Guide to

Farm Trucking

in Oregon

January 2024

Commerce and Compliance Division

Table of Contents

Table of Contents ...................................................................................................................... 1

Introduction and Contact Information ......................................................................................... 1

Oregon Farm Bureau ........................................................................................................................... 1

Oregon Wheat Growers League .......................................................................................................... 1

Oregon Association of Nurseries .......................................................................................................... 1

Oregon Department of Transportation Commerce and Compliance Division (CCD) .......................... 1

Oregon Department of Transportation Driver and Motor Vehicle (DMV) Services ............................... 1

DMV Forms .......................................................................................................................................... 1

Farm Trucking in Oregon – The Basics ..................................................................................... 2

Get a USDOT Number ......................................................................................................................... 2

Get Farm-Certified ................................................................................................................................ 2

Get Farm License Plates ...................................................................................................................... 2

Meet Fuels Tax Requirements ............................................................................................................. 2

Determine if vehicles are subject to safety regulations. ....................................................................... 2

Interstate Operations need UCR .......................................................................................................... 3

Benefits of Oregon Farm Certification .................................................................................................. 3

Permitted Uses of Farm-Plated Vehicles ............................................................................................. 3

“T” Truck Plate Requirements .............................................................................................................. 4

Determining Commercial Vehicle Registration Weight ......................................................................... 4

Over-Dimension Permits ...................................................................................................................... 4

Operating Vehicles Under Lease Agreements ..................................................................................... 5

Oregon Use Fuel Tax ........................................................................................................................... 5

For-Hire Hauling ................................................................................................................................... 5

What is Interstate Commerce? ............................................................................................................. 6

Safety Exemptions ............................................................................................................................... 6

49 CFR 390.5, Definitions of “Covered Farm Vehicle” ......................................................................... 6

Farm Vehicle Operations Checklist ........................................................................................... 6

Definition of a Commercial Motor Vehicle ............................................................................................ 6

Safety Regulations for Interstate Farm Operations .............................................................................. 7

Annual CMV Safety Check ................................................................................................................... 8

ORS 807.035 Farm Endorsements ...................................................................................................... 8

Crash Reporting ................................................................................................................................. 10

Farm Operations in Oregon’s Neighbor States .................................................................................. 12

Vehicle Safety Inspections ....................................................................................................... 13

Most Common Types of Vehicle Safety Inspections Conducted Throughout North America ........... 13

For-Hire Farmer Records Requirements ................................................................................. 14

Form 735-9942 online Page 1 July 2024

Introduction and Contact Information

This publication is a basic guide to farm trucking in Oregon, but it cannot contain everything a farmer

needs to know.

Farmers with questions regarding regulations can contact their association representatives or the

Oregon Department of Transportation listed below.

Oregon Farm Bureau

1320 Capitol St. NE, Suite 200

Salem OR 97301

• Phone: 503-399-1701.

• Oregon Farm Bureau

website.

Oregon Wheat Growers League

115 SE 8th St.

Pendleton OR 97801

• Phone: 541-276-7330.

• Oregon Wheat Growers League

website.

Oregon Association of Nurseries

29751 SW Town Center Loop W

Wilsonville OR 97070

• Call 888-283-7219 or 503-682-5089.

• Oregon Association of Nurseries

website.

Oregon Department of Transportation

Commerce and Compliance Division (CCD)

455 Airport Road SE, Building A

Salem, OR 97301

• Email

our Farm Certification Unit or call 503-378-5203.

• Visit our Oregon Farm Trucking web page.

• See a complete list of CCD Roadside Enforcement and Safety Offices throughout Oregon.

Oregon Department of Transportation

Driver and Motor Vehicle (DMV) Services

1905 Lana Ave. NE

Salem OR 97314

• Phone: 503-945-5000

• Visit the Oregon DMV

website.

DMV Forms

Application for Registration, Renewal, Replacement or Transfer of Plates and/or Stickers (DMV Form 268)

Application for Title and Registration (DMV Form 226)

Farm Endorsement Application Form (DMV Form 6776)

Fee Schedule – Vehicles Registered for Farm Use (DMV Form 152)

Form 735-9942 online Page 2 July 2024

Farm Trucking in Oregon – The Basics

Get a USDOT Number

A U.S. Department of Transportation (USDOT) number is used as an identification number and is

issued by Federal Motor Carrier Safety Administration (FMCSA). Companies who operate vehicles with

a gross vehicle weight rating or actual weight over 10,000 pounds must obtain a USDOT number.

Note: The only option available for obtaining a USDOT number is through the FMCSA

Unified

Registration System (dot.gov) online.

Get Farm-Certified

Apply for farm plates by first completing the Farm Certification Application (form 9670) and submitting it

to the CCD Farm Certification Unit in Salem.

Some farm commodities require additional licensing through other state agencies. Christmas Trees,

Nursery Stock, Apiary, Industrial Hemp, Hemp Seed, Medical Marijuana and Recreational Marijuana,

require licensing from the Oregon Department of Agriculture, the Oregon Health Authority, or the

Oregon Liquor Control Commission. If you have one of these commodities listed on your Farm

Certification Application you will need to include the Regulated Commodities Verification

(form 9370a).

