STATE OF NEVADA

DEPARTMENT OF BUSINESS AND INDUSTRY

OFFICE OF LABOR COMMISSIONER

1818 COLLEGE PARKWAY, SUITE 102

CARS0N CITY, NEVADA 89706

775-684-1890

3300 WEST SAHARA AVENUE, SUITE 225

LAS VEGAS, NEVADA 89102

702-486-2650

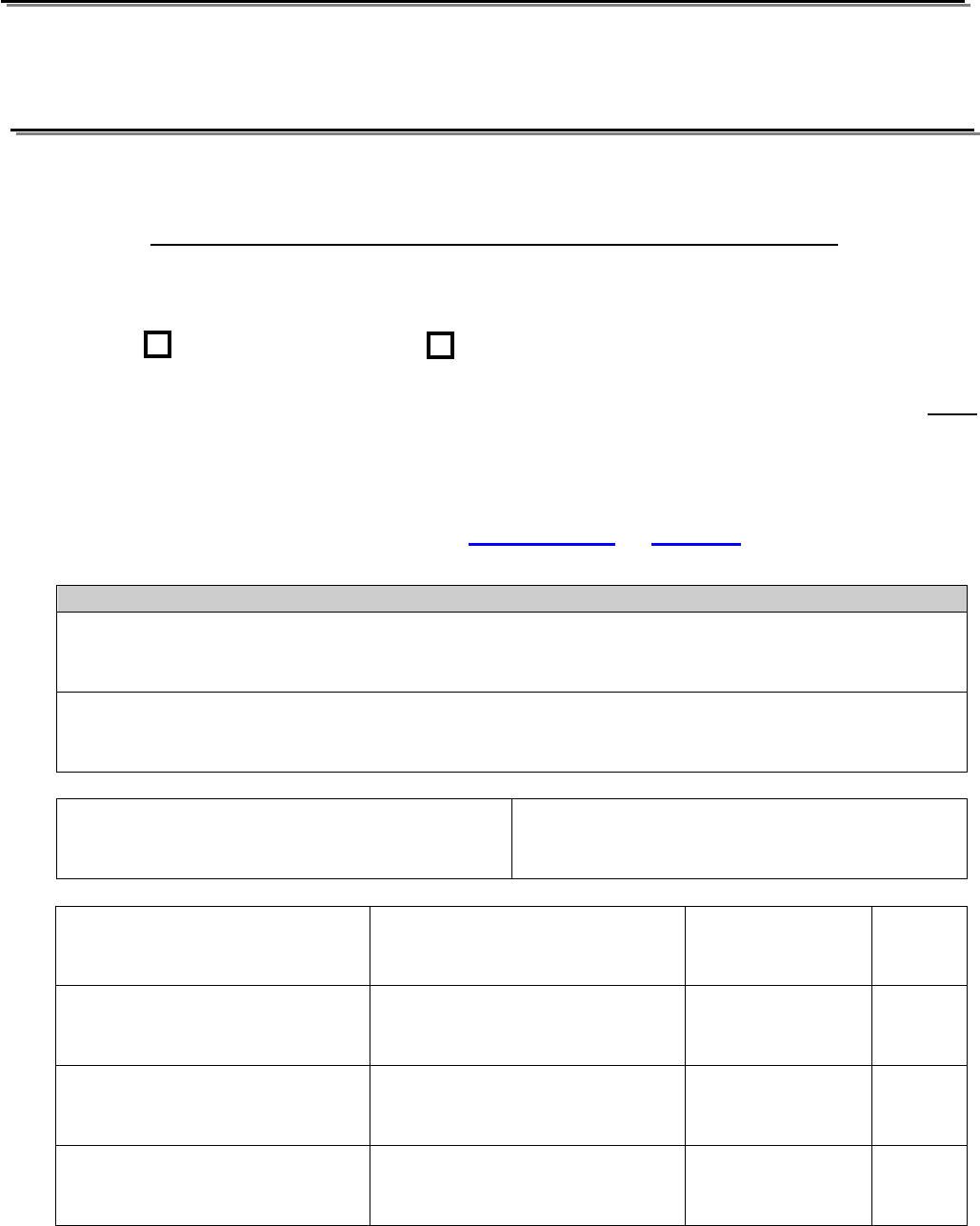

APPLICATION FOR PROFESSIONAL EMPLOYER ORGANIZATION LICENSE

All Questions Must be Answered – Application Must be Completed in either Blue Ink or be Typewritten

