State Street’s Acquisition

of Charles River Development

July 20, 2018

(Revised, July 23, 2018)

2

• Asset management solutions market is evolving to an integrated front, middle, and back office

• Facilitates compatibilities with clients’ existing solutions; works across third party platforms

Forward-looking statements

This presentation contains forward-looking statements as defined by United States securities laws, including statements relating to State Street’s planned acquisition of Charles River Development (CRD) and its

related business, financial and operational effects. Forward-looking statements are often, but not always, identified by such forward-looking terminology as “will,” “opportunity,” “expect,” “estimate,” “project,”

“anticipate,” “plan,” “strategy,” “propose,” “priority,” “intend,” “may,” “objective,” “forecast,” “outlook,” “believe,” “seek,” “trend,” “target,” and “goal,” or similar statements or variations of such terms. These

statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual

outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any time subsequent to

the time this presentation is first issued.

Factors that could cause changes in the expectations or assumptions on which forward-looking statements are based cannot be foreseen with certainty and include, but are not limited to: the possibility that some

or all of the anticipated financial, operational, product innovation or other benefits or synergies of the acquisition will not be realized when expected or at all, including as a result of the impact of, additional costs or

unanticipated negative synergies associated with, or problems arising from, the integration of CRD, as a result of regulatory or operational challenges we may experience, as a result of disruptions from the

transaction harming relationships with our clients, employees or regulators, or as a result of the strength of the economy and competitive factors in the areas where we and CRD do business; the failure to obtain

necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect us or the expected benefits of the transaction), to satisfy any of the other

conditions to the acquisition on a timely basis or at all or to arrange financing consistent with our expectations or at all; the occurrence of any event, change or other circumstances that could give rise to the

termination of the definitive purchase agreement in respect of the acquisition; potential adverse reactions or changes to client, regulatory, business or employee relationships, including those resulting from the

announcement or completion of the acquisition; demand for our and CRD’s services and product offerings; requirements to obtain the prior approval or non-objection of the Federal Reserve or other U.S. and non-

U.S. regulators for, or other market, business or other factors that could challenge our execution or implementation of or cause changes to, the use, allocation or distribution of our capital or other specific capital

actions or corporate activities, including, without limitation, acquisitions, dividends, stock purchases and redemptions and investments in subsidiaries; the large institutional clients on which we focus are often able

to exert considerable market influence and have diverse investment activities, and this, combined with strong competitive market forces, subjects us to significant pressure to reduce the fees we charge for our or

may charge for CRD’s products or services and to potentially significant changes in our fee revenue; our ability to recognize evolving needs of our and CRD’s clients and to develop products that are responsive to

such trends and profitable to us; the performance of and demand for the products and services we and CRD offer; and the potential for new products and services to impose additional costs on us and expose us

to increased operational risk; our ability to control operational risks, data security breach risks and outsourcing risks, our ability to protect our intellectual property rights, the possibility of errors in the quantitative

models we use to manage our business and the possibility that our controls will prove insufficient, fail or be circumvented; our ability to expand our use of technology to enhance the efficiency, accuracy and

reliability of our operations and our dependencies on information technology and our ability to control related risks, including cyber-crime and other threats to our information technology infrastructure and systems

(including those of our third-party service providers) and their effective operation both independently and with external systems, and complexities and costs of protecting the security of such systems and data;

adverse changes in the regulatory ratios that we are, or will be, required to meet, whether arising under the Dodd-Frank Act or implementation of international standards applicable to financial institutions, such as

those proposed by the Basel Committee, or due to changes in regulatory positions, practices or regulations in jurisdictions in which we engage in banking activities, including changes in internal or external data,

formulae, models, assumptions or other advanced systems used in the calculation of our capital or liquidity ratios that cause changes in those ratios as they are measured from period to period; changes in law or

regulation, or the enforcement of law or regulation, that may adversely affect our or CRD’s business activities or those of our or CRD’s clients or counterparties, and the products or services that we or CRD sell,

including additional or increased taxes or assessments thereon, capital adequacy requirements, margin requirements and changes that expose us or CRD to risks related to the adequacy of our or CRD’s controls

or compliance programs; adverse publicity, whether specific to State Street or CRD or regarding other industry participants or industry-wide factors, or other reputational harm; changes or potential changes to the

competitive environment, including changes due to regulatory and technological changes, the effects of industry consolidation and perceptions of State Street or CRD as a suitable service provider or counterparty;

our ability to grow revenue, manage expenses, attract and retain highly skilled people and raise the capital necessary to achieve our business goals and comply with regulatory requirements and expectations; and

changes in accounting standards and practices.

Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in State Street’s 2017 Annual Report on Form 10-K and its

subsequent SEC filings. Investors are encouraged to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any

investment decision. The forward-looking statements contained in this presentation should not be relied on as representing State Street’s expectations or beliefs as of any time subsequent to the time this

presentation is first issued, and State Street does not undertake efforts to revise those forward-looking statements to reflect events after that time.

3

State Street to acquire Charles River Development (CRD)

Leading the industry evolution of investment servicing

Creates a powerful opportunity to provide an integrated front-to-back platform

• Positions State Street as a premier provider of investment management software across asset classes

• Allows State Street to address a new front office revenue opportunity at scale

• Leverages State Street’s established capabilities in front, middle and back office including data aggregation services

and analytics; platform’s interoperability will enable clients to integrate their preferred providers

Investing in the future while reducing legacy costs

• CRD functionality automates the front office investment process for asset managers, improving operations and

controlling costs

• Builds on the success of State Street Beacon’s digitization program in the front-to-back office

Generates attractive long-term financial returns and a new growth avenue for shareholders

• Purchase price of $2.6B

• EPS accretion anticipated in 2020

3

• Meaningful acceleration in overall State Street growth

− Revenue synergies expected to contribute ~$80M of EBIT; cost synergies contribute ~$60M of EBIT

A

• Adds significant predictable revenue, which is ~85% recurring

6

• IRR estimated at ~14% with anticipated cost synergies only; over 20% with revenue and cost synergies

First-ever

front-middle-back

office platform

in the industry

2

Premier provider of

investment

management front

office solutions across

all asset classes for

portfolio management,

trading and compliance

A

Assumes ~$260-280M in gross revenue synergies with delivery costs to achieve of ~$180-200M. Please refer to endnotes 4 and 5 for additional details on revenue and

A

cost synergies, respectively.

Refer to the Appendix included with this presentation for endnotes 1 to 22.

One of the world’s

leading investment

service providers

responsible for more

than 10% of the

world’s assets

1

4

CRD Overview

• CRD’s primary focus is providing solutions that

automate front office workflows and middle office

investment management functions across asset

classes on a single platform.

• Serves more than 300 of the world’s largest

institutional investment managers, asset owners,

alternative investment managers, and wealth

managers

- Additionally offers a comprehensive wealth

management solution for wealth managers,

sponsors, advisors, and private bankers

• $25T on platform with 25,000 investment professional

users across 40 countries

• Contemporary technology architected to integrate

third party solutions

• Headquartered in Burlington, MA with offices in 11

global locations and 745 employees

• Recent industry awards include:

- Best Buy-Side Compliance Product at Waters

Technology’s Buy-Side Technology Awards 2017

- Best Portfolio Management at ClearView’s

WealthBriefing Asia Awards 2018

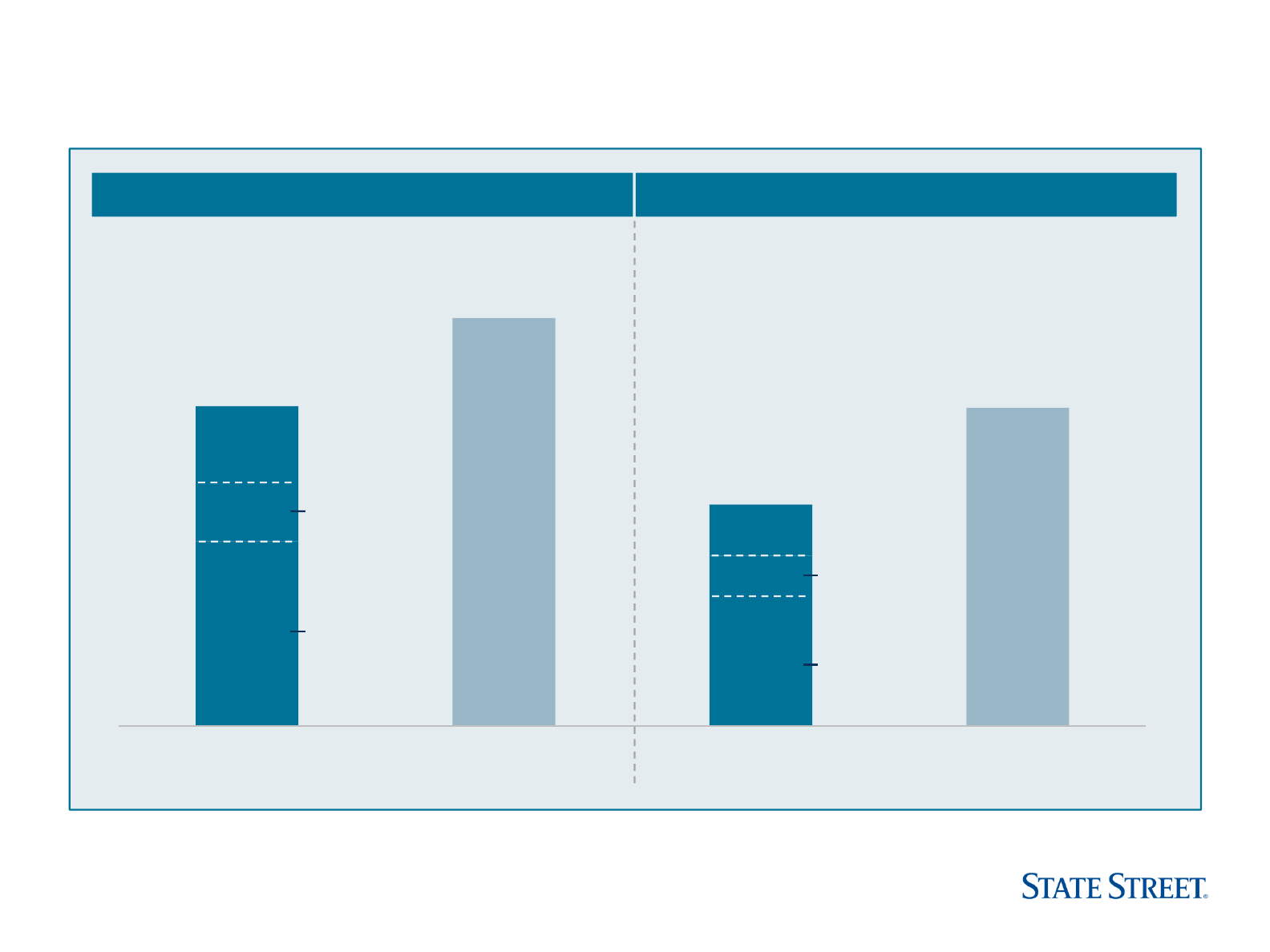

Long-standing global enterprise Attractive growth profile

7

311

238

7% CAGR

20172013

149

109

8% CAGR

20172013

Revenue ($M)

Broad client base and business segments

8

Client type

Asset

Managers,

68%

Wealth

Managers,

18%

Alternatives,

5%

Asset

Owners,

5%

Other, 4%

Business line

Software

Solutions,

72%

Trading

Support,

16%

Professional

Svcs

9

,

12%

Region

Americas,

74%

EMEA,

18%

APAC,

8%

Refer to the Appendix included with this presentation for endnotes 1 to 22.

Adjusted Operating

Income ($M)

