GEORGIA HAZELNUTS

ASSESSMENT

FINAL

Tuesday, August 30, 2011

This publication was produced for review by the United States Agency for International

Development. It was prepared by Deloitte Consulting LLP.

GEORGIA HAZELNUTS

ASSESSMENT

FINAL

USAID ECONOMIC PROSPERITY INITIATIVE (EPI)

CONTRACT NUMBER: AID-114-C-10-00004

DELOITTE CONSULTING LLP

USAID/CAUCASUS

TUESDAY, AUGUST 30, 2011

DISCLAIMER:

The author’s views expressed in this publication do not necessarily reflect the views of

the United States Agency for International Development or the United States

Government.

ECONOMIC PROSPERITY INITIATIVE (EPI) i

DATA

Author(s): Thomas J. Payne

Name of Component: Agriculture Sectors

Practice Area: Hazelnuts

Key Words: Georgia, hazelnuts, exports, Farm Service Centers, seedlings, fertilizers,

pesticides, processors, access to capital, access to financing, loans, Microfinance Institution,

commercial banking, capacity building, education and training, associations, government

agency, credit, marketing, exports, standards, pruning, nutrition

Reviewed by:

David Grigolia, EPI Value Chain Manager, Hazelnuts

Dennis Zeedyk, EPI Ag Component Team Leader

ECONOMIC PROSPERITY INITIATIVE (EPI) ii

ABSTRACT

USAID/EPI brought a consultant who is a hazelnut marketing expert to Georgia on a

two-week visit. The consultant’s deliverables were to observe and analyze which if any

improvements needed to be made to the hazelnut value chain. In order to market hazelnuts

to the most profitable markets, and in order to ensure that hazelnuts are of the best quality

that they can be, this Georgian hazelnut assessment was conducted.

Currently, in Georgia, most hazelnut production takes place in small farms and gathering

conditions in two major regions of the country: east and west. The hazelnut key value chain

players were met with and discussions were held. Harvested hazelnuts are handled by

collectors who speculate on the market and deliver product to packers. Packers select

product for two distinctive channels: inshell and shelled hazelnuts and do some further

processing, including roasting, blanching, slicing, dicing and paste production. The value

chain was investigated and improvements to the hazelnut value chain in Georgia were

recommended.

ECONOMIC PROSPERITY INITIATIVE (EPI) iii

CONTENTS

I. EXECUTIVE SUMMARY ........................................................................................ 1

A. FINDINGS & RECOMMENDATIONS......................................................... 5

B. ADDITIONAL INFORMATION .................................................................. 26

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 1

I. EXECUTIVE SUMMARY

Georgia is a traditional production region for hazelnuts. Currently, most production is in

small farms and gathering conditions in two major regions of the country: east and west.

Harvested hazelnuts are handled by collectors who speculate on the market and deliver

product to packers. Packers select product for two distinctive channels: inshell and shelled

hazelnuts and do some further processing, including roasting, blanching, slicing, dicing and

paste production. Although most Georgian hazelnuts could be considered organic, there is

no certification of organic production in the country. Georgian production is either shipped to

neighboring Turkey which is the dominant world producer of hazelnuts, or to European

customers. Georgian production lacks some of the processing quality and packing that is

required for direct sales to confectionery and food industries. So, intermediate customers or

―partners‖ fulfill an important function of getting product to delivery condition, i.e. cleaning,

grading and packaging.

Description and Structure of Markets

The world trade of hazelnuts centers on a very few large trading companies who have long-

established relationships with confectionery companies who use a majority of hazelnut

production. For example, there are 10 more traders in Hamburg and Rotterdam, and they all

have offices in the same neighborhoods near the port. These companies are in very tight

formation with buyers and have decades of business on the books. The new companies that

are listed are on the fringes and are currently already sourcing from secondary sources or

are looking to fill requirements for new customers. The new import companies have direct

linkages with the end users, have technical service capabilities and are in a position to

develop new markets for hazelnuts. Where they lack in huge volumes, they make up in

willingness to work with new suppliers and provide assistance and support. This will be a

recommended channel for Georgian hazelnuts.

Georgian Production Capacity

Georgia is currently a small player in the global hazelnut industry. Being attached to Turkey,

the main player, Georgia fills supply needs in this country and has direct field grade and raw

material and semifinished product shipments to main European markets. In addition, the

production is stable and limited to small farming activities, in which packers are supplied by

farmers through a middleman and direct sales to packers. This situation is seriously limiting

the development of new production. Georgia has substantial amounts of land available for

hazelnut production and some of this is in areas where discontinued tea production as

occurred. Other acres are in the East and in new and nontraditional hazelnut production

areas. The small producer, handler and packer arrangements does not seem to stimulate

new plantings and business because the middle men are regulating supply to keep pricing

up to the packer. Packers are struggling to get supply. The supply pull will not begin until

packers start to source directly from producers. They will initially compete for producers,

and provide incentives like higher prices and some serviced and technical support. In time

relationships will develop and packers will build bases of production which will grow as the

market grows.

Identification of Policy and Regulatory Conditions to Improve Sector

The hazelnut sector is a priority agricultural commodity in Georgia and has received a

substantial amount of attention from the central government. It is also a priority item for

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 2

assistance from donor nations, and assistance programs. From a policy standpoint, the

formation of a ―marketing order‖ type of program, which would allow development activities

and controls, which could benefit the entire sector. Modeled after the Oregon Hazelnut

Committee in the USA, the program could address four different areas:

1. Quality. A law would be established to define quality standards for Georgian

hazelnuts. This would include size, color, and other criteria that are important to the

buyers. In short, anyone would be able to grow hazelnuts in Georgia, but only those

which meet the mandated quality criteria could be marketed and exported. The law

would define an inspection mechanism at the packer level, as well as fines and

consequences for violating this aspect of the marketing order.

2. Research. The law would allow for identification and funding of research to serve the

needs of the Georgian hazelnut industry. This would include research and

development of new plant stocks, new products and processes and economic

research.

3. Promotion. The law would allow funding of market development and promotions in

the domestic and world markets, including market research, exhibitions, advertising

and trade missions.

4. Control. A board would have powerful marketing functions to create order in the

marketplace. This includes setting marketable supply, reserve pools, tools for

limiting product on the market, such as green drops (payment for destruction of the

product on the tree) and other mechanics.

The marketing order would be funded by an assessment per metric ton, on product received

by packers. The assessment would be passed along to the end user, and in the case of

Georgia, there is adequate room for price increases. In the USA, assessments for

commodity boards range from one cent per lb for honey to around $12 per ton for

blueberries. Most products, such as almonds and walnuts, are assessed at around $24-36

per ton. This would cover operating expenses of a board office and a collection mechanism.

A board would be formed which would represent the geographic profile of the industry and

would be selected in an election by industry stakeholders. Typically, this would be the

growers, but could also be the packer who in turn represents a producer base.

Constraints:

Some of the main hazelnut industry problems are listed below:

Infrastructure – due to the current approach of collecting and sourcing hazelnuts through

collectors, there is no long-term, direct relationship between farmers and processors as

there is a middleman collector in between. Thus, there is no way to directly incentivize

farmers to make changes in production practices or quality.

Product and Market Selection – the in-shell market is a lucrative business that requires far

less packer input than the shelled market. Additionally, the packer is selling 100% of the

product and not worrying about hazelnut shell disposal. For the inshell market, the nuts

must be large, round, clean and with no blemishes and there is a small window of sales

opportunity primarily based on the Christmas market in Europe. The shelled market, size of

the nut meet kernel is the primary concern, but there are no real market standards used in

Georgia. Appropriate packing in cardboard boxes with plastic liners not only keeps the

product cleaner and looks more professional, but also allows for cases to be loaded on a

pallet with 1/3 more hazelnuts per container, lowering freight rates on a per unit basis.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 3

Certification and Standards – currently buyers and sellers informally agree on the

standards of traded hazelnuts. The adoption of USDA hazelnut standards, which is the

basic world standard, will allow buyers, sellers and intermediate traders to speak the same

language in terms of product quality, as well as setting and avoiding disputes.

Business Management – The Georgian hazelnut industry needs a quality improvement

guide and framework. A good model is the Dried Fruit and Treenuts Association (DFA) from

the USA, which was established in the US over 100 years ago. There should also be an

improvement in record-keeping, traceability, inspection and implementation of standards.

Linkages and Partnerships – The global treenut business is a tight-knit group of packers,

handlers, importers and end-users. There needs to be a significant amount of linking

Georgian companies with real, substantial customers in markets that will not interfere with

their current business relationships. There should be some image development for

Georgian companies and develop a packer list of Georgian hazelnut processors. Some

simple technical assistance on plant improvement will enable them to help in image

improvement.

Conclusions and Recommendations

Recommendations have been made in individual sections. But, overall it is recommended

overall that to help Georgian producers enter the 20

th

century with key trade contacts in

regions of the world. These new buyers will help move hazelnuts to new markets in

significant volumes and will work with Georgian suppliers on ascension to real world

standards and specifications.

Georgian packers must seek direct business relationships with dedicated grower

base in order to influence production improvement and extension activities that will

encourage more production of marketable types of hazelnuts.

Georgian packers must diversify their customer base and work with more than single

customer ―partners‖ who can provide guidance and product improvement in the

marketplace.

Georgia can begin gaining a presence in the treenut world, and seek out new

customers in alternative areas of the world such as Canada, Southeast Asia, Central

and South America, and other areas – where they can market more hazelnuts and

not disturb the important status quo in western Europe.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 4

A. FINDINGS & RECOMMENDATIONS

B. ADDITIONAL INFORMATION

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 5

A. FINDINGS &

RECOMMENDATIONS

MARKET ACCESS

Georgia is a small player in the world hazelnut production with less than 2% of total

production. Turkey and the Black Sea regions next door are the major producers of

hazelnuts, producing more than 570,000 metric tons and 80% of the total world supply.

Hazelnuts are produced in two distinctive regions of Georgia, the East and West. The west

appears to be the more traditional area for production and an extension of the Turkish Black

Sea hazelnut belt.

PARTNERS

At face value, the industry is doing just fine. Each of the 15 processors, which were visited,

initially says they are ―doing good business, with a partner in Western Europe.‖ At second

swipe, it was learned these partners are actually solo customers who come into the market

once a year to buy their requirements. They purchase the product ―as is‖ and dictate prices.

These ―partners‖ are extremely important, as some may actually be investors. However, at

the same time, they have kept the packers in suspended animation. They need to do little to

improve product to world standards, and all recognize that they are receiving purchase

prices well below the world trading ceiling for hazelnuts. On second and third meeting,

packers would disclose their need for diversified market. They are concerned that they not

rock the boat with their current customer. But, they also show a high degree of interest to

initiate new market initiatives.

