 7,000.00

Total Fixed Capital:

SlNo

Particulars

Amount (Rs.)

1.

Machinery & Equipment

53,400.00

2.

Fixed Assets

11,600.00

3.

Preliminary & Pre-operative Expense

7,000.00

TOTAL

Rs. 72,000.00

WORKING CAPITAL:

Raw Material (Per Month):

SlNo

Particulars

Amount (Rs.)

1.

Sewing Thread

2,000.00

2.

Buttons

500.00

3.

Hooks, collars, zips, machine oils, needles, etc

1,500.00

4.

Clothes various qualities

50,000.00

5.

Misc. Expense

1,000.00

TOTAL Rs. 55,000.00

58

Prepared by Indian Institute of Entrepreneurship

Administrative Expense (Per Month):

SlNo

Particulars

Amount (Rs.)

1.

Rent

5000.00

2.

Electricity

1500.00

3.

Postage & Stationery

500.00

4.

Repairs & Maintenance

1,500.00

TOTAL

8500.00

Total Working Capital:

SlNo

Particulars

Amount (Rs.)

1.

Fabrics, button, stitching thread etc (

Consumables)

55,000.00

2.

Manpower

37,000.00

3.

Administrative Expense

8,500.00

TOTAL

Rs. 1, 05,000.00

Manpower (Per Month):

SlNo

Personnel

No

Salary (Rs.)

Amount (Rs.)

1.

Manager/ Cutter (Self)

1

2000.00

2,000.00

3.

Tailors

4

8000.00

32,000.00

5.

Unskilled Workers

1

3000.00

3000.00

TOTAL

6

37,000.00

59

Prepared by Indian Institute of Entrepreneurship

WORKING CAPITAL REQUIREMENT

Sl

Items

Stock period

Amount

Consumables

1.5 months

82,500.00

Manpower Cost

1 month

37,000.00

Administrative overheads

1 months

8500.00

1,28,000.00

Total Capital Investment:

SlNo

Particulars

Amount (Rs.)

1.

Fixed Capital

72,000.00

2.

Working Capital Required

1,28,000.00

TOTAL Rs.2, 00,000.00

Means of Finance:

1

Promoters Contribution (25%)

50,000.00

2

Bank Loan

1,50,000.00

Total:

2,00,000.00

Interest subsidy 7% on total loan amount under NULM,

Government of Assam

Projected Sales Realization ( Per Months)

SL

Tailoring Charges

4 tailor X 3umbers of job works @

average rate Rs.200/- X 25 days=

Rs.2400/- daily X 25 days

60,000.00

Supply of Cloth with

the job works

Sale of Cloth( in Stock) if required:

54580.00

Monthly Sales

114580.00

Annual Sales turn over

13,74,960.00

Say Rs.

