AEB 0070

November 2022

Orchard Economics:

The Costs and Returns to

Establish and Produce

Sweet Cherries in a High-Density and

Ultra-High-Density Orchard

In Wasco County

Ashley Thompson, Clark Seavert, and Lynn Long

| P a g e

1

Orchard Economics: The Costs and Returns to Establish and Produce Sweet

Cherries in a High-Density and Ultra-High-Density Orchard in Wasco County

Ashley Thompson, Clark Seavert, and Lynn Long*

Introduction

Cherry growers worldwide have

moved mainly to high-density plantings on

semi-dwarfing or dwarfing rootstocks. This

affords several advantages, including greater

precocity, faster return on investment, the

potential for higher annual yields, easier

maintenance, increased worker efficiency,

and the ability to protect the orchard more

easily from rain, hail, and bird damage.

However, with these advantages come

significant production risks. A high-density

system on dwarfing rootstock is less

forgiving than a standard-density orchard.

Improper management can mean small,

poor-quality fruit. Poor pruning can lead to

excessive shading and spur death, and lack

of vigor can increase pest and disease

attacks. For these reasons, it is essential that

growers properly evaluate their

scion/rootstock choices in relation to the

proposed orchard site while critically

assessing their own management skills

before deciding to plant a high- or ultra-

high-density orchard.

This study is intended for growers and

investors considering the economic and

financial consequences of planting a high-

density or ultra-high-density sweet cherry

orchard. It is impossible to cover all variety,

rootstock, and training system combinations

in a publication of this type, so combinations

commonly grown in Wasco County were

chosen for comparison.

Assumptions for Both the High-

and Ultra-High-Density Systems

In the preparation of this publication,

assumptions were made that reflect current

trends in orchard design for establishing a

sweet cherry orchard. These assumptions

are:

1. Farm size. The typical size operation in

Wasco County growing fruit is 100 acres.

2. Land. The market value of irrigated land

with no fruit trees is $15,000 per acre.

3. Grower returns. The average sweet

cherry prices are $0.85 per pound

returned to the grower after subtracting

packing costs.

4. Tree density and acres. The typical

acreage for a sweet cherry farm includes

45 acres of standard density, 45 acres of

high-density, and 5 acres of ultra-high-

density plantings, all producing fresh

market sweet cherry varieties.

Approximately 5 percent, or 5 acres, of

the orchard is non-bearing fruit trees.

Generally, standard density orchards have

less than 300 trees per acre, ultra-high-

density orchards greater than 660, and

high-density orchards in between.

5. Labor. Beginning in Year 0, general

orchard labor is paid $16.75, tractor

drivers $20.25, supervisory labor $24.50

per hour, and workers harvesting cherries

are paid a piece rate of $0.26 per pound.

All rates include worker's compensation,

unemployment insurance, and other

overhead expenses; therefore, all general,

tractor, supervision, and harvest labor are

cash variable costs. In addition, labor

rates increase three percent annually for

inflation in subsequent years after Year 0.

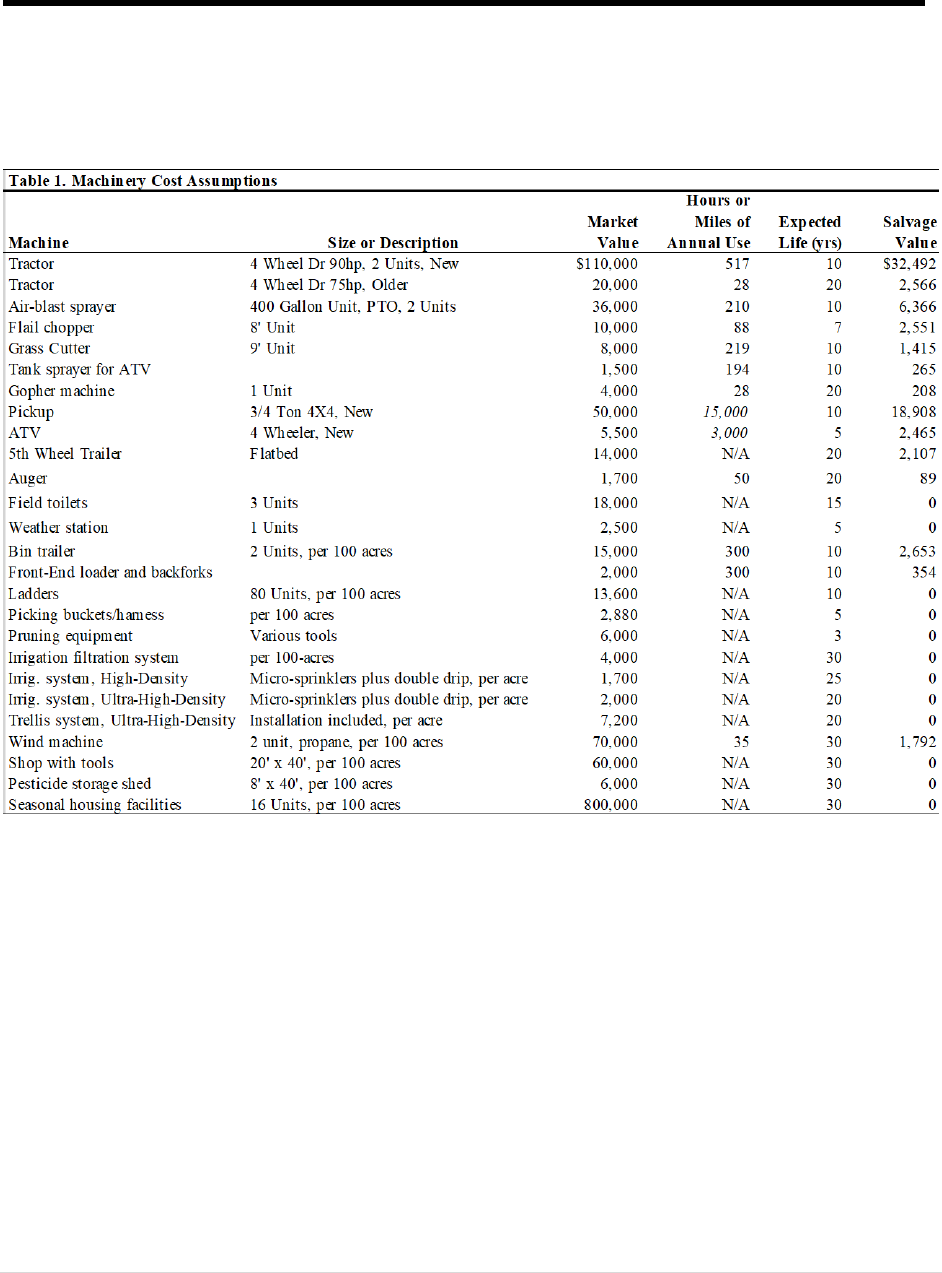

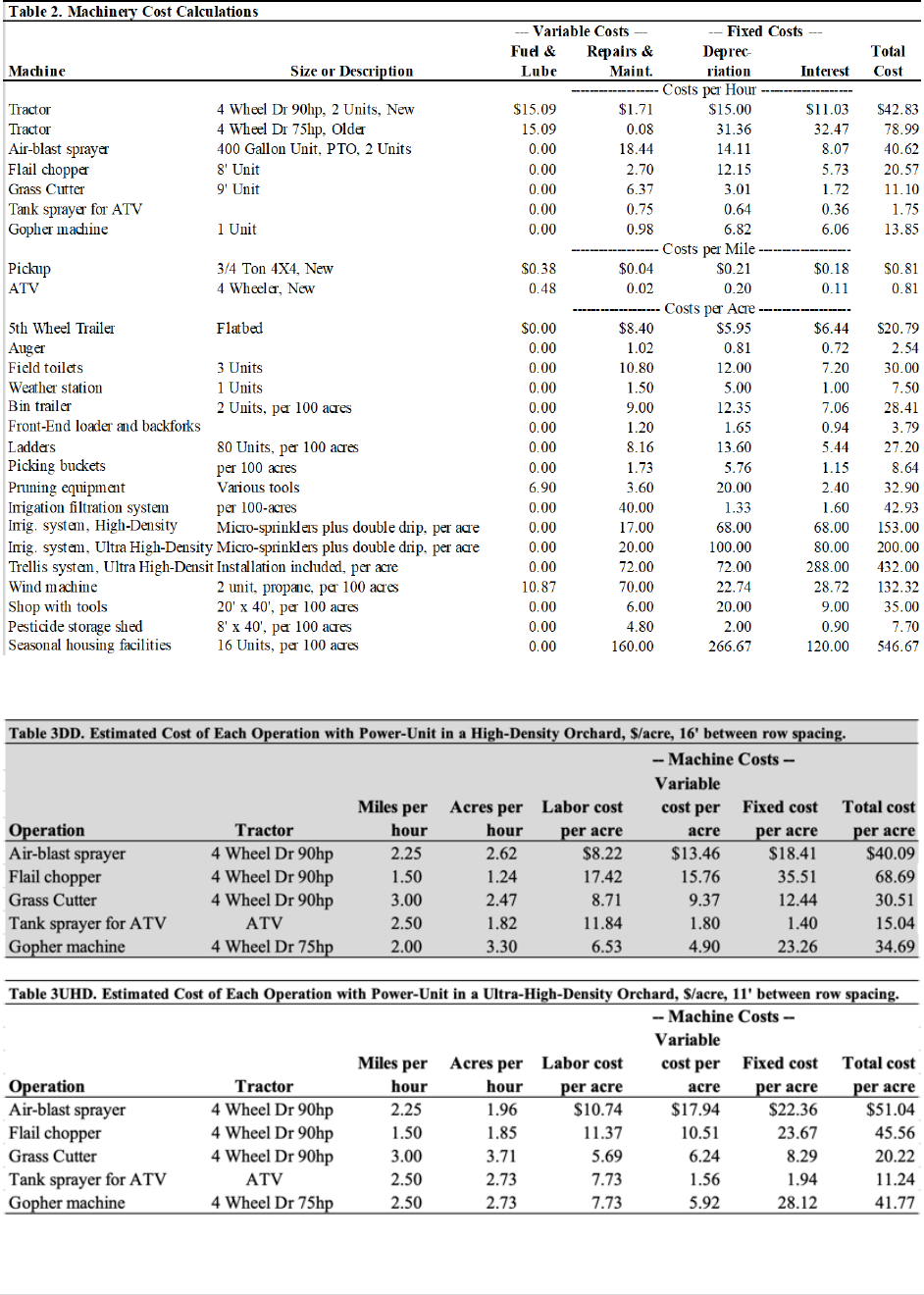

6. Machinery and equipment. The

machinery and equipment reflect the

typical machinery complement of a 100-

*Ashley Thompson, Extension Horticulturalist,

Wasco and Hood River counties, Department of

Horticulture, Clark Seavert, Professor Emeritus,

Department of Applied Economics, and Lynn

Long, Professor Emeritus, Department of

Horticulture, all at Oregon State University.

| P a g e

2

acre farm in Wasco County (Appendix A,

Tables 1 and 2, pages 12 and 13). A 90-

hp tractor is used to pull an air-blast

sprayer, flail chopper, grass cutter, and

assist during harvest. A 75-hp tractor is

used to harvest. An ATV is equipped

with a tank sprayer for weed control.

7. Fuel. Gasoline, diesel, and propane costs

are $4.00, $4.00, and $2.25 per gallon.

8. Interest. The interest rate on operating

funds is eight percent, treated as a cash

expense. One-half of the cash expenses

are borrowed for six months.

9. Machinery, labor housing, and land are

owned and assessed at an eight, three,

and four percent interest rate,

respectively, and treated as a fixed non-

cash opportunity cost to the owner.

10. The operator funded the establishment

costs of this orchard at a charge of six

percent interest and treated it as a fixed

non-cash opportunity cost.

11. Chemicals. Herbicides used for strip

maintenance are applied to 30 percent of

each acre.

12. Housing. Seasonal labor facilities

provided by the owner cost $800,000.

Sixteen five-person units are required for

this size of operation. A charge of $0.02

per pound of harvested cherries is

assessed for picker camp maintenance

during harvest.

13. Irrigation systems. A micro-sprinkler

plus double-drip irrigation system is used

in both the high-density and ultra-high-

density orchard systems at an estimated

cost of $1,700 and $2,000 per acre,

respectively.

14. Frost control. Two wind machines are

valued at $35,000 each.

15. Shop and tools. A shop building with

equipment and tools is valued at $60,000.

16. Replacement cost calculations.

Replacement costs for irrigation systems,

wind machines, housing, buildings, and

trellis system are calculated using the

straight-line method of depreciation

((purchase price - salvage value) ÷ total

acres, if the purchase price is not on an

acre basis).

17. Interest calculations. Interest charges

for irrigation systems, wind machines,

housing, buildings, and trellis system are

calculated using the average value of the

system multiplied by an interest rate

((((purchase price + salvage value) ÷ 2) x

interest rate) ÷ total acres, if the purchase

price is not on an acre basis).

18. Repairs and maintenance calculations.

Repair and maintenance for irrigation

systems, wind machines, buildings, and

trellis system costs are calculated using

one percent of the per acre purchase price

per year. Housing is two percent of the

purchase price.

19. Fixed costs. Fixed cost input

assumptions are listed in Appendix B,

Table 5, page 15.

20. Omitted from this study. Not included

in this study is a return to management,

owner labor, family living withdrawals,

an accounting for all regulatory costs,

annual price and yield volatility, price

inflation, and local, state, and federal

income taxes paid by the owner.

High-Density Orchard Assumptions

21. Orchard description. This orchard is

planted to a spacing of 10' x 16' (340

cherry trees per acre), with 11 percent

pollinizer trees.

22. The productive life of this orchard is 25

years once full production of 14,000

pounds of field-run cherries per acre is

reached.