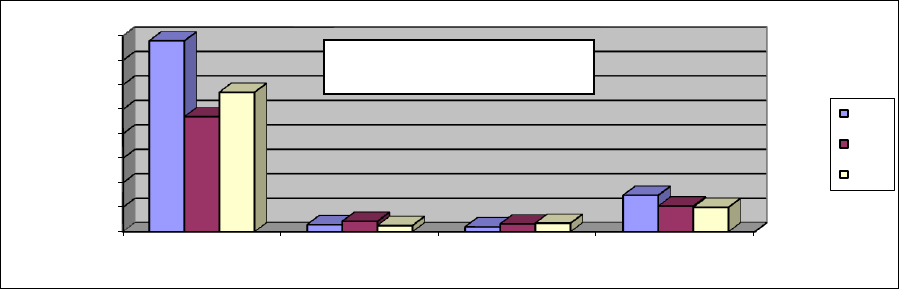

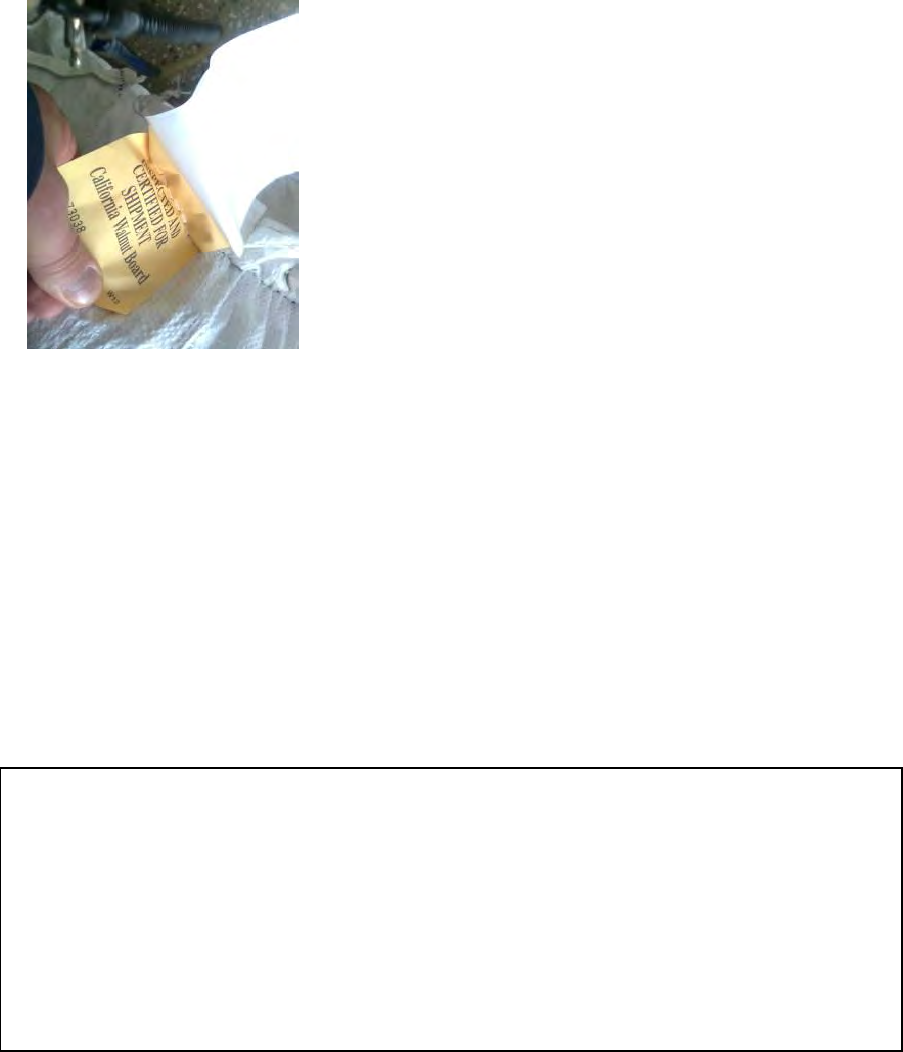

0

100000

200000

300000

400000

500000

600000

700000

800000

Turkey

USA

Azerbajian

EU-27

2008

2009

2010

World Hazelnut production

(metric tons)

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 6

MARKETING

None of the packers has many of the fundamentals for sales in the ―real‖ marketplace. It is

extremely difficult to discuss product offerings of individual packers, who have very vague

terminologies, no standardized specifications or marketing information. They have the

calibration and sizing down pat, but besides this, they have ambiguous descriptors of further

processed products, unclear terminologies.

PRODUCT AND SERVICE ENHANCEMENT

PRODUCT DEVELOPMENT AND OFFERINGS

Typically, nut producers experience company expansion from inshell producers, to shellers,

to specified items and specialty products. In Georgia, this is a mixed bag of product

offerings based of course on the demands of their European customer, which is always

almost a primary nut product. They are struggling with new product items that they know are

traded on the world market, especially in the confectionery area. This includes simple

product adaptations such as sizing and shape selection to categories that require extensive

capital expenditures such as roasting, blanching, slicing, dicing and production of paste. It is

recommended that most of these producers concentrate on their mainstay product, the

natural whole hazelnut and work on getting their production and processing optimized,

before they start new lines.

The current European customers are sourcing the bargain nuts from Georgia because of

deficiencies in the process that is not up to European or American nut processing standards

— which customers want to see. It is important to ask what would the buyer from Nestle

think if he was in this plant? The reality is that most Georgian processors will ship raw

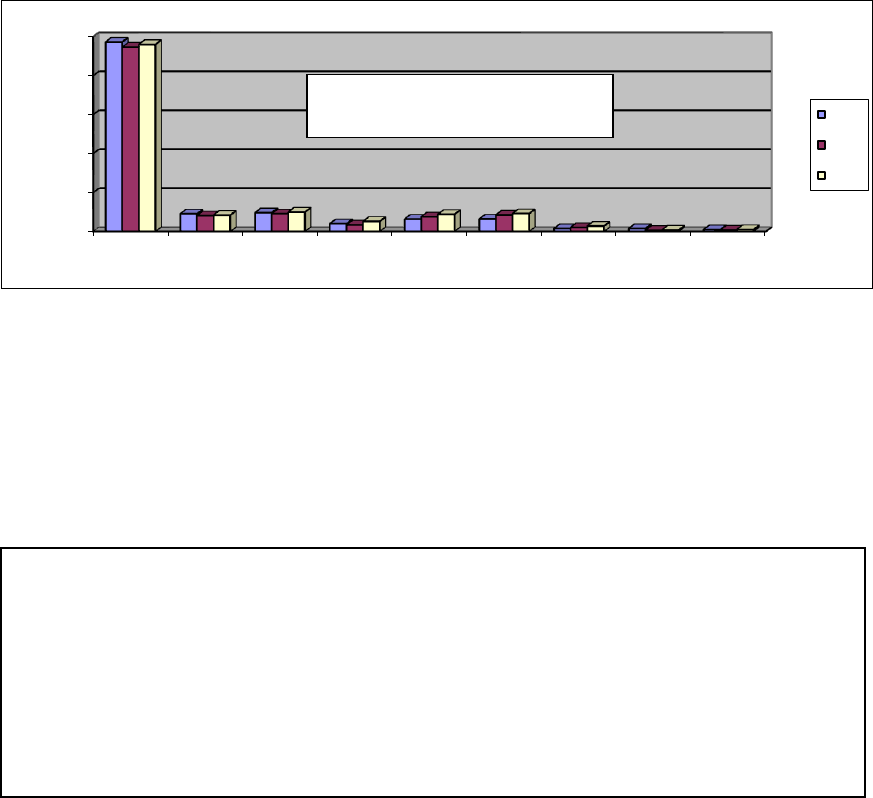

0

50000

100000

150000

200000

250000

EU-27

Switz

Russia

USA

HK

Canada

Ukraine

Turkey

Serbia

2008

2009

2010

World Hazelnut Imports/MT

Activity:

INC Meeting. Georgian delegation attends the International Nut

Congress (INC) in 2012. This will be a ―coming out party‖ for the

group and attendees will see the real world of buyers and sellers, and

will also make key contacts with new customers and channel partners.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 7

materials in jute bags, and they are reprocessed in Europe to meet end user specs. Most

probably, many companies are moving into the value-added products area based on instinct

and have no market demand at the end of the investment. It was clear that several

companies with large unused roasters and other owners spoke with stars in their eyes about

the need top of the line laser sorters, blanchers and paste operations.

SERVICE ENHANCEMENT

The Georgian producers have been buffered from the real world of marketing and new

market activity. For the most part, they are terrified about the prospect of dealing with new

customers in strange lands. They are lacking some very basic fundamentals that are

necessary for going from total stranger to customer. Unfortunately, many are looking to the

Internet and sales portals as the answer, which is indeed an extremely dangerous

proposition. Even describing very basic fundamentals of sales prospecting takes a long

time. This included:

Prequalification of companies – what to look for as a danger signal of a waste of

time. Product description methods using digital photos, measurement and

terminologies.

Sampling to legitimate companies and how to ship, and keep cost down and gain

commitment from potential customers with partial payment.

Test samples (dispute prevention).

Simple laboratory analysis. Just a few basic analysis are required.

Pricing.

Export packing.

Money collection. Many companies are ready to ship without payment just because

the customer is from a developed country.

INFRASTRUCTURE IMPROVEMENT

The Georgian hazelnut industry is structured differently from other treenut industries – and

some of the differences are responsible for typecasting as a raw material supplier rather

than an ingredient supplier to the food industry.

