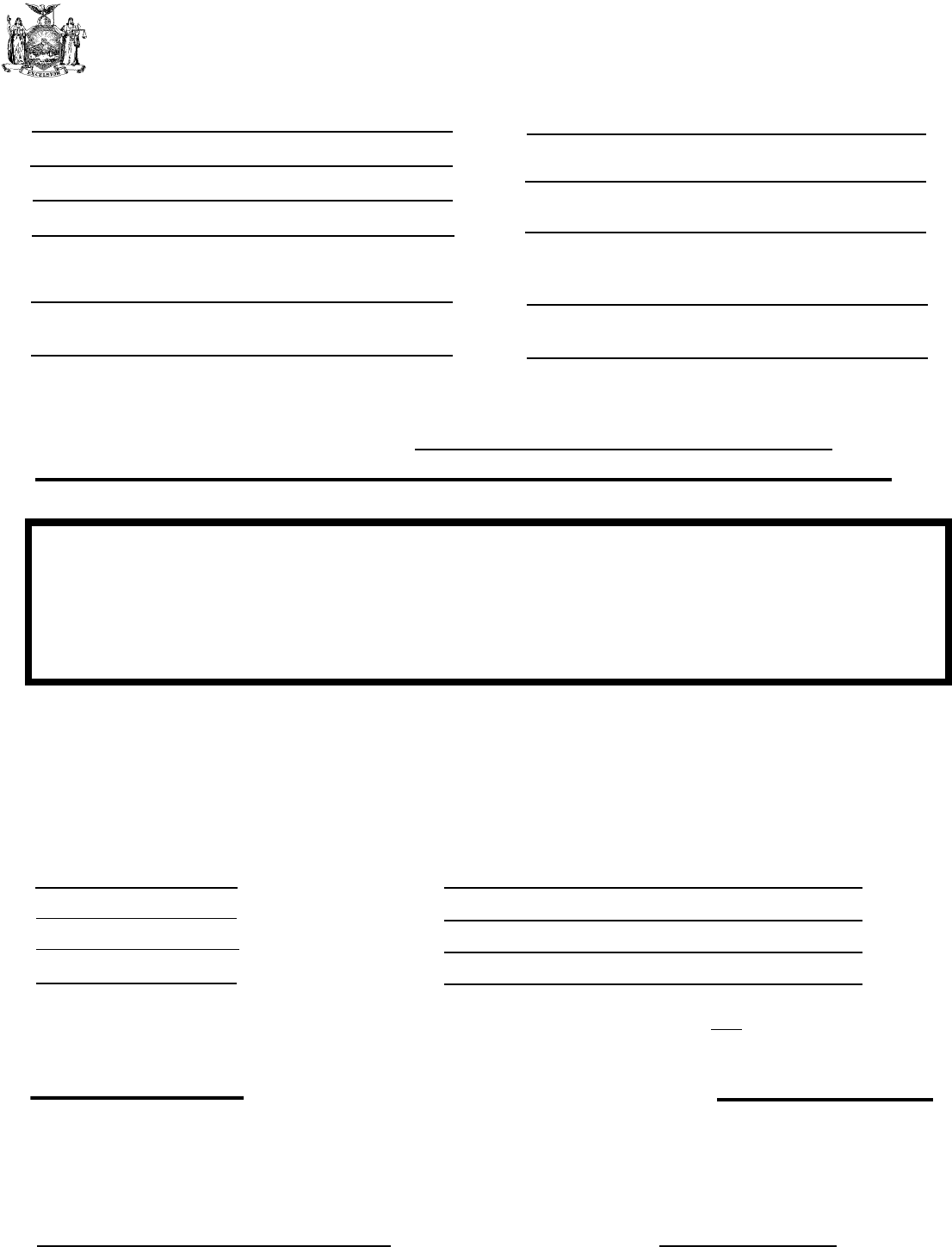

APPLICATION FOR SCHOOL TAX RELIEF (STAR) EXEMPTION

RP-425 (9/97)

NOTE:

This application must be filed with your local assessor. Do not file this form

with the State Board of Real Property Services.

(See instructions on back )

New York State Board of Real Property Services

4. Income information: ONLY for senior citizens who seek additional(enhanced) exemption

5. Certification

If all of the owners are at least 65 years of age (or, for property owned by husband and

wife, if one of the owners is at least 65 years of age) and the total income does not exceed

$60,000, enter the total income _________________ . Attach a copy of the latest federal or

New York State income tax return if filed and proof of age.

