Washington Apple Health (Medicaid)

Physician-Related

Services/Health Care

Professional Services

Billing Guide

September 1, 2020

Every effort has been made to ensure this guide’s accuracy. If an actual or apparent conflict between this

document and an HCA rule arises, HCA rules apply.

Physician-Related Services/Health Care Professional Services

2

About this guide

*

This publication takes effect September 1, 2020, and supersedes earlier guides to this program.

The Health Care Authority (HCA) is committed to providing equal access to our services. If you

need an accommodation or require documents in another format, please call 1-800-562-3022.

People who have hearing or speech disabilities, please call 711 for relay services.

Washington Apple Health means the public health insurance programs for eligible

Washington residents. Washington Apple Health is the name used in Washington

State for Medicaid, the children's health insurance program (CHIP), and state-

only funded health care programs. Washington Apple Health is administered by

the Washington State Health Care Authority.

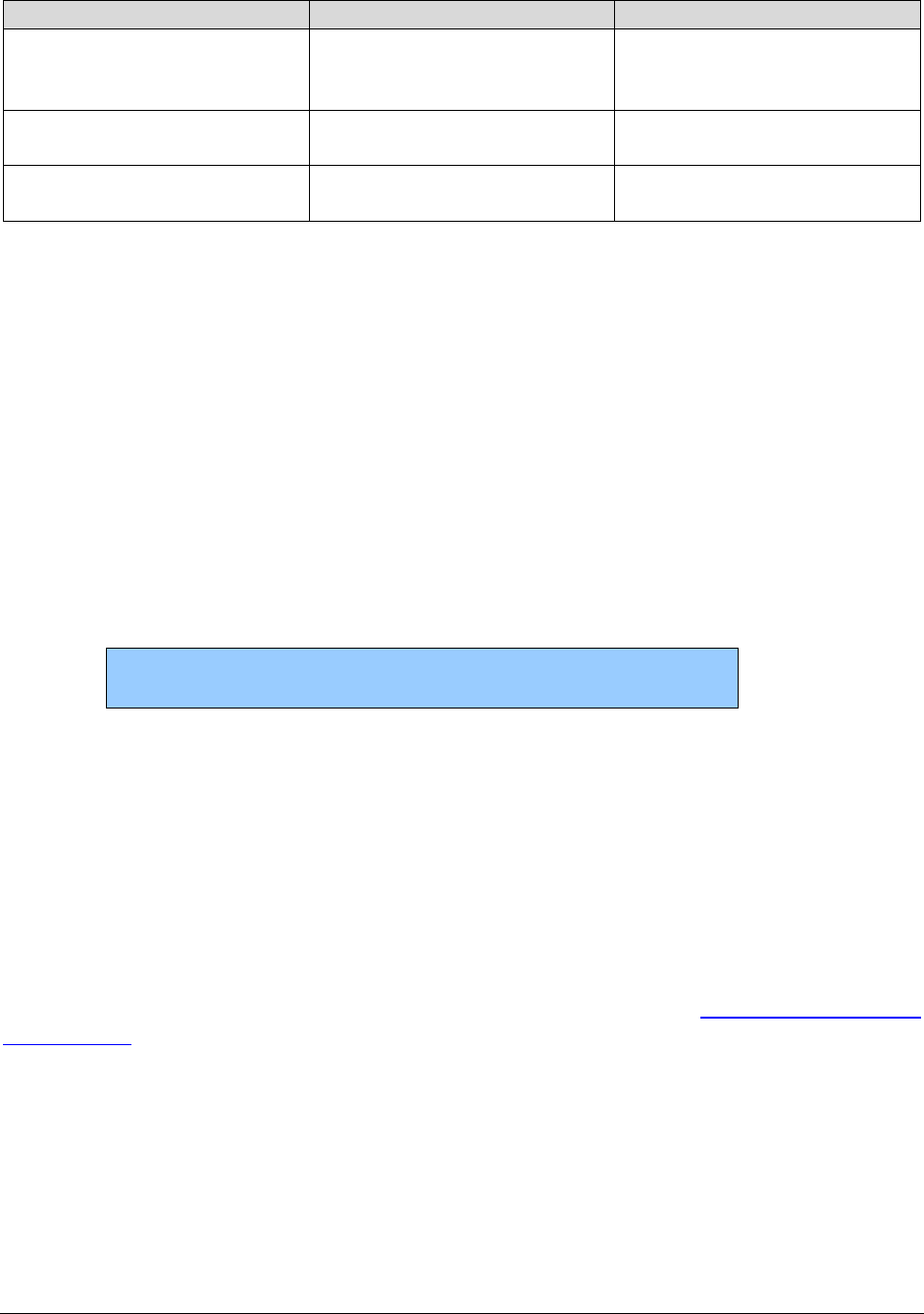

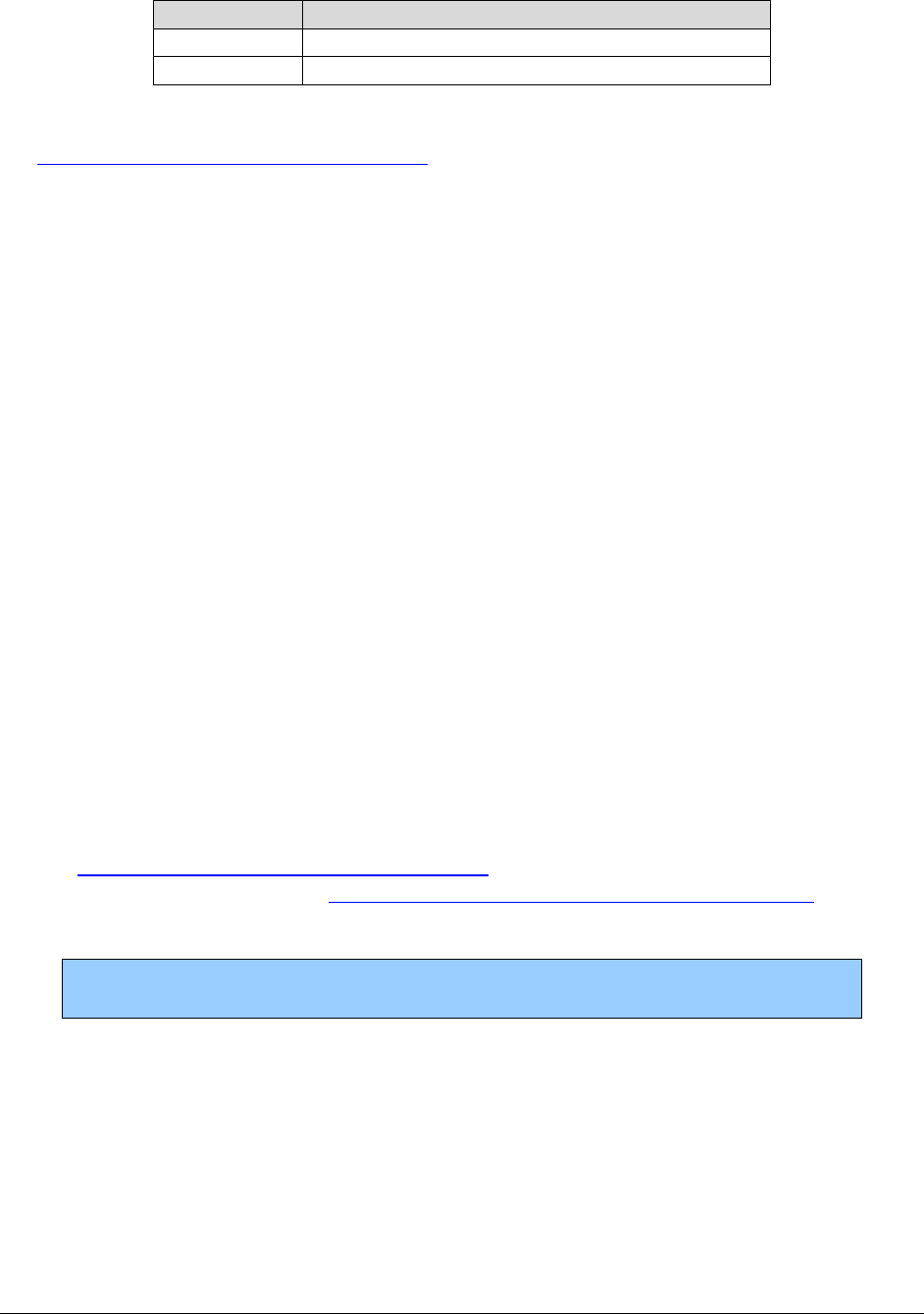

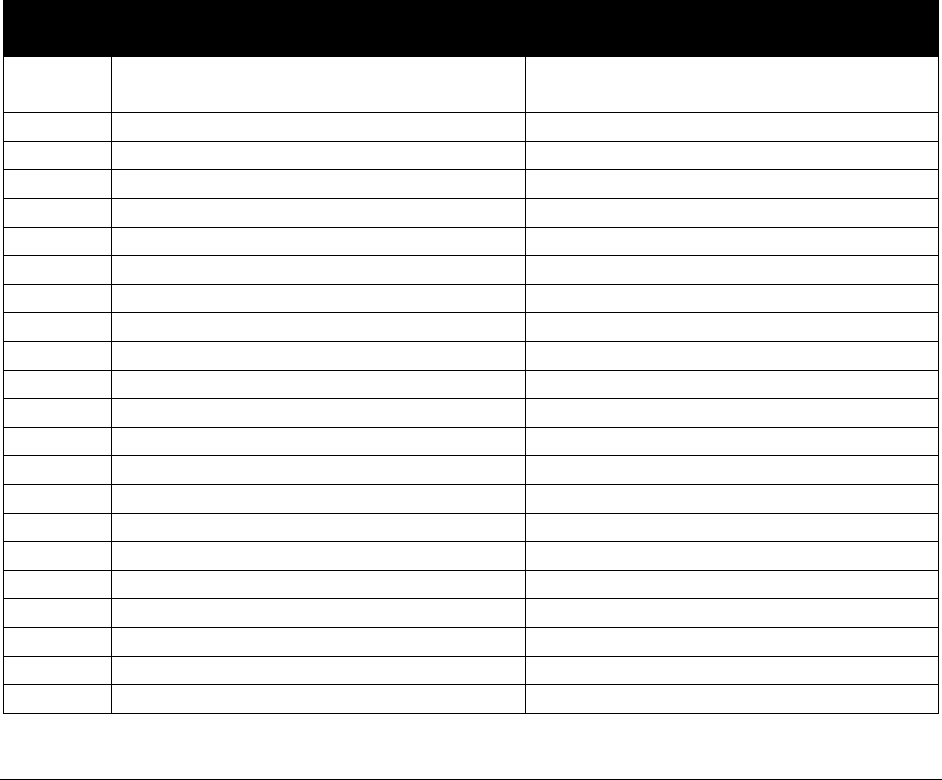

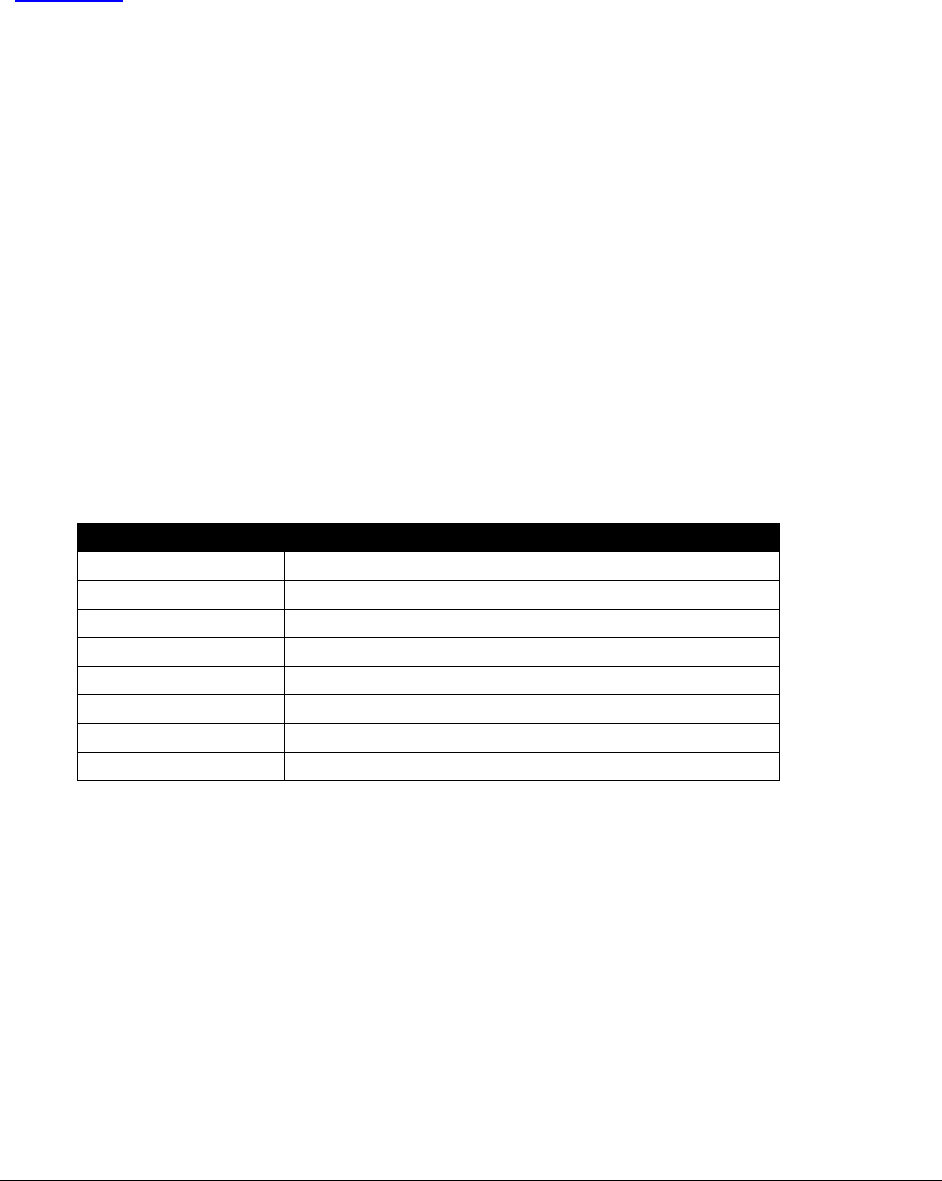

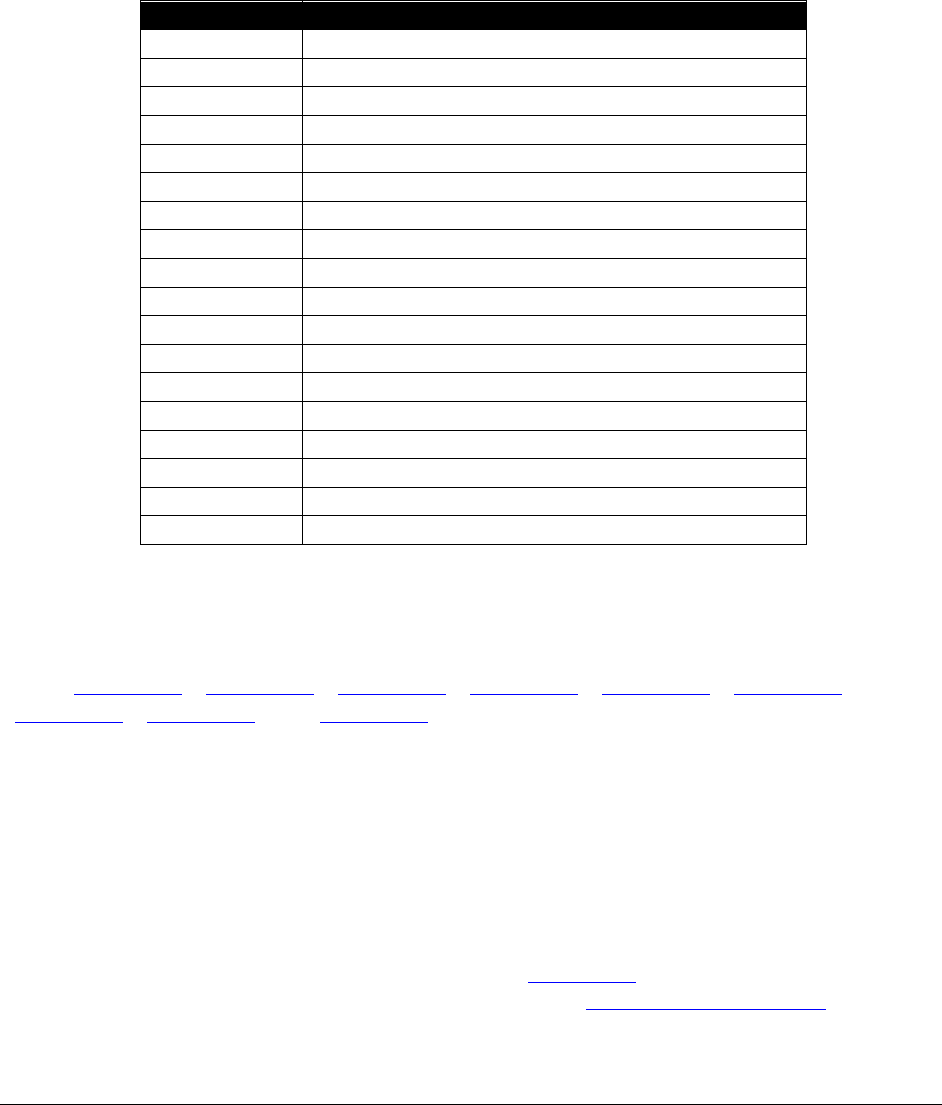

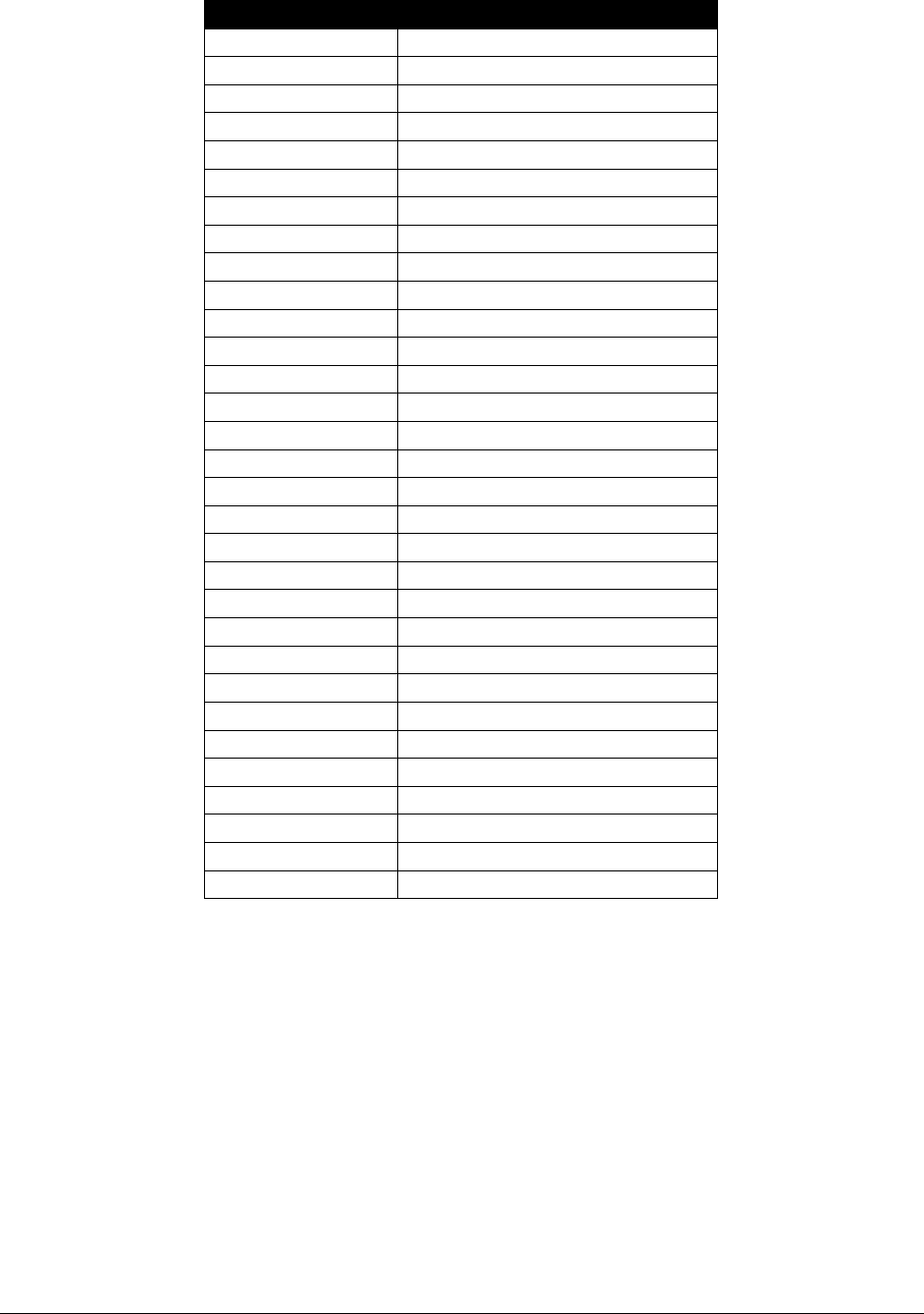

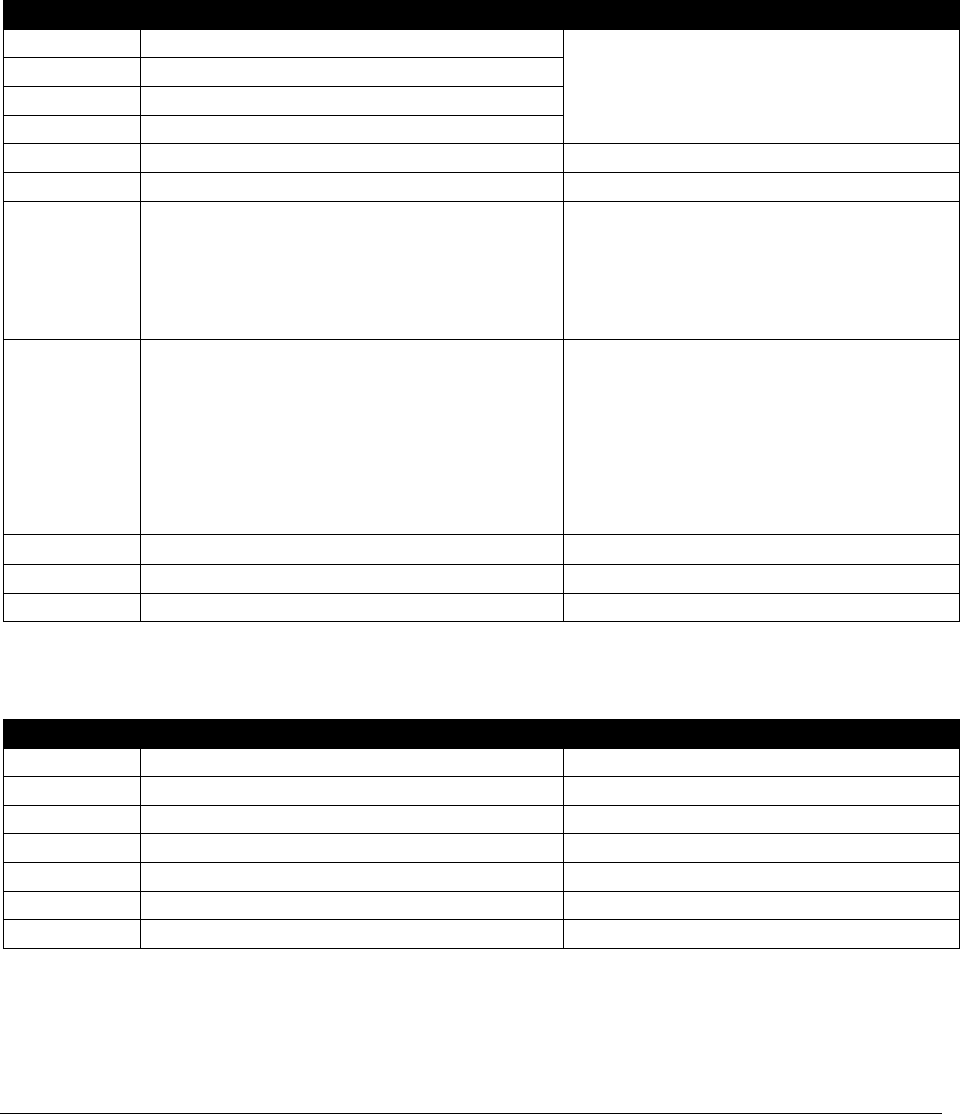

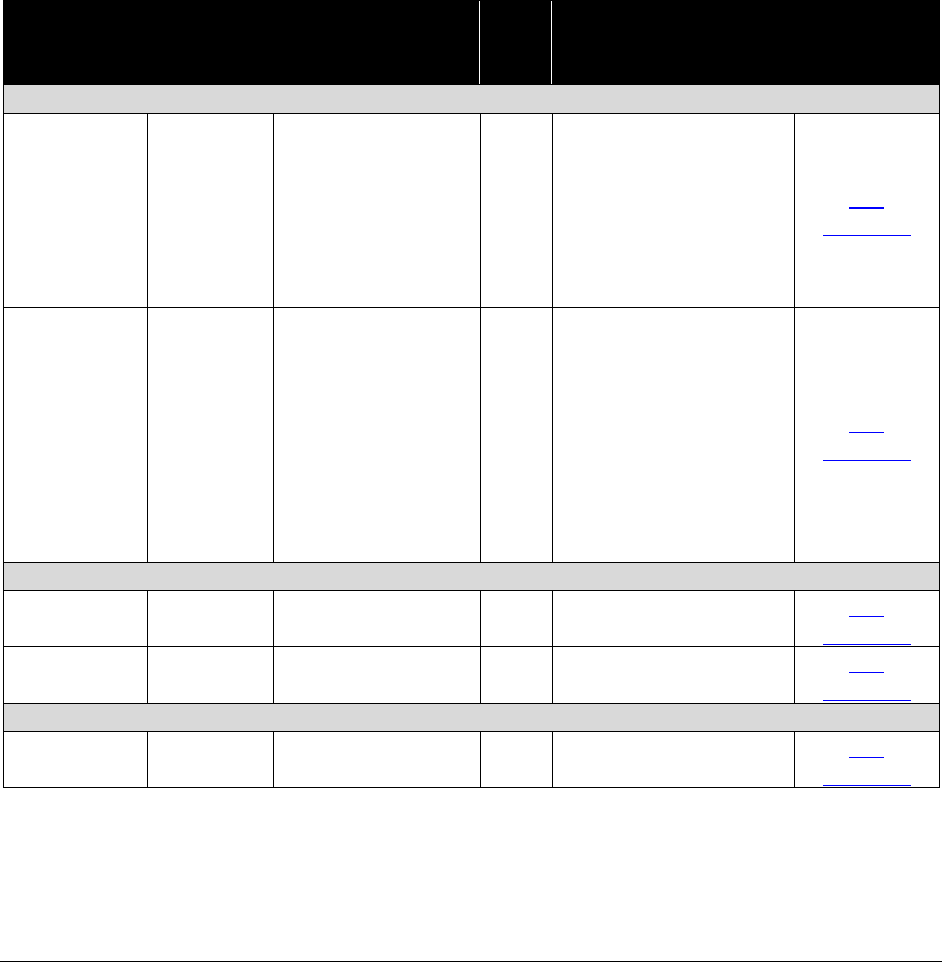

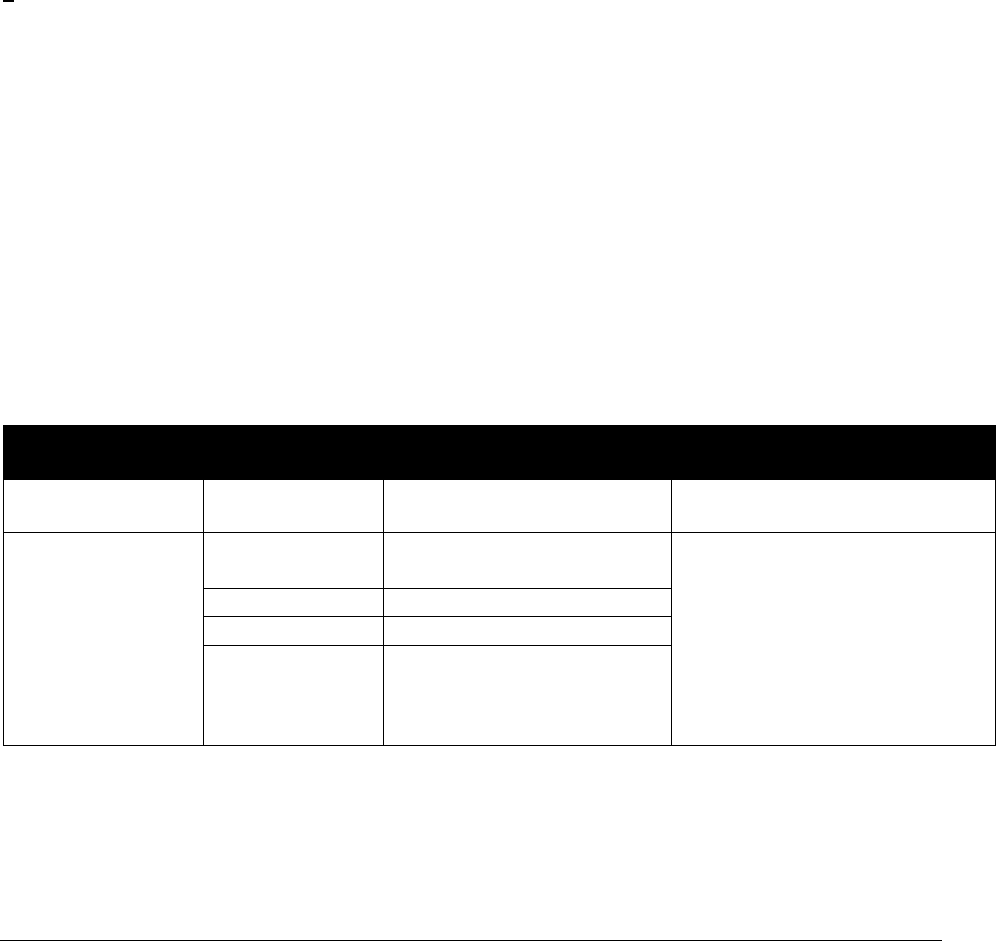

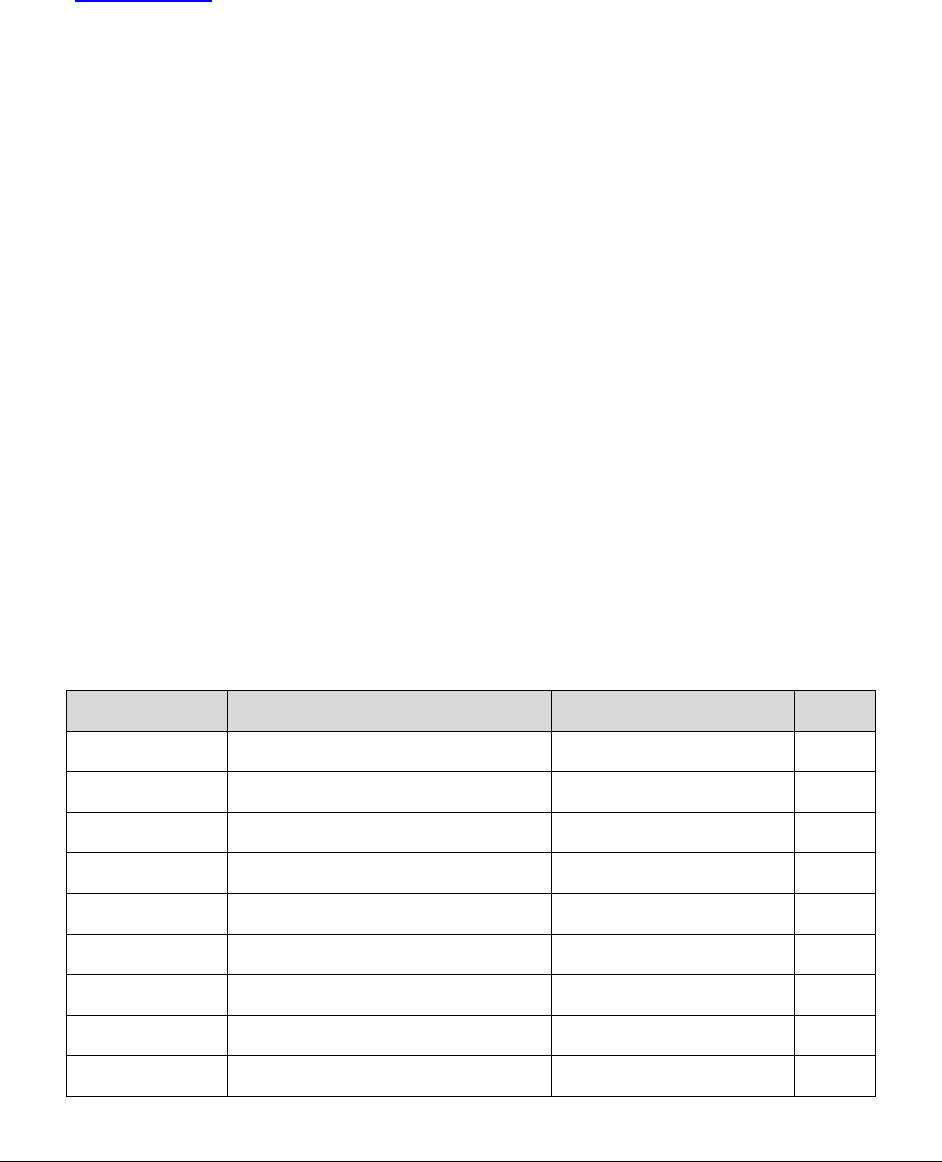

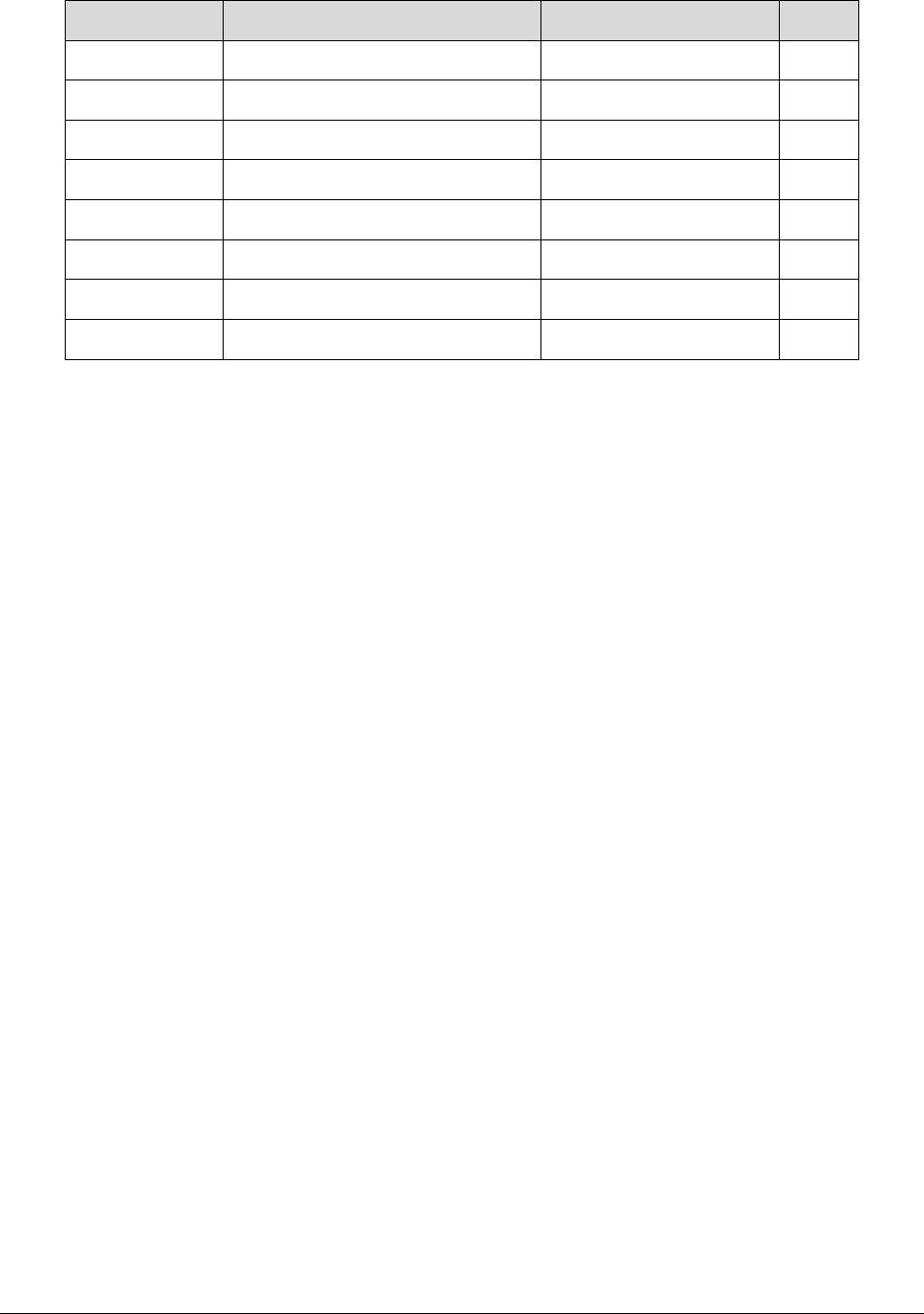

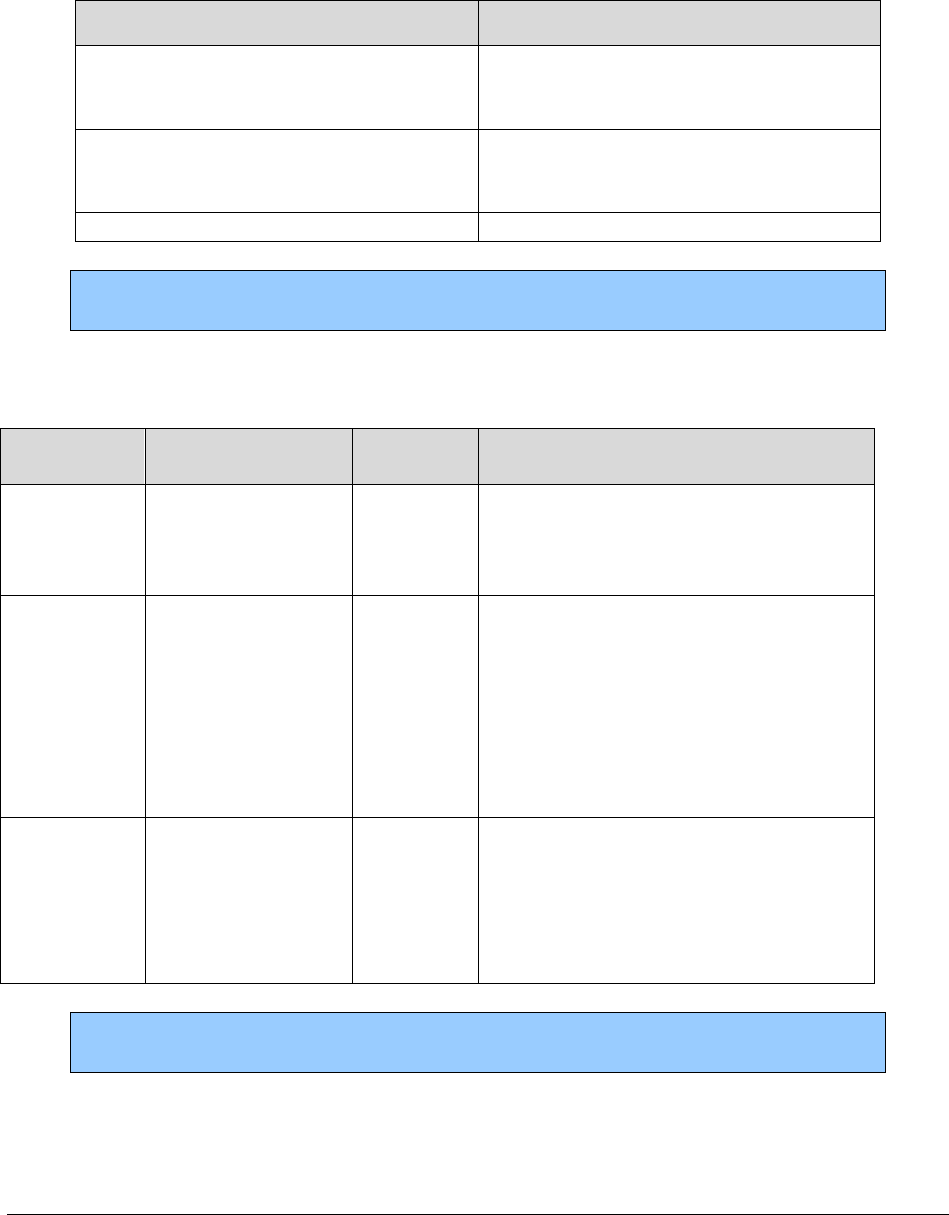

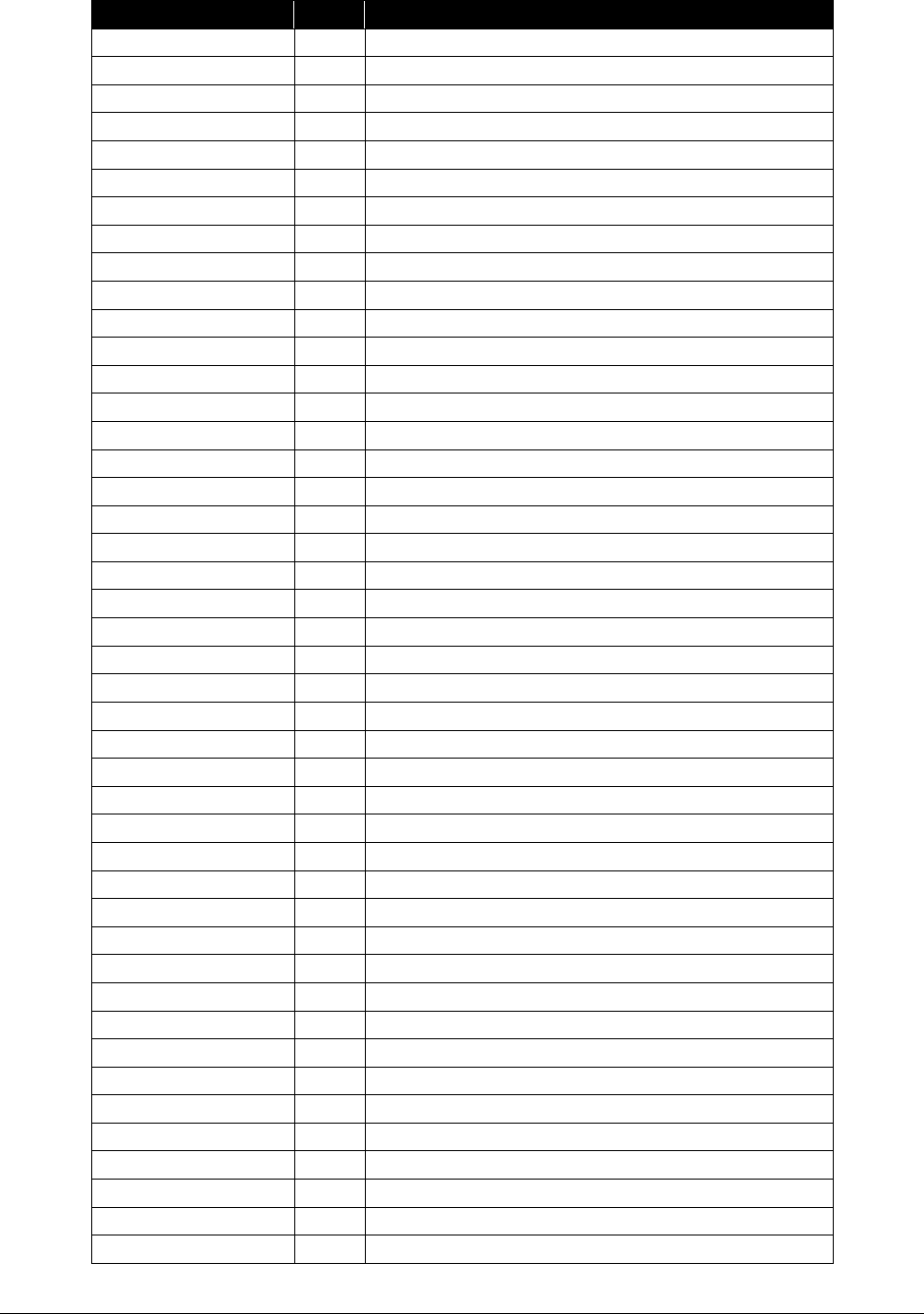

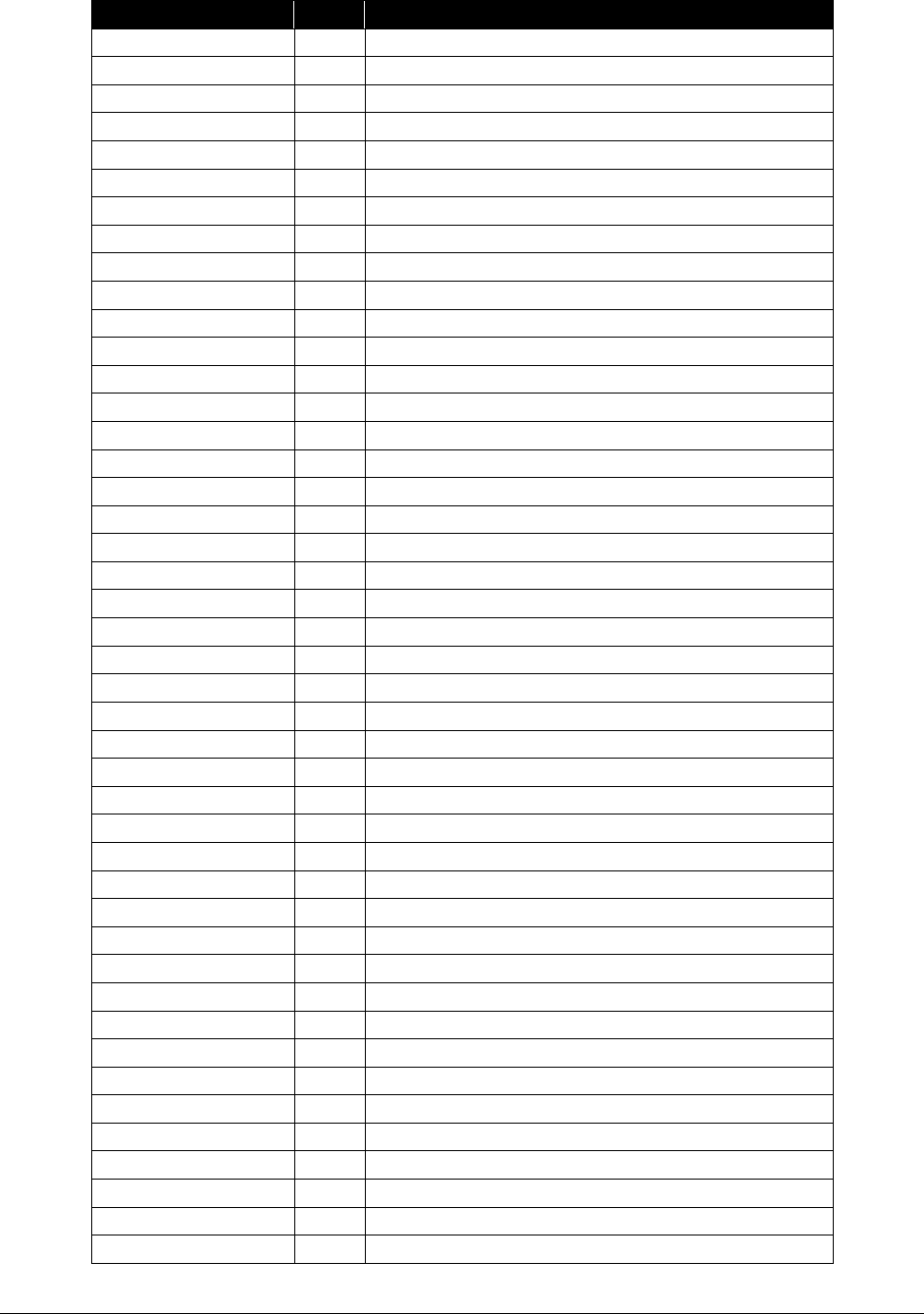

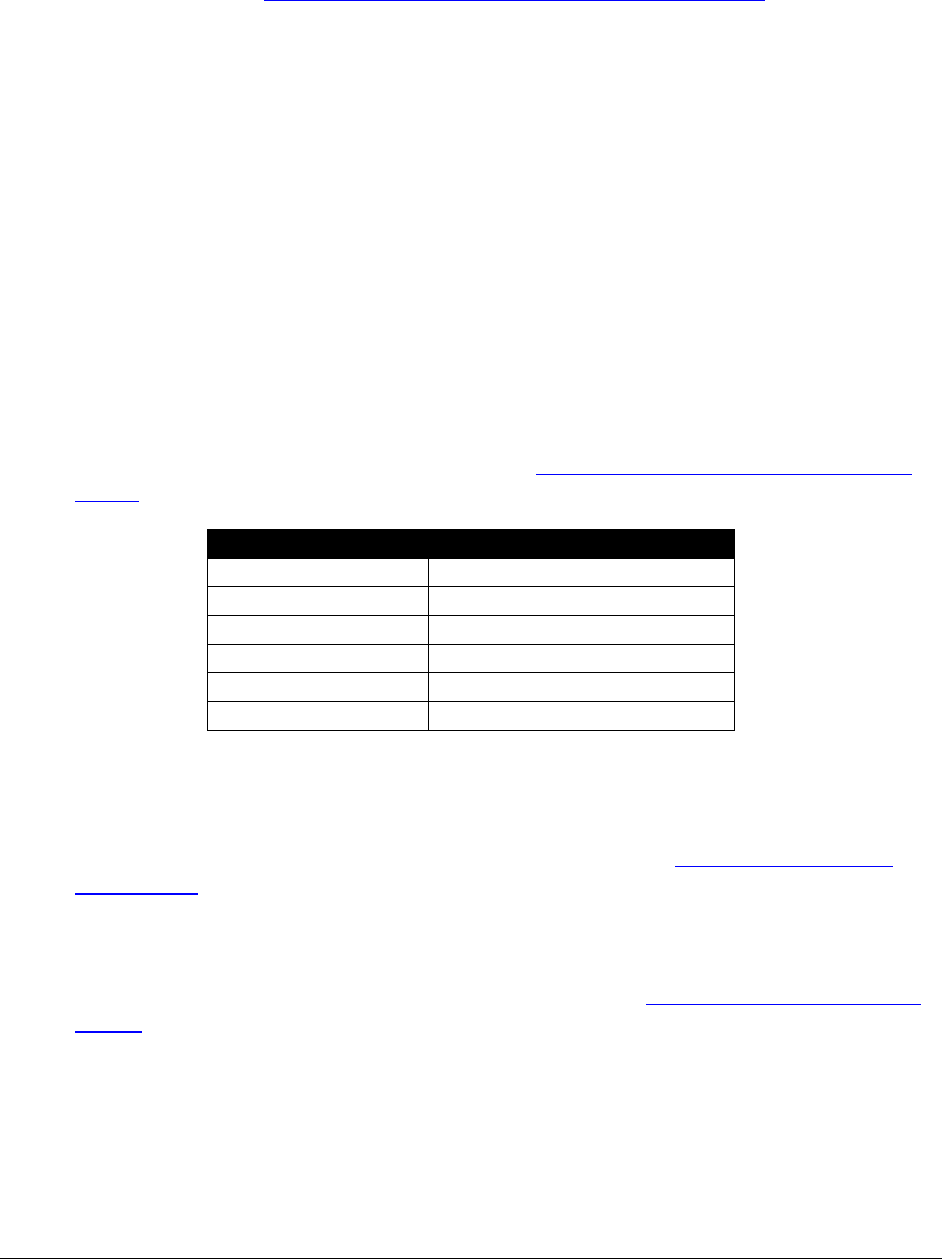

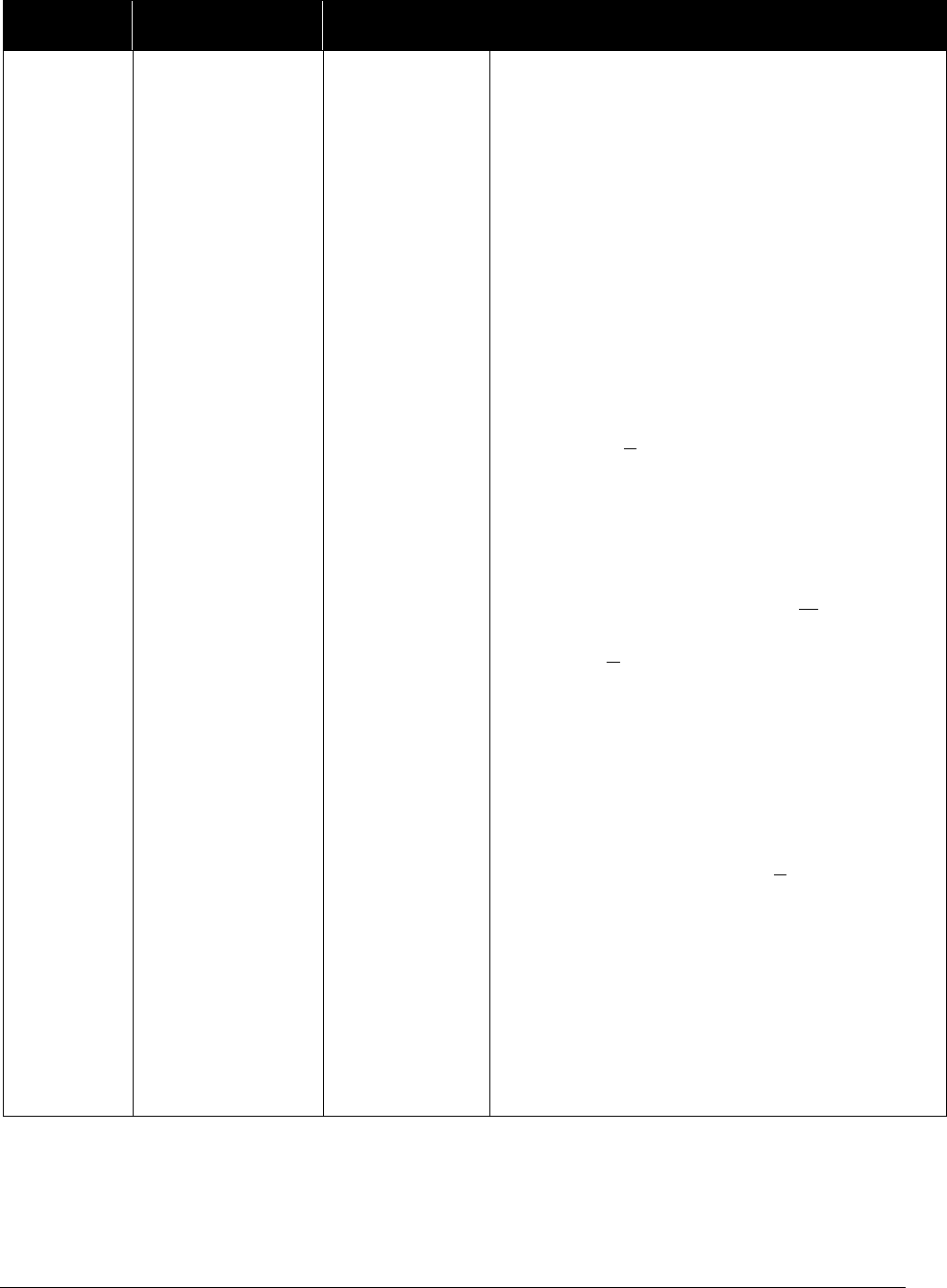

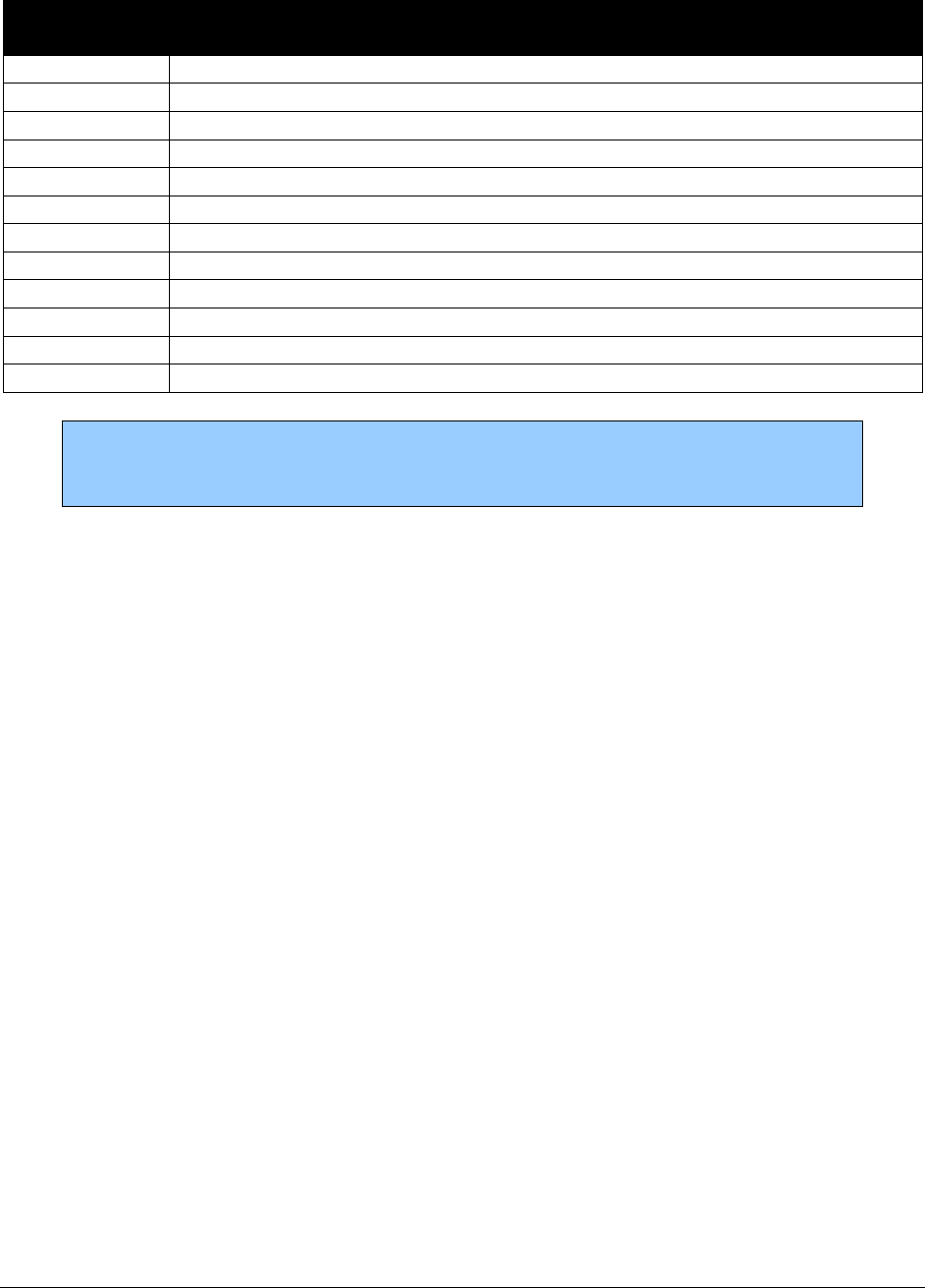

What has changed?

Subject

Change

Reason for Change

Entire document

Housekeeping changes

Changed all reference to “BAHA”

or “bone-anchored hearing aid” to

“bone conduction hearing device”

To improve usability

To align with HCA’s

Hearing Hardware

Billing Guide

Medical policy updates

For policy updates effective

9/1/2020, added that HCA does

not consider bronchial

thermoplasty for asthma to be

medically necessary

For policy updates effective

9/1/2020, added that HCA does

not consider autologous

blood/platelet-rich plasma

injections to be medically

necessary

HTCC decision. See

findings and decision.

HTCC decision. See

findings and decision.

Varicose vein treatment

Revised language concerning

medical necessity of varicose vein

treatment and added reference to

HTCC decision

No policy was changed.

Revised to improve

clarity regarding medical

necessity

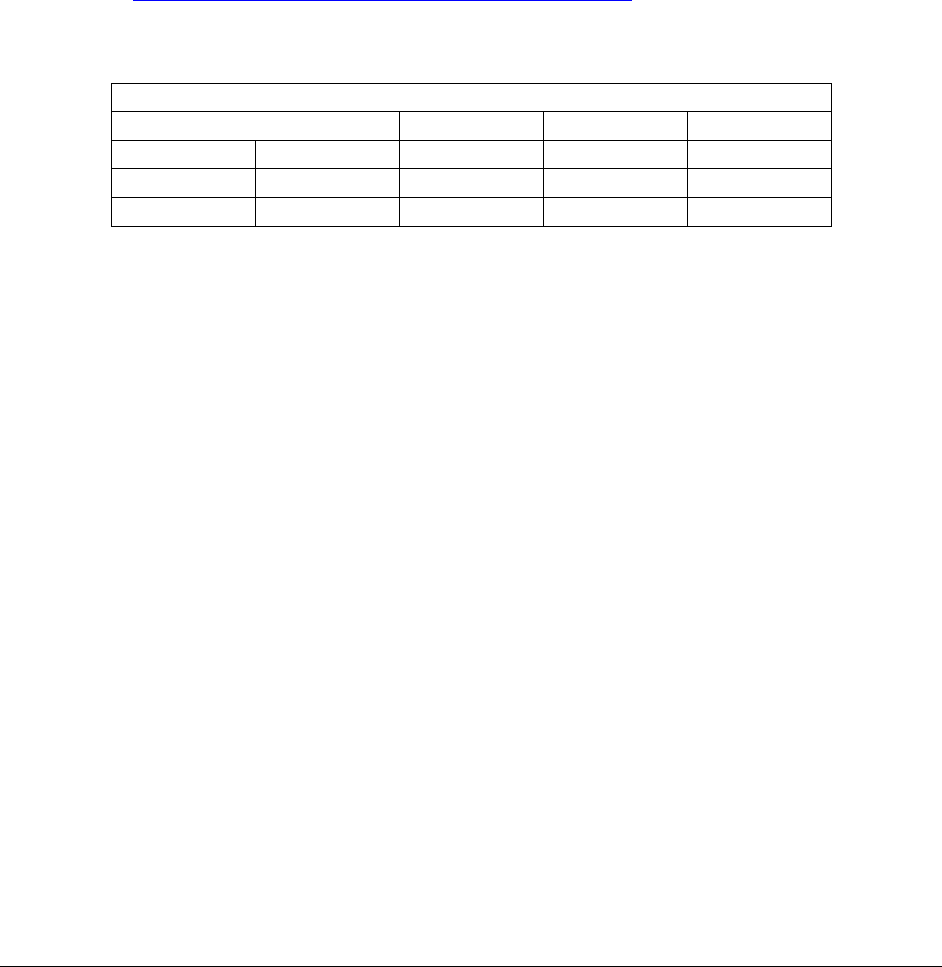

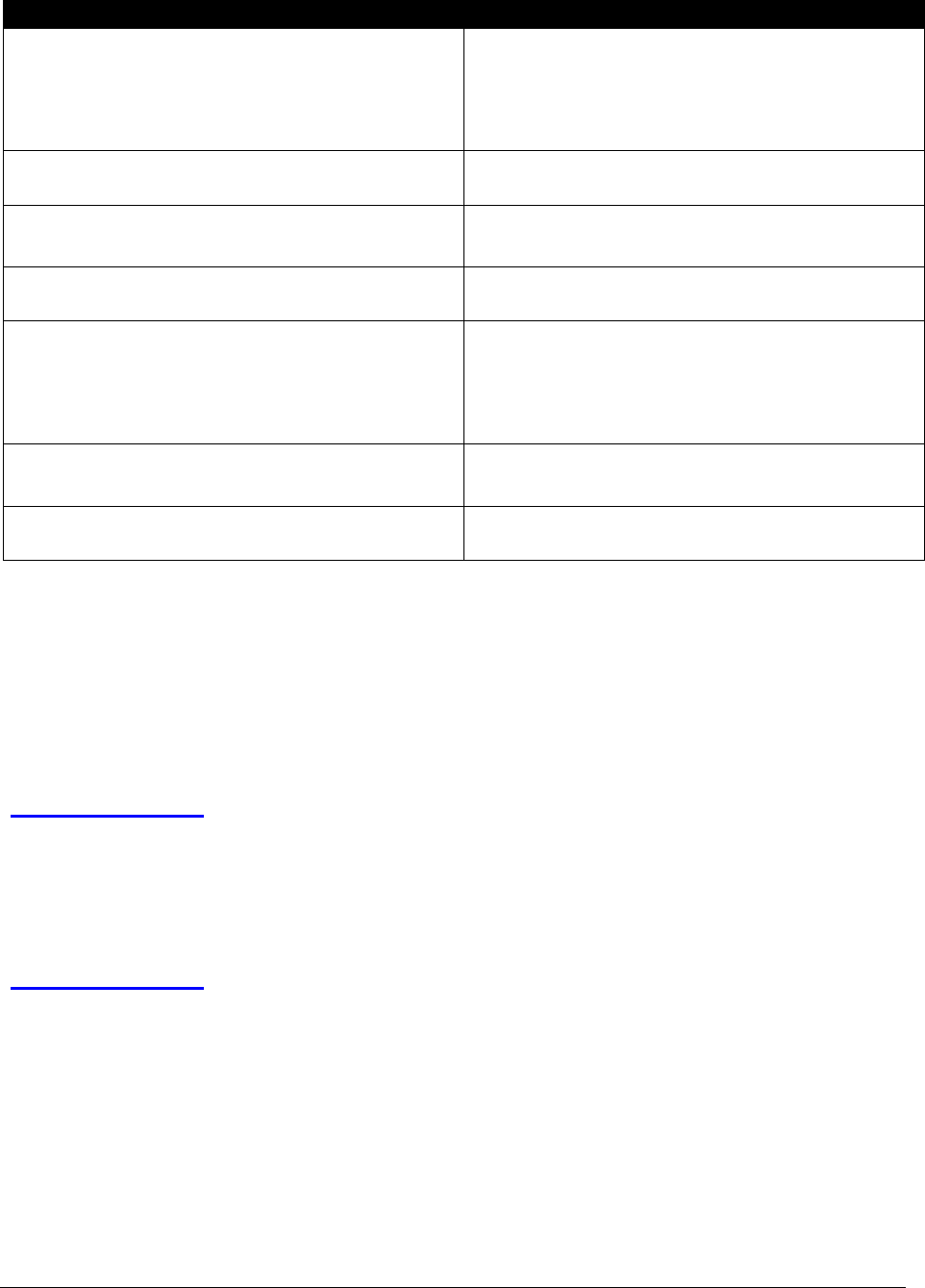

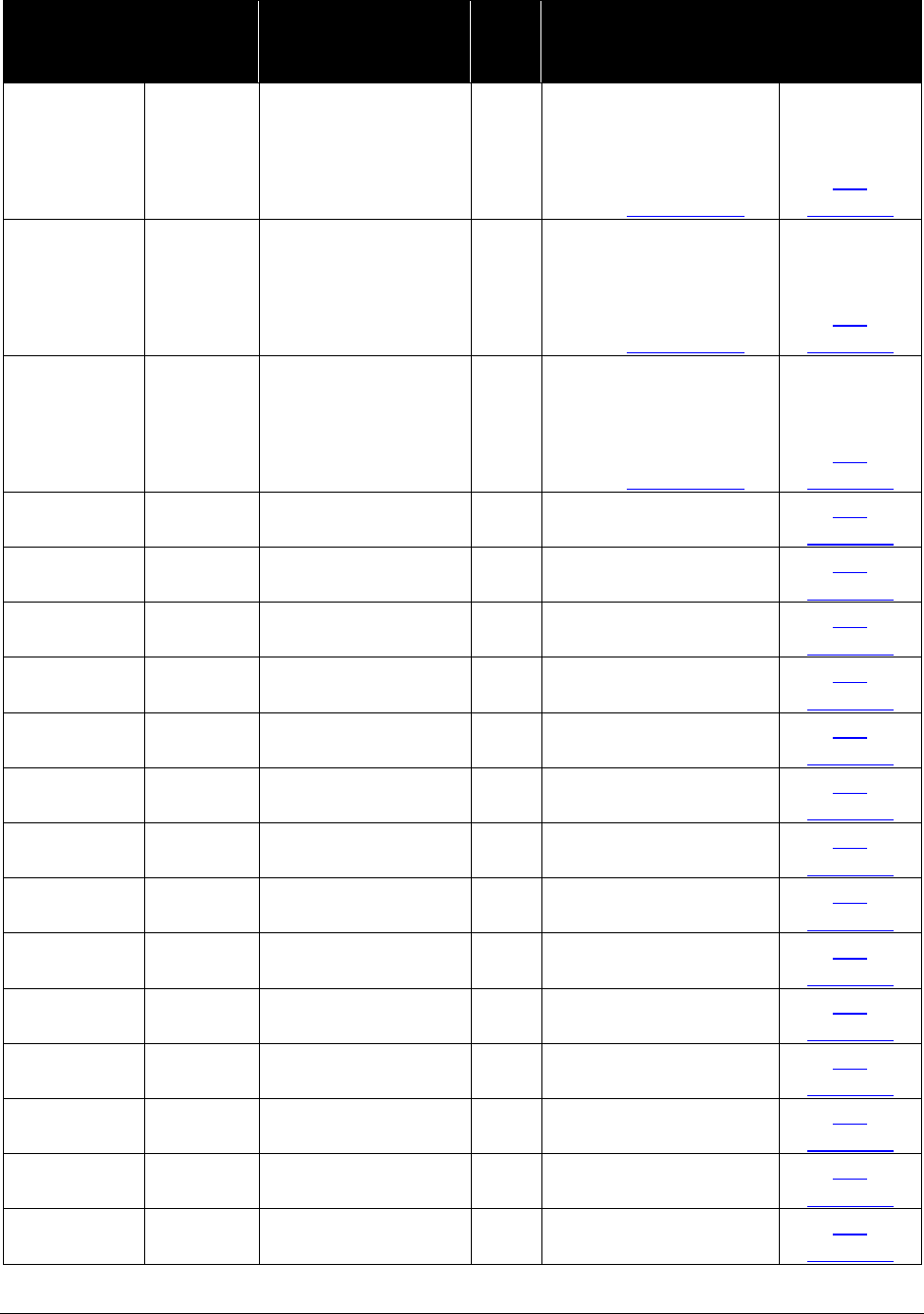

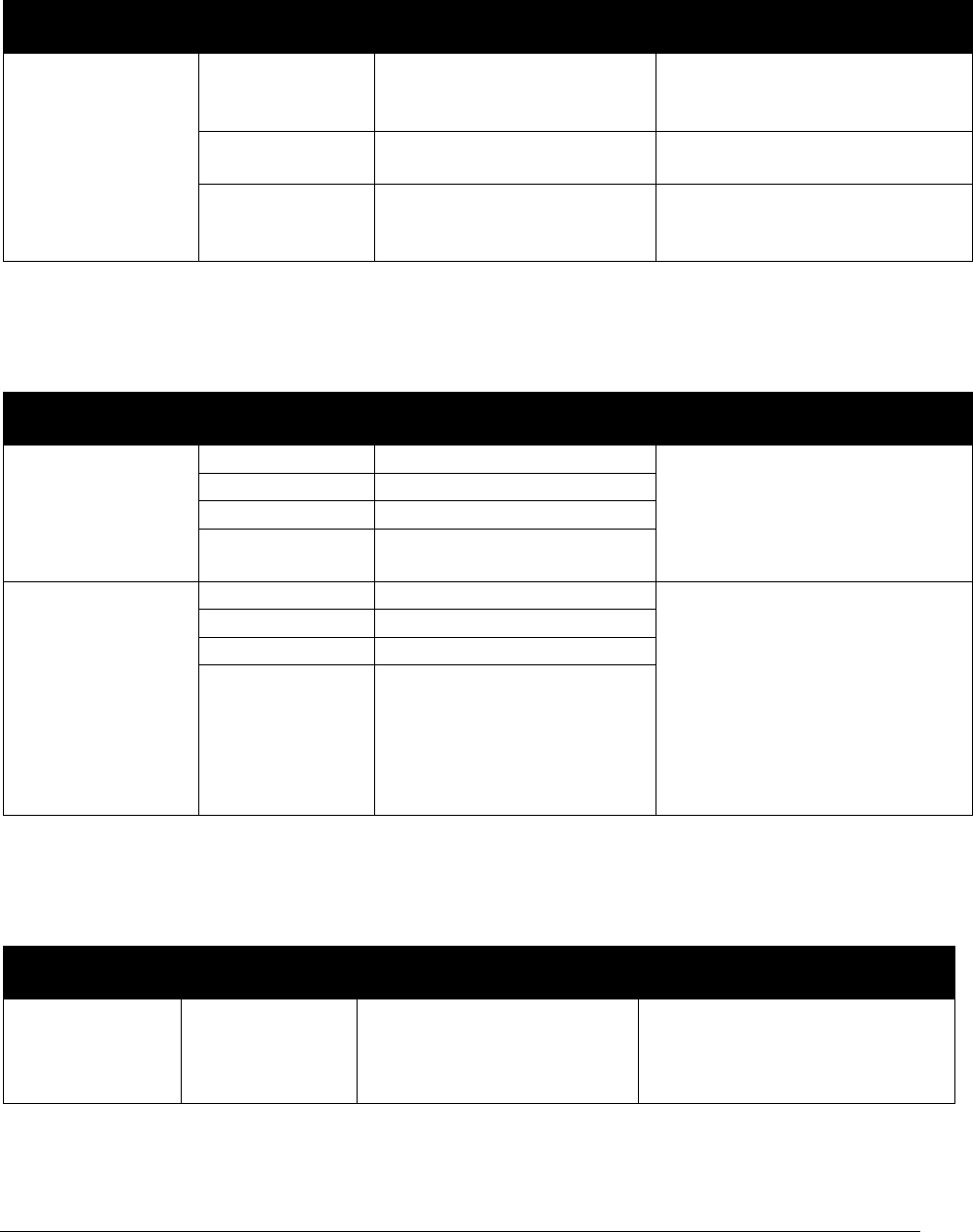

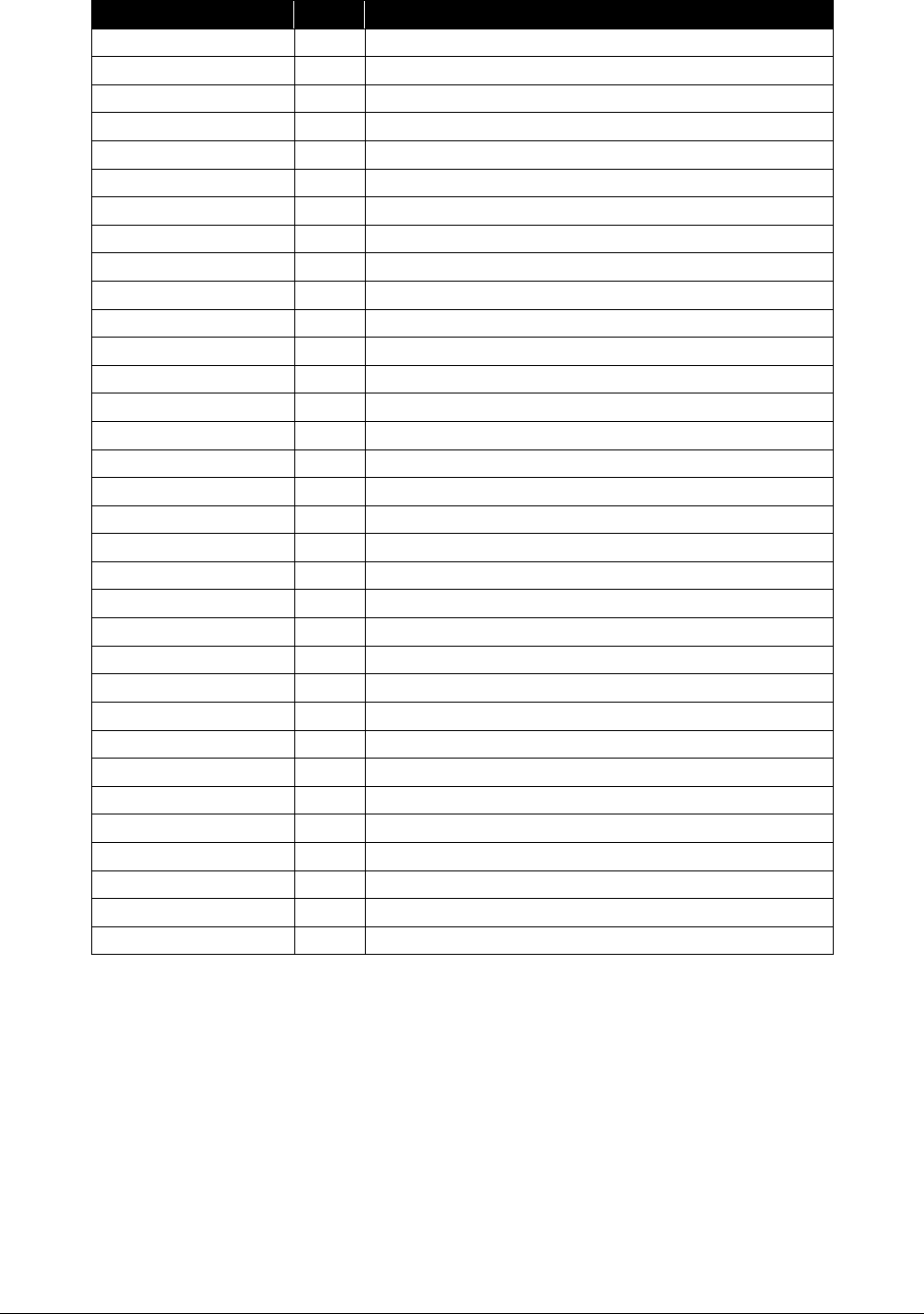

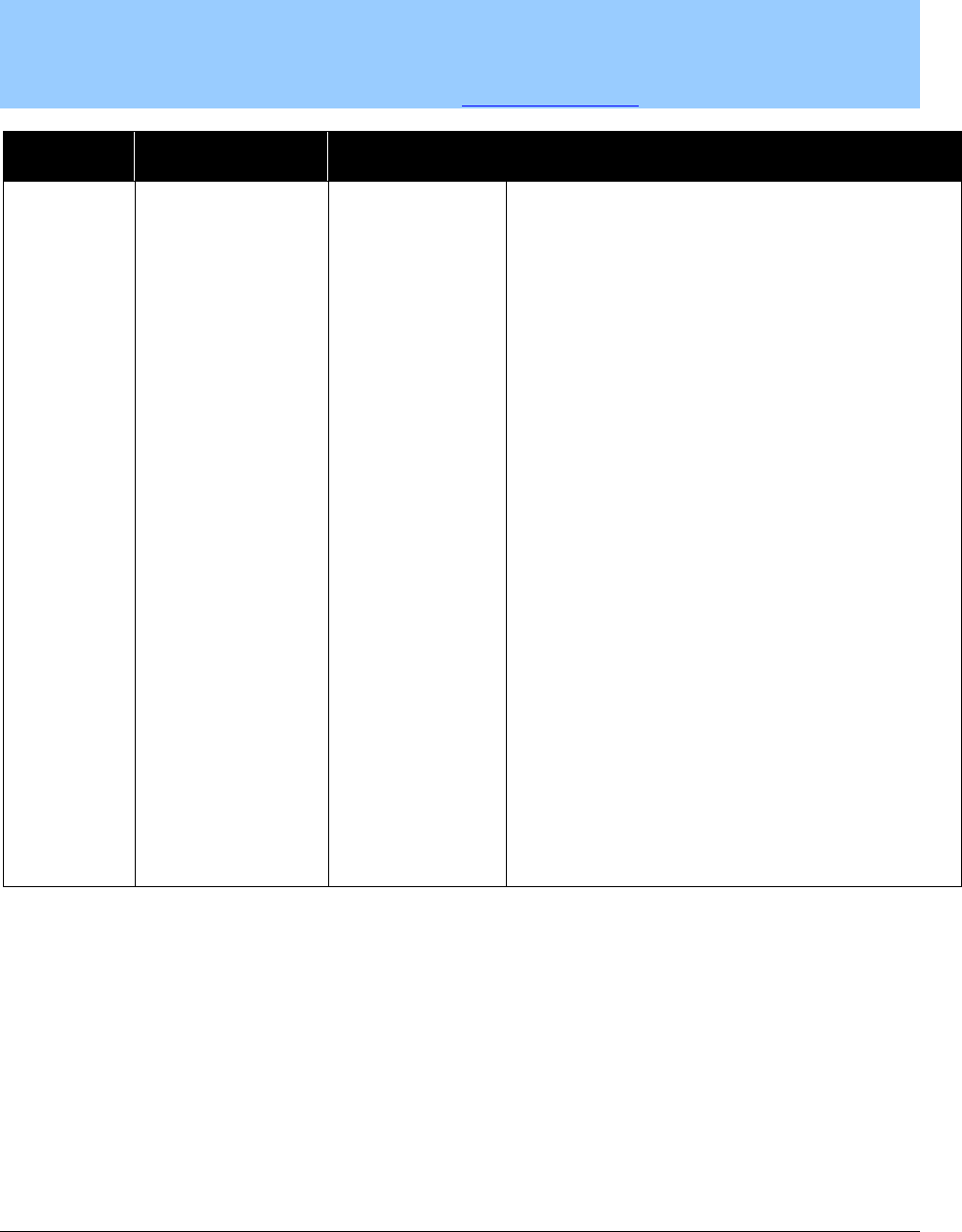

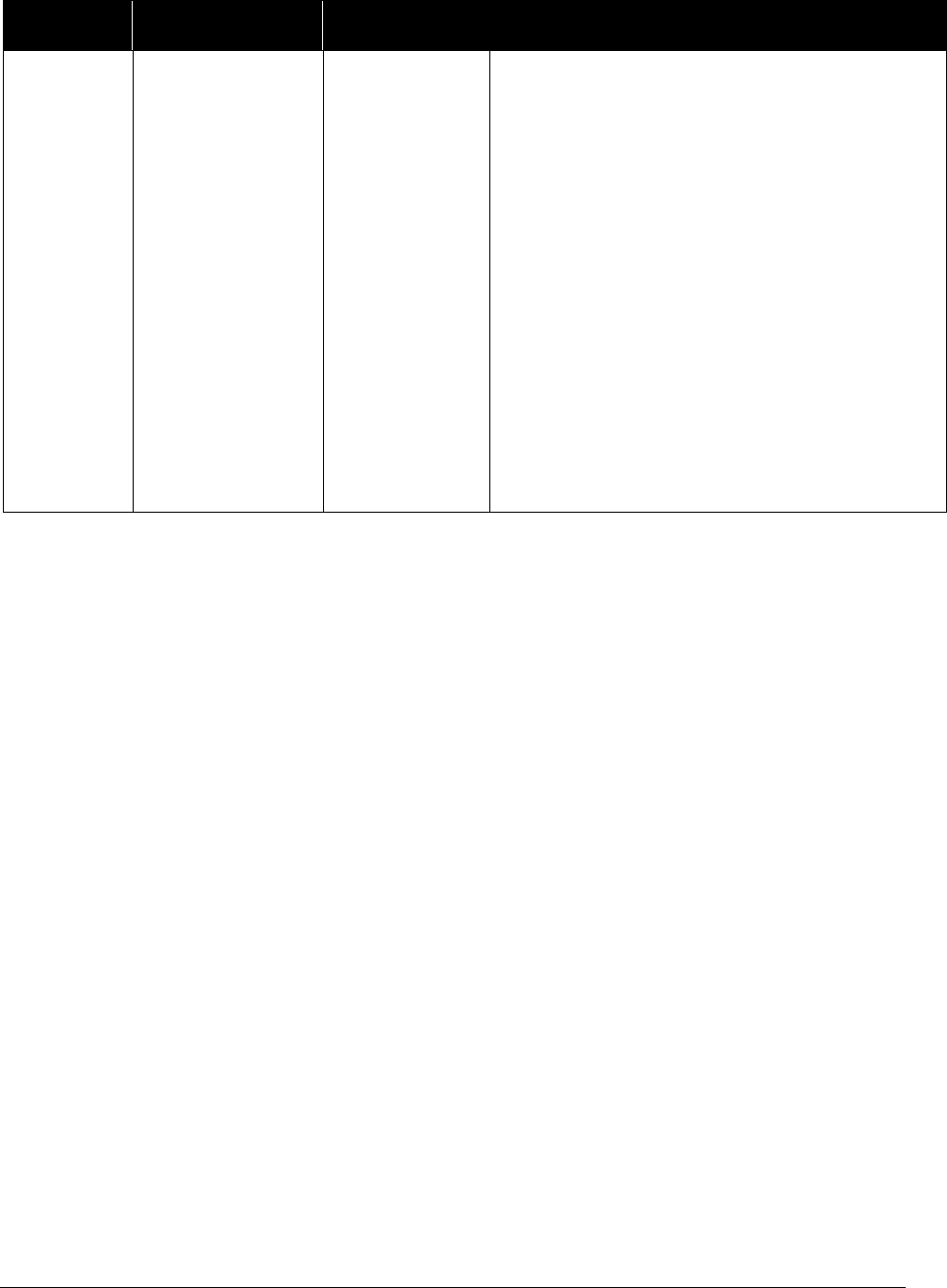

*

This publication is a billing instruction.

Physician-Related Services/Health Care Professional Services

3

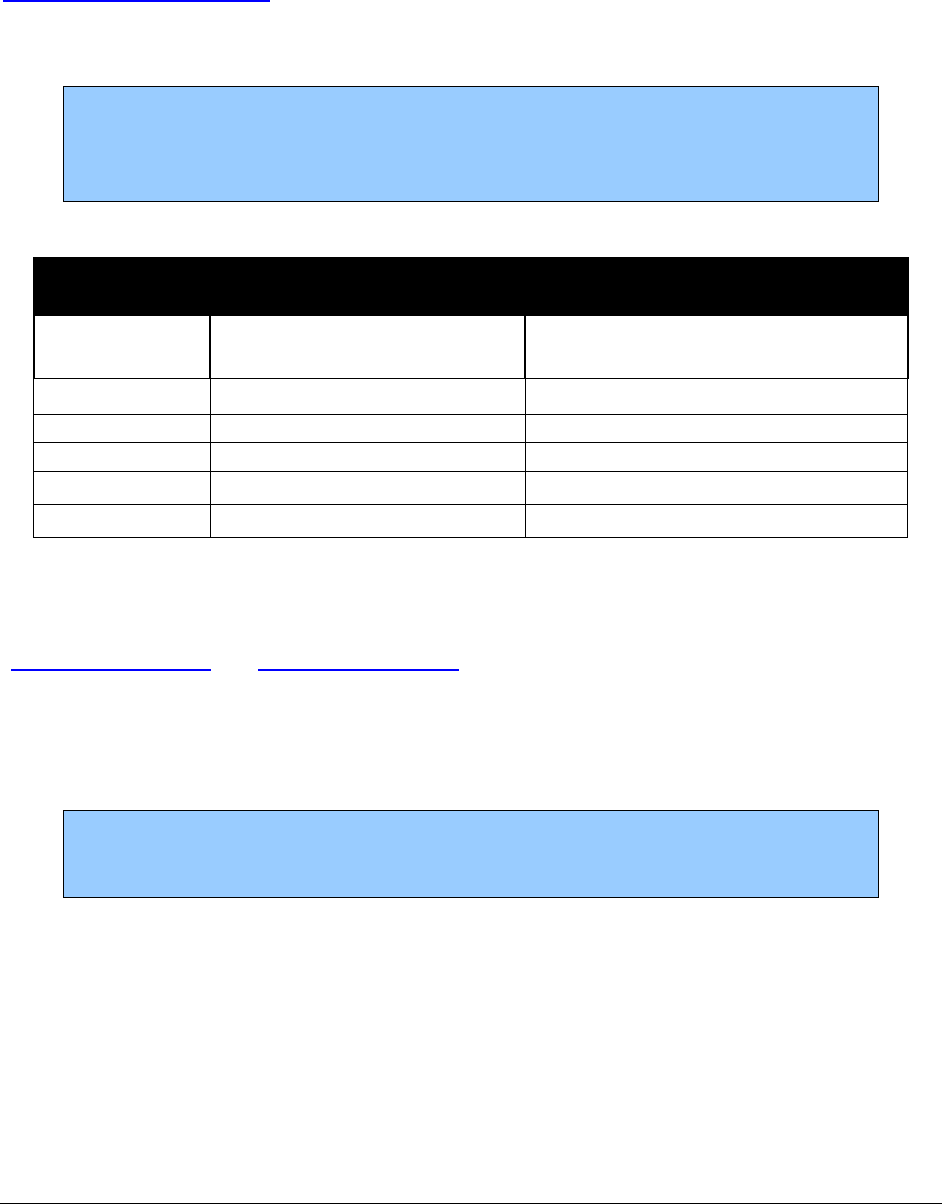

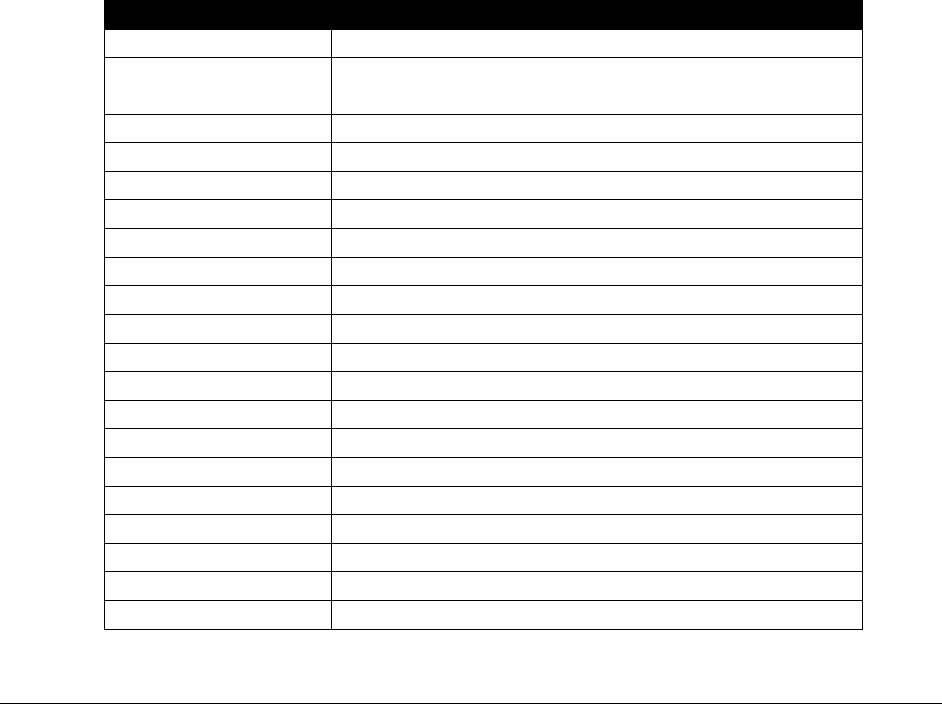

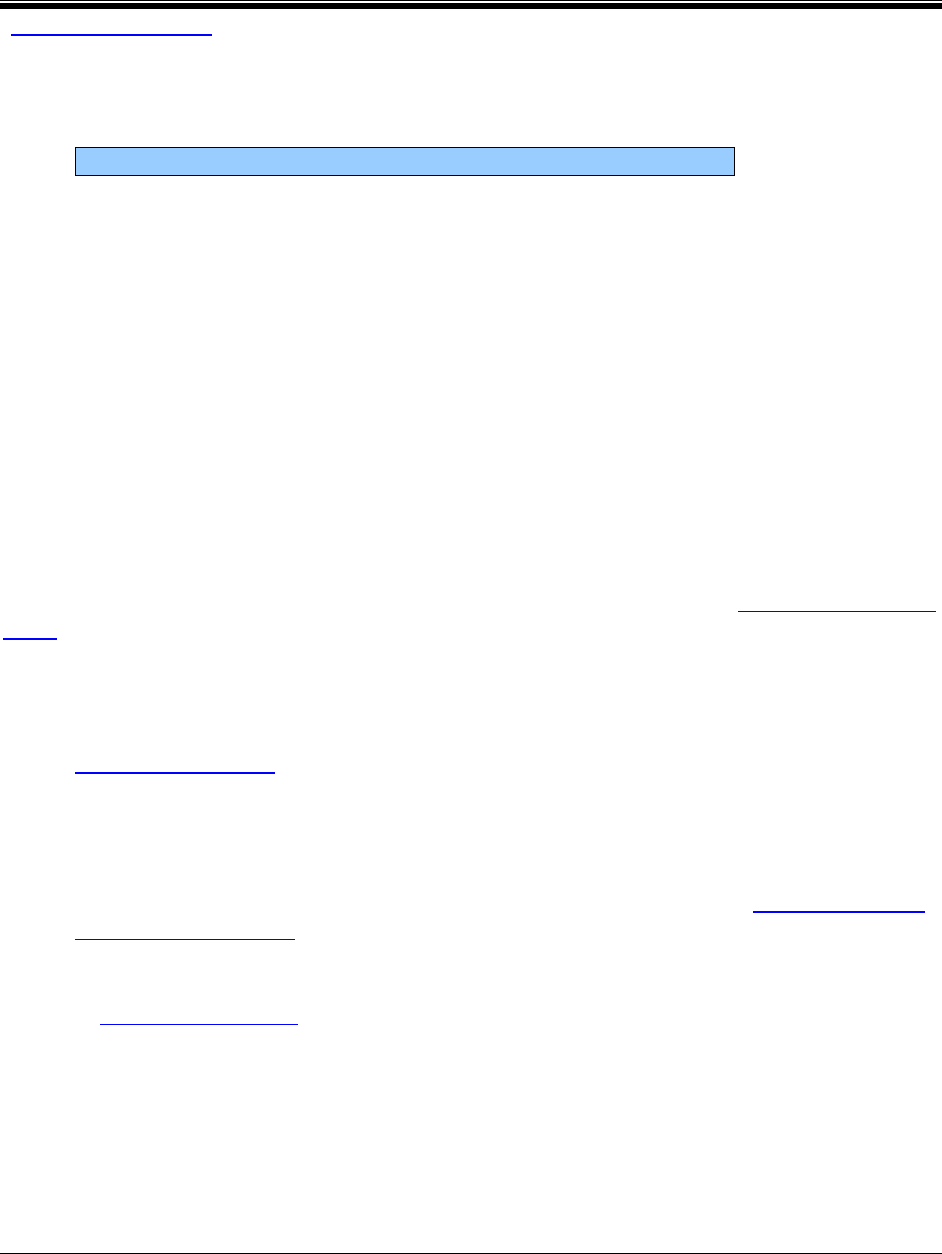

Subject

Change

Reason for Change

Functional neuroimaging for

primary degenerative

dementia or mild cognitive

impairment

Revised language concerning

medical necessity of catheter

ablation and added reference to

HTCC decision

No policy was changed.

Revised to improve

clarity regarding medical

necessity

Bronchial thermoplasty for

asthma

Added that HCA does not

consider bronchial thermoplasty

for asthma to be medically

necessary

HTCC decision. See

findings and decision.

Catheter ablation for

supraventricular

tachyarrhythmias

Revised language concerning

medical necessity of catheter

ablation and added reference to

the HTCC decision

No policy was changed.

Revised to improve

clarity regarding medical

necessity

Withdrawal management

services

Added information on medical

necessity and instructions for

billing HCA for withdrawal

management services

To provide clarifying

information

Autologous blood/platelet-

rich plasma injections

Added that HCA does not

consider autologous

blood/platelet-rich plasma

injections to be medically

necessary

HTCC decision. See

findings and decision.

Organ procedure fees and

donor searches

Added bullet stating “include

donor operative notes with claim”

Providers must now

provide this information

with the claim when

billing for services

Physician-Related Services/Health Care Professional Services

4

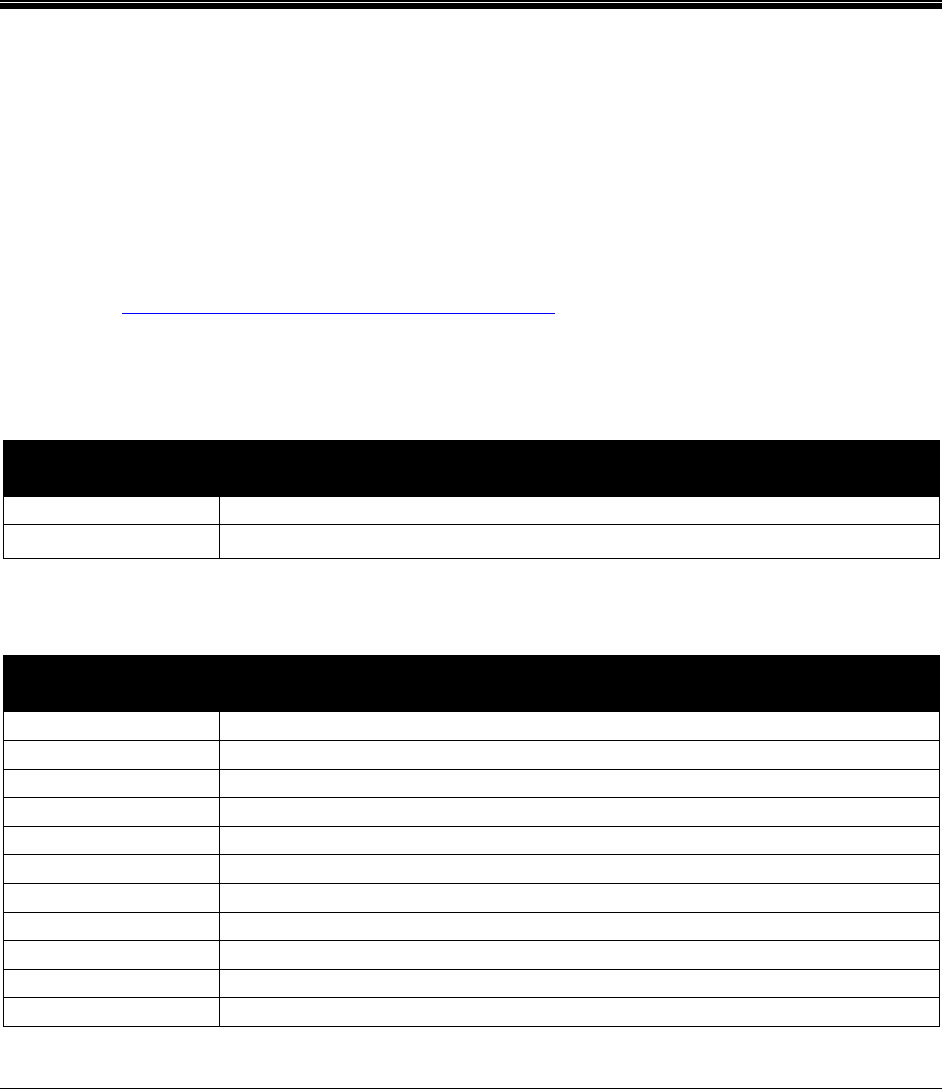

How can I get HCA provider documents?

To access provider alerts, go to HCA’s Provider alerts webpage.

To access provider documents, go to HCA’s Provider billing guides and fee schedules webpage.

Where can I download HCA forms?

To download an HCA form, see HCA’s Forms & Publications webpage. Type only the form

number into the Search box (Example: 13-835).

Copyright disclosure

Current Procedural Terminology (CPT) copyright 2019 American Medical Association (AMA).

All rights reserved. CPT is a registered trademark of the AMA.

Fee schedules, relative value units, conversion factors and/or related components are not

assigned by the AMA, are not part of CPT, and the AMA is not recommending their use. The

AMA does not directly or indirectly practice medicine or dispense medical services. The AMA

assumes no liability for data contained or not contained herein.

Physician-Related Services/Health Care Professional Services

5

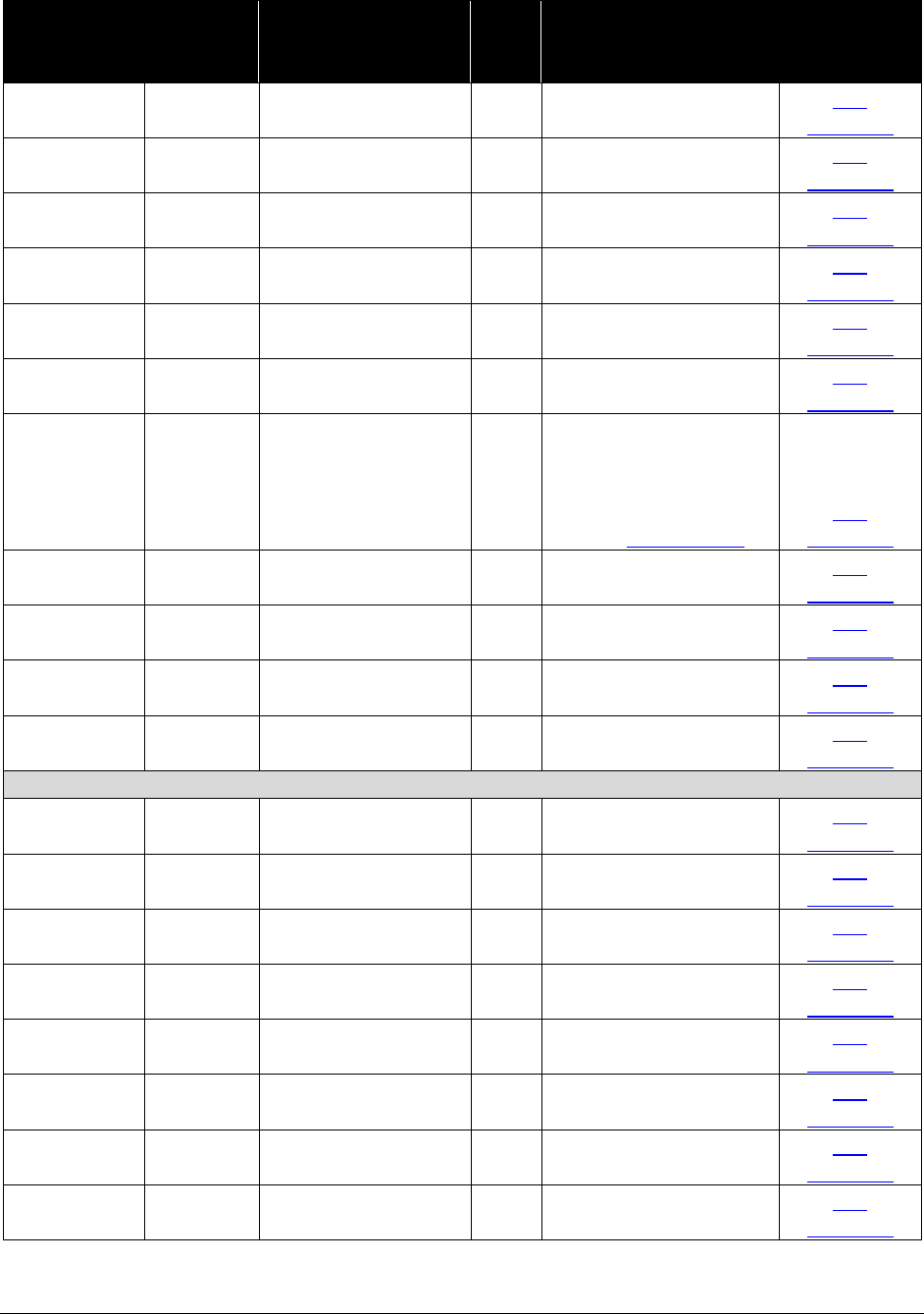

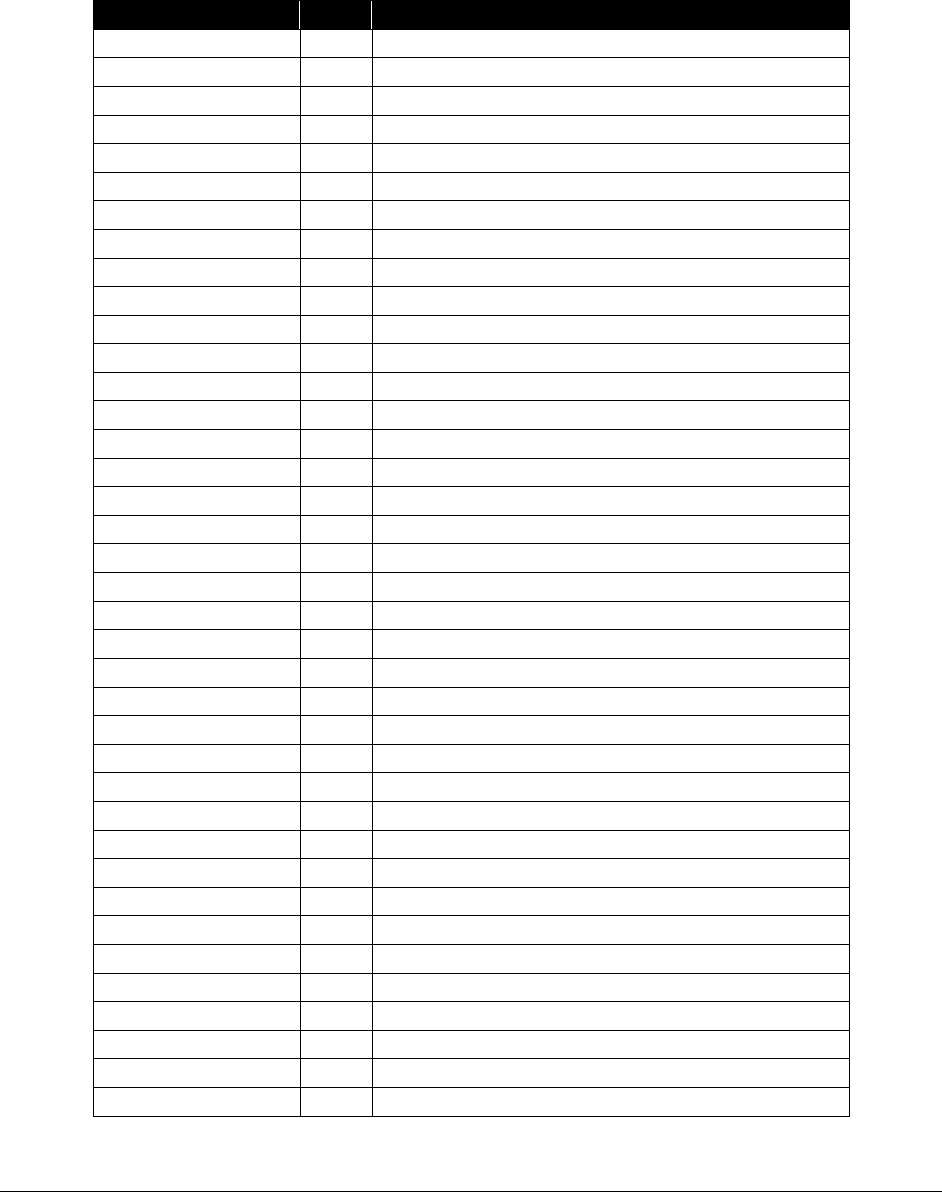

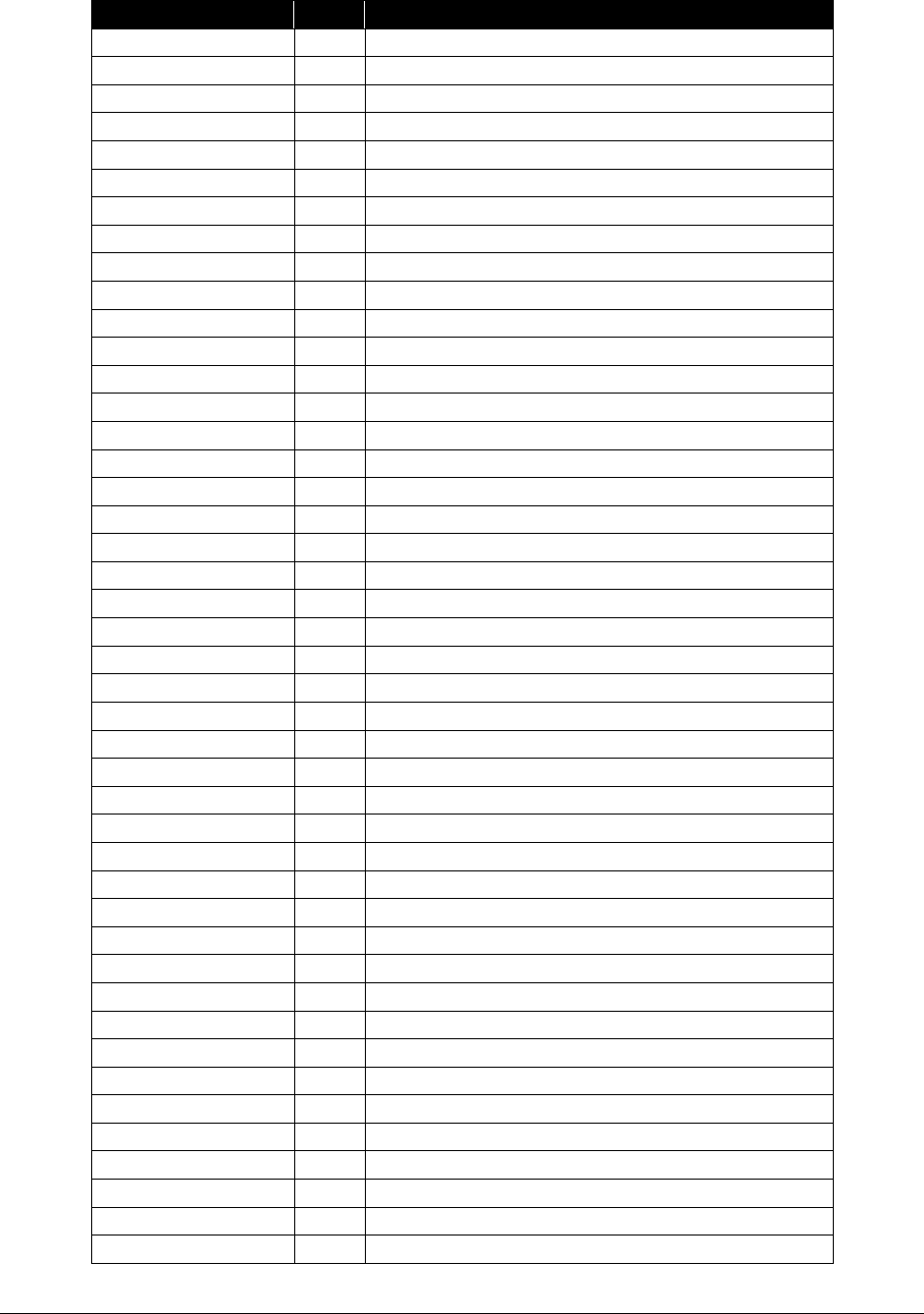

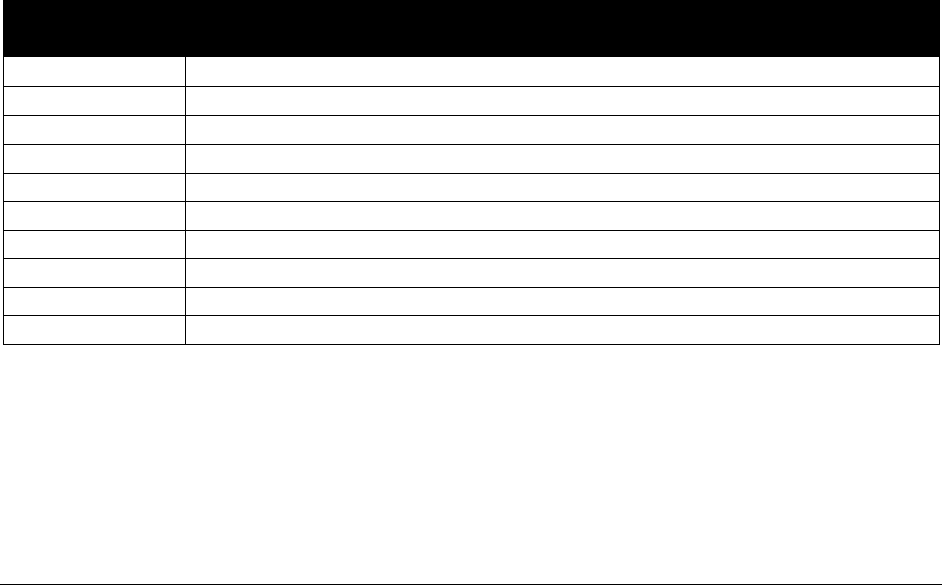

Table of Contents

Definitions .....................................................................................................................................19

Introduction ..................................................................................................................................22

Acquisition cost .......................................................................................................................22

Add-on codes ...........................................................................................................................22

By report ..................................................................................................................................22

Codes for unlisted procedures ..................................................................................................23

Conversion factors ...................................................................................................................23

Diagnosis codes .......................................................................................................................23

Discontinued codes ..................................................................................................................23

National correct coding initiative.............................................................................................24

Procedure codes .......................................................................................................................24

Provider Eligibility.......................................................................................................................25

Who may provide and bill for physician-related services? ......................................................25

Can naturopathic physicians provide and bill for physician-related services? ........................26

Can substitute physicians (locum tenens) provide and bill for physician-related

services? .............................................................................................................................27

Resident Physicians ...........................................................................................................28

Which health care professionals does HCA not enroll? ..........................................................28

Does HCA pay for out-of-state hospital admissions? ..............................................................29

Client Eligibility ...........................................................................................................................30

How do I verify a client’s eligibility? ......................................................................................30

Are clients enrolled in an HCA-contracted managed care organization (MCO)

eligible? ..............................................................................................................................31

Managed care enrollment ...................................................................................................32

Apple Health – Changes for January 1, 2020 ..........................................................................33

Clients who are not enrolled in an HCA-contracted managed care plan ...........................33

Integrated managed care (IMC) .........................................................................................34

Integrated managed care regions .......................................................................................34

Integrated Apple Health Foster Care (AHFC) ...................................................................35

Fee-for-service Apple Health Foster Care .........................................................................35

What if a client has third-party liability (TPL)? ......................................................................36

Coverage - General ......................................................................................................................37

What is covered? ......................................................................................................................37

Does HCA cover nonemergency services provided out-of-state? ...........................................39

What services are noncovered? ................................................................................................39

General information ...........................................................................................................39

Noncovered physician-related and health care professional services ................................40

Physician-Related Services/Health Care Professional Services

6

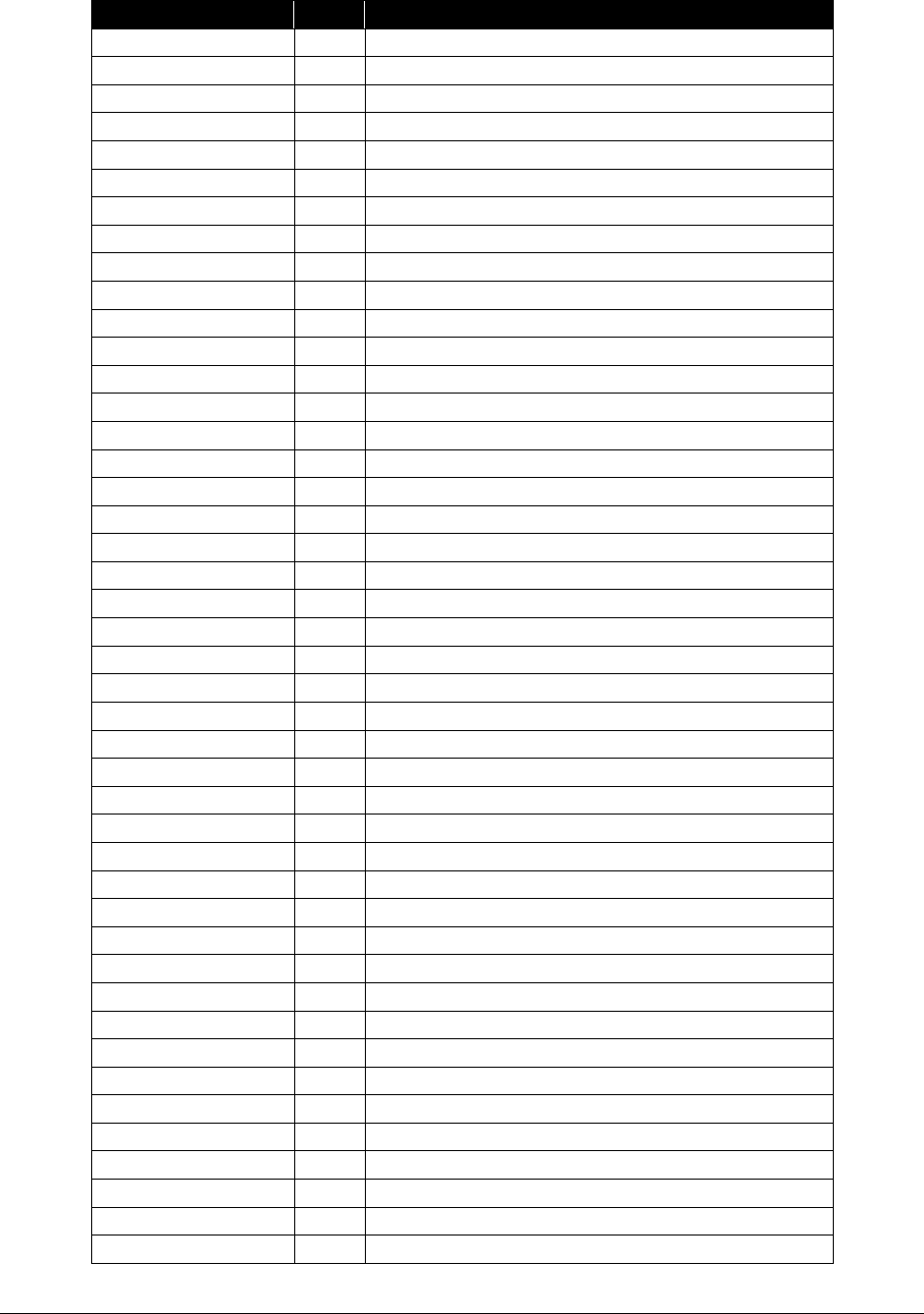

Medical Policy Updates ...............................................................................................................43

Policy updates effective 9/1/2020 ............................................................................................43

Policy updates effective 7/1/2020 ............................................................................................43

Policy updates effective 1/1/2020 ............................................................................................43

Policy updates effective 10/1/2019 ..........................................................................................44

Billable Services Provided By Resident Physicians ..................................................................45

Billable services provided by resident physicians ...................................................................45

Billing requirements for teaching physicians ....................................................................45

General documentation guidelines .....................................................................................46

Billing codes ......................................................................................................................46

Medical students ................................................................................................................47

Evaluation and Management ......................................................................................................48

Evaluation and management documentation and billing .........................................................48

Advance directives/physician orders for life-sustaining treatment ..........................................49

Telephone services ...................................................................................................................50

Partnership Access Line ...........................................................................................................51

Office and other outpatient services ........................................................................................51

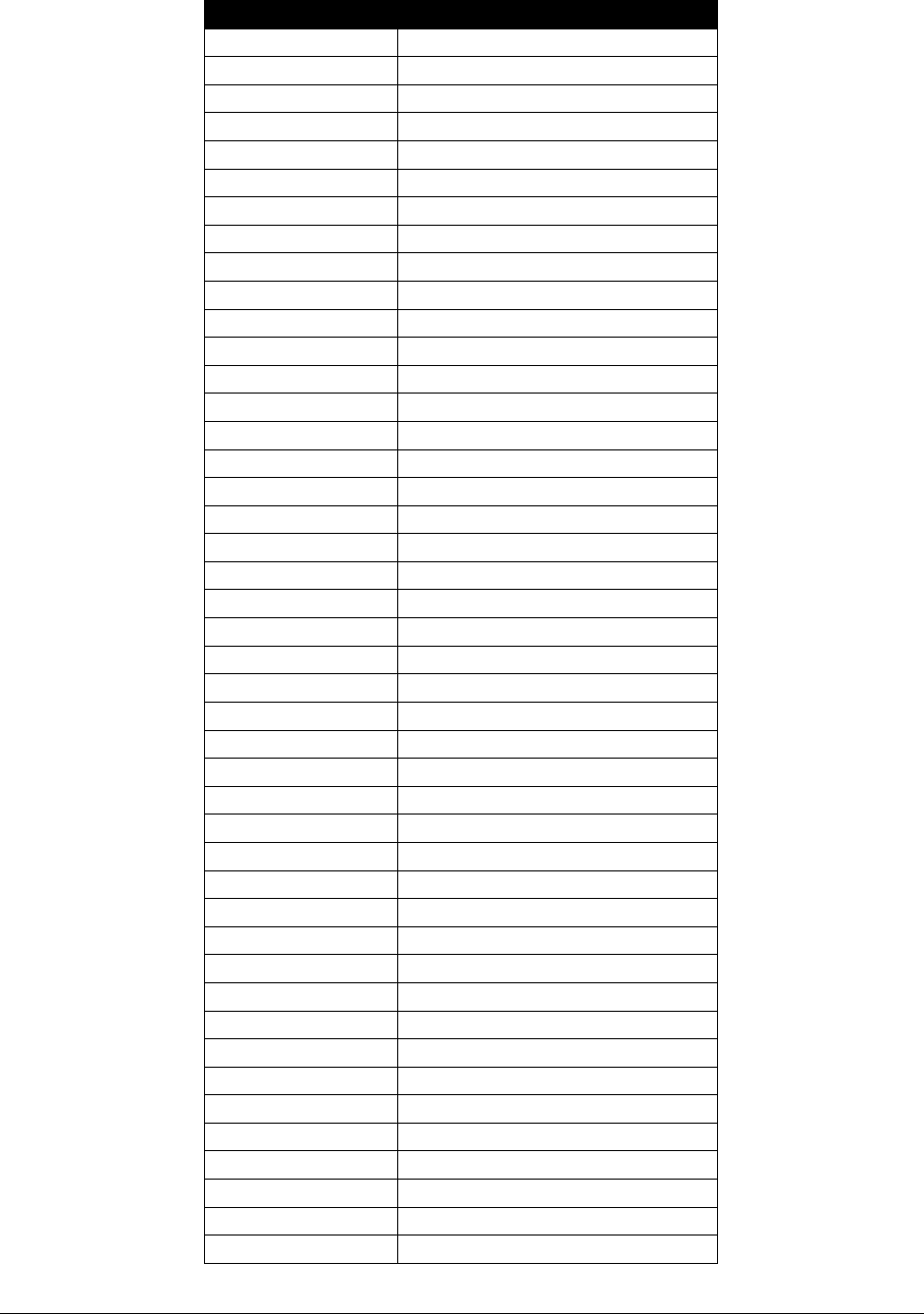

Office or other outpatient visit limits .................................................................................51

New patient visits ...............................................................................................................51

Established patient visits ....................................................................................................52

Nursing facility services ....................................................................................................52

Pre-operative visit before a client receives a dental service under anesthesia ...................52

Physical examination - clients of the DSHS’ Developmental Disabilities

Administration .............................................................................................................52

Office visit related to acamprosate, naltrexone, buprenorphine/naloxone ........................53

Aged, Blind, or Disabled (ABD) Evaluation Services ............................................................53

Behavior change intervention - tobacco/nicotine cessation .....................................................54

Services available...............................................................................................................54

Washington State Tobacco Quitline ..................................................................................54

Client eligibility .................................................................................................................55

Payment for a tobacco/nicotine cessation referral .............................................................55

Tobacco/nicotine cessation referral for an evaluation for a tobacco/nicotine

cessation prescription ...................................................................................................55

Tobacco/nicotine cessation for pregnant clients ................................................................56

Face-to-face visit requirements for pregnant women ........................................................56

Provider types for providing face-to-face tobacco/nicotine cessation counseling

for pregnant women .....................................................................................................56

Benefit limitations for providing face-to-face tobacco/nicotine cessation

counseling for pregnant women ...................................................................................56

Documentation requirements .............................................................................................57

Billing codes ......................................................................................................................57

Substance use disorder treatment .............................................................................................57

How to bill for combination therapy ..................................................................................58

How to bill for monotherapy ..............................................................................................58

Physician-Related Services/Health Care Professional Services

7

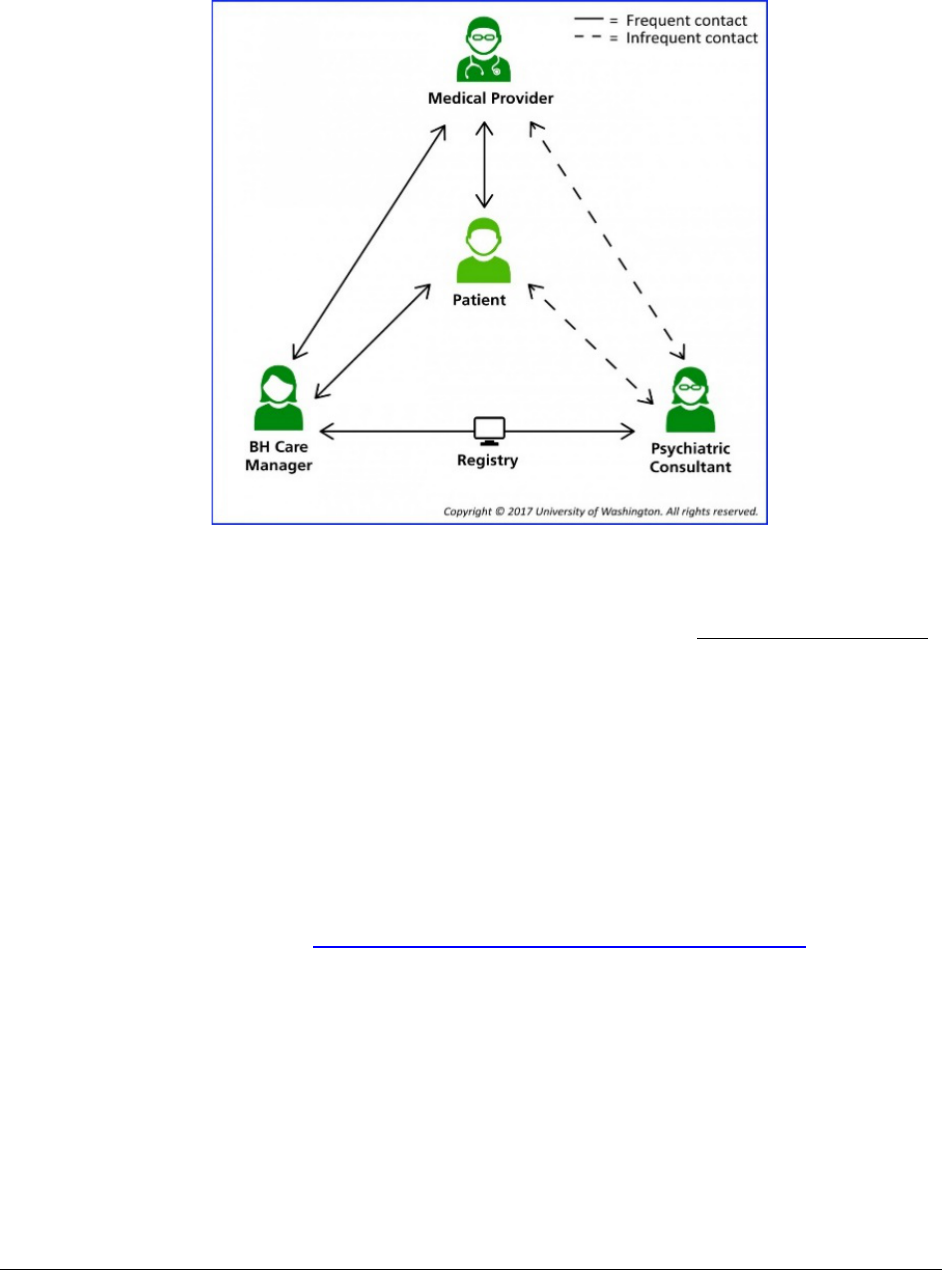

Collaborative care model guidelines ........................................................................................59

Collaborative care ..............................................................................................................59

Psychiatric collaborative care model .................................................................................59

Core principles ...................................................................................................................60

Additional billing information ...........................................................................................67

Health and behavior codes .......................................................................................................67

Children's primary health care .................................................................................................68

Pediatric primary care rate increase ...................................................................................68

Consultations............................................................................................................................69

TB treatment services ........................................................................................................69

Critical care ..............................................................................................................................69

Billing for critical care .......................................................................................................70

Where is critical care performed? ......................................................................................70

What is covered? ................................................................................................................70

Domiciliary, rest home, or custodial care services ..................................................................71

Emergency department services ..............................................................................................71

Emergency physician-related services ...............................................................................71

Habilitative services .................................................................................................................72

Billing for habilitative services ..........................................................................................72

Home services ..........................................................................................................................73

Home evaluation and management ....................................................................................73

TB treatment services – performed by professional providers – in client’s home ............73

Hospital inpatient and observation care services .....................................................................73

Admission status ................................................................................................................73

Change in admission status ................................................................................................74

Payment..............................................................................................................................76

Other guidelines .................................................................................................................77

Inpatient neonatal and pediatric critical care ...........................................................................78

Neonatal intensive care unit (NICU)/Pediatric intensive care unit (PICU) .......................78

Intensive (noncritical) low birth weight services ...............................................................79

Perinatal conditions ............................................................................................................80

Mental health .....................................................................................................................80

Services provided to an MCO client during BHO-approved admissions ..........................81

Newborn care ...........................................................................................................................81

Physician/Professional services ...............................................................................................82

Does HCA pay for newborn screening tests? ....................................................................82

Physicals for clients of DSHS’ Developmental Disabilities Administration...........................83

Physician care plan oversight...................................................................................................83

Physician supervision of a patient requiring complex and multidisciplinary care

modalities .....................................................................................................................84

Preventative medicine services ................................................................................................85

HIV/AIDS counseling/testing ............................................................................................85

Prolonged services ...................................................................................................................85

Prolonged services with direct patient contact...................................................................85

Physician standby services .................................................................................................86

Telemedicine ............................................................................................................................86

Physician-Related Services/Health Care Professional Services

8

What is telemedicine? ........................................................................................................86

Who is eligible for telemedicine? ......................................................................................87

When does HCA cover telemedicine? ...............................................................................87

Telemedicine and COVID-19 ............................................................................................87

What are the documentation requirements? .......................................................................88

Originating site (location of client) ....................................................................................88

Distant site (location of consultant) ...................................................................................89

Store and Forward ..............................................................................................................90

Anesthesia .....................................................................................................................................92

General anesthesia ...................................................................................................................92

Regional anesthesia ..................................................................................................................94

Moderate sedation ....................................................................................................................94

Other ........................................................................................................................................95

Teaching anesthesiologists.......................................................................................................95

Physician fee schedule payment for services of teaching physicians ................................96

Anesthesia for dental................................................................................................................96

Anesthesia for maternity ..........................................................................................................97

Anesthesia for radiological procedures ....................................................................................98

Anesthesia payment calculation for services paid with base and time units ...........................98

Surgery ..........................................................................................................................................99

Tobacco/nicotine cessation ......................................................................................................99

Pain management services .......................................................................................................99

Pain management procedure codes ..................................................................................100

Interoperative or postoperative pain management ...........................................................101

Registered Nurse First Assistants ....................................................................................101

Billing/Payment .....................................................................................................................102

Bilateral procedures .........................................................................................................102

Bundled services ..............................................................................................................102

Global surgery payment ...................................................................................................104

Global surgery payment period ........................................................................................105

Multiple surgeries ............................................................................................................105

Other surgical policies .....................................................................................................106

Breast removal and breast reconstruction ........................................................................107

Panniculectomy ................................................................................................................108

Pre-/intra-/postoperative payment splits ..........................................................................108

Auditory system .....................................................................................................................109

Tympanostomies ..............................................................................................................109

Cochlear implant services (clients age 20 and younger) .................................................109

Bone conduction hearing devices for clients age 20 and younger ...................................109

Bariatric surgeries ..................................................................................................................110

Cardiovascular system ...........................................................................................................112

Carotid artery stenting......................................................................................................112

Implantable ventricular assist devices .............................................................................113

Varicose vein treatment ...................................................................................................114

Physician-Related Services/Health Care Professional Services

9

Digestive system ....................................................................................................................115

Diagnostic upper endoscopy for GERD ..........................................................................115

Closure of enterostomy ....................................................................................................116

Fecal microbiota transplantation ......................................................................................116

Drug eluting or bare metal cardiac stents ..............................................................................117

Cardiovascular .......................................................................................................................117

Angioscopy ......................................................................................................................117

Apheresis..........................................................................................................................117

Extracorporeal membrane oxygenation therapy (ECMO) ...............................................118

Transcatheter aortic valve replacement (TAVR) .............................................................118

Percutaneous pulmonary valve implantation (PPVI) .......................................................119

Female genital system ............................................................................................................120

Hysterectomies .................................................................................................................120

Sterilizations ....................................................................................................................121

Integumentary system ............................................................................................................121

Clarification of coverage policy for miscellaneous procedures .......................................121

Male genital system ...............................................................................................................121

Circumcisions ..................................................................................................................121

Musculoskeletal system .........................................................................................................122

Artificial disc replacement ...............................................................................................122

Bone growth stimulators ..................................................................................................122

Bone morphogenetic protein 2 for lumbar fusion ............................................................122

Bone morphogenetic protein 7 for lumbar fusion ............................................................123

Cervical spinal fusion arthrodesis ....................................................................................123

Cervical surgery for radiculopathy and myelopathy ........................................................123

Endoscopy procedures .....................................................................................................124

Epiphyseal ........................................................................................................................124

Hip resurfacing.................................................................................................................124

Hip surgery for femoroacetabular impingement syndrome .............................................124

Knee arthroscopy for osteoarthritis ..................................................................................124

Microprocessor-controlled lower limb prostheses ...........................................................125

Osteochondral allograft and autograft transplantation .....................................................125

Osteotomy reconstruction ................................................................................................125

Percutaneous kyphoplasty, vertebroplasty and sacroplasty .............................................125

Sacroiliac joint fusion ......................................................................................................126

Robotic assisted surgery ..................................................................................................126

Nervous system ......................................................................................................................126

Discography .....................................................................................................................126

Facet neurotomy, cervical and lumbar .............................................................................127

Lumbar radiculopathy ......................................................................................................127

Implantable infusion pumps or implantable drug delivery systems ................................128

Spinal cord stimulation for chronic neuropathic pain ......................................................128

Spinal injections for diagnostic or therapeutic purposes (outpatient) ..............................128

Transcutaneous electrical nerve stimulation (TENS) device ...........................................130

Vagus nerve stimulation (VNS) .......................................................................................130

Skin substitutes ......................................................................................................................131

Physician-Related Services/Health Care Professional Services

10

Limitations .......................................................................................................................131

Sleep apnea ............................................................................................................................132

Surgical treatment for sleep apnea ...................................................................................132

Urinary systems .....................................................................................................................132

Collagen implants ............................................................................................................132

Indwelling catheter...........................................................................................................132

Urinary tract implants ......................................................................................................133

Urological procedures with sterilizations in the description ............................................133

Radiology Services .....................................................................................................................134

Radiology services – general limits .......................................................................................134

Radiology modifiers for bilateral procedures ........................................................................134

Breast, mammography ...........................................................................................................135

Mammograms ..................................................................................................................135

Diagnostic radiology (diagnostic imaging) ............................................................................135

Multiple procedure payment reduction (MPPR) ..............................................................135

Which procedures require a medical necessity review by Comagine Health? ................136

Imaging for rhinosinusitis ................................................................................................138

Computed tomography angiography (CTA) ....................................................................139

Contrast material ..............................................................................................................139

Consultation on X-ray examination .................................................................................140

Coronary artery calcium scoring ......................................................................................140

Magnetic resonance imaging (MRI) ................................................................................140

Portable X-rays ................................................................................................................141

Ultrasound screening for abdominal aortic aneurysm .....................................................141

Virtual colonoscopy or computed tomographic colonography ........................................142

Screening and monitoring tests for osteopenia/osteoporosis ...........................................142

Functional neuroimaging for primary degenerative dementia or mild cognitive

impairment .................................................................................................................142

Diagnostic Ultrasound ...........................................................................................................143

Obstetrical ultrasounds.....................................................................................................143

Nuclear medicine ...................................................................................................................143

Which procedures require a medical necessity review from HCA? ................................143

Which procedures require a medical necessity review by Comagine Health? ................144

Radiopharmaceutical diagnostic imaging agents .............................................................145

Positron emission tomography (PET) scans for lymphoma ............................................145

Nuclear medicine - billing ...............................................................................................146

Radiation oncology ................................................................................................................146

Intensity modulated radiation therapy (IMRT) ................................................................146

Proton beam therapy ........................................................................................................147

Stereotactic radiation surgery ................................................................................................147

Stereotactic body radiation therapy .......................................................................................147

Tumor treating fields..............................................................................................................148

Pathology and Laboratory ........................................................................................................149

Certifications ..........................................................................................................................149

Physician-Related Services/Health Care Professional Services

11

Independent laboratories - certification ...........................................................................149

Reference labs and facilities - CLIA certification ...........................................................149

Anatomic pathology ...............................................................................................................149

Pap smears .......................................................................................................................149

Screening exams ....................................................................................................................150

Cancer screens .................................................................................................................150

Disease organ panels--automated multi-channel tests .....................................................151

Fetal fibronectin ...............................................................................................................152

Noninvasive prenatal diagnosis of fetal aneuploidy using cell-free fetal nucleic

acids in maternal blood (NIPT)..................................................................................153

Vitamin D screening and testing ......................................................................................153

Lead toxicity screening ....................................................................................................155

Drug Testing for Substance Use Disorder .............................................................................155

Drug screening for medication for opioid use disorder ...................................................155

Buprenorphine when used for pain control ......................................................................158

Enhanced reimbursement rate for medication for opioid use disorder ............................159

Immunology ...........................................................................................................................159

HIV testing .......................................................................................................................159

Targeted TB testing with interferon-gamma release assays ............................................160

Molecular Pathology Tests ....................................................................................................160

Genomic microarray ........................................................................................................161

Companion diagnostic tests .............................................................................................161

Organ and disease-oriented panels.........................................................................................162

Automated multi-channel tests - payment .......................................................................162

Disease organ panel - nonautomated multi-channel ........................................................163

Gene expression ...............................................................................................................163

Breast and ovarian genetic testing ...................................................................................163

Billing ....................................................................................................................................164

Billing for laboratory services that exceed the lines allowed ..........................................164

Clinical laboratory codes .................................................................................................164

Coding and payment policies ...........................................................................................164

Laboratory physician interpretation procedure codes ......................................................166

Laboratory codes requiring modifier and PA clarification ..............................................166

Laboratory modifiers .......................................................................................................166

Laboratory services referred by CMHC or DBHR-contracted providers ........................167

STAT laboratory charges .................................................................................................168

Medicine ......................................................................................................................................171

Allergen and clinical immunology.........................................................................................171

Allergen immunotherapy .................................................................................................171

Audiology ..............................................................................................................................172

Who is eligible to provide audiology services? ...............................................................172

What type of equipment must be used? ...........................................................................173

Audiology coverage .........................................................................................................173

Audiology billing .............................................................................................................173

Bronchial thermoplasty for asthma ..................................................................................173

Physician-Related Services/Health Care Professional Services

12

Cardiovascular .......................................................................................................................174

Catheter ablation for supraventricular tachyarrhythmias .................................................174

Heart catheterizations.......................................................................................................174

Outpatient cardiac rehabilitation ......................................................................................174

Central nervous system assessments/tests .............................................................................176

Coverage for developmental screening for delays and surveillance and screening

for autism ...................................................................................................................176

Chemotherapy ........................................................................................................................177

Chemotherapy services ....................................................................................................177

Irrigation of venous access pump ....................................................................................178

Dialysis - end-stage renal disease (ESRD) ............................................................................178

Inpatient visits for hemodialysis or outpatient non-ESRD dialysis services ...................178

Inpatient visits for dialysis procedures other than hemodialysis .....................................179

Endocrinology ........................................................................................................................179

Professional or diagnostic continuous glucose monitoring .............................................179

Genetic testing .......................................................................................................................180

Whole exome sequencing ................................................................................................180

Hydration, therapeutic, prophylactic, diagnostic injections, infusions ..................................181

Hydration therapy with chemotherapy.............................................................................181

Therapeutic or diagnostic injections/infusions ................................................................182

Concurrent infusion .........................................................................................................182

Immune globulins, serum, or recombinant products .............................................................182

Hepatitis B (CPT code 90371) .........................................................................................182

Immune globulins ............................................................................................................183

Rabies immune globulin (RIg).........................................................................................183

Medical genetics and genetic counseling services .................................................................183

Genetic counseling and genetic testing ............................................................................183

Prenatal genetic counseling..............................................................................................184

Applying to HCA to become a genetic counseling provider ...........................................186

Miscellaneous ........................................................................................................................187

After-hours .......................................................................................................................187

Neurology and neuromuscular procedures ............................................................................188

Needle electromyography (EMGs) ..................................................................................188

Nerve conduction study (NCS) ........................................................................................188

Sleep medicine testing (sleep apnea) ...............................................................................189

Ophthalmology – vision care services ...................................................................................189

Eye examinations and refraction services ........................................................................189

Coverage for additional examinations and refraction services ........................................189

Visual field exams............................................................................................................190

Vision therapy ..................................................................................................................190

Corneal topography ..........................................................................................................191

Ocular prosthetics ............................................................................................................191

Eye surgery ......................................................................................................................191

Vision coverage table .......................................................................................................193

Manipulative therapy .............................................................................................................199

Other services and procedures ...............................................................................................200

Physician-Related Services/Health Care Professional Services

13

Hyperbaric oxygen therapy ..............................................................................................200

Testosterone testing .........................................................................................................202

Transient elastography .....................................................................................................202

Neuropsychological testing ..............................................................................................202

Psychiatry ...............................................................................................................................202

Clozaril - case management .............................................................................................202

Pulmonary ..............................................................................................................................203

Extracorporeal membrane oxygenation therapy (ECMO) ...............................................203

Ventilator management ....................................................................................................203

Special dermatological services .............................................................................................203

Ultraviolet phototherapy ..................................................................................................203

Special services ......................................................................................................................204

Group clinical visits for clients with diabetes or asthma .................................................204

Therapies (physical, occupational, and speech therapy) ........................................................205

Modifier required when billing ........................................................................................206

Treatment of chronic migraines and chronic tension-type headaches ...................................206

Vaccines/toxoids (immunizations) .........................................................................................207

Clients from birth through age 18 ....................................................................................207

Clients age 19 and older ...................................................................................................207

How to bill HCA for adult immunizations ......................................................................208

Maternity Care and Delivery ....................................................................................................209

Confirmation of pregnancy ....................................................................................................210

Problem visits during pregnancy ...........................................................................................210

HIV/AIDS counseling/testing ................................................................................................211

Tobacco/nicotine cessation for pregnant clients ....................................................................211

Early pregnancy loss and abortion services ...........................................................................211

Global (total) obstetrical (OB) care .......................................................................................214

Unbundling obstetrical care ...................................................................................................214

Antepartum care .....................................................................................................................216

Coding for antepartum care only ...........................................................................................216

Coding for deliveries without antepartum care ......................................................................217

Coding for postpartum care only ...........................................................................................217

Additional monitoring for high-risk conditions .....................................................................218

Consultations..........................................................................................................................219

Elective deliveries ..................................................................................................................220

Labor management.................................................................................................................220

High-risk deliveries ................................................................................................................221

Additional delivery payment policies and limitations ...........................................................222

Global (total) obstetrical (OB) care .......................................................................................222

Antepartum care only .............................................................................................................223

Deliveries ...............................................................................................................................223

Postpartum care only..............................................................................................................223

Additional monitoring for high-risk conditions .....................................................................224

Labor management.................................................................................................................224

High-risk deliveries ................................................................................................................224

Physician-Related Services/Health Care Professional Services

14

Billing with modifiers for maternity care ..............................................................................225

Medical Supplies and Equipment .............................................................................................226

Physician signature requirement ............................................................................................226

General payment policies .......................................................................................................227

Supplies included in an office call (bundled supplies) ..........................................................227

Alcohol and Substance Misuse Counseling..............................................................................231

What is included in SBIRT? ..................................................................................................231

What is covered? ....................................................................................................................232

Who is eligible to become a certified SBIRT provider? ........................................................233

What are the requirements to be a certified SBIRT provider? ...............................................234

Required training .............................................................................................................234

Who can bill for SBIRT services? .........................................................................................235

Alcohol and Substance Abuse Treatment Services .................................................................236

Medical services for clients in residential chemical dependency treatment ..........................236

Withdrawal management services .........................................................................................237

Blood, blood products, and related services ............................................................................238

Payment for blood and blood products ..................................................................................238

Autologous blood/platelet-rich plasma injections ...........................................................238

Fee schedule ...........................................................................................................................238

Centers of Excellence .................................................................................................................239

List of approved Centers of Excellence (COEs) ....................................................................239

Services which must be performed in a COE ........................................................................239

Hemophilia treatment COEs ............................................................................................239

Sleep studies.....................................................................................................................242

Transplants .......................................................................................................................243

Drugs Professionally Administered ..........................................................................................245

Invoice requirements ..............................................................................................................245

Drug pricing ...........................................................................................................................246

National drug code format .....................................................................................................246

Physicians billing for compound drugs..................................................................................247

Drugs requiring prior authorization .......................................................................................247

Contraceptives........................................................................................................................247

Injectable drugs - limitations .................................................................................................248

Billing for injectable drugs and biologicals ...........................................................................249

Chemotherapy drugs ..............................................................................................................249

Billing for single-dose vials ...................................................................................................250

Billing for multiple dose vials................................................................................................250

Billing for oral anti-emetic drugs when part of a chemotherapy regimen .............................251

Rounding of units ...................................................................................................................251

Physician-Related Services/Health Care Professional Services

15

Unlisted drugs ........................................................................................................................252

Botulinum toxin injections (Botox) .......................................................................................253

Collagenase injections ...........................................................................................................253

Hyaluronic acid/viscosupplementation ..................................................................................253

Alpha Hydroxyprogesterone (17P) ........................................................................................255

How to bill for Alpha Hydroxyprogesterone (17P) .........................................................256

Makena® ................................................................................................................................256

Prolia/Xgeva ..........................................................................................................................256

Spinraza™ ..............................................................................................................................256

Synagis® ................................................................................................................................257

What are the requirements for administration and authorization of Synagis®? ..............257

Are there other considerations when administering Synagis®? ......................................257

What are the authorization and billing procedures for Synagis®? ..................................258

What is the criteria for coverage or authorization of Synagis®? .....................................258

What are the authorization procedures for Synagis? ....................................................259

Verteporfin injection ..............................................................................................................260

Vivitrol ...................................................................................................................................260

How do providers who participate in the 340B drug pricing program bill for drugs

and dispensing fees? ........................................................................................................261

Drugs administered to managed care clients but reimbursed through fee-for-service ..........261

Foot Care Services .....................................................................................................................263

Are foot care services covered? .............................................................................................263

What foot care services are not covered? ..............................................................................263

What foot care services does HCA pay for? ..........................................................................264

What foot care services does HCA not pay for? ....................................................................266

May I bill the client for foot care services which HCA does not pay for? ............................266

How do I bill for foot care services? ......................................................................................267

Home Health and Hospice .........................................................................................................268

Physician signature requirement for home health services ....................................................268

Physicians providing service to hospice clients .....................................................................268

Concurrent care for children who are on hospice ..................................................................268

Major Trauma Services .............................................................................................................269

Increased payments for major trauma care ............................................................................269

Client eligibility groups included in TCF payments to physicians ........................................269

Client eligibility groups excluded from TCF payments to physicians ..................................270

Services excluded from TCF payments to physicians ...........................................................270

TCF payments to physicians ..................................................................................................270

Enhanced rates for trauma care ........................................................................................270

Criteria for TCF payments to physicians .........................................................................271

TCF payments to providers in transferred trauma cases ........................................................272

Billing for trauma care services .............................................................................................273

Adjusting trauma claims ........................................................................................................273

Injury severity score (ISS) .....................................................................................................274

Physician-Related Services/Health Care Professional Services

16

Physician/clinical provider list ...............................................................................................275

Oral Health .................................................................................................................................276

Access to Baby and Child Dentistry (ABCD) Program.........................................................276

What is the purpose of the ABCD program? ...................................................................276

Who may provide ABCD dentistry? ................................................................................276

What ABCD dental services are billable by certified primary care medical

providers? ...................................................................................................................277

Topical fluoride treatment................................................................................................278

Dental services coverage table for nondental providers ..................................................278

Oral surgery ...........................................................................................................................279

Services performed by a physician or dentist specializing in oral maxillofacial

surgery........................................................................................................................279

Provider requirements ......................................................................................................279

Oral surgery coverage table ...................................................................................................280

Prosthetic/Orthotics ...................................................................................................................288

Prosthetic and orthotics for podiatry and orthopedic surgeons ........................................288

Supplies paid separately when dispensed from provider’s office/clinic ...............................289

Casting materials ..............................................................................................................289

Inhalation solutions ..........................................................................................................289

Metered dose inhalers and accessories ............................................................................289

Miscellaneous prosthetics and orthotics ..........................................................................289

Miscellaneous supplies ....................................................................................................290

Radiopharmaceutical diagnostic imaging agents .............................................................290

Urinary tract implants ......................................................................................................290

Transgender Health Services ....................................................................................................291

What transgender health services are covered? .....................................................................291

Fee-for-service clients ......................................................................................................291

Managed care clients........................................................................................................292

What are the components of transgender health services? ....................................................292

Who can provide gender dysphoria-related treatment? .........................................................297

Medical Necessity Review by Comagine Health .....................................................................298

What is a medical necessity review by Comagine Health? ...................................................298

Who can request a review? ....................................................................................................298

How do I register with Comagine Health? ............................................................................299

Is authorization required for all Washington Apple Health (Medicaid) clients? ...................299

How do I submit a request to Comagine Health? ..................................................................300

What is the Comagine Health reference number for? ............................................................301

When does HCA consider retroactive authorizations? ..........................................................301

What are the authorization requirements for advanced imaging? .........................................302

How does HCA’s hierarchy of evidence protocol apply? .....................................................302

Physician-Related Services/Health Care Professional Services

17

What are the authorization requirements for surgical procedures? .......................................303

Surgical modifiers ..................................................................................................................303

How does HCA’s hierarchy of evidence protocol apply? .....................................................304

What criteria will Comagine Health use to establish medical necessity? ..............................304

Is there a provider appeals process for Comagine Health? ....................................................304

Authorization..............................................................................................................................306

Prior authorization (PA) .........................................................................................................306

What is prior authorization (PA)? ....................................................................................306

How does HCA determine PA? .......................................................................................306

Services requiring PA ......................................................................................................307

Documentation requirements for PA or LE .....................................................................310

Requesting prior authorization (PA) ......................................................................................312

Online direct data entry into ProviderOne .......................................................................312

Written or Fax ..................................................................................................................312

Limitation extension (LE) ......................................................................................................313

What is a limitation extension (LE)? ...............................................................................313

How do I request an LE authorization? ...........................................................................313

Expedited prior authorization (EPA) .....................................................................................314

What is expedited prior authorization (EPA)? .................................................................314

EPA guidelines.................................................................................................................315

EPA criteria list ......................................................................................................................316

Modifiers .....................................................................................................................................338

CPT/HCPCS ..........................................................................................................................338

Anesthesia ..............................................................................................................................344

Site-of-Service .............................................................................................................................345

Payment Differential ..................................................................................................................345

How are fees established for professional services performed in facility and

nonfacility settings? .........................................................................................................345

How does the SOS payment policy affect provider payments? .............................................345

Does HCA pay providers differently for services performed in facility and nonfacility

settings?............................................................................................................................346

When are professional services paid at the facility setting maximum allowable fee?...........346

When are professional services paid at the nonfacility setting maximum allowable

fee? ...................................................................................................................................347

Which professional services have a SOS payment differential? ...........................................348

Fee Schedule Information .........................................................................................................349

Billing ..........................................................................................................................................350

What are the general billing requirements? ...........................................................................350

Billing for multiple services.............................................................................................350

Billing for outpatient hospital services in hospital-based clinics.....................................351

Physician-Related Services/Health Care Professional Services

18

How do I resolve issues with gender indicator when billing for transgender clients? ..........352

How do I bill claims electronically? ......................................................................................353

Submitting professional services for Medicare crossovers ..............................................354

Utilization review...................................................................................................................355

Physician-Related Services/Health Care Professional Services

19

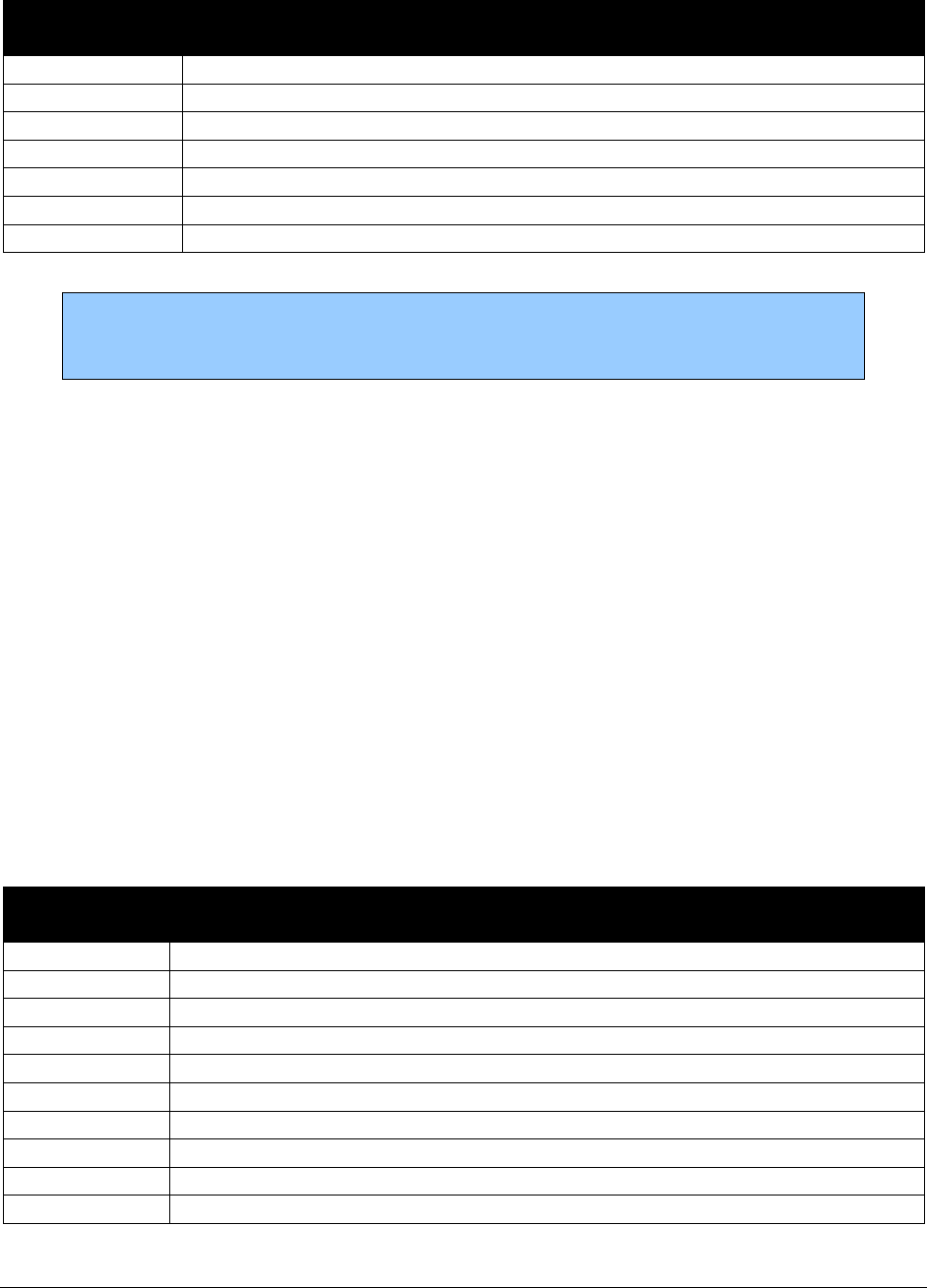

Definitions

This section defines terms and abbreviations, including acronyms, used in this billing guide.

Refer to Chapter 182-500 WAC for a complete list of definitions for Washington Apple Health.

Acquisition cost (AC) – The cost of an item

excluding shipping, handling, and any

applicable taxes.

Acute care – Care provided for clients who

are not medically stable or have not attained

a satisfactory level of rehabilitation. These

clients require frequent monitoring by a

health care professional in order to maintain

their health status.

Add-on procedure(s) – Secondary

procedure(s) performed in addition to

another procedure.

Admitting diagnosis – The medical

condition responsible for a hospital

admission. [WAC 182-531-0050]

Assignment – A process in which a doctor

or supplier agrees to accept the Medicare

program’s payment as payment in full,

except for specific deductible and

coinsurance amounts required of the patient.

Base anesthesia units (BAU) – A number

of anesthesia units assigned to an anesthesia

procedure that includes the usual