Certain types of vehicles are not what you would consider a Farm vehicle but may have a purpose or

specific use for the farming operation. Vehicles such as Dump Trucks, Water Trucks, Fire Trucks and

Vans would not be considered Farm vehicles. If you intend to register a vehicle like these with Farm

plates you will need to fill out an Oregon Farm Special Use Vehicle Application

(form 9925) and submit

it to the Farm Desk. The description of use for special use vehicle section on the form, is where you

provide specific details on the use of the vehicle on the farm.

Get Farm License Plates

Oregon DMV issues “F” farm plates, with the approval of ODOT

Commerce and Compliance Division (CCD). DMV requires CCD

approval of the Farm Certification Application before issuing farm

plate(s). If there is a delay getting CCD approval of either the initial

Farm Certification Application or a later request for additional plates,

DMV staff issues temporary, 45-day farm registration permits for a

farmer’s vehicle(s).

Online Certification for Farmers

See our Oregon Farm Trucking

web page.

Meet Fuels Tax Requirements

A farmer with a bulk storage tank, an F-plated vehicle, and/or a diesel-powered vehicle commonly

requires a Use Fuel User License and must file Use Fuel Tax Reports. Contact the ODOT Fuels Tax

Group by calling 888-753-2525 or 503-378-8150. For more information, visit the New to Fuels Tax

web

page.

Determine if vehicles are subject to safety regulations.

The term “Covered Farm Vehicle” is used to describe farm vehicles that are exempt from many safety

regulations. For more information, see 49 CFR 390.5, Definitions of “Covered Farm Vehicle”

.

Form 735-9942 online Page 3 July 2024

Interstate Operations need UCR

USDOT adopted into federal law the Unified Carrier Registration (UCR) program. The UCR is a base-

state system for registering interstate motor carriers with vehicles exceeding 10,000 pounds Gross

Vehicle Weight Rating (GVWR) or Gross Combined Weight Rating (GCWR), including private, for-hire,

and exempt carriers, farmers operating in interstate commerce, brokers, freight forwarders and leasing

companies.

• Oregon-based interstate motor carriers must pay online at a UCR-designated website

or they

must select a western state, other than Oregon, and pay the fees to that state.

Benefits of Oregon Farm Certification

• Lower annual vehicle registration fees. A 26,000 pounds farm vehicle pays $195.00, which is

$882.00 less than the fee for a non-farm vehicle. An 80,000 pounds farm vehicle pays $625.00,

which is $389.00 less than the fee for a non-farm vehicle.

• Exemption from Oregon weight-mile tax when used for qualified Farm operations. May still be

subject to Oregon state fuels tax.

• Exemption from CCD insurance requirements. Farm vehicles must comply with DMV insurance

requirements.

• Farm vehicles are exempt from some motor carrier safety regulations when operating in Oregon.

• Exemption from Oregon DEQ pollution control equipment and emissions testing.

• Lower fee for participation in the Oregon International Fuel Tax Agreement (IFTA).

• Farm plates help identify vehicles that can be operated with a regular driver license with a “Y” or

“Z” farm endorsement.

Permitted Uses of Farm-Plated Vehicles

Oregon law ORS 805.390 allows farm-registered vehicles to be used in the following ways:

• Hauling the farmer’s own agricultural commodities, products or livestock that were originally

grown or raised by the farmer on their own farm, ranch or orchard. This includes products or

byproducts of commodities or livestock that were packed, processed or manufactured by the

farm or for the farm, if the farmer retains ownership of the products. This does not include

products that have been transformed into a finished state.

• Hauling materials that are incidental to the regular operation of the farmer’s farm. Also, hauling

supplies, equipment or materials that will be consumed or used on the farmer’s farm.

• Hauling forest products to their farm or hauling forest materials originating on a farm or as an

incident to the regular operation of the farm. But the vehicle cannot be used to haul piling or

poles over 30 inches around at the large end or logs over 8 foot 6 inches long. A farm-plated

vehicle with a loaded weight of 16,000 pounds or less may, however, transport logs over 8 foot 6

inches if they’re not over 16 foot 6 inches long.

• Transporting straw, whether or not the straw was grown on the farmer’s own farm, if the farmer

hauling the straw is the one who bales it. “Straw” is defined as the stalk of grass or grain left after

threshing.

• Personal use by the farmer, any member of their immediate family or any person employed by

the farmer. “Personal use” includes such things as taking the boat to the lake, hauling the

camper and going to the movies or the grocery store.

• Hauling products, supplies, equipment or materials for another qualifying farmer on a bona fide,

documented exchange of labor basis if what is hauled will be used or consumed on that farmer’s

farm or is directly related to the operation of the farm.

• Farm vehicles may be rented or borrowed by a farmer to haul their own agricultural commodities,

products or livestock that were originally grown or raised on their farm, but only if that farmer

could qualify for farm registration for vehicles of the type and size rented or borrowed.

Form 735-9942 online Page 4 July 2024

“T” Truck Plate Requirements

Vehicles that don’t have a farm plate will need an Oregon “T” plate if they

operate with a combined weight over 10,000 pounds Truck-tractors will

need one if they operate with a combined weight over 8,000 pounds, per

ORS 803.430(3) (a)(b). “Combined weight” means the total empty weight

of all vehicles in a combination plus the total weight of the load carried on

that combination of vehicles, per ORS 801.199. Commercial Motor

Vehicles (CMV) over 26,000 pounds are subject to weight-mile tax display

an Oregon Commercial or Apportioned plate rather than a T-plate.

Determining Commercial Vehicle Registration Weight

Registration weight is the total weight of a vehicle or all vehicles in a combination (e.g., a vehicle and

any trailers it may pull) plus the total weight of the load carried on that vehicle or combination of

vehicles.