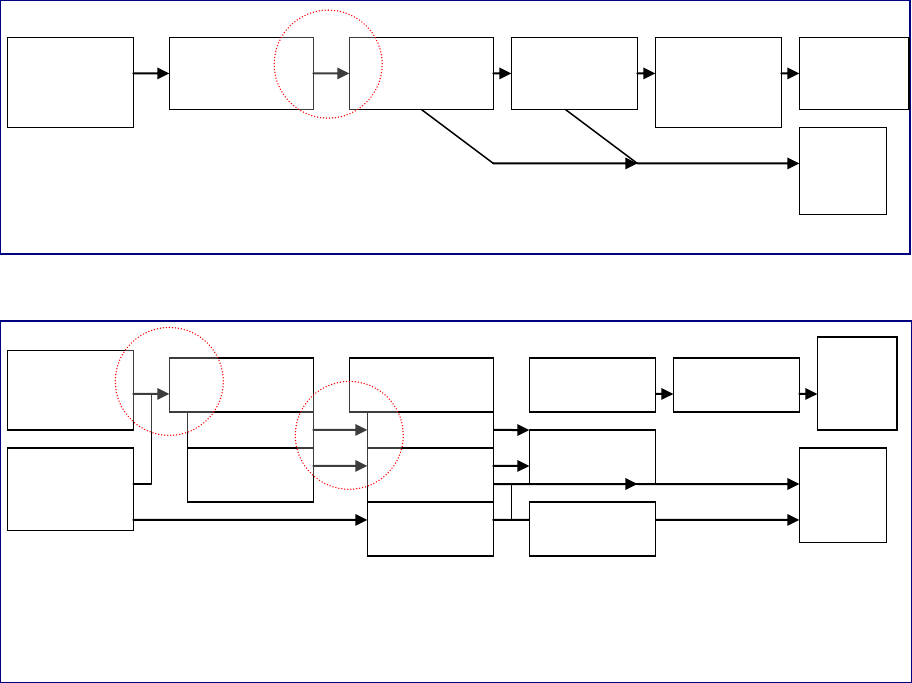

STRUCTURE

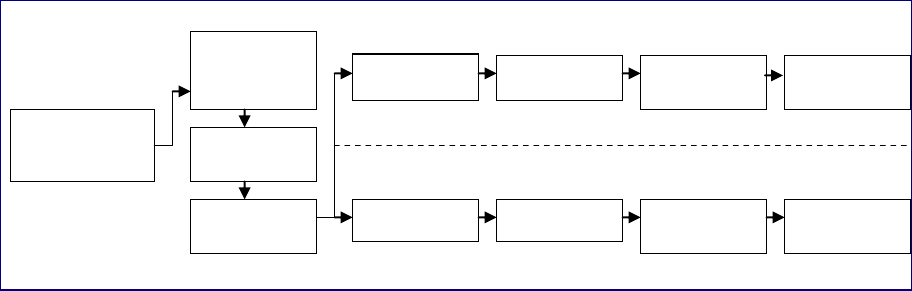

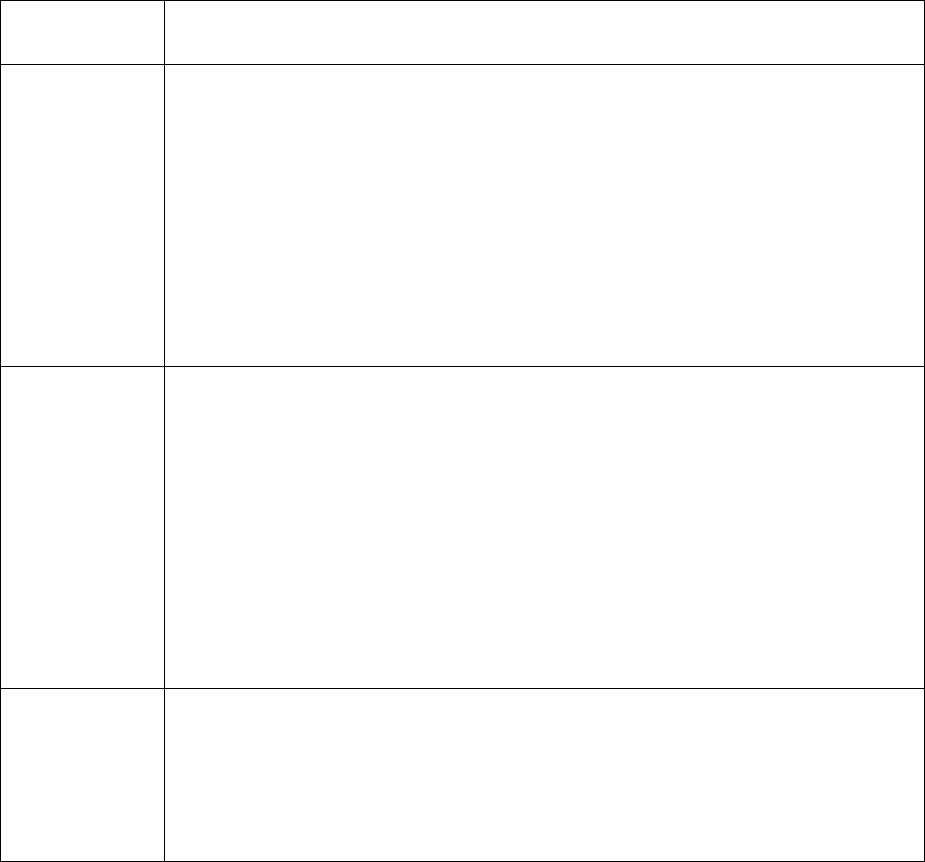

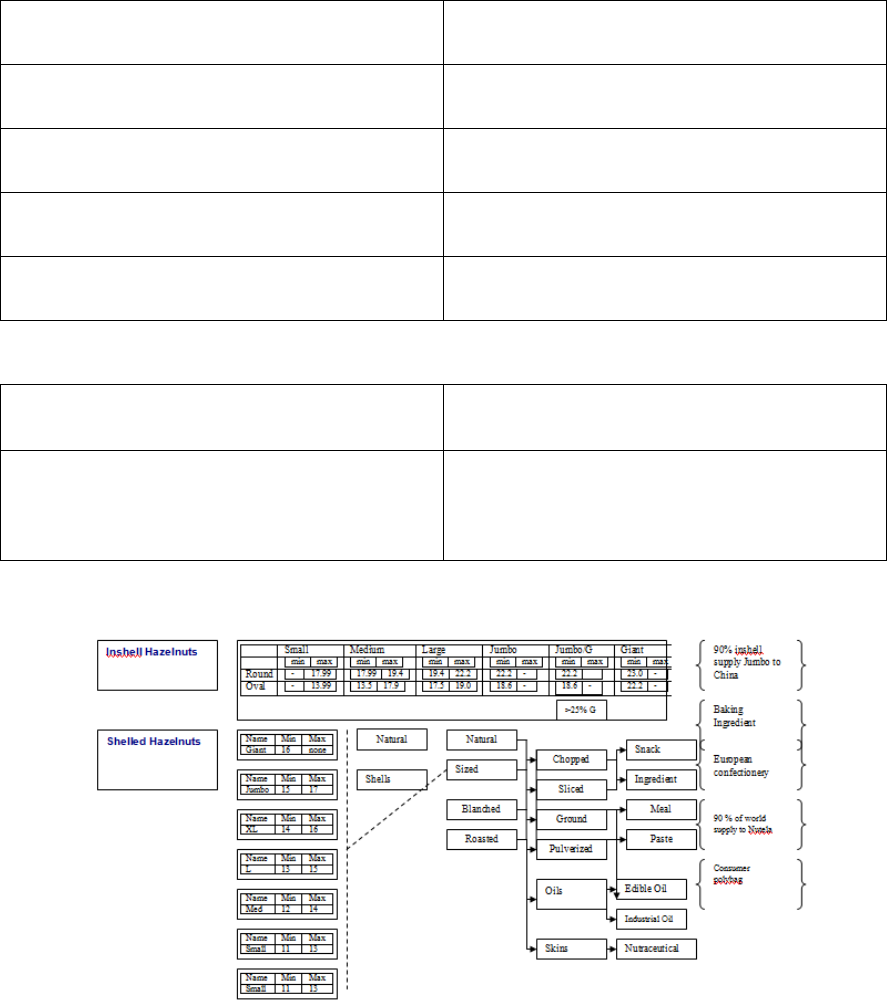

The Following two charts show the differences between Georgia and Oregon in the USA.

Activities:

Marketing plan. Development of a comprehensive industry marketing

plan to document situation, competitive analysis, market situations,

constraints/opportunities, strategies, tactics and evaluation methods

for new market activity.

Individual consultations. One-on-one meetings and consultations as

well as follow-up on sales and marketing issues will be provided. This

will help guide Georgian producers on sales prospecting, market

development and transaction fundamentals.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 8

Georgia:

Oregon/USA (Exhibit X)

PRODUCTION TO PACKER COMPONENTS

Production: Georgia is a country of thousands of small producers scattered around

the two main growing regions. Growers produce the nuts in small plots or on their

own lands and knock the trees to produce field-grade hazelnuts. The hazelnuts are

air dried on the ground down to a point of equilibrium where there will be no mold or

spoilage. Note: this gives the producers in the eastern regions an advantage in that

due to their dry climate, this gives them the opportunity to sell directly and quickly

with less or no additional dehydration.

Field Transportation. There is very little organization among producers, and all are

freelancers. Producers place field grade hazelnuts into used plastic mesh bags and

transport to local towns or cities where they deliver bags of nuts to collectors.

Typically, transportation is done in the back of small trucks and cars and the average

delivery is six bags of 50 lbs.

Collectors. Dozens of collectors operate in each region. They operate out of small

storefronts with some warehouse space. Some are attached to stores or money

exchange operations. Typically, they will have a storage area with a scale and

enough space to store around one truckload (16 MT) of field-grade hazelnuts. The

collector will inspect the bags of nuts and probe the interior for rocks or foreign

materials. Collectors will test a random sample of each bag to look at the percentage

of empty shells. This is a huge problem in the Georgian hazelnut business. Inshell

Large

producers

Field agents

Packers

Retail

Broker

Secondary

Processors

End

user

Inshell

buyer

(China

/W.

Europ

e)

Small

producers

Cooperative

Medium/Larg

e Packers

Coop

Med/.Large

packers

Small

Packers

Industrial

Broker

Exporter

Small

producers

Collectors

Packers

Importer

Secondary

processor

End user

Inshell

buyer

(China

/W.

Europ

e)

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 9

buyers abroad complain about the Georgian origin because of a high percentage of

empty shells. The collector will pay the grower with cash, and reportedly pay a

premium of up to 5 % for quality (large size). There are no real specifications that

they look for, rather the quality appreciated by their packer customer. Hazelnuts are

shipped by car of small truck to local packers. There is no real pattern of which

packer they serve or how they choose a packer. It might be that they talk via cell

phone with packers and play the field to know who needs what where. It was

discussed that some collectors are actually speculators. They buy cheap and hold

product and store until there is a desirable time to sell.

INFRASTRUCTURE PROBLEM

Perhaps the current shotgun approach to collecting and sourcing is the root cause of many

problems facing the Georgian hazelnut industry. If you look at the Oregon structure (Exhibit

X) note that there is a long-term direct relationship between the packer and the producer. In

Georgia, there is a middleman collector, who plays the field and keeps the producers one

step removed from the packer. In Oregon, and other nut industries, such as the California

walnut and almond industries, there is a well-established and formal and informal linkage

between producer and packer.