23. Trees in this system are trained to a

central leader system.

24. Sweet cherry yields. Commercial yields

begin in year 3, and full production is

reached five years after planting with

1,000, 5,000, 10,000, and 14,000 pounds

per acre, respectively.

| P a g e

3

25. Machine costs per acre. Appendix A,

Table 3HD, page 13, lists the estimated

costs per acre for each machine operation

with an 16' tree row spacing.

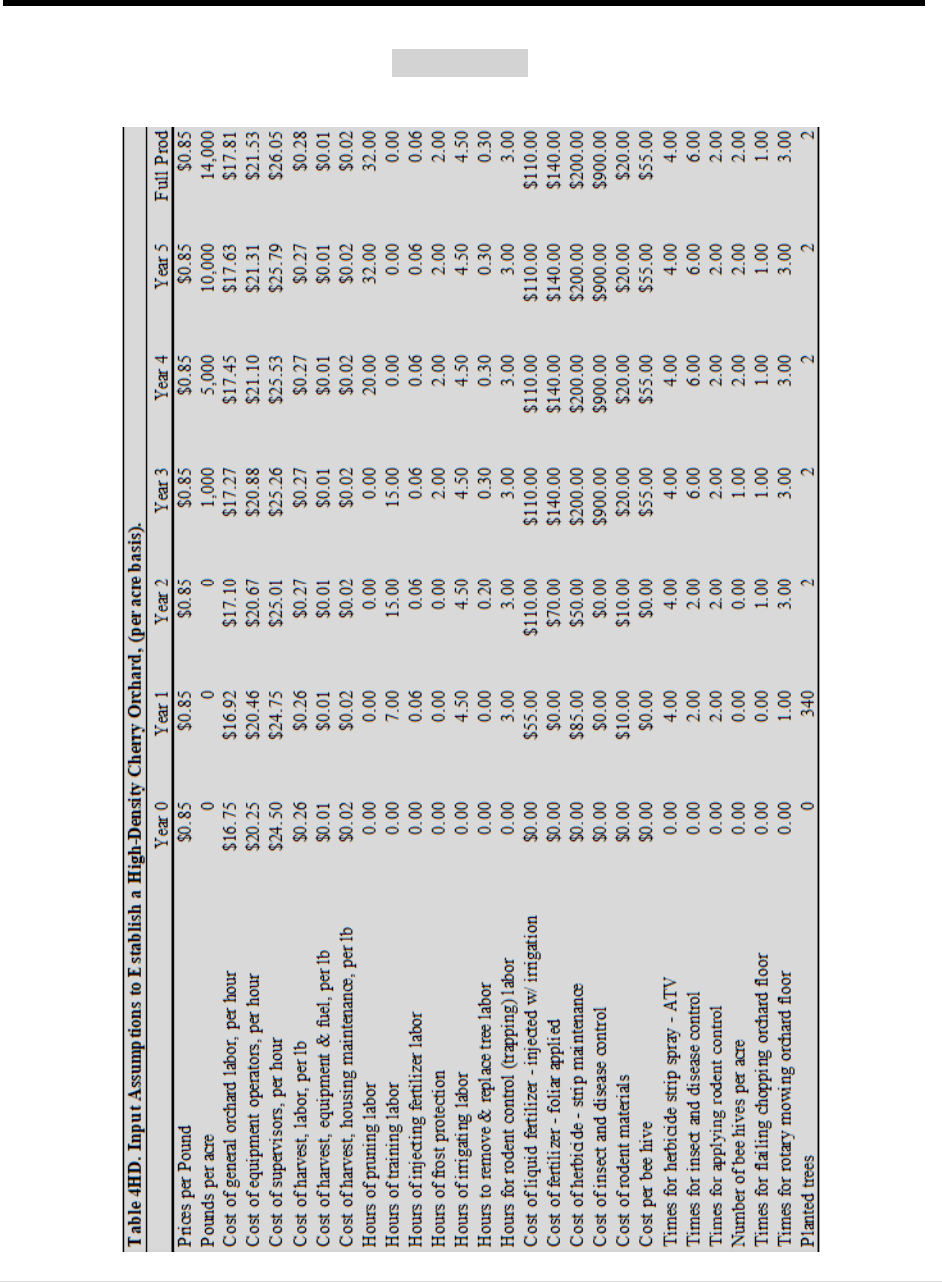

26. Other assumptions. Other assumptions

for variable, cash fixed, and non-cash

fixed costs are listed in Appendix B,

Table 4HD, page 14.

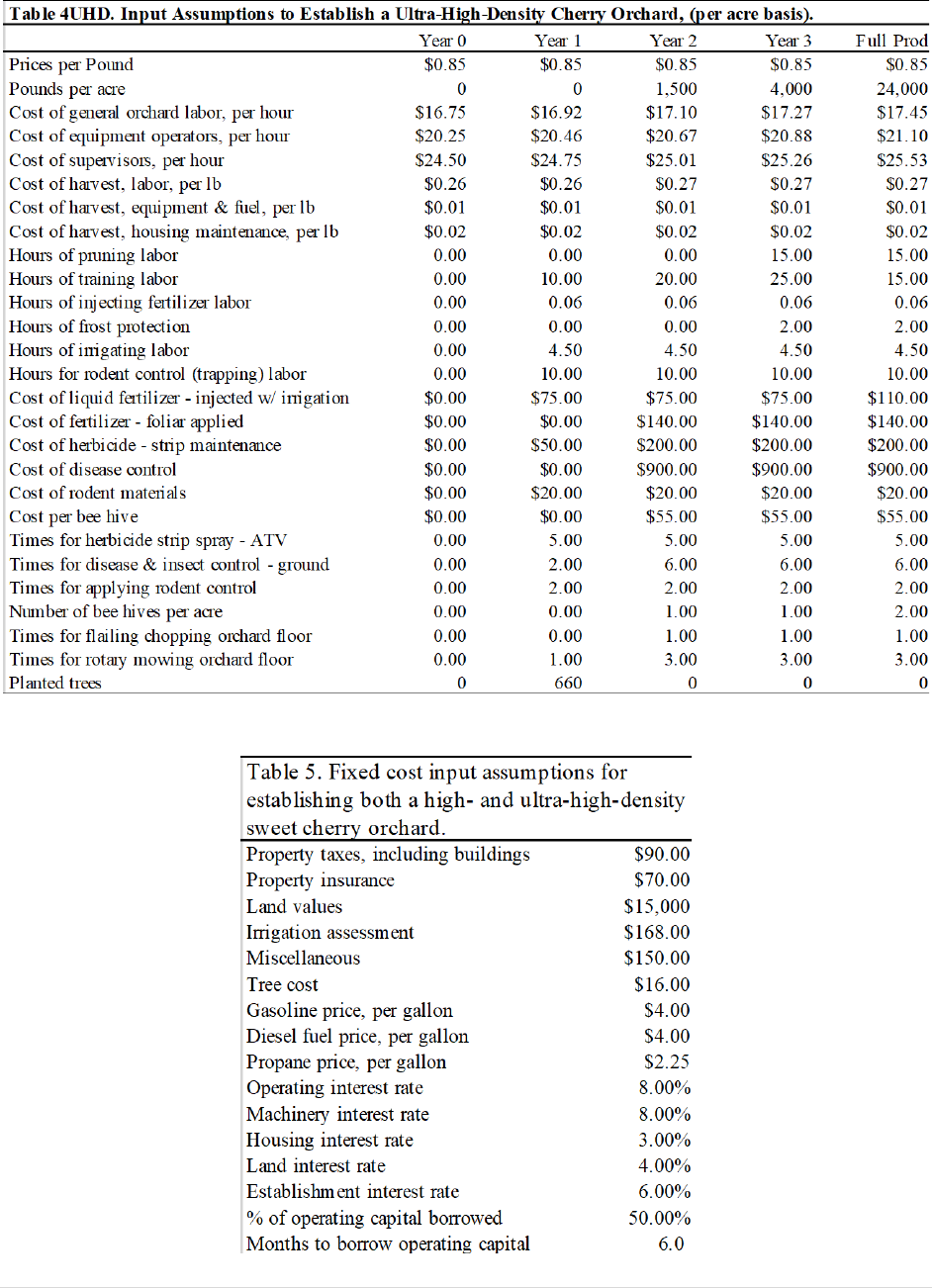

Ultra-High-Density Orchard

Assumptions

27. Orchard description. This orchard is

planted to a spacing of 6' x 11' (660

cherry trees per acre), with 11 percent

cherries as pollinizers.

28. The productive life of this orchard is 20

years once full production of 24,000

pounds of field-run cherries per acre is

reached.