The weight of a camper or the trailing vehicles listed below should not be included when determining

registration weight:

• Trailers with a loaded weight of 8,000 pounds or less.

• Special-use trailers, travel trailers or manufactured structures and fixed load vehicles.

• Towed motor vehicles.

If your vehicle will temporarily exceed your registration weight, you must obtain a temporary

Registration Weight Trip Permit. This permit is available from a DMV field office or CCD. CCD

Registration can be reached at 503-378-6699.

Note: Operations that exceed legal size and weight may need a variance permit issued by the CCD

Over-Dimension Permit Unit.

Over-Dimension Permits

CCD issues single-trip and annual variance permits for overweight, overheight, overwidth and

overlength loads. Vehicles require an over-dimension permit when operated in combinations that

exceed maximum size and/or weight limits. For example, a farm vehicle needs one when it is operated

over 80,000 pounds DMV may issue a farm plate for that vehicle, but the farmer still needs to contact

CCD to acquire a variance permit to operate over the maximum legal weight limit.

Contact our Over-Dimension Permits Unit at 503-373-0000. For more information, visit our

Over-

Dimension Operations web page.

A permit is also needed for any non-divisible load for which any one of the following applies:

• Width of the load or hauling equipment exceeds 8 feet, 6 inches, and/or height of vehicle or

vehicle combination and load exceeds 14 feet.

• Any single axle weight exceeds 20,000 pounds, and/or any tandem axle exceeds 34,000

pounds., and/or gross combination weight exceeds 80,000 pounds, and/or gross weight of any

group of axles exceeds those in the legal weight table shown on Group Map 1

(form 8100).

• Front overhang exceeds four (4) feet beyond the front bumper of the vehicle.

• Rear overhang exceeding five (5) feet beyond the end of the trailer when hauling a single non-

divisible load.

• Vehicle combination length exceeds those authorized on Group Map 1 (form 8100).

• Oregon law provides an exemption for farm vehicles that exceed maximum allowable weight

limits. A farm vehicle transporting field-loaded agricultural commodities in Malheur County may

operate at greater weights than those listed in ORS 818.010(4). Field-loaded vehicles can travel

on state and county roads in Malheur County (unless they violate posted weight limits on a road

or bridge), but the law specifies that they cannot travel on I-84 or US95.

Form 735-9942 online Page 5 July 2024

• The law provides an exemption from maximum size limits for implements of husbandry hauled,

towed, or moved on any highway not a part of the Interstate system if the movement is

incidental to a farming operation and the owner is engaged in farming or is hired by or under

contract to a farmer to perform agricultural activities, per ORS 818.100(12). This type of

movement is subject to the maximum limit of allowable extension beyond the last axle of a

combination of vehicles shown in Table II of ORS 818.080(2).

• The law also provides an exemption from the limits on the number of vehicles in combination,

allowing for a combination of three implements of husbandry, or two implements of husbandry

hauled or towed by another vehicle, per ORS 818.120(7).

Operating Vehicles Under Lease Agreements

Farmers may lease vehicles for their farming operation, but only the number of vehicles reasonable to

support their farming operations.

When an Oregon-based or an out-of-state farmer leases a vehicle for their farm-related operations in

Oregon, the farmer must carry in that vehicle a copy of the leased vehicle letter that is obtained from

the CCD Farm Certification Unit. This is a vehicle-specific leased vehicle letter. The farmer must also

carry a copy of the Lease/Rental Agreement that contains the starting and ending date and the terms of

the rental basis (daily, weekly, monthly, annually).

Oregon Use Fuel Tax

An Oregon Farm Certification or an Out of State Farm Verification does not exempt a farmer from

Oregon use fuel tax law. For further information about the law, contact the ODOT Fuels Tax Group by

calling 888-753-2525 or 503-378-8150. For more information, visit the New to Fuels Tax

web page.

Questions?

Contact the CCD Farm Certification Unit at 503-378-5203.

For-Hire Hauling

A trucker is considered to be “for-hire” if they hold themselves out to provide transportation service to

the public for compensation.

A farmer may use their farm-registered vehicle to haul products, supplies, equipment or materials for

another qualifying farmer on a bona fide, documented exchange of labor basis if what is hauled will be

used or consumed on that farmer’s farm or is directly related to the operation of the farm.

In other situations, a farmer with a farm-registered vehicle that wants to haul for-hire must obtain a

Class 1A permit from CCD. The permit authorizes occasional use of the vehicle to haul for-hire from

point to point within Oregon only. It does not authorize hauling household goods or passengers or

hauling for-hire interstate. There is a one-time $300 filing fee for the Class 1A permit.

Farmers who want to haul for-hire within Oregon also need to enroll their vehicle(s) into the Oregon

Weight-Mile Tax Program allowing them to conduct both farm and for-hire operations. The haul-for-hire

operations are subject to motor carrier regulations, including requirements related to weight-mile tax,

bond, insurance, safety and record keeping. Farmers must keep records showing the miles operating

for-hire, the miles the vehicle was used in exempt farm operations and file monthly or quarterly tax

reports.

Questions? Contact the CCD Farm Certification Unit at 503-378-5203.

Form 735-9942 online Page 6 July 2024

What is Interstate Commerce?