In Oregon, growers work with the packer on the necessary quality and product, and

receive immediate feedback and rewards for good products (size, moisture etc.). In

Georgia, the intermediary takes any and all products and is the judge and jury on

payment.

Oregon packers give growers a monetary incentive for meeting and exceeding

specific quality specifications.

Oregon packers have specific year-to-year requirements and can work with a

producer base on raising production to meet goals.

Oregon packers serve as an extension outlet for new technology, production

practices, fertilization and other improvements.

This will be a very difficult adjustment to implement, and would involve pinching out

intermediaries from the nut business. Perhaps, these middlemen could be converted to

become more or less buying agents for individual packers. Without a producer-packer

relationship, it will be quite difficult to implement change in the hazelnut business in Georgia.

With a structure in place, changes could occur which would result in raised quality, and more

importantly, increased production of hazelnuts in an orderly manner.

PRODUCT AND MARKET SELECTION

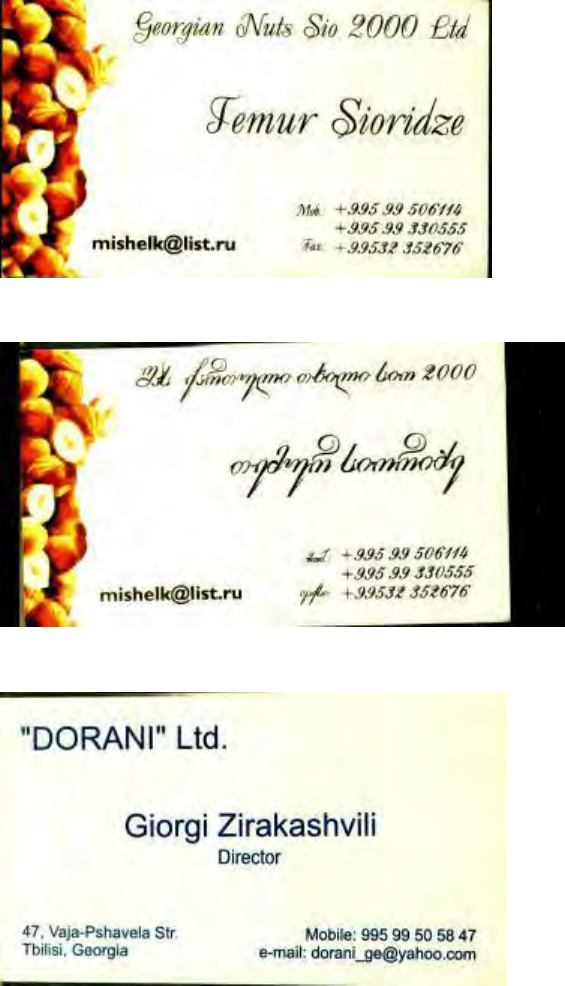

The hazelnut can go to one of two different market paths: inshell and shelled. It is

interesting to note that the processes used throughout Georgia are almost identical to that in

all other areas of the hazelnut-producing world.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 10

In this section, the process was reviewed, and some differences and areas of structural

adjustment that could be implemented were identified.

INSHELL

The inshell market is a lucrative business that requires far less packer input than the shelled

area. In addition, the packer is selling 100 percent of product and not relegating shell to

cogeneration use. Product for the inshell market is normally different than that of the shelled

in that the market looks for big round nuts, clean surface and zero blemishes. For shelled

product, size of the nut meat kernel is the main concern. The inshell market is a tricky

business with small windows of opportunity, a few trading entities and a lot of chance for

making or losing big money. The Georgian packers are getting closer to the inshell market,

and will need to learn the nuances of the business in order to play the game.

The hazelnut season has peaks and valleys in production and pricing. This is based on a

number of factors:

West European Inshell Market. Besides the Chinese trade of jumbo inshell nuts

and Balkan Ramadan season (Bosnia, Kosovo, Albania, Turkey, etc.) – the only real

market for this product is the Christmas market in West Europe. Countries such as

Germany, Holland, Belgium, Switzerland and Austria, all have long-standing inshell

nut traditions associated with Christmas time. This is not a hazelnut-only tradition

and it includes walnuts and other inshell nuts. A whole culture has developed around

this tradition, including nutcrackers, nonfood decorative use and cracking rituals.

Because of the importance of the inshell trade, most nut traders in Rotterdam and

Hamburg all have very rigid buying criteria that must be followed. Perfectly dried

Inshell nuts must be landed in the key markets in early October which creates rush to

match the demand. For this purpose, specific markets and cultivars of hazelnuts are

selected and propagated to provide for an early harvest, lower moisture weight at

harvest, which will accelerate the amount of time a hazelnut will take from harvest to

market.

Moisture content of incoming nuts. It is widely known that eastern Georgian

hazelnuts are harvested with lower moisture content. Although the percentages may

seem minute, they are actually quite significant; in that a packer can more rapidly dry

an inshell nut for market. This takes less energy time and input and a packer can

gain more than 10-20 % premium by hitting the inshell market just right.

Incoming nuts

Shelled

Field drying

Air drying

Calibration

Cleaning

Field

sorting

Calibration

Visual

sorting

Visual

sorting

Sacked

Packed

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 11

Chinese Buying Patterns. Each year, traders from the People’s Republic of China,

source the entire world supply of large sized inshell hazelnuts. Oregon in the USA is

the main producer of this product. However, the Chinese are always on the lookout

for alternative suppliers to supplement the Oregon production. The Chinese trade is

actually Hong Kong and South China based, yet the usage market is North China.

Hong Kong ―sister‖ companies conduct the actual transaction and land the inshell

nuts at the port of Hong Kong. The nut are transshipped to Chinese sister companies

who warehouse nuts in Guangdong province, mainly in the Zhuhai area. The main

users are the nut roaster trade. These are a group of 10 or so companies who roast

inshell nuts and bag for the north Chinese markets mainly in Beijing, Dalian, and

Tianjin cities. The product is roasted and the shells crack allowing infusion of flavors,

such as salt, li hing powder (salty plum) and others into the interior nut. The product

is sold in foil pouches, as well as bulk in wet markets. Typically, all inshell nuts,

including almonds, hazelnuts and even cashews are identified as USA or California

origin. This is despite the fact that cashews are not even produced in the USA. In

the past, the Chinese buyers have visited Georgia, and according to most packers,

they had very poor results. The Chinese made great demands, on quality, credit on

goods, and just bad and rude behavior in general. It is interesting to note that when

queried the Chinese concerning Georgia, each buyer has a similar impression of

Georgia which should be taken into consideration: They believe that the Georgian

product may be cheap, but not a good value because there is too high a percentage

of empty shells in each order.

Location of plants. As a remnant of the old system, some plants are in areas far

from hazelnut production. Some smart companies are building plants in the areas.

Unique varieties. Several packers mentioned that there were specific regional

differences and some exquisite types of hazelnuts produced in the East of Georgia.

This would give Georgia some interesting potential for developing appellations and

specific branded products, such as the way that the Iranians have done with their

almond crop. Some varieties are valued at more than 80 percent above conventional

nuts.

SHELLED HAZELNUTS

Georgia produces a world-class shelled hazelnut. The shape, soundness of the kernel,

adhesion of the skin and other attributes make it a most desirable product. All Georgian

producers who were visited, utilized similar or same flow process, which included drying,

cracking, calibrating and packing. They also segment out co-products, such as hazelnut

meal and have developed the basics of further processed items, such as roasted, blanched,

sliced, diced and meal.

Sizes and classifications. Georgian producers have the size and calibration

system down pat. This is the main descriptor for buyers, concerning the screen sizes

that a product will not fall through. This terminology is very adequate, yet there are

some concerning about the shape of some Georgian hazelnuts, which are an oblong

shape due to nature. This would distort the screen size. We should consider

alternative size grades, such as pieces per kg, which are used in the confectionery

industry as well.

Packing. The standards packing methodology for hazelnuts for the food industry is

the cardboard box with a blue plastic poly liner. Typically, the size will be 13.5 kg.

This depends on the size of the kernels. Almost all production Georgia leaves the

country in clean jute bags. This is a wonderful throwback to the old days, but for

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 12

Activity:

Development of technical specifications for Georgian

hazelnut offerings with terminologies, size, shape, color

and other specifications.

Provide a market analysis of potential sales in various

categories, including requirements, formats, packing and

potential volumes required. This will give the Georgian

producers an idea of target markets and goals for market

development.

sanitary reasons, we must advance to food grade containers. In fact, there are many

advantages to the corrugated box.

Due to the cube dimensions, a packer can pack up to 1/3 more hazelnuts in

an ocean container or truck trailer. They can be stacked higher have sheer

strength.

Cases load easier on a pallet.

Hazelnuts will not absorb jute particles and the plastic case liner is sanitary

and of food grade.

Cardboard cases cost about the same or less than clean jute bags.

Emphasis on further processing. Several Georgian factories have new roasting

and other equipment and a few are producing new items. This is a wonderful

advancement, but at the same time, it is clear that the most useful place for

hazelnuts will be in the whole kernel market and this is what the Georgians do quite

well. The hazelnut has a perfect antioxidant barrier in the adhering skin and this

keeps the product fresh for long periods of time. To roast, blanch, and grind will

immediately accelerate oxidative rancidity, which is the enemy of all nut producers

and buyers. It is best to keep the whole nuts in skin as long as possible and make

product to specs for customers. In short, it is a good strategy to focus on what is

best and not get carried away with the co- and by-products.

Terminologies for value-added products. Georgia needs to establish standard

terminologies for further processed items to ensure buyer understanding. This

includes sliced items, ground, blanched, etc. The recommendation and development

of a technical brochure that shows the standard offerings across the board would be

beneficial. This would include photographs, size descriptions and shapes.

WORKFORCE ENHANCEMENT

OREGON GRADE STANDARDS

FILBERTS (HAZELNUTS) IN SHELL

(effective August 25, 1975)

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 13

OREGON NO. 1 GRADE. ―Oregon No. 1‖ consists of filberts in the shell, which meet the

following requirements:

1) Similar type; and,

2) Dry

3) Shells:

a. Well formed; and,

b. Clean and bright

c. Free from:

i. Blanks; and,

ii. Broken or split shells.

d. Free from damage caused by:

i. Stains; and,

ii. Adhering husk; or,

iii. Other means.

4) Kernels:

a. Reasonably well developed; and,

b. Not badly misshapen.

c. Free from:

i. Rancidity;

ii. Decay;

iii. Mold; and,

iv. Insect injury.

d. Free from damage caused by;

i. Shriveling; and,

ii. Discoloration; or,

iii. Other means.