5

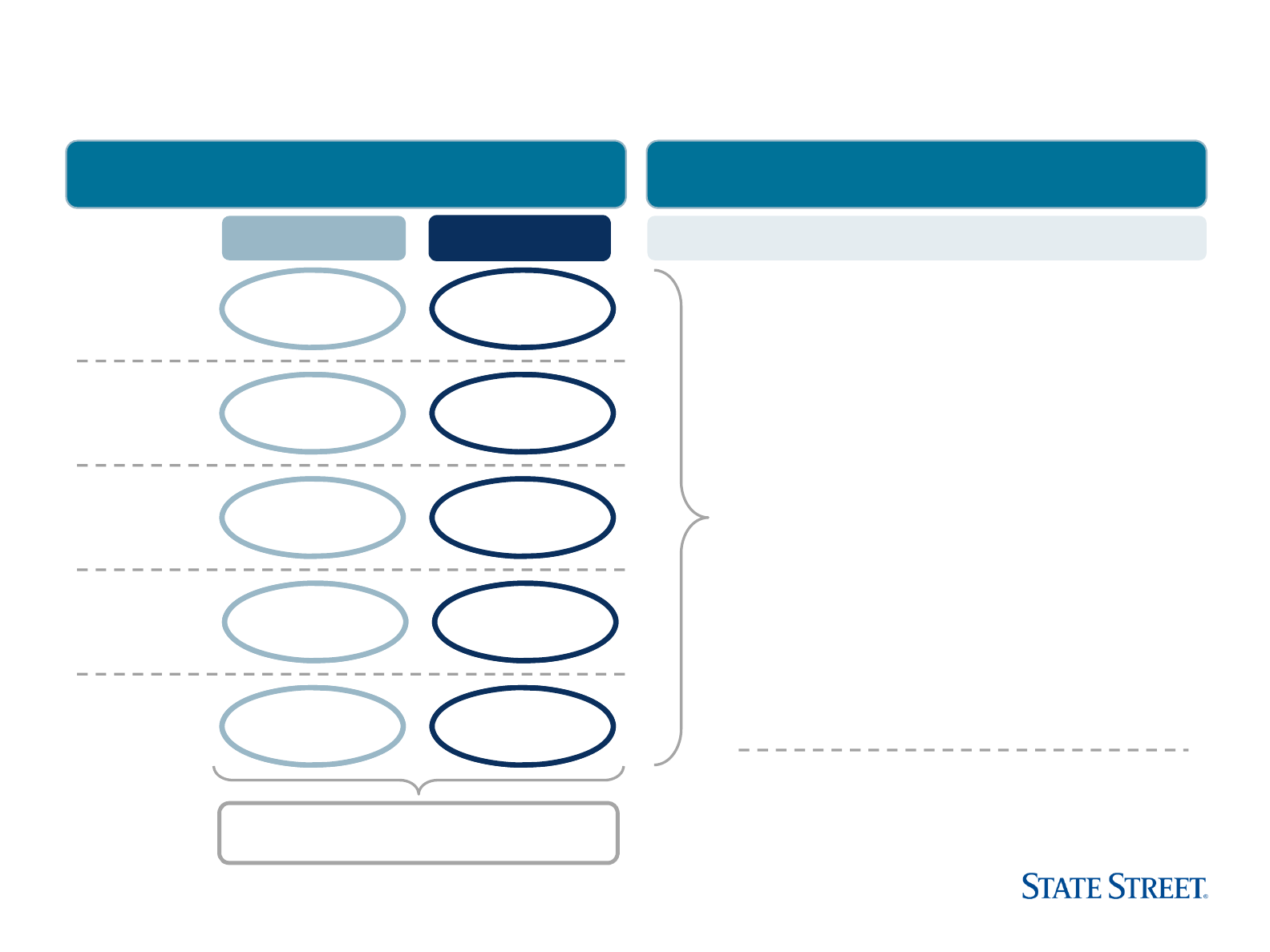

Combining two leading firms creates a unique front-to-back

office platform to serve our clients

Key Activities

Integrated Front-to-

Back Platform

Front

Office

>$25T AUM

10

• Portfolio Modeling & Construction

• Investment Risk & Compliance

• Data Management

• Trade Management & Execution

• FX Trading & Securities Finance

Middle

Office

~$13T AUA

11

• Post-Trade Workflow Management

• Investment Risk Monitoring

• Performance & Attribution

• Client Reporting

• Investment Accounting (IBOR

12

)

Back

Office

~$34T AUCA

11

• Custody

• Fund Accounting

• Fund Administration

Refer to the Appendix included with this presentation for endnotes 1 to 22.

6

CRD acquisition is a compelling strategic and financial

opportunity

A

Assumes ~$260-280M in gross revenue synergies with delivery costs to achieve of ~$180-200M. Please refer to endnote 4 for additional details on revenue synergies.

Refer to the Appendix included with this presentation for endnotes 1 to 22.

Other pro

forma

financial

impacts

• Total acquisition & restructuring costs estimated at ~$200M through 2021

• Identifiable intangibles of ~$800-900M to be amortized over ~10 years

• Tax basis step-up associated with the transaction provides positive cash benefits with an estimated

present value of ~$345M over a period of 15 years

15

Compelling

financial

projections

• EPS accretion anticipated in 2020

3

• Meaningful acceleration in overall State Street growth expected

- Significant revenue synergies resulting in ~$80M of EBIT in 2021

A

- Incremental annual fee revenue growth of 75-125bps in 2021

14

• Substantial annual cost synergies of ~$60M expected in 2021

5

• IRR estimated at ~14%, inclusive only of cost synergies; >20% with anticipated revenue and cost

synergies

Purchase

price &

financing

• Purchase price of $2.6B

• Valuation of 13.9x CRD estimated 2018 net income including only 2021 cost synergies;