13,75,000.00

60

Prepared by Indian Institute of Entrepreneurship

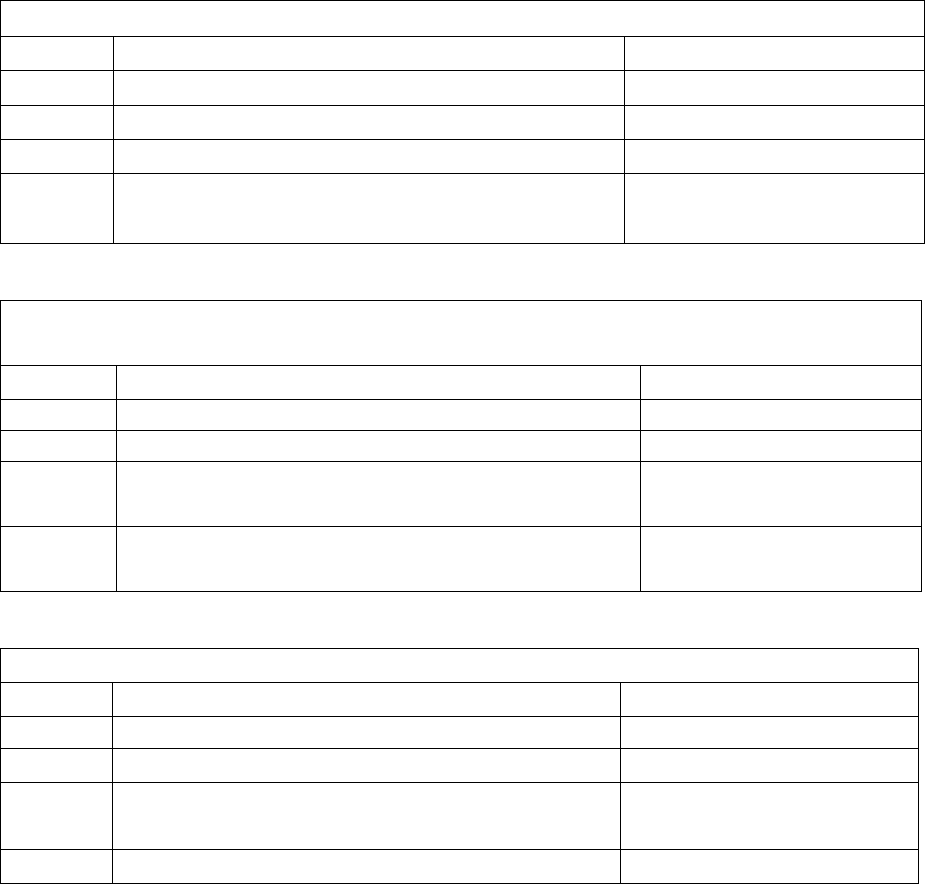

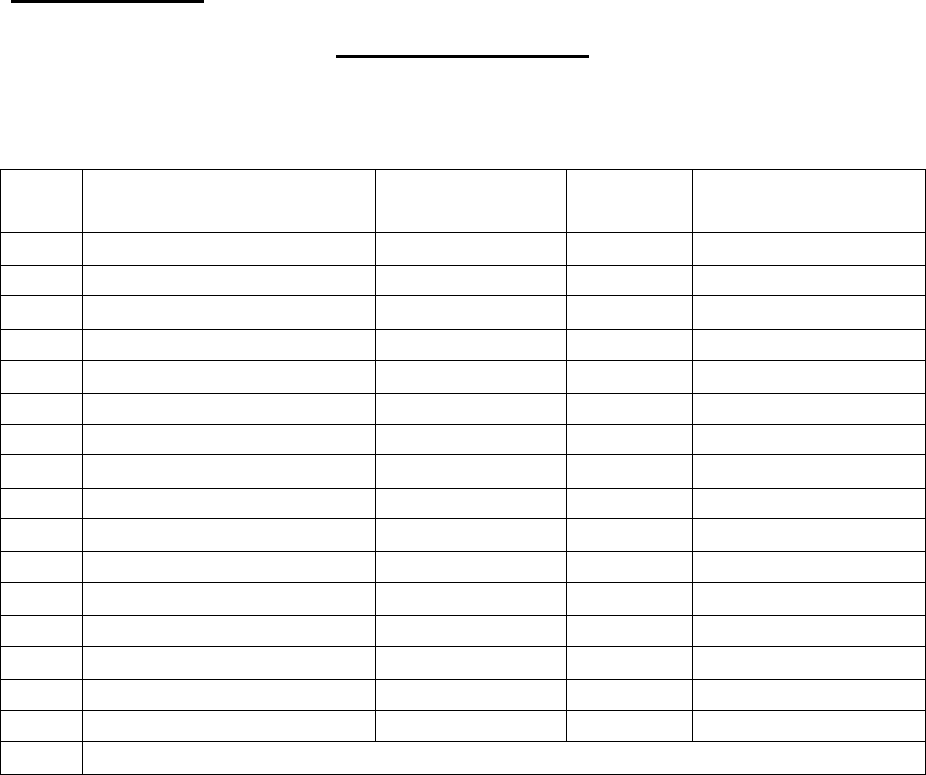

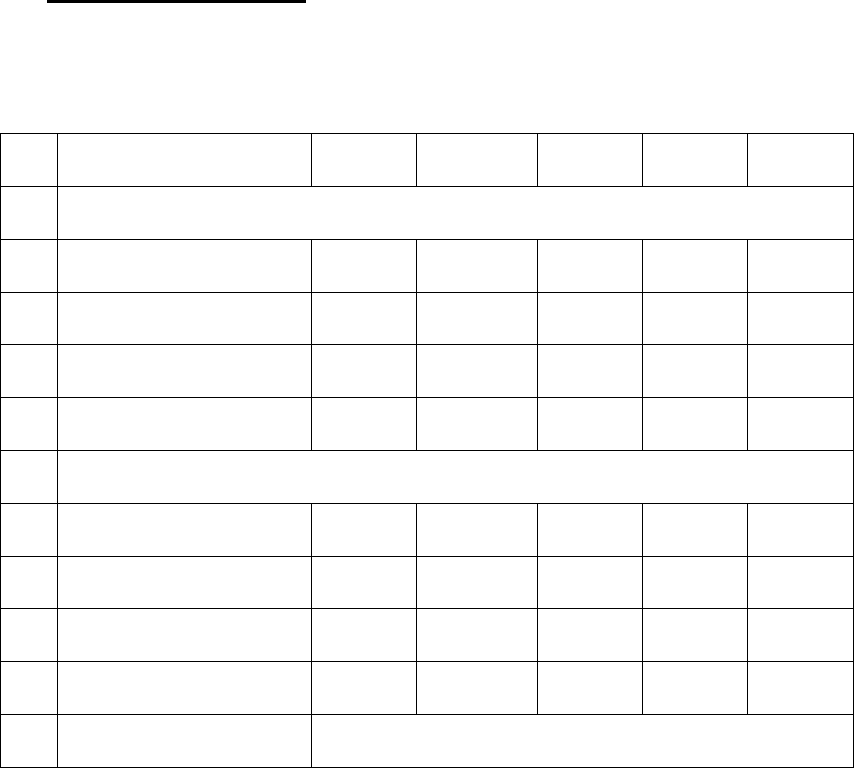

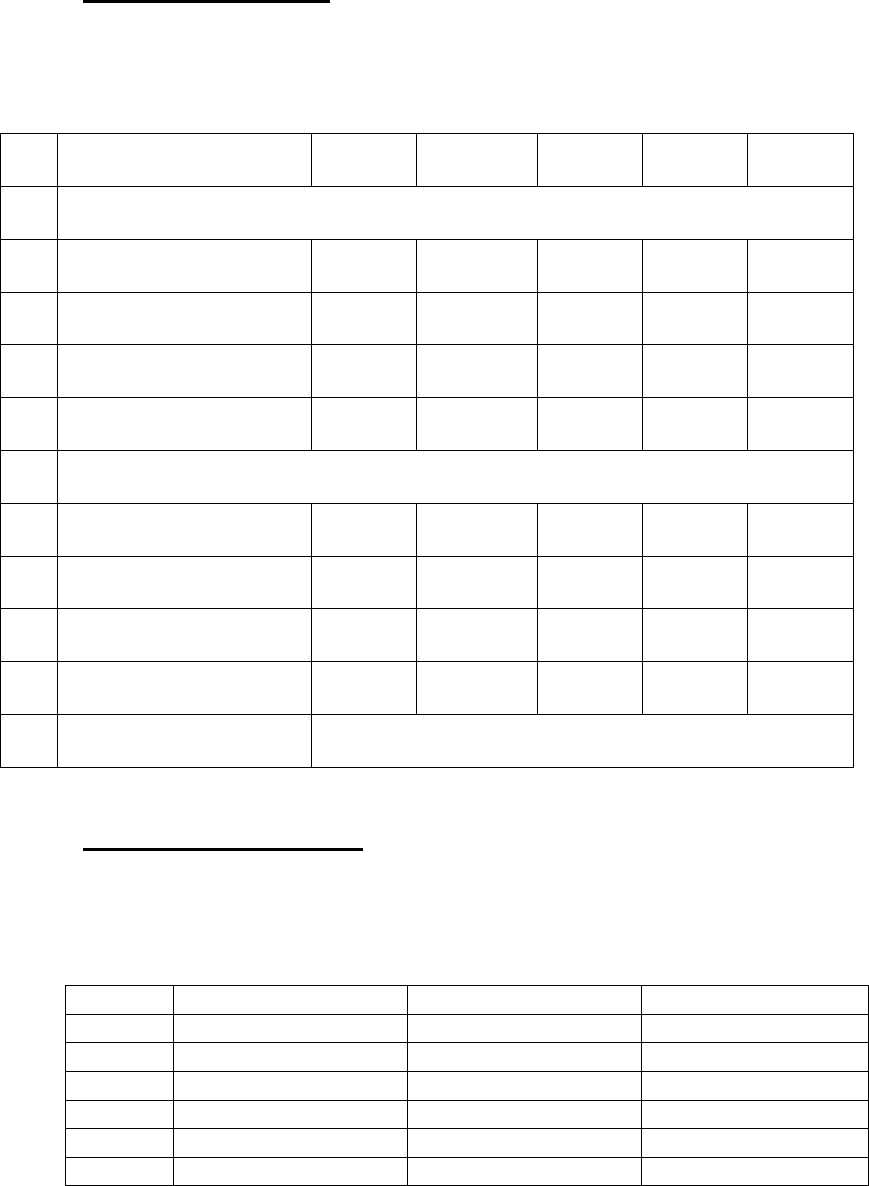

ANNEXURE – XXIII

PROJECTED PROFITABILITY STATEMENT

Rs. In thousand

SL

Particulars

1

st

Year

2

nd

Year

3

rd

Year

4

th

Year

5

th

Year

Capacity assumption

50%

55%

60%

65%

65%

A

Sales Realization

1375.00

1512.5

1650

1787.5

1787.5

B

Expenditures

Consumables

660.00

726.00

792.00

858.00

858.00

Manpower

444.00

467.00

493.00

520.00

520.00