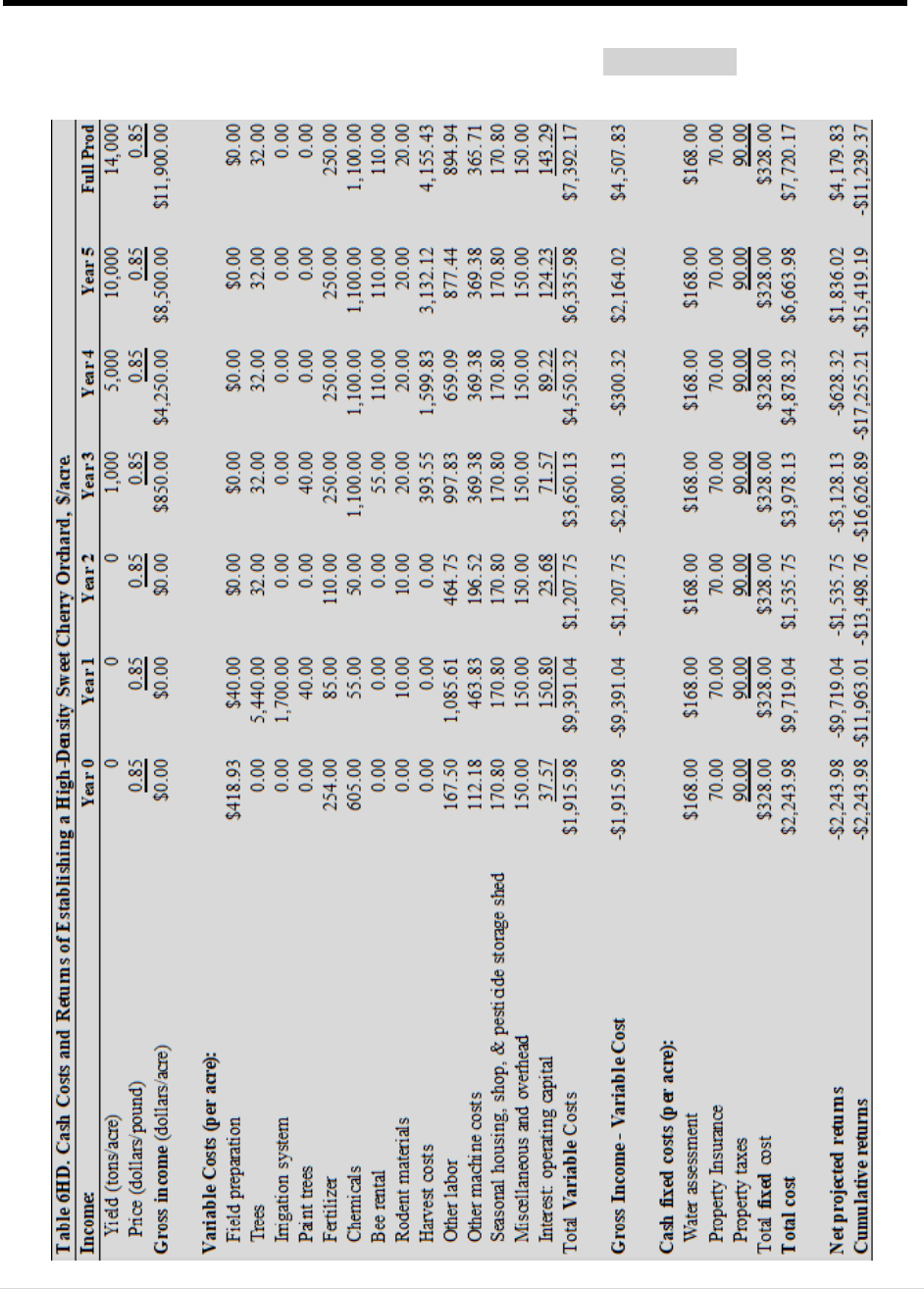

Results of establishing a high-

density cherry orchard

Cash flow analysis

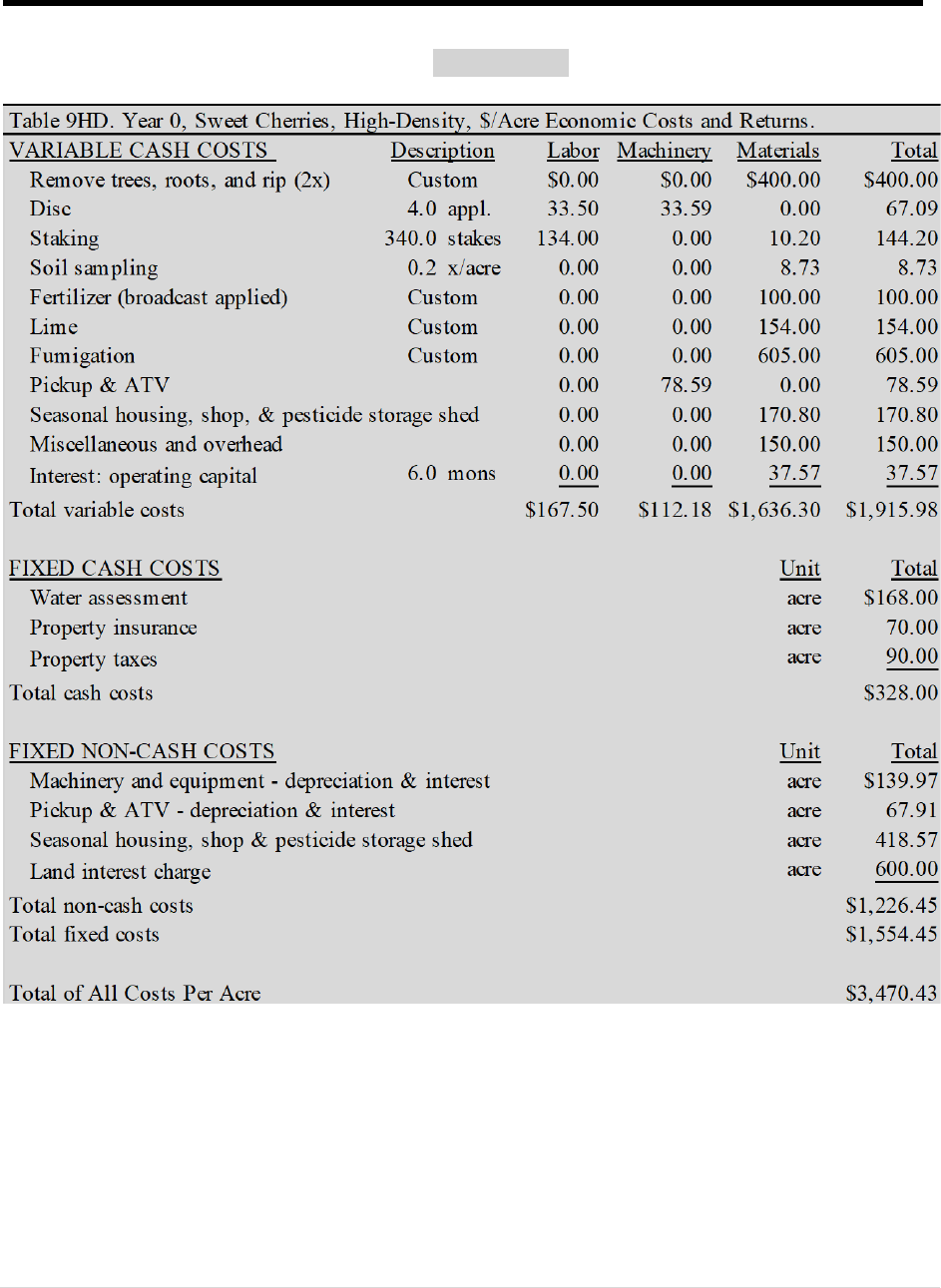

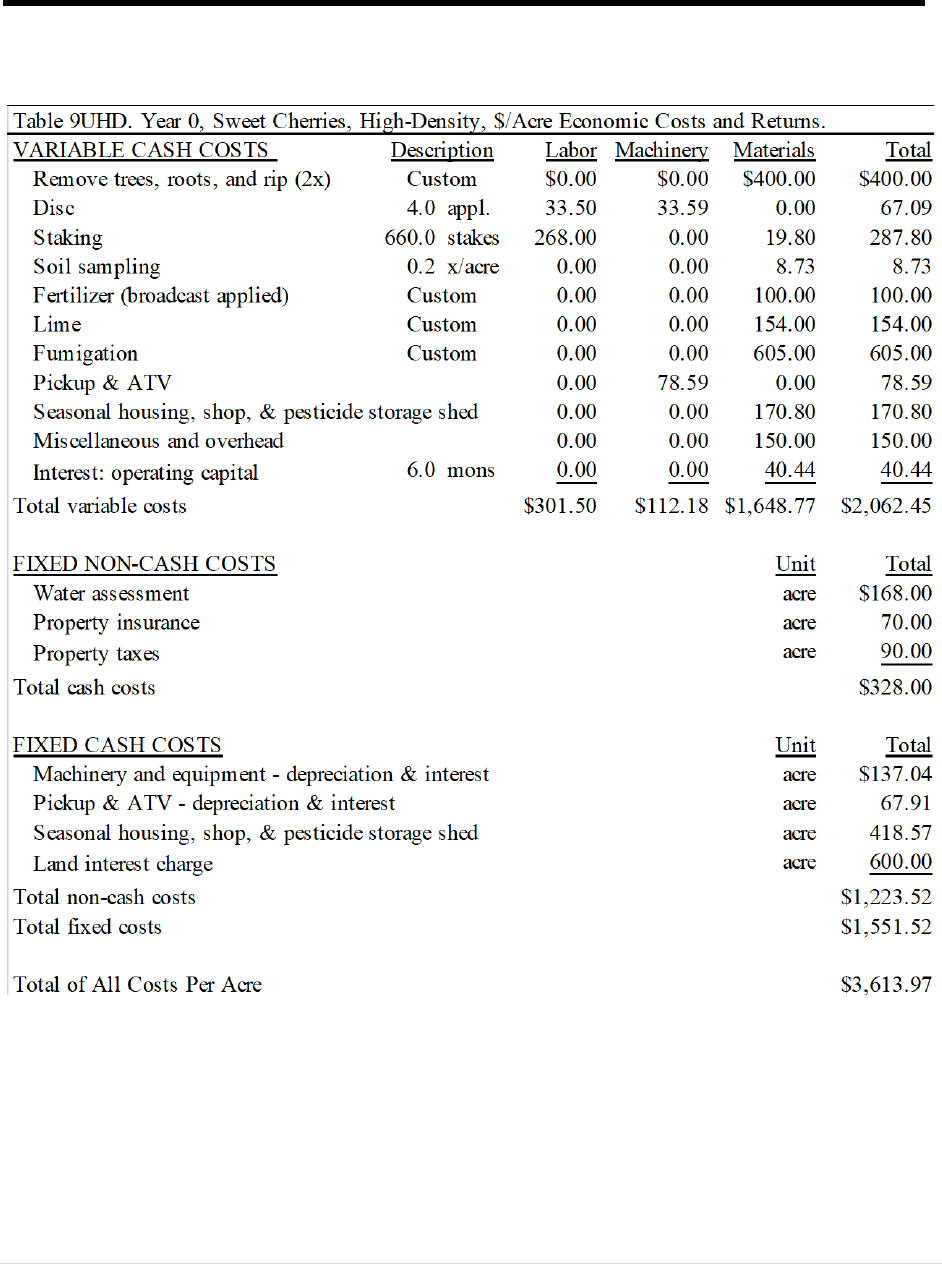

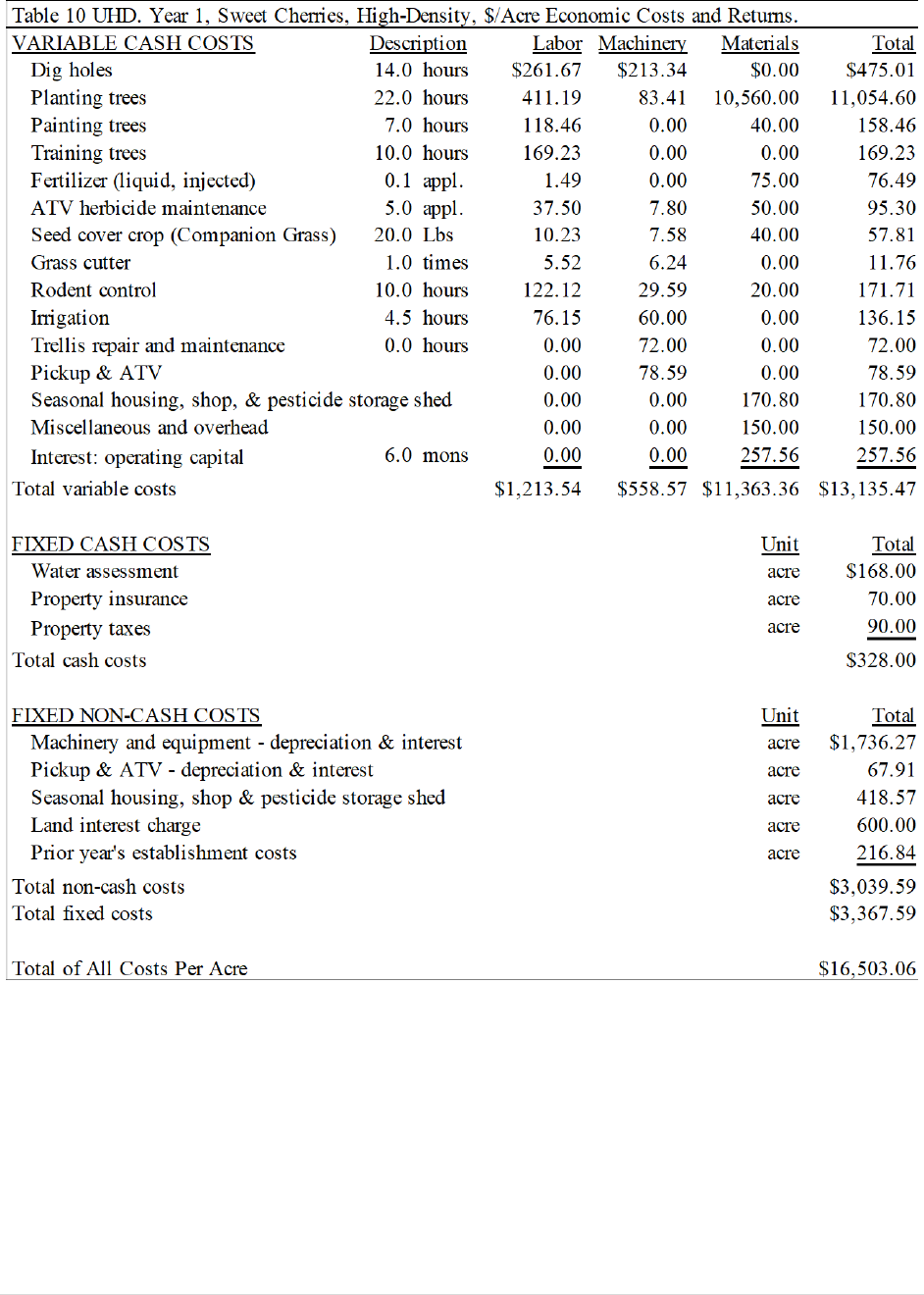

A cash flow analysis for establishing a

high-density cherry orchard is presented in

Appendix C, Table 6HD, page 16. It shows

the cash costs required to develop this type

of orchard. Cash costs include labor, trees,

irrigation system, fertilizer, chemicals,

beehives, machinery repairs, fuel, lube and

oil, labor housing repairs and maintenance,

operating (short-term) interest, machinery

and whole-farm insurance, irrigation water

assessments, and property taxes. The

income, variable costs, and cash fixed costs

are shown for each of the six establishment

years plus the first full production year.

Total variable costs are $1,916 in year 0,

with an additional $328 of cash fixed costs

for a total cash cost of $2,244 per acre. In

year 0, the old orchard trees are removed,

and the ground is prepared for planting

29. Trees in this system are trained to a

spindle system on to a trellis

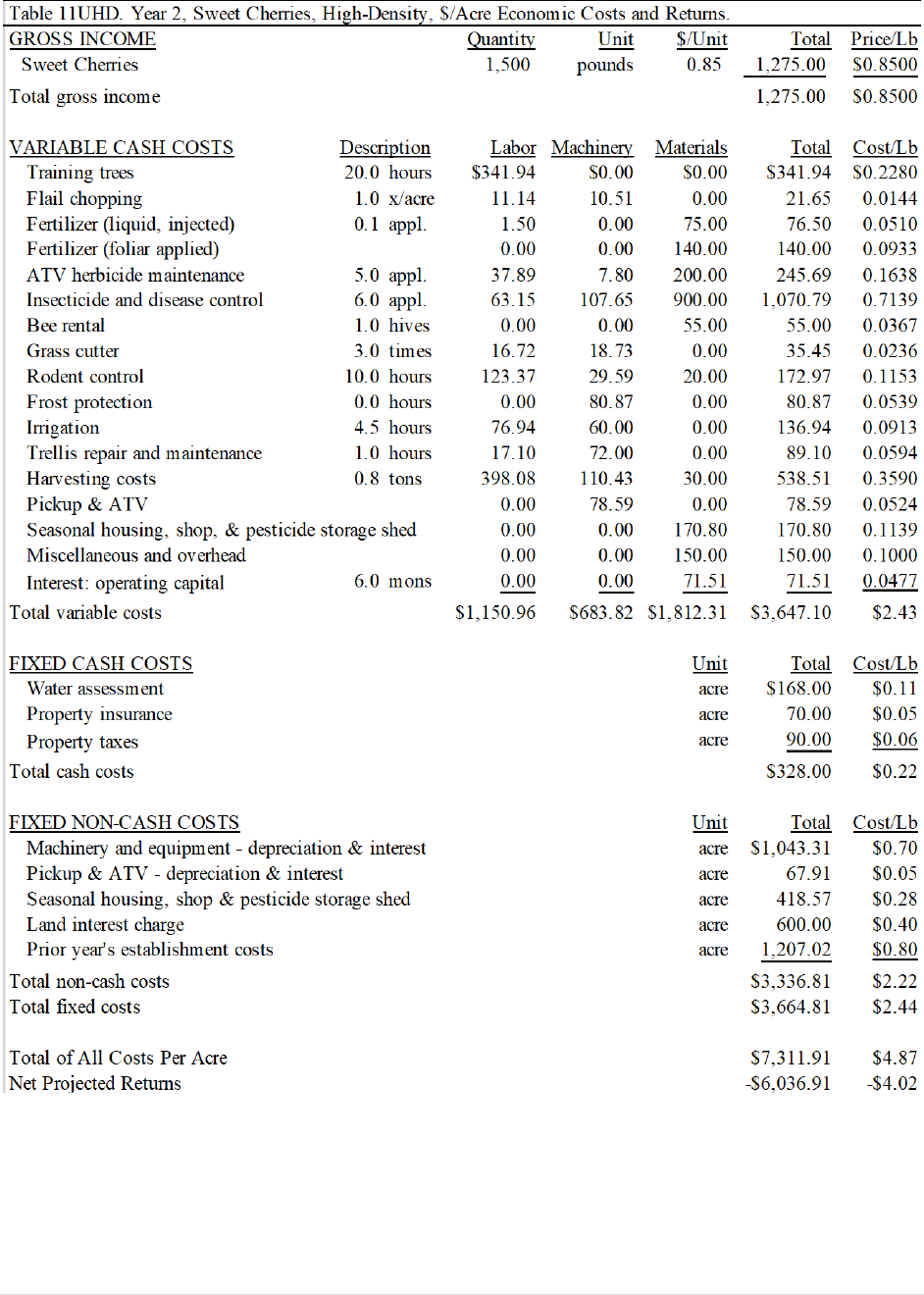

30. Sweet cherry yields. Commercial yields

begin in year 2, and full production is

reached three years after planting with

1,500, 4,000, and 24,000 pounds per acre,

respectively.