5) Size: The size shall be specified in connection with the grade in accordance with one

of the size classifications in Table 1.

6) Tolerances: In order to allow for variations incident to proper grading and handling,

the following tolerances, by count, are permitted as specified:

a. For mixed types: 20 percent for filberts which are of a different type.

b. For defects: 10 percent for filberts which are below the requirements of his

grade: Provided that not more than one-half of this amount or 5 percent shall

consist of blanks, and not more than 5 percent shall consist of filberts with

rancid, decayed, moldy or insect injured kernels, including not more than 2

percent for insect injury.

c. For off-size: 15 percent for filberts which fail to meet the requirements for the

size specified, but not more than two-thirds of this amount, or 10 percent shall

consist of undersize filberts.

CERTIFICATION AND STANDARDS ATTAINMENT

Because most Georgian producers are a step removed from end users, such as major candy

companies, the product offerings are only measured by informal criteria agreed between the

European partner and Georgia packer. In other producing regions of the worked, industry-

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 14

wide quality and grading standards have been implemented which raise the product quality

to world standards and give end users confidence in purchase.

QUALITY STANDARDS

In Oregon, anyone can produce hazelnuts. However, in order for hazelnuts to be marketed,

they must meet USA federal government (USDA) standards. These standards were

implemented decades ago at the insistence of growers, packers and end users as a way to

bring order to the marketplace. USDA standards are the basic standard and all products

must exceed. The standards are part of public law and cover, size, defects, color and many

of the concerns of the shelled and inshell buyer (attachment Oregon Standards).

INSPECTION AND IMPLEMENTATION OF STANDARDS

The nut industry has an inspection mechanism in place to implement quality standards. In

the walnut industry, this is the Dried Fruit and Treenuts Association (DFA), but other

inspection services can also be used, such as the Society General Service or others.

Packers pay a per ton inspection fee and a DFA or USDA inspector is present at all packing

facilities. A random sample of incoming nuts is taken and product is graded or failed for

human consumption. Packers use this incoming inspection as the basis for payment to

growers. Outgoing inspections designate the nut by grade and are the basis for market

pricing by buyer and seller. A tag or sticker is placed on all outgoing cases of shelled nuts

and sacks of inshell nuts. This tag is sought after by buyers around the world as an

assurance of quality.

RECORDKEEPING

As part of the incoming inspection, records are kept by the packer on intake nuts. Test

samples are kept and this ability to trace the nut to a grower intake lot becomes a very

important factor in satisfying end user requirements for after reception traceability. Packers

can monitor grower quality and pay the appropriate premiums. Most importantly, they can

rapidly trace lots to the grower when there is a quality dispute or recall.

DISPUTE RESOLUTION

The quality inspection becomes a business tool for the packer and a means of setting and

avoiding disputes. In talking with Georgian packers, they are always in trouble when

shipping to new markets, such as the Gulf, India and China. The product grade and

inspection certificate, as well as test samples become an important tool for avoiding frivolous

quality claims and for setting legitimate disputes.

ORGANIC CERTIFICATION

The value of organic certification has been debated by buyers for years. What is certain is

that a number of the new buyers, in places like Asia, Canada, South America and Australia

are all asking for organic. Georgia, of course is an organic ―island,‖ and growers do not

utilize pesticides and herbicides in hazelnut production. The question is posed, should we

capitalize on the organic nature of Georgian hazelnuts.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 15

Advantage: Georgian hazelnuts are definitely organic.

Disadvantage: Because of the small and disorganized structure of the grower base, it would

be quite difficult and expensive to certify large combined lots of hazelnuts destined for a

packer under the current system. If packers did deal direct with producers, this would be

much easier to implement. But currently, the collector system does not work for inputs back

down the value chain.

In talking with buyers, they do ask for organic as a wish, but would also be quite satisfied

with products which –although not technically certified by a certification body – are logically

organic, natural. It is recommended that there is investigation held for the use of terminology

that describes the organic yet not certified nature of Georgian hazelnuts. ―Georgian

Natural.‖ ―Georgian Supra.‖

BUSINESS MANAGEMENT IMPROVEMENT

While visiting numerous plants in Georgia, it was noted that they are producing a fine

product under very difficult conditions and little guidance. (It is the notion that the companies

are currently adequate to their ―partners‖ as suppliers of raw materials that must be

reprocessed in Western Europe. The Georgian hazelnut industry needs a quality

improvement guide and framework. Perhaps a best practices model from the DFA of

California, which is the premiere food quality and plant inspection service worldwide, can be

Activities/Recommendations:

Development of a DFA like organization in Georgia, utilizing the expertise

of a visiting expert from the USA to help establish. This would include

development of plant inspection guidelines, product specification and

inspection system and certification.

Consultations with individual plants with nut production expert to show

how to improve quality from within, raising the standards of cleanliness

and production efficiencies to higher levels.

Certification on inshell California walnuts

shipped to Georgia for reprocessing

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 16

used. In the 1880s, California’s dried fruit packers founded the DFA as a means of

preventing disputes with overseas buyers. The DFA concept developed a 2000-point

system for plant cleanliness and operations, which covers all aspects of the dried fruit and

nut business. The organization inspects most of the fruit and nut companies on the West

Coast of the USA, and packers fiercely compete to get the 1800 Club certification, which is

recognized by confectionery and food industry buyers around the world. Perhaps the DFA

could consult with the Georgian hazelnut industry to establish a similar organization, which

could provide the framework for raising quality plant operations worldwide. The organization

could also become a contracted inspection service as it is in the USA. If run properly, this

organization should become an independent and self-sustaining entity with a board of

directors.

2010 Exports

LINKAGES & PARTNERSHIP

The treenut business in the world is a tight knit group of packers, handlers, importers and

end users. When looking at the cohesiveness of the group – for example, under the

umbrella of the International Nut Congress, it is easy to say that: anyone who needs to buy

hazelnuts – knows where to get them. The world nut handlers, such as the Pont Brothers

Turkey

Azerbajian

EU-27

HK

USA

Activities/Recommendations:

Development of a DFA like organization in Georgia, utilizing the

expertise of a visiting expert from the USA to help establish. This

would include development of plant inspection guidelines, product

specification and inspection system and certification. Note that the

organization has a new name, American Council for Food Safety,

which shows the initiative to become more than a California Nut

organization. The former director, Rich Novy is now an independent

consultant available for consultations as well.

o http://agfoodsafety.org/

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 17

(Borges) in Spain, Bessana Nut (Italy), George Goeck (Germany) and other such companies

do a tremendous job of handling a huge quantity of nuts and hazelnuts in particular. But,

the world market is also much larger and a whole end user base abroad is un-serviced and

willing to try new sources such as Georgia.

LINKAGES

We will go beyond the European market and match Georgian hazelnut packers with ―real‖

substantial customers in markets that will not interfere with their current business

relationships. This will include companies in Canada, USA, China (shelled), Central

America, Brazil, Mexico, Southeast Asia and other markets. The companies suggest that

they are eager to find new direct sources, and are willing to come to Georgia, work with the

packers on quality improvement and marketing strategies.

IMAGE DEVELOPMENT

We will place Georgia on the world tree nut map, and publish an article with photos in the

Germany food technology publication Food Marketing and Technology. This will be read by

major end users and buyers.

ONLINE PACKER LIST

Establish a packer list as a means for reaching packers and individual products. The world

candy customers are bigger than any individual packer in Georgia. We need to establish a

packer list online that includes product offerings and e-mails for contact.

TECHNICAL ASSISTANCE TO PACKERS

We will assist the packers in the field to help them find new customers and execute

transactions. This will include individual consultations, ongoing assistance and advice on

sampling, pricing, collections and sales.

TECHNICAL BROCHURE

The Georgian hazelnut industry needs a flagship document that has Georgian specific

technical information, including the production region, products offered, photos,

specifications and contact information.

Size and color chart.

Product specifics and Georgian terminologies: natural, blanched, roasted, etc.

Background on the industry: not technical but very important for understanding.

Information on Georgian hazelnuts: natural, no pesticide use and term for ―uncertified

organic.‖

Packing sizes available: very important information for buyers.

Georgian Commitment to quality: information on quality improvement programs listed

in another section of this document.

Would suggest making two technical specification documents: inshell and shelled

(kernels). The inshell market is quite simple in requirements.

o Georgian size and shapes

o Processing, drying and cleaning

o Moisture content

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 18

Activities/Recommendations:

Bring qualified buyers with a long-term interest in working with the

Georgian producers, into the country in a harvest-time visit . This will

result in immediate sales, and long- term communications and real

partnerships for future growth. Specific activities are listed above in

sections 7.1 to 7.4. With these linkages will come valuable technical

assistance.

o Georgian quality commitment. (Hit the hollow nut problem right on the head

and list initiatives in place to ensure valued product).

Shelled Hazelnut Imports. EU is dominant importer.

CONCLUSIONS/RECOMMENDATIONS

Recommendations have been made in individual sections. But, overall it is recommended

overall that to help Georgian producers enter the 20

th

century with key trade contacts in

regions of the world. These new buyers will help move hazelnuts to new markets in

significant volumes and will work with Georgian suppliers on ascension to real world

standards and specifications.

VALUE-ADDED TASKS

Market analysis – The world hazelnut market, like other treenuts, such as almonds, walnuts

and pecans, is a demand-driven specialty commodity. There are two major segments of the

industry: inshell and shelled. Although many channel partners or intermediaries are active in

the trade of both, the end users are totally separate.

Australia

Brazil

Croatia

EU-27

HK

Japan

S.Korea

Norway

Russia

Serbia

S.Africa

Switz.

Turkey

Ukraine

USA

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 19

ANALYSIS OF CURRENT AND PROSPECTIVE MARKETS OF OPPORTUNITY

Most inshell hazelnuts are either shipped to Europe for Christmas time or to China for

roasting. On the shelled side, although there are a number of different supplier nations and

regions, Turkey is the main entity and focus of buyers. The customer base is quite small

and most products go to the confectionery industry for a number of long established candy

products that require hazelnuts, hazelnut paste and kernels. Consumer packs of hazelnuts,

foodservice, dairy use and other applications are smaller, yet are quite interesting for market

development and are a focus of hazelnut producers in Turkey and elsewhere. Currently,

almost all trade of hazelnuts is locked up by a small number of suppliers and intermediaries

(mainly in Hamburg, Rotterdam) who have long established relations with the major world

confectionery companies, such as Ferrero, Mars, Nestle and Nutella.

