Error! Unknown info keyword.

NSA’s BENEFITS GUIDE

Rev. May 2023

1

NSA’s Benefits

Guide

Processing and What to Expect

Our success in helping preserve the Nation’s security depends

on the dedicated members of our workforce; we cannot fulfill our

mission without them. That is why we are equally committed to

our employees by offering them tremendous benefits and

developmental opportunities that we hope you take advantage

of. This guide will aid in your familiarization with the benefits

NSA has to offer.

Error! Unknown info keyword.

NSA’s BENEFITS GUIDE

Rev. May 2023

2

Table of Contents

Paid Relocation

Advance of Pay

Employment Verification

Paid Time-Off

03

Retirement (continued)

Military Deposit Information

04

Paid Time-Off (continued)

Retirement

05

06

07

08

Continuing Education

Field Assignments Opportunities

External Details and Intergovernmental

Personnel Mobility Act (IPA) Program

Insurance

Insurance (continued)

Well-Being Services

Public Transportation To/From Work

Employee Resource Groups (ERG)

Error! Unknown info keyword.

NSA’s BENEFITS GUIDE

Rev. May 2023

3

Paid Relocation

Newly hired individuals who are relocating from an area

at or greater than a 50-mile radius may qualify to receive

relocation compensation. If you have been advised that

you are eligible for this benefit, please be sure to review

the “Relocation Assistance” packet provided to you with

your Final Job Offer (FJO).

Advance of Pay

We understand that there may be financial hardships

associated with relocating to a new area and/or starting

new employment. As a result, we offer pay

advancements on a case-by-case basis to eligible

employees who request it within 60 days of entering on

duty (EOD). Advance of pay is a one-time payment of up

to two paychecks’ worth of basic net pay before it has

been earned that must be repaid within 28 weeks

(equivalent to 14 pay periods) of receipt. Additional

information on this program and how to formally request

and repay this benefit will be provided by a Human

Resources Customer Service Center (HRCSC)

representative during your New Employee Orientation.

Employment Verification

In the event that you need verification of your Agency

employment prior to New Employee Orientation, you

may use your signed Final Job Offer. After EOD, you will

have the access and ability to request an official

employment verification document online through

Human Resources.

Paid Time Off

A variety of paid leave options are available to Agency

employees to aid in their work/life balance:

Holidays – 11 paid holidays per calendar year

Sick Leave – 13 days per year earned biweekly

(every two weeks) in increments of four hours

Annual Leave (e.g. vacation) – Earned biweekly

in one of three increments as determined by the

type of appointment being hired to and years of

creditable service (i.e. verified prior Federal

service and/or approved Enhanced Annual

Leave).

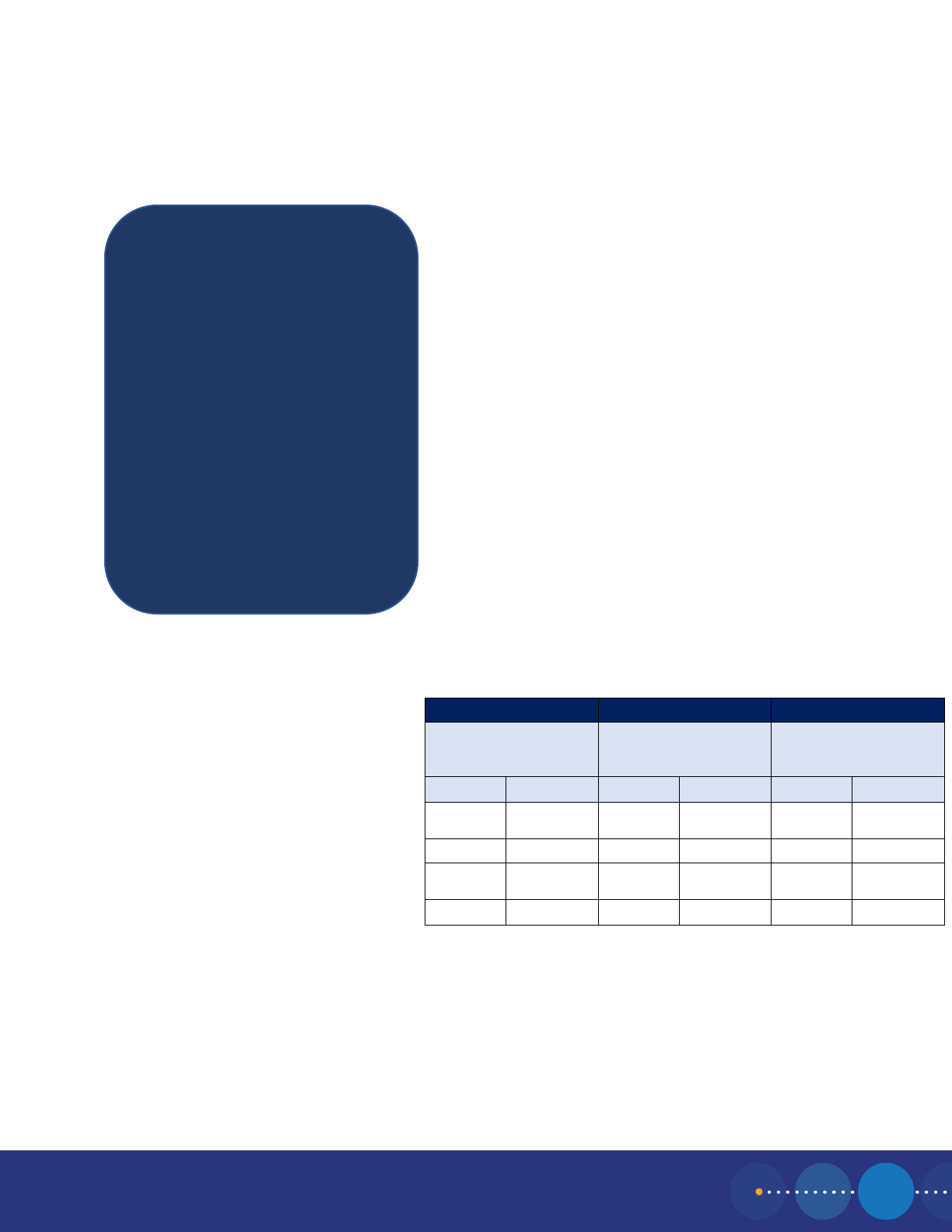

Annual Leave Accrual Increments

Leave Category

Creditable Service

4 hours bi-weekly

1-3 years

6 hours bi-weekly

3-15 years

8 hours bi-weekly

15+ years

Employees in the 4 and 6-hour Annual Leave

accrual categories advance to the next highest

accrual category each time they meet the

creditable service requirement. For example, a

newly hired employee deemed to have two

years’ worth of creditable service would EOD in

the 4-hour accrual category. Once he/she is with

NSA for one year, he/she will advance to the 6-

hour accrual category because he/she now has

three years’ worth of creditable service.

Civilian Fitness Program – Up to 3 hours of

paid leave per week to engage in physical

fitness activities at approved locations.

Morale Building Activities – Up to 12 hours of

paid leave per calendar year to participate in

activities with eligible colleagues for the purpose

of promoting employee morale (e.g. picnics,

sporting activities, etc.).

Inclement Weather (e.g. snow) – Varying

amounts of paid leave for eligible employees

during Agency-deemed dangerous conditions

in/around impacted work locations.

Enhanced Annual Leave (EAL) –EAL is a

benefit derived from the Federal Workforce

Flexibilities Act of 2004 that can increase new

hires’ Annual Leave accrual rates. EAL credit

may be granted to individuals who meet the

following criteria:

• Are newly appointed Federal civilians

(no prior Federal civilian service); or

• Are reappointed to Federal civilian

service after a 90+ day break in Federal

service from the date of the individual’s

last period of Federal civilian

employment; and

• Are hired as a GG-15 or below; and

• Possess 1+ cumulative years of eligible

service within the previous five years

that was no less than 16 hours per week

and is deemed essential to, and directly

related to, the NSA position being hired

to as well as necessary to achieve an

important Agency mission or

performance goal.

In preparing your FJO, Recruiters review all non-

Federal work experience, volunteer service,

and/or service that cannot otherwise be credited

toward your initial Annual Leave accrual rate

Error! Unknown info keyword.

NSA’s BENEFITS GUIDE

Rev. May 2023

4

(i.e. honorably retired active duty uniformed

service and Title 32 National Guard service)

contained in your resume against the Agency’s

description of the position to which you are

being hired in order to determine EAL eligibility.

Your Annual Leave accrual rate will be adjusted

accordingly for any service deemed creditable.

Temporary Medical Leave Assistance

Program (TMLAP) – TMLAP offers temporary

paid leave to civilian employees who have

exhausted their available paid leave and

are facing an acute personal temporary

medical crisis/condition or a family medical

crisis. Participation in the program is

voluntary and requires membership with

annual dues paid in the form of one Annual

Leave accrual (e.g. if in the 4-hour

category, membership dues is four hours

per year); however, dues are subject to

change each year. You have 60 days from

your EOD date to join the TMLAP. If you

do not join within the 60-day window, you must

wait until TMLAP Open Season to enroll

(typically in November of each year).

Family Medical Leave Act (FMLA) Act/Paid

Parental Leave (PPL) – Employees who are

eligible for and invoke FMLA coverage, and

welcome a new child into their lives through

childbirth, adoption, or foster care have access

to a paid leave benefit to bond with and care for

a child. The benefit provides up to 12 weeks of

PPL to eligible employees. Full-time and part-

time employees are eligible for PPL if:

• They invoke FML;

• The birth or placement of a child

occurred on or after 1 October 2020;

and

• They certify, in writing, that they will

work for the employing agency for at

least 12 weeks after PPL concludes.

For more information on how to invoke

FMLA/PPL, please contact HR at 667-812-3864

to be directed to the appropriate HR Customer

Service Center.

Retirement

Your overall retirement benefits package is three-tiered

and consists of the Federal Employees Retirement

System (FERS — your basic benefit), Social Security,

and the Thrift Savings Plan (TSP). There are currently

three forms of the FERS retirement plans: FERS, FERS-

RAE and FERS-FRAE. The FERS retirement plan you

will contribute to is not a matter of choice; it is derived

from Federal law, non-negotiable, and is automatically

withheld from your biweekly Leave and Earnings

Statement (in other words, you cannot opt-out). FERS

employees contribute 0.80% to their retirement system;

FERS-RAE employees contribute 3.10%; and FERS-

FRAE employees contribute 4.4%. All FERS employees,

regardless of form, must also contribute 1.45% to

Medicare and 6.20% to Social Security.

The TSP is similar to 401(k) plans offered to private

sector employees; contributions may be made via pre-

tax (Traditional) or post-tax (Roth) contributions, or a

combination of both, up to the IRS Elective Deferral Limit

which is subject to change each tax year. While

contributing to TSP is ultimately optional, participation

is strongly encouraged, which is why you will be

automatically enrolled to contribute 5% pre-tax into a

Lifecycle (L) fund upon EOD. After EOD, you will have

FERS

FERS-RAE

FERS-FRAE

First time hire on/after

01/01/1984

Hired between

01/01/2013-

12/31/2013

Hired on/after

01/01/2014

Benefit

Contribution

Benefit

Contribution

Benefit

Contribution

Basic

Benefit

0.80%

Basic

Benefit

3.10%

Basic

Benefit

4.40%

Medicare

1.45%

Medicare

1.45%

Medicare

1.45%

Social

Security

6.20

Social

Security

6.20%

Social

Security

6.20%

Total

8.45%

Total

10.75%

Total

12.05%

Note: Non-retired active duty, active

duty reservist (retired and non-retired),

and Title 10 National Guard services

may not be taken into EAL

consideration because those services

are generally already creditable toward

your Annual Leave accrual rate

(provided that acceptable proof(s) of

service is furnished). Individuals hired

into any designated NSA Student

Program (i.e. Cooperative Education

(Co-Op), Gifted & Talented, High

School Work Study, National Security

Scholarship Program, Stokes

Educational Scholarship Program,

Summer Internships) or Reemployed

Annuitant Program (i.e. Selective

Employment of Retirees (SER),

Standby Active Reserves (SAR)) are

ineligible for EAL consideration.

Error! Unknown info keyword.

NSA’s BENEFITS GUIDE

Rev. May 2023

5

the ability to increase, decrease, or redistribute your

contributions across different fund(s) as well as elect

post-tax contributions at any time throughout your

Agency employment. NSA provides matching TSP

contributions up to 5% (dollar for dollar for the first 3%

and 50 cents on the dollar for 4% and 5%). As a FERS

employee, you also receive an automatic 1% from the

Agency whether or not you contribute to TSP (3% +

0.5% + 0.5% + 1% = 5%).

Military Deposit Information

If you are a veteran of the Unites States Armed Forces,

thank you for your service to your country! We hope you

find the following information about military deposits, a

unique benefit afforded to eligible prior service members,

helpful, and we look forward to providing more

information upon New Employee Orientation. A military

deposit, commonly referred to as “military buyback,” is a

payment to the Federal Employees Retirement System

(FERS) to allow creditable military service to be used

toward retirement eligibility and annuity computation.

Uniformed service performed after 12/31/1956 is

automatically creditable toward your Social Security

benefits, the service cannot be credited in the

computation of your Federal Employees Retirement

System (FERS/FERS-RAE/ FERS-FRAE) basic

retirement benefit unless a deposit is paid for the service

prior to your Federal civilian retirement.

You may have the option to “buy back” your uniformed

service upon hire in order to receive the civilian

retirement credit, provided that you furnish approved

proof(s) of service and approved earnings for the

period(s) of service that you wish to buy back. Military

deposits for FERS employees are equal to 3% of your

basic pay (minus allowances) earned during the

period(s) of uniformed service that occurred after

12/31/1956. You have a 3-year interest-free period on

your military deposit balance(s) that begins the first day

you are covered under FERS (i.e. the day you were first

hired to Federal civilian employment). After the interest-

free period ends, any remaining balance(s) on the

deposit(s) will accrue interest annually at the variable

market interest rate. If you are interested in buying back

your uniformed service, we advise paying it as soon as

possible to avoid interest accrual. You will have the

opportunity to request deposit estimates through your

HR Customer Service Center after completing New

Employee Orientation.

Please be advised that Federal law distinguishes

between four general “categories” of uniformed services

for the purposes of military deposits and how they relate

to Federal civilian retirement: non-retired active duty

and/or active duty reservist, retired active duty, retired

reservist, and Title 32 National Guard service.

• Non-retired active duty and/or active duty

reservist – Paid military deposits will be credited

toward the computation of your FERS basic

retirement. This deposit is generally the most

common type of military deposit paid.

• Retired active duty – Paying this military deposit

will require you to waive your military retirement

annuity immediately prior to civilian retirement in

order to receive one Federal retirement annuity

encompassing both your uniformed and civilian

services. In many cases, the retiree receives

more money by keeping the two annuities

separate (by not paying the deposit); however,

when the military retirement annuity is either 1)

Based on disability incurred in combat with an

enemy of the United States or caused by an

instrumentality of war and incurred in the line of

duty during a period of war, or 2) Granted to

members of reserve components of the Armed

Forces on the basis of service instead of

disability, it does not have to be waived.

• Retired reservist – Paying a military deposit for

retired reservist service follows the same

guidance as “Non-retired active duty” (see

exception #2 in “Retired active duty” section).

• Title 32 National Guard service – Title 32 service

performed prior to a Federal civilian appointment

may not be bought back as it is state service

ordered by the Governor and cannot be credited

as Federal service. If the service is federalized

(i.e. Title 10 service), the service may be eligible

to be bought back.

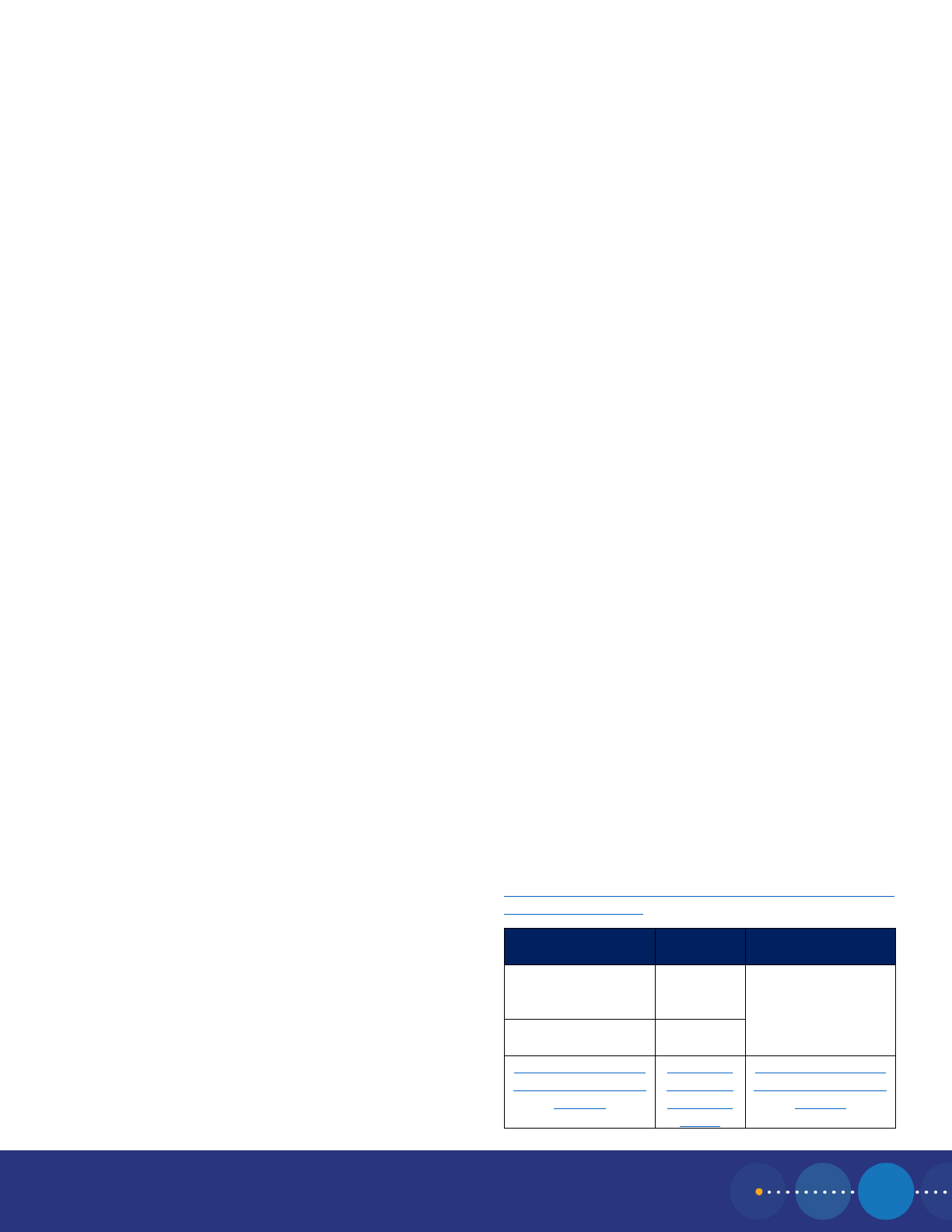

If you wish to obtain deposit estimates, you must request

Estimated Earnings from the appropriate DFAS activity

according to the branch of service you performed the

service(s) in. To do this, you will need to provide a

readable DD214 or other approved form of proof and a

completed RI20-97 (Estimated Earning During Military

Service) form. For your convenience, we have provided

the contact information for each DFAS activity in order

for you to send your requests along with a copy of the

appropriate RI20-97 for you to complete. If you would

like additional information on military deposits prior to

New Employee Orientation or would like to run

preliminary estimates, please visit:

https://www.dfas.mil/CivilianEmployees/militaryservice/m

ilitaryservicedepsits/.

Army, Air Force

Coast

Guard

Navy, Marine

Corps

Phone: 1-888-332-

7411, option 4

Phone:

785-339-

2200

Fax: 866-401-5849

Fax: 866-401-5849

Fax: 785-

339-3780

https://corpweb1.df

as.mil/civpaywf/cov

ersheet

PPC-DG-

Customer

Care@us

cg.mil

https://corpweb1.df

as.mil/civpaywf/cov

ersheet

Error! Unknown info keyword.

NSA’s BENEFITS GUIDE

Rev. May 2023

6

Insurance Benefits

Federal Employees Health Benefits (FEHB) Program

– FEHB is a program offering comprehensive health

insurance coverage for you, your spouse, and your

children under the age of 26. Most employees are

eligible to enroll in FEHB within 60 days of EOD. There

are Nationwide Fee-for-Service, Health Maintenance

Organizations, Consumer Driven, and High Deductible

plans. Enrollment in a plan is voluntary and paid for by

contributions from you and the Federal government.

Your pre-tax biweekly share of the premium depends on

the plan you select, but the Federal government’s share

of the premium is approximately 72% of the total

premium. Coverage is effective the first day of the

following pay period after you enroll. If you do not enroll

within the 60-day window, you will have to wait until

either the annual “Open Season” (occurring in

November/December timeframe) or within 60 days of a

qualifying life event (QLE) (loss of coverage, marriage,

divorce, birth, etc.). Open Season elections become

effective in the first full pay period in January. For more

information, please visit the OPM website at

www.opm.gov/health.

Family members of employees must be verified before

they can be added to FEHB enrollment. Eligible family

members in the FEHB program are spouses and

children until age 26 including legally adopted children,

stepchildren, and foster children. Children age 26 and

over who are incapable of self-support due to a disability

that existed before the age of 26 may also be covered if

they meet certain criteria. Specific documents must be

provided in order to establish family member eligibility for

FEHB coverage. Please visit

https://www.opm.gov/retirement-services/publications-

forms/benefits-administration-letters/2021/21-202a2.pdf

to review the list of required documents. Submission of

acceptable documents is required before family

members can be enrolled in the FEHB program and

should be done at the time of FEHB enrollment.

Federal Employees Dental and Vision Program

(FEDVIP) – FEDVIP is a supplemental form of insurance

offering dental and/or vision insurance to you, your

spouse, and your unmarried dependent children under

the age of 22. Most employees are eligible to enroll in

one of several federal dental and/or vision plans within

60 days of EOD. The Federal government does not

contribute to dental or vision premiums; therefore, you

will pay 100% of the costs. There are various dental

and/or vision plans to pick from. Your biweekly share of

the dental premium (pre-tax) is determined by the plan

you select as well as your zip code. Vision premiums

(also pre-tax) are determined solely by the plan you

select (in other words, your zip code is not a factor). If

you do not enroll in either insurance within the 60-day

window, you will have to wait to enroll until either the

annual Open Season or within 60 days of a QLE (loss of

coverage, marriage, etc.). Open Season is held annually

in the November/ December timeframe with coverage

becoming effective on 1 January. Without a QLE, you

may only cancel your dental and/or vision coverage

during the annual Open Season. Enrollment is not

conducted at the Agency; therefore, for more information

or to enroll, please visit www.benefeds.com.

Flexible Spending Account (FSA) – FSA is a benefit

that allows enrollees to set aside pre-tax money for their

health care expenses with a Health Care or Limited

Expense Health Care FSA or for their dependent and/or

elder care expenses through a Dependent Care FSA (in

other words, an account that helps you pay for items that

typically are not covered by your FEHB, FEDVIP, or

other health insurance plans). Most employees are

eligible to enroll in the FSA program within 60 days of

EOD. If you do not enroll within the 60-day window, you

will have to wait to enroll until either the annual Open

Season or within 60 days of a QLE. Open Season is

held in the November/December timeframe with

coverage becoming effective on 1 January. Enrollment is

not conducted at the Agency; therefore, for more

information or to enroll, please visit www.fsafeds.com.

Federal Long Term Care Insurance Program

(FLTCIP) – FLTCIP provides long term care insurance to

help pay for costs of care if/when the enrollees can no

longer perform everyday tasks such as eating, dressing,

bathing, etc. due to chronic illness, injury, disability or

aging, or have a severe cognitive impairment (such as

Alzheimer’s disease) and need supervision at either

home, in a nursing home, or at another long term care

facility. Current spouses, parents, parents-in-law,

stepparents, adult children (adopted and stepchildren at

least 18 years old), and domestic partners all of living

eligible employees are eligible to enroll in FLTCIP. Most

employees are eligible to enroll in the FLTCIP program

within 60 days of EOD (with abbreviated underwriting).

After the 60-day window ends, you may still apply but

you will be subject to the full underwriting. Enrollment is

not conducted at the Agency; therefore, for more

information or to enroll, please visit www.ltcfeds.com.

Federal Employees Group Life Insurance (FEGLI) –

FEGLI is term life insurance with an option for coverage

of your spouse and/or your unmarried dependent

children under the age of 22. Your initial FEGLI

coverage will depend on whether or not you are a newly

appointed Federal civilian (no prior Federal civilian work

experience) or a reappointed Federal civilian (with prior

Federal civilian service). For additional information,

please visit www. opm.gov/insure.

• Newly appointed – You will be automatically

enrolled in the “Basic” FEGLI option upon

hire; equivalent to your annual base pay

(including locality) rounded up to the next

$1,000, plus $2,000. You will pay two-thirds

of the cost of Basic FEGLI coverage while

the government pays one-third. You may

increase your coverage or elect family

coverage within 60 days of EOD. After the

60-day window ends, you may only increase

Error! Unknown info keyword.

NSA’s BENEFITS GUIDE

Rev. May 2023

7

coverage with a QLE or through the Request

for Insurance process. This process involves

a physical examination completed at your

expense; the results of which are used by

the Office of FEGLI to determine your

enrollment eligibility. If you decide you wish

to decrease or waive your Basic coverage

altogether, you may do so at any time

throughout your employment (no QLE

needed).

• Reappointed – The type of FEGLI coverage

you will be hired with depends on how long it

has been since your last Federal civilian

appointment. If it has been fewer than 180

days since your last Federal civilian

appointment, you will EOD with the same

coverage you had previously but may only

increase the coverage with a QLE; however,

you may decrease or cancel your coverage

at any time. If your previous coverage had

been waived, that waiver of coverage

remains in effect until you experience a

QLE. If it has been more than 180 days, you

will still EOD with the same coverage you

had previously but may only increase this

coverage within 60 days of EOD or with a

QLE. If you had previously waived coverage,

you will automatically be enrolled in the

Basic option upon hire with the ability to

increase your coverage with a QLE or

decrease or cancel your coverage at any

time.

Behavioral Health and Life

Services

Behavioral Health and Life Services (BHLS) provides

whole-person consultation, treatment services,

education, and resources to the worldwide NSA/CSS

workforce, organizations, and their family members.

Employee Assistance Program (EAS) –

Ready access to confidential mental health

treatment (individual, couples, group, addictions)

for service members, civilians, and their spouses

provided by fully cleared clinicians. 24/7

psychological crisis support.

Workplace Psychological Consultation –

Consultation to managers at all levels including

Embedded Psychological Support in high-tempo

and challenging workplace environments,

Tailored Consultations on various issues (e.g.,

organizational crises, change, challenging

employees, low morale) and Psychological

Education and Training on topics such as stress,

suicide awareness, and coping with uncertainty.

Work/Life Services – Offers a broad array of

strategies and resources for family/dependent

care and workplace support to strengthen

employees’ work/life balance in order to

enhance mission effectiveness and personal

well-being. Additionally, the Financial Coaching

Center (FCC) is housed in Work/Life and

provides free financial counseling to help both

military and civilian employees understand their

finances, control debt, and improve credit.

Well-Being Bulletin (blog) – Relevant and

timely articles with a whole-person approach to

enhancing the total well-being of the workforce.

Public Transportation To/From

Work

NSA’s Commuter & Transportation Center (CTC) assists

NSA employees with commuter and ridesharing

assistance (to include carpool, vanpool, and cycle

commuting), traffic and parking, and official local travel

requirements. NSA provides shuttles to and from the

MARC and Light Rail stations, with pick-ups and drop-

offs occurring at Fort Meade and/or the FANX1 Visitors’

Center. For more information on transportation options

for NSA employees, please contact the CTC at 301-688-

7520.

Employee Resource Groups

Employee Resource Groups (ERGs) provide employees

of underrepresented groups and their allies with the tools

and abilities to identify and address barriers that may

hinder that population’s achievement. ERG leaders and

members serve as change agents by engaging with

fellow members to monitor the climate and assist with

generating solutions which ultimately benefit all

members of the workforce by ensuring a diverse and

inclusive environment. Employees are able and

encouraged to join one or more of the 11 currently

offered ERG(s):

• African American

• American Indian Alaska Native

• American Veterans

• Asian American/Pacific Islander

• English as a Second Language

• Hispanic/Latino

• Islamic Cultural

• Pride (LGBTQ+)

• NextGen (Next Generation)

• People with Disabilities

• Women

Continuing Education

NSA values continuing education and dedicates an

entire school, the National Cryptologic School (NCS),

accredited by the Council on Occupational Education, as

well as college tuition assistance programs and other

training opportunities. The flexible education, training,

and learning solutions offered by the NCS enables and

Error! Unknown info keyword.

NSA’s BENEFITS GUIDE

Rev. May 2023

8

optimizes NSA’s mission readiness to support our global

cryptologic mission.

NCS currently offers four college tuition assistance

programs:

Undergraduate Scholarship (competitive) –

You study full-time while NSA pays your salary,

100% tuition, and associated lab fees for up to

two consecutive semesters. To be eligible for

the program, you must have completed at least

90 semester hours, have three years of NSA

service, and earn a grade of “B” or better.

Graduate Fellowship (competitive) – You

study full-time while NSA pays your salary,

100% tuition, and associated lab fees for up to

two consecutive semesters. To be eligible for

the program, you must be accepted into a

graduate program, have three years of NSA

service, and earn a grade of “B” or better.

Advanced Study (competitive) –This program

provides time-off to pursue studies in “mission

critical” skill fields. You study part-time while

NSA pays your salary, 100% tuition, and

associated lab fees for up to four semesters of

upper-undergraduate or graduate level courses.

You may be approved up to 20 hours/week to

attend classes and study. To be eligible for the

program, you must have completed 60 semester

hours, have one year of NSA service, and earn

a grade of “B” or better.

After Hours College (non-competitive) – You

work full-time and attend classes after duty

hours. NSA pays your salary, 100% tuition, and

associated lab fees. With approval, you may

participate in this program upon hire and take

undergraduate, graduate, or post-graduate level

courses but must earn a grade of “C” or better.

Field Assignment Opportunities

The NSA has a global footprint and offers civilian

employees many exciting U.S. and Foreign Field Tour

opportunities once they have completed their first two

years at the Agency. Tours may vary in length and are

offered in U.S. locations such as Colorado, Georgia,

Hawaii, and Texas; overseas locations include Australia,

Canada, England, and New Zealand. Field Tours

provide the NSA civilian workforce career-broadening

opportunities that allow them to benefit from experiences

gained from such assignments.

Additionally, when an NSA employee’s spouse must

relocate due to employment, either at NSA, with the

military, another Federal agency, a contractor, or private

sector, field opportunities may be available for the

employee. To help keep married couples co-located,

NSA manages the Married Agency Employee (MAE)

Program. MAE assignments provide current NSA civilian

employees the opportunity to accompany their spouses

on field assignments without having to resign from the

Agency or be placed in a long-term unpaid status when

a permanent position is not available for them at site.

External Details and

Intergovernmental Personnel Act

(IPA) Mobility Program

In addition to taking advantage of the Agency’s global

footprint, NSA employees can pursue external

assignment opportunities currently offered within and

outside of the local area:

Joint Duty Assignments (JDAs) – JDAs allow

Intelligence Community (IC) employees to detail

to other IC agencies and receive “JDA credit” for

the assignment. JDAs ensure that IC employees

have an IC-wide perspective, cultivate cross-

organizational networks, and facilitate

knowledge and information sharing and

obtaining JDA credit demonstrates a

commitment to those goals.

External Details – External details facilitate

temporary assignments to and from Federal,

state, and local governments, institutions of

higher education, Indian tribal governments and

other eligible organizations. Such assignments

facilitate cooperation between the Federal

Government and the non-Federal entity and

further mutually-beneficial goals, in addition to

sharing knowledge and information.

Professional Opportunities in Private Sector

(POPS) – POPS provides a unique career

enhancing opportunity for NSA employees to

gain first-hand knowledge of best practices in

private industry through temporary external

assignments.