*License will expire on September 30. Renewal is incumbent upon the license holder.*

PLEASE SELECT THE PURPOSE OF YOUR APPLICATION:

___-______

New Renewal

License Number: OLC-

Professional Employer Organization License (PEO) for the year ending September 30, 20____

An applicant shall submit to the Labor Commissioner any change in information as required

in NRS 616B.679 within 30 days after the change occurs. The Labor Commissioner

may revoke the certificate of registration of an Professional Employer Organization which

fails to comply with the provisions of NRS 616B.670 to 616B.697, inclusive.

Section A:

Name of Professional Employer Organization (PEO):

FEIN ________________________

Business Address of Professional Employer Organization (PEO) (P.O. Box is NOT acceptable):

Business Telephone:

Business Contact Name and Title:

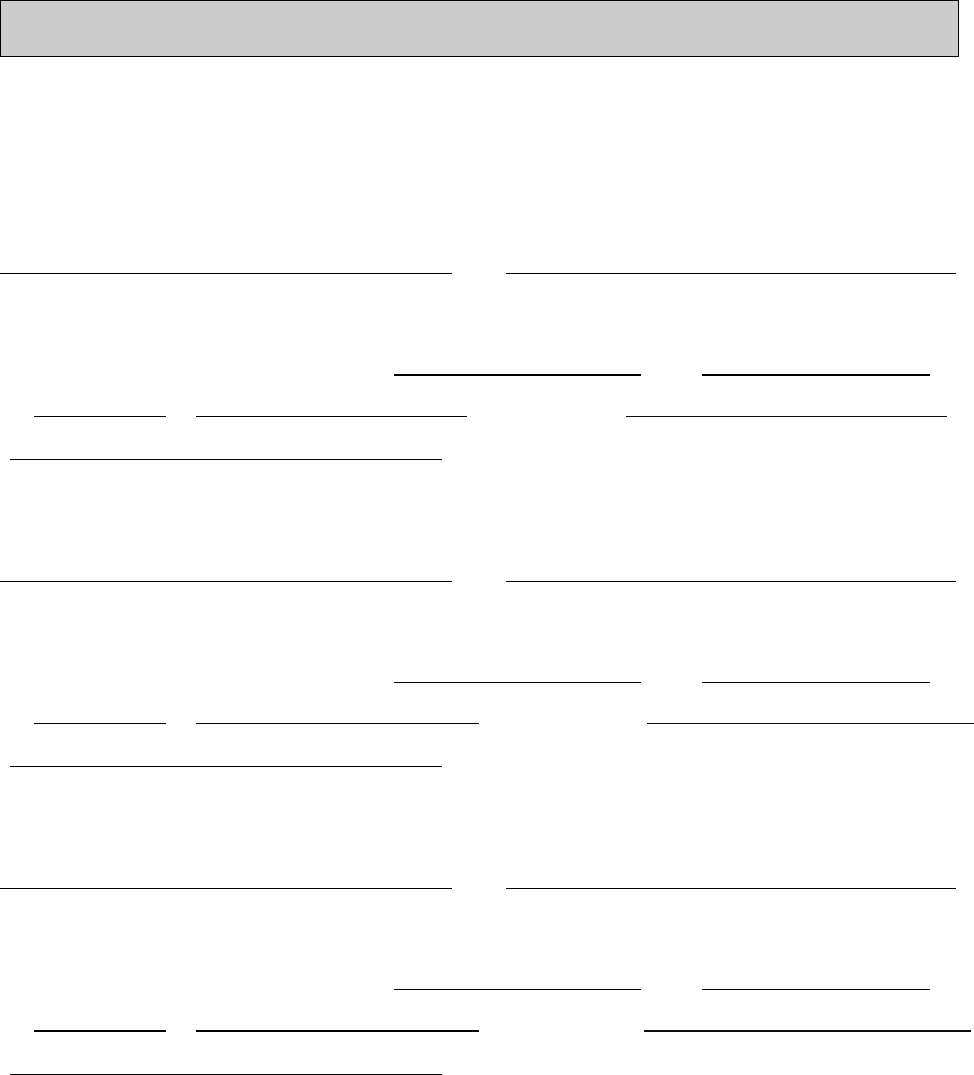

List the Names of all Owners, Partners, and/or Corporate Officers:

Name

Title

SSN

% of

Ownership

Name

Title

SSN

% of

Ownership

Name

Title

SSN

% of

Ownership

Name

Title

SSN

% of

Ownership

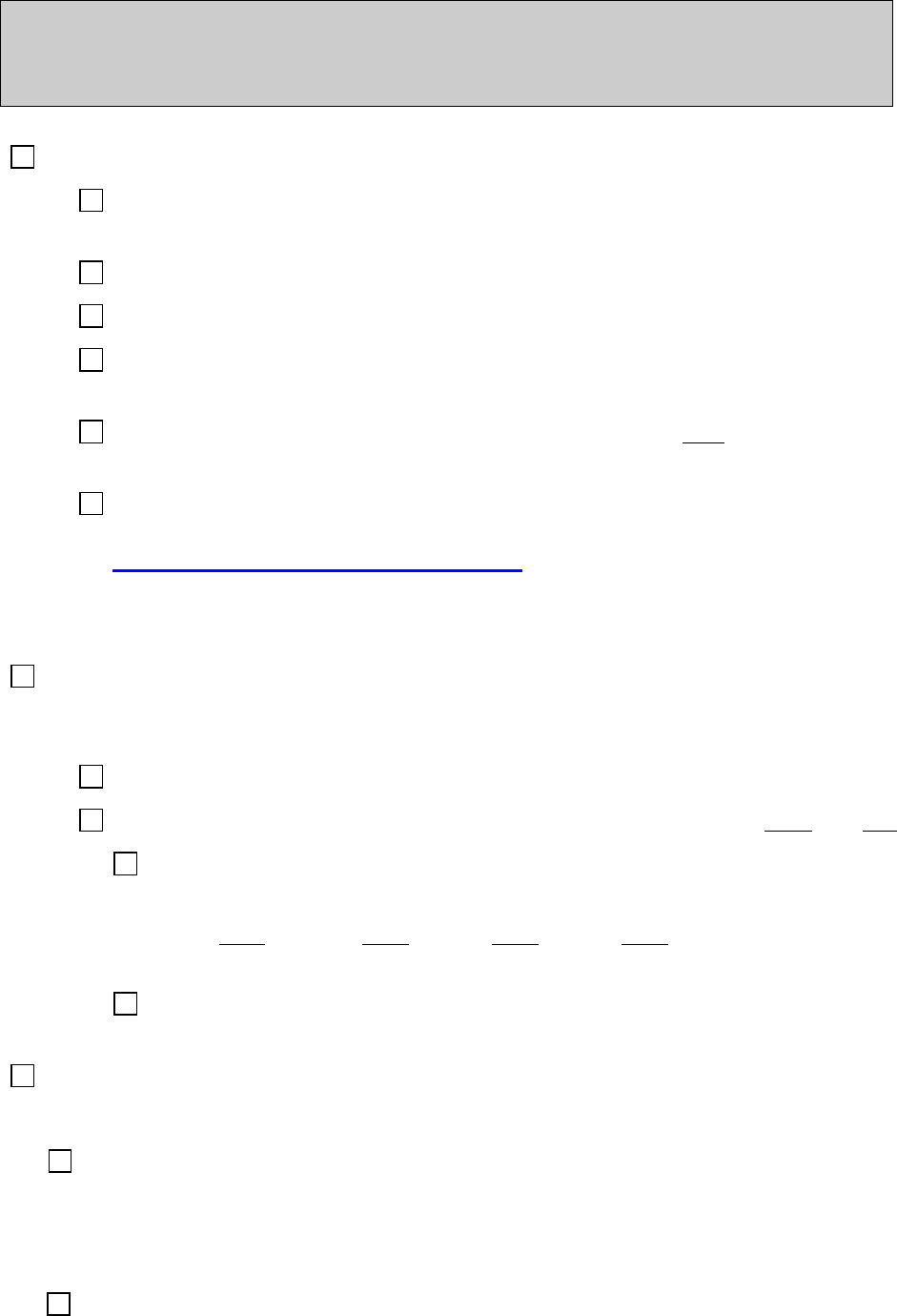

Part #1 – Application and attachments

PEO Registration Fee of $500 (Make check Payable to the Office of the Labor

Commissioner)

PEO Registration Application

Section B - Checklist

Section C – Client Company List. A separate list may be used, however all

information requested must be included in the table.