Other Expenses

102.00

109.00

116.00

121.00

121.00

C

Total Operating Cost

(Total of (B)

1206.00

1302.00

1401.00

1499.00

1499.00

D

Total Operating Profit

(A-D)

169.00

210.50

249.00

288.50

288.50

E

Depreciation

7.14

7.14

7.14

7.14

7.14

F

Profit after Depreciation

(D-F)

161.86

203.36

226.86

226.86

226.86

G

Interest

18.00

14.40

10.80

7.20

3.60

H

Profit after Interest &

Depreciation (F-G)

143.86

188.96

216.06

219.66

223.26

I

Marketing Expenses

@3% on Sales

41.25

45.375

49.5

53.625

53.63

J

Net Profit

102.61

143.59

166.56

220.54

224.13

K

Cash flow

109.75

150.73

173.70

227.68

231.28

61

Prepared by Indian Institute of Entrepreneurship

Annexure XXIV

Depreciation Schedule,

Straight-line Methods

(05 years)

(Rs. In Thousands ‘000)

Sl

Items

1

st

year

2

nd

year

3

rd

year

4

th

year

5

th

year

A

Opening Stock

50.00

42.86

35.72

28.58

21.44

B

Depreciation

7.14

7.14

7.14

7.14

7.14

C

Closing Stocks

42.86

35.72

28.58

21.44

14.30

ANEXURE-XXV

LOAN REPAYMENT SCHEDULE @15 % ANNUALLY

(Rs. In Thousands)

ITEM

01

02

03

04

05

Opening Balance

150.00

120.00

90.00

60.00

30.00

Repayment Principal

30.00

30.00

30.00

30.00

30.00