A farmer operating vehicles that are NOT Covered Farm Vehicles may be subject to safety regulations

when operating in interstate commerce. See 49 CFR 390.5, Definitions of “Covered Farm Vehicle”

. In

federal law 49 CFR 390.5, “interstate commerce” means trade, traffic or transportation in the United

States:

1) Between a place in a state and a place outside of such state, including a place outside the U.S.

2) Between two places in a state through another state or a place outside the U.S.

3) Between two places in a state as part of trade, traffic or transportation originating or terminating

outside the State or the U.S.

Sometimes even hauling from point to point within a state can be interstate commerce. For example, it

is usually interstate commerce when a farmer hauls wheat from an Oregon field to an Oregon elevator.

After the elevator buys the wheat, it may ship some to a local flour mill and some to a facility for

shipment overseas. The fact that the wheat stops and changes hands at a middle point like the storage

elevator doesn’t necessarily break its transportation into two separate parts. The trip from the field to

the elevator and then later delivery to various customers can both be trips in interstate commerce. Also,

when wheat is commingled and there is no way to know which grain went where, it is more likely to be

interstate commerce. Wheat taken from an Oregon field to an Oregon mill and turned into flour is

intrastate commerce because the wheat is substantially changed into something else.

Safety Exemptions

Certain farm vehicles are exempt from some safety regulations. 49 CFR 390.39 provides exemptions

for “covered farm vehicles”. Vehicles that meet the definition of a covered farm vehicle are exempt from

Part 383 CDL requirements, Part 382 drug and alcohol testing requirements, Part 391 physical

qualifications and examinations, Part 395 hours of service and Part 396 Inspection, repair, and

maintenance.

49 CFR 390.5, Definitions of “Covered Farm Vehicle”

A straight vehicle or articulated vehicle registered in a state with a designation that identifies the vehicle

as a farm vehicle; and is operated by the owner or operator of a farm or ranch, or an employee or

family member of an owner or operator of a farm or ranch; and is used to transport agricultural

commodities, livestock, machinery or supplies to or from a farm or ranch and is not used in for-hire

motor carrier operations; and not transporting hazardous materials requiring placarding.

Covered Farm Vehicles with a gross vehicle weight or gross vehicle weight rating of:

• 26,000 pounds or less may utilize the safety exemptions anywhere in the United States.

• More than 26,001 pounds may use safety exemptions anywhere in the state of registration or

across state lines within 150 air-miles of the farm or ranch.

Farm Vehicle Operations Checklist

The following pages provide a checklist of the basic federal and state safety requirements for farm

trucking in Oregon. 49 CFR 390.5, Definitions of “Covered Farm Vehicle”

If the vehicle is being used in commerce and it meets the definition below, all rules apply unless the

vehicle is being used as a covered farm vehicle. Covered farm vehicles are exempt from some of the

rules. See 49 CFR 390.5, Definitions of “Covered Farm Vehicle”. Some

Safety Regulations for

Interstate Farm Operations rules still apply.

Definition of a Commercial Motor Vehicle

1) Vehicles with a gross vehicle weight rating (GVWR) or combination weight rating (GCWR), or

Actual weight rating of 10,001 pounds or more.

Form 735-9942 online Page 7 July 2024

2) Vehicles designed or used to transport more than 8 passengers, including the driver, for

compensation.

3) Vehicles transporting a hazardous material in a quantity requiring placards.

4) A vehicle designed to transport more than 15 passengers, including the driver.

Safety Regulations for Interstate Farm Operations

49 CFR Part 397, Insurance

Have at least the minimum amount of liability insurance required by DMV. Vehicles transporting

hazardous materials may need insurance coverage between $1 million and $5 million.

49 CFR Part 393, Parts & Accessories

All vehicles, including covered farm vehicles, are required to check all of the following items. Even

though a farm vehicle is exempt from an inspection, law enforcement can write citations for unsafe

vehicles under Part 393.

• Headlights and brake lights work.

• Tractor and trailer have reflective sheeting or reflectors to make them more visible at night.

• Vehicle has a service brake, parking brake and brakes on all wheels. Vehicles towing a trailer

have breakaway and emergency brakes.

• Brake tubing and hoses are okay.

• Vehicle has brake warning system that tells driver of problems with hydraulic brakes, air brakes

or vacuum brakes.

• Windshield isn’t discolored or cracked in area from top of steering wheel to within two inches of

windshield top.

• No fuel system part is wider than the widest part of the vehicle or forward of the front axle. Fuel

lines don't extend between the vehicle and trailer.

• Coupling devices and fifth wheel assemblies are securely attached and safe.

• Cargo is loaded and secured so it will not shift or fall off.

• Tires are in good shape, including 4/32 inch or more tread on front tires and 2/32 inch or more

on other tires. Wheels are in good shape - no cracks or loose fasteners.

• Exhaust system is securely fastened and not located below fuel tank or tank filler pipe, or

located where it could burn or damage wiring, fuel supply or anything combustible. Also, there

are no temporary repairs or patches and it is not leaking at a point under the cab or sleeper.

• There is a bumper or other device to prevent under ride if another vehicle strikes the rear end.

(Tractors, pole trailers and driveaway towaway vehicles are exempt.)

• Vehicle is equipped with functional seat belts (applies to post-1965 vehicles).

• Emergency equipment includes stopped vehicle warning devices, spare fuses and fire

extinguisher with a rating of at least UL 5 B:C or 10 B:C if transporting hazardous materials.