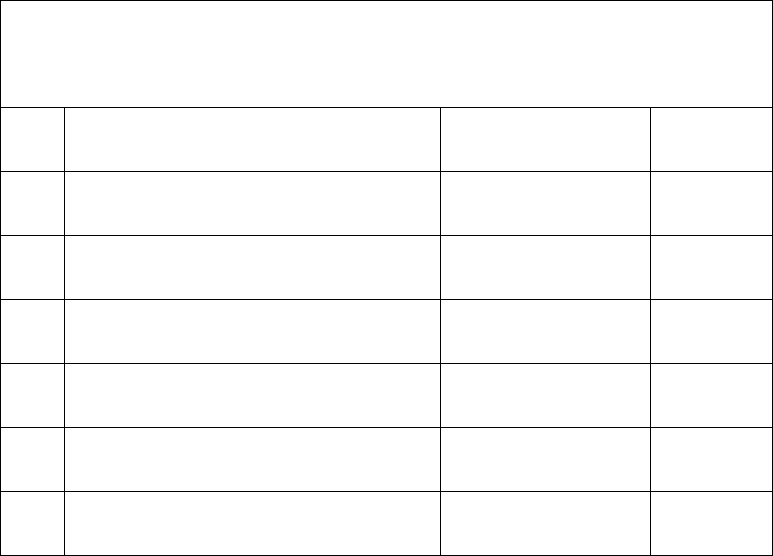

LIST OF POTENTIAL BUYERS

The current universe of hazelnut intermediaries and buyers is quite small. Here are a few

leaders.

Country

Contact

United

Kingdom

CG Hacking Co.

Mr. Christopher Hacking, Chariman

Calverts Buildings, 50 Borough High Street, London, SE1 1XW, United Kingdom

Tel: + 44 (0) 207 407 6451

Fax.: +44 (0) 207 407 300

Email: ghacking@cghacking.com

Web site: http://www.cghacking.com

Spain

BORGES, S.A

Marti Jordi

C/. Flix 29, 43205 Reus, Spain

Tel: +34 (977) 30 90 00

Fax: +34 (977) 77 20 52

Email: info@borges.es

Web site: http://frutossecos.borges.es

Italy

Besana Nut

Pino Calcagni

V. Besana S.p.A. - Via Ferrovia, 210 - 80040 - San Gennaro Vesuviano (NA) –

Italia

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 20

Country

Contact

Tel: +39 081 8659111

Fax: +39 081 8657651

E-mail: info@besanaworld.com

Germany

Max Kiene GmbH

Oberhafenstraße 1

20097 Hamburg, Germany

Tel: 040 309655-0

Belgium

Q.M. BVBA

Mr. Frank Vaerewijck, Director

Scousele 30. B-9140 Steendorp. Belgium.

Tel: 32 (2) 711 0895

Fax: 32 (2) 711 0879

E-mail: q.m[email protected]

Netherlands

van de Sandt B.V.

Kleiweg 307. 3051 XR Rotterdam, The Netherlands.

Tel: +31(0)10 418 2060. +31(0)10 422 1177

E-mail: info@cvandesandt.com.

Web site: www.cvandesandt.com

Australia

MWT Foods

Pelaco Building

Ground Floor, building 2, 21-31 Goodwood Street, Richmond, Victoria Australia

Tel: +61-3-9420-2900

Fax: +61-9421-0507

Email: info@mwtfoods.com

Web site: http://www.mwtfoods.com

Germany

Bösch Boden Spies

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 21

Country

Contact

Lippeltstr. 1, Hamburg, Germany

Tel: +49-40 333016-66

Email: info@boesch-boden-spies.com

Web site: www.boesch-boden-spies.com

Canada

Balcorp Limited

4103, Sherbrooke Ouest Montréal, (Québec), Canada H3Z 1A7

Tel: (514) 939-0909.

Fax : (514) 939-0777

Email: [email protected]

France

Raul Gamon

Somervom SRL, 12 Rue Marbeuf, 75008 Paris

Tel: 01 40 70 94 50

Fax: 01 40 70 94 80

INTERVIEWS WITH BUYERS (COMPLETED)

A number of buyers of Hazelnuts were interviewed. In doing so, it validated the fact that the

large entities are already well tied in with other Turkish other suppliers. For this purpose, it is

important to operate outside of the current structure and work on new markets.

Singapore: Ken Davis, Spectrum In gradients

Japan. Toyo Nuts, Kobe

Canada, All Gold, Toronto

Germany, DIA, Cologne

Costa Rica, Resosco, San Jose

Others

DESCRIPTION AND STRUCTURE OF MARKETS

The world trade of hazelnuts centers on a very few large trading companies who have long-

established relationships with confectionery companies who use a majority of hazelnut

production. For example, there are 10 more traders in Hamburg and Rotterdam, and they all

have offices in the same neighborhoods near the port – sometimes even in the same

building. These companies are in very tight formation with buyers and have decades of

business on the books. The new companies that are listed are on the fringes and are

currently already sourcing from secondary sources or are looking to fill requirements for new

customers. The new import companies have direct linkages with the end users, have

technical service capabilities and are in a position to develop new markets for hazelnuts.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 22

Where they lack in huge volumes, they make up in willingness to work with new suppliers

and provide assistance and support. This will be a recommended channel for Georgian

hazelnuts.

GEORGIAN PRODUCTION CAPACITY

Georgia is currently a small player in the global hazelnut industry. Being attached to Turkey,

the main player, Georgia fills supply needs in this country and has direct field grade and raw

material and semifinished product shipments to main European markets. In addition, the

production is stable and limited to small farming activities, in which packers are supplied by

farmers through a middleman and direct sales to packers. This situation is seriously limiting

the development of new production. Georgia has substantial amounts of land available for

hazelnut production and some of this is in areas where discontinued tea production as

occurred. Other acres are in the East and in new and nontraditional hazelnut production

areas. The small producer, handler and packer arrangements does not seem to stimulate

new plantings and business. My guess is that this is because the middle men are regulating

supply to keep pricing up to the packer. Packers are struggling to get supply. The supply

pull will not begin until packers start to source directly from producers. They will initially

compete for producers, and provide incentives like higher prices and some serviced and

technical support. In time relationships will develop and packers will build bases of

production which will grow as the market grows.

The exception to the above described situation is the big farming activity from investors and

Fererro. The large confectionery company has jumped into the Georgian market seeing the

available land and potential and is producing on its own with substantial plantings in the

ground. Other private investors have developed hazelnut plantations in the East, and

unfortunately they do not seem to be experts in nut production and there is not much

progress or prospect for success in the future.

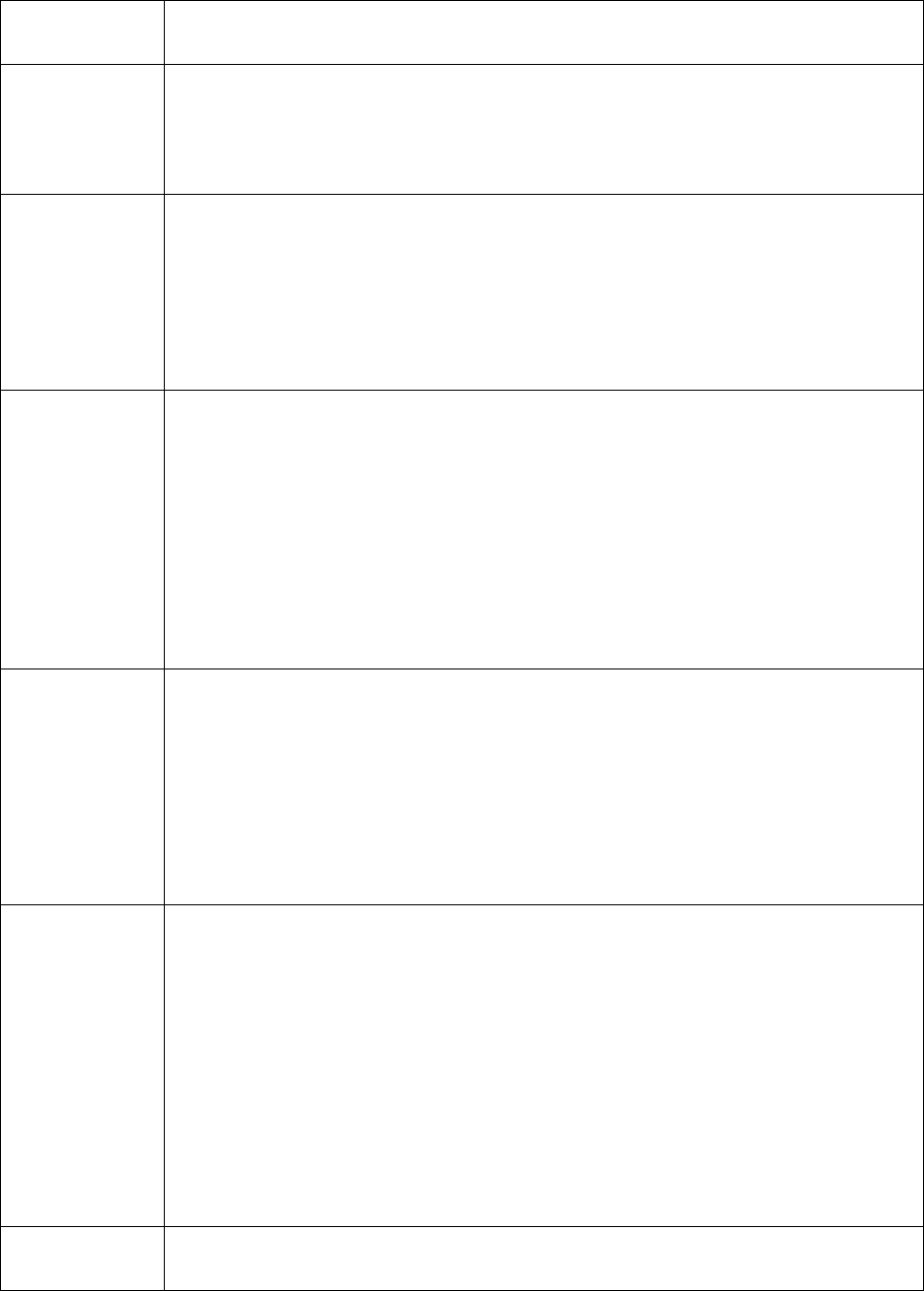

Nut Aggregators & Processors

Company Name

Contact person

Phone No

1

Nut producing and processing company

Besik Akhaladze

899170698

2

Kartu Group HCP

Irakli Amanatashvili

895222216

3

LLC Keskia

Fridon Kodua

899515194

4

LLC Tskaros Tavi

Koba Gvazava

877431517

5

LLC Didinedzis meurneoba

Goneli Kukava

899584234

6

LLC Kristali

Dato Lashqarava

877419587

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 23

7

LLC Kartuli Sio 2000

Begi Sioridze

899989090

8

LLC GN Company

Mokho Khomeriki

899115370

9

LLC Argo Natia

Mamuka Todua

10

LLC Dioskuria

Ronaldi shelia

899299845

11

LLC Impex

Levan Jorjikia

877544445

12

LLC G-Nut

Shota Bukhaidze

877777374

13

LLC Georgian Nuts

Kakha Bochorishvili

877797574

14

LLC Fima Georgia

Aleko Motserelia

899953737

15

LLC Megobrebi da Kompania

Paata Erqvanidze

899180803

16

LLC Kardiko

Tengo Arqania

899519214

17

Ferero International

Merab Murgulia

899583658

18

I/E Badri Lorchoshvili

Badri lorchoshvili

899507823

19

LLC Agro+

David Quhilava

20

LLC Verdzi

Gela dzidzava

895343358

21

I/E Tskvitava Paata

Badri Lorzoshvili

899508852

IDENTIFICATION OF POLICY AND REGULATORY CONDITIONS TO IMPROVE

SECTOR

The hazelnut sector is a priority agricultural commodity in Georgia and has received a

substantial amount of attention from the central government. It is also a priority item for

assistance from donor nations, and assistance programs. From a policy standpoint, I would

recommend development and formation of a ―marketing order‖ type of program, which would

allow development activities and controls, which could benefit the entire sector. Modeled

after the Oregon Hazelnut Committee in the USA, the program could address three different

areas:

5. Quality. A law would be established to define quality standards for Georgian

hazelnuts. This would include size, color, and other criteria that are important to the

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 24

buyers. In short, anyone would be able to grow hazelnuts in Georgia, but only those

which meet the mandated quality criteria could be marketed and exported. The law

would define an inspection mechanism at the packer level, as well as fines and

consequences for violating this aspect of the marketing order.

6. Research. The law would allow for identification and funding of research to serve the

needs of the Georgian hazelnut industry. This would include research and

development of new plant stocks, new products and processes and economic

research.

7. Promotion. The law would allow funding of market development and promotions in

the domestic and world markets, including market research, exhibitions, advertising

and trade missions.

8. Control. A board would have powerful marketing functions to create order in the

marketplace. This includes setting marketable supply, reserve pools, tools for

limiting product on the market, such as green drops (payment for destruction of the

product on the tree) and other mechanics.

The marketing order would be funded by an assessment per metric ton, on product received

by packers. The assessment would be passed along to the end user, and in the case of

Georgia, there is adequate room for price increases. In the USA, assessments for

commodity boards range from one cent per lb for honey to around $12 per ton for

blueberries. Most products, such as almonds and walnuts, are assessed at around $24-36

per ton. This would cover operating expenses of a board office and a collection mechanism.

A board would be formed which would represent the geographic profile of the industry and

would be selected in an election by industry stakeholders. Typically, this would be the

growers, but could also be the packer who in turn represents a producer base.

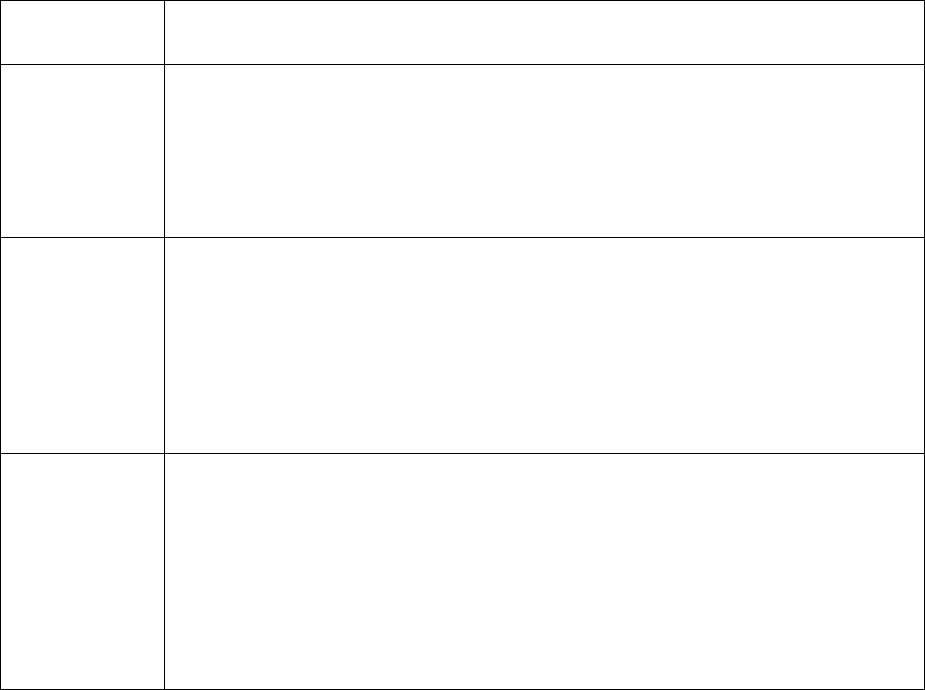

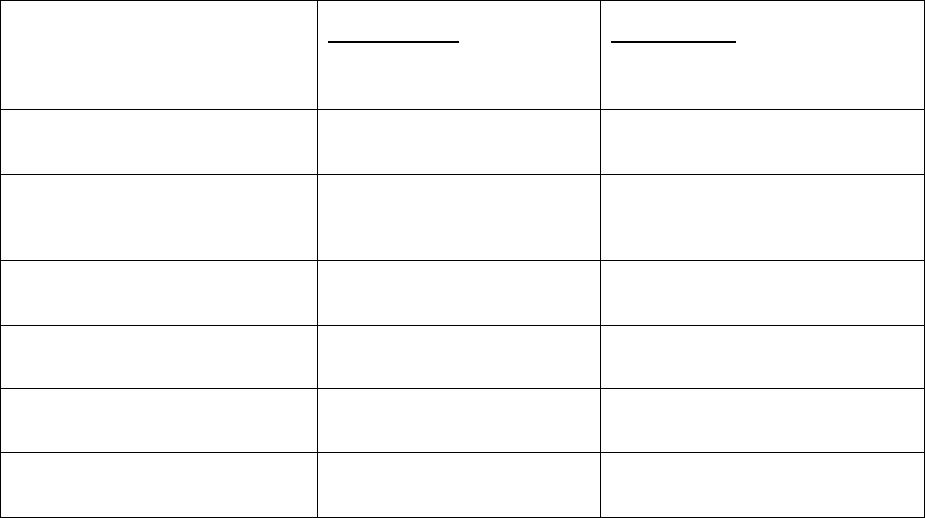

GAP ANALYSIS

Where we are

Where we want to be

What is stopping us

from getting there

What we can do to get

there

Production: small stable

production, little growth.

Want to achieve at least 3-

5% increases in production.

No ability for packers to

stimulate production due to

middle men (collectors)

keeping the producers

hungry.

Encourage direct relationship

between packers and longer

term and steady supply

relationships that can be built

and developed.

Most products are sold ―as

is‖ to intermediary

customers who do

reprocessing.

Want to achieve market

price sales of hazelnut

products to real customers

based on quality and

appropriateness for the end

user.

Georgian plants are

deficient in many quality

control attributes and

practices due to lack of

knowledge of end user

standards.

>Engage Georgian producers

with real customers who can

help advise on quality steps.

>Utilize food safety and

processing experts in market

to work with companies to fix

gaps.

>Implement ongoing quality

and processing standards

certification program.

Few packers offer product

in a form and condition for

the end market.

Georgia should have a wide

range of offerings in proper

world packing materials.

Current solo customers are

content to get cheap prices

and do not push for world

class packaging and

products.

Provide consul to industry on

market requirements,

demands and product forms

that are needed in the

marketplace and show how to

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 25

get there.

Although most product is

produced without

pesticides, there is no

organic certification in

Georgia.

Georgia should have a

small yet significant organic

hazelnut category and thus

could well differentiate this

origin in new markets for

higher prices and growth

outside of the commodity

business.

Because of the current

structure where packers are

removed from growers by

collectors, there is a

difficulty to get organic

certification for such a large

grower base.

We should work with a few

larger packers with a large

direct grower base to begin

certification process to obtain

new organic production for the

marketplaces. At the same

time, we should develop a

terminology for Georgian

product that is certainly

organic yet not certified. This

would be immediately

accepted in some markets and

would add value.

Georgian product has little

or no image and awareness

in the world tree nut

community.

Georgia should obtain a

unique and positive identity

for hazelnuts – as an

original home of hazelnuts,

a provider of unique

cultivars and products.

Georgia is close to Turkey,

which is the leading

producer in the world, and

current customers come to

Georgia.

Georgia should gain a

presence in the International

Nut Congress, as well as gain

awareness through

participation in international

food exhibitions, such as

International Sourcing &

Marketing (confectionary)

FOODEX, Japan, Food and

Hotel Korea trade articles in

European, American and

Asian trade magazines and

online information portals.

Georgian packers lack the

fundamental knowledge for

succeed in new export

market transactions.

Current single customer

―partner‖ system has not

required packers to learn

and implement a lot of the

basic practices and

fundamentals of import

export business.

Georgian producers need

basic skills in sales

prospecting, sampling,

pricing, dispute resolution

and other skills to work in

new markets.

We should implement

seminars and consultations

with individual packers on

export transactions, sampling,

prospecting, pricing, dispute

resolution and collection.

Recommendations (Completed) followed outline of project tasks as provided to ensure that

the recommendations fit into the project structure.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 26

B. ADDITIONAL INFORMATION

DEFINITION OF TERMS

Collector – A person or company which is not a producer of packer, which is located in a

stationary location, normally a town near hazelnut production, which receives and buys

incoming deliveries of hazelnuts from producers.

Handler – Typically is the first company who handles raw material from field. In Georgia, this

is also called a collector.

Packers – a company or individual who receives raw material and transforms product

through cleaning, processing for shipping to customers.

Exporter or street broker – A person or company who works with a packer independently as

an export seller of hazelnuts. Normally is allied with one or two packers.