Valuation of 18.2x CRD estimated 2018 net income

• Financing via issuance of common equity, preferred stock, and suspension of buybacks through the end of

the year

• Dividend increase of 12% in 3Q18 as recently announced

13

7

State Street and CRD serve top buy-side core clients

49 of the

top 100

Asset

Managers

12 of the

top 30

Asset

Owners

11 of the

top 30

Insurance

7 of the

top 30

Alternatives

7 of the

top 30

Wealth

Managers

86 of the

top 100

22 of the

top 30

26 of the

top 30

24 of the

top 30

Growth

opportunity

CRD State Street Strategic Approach to Capture Opportunities

• Grow CRD’s client base by leveraging State

Street’s relationships and reputation

• Expand CRD and State Street share of

wallet by offering solutions to shared clients

• Enhance distribution of State Street

products to CRD clients

• Offer State Street’s differentiated platform to

firms seeking an integrated experience

• Increase wealth management market share

through CRD’s strong position

Institutions outside the top 220

Expand presence across additional firms with

~45% of global AUM

17

Top 220 Institutions

16

(~55% of Global AUM

17

)

A strong footprint in the

top 220 global institutions

A

Significant opportunities to expand share of

wallet and to grow the client base

A

The top 220 institutions included 15 CRD only clients, 87 State Street only clients, 71 shared clients, and 47 neither State Street nor CRD.

Refer to the Appendix included with this presentation for endnotes 1 to 22.