• Frames and suspension systems (axles, adjustable axles, leaf and coil springs, torsion bars, air

suspensions) are structurally sound and in safe working order. There are no cracked or broken

frame members.

• Steering system - steering wheel, steering column, gear box, ball joints - are in proper working

order.

49 CFR Part 396, Inspection, Repair, and Maintenance

Note: Covered Farm vehicles are exempt from Part 396, but it is recommended to maintain these

records.

Inspection, repair and maintenance records for each vehicle must be saved on file for one year. Drivers

are not required to submit daily driver vehicle inspection reports (DVIRs) unless defects are found.

Completed reports must be maintained for at least 3 months. Pre- and post-trip inspections are still

Form 735-9942 online Page 8 July 2024

required to cover service brakes (including trailer brake connections), parking brake, steering, lights,

tires, horn, windshield wipers, rearview mirrors, coupling devices, wheels and emergency equipment.

Post-trip reports do not apply to one-vehicle operators.

Annual CMV Safety Check

Any vehicle that operates in interstate commerce must be checked by a qualified person at least once a

year and a copy of that checkup must be kept for 14 months. Knowledgeable farmers can do their own

annual vehicle safety check.

49 CFR Part 391, Driver Qualifications

A Covered Farm Vehicle driver must be at least 18 years old, be able to safely operate the type of

vehicle being driven, be able to read and speak English and be physically qualified. Also, they must

provide a list of all traffic violations to their employer and pass a road test. The driver may not be

disqualified (driving privileges suspended in any state), and must have a current, appropriate operator

license.

Note: Medical Qualification Standards are Not Required for Covered Farm Vehicles. See

49 CFR

390.5, Definitions of “Covered Farm Vehicle”.

49 CFR Part 383, CDL Requirements

A driver needs a CDL to operate a CMV when:

1) Group A – The vehicle and trailer have GCWR or actual weight of 26,001 pounds or more, and

the trailer GVWR or actual weight is 10,001 pounds or more, or

2) Group B – The vehicle has a GVWR or actual weight of 26,001 pounds or more, can pull a

trailer up to 10,000 pounds, or

3) Group C – Any size vehicle transporting hazardous materials that require placards, or a vehicle

that is designed to transport 16 or more passengers, including the driver.

Note: A driver of a Covered Farm Vehicle does not require a CDL. See 49 CFR 390.5, Definitions of

“Covered Farm Vehicle”.

ORS 807.035 Farm Endorsements

Drivers operating vehicles meeting the definition of a Covered Farm Vehicle are not required to have a

CDL. If the farm vehicle is hauling hazmat that does not meet the exemption in 173.5 and requires

placards, the driver no longer meets the exemption as a covered farm vehicle and would require a CDL.

However, if the driver of a farm vehicle stays within 150 miles of the farm, they can get a farm

endorsement on their regular license.

49 CFR Part 382, Drug and Alcohol Testing

Drivers required to have a CDL are subject to drug and alcohol testing for:

• Pre-employment.

• Post-accident.

• Random.

• Reasonable suspicion.

• Return-to-duty and follow-up.

It is important to keep records related to testing. Also, motor carriers must establish a policy regarding

alcohol misuse and controlled substance abuse and provide drivers with related educational materials.

Testing requirements don’t apply to farmers with a farm endorsement operating within 150 miles of the

farm or drivers who are not required to have a CDL for the type of vehicle they’re operating. If a driver

does not need a CDL but chooses to have one, they are not subject to testing.

Note: Not required for Covered Farm Vehicles. See 49 CFR 390.5, Definitions of “Covered Farm

Vehicle”.

Form 735-9942 online Page 9 July 2024

49 CFR Part 395, Hours of Service

Note: Not Required for Covered Farm Vehicles. See

49 CFR 390.5, Definitions of “Covered Farm

Vehicle”.

• No more than 11 hours driving following 10 hours off duty.

• No driving after 14 hours after coming on duty following 10 hours off duty.

• No driving after 60 hours on duty in 7 consecutive days, or 70 hours on duty in 8 consecutive

days.

• A 7 or 8 consecutive day period may restart after 34 hours off duty.

• Keep electronic logging device (ELD) records for six months from the date of receipt.

Exception: Under Oregon Administrative Rules, carriers operating in intrastate commerce and

transporting property other than hazardous materials can follow these limits:

• Drivers may not exceed 12 hours driving after 10 consecutive hours off duty.

• Drivers may not drive beyond the 16th hour after coming on duty following 10 consecutive hours

off duty.

• Drivers may not drive following 70 hours on duty in any 7 consecutive days, or 80 hours on duty

in any 8 consecutive days.

• A 7 or 8 consecutive day may restart after 34 hours off duty.

49 CFR Part 390.21, Vehicle Identification

Vehicles should be marked on both sides with the

operating company’s legal name or trade name and

USDOT number. Letters and numbers must contrast

sharply with background colors and be legible from a

distance of 50 feet.

Farmers who operate vehicles up to 26,000 pounds

and solely intrastate are exempt from these marking

requirements.

Note: The only option available for obtaining a USDOT

number is through the FMCSA

Unified Registration

System (dot.gov) online.

Motor carriers must keep their USDOT Registration and Authority up to date. Biennial updates are

required. Motor carriers must complete and submit an FMCSA Motor Carrier Identification Report

(MCS-150). Visit the FMCSA website to update your registration or authority

.