Section D – Declaration Page. This form MUST be signed by each officer as listed in

the registration application and registered by the Nevada Secretary of State.

Proof of State Business License required by Chapter 76 of the Nevada Revised

Statutes. Please Contact the Nevada Secretary of State for assistance.

http://www.nvsos.gov/index.aspx?page=267.

Acceptable proof is a copy of the Business License Certificate and a printout from the

Nevada Secretary of States website showing current officers/managers/directors.

Part #2 - Insurance Benefit Plans. Pursuant to Title 57 of the Nevada Revised Statutes, a

Professional Employer Organization (PEO) shall not offer its employees any self-funded

insurance program or act as a self-insured employer.

Completed PEO Domicile & Contact Information Sheet (required)

Do you offer insurance benefit plan(s) to your leased employees? Yes

If yes, check the plan(s) you offer:

No

Life Medical Dental Vision

The Professional Employer Organization (PEO) Insurance Certification Form

must be included for each Benefit Plan offered.

Part #3 - Industrial Insurance Coverage as required by the Nevada Industrial Insurance and

Occupational Diseases Acts (Chapters 616A to 616D, inclusive, and Chapter 617 of the Nevada

Revised Statutes).

I hereby certify under penalty of perjury that Workers’ Compensation Insurance is maintained

for each Client listed in Section C of the application.

Each client must have Nevada Specific coverage or Nevada must be listed in 3A of the Declaration

page of the Master policy and must have correct client name on it.

I hereby certify under penalty of perjury that Workers’ Compensation Insurance is

maintained for internal staff.

Section B:

The application for PEO registration should be submitted in a complete and organized

manner. Incomplete submission will be returned without further review. The following

items must be included with the application:

Part #4 - Payment of contributions or payments in lieu of contributions to the Nevada

Employment Security Department as required by Chapter 612 of the Nevada Revised Statutes.

Include Nevada Employment Security Dept (DETR) Notice of Contribution or Wage

Report for each client listed in Section C of the application. (Confirmation from

DETR showing that an account number has been assigned may be submitted for new

companies.) The forms should be in the same order as the list of clients.

Part #5 – Financial Statement and Proof of Working Capital

NRS 616B.679(1)(h)

1.

(h) A financial statement of the applicant setting forth the financial condition of the Professional

Employer Organization. Except as otherwise provided in NRS 616B.679 subsection 5, the financial

statement must include, without limitation:

(1)

For an application for issuance of a certificate of registration, the most

recent audited financial statement that includes the applicant, which must have been

completed not more than 13 months before the date of application; or

(2)

For an application for renewal of a certificate of registration, an audited

financial statement that includes the applicant and which must have been completed

not more than 180 days after the end of the applicant’s fiscal year.

NRS 616B.679 subsection 5 and 6

5.

A financial statement submitted with an application pursuant to this section must be prepared in

accordance with generally accepted accounting principles, must be audited by an independent

certified public accountant licensed to practice in the jurisdiction in which the accountant is located

and must be without qualification as to the status of the Professional Employer Organization as a

going concern. Except as otherwise provided in subsection 6, a Professional Employer Organization

that has not had sufficient operating history to have an audited financial statement based upon at

least 12 months of operating history must present financial statements reviewed by a certified

public accountant covering its entire operating history. The financial statements must be prepared

not more than 13 months before the submission of an application and must:

(a)

Demonstrate, in the statement, positive working capital, as defined by generally accepted

accounting principles, for the period covered by the financial statements; or

(b)

Be accompanied by a bond, irrevocable letter of credit or securities with a minimum market

value equaling the maximum deficiency in working capital for the period covered by the financial

statements plus $100,000. The bond, irrevocable letter of credit or securities must be held by a

depository institution designated by the to secure payment by the applicant of all taxes, wages,

benefits or other entitlements payable by the applicant.

6.

An applicant required to submit a financial statement pursuant to this section may submit a

consolidated or combined audited financial statement that includes, but is not exclusive to, the

applicant.

Please mark the appropriate box for items included:

Audited Financial Statement Bond

Irrevocable Letter of Credit Securities

Include a copy of the appropriate page that demonstrates working capital in the

application.