8

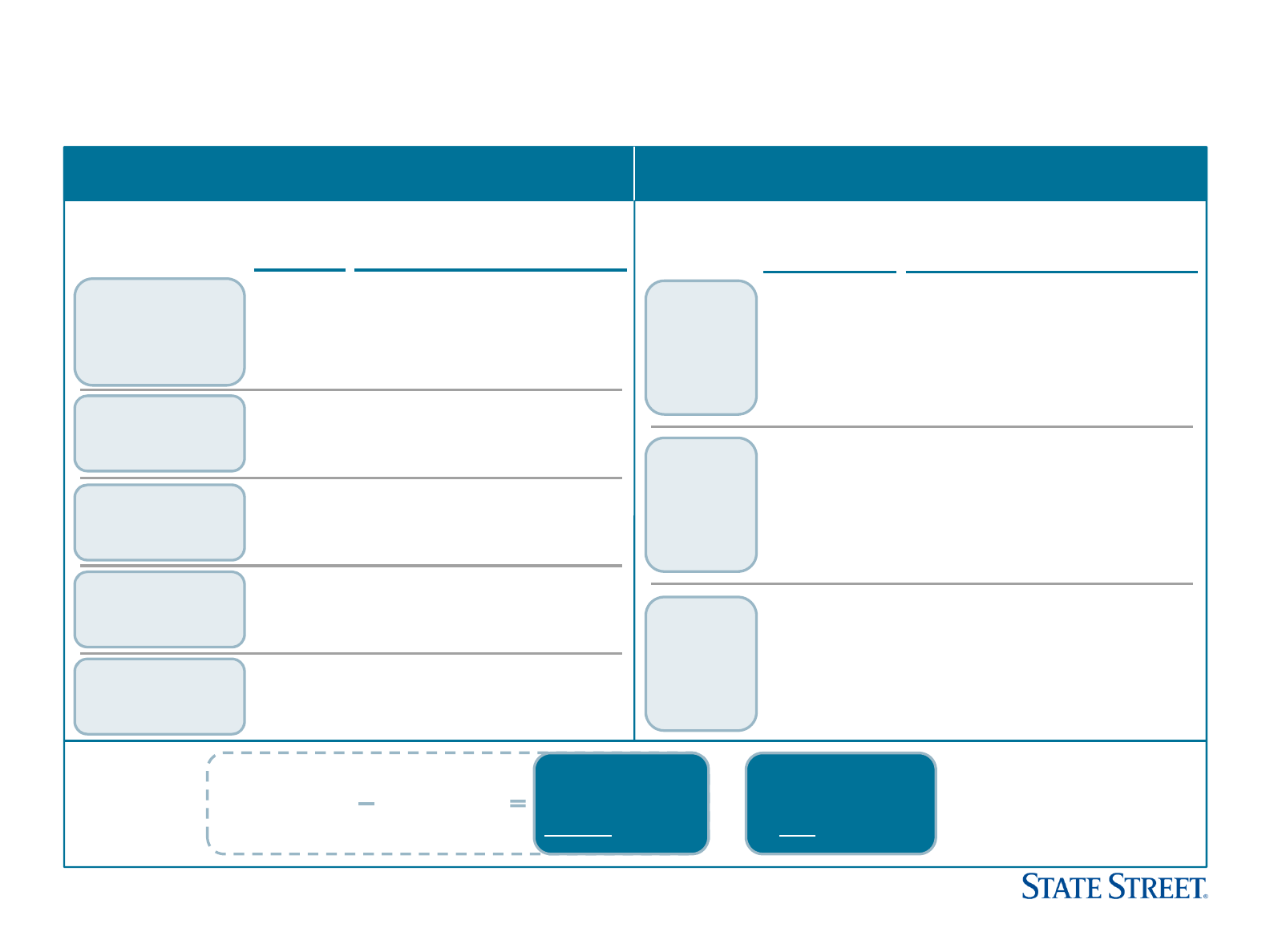

Annual revenue synergies in 2021

4

Annual cost synergies in 2021

5

Expected to generate meaningful revenue and cost

synergies from enhanced platform services and efficiencies

Refer to the Appendix included with this presentation for endnotes 1 to 22.

Estimated

Range

in 2021

Revenue

Synergy Highlights

~$70-75M

Upgrade CRD clients from client-

installed software to STT cloud

Expand CRD share of wallet by

introducing CRD software solutions

to STT clients

~$55-60M

Grow STT share of wallet by

offering STT middle and back

office services

~$70M

Data management and analytics

services underpin front-to-back

office services growth

~$35-40M

Expand STT share of wallet by

offering integrating trading

services into the CRD platform

~$30-35M

Increase existing CRD presence

in the wealth management

segment

CRD’s front office

solutions

Estimated

Range

in 2021

Cost

Synergy Highlights

~$35M

Streamline State Street custody,

accounting and middle office

operations creating greater

efficiency and lower unit costs

~$10-15M

Capture of efficiencies through

retirement of legacy State Street

middle and back office systems

~$10-15M

SSGA implementation of CRD’s

established front office solution

drives system rationalization

Integrated

client

servicing

platform

Systems &

application

retirement

Operational

efficiency

State Street’s

middle & back

office services

Expand State

Street data mgmt

and analytics

Distributing

State Street’s

trading services

Expand presence

in wealth segment

~$260-280M

annual revenue

synergies

~$180-200M

delivery costs

to achieve

~$55-65M

EBIT from

cost synergies

~$75-85M

EBIT from

revenue synergies

9

Summary

Industry’s first-ever global front-middle-back office solution

2

• Represents a significant milestone in State Street’s technology transformation

• Combination of State Street and CRD will provide a comprehensive, open architecture data-enabled

platform

– Enterprise end-to-end offering – front, middle and back office software and services configurable to

different client needs

– Information-enabled platform, interoperable with other front office systems

• Allows State Street to access a new front office revenue opportunity at scale

Transaction generates attractive projected long-term financial returns

• EPS accretion anticipated in 2020

3

• IRR estimated at ~14%, inclusive only of cost synergies; >20% with anticipated revenue and cost synergies

• Meaningful recurring fee income, which increases annual fee revenue growth

14

• Specific revenue and cost synergies

• Timing and approvals:

– Subject to regulatory approvals and customary closing conditions

– Expect to close in 4Q18

Refer to the Appendix included with this presentation for endnotes 1 to 22.

10

Appendix

Demonstrating the value of the integrated

platform for our core clients

11

Addressing new market opportunities 12

Perspectives on transaction value 13

Slide endnotes 14

11

Demonstrating the value of the integrated platform for our

core clients

1-2

Risk

systems

2-3

Portfolio

tools

1-2

IBORs

12

1-2

Trading

solutions

1

Data

platform

4-7

Risk

systems

8-15

Portfolio

tools

3-8

IBORs

12

2-4

Data

systems

3-6

Trading

solutions

Front

Office

Middle

Office

Back

Office

18

Potential investment manager systems’ consolidation

A

Current State Future State

• Integrated State Street data-driven platform

- Optimizes front-middle-back office operations and

processes

- Enables efficient flows of data throughout the

investment process, minimizing error and improving

accuracy

• Interoperable with third party solutions

- Interoperability allows flexibility to communicate and

exchange data with other external solutions

• Combats client margin compression

- Reduces internal technology and operations costs;

enables vendor rationalization

Illustrative example: $500B+ Asset Manager

B

Platform for growth and efficiencies

A

Example for illustrative purposes only

B

Current state systems architecture based on a composite of $500B+ asset managers. Multiple systems are used due to asset class segmentation,

B

geography and the retention of legacy systems subsequent to acquisitions.