49 CFR 393.13, Trailer and Truck-Tractor Markings

Trailers and the rear of truck-tractors need to be

marked with red and white reflective material to

make them visible to other drivers at night.

Since 1993, manufacturers have been outlining

trailers with red and white reflective tape or hard

plastic reflector strips. In 1999, FMCSA ordered all

older trailers to be retrofitted to the new standards.

The requirements apply to all trailers and

semitrailers with an overall width of 80 inches and a

gross vehicle weight rating of 10,001 pounds or

more.

Form 735-9942 online Page 10 July 2024

The only exceptions are pole trailers, trailers transported in a driveaway towaway operation (when the

trailer itself is the cargo or is being towed for repair), and trailers used only as offices or dwellings.

Marking requirements are found in Part 393.13 of Federal Safety Regulations at

Federal Motor Carrier

Safety Administration (dot.gov).

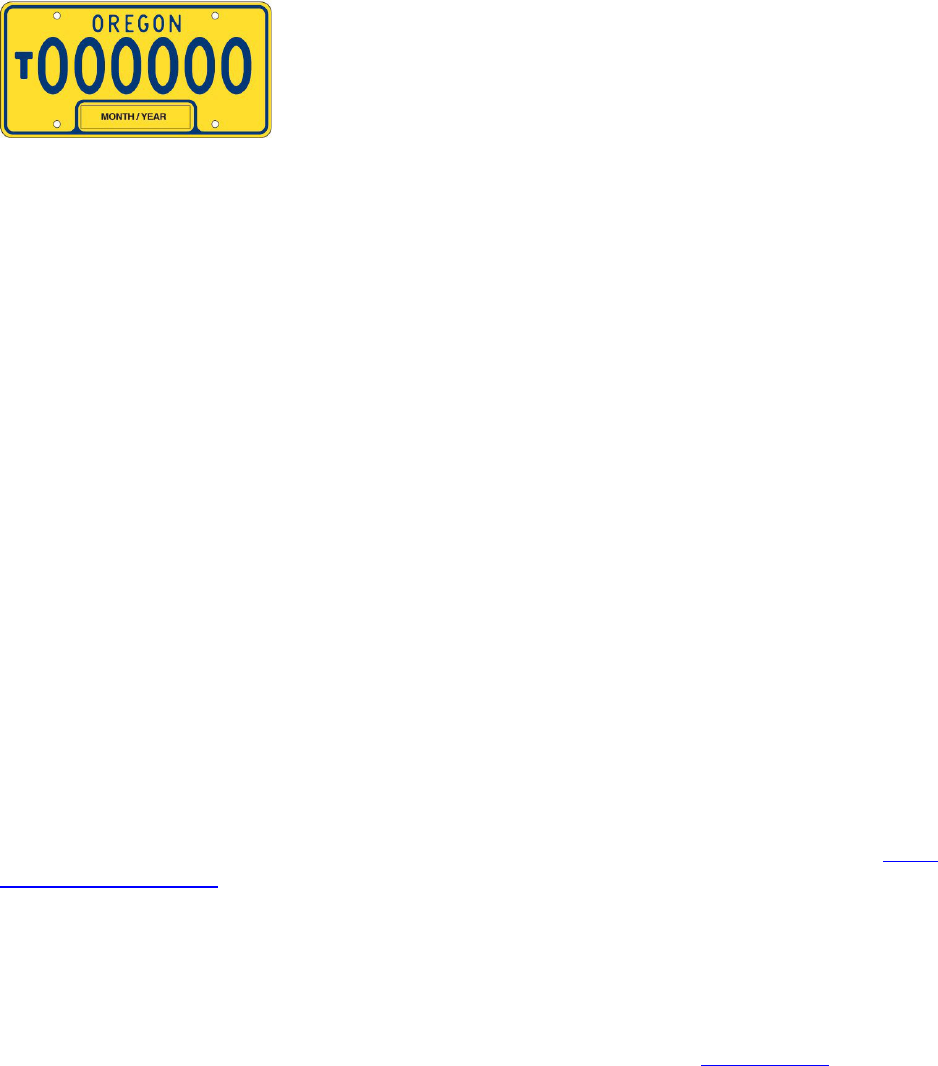

49 CFR 393.86, Rear Impact Guards

Trucks and trailers need a rear impact guard to protect against vehicles going under them in a collision.

For trailers manufactured after January 26, 1998, the rear impact guard must be within 12 inches of the

rear of the vehicle, no more than 22 inches from the ground, and extending to within 4 inches of the

sides. All trucks and older trailers can have a rear impact guard that is within 24 inches of the rear of

the vehicle, no more than 30 inches from the ground, and extending to within 18 inches of the sides.

The requirements apply to all vehicles with a gross vehicle weight rating of 10,000 pounds or more,

except truck tractors, pole and pulpwood trailers, special purpose vehicles and certain temporary living

quarters.

Crash Reporting

Report to DMV any crash involving a fatality, injury or damage exceeding $2,500. Also, report to the

ODOT Crash Analysis and Reporting Unit any crash involving a fatality, injury or disabling damage

requiring that a vehicle be towed away. The Motor Carrier Crash Report can be completed on paper or

online.

To report on paper, complete the Oregon Traffic Accident and Insurance Report

(DMV form 32), which

includes a Motor Carrier Crash Report on pages 6 and 7. File that with the Crash Analysis and

Reporting Unit of ODOT´s Transportation Development Division.

To report online, use the Oregon Trucking Online Motor Carrier Accident Report Online Form.