31. Trellis system. The trellis system costs

$7,200 per acre installed.

32. Machine costs per acre. Appendix A,

Table 3UHD, page 13 lists the estimated

costs per acre for each machine operation

with a 11' tree row spacing.

33. Other assumptions. Other assumptions

for variable, cash fixed, and non-cash

fixed costs are listed in Appendix B,

Table 4UHD, page 15.

young trees the following year.

A positive cash flow begins in year 5 with

gross income exceeding total cash costs by

$1,836 per acre. However, the orchard does

not return a sufficient gross income to pay

all previous years’ cash costs at full

production. There is $11,289 per acre of

cumulative cash flows remaining over and

above prior expenses.

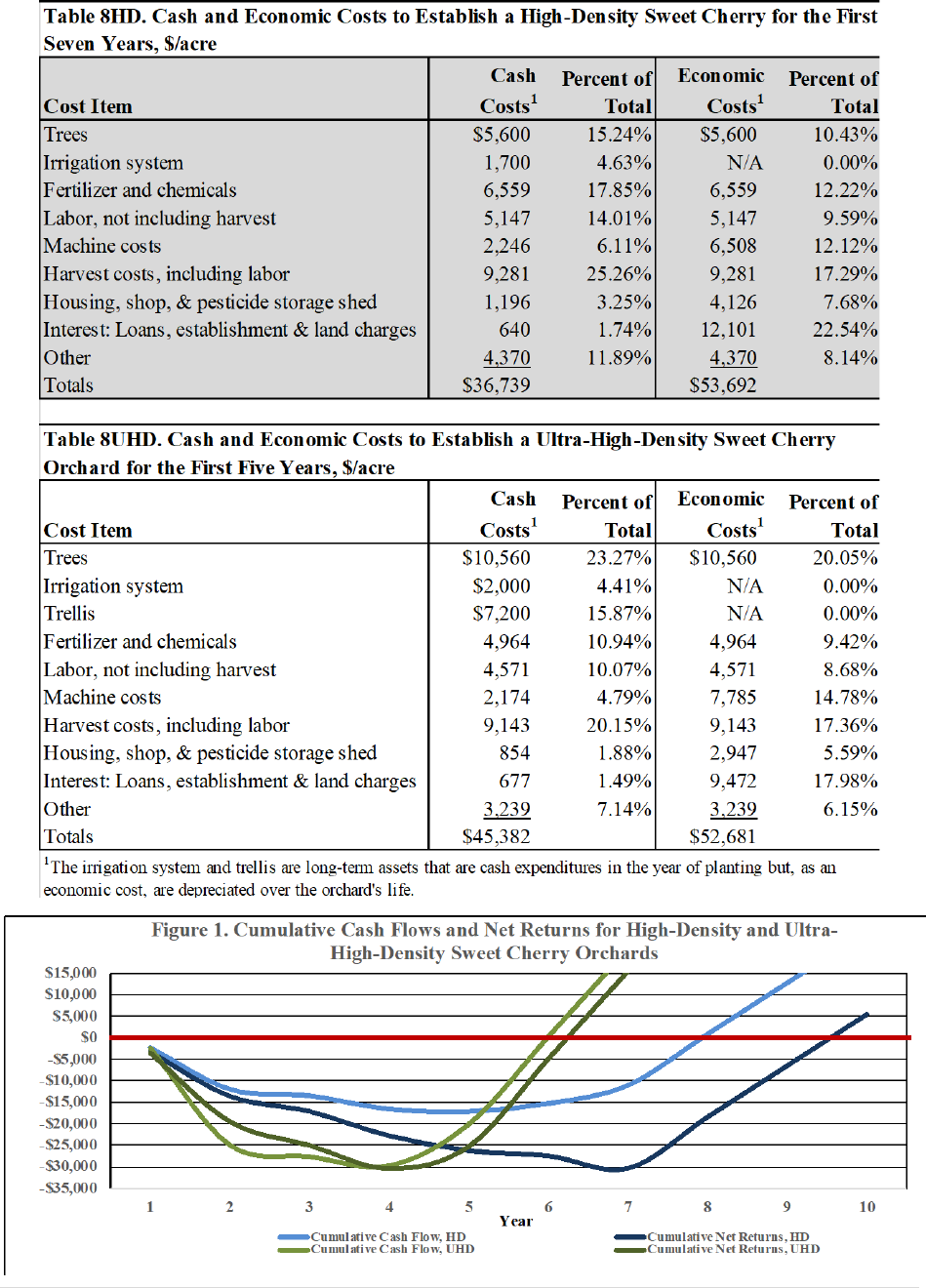

The major cost components to total cash

costs are shown in Table 8HD, page 20.

Harvest costs represents 25 percent of the

total cash costs to establish this orchard.

Fertilizer and chemicals are the second-

largest item, making up 18 percent of the

total cash costs. Trees and labor, not

including harvest labor, is 15 and 14

percent, respectively, of the cash costs. The

remaining four items comprise about 28

percent of the total cash costs.

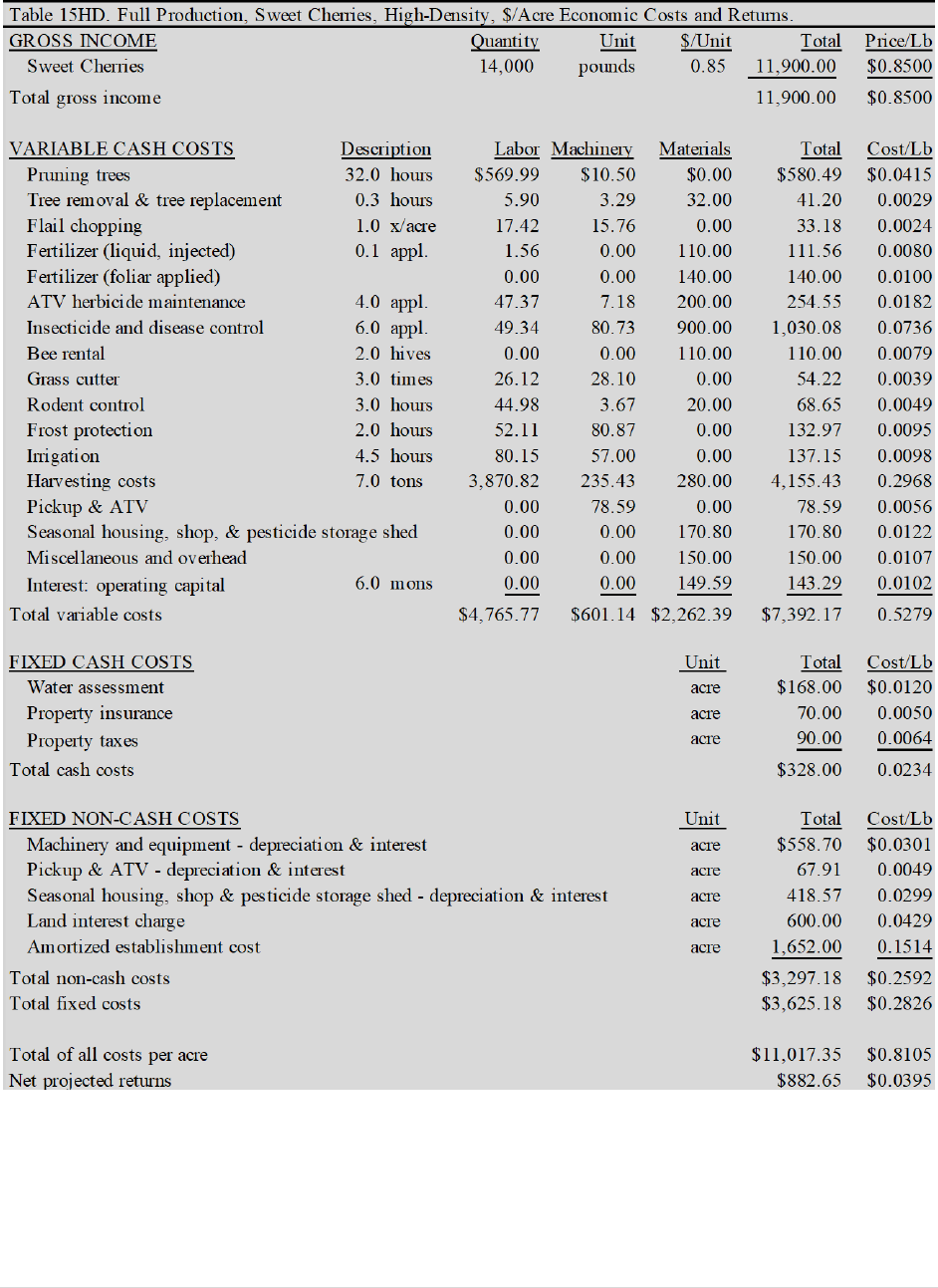

Economic costs and returns

The economic costs and returns for

establishing a high-density cherry orchard

are shown in Appendix C, Table 7HD, page

17. Economic costs include all cash out-of-

| P a g e

4

pocket and ownership costs, which consist

of a combination of principal and interest

payments and a return on investment to the

grower, or both, for machinery, housing,

land, and funds to pay previous years’

establishment costs. The gross income and

variable cash costs remain the same as in

Table 6HD, except the irrigation system are

amortized over their productive life and

included in fixed costs.

Net projected returns (gross income

minus total costs) become positive at full

production, with gross income exceeding

total costs of $415 per acre. At the end of

the establishment period, $27,723 per acre

remains to repay all previous establishment

costs. This cost is amortized over 25 years

as an annual payment of $1,652 per acre,

including principal and interest, to recover

the capital investment of establishing the

orchard.

The major cost components as a percent

of total economic cost are shown in Table

8HD, page 20. When all expenses are

Results of establishing a Ultra-high-

density cherry orchard

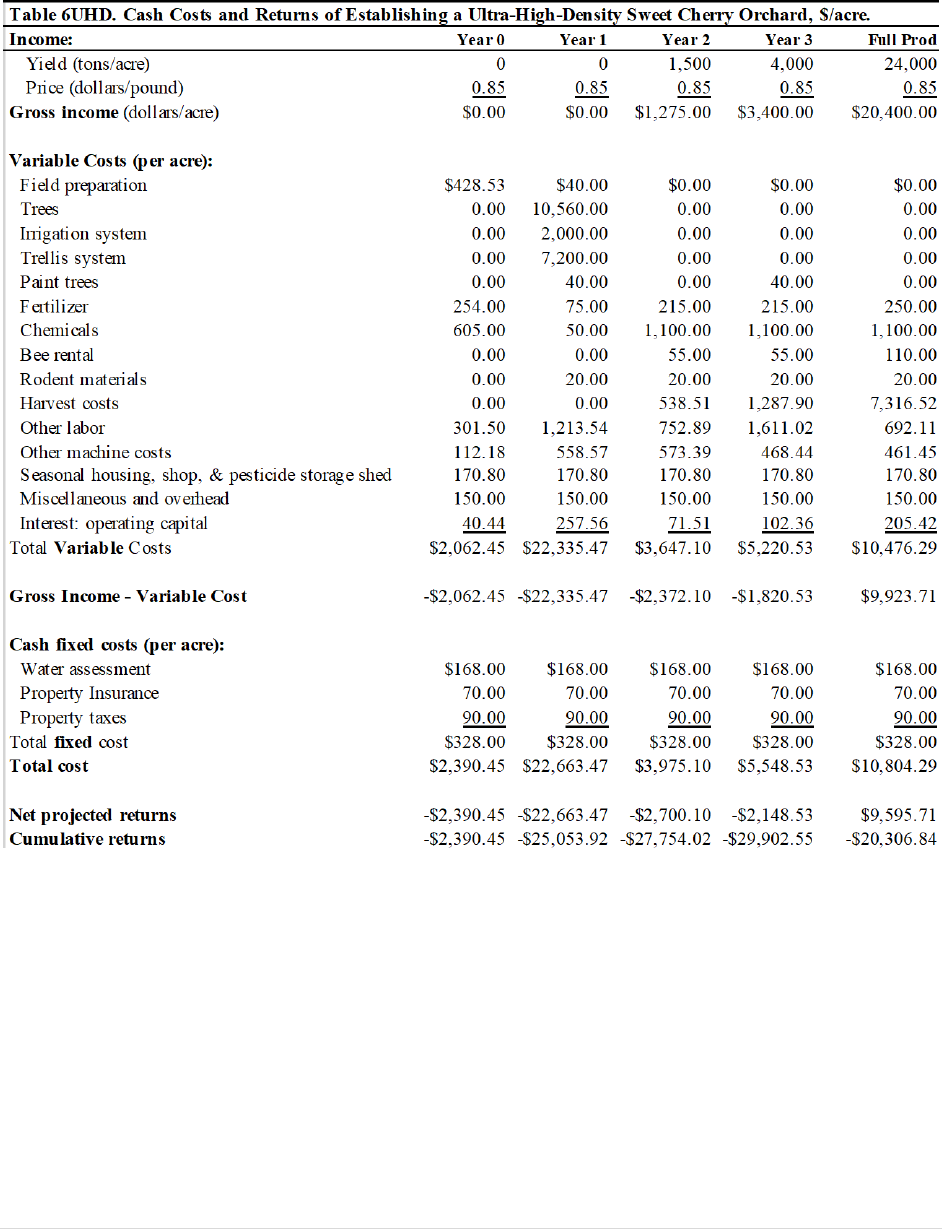

Cash flow analysis

A cash flow analysis for establishing an

ultra-high-density cherry orchard is

presented in Appendix C, Table 6UHD,

page 18. It shows the cash costs required to

develop this type of orchard. Cash costs

include labor, trees, irrigation system, trellis,

fertilizer, chemicals, beehives, machinery

repairs, fuel, lube and oil, labor housing

repairs and maintenance, operating (short-

term) interest, machinery and whole-farm

insurance, irrigation water assessments, and

property taxes. The income, variable costs,

and cash fixed costs are shown for each of

the four establishment years plus the first

full production year. Total variable costs are

$2,062 in year 0, with an additional $328 of

included, the top two items are charges and

harvest costs at about 23 and 18 percent,

respectively. Fertilizer and chemicals, trees,

and machine costs follow at 13, 11, and 10

percent, respectively. The remaining four

cost items comprise about 25 percent of the

total economic costs.