Refer to the Appendix included with this presentation for endnotes 1 to 22.

12

With CRD, State Street will be positioned to consolidate the

fragmented market for front and middle office solutions

Back

Office

Middle

Office

Front

Office

Market Size

A

Growth Rate

19

Market Structure Strong Strategic Rationale

~$6-8B

20

~4-6%

• Highly fragmented market

• Multiple vendors at the

same firm across

investment strategies and

geographies typical

Offers solutions in the front,

middle, and back office,

spanning a revenue pool of

~$40-50B

Supports clients’ desire to

outsource more activities

across investment

operations

Platform will be able to

integrate third party

providers, in both the front

and back office, for State

Street clients

A

bilit

y

to inte

g

rate from front

to back will differentiate

State Street

~$3-8B

21

~5-7%

• Fragmented

• Majority of spend is internal

• Increasing automation and

outsourcing

~$30-35B

22

~4-5%

• 4 large established players

• Segment specialists

• Majority of spend is

outsourced

A

Range assumes level of outsourcing that develops over time

Refer to the Appendix “Slide endnotes” page for endnotes 1 to 22.

Allows State Street to address a new revenue opportunity at scale

13

Perspectives on Transaction Value

CRD Public

Comparables

CRD Public

Comparables

18.2x

23.2x

12.6x

18.1x

10.5x

7.4x

Includes 2021

revenue & cost

synergies

B

2018E Price / Earnings

A

2018E EV / EBITDA

A

C

A

Assumes illustrative 27.3% tax rate on CRD earnings. 2018E earnings and EBITDA estimates apply ASC 606 and reflect State Street’s estimates for CRD’s earnings and

EBITDA under State Street’s ownership.

B

Assumes illustrative 27.3% tax rate on synergies. Synergies include costs to achieve and associated expenses and reflect synergies at CRD and at

B

State Street.

C

Public comparables to CRD include SEI Investments, SS&C, Factset, and Envestnet. Estimates for public comparables taken from median IBES

C

consensus estimates. Market data as of July 17, 2018; financial data as of most recently available quarter.

13.9x

Includes 2021

cost synergies

9.7x

Includes 2021

revenue & cost

synergies

B

Includes 2021

cost synergies

Purchase price attractive relative to comparables

14

Slide endnotes

1. Source: State Street and McKinsey Global Institute, Global Capital Markets, December 31, 2016 and updated on January 2018 per bespoke McKinsey report.

2. Offered by a single provider.

3. EPS accretion excludes acquisition and restructuring costs.

4. Revenue synergies mainly represent opportunities to enhance the distribution of State Street products and capabilities to Charles River Development clients, cross sell Charles River

Development into State Street client base, expand share of wallet across our combined client base, bundle services to clients seeking an integrated experience and expand combined and

integrated capabilities into new client segments.

5. Listed synergies are net of expenses and cost to achieve, excluding restructuring charges, on a pre-tax basis.

6. Recurring revenues defined as revenues that are fixed and not dependent on market levels; As of FY2017 and may not be indicative of post-acquisition retention.

7. Historical financials recorded under ASC605. Post-acquisition, financials will be recorded under ASC606 and may result in timing differences. Adjusted operating income is calculated by

excluding: (i) non-cash compensation expense associated with change in control phantom equity plan (non-recurring post-acquisition, due to expiration of plan at closing), which was $11

million in 2013 and $29 million in 2017; and (ii) depreciation and amortization, which was $1 million in 2013 and $2 million in 2017. Historical presentation of adjusted operating income differs

from projected 2018 EBITDA presented on slide 13 (see note A on slide 13).

8. Breakout of client type, region and business line based on revenue from client annual contract values as of December 31, 2017.

9. Professional Services and Value Added Services include providing data management, compliance and shareholder disclosure services.

10. Based on Charles River Development ‘s total client AUM size being managed on their platform as reported in January 2018.