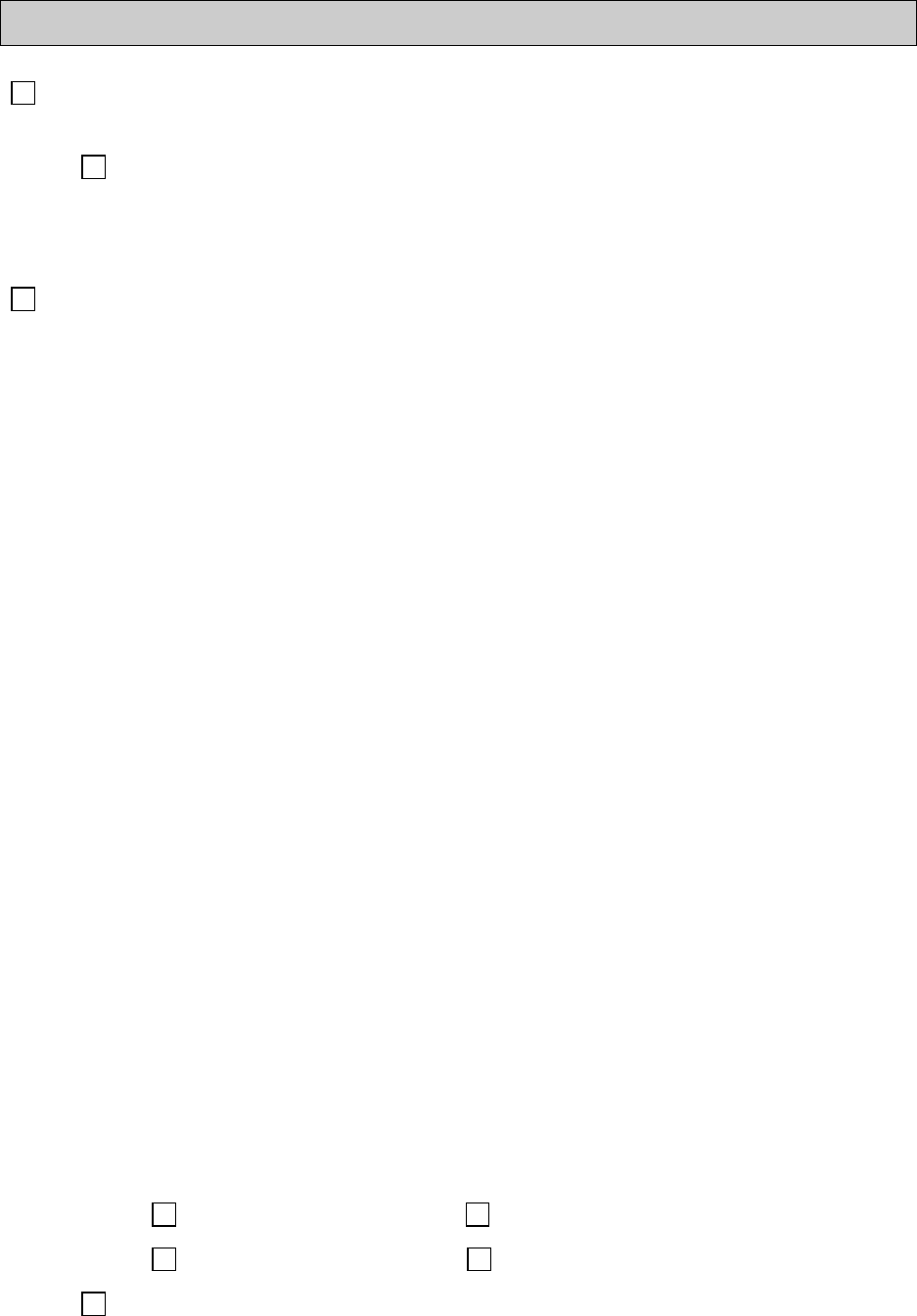

Section B: Continued

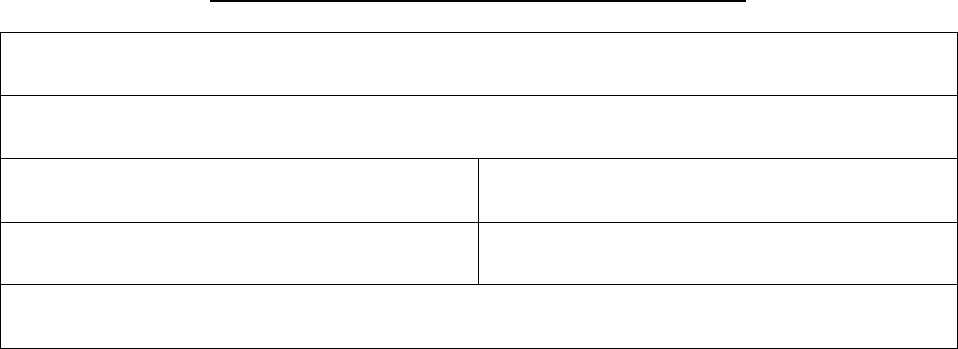

Name of Business FEIN #

Primary Business Operation (Construction,

Sales, Etc.)

Business Address (P. O. Box NOT acceptable)

Business Telephone

Estimated Number of

Client’s Employees

Number of Leased

Employees

Estimated Monthly Payroll of Employees

Leased to Business

Entity Type:

Sole Proprietor

Corporation

Partnership

Name of Business FEIN #

Primary Business Operation (Construction,

Sales, Etc.)

Business Address (P. O. Box NOT acceptable)

Business Telephone

Estimated Number of

Client’s Employees

Number of Leased

Employees

Estimated Monthly Payroll of Employees

Leased to Business

Entity Type:

Sole Proprietor

Corporation

Partnership

Name of Business FEIN #

Primary Business Operation (Construction,

Sales, Etc.)

Business Address (P. O. Box NOT acceptable)

Business Telephone

Estimated Number of

Client’s Employees

Number of Leased

Employees

Estimated Monthly Payroll of Employees

Leased to Business

Entity Type:

Sole Proprietor

Corporation

Partnership

Name of Business FEIN #

Primary Business Operation (Construction,

Sales, Etc.)

Business Address (P. O. Box NOT acceptable)

Business Telephone

Estimated Number of

Client’s Employees

Number of Leased

Employees

Estimated Monthly Payroll of Employees

Leased to Business

Entity Type:

Sole Proprietor

Corporation

Partnership

Name of Business FEIN #

Primary Business Operation (Construction,

Sales, Etc.)

Business Address (P. O. Box NOT acceptable)

Business Telephone

Estimated Number of

Client’s Employees

Number of Leased

Employees

Estimated Monthly Payroll of Employees

Leased to Business

Entity Type:

Sole Proprietor

Corporation

Partnership

Section C:

List all client companies currently under contract with your firm. (Print additional sheets

if necessary.)