Summary of establishing a high-density

orchard

Figure 1, page 20, shows the cumulative

cash flow and economic costs of

establishing a high-density orchard. The

light and darker blue lines denote these

results. The cumulative cash flow turns

positive by $661 in year 8, and the

cumulative economic returns by $7,508 in

year 10. Appendix D, Tables 9HD-15HD,

pages 21-27, contains the annual cost and

return budgets for establishing this high-

density orchard.

cash fixed costs for a total cash cost of

$2,390 per acre. As in the high-density

system, in year 0, the old orchard trees are

removed, and the ground is prepared for

planting young trees the following year.

A positive cash flow begins at full

production with gross income exceeding

total cash costs by $9,596 per acre.

However, the orchard does not return a

sufficient gross income to pay all previous

years’ cash costs; there is $20,306 per acre

remaining over and above prior expenses.

The major cost components to total cash

costs are shown in Table 8UHD, page 20.

Tree costs represents 23 percent of the total

cash costs to establish this orchard. Harvest

costs are the second-largest item, making up

20 percent of the total cash costs. The trellis

system, fertilizer and chemicals, and all

labor, not including harvest labor, is 16, 11,

| P a g e

5

and 10 percent, respectively. The remaining

five items comprise about 20 percent of the

total economic costs.

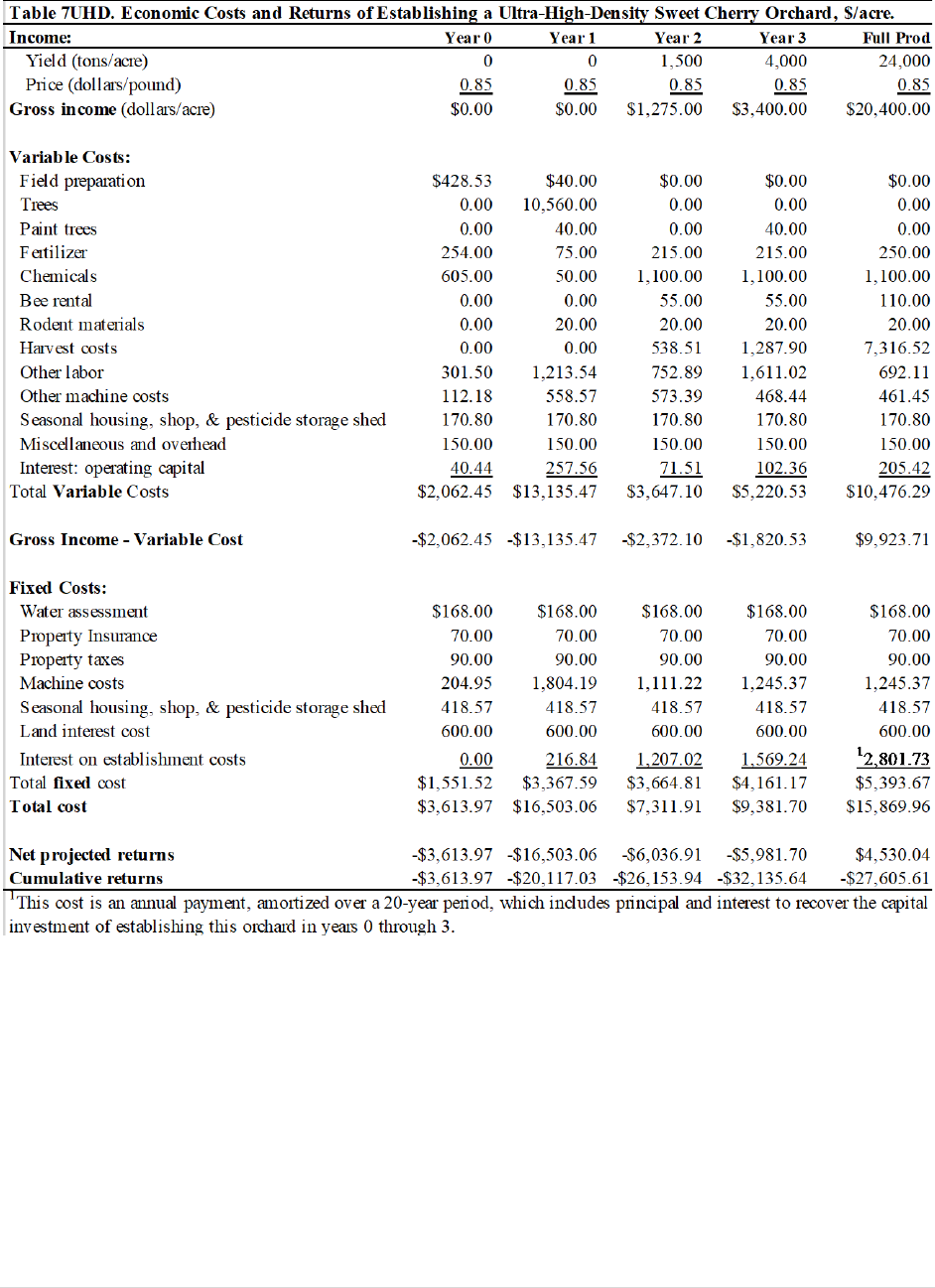

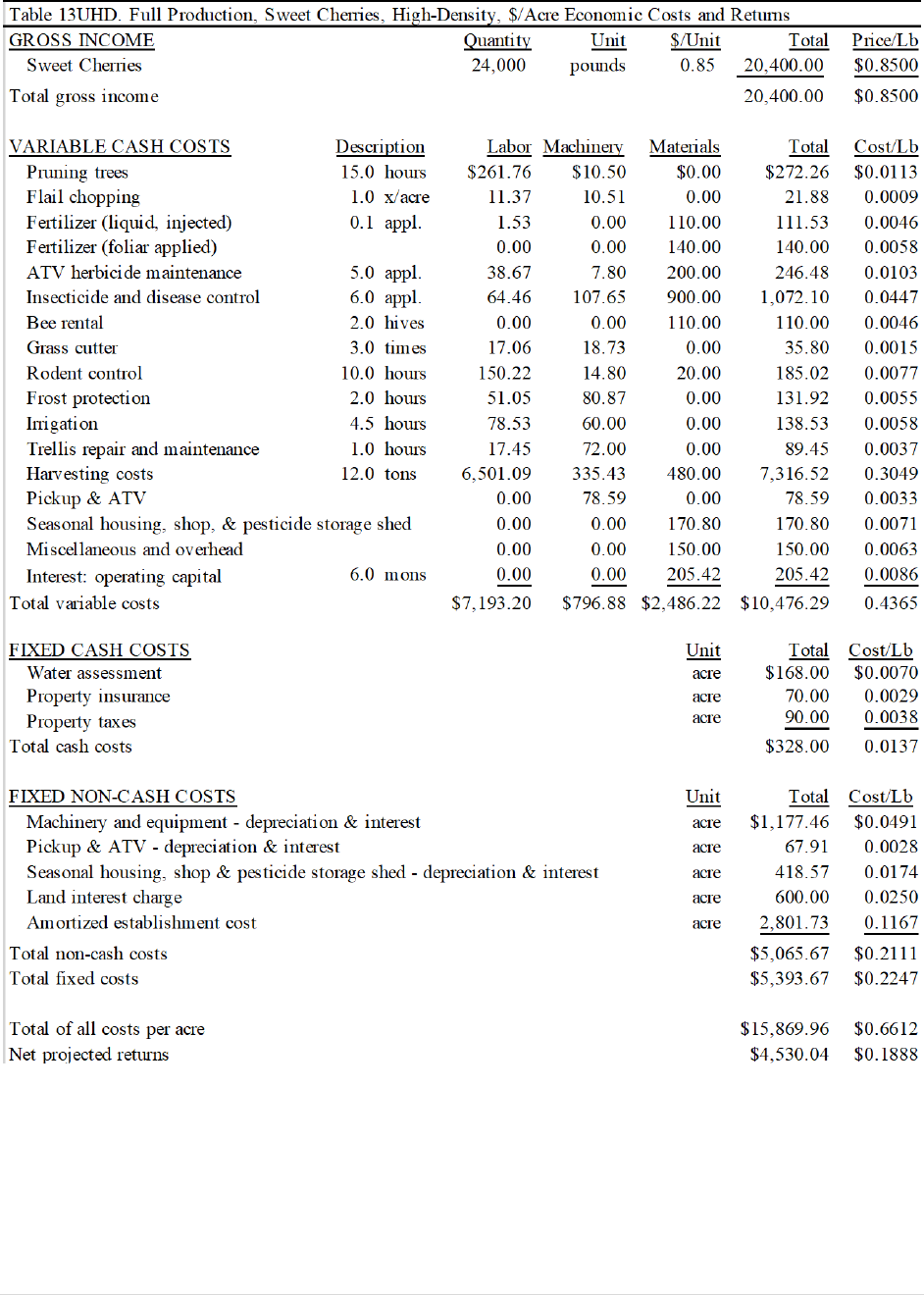

Economic costs and returns

The economic costs and returns for

establishing an ultra-high-density cherry

orchard are shown in Appendix C, Table

7UHD, page 19. Economic costs include all

cash out-of-pocket and ownership costs,

which consist of a combination of principal

and interest payments and a return on

investment, or both, to the grower for

machinery, housing, land, and funds to pay

previous years’ establishment costs. The

gross income and variable cash costs remain

the same as in Table 6UHD, except the

irrigation system and trellis are amortized

over their productive life and included in

fixed costs.

Net projected returns (gross income

minus total costs) become positive at full

production, with gross income exceeding

total costs of $4,530 per acre. At the end of

the establishment period, $27,606 per acre

remains to repay all previous establishment

costs. This cost is amortized over 20 years

as an annual payment of $2,802 per acre,

including principal and interest, to recover

the capital investment of establishing the

orchard.

The major cost components as a percent

of total economic cost are shown in Table

8HD, page 20. When all expenses are

included, the top item is trees at 20 percent

of the total economic costs. Next, interest

charges and harvest costs are 18 and 17

percent, followed by machine costs and

fertilizer and chemical costs at 15 and 9

percent, respectively. The remaining four

cost items comprise about 21 percent of the

total economic costs.