I (we) certify that all of the above information is correct and that the property listed above

is my (our) primary residence. I (we) understand it is my (our) obligation to notify the

assessor if I (we) relocate to another primary residence.

Signature

Date

SPACE BELOW FOR USE OF ASSESSOR

Application received _____________

Assessor 's signature

Date

Proof of age _____________

Proof of income _____________

Approved _____ Yes _____ No

Senior additional

_____ Yes _____ No

School district

City/Town

Village (if any)

Street address

3. Location of property

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot

2. Mailing address of owner(s)

1. Name and telephone no. of owner(s)

Day No. ( )

Evening No. ( )

(All resident owners must sign)

RP-425 (9/97)

Page 2

The New York State School Tax Relief (STAR) Program provides an exemption from school taxes

for owner-occupied, primary residences. Senior citizens with combined incomes that do no exceed

$60,000 may qualify for a greater ("enhanced") exemption. The STAR exemption is authorized by section 425

of the Real Property Tax Law.

The "enhanced" STAR exemption for eligible senior citizens first applies to 1998-99 school taxes. If

your property will be receiving the "Senior Citizens Exemption" authorized by section 467 of the Real

Property Tax Law, you do not need to apply for the STAR exemption; your property automatically qualifies

for the enhanced STAR exemption as long as it is eligible for the Senior Citizens Exemption. If you are a low

or middle income senior whose property is not receiving the Senior Citizens Exemption, your property may

still be eligible for the enhanced STAR exemption, but you must apply for it. If your application is granted,

you must then reapply each year thereafter in order to keep the enhanced exemption in effect.

The "basic" STAR exemption for non-seniors, and for seniors whose combined incomes exceed

$60,000, first applies to 1999-2000 school taxes. If you own your primary residence, your property should be

eligible for the basic STAR exemption, but you must apply for it. If the basic exemption is granted, you

usually do not need to reapply in subsequent years. However, you must notify the assessor if your primary

residence changes.

To apply for either the basic or enhanced STAR exemption, you must file application form RP-425

with the assessor of your city or town (in Nassau or Tompkins County, with the county assessor) on or before

the applicable "taxable status date." In towns, taxable status date is generally March 1, except in the counties

of Erie (June 1), Nassau (January 2), and Westchester (June 1); in cities, check with your assessor. For

further information, ask your local assessor for the pamphlet "Q&A about the STAR Exemption".

Application Instructions: 1 and 2. Print the name and mailing address of each person who both owns and

primarily resides in the property. (If the title to the property is in a trust, the trust beneficiaries are deemed

to be the owners for STAR purposes.) There is no single factor which determines whether the property is

your primary residence, but factors such as voting and automobile registrations, and the length of time you

occupy the property each year may be relevant. The assessor may ask you to provide proof of residency with

the application. In addition, the assessor may occasionally request proof of residency after the exemption has

been granted, to verify that the property remains your primary residence.

3. The parcel identification number may be obtained from either the assessment roll or the tax bill.

4. Question 4 should be completed ONLY by senior citizens with combined incomes that do not exceed

$60,000. All of the owners must be at least 65 years of age as of taxable status date, except that if the

property is owned by a husband and wife, only one of them must be at least age 65. If you meet these

criteria, enter in the space provided the total income of all property owners (including any non-resident

owners) for the calendar year immediately preceding the date of application. Your income for STAR

purposes is not necessarily the same as your income for federal or state income tax purposes. When

calculating your income for STAR purposes, include salary or earnings, social security and retirement

benefits, interest, dividends, total gain from the sale or exchange of a capital asset (which may be offset by a

loss from the sale or exchange of a capital asset in the same income tax year), and net income from rental

property or self-employment (which may not be offset by a depreciation allowance for the exhaustion, wear

and tear of real or personal property held for the production of income). Do not include any return of capital,

gifts, inheritances, monies earned through the federal Foster Grandparent Program, or reparations received as

a victim of Nazi persecution. Be sure to attach proof of age and copies of your latest federal or New

York State income tax returns if filing was required.

5. All resident owners must sign and date the application. Caution: Anyone who misrepresents his or her

primary residence (or his or her age or income, if answering Question 4) may be subject to a $100 penalty,

may be prohibited from receiving the STAR exemption for five years, and may be subject to criminal

prosecution.

GENERAL INFORMATION