11. Based on State Street’s middle office AUA and back office AUCA size as reported in 2Q18.

12. IBOR defined as investment book of record.

13. State Street’s common stock dividends, including the declaration, timing and amount thereof, remain subject to consideration and approval by State Street’s Board of Directors at the relevant

times. The timing of any repurchases, type of transaction and number of shares purchased under the newly authorized common stock purchase program will depend upon various factors,

including alternative investment opportunities, such as merger and acquisition activity, internal capital generation, market conditions, State Street’s capital position, the amount of common

stock issued as part of employee compensation programs and other factors. Stock purchases may be made using various types of transactions, including open-market purchases,

accelerated share repurchases or other transactions off the market, and may be made under Rule 10b5-1 trading programs. The common stock purchase program does not have specific

price targets and may be suspended at any time.

14. Baseline for 2021 pro-forma revenue growth from 2020 is based on gross revenue synergies and includes Charles River Development’s standalone revenues under ASC606.

15. Benefit assumes a tax basis step-up which is deductible over 15 years at a 26.38% combined federal and state tax rate, present valued using a 10% discount rate.

16. Institutions ranked by AUM.

17. PwC Strategy & Analysis, WillisTowersWatson; Prequin Hedge Fund Online; Swifi; PIO Online; Cerulli Associates; Scorpio Partnership; PwC Market Research Center Analysis; aiCIO;

Investor presentations and annual reports.

18. There are instances where a manager’s underlying clients select other custodians in addition to State Street.

19. Growth rates are internal estimates of three-year forecasted growth rates, with key assumptions and sources as follows:

• Front Office: includes Order Management System (OMS), electronic trading/Execution Management System (EMS), risk technology, market surveillance, and trade compliance; industry

data from TABB Group (“State of the OMS: A Time for Change”; May 2018), Aite (“Trade Surveillance and Compliance Technology: 2017 Spending Update”;

https://www.aitegroup.com/report/trade-surveillance-and-compliance-technology-2017-spending-update; January 10, 2017), Greenwich Associates (“Buy Side Goes Outside for

OMS/EMS Platforms”; https://www.greenwich.com/fixed-income-fx-cmds/buy-side-goes-outside-omsems-platforms; May 23, 2018), and Institutional Investor (“Institutional Investors

Crank Up Their Spending on Risk Technology”; https://www.institutionalinvestor.com/article/b17r4w1mk4z5gv/institutions-crank-up-their-spending-on-risk-technology; April 12, 2018).

• Middle Office: expected AUM growth 2017-2020 with internal analysis for estimates of rates of outsourcing change and fee trends; industry AUM data from PwC (“Asset & Wealth

Management Revolution: Embracing Exponential Change”, 2017).

• Back Office: expected AUM growth 2017-2020 and internal estimate of fee trends; industry AUM data from PwC (“Asset & Wealth Management Revolution: Embracing Exponential

Change”, 2017).

20. Addressable market defined as OMS spend, electronic trading/EMS spend, risk technology spend, and market surveillance and trade compliance spend; industry data from TABB Group

(“State of the OMS: A Time for Change”; May 2018), Aite (“Trade Surveillance and Compliance Technology: 2017 Spending Update”; https://www.aitegroup.com/report/trade-surveillance-

and-compliance-technology-2017-spending-update; January 10, 2017), Greenwich Associates (“Buy Side Goes Outside for OMS/EMS Platforms”; https://www.greenwich.com/fixed-income-

fx-cmds/buy-side-goes-outside-omsems-platforms; May 23, 2018), and Institutional Investor (“Institutional Investors Crank Up Their Spending on Risk Technology”;

https://www.institutionalinvestor.com/article/b17r4w1mk4z5gv/institutions-crank-up-their-spending-on-risk-technology; April 12, 2018). Outsourcing rates based on internal analysis and

industry data from Greenwich Associates (“Buy Side Goes Outside for OMS/EMS Platforms”; https://www.greenwich.com/fixed-income-fx-cmds/buy-side-goes-outside-omsems-platform;

May 23, 2018).

21. Includes Middle Office operations and functions outsourced by asset managers to securities services providers; industry data from PwC (“Asset & Wealth Management Revolution:

Embracing Exponential Change”, 2017) with outsourcing and fee rates based on internal analysis.

22. Global securities services industry revenue (including Custody, Accounting, Administration and Net Interest Income) with estimate of Middle Office revenue

removed; industry data from BCG (“Embracing the Digital Migration”, 2018) with outsourcing rates based on internal analysis.