Maintain a crash register, including copies of crash reports, for three years after a crash.

49 CFR 393.100 through 393.114, Load Securement

A CMV must be loaded and equipped, and its cargo secured, to prevent anything from leaking, spilling,

blowing or falling from the vehicle. Cargo must also be contained, immobilized or secured to prevent

any shifting that affects vehicle stability or maneuverability.

Hay and straw hauling provide one example of the load securement challenges farmers commonly

face. In recent years, FMCSA confirmed that a combination of longitudinal tiedowns can unitize hay

Form 735-9942 online Page 11 July 2024

bales and with one or two lateral securement devices, depending on vehicle length, provide a system

that meets or exceeds securement requirements.

Here is a summary of acceptable securement practices:

Bale Placement

Loads must be well-balanced and positioned on the vehicle so the load is stable without tiedowns.

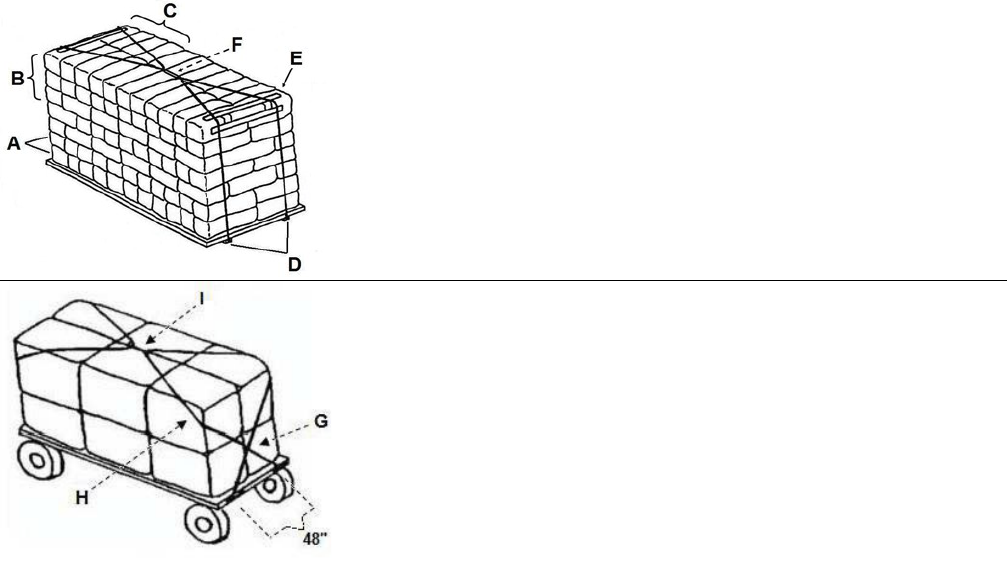

Small Bales — See diagram 1 below.

• Sides of load: Outside bales must not be placed in the same direction in more than two

successive tiers (A) except one bale above and below a tier up to three tiers in succession (B).

• Bales in the top tier must be loaded crosswise to the vehicle (C).

• No bale must be loaded vertically.

Big Bales

• Sides of load: Outside bales must not be placed in the same direction in more than three

successive tiers.

• Load projection: Bales may extend over the truck cab provided they are supported, interlocked

with other bales, and do not obstruct the driver’s view. No bales may extend:

o Beyond the vehicle bed between a truck and trailer or semi-trailer and trailer.

o More than one-third the bale length beyond the rear of the bed surface on a single vehicle or

the last vehicle in a combination of vehicles.

Longitudinal Tiedowns

The load must be unitized with two longitudinal tiedowns, each having a minimum WLL of 2,100 pounds

and secured with a tightening device (F) (I). The tiedowns must be applied over V-boards (E), or big

bales may use the alternate method below.

Diagram 1

V

-Boards (big or small bales):

Two tiedowns must be:

• Anchored at the front and rear near the corners (D).

• Extended over the top.

• And crossed or connected with a tightening device at the

center (F).

Diagram 2

Alternate Securement (big bales)

Two tiedowns must be:

• Anchored at the front and rear of the load at least

48 inches apart.

• Crossed at the front and rear (G).

• Passed to the outside around the upper corners of the

load (H).

• And connected with a tightening device at the top center (I).

Lateral Tiedowns

Form 735-9942 online Page 12 July 2024

Each tiedown must have a minimum WLL of 4,000 pounds Multiple tiedowns may be substituted,

provided each has a minimum WLL of 625 pounds with a combined WLL of 4,000 pounds or more.

Tiedowns less than two inches in width or diameter must include V-boards.

Vehicles 32 Feet or Less in Length

One tiedown shall be placed in the center of the length of the vehicle.

Vehicles Greater Than 32 Feet in Length

Two tiedowns shall be positioned at one-third and two-thirds the length of the vehicle.

Note: Bales not unitized by longitudinal tiedowns must be secured according to the general cargo

securement requirements of FMCSR 393.100 through 393.114

.

Farm Operations in Oregon’s Neighbor States

Commercial Registration

Washington and Idaho have agreements with Oregon to waive its registration requirements for farm-

plated vehicles operating within 50 miles of the border. Oregon farmers can haul products from point of

production to market or warehouse in that state. They can also haul commodities, supplies or

equipment for their farm or ranch. But if they go beyond 50 miles of the border, farmers must meet state

registration requirements.