EXHIBITS/PHOTOS

New drying chamber

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 27

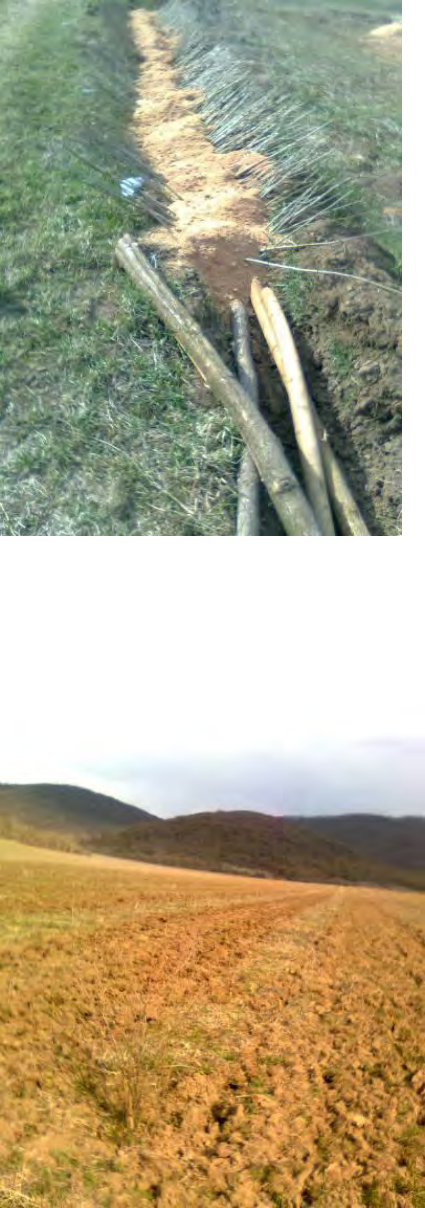

Hazelnut nursery, East Georgia

New three-year old plantings in East Georgia

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 28

New plantations in East Georgia

New generation of hazelnut processors in Georgia. Tom Payne on Right.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 29

Hand cracking of California Walnuts in plant in Zigdidi, West Georgia. Inshell walnuts are

shipped in sacks to Georgia for hand cracking for the French market. This is done alongside

conventional hazelnut processing

Perfect hand cracked California walnuts

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 30

Hand cracking of California walnuts in Zigdidi, West Georgia

Sorting of hazelnut kernels after cracking

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 31

Collector checks probe of inshell hazelnuts for hollow nuts as well as foreign object

Boss collector inspects inshell nuts

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 32

Entrepreneurs with new roasting equipment

Drying tower

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 33

New drying tower

Cracking machinery

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 34

Inshell walnuts ready to ship. Note, stacked directly on floor!!!

Large inshell walnuts ready to ship to China.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 35

“Big Boss” at his new factory in Zigdidi.

Shelled hazelnuts

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 36

Processed shelled hazelnuts ready to ship on pallets.

Blanched hazelnuts in vacuum pack

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 37

Hazelnut meal in vacuum pack

Shelled product for Middle East customer with Halal certification

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 38

Variety of product offerings in vacuum pack for samples and evaluation

Loading of truck in Zigdidi

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 39

Incoming hazelnuts loaded into dryer

Sorting of shelled hazelnuts. Note hairnets.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 40

Properly packed product ready to ship on pallets

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 41

Blanched hazelnuts in vacuum pack blocks.

Posters on proper propagation of hazelnuts.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 42

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 43

Sorting table, note unprotected fluorescent tubes!

New cracking machinery

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 44

New inshell dryers

Incoming inshell hazelnuts

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 45

Inshell probe. Note, notations of grower on sack.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 46

Packer inspects incoming field-grade product.

Scale at raw material reception area at packer.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 47

Hazelnut cracker

Outside of plant, note rodent control measures and barriers on peripheral of plant.

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 48

OREGON STANDARDS FOR HAZELNUTS

OREGON GRADE STANDARDS

FILBERTS (HAZELNUTS) IN SHELL (Effective August 25, 1975)

OREGON NO. 1 GRADE. ―Oregon No. 1‖ consists of filberts in the shell which meet the

following requirements:

(1) Similar type; and,

(2) Dry.

(3) Shells:

(a) Well formed; and,

(b) Clean and bright.

(c) Free from:

(i) Blanks; and,

(ii) Broken or split shells.

(d) Free from damage caused by:

(i) Stains; and,

(ii) Adhering husk; or,

(iii) Other means.

(4) Kernels:

(a) Reasonably well developed; and,

(b) Not badly misshapen.

(c) Free from:

(i) Rancidity;

(ii) Decay;

(iii) Mold; and,

(iv) Insect injury.

(d) Free from damage caused by:

(i) Shriveling; and,

(ii) Discoloration; or,

(iii) Other means

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 49

(5) Size: The size shall be specified in connection with the grade in accordance with one of

the size classifications in Table 1.

(6) Tolerances: In order to allow for variations incident to proper grading and

handling, the following tolerances, by count, are permitted as specified:

(a) For mixed types, 20% for filberts, which are of a different type.

(b) For defects, 10% for filberts which are below the requirements of this

grade: Provided, that not more than one-half of this amount or 5% shall

consist of blanks, and not more than 5 percent shall consist of filberts with

rancid, decayed, moldy or insect injured kernels, including not more than 2%

for insect injury.

(c) For off-size, 15% for filberts which fail to meet the requirements for

the size specified, but not more than two-thirds of this amount, or 10%

shall consist of undersize filberts.

Table 1

Round type varieties:

Size classifications for kernerls

packed in containers holding

more than 1 kilogram

Maximum Size

Will pass through a round

opening of the following size

Minimum Size

Will not pass through a round

opening of the following size

Giant

No Maximum

23 m.m.

Jumbo/Giant (at least 25% giant

size and balance jumbo size)

No Maximum

22.2 m.m.

Jumbo

No Maximum

22.2 m.m.

Large

22.2 m.m.

19.4 m.m.

Medium

19.4 m.m.

17.9 m.m.

Small

17.9 m.m.

No Minimum

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 50

Table 2

Long type varieties:

Size classifications for kernerls

packed in containers holding

more than 1 kilogram

Maximum Size

Will pass through a round

opening of the following size

Minimum Size

Will not pass through a round

opening of the following size

Giant

No Maximum

22.2 m.m.

Jumbo/Giant (at least 25% giant

size and balance jumbo size)

No Maximum

18.6 m.m.

Jumbo

No Maximum

18.6 m.m.

Large

19.0 m.m.

17.5 m.m.

Medium

17.9 m.m.

13.5 m.m.

Small

13.9 m.m.

No Minimum

Application of standards

(1) The grade of a lot of filberts shall be determined on the basis of a composite

sample drawn from containers in various locations in the lot. However, any

container or group of containers in which the filberts are obviously of a quality,

type or size materially different from that in the majority of containers shall be

considered a separate lot, and shall be sampled separately.

(2) In grading the sample, each filbert shall be examined for defects of the shell before

being cracked for kernel examination. A filbert shall be classed as only one

defective nut even though it may be defective externally and internally.

Definitions

(1) ―Similar type‖ means that the filberts in each container are of the same general type

and appearance. For example, nuts of the round type shall not be mixed with those

of the long type in the same container.

(2) ―Dry‖ means that the shell is free from surface moisture, and that the shells and

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 51

kernels combined do not contain more than 10 percent moisture.

(3) ―Well formed‖ means that the filbert shell is not materially misshapen.

(4) ―Clean and bright‖ means that the individual filbert and the lot as a whole are practically

free

from adhering dirt and other foreign material, and that the shells have characteristic color.

(5) ―Blank‖ means a filbert containing no kernel or a kernel filling less than one-fourth

the capacity of the shell.

(6) ―Split shell‖ means a shell having any crack which is open and conspicuous for a

distance of

more than one-fourth the circumference of the shell, measured in the direction of the crack.

(7) ―Damage‖ means any specific defect described in this section; or an equally

objectionable

variation of any one of these defects, and other defect, or any combination of defects which

materially detracts from the appearance, or the edible or marketing quality of the filberts.

The following specific defects shall be considered as damage:

(a) Stains which are dark and materially affect the appearance of the individual shell.

(b) Adhering husk when covering more than 5 percent of the surface of the shell in the

aggregate.

(c) Shriveling when the kernel is materially shrunken, wrinkled, leathery or tough.

(d) Discoloration when the appearance of the kernel is materially affected by black color.

(8) ―Reasonably well developed‖ means that the kernel fills one-half or more of the capacity

of the shell.

(9) ―Badly misshapen‖ means that the kernel is so malformed that the appearance is

materially affected.

(10) ―Rancidity‖ means that the kernel is noticeably rancid to the taste. An oily appearance of

the flesh does not necessarily indicate a rancid condition.

(11) ―Moldy‖ means that there is a visible growth of mold either on the outside or the inside

of the kernel.

(12) ―Insect injury‖ means that the insect frass or web if present inside the nut or kernel

shows definite evidence of insect feeding.

Metric Conversion Table

Millimeters (m.m.) Inches: Millimeters (m.m.) Inches:

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 52

24.6…………………………..... 62/64 18.6……………………………..47/64

23.4…………………………….59/64 17.9……………………………..45/64

23.0…………………………….58/64 17.5……………………………..44/64

22.2…………………………….56/64 16.7……………………………..42/64

19.4…………………………….49/64 13.9……………………………..35/64

19.0…………………………….48/64 13.5……………………………..34/64

OREGON STANDARDS FOR SHELLED HAZELNUTS

OREGON GRADE STANDARDS

HAZELNUT (FILBERT) KERNELS (Effective August 1, 1980)

603-51-305 APPLICATION OF STANDARDS. The grade of a lot of hazelnut kernels

shall be determined on the basis of a composite sample drawn from containers in

various locations in the lot. However, any container or group of containers in which the

hazelnuts are obviously of a quality, type, or size materially different from that in the

majority of containers shall be considered a separate lot, and shall be sampled

separately.

51-310 OFFICIAL GRADES.

(1) OREGON FANCY, which consists of whole hazelnut kernels meeting the following

requirements:

(a) Similar type, well dried and clean;

(b) Free from foreign material, mold, rancidity, decay and insect injury;

(c) Free from damage caused by chafing or scraping, shriveling, deformity,

internal flesh discoloration or other means;

(d) Free from serious damage caused by serious shriveling, broken kernels or

other means; and

(e) The size meets, and is declared as, those specified in connection with the

grade, in accordance with one of the size classifications in Table I or Table II

of OAR 603-51-311.

(2) OREGON NO. 1, which consists of whole hazelnut kernels meeting the following

requirements:

GEORGIA HAZELNUTS ASSESSMENT FINAL

ECONOMIC PROSPERITY INITIATIVE (EPI) 53

(a) Well dried and clean;

(b) Free from foreign material, mold, rancidity, decay and insect injury;

(c) Free from damage caused by chafing or scraping, shriveling, internal flesh

discoloration or other means;

(d) Free from serious damage caused by serious shriveling, broken kernels or

other means; and

(e) The size meets, and is declared as, those specified in connection with the