Summary of establishing an ultra-high-

density orchard

Figure 1, page 20, shows the cumulative

cash flow and net returns of establishing a

ultra-high-density orchard. The light and

darker green lines denote these results. The

cumulative cash flow turns positive by $93

in year 6, and the cumulative economic

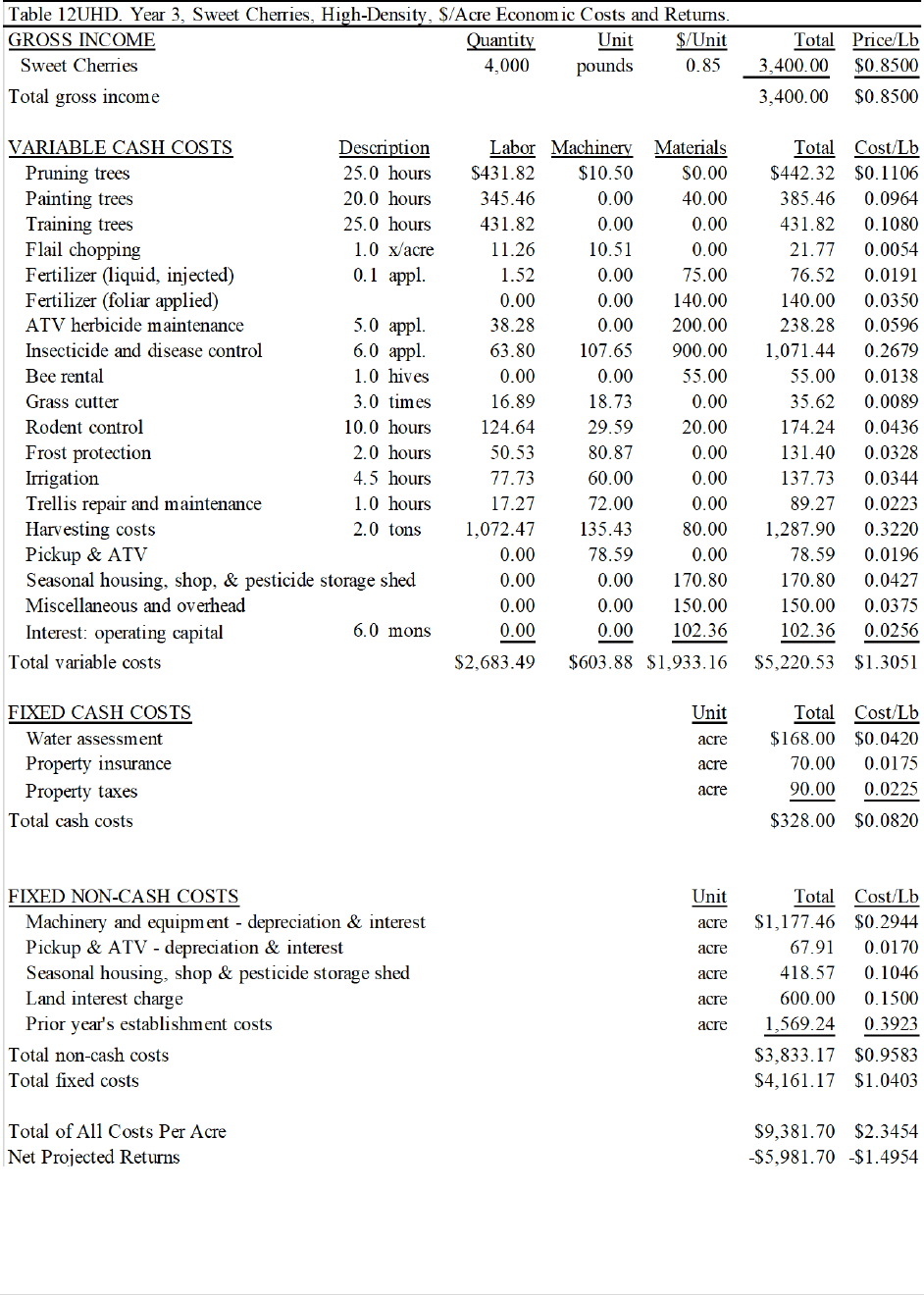

returns by $13,194 in year 7. Appendix E,

Tables 9UHD-13UHD, pages 28-32, contain

the annual cost and return budgets for

establishing this ultra-high-density sweet

cherry orchard.

Conclusion

Historically, growers in Wasco County

renew orchards when production levels no

longer cover the cash variable costs of

producing cherries. However, as higher

density systems have been proven

economically in the area, interest in

replacing old trees with modern, higher-

density cherry orchards has increased.

Ultra-high-density orchards can offer

higher net returns with higher yields that are

obtained earlier in the life of the investment.

The trade-off, however, is a higher risk due

to more considerable up-front costs and

higher management requirements.

There are two key concepts to consider

when planting an orchard: profitability and

financial feasibility. Profitability determines

if future revenues exceed expenses based on

the time value of money. Financial

feasibility establishes whether the grower

has the equity or can borrow funds for the

investment. The following are economic

theory and financial concepts, focusing on

the outcomes of this study, that growers

should find valuable in determining

management strategies for long-term

business success.

6 | Page

Profit Maximization Theory and

Measuring Profitability

There are three critical factors to

maximizing profits when planting and

establishing tree fruit crops. They are in

order of importance:

1. fruit prices received.

2. yields, not only how much is produced

annually but, more importantly, early

yields in the life of an establishment

period, and

3. establishment costs.

What is often misunderstood is that there

is an absolute either/or trade-off to

maximize profits. This misunderstanding

results in growers concluding that the only

way to increase profits is to avoid or cut

costs. There are two flaws to this reasoning.

First, it may be necessary to increase

operating expenses to increase profits in

some situations. This is possible if these

increases in input costs result in an increase

in revenues. The second flaw in this cost-

minimizing "penny-wise, pound-foolish"

mental trap relates to attitudes about risks.

Spending money on more costly inputs may

increase perceived and/or actual risks.

Hence, many producers are good at

minimizing costs but cannot maximize

profits because they are not investing in

technology, genetics, quality products, or

scale (expansion). It is logical for producers

to be risk-averse. Still, if done in excess, it

can impede the adoption of much-needed

investments. The farm operation will not be

able to compete with other producers who

make the investments and associated

changes. Therefore, risk aversion may create

more risk than otherwise would be. This can

lead growers to focus on avoiding or

reducing expenses when they should be

seeking profit-maximizing strategies by

investing dollars in:

1. growing high, quality fruit.

2. technologies that achieve early and

higher yields.

3. techniques that result in increased

efficiencies.

Economic theory suggests that dollars be

invested if marginal revenues exceed

marginal costs. A few examples would be

investing in the following if the producer

applies the profit maximization theory:

1. higher quality nursery stock.

2. support systems.

3. additional detailed pruning.

4. precision irrigation systems.

As the adage goes, sometimes it takes

money to make money!

Another mental trap is thinking only

about ongoing costs and concluding that all

is well if profits are defined as gross income

minus operating expenses. But this

reasoning does not consider the profitability

of the orchard. As with most perennial crop

investments, there are both up-front

investments and ongoing costs. The

financial metric of net present value captures

an investment's total up-front investments

and stream of future net cash flows to

measure profitability. While profit is an

absolute measure of a positive gain from an

investment, profitability is the profit relative

to the size of the investment. For example,

compare two investments when both earn

$1,000 in profits. One of these investments

was for $10,000, and the other was for

$100,000. The $10,000 investment had

better profitability, even though both

investments generated equal profits.

Profitability measures the efficiency of the

investment to generate profit, as in an

internal rate of return. Unlike profit,

profitability is a relative measure of the rate

of return expected on investments, or the

size of the return, compared to what could

have been obtained from an alternative

investment (opportunity cost). Therefore,

projections could indicate that a new

planting may generate a net profit, but not

necessarily provide long-term profitability

7 | Page

when considering the opportunity cost of the

capital invested.

Addition through Subtraction

It is not uncommon for growers to

remove and plant trees based on available

annual cash flows, which runs counter to

determining replacement based on the

economic life of an orchard. This renewal

strategy can lead to many unproductive

orchards, which creates a challenge for the

farm to survive in the long run.

There is a two-prong approach when

evaluating orchards and renewal: addition

through subtraction and applying financial

management principles to existing resources

to fund more planted acres. The addition

through subtraction concept suggests

removing orchards when revenues do not

exceed cash variable costs, which could

result in several acres without fruit trees.

However, this strategy allows growers to

allocate resources to the more productive

orchards, applying the profit maximization

theory described above. Many times, this

allocation of resources can increase overall

net farm income.

The other strategy is to analyze the

business's financial strength and set limits to

key financial ratios and performance

measures to determine the funds available to

invest in more acres of fruit trees. Over the

long run, this strategy will create

opportunities to replace orchards sooner,

resulting in a higher orchard renewal rate by

increasing net farm incomes.

Takeaways from this study

Cherry growers understand the risks

involved in farming tree fruits, recognizing

most times, they could make more money in

alternative investments of similar risk and

receiving a much higher return on their

investment. The high capital investments in

both orchard systems in this study may

explain the low removal rates of cherry

orchards.

One reason why these systems are so

profitable is they do follow the three critical

factors to successful orchard renewal

discussed earlier due to:

1. planting varieties that provide a

premium price to the grower.

2. planting variety, rootstock, and

training system combinations that

obtain early and higher yields.

3. integrating technologies and

techniques that create efficiencies in

the production system.

A criticism of university cost studies is

they do not include all the regulatory costs

incurred by growers. Although we recognize

these additional costs exist, it is challenging

to itemize them due to the diversity of

growing crops, hiring labor, and providing

housing or not. Another criticism is these

studies do not reflect a specific grower's

costs for their farm. In addition, they include

too many economic costs and assumptions

that some growers do not have. The

following section will discuss how growers

can use the AgBiz Logic decision tool to

modify the information from this study as

their own.

Using AgBizLogic™ to Analyze Different

Price and Yield Scenarios

Different price and yield scenarios can

give growers a greater appreciation of the

financial risk involved in orchard

establishment or renewal. In addition,

numerous factors and unforeseen events

(e.g., damage from a freeze, rain, hail,

changes in market conditions) can impact

yield and price, which are ignored in this

study.

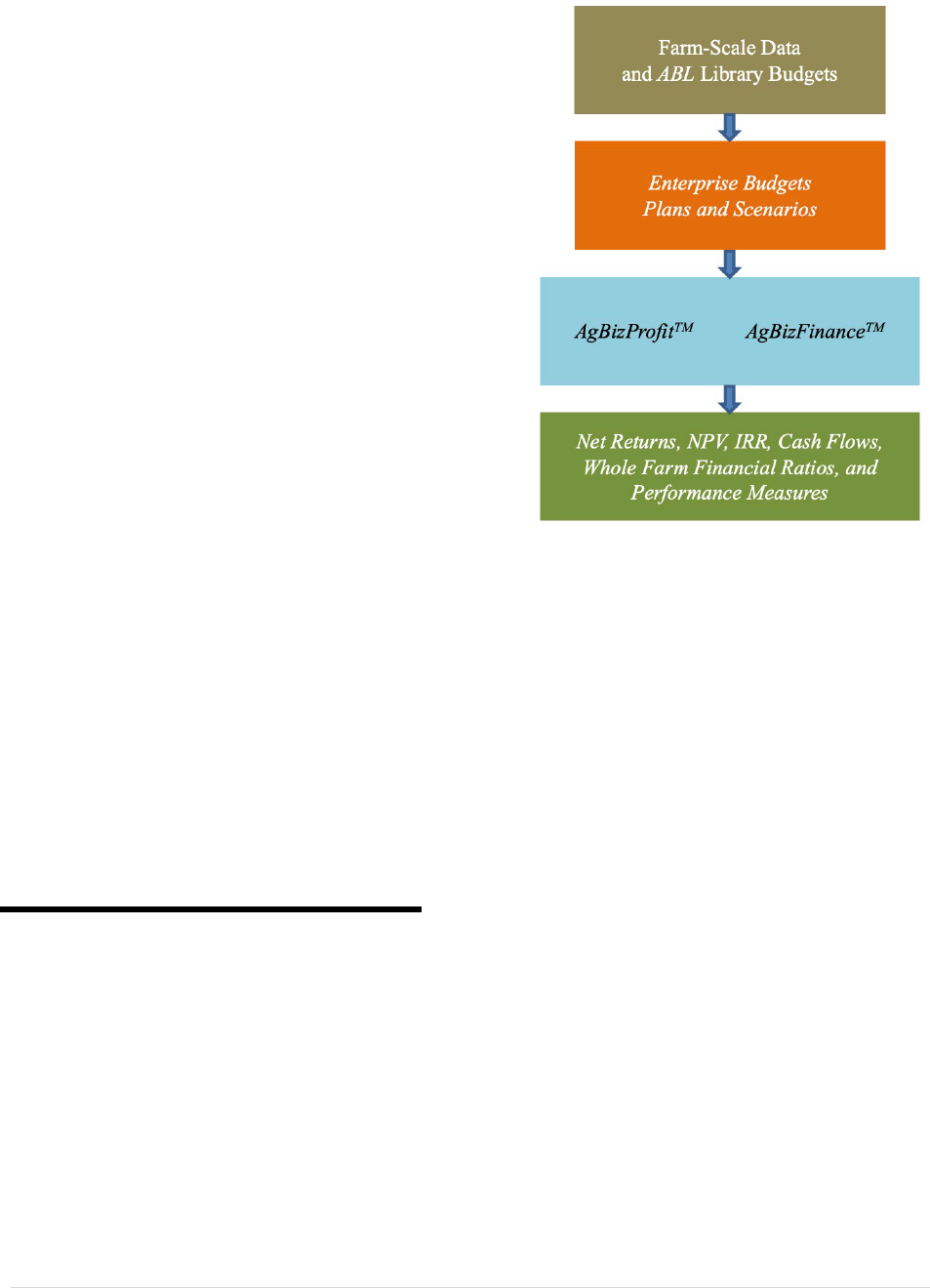

AgBiz Logic

TM

(ABL) is an online

decision tool that considers economic and

financial factors when analyzing

investments. The following schematic shows

the data flow and results from the ABL

decision tool. Grower farm-level data is

collected from the tax form Schedule F

(Form1040) to generate enterprise budgets.

8 | Page

In addition, enterprise budgets from

universities, industry and USDA-ERS are

stored in the ABL Library for grower use

when returns and inputs are unknown

(brown). Enterprise budgets are sequenced

in ABL plans and adjusted for inflation,

discount rates, and beginning and ending

investment values which provide the basis

for a capital investment analysis (orange).

Scenarios consist of several plans that can

be compared and are required for the ABL

tools (blue) to calculate the economic and

financial outputs (green).

The AgBizProfit

TM

module enables users

to make capital investment decisions by

measuring an investment's profitability

based on its Net Present Value, Internal Rate

of Return, and cash flow breakeven.

The module AgBizFinance

TM

empowers

producers to make whole-farm investment

decisions based on 20 financial ratios and

performance measures. In addition, this

program lets users input their current

balance sheet information, loans, and capital

leases.

AgBizFinance uses this information with

plans and scenarios to generate up to 10

years of proforma cash flow statements,

balance sheets, and income statements. As a

result, growers can evaluate how orchard

renewal plans can impact their short- and

long-term finances and how best to fund

capital investments.

These AgBizLogic decision tools can

currently be accessed at

https://www.agbizlogic.com or

https://www.agbizlogic.oregonstate.edu at

no cost. Also, budgets from this study will

be available in the ABL Library.

It is recommended that before investing

in any long-run perennial crop, the potential

investor use AgBiz Logic modules to

thoroughly analyze the profitability and

financial feasibility of potential investments

under varying price and yield scenarios.

AgBiz Logic Example

From a horticultural perspective, finding

the appropriate variety, rootstock, and

training system combination is critical to

orchard renewal. These factors can generate

large, firm fruit, early and higher annual

yields, and orchard labor efficiencies.

However, problems arising from

mismatched training systems or rootstocks

can be a horticultural nightmare. Some of

the issues can be poor quality fruit and/or

reduced yields, which results in lower

returns to the grower. Labor requirements

can also increase, which drives up costs of

production.

The question growers face is whether to

remove a young orchard and start over or

graft or perform heavy pruning to prune

trees to a different training system. Although

the former generated a profit during its early

life, it may not have yielded sufficient net

9 | Page

returns to provide an acceptable rate of

return on investment to the grower. The

latter can be less expensive and has the

potential to reach full production much

earlier. However, other factors, such as labor

inputs, could be higher in the future.

This dilemma is an excellent example of

how AgBiz Logic can assist growers in these

situations. This tool can generate an

economic and financial assessment of

whether to replant to a new orchard or stay

the course with the variety and rootstock but

perform heavy pruning to a new training

system. The following are assumptions used

in AgBiz Logic budgets and scenarios to

conduct such an analysis. Next, the

AgBizProfit module will generate a net

present value analysis to compare the

profitability and costs of establishing each

system.

Assumptions

1. New Orchard. The returns and costs of

establishing a new orchard will come

from this study as described in the high-

density sweet cherry system.

2. Steep Leader System. The costs to

perform heavy pruning are estimated to

be $500 per acre, which includes the

labor to make the significant cuts, load,

and haul limbs from the field.

3. The costs to maintain the trees will be

the same as in the full production year

of the high-density system. However,

there will be no pest and disease control

costs, and fertilizer inputs will decrease

by 50 percent until the trees begin to

bear fruit. These costs then increase

with annual production, as in the high-

density orchard.

4. Harvest and beehive costs are excluded

until reaching commercial yields.

5. Labor increases by 30 percent for all

tasks in the orchard.

6. Production begins in year 3 with 1,000

pounds, 4,000 in year 4, 8,000 in year 5,

10,000 in year 6, and reaches full

production in year 7 with 14,000

pounds per acre.

7. The time horizon to evaluate these

investments will be 20 years.

8. The discount rate will be six percent.

9. The beginning investment value will be

$15,000 per acre for the new orchard

and $20,000 for the heavy pruning

option. The ending investment value

will be $30,000 for each orchard

system.

RESULTS

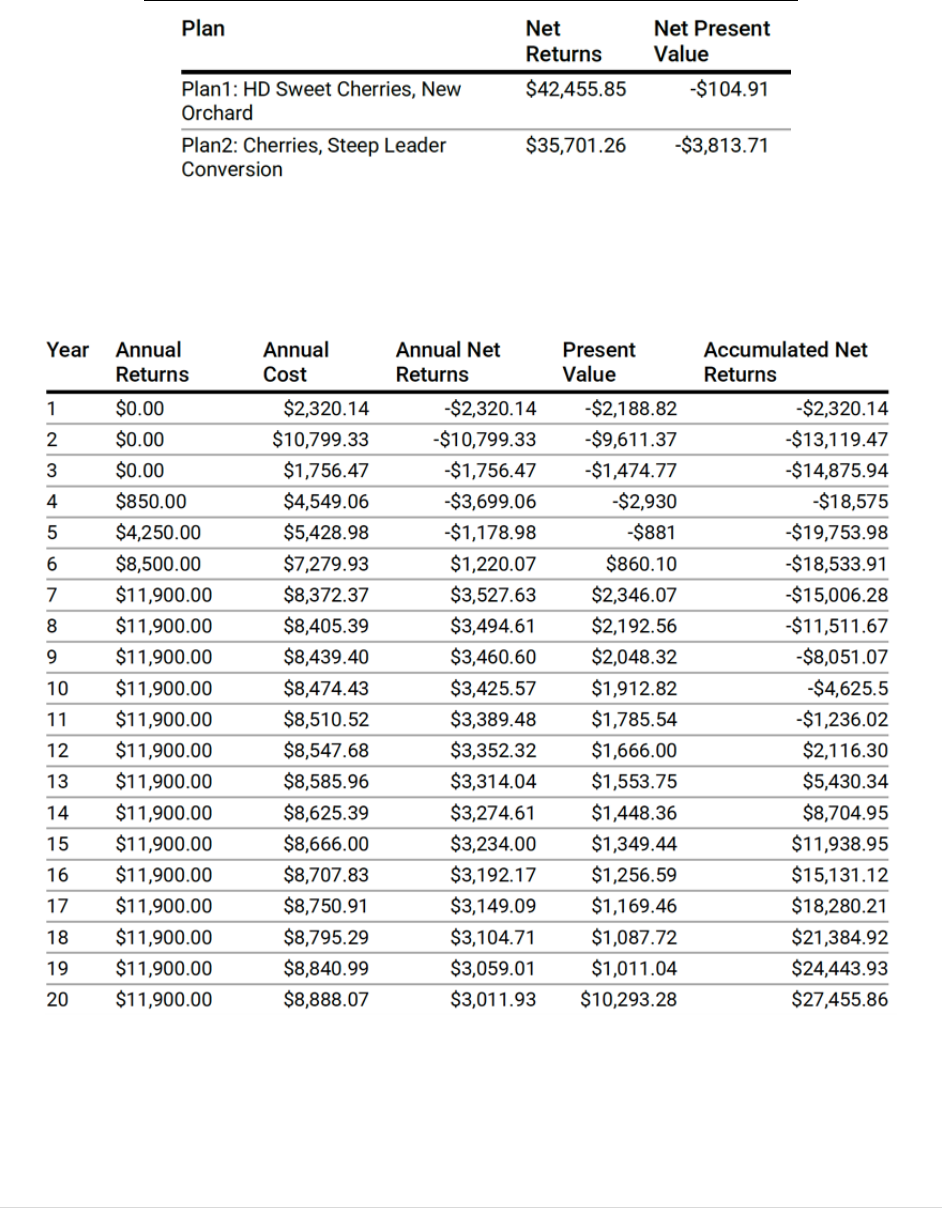

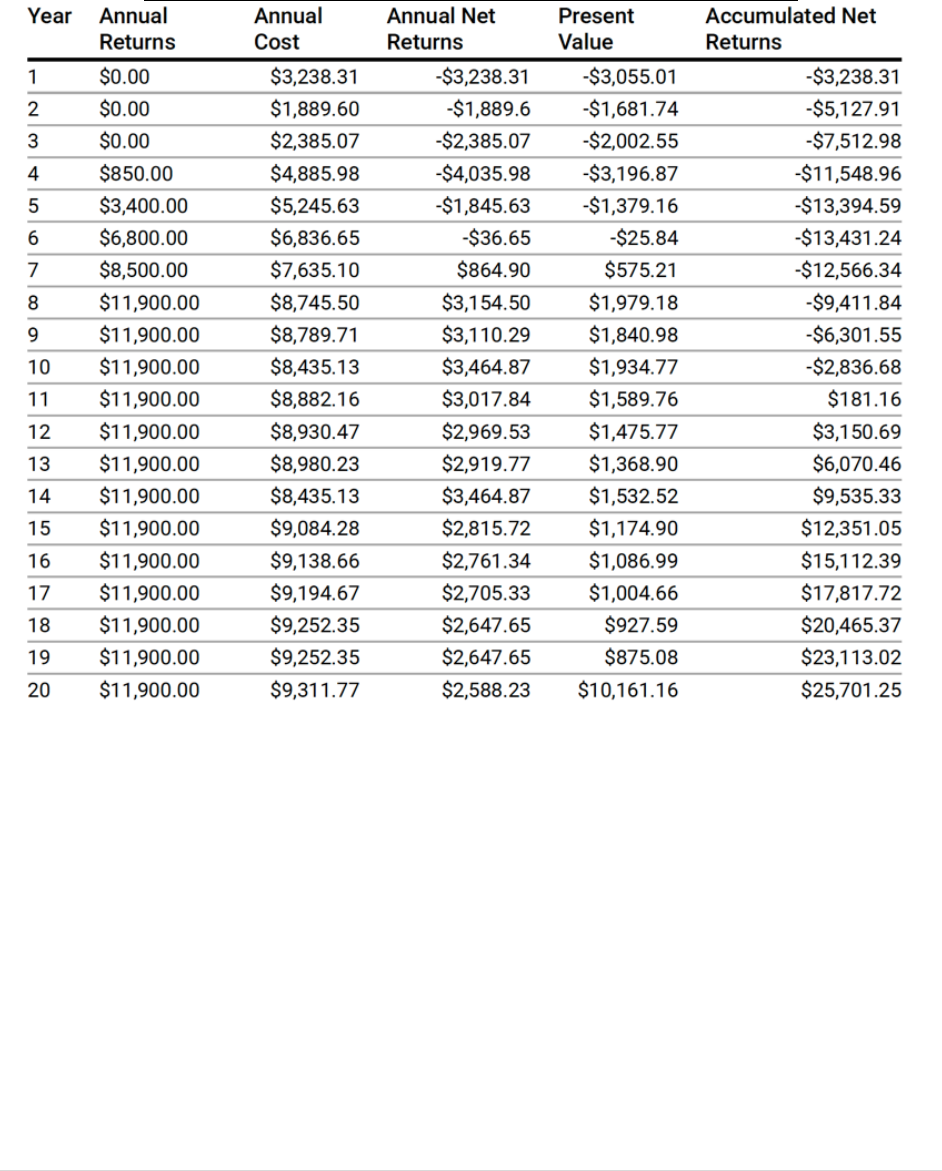

An AgBizProfit analysis compares

multiple investments simultaneously, which

allows the grower to quickly evaluate each

on its own merits. Table ABL1, page 10,

shows planting a new orchard system has a

higher net present value, although negative,

than the heavy pruning option. The net

present value to renew the orchard is -$105

per acre, while the steep leader conversion is

-$3,814. Tables ABL2 and ABL3, pages 10

and 11, show the annual returns, costs, and

net returns, as well as the present value of

each year and the accumulated net returns

before discounting. The year that returns are

greater than the total costs of previous years

is 12 for the new orchard and 11 for the

conversion.

Although there are numerous

combinations of varieties, rootstocks, and

training systems to convert young but

unprofitable orchards, this is one example of

how to use the AgBiz Logic program. The

ABL budgets used in this analysis are

located in the AgBiz Logic library. Look for

“EXTENSION” in the budget title, followed

by “Steep Leader” …”.

We encourage growers to create an AgBiz

Logic account to evaluate the economics and

financial implications of similar situations.

10 | Page

Table ABL1. Total Net Returns and Net Present Value to Establish

a High-Density Orchard and Converting an Orchard to a Steep

Leader Training System.

Table ABL2. Annual Returns, Costs, and Net Returns, Present

Values, and Accumulated Net Returns Before Discounting to

Establish a New High-Density Orchard.

11 | Page

Table ABL3. Annual Returns, Costs, and Net Returns, Present

Values, and Accumulated Net Returns Before Discounting to

Convert an Existing Orchard to a Steep Leader Training System.

12 | Page

APPENDIX A

Machinery and Equipment Assumptions and Cost Calculations for a 100-acre Orchard in

Wasco County.

13 | Page

14 | Page

APPENDIX B

Input Assumptions for Establishing a High-Density and Ultra-High-Density Sweet Cherry

Orchard in Wasco County.

15 | Page

16 | Page

APPENDIX C

Cash Costs and Economic Returns and Costs to Establish a High-Density and Ultra-High-

Density Sweet Cherry Orchard.

17 | Page

18 | Page

19 | Page

20 | Page

21 | Page

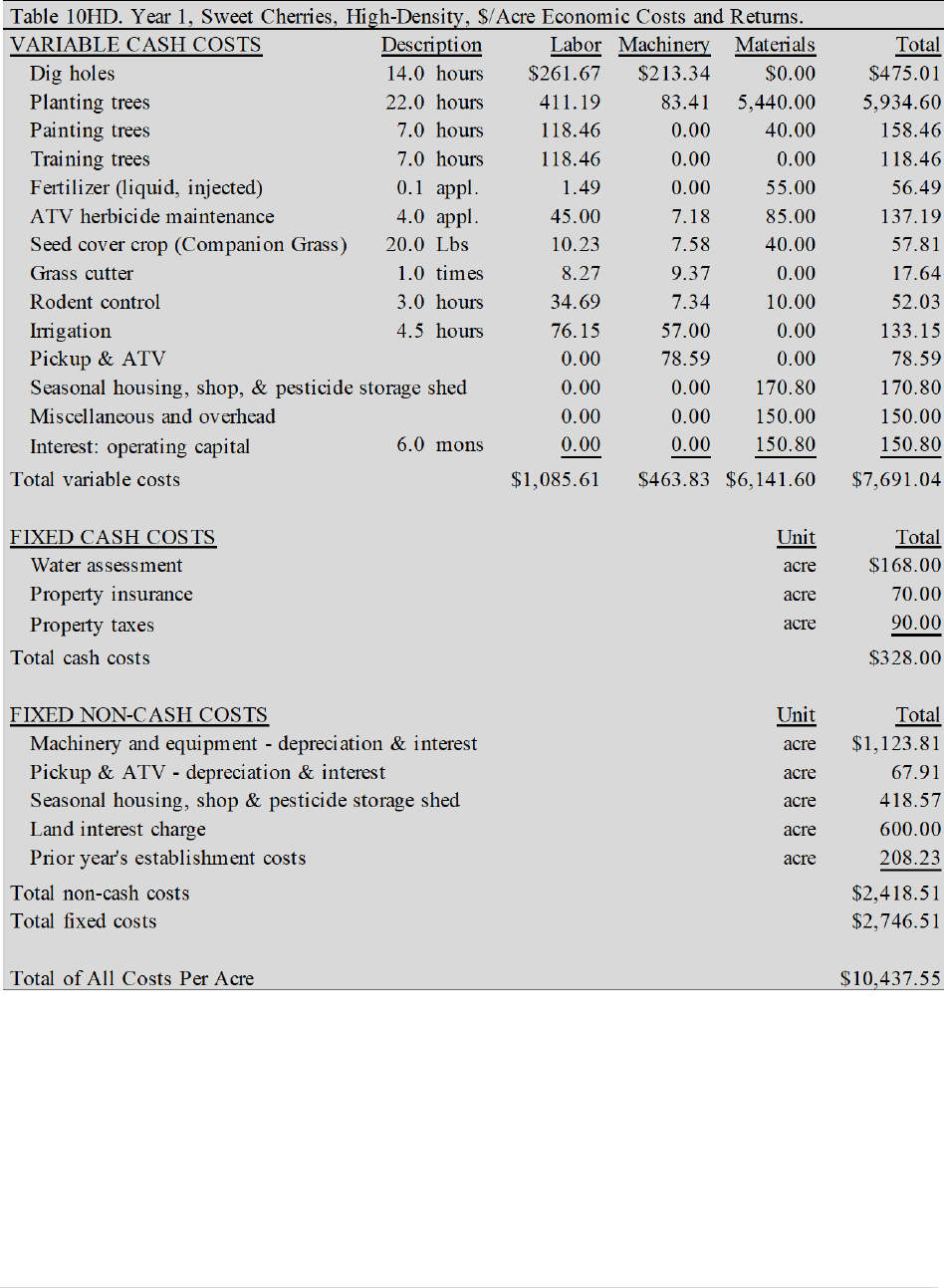

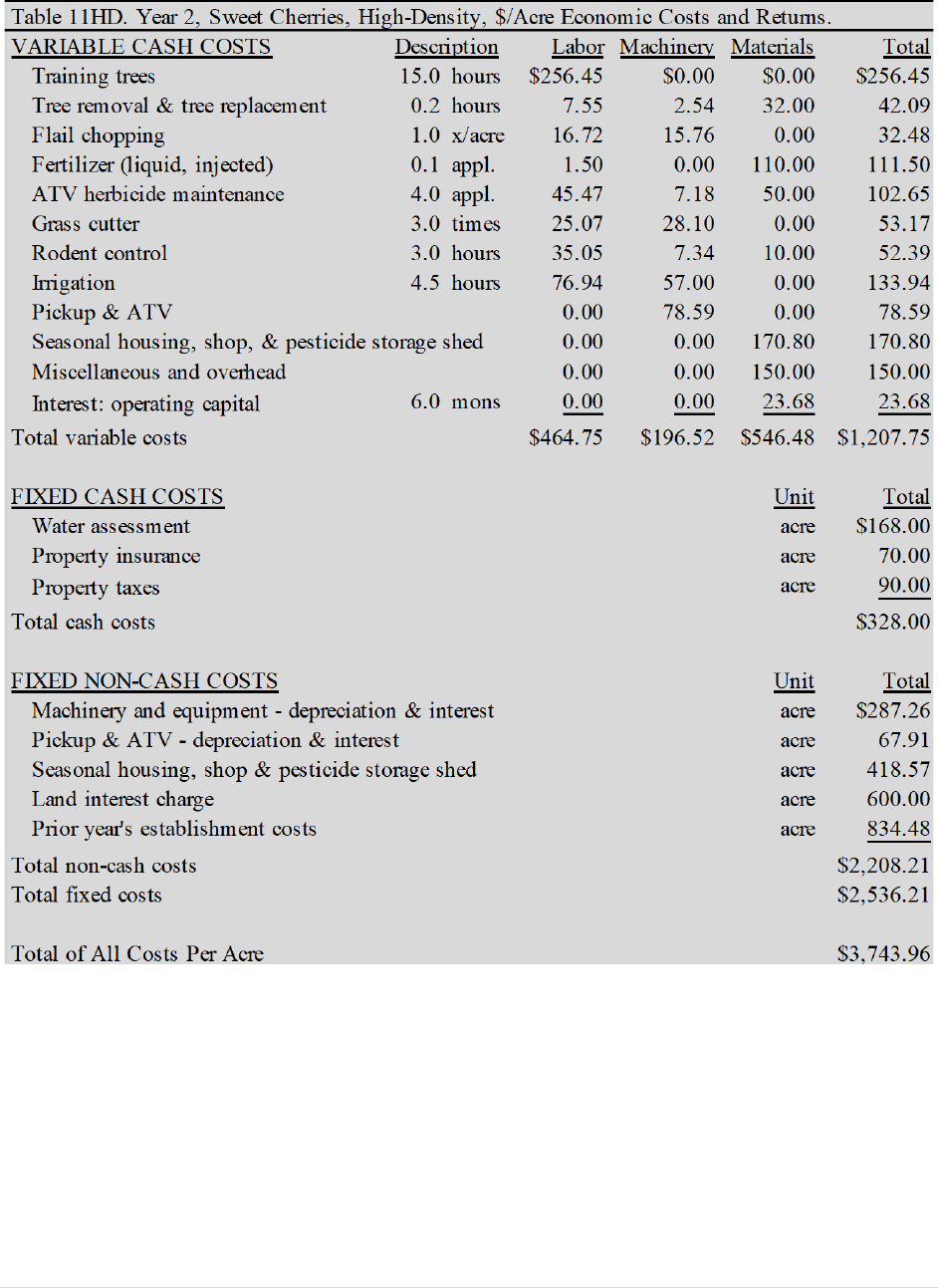

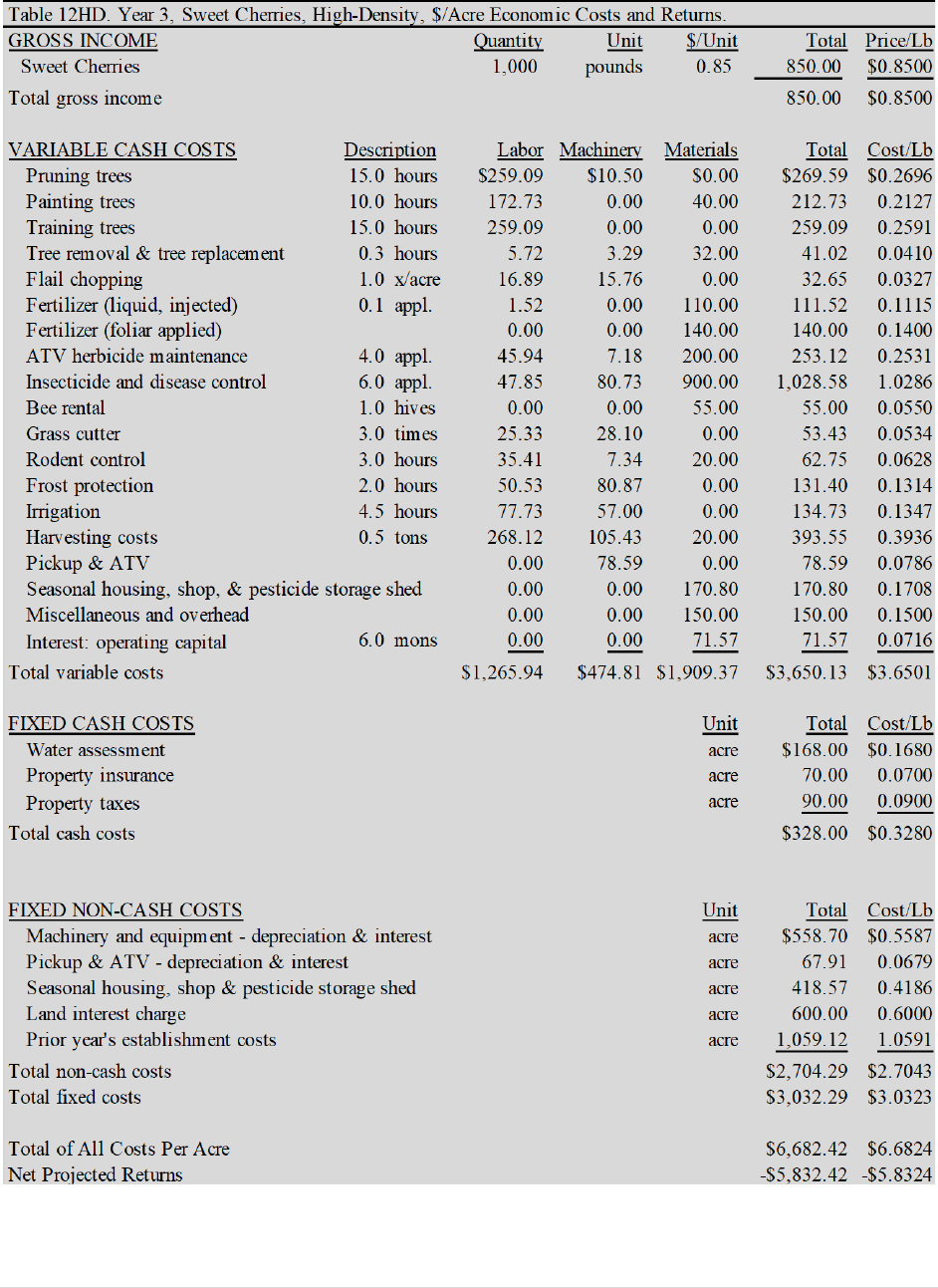

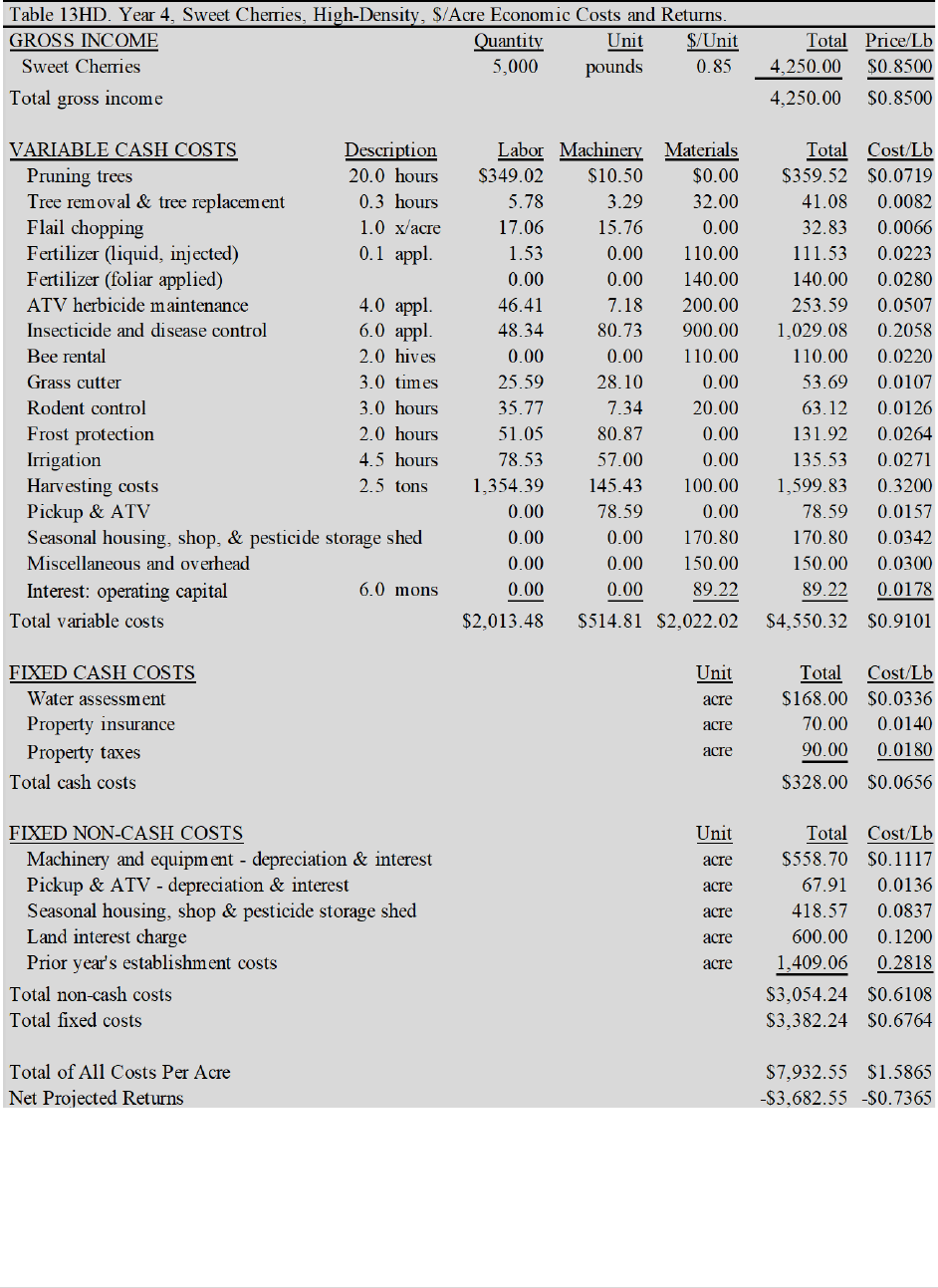

APPENDIX D

Annual Enterprise Budgets to Establish a High-Density Sweet Cherry Orchard.

22 | Page

23 | Page

24 | Page

25 | Page

26 | Page

27 | Page

28 | Page

APPENDIX E

Annual Enterprise Budgets to Establish an Ultra-High-Density Sweet Cherry Orchard

29 | Page

30 | Page

31 | Page

32 | Page