Oregon has other farm-related agreements with Idaho, Kansas, Missouri, Nebraska, North Carolina,

Wyoming, Nova Scotia and Saskatchewan. Oregon has a very limited agreement with Nevada and no

agreement with California. For more information about reciprocity, contact the CCD Farm Certification

Unit at 503-378-5203.

Fuel Tax

Oregon farmers may operate in neighboring states if they pay each state’s diesel fuel tax. Oregon

farmers either need to participate in the International Fuel Tax Agreement (IFTA) or get a temporary

fuel tax trip permit before going to California, Nevada or Washington. Those states don’t allow truckers

to stop at the nearest truck stop or Port of Entry to get a permit. Idaho is the only neighboring state that

allows farmers who don’t participate in IFTA to obtain a fuel tax trip permit at their first stop in the state.

Under IFTA, an Oregon farmer pays an annual license fee to operate in other states and Canada. It is a

$50 fee if more than half of the farmer’s IFTA-qualified vehicles are farm vehicles. The farmer then files

quarterly reports showing the miles traveled and fuel taxes owed. Oregon collects the fuel tax and

distributes it on behalf of the farmer. Call the CCD IFTA Unit at 503-373-1634 for more information.

California Fuel Tax Permits

Temporary permits can be obtained at two Medford truck stops on I-5:

• Petro Truck Stop at 541- 535-3372.

• Freightliner Northwest, Medford at 541-779-4622.

• Truckers can also call California Department of Tax and Fee Administration (CDTFA)

in

Sacramento at 1-800-400-7115.

Idaho Fuel Tax Permits

For service, farmers registered with Idaho can go online to Welcome to Trucking Idaho

.

Temporary permits can be obtained:

• At the first Idaho truck stop or Port of Entry.

• By calling East Boise Port of Entry at 208-334-3272.

Form 735-9942 online Page 13 July 2024

Nevada Fuel Tax Permits

Temporary permits can be obtained from the following sources:

• ADK Permit Services at 800-257-4568.

• The Permit Co. at 800- 331-0418.

• ComData at 800-749-6058.

• Call Nevada DMV Motor Carrier Bureau at 775-684-4711 for more information.

Washington Fuel Tax Permits

Temporary permits can be obtained from several permit agents, but Washington Trucking Association

(WTA) is the only one through which a person can call, pay by credit card and have a permit faxed

back.

• Visit the Washington Trucking Association

online.

• Call 800-732-9019 or 253-838-1650.

Vehicle Safety Inspections

Most Common Types of Vehicle Safety Inspections Conducted Throughout

North America

Level 1

A complete inspection that includes a check of the driver’s license, medical examiner’s certificate (and

waiver, if any), alcohol and drugs, hours of service, seat belt, annual vehicle inspection report, brake

system, coupling devices, exhaust system, frame, fuel system, turn signals, brake and tail lamps,

headlamps, lamps on loads, load securement, steering, suspension, tires, van and open-top trailer

bodies, wheels and rims, windshield wipers, emergency exits on buses and hazardous materials

requirements, as applicable.

Level 2

A “walk-around” inspection that includes a check of each of the items in a Level 1 inspection, but not

items that require the inspector to physically get under the vehicle.

1) Identify company name and check for USDOT number.

2) Review driver documents and check for appropriate driver’s license.

3) If hauling hazardous materials, check shipping paper, package labels and placarding.

4) Inspect front of the vehicle. Check lights, windshield, wipers, horn, wheels and tires.

5) Inspect left side of vehicle. Check fuel tanks, air and electrical lines, wheels and tires, exhaust

system, coupling device, side lamps and condition of vehicle and trailer body. Check tractors

and trailers for required reflective tape.

6) Inspect rear of vehicle. Check lights, rear bumper, wheels and tires, reflective tape.

7) Inspect right side of vehicle. Inspect as described in #5.

8) Check for proper cargo securement. Check for unsecured dunnage, tools and spare tire.

9) Inspect inside vehicle. Check for low air brake warning device. Check same for vacuum and

hydraulic brakes. Check fire extinguisher and reflective triangles.

10) Complete the inspection document and return documents to the driver.

Level 3

An inspection of just the driver-related items in a Level 1 inspection.

Level 5

An inspection of just the vehicle related items in a Level 1 inspection.

Form 735-9942 online Page 14 July 2024

For-Hire Farmer Records Requirements

Oregon farmers hauling commodities for-hire are subject to Oregon weight-mile

tax and record keeping requirements. Once a farmer begins for-hire operations,

records must be kept for at least 3 years on all operations to determine which

miles are subject to weight-mile tax and which are exempt. Operations exempt

from weight-mile tax are still subject to Oregon fuels tax and must file monthly or

quarterly tax reports. Farmers who conduct for-hire operations in addition to their

own farm operations must keep a Daily Record of Farm Vehicle Operation

(form

9448) of their for-hire and farm operations.

One confusing aspect of conducting both for-hire and farm operations is determining when tax status

changes. If a farmer hauls for-hire one week and for their farm the next, when did the for-hire hauling

end and when did the farm-related hauling begin? For-hire miles begin at the point of loading a for-hire

commodity and continue until a farm-related commodity is loaded. This includes all empty miles from

the time the for-hire load is delivered until a farm-related commodity is again loaded. If an auditor is

unable to distinguish between farm-related and for-hire mileage, all miles, including the farm operation

mileage, may be considered taxable.

Questions? Contact the CCD Tax Monitoring Unit at 503-979-5020.