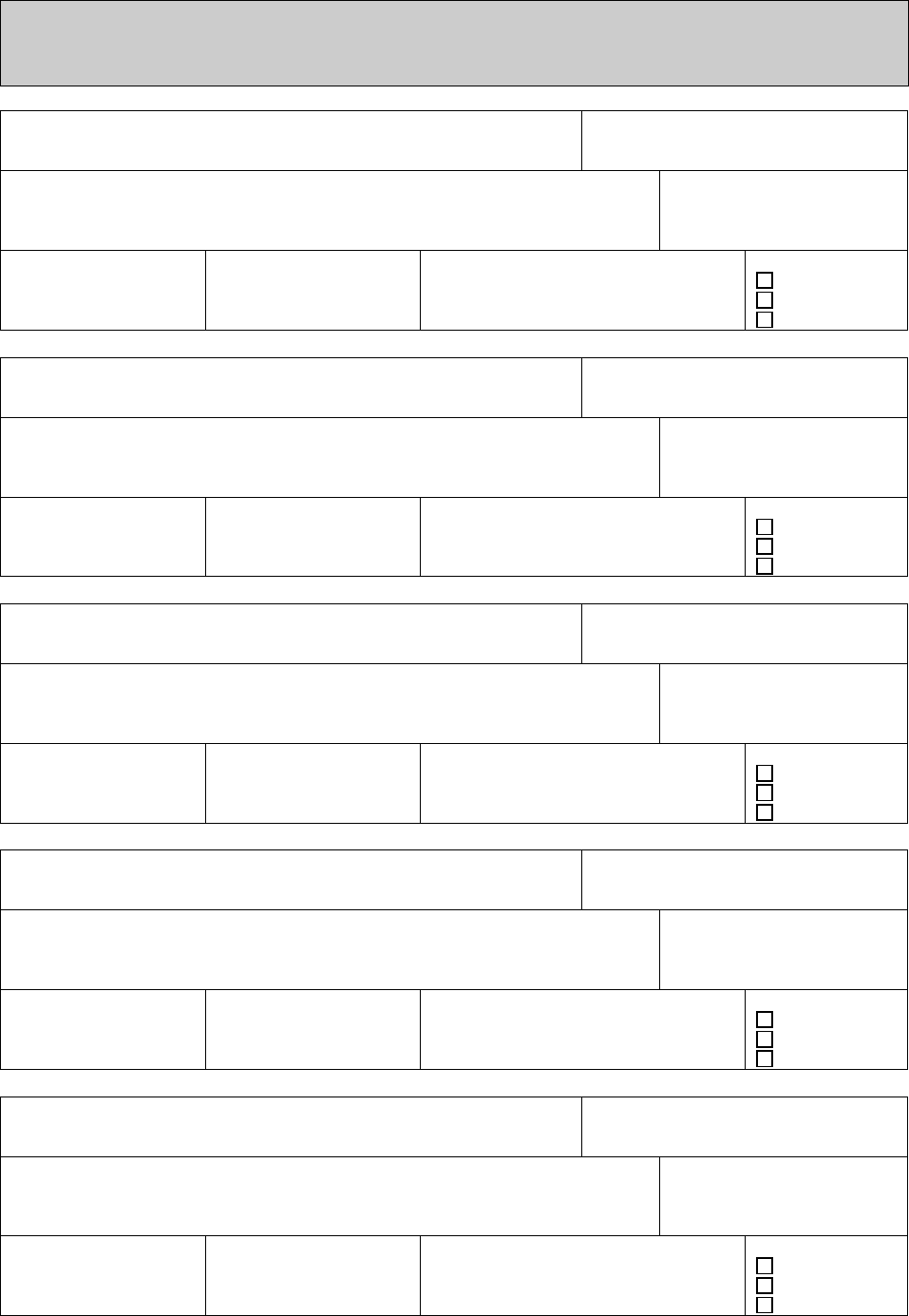

• I/we, the undersigned, swear under penalty of perjury that the information given in this form is true and

accurate and that each client has a valid worker's compensation policy in the State of Nevada as defined by

NRS 616B.692. I/we agree to submit to the Office of the Labor Commissioner, any changes in this information

within thirty (30) days, pursuant to NRS 616B.679 (3). Any falsification of this application or statements

therein will be cause for denial, revocation and/or Administrative Penalties being assessed.

This form must be signed by the sole proprietor, each partner, or each corporate officer of the Professional

Employer Organization. Each signature(s) must be notarized.

Signature of sole proprietor, partner, or corporate officer of

Professional Employer Organization

Full name of sole proprietor, partner, or corporate officer

of Professional Employer Organization (type or print)

Subscribed and sworn before me on this day of ,

20 , in County, State of

Notary Public Seal

Signature of sole proprietor, partner, or corporate officer of

Professional Employer Organization

Full name of sole proprietor, partner, or corporate officer

of Professional Employer Organization (type or print)

Subscribed and sworn before me on this day of ,

20 , in County, State of

Notary Public Seal

Signature of sole proprietor, partner, or corporate officer of

Professional Employer Organization

Full name of sole proprietor, partner, or corporate officer

of Professional Employer Organization (type or print)

Subscribed and sworn before me on this day of ,

20 , in County, State of

Notary Public Seal

Additional page(s) must be attached for additional signature(s) of all partners or additional

corporate officers.

Mail completed application packet to:

STATE OF NEVADA

OFFICE OF LABOR COMMISSIONER

1818 COLLEGE PARKWAY, SUITE 102

CARS0N CITY, NEVADA 89706

775-684-1890

Section D:

Declaration Page must be signed by each officer/director of the PEO

PEO CONTACT INFORMATION

Name of PEO:

Address of PEO:

Name of PEO Contact:

Title of PEO Contact:

Contact Phone:

Contact Fax:

Contact E-mail:

Professional Employer Organization (PEO)

Insurance Certification / Instruction Sheet

Line of Insurance: Complete a certification form for each line of insurance. Identify whether the

policy is medical, dental, vision or life insurance. If it is a voluntary product, such as cancer

protection, short-term disability, long-term disability, etc., it is not necessary to complete a

certification form.

Policy #: The Employer Group Policy number.

Form #: The form number of the policy. This number is typically found on the lower left hand

corner of the policy and will be compared to the Nevada Division of Insurance’s database to ensure

the Division has approved the form. An application cannot be approved without a valid form

number.

Licensed Nevada Insurance Company: The insurance company providing the policy must have a

Nevada Certificate of Authority to sell insurance products to Nevada residents.

Insurer’s NAIC ID#: The insurer’s National Association of Insurance Commissioner’s

identification number.

FEIN: The Federal employer’s identification number.

NV ID#: The identification number provided on the insurer’s Nevada Certificate of Authority.

Contact information for the “Licensed Salesperson/Producer” that marketed the above

referenced policy to the Professional Employer Organization (PEO): This section must be

completed by the person that actually marketed the insurance product to the PEO. This person is

responsible for the completion of the application and will be contacted by the Nevada Division of

Insurance to answer questions concerning the accuracy of the information provided.

Insurance Company Certification: An authorized representative of the insurance company and

the leasing company must confirm that the insurance product is fully insured. Fully-insured is a

plan where the employer contracts with another licensed organization to assume financial

responsibility for the enrollees’ claims and for all incurred administrative costs. The plan cannot

include stop-loss coverage or any other out-of-pocket expenses to the employer.

Professional Employer Organization’s Certification: The sole proprietor, partner or corporate

officer of the Professional Employer Organization must certify that the Company shall not offer its

employees any self-funded insurance program or be a member of an association of self-insured

public or private employers.

Professional Employer Organization (PEO) Insurance Certification

A Professional Employer Organization shall not act as a self-insured employer or be a member of an

association of self-insured public or private employers pursuant to chapters 616A to 616D, inclusive, or

Chapter 617 of NRS, or pursuant to Title 57 of NRS. Please complete this certification of compliance and

submit to the Office of the Labor Commissioner with the Professional Employer Organization (PEO)

Registration Application.

PEO Company Name

Line of Insurance:

Policy #:

Form#

Licensed Nevada Insurance Company:

Insurer’s NAIC#:

FEIN:

NV ID#:

Contact information for the “Licensed Salesperson/Producer” that marketed the above referenced

policy to the Professional Employer Organization (PEO):

Name:

Direct Telephone #:

Address:

Direct Fax #:

Direct E-mail Address:

Insurance Company’s Certification:

As an officer of the above-named licensed Nevada Insurance Company, I certify that the product provided

to the named Professional Employer Organization (PEO) is fully insured* and the policy form approved by

the Nevada Division of Insurance.

Printed Name in full Date

Signature Date

Professional Employer Organization’s Certification:

As an authorized representative of the above-named Professional Employer Organization (PEO), I certify

that the Company shall not offer its employees any self-funded insurance program or be a member of an

association of self-insured public or private employers.

Printed Name in full Date

Signature Date

*Fully-insured is a plan where the employer contracts with another licensed organization to assume financial

responsibility for the enrollees’ claims and for all incurred administrative costs. The plan cannot include stop-loss

coverage or any other out-of-pocket expenses to the employer.

An incomplete or inaccurate application will be returned to the Professional Employer Organization (PEO). All

certifications must be clearly signed and dated. A photocopy of an application will not be accepted.

OLC (rev 12/10/2021)

CHANGES TO THE PEO APPLICATION:

For PEO applications to be approved and/or renewed, you must certify, under penalty of perjury, that the

client(s) are covered in accordance with NRS Nevada Industrial Insurance and Occupational Diseases

Acts (Chapters 616A to 616D, inclusive, and Chapter 617 of the Nevada Revised Statutes). You must keep

records of the insurance policies and be able to provide them upon request.

The SMEAD folder is no longer required, but we do request you put the documents in a logical order so

we can easily enter them into our system for review. Please keep the order of documents as close to those

listed in Section B as possible.

The Office of the Labor Commissioner would like to announce that we have signed an agreement with

Employer Services Assurance Corporation (ESAC), a PEO Accreditation company. If you are registered

with ESAC, please review and update your accounts to meet the State of Nevada requirements. For more

information regarding ESAC and their services, please go to http